Over $1.4 Billion of Laundered Money Came to Crypto Exchanges

The latest report by Peckshield, a company specializing in blockchain security, shows that over $1.4 billion of laundered money found its path to crypto exchanges in 2020.

Peckshield has been collecting data from both online and offline sources for more than one year, and then, verified and analyzed it. In this process, they were able to identify more than 100 million transaction addresses.

The company found that around 147,000 Bitcoin, currently worth more than $1.4 billion, has moved onto top exchanges this year.

These assets were associated with hacks, the dark web economy, illegal gambling, etc.

“We ranked the exchanges by the amount of stolen money on them, and found that the top ten exchanges for illegal funds were: Huobi, Binance, Okex, then ZB Gate.io, Bitmex, Luno, HaoBTC, Bithum, and lastly Coinbase.” – Peckshield stated in its report.

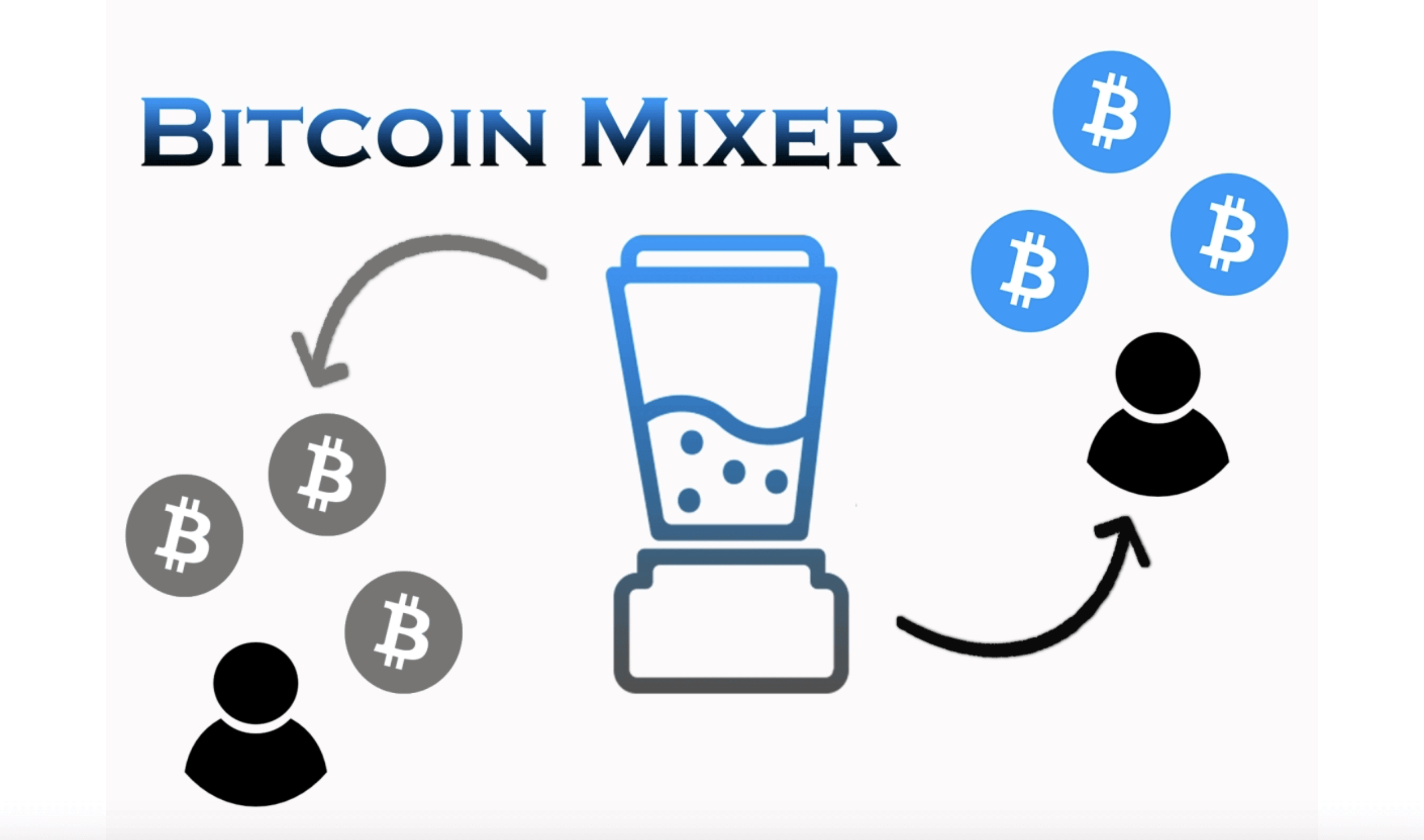

The company also said that some of the monitored addresses moved their funds to crypto mixers, which made it difficult to continue tracing them.

“As of June 30, we have monitored the high-risk address, out of which $1.62 billion flowed into the blacklisted address, while $15.9 billion went into the mixed currency service provider. It should be emphasized that the majority of the funds that went through the mixed currency service have been successfully laundered, and were untraceable after that.”

Wallets associated with the PlusToken scam have been followed by suspected massive open-market sales on crypto exchanges. In turn, this created fake spikes in Bitcoin, Ethereum, and altcoin prices.