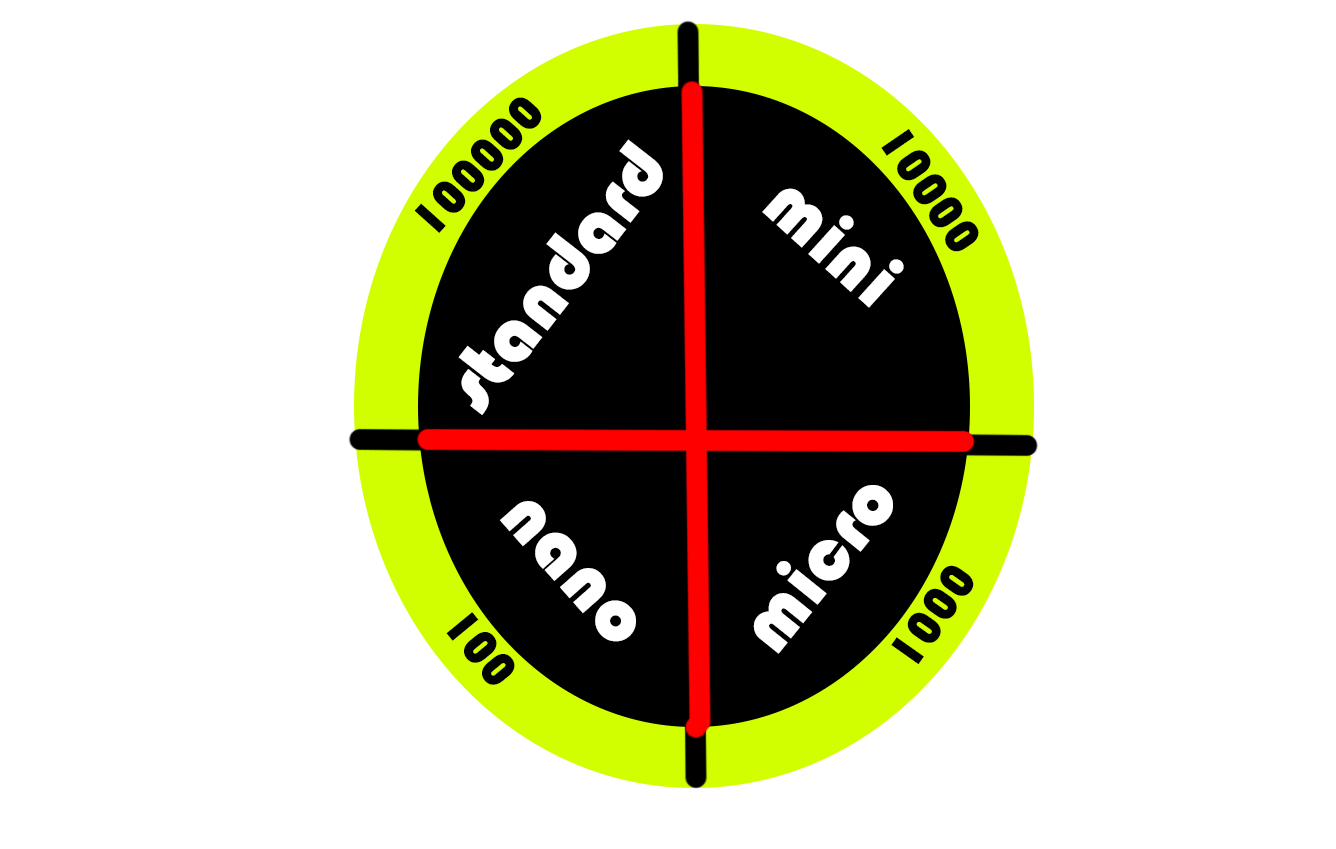

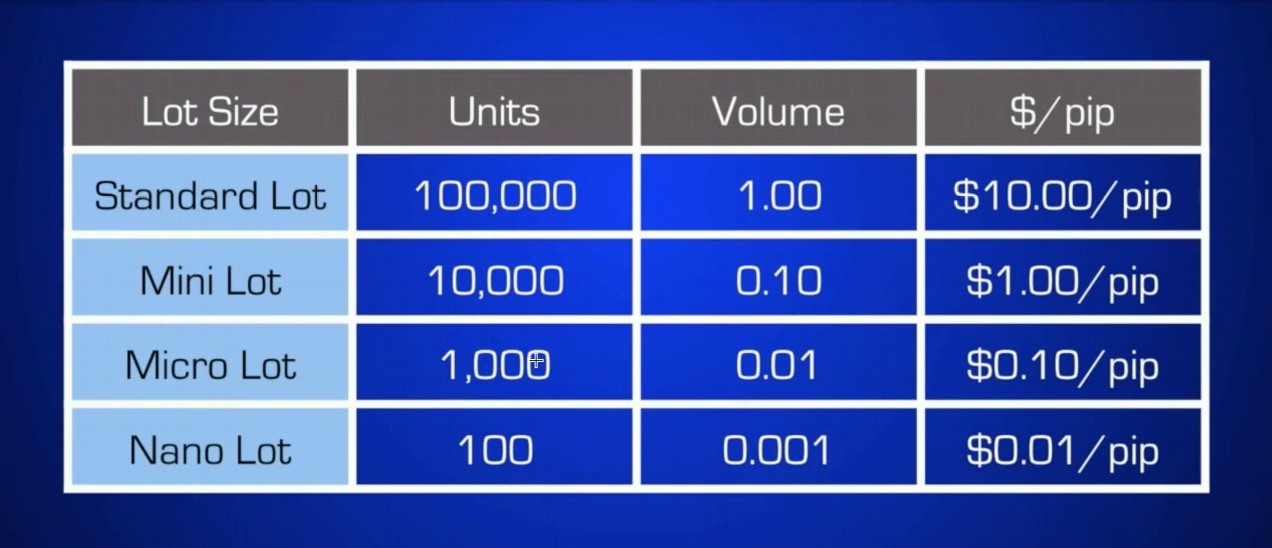

Position size is usually the easiest way to keep maximum transaction loss under control, and sometimes it is the only way. The size of the forex position is how many forex batches (micro, mini or standard) you order per transaction. Your risk is broken down into 2 parts-transaction risks and account risk.

What is a lot in forex, how much is a lot and why does it matter? An obsessive approach to risk and money management, which means keeping transaction risk as low as possible or avoiding relatively large losses, whatever you call it, it separates the long-term elite survivors from the majority who eventually retire. The size of your positions is a fundamental part of risk management because the smaller the lots you handle, everything else being the same (leverage, number of lots, and more), the lower the value of a pip.

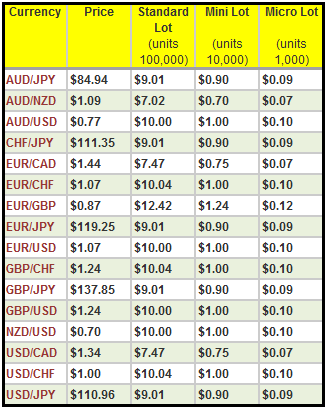

So, smaller batches of forex mean less profit in each percentage of movement in price, but also more important, less loss. It’s the losses that could end up with your capital, your trust, and your trading career. For a large number of reasons based on the history of fórex trading, currency pairs are traded in standard batches of 100,000 units of base currency (1 forex lot). To make trading more profitable for the average individual, online fórex brokers invented mini accounts with lots of 10,000 (1 mini lot) and micro-accounts with lots of the size of 1,000 units (1 micro lot). We don’t just like these innovations. We love them. Because a small lot reduces the risk for each lot traded, they give you a large number of advantages over standard lots.

They provide better flexibility to adjust the size of your positions to the circumstances:

When you’re winning, you can increase the size of the position by adding foxes.

While you’re learning, making the transition from a demo to a live account or a losing streak, small batches help you keep losses in check until your situation improves and is successful for weeks or months.

When you want to enter or exit from a staged position with only part of your planned position (another risk management technique), small lots make this technique easier to do while keeping total venture capital within 1-3 percent.

Here is how these elements link to give you the ideal forex position size, no matter what the market conditions, the mode of the transaction, or what forex strategy you are using.

Continue reading for more information on what is a lot in forex, how much is a lot, or begin to trade and see for yourself in real-time as the size of the lot in the forex influences your gains and losses.

01 – Determine the limit risk per transaction in your account.

