Introduction

At this stage, you are now familiar with how to conduct multiple timeframe analysis for the different type of forex trades. In the previous lesson, we covered why you should look at multiple timeframes when trading forex. Now, let’s narrow down to how you can use multiple timeframe analysis to determine which price levels make the best entry and exit points to match your trading style.

Why is it important?

Using longer timeframes helps get the bigger picture while the shorter timeframes show you how the dominant trend is constituted. Support and resistance levels are used to determine the best entry and points of a trade. To properly illustrate this, we will use the example of a forex swing trader.

For a forex swing trader, positions are left open from overnight up to a few weeks. Daily timeframes are used to establish the dominant market trend for a currency pair. This timeframe will help you establish long-term support and resistance levels.

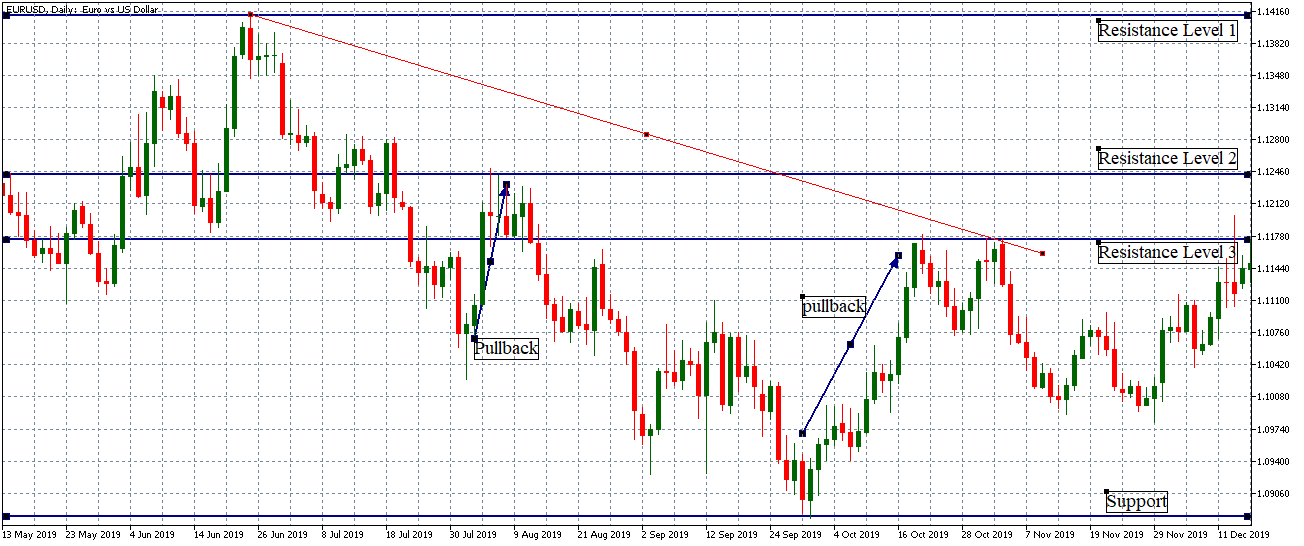

Forex Swing Trader Daily Timeframe for EUR/USD Primary Trend

The daily forex timeframe for the EUR/USD shows that the pair is on a downtrend, as evidenced by the lower lows and lower highs. The lowest low from the daily timeframe will enable the forex swing trader to establish the support level. Lower highs are formed when the price of the pair attempts a ‘pull-back.’ These lower highs will be used to set the resistance levels.

Since the dominant trend is downward, the resistance levels will be used as the ‘high swings, ’ which will be the best entry point for a short position. The resistance levels are used since the currency pair’s price is unlikely to break above this level.

