In the forex market where every activity and movement happens rather quickly, traders need to be particularly prepared to take on unexpected challenges. This form of readiness requires preparedness and understanding of various steps that would secure one’s position regardless of external influences or triggers. Naturally, traders may find a specific activity to be of greater difficulty, such as journaling is for many, yet these tasks need to be incorporated and accepted as habits. It is in the acknowledgment of the purpose and effectiveness of having a fixed routine where traders can finally learn how to exercise control and minimize the risks in which this market is so profoundly abundant. As this article focuses on risk as a concept and as an inherent part of the forex market, traders are invited to think through and analyze what their understanding of this term is and assess how much risk they are generally ready to take. Today’s topic is also a path to a discovery of one’s own perception and risk tolerance, supported by constructive advice on how to actively control and limit any risk-related issue, towards learning how to use this knowledge to create a functioning trading plan.

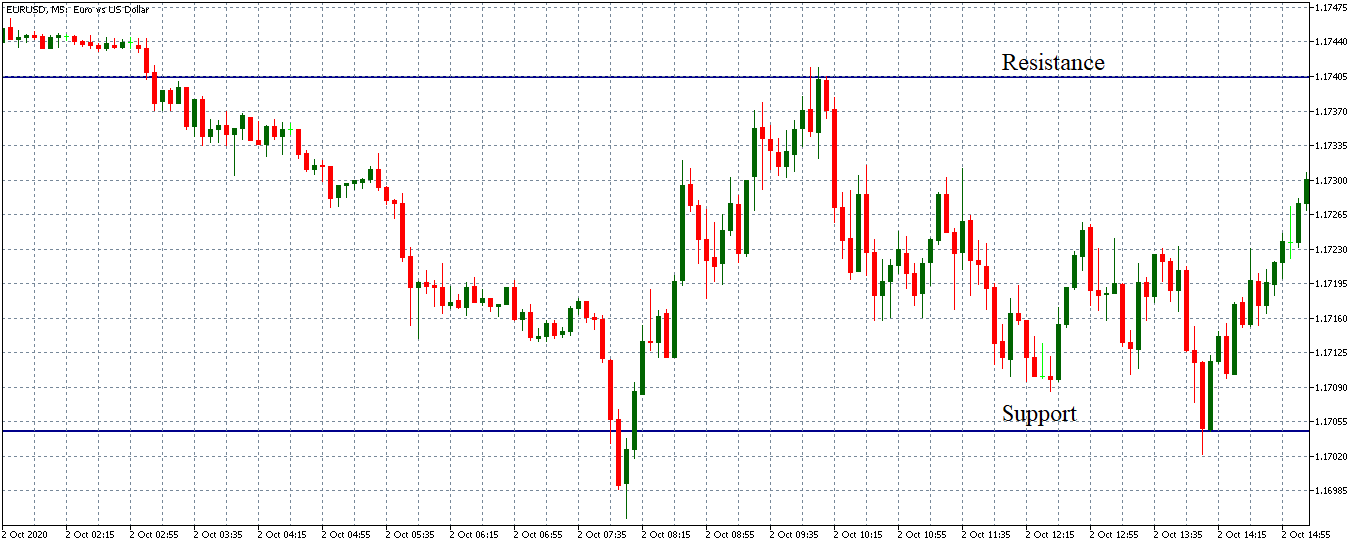

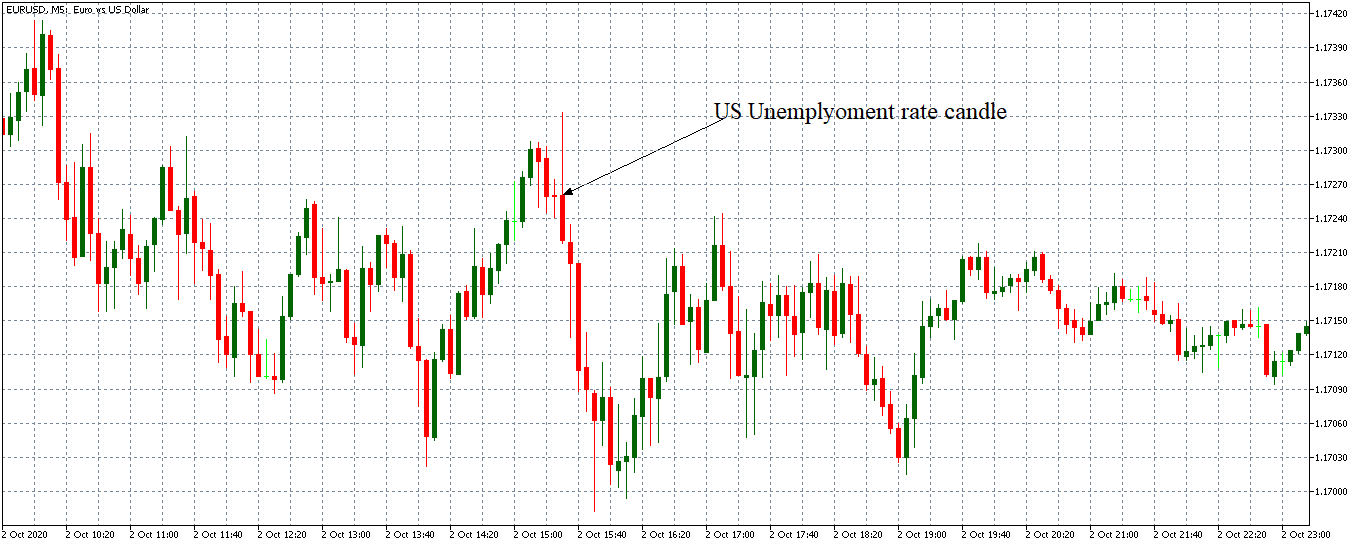

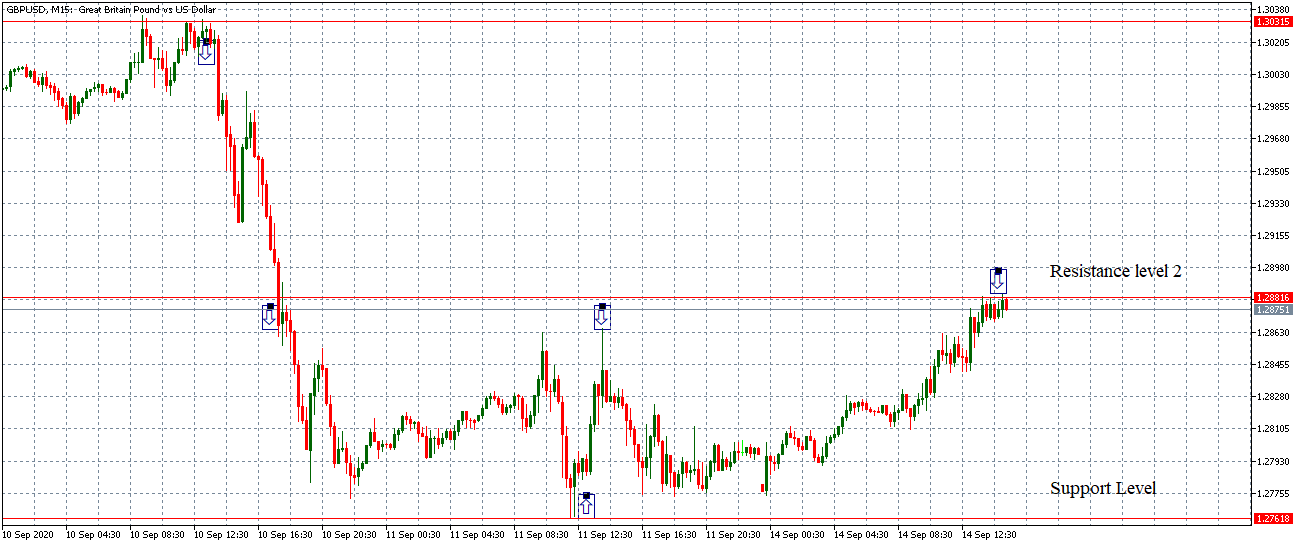

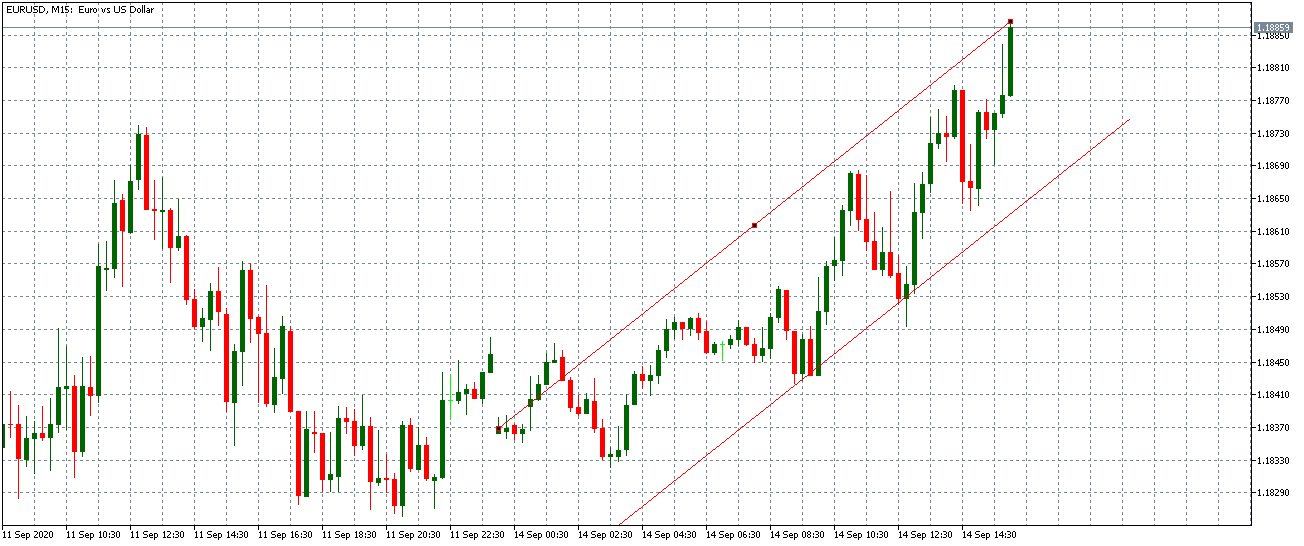

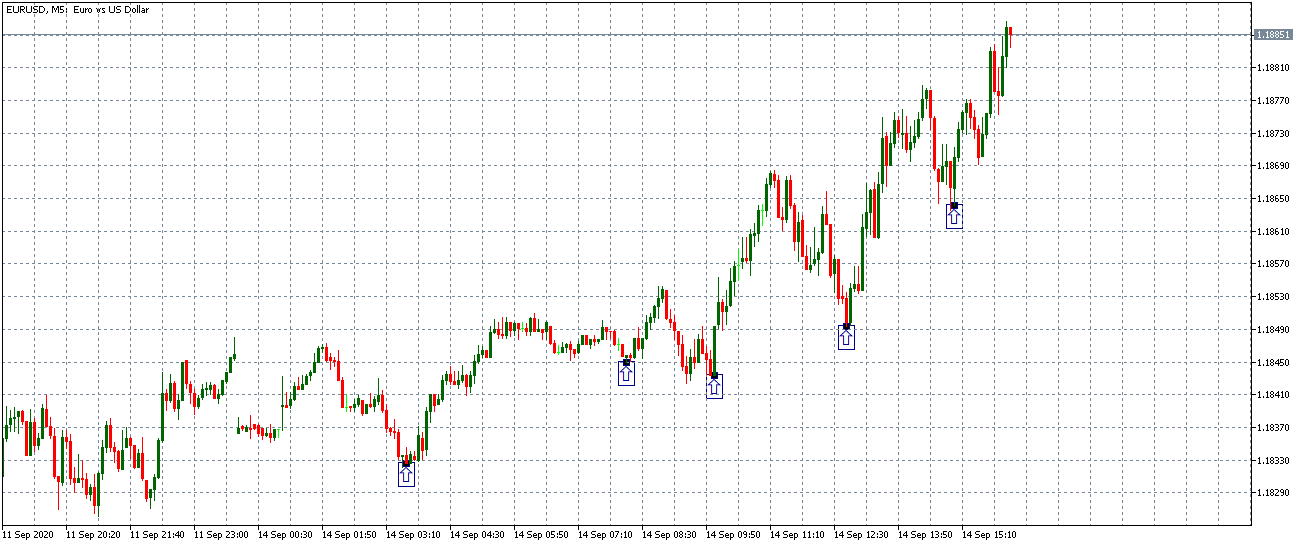

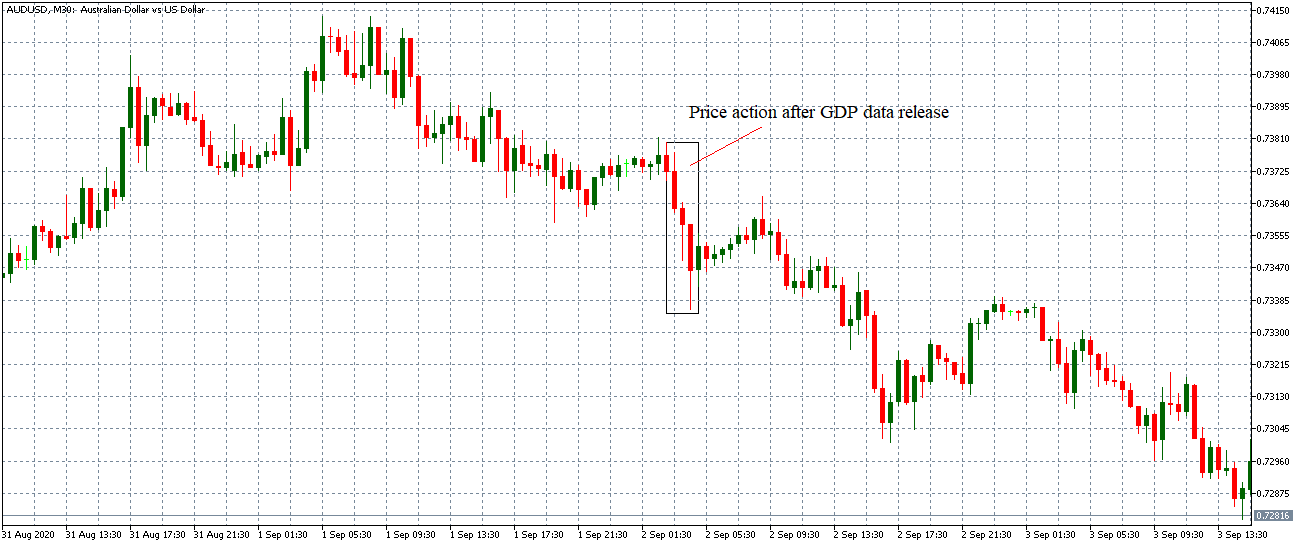

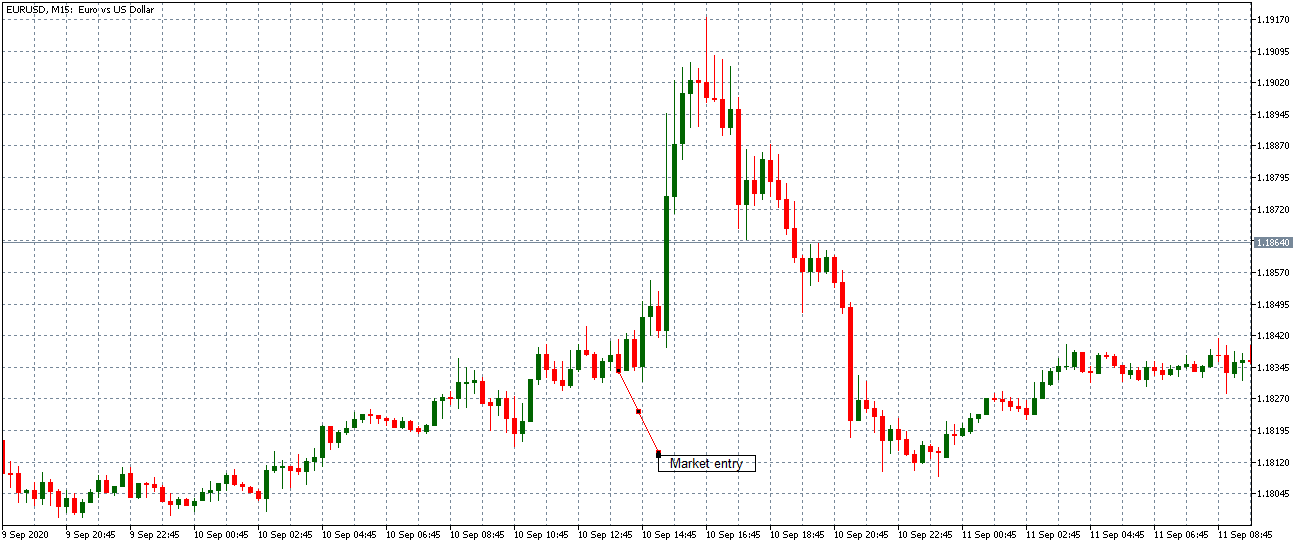

We know that the forex market is, unlike others, almost always open and this characteristic often draws traders into assuming that they are in a position to take action just because there seems to be movement. This compulsive and uncontrolled drive is frequently emphasized by a desire to increase one’s capital, but they, unfortunately, lack the insight into the market’s nature and the skills to plan their actions. As the market typically moves quite randomly and unexpectedly, traders usually fail to grasp the fact that they can only trade when there is an actual trend or a move taking place that is worth the risk they are about to take on. Due to these reasons, it is crucial that traders learn how to plan their trades, weigh their options, and construct a plan based on the charts.

What traders are summoned to do is strive to understand why their results do not match their initial expectations and become introspective to reach invaluable conclusions. The ability to ponder actively and check in on oneself is key because the realization of what has caused all the losses one has had to take renders the trader free. When people get into thinking of why they made a certain move and what kind of behavior enabled a certain string of events, they may come to understand how their personality is linked to the outcome they have never seen coming. Once they start unfolding layers and opening up to an internalized assessment, traders have a real opportunity to see how their traits and characteristics affect and create their trading styles. What is more, this process also allows traders to discover areas where they are likely to struggle as well as parts of their personality which can be particularly useful for their trading careers.

Since many of us, including traders with years of experience in this market, lack this deep understanding of why we keep making the same mistakes over and over again, it is high time that we asked ourselves why this keeps happening. Why is it that we repeat the same actions that continually impact our trading in a negative way? Unfortunately, even when traders make a promise to themselves that they would be more disciplined and that would strive to control hazardous behaviors, their actions often fail to follow their thinking. If we had the power to do everything ourselves, we would have corrected our flaws by now. As this is not the case and we are unable to effectively alter the behaviors that proved to be detrimental to our finances and accounts long ago, we need to acknowledge the fact that there is a deeper underlying problem.

Learning the basics of this market may take a few months, after which you will be fairly versatile in charts, currencies, crosses, and rates although, needless to say, the amount of time needed to study yourself is much longer. With the development of a trading plan, you are rounding off your trading career, thus setting yourself off on a good path to prosperity. We know by now how the market is going to oscillate freely and regardless of what you chose to do at a particular moment and, as such, it is still not the least uncontrollable factor – you are. Each trader is the variable that can put effort and work on himself/herself to become a constant in whichever context. And, again, in spite of what market situation you find yourself in, you need to find the beliefs, skills, and steps that will put you in the group of winners because this market is always going to bread both winners and losers under all circumstances.

To be able to create an effective trading plan, traders need to set realistic goals and returns, so once they complete their education on forex basics, they need to move on to its practical applications. It is unfortunate that after years of trading, many individuals still show no knowledge of some elementary terms such as currency swap. What is more, even when they do complete the initial learning stage, traders are faced with the cold reality where many theoretical items of knowledge go against what they are required to do in actuality. As in real life, theory always differs from practice and this is the concept shared across various businesses, asking people to always come up with new and innovative ideas to adjust to real-life situations.

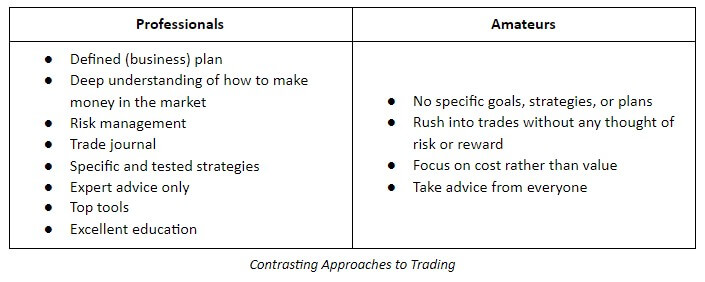

