“Information stored online can be copied and stolen,” that’s Trezor’s unique selling point.

Trezor is a hardware wallet – a car-key-sized device that you can use to store, send, and receive most of the major cryptocurrencies. If you’ve not used a hardware wallet before, you might be wondering how you are supposed to view your balances and even transact on such a mini dongle. Stick around to the end as we discuss this and much more.

For starters, a hardware wallet is a physical device that stores private keys used for signing cryptocurrency transactions. Contrary to potential misconception, it does not store the actual funds, just the keys.

Trezor claims superior security and comes in a variety of flavors with different descriptive code names. For example, you will hear Trezor Model T, Trezor One Metallic, Trezor Ultimate Pack, and so on. Trezor Model T is the flagship wallet that was released by SatoshiLabs, the makers of this wallet.

This review is all about Trezor. We will look at how to acquire one and get it up and running. We will also look at its security, ease of use, customer support, and other aspects that constitute a balanced cryptocurrency wallet evaluation. Stay tuned!

Key Features

- Hardware wallet – You use a dedicated physical device for storing your private keys.

- Multi-currency support – Trezor supports most of the major currencies.

- Excellent customer support – The product is supported round the clock by a team of specialists.

- U2F (universal second factor) account reinforcement – This feature works just like two-factor authentication, only that the second factor, in this case, is a hardware device you possess. Trezor’s U2F kicks in when authorizing transactions. This ensures that you never authorize an unknown transaction request.

- Good reputation – Getting yourself a hardware wallet from a reputable vendor is critical. Imagine buying a cheap device only to find that it slowly siphons your coins to a secret address. Trezor’s reputation among its users will let you rest assured that your money is safe and will always be.

Security Features

Trezor is a hardware wallet, and for this, it boasts of unmatched security. Hardware wallets protect your funds with far greater security than their software counterparts, and it’s easy to understand why – when using these gadgets, your private keys and their associated data never have to see the internet. It’s technically impossible for cryptocurrency hackers to lay their hands on your private keys.

“But software cold wallets do the same,” some will argue. Well, if you are operating a hot wallet and your computer is compromised by malware, you might be fast running out of luck. But with a hardware wallet like Trezor, crypto-malware stands no chance.

However, like any other hardware wallet, it is important to take note of the following potential risks:

Acquiring and Setting up the Wallet

The first step in setting up Trezor is purchasing one, of course! The Model T goes for €149 on trezor.io, its official store. You can also find it on Amazon, thecryptomerchant.com, and probably a few other online shops. Weigh your options then decide.

Your order has arrived, and you can’t wait to set up your literally shiny new wallet. Follow this quick guide:

- Unbox the product. You should see the dongle, a USB cable, and two sheets for storing your recovery seeds (this is what you will need to recover your account if you ever lose your Trezor).

- Connect one end of the USB cable to Trezor and the other to your computer.

