Introduction

USDCZK is the short-form for the US Dollar against the Czech Koruna. Since CZK is involved in this pair, it is classified as an exotic currency pair. Here, the US Dollar is called the base currency and the CZK the quote currency.

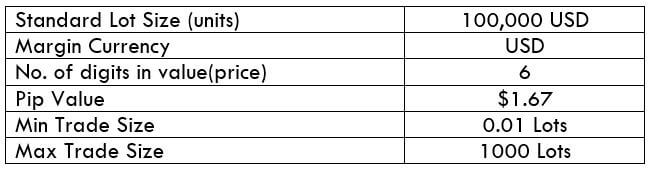

Understanding USD/CZK

The value of USDCZK determines the value of CZK equivalent to one USD. It is quoted as 1 USD per X CZK. So, if the market value of this pair is 22.4773, then many Koruna is required to buy one US Dollar.

Spread

Spread is the difference between the bid and the ask prices set by the broker. The amount of spread varies based on the type of execution model.

ECN: 16 pips | STP: 18 pips

Fees

The fee is a commission that has to be paid to the broker for every trade the clients take. This value depends on the type of execution model used by the broker. As a matter of fact, there is no fee on STP accounts.

Slippage

The difference between the trader’s required price and the broker’s executed price is referred to as the slippage. The slippage size depends on the broker’s execution speed and the volatility of the market.

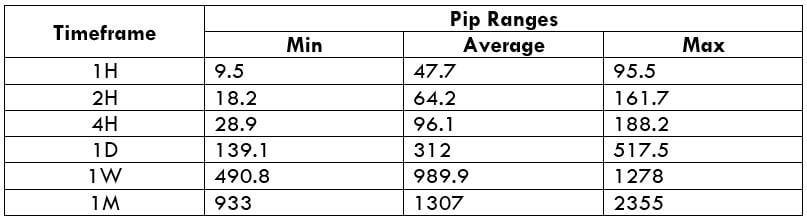

Trading Range in USD/CZK

The minimum, average, and maximum volatility of the market are necessary to assess the profit/loss that can be made on a trade. And is a representation of the same for USDCZK.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can determine an extensive period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

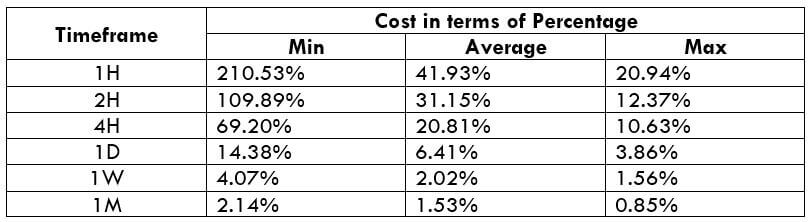

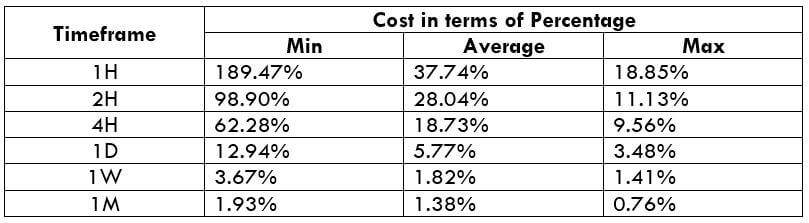

USD/CZK Cost as a Percent of the Trading Range

The total cost depends on the volatility of the market. Below is a table that shows the variation in the total costs for different volatilities in terms of percentages.

NOTE: These percentages are obtained by finding the ratio between the total cost and the volatility of the market in different timeframes.

ECN Model Account

Spread = 16 | Slippage = 3 |Trading fee = 3

Total cost = Slippage + Spread + Trading Fee = 3 + 16 + 3 = 22

STP Model Account

Spread = 18 | Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 18 + 0 = 21

The Ideal way to trade the USD/CZK

The volatility in this currency pair is pretty high compared to major and minor currency pairs. And the costs are low by default for the exotic currency pairs. However, it is not ideal for this pair at any time.

The main focus of exotic currencies is to trade when the volatility is not too high. Hence, trading when the volatility is around average and maximum values in the volatility table will ensure decent volatility with lower costs as well.

Another simple technique to reduce costs is by placing limit/stop orders instead of executing by the market. In doing so, the slippage will be taken away from the total costs, which will, in turn, reduce the total cost of the trade.