This article will be divided into several sections – we will firstly assess and explain the forex market, show how it operates, and reveal some interesting facts that traders may use in the future. Then, we will move on to currencies and learn about the major currencies and different monetary systems across the globe. Afterward, we will highlight the differences between going short and going long, which are considered essential for trading, and see how we can use pairs trading. We will also learn how traders actually get their orders filled and how we can reach the market. In addition, we will cover the differences between amateurs and professionals, where you can go through a checklist and assess yourself. Last, we are going to analyze different constituents of a trading plan, giving you a definitive list of the parts you need to incorporate when creating your own trading plan.

The Forex Market

The Foreign Exchange market, otherwise known as the FX, Spot, Cash, Currency, or Interbank market is the largest one in the world so far. With an incredible turnover of people and finances, this market is entirely different from any other marketplace or trading experience. As such, forex required all interested parties to exude a special interest in these topics and show a true passion for trading. For example, many expert traders who first started off in some other markets quickly learned that trading currencies differs greatly from experience accumulated while trading equities or futures. With equities, in particular, the stock market opens at 9.30 AM EST and closes at 4 PM EST each and every day. This schedule allows stock traders to go home at the end of the day and relax without thinking about trading or needing to make a move outside their working hours. Trading currencies is, however, vastly dissimilar because of the market uniqueness and the fact that it does not close the way others do. Many professional trades explain how they see forex both as a blessing and as a curse, having experienced the greatest wins and the biggest stress trading in this market. Experts also point out how the FX market rendered their lives less traditional than before owing to the intricate characteristics and a distinctive schedule each currency trader comes to develop over time.

It is interesting to note how traders within the United States of America typically trade currencies on the side, while they primarily engage in trading stocks, options, and/or futures. Traders in some other countries, however, appear to be strictly focused on the forex market because the local markets are quite underdeveloped in comparison to the currency market. Canada could serve as a great example of a country whose stock exchange includes solely a few hundred stocks out of which only approximately 100 have a volume decent enough to start trading in the first place. As the market is simply not big enough in terms of depth and liquidity, Canadian traders are understandably more specific with regard to the markets they choose to trade. Similarly, Indian local markets severely lack structure and are highly affected by corruption, which directly propels locals to turn to currency trading.

With $4 trillion transactions a day, the forex market is undeniably immense and diverse. As such an immense marketplace, its scope encompasses the US stocks, futures, commodities, and the Treasury markets combined and multiplied by three. Interestingly enough, despite its wide applications from the perspective of geography and the fact that it is so widely dispersed and lucrative, forex actually has no physical marketplace. Stocks, for example, are traded at the New York Stock Exchange and, even though technology has changed the way everything is processed, orders are still sent to the nearest exchange where they are filed electronically whenever a trader clicks to buy shares. Another American stock exchange, the NASDAQ, however, does not have an actual building although it ranks second after the New York Stock Exchange. The advertisements created for this exchange even seem to suggest that traders can actually walk freely into its offices when, in fact, one could only find empty desks and computers in their database located in New Jersey.

The forex market resembles the NASDAQ, as traders cannot find an actual exchange that they could visit. In actuality, the forex market is comprised of various banks, corporations, and traders that weave this intricate network together. All rates are put on the interbank rate list with thousands of participants giving their bids and ask, thus creating the market in question. Forex is also known for its high liquidity that surpasses any other market along with the unique speed of trade and transaction costs. In addition, when compared with the stock market, forex traders need not worry about the low volume and large spreads between the bid and the ask (or between what you buy it for and what you sell it for). In the currency market that numbers such so many participants, the number of transactions is incredibly high, which entails that traders need not worry about the same challenges that are present in other markets. Aside from its tight spreads, the FX market is also praised for the best possible rates for spreads and commissions.

Trading styles can be truly diverse and they may vary from one market to the other. As forex is a trending market, most traders are solely interested in directional trading, i.e. traders buy and you sell or they sell and then they buy, although they have a plethora of other options at their disposal. For example, in options and futures, it is possible to try spread trading; in trading stocks, participants can learn about pair trading and, in trading currencies, everyone is mostly governed by the notion of making a profit based on the difference between buying and selling, which is what directional trading essentially means. Despite the many trading variations that traders can test and use, forex is an exceptionally good market for directional trading because of its depth, the lowest prices, and the best trends.