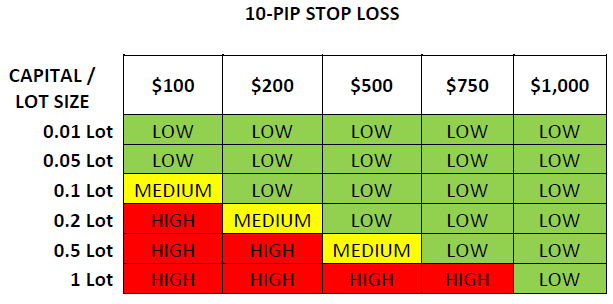

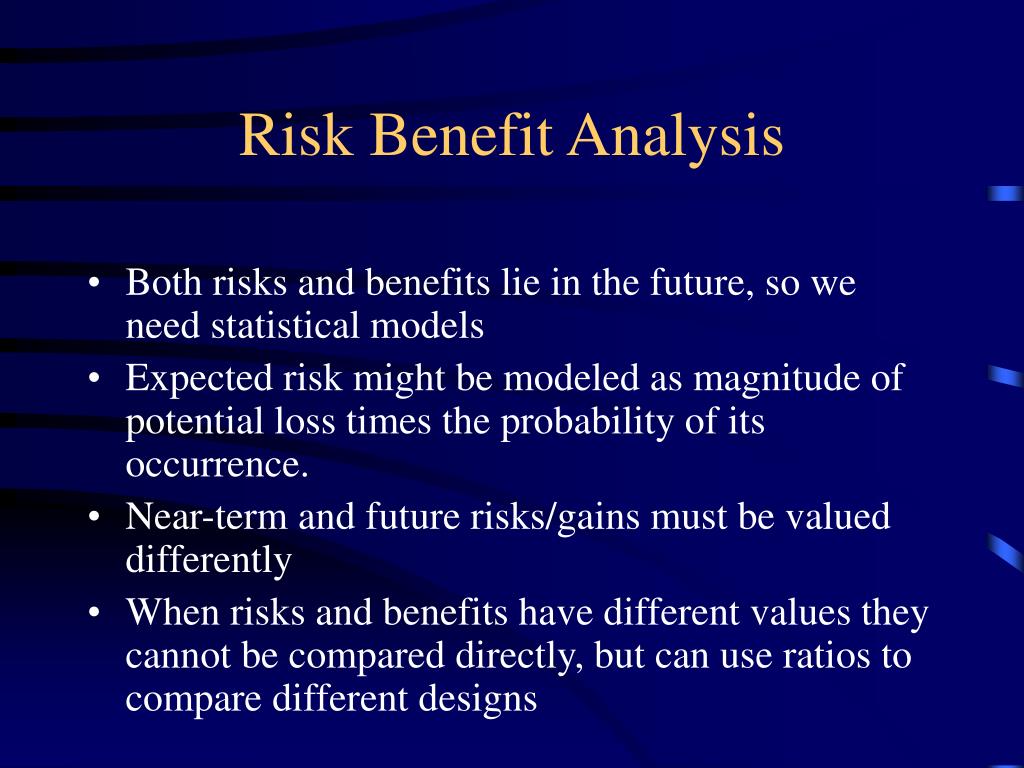

This is the most important step in determining the size of the forex batch. Determine a percentage or a limit amount that you will risk for each transaction. The vast majority of professional traders dispose of their risk in a ratio of 1 to 3 percent of their account. Let’s take an example, if you have a $10,000 trading account, you could risk $100 per transaction if your risk is 1 percent of your account. If you risk 2%, then you can risk $200. You can also use a fixed amount, but ideally, this should be less than 2% of the value of your account. For example, you risk $150 per transaction. As long as your account balance is at $7,500, then you’re risking 2% or less. While other transaction variables may change, account risk remains constant. Choose how much you’re willing to risk in each transaction, and stick to that. Don’t risk 5% on one transaction, 1% on the next, and then 3% on another. If you choose 2% as the risk limit per transaction, then each transaction should risk 2%.

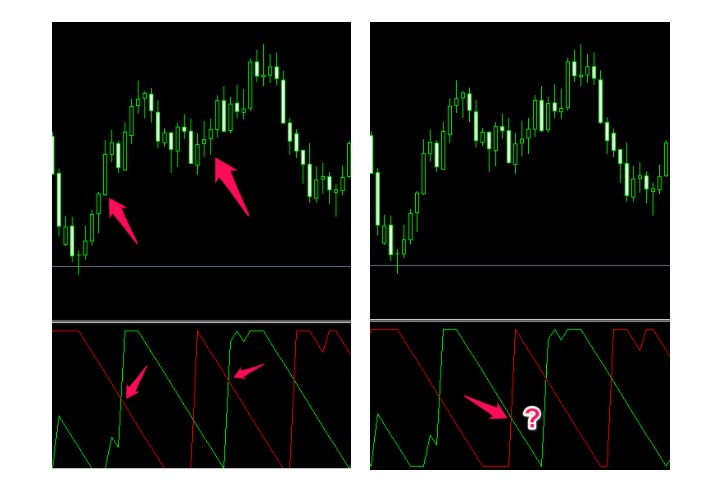

02 – Determine pip risk in a transaction.