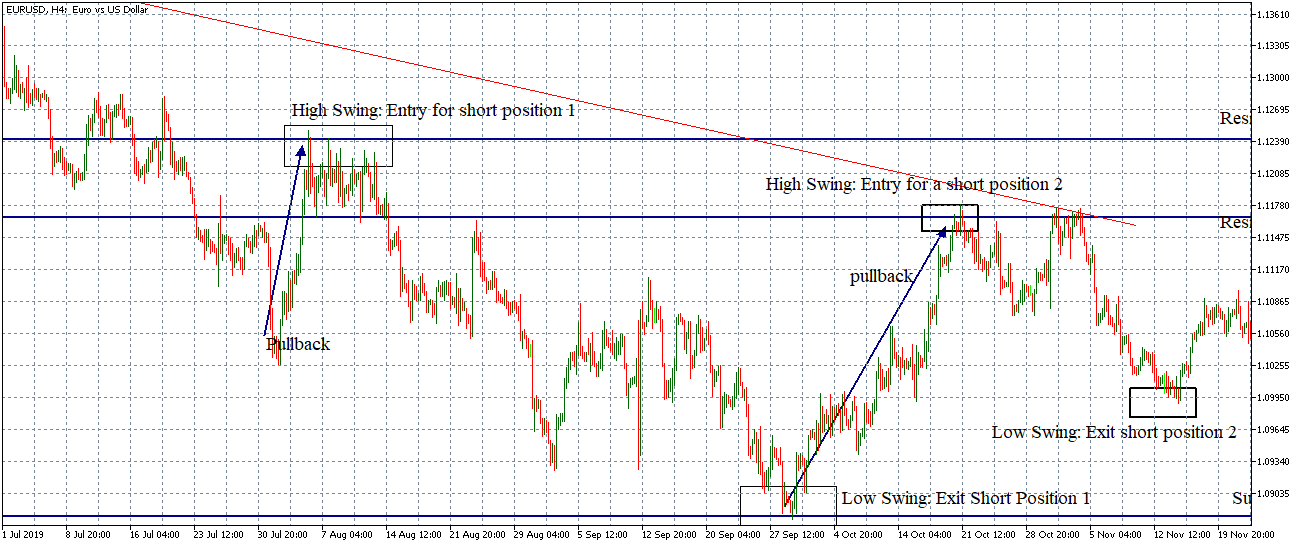

Forex Swing Trader EUR/USD 4-hour Trigger Timeframe

To determine the best entry and exit points, as a forex swing trader, you use the 4-hour timeframe. When the 4-hour candles don’t breach the resistance level, you open a short trade and exit when the 4-hour candle touches the support level at the low swing.

This strategy can be adopted for the other type of forex trades.

Using multiple timeframe analysis for different forex orders

With a top-down analysis approach, different types of traders can use multiple timeframe analysis for executing different types of forex orders. Take a forex day trader, for example.

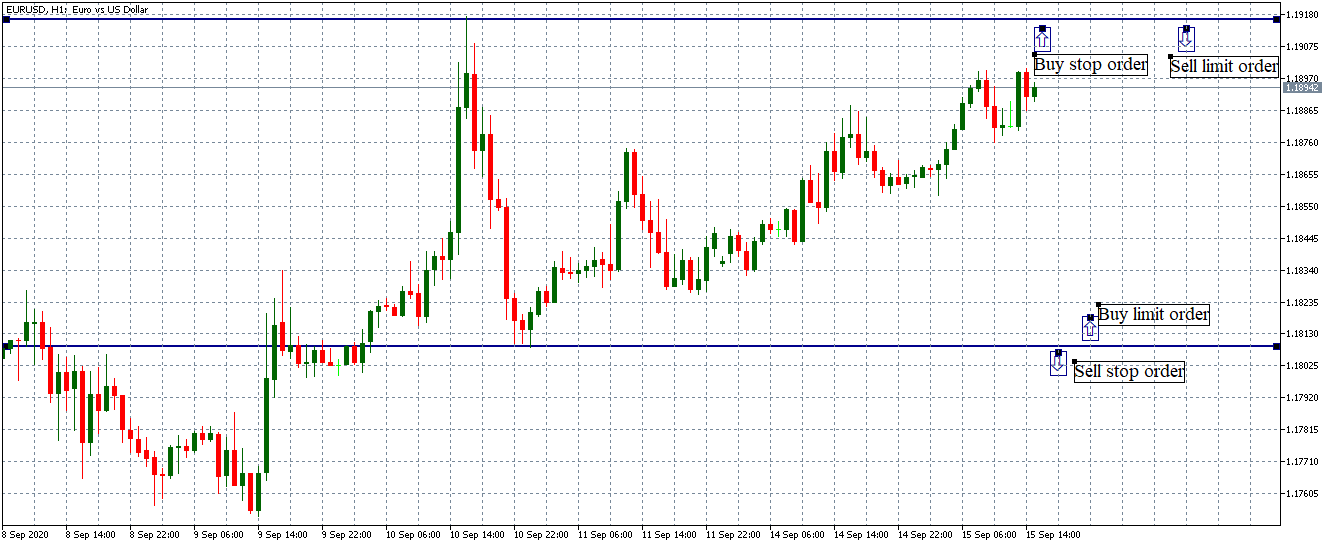

Forex Day Trader 1-hour Primary Trend Timeframe for EUR/USD

After establishing the support and resistance level, the forex day trader can use the resistance level to set the sell limit or the buy stop order. The support level is ideal to set the buy limit or the sell stop orders. The ‘stop-loss’ and ‘take profit’ levels can then be set to exit these trades depending on your risk management measures. [wp_quiz id=”89182″]