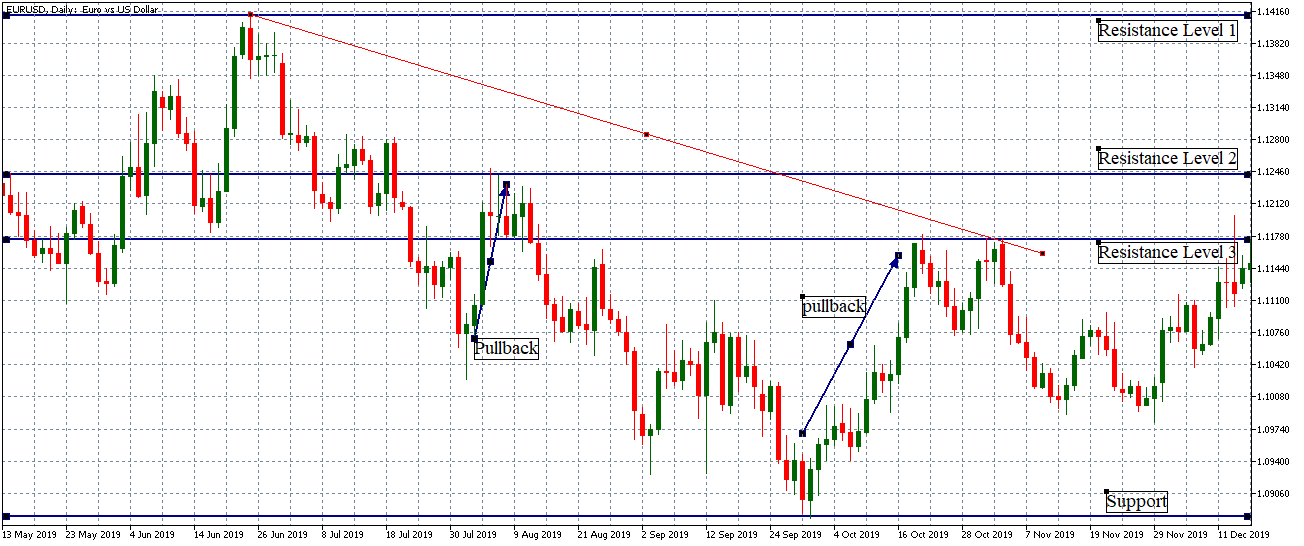

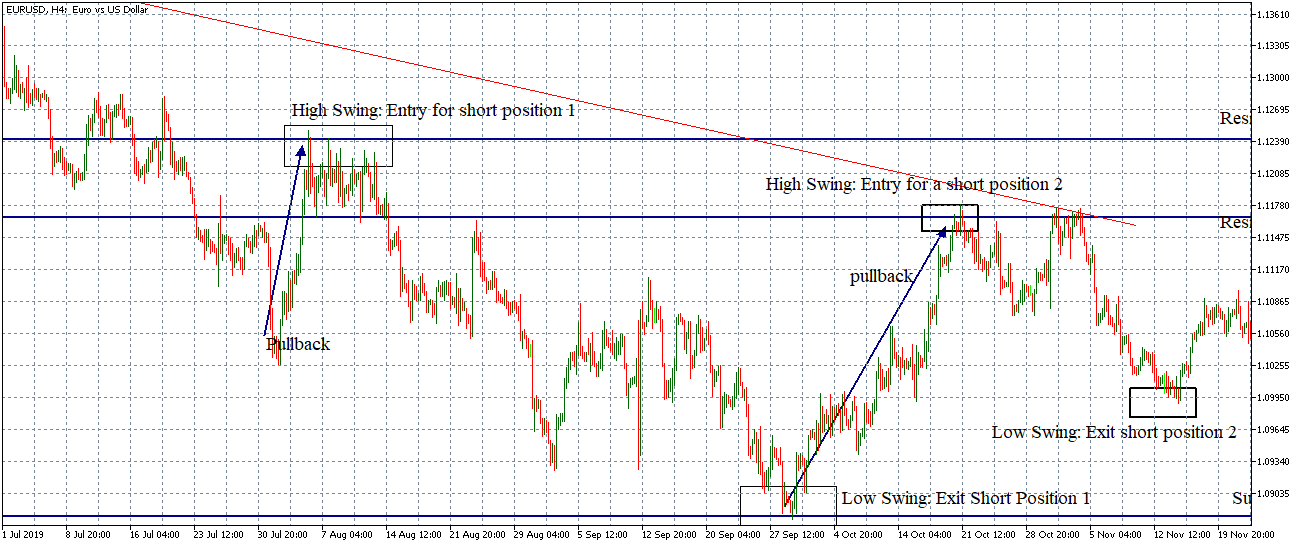

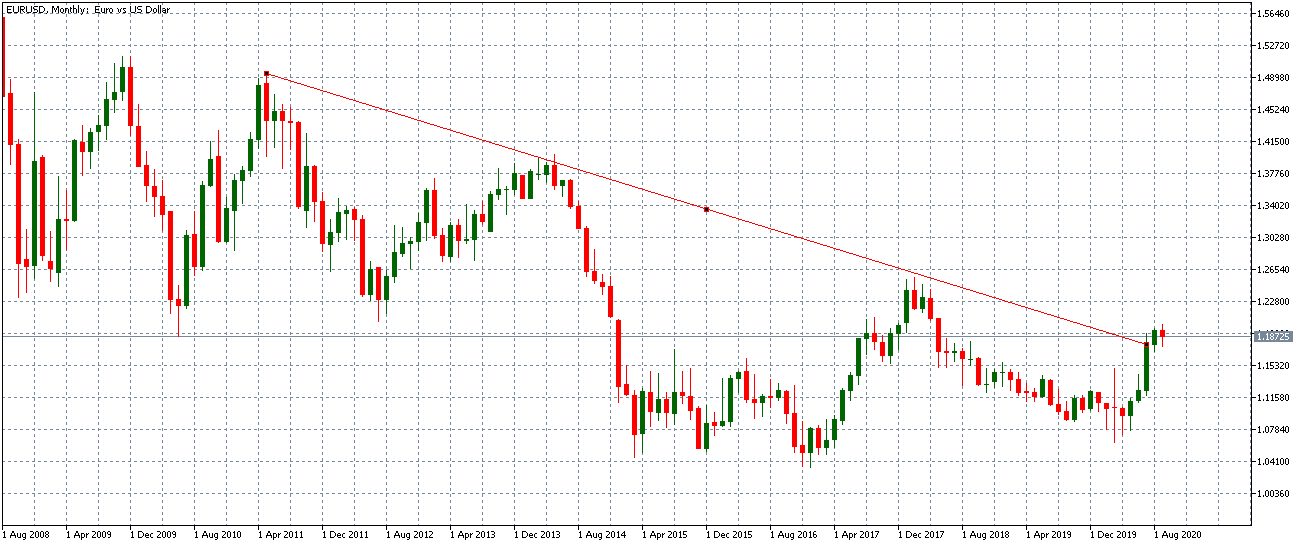

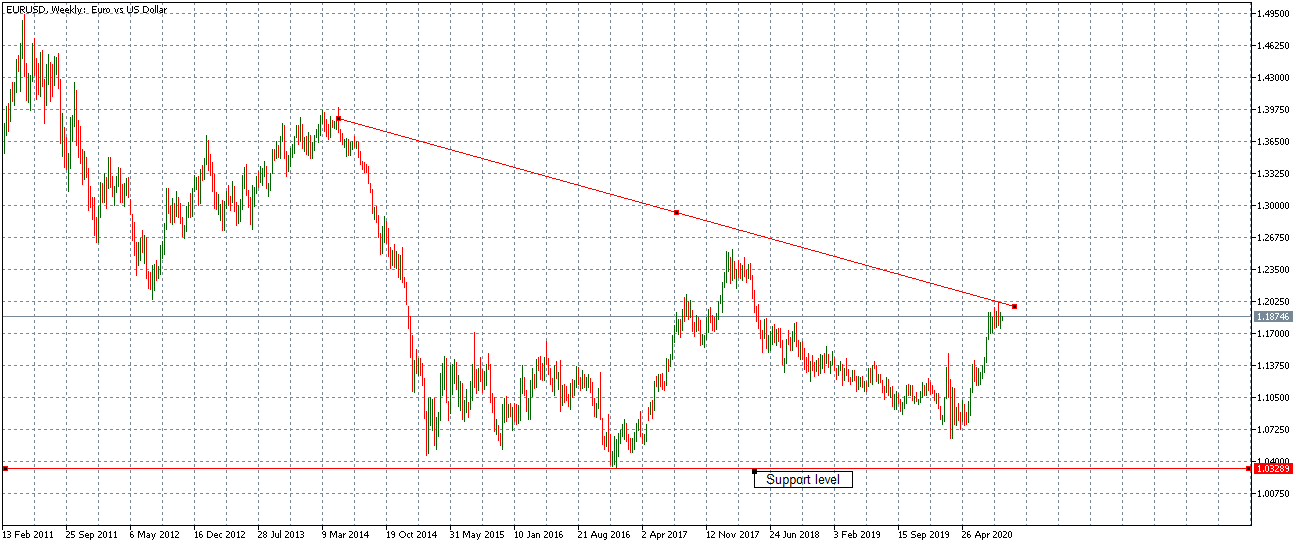

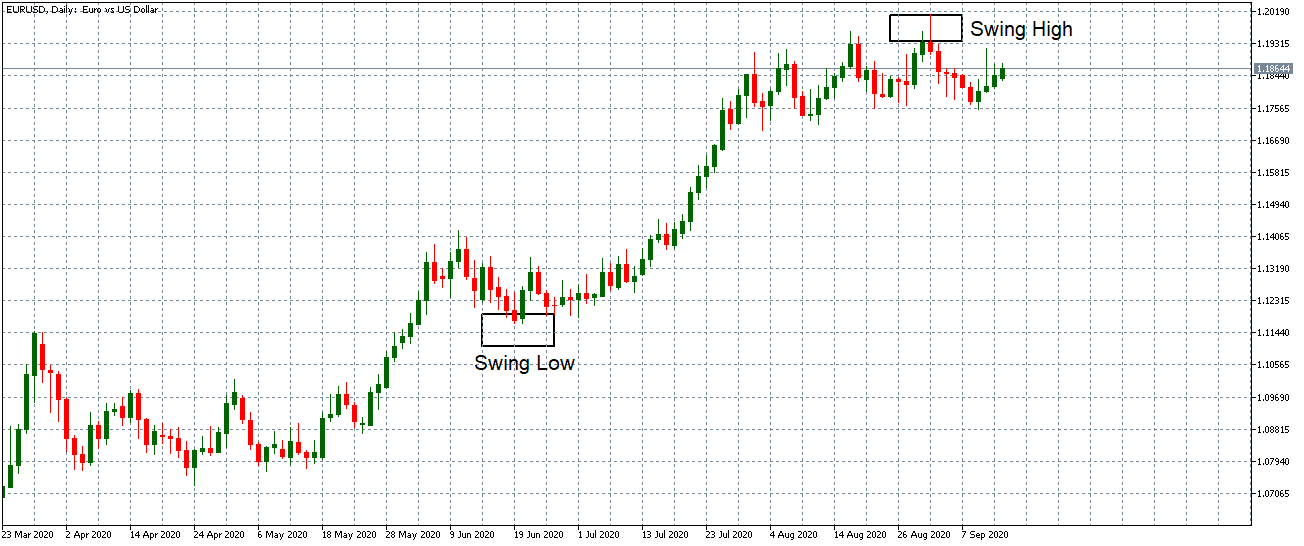

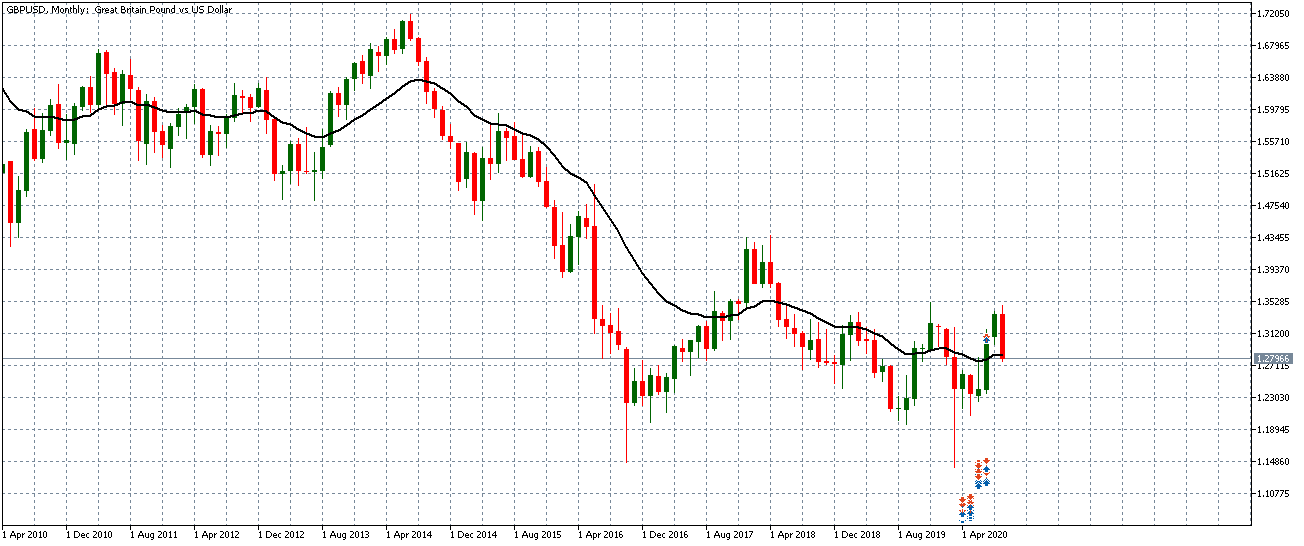

In the stock market, a particular stock can move in a specific direction for a few days or a few hours before it finally pulls back. In the currency market, the price has been known to keep moving one way for five or more days without any substantial pullback. Prices in forex can even keep going down without a bounce for over a month too, which leaves much room for successful directional trading due to the trending nature of this market.

As explained before, it is the nature of this market to be constantly open. In fact, the forex market offers 24-hour access over 5 days a week. It opens at roughly 5 PM EST on Sunday and closes at about the same time each Friday. Due to its availability and ease of access, traders often feel compelled to trade and they often do it excessively, falling into the trap of overtrading. Many professional traders explain how they have struggled with this issue in the past, feeling grateful that they started in some other market first. We have seen above with some other markets how traders are unable to click any more buttons or make additional trades once these markets close at the end of each day. As forex does not have this ability, it is important to remember that we can only enter trades when the market is there or when there is sufficient energy to do so. As in the forex market, we do not need to wait for the following morning to start trading again, we truly need to learn when we can and cannot trade because trading whenever we feel like it is unproductive and quite hazardous as well.