You know the maximum risk you will take per transaction, now pay attention to the transaction in front of you. The Pip risk of each transaction is determined by the difference between the entry point where you place your stop-loss command. The stop-loss closes the transaction if the losses reach a certain amount. This is how we control the risk in each transaction to keep it within the limits set for the account, as discussed above.

Each transaction varies, based on volatility or strategy. Sometimes a transaction can have 5 pips of risk, and in another, there can be 15 pips of risk. When making a transaction, consider both your point of entry and the stop loss point. You want the stop loss point to be as close as possible to your entry point, but not so close that the transaction is settled before the expected movement occurs. Once you know how far the stop-loss entry point is, in pips, you can calculate the size of the ideal lot for the transaction.

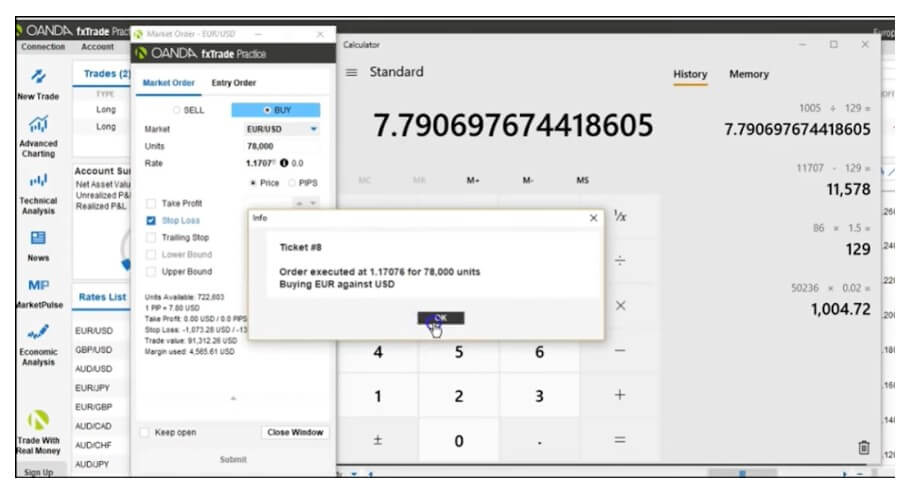

03 – Determine the size of the forex position.

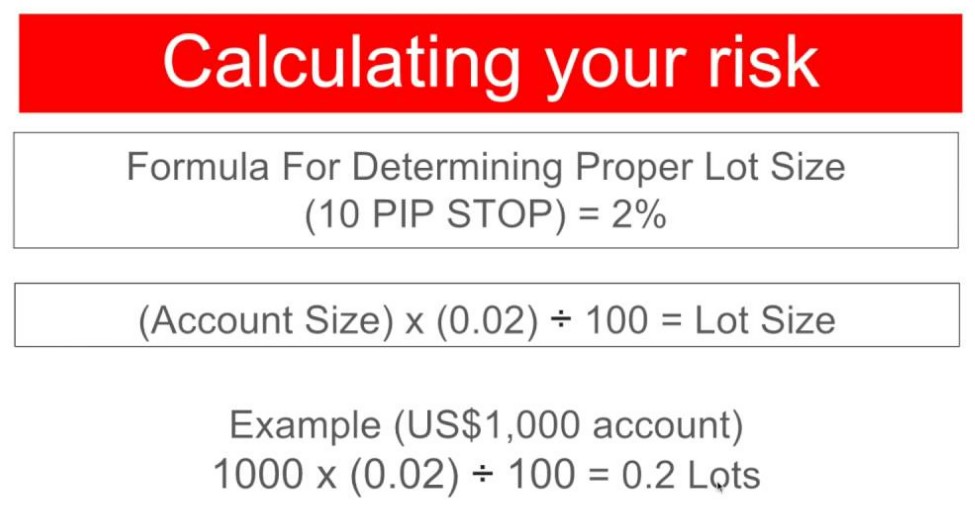

The ideal size of the fórex position is simply a mathematical formula equal to:

Pips at risk * value of the pip * negotiated lots = money at risk

We already know the figure of money at risk, because this is the maximum we can risk in any transaction (step 1). We know the Pips put at risk (step 2). We also know the value of the Pip for each currency pair (or you can search for it).

