After our last articles on candlestick reversal patterns, test your knowledge.

If you need to give a second read, these are the links:

Let’s begin

[wp_quiz id=”59882″]

Reference:

The Candlestick Course: Steve Nison

After our last articles on candlestick reversal patterns, test your kowledge.

After our last articles on candlestick reversal patterns, test your kowledge.

After our last articles on candlestick reversal patterns, test your knowledge.

If you need to give a second read, these are the links:

[wp_quiz id=”59882″]

Reference:

The Candlestick Course: Steve Nison

Introduction

Introduction

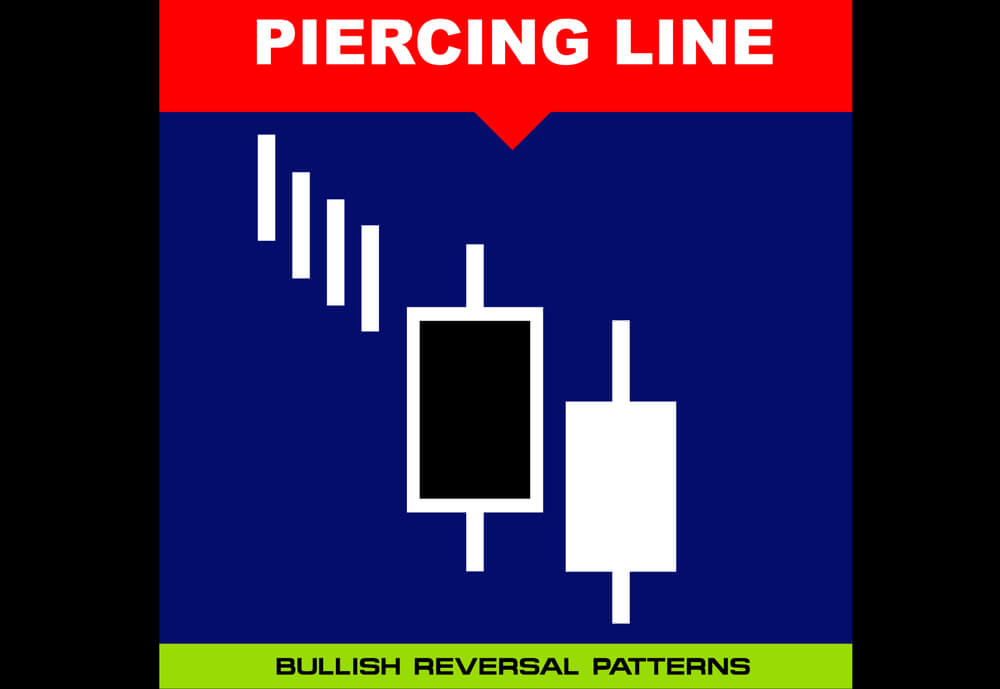

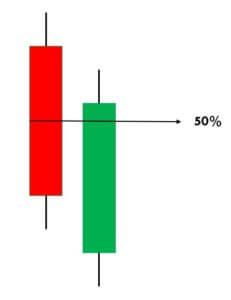

The Piercing Line is a simple and effective candlestick pattern, and it is used to trade the bullish reversals in the market. This pattern typically appears in a downtrend. Also, when it appears in a significant support area, we can consider it more reliable. Piercing Line is a two candlestick pattern where the sellers influence the first candle, and the second candle is responded by enthusiastic buyers. Piercing Line essentially indicates the bears losing control, and bulls taking over the market.

This indicates that buyers now overwhelmed the sellers. In terms of supply-demand, this pattern shows that the supply is depleted somewhere, and the demand for buying has increased. Remember not to trade this pattern alone. Always use it in conjunction with some credible indicators or other trading tools to further enhance the probability of winning.

In this strategy, we have paired the Piercing Line pattern with the Percentage Price Oscillator to generate credible trading signals. The Percentage Price Oscillator is a momentum indicator. It consists of a centerline, histogram, and the two moving averages. Just like the MACD indicator, the PPO also represents the convergence and divergence in price action. This indicator gives a crossover at the overbought and oversold market conditions.

When price action crosses the centerline, it means that the bullish or bearish momentum is super strong. We want to let you know that PPO is not that popular in the industry. Also, it is not available in the MT4 terminal. However, you can download this indicator from this link and add it to your MT4 terminal. If you are a Tradingview user, search the PPO indicator in the indicators tab, and you should be able to find it.

Step 1 – Find out the Piercing Line pattern in a downtrend.

Step 2 – Once you find the Piercing Line pattern, the next step is to wait for the reversal to happen on the PPO indicator at the oversold market conditions.

In the below CHFJPY chart, the market was in an overall downtrend. We can see the market printing Piercing Line pattern, and that is an indication of a trend reversal. We can also see the PPO indicator giving crossover in the overbought area at the same time. Both of these clues indicate a clear buy signal in this pair. We can also see the price action showing divergence, which is another clue to go long. If we are able to find all of these clues on a single price chart, we shouldn’t mind placing bigger trades.

Step 3 – Stop-loss and Take Profit

PPO indicator quite often gives high probability trading signals. So when we take trades of that kind, most of the time, we must place the stop loss just below the first candle of the Piercing Line indicator.

There are several ways to book profits. For this particular strategy, we can close our position when the PPO reversed at the overbought area or when the market starts printing the opposite pattern. If you plan to make more money in a single trade with extra risk, it is advisable to book the profit at the higher timeframe’s major resistance area.

In the below chart, we can see that we have closed our whole position at the major resistance area and the stop-loss order was just below the recent low.

In this strategy, we have paired the Piercing Line pattern with the Double Moving Average. Moving Average is a very well-known indicator in the industry. Many average indicators are available in the market. If you are using the lower period average, expect more trading signals. Contrarily, if you are using the higher period average, expect fewer but accurate signals.

Step 1 – First of all, find out the Piercing Line pattern in a downtrend.

Step 2 – Activate the buy trade when the lower period MA crosses the higher period MA. In the below EURAUD Forex chart, the price action was in a downtrend, and around the 22nd of December, the market prints the Piercing Line pattern. This means that the sellers now have a hard time to go lower, and buyers took over the market. Furthermore, when a lower period moving average crosses the higher period moving average, it is a clear indication to go long. After our entry, price action immediately prints a brand new higher high.

Step3 – Stop-loss and Take Profit

If you are an aggressive trader, use the recent low for stop loss. But if you are a conservative trader, make sure to place wider stop losses. If you plan to ride the longer moves, wait for the price action to hit the daily support area. But if you plan to go for intraday trades only, we suggest you exit your position when the double MA gives the opposite signal.

In the below chart, we can see that we have closed our full positions at the higher timeframe major resistance area, and stop-loss was just below the recent low. Overall, it was a 3R trade.

Piercing Line pattern is a bottom reversal pattern, and it is one of the very well-known bullish reversal patterns. We can say that this pattern is exactly the opposite of the Dark Cloud Cover pattern. We won’t be able to see this pattern very frequently on the price chart, but when it appears, a trend reversal is guaranteed. Sometimes you will find this pattern in the consolidation phase, but it’s not worth your time to trade it in ranges. So it is always recommended to find this pattern in a clear trending market because that’s where we can generate more effective signals. The only limitation of this pattern is that it requires the use of other technical tools to confirm the signal and cannot be used stand-alone. But that’s the case of most of the candlestick patterns, so that’s not a major limitation.

That’s about the Piercing Line candlestick pattern. Let us know if you have any questions in the comments below. Cheers!

Chart Patterns – Broadening Pattern & The Diamond Pattern

Chart Patterns – Broadening Pattern & The Diamond Pattern

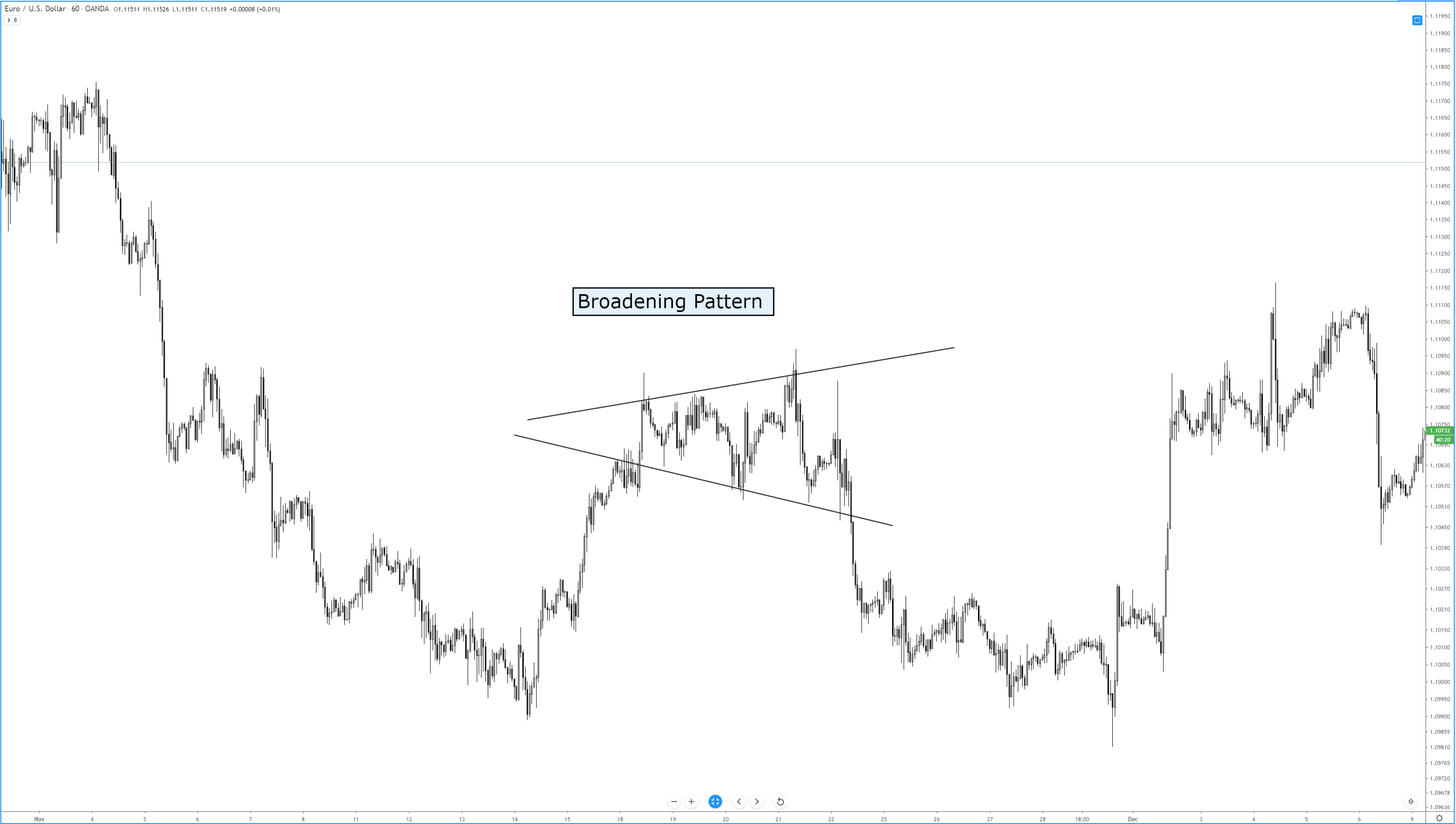

This pattern is also called a funnel or a megaphone pattern. It’s an inverse symmetrical triangle. This pattern is definitely not that common, and it’s a tricky pattern to trade. The behavior of price in a broadening pattern is to increase swing ranges where new higher highs and new lower lows are made. In my opinion, it is best to ignore this pattern. The breakout and retest of the upper or lower trendlines are the prevailing trade strategies utilized for this pattern. Of all the patterns, to trade, this is one of the least profitable. However, I’ve learned that the breakouts are often false, due to the nature of the final swing in the pattern being mostly overbought or oversold. It is not uncommon to see megaphone patterns turn into a triangle pattern – which results in a rare but profitable pattern known as a Diamond.

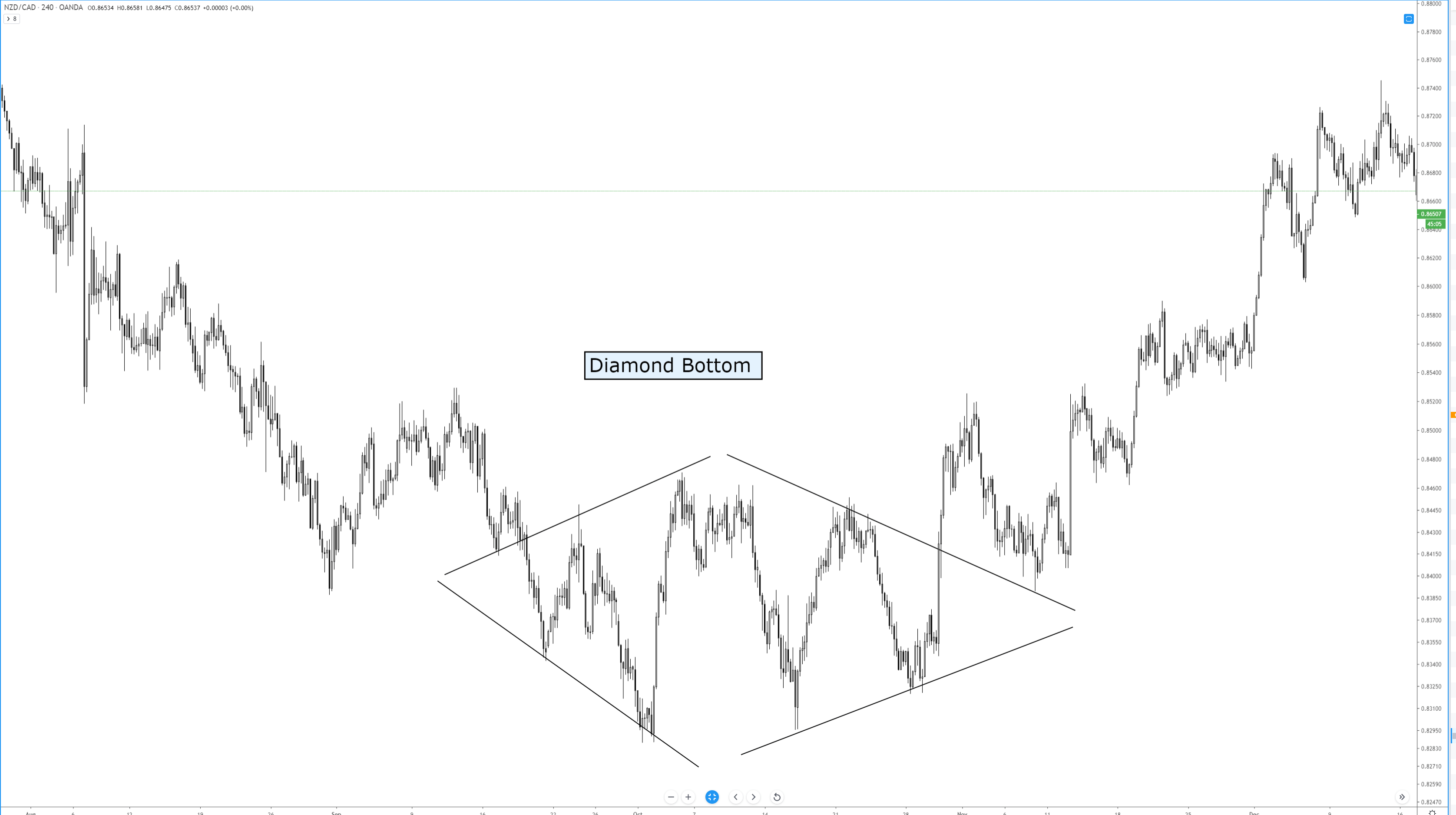

The diamond pattern is rare. It is also difficult to even notice if it exists. In fact, Thomas Bulkowsi writes on his site, ‘Let me clear about this. I don’t like diamonds. They are as tough to spot as nightcrawlers in the grass on a summer night.’ I believe that is a pretty accurate description. But, while diamond patterns are challenging to spot, they are a very powerful pattern that often results in fast and violent moves in the opposite direction – higher for diamond bottoms and lower for diamond tops. It is ok for the patterns to have one side that seems more slanted than the other and, in fact, they often do not appear as symmetrical as the example above. We trade a diamond pattern the same way we would any other triangle pattern.

Sources:

Kirkpatrick, C. D., & Dahlquist, J. R. (2016). Technical analysis: the complete resource for financial market technicians. Upper Saddle River: Financial Times/Prentice Hall.

Bulkowski, T. N. (2013). Visual guide to chart patterns. New York, NY: Bloomberg Press.

Bulkowski, T. N. (2008). Encyclopedia of candlestick charts. Hoboken, NJ: J. Wiley & Sons.

Bulkowski, T. N. (2002). Trading classic chart patterns. New York: Wiley.

Introduction

Introduction

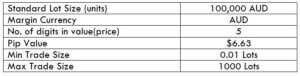

CADJPY is the abbreviation for the currency pair, the Canadian dollar against the Japanese yen. This pair is one of the most extensively traded cross currency pairs. In CADJPY, CAD is referred to as the base currency and JPY as the quote currency.

The value of CADJPY is the value of JPY, which is required to purchase one CAD. It is quoted as 1 CAD per X JPY. For example, if the current market price of this pair is 82.651, then these many units of Japanese yen are needed to buy one Canadian dollar.

The bid price is the price used to sell a currency, and ask price is the price used to buy a currency. There is always a difference between the two prices. This difference is called the spread. It varies from broker to broker and also the type of their execution model.

ECN: 1.1 | STP: 2

Similar to stockbrokers, there are forex brokers who charge a few pips of fee on each position a trader opens and closes. This fee is no different from the commission brokers levy. On STP accounts, the fee is nil, while on ECN accounts, it is between 6-10 pips depending on the broker one is using.

Slippage in trading is the difference between the price requested by the trader and the price he actually received. The two factors responsible for slippage are,

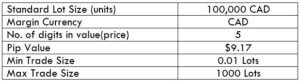

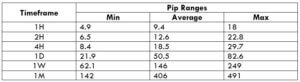

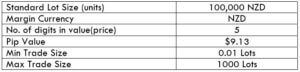

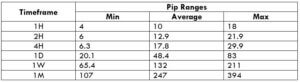

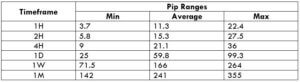

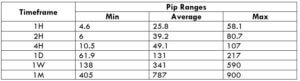

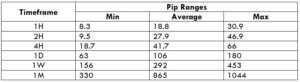

A trading range is a tabular representation of the number of pips a currency pair moved in a given timeframe. It represents the minimum, average as well as the maximum pip movement in six different timeframes. These values prove to be important for assessing one’s risk on a trade. For example, if the minimum pip movement in CADJPY on the 4H timeframe is ten pips, then a trader can expect to lose $917 in about 4H.

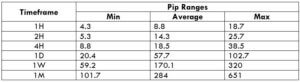

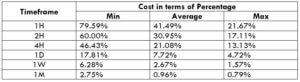

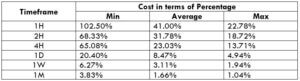

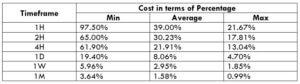

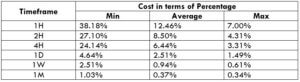

As already mentioned, there is a fee for every trade you take. And knowing the percent fee on the trades you are taking is important, as it depends on the volatility of the market and the timeframe you are trading.

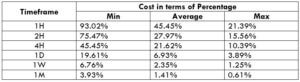

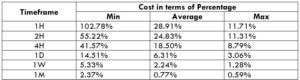

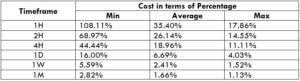

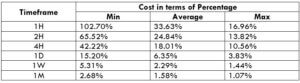

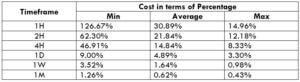

Below is a representation of the total cost variation on trade in terms of percentages. Since costs on ECN accounts are different from STP accounts, we have two separate tables for this concept.

Spread = 1.1 | Slippage = 2 |Trading fee = 1

Total cost = Slippage + Spread + Trading Fee = 2 + 1.1 + 1 = 4.1

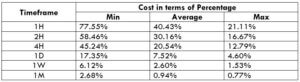

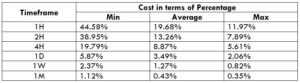

Spread = 2 | Slippage = 2 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 2 + 2 + 0 = 4

Before getting right into it, let us comprehend the above tables. The higher the values of the percentages, the higher are the costs on the trade. It is pretty evident from the table that, percentage values are on the higher side in the min column and comparatively lower in the max column. This means that the costs are high when the volatility of the market is low and vice versa. Also, the trades that are taken based on a long term perspective, the costs are considerably low.

One may trade the high volatility markets to minimize your costs, or trade during low volatility by paying high costs. However, it is ideal to enter during those times of the day when the volatility is close to the average values. During these times, one can expect comparatively low costs with enough volatility as well.

On a further note, another simple and effective way to reduce costs is by trading using limit orders. This entry method will take slippage out of the total costs and bring down its value considerably. An example of the same is given below.

Spread = 2 | Slippage = 0 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 2 + 0 + 0 = 2

What are Candlestick Charts?

What are Candlestick Charts?

A candlestick chart is simply a way of depicting the price moment’s information. Since these chats are very famous, they are available on almost every trading platform. Candlestick charts were first developed by a Japanese rice trader Sokyu Honma in the late 17th century. He is known as the father of candlesticks. Yes, it has been more than 250 years since this chart has been devised and yet they are so relevant even today.