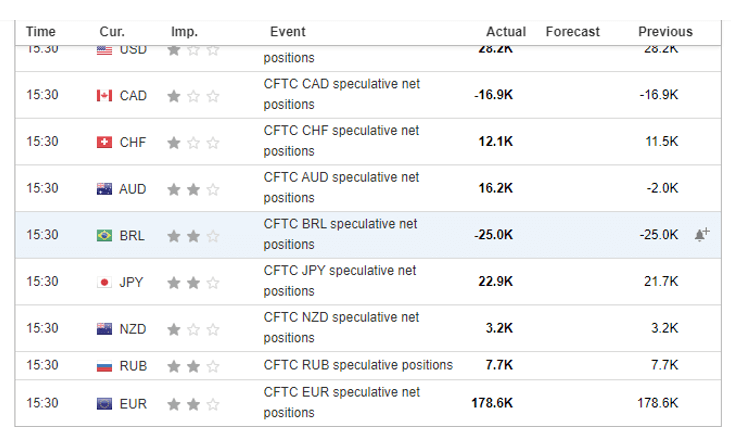

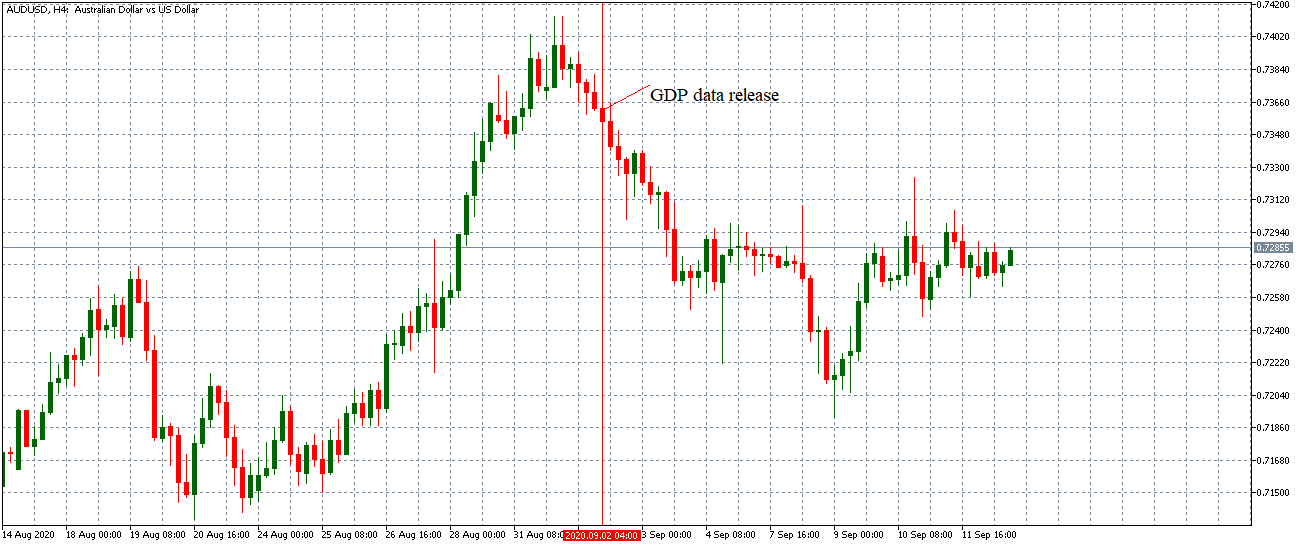

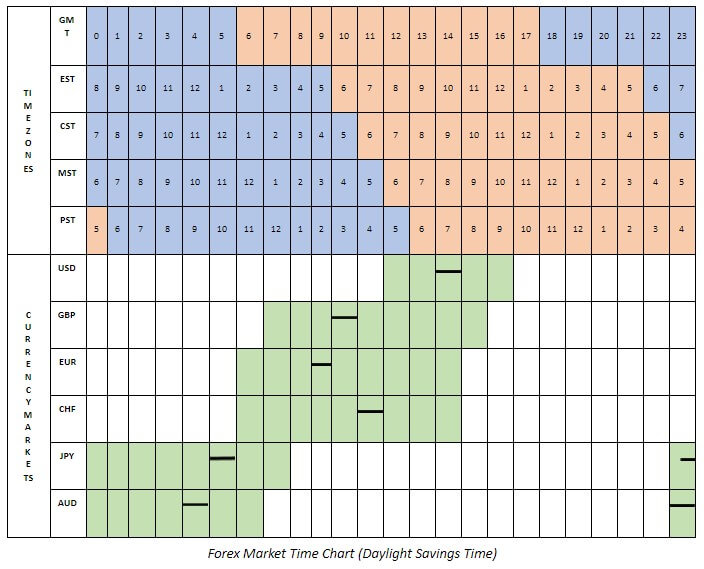

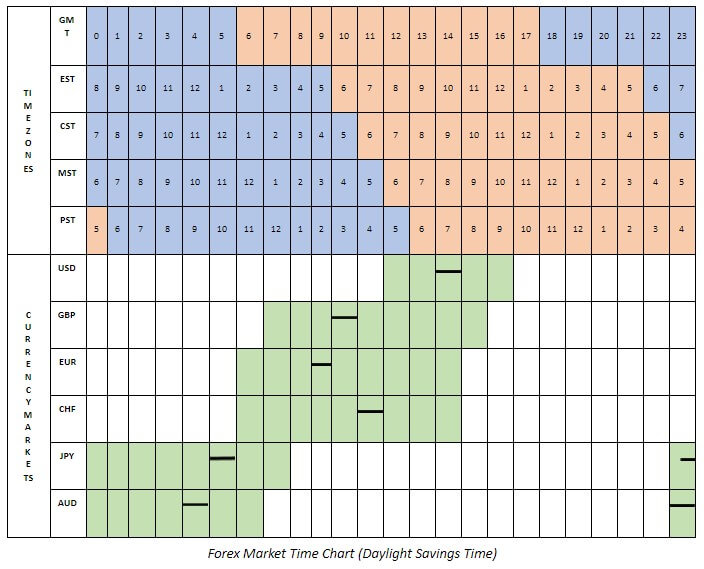

Most currency trading is done through the banks, which are major market participants that are always in the act of buying and selling, as well as through the interbank rates. The reason why the forex market is always open lies in the fact that one can always find banks to be open sometime, somewhere in the world. The first bank that opens on Sunday with respect to the daylight savings time is located in New Zealand, immediately followed by the banks of Australia and Japan. As the chart below shows, both the Australian and the Japanese banks close just after European banks open, which only points to the nature of the currency markets to always be open and running somewhere on the planet. We can also see how when the US market closes, the New Zealand banks open up, so trading happens continuously. This chart below is clearly very inviting for anyone who wishes to start trading, and with so many options and availability in terms of time, it is easy to fall for the illusion that you can trade anytime, whenever you please.

High leverage, which is an inherent part of trading currencies, can be either good or bad, depending on how it is used. Many traders struggle with overleveraging, which is one of the fastest proven ways to lose an account. Traders have confessed to having lost 25% of their accounts in the past, and some have even gone beyond 50%. Even with a loss of smaller proportions and of a lower percentage, after two losses in a row, all of a sudden, this person is down by nearly half of their account, which means that they need to double that return to get that back. Even if they do get wins, the losses in between can be so heavy that they enter a downwards spiral causing their account to gradually fall down in value.

While it is increasingly wise not to start with a lot of leverage, it is also incredibly important to get used to adding leverage to the winning trades. The Forex market is truly exceptional because it proved the traders with the highest leverage power among all markets; however, it is at the same time one of the greatest challenges for forex beginners. It is because of these hidden dangers that traders need to use a strategy and determine where to put a limit. For example, you can limit your leverage to 5%, but there is no need to go all in all at once. You can start slow and buy one lot, and if this turns out to be a good trade, you can then buy another lot and repeat the process again and again. Most importantly, if this trade keeps going your way, you may end up buying five lots in the end, but you do not need to hit your limit right at the start. This is extremely significant advice, as you will be much better off if you gradually build up your position. That way, even if you do take a loss, it is minimal, whereas you leave room for your wins to get really big.

Some additional benefits of the FX market include low transactional costs, low accounts minimums, and above-average profit potential. The amount of cost to execute trades has dropped considerably in recent years. Nowadays, there are no exchange fees and clearing fees since forex is an over-the-counter market. Additionally, individuals today can get started with a minimum account for as little as $500 and there is no doubt that forex trading has massive potential regardless of where you are on this planet.

Currencies

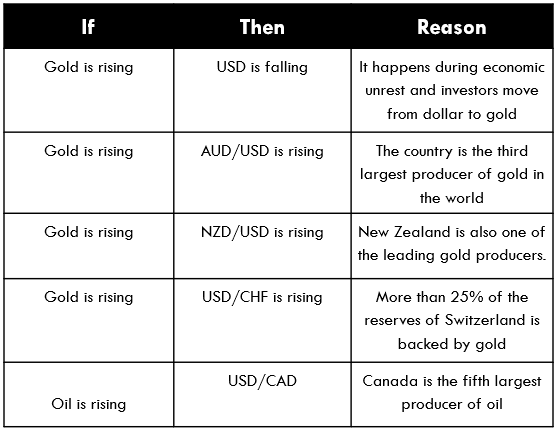

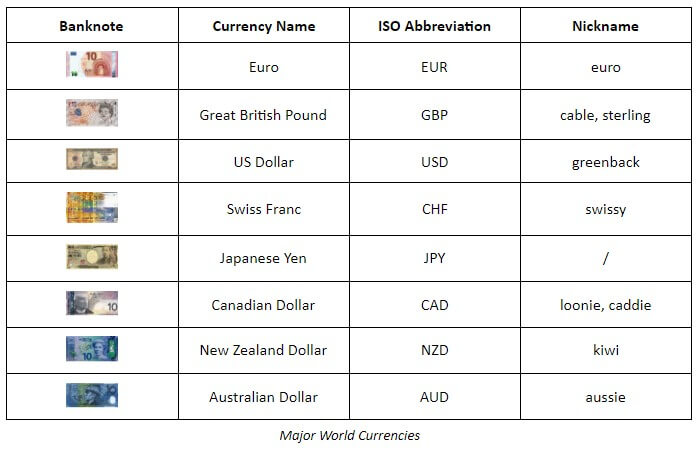

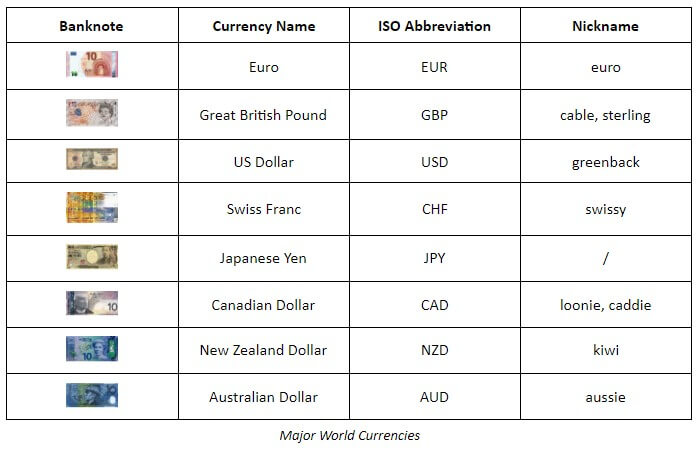

Today, there are more than 80 currencies in the world and, understandably, we cannot possibly trade them all. Despite this diversity and abundance, we only want to trade the most liquid currencies. We have no desire to trade some obscure currencies such as the Indonesian rupiah because there is a lack of volume, the spreads are wide, and there is a lot of slippage involved. Traders are advised to focus on the major eight currencies – the EUR, the USD, the JPY, the CHF, the GBP, the AUD, the NZD, and the CAD. Some people also like to add currencies such as the Swedish krona to this list, which may not make a lot of sense because this currency is highly correlated to the EUR. This essentially means that if the EUR goes up, the krona will do too. Therefore, if either one of them goes down, the other one will follow as well, so experts would typically recommend traders to just trade the EUR in this case. Similarly, a person wishing to trade the Hong Kong dollar might want to know that this currency is pegged to the USD, so trading the latter would simply be more sensible.

As traders should always focus on the major currencies, they should also strive to learn as much as possible about them, including their nicknames. The alternative name for the GBP, for example, is cable, which is completely understandable considering the currency’s history. Back in the 1920s, the very first telecommunications line was laid across the ocean from London to New York City in order to get quotes in real-time. Therefore, whenever someone wanted to get a quote on the exchange rate of the GBP, they had to go through that cable stretched across the Atlantic Ocean. Soon enough they started asking “What’s the quote on the cable?” and the rest is history. It became common knowledge that whenever someone would refer to the cable, this person was referring to the GBP in fact. Additional names for the GBP also include the sterling or the pound sterling, while some other currencies such as the EUR do not have any nicknames. Nicknames can get quite creative, such as the greenback for the USD, and we may see how certain alternative names are often derived from the actual name of the country (e.g. swissy).

Some traders even shared that when they heard some currencies’ nicknames (e.g. loonie for the CAD), they assumed that they referred to an unstable person due to the meaning of the word. The loonie, clearly, is not a name for someone who is challenged in any way, but the name of the C$1 coin, which originates from the name of the bird (loon) engraved on the front of the coin, which is why the Canadian $2 coin is called the toonie. Each one of these currencies will also have a symbol, and most of them are acronyms or first letter abbreviations that are used frequently in writing and in speech.