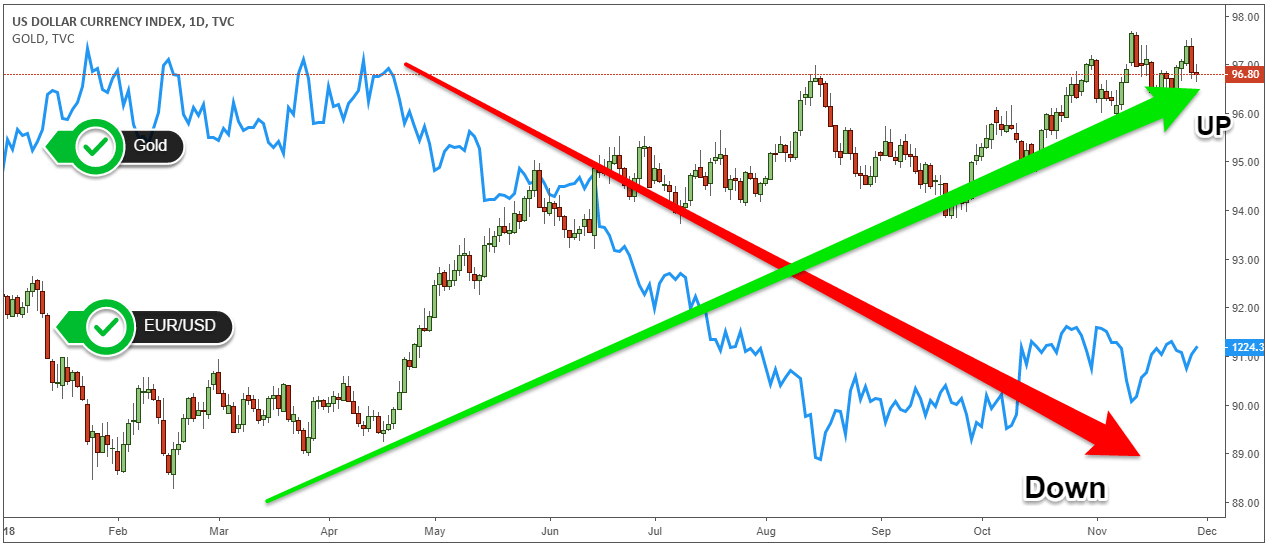

Now what needs to be done is discover the lots negotiated, what is the size of our position. Let’s assume you have a $5,000 account and risk 2% of your account on each transaction. You have the possibility to risk up to $100, and contemplate a transaction in EUR/USD where you want to buy at 1.3030 and set a stop loss at 1.2980. This situation results in 50 risk pips.

If you are trading mini lots, this way every pip move is worth $1. Therefore, taking the position of 1 mini lot will result in a risk of $ 50. But you are in the possibility to risk $ 100, therefore, you can acquire a position of 2 mini-batches. If you lose 50 pips in 2 mini fórex positions, you will have lost $100. This is the exact amount of risk you tolerate in your account; then the position size is accurately measured with respect to the size of your trading account and transaction specifications. You can enter any number in the formula to get the ideal size of your positions (in batches). The number of batches produced by the formula is linked to the value of the pip entered in the formula.

A proper selection of the size of forex positions is essential. Set the percentage you will risk per transaction; 1 to 3 percent is recommended. Note the risk per pip in each transaction. In relation to the risk taken on your account and pip, you can already calculate the batch size for your forex positions.

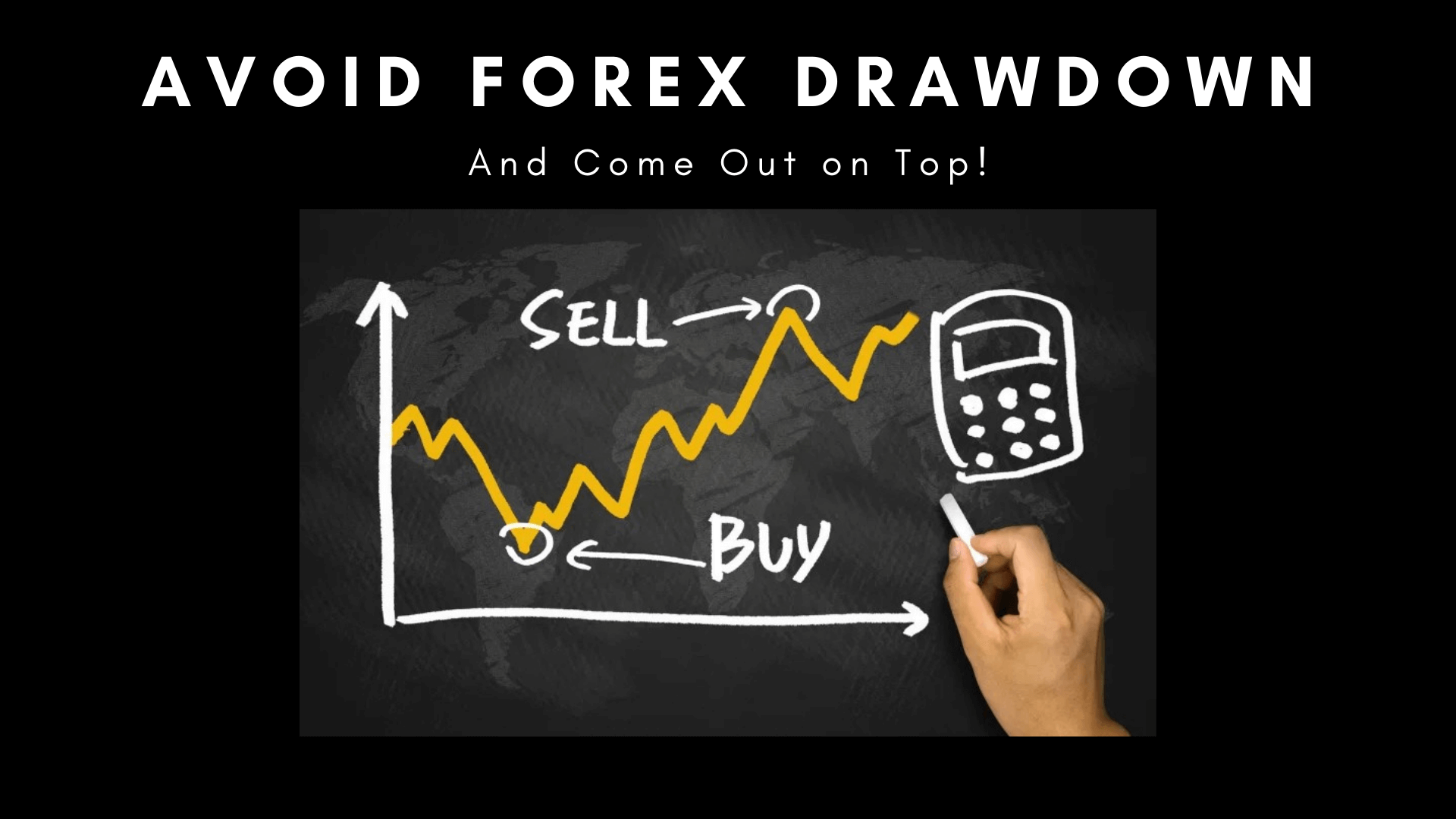

The smaller the size of the forex lot, the lower the risk because it reduces the following:

- The value of each forex pip.

- The cost of every 1 percent that moves against you.

Potential loss if your stop-loss order is reached. We measure the risk not by the total size of your position but by the potential loss if your stop-loss order is reached.

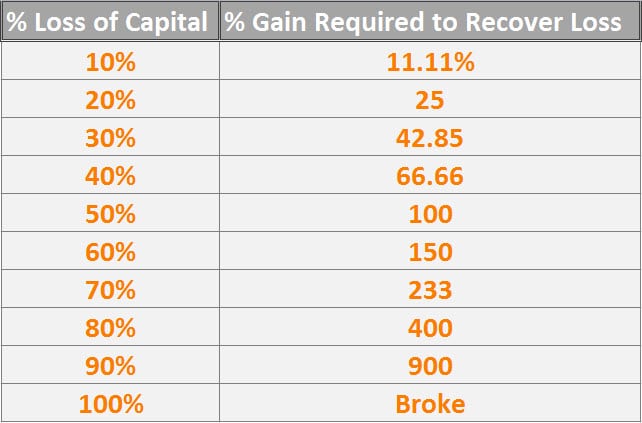

Yes, a smaller position means less profit when prices move in your favor, with less income as a result of trading operations. But the top priority is to have as few losses as possible. Always. A loss percentage requires a higher percentage to recover, as you have less base capital. Once you find the right combination of trading styles, instruments, and analysis that best suits you, you’ll have the time to increase batch size, risk, and profit potential.

Until you are consistently successful for many months (regardless of the percentage of successful transactions), the priority is to maintain risk and loss in any transaction within 1 to 3 percent of your account size. Benefiting only from the minority of successful transactions is fine, because many successful traders achieve it that way, as we will discuss in other articles.

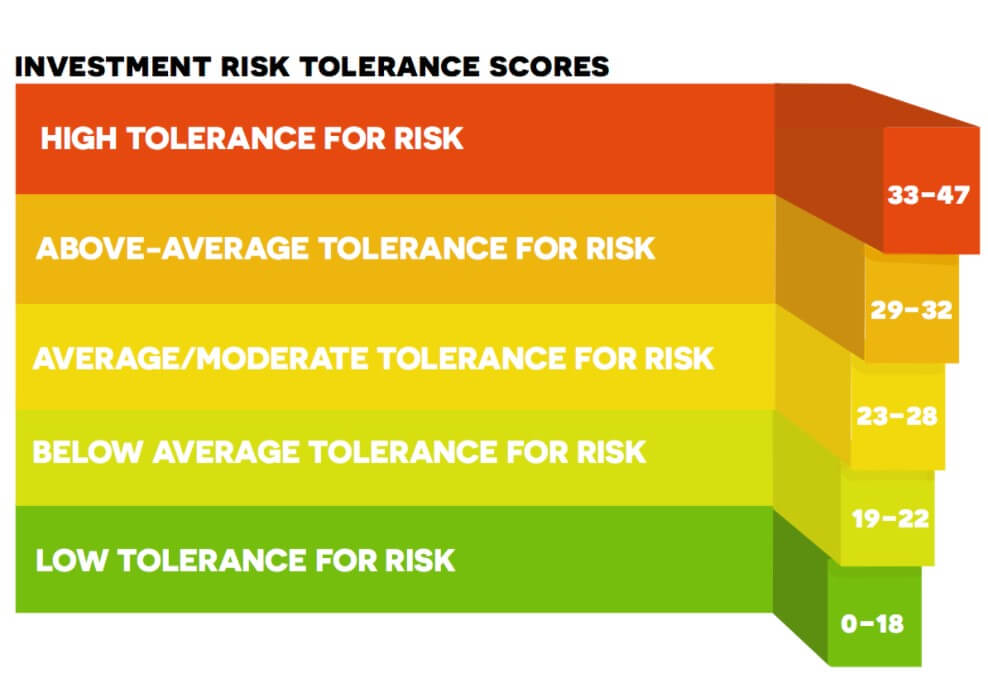

With that being said, how do you know whether your own appetite for risk is appropriate and reasonable? Firstly, if you are getting severe anxiety or stress from trading, you don’t really want to press that trade button due to worry that you may lose something then your risk tolerance and appetite is on the low side, if it is really bad, then this can be a sign that trading is simply not for you, there will be risks and to trade is to accept those risks. For some it is possible to work through it and to develop a better tolerance to the trades, for others it is simply not possible and so trading will simply be a stressful situation for you.

With that being said, how do you know whether your own appetite for risk is appropriate and reasonable? Firstly, if you are getting severe anxiety or stress from trading, you don’t really want to press that trade button due to worry that you may lose something then your risk tolerance and appetite is on the low side, if it is really bad, then this can be a sign that trading is simply not for you, there will be risks and to trade is to accept those risks. For some it is possible to work through it and to develop a better tolerance to the trades, for others it is simply not possible and so trading will simply be a stressful situation for you. So let’s assume that you are either high or low on the appetite level, what can we do to help? The first thing is to create a trading plan, within this plan you will have set out some rules, these rules are there for one important thing. They are there to ensure that you are in line with your plan and that your risks are limited. These rules will help someone with a low appetite for risk to understand that they are still in charge and that trading along these rules gives them the essence of safety, a way of controlling the risks that they are being put under.

So let’s assume that you are either high or low on the appetite level, what can we do to help? The first thing is to create a trading plan, within this plan you will have set out some rules, these rules are there for one important thing. They are there to ensure that you are in line with your plan and that your risks are limited. These rules will help someone with a low appetite for risk to understand that they are still in charge and that trading along these rules gives them the essence of safety, a way of controlling the risks that they are being put under.

Don’t try to force rigid money management goals in a fluctuating environment. Pretend you are in the last week of the month; What are you going to do if you are not even close to completing your “monthly fee”? In what way you will give an answer to the pressure you put on yourself to achieve your monetary goal?

Don’t try to force rigid money management goals in a fluctuating environment. Pretend you are in the last week of the month; What are you going to do if you are not even close to completing your “monthly fee”? In what way you will give an answer to the pressure you put on yourself to achieve your monetary goal? The value of each pip is defined by the following factors:

The value of each pip is defined by the following factors: The ironic thing about forex is that you can start and operate with small amounts of money. Technically you can operate with initial investments as small as $100! That being said, if you want forex to generate $500 a week with a $100 investment, then you’re very undercapitalized!

The ironic thing about forex is that you can start and operate with small amounts of money. Technically you can operate with initial investments as small as $100! That being said, if you want forex to generate $500 a week with a $100 investment, then you’re very undercapitalized!

In case you are facing a similar problem, the best step you can take is to withdraw from trading, start all over again, and learn more about this market. This is such a specific situation and such an important signal that some traders should consider moving on to some other markets or businesses. Having this outcome directly indicates that a trader has not developed the necessary mindset which this particular market requires. Both reckless trading and the timid one may equally endanger your account because the risk can never be too high or too low in the forex market. Even if you managed to increase your account by 4% in a single year, it would still not be good enough if you had to go at great lengths to achieve this. Traders need to find that right balance and also think of some other factors, such as time, effort, and profitability, because there may be a safe but much easier, faster, and more lucrative way to seeing your finances grow.

In case you are facing a similar problem, the best step you can take is to withdraw from trading, start all over again, and learn more about this market. This is such a specific situation and such an important signal that some traders should consider moving on to some other markets or businesses. Having this outcome directly indicates that a trader has not developed the necessary mindset which this particular market requires. Both reckless trading and the timid one may equally endanger your account because the risk can never be too high or too low in the forex market. Even if you managed to increase your account by 4% in a single year, it would still not be good enough if you had to go at great lengths to achieve this. Traders need to find that right balance and also think of some other factors, such as time, effort, and profitability, because there may be a safe but much easier, faster, and more lucrative way to seeing your finances grow.

Starting with a balance that is too long can make it hard to implement some proper risk management into your trading plans. It is great that some brokers are now letting you start trading with low amounts, even $10 with some brokers, but what are you going to do with this? Even a currency trade at 0.01 lots can easily decrease to -$10 which would then blow the account. You are not able to apply risk or money management to such small amounts. It knows you want to learn and start earning, but you will need to invest a slightly more amount if you want to be successful at it.

Starting with a balance that is too long can make it hard to implement some proper risk management into your trading plans. It is great that some brokers are now letting you start trading with low amounts, even $10 with some brokers, but what are you going to do with this? Even a currency trade at 0.01 lots can easily decrease to -$10 which would then blow the account. You are not able to apply risk or money management to such small amounts. It knows you want to learn and start earning, but you will need to invest a slightly more amount if you want to be successful at it. Overconfidence

Overconfidence

As you already know the Forex market is really dynamic and things can change each second on a daily basis. In order to succeed and make a profit trading currencies besides some basic, or more advanced knowledge, depending on your level, and experience, you will need to have one more thing, and that is a really good money management skill.

As you already know the Forex market is really dynamic and things can change each second on a daily basis. In order to succeed and make a profit trading currencies besides some basic, or more advanced knowledge, depending on your level, and experience, you will need to have one more thing, and that is a really good money management skill.

The next question you can ask yourself is why should you do something just to minimize your losses? Isn`t Forex all about profit and earning money? That brings us to a big mistake Forex traders make when using 2:1 or 3:1 ratios. They just cap their upside. They miss out on 600, 800, 1000 pip trends that happen more than once a year.

The next question you can ask yourself is why should you do something just to minimize your losses? Isn`t Forex all about profit and earning money? That brings us to a big mistake Forex traders make when using 2:1 or 3:1 ratios. They just cap their upside. They miss out on 600, 800, 1000 pip trends that happen more than once a year.