Sokyu Honma – Father of Candlesticks

(Photo Credits – Alchetron)

Japanese are huge technical traders. They use a combination of candlestick techniques & western charts to analyze the market. The primary advantage of a candlestick chart is that it identifies the underlying psychology of traders in the market. This feature differentiates candlesticks from the other chart types we know today.

Have you come across terminologies like ‘hanging-man,’ ‘dark-cloud,’ and ‘evening-star’ but not sure what they are? Good. In the first part of this course lessons, we will be discussing everything about candlesticks and its patterns. We will also discuss how to use these charts & patterns to make profitable trades, as it will open a new way of analysis for you and show how Japanese candlesticks can enhance your trading performance.

There is a great interest in candlesticks by top traders. There are many reasons for that, and few of them are listed below:

🕯️ Candlestick charts are flexible. This is because they can be used as standalone or in combination with other technical indicators. These charts provide an extra dimension to the analysis.

🕯️ This technical approach is an age-old tradition of analysis, which has evolved from centuries of trial and error.

🕯️ Japanese are quite visual on the terms used to describe the patterns. A term like ‘hanging-man’ will spark interest among traders. There are hundreds of such names. Once a trader gets an understanding of what that pattern is, they will not be able to trade without using them.

🕯️ Another important reason for using the candlestick chart is that it can be paired along with the bar charts for people who see bar charts alone.

🕯️ All the usual technical analysis tools can be easily used with candlestick chartings, such as moving averages, trend lines, Elliot waves, retracements, and more. These charts provide a unique way of analysis, which is not provided by any other charting tool.

🕯️ As with all other charting methods, candlestick pattern depends on the interpretation of the trader. This could be one of their limitations. As a trader gain experience, they discover which candlestick pattern suits them the best.

🕯️ Every candlestick has a close. Therefore, traders will have to wait for the close to get a valid trading signal. However, a trader might try and anticipate what the close would be a few minutes before the actual close.

🕯️ The opening price is vital in candlestick. Traders with no access to live market data might not be able to get the opening price of a security.

That’s about the introduction to Candlestick charts, its pros & cons. In the next article, we will learn the anatomy of a single candlestick chart so that you can read the chart better. Make sure to take the quiz below before moving on. Cheers!

[wp_quiz id=”59568″]https://youtu.be/t_7qOjRLbz8

https://youtu.be/t_7qOjRLbz8

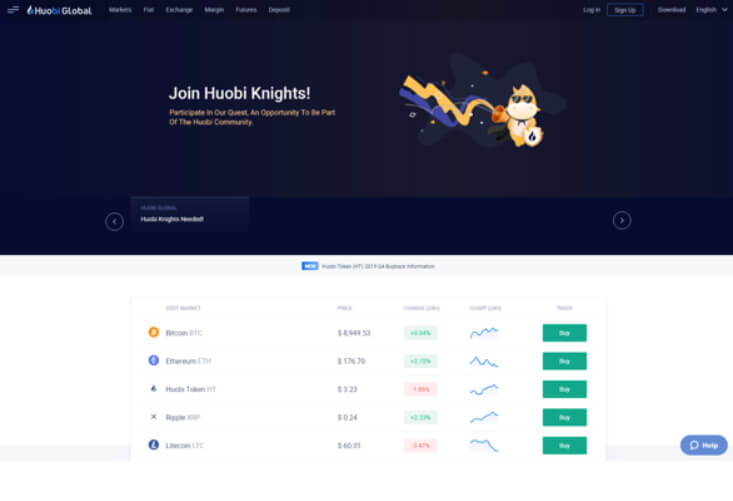

Huobi is a cryptocurrency exchange that started operating in 2013. It currently has over a million users as well as over $1 billion in assets under its custody. Though headquartered in Singapore, Huobi has an international presence. It has subsidiaries located in China, South Korea as well as the United States, where it is registered with the FinCen under HBUS Inc. As of March 2018, Huobi is active in 52 US states, operating as a Money Service Business (MSB).

Huobi offers support to nearly 280 crypto assets, including 88 Ethereum-priced pairs, 105 Bitcoin-priced pairs, 37 pairs priced in USDT, as well as over 50 pairs on its HADAX platform.

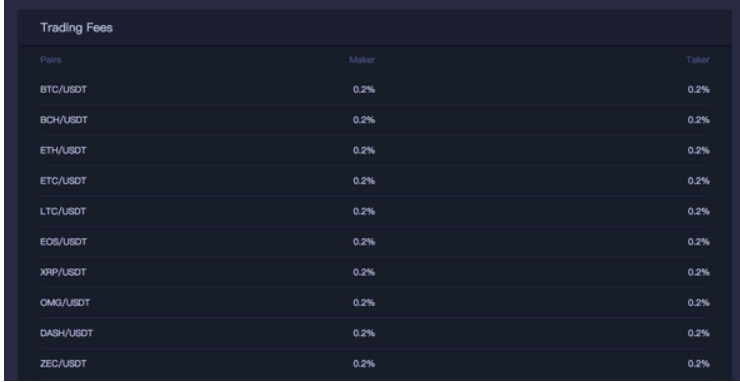

Huobi Commissions & Fees

Huobi tries to offer competitive trading fees to its users. It charges a 0.2% fee on major crypto pairs. Being a market maker or taker does not matter on Huobi.

Huobi offers a VIP trading commission schedule to its active traders. The VIP trading commission is tier-based. The higher the VIP membership tier, the greater the commission discount is. In order to obtain a VIP trading discount, Houbi users must pre-purchase the VIP tier they think is the most cost-effective for them. This purchase can only be made with the Huobi Token that is issued by Huobi.

The Huobi Token simply acts as a discount token for the Houbi VIP users. The number of tokens directly determines the level of VIP access. The VIP level can range from level 1, which requires 120 tokens per month all the way up to level 5, which requires 12,000 tokens per month.

Determining the most cost-effective deal is detrimental. A user looking for a 10% discount on their trading fees would need to pay 120 HT, which, with Huobi Token costing $3.23 per unit, would cost $387.6. Therefore, buying this discount level would only be worth it if the trader is willing to spend more than $3,876 in trading commissions. This would, at a 0.2% commission rate, require spending of $1,938,000. However, as the company gave away around three million Huobi Tokens for free in early 2018, the exchange’s earliest users can have access to the greatest discounts if they use these tokens to purchase their VIP memberships.

While Houbi’s VIP profitability “threshold” is high, its base fees seem competitive enough for regular traders.

Security

Huobi offers its users a hosted wallet solution, where users can enable Two-Factor Authentication (2FA). However, this security layer has become an industry standard and, therefore, cannot be considered a feature. Users are notified via SMS upon each successful login.

When talking about storage security, Huobi users should not be worried about security breaches as much as other exchange users. This is because Huobi keeps 98% of its assets in cold storage. The access to cold storage is only granted to internal staff. It is also protected by multi-sig technology.

Huobi has built an anti-DDOS attack system to keep its infrastructure as sturdy as possible.

Account security is also something Huobi is proud of, as fund withdrawals have a couple of interesting caveats. If users change their security settings and immediately attempt to withdraw their funds, Huobi will manually review the withdrawal. On top of that, they may email or call the user to obtain a withdrawal confirmation. Otherwise, withdrawals require three separate codes:

One sent via SMS to the user!

One sent via email!

One 2FA code generated on the user’s device.

In addition to these security features, Huobi created an Investor Protection Fund in January 2018. This fund is used for compensating investors in extraordinary circumstances.

Check out our part 2 of Huobi in-depth review for more on how the platform works.

Introduction

Introduction

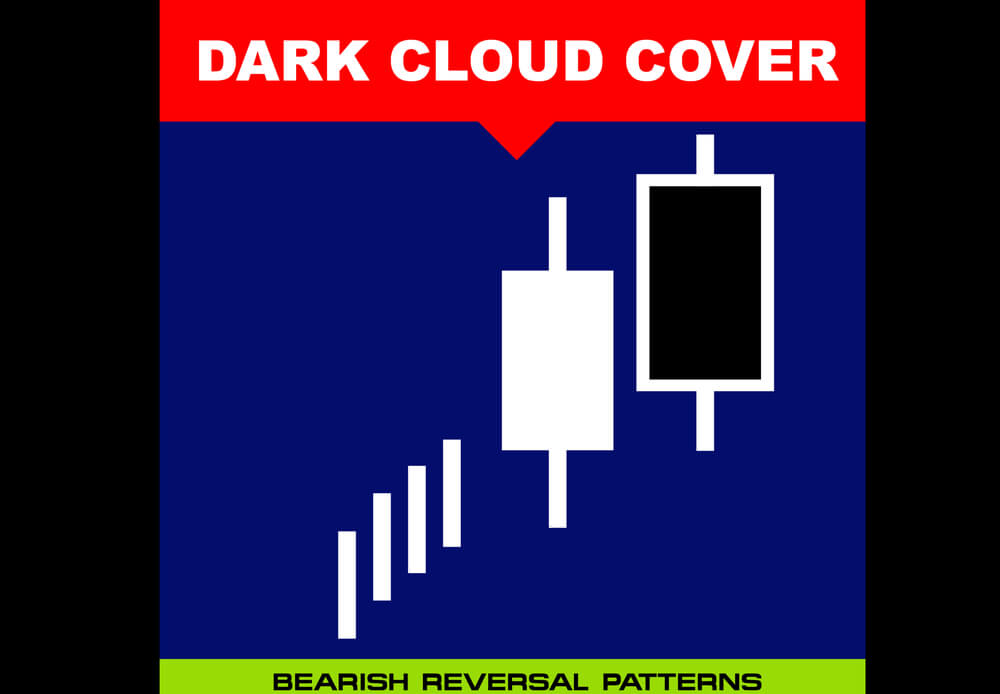

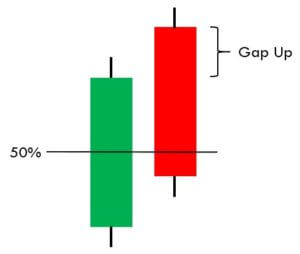

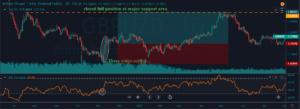

Dark Cloud Cover is a bearish reversal candlestick pattern. It essentially shows the shift in momentum from the buyers to sellers. This pattern is formed by a bullish candle, which is then followed by a bearish candle. Traders can look for an entry on the next red candle. The Dark Cloud Cover pattern can only be used when it occurs in an uptrend. Because, if the price rises above the Dark Cloud Cover pattern, it becomes less significant to trade. It is essential to know that the bearish engulfing pattern and Dark Cloud Cover pattern are very similar in their appearance. If the second candle of the pattern closes below the previous candle, you have the bearish engulfing pattern; if not, it is a dark cloud pattern.

As we always say, do not trade any pattern stand alone in the market. Pairing the pattern with other credible trading tools like indicators or oscillators will dramatically increase the odds of your trades. In this strategy, we have paired the Dark Cloud Cover pattern with the MACD indicator to filter out the low probability trades. MACD indicator stands for Moving Average Convergence and Divergence. It is one of the most popular indicators that has been in use since the late 1970s. It belongs to the oscillator family, and it is designed to measure the magnitude, direction, and rate of change in any underlying currency pair.

Once you have found the Dark Cloud Cover pattern, the next step is to take the sell trade when MACD gives crossover at the oversold area.

As you can see in the below daily chart of the GBPJPY forex pair, the price action turned sideways for some time. After that, it prints the Dark Cloud Cover pattern, and at the same time, we can see the MACD indicator giving a reversal at the overbought area. This is a potential sign for us to go short on this pair. As mentioned earlier, do not confuse between the Dark Cloud Cover and Engulfing Pattern. In a Bearish engulfing pattern, the red candle completely takes over the preceding green candle, whereas, in the Dark Cloud Cover pattern, the red candle takes over only 50% of the previous green candle.

In this strategy, we have closed our full position at the major support area, and stop-loss was above the Dark Cloud Cover pattern. Price action holds below the support area, but it immediately came back, and prints a brand new higher high. We can also close our positions based on the MACD indicator. When the MACD indicator reversed at the oversold area, it’s a perfect sign to exit our position. Always remember the sure sign of market reversal is when the price action is at the significant support area and the MACD lines crossover at the oversold region.

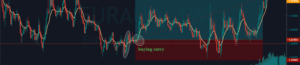

In this strategy, we have paired the Dark Cloud Cover pattern with the Donchain Channel. Richard Donchain developed the Donchain channel indicator in 1936. He was a fund manager, writer, and also known as the father of trend trading. Once the Donchain channel indicator is plotted on to the price chart, it helps the traders to visualize the price of an asset and if it is relative to the upper and lower bounds of the indicator.

Once you find the Dark Cloud Cover pattern in an uptrend, the next step is to check if the price action respects the upper Donchain Channel.

The image below represents the EUR/AUD forex pair, and the price action was held at the major resistance area. Before printing the Dark Cloud Cover pattern, the price hits the upper bound of the Donchain channel twice. When price action hits the upper bound of the Donchain channel and if the market prints the Dark Cloud Cover pattern at the same time, it is a clear indication of sellers stepping into the market. After the completion of the pattern, we activate our trade, and for a profit-booking, we aim for the second target.

In this example, we have two target areas. If you are a short term or intraday trader, then exit your position at first support area, and if you are a positional trader or a swing trader, then go for target two. When you activate your trade and if the market has two major support areas, always try to exit your position at target two, because the end goal of every trader is to make as much money as possible when the market gives them an opportunity & minimize the losses when the trade goes against them. The placement of stop-loss should always be above the Dark Cloud Cover pattern.

The Dark Cloud Cover is quite a popular trading pattern in the industry, and it can easily be recognized on the price charts. This pattern is only useful or reliable to trade when it appears in an overall uptrend. This pattern identifies the shift in momentum from buyers to sellers. The test of the resistance line or trend line can be used as a confirmation tool to take sell trades. If you are using the Dark Cloud Cover pattern alone, always use it on the higher timeframe. Also, use more significant stop loss because none of the indicators or patterns are capable enough to indicate accurate signals all alone. On a lower timeframe, this pattern often provides some false signals. Still, by pairing it with other trading indicators, we can dramatically filter out the low probability signals.

We hope you find this article useful. Try trading this pattern with the indicators we have mentioned above to maximize your profits, as these combinations have been back-tested by experienced traders. Cheers!

Bitcoin’s underlying technology – blockchain – is hailed as an unrivaled, ultra-secure technology. And it’s true – Bitcoin’s cryptographic encryptions are some of the strongest in contemporary times. However, as is the norm with technology, the reality of ‘bigger and better’ is always looming.

Bitcoin’s underlying technology – blockchain – is hailed as an unrivaled, ultra-secure technology. And it’s true – Bitcoin’s cryptographic encryptions are some of the strongest in contemporary times. However, as is the norm with technology, the reality of ‘bigger and better’ is always looming.

Bitcoin’s underlying technology – blockchain – is hailed as an unrivaled, ultra-secure technology. And it’s true – Bitcoin’s cryptographic encryptions are some of the strongest in contemporary times. However, as is the norm with technology, the reality of ‘bigger and better’ is always looming.

Quantum computers, the super-powerful computers relying on naturally occurring phenomena to perform calculations, are becoming a reality. When Google announced that it had achieved “quantum supremacy” in 2019, the blockchain and crypto universe had legit cause for concern. This is because quantum computing is sufficiently powerful to compute equations spellbindingly quickly. And for this same reason, the very encryption securing Bitcoin and other cryptocurrencies might not be so strong, at least when it comes to quantum computing.

Is the quantum threat real, though, and if so, how immediate is it? And what does the future hold for blockchain in light of the quantum threat? We’ll answer these questions in this article – right after we dig into this quantum phenomenon.

A quantum computer is any device that harnesses quantum mechanics to perform tasks. Quantum computers can achieve massive computational speeds because they rely on ‘quantum bits’ (qubits).

The regular computer uses binary units called bits to perform tasks. Bits can only represent one of two possible states at a single time: 0 or 1. However, qubits can represent both 0 and 1 states at the same time. The phenomenon is known as superposition, and it’s what allows quantum computers to perform calculations at ultra-fast rates.

Another state in quantum theory is entanglement – a state in which two members of a pair exist in the same quantum state. When two particles are entangled, a change of state in one prompts a change of state in the other, even if they are far apart from each other in physical space. Nobody knows the cause of this phenomenon, but pairing qubits this way in a quantum machine leads to exponential growth in the machine’s processing power.

Coming back to superposition – it’s an extremely hard state to achieve and just as hard to maintain. It’s an incredibly fragile state – with the slightest vibration or temperature change causing them to fall out of the superposition state. This is known as the ‘decoherence’ phenomenon. When quantum bits are ‘disturbed’ this way, they decay and eventually disappear. When this happens, the task at hand cannot be successfully completed.

To correct this, physicists use a variety of techniques to protect qubits from the outside world – like placing them in extremely cold fridges and vacuum chambers.

A quantum machine’s computational power is determined by the number of quantum bits it can leverage at the same time. The first experiments in the late 1990s yielded two qubits. These days, the most powerful computer can leverage 72 qubits. This computer is currently owned by Google.

Thanks to its superfast calculating speed, quantum computing can redefine entire industries for the better – from healthcare to finance to supply chain to transportation to weather prediction.

Blockchain and cryptocurrencies are not 100% foolproof (cue the many hacking incidents), but they remain one of the most secure technologies in modern times. People trust blockchain because of its revolutionary qualities like immutability, utter transparency, and high security.

But quantum computers are a real threat to the blockchain.

To begin with, blockchain transactions are encrypted with cryptography based on elliptic curve cryptography (ECC). But ECC is not “quantum-proof,” meaning a powerful quantum machine could potentially decrypt a crypto holder’s private keys and forge signatures. With crypto-based on trust – once that trust is broken, it could very well be the end of Bitcoin and other cryptocurrencies.

Right now, scientists are already aware of a possible algorithm that could break down many existing encryption techniques – including elliptic curve signatures. Researchers and mathematicians are already versed with how quantum machines could look like – and they worry about what that could mean for blockchain.

In fact, the general contention is that no one knows the sheer power that quantum computing could herald. It could very well exceed everyone’s expectations and render blockchain technology obsolete.

Speaking to Forbes in October 2019, Dragos Illie, a quantum and encryption researcher at Imperial College London, said it would take at least 1500 qubits to have any effect on Bitcoin and other cryptocurrencies.

Going by achievements in quantum physics, it would take even decades before we can reach that milestone. As previously mentioned, the largest quantum machine has 72 qubits.

What do Researchers Say?

Researchers from the Russian Quantum Centre have noted that one of blockchain’s weaknesses is that it relies on one-way mathematical functions that are easy to run but difficult to run in reverse. These formulas are used to generate digital signatures as well as verify transactions.

A bad actor armed with a quantum device could perform these reverse calculations in a matter of seconds. They could also forge transaction signatures, impersonate crypto holders, and gain access to their wallets. Such an actor could also very easily meddle with the mining process. They could commandeer the public ledger and manipulate records.

The researchers suggested developing countermeasures to this threat immediately. One solution would be replacing the current digital signatures with “quantum-safe” cryptography. This cryptography would conceivably be able to withstand attacks from a powerful quantum machine. Another solution would be based on quantum internet – although that’s decades away. It would entail quantum-based wireless communication architecture that would unlock new possibilities for blockchain technology.

Other quantum researchers – Del Rajan and Matt Viser from Victoria University propose leaping straight to making blockchain a quantum-based system. Their idea envisions a blockchain-based on qubits that are entangled not just in physical space – but also in time itself. They rationalize that it would be difficult for malicious actors to retroactively alter records on the blockchain – as to do this would require destroying the particle altogether. However, this would only be possible after the actualization of a quantum internet.

While researchers propose solutions that are only possible in the far future, there’s a lot of hands-on research in this field that’s already going on. Quantum experts are already developing quantum cryptography to curb the threat of quantum computing on blockchain. However, experts differ on just how immediate the quantum threat is.

For instance, Yaniv Altshuler, founder of predictive analysis Endor Protocol said to Cointelegraph, the crypto website: “Quantum computers are becoming incredibly powerful…but there is no evidence that quantum computing can compromise the blockchain.”

Stewart Allen, CEO at quantum computing firm IonQ, believes that by the time quantum computing becomes powerful enough to pose a danger to the blockchain, security algorithms will have advanced to be able to counter them:

“There is no real threat of quantum computers breaking blockchain cryptography in the short-term…We’re at least a decade from quantum computers being able to break blockchain cryptography.”

Bitcoin advocate Andreas M. Antonopoulos believes the quantum threat is grossly overstated. In a 2018 YouTube Q&A, Antonopoulos said: “We can migrate quite easily to another algorithm. It’s not really as big a threat as people think it is.”

But other experts believe the quantum threat is real and immediate.

Norbert Goffa, executive manager of on-chain data storage system – ILCoin, has concerns over quantum-based mining pools. “Today, we do not have any quantum-based mining machines. On the other hand, a lot of companies are working on quantum-based computing technology. We believe that in the next five years, it could be real…”

Rakesh Ramachandran, CEO of QBRICS, an enterprise blockchain platform, believes that quantum computing will cause a systemic shift in blockchain tech.

“Quantum computers will be redefining cryptography…wherever there is an application of cryptography…The challenge lies in how blockchain will migrate to the new version of cryptography.”