Pairs Trading

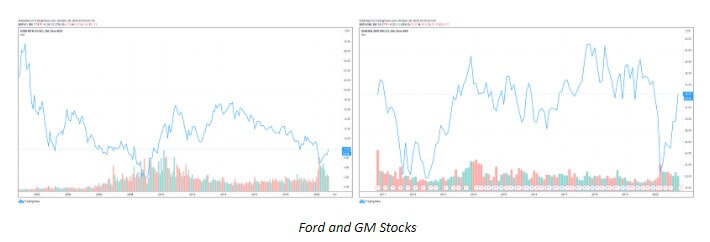

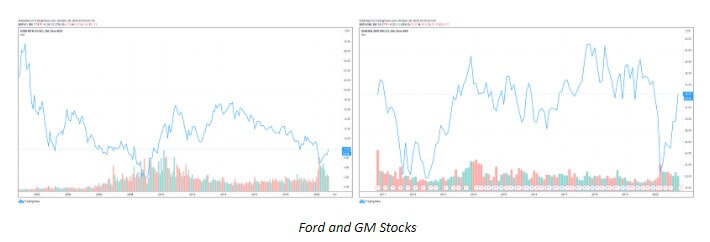

Pairs trading is a strategy that consists of going long on one thing and short on something else, which means that traders will always enter two trades at the same time. For example, a trader can show interest in Ford and GM stocks (the two companies’ charts are shown below) and decide to go long on Ford and short on GM. This concept entails that the undervalued stock is bought while the overvalued one is sold short because of the premise that one is a better stock than the other. By doing so, the profit does not depend on market activity any longer because both of these stocks are going to go down if the stock market starts to sink. Should the market go up, however, both of them will also rise in value. In addition, if money starts pouring into the Automobile sector, it will reach both of these stocks too. This is called a market-neutral strategy which entails the effort to reduce the impact of all the things that make stocks move up and down in value. If you do a pairs trade with Ford and GM stocks, you are taking all the components affecting these stocks out of the equation. That way you will inevitably make money if your premise is right. Even if both of these stocks crash, which is what happened in 2009 when GM almost reached zero and Ford went down by 42%, your short position made a profit of 60%.

To further clarify the previous strategy and provide additional information, it is also vital that we practically explain what going long and going short entail. The two are found among the most important concepts to remember because trading will always involve one of the two if not both at the same time. Whenever a trader goes long, he/she actually buys something first only to sell it after. Traders always look for a discrepancy in price, so they may buy something for $50 and sell it after for $5 more. This concept is something that most beginners in the forex market seem to comprehend effortlessly. However, early on, traders seem to have difficulty with understanding the other concept because it seemingly differs from what most people are accustomed to. When we go short, what we actually do is sell first and buy second. This is what traders do when they, for example, believe that a stock is going to go down, so they may sell it for $50 (which is allowed), which then makes them short. If the stock goes down to $45 and the trader buys it at that price, he/she makes a $5 profit. Unfortunately, if its value goes up, this person will find himself/herself at a loss. This is the essence of going long and short in trading.

Forex Brokers

Any trader who is ready to make use of his/her system and buy a specific cross must do so through FCM which handles all such transactions. FCM is in fact a name for a broker in the stock market which acts as an intermediary between the two sides. As traders cannot possibly visit the nearest stock exchange and buy 100 shares of a company, they actually have to go through an individual, a broker, having a seat on the New York Stock Exchange. The same applies to the forex market where all traders pass through an FCM because the entire process is regulated in the same manner. Hence, any trader wishing to get to the market must do so through a broker.

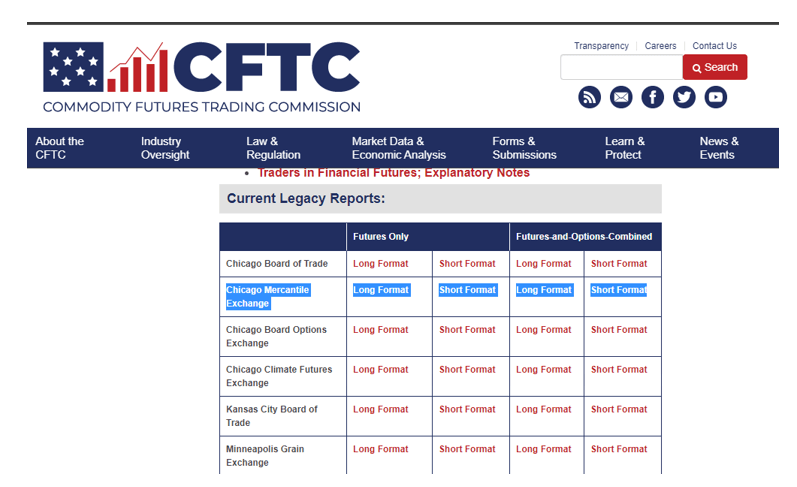

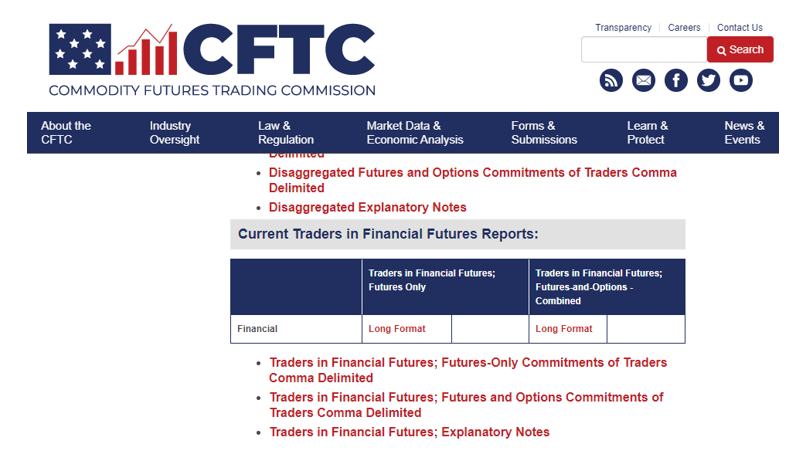

In the world of currency trading, there are several brokers traders may already know of. The largest currency trading firm in the world is FXCM, which is also known for its infamous moment when they almost went out of business due to the Swiss national bank decision to pull their peg to the EUR in 2015. The company ended up losing more money than what they had in their accounts, thus threatening all clients’ finances. Luckily for everyone involved, FXCM managed to emerge from the potential catastrophe unharmed as they were bailed out. The company is no longer operating within the United States after it was banned by the Commodity Futures Trading Commission (CFTC) which revealed some fraudulent behavior on behalf of the company. The entire turmoil over the event and disclosure of the information was settled in 2017 when FXCM agreed to pay a $7 million fine and never seek to register with the CFTC again.

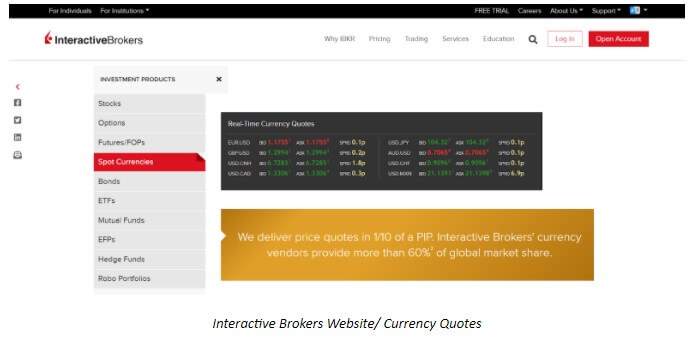

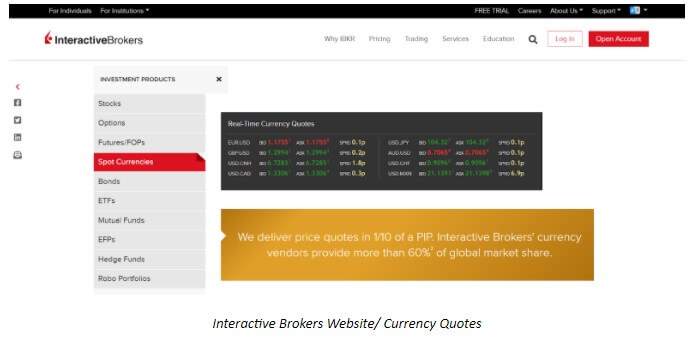

Another well-known brokerage firm is IB (Interactive Brokers), which is a huge multinational company often praised for their professionalism. The benefit of collaborating with such a company lies in the fact that it is used to dealing with currency traders and currencies. Besides, Interactive Brokers always wins all the awards for the fastest execution and the lowest cost alongside having been rated first by Baron’s, a US weekly magazine/newspaper published by Dow Jones & Company. Along with that, since all brokers, or FCMs, always publish the percentage of their profitable currency traders, IB usually displays between 15% and 20% of such winning traders although this percentage is at about 50% almost every single month. The company is also preferred by expert traders owing to its professional and fast execution as well as the greatest spreads and fees.

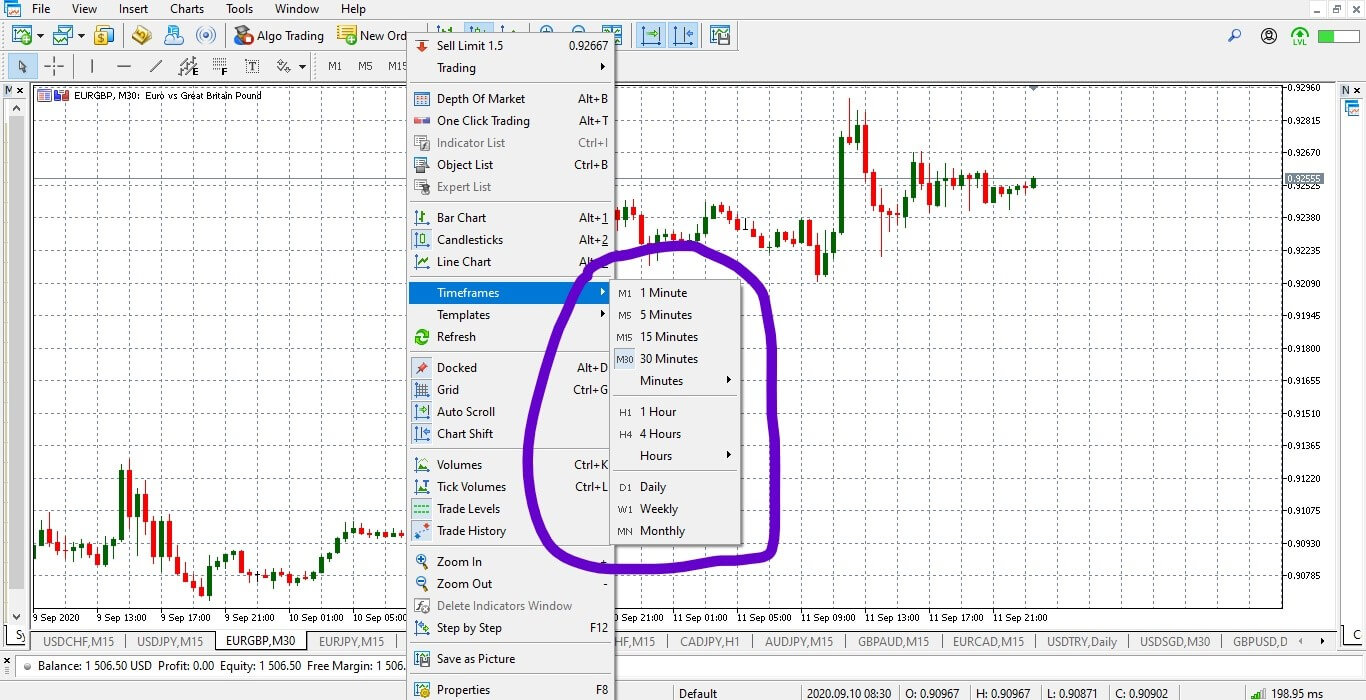

Apart from choosing a broker you wish to collaborate with, it is also necessary to create a demo account after you have worked on your simulator and perfected some of your strategies. Different people will always use different systems, so some traders might opt for MetaTrader for example. MetaTrader operates similarly to IB and traders should expect to become conformable using the platform after a week’s time. Traders are simply required to get used to having and using a demo account; besides, it is typically the place where professionals go too.

Interactive Brokers also offers multiple trading platforms and they have the best mobile trading platforms (e.g. TWS or Trader Workstation) for which they have already been awarded in the past. These platforms are truly applauded by many forex trading experts who used to have difficulty making a work-life balance in the past due to technological limitations of the time. Most professionals nowadays actually first started to trade in the 1990s, when it was impossible to use phones to check or manage trades unless they were physically behind a system. The internet was a luxury at the time and it was mostly available in the offices only, which meant that traders would have to leave their homes or other social engagements to be able to know where the market was and what was happening, get quotes, or close out a position.

Mobile trading alleviated most of these problems, so traders are not obliged any longer to go into their offices at night and close their positions which they did not want to keep overnight. These platforms also give traders the freedom to do business wherever they please, and some experts even say how they have had the experience of trading in some unusual places such as a cave or an island. As mobile trading allows you to trade regardless of your current location, it does bear a negative side to it as well. Similarly to the nature of the forex market, which is always open, mobile trading platforms may put extra pressure on traders who are prone to making rash decisions and overtrading. Traders need to have discipline and set up strict rules to prevent making mistakes when they feel bored or compelled to enter a trade, which understandably never leads to success in most cases.

While MetaTrader is undeniably the most popular platform, it typically does not function as an FCM although it can be attached as software to one. Aside from FXCM and IB, traders can also have an account with TDM or ETrade, which equally allow you to make money because they are going to the same place or the same market. Regardless of which platform or broker you chose to use, the rules are always the same. If a trader is unable to trade well and keeps making mistakes taking many losses, he/she will not be able to earn a profit through either of them and vice versa.

