While it may appear as though crypto has received a lot of support and adoption, the reality is that penetration is yet to even go beyond 1%. The reasons for this are the massive obstacles standing between Fiat and crypto, such as high fees, complex procedures, regulatory hurdles, etc. Also, existing on-ramp solutions grapple with high deposit and withdrawal fees, delays, and users not truly owning their own money.

WazirX is a decentralized crypto exchange that wants to solve these and more problems to provide users with the means to adopt cryptocurrency. Based in India and acquired by Binance, the platform’s name, Wazir, is another name for the “queen” in chess. The queen piece can not only play any move; it’s also the strongest. WazirX wants to live up to these characteristics.

What’s WazirX?

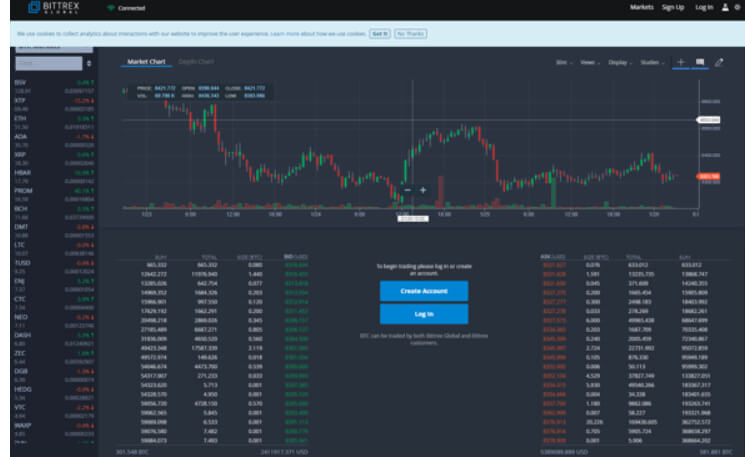

Launched in 2018, WazirX is a crypto exchange with advanced buy, sell, and trade functionalities. It features a live and open order book on which users can trade over 80 crypto assets, including Bitcoin, Litecoin, BNB, Dash, and more.

On WazirX, you can also deposit or withdraw crypto and cash in or cash out stablecoins such as USDT in a fast, secure, and peer-to-peer manner. WazirX’s goal is to bridge the chasm between Fiat and crypto.

WRX’s native token is the backbone of the ecosystem and has several use cases, including trading fee discounts, participation rewards, payment for margin fees, and more. WazirX supports five platforms at the time of writing: Web, Android, iOS, Windows, and Mac.

History of WazirX

The WazirX team launched the platform to respond to the Indian government’s banning of crypto businesses, exchanges, and shops. Banks had also been banned from engaging in any crypto-related activities.

Today, the platform is, first and foremost, the go-to platform for Indian users to trade in crypto – in an uncensorable manner. But that’s not where the team is stopping. They intend to take the WazirX proposition to more developing and underdeveloped countries for Fiat on-ramp solutions.

Binance acquired WazirX in November 2019. However, it continues to operate independently with a focus on peer-to-peer crypto trading. The WazirX team shares a vision with Binance, and that’s to increase the freedom of money around the world and improve people’s lives.

How Does WazirX Realize Security?

The WazirX team ensures security for the network through the following actions:

