Blue Wallet is one of the best free and open-sourced wallets originally designed as an iOS-specific crypto wallet. It is relatively easy to use and features a wide range of both operational and security features that also make it one of the most versatile crypto wallet apps. For instance, it is extremely light, ensuring that it doesn’t eat up your phone memory, and this also facilitates faster transactions. Its top security features, on the other hand, include QR Code technology and 2-factor authentication.

In this review, we’ll get a deeper insight into its primary operational features, customer support, security features, and pros and cons.

Blue wallet key features

Batch Transactions: One of the most innovative and unique aspects of Blue wallet is its support for batch transactions. This implies that you can bundle up two or more crypto transactions and execute them as a single transaction. This ensures that your interactions with Blue wallet aren’t just less time consuming but that cheaper given that bundling multiple transactions into one makes your transfers out less expensive.

Lightning wallets: They are as its name suggests. Wallets with support for the Lightning Network Protocol are extremely fast and unbelievably cheap. You can send, receive, and top up your wallet at lightning speed.

SegWit: If you are a crypto enthusiast, you’ve probably heard of SegWit. It’s a significant upgrade to the Bitcoin blockchain technology executed in 2017. Today, you’ll find the majority of wallets integrating this feature by default. SegWit is supported in both bech32 Native Mode and P2SH-compatibility.

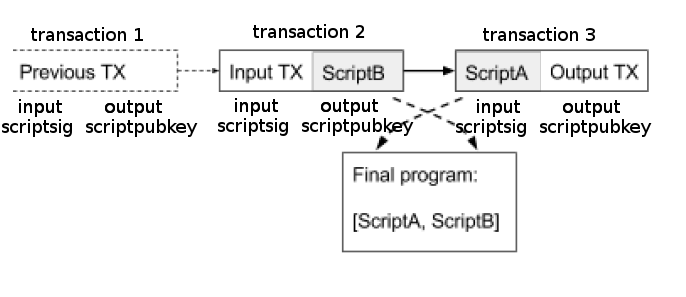

Hardware wallet integration: Blue crypto wallet is considerably safe and supports a wide range of cryptocurrencies and tokens. You can, however, boost this security and make it possible for the app to support an even wider range of digitals assets and tokens. The crypto wallet app will integrate with any PSBT-enabled (Partially Signed Bitcoin Transactions) hardware wallet.

Offline transactions: Unlike most other crypto wallet apps that have to be online to initiate and execute transactions, the PSBT feature on Blue crypto makes it possible for you to send and receive cryptocurrencies while offline.

In-built marketplace: The fact that Blue Wallet operates within the Lightning Network implies it also has access to the network’s browser and associated marketplace.

BTCPay point-of-sale integrated: According to the Blue Wallet roadmap, the crypto app will soon integrate the BTCPay server point-of-sale system. This is an open-sourced and bitcoin-based payment solution that allows you to pay for your in-store purchases using Bitcoins.

Blue wallet security features

Password: Like most other crypto mobile apps, the Blue wallet is secured by a password that you set when installing the app. The highly dynamic wallet has also added several biometric security features. You can now secure the app using the face ID or Fingerprint.

Military-grade encryption: The Blue wallet is also highly encrypted. Any piece of data collected and stored within the wallet app, including your passwords, sensitive personal information, and your private keys, are all encrypted.

Recovery seed: When setting the wallet app, you will also be presented with a set of random phrases referred to as the recovery seed. Write these down and keep them safe. You will need them to either reset your wallet app password or when recovering private keys.

Plausible deniability: It is a customized feature with the user’s personal security in mind. The app allows you to set up and encrypt several other fake wallets. These come in handy in the event you are forced or coerced to give access to your wallet.

Hierarchically deterministic: In addition to the plausible deniability feature, the crypto wallet app also uses its Hierarchical deterministic feature to throw trackers off. The features allow the wallet to auto-generate private wallet addresses for each transaction that mask your primary wallet address, making it impossible to track the activities of crypto activity and transaction history.

Open source: Blue wallet is designed using an open-sourced technology that speaks volumes about its transparency and commitment to security. This implies that the wallet has been probed and vetted by industry experts with possible defects identified and corrected in earnest.

Blue Wallet’s supported currencies

Blue wallet is a multi-currency crypto app that supports both fiat and cryptocurrencies. Currently, the wallet app supports up to 20 fiat currencies, including BRL, CNY, GDP, MXN, USD, CAD, RUB, AUD, CHF, and CZK as well as 100+ cryptocurrencies that include Ethereum, Bitcoin, NEO, Bitcoin Cash, and Dash.

How to set up and activate the Blue Wallet crypto app

Step 1: Download and install the blue wallet app

Start by downloading and installing the Blue wallet app from the Apple app store, Google Play, or the official Blue wallet website. Note that while the wallet was initially designed for the iOS infrastructure, the equally effective Android version has since been introduced to the market.

Step 2: Create a Wallet

Once you have downloaded the app, the next step would be to click on the “Create a wallet” button. It is recommended to start with a BTC on-chain wallet as it might come in handy when funding your lightning wallet.

In the advanced option, you can proceed to set up different wallets PSBT-enabled wallets that include HD SegWit (BIP 49 P2SH) – multiple addresses, SegWit (P3SH) – Single address, and HD SegWit (BIP84 BECH32 Native) – various addresses. The best option for a beginner is HD SegWit (BIP 84 Bech32 Native) – multiple addresses.

Step 3: Create a password for the wallet

After installing the app, you will now be required to create a password for the wallet.