Professionals vs. Amateurs

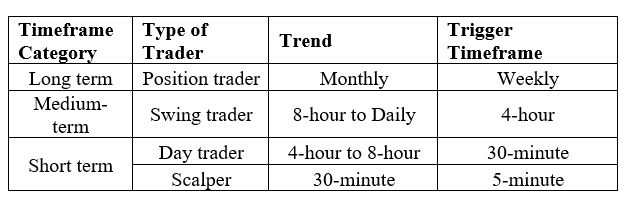

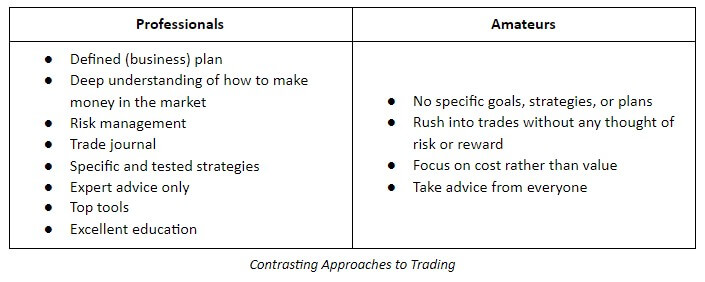

In order for any trader to make it in this market, every single participant needs to treat the entire process as a professional and set the ground for the next steps. Naturally, in order for anyone to be able to see trading from a different perspective, he/she also needs to grasp the difference between the professional and the amateur approach to trading shown in the table below. Professional traders always have clear trading plans with set goals which may vary between daily, weekly, monthly, and even yearly ones. They also know how to make money in the market and manage their risk through the use of stops/hedges. To ensure consistent and continual growth, experts always keep their records making it a habit despite the difficulty. Moreover, professional traders rely on strategies, which is the biggest difference between the professionals and the amateurs, who are likely to jump on any opportunity. As amateurs are likely to be drawn to any movement they notice without a previously devised plan, they are highly exposed to failure because this approach rarely works since traders need to have specific entry and exit points. Furthermore, amateurs are prone to taking advice and tips from any individuals, while professionals in the market strive to consult with other professionals seeking expert opinion. The more advanced traders have also already made their selection of tools and they insist on using the best suitable ones which have emerged top after thorough testing. Furthermore, they have invested in getting informed and educated on topics that may relate to forex. The essence of prosperity in this market lies in having a plan and as you can see, the moves that amateurs make are not only fewer in terms of numbers but are completely opposite from what professionals do to remain on the top of the game. As a professional, everything is clearly designed and set up, which further entails that traders cannot just click buttons whenever they feel like it.

Trading Plan

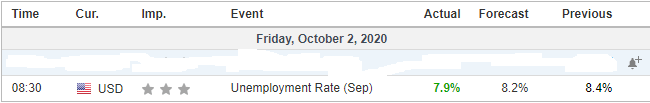

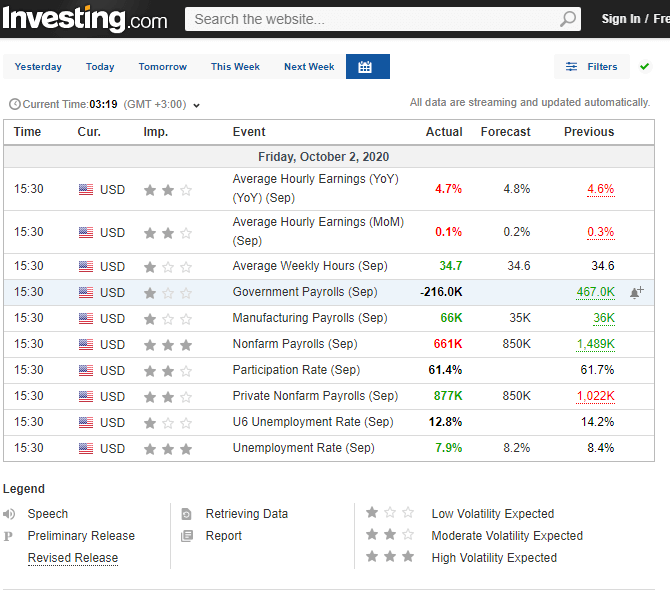

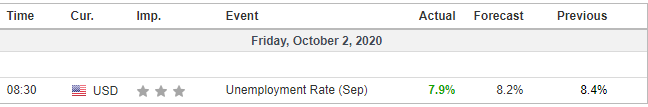

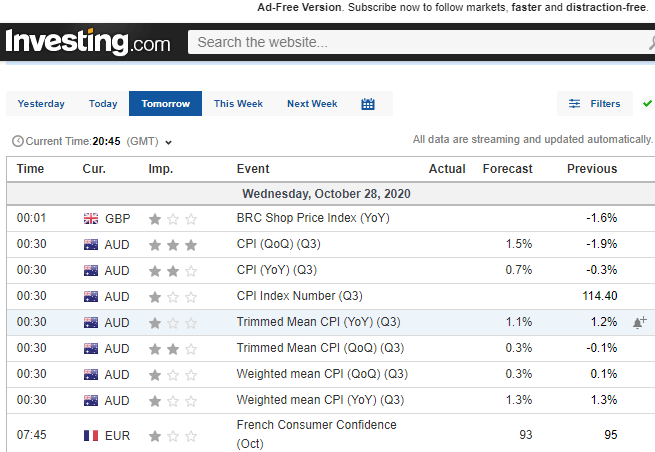

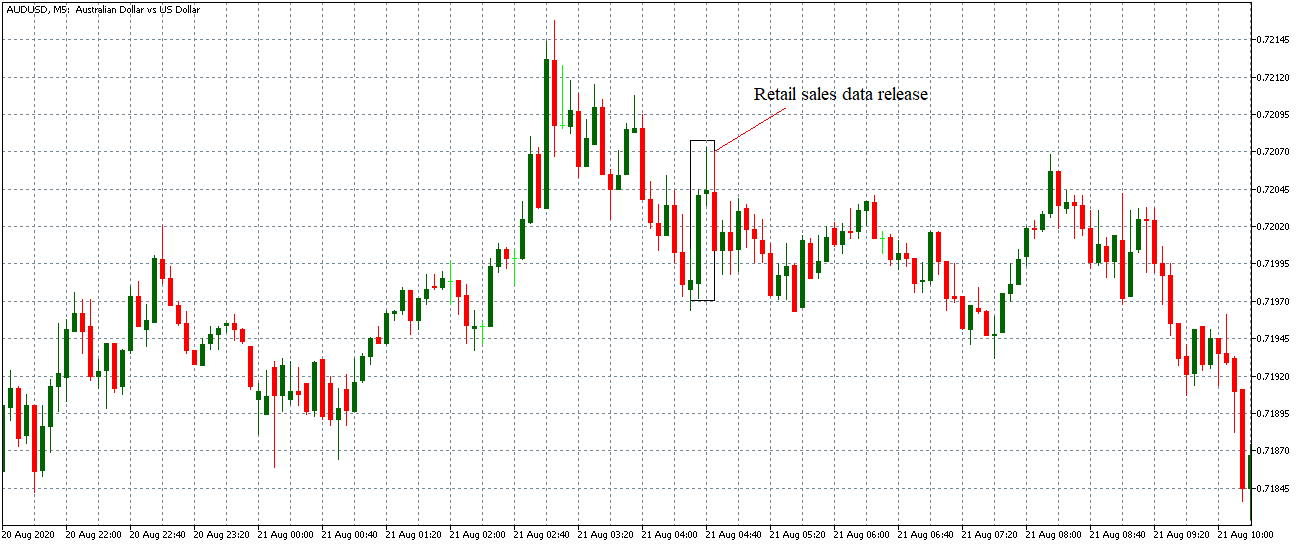

Before any decision is made, it is crucial to design a trading plan which lies in the basis of any and every activity a trader wishes to take. Simply put, a trading plan translates as the steps you are going to take in every possible situation. It also includes decisions on specific moves you may take on a particular day when an important news announcement is supposed to come out. These choices are never made randomly because they all comprise your trading plan. Every trading plan consists of a number of such decisions that have been drawn and written before any event takes place as a result of your own action or occurring independently in the market. Professional traders predetermine everything and if you do the same, you will know that the market is aligning with your intentions rather than going against you. With a plan and discipline, every trader can achieve success in the forex market.

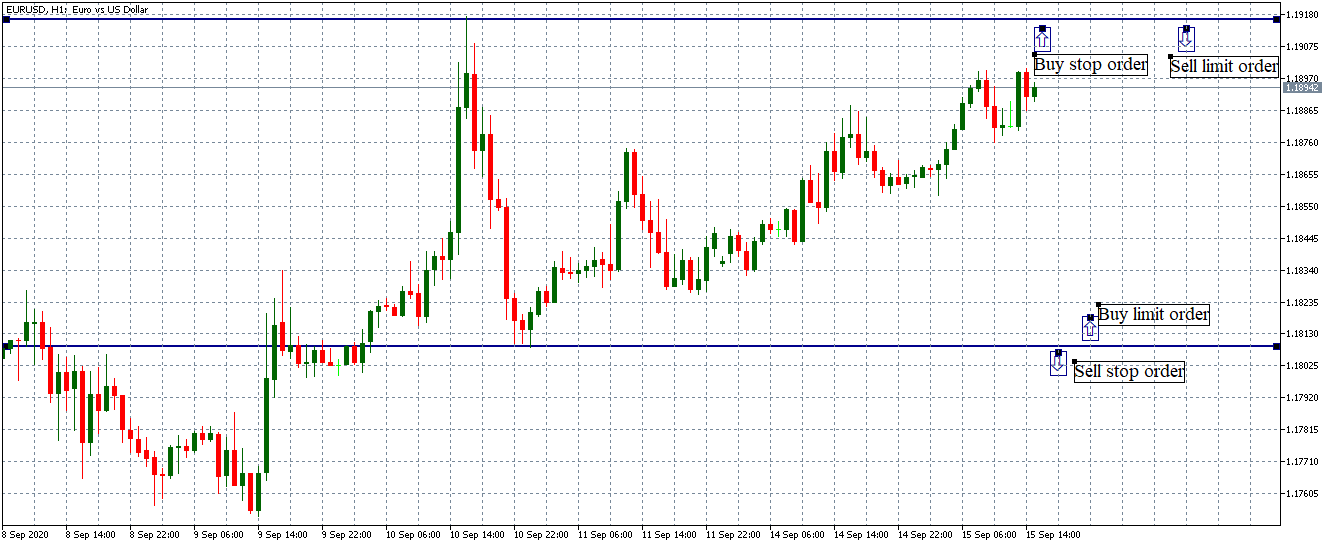

To better explain what a trading plan is, we need to precisely separate its consistent parts and discuss each one separately. Firstly, the initial part of the trading plan always boils down to several questions: why am I am going to do something; how am I going to achieve this; and, what my hours are going to be? The beginning stages always involve the type of questions that concern the trader alone, while the following parts will mostly have to do with your strategies. Naturally, as there are numerous ways to earn a profit, you may need to ask yourself if you are willing to trade breakouts, cup and handles, hammer candles. It is vital that you assess and predetermine what you are going to trade, letting go of all other options. Traders who fail usually assume that it is enough to just sit down and trade without giving it any thought before, but as you can see, the planning stage is essential for achieving success and each part of the picture is equally relevant.

Goals

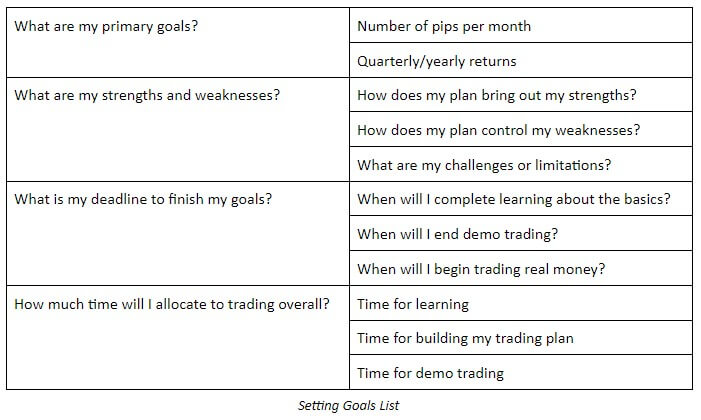

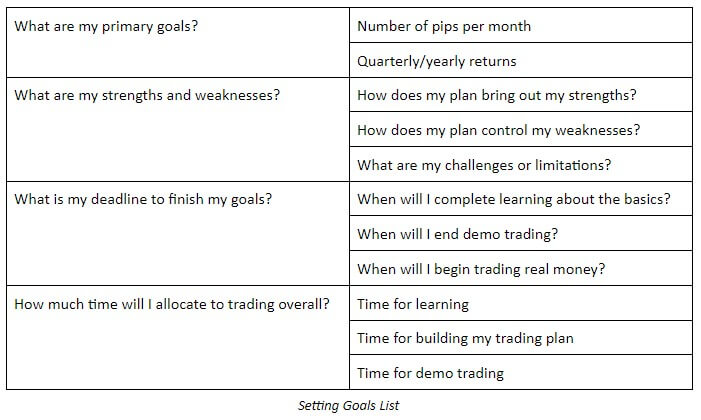

Before proceeding to read the importance of having clear goals, you can use a pen and paper and create an outline based on these instructions. The first step in your trading plan should be to write about you and determine when you want to complete each stage of the process. For example, when are you going to start demo trading or live trading? When are you going to leave time for education? Is it going to be a span of a few hours on a specific day or will you divide this time frame into several days? You can make use of the list of questions below and fill it with your own answers. Of course, allocating time to clearing up what you want and how you are going to achieve your goals may not be a particularly fun activity but it is the only way to properly build a foundation for your future trading.

