FX Procent (FRESHCENT) is a trademark of the Freshforex company; in fact, if you try to register an account, you will be transferred directly to the Freshforex website. Although an offshore broker, Freshforex has more than 14 years of experience in the Forex market and has earned a reasonably favorable reputation within the forex community.

FRESHCENT is owned and operated by Riston Capital Ltd., an international business company of San Vicente (IBC). Companies in this offshore zone only have to follow a simple and economical registration procedure with the FSA. It should be noted that any financial authority does not supervise foreign exchange brokers registered with SVG and that their clients do not enjoy the guarantees of a European or Australian regulator, for example.

By comparison, brokers regulated by reputable financial authorities (in the EU, Australia or the U.S. are required to follow strict financial and ethical discipline, and to maintain a transparent account of all transactions involving client funds. That is why we advise our readers to do trading with duly authorized brokers, and if they are offshore, be well informed to know that they are also reliable.

The FX Procent website is available in English and Russian.

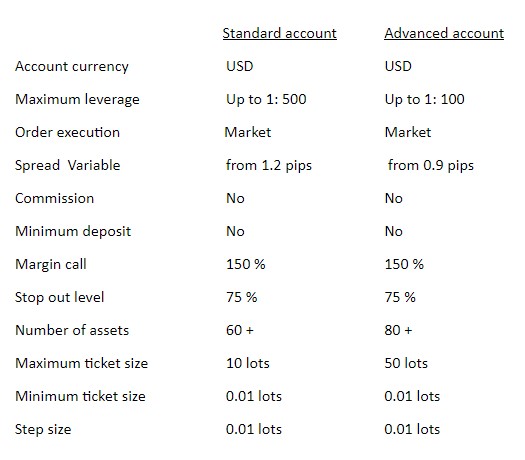

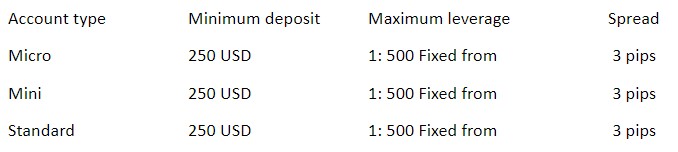

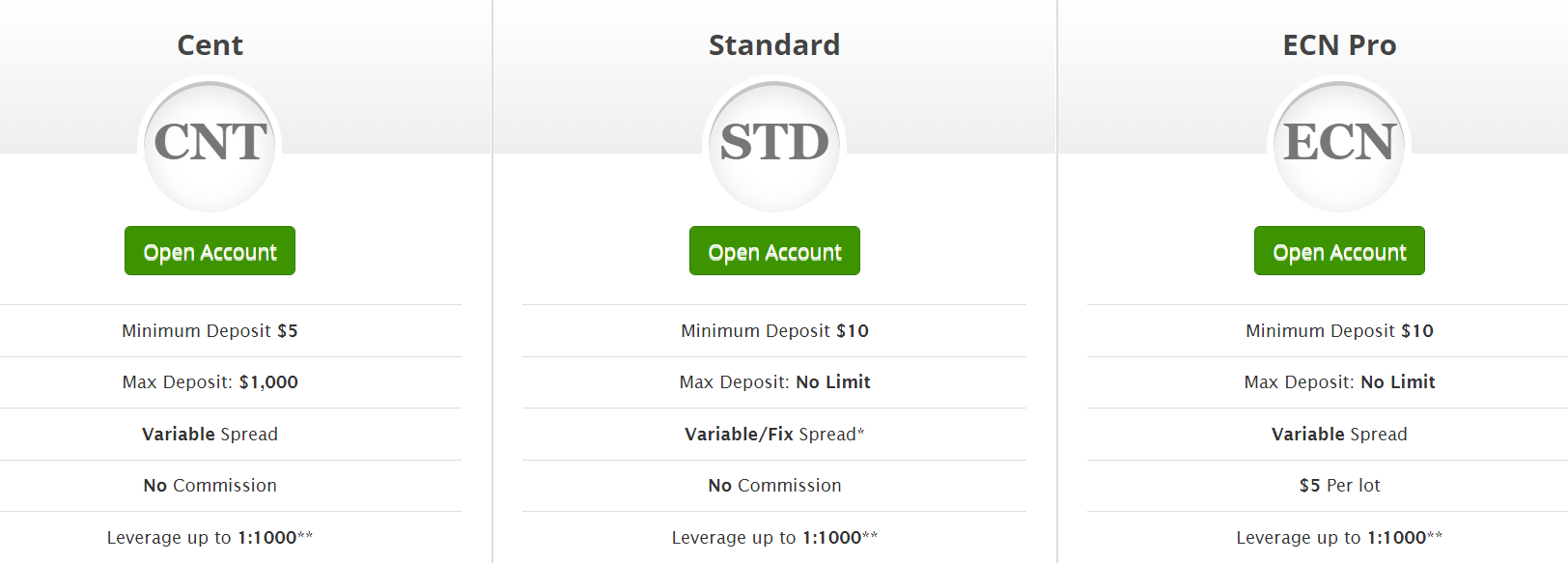

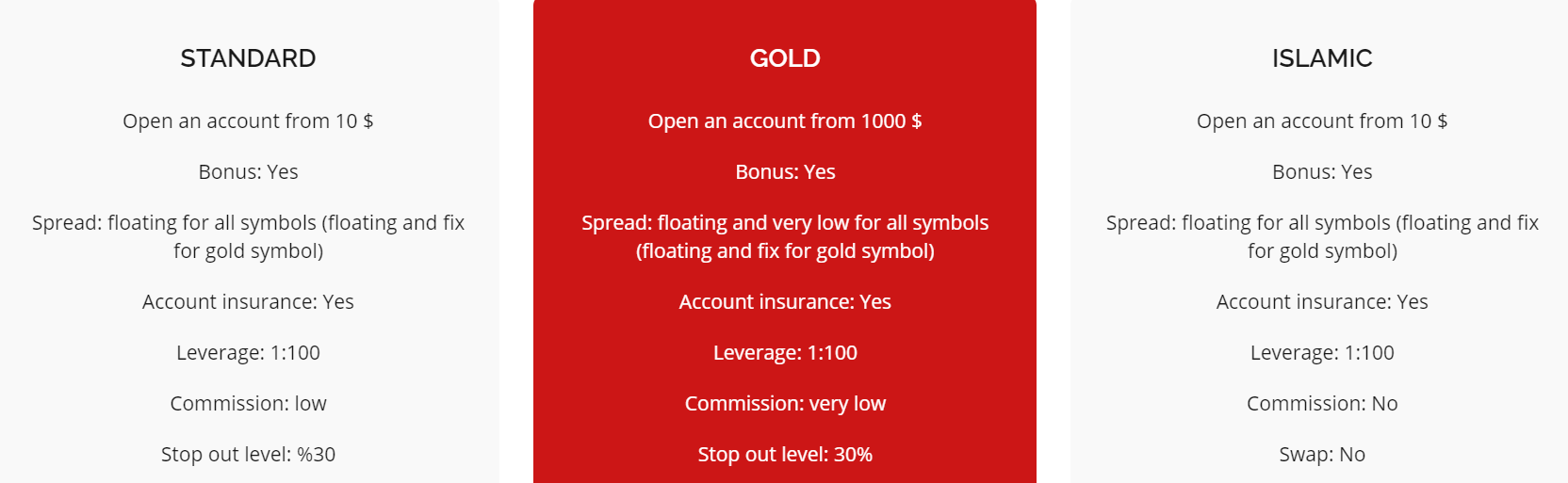

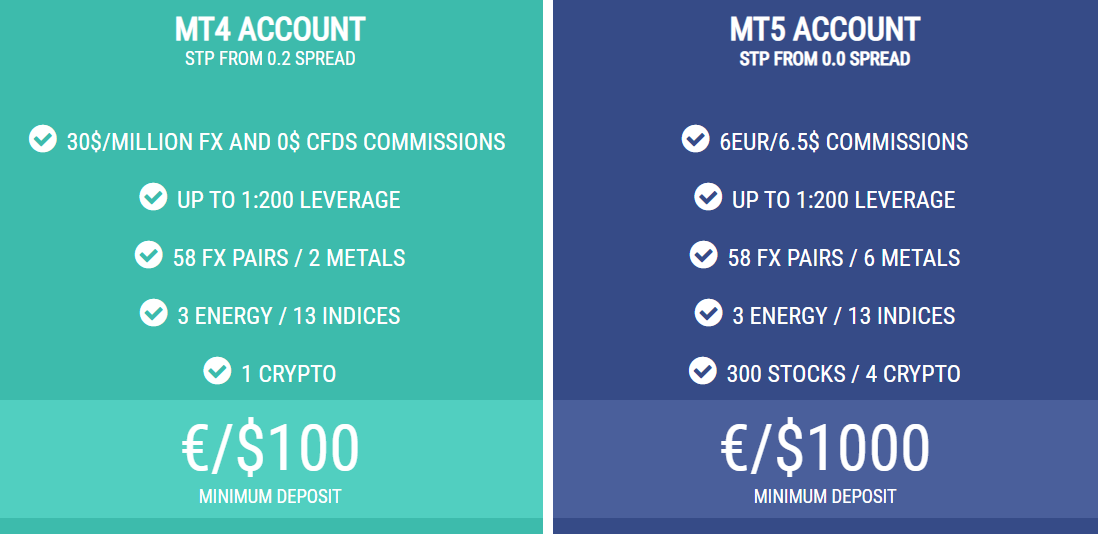

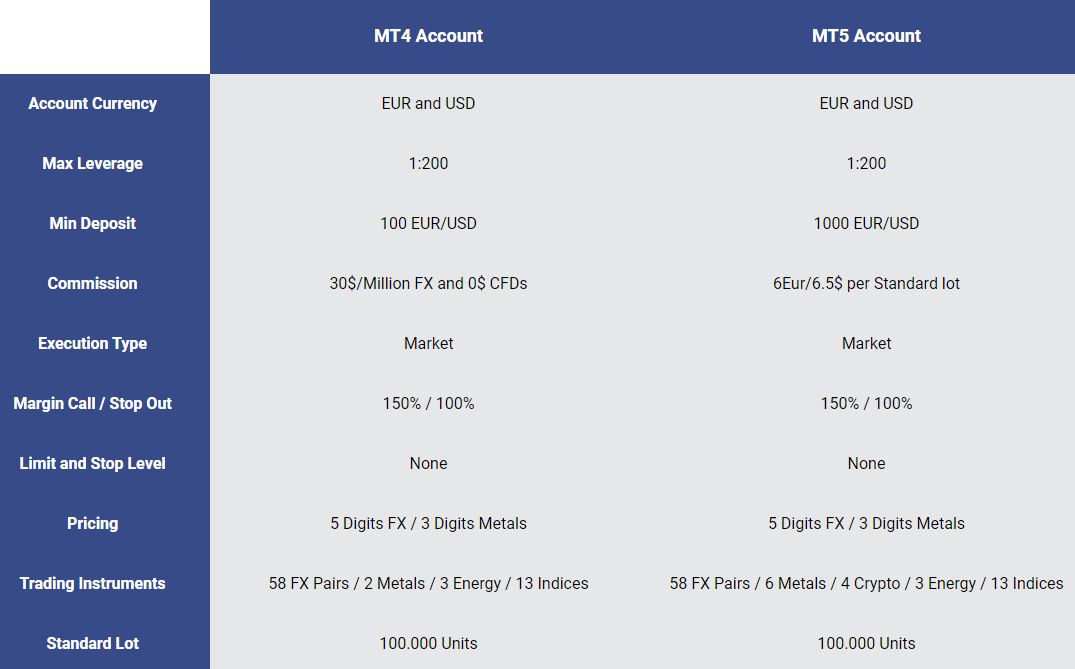

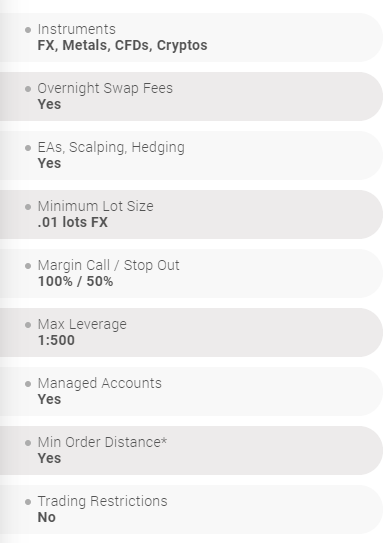

ACCOUNT TYPES

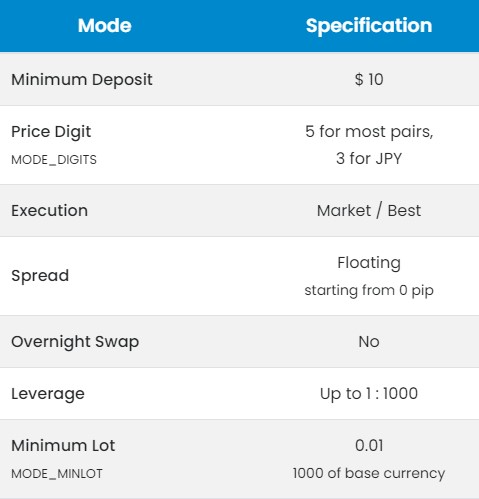

We start from the idea that this broker offers a single account that we are going to call “Standard”, and whose basic characteristics would be a $20 minimum deposit, fixed leverage of 2 pips, and a maximum leverage of 1:1000. FX Procent seems to offer only one type of account (cent). Your customers can choose to trade on the MT4 or MT5 platform, and they can use very high leverage rates.

It looks like FRESHCENT is the Riston Capital brand specializing in nickel bills. In short, these are accounts where the deposit, gains, and losses, are measured in cents, rather than dollars. These types of accounts are more suitable for traders exploring automated trading, using Myfxbook and Metatrader market systems, or those traders who are encoding bots.

