Crypto subjects are not for the faint of heart. They’re sometimes highly technical by nature, and with the unpredictable prices of the crypto market, it can be harder to keep up with what’s going on. Of course, when it comes to crypto trading, every latest piece of news of your favorite crypto is important. This is true for the traditional stock market, but even more so for the crypto market, which is affected by the smallest events.

One of the best places to keep on top of things is Telegram. The Durov brothers’ end-to-end encrypted platform has 400 million+ active monthly users and has become a crypto community favorite, with discussions on any and everything, from trading and investment tips to market behavior, to industry news, to memes and everything in between.

It would be ideal if all Telegram crypto channels were worth their salt. Unfortunately, you’re more bound to come across a Telegram channel full of inane content and even spam. That doesn’t mean all Telegram channels are like that.

We combed the internet to bring you the top telegram channels that are worth your time and attention.

Though it currently only has 1632 members, UK crypto focuses on quality over quantity, with a regular mix of educational content, trading insights, and the latest trends.

If you would like to learn how to expertly employ technical and fundamental analysis in your crypto trading, then UK crypto is your go-to telegram channel.

If swing trading is more your jam, then you’ll be at home with Cointrendz. In the channel, you will receive a regular stream of updates on which cryptos are going bullish. If you are one for monitoring volume trends and taking what’s on the top, then Cointrendz has you covered.

Cointrendz currently has 5,951 members.

A trading signal is an indicator to buy or sell. A signal could indicate that a resistance or support level has been broken, that the volume for a cryptocurrency is on an uptrend, a new pattern is emerging, and so on.

With 578 members, Trading Signals for Free is a Telegram channel that provides reliable crypto trading signals, unlike other channels that claim to do so but, in actuality, are pump-and-dump schemes.