Education

Whenever we discuss education, it is necessary that we first accept that we do not know everything and remain open to being molded and shaped by the information we absorb. Many people turn to professionals for help, but all they are truly looking for is not education but money, wishing to amass a fortune quickly and effortlessly. In trading, however, there are no quick fixes, so if someone already claims to know everything, we may naturally wonder why this person does not already enjoy the abundance that should naturally spring from this richness of information they supposedly possess. When you are open to learning, you reveal that you are a humble individual and that you understand how there are areas you may need to clean up to make room for prosperity.

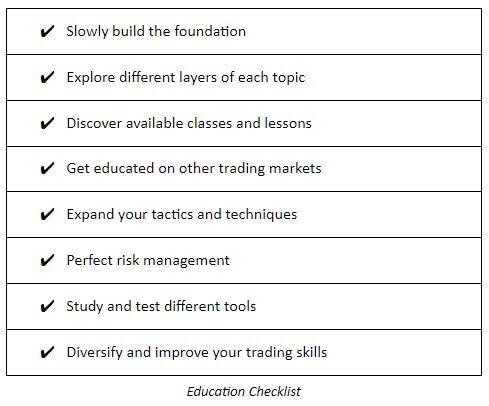

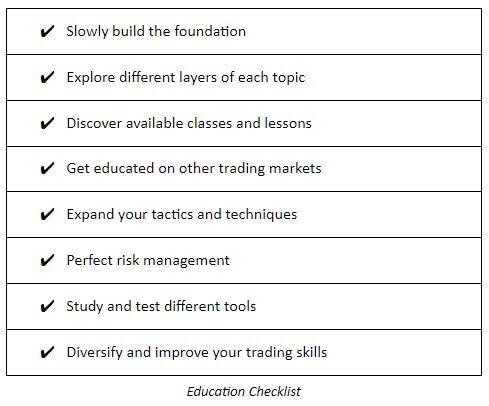

While being open to learning is important, it is also vital that you create your own style of trading because no one can trade exactly like someone else. Everyone is different, thus having different psychology, triggers, and personality. Therefore, adopting someone else’s choices and positions might be an unnerving experience, which is why it is important to realize what you can accept, apply, and control. Nonetheless, it is a must for any trader to build his/her foundation slowly and thoroughly. Understand that, as with anything else, there are layers to knowledge on trading, and you can come up with ideas with time how and when you want to learn different things. You should strive to explore classes and lessons that are available and seek professional advice. Expand the tactics and techniques you can apply, and also get educated on other markets where you can trade such as options or futures for example. Last but not least, keep building on your risk management, tools, and skills.

Go through this process and see how the information you take in corresponds to your own personality and traits. Some people may like trading the hourly chart, but you are free to choose any other time frame instead if you feel like that is too slow for you. Most importantly, learn how to use all the knowledge in a practical manner and test it via a demo account. Soak in as much as you can because the more you know, the greater the protection from your own self-sabotaging mechanisms is and, hence, the healthier your trading plan will be.

Risk Management

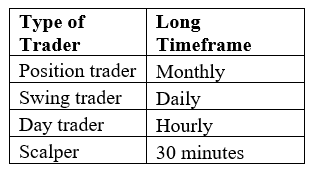

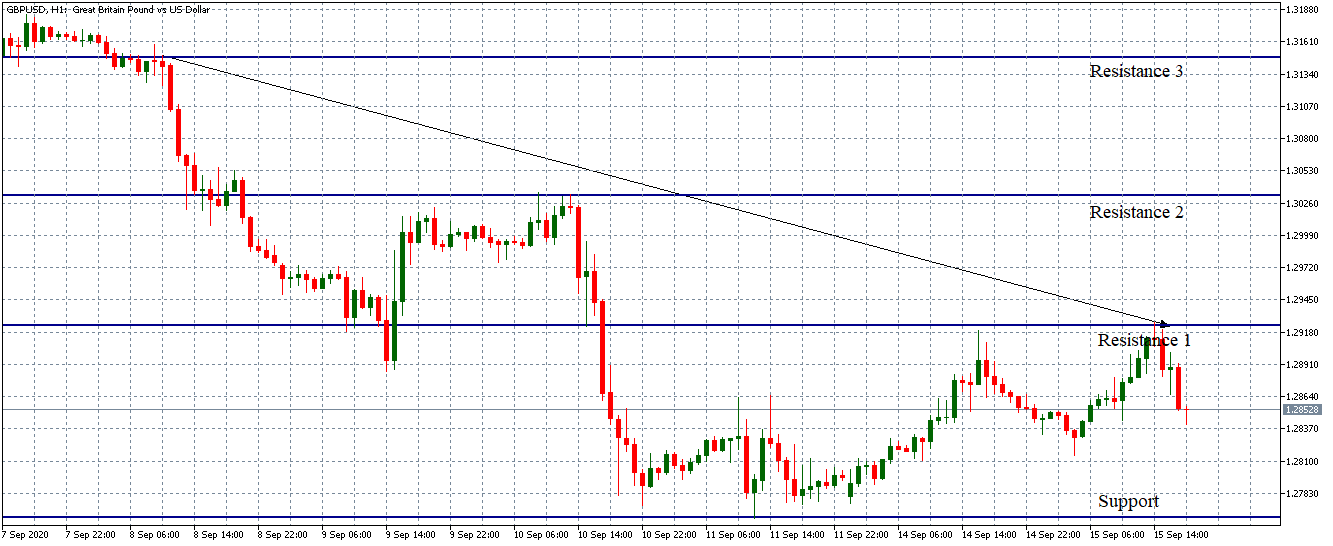

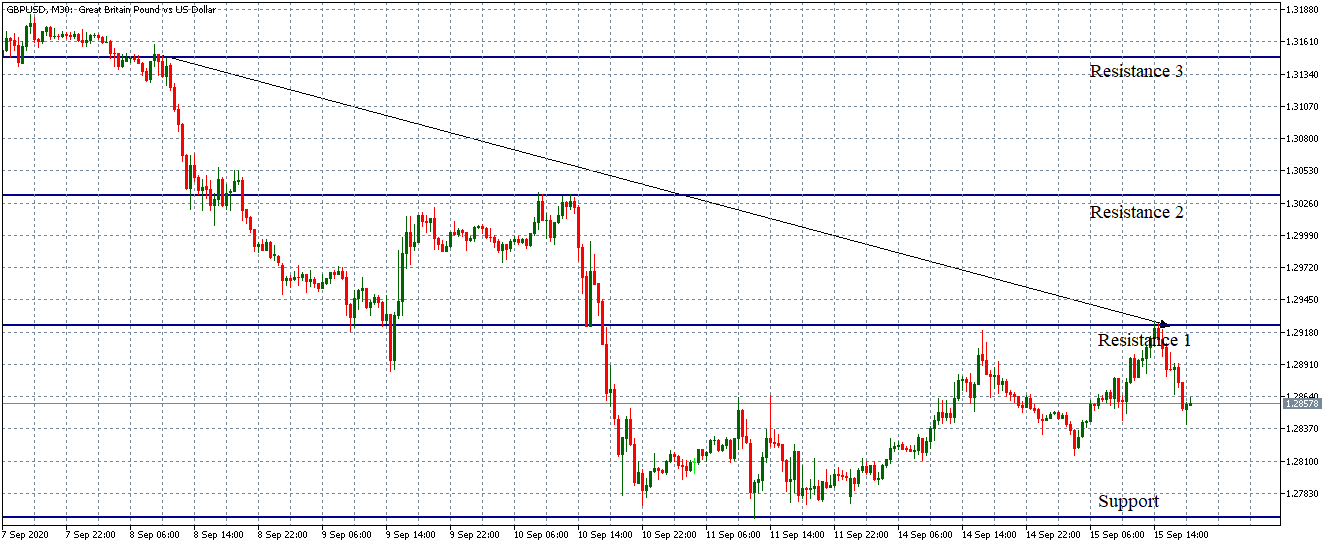

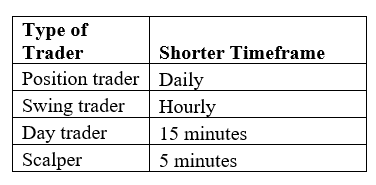

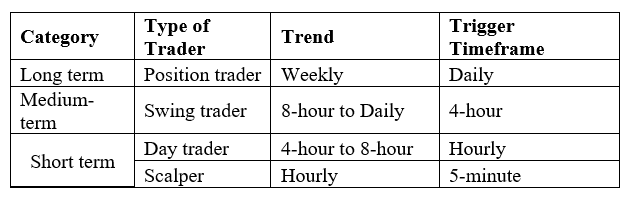

As we all understand by now, every trader is unique, which is why some people are going to want to enter the daily chart, while some others will prefer different time frames. Although these questions are open to interpretation and depend on personal preferences, time management is an area where such variations must not exist. Especially when you start working as a prop trader and you are given someone else’s money, you are expected to treat that money with respect. Nevertheless, one cannot build this kind of attitude unless it is initiated from the very beginning.

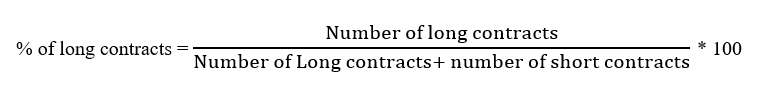

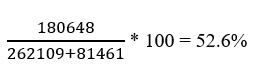

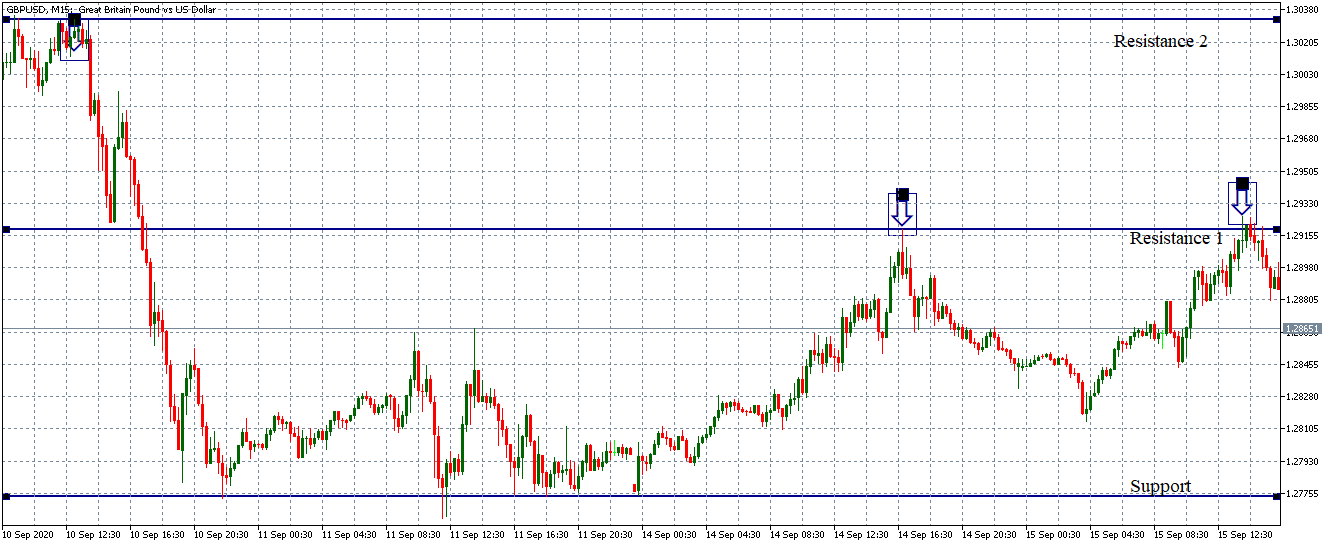

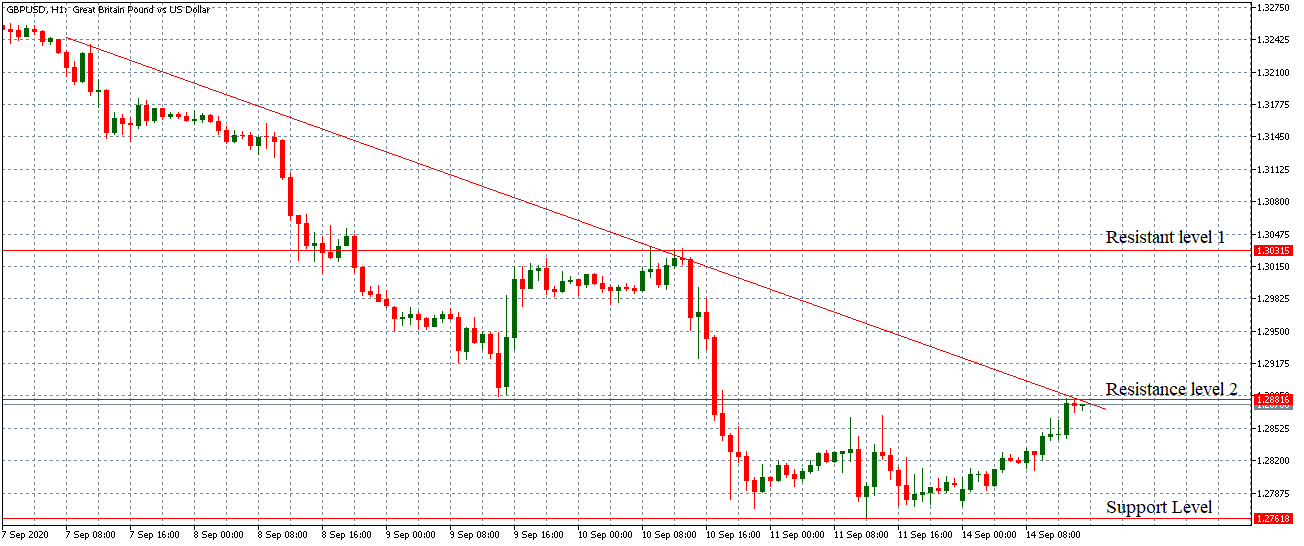

You need to know your rules and as things can quickly turn against you in trading. How can you control the situation and yourself? If you see that a trade is turning sour, when will you draw the line and decide to exit? Also, when you want to enter a trade, how much are you willing to risk if it turns out to be a winning or a losing one? When a particular pair you are trading breaks up above or goes below a certain price, when are you getting out? How much in terms of percentages does it need to pull back for you to exit the trade? All of these points are incredibly important and you need to be aware of them and know the answers in advance.