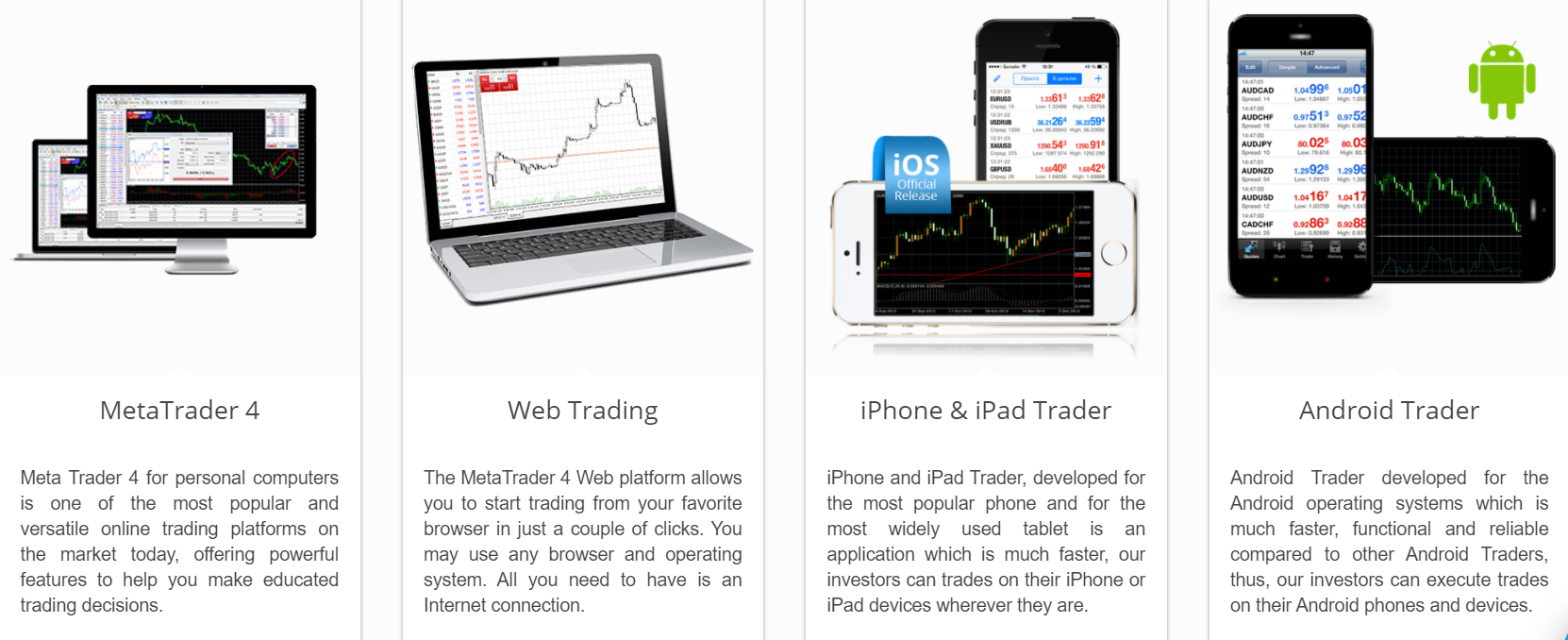

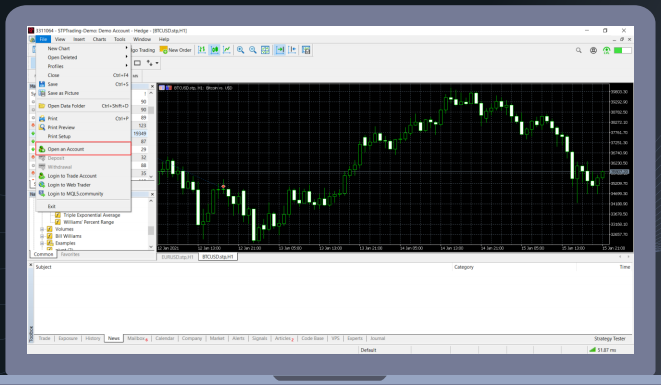

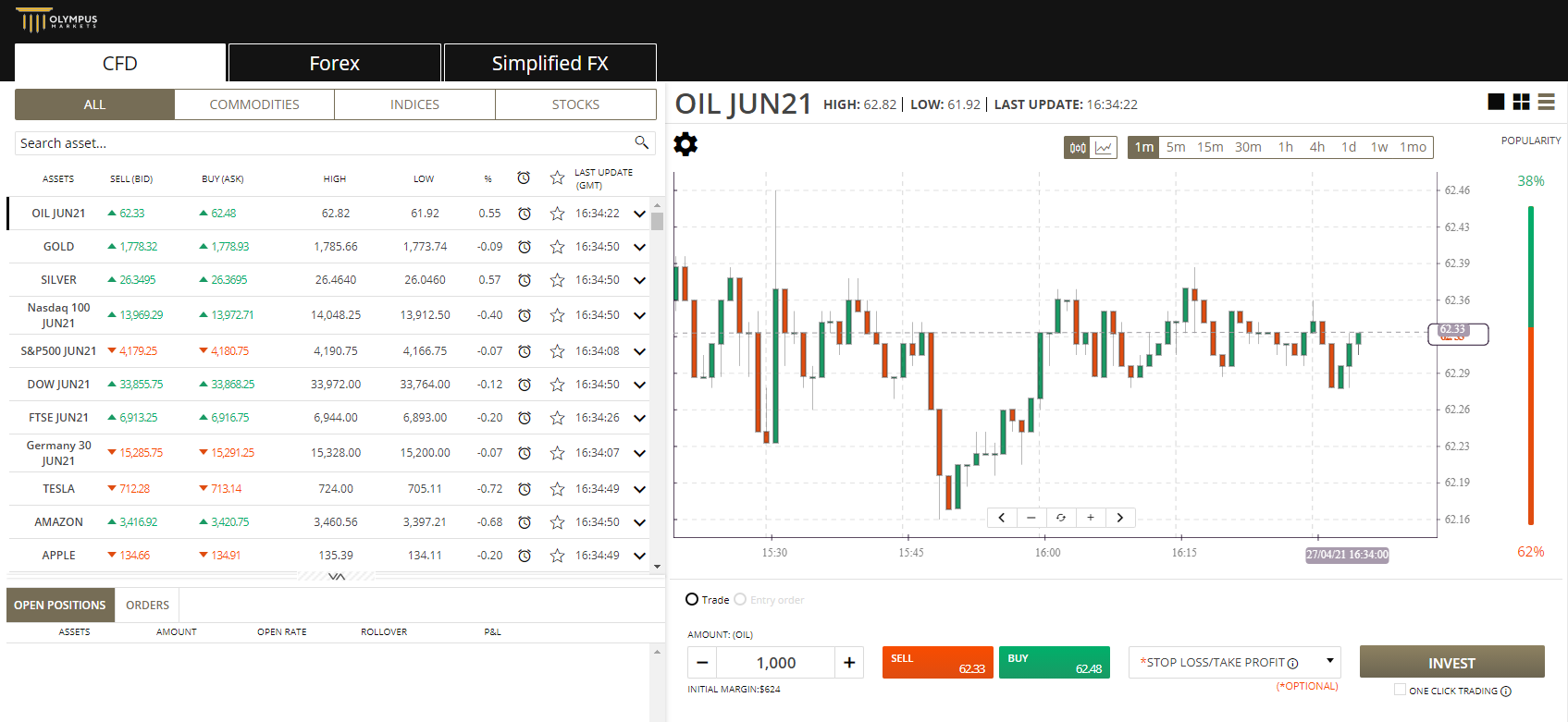

PLATFORMS

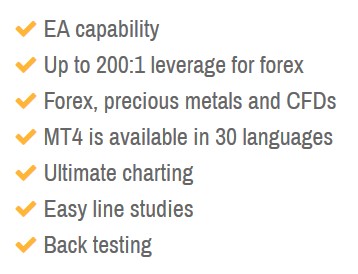

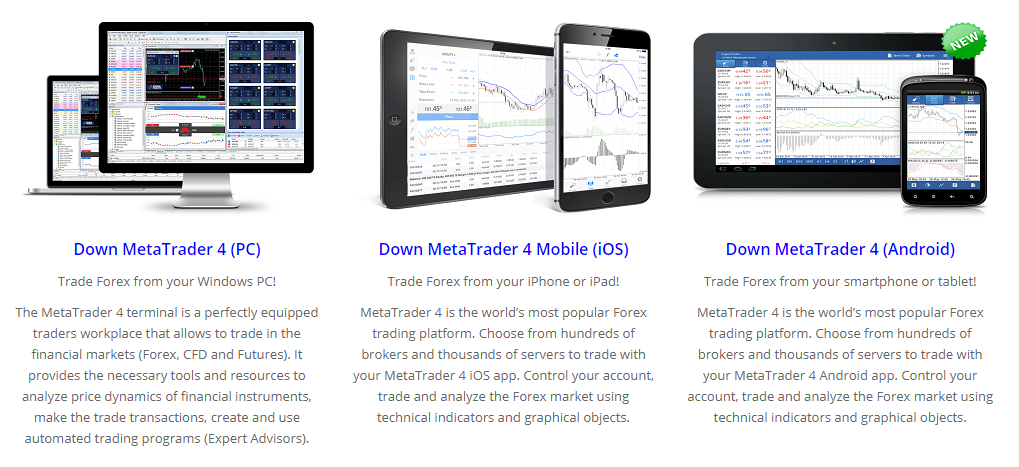

We have the good news of knowing that this broker is compatible with MT4 and MT5 platforms. FX Procent has in its commercial offer the platforms Metatrader4 and Metatrader5, which are two of the most popular and well-known forex platforms.

MT4 provides all the needs a trader may need: a secure business environment, a wide range of technical indicators, a sophisticated advanced graphics system, a variety of Expert Advisors (Eas) for automated trading, and extensive back-testing options for traders to analyze their trading strategies.

The Metatrader 5 platform is compatible with most MT4 features and offers more time frames, advanced built-in event management, and improved debugging tools. It also allows users to trade in derivatives and stocks traded on the stock exchange, all from the same account.

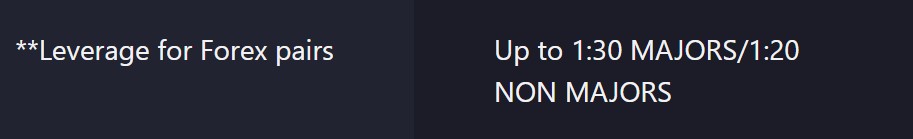

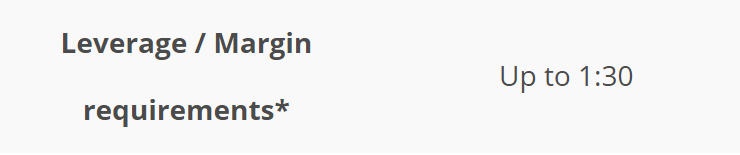

LEVERAGE

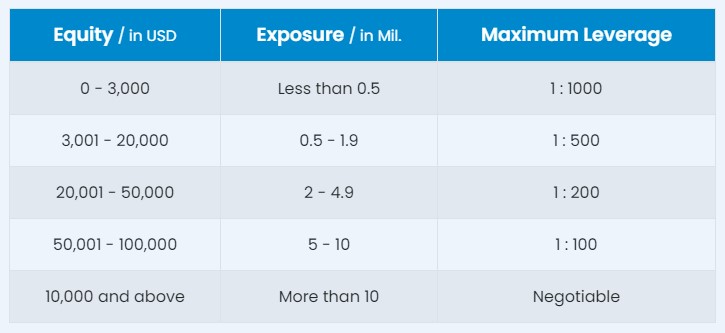

FRESHCENT customers are offered relatively high leverage rates. You can choose between a leverage level of 1: 25, up to 1: 1.000. In reality, professional operators rarely use leverage above 1: 100, and even this leverage is sometimes considered a high-risk investment. However, leverage as high as 1: 1000 is considered a plus, as it will be sufficient for the needs of all types of traders. The downside of using high leverage is that it can be risky, and if you don’t have a lot of experience in trading, you could lose your investments in a matter of seconds.

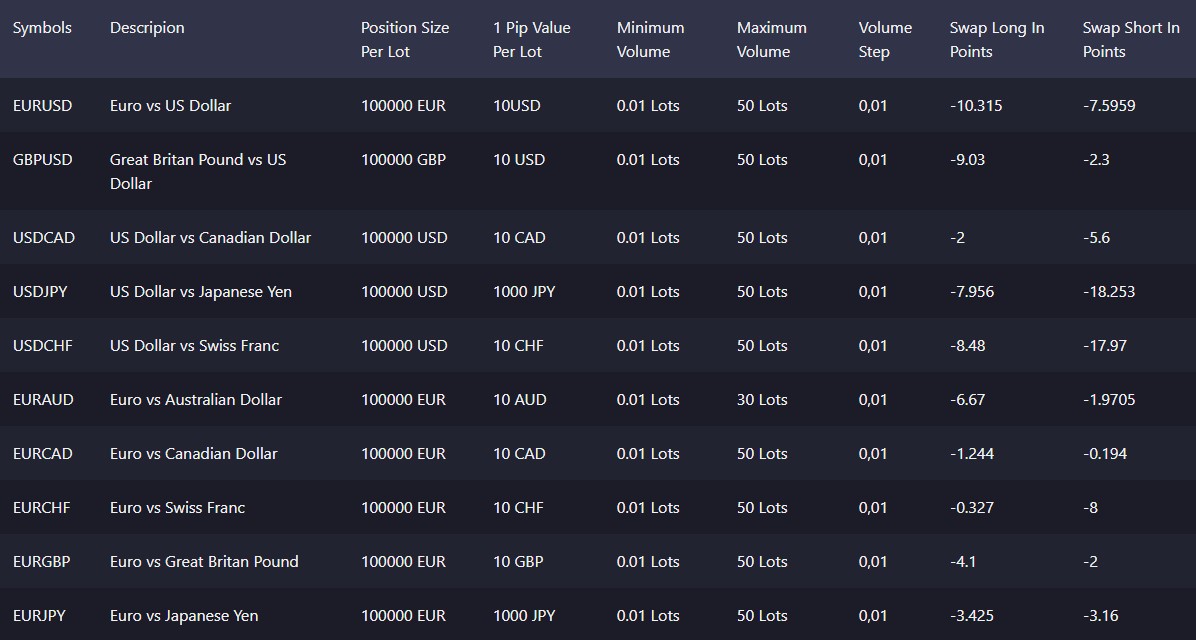

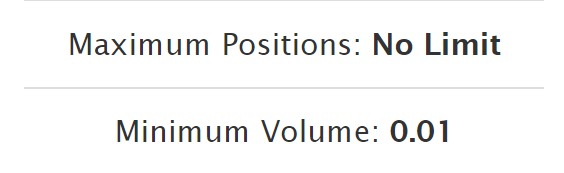

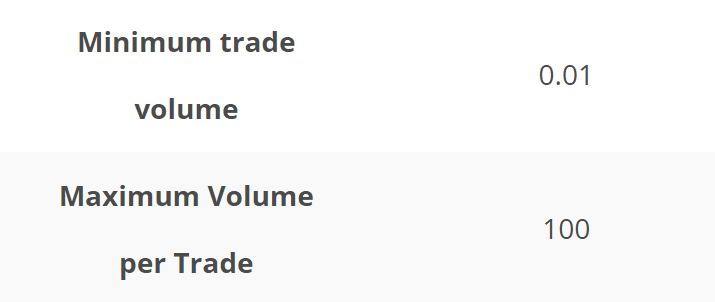

TRADE SIZES

TRADE SIZES

The mínimum order size is 0.01 of a lot (10 OF BASIC CURRENCY UNITS). The brokers say that there are no restrictions on the máximum order volume.

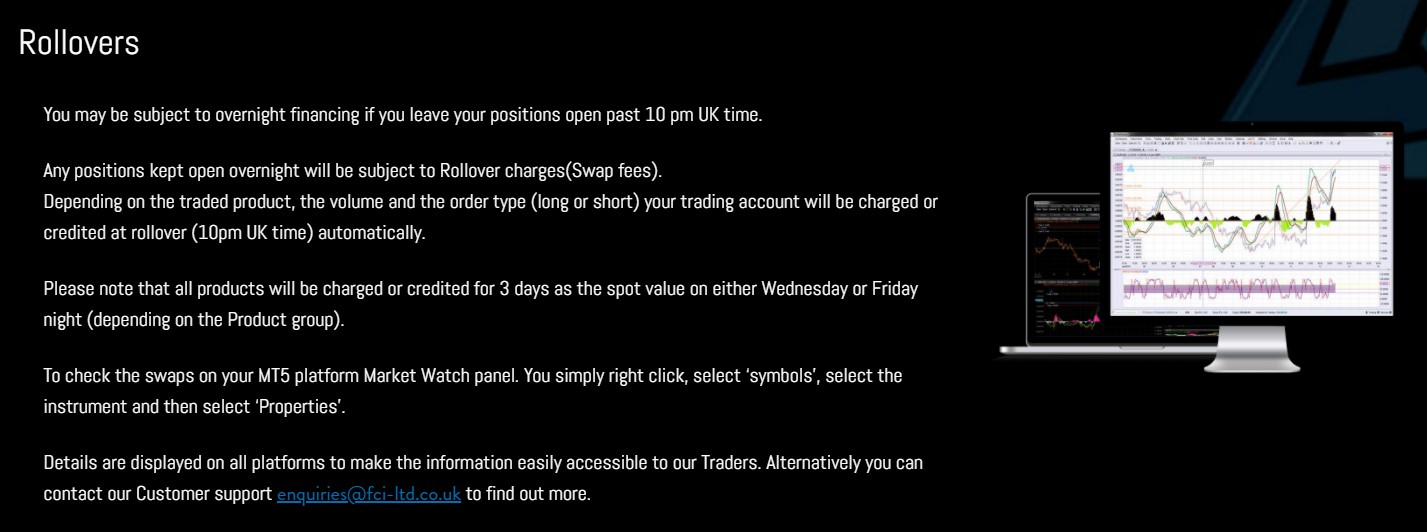

TRADING COSTS

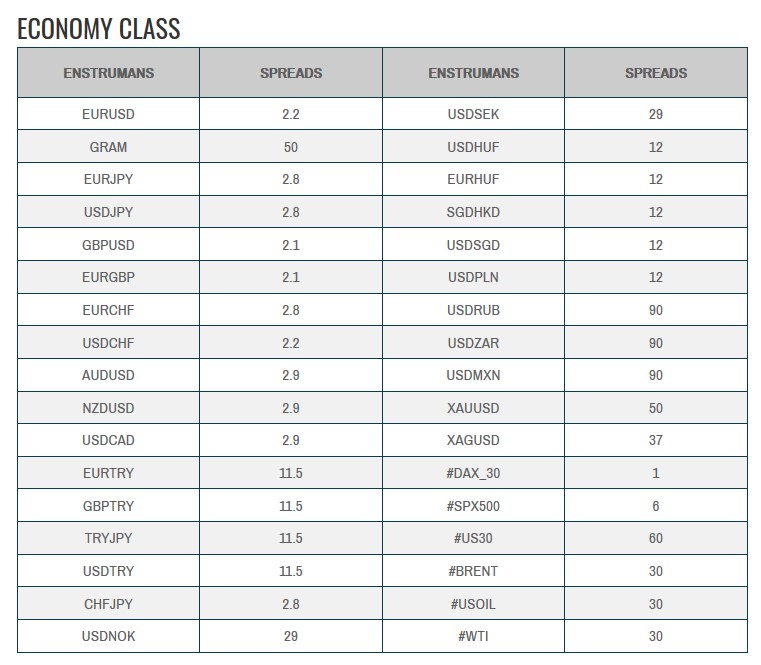

The highest cost is in the spread, as this broker applies fixed spreads of at least 2 pips in the most liquid currency pairs. On the positive side, we have that FRESHCENT does not apply any commission to trade. The other cost we have to take into account is the Swap or Overnight Financing, which is any position held overnight, which will incur a maintenance cost (interest). This amount can be negative or positive depending on the instrument and the direction of the position, and its amount is fixed by the central banks of the base currency of the open position.

