What is Money Laundering?

Money Laundering is the legitimization of money earned through illegal means. Generally, it is the separation of money obtained through illegal activities and mixed with the money made from legal sources like small businesses that accepts cash as the primary mode of payment. The legitimized money is again funneled to the criminal enterprises to fund illegal activities.

Different Ways of Money laundering

Money laundering is prevailing for many decades in our financial history. Governments have been continuously upgrading the technology to avoid the money laundering cases, especially to reduce the funding of illegal activities. Cash still occupies the first place when it comes to laundering the money. Because it is difficult to trace the money that is transacted in cash. Hence selling/buying drugs, trafficking, and theft are mostly dealt with cash.

Gold is another popular form of laundering money. Other than these, we have large banks that don’t question with the source of the wealth when the cash is deposited in their vaults, casinos, tax havens, etc. But ever since the revolution of Cryptocurrency has begun, this asset is paving new ways for money laundering. Let’s discuss more about this below.

Is Money Laundering Using Cryptos A Real Problem?

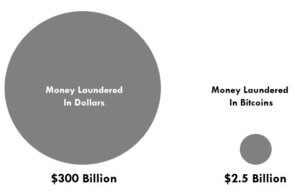

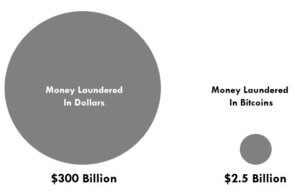

There are significant concerns across most of the governments with regard to money laundering using cryptocurrencies. But most of them are not true when it comes to reality. It is estimated that since 2009 approximately $2.5 billion worth of Bitcoins are laundered, whereas ~ $100-$300 billion dollars are being laundered every year in different ways.

Hence, if we compare the stats, the amount of money laundered using Cryptocurrency is very sparse. Moreover, it is not advisable to launder money using Cryptocurrency as all the crypto networks are permissionless and transparent for literally anyone to check. It is easy to put together the Bitcoin transactions as the transactions are only pseudo-anonymous.

How are cryptocurrencies used to launder money?

These are some of the ways how Cryptocurrency is used for money laundering:

₿ While most of the cryptocurrencies are regulated there are some exchanges that aren’t. This means they don’t perform KYC procedures and none of the details of their customers is collected while they perform crypto transactions. This makes it challenging to match the transactions made by their customers to their id’s. When several such transactions are made using unregulated crypto exchanges, a degree of privacy is added which may eventually result in using that money for illegal activities.

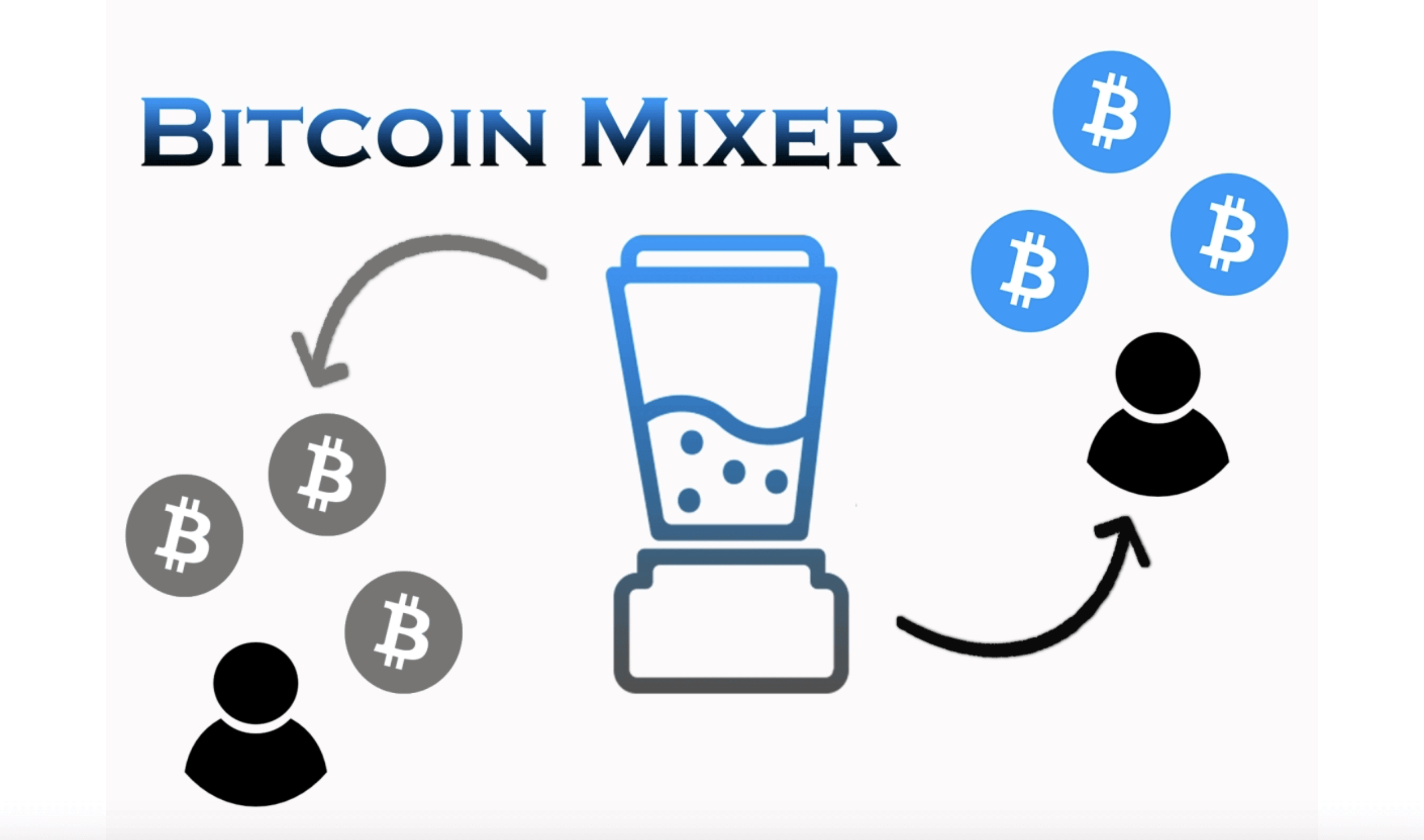

₿ Exchanging the Cryptocurrency with different altcoins, thus making it difficult to know the origins of the actual cryptos. This can also quickly be done by participating in an ICO.

₿ Using Bitcoin ATM’s, we can deposit fiat cash and take Cryptocurrency at any place where a crypto ATM is available.

₿ As the cryptocurrency market is too volatile, it is easy to show that the illicit income is a result of some profitable venture or some other currency appreciation.

₿ With ever-increasing online payments using Cryptocurrency, we can easily create an online company which accepts Bitcoin and convert black money into clean Bitcoin.

How are the governments controlling the crypto money laundering?

Governments are taking various measures by developing multiple tools to link the transactions to the ids of the users using KYC details. Anti-laundering laws are amended to include cryptocurrencies. The US, Canadian, and European governments have made changes to the rules already. Some governments are, in turn, taking measures by legalizing cryptos so that the transactions would be made through regulated exchanges instead of fraudulent ones.

Finally, it can be said that, since the usage of digital cash is going to be inevitable, all measures are being taken to curb the negativities that we see in today’s world with fiat cash. If you have any questions, shoot them in the comments below. Cheers!