Quantum computing is an exciting technology with the ability to compute equations super-fast – and plenty of industries are poised to benefit greatly from the technology when and if it develops. However, that same technology could be maliciously used to unravel the whole world of blockchain. Thankfully, brilliant researchers are hard at work, figuring out how to protect blockchain and cryptocurrencies from the quantum wave. In essence, there is no big cause of worry.

Introduction

Introduction

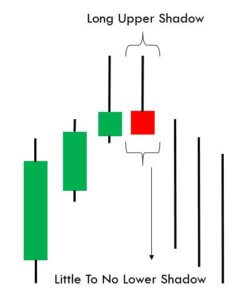

The Shooting Star is one of the most popular bearish candlestick patterns in the industry. This pattern appears in an uptrend most of the time, and it indicates bearish reversals in the price action of any underlying currency. So basically, when this pattern appears on the charts, it implies that the buyers are exhausted, and its sellers turn to lead the market. Once we have identified the Shooting Star pattern in an uptrend and confirm the trend reversal with any other credible indicator, we should look to open a short position.

This pattern has a unique structure as it consists of a small body and a high upper wick, as shown in the image below. This image accurately represents the trend reversal because we can clearly see the buyers losing momentum and sellers taking over the market.

In this strategy, we have paired the Shooting Star pattern with the Stochastic Indicator to identify the trading opportunities. Just like RSI and MACD, the Stochastic Indicator also belongs to the oscillator group. It is developed in the 1950s, and it is still widely used by the traders. The Stochastic indicator oscillates between 0 & 100 levels. When the indicator goes below 20, it means that the currency pair is oversold. Similarly, when the indicator goes above the 100 level, it indicates that the currency pair is overbought.

Once you find the Shooting Star pattern, the next step is to check the Stochastic Indicator. If the indicator is giving a reversal at the oversold area, it indicates the overbought market conditions.

The image below represents the EUR/USD weekly Forex chart. In this pair, price action was held at a significant resistance area, and it prints the Shooting Star pattern. Also, the Stochastic indicates the overbought conditions. These three clues clearly say that this pair is all set to change its direction. The Stochastic pattern on a higher timeframe has very higher chances to perform. So whenever you find this pattern, and if it supports the rules of this strategy, always trade big.

A stop loss is specially designed to limit the loss of the trader. So before activating your trade, it is essential to decide where you are going to place the stop loss. In the example above, we put the stop loss just above the Shooting Star candle.

Shooting Star pattern indicates the reversal in price action. This means that we are catching the top of the trend. As the end goal of every trader is to maximize their profits and minimize losses, always try to hold the positions for more extended targets.

In the example, we have closed our position at a higher timeframe support area. We can use the higher timeframe support or look for the Stochastic Indicator to reach the oversold area. Another way to close the position is when the market reaches the major support area while the Stochastic is in the oversold area.

As we can see in the image below, we closed our full position at a significant support area. You can use the Stochastic or any other trading tool to exit your position, but we always suggest to use the considerable support/resistance area to book profits.

In this strategy, we have paired the Shooting Star pattern with the Awesome Oscillator to identify the trading opportunities. The Awesome Oscillator is a boundless indicator. When the Awesome Oscillator reverses below the zero-level, it indicates the buying pressure. When it reverses above the zero-level, it means sellers are ready to lead the market. Furthermore, some traders use this indicator to confirm the strength of the trend. When the indicator goes above zero-level, it means the buying trend is quite strong, and when it goes below the zero-level, it shows the sellers dominating the market.

Once we find the Shooting Star pattern, the next step is to take a sell-entry when the Awesome Oscillator reverses at overbought market conditions.

The image below is the EURUSD 240 chart. On this pair, at first, the buyers were quite weak, and they started holding at the resistance area. Furthermore, in that small range, price action turned sideways, and it printed the Shooting Star pattern. The Awesome Oscillator even reversed at the overbought conditions. Both of the trading tools are indicating the exhaustion of the buyers. And sellers are ready to take over the market.

Every trader has different expectations from the market, some like to trade short term trends, and some like to trade longer-term moves. If you are an intraday trader, then we suggest you close your position when the Awesome Oscillator reverses at the oversold area. But, if you are a swing trader or investor, wait for the opposite pattern (Hammer Pattern) to appear to close all of your positions. We can even use the higher timeframe support/resistance area to close our positions.

We advise you to place the stop-loss order above the Shooting Star pattern. As you can see in the image below, we booked full profits at the major support area. After that, the price action dropped a bit more but reversed immediately to follow the buy direction. It is important not to ignore the higher timeframe support/resistance areas.

At first, we see the buyers enjoying the uptrend as the price of the currency keeps printing brand new higher high. As this euphoric moment begins to set in, the sellers start to sell their positions at higher prices. Now the buyers get panicked, and even they start to sell their positions. Now that the buyers and sellers are both selling their positions, panic is created in the market, which leads to a sharp reversal in price action. Thus a long wicked small body candle appears on the trading charts.

Keep in mind that the Shooting Star pattern is more reliable when it is formed after the three consecutive bullish candles. It creates strong bullish pressure on the price chart, and in such cases, the upper wick of Shooting Star is even longer. It indicates that the price is about to reverse with even more strength.

The Shooting Star is a single candle pattern, and it is the most popular trend reversal pattern in the industry. There is a strong psychological pattern that exists beyond the Shooting Star pattern. When the market is in an uptrend, and when buyers gain exponential strength, most of the traders book the profit, and as a result, the bullish trend loses its strength. This results in sellers sending the price down. Most of the time, the Shooting Star pattern provides the 3:1 risk-reward ratio trades.

We hope you find this article informative. Please let us know if you have any questions regarding the same in the comments below. Cheers!

https://youtu.be/hnNdfQFM_vs

https://youtu.be/hnNdfQFM_vs

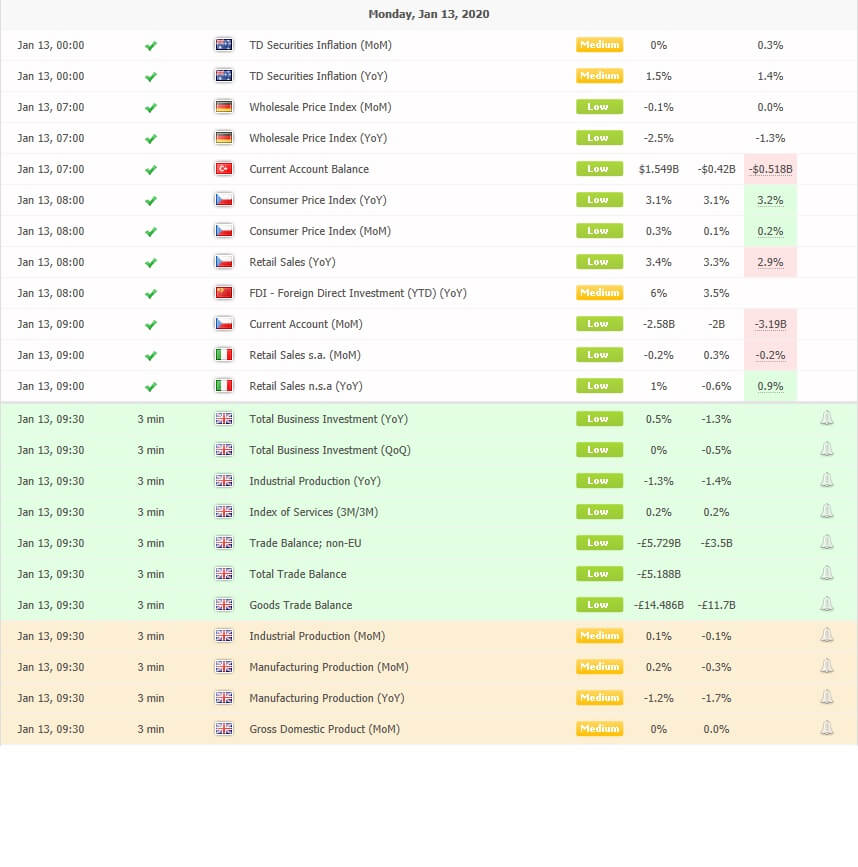

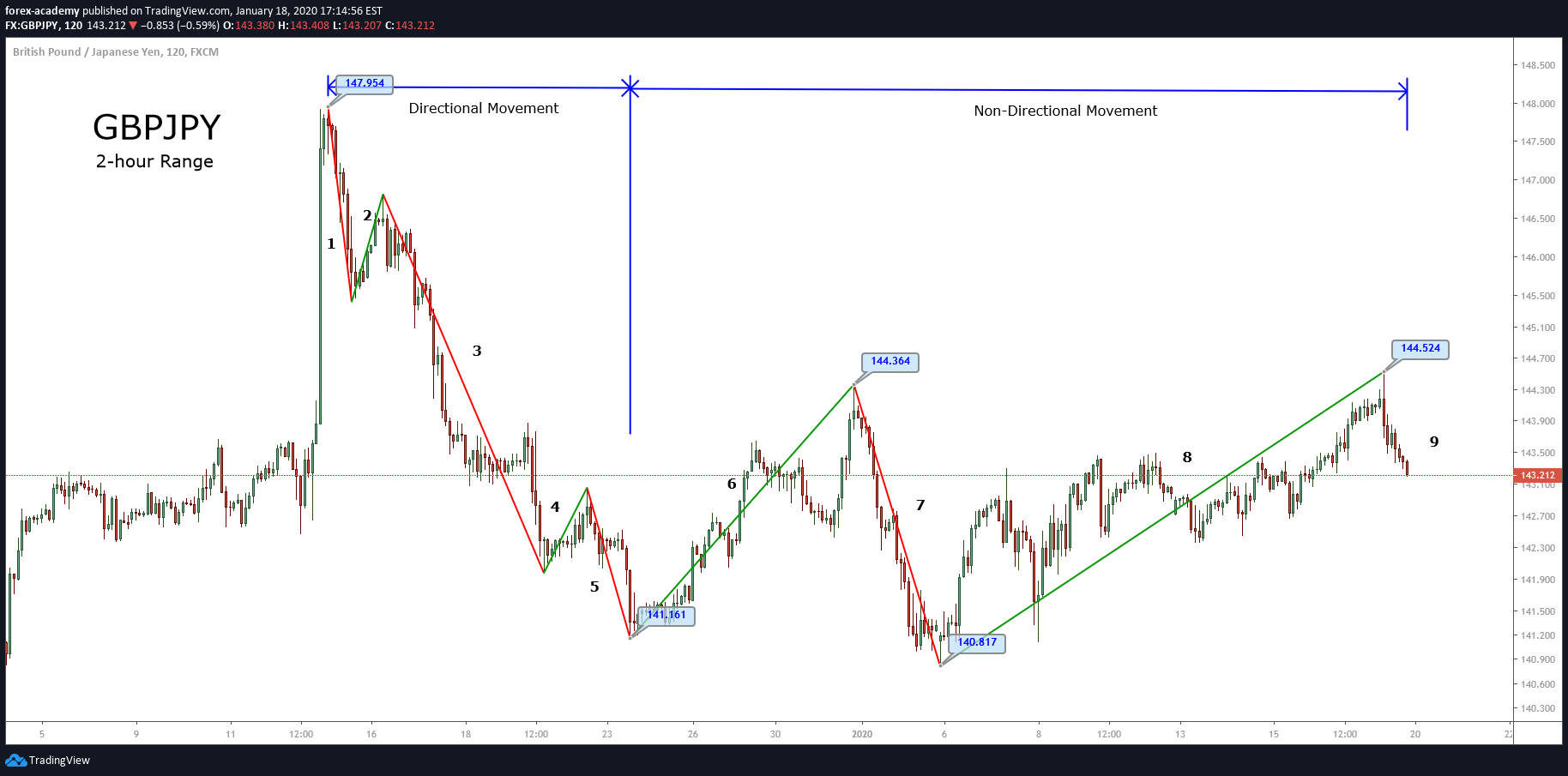

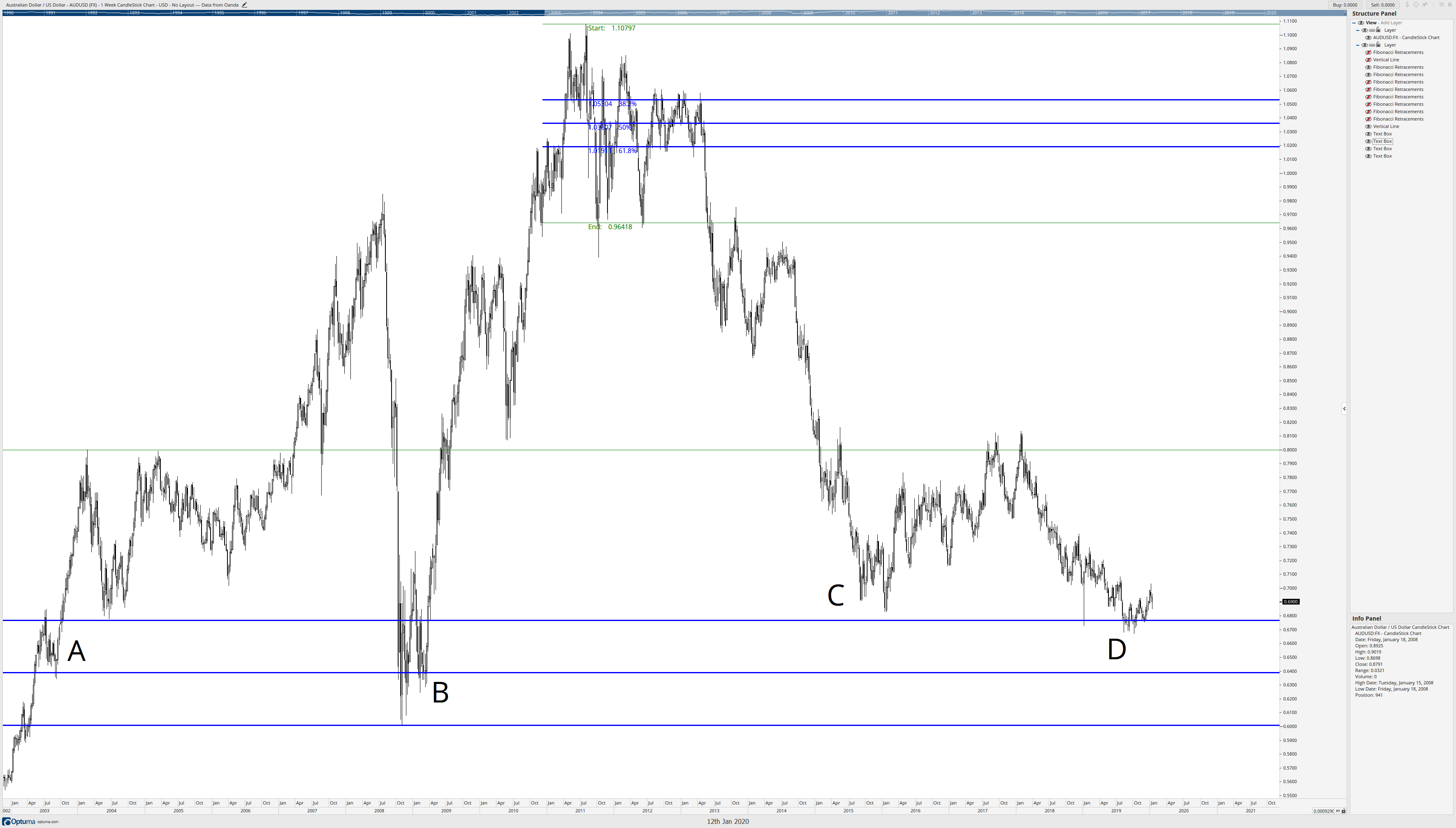

Professional traders plan ahead, and so should you too. Whether you are an institutional trader with a long-term view you or an intraday retail Forex trader looking to scalp a few pics here and there. It is absolutely necessary that you plan in advance by looking at your economic calendar in order that you do not inadvertently trade at times of potential increased volatility.

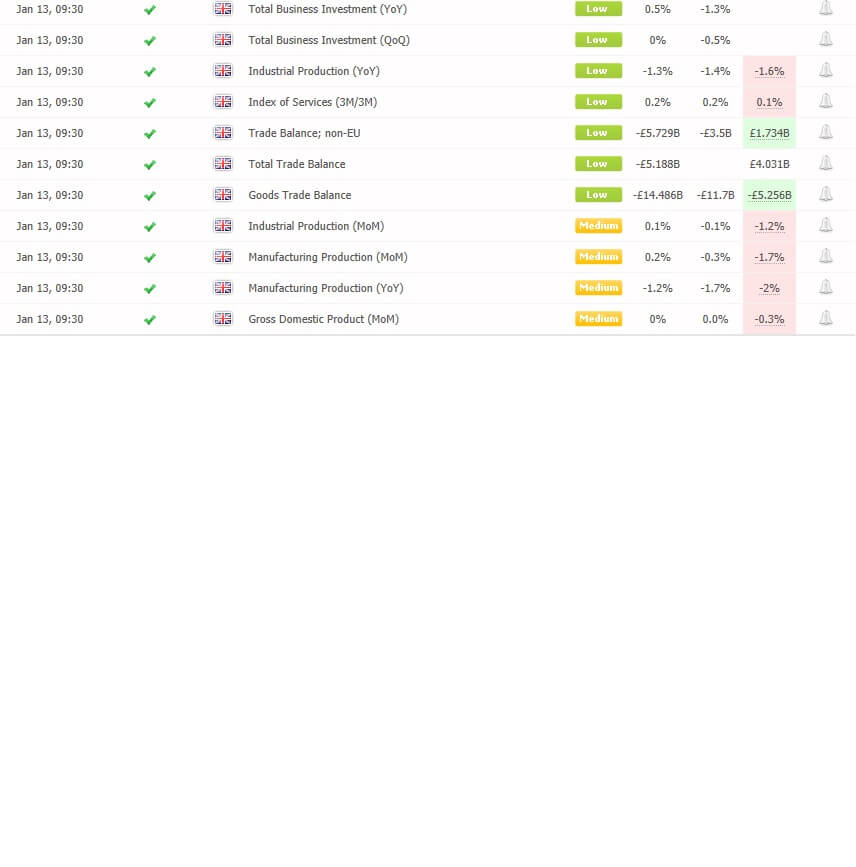

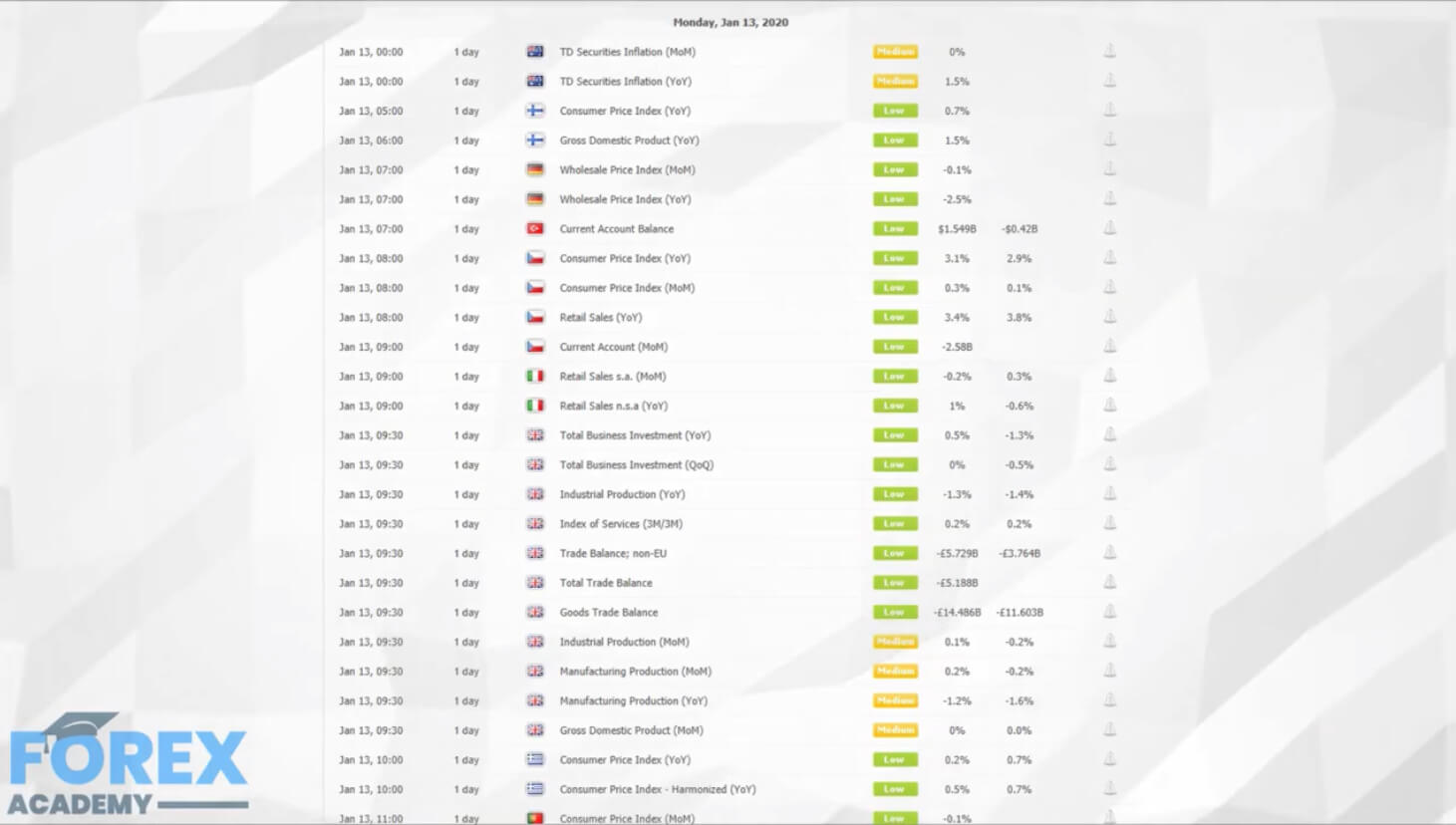

Example A

In example A, on Monday 13th January 2020, we can see from our economic calendar that there is a slew of data pertaining to the British economy, which due to be released into the market at 9:30 a.m. GMT. The data is considered to be low to medium in importance and covers things such as total business investment year on year, the trade balance and industrial production month on month, which is of medium important and gross domestic product, month on month, which is also of medium importance.