- Majority of funds kept in cold storage

- A muti-sig wallet system

- Two-factor authentication system for transactions

- Strong KYC/AML procedures

- Regular security audits

WRX Value

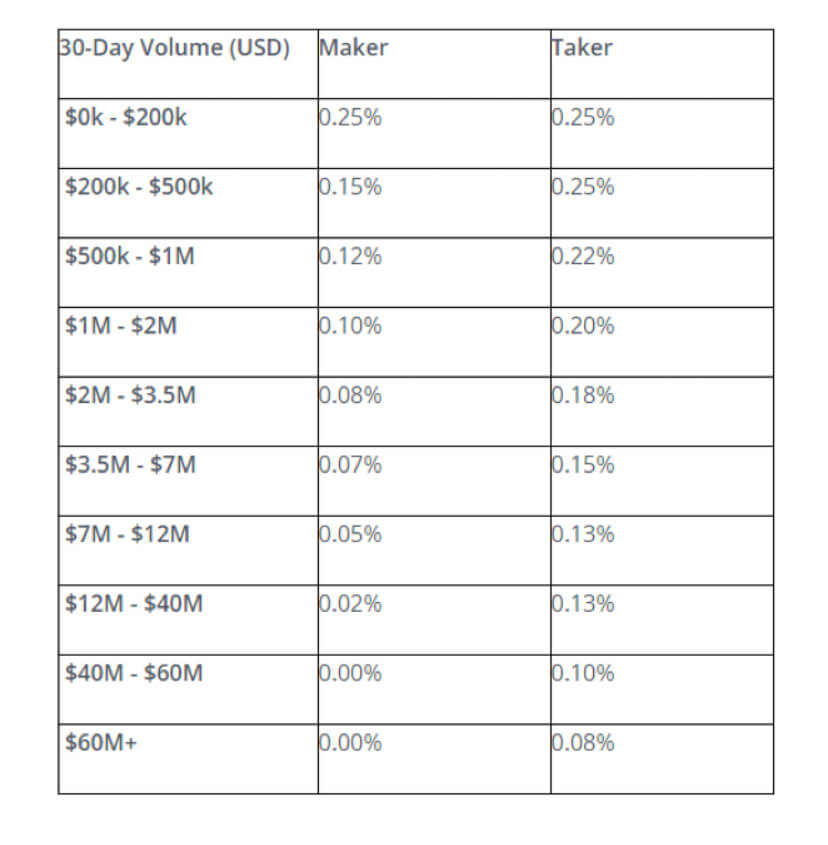

WRX token holders will receive perks, including but not limited to discounts in payment of fees. The discount structure is as follows:

- 1st year: 50% trading fee discount

- 2nd year: 25% trading fee discount

- 3rd year: 12.5% trading fee discount

- 4th year: 6.25% trading fee discount

Users will also earn participation rewards for performing P2P trades. Also, token holders will have voting power to determine issues such as future listings, update releases, etc.

WazirX will burn 10% off WRX tokens every quarter based on the trading volume. In the end, about 100 million tokens will be burned – in a bid to prevent the token from overflooding the market.

Who’s on the WazirX Team?

WazirX is the brainchild of a core team of members. We have founder and CEO Nischal Shetty, who is also the founder of Crowdfire and is an awardee of Forbes 30 under 30.

Co-founder and CTO is also a co-founder of Crowdfire Sameer Mhatre is a full-stack developer and designer. He describes himself as “a huge Java and JS fan.”

Co-founder and COO Siddharth Menon also co-founded Crowdfire. He’s also the founder of 3Crumbs, one of the early mobile startups in India.

Community Growth Strategies of WazirX

The WazirX team intends to implement several community growth strategies in a bid to expand the growth of the network. Current strategies include:

- Innovative participation reward programs, e.g., the WRX Trade Mining program

- Publish media content including guest posts and features

- Conduct AMAs and both virtual and physical conferences

- Conduct interviews with influencers

- Release progress updates every month

- Headline events and partner with industry influencers

Future strategies include:

- Create dedicated Telegram channels for various countries

- Headline and participate in more events such as meetups and conferences to grow further its offline presence

- Continue to innovate with rewards programs

- Collaborate with various wallets and decentralized finance apps to explore Fiat gateway solutions

WRX: Token Supply Distribution

The ERX token was distributed in the following manner:

- Launchpad sale tokens: 10%

- Private sale tokens: 5%

- Foundation tokens: 30%

- Product and marketing tokens: 20%

- Partnership and ecosystem tokens: 20%

- WRX Airdrop tokens: 11.10 percent

- WRX trade mining tokens: 3.90%

How’s the WazirX Token Doing in the Market?

As of October 31, 2020, WRX traded at $0.088615 with a market cap of $20,718,698 that placed it at #323 in the market. The token had a 24-hour volume of $8,866,743 and a circulating and total supply of 233,817,289 and 995,833,334. WRX has an all-time high of $0.229263 (Mar 07, 2020) and an all-time low of $0.055241 (Mar 13, 2020).

Where to Buy WRX

You’ll find WRX listed as a market pair of USDT, BTC, BUSD, BNB, TRX, and more in several exchanges. They include but are not limited to WazirX, Binance, BinanceDEX, Bilaxy, Sistemkoin, BiKi, Poloniex, FTX, and Bitsonic.

Final Thoughts

WazirX is relatively young, but it has done well. With its plan to spread its wings to more countries, the project is poised for more success and could very well compete with more established exchanges like Huobi, Coinbase, etc. Here’s to hoping it succeeds in both expanding and democratizing money for populations.