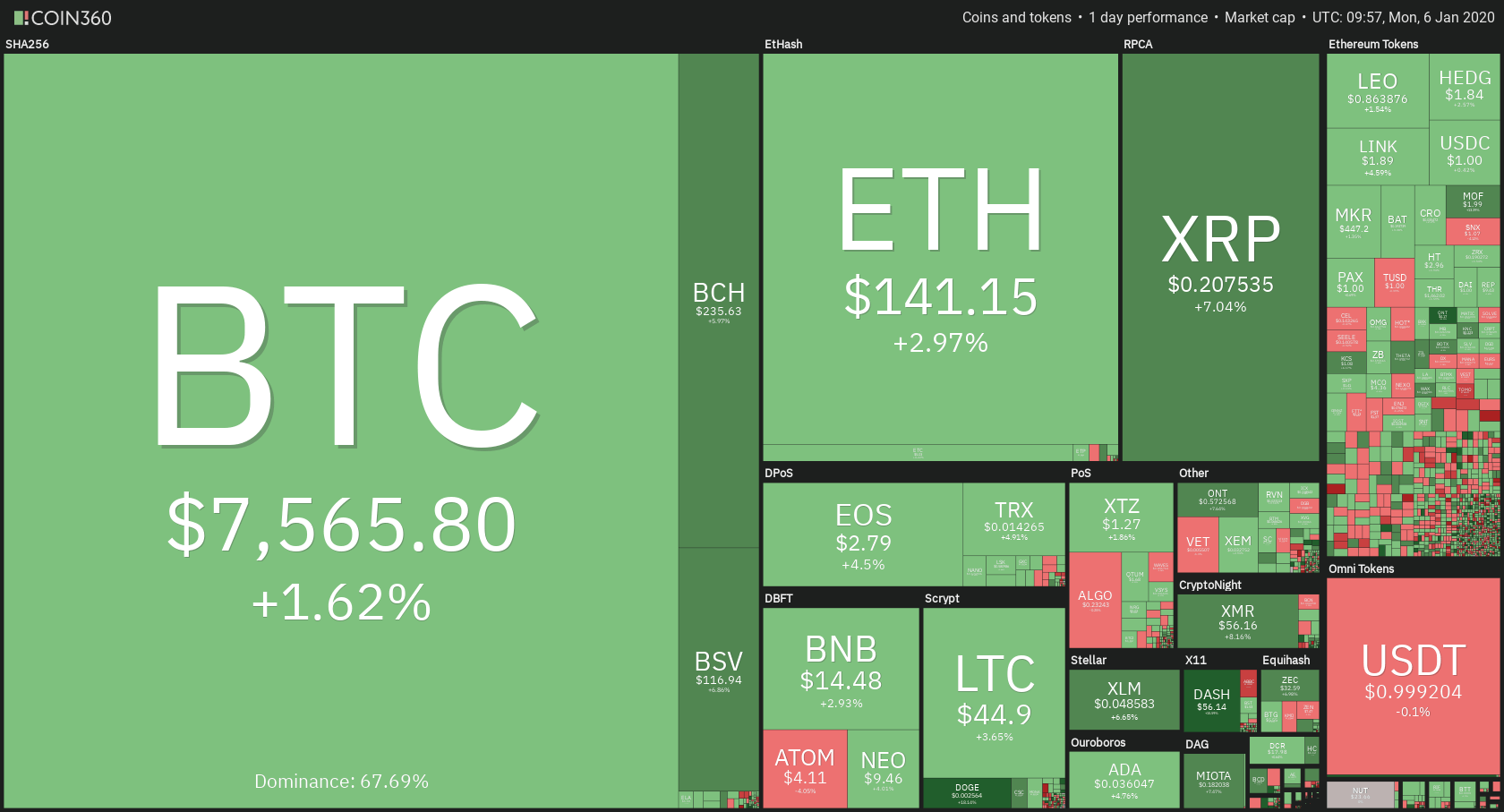

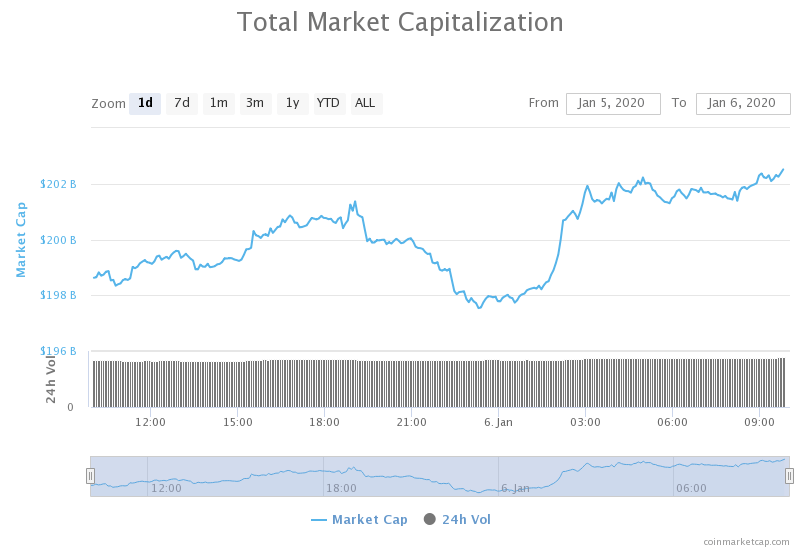

CoinMarketCap has established itself as one of the best platforms for checking crypto prices, circulating volume, market position, chart history, and so on.

And Telegram users can find the website’s channel, providing them with a supply of the current statistics of the top 10 cryptocurrencies, including price changes, market cap, 24-hour volume, price history of the last seven days and so on.

Wait, a group for whales?! Not so fast. If that were the case, everybody would troop there to get the insider whale strategy. Whale Club Bitcoin Traders is a regular crypto channel with occasional tips on trading and analysis of what’s going to happen in the crypto market. 1, 714 people have subscribed to the channel currently.