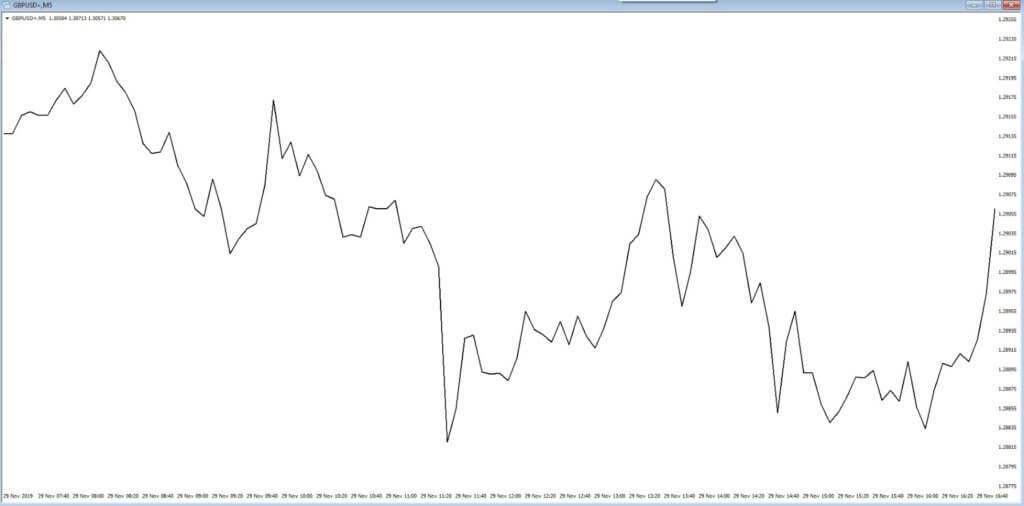

Example B

In example B, which is a 1-hour chart of the GBPUSD pair, we can see that there has been a sell-off in the pair in the run-up to these figures being released. This is somewhat due to the fact that in the last few days, the Bank of England has been quite dovish regarding future growth for the British economy this year, plus strong hints that they may reduce interest rates by a half a point by the end of the year. Therefore traders are on the back foot while expecting that the British economy will continue to slow down and they will be sensitive to any data releases that point too to a weakening in the economy, which will provide further ammunition for policymakers in the Bank of England to reduce interest rates in the United Kingdom.

Example C

In example C, of our economic calendar, just a moment after the data has been released, we can see that the figures across the board are largely worse than expected, with the most important figure; which is the gross domestic product – month-on-month – showing a worse than expected decline of – 0.3%.

Example D

In example D, we have returned to our 1-hour chart of the GBPUSD, and we can see that there was a further spike lower in the pair post announcement of the economic data release.

However, we often find in the forex market, that institutional traders will have anticipated that the market data may have been worse than expected. And in some circumstances, even though the economic data release is bad for the economy, it might be perceived by traders as not being as bad as expected.

If we stick with this example for one moment, we can see that the overall trend has been to the downside with this pair. Therefore, new traders should be on their guard, because the pair may have bottomed out, even though there was bad data, and set for a reversal in price action. And this is one of the dangers when it comes to trading around economic data releases.

Example E

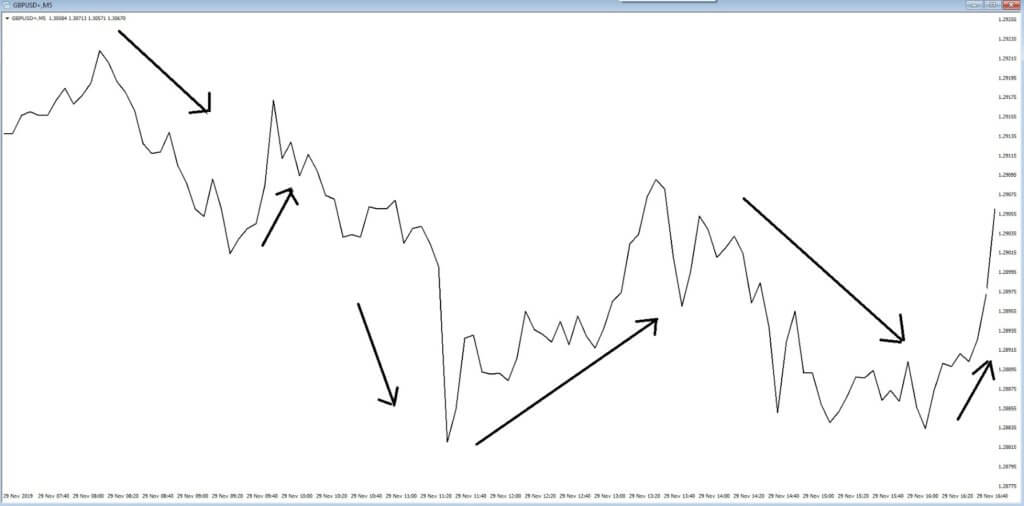

In example E, we return just 4 hours later to our hourly chart of the GBPUSD pair, and we can see that indeed price action had bottomed out because traders had anticipated that all the bad news was already in the price, and they decided to buy the pair.

In part 3, we will be looking at different types of economic indicators and their importance to the financial markets.

https://youtu.be/wCsg8rbHw6Q

https://youtu.be/wCsg8rbHw6Q

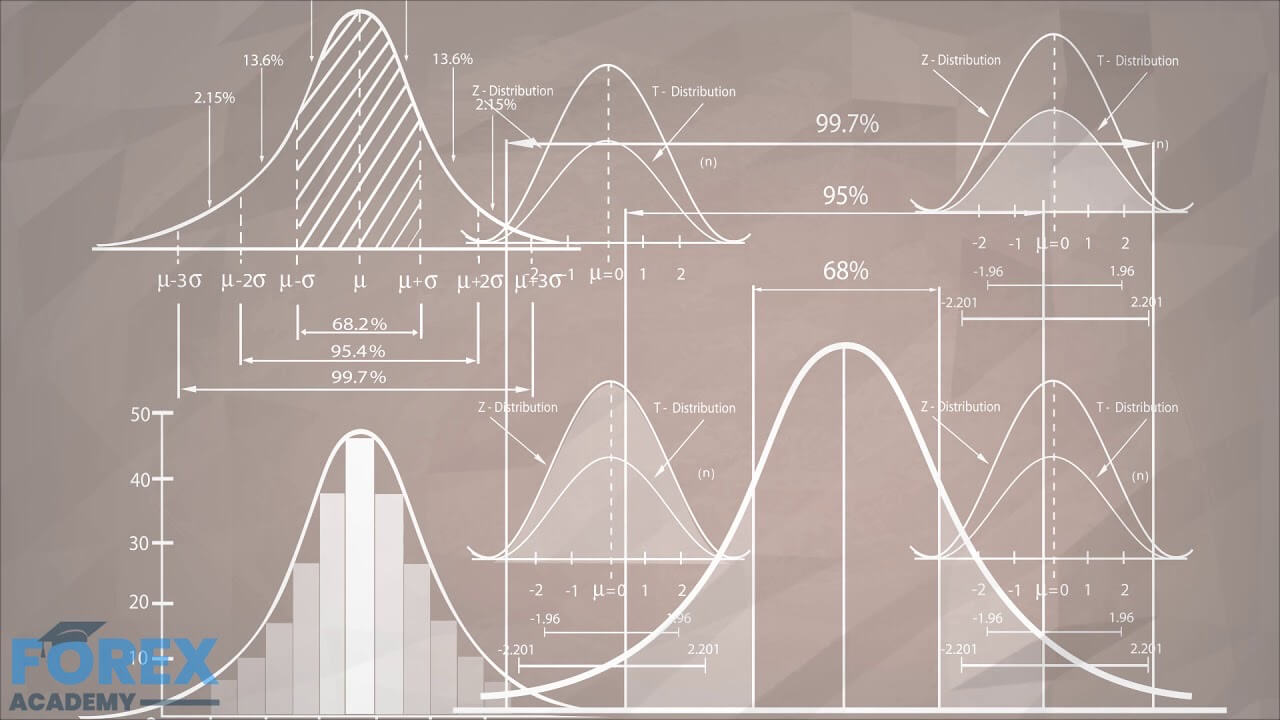

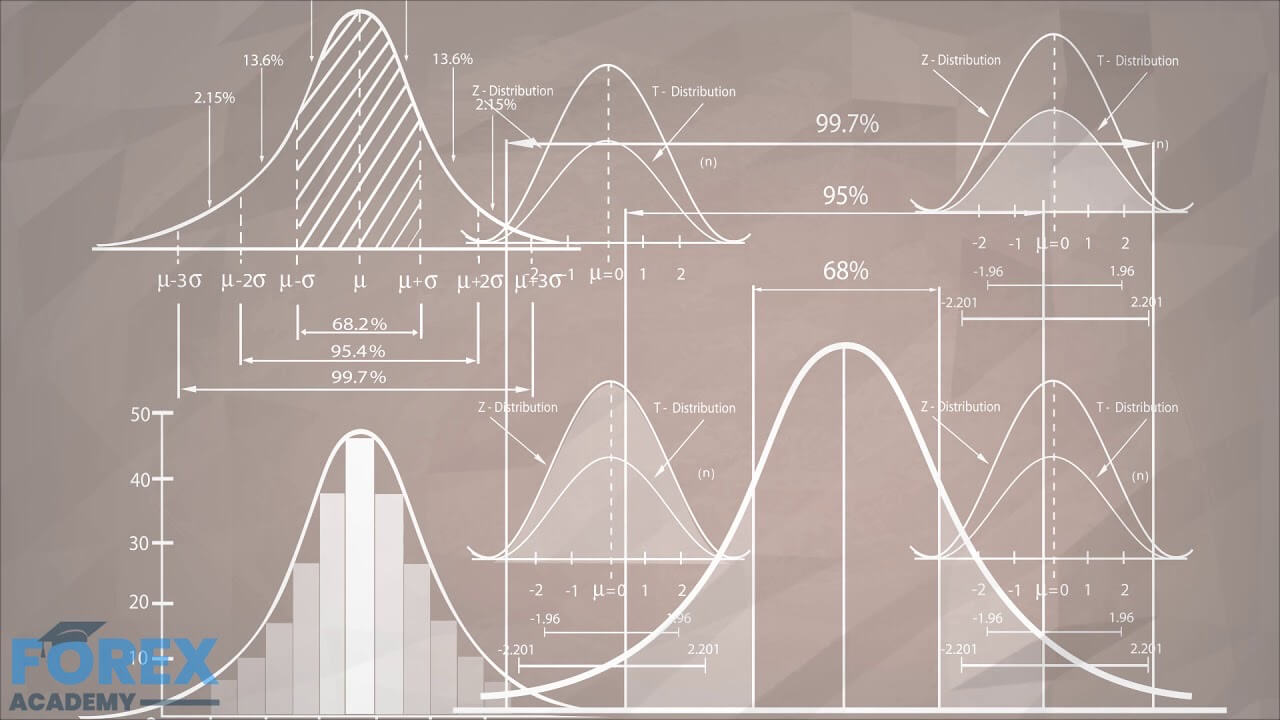

To determine if something is good or just a product of randomness is not easy. The pharma industry spends years and costly double-blind studies to determine if a new chemical compound is better than a placebo (distilled water, or just a pill of sugar). This kind of evidence is needed because, as we have seen, almost nothing is sure in mother nature.

Taking the example of the pharma industry, to assess the properties of the new drug, scientists basically create two data sets. One dataset contains all the data measurements of the specimens taking the placebo and another dataset recording the same data of the specimens being administered the drug. So they end up with two groups, and, basically, they want to know if both groups belong to the same statistical distribution or from a different one. The statistical test to do this analysis is called the T-Test.

A T-test allows us to compare the average values of the two data sets and determine if they came from the same population. In the case of Pharma, the placebo group is the equivalent of a random sample with a zero mean, and scientists apply the T-Test to see if the average parameters of the group treated with the drug are similar or different from the placebo group. In the case of a trading system, we would like to know how far is the trading system away from a random trading system. The T-Test will answer not just the question of whether the system or strategy has the edge over a random pick, but it enables us to qualify and rank systems.

For a T-Test to be valid, we need to ensure several details! Scales of measurement must be standardized in both data sets. That means, the collection of the data should be standardized with one unit of trade, and preferably also using units of a standard Risk as a description of profits and losses.

The data collected is representative of the system. That means the data should be collected under all possible conditions the system will experience. The number of samples must be as large as feasible, and to comply with point 2 from a large historical database to account for every possible market situation: Bull, bear, sideways with low, mid and high volatility.

The standard deviation on both samples – random and strategy – should be similar. Making sure point 1 is guaranteed, point 4 is also insured.

The basic formula for when the size of both groups is equal:

t = (m1 — m2) / (σ / √N )

where m1 and m2 are the averages of the two groups and sigma σ is the standard deviation of the samples (assuming equal sigma on both)

if m2 is zero (random) the formula simplifies to:

Q = m / (σ / √N )

Where we have changed the t letter for Q, meaning quality, therefore knowing the average m and standard deviation sigma (σ) of a trading system, we can compute its quality Q.

We can look at m as the signal of our system

And σ / √N as the nose of the system.

Therefore, to maximize Q, we need to make m large and the denominator σ / √N as small as possible.

Qualifying trading systems.

From the Q equation, we can see that the denominator σ / √N is the ratio of the standard deviation and the square root of N, the number of trades. This makes it hard to compare systems with a different number of trades since it will make substantially better the same trade system as the number of samples grows.

SQN

Dr. Van K Tharp came with the idea of capping N the trade number to 100, even when the test is made with a large sample number. This way, we can compute m, the mean with all available data, but cut N to 100 to calculate the Q metric. That formula modification is called SQN, or System Quality Number.

SQN is

Q = m / (σ / √N ) when the sample size N is below 100 and

Q = m / (σ / 10 ) when the sample size N exceeds 100.

The SQN reveals if the system is worth trading. Systems below 1 are hard to trade because it presents a noise figure higher than the signal. That will create lots of doubts on a trader because, on multiple occasions, the system will underperform. An SQN of 1.5 is a very decent system, that can be traded with discipline. Systems beyond 2 are sound. If by chance, you end up with a system with SQN greater than 3, you’re a lucky fellow. Please call and share it with us.

The next release will explain how to make use of the SQN to assess the health of the markets.

Introduction

Introduction

AUD/NZD is derived from the full-form of the currency pair, the Australian dollar, and the New Zealand dollar. It comes under the classification of cross currency pairs. In this pair, AUD is the base currency, and NZD is the quote currency.

The value of AUD/NZD depicts the value of NZD that is equivalent to AUD. It is simply quoted as 1 AUD per X NZD. For example, if the current value of this pair is 1.0405, then these many New Zealand dollars are needed to purchase one Australian dollar.

Spreads are a typical way through which brokers make money. The pip difference between the bid price and the ask price is their profit margin, which is referred to as the spread. It varies from the type of account model.

ECN: 0.9 | STP: 1.8

The fee is basically the commission on a trade levied by the broker on each trade. Again, it varies from the type of account model.

Fee on STP = 0

Fee on ECN = 6 to 10 pips (starts from as low as one pip)

The slippage is the difference between the broker’s executed price and the trader’s execution price. There is this variation as the order is executed using market execution. There are two reasons for slippage to take place.

Assessing the profit/risk is a great add-on to one’s trading analysis. With this, the trader can know how long he must before his trade performs. And below is the table that enables the analysis of it.

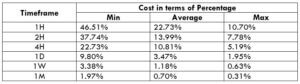

This is one great application of the above table. By combining these values with the total cost of trade, one can determine variations in the costs by varying the parameters like volatility and timeframe.

Spread = 0.9 | Slippage = 2 |Trading fee = 1

Total cost = Slippage + Spread + Trading Fee = 2 + 0.9 + 1 = 3.9

Spread = 1.8 | Slippage = 2 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 2 + 1.8 + 0 = 3.8

The Ideal way to trade the AUD/NZD

The Ideal way to trade the AUD/NZDBefore getting into finding the best way to trade this pair, let us comprehend what the above table has got to say.

The higher the magnitude of the percentages, the higher is the cost on the trade for that particular volatility and timeframe. The min column represents low volatility, and the max column represents high volatility.

It can clearly be ascertained from the table that the percentages are comparatively higher on the min column and lower on the max column. This means that the costs are high when volatility is low and vice versa.

But, it is not ideal to trade in neither of the two situations mentioned below.

When the volatility is high -> because of the risk involved When the volatility is low -> because the costs are high

Now, to maintain a balance between all the parameters, it is best to trade when the pip movement is around the average values.

Furthermore, another simple way to reduce cost is by trading using a pending/limit order instead of market orders, as it will nullify the slippage on the trade. And this, in turn, will reduce the total cost of the trade as well.

The Forex market is open from Monday to Friday. Since Friday is the last day of the week, traders may need to look after their trade more. To be precise, they may need to close their intraday trades manually. In today’s lesson, we are going to demonstrate an example of this.

The Forex market is open from Monday to Friday. Since Friday is the last day of the week, traders may need to look after their trade more. To be precise, they may need to close their intraday trades manually. In today’s lesson, we are going to demonstrate an example of this.

The Forex market is open from Monday to Friday. Since Friday is the last day of the week, traders may need to look after their trade more. To be precise, they may need to close their intraday trades manually. In today’s lesson, we are going to demonstrate an example of this.

This is an H1 chart. The price after being bearish has been trapped within a rectangle. It could make a breakout either side. However, the last candle suggests that the price is bearish biased. It closes within the level of previous swing low. If the price makes a bearish breakout, the sellers may trigger a short entry upon the breakout confirmation. Let us proceed to the next chart.

The price action produces an inside bar. As we know, an inside bar is a relatively weak reversal candle. It may push the price towards the North; however, if a bearish candle breaches the level of support, the sellers may get ready to go short on the pair.

The last candle breaches the level of support. It is not an explicit breakout. Nevertheless, the candle closes below the level. If the next candle closes well below the breakout candle, the sellers may trigger a short entry by setting the Stop Loss above the trend-initiating candle.

Yes, the next candle closes well below the breakout candle. The sellers may trigger a short entry right after the last candle closes. Usually, the take profit level is to be set with a 1:1 risk-reward ratio on the H1 breakout strategy. Do not forget that it is Friday. It is an essential factor to remember while trading in the H1 breakout trading strategy.

The last candle gets us some green pips. It looks good now. Most probably, it is going to get us the reward, which it usually does. We must wait and hold the position.

We have been waiting for long. The price has been on strong consolidation. It is still to travel more to hit the Take Profit. As mentioned, it is Friday. The market is about to close (within 2 hours). Usually, most of the pairs get sluggish before the market closes on Friday. On Monday, many pairs start trading with a gap. There is no point holding H1 breakout positions during the weekend. Thus, we may close the trade manually and be happy with half the profit of our expectations.

https://youtu.be/i_AO21esRws

https://youtu.be/i_AO21esRws

Trading any asset in the financial markets is complicated, and there are simply no shortcuts to becoming a successful trader, it all comes down to education. One of the biggest mistakes that new traders make is to learn about technical analysis without also learning about fundamental analysis, which is just as critical, if not more so. Fundamental analysis is the study of the macroeconomics pertaining to a particular country. It measures its wealth, and in the Forex market, a country’s wealth will determine what its currency exchange rate value is against other countries’ exchange rates.

Fundamental analysis is expressed in the markets by way of economic indicators, which are released by why governments, and non-profit organizations, which monitor economic activity within a country on a regular basis. Economic indicators are in levels of importance attached to each data point where risk rises from low, medium, to high. They can be leading indicators, which tend to precede trends, lagging, which might confirm trends, or coincident, which means the current state of an economy.

Leading indicators include consumer durables and share prices. Coincident indicators include GDP, employment levels, and retail sales. And lagging indicators include the gross national product (GNP), CPI, unemployment rates and interest rates, Once collated, and calculated, the economic information is released and is usually subject to a time embargo, and this typically happens once a month at a set time and day of the week. These are then updated each month, quarter, and each year. Economic indicators are segregated into groups. The higher the rise, the more the likelihood of increased market volatility post-release. More importantly, the release of such data allows traders and investors to understand the current and future economic position of a country and to plan in advance and adjust their portfolios or positions as appropriate.

Once economic indicators are updated, financial policymakers within a country can use the data on how to change policy. Therefore information which may suggest that an economy is overheating, or has as inflation which is below or above government targets, can be critical to policymakers may be forced to make adjustments and therefore perfect a currency exchange rate. Traders will be looking out for such data in order to try and predict if major policy decisions such as interest rate changes could be about to happen in order to adjust their portfolios accordingly. Traders are strongly advised to have access to a reliable economic calendar and refer to it on a regular basis in order to not to get caught out by events such as these. Decent calendars are freely available, and offer a breakdown of economic releases times and will also include things such as expected speeches from political and economic leaders. See example A.

In part 2, we will be looking at how professional traders plan ahead for forthcoming economic data releases.

Introduction

Introduction

NZDJPY, or the NZD/JPY or the New Zealand dollar against the Japanese yen, is a cross-currency pair in the Forex market. The left currency (NZD) represents the base currency, and the one the right (JPY) represents the quote currency.

The market value of NZDJPY is a value of JPY that is required to buy one NZD. It is quoted as 1 NZD per X JPY. For example, if the CMP (current market price) of NZDJPY is 72.657, then it takes 72.657 yen to buy one New Zealand dollar.

Spread is the difference between the bid price and the ask price controlled by the broker. It varies across brokers and their type of execution.

ECN: 0.8 | STP: 1.7

On every trade a trader takes, there are few pips of fee on it. And this is only on ECN accounts because the fee on STP accounts is nil.

Slippage, which happens on market orders, is the difference between the price asked by the client and the price he actually received. There are two primary reasons for it, namely, the broker’s execution speed and the change in volatility of the market.

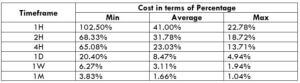

The average, minimum, and maximum pip movement is determined in the trading range table. This comprehensive table helps traders assess the profit they can generate and loss they can incur in a given timeframe. Moreover, this table is helpful in analyzing the cost variation in a trade, which shall be discussed in the next section.

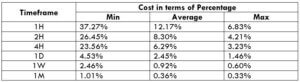

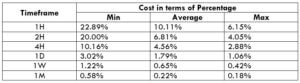

The cost of a trade is not the same throughout the trading day. It varies based on the volatility of the market. Hence, it is necessary to know during what times the cost is high and what times it is low. This could be found out from the table illustrated below.

Spread = 0.8 | Slippage = 2 |Trading fee = 1

Total cost = Slippage + Spread + Trading Fee = 2 + 0.8 + 1 = 3.8

Spread = 1.7 | Slippage = 2 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 2 + 1.7 + 0 = 3.7

The magnitude of the cost percentage is directly proportional to the cost of a trade. So, the higher the value of the percentage, the higher is the cost of a trade. From the table, it can be observed that the cost is highest in the min column compared to the other two columns. This means that the costs are highest when the volatility of the market is low and vice versa, irrespective of the timeframe you’re trading. It is neither ideal to trade when the volatility of the market is high, nor when the costs are high. The average column is on the one we focus on. Trading when the volatility is at the average value is when you can expect moderate volatility and decent costs.

Also, you may reduce your costs by trading using limit or pending orders instead of market orders. This will bring the slippage to ground zero. This, in turn, will reduce the total cost of the trade as well. An example of the same is illustrated below.

Spread = 1.7 | Slippage = 0 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 0 + 1.7 + 0 = 1.7

Hence, it is seen that the costs have reduced by around 50% of the previous value.

Introduction

Introduction

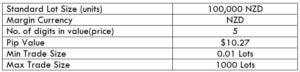

NZDCHF is a cross-currency pair in the Forex market. It is an abbreviation for the New Zealand dollar and the Swiss franc. Here, NZD is the base currency, and CHF is the quote currency.

The value of NZDCHF simply represents the units of CHF equivalent to one unit of NZD. It is quoted as 1 NZD per X CHF. For example, in the market, if the price of NZDCHF is 0.64535, then it requires those many units of CHF to buy one NZD.

The bid price and ask price in the market is typically not the same. The difference between these two prices is referred to as the spread. And this difference amount is used by the broker. It varies from the type of account model.

ECN: 1.1 | STP: 1.9

The fee is basically the commission that has to be paid on each trade you take. It varies from broker to broker and their execution type. Typically, there is no fee on STP accounts, but a few pips on ECN accounts.

Another type of fee traders have to bear is the slippage. It is the difference between the trader’s requested price and the broker’s executed price. Slippage always is changing due to the ups and downs in market volatility and the broker’s execution speed.

Many novice traders randomly take trades without determining the amount they’re going to risk. The trading range is that representation, which indirectly illustrates the risk and profit area in a trade, in a given time frame. For example, if the average pip movement on NZDCAD on the 4H timeframe is 20 pips, then the trader will be risking $205.4 in an hour on an average.

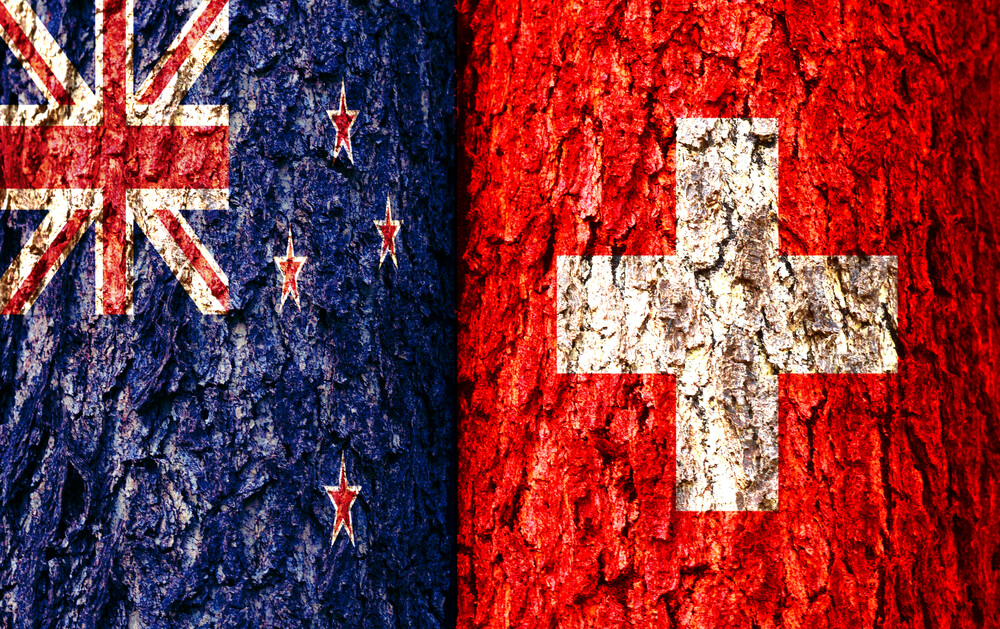

Apart from knowing the profit/loss that can be made from a trade in a given time, it is also necessary to know the cost variation in different volatilities and timeframes. Below is a table representing the cost as a percentage that is obtained by considering the volatility, timeframe, and the total cost on a trade.

Spread = 1.1 | Slippage = 2 |Trading fee = 1

Total cost = Slippage + Spread + Trading Fee = 2 + 1.1 + 1 = 4.1

Spread = 1.9 | Slippage = 2 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 2 + 1.9 + 0 = 3.9

Trading on any timeframe and during any volatility is not an efficient way of trading. There are specific times in the market when you must enter/exit. This can be determined from the above two tables. Firstly, the higher the magnitude of the percentage, the higher is the cost of a trade for that particular timeframe and volatility. It can be ascertained from the table that the costs are low for high volatilities and high for low volatilities. And neither of the two states is ideal to trade. To keep your cost affordable and volatility moderate, it is ideal to trade when the volatility is nearby the average values.

Furthermore, it is recommended to have strategies that enable the use of limit orders. Because trading with limit orders will completely cut off the slippage on the trade Nullifying it, the total cost will significantly reduce, which, in turn, will reduce the cost percentage as well. For example, it was observed that cost percentages were reduced by about 50% when the slippage was removed.

https://youtu.be/PeBr1Eq8xN4

https://youtu.be/PeBr1Eq8xN4

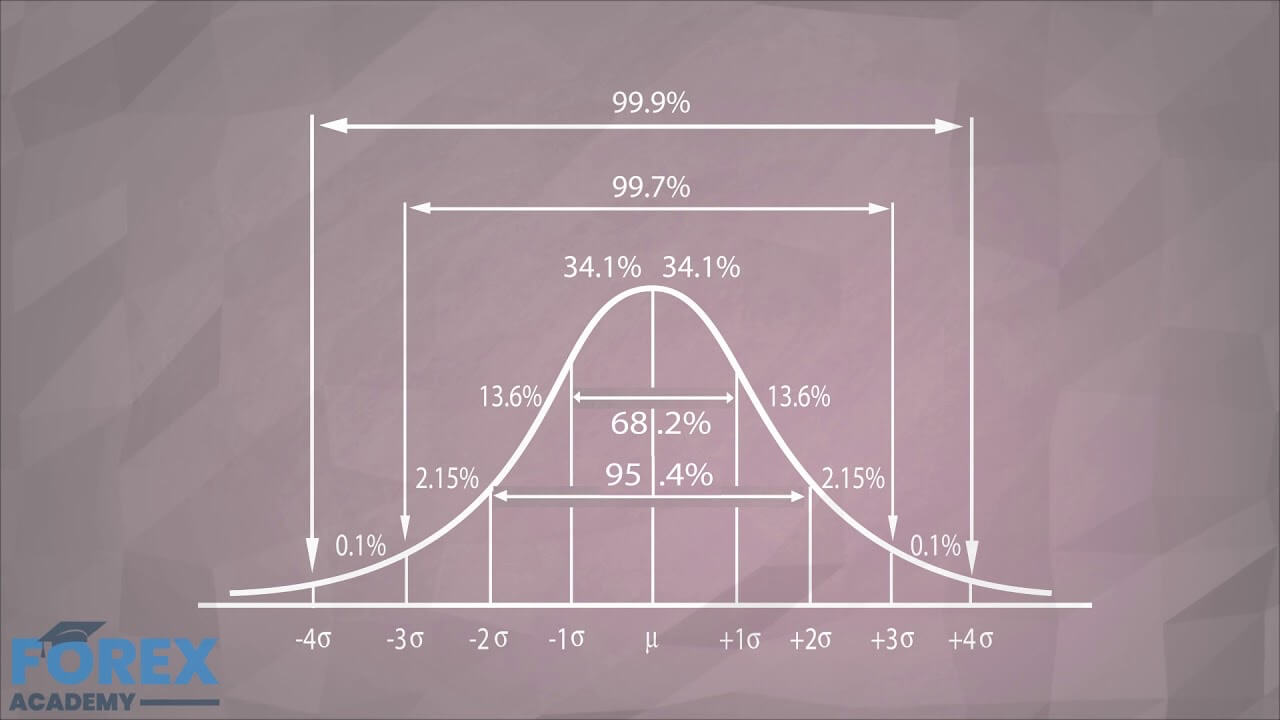

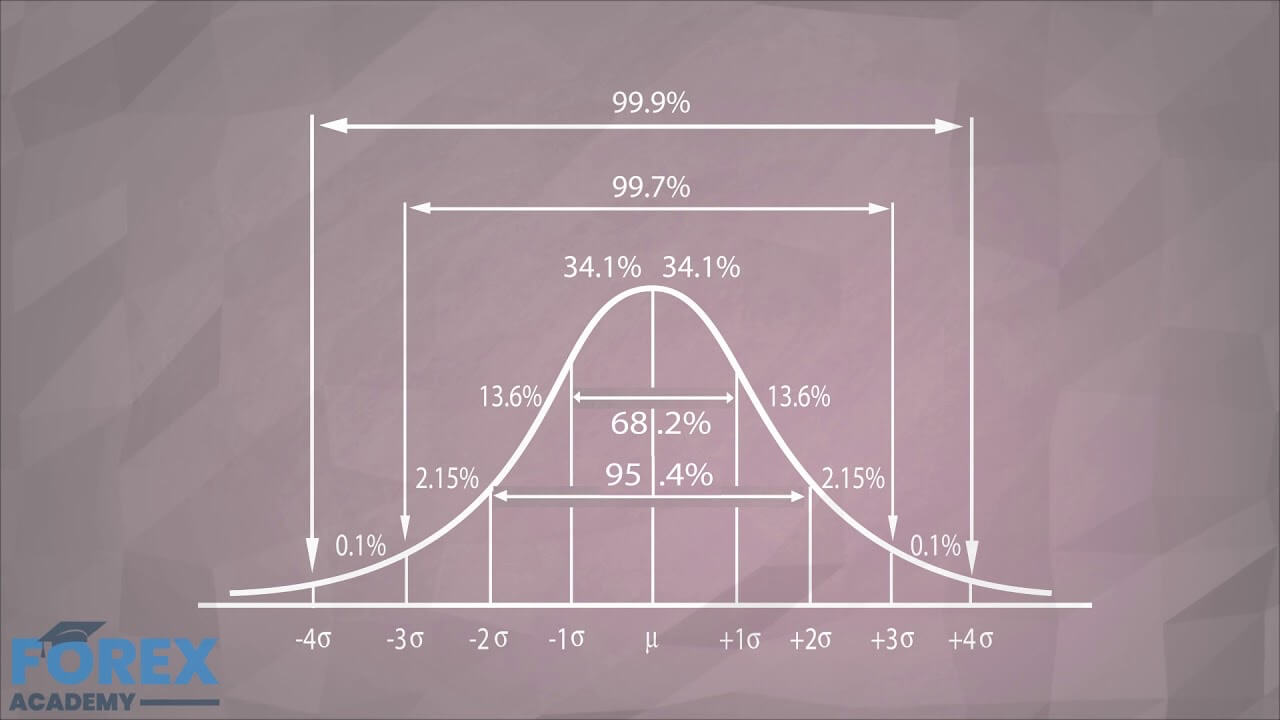

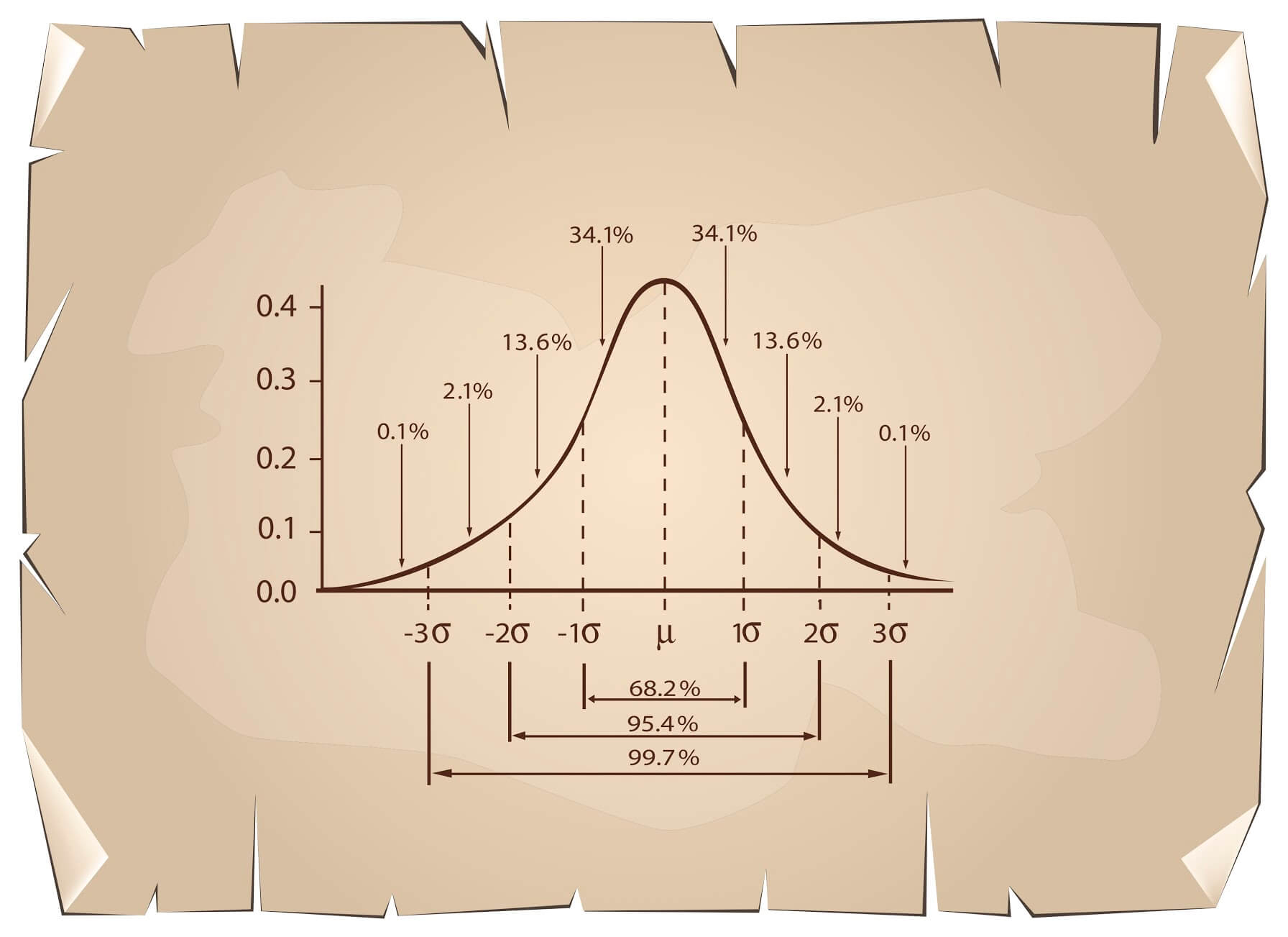

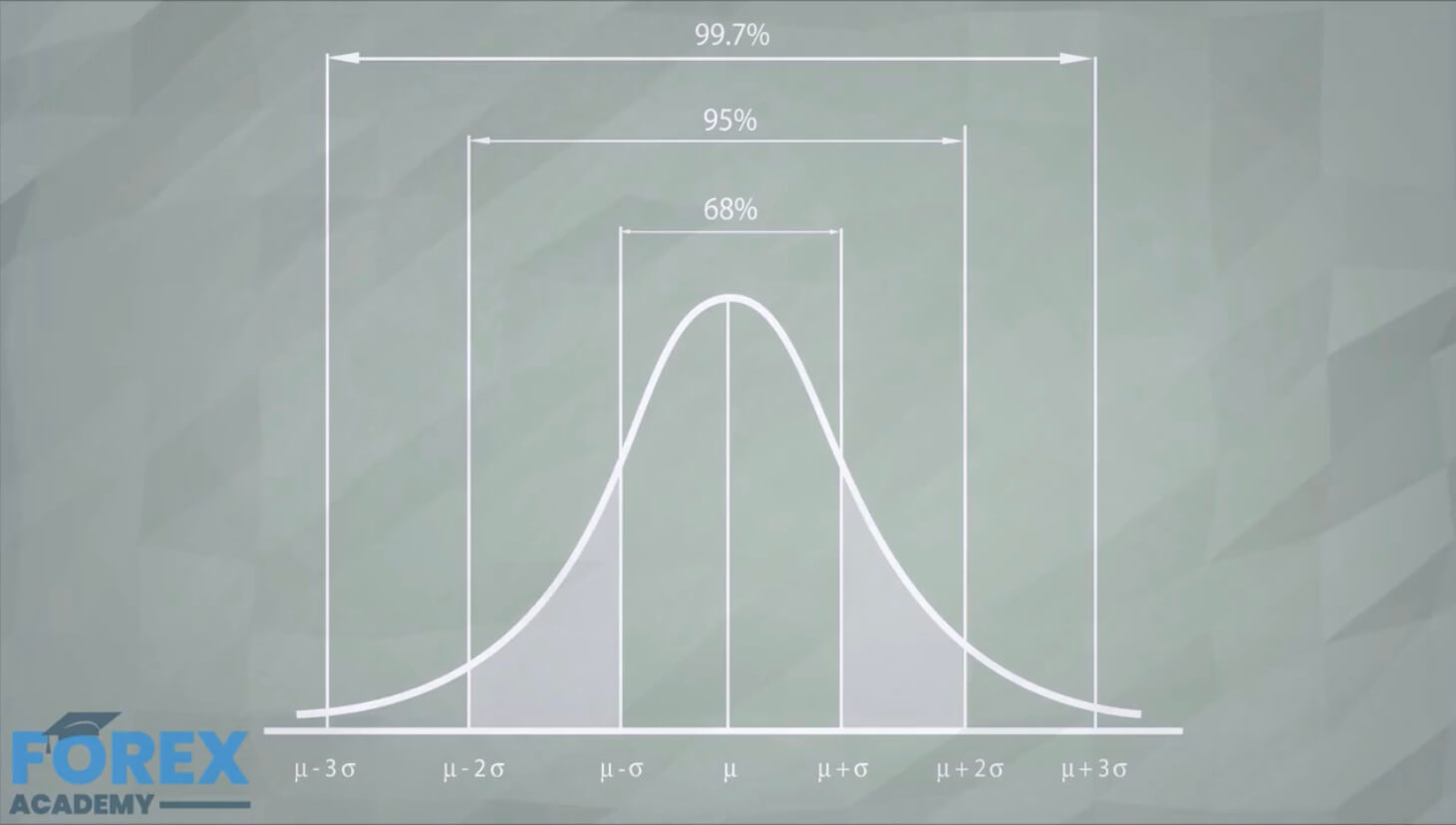

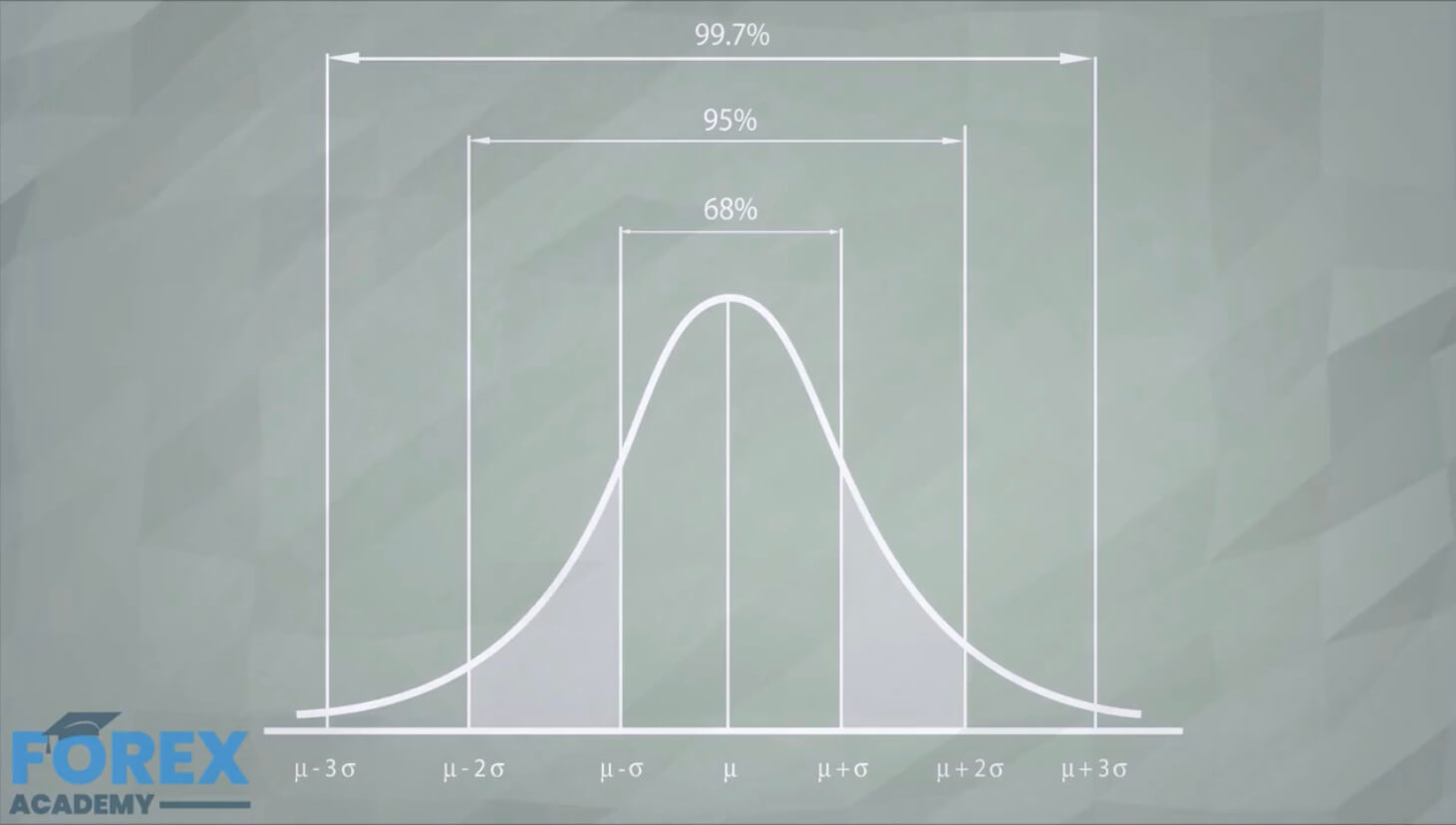

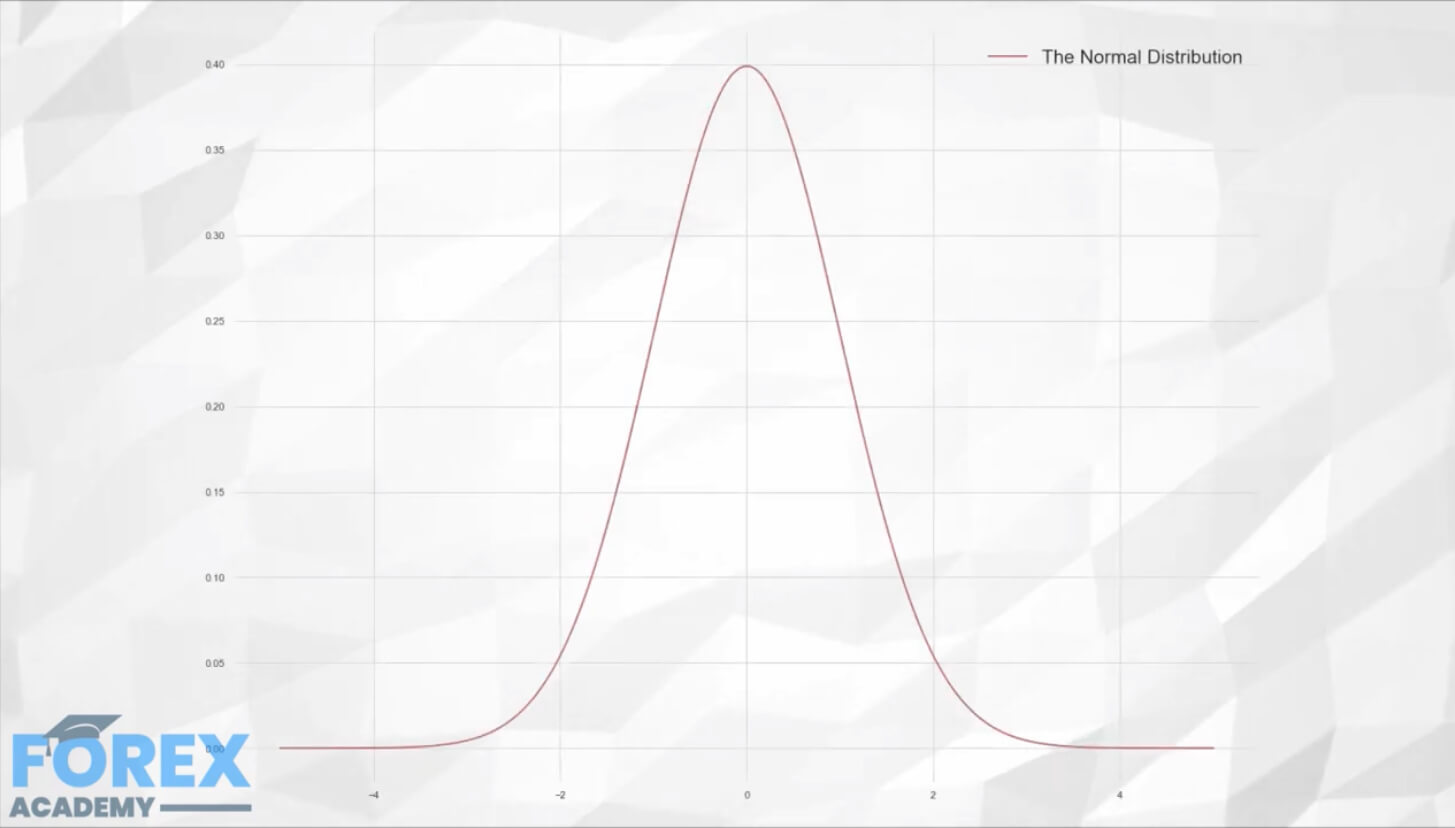

In our last episode, we discussed how to qualify turning points as a filter to validate TA signals based on the intrinsic statistical properties of the Normal Distribution.

In this video, we will continue developing ideas to improve the chances of success in Forex and Crypto trading.

