Cryptocurrency provides so many avenues for people to make money. Whether it’s trading, mining, staking, or lending, you can make money from crypto in any of several ways. However, one method that flies under the radar (and hence many people don’t know about!) is arbitrage trading. Arbitrage trading is a way through which you can make extra cash in a (relatively) risk-free manner.

This article explores the world of arbitrage trading. And, in the end, you will know whether it’s for you.

What’s Arbitrage Trading?

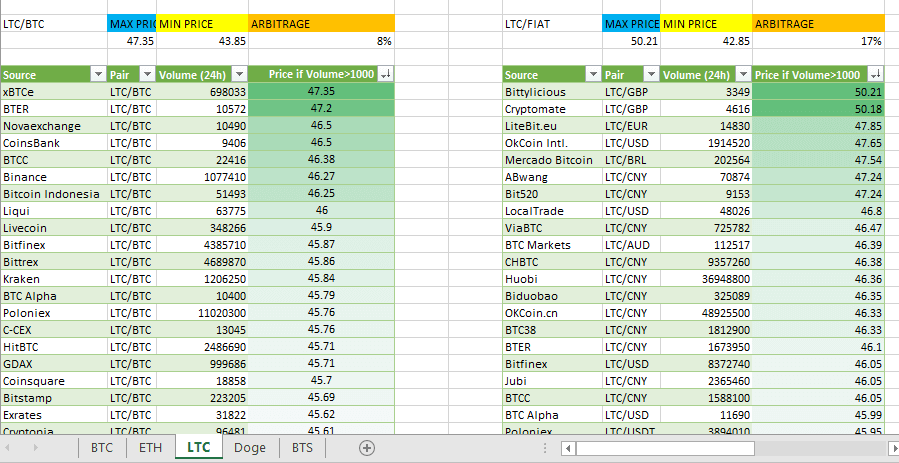

Arbitrage trading is an approach to trading that exploits the differences in the price of a cryptocurrency in various exchanges. For instance, let’s say Bitcoin is trading at $9,000 on Coinbase but at $9,200 on Huobi. A savvy trader might move in to take advantage of this price difference by buying the currency from Coinbase and immediately selling it at the price listed on Huobi.

One may wonder, what causes the difference in pricing of the same asset on different exchanges? This could be due to issues like an exchange having a limited supply of a currency and hence selling it at a higher price than other exchanges that have the currency in a higher volume.

Various crypto arbitrage methods

You can participate in arbitrage trading using either of three ways: spatial, cross-border, and statistical.

#1.Spatial Arbitrage

This method involves exploiting the imbalance in prices of a cryptocurrency on two exchanges. While Exchange A might have set Bitcoin at $8,000, exchange B might be offering it at $8,400. A trader can buy the crypto from Exchange A and sell it on Exchange B. Such discrepancies are likely to occur due to the unregulated nature of the market.

#2. Cross-border arbitrage

This method is not so different from spatial arbitrage – the only difference is that the exchanges involved are in different countries. It can be difficult to pull off cross-border arbitrage because it can be difficult to move the assets between such exchanges.

#3. Statistical Arbitrage

This is the most sophisticated arbitrage of all three. Statistical arbitrage involves mathematical modeling using bots that take advantage of pricing imbalances that can exist in very short amounts of time.

Why is Crypto Arbitrage Trading Worth it?

There are several reasons why you might want to dip your toes in crypto arbitrage trading. Let’s look at these:

#1. Fast and easy profits

If your arbitrage trading goes according to plan, it’s a quick way to earn a profit. Since the process depends on speed, it’s easier to make money than with regular trades.

#2. Lots of opportunities

There are practically hundreds of exchanges where you can trade crypto, meaning you have lots of arbitrage opportunities.

#3. The crypto market is still growing and volatile

The crypto market is still young, and there are no structures in place, meaning most exchanges will not share information and work independently. Most cryptos undergo quick rises and equally quick drops, causing price discrepancies and profitable arbitrage opportunities.

#4. Limited competition

In the crypto space, there’s less competition when you compare with the traditional finance market. Not many traders are looking to explore crypto, much less crypto arbitrage, making the field so much less competitive.

#5. Guaranteed price disparities

It’s almost a given that a given cryptocurrency will have different prices on different exchanges – with the difference between 3% to 5% and sometimes (though rarely) even up to more than 20%.

#6. Choosing an exchange for crypto arbitrage

Fancy giving crypto arbitrage a trial? The first step is to evaluate the desired exchanges and then registering. Some exchanges require customers to have their account verified, which may take days or weeks, depending on the exchange. Others will require you to deposit money before you can start trading. Still, other exchanges may be less strict in their onboarding process, but most of them will require you to undergo a Know Your Customer (KYC) process.

What to consider before you sign up on an exchange

- Fees: When it comes to trading, fees matter, period. Always try and go for low fees. However, don’t sacrifice quality for cheap fees. Always find a balance.

- Geography: Check whether an exchange or its features are restricted in your jurisdiction.

- Reputation: Check what people are saying about the exchange before you put in your money. Search on Google, check various crypto platforms, and so on. The goal is to avoid shady and spammy exchanges.

- Withdraw time: An exchange might take hours or days to allow cashouts, so make sure to understand the rules beforehand.

- Account verification: Some exchanges allow you to withdraw money or provide full access to the markets only after verifying your account. Always confirm the procedure for the exchange before you sign on.

- Liquidity: Exchanges do not have liquidity in equal measure. If you’re planning on trading large quantities of funds, make sure the exchange has sufficient liquidity.

