It is common practice for financial analysts and investors to look for simple and informative indicators to assess particular assets before investing in them. In recent years, crypto assets have become the latest focus for a viable indicator search, and it has not been easy.

Usually, the ideal indicator should reflect the asset fundamentals position relative to the market valuation position. Achieving the two with a particular measure is not usually a walk in the park, especially with tokens and crypto coins.

So, which is the most effective indicator for a cryptocurrency’s value?

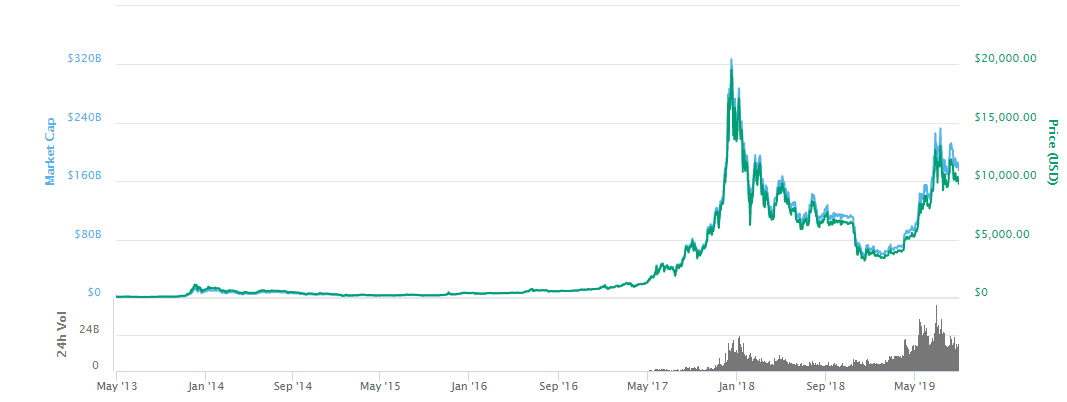

Price is the most straightforward measure of any crypto coin, and it is usually in U.S. dollars. While it is easy to explain stocks and other assets’ market price, bitcoin price fluctuations are a different ball game.

Some predictions and metrics try to explain the phenomenon, and they include present and future scarcity. We will discuss the scarcity of some of the most popular crypto coins to gain a better understanding of their value.

What is Value Per User?

The market cap can accurately quantify the market valuation of an asset. Unfortunately, the same does not apply to asset fundamentals since they are not easy to determine.

One of the most simplistic and effective asset measures is the price-to-earnings ratio, which takes its annual earnings or dividends given to shareholders.

The challenge with crypto assets is that they do not bear dividends, so the price-to-earnings ratio is not applicable. A more effective approach proposed has been the network value-to-transaction ratio. But how does it work?

The network value-to-transaction approach gauges the fundamentals of coins on the blockchain by considering the transaction volume value within the last 24 hours. The method treats the token as a medium of exchange as opposed to a store of value.

Value per user is yet another model based on the scarcity of crypto assets. This unit of measure hinges on the likely ownership of a coin founded on data for active addresses.

The assumption behind measuring per user is that everyone within the network is interested in the coin’s success.

However, not everyone within the network can sell at the level of value per user. As such, the unit of measurement does not refer to the realized value of a coin. Value per user is a reliable indicator of the network’s value.

Normally, users can access every new blockchain’s potential and realized value with its native crypto asset. To test the value of a user model, we compare different projects and tokens to see how the measurement unit applies and whether there are visible differences.

Bitcoin

The user base for bitcoin is pseudonymous, with more than 3 million BTC considered lost. The supply of bitcoins is 21 million, with a market capitalization of 600 billion U.S. dollars as of January 14, 2021.

According to the current estimations, there are about 30,605,330 BTC wallet users. But this figure can include individuals and businesses with more than one wallet.

Given the above figures, the value per user metric is around $19,600. You cannot use the BTC total supply in the calculations since they will be mined in the future.

The main challenge with bitcoin estimations is the uneven distribution of wealth. Well, the big exchange wallets and top wallets have an undue advantage in the distribution.

Ethereum

Ethereum is one of the most active in decentralized finance. The Ethereum network has 126,819,085 total unique addresses and has a market capitalization of $67,815,701,234. Using this info, you get a coin’s value per user (CVPU) of $543.

You will notice that the CVPU is very close to the market price of around $600 as of December 2020. There are various reasons for the low CVPU.

The ETH behavior is similar to that of a utility coin as opposed to a scarce asset. Ethereum is also highly distributed and grows to depend on secondary projects that require ETH as a basis for trading or financing.

EOS

Another way to map the value per user is by using unique crypto assets such as EOS. By October 2020, the network had 1,500,206 accounts with a market capitalization of $2,877,691,183. This gives us a value per user of $1,918.

The EOS market price stands at $3.07, which is a long way from the value per user.

SocialGood (S.G.)

The primary goal of SocialGood is two-pronged: democratize crypto assets and solve economic inequality.

The platform gifts users SocialGood (S.G.) cryptocurrency to shop at major online retailers through their application.

The current S.G. market price is $3.93 as of January 15, 2021. S.G. has a total issuance limit of 210 million coins, which is ten times that of a bitcoin. SocialGood chose this number deliberately to accommodate the needs of its community.

Unlike bitcoin, SocialGood has actual numbers of its user base; over 100,000 people as of December 2020. The issuance limit is approximately $821,814,000. Based on this data, the coin’s value per user (CVPU) is $8,218.

The number of users could increase to 1 million in the future. In such a case, the market capitalization will be roughly $8.218 billion, and the market price of S.G. would be around $39.30.

SocialGood has a limit on its issuance, which means an increase in S.G. holders will also lead to a price increase.

What Does it All Mean?

No particular model can easily determine the value of the crypto-coin. Regardless, the network value-to-transaction ratio is one of the proposed methods that indicate some practicality when it comes to crypto assets.

There are various challenges with valuing cryptocurrencies. For example, a potential user can select a particular coin and set its price higher than the value per user. This goes against democratic wealth distribution, where users realize much higher market prices or whales.

However, particular projects such as SocialGood have a more democratic coin distribution and wealth-sharing business model. And since S.G. coins are linked to retail activity, it is not easy to establish whales.

The token price is highly volatile, and so they do not serve as a unit of account. The exception is stablecoins. Effective measures of the fundamentals of crypto assets should primarily incorporate functions as a medium of exchange and storage value.

The practical use of the value per user method determines the cryptocurrency coin’s distribution level and has a clearer picture of how it works. The utility status of Ethereum highlights it not as a store of value but rather, a highly fluctuating asset.

Conclusion

Predicting the exact market price of a crypto asset is as difficult as it can get. Using the example of SocialGood and Ethereum, it is clear that there is a big difference in picking an asset seeking real-world application and a clear business model.

The value per user metric can still be used to gauge the potential of the coin or token. A relatively effective method is the network value-to-transaction ratio based on Metcalfe’s Law.

According to Metcalfe’s Law, the network value is proportional to the square of the token holders. The network value-to-transaction ratio views the crypto assets as a medium of exchange instead of a store of value. It is, therefore, a better-placed measure for the highly volatile tokens or coins,