Introduction

In forex trading, every trader anticipates the upcoming price of a currency pair in several ways. Traders and analysts use market analysis tools like capital flows or price action to predict the currency pair’s future direction. However, some use interest rate differentials to predict the upcoming price movement of a currency pair.

What is the Interest Rate Differential?

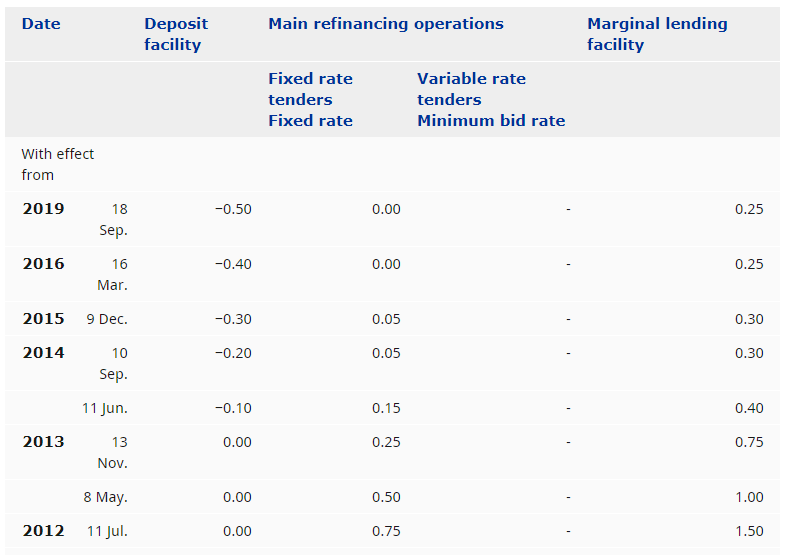

In trading a currency pair, buying towards the currency with a higher interest rate and selling the currency with a lower interest rate is a way to make money from the forex market, which is known as interest rate differential or price appreciation.

The interest rate differential makes the forward point that makes up a forward currency rate. The forward rate is created by adding or subtracting the current exchange rate and making a new rate. At that rate, traders can buy or sell a currency pair in the future. Let’s have a look at the example of interest rate differential.

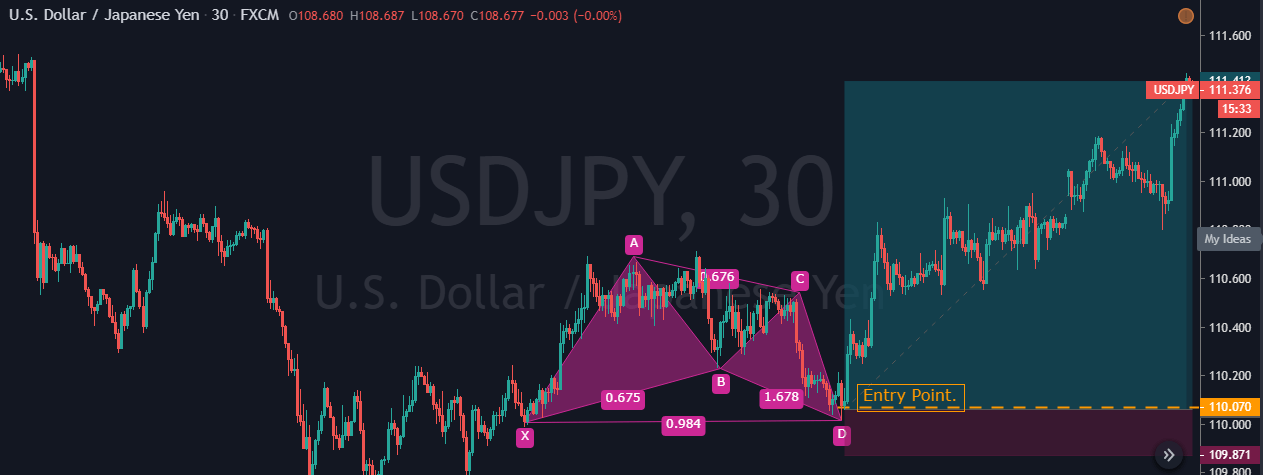

If we want to sell the USDJPY 10 year in the future, we have to make a payment to the buyer. The amount should be based on the difference between the US interest rate and the Japanese interest rate. Later on, we will make payment to the buyer at the current spot rate plus interest rate differential between the US interest rate and the Japanese interest rate.

How to Make Profit from Interest Rate Differential

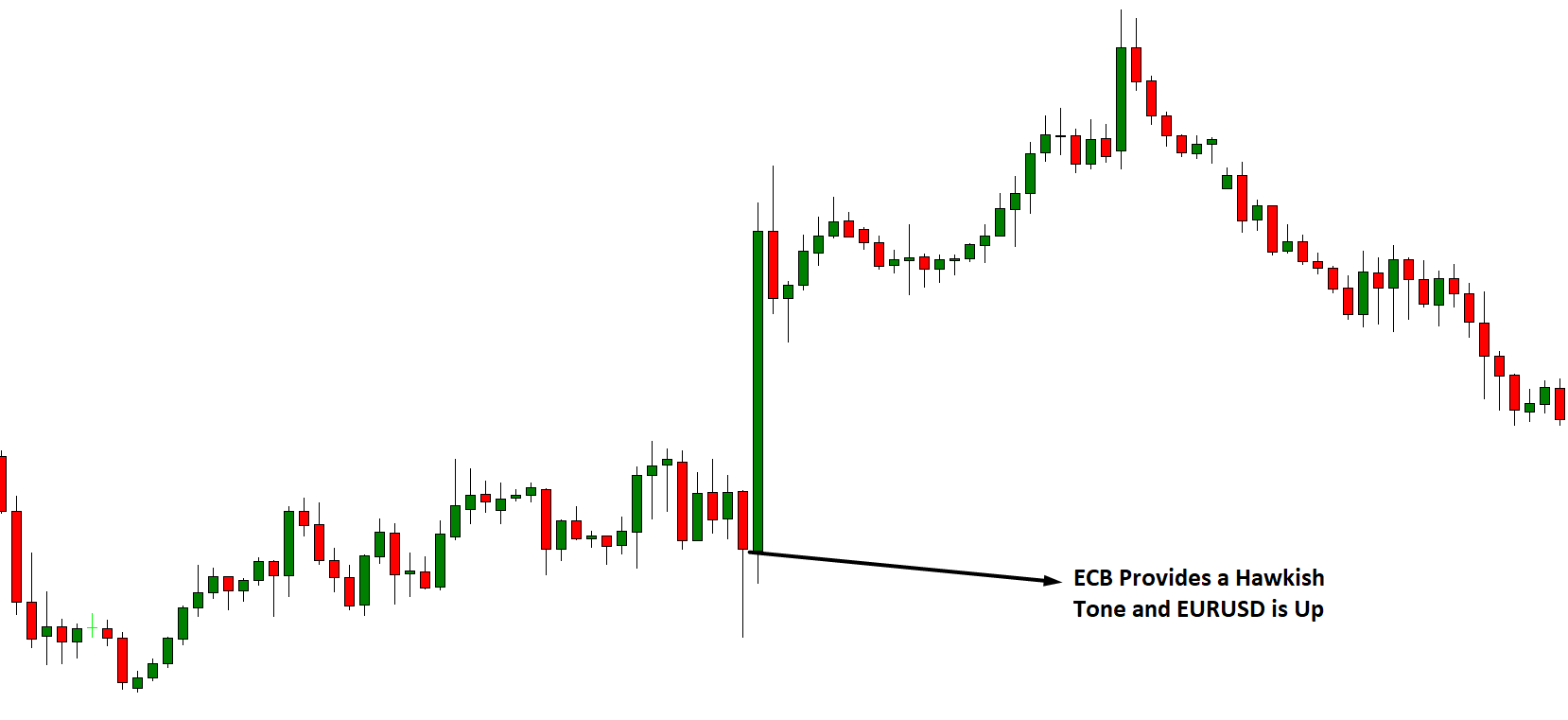

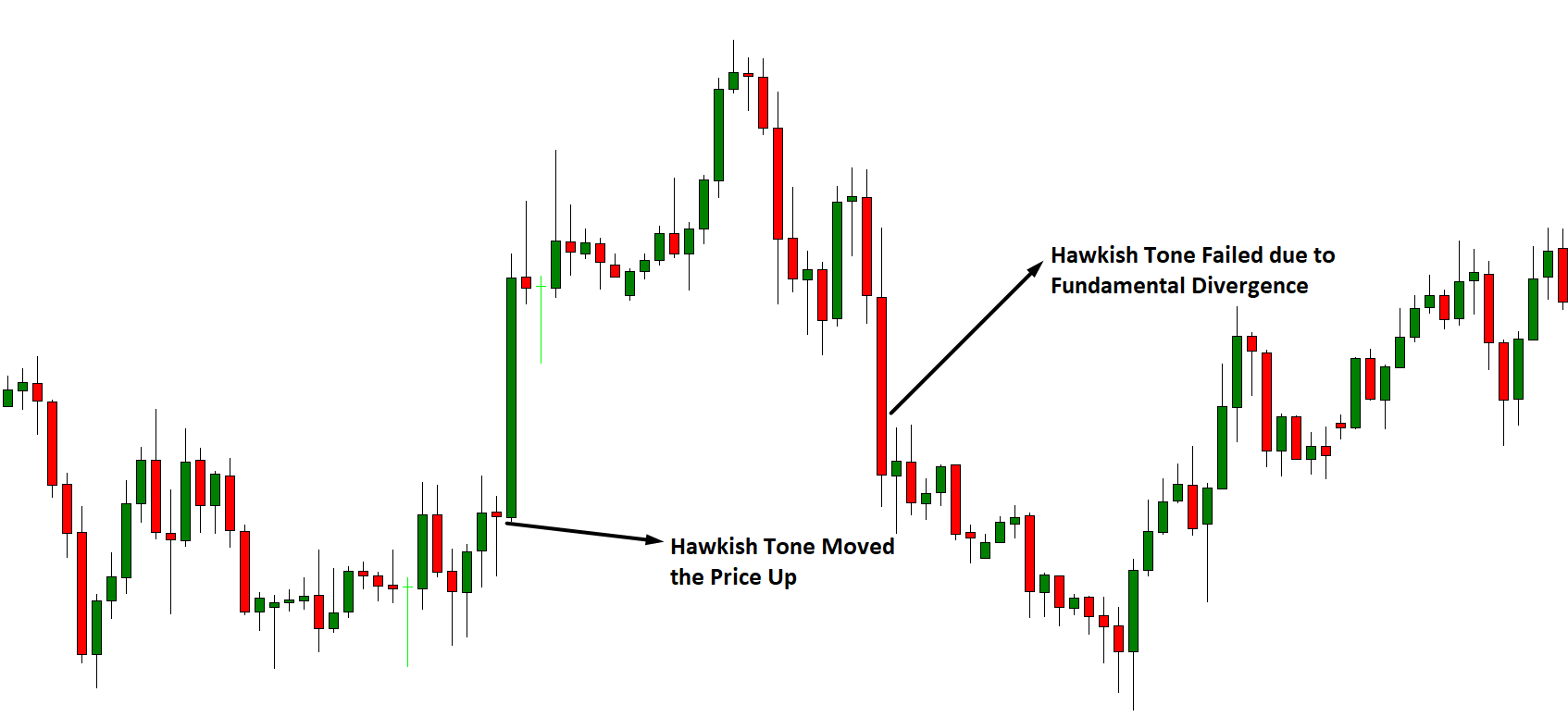

The higher interest rate of a country has a higher demand for holding currencies than the country with a lower interest rate. The main reason behind the differential is that it costs a trader to hold on to a currency that has a lower interest rate.

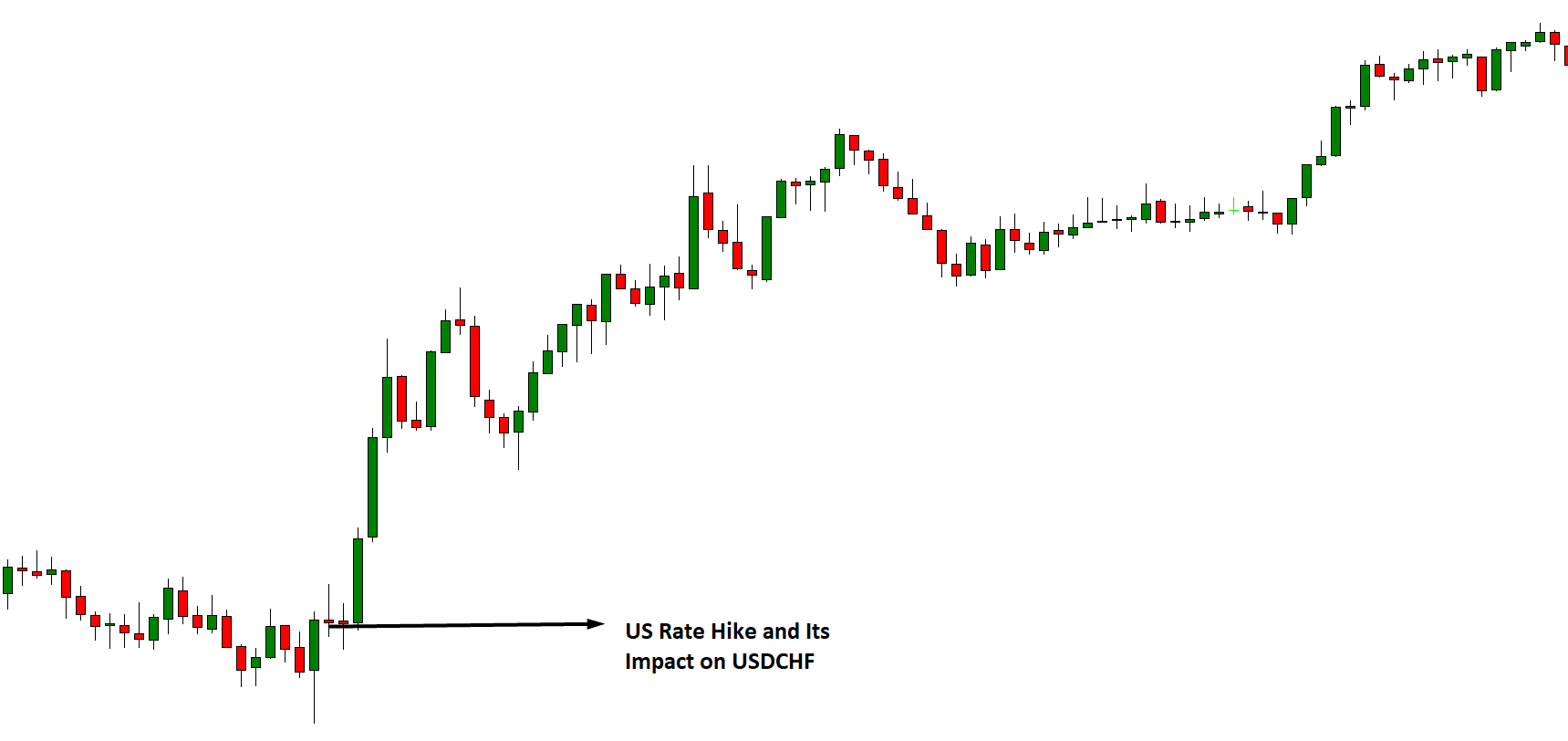

Using this concept, we can predict the future price of a currency pair. If the US interest rate goes higher or the Japanese interest rate goes lower, the USDJPY price will move towards the direction of interest rate differential. Similarly, if the US interest rate goes lower or the Japanese interest rate increases, the USDJPY price will likely move lower.

Conclusion

In forex trading, we take trading decisions based on probabilities, and interest rate differential is one of these probabilities. Traders can take the ultimate trading decision by considering this element besides the fundamental and technical analysis.

[wp_quiz id=”86464″]