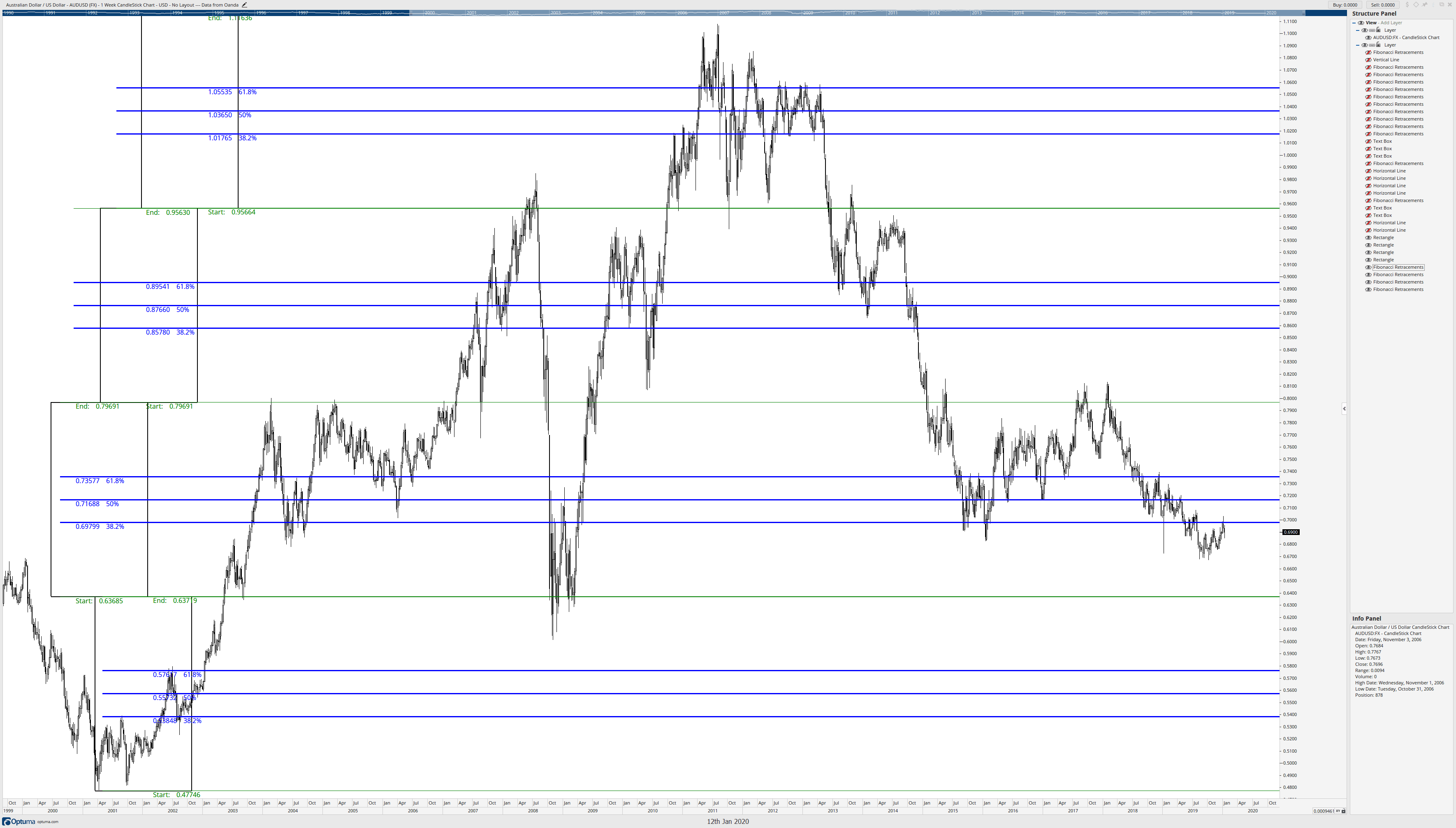

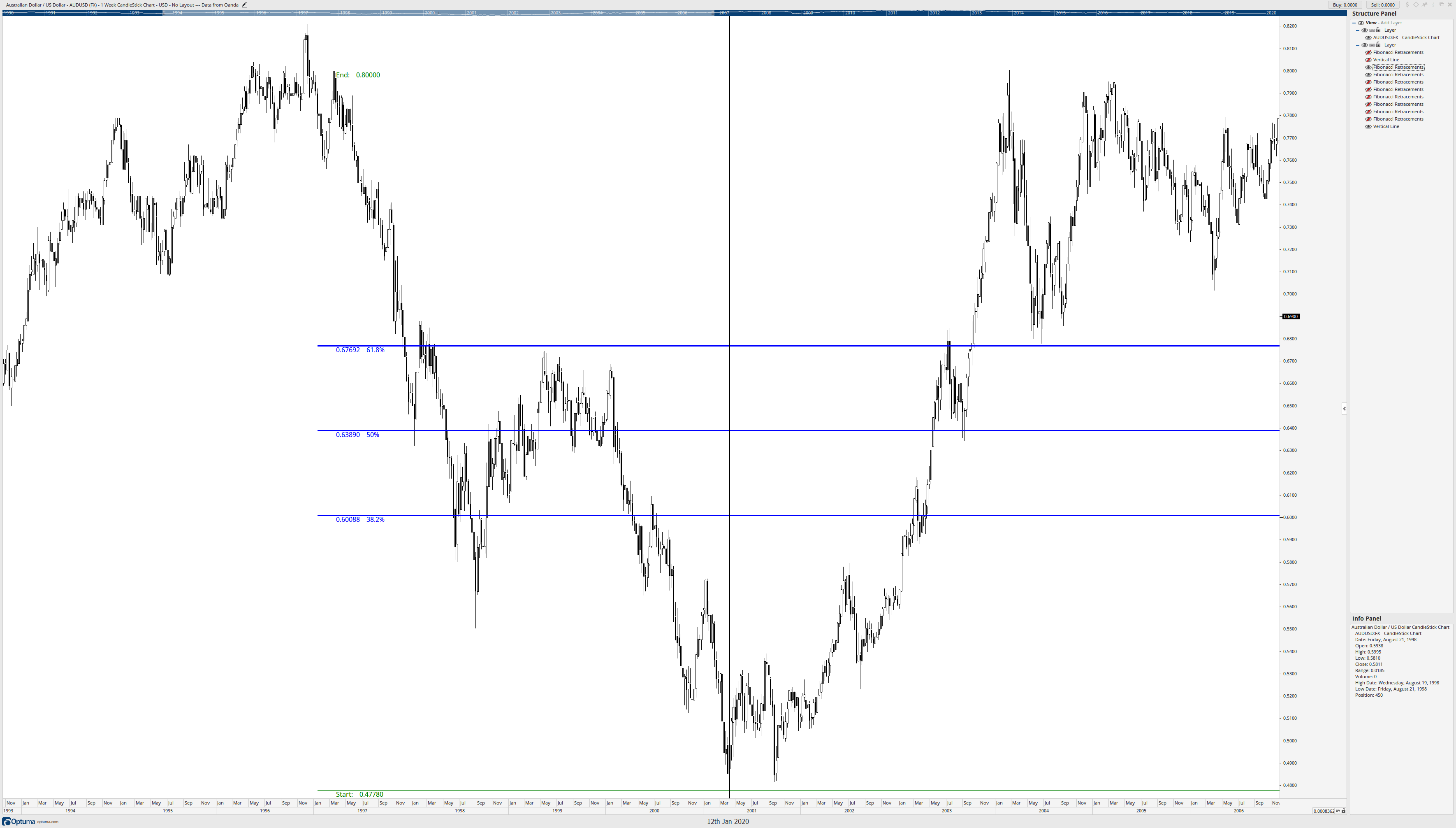

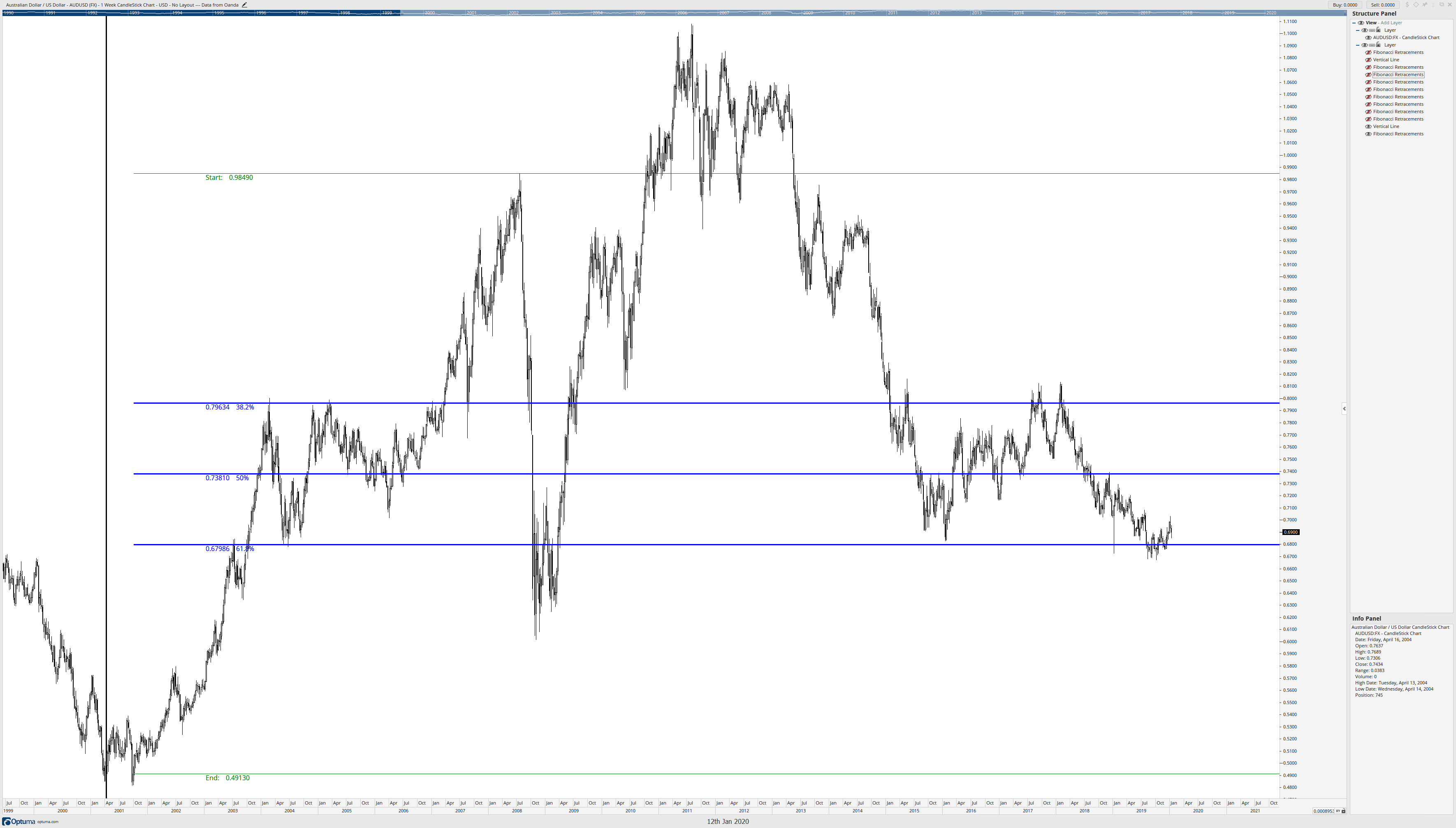

Better Fibonacci Retracements and Extensions

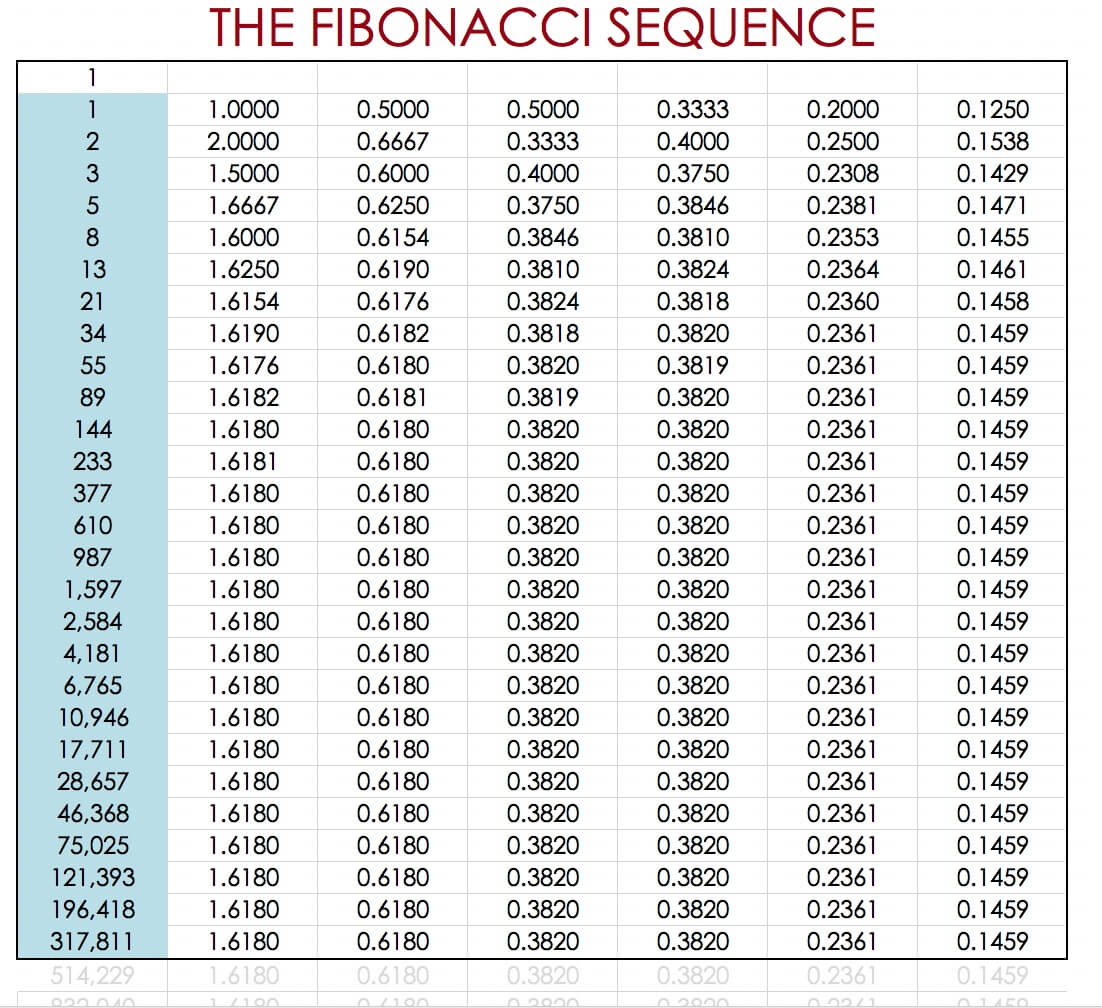

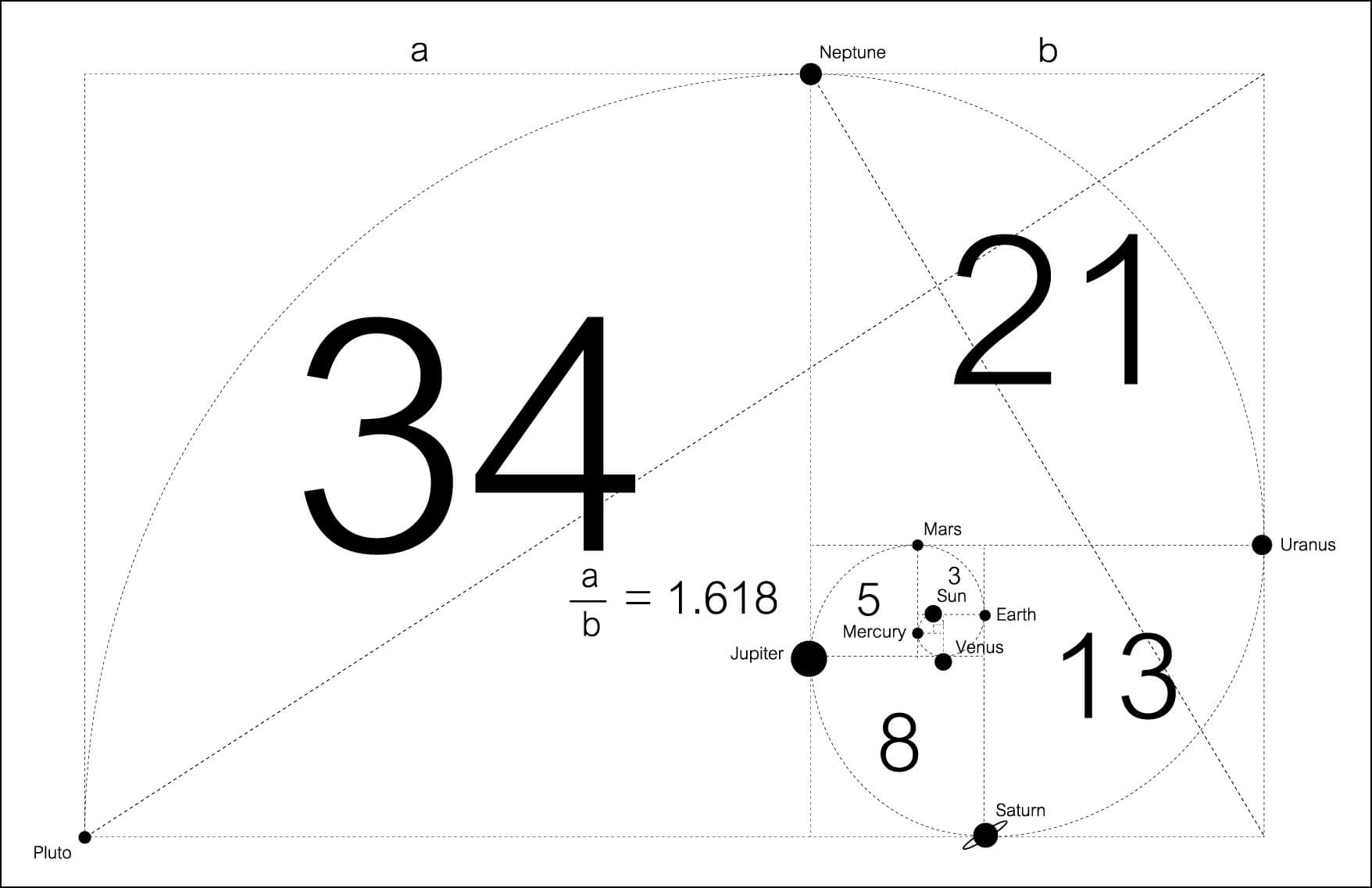

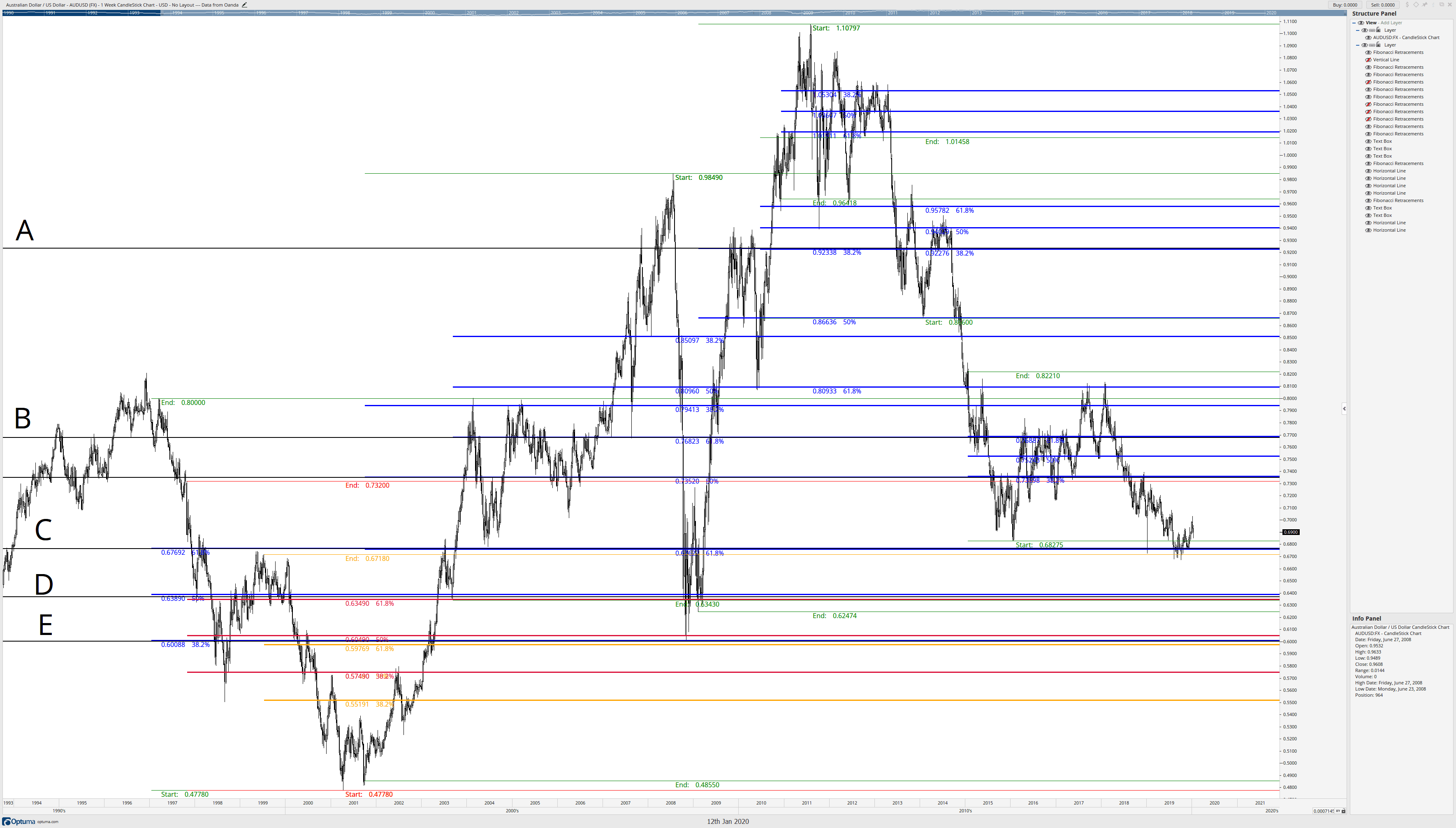

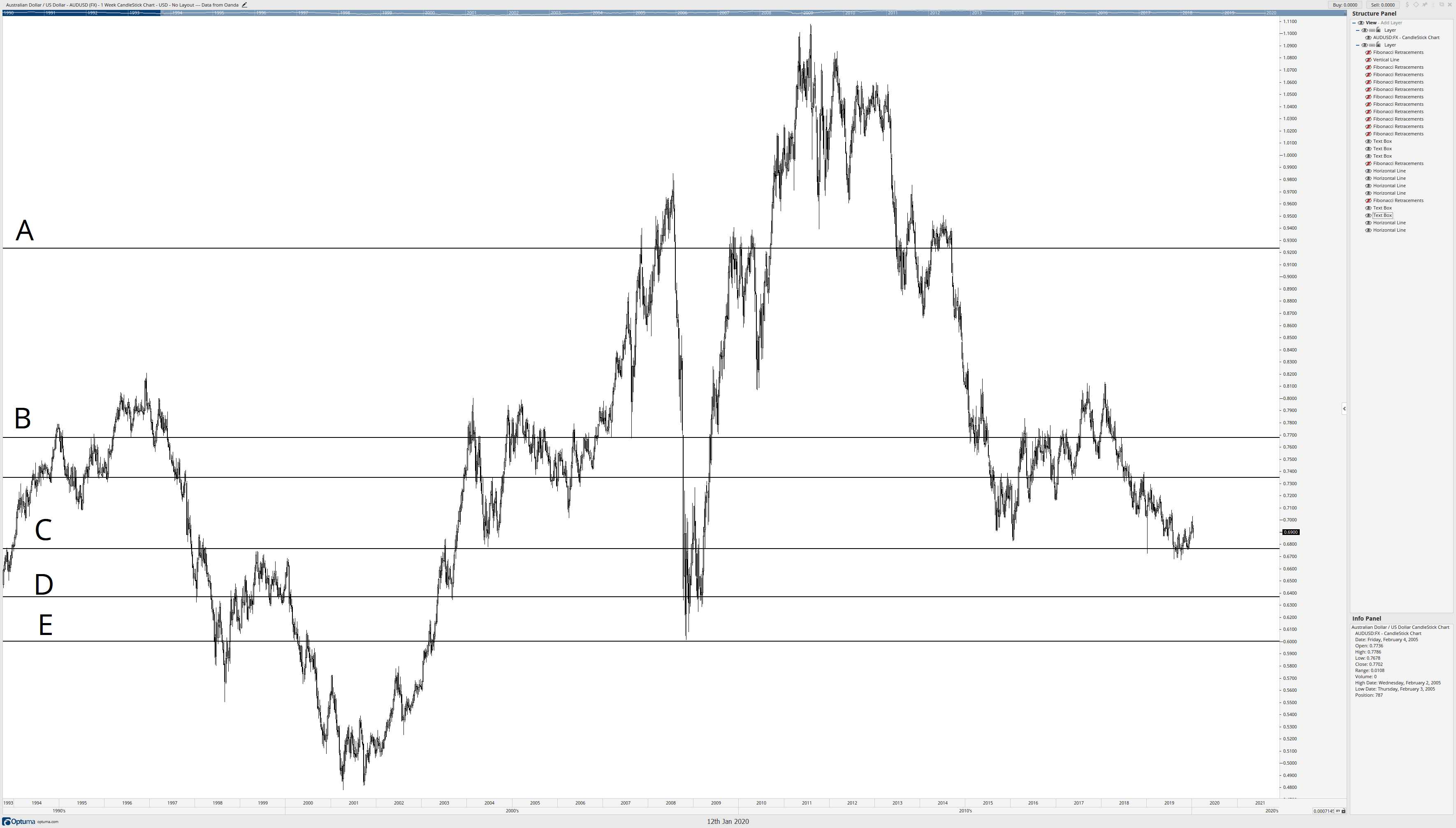

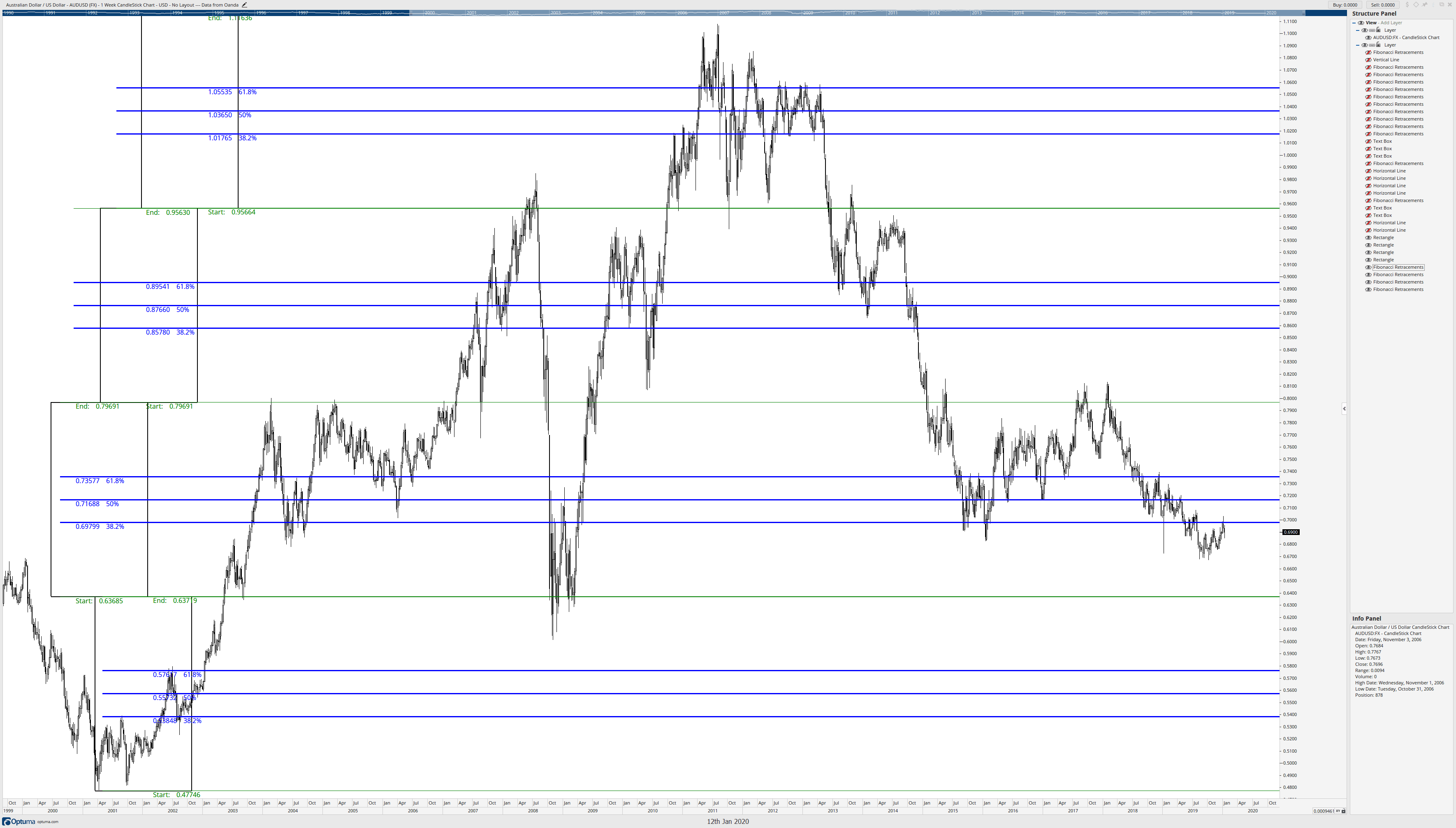

Fibonacci retracement is a prevalent indicator to evaluate retracement entry points, and a Fibonacci extension is also a popular method to assess potential target levels. It is based in the golden ratio, coming from the Fibonacci number sequence. As you should know, the Fibonacci sequence starts by 1,1, and the following members come from the addition of the two previous numbers.

As the numbers grow, a Fibonacci number divided by its previous number in the series gives the golden ratio: 1.6180. The reciprocal, a Fibonacci number divided by the next number, provides the other golden ratio: 0.6180. 0.382 comes from the ratio of a Fibo number and the second next. 0.236 is the result of a Fibo number divide by its 3rd next. 0.1459 results from the division of four distanced Fibo numbers, and we could go on forever. To these ratios, trading software adds the 0.5 and 0.75 levels and the complimentary and extensions.

It is hardly useful to have a forecasting tool that tells you the next retracement could end at 14.6%, 23.8%, 38.2%, 50%, 61.8%, 75%, 85%, or 100% of the last top, but with no likelihood associated with each level.