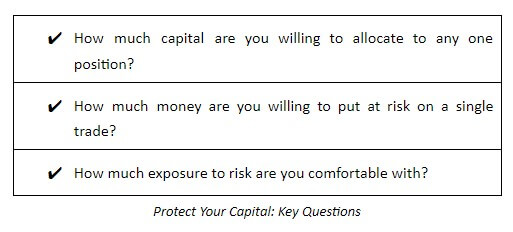

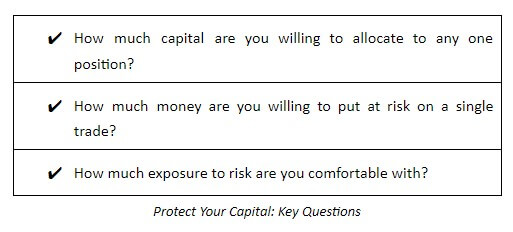

Many amateurs start trading immediately, without any preparation, only to realize how they should have learned and figured out everything before they started investing their capital. What this means is that the majority approaches trading as gamblers, not knowing what they want to achieve, how much is at stake, and how much they are willing to risk. As the first rule of trading is to protect your capital, consider the following questions:

Strategies

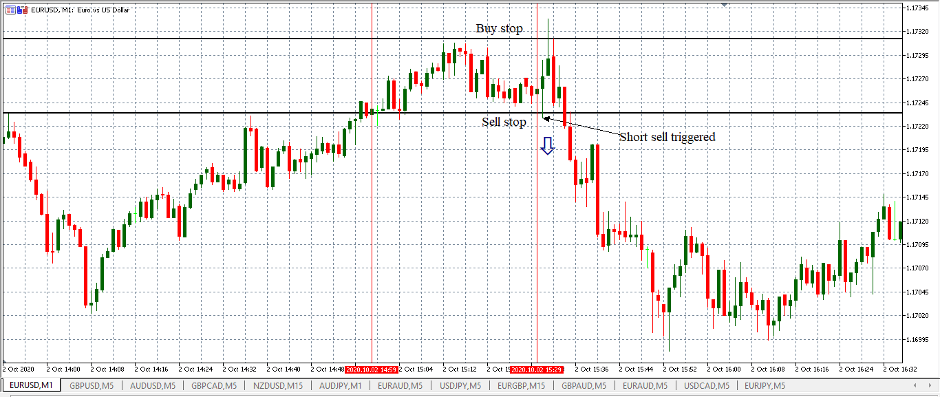

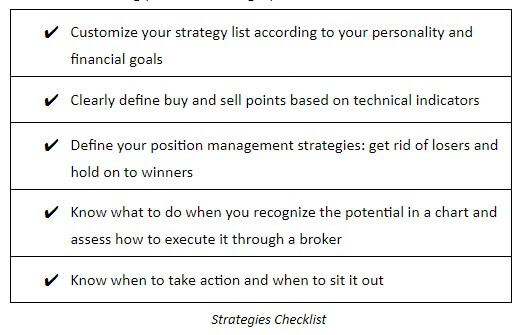

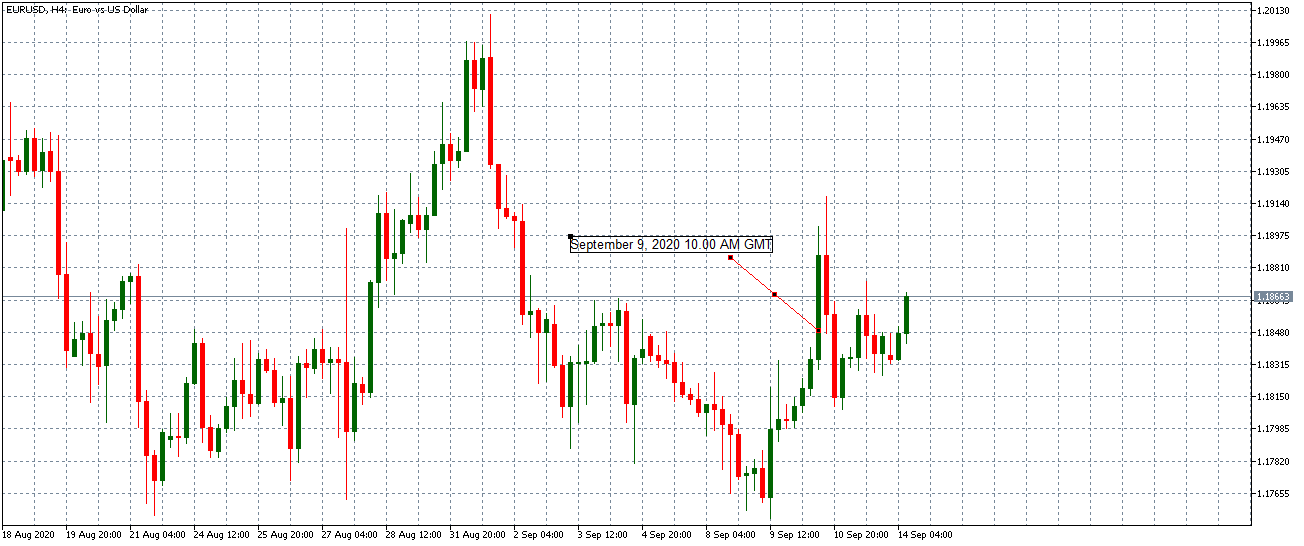

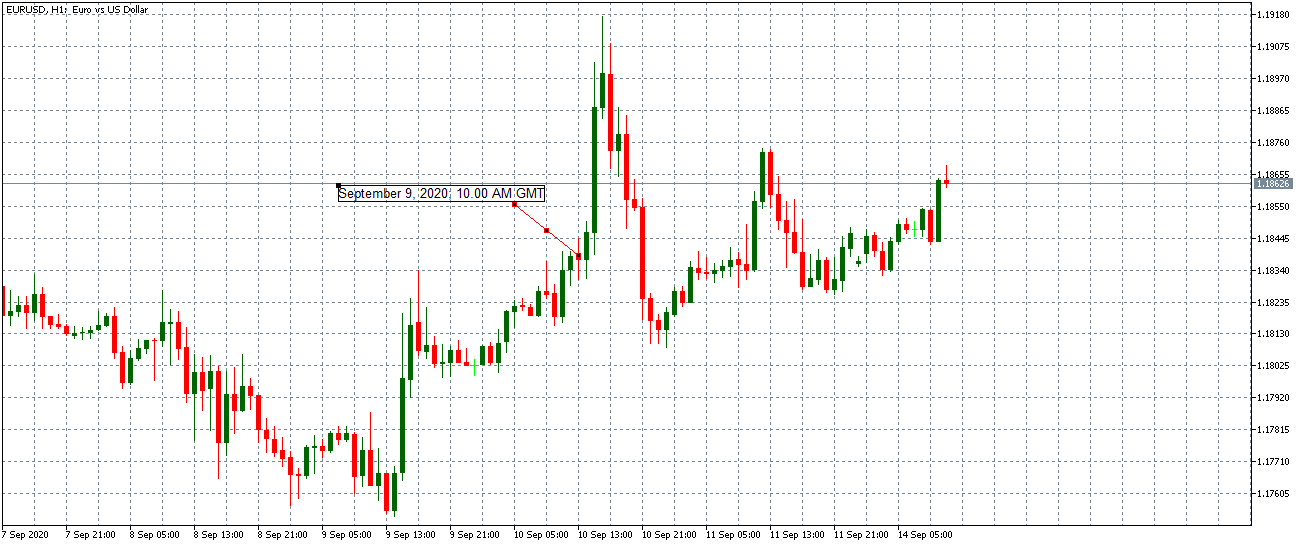

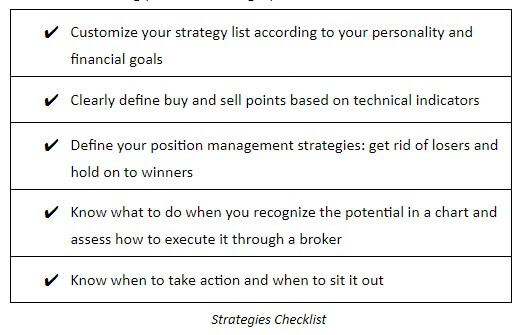

Strategies may vary from person to person and they can, in fact, turn out to be vastly different from what other participants chose to use in trading. When creating your own array of strategies, always think of the question of when you want to enter and exit the market. It is vital that you be as specific as possible and explain to yourself every step you may take at some point. For example, some traders only trade specific circumstances such as high breakouts during some events. While this may seem like a narrow option, it is still an excellent approach because these traders clearly defined the circumstances, their goals, and their actions both for a winning and for a losing trade. Even if you wish to try something new, always make sure that you test it before you incorporate it into trading. It is all these points that your strategy list should consist of and, as long as you test everything out with your system and through your demo account, you and your finances are safe. You can also consider the checklist added below to serve you as a reminder when creating your own strategic plan.

Analysis

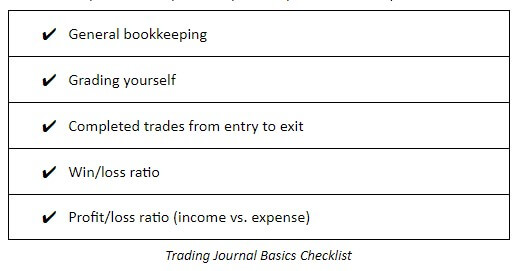

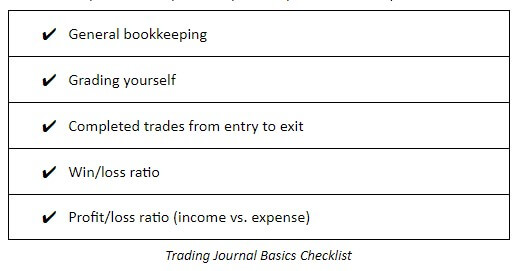

With so much room for making mistakes, trading must be kept under close control. To achieve that level of scrutiny, each trader must keep a trading journal. Trading journals are the most effective way in which a trader can keep track of past actions and develop himself/herself. It also allows traders to learn from their mistakes and not repeat them while revealing which behaviors turned out to be beneficial in the past and should be used in the future as well.

During this process, while you are learning from different materials, taking tests, using a simulator, developing a trading plan, and testing it all through a demo account, you still need to know what your results are. All traders need this form of analysis to know that they are going to make money before real trading begins. Keeping a journal may be the most difficult part of the process for some people, but at the same time, it is difficult to understand why anyone would want to invest real money without any preparation, backtesting, forward testing, and without realizing whether those actions can lead up to any profit. Being detailed and meticulous is a must if you desire to become a professional trader.

Trading journals are essentially Excel sheets where you enter your trades, your win/loss ratio, risk and rewards, percentage of gain, pip gain, and profit/loss ratio. These pieces of information help you know how many pips you earned this month and what your growth percentage is. Journals may differ based on what you want to keep track of – for example, you may keep different journals for a simulator and for your demo trades.

If you happen to lack this kind of information and do not keep track of these numbers, you are not trading but gambling. However, if you know that after 100 trades, you win 55 and lose 45 of them; if you are aware of the averages you are making on both winning and losing trades and you can compare them effectively, this no longer falls under gambling. Even if your results have not reached the level of satisfaction or success you want to have while trading, by possessing this information, you are already ahead of the majority of traders who go into this business blindly. Keeping your records and tracking your progress is an immensely important topic and one of the major stepping stones to becoming a professional trader where you can independently follow your rules and system.

While we discussed a number of different aspects that make the essence of a trading profile and portfolio, understand that this is also the very foundation. You should, therefore, view today’s lessons both as one of many facets that constitute any professional trader as well as an approach to trading that makes it possible for anyone to keep trading. In order to complete our trading plans, we also need to educate ourselves on forex basics, currency pairs, and margins, and pips, thus helping ourselves understand the forex market. After we take in all the information and absorb whatever knowledge we had the chance of learning, the time for practice comes. Practice is not only about trading with a demo account but space where you have room to test yourself and see if you are ready to take on the next level. Practice is also where you should stress your tracking skills and use the time for deep analysis that will prepare the ground for the real game. The matter of fact is that, while all these processes may seem dull and too detailed, all effort will pay off the moment you start trading real money. If you desire to be on top and bear the fruit of the market, you must devote time and prepare to get out of the comfort zone. Use today’s tips and advice as practical steps you can take and as an outline on which you can base your trading plan.

Finally, remember that if you could get over your weaknesses on your own, without seeking expert advice, you would have already managed to do so by now. Understand that some faults and flaws cannot be fixed and that we go into detailed planning so as to create a trading plan that could go around those negative aspects of our personalities. See this process as the most useful way in which you can use your personality, knowledge, and skills to evade your weaknesses, stop repeating the same negative patterns, and get the most from trading in the forex market.