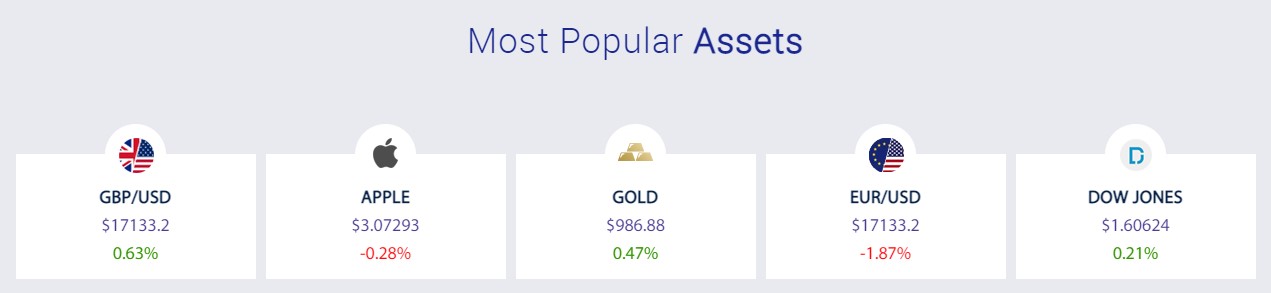

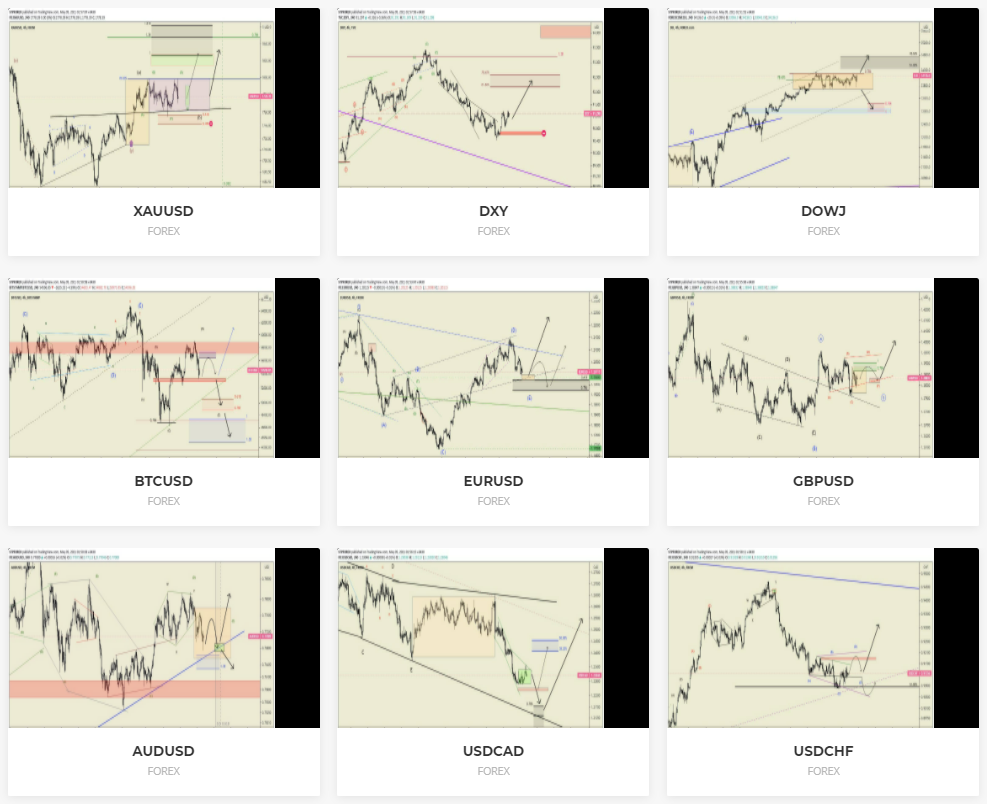

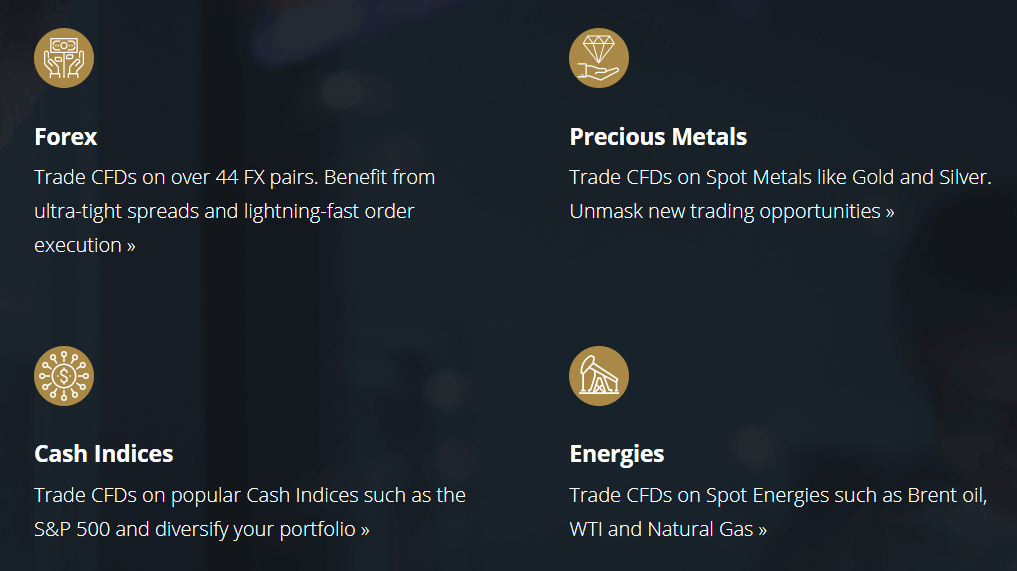

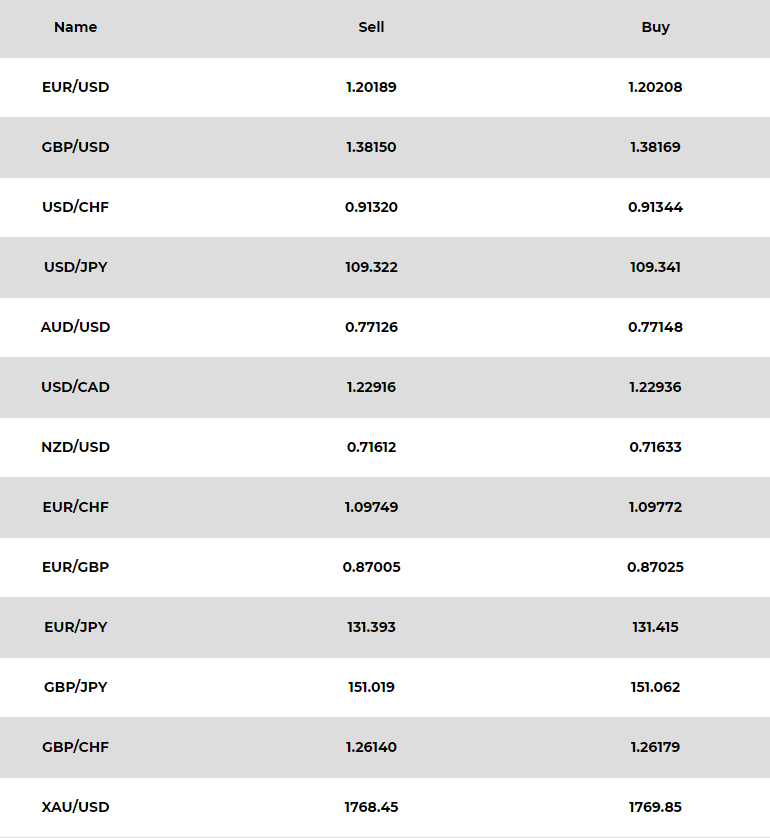

ASSETS

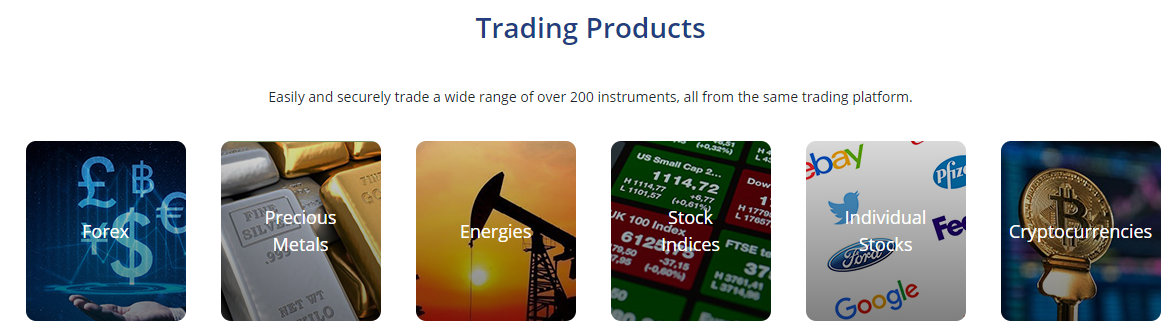

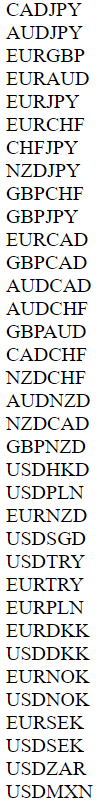

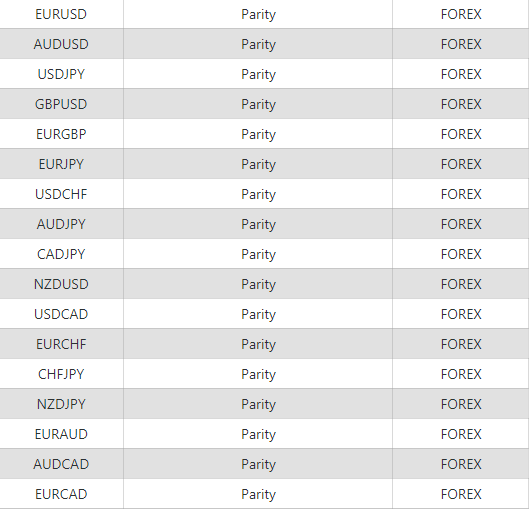

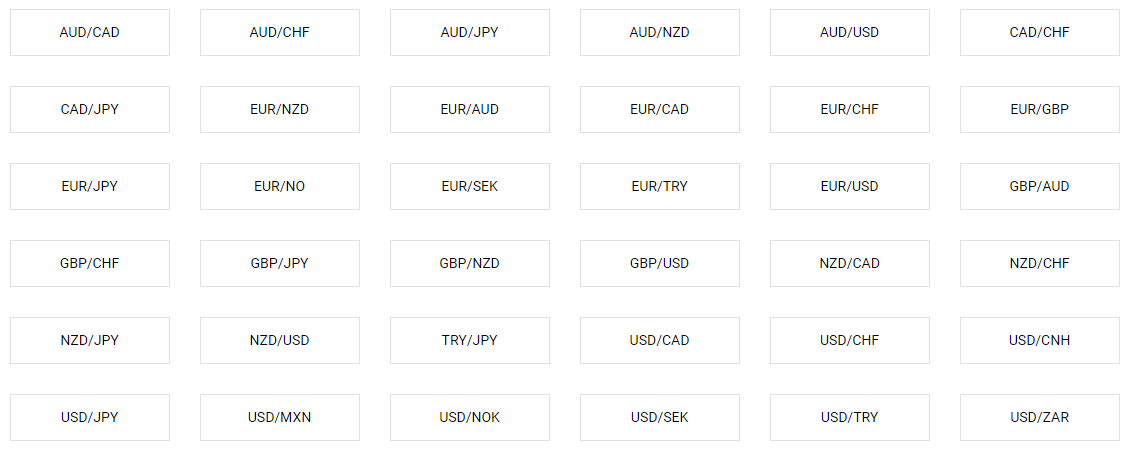

With FX Procent we can trade a good number of assets. We will not list them all but segment them by asset types and quantity available for each of them, in this way, you get an idea of the offer of this broker.

With FX Procent we can trade a good number of assets. We will not list them all but segment them by asset types and quantity available for each of them, in this way, you get an idea of the offer of this broker.

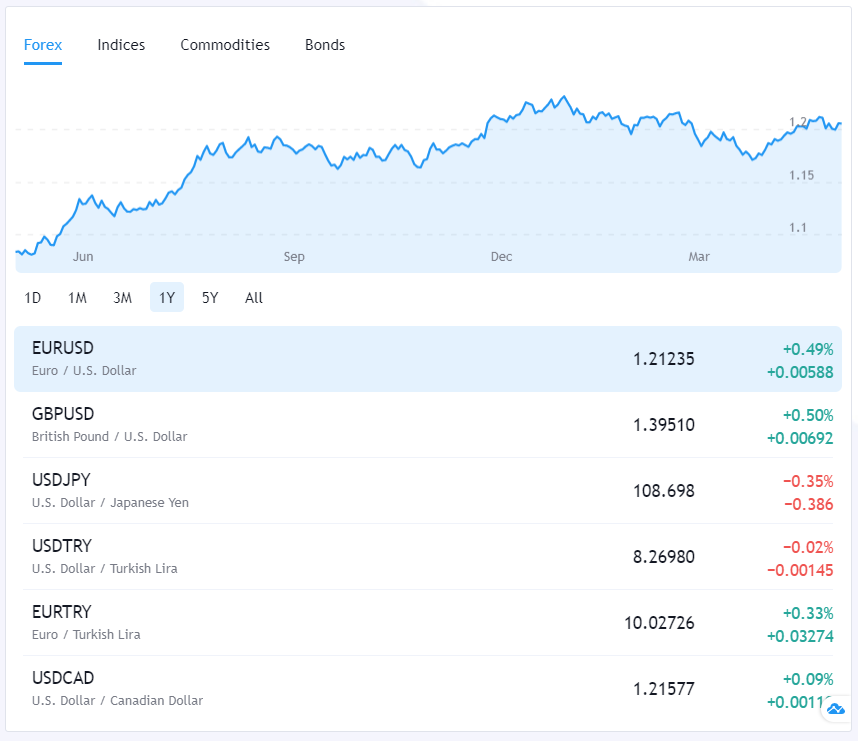

- 49 currency pairs in FOREX

- 5 CFDs ON METALS

- 66 CFDs ON STOCKS

- 11 CFDs ON INDEXES

- 3 CFDs ON ENERGY FUTURES

- 6 Cfds ON CRYPTOCURRENCIES

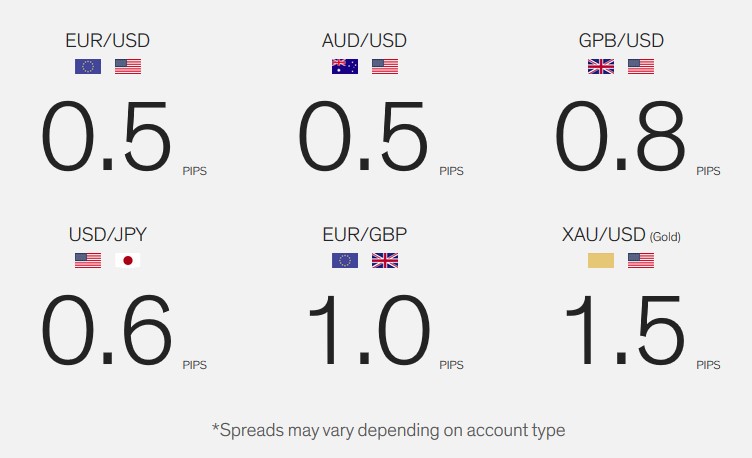

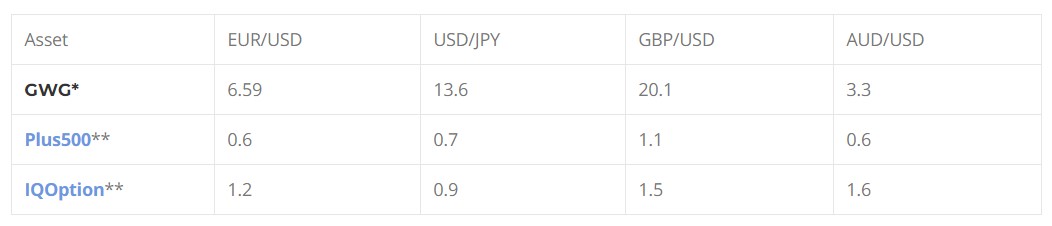

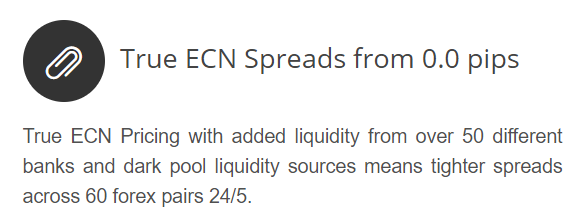

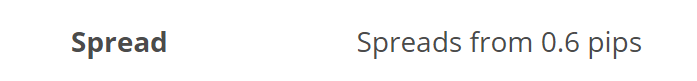

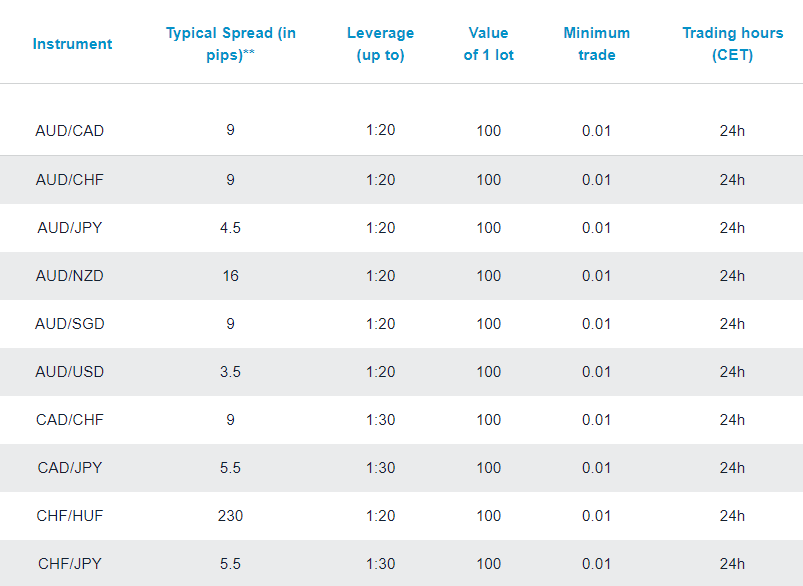

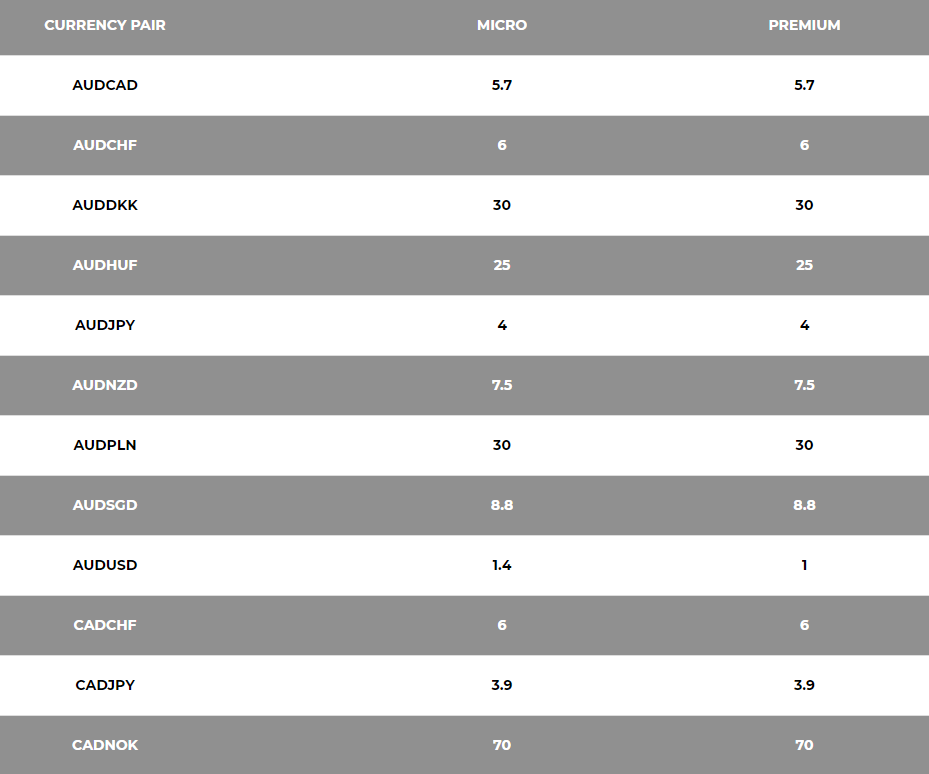

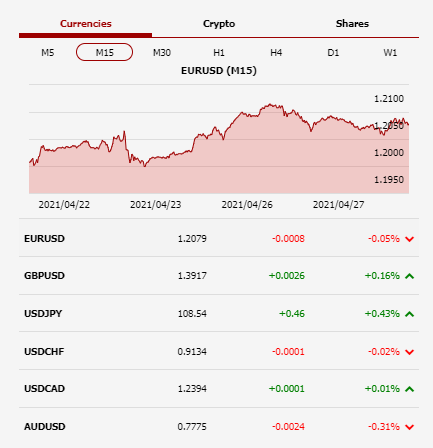

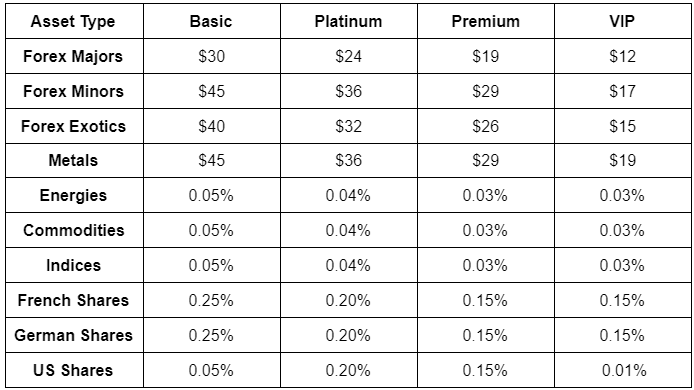

SPREADS

Spreads with FRESHCENT are 2 pips in more significant pairs, which is a little high spread for any trader who wants to deposit a significant amount of money. By comparison, most currency brokers offer spreads within the range of 1.0 – 1.5 pips in the EUR / USD pair.