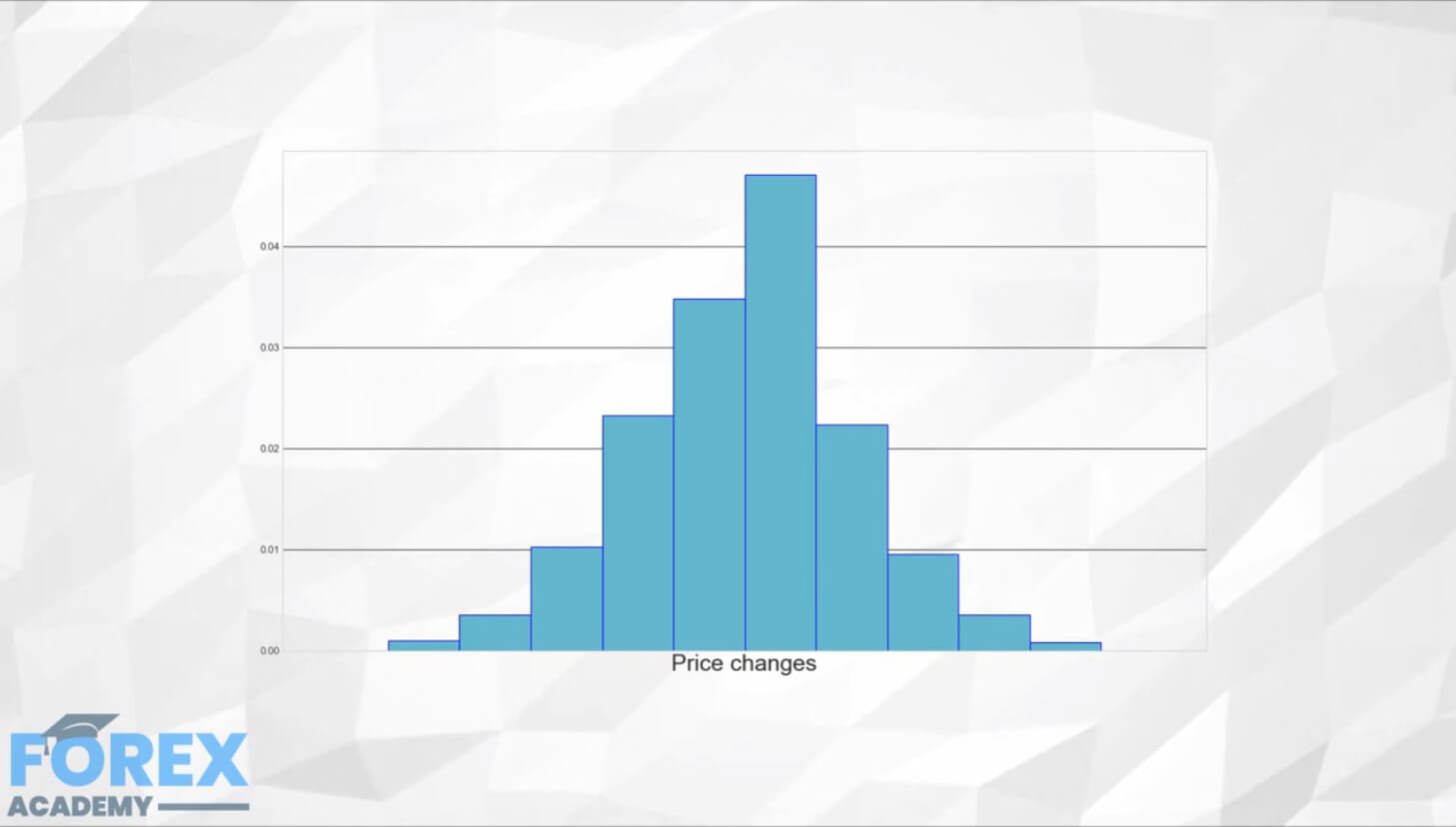

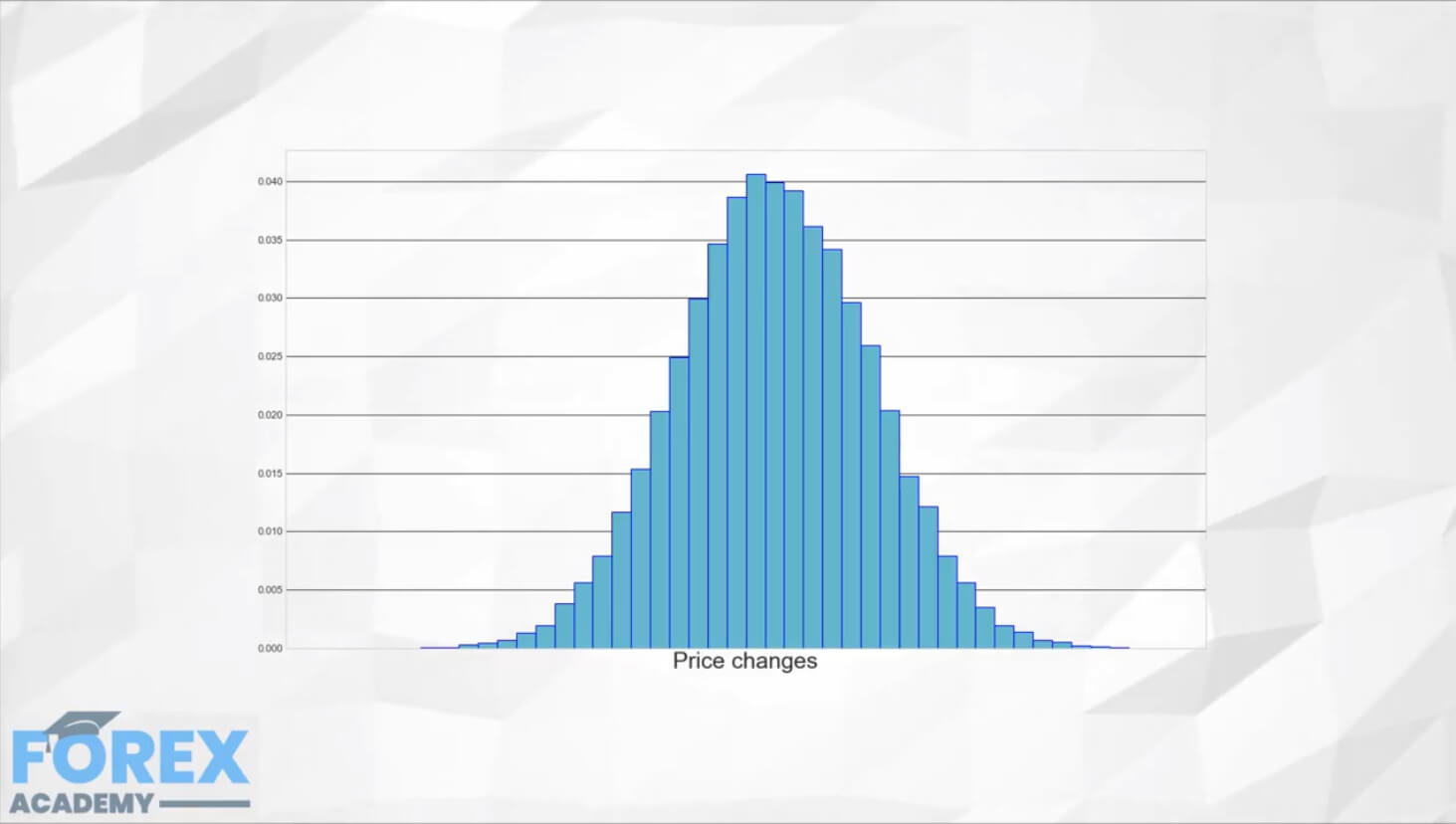

What if we could classify the retracements and assign them the probability of occurrence? Well, we really can. We could keep a record of all the past retracement, organized for the bull and bear movements, and then bin them in chunks of 10 percent and create a histogram and, from there, assign a probability to each bin. Or, we could just take the average and the standard deviation of all retracements for bulls and bears, separated, and use the well known probabilistic profile of the Normal Distribution to assess probabilities.

That would also apply to extensions. By keeping track of every impulsive movement following a retracement, we can typify the behavior of the asset. We could create the average and standard deviation of the last 30-50-100 occurrences and create a statistical profile similar to the retracement case.

In the case of the retracements, we can see that the average plus 1SD would be very high probability entry points since only 16% of the cases the retracement went further down.

In the case of extensions, the average minus one SD would be a sweet spot for the first take profit level, being the second the average and the third the average plus one SD.

Stop Settings

Until now, we have discussed entry and exit points taken from a statistically minded perspective. What about setting stops in the same way instead of the obvious levels everybody notices, including institutional traders?

Setting stop levels can be rather straightforward if we know the distribution of the prices. If the entry point takes place at the average +1SD retracement level, the average plus 2SD is a good stop level, as the likelihood of the retracement to reach it would be just 5%.

We could, even, keep track of the history of stops, using John Sweeney’s Maximum Adverse Excursion concept. To summarize it, The MAE method is a stop-loss setting system that tries to place the stops at the historical optimal level based on past trades.

The method tracks the price paths during positive trades to see the maximum adverse excursion taken by the trades before moving in our favor. That way, we could detect the level beyond which there is a high probability that the trade will not be profitable. That is the optimal level for the stop-loss.

For more on Stop settings, please read:

Masteting Stop-Loss setting: How about using Kase Dev-Stops?

Introduction

Introduction

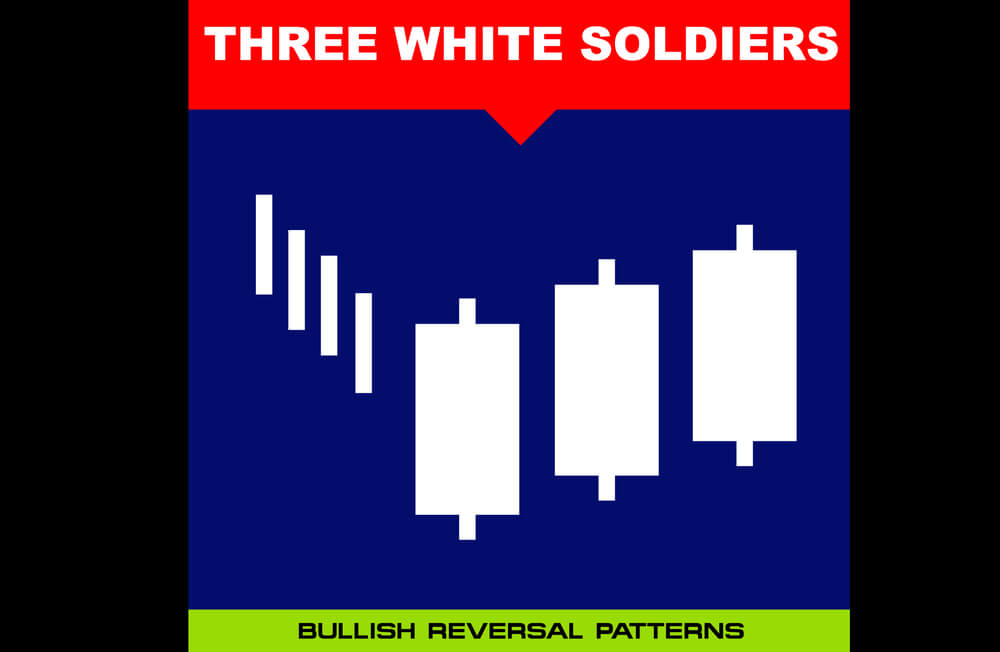

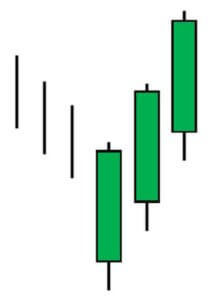

The Three White Soldiers is a bullish candlestick pattern. This pattern is highly reliable and quite potent when it is found at a significant support area in a downtrend, which indicates sharp price reversals from a bear market to a bull market.

Candles get printed on every trading chart in all the timeframe. But only the candlestick patterns in the right context of the market will be rewarded. The Three White Soldiers pattern that we are going to discuss is one of the most credible and reliable patterns we have come across. Trading legend Gregory L. Morris, in his book ‘Candlestick Charting Explained,’ said that the Three White Soldiers is extremely rewarding if traded correctly and it should never be ignored.

In this strategy, we have paired the Three White Soldiers pattern with the RSI indicator to identify good trading signals. RSI is a well-known oscillator, and it stands for the Relative Strength Index. The RSI indicator has a reading from 0 to 100. When the indicator line goes above the 70, it indicates the overbought conditions. When the indicator lines go below the 30 levels, it means the market is in an oversold condition.

Step 1 – First of all, find the Three White Soldiers pattern in a downtrend.

Step 2 – When market prints the Three White Soldiers, our next step is to check the RSI indicator. If the RSI indicator is at the oversold area and gives a sharp reversal, it means that both of the trading tools support the buying entry in any underlying currency pair.

In the example below, GBPNZD was in an overall downtrend. At first, market prints the Three White Soldiers pattern, and the RSI was at the oversold area. This condition indicates a potential trend reversal. We can see that the pattern candles are quite strong, and the RSI indicator also supported our strategy. This aspect creates an illusion for novice traders to take the trade immediately. However, it is not a good way to enter the trade. We suggest you always wait for 2-3 candles to confirm the stability of the pattern.

Step 3 – Step Loss & Take Profit

Step 3 – Step Loss & Take Profit

In this example, we have put the stop loss just below the low of the first candle of three green candles. When two leading trading tools indicate the same signal, always use smaller stops so that you can maximize your profits.

For this strategy, there are several ways to book the profit. We can close our position at a significant resistance area or when the RSI indicator reaches the overbought area. If your plan is to ride the longer moves, we suggest you closing your position when the market prints the Three Black Crows patterns. This pattern is the complete opposite of the Three White Soldiers pattern.

The example below belongs to the daily chart. Keep in mind that stronger the support/resistance area on the higher timeframe, more chances the market has to respect that area. In our example, the last time price respects the resistance line, so we decided to close our full position at a resistance area. Overall it was 1500+ pip move on the daily chart. These kinds of higher timeframe trades are suitable only for big investors.

In this strategy, we have paired the Three White Soldiers pattern with the EMA to filter out the bad trading signals. EMA stands for Exponential Moving Average. The EMA is used to highlight the current trend and to spot the trend reversals. Trading signals can also be generated when the EMAs are read correctly. Generally, when the EMA goes above the price action, it indicates a sell signal, and when it goes below the price action, it indicates a buying signal.

Step 1 – Of course, the first step here is to identify the Three White Soldiers pattern on the charts.

Step 2 – When market prints, the Three White Soldiers, and EMA go below the price action, it indicates the buying signal.

In the below EURAUD weekly Forex chart, when the market prints the Three White Soldiers pattern, EMA was also below the price action. This indicates a potential price reversal of this currency pair. Even when both the pattern and EMA indicates the signal, we decided to wait for 3 to 4 candles to confirm the strength of the pattern. We can see that the market holds there for a couple of candles, which is a clear cut sign to go long on this pair.

Initially, the market goes higher for some candles, but it didn’t reach our major target. Our position goes into the loss a couple of times. Do not panic and lose trust in your strategy because the price didn’t hit the stop loss yet. Trading is a game of patience and only close your position when the market hit the stop loss or take profit. In this case, waiting patiently led to fruitful results as our trade hits the take profit.

Step 3 – Stop Loss & Take Profit

In the above chart, we have placed the stop loss above the exponential moving average because it works as a dynamic support/resistance to price action. We closed our full position when EMA goes above the price action.

Most of the times, Three White Soldiers pattern appears at the end of a downtrend. Sometimes it also prints after a lengthy consolidation phase. Although it is not a strong bullish sign if you want to trade the consolidation phase, always pair this pattern with other technical tools to filter out the negative signals. The volume is the most critical thing to enhance the reliability of the pattern when the market is in a consolidation phase.

Introduction NZDCAD is the abbreviation for the currency pair New Zealand dollar against the Canadian dollar. It is referred to as a cross-currency pair. Here, NZD is the base currency, and CAD is the quote currency. In this article, we shall be going over everything you need to know about this currency. Firstly, let’s get […]

Introduction NZDCAD is the abbreviation for the currency pair New Zealand dollar against the Canadian dollar. It is referred to as a cross-currency pair. Here, NZD is the base currency, and CAD is the quote currency. In this article, we shall be going over everything you need to know about this currency. Firstly, let’s get […]

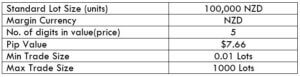

NZDCAD is the abbreviation for the currency pair New Zealand dollar against the Canadian dollar. It is referred to as a cross-currency pair. Here, NZD is the base currency, and CAD is the quote currency. In this article, we shall be going over everything you need to know about this currency. Firstly, let’s get started by understanding what the value of NZDCAD depicts.

Comprehending the value of a currency pair is simple. The value of NZDCAD determines the Canadian dollars that must be paid to buy one New Zealand dollar. It quoted as 1 NZD per X CAD. For example, if the current value of NZDCAD is 0.86595, then 0.86595 CAD is required to purchase one NZD.

Spread is the primary way through which brokers make revenue. They have a different price for buying and selling. The difference between these prices is called the spread. It varies from broker to broker and their execution type.

ECN: 1 | STP: 1.8

For every execution, there is a fee levied by the broker. This fee is also referred to as the commission on a trade. It is nil on STP accounts. And on ECN accounts, it is usually within 6 to 10 pips.

Slippage is the variation in the price executed by you and the price you actually received. It happens on market orders. Slippage depends on two factors:

The trading range is a tabular representation of the pip movement in a currency pair in various timeframes. These values help in assessing the risk-on trade as it determines the minimum, average, and maximum profit that can be made on a trade.

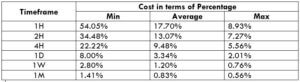

Cost a percentage of the trading range is an excellent application of the above table. By manipulating the values with the total cost, the variations in costs in different at different volatilities and timeframes can be calculated. For this, the ratio between the total cost and pip movement is found out and represented in percentage.

Spread = 1 | Slippage = 2 |Trading fee = 1

Total cost = Slippage + Spread + Trading Fee = 2 + 1 + 1 = 4

Spread = 1.8 | Slippage = 2 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 2 + 1.8 + 0 = 3.8

There are two variables here, namely, timeframe and volatility. By varying these two, the variation in the total cost is examined. Note that the higher the percentage, the higher is the cost on a trade and vice versa. From this, we can make out that the prices are high when the volatility is low. And prices are low when volatility is high. Also, as the timeframe widens, the cost decreases.

It is not ideal to trade when the volatility is high, as it is risky. It is also not the best choice to trade when the volatility is low, as the costs are high. So, to keep a balance between both volatility and cost, it is ideal to trade when the pip movement of the pair is around the average values.

Talking about timeframes, trading the 4H or the Daily would be great, as the cost is bearable, and the trade wouldn’t take too long to perform as well.

Another simple hack to reduce cost is by trading using limit/pending orders instead of market orders. This will significantly reduce costs on a trade because the slippage on the trade becomes 0. It is observed that the cost reduces by about 50% of the original value. Below is a table representing the cost percentage when the slippage is made zero.

https://youtu.be/QcbJj5nxnLY

https://youtu.be/QcbJj5nxnLY

How to get an Edge using Statistical Thinking I

Do you know the difference between institutional traders and the average retail trader?

Well, there are many obvious differences, including the capital available to them. Still, the most significant factor is that you blindly believe in technical analysis, whereas they use other higher-level techniques to be ahead of them, ahead of you.

The mathematician is highly paid in the financial markets for a reason: They make the real difference. The marketplace is a battlefield, and quant analysis is analogous to smart drone attacks, whereas trading using TA is like fighting with spears and arrows.

But I don’t have that software!

Of course, pros use large databases and sophisticated analytical software, machine learning, and so forth. If you are serious about trading, you should consider creating your custom analytical software. The use of high-level languages such as Python in combination with Pandas, a terrific statistical package, and a bit of code, would put you into the next level. Still, with patience, dedication, and a spreadsheet, you could collect your own information. Excel also included quite a decent statistical package.

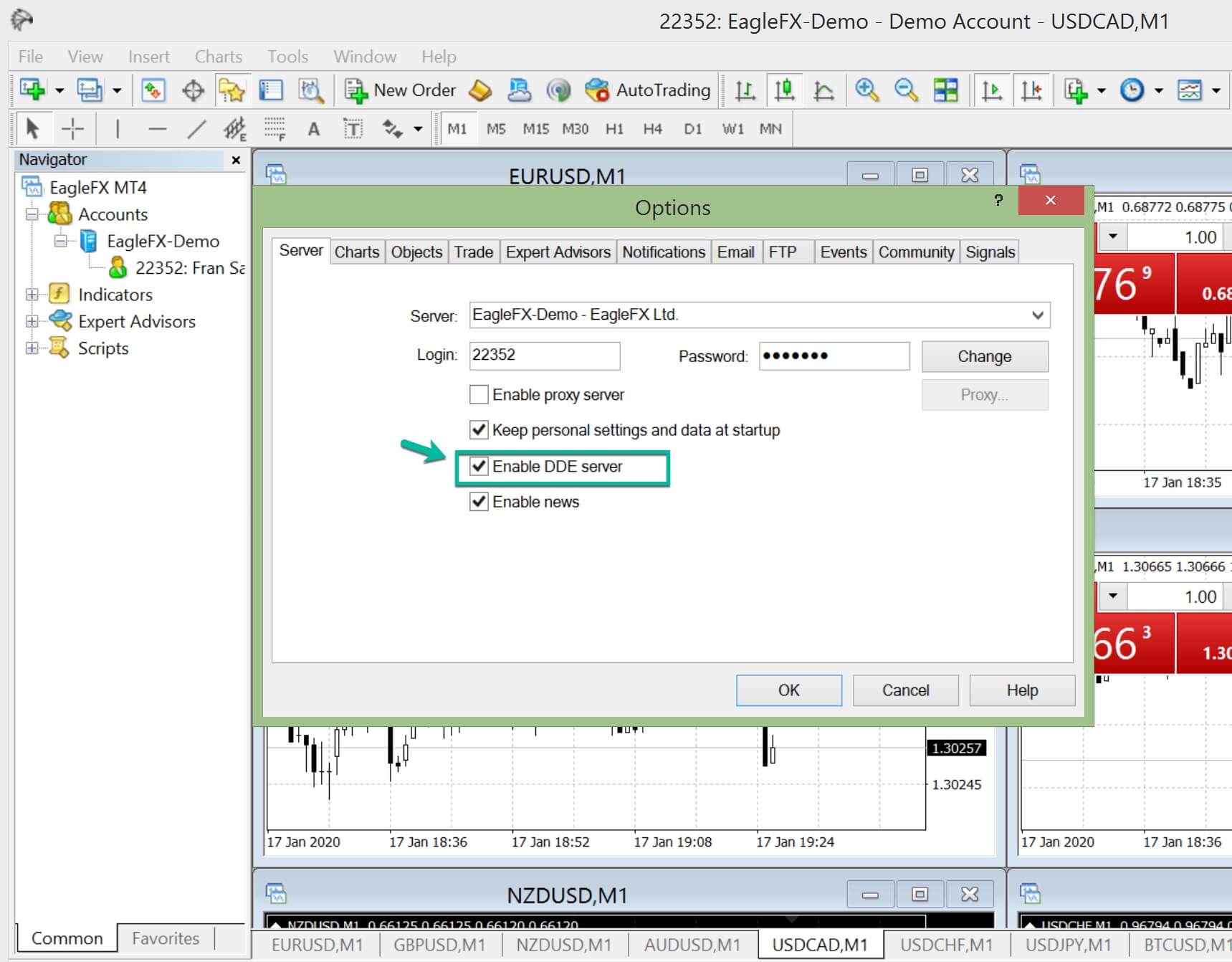

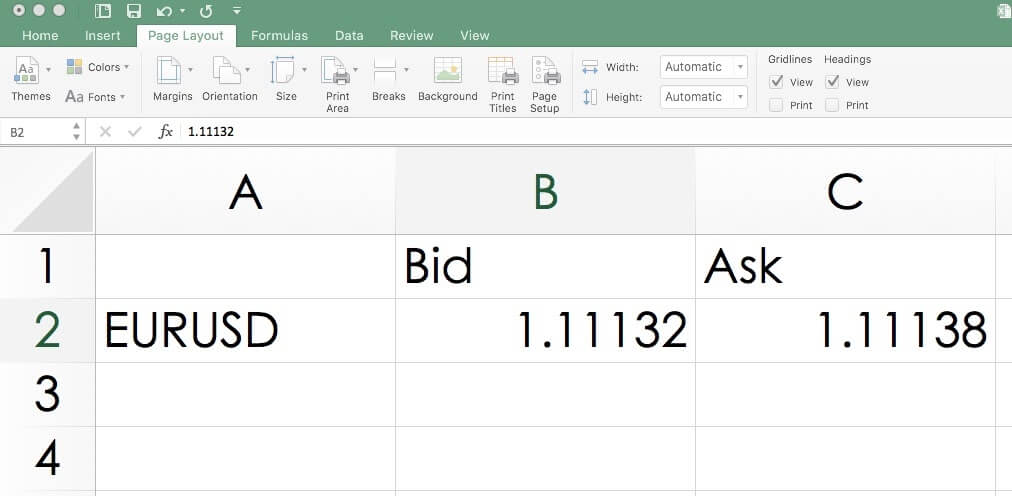

Metatrader 4 to Excel

It is possible to automate your data capture from your MetaTrader 4. MetaTrader 4 has a DDE Link. It is straightforward to get it done.

You simply need to enable the MT4 DDE server and place a simple code in the corresponding Excel cells.

=MT4|BID!EURUSD

=MT4|ASK!EURUSD

=MT4|HIGH!EURUSD

=MT4|LOW!EURUSD

=MT4|TIME!EURUSD

Average Trading Ranges