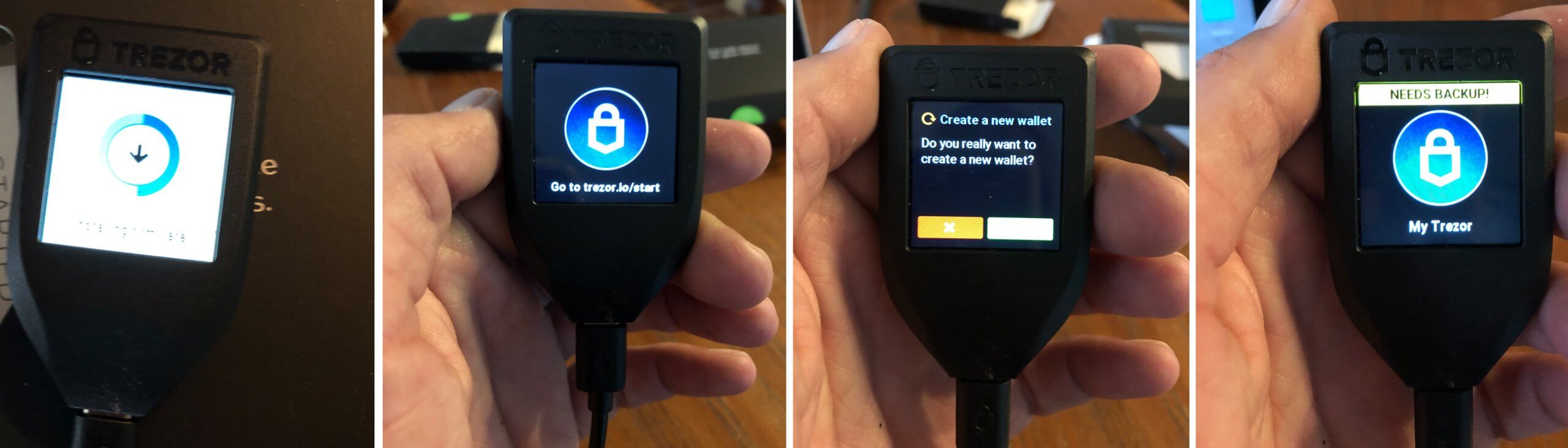

- Once plugged in, the device’s display turns on, and it will ask you to visit trezor.io/start.

- Visit the web link above. The page has simple instructions on configuring the device. One of the key tasks at this stage is updating the firmware. Click on the “done” button on the page and the “continue” button on the device. Wait for the update to finish, then remove the device and plug it back in. Meanwhile, don’t close the webpage.

- You will see a “Welcome to TREZOR” message on the web page and an input box for configuring your device’s name. Add a name and save.

- The next step is setting up your PIN. You will do this on the web page as well. However, the keypad on the web page is a little weird – it is a matrix of dots instead of numbers! The actual keys will be on your Trezor’s mini display. Please note that the keys are not arranged sequentially as you would find on a traditional keypad, and their arrangement changes every time you open it. To set the PIN, tap the dots on the web page – they correspond to the keys on the Trezor display.

- Confirm your PIN. Note that the keypad arrangement has already changed!

- Next, you need to set up your recovery seed – very important. This mysterious recovery tool is a set of 24 words that Trezor will display, one at a time and in a specific order. You need to write them down in the order they are presented. There were two sheets of paper in the original box, which are to be used for this purpose. Now, after writing down the words on the first sheet and duplicating, then on the second, you need to store the papers in different locations – that’s how disaster recovery works, different locations.

Just like that, Trezor is set up, and you’re ready to transact. So, let’s see if that too is easy.

Sending Funds

As you might be aware by now, you will be operating your Trezor mostly from your computer. To send funds,

- Go to trezor.io and click on the Wallet menu. It will ask you to plug in to continue. So, plug in your Trezor.

- Enter your PIN on the keypad on the web page.

- Confirm login on your Trezor.

- Once you log in successfully, you will see your dashboard with a summary of your transactions.

- Since Trezor supports different currencies, there’s an option to select which coins you want to send. The option for changing the currency is at the top right corner of the dashboard. Select the appropriate currency and click on the Send menu.

- Provide the recipient’s address and amount to send in the screen that appears next.

- Select the network fee. Typically, higher fees result in faster transaction completion. However, the network fee and amount of time it takes to complete a transaction depend on the coin you are sending.

- Confirm the transaction on your device.

Receiving Funds

- Go to trezor.io and log in as above.

- Change to the appropriate currency if necessary and click on the Receive menu. Your deposit address will be generated. Right-click to copy the address and share it with the sender.

NB: Trezor provides immunity against address swapping (which may occur if you have crypto malware on your computer) by allowing you to confirm the address on its mini display.

Supported Currencies

You can deposit it send the following coins using Trezor:

- Bitcoin

- Bitcoin Cash

- Litecoin

- Dash

- Zcash

- Bitcoin Gold

- Ethereum

- Ethereum Classic

Customer Care

SatoshiLabs’ customer service is pretty much reliable. You can raise support issues through the contact form on the website, and they will contact you back.

Pros

- Highly secure

- Easy to set up and use

- Reliable customer service

Cons

- The initial cost is high considering software wallets are free

Final Thoughts

Trezor is undoubtedly an outstanding hardware wallet. It looks good. It’s secure, it’s easy to use and is supported by reliable customer care. These benefits come at a cost – Trezor Model T is €149 more expensive than it’s free software counterparts. Nevertheless, you can bet that this small investment will be worth every cent in the long run.