The Potential Downsides of Arbitrage Trading

Just like with any worthy endeavor, crypto arbitrage trading has its downsides. Let’s see what you need to look out for:

KYC Restrictions: As we’ve mentioned above, nearly every exchange has KYC regulations in place. You need to observe these regulations, even if they are inconvenient. For instance, you may need to have a bank account in the home jurisdiction of the exchange. Other requirements may include verifying your identity, and so on. Sometimes these procedures can take days before you’re allowed to trade.

Safety of funds: Since you will be moving funds across several exchanges, you will most likely need to have funds across all of them. Most of the time, such funds are stored in online wallets, making them susceptible to theft. Some lesser-known exchanges could also steal from customers. It would be best if you were extra vigilant with where you sign up for trading.

Fees: Exchanges usually charge a definite percentage of your profit as fees. Ensure to calculate this before you start celebrating

The larger the trades, the more the profit: Profits from Bitcoin trading can be very meager when you factor in the processing delays and fees. So to make any substantial profits, you may need to trade more or increase the volume.

Withdrawal limits: Some exchanges impose withdrawal limits once trade volumes cross a certain threshold. This means you will not withdraw all your money within the same day.

Timing: Transactions can take minutes to be completed, depending on the blockchain. This is a very long time in the world of crypto. By the time they are over, you may have lost your potential profit. Indeed, many are times when you may not receive profits as the markets correct themselves, and the profits turn into a loss. You may have bought crypto in one exchange in some cases, but by the time you transfer them to the other, the markets have moved in the opposite direction.

Slow transactions: As crypto increases in popularity, so does trading volumes on crypto exchanges increase. This may make for slower transactions, which is the last thing you want in arbitrage trading.

Competition: As more people move into crypto trading, the more the competition, and the fewer arbitrage opportunities for everyone

Final Words

Arbitrage trading is a worthwhile way to make extra money with crypto. As long as you play your cards smart – and quickly – you can make good bucks. But like anything, there are a few downsides. However, you win some and lose some. That’s just life.

One primary application of smart contracts lies in the healthcare industry. Transferring and sharing patients’ electronic medical records (EMR) should be done in the most secure way. We are not saying that the current technology is not secure at all. We are just saying that using this technology will enhance the existing security.

One primary application of smart contracts lies in the healthcare industry. Transferring and sharing patients’ electronic medical records (EMR) should be done in the most secure way. We are not saying that the current technology is not secure at all. We are just saying that using this technology will enhance the existing security. Banking systems have undergone a lot of changes proportional to technology adoption by the people. Smart contracts can play a crucial role in the mortgages provided by banks or any non-banking financial institutions. Banks spend a lot of money to check if the property that is being mortgaged currently is already mortgaged or not. To check if the property does indeed belong to the person applying for the mortgage or not. If the documents of the property are placed in blockchain with the help of smart contracts, this can be verified in a click. This saves a lot of money to both consumers and banking, reportedly in billions.

Banking systems have undergone a lot of changes proportional to technology adoption by the people. Smart contracts can play a crucial role in the mortgages provided by banks or any non-banking financial institutions. Banks spend a lot of money to check if the property that is being mortgaged currently is already mortgaged or not. To check if the property does indeed belong to the person applying for the mortgage or not. If the documents of the property are placed in blockchain with the help of smart contracts, this can be verified in a click. This saves a lot of money to both consumers and banking, reportedly in billions. These days we have to provide our KYC documents at various places like to open a bank account, to take a sim card, driving license, registering property to name some. If the KYC documents are stored in a blockchain, with the help of smart contracts, the right people can be given proper authority to access them. Also, if any changes required from our side, we need to make a change at one single repository instead of making changes at every entity where we have given the documents.

These days we have to provide our KYC documents at various places like to open a bank account, to take a sim card, driving license, registering property to name some. If the KYC documents are stored in a blockchain, with the help of smart contracts, the right people can be given proper authority to access them. Also, if any changes required from our side, we need to make a change at one single repository instead of making changes at every entity where we have given the documents. Supply Chain is one major area that can benefit hugely using blockchain adaptability and thereby using smart contracts. There are various documents throughout the supply chain cycle which can be misplaced and tough to authenticate at and every area required. If smart contracts are used to share and verify these documents, a lot of time and money can be saved to clear the goods at national highways, significant seaports, etc. Provenance tracking can also be done, thus increasing the bar of trust among consumers.

Supply Chain is one major area that can benefit hugely using blockchain adaptability and thereby using smart contracts. There are various documents throughout the supply chain cycle which can be misplaced and tough to authenticate at and every area required. If smart contracts are used to share and verify these documents, a lot of time and money can be saved to clear the goods at national highways, significant seaports, etc. Provenance tracking can also be done, thus increasing the bar of trust among consumers. Voting can be achieved relatively and transparently using blockchain and smart contracts. With blockchain involved, no one can tamper with the election process, and with the smart contracts, it is possible to ensure the correct person is voting instead of the duplicity of votes.

Voting can be achieved relatively and transparently using blockchain and smart contracts. With blockchain involved, no one can tamper with the election process, and with the smart contracts, it is possible to ensure the correct person is voting instead of the duplicity of votes. We all know it takes time for the insurance industries to clear the claims as it takes time to check the claims for its authenticity. With the adoption of smart contracts, the respective authorities can easily fact check the claims. For example, for travel insurance, we can easily verify whether the flight is a delay or canceled, thus passing the request.

We all know it takes time for the insurance industries to clear the claims as it takes time to check the claims for its authenticity. With the adoption of smart contracts, the respective authorities can easily fact check the claims. For example, for travel insurance, we can easily verify whether the flight is a delay or canceled, thus passing the request.