Step 4: Back Up Your Recovery Phrase

The app will then display a set of seemingly random phrases that make up your app’s recovery seed. Write them down and keep the record safe.

Step 5: Complete the Set-Up

The app set-up process is now set, and you will be directed to the wallets dashboard. You can now start adding cryptos and fiat currencies into your app, using the in-built browser to monitor the cryptocurrency prices on the different exchanges and even interact with crypto traders on the LAPP marketplace.

How to add/receive cryptos into your Blue wallet

Step 1: Launch the Blue Wallet crypto app and clicking on the ‘Receive’ icon.

Step 2: Click on the cryptocurrency you wish to add or receive to your wallet to reveal the wallet address and QR code.

Step 3: Copy the wallet address and send it to the party sending you the crypto or have them scan the QR code.

Step 4: Wait for the crypto to reflect on your wallet.

How to send cryptos using your blue wallet

Step 1: Start by launching the app and clicking on the ‘Send’ icon.

Step 2: Click on the cryptocurrency you wish to send

Step 3: Paste or key in the recipient’s wallet address and enter the amount of coins you wish to send. Alternatively, you can also scan their QR code.

Step 4: Confirm that the wallet address and the amount are correct and hit send.

Blues Wallet ease of use

Installing and activating the Blue wallet crypto app is quite easy and straightforward. Blue wallet is also highly customizable, and this makes it easy to use for both beginners and highly experienced crypto traders. Besides, the website supports several languages such as Chinese, French, and Portuguese, which makes it a diverse platform for crypto users across the globe.

Blue wallet cost and fees

Acquiring a Blue Crypto wallet app is free and you also won’t be charged for storing your cryptocurrencies. You, however, will incur varied transaction fees every time you transfer cryptocurrencies out to exchanges or other wallets. How much you pay for each transaction is dependent on such factors as the transaction volumes and the type of cryptocurrency involved.

If you are looking to lower these transaction costs when executing multiple transactions, you may consider taking advantage of Blue Wallet’s unique Batch processing tool. This lets you bundle together all your transfers out and execute them as a single transaction, effectively lowering your transaction costs.

In yet another innovative gesture, the Blue wallet crypto app has introduced the Replace-By-Fee (RBF) feature that lets you take control of the transaction charges and speeds. By implementing RFB in your transactions, this feature lets you increase or decrease the speed by which a transaction is executed whereby low transaction fees equal lower transaction speeds while higher fees translate to faster crypto transaction processing. Note that these fees go to blockchain miners and network administrators – not Blue wallet.

Within the LAPP marketplace, cryptocurrency trades and conversions are subjected to spreads. This implies that the different cryptos and fiat currencies sold on the LAPP marketplace are availed at marked-up prices. These spreads are highly variable and largely depend on the type of crypto involved.

Blue wallet customer support

Apart from the flexible fees and seamless transactions, its customer support is exceptional. Blue wallet is a dedicated community of crypto enthusiasts aiming to educate and improve how we make transactions. As a result, they integrate a couple of customer support features, including a live chat section, 24-hour email support, and an online documentation section for Frequently Asked Questions (FAQs).

Apart from that, there is also a community channel and a telegram group where Blue Wallet sends relevant notifications, changes, or updates. Users can also interact, share ideas, or ask questions, which makes it quite an excellent platform for anyone looking for a reliable website.

What are the pros and cons of Blue wallet

Pros:

- It operates with the Lightning network and thus benefits from speedy transaction processing and reduced transaction fees.

- The app is multi-lingual and very user-friendly.

- The crypto wallet integrates several innovative security protocols like plausible deniability that make it highly secure.

- Blue wallet is non-custodial and therefore gives you near-absolute control over your digital assets.

- The mobile wallet app is highly innovative and features a host of unique features like batch processing and Partially Signed Bitcoin Transactions (PSBT)

- The mobile wallet app is built on an open-sourced technology and is hierarchically deterministic.

Cons:

- The online nature of the wallet app exposes it to virus threats and malicious attacks.

- The wallet doesn’t have the multi-signature function and doesn’t support two-factor authentication.

- One may consider the number of cryptocurrencies supported by the Blue Wallet relatively limited.

Comparing Blue wallet with other crypto wallet apps

The Blue wallet is by far one of the most innovative crypto wallet apps we have come across. It is highly dynamic and features some unmatched operational and security features. When compared to the eToro crypto wallet app, for instance, Blue wallet comes off as the most user effective and user friendly. Blue wallet users have access to a myriad of features and tools not available on eToro’s wallet, such as the batch processor, watch-only wallets, and even fake wallets for plausible deniability. eToro only has the upper hand when it comes to regulation and due to the fact that it has the backing of a more reputable brand – the globally renowned eToro Trading platform.

When compared to most hardware wallets, Blue crypto wallet app comes off as more convenient and highly dynamic. One may even consider it more innovative and less expensive. It, however, pales in the face of some hardware crypto wallets like Trezor or Ledger Nano S when it comes to the number of supported cryptocurrencies and tokens as well as the security of your private keys. Neither the watch-only nor the fake wallet features of the crypto wallet app can compare to the cold storage attribute of a hardware wallet.

Verdict: Is blue crypto wallet safe?

Well, having introduced fake wallets, watch-only, and hierarchical deterministic security features, one may consider the Blue crypto wallet app relatively safe. The fact that it integrates with hardware wallet that not only boost the number of supported cryptocurrencies but provide an additional security layer make it even safer. We, however, would have been more confident about the wallet developers’ commitment to the security of your private keys if they integrated two-factor authentication.