MINIMUM DEPOSIT

Customers of FX Procent are not required to deposit a certain minimum amount to open an account; however, the initial investment recommended by the broker is $20, an amount that anyone can afford to spend. The truth is that 20 USD is an amount in which any sudden movement of the market will mean a margin call (if the move was against us), or directly lose all capital. Remember that the currency of the accounts is the USC (US DOLLAR CENT).

Customers of FX Procent are not required to deposit a certain minimum amount to open an account; however, the initial investment recommended by the broker is $20, an amount that anyone can afford to spend. The truth is that 20 USD is an amount in which any sudden movement of the market will mean a margin call (if the move was against us), or directly lose all capital. Remember that the currency of the accounts is the USC (US DOLLAR CENT).

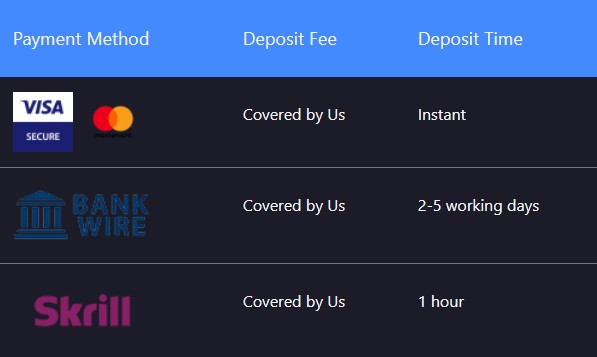

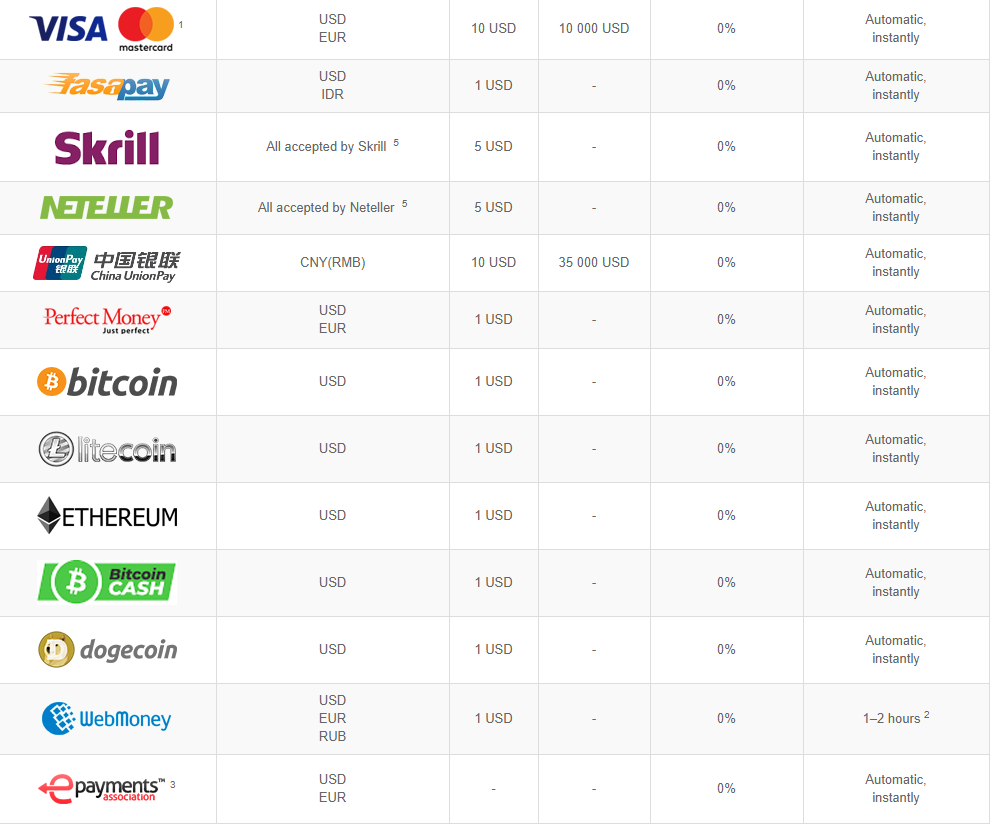

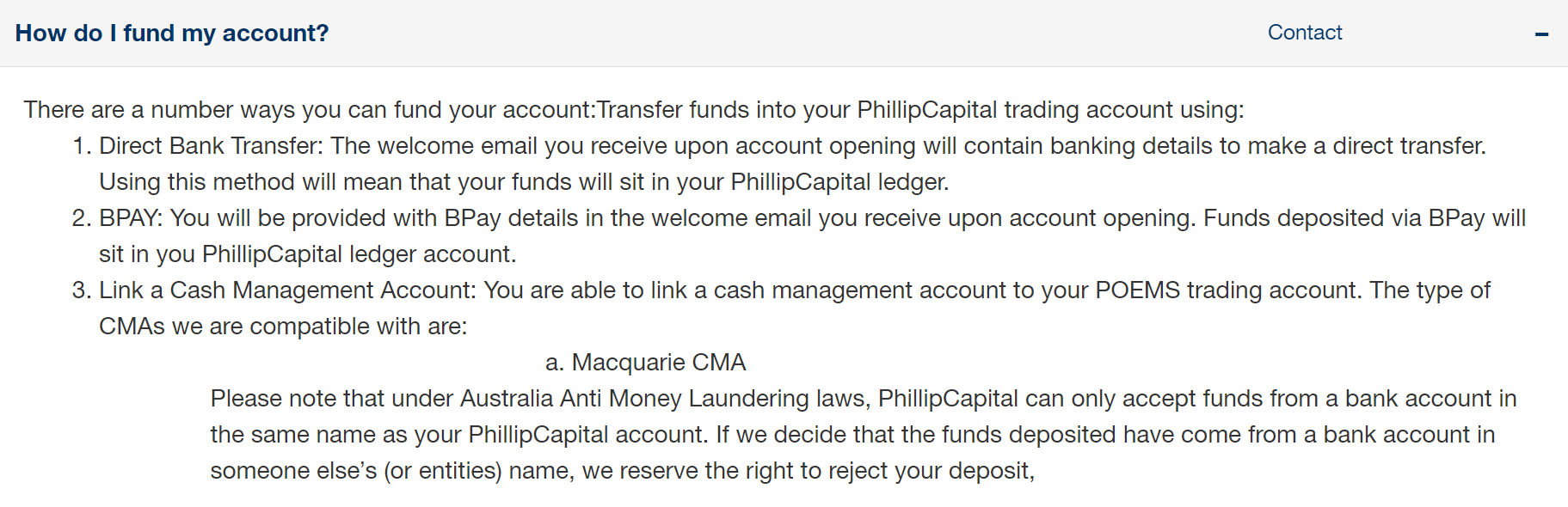

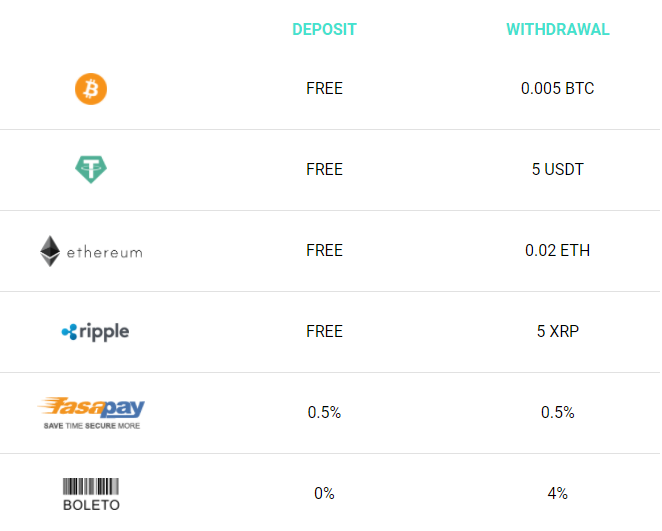

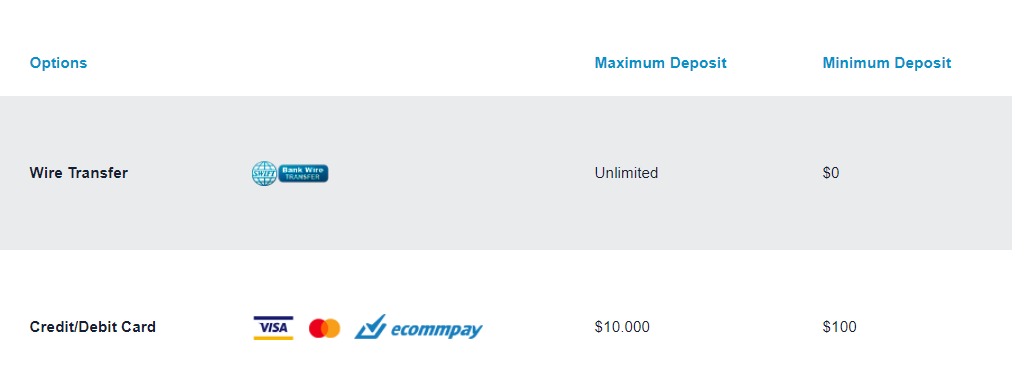

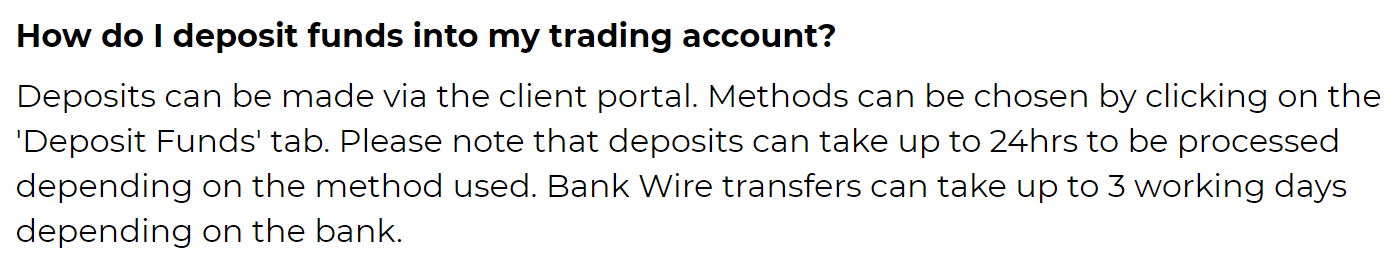

DEPOSIT METHODS & COSTS

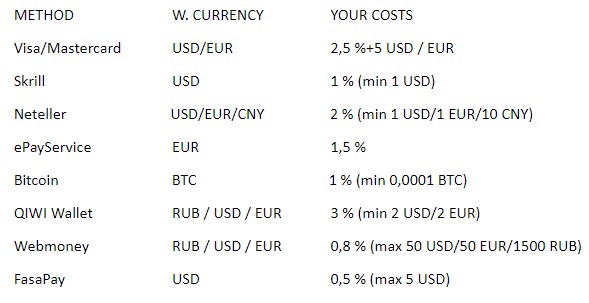

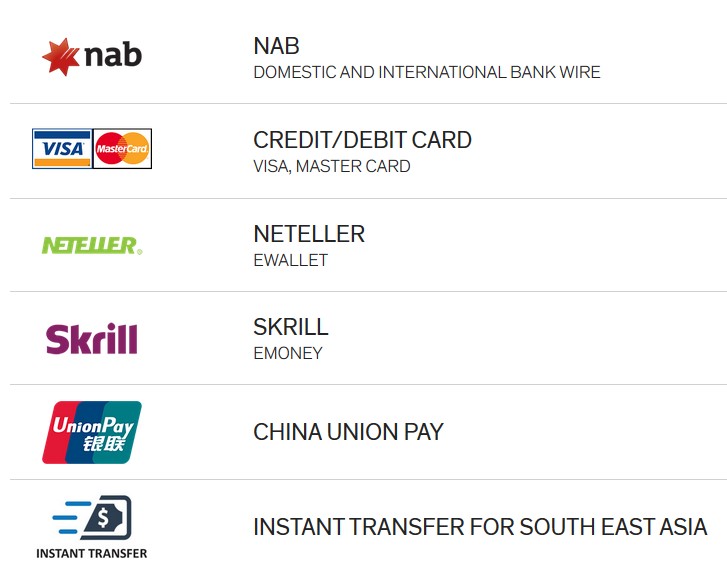

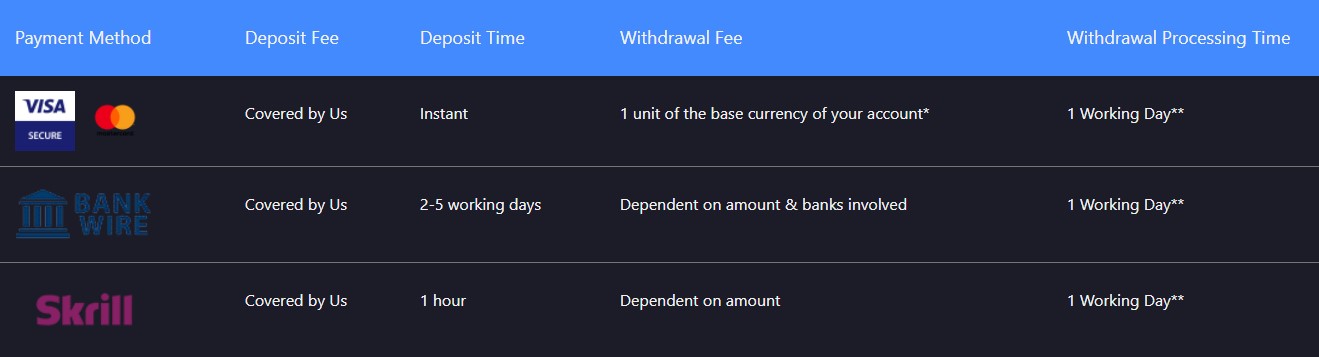

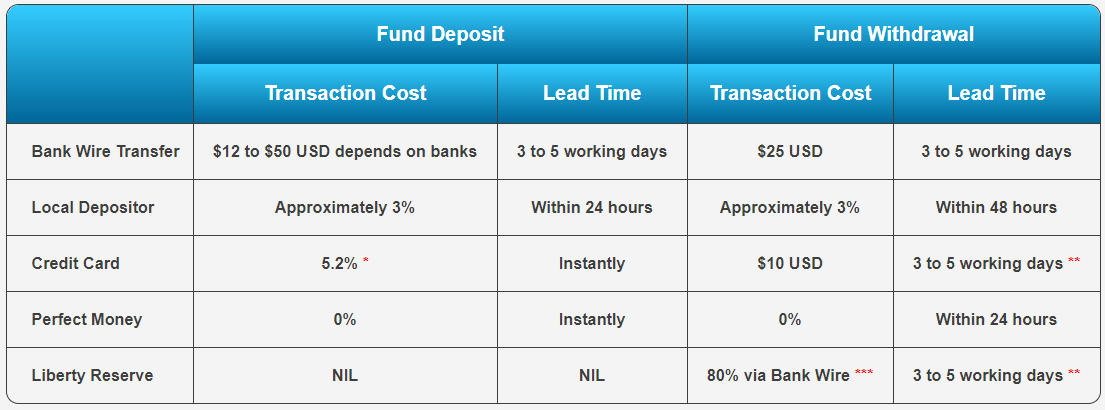

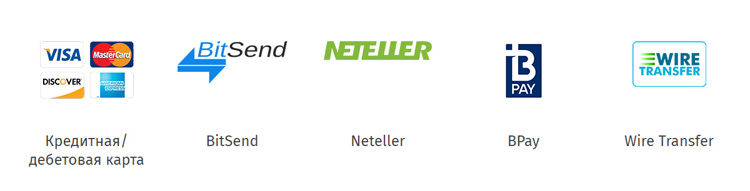

FRESHCENT has a wide variety of methods for customers to make deposits. In the following table, the deposit methods, the accepted currencies, the associated costs (free deposits), and the waiting time are detailed:

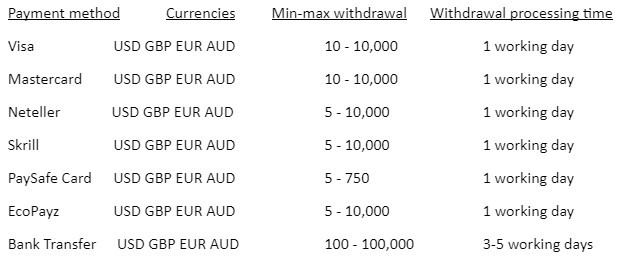

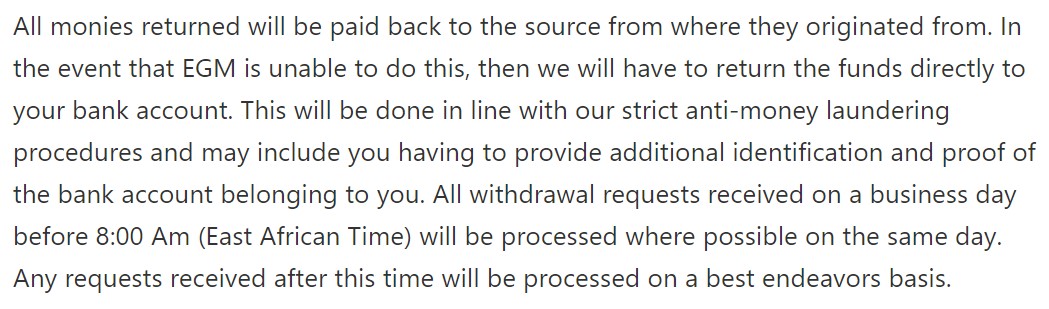

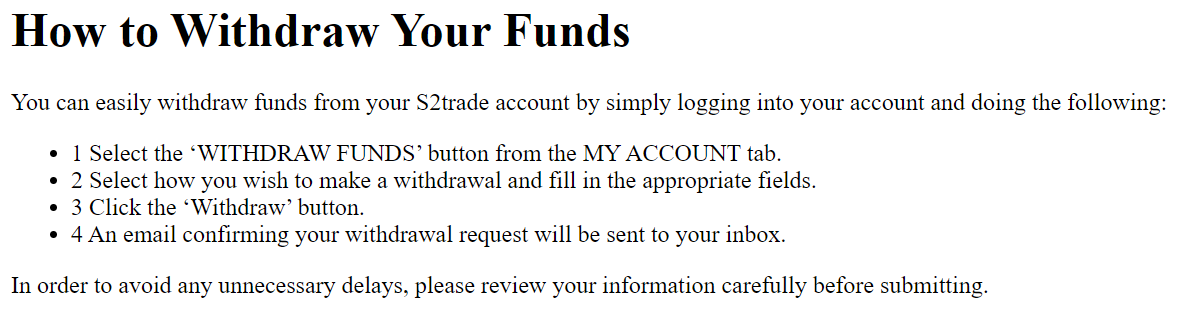

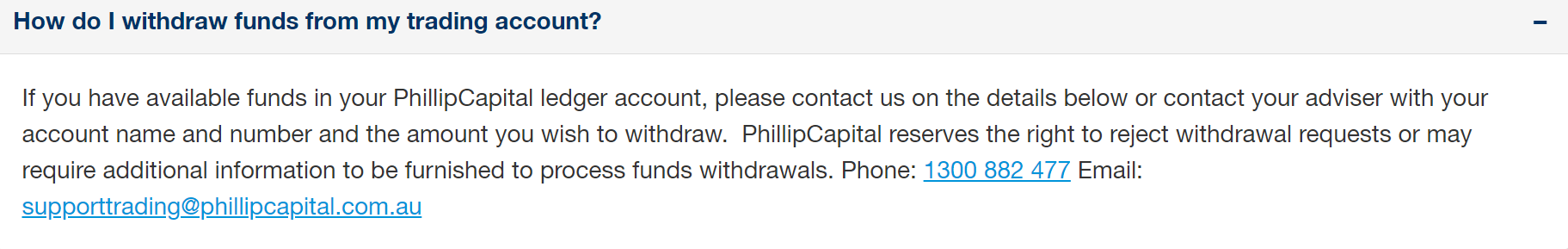

WITHDRAWAL METHODS & COSTS & WAIT TIME

The broker also facilitates the task at the retreats, as he has a good variety of them. Below is a chart with available withdrawal methods, accepted currencies, withdrawal costs, and estimated waiting time until you can see the money in your account.

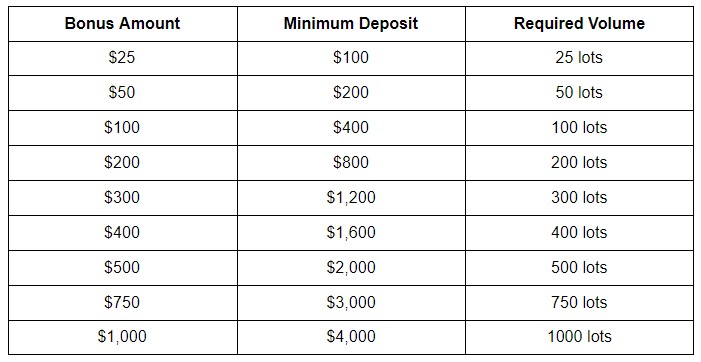

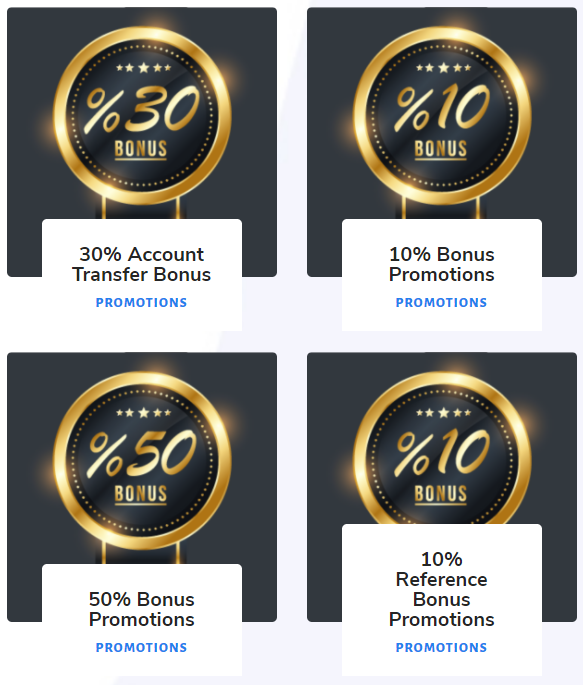

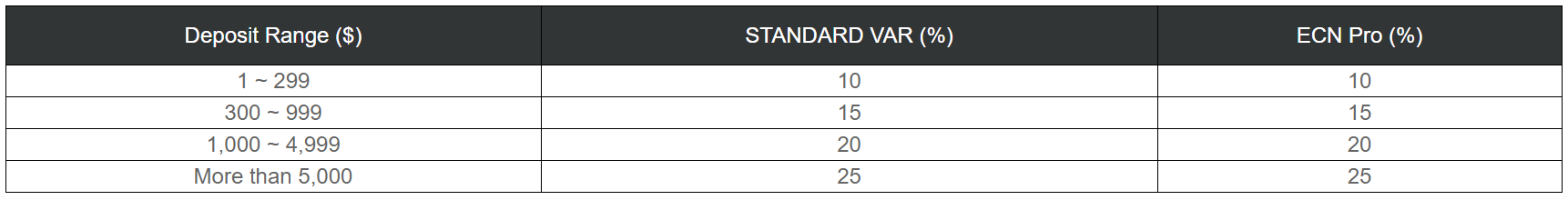

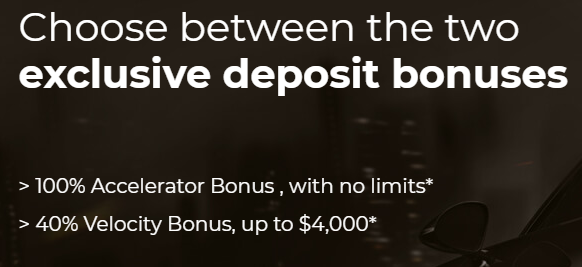

BONUSES & PROMOTIONS

FX Procent currently has 2 current promotions. The first promotion is a gift bonus of 100 cents USD (1 USD), 100% WITHDRAWABLE, and 100% TRADABLE. This offer is available only for new customers. The other promotion consists of a Cashback for the trades, be they winners or losers. Specifically, the broker reimburses 20 cents for each trade loser and 10 cents for each trade winner.

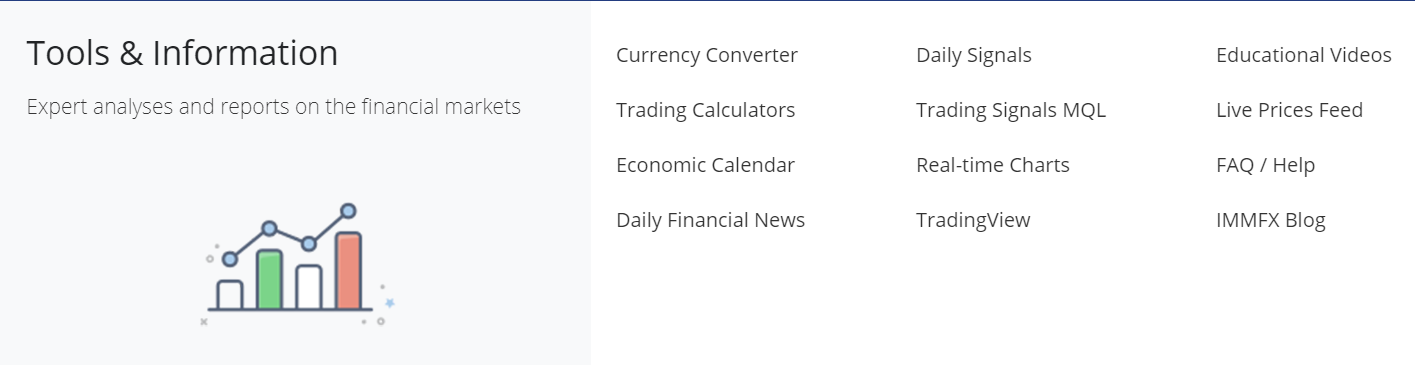

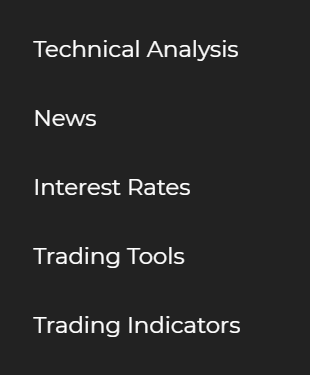

EDUCATIONAL & TRADING TOOLS

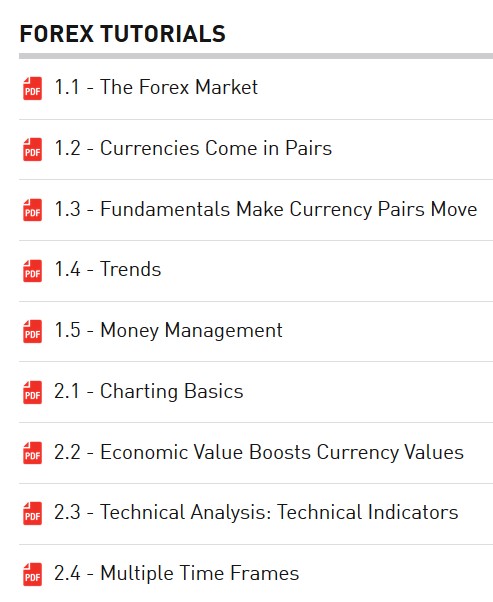

FX Procent has an educational area with a lot of exciting content. It has a bookstore with different articles; we point out below which are:

- Quotation on the Forex market

- Popularity of pairs over the week

- Margin trading on the Forex market

- Knowing Foreign Currency (Forex) Best Business Ever

- Internet Trading: What Is It?

- How to Trade in Forex

- Foreign Exchange Market Definition

- Financial Instruments: forward contracts, options trading, etc.

- Common Myths in Forex Trading

- Characteristics of a good trader

- Basic fundamentals of trading on the Forex market

- Trader’s way

- Forex Currency Pair | Key Forex Terms

- Forex Support and Resistance

- Forex Market Trading Hours

- Types of Forex Charts and Graphs

CUSTOMER SERVICE

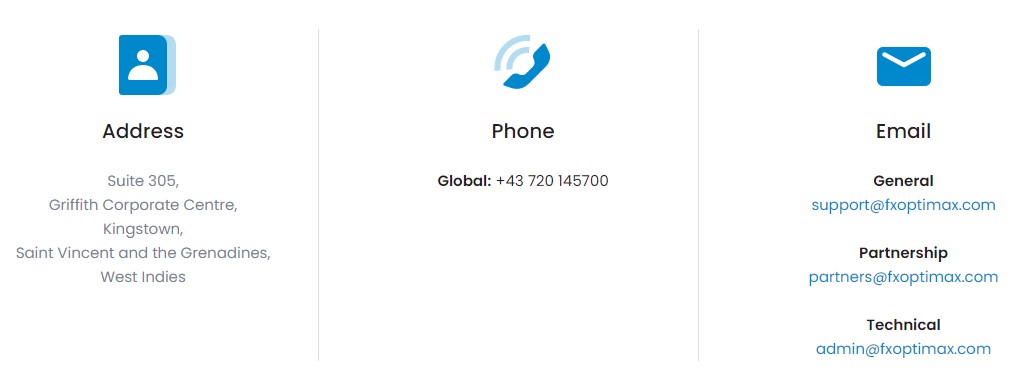

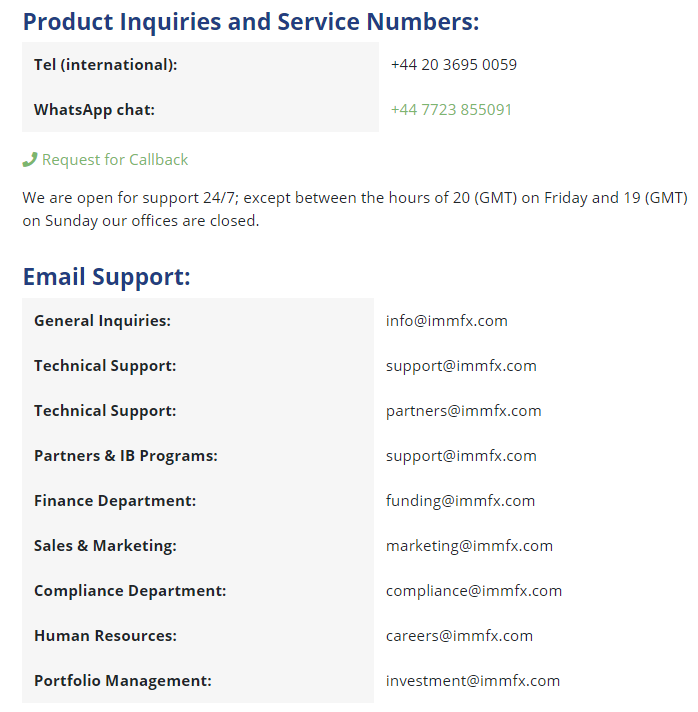

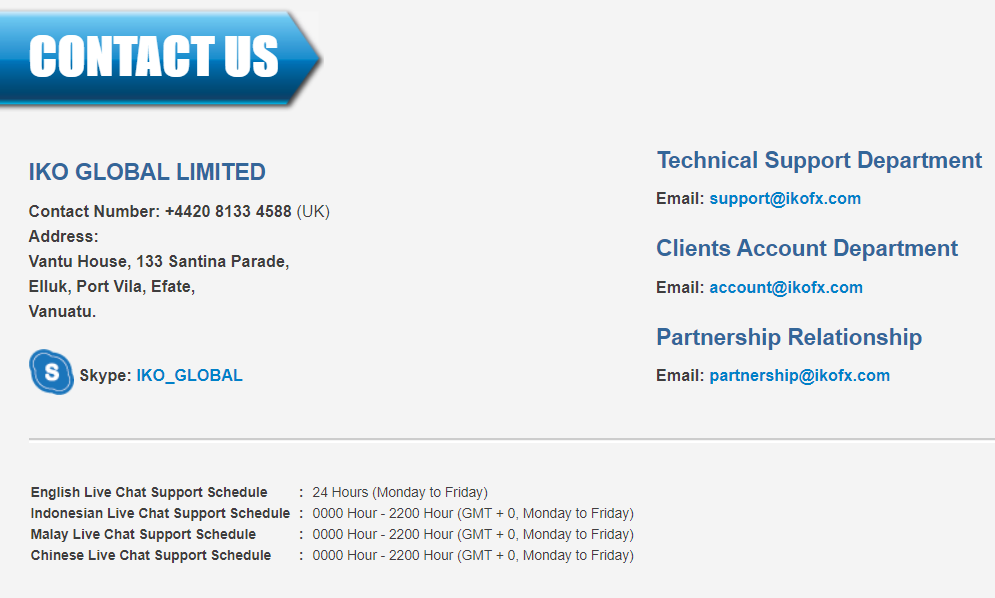

It’s incredible, but we couldn’t find a phone, an email, from FRESHCENT. There seems to be no customer service available, which is unusual. There is also no contact form or live chat on the website. We have not found any way to contact this broker. All we know is his postal address: St. Vincent and the Grenadines, Kingstown, Beachmont, P.O. Box 1510, Suite 305, Griffith Corporate Centre.

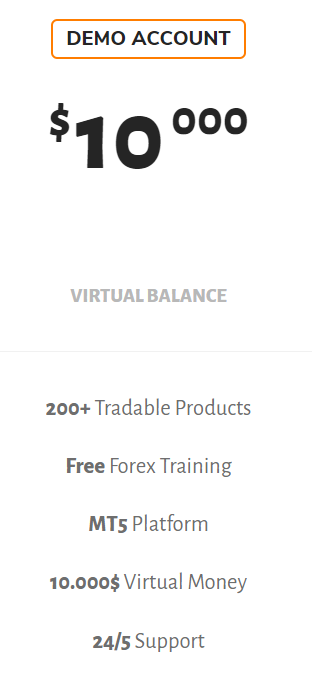

DEMO ACCOUNT

We regret to report that this broker does not provide a demo account, which we consider to be bad news and a negative point for FX Procent.

COUNTRIES ACCEPTED

Financial services provided by Riston Capital LTD. Services described on their website are not available in Iraq, North Korea, the UK, and the USA.

CONCLUSION

FRESHCENT is an offshore currency broker specializing in nickel accounts and part of the Freshforex group, which operates mainly in Russia and Asia. Although Freshforex is a well-known name in the trading world, we advise traders to be extremely cautious in dealing with offshore brokers as a general rule. The clients of these brokers basically don’t have much protection in case something goes wrong.

However, traders can target better trading options. For example, there are many brokers, which we have already analyzed in other reviews, duly regulated in Australia or Cyprus, and which offer even better trading conditions.

We did not like the broker not to specify what types of accounts he can offer, it seems that he only offers one type of account, and we have taken this into account. We also didn’t like the trading costs, which are priced by the fixed spread that this broker applies; even without having commissions, trading with FX Procent is more expensive than with most brokers. And the other 2 things we didn’t like were, not finding customer service data to contact the broker, not even having an email address is something that had never happened to me… On the other hand, the absence of a demo account is another negative point for this broker.

On the positive side, we find that FRESHCENT has available the 2 most popular platforms in the market and that they have all the necessary tools for any trader. Leverage is another point in favor, although leverage of 1: 1.000 is excessive, the ability to choose between a leverage range of 1: 25 to 1: 1.000, is something that few brokers offer, and perhaps some traders will demand it. The amount of assets available is entirely acceptable and sufficient for most customers, and the broker’s requirement for no minimum deposit is also a positive point as it will be possible to start trading with little capital and risk little money.

We appreciate the amount of deposit and withdrawal methods offered by this broker, they are quite numerous, and few brokers offer so many options. Current and proposed promotions do not seem attractive enough, not as the main reason to open an account. What we do value positively is the educational area, which has the right amount of content of interest.

Finally, we summarize the advantages and disadvantages that we have observed in FX Procent:

Advantages:

- The broker is part of the Freshforex group, which has a certain prestige

- It has the MT4 and MT5 platforms

- Leverage available up to 1:1000

- They do not require a particular initial deposit

- A lot of financial assets available to trade

- Many varieties of deposit and withdrawal methods

- A good educational area with exciting content

Disadvantages:

- Regulation can be improved

- Fixed spreads somewhat high

- There is no (or we have not found) any customer service

- Absence of demo account

- The promotions are unattractive

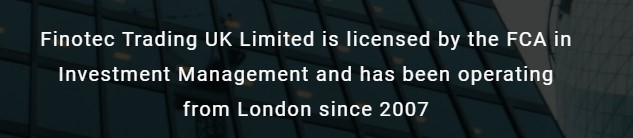

All FCA licensed brokerage houses are required to hold net tangible assets of at least EUR 730,000 and are required to comply with several rules and procedures, for example, to keep client money in segregated accounts, to send regular reports on transactions to the commission, etc.

All FCA licensed brokerage houses are required to hold net tangible assets of at least EUR 730,000 and are required to comply with several rules and procedures, for example, to keep client money in segregated accounts, to send regular reports on transactions to the commission, etc.

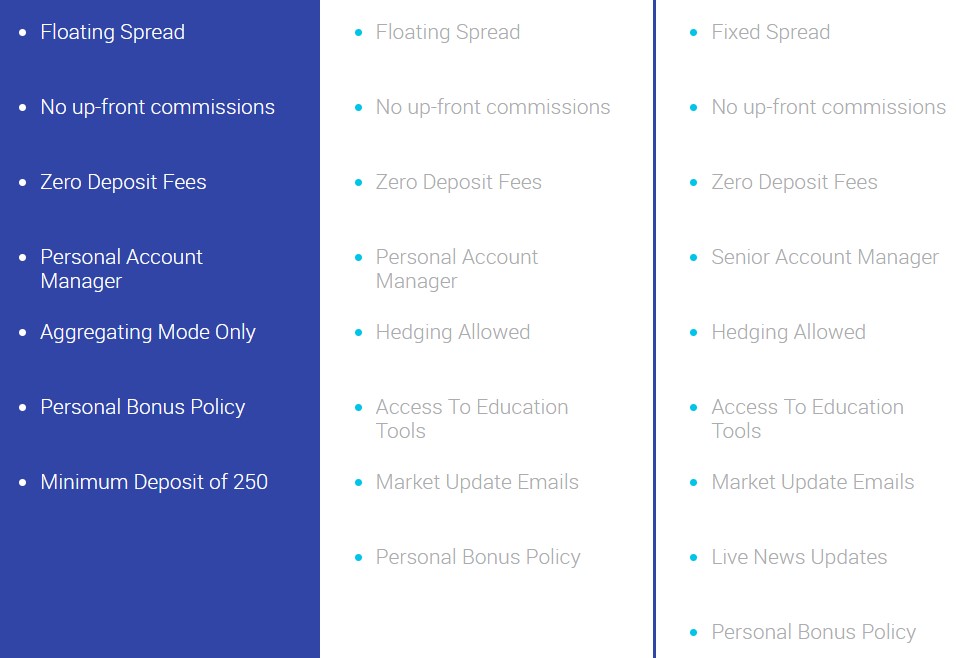

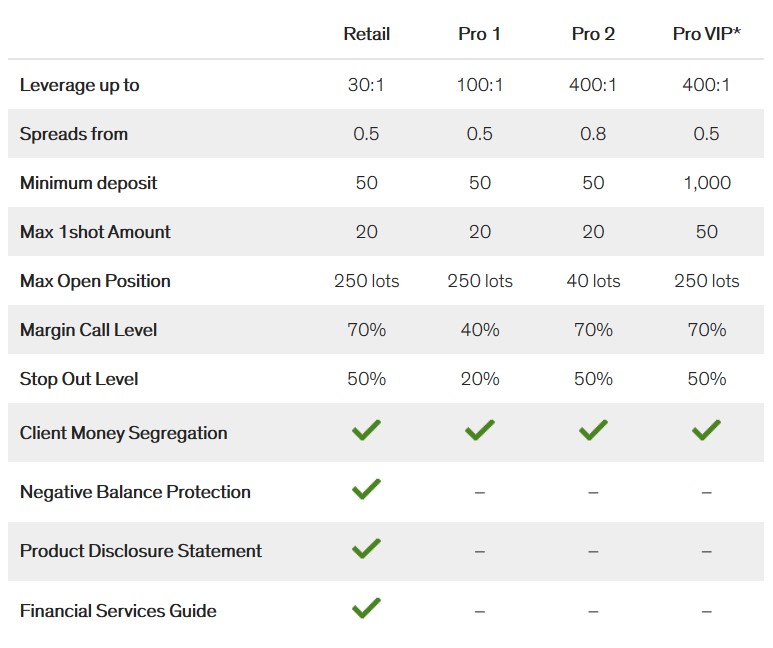

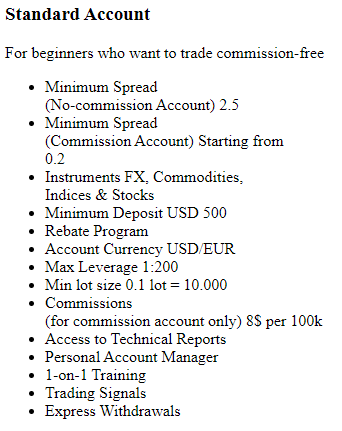

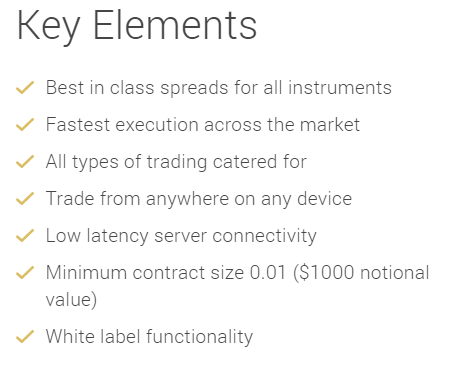

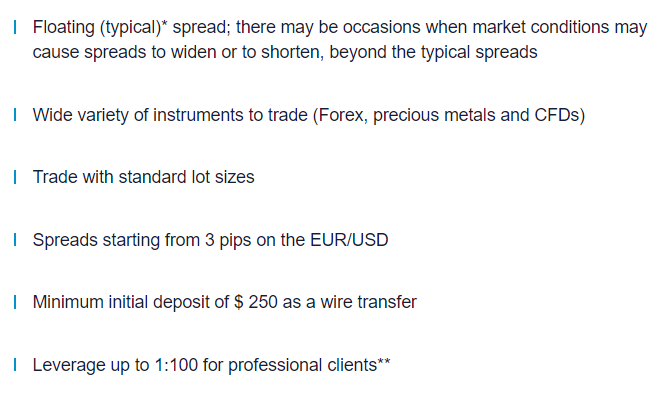

Pro Account:

Pro Account:  Platforms

Platforms

Each account has a different style of spread. The Pro account uses

Each account has a different style of spread. The Pro account uses

Classic Account: This account requires a minimum deposit of at least $1,000, it comes with daily briefings & research, access to the desktop and mobile trading platform, and access to video tutorials.

Classic Account: This account requires a minimum deposit of at least $1,000, it comes with daily briefings & research, access to the desktop and mobile trading platform, and access to video tutorials.

There are a few sections relating to education and tools. For education there is a page simply explaining

There are a few sections relating to education and tools. For education there is a page simply explaining

Assets

Assets As we do not know anything about the deposit methods you would be right to think that we also do not know much about the withdrawal methods. This information is some of the most important for potential clients to know, as you do not want to deposit and then try to withdraw only to know that your preferred method is not available to withdraw with, we also do not know the fees, so withdrawing could potentially cut into your profits, not something that you will want to happen.

As we do not know anything about the deposit methods you would be right to think that we also do not know much about the withdrawal methods. This information is some of the most important for potential clients to know, as you do not want to deposit and then try to withdraw only to know that your preferred method is not available to withdraw with, we also do not know the fees, so withdrawing could potentially cut into your profits, not something that you will want to happen.

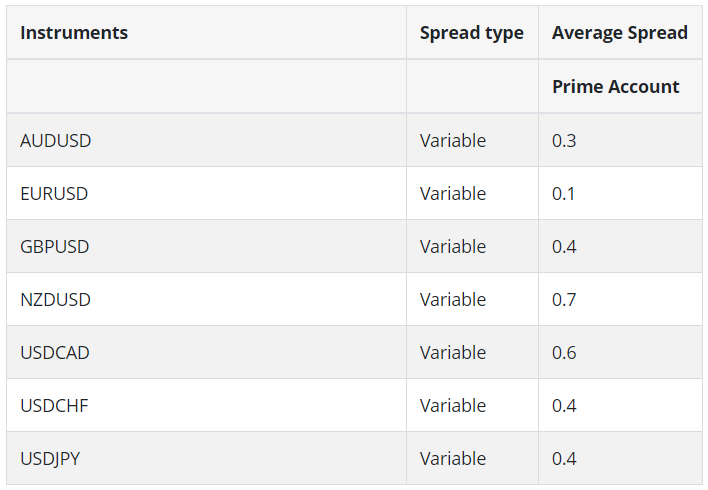

The spreads depend on the account you are using, the Private account has a spread starting from 4 pips, the Capital account has a spread starting from 3 pips and the Pro account has spreads starting as low as 0.2 pips. Different instruments will also have different spreads, so while EURUSD on the Pro account may start from 0.2 pips, GBPCHF on the same account starts from 2 pips. The spreads are also variable which means they will move with the markets, the more volatility in the markets will cause the spreads to grow larger.

The spreads depend on the account you are using, the Private account has a spread starting from 4 pips, the Capital account has a spread starting from 3 pips and the Pro account has spreads starting as low as 0.2 pips. Different instruments will also have different spreads, so while EURUSD on the Pro account may start from 0.2 pips, GBPCHF on the same account starts from 2 pips. The spreads are also variable which means they will move with the markets, the more volatility in the markets will cause the spreads to grow larger. Bonuses & Promotions

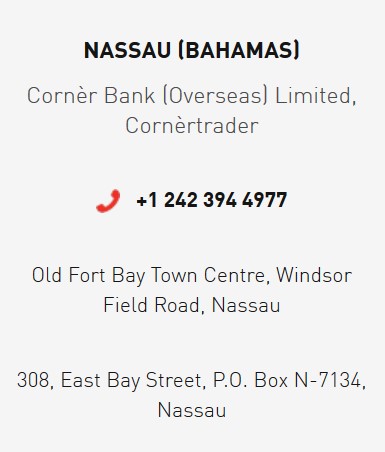

Bonuses & Promotions At the bottom of the page there is a phone number, email address, and postal address available to use, we do not know the opening times of the customer service team.

At the bottom of the page there is a phone number, email address, and postal address available to use, we do not know the opening times of the customer service team.

Trade sizes start from 0.01 lots which are also known as micro-lots, the trade sizes will then go up in increments of 0.01 lots so the next trade would be 0.02 lots and then 0.03 lots. There is no information on the site relating to what the maximum

Trade sizes start from 0.01 lots which are also known as micro-lots, the trade sizes will then go up in increments of 0.01 lots so the next trade would be 0.02 lots and then 0.03 lots. There is no information on the site relating to what the maximum

Leverage

Leverage Trading Costs

Trading Costs

Deposit Methods & Costs

Deposit Methods & Costs

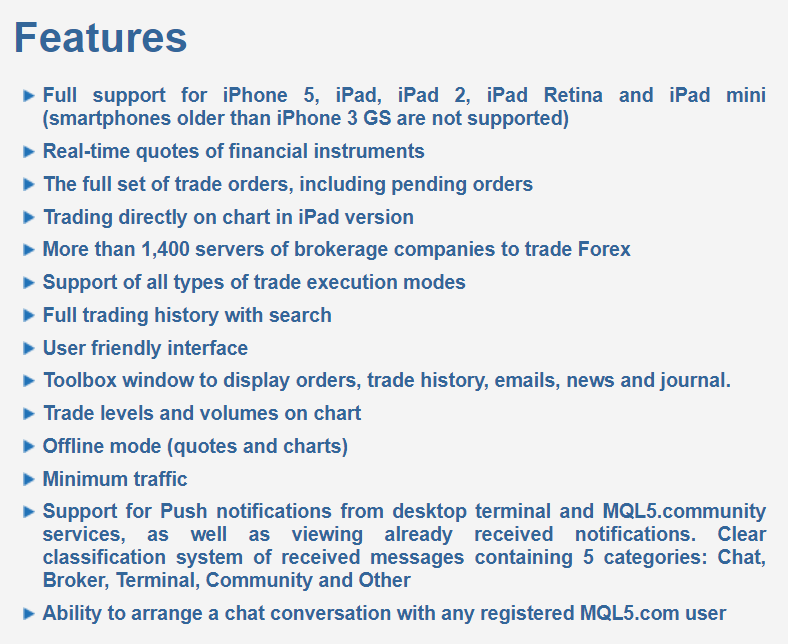

LKM Groups is offering its clients the use of MetaTrader 4 as their trading platform. MetaTrader 4 (MT4) is one of the world’s most used trading platforms which hosts the trades of over 1,000,000 traders worldwide. It offers a whole host of features including built-in indicators and compatibility with thousands of others to help with analysis and thousands of expert advisors to allow for automated trading. There are multiple chart windows and timeframes available as well as features such as one-click trading. Normally not having a choice of available platforms can be negative, but when the only platform available is MT4, it is not all bad.

LKM Groups is offering its clients the use of MetaTrader 4 as their trading platform. MetaTrader 4 (MT4) is one of the world’s most used trading platforms which hosts the trades of over 1,000,000 traders worldwide. It offers a whole host of features including built-in indicators and compatibility with thousands of others to help with analysis and thousands of expert advisors to allow for automated trading. There are multiple chart windows and timeframes available as well as features such as one-click trading. Normally not having a choice of available platforms can be negative, but when the only platform available is MT4, it is not all bad. Trade Sizes

Trade Sizes

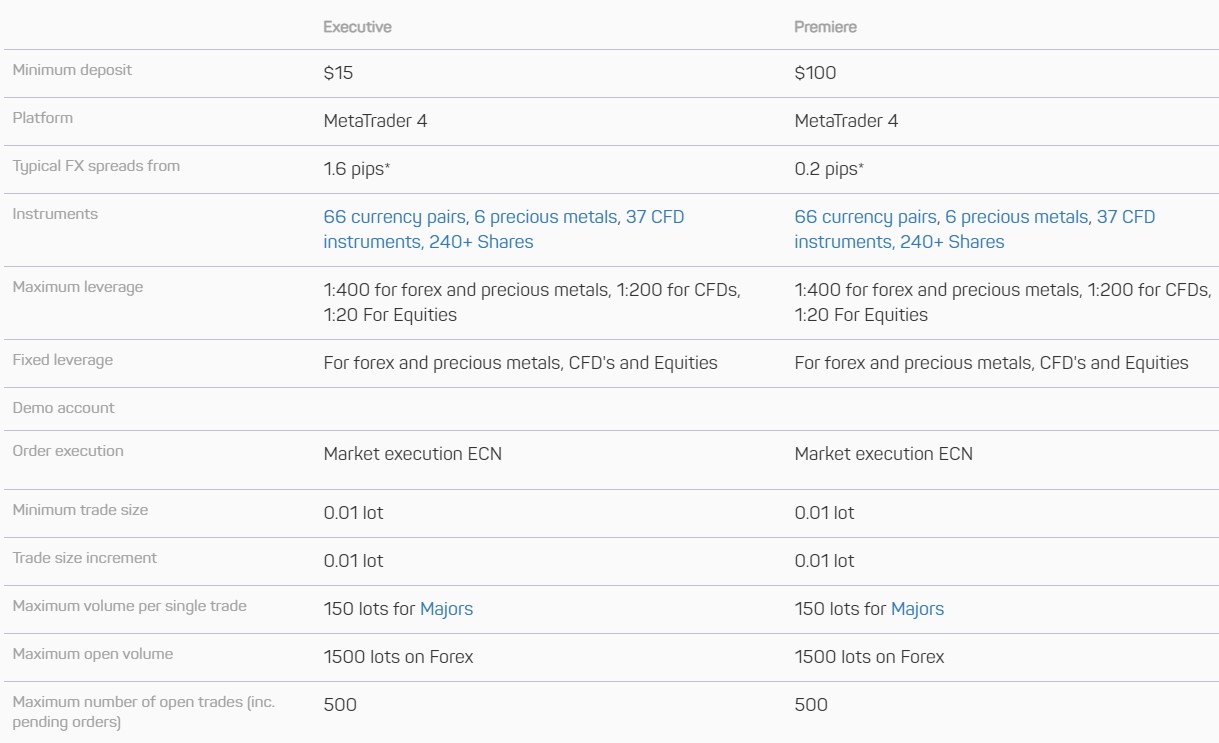

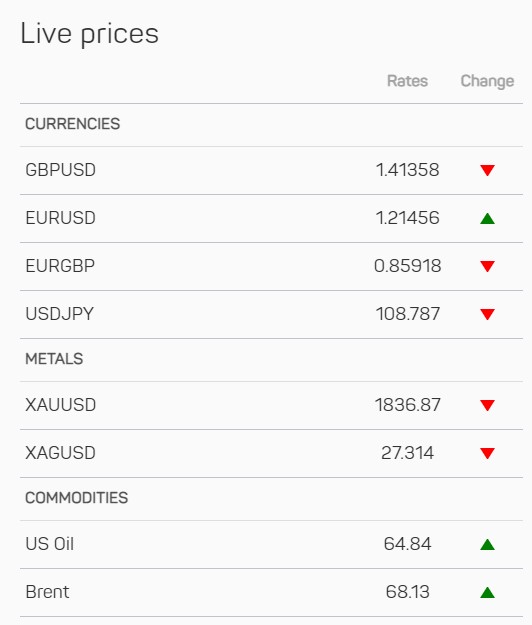

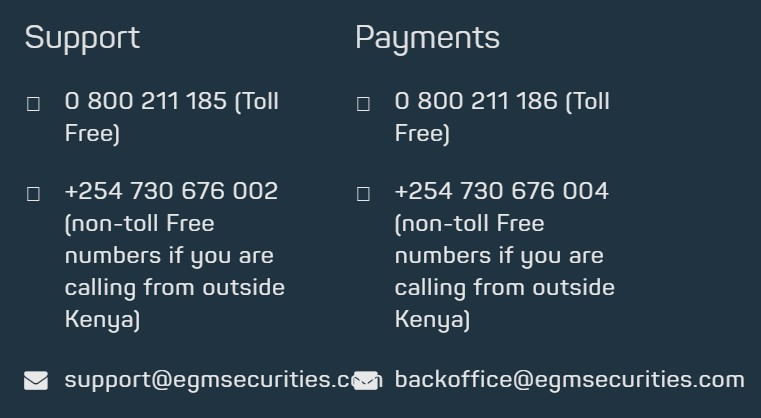

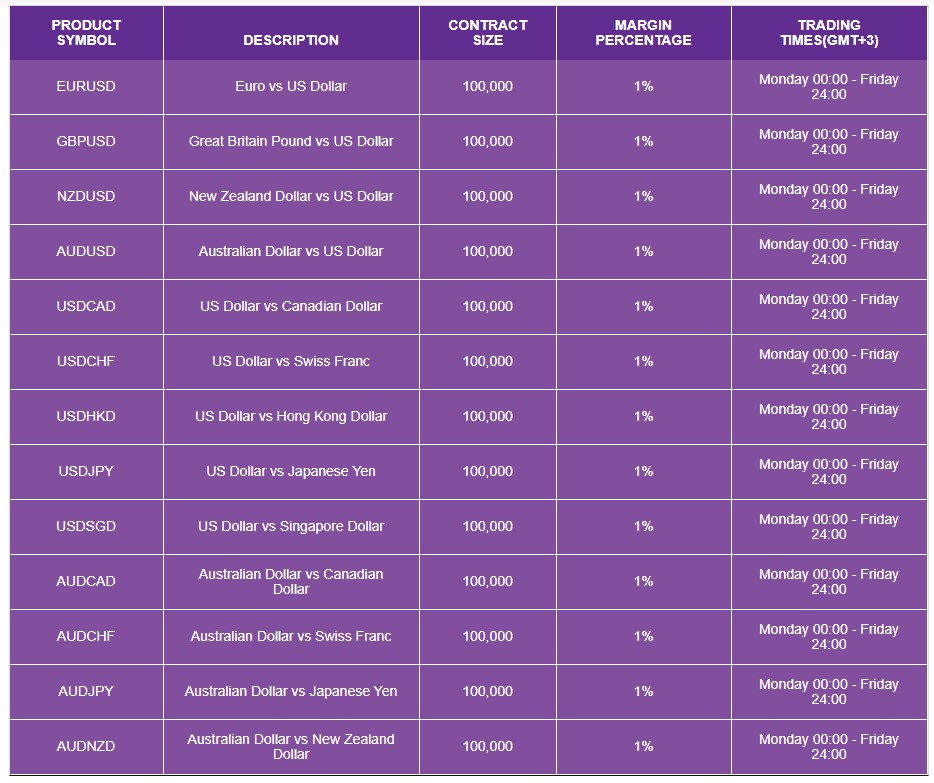

EGM Futures gives you access to more than 60 currency pairs. It is also possible to trade with 11 stock indices and 6 commodities.

EGM Futures gives you access to more than 60 currency pairs. It is also possible to trade with 11 stock indices and 6 commodities. EGM Broker offers a good variety of methods for its customers to make deposits. The Broker wishes to satisfy the needs of the clients giving them all the facilities in this regard.

EGM Broker offers a good variety of methods for its customers to make deposits. The Broker wishes to satisfy the needs of the clients giving them all the facilities in this regard.

PLATFORMS

PLATFORMS

After research, it seems that the only deposit method available is bank transfer.

After research, it seems that the only deposit method available is bank transfer.

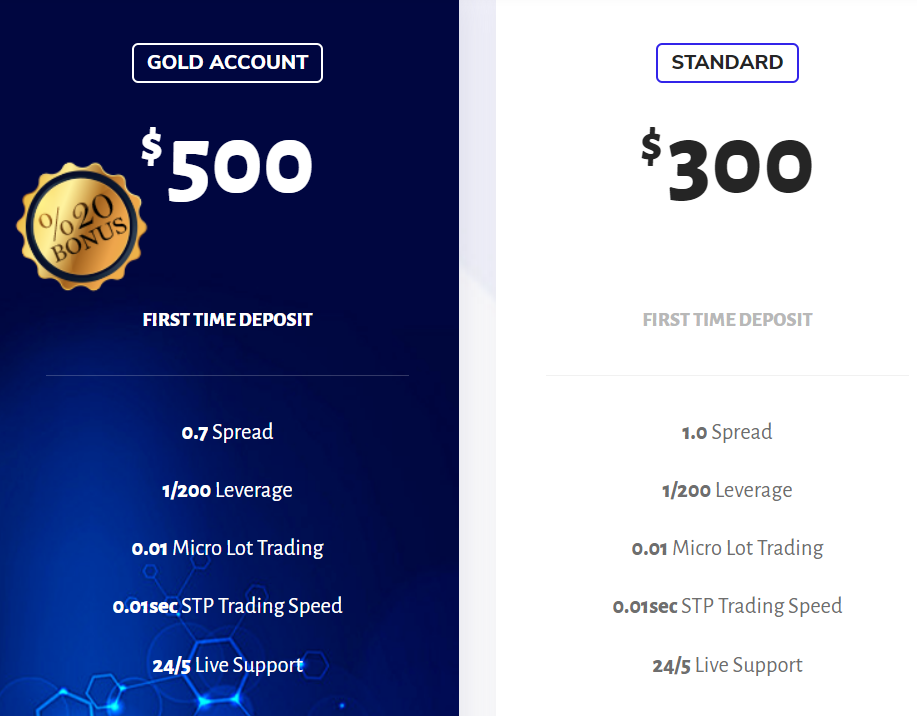

Prime Account: This account has a minimum deposit requirement of $100, it comes with spreads starting from 0.2 pips and has leverage up to 1:200. It can trade currencies, energies, metals, and indices with trade sizes starting at 0.01 lots and going up in increments of 0.01 lots up to a maximum of 50 lots. Swap-free versions are available and there is an added commission of $8 per lot traded on forex and $18 commission on stock indices, energies, and crypto. You can have a maximum of 1,000 trades open at any one time, the margin call level is set at 100% with the

Prime Account: This account has a minimum deposit requirement of $100, it comes with spreads starting from 0.2 pips and has leverage up to 1:200. It can trade currencies, energies, metals, and indices with trade sizes starting at 0.01 lots and going up in increments of 0.01 lots up to a maximum of 50 lots. Swap-free versions are available and there is an added commission of $8 per lot traded on forex and $18 commission on stock indices, energies, and crypto. You can have a maximum of 1,000 trades open at any one time, the margin call level is set at 100% with the  The platform on offer is the powerful MetaTrader 4 which allows you to implement strategies of any complexity. Market and pending orders, Instant Execution, and trading from a chart stop order and trailing stop are just a few of the execution methods available. Analytical functions are one of the MetaTrader 4 platform’s strongest points. Online quotes and interactive charts with 9 periods allow you to examine quotes in all the details quickly responding to any price changes. 33 analytical objects and 30 built-in technical indicators greatly simplify this task.

The platform on offer is the powerful MetaTrader 4 which allows you to implement strategies of any complexity. Market and pending orders, Instant Execution, and trading from a chart stop order and trailing stop are just a few of the execution methods available. Analytical functions are one of the MetaTrader 4 platform’s strongest points. Online quotes and interactive charts with 9 periods allow you to examine quotes in all the details quickly responding to any price changes. 33 analytical objects and 30 built-in technical indicators greatly simplify this task.

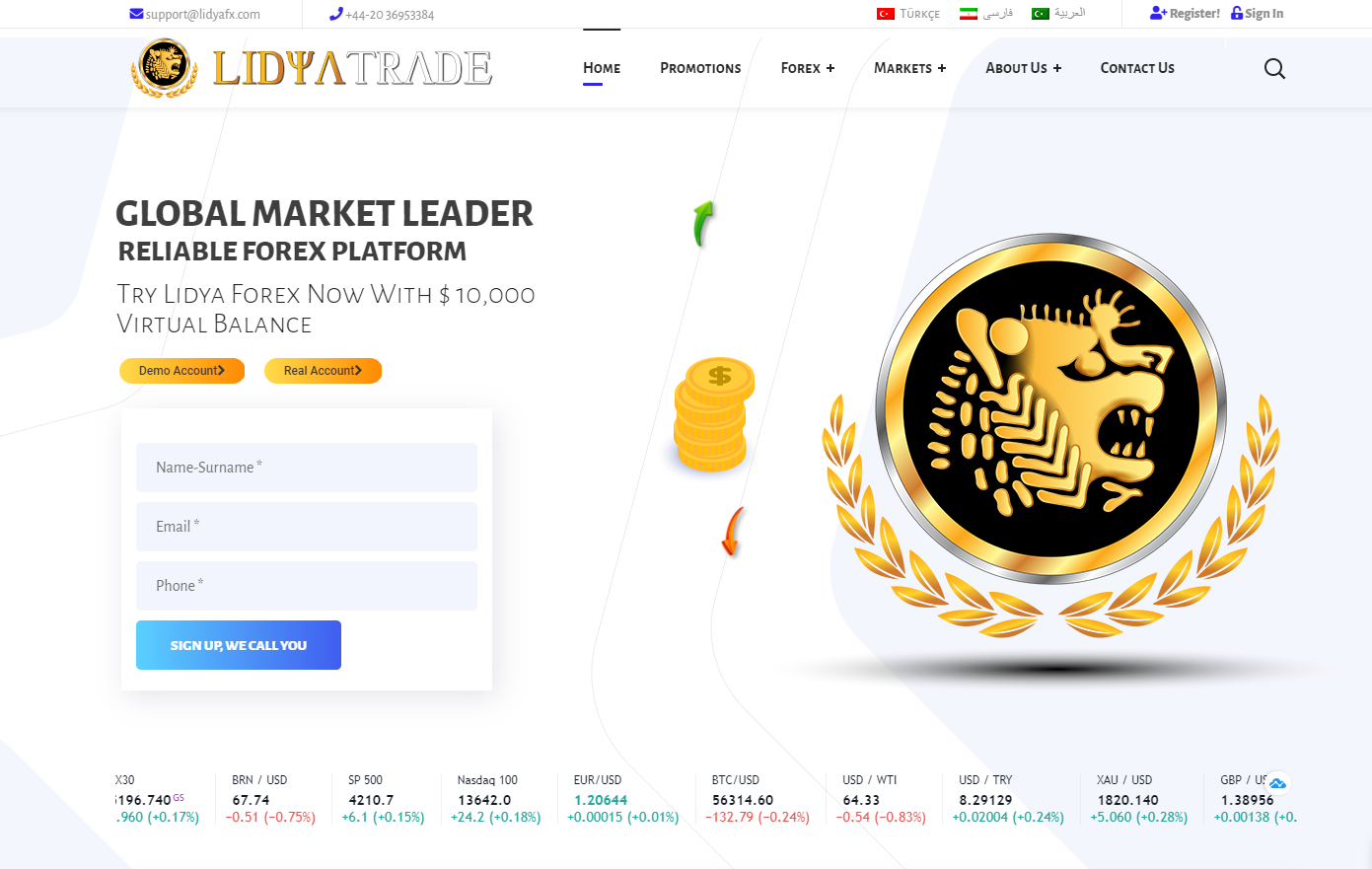

LidyaTrade offers MetaTrader 4 as its sole trading platform. It is a great platform to have and it is one of the most used trading platforms, used by over 1 million traders worldwide. The platform can be used anywhere as a desktop download, web trader, and mobile application. It is compatible with thousands of expert advisors and indicators which can help with your analysis as well as allowing for automatic trading. The platform is highly customizable and offers multiple charts and timeframes to allow you to trade in the style that you prefer.

LidyaTrade offers MetaTrader 4 as its sole trading platform. It is a great platform to have and it is one of the most used trading platforms, used by over 1 million traders worldwide. The platform can be used anywhere as a desktop download, web trader, and mobile application. It is compatible with thousands of expert advisors and indicators which can help with your analysis as well as allowing for automatic trading. The platform is highly customizable and offers multiple charts and timeframes to allow you to trade in the style that you prefer.

Demo Account

Demo Account

Standard Account:

Standard Account:  There are two platforms available to use, including the well-known MT4 and MobileTrade. There isn’t much left to say about

There are two platforms available to use, including the well-known MT4 and MobileTrade. There isn’t much left to say about  Forex Majors:

Forex Majors:  Dax 30, FTSE 100.

Dax 30, FTSE 100. Deposit Methods & Costs

Deposit Methods & Costs

There seem to be two different accounts available, one standard and one VIP.

There seem to be two different accounts available, one standard and one VIP.

Bonuses & Promotions

Bonuses & Promotions Educational & Trading Tools

Educational & Trading Tools Stock STP offers a few different ways to get in touch with them, you can use the online submission form, fill it in and then get a reply via email. You can also use the postal address provided along with the number of phone numbers based in the UK, Cyprus, and Spain and an email address for support.

Stock STP offers a few different ways to get in touch with them, you can use the online submission form, fill it in and then get a reply via email. You can also use the postal address provided along with the number of phone numbers based in the UK, Cyprus, and Spain and an email address for support.

There are a few different sections when it comes to education and tools, the first is an economic calendar which details upcoming news events and also what markets they may have and affect on there is also a news section but the page was constantly loading for us so we could not view the content. The interest rate page has not been updated since 2012. There are also forex calculators for

There are a few different sections when it comes to education and tools, the first is an economic calendar which details upcoming news events and also what markets they may have and affect on there is also a news section but the page was constantly loading for us so we could not view the content. The interest rate page has not been updated since 2012. There are also forex calculators for

Platforms

Platforms

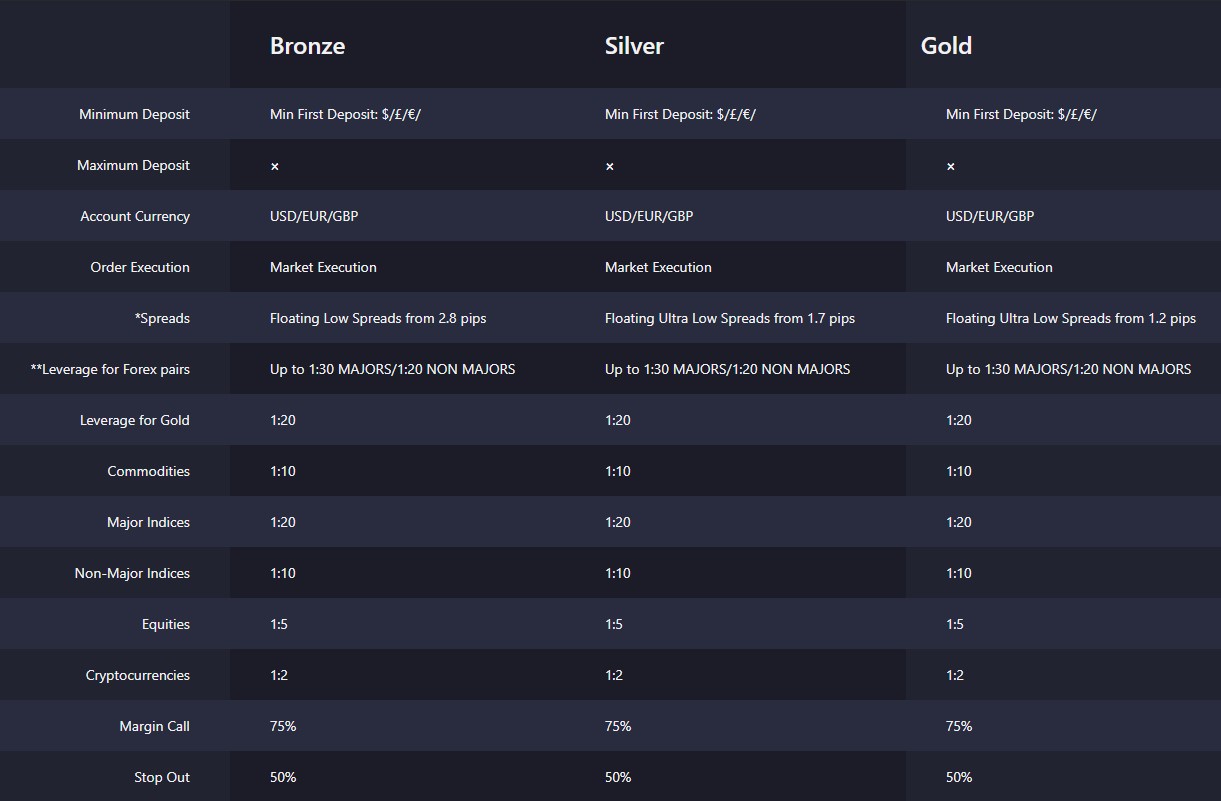

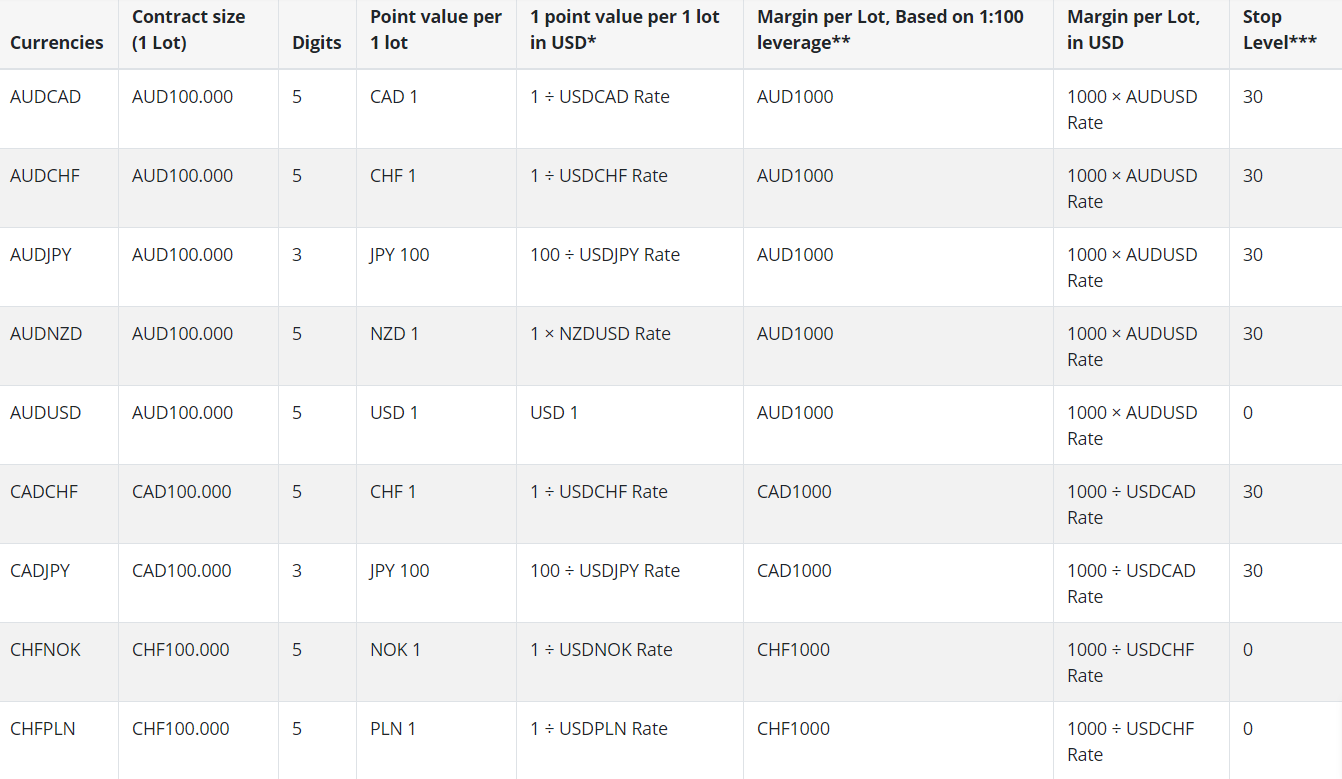

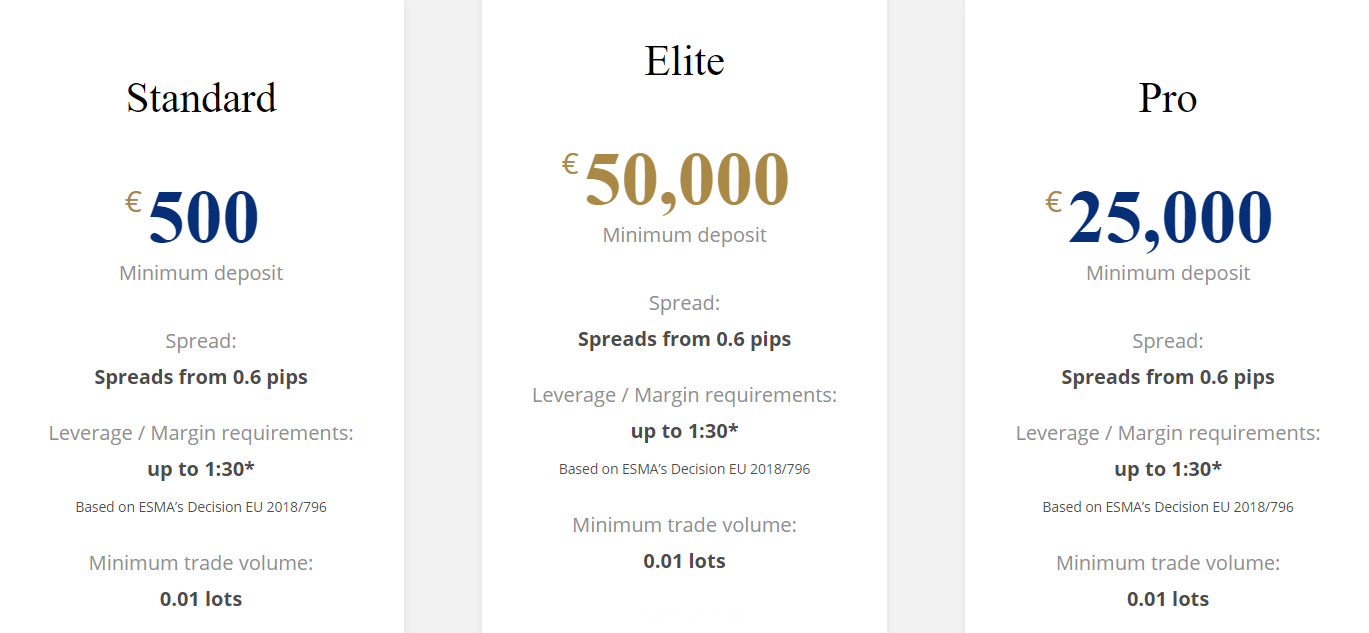

Trading costs differences are just with the commission, spreads are the same except for the Elite Account for which they are a bit tighter. Interestingly, the accounts comparison table also states Stop levels, something most brokers are not considering as important, but for fast trading strategies, it is. The leverage is the same for all accounts as the broker is under the ESMA directives.

Trading costs differences are just with the commission, spreads are the same except for the Elite Account for which they are a bit tighter. Interestingly, the accounts comparison table also states Stop levels, something most brokers are not considering as important, but for fast trading strategies, it is. The leverage is the same for all accounts as the broker is under the ESMA directives.

Address: Freepost RRRS-GTBG-HGZB, Spreadex Ltd., Churchill House, Upper Marlborough Road, St Albans. Hertfordshire, AL1 3UU

Address: Freepost RRRS-GTBG-HGZB, Spreadex Ltd., Churchill House, Upper Marlborough Road, St Albans. Hertfordshire, AL1 3UU

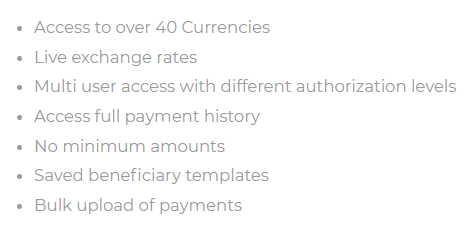

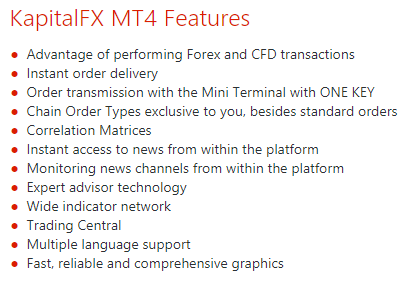

MetaTrader 4 is the only platform on offer and it is a good one to have, it is one of the world’s most popular trading platforms due to its massive selection of features. KapitalFX has detailed some of the benefits of using it with them as receiving one-hour response time on all customer inquiries,

MetaTrader 4 is the only platform on offer and it is a good one to have, it is one of the world’s most popular trading platforms due to its massive selection of features. KapitalFX has detailed some of the benefits of using it with them as receiving one-hour response time on all customer inquiries,

Platforms

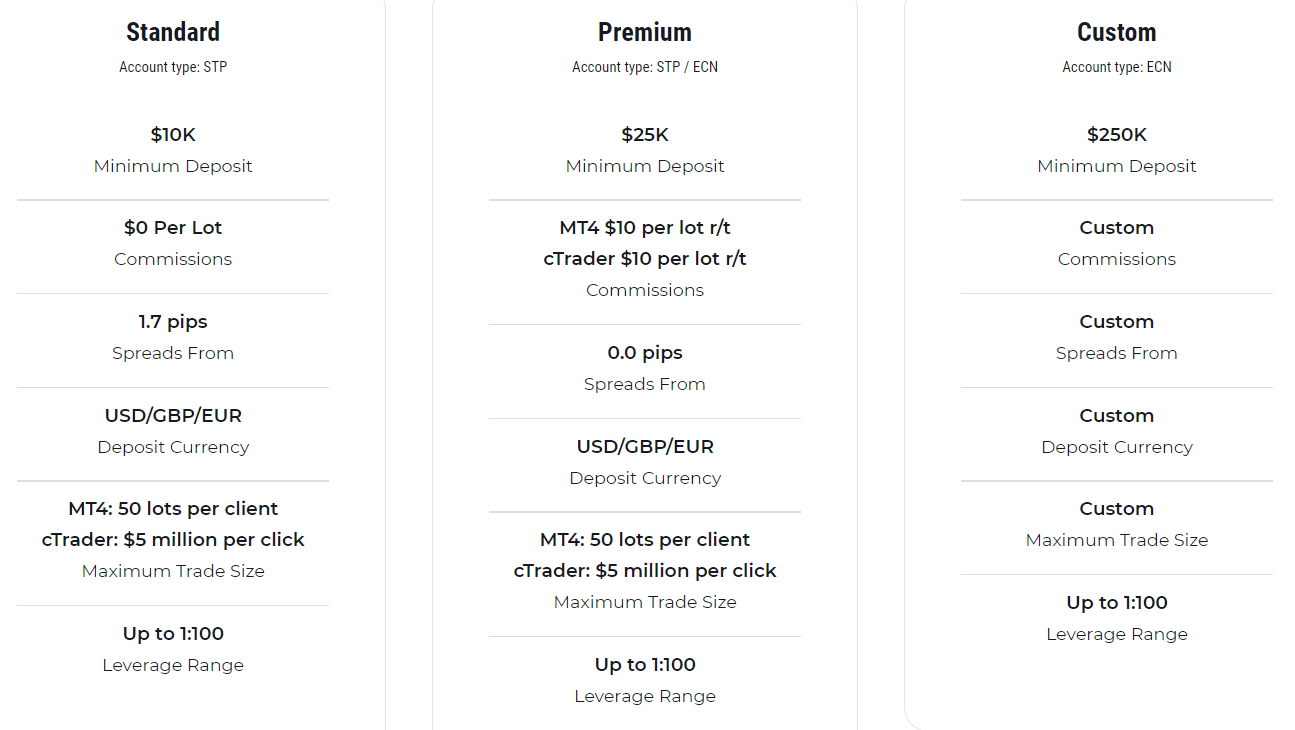

Platforms The Premium account has an added commission of $10 per lot traded on MT4 or $100 per million traded on cTrader which equates to a similar amount. The Custom account has commissions but this needs to be negotiated before opening up the account. The Standard account uses a spread-based system and so there are no added commissions.

The Premium account has an added commission of $10 per lot traded on MT4 or $100 per million traded on cTrader which equates to a similar amount. The Custom account has commissions but this needs to be negotiated before opening up the account. The Standard account uses a spread-based system and so there are no added commissions.

Account Features:

Account Features: The forex side of the broker uses MetaTrader 4 (MT4) as its trading platform. MT4 offers a whole range of features that helped to make it one of the world’s most used trading platforms. It offers a

The forex side of the broker uses MetaTrader 4 (MT4) as its trading platform. MT4 offers a whole range of features that helped to make it one of the world’s most used trading platforms. It offers a

The website does not have a full breakdown of the available assets to trade, so instead, we had to download the MT4 platform in order to view them within, so we have outlined the instrument that we have found below.

The website does not have a full breakdown of the available assets to trade, so instead, we had to download the MT4 platform in order to view them within, so we have outlined the instrument that we have found below. The spreads that are on offer start from around 0.8 pips, these spreads are variable which means they will move with the markets, the more volatility or less liquidity will mean that the spreads grow larger. Different instruments will also have different starting spreads, so while some may start at 0.8 pips, others will be higher at 1 or

The spreads that are on offer start from around 0.8 pips, these spreads are variable which means they will move with the markets, the more volatility or less liquidity will mean that the spreads grow larger. Different instruments will also have different starting spreads, so while some may start at 0.8 pips, others will be higher at 1 or

Platforms

Platforms

PLATFORMS

PLATFORMS

PLATFORMS

PLATFORMS LEVERAGE

LEVERAGE

MINIMUM DEPOSIT

MINIMUM DEPOSIT

EDUCATIONAL & TRADING TOOLS

EDUCATIONAL & TRADING TOOLS Telephone:+ 44-2031501511

Telephone:+ 44-2031501511

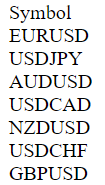

Forex: EURUSD, GBPUSD, USDJPY, USDCHF, AUDUSD, USDCAD.

Forex: EURUSD, GBPUSD, USDJPY, USDCHF, AUDUSD, USDCAD.

Multi-Interface Platform: This platform focuses on functionality for desktop users. A few of the main benefits include an easy-to-navigate user interface, a comprehensive choice of order types, interactive in-window charting tools, state-of-the-art technical indicators, customized, automated EA’s and, instant trade execution.

Multi-Interface Platform: This platform focuses on functionality for desktop users. A few of the main benefits include an easy-to-navigate user interface, a comprehensive choice of order types, interactive in-window charting tools, state-of-the-art technical indicators, customized, automated EA’s and, instant trade execution.

Leverage

Leverage Currencies: EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, USDCHF, EURGBP, EURCHF, NZDUSD, EURJPY, GBPJPY, EURAUD, EURCAD, EURNZD, GBPAUD, GBPCAD, GBPCHF, GBPNZD, AUDCHF, AUDJPY, AUDNZD, CADCHF, CADJPY, CHFJPY, NZDCHF, USDNOK, USDSEK, USDZAR, USDRUB, USDNOK, USDSEK, USDZAR, USDRUB, EURRUB, USDCNH, USDDKK, USDHKD, USDTRY, AUDCAD, EURDKK, EURHUF, EURNOK, EURPLN, EURSEK, EURTRY, EURSEK, EURTRY, NZDCAD, NZDJPY, USDHUF, USDMXN, USDPLN,. USDSGD,

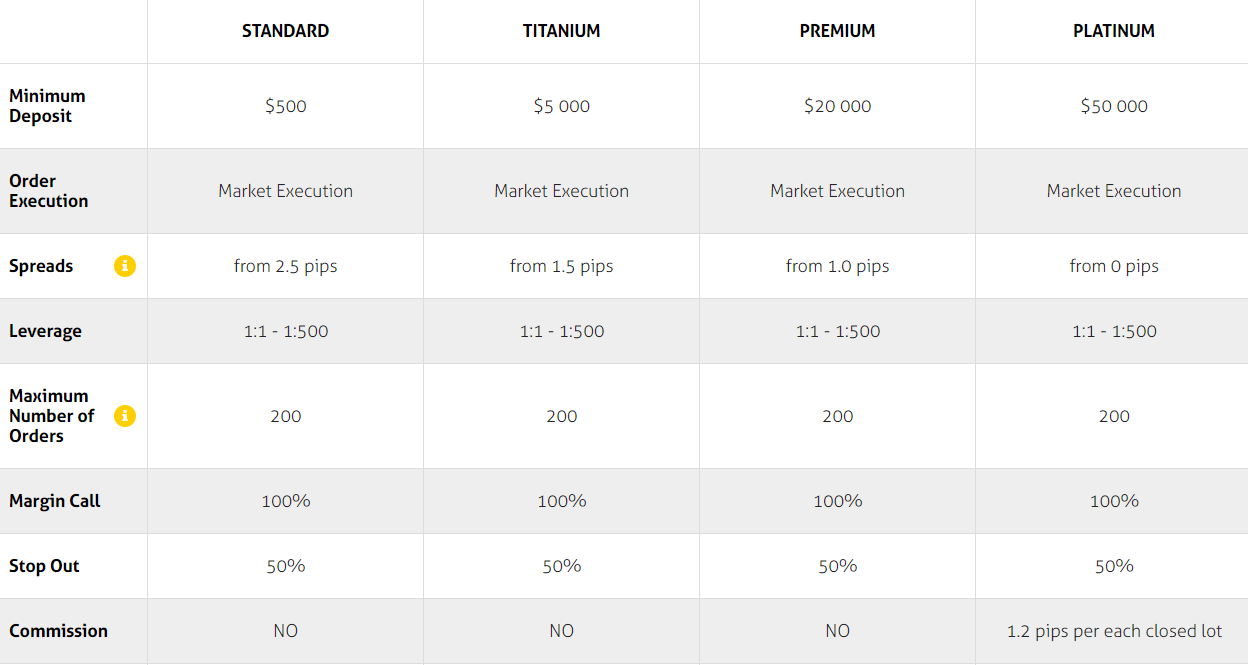

Currencies: EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, USDCHF, EURGBP, EURCHF, NZDUSD, EURJPY, GBPJPY, EURAUD, EURCAD, EURNZD, GBPAUD, GBPCAD, GBPCHF, GBPNZD, AUDCHF, AUDJPY, AUDNZD, CADCHF, CADJPY, CHFJPY, NZDCHF, USDNOK, USDSEK, USDZAR, USDRUB, USDNOK, USDSEK, USDZAR, USDRUB, EURRUB, USDCNH, USDDKK, USDHKD, USDTRY, AUDCAD, EURDKK, EURHUF, EURNOK, EURPLN, EURSEK, EURTRY, EURSEK, EURTRY, NZDCAD, NZDJPY, USDHUF, USDMXN, USDPLN,. USDSGD,  The Standard account comes with spreads starting from 2.5 pips, the Titanium account from 1.5 pips, the Premium account from 1 pip, and the Platinum account has starting spreads as low as 0 pips. The spreads are variable which means that the markets can have an influence on the spreads provided, the more volatility the higher the spreads will be. Different instruments will also have different starting spreads as on the Titanium account, EURUSD has a typical spread of 1.8 pips while GBPUSD has a typical spread of 2.6 pips.

The Standard account comes with spreads starting from 2.5 pips, the Titanium account from 1.5 pips, the Premium account from 1 pip, and the Platinum account has starting spreads as low as 0 pips. The spreads are variable which means that the markets can have an influence on the spreads provided, the more volatility the higher the spreads will be. Different instruments will also have different starting spreads as on the Titanium account, EURUSD has a typical spread of 1.8 pips while GBPUSD has a typical spread of 2.6 pips.

Phone: +44 7441 953908

Phone: +44 7441 953908

The educational side of the site has a few different aspects to it. The first section is e-books, there are

The educational side of the site has a few different aspects to it. The first section is e-books, there are