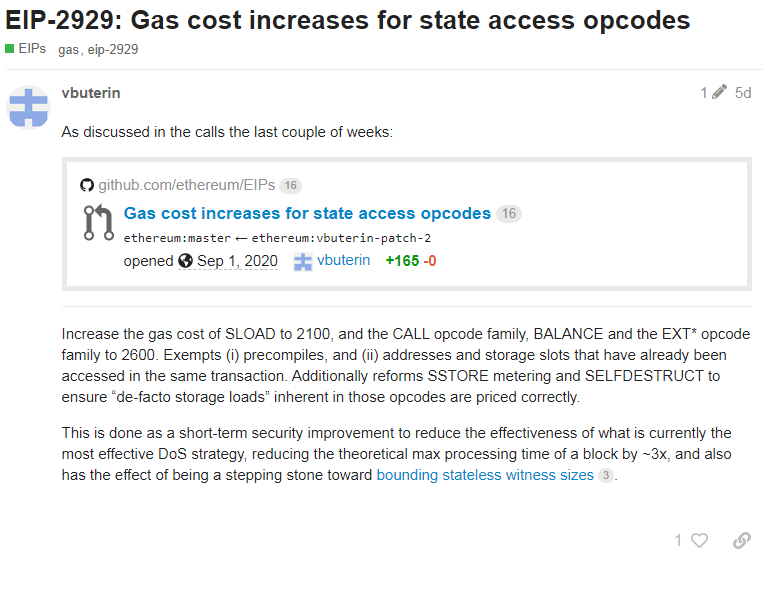

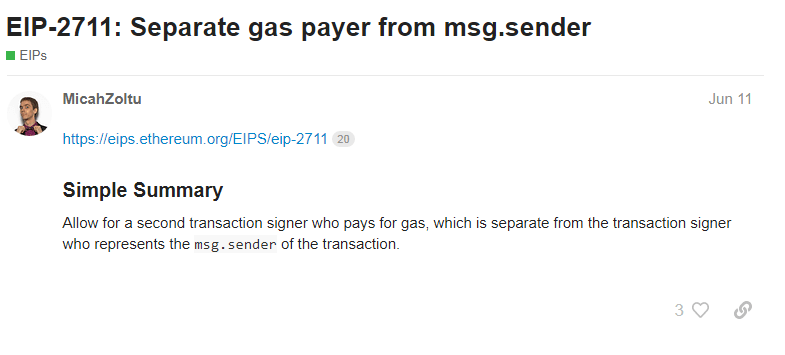

Unlike other crypto telegram channel groups, ETH Trader is a channel where Ethereum traders can receive regular updates on what’s happening with their fave crypto. Both novice and experienced traders can learn something every day from this channel. The channel has 4, 765 subscribers.

A cryptocurrency airdrop is an event where developers of a new currency distribute free coins to existing wallet addresses to promote its awareness and inspire/reward loyalty.

As people receive the tokens, they talk about it on social media and other forums, helping it gain traction. You can find info on upcoming airdrops in many places, including websites, Twitter, Facebook, and crypto forums.

However, if you like to stay updated on upcoming airdrops (who doesn’t?) and prefer Telegram, you need to join the AirDropAlert channel. Presently, the channel has 4, 560 members.

Crypto News may have only 335 members, but that small number has no bearing on the quality of the content that you will find on the channel. In fact, fewer members on a Telegram channel makes the platform more organized and manageable, improving the overall experience. On the other hand, a massive Telegram channel can feel cluttered and confusing just for the sheer amount of messages.

Crypto News is a telegram channel that provides a steady stream of news on the most relevant happenings in the crypto space. Members can share their insights and perspectives on these events.

Initial coin offerings (ICOs) are the cryptocurrency industry’s equivalent of IPOs. Through ICOs, upcoming crypto projects can raise money in order to fund their vision.

ICOs are another way through which to secure new tokens, and they are massively popular in the community. In the first half of 2019 alone, ICOs had raised a total of $1.97 billion. If you want to be in the know about upcoming ICOs, ICO Countdown is a great platform to join. The group has 5, 628 members.

Venture Coinist is run by crypto Twitter influencer Luke Martin, who is one of the leading voices in crypto trading technical analysis. If you find thrill in technical analysis charts and spotting potential market entry points through them, then Venture Coinist is your go-to channel.

Martin breaks down the most popular altcoins but dedicates much of his time and effort to the top 10 cryptos by market cap. There is also a decent amount of educational content, including old charts. Through this, you can identify price patterns and see what triggered what event.

The channel currently has 3, 366 members.

Cointelegraph is the official Telegram channel by the crypto website Cointelegraph. The channel currently has 66, 127 members.

While the numbers seem daunting to keep up with, there are a few advantages to huge telegram channels. First, you are guaranteed to always find people online to chat with. Second, every single piece of information will always be taken apart and analyzed to the bone. It’s also hard for such an enormous number of people to fall victim to fake news, which is uber-common in crypto.

On the Cointelegraph channel, you will find the latest and most relevant crypto news, research on the newest and hottest trends, and market data and analysis.

The Crypto Room is a Telegram channel where you can interact with other members and interpret the goings-on in the crypto space. What you get is focused on discussions that are backed with evidence and are easy to follow.

The channel currently has 2, 057members.

Previous reports showed that Brazil spends around 90 billion reals or $16 billion annually to ensure a functional supply of cash in circulation. This amount of money represents between 1% and 2% of Brazil’s GDP.

Previous reports showed that Brazil spends around 90 billion reals or $16 billion annually to ensure a functional supply of cash in circulation. This amount of money represents between 1% and 2% of Brazil’s GDP. Information Technology Department of the Brazilian central bank’s official Rafael Sarres de Almeida made a public statement, saying:

Information Technology Department of the Brazilian central bank’s official Rafael Sarres de Almeida made a public statement, saying: