According to the dictionary, someone or something is volatile when it changes or varies easily and unpredictably. Speaking of a financial asset, its volatility or standard deviation is a statistic that describes simply with a number how much the price moves over time. That is the more volatility an asset exhibits, the faster and more extreme its unpredictable fluctuations are.

“That morning no one could imagine that John Appleseed would decide, instead of going to his office, to go to the mall with his AK-47 and murder for no apparent reason a dozen of his neighbors. Later, a friend of his commented in tears to the news channel: We don’t understand what happened to him, he seemed so normal, so non-volatile…”

The adjective “descriptive” here is key, as volatility only gives us observable information of past price variations. It tells us nothing about the nature and risk of the underlying process that produces it. This distinction is essential and is often ignored, mistakenly identifying risk with volatility. The adjective “descriptive” here is key, as volatility only gives us observable information of past price variations.

Risk is a difficult, complex, and multidimensional concept. Meanwhile, volatility and other descriptive statistics are a comfortable attempt to reduce their many faces to a simple number. As if the speedometer of the car gave us all the necessary information regarding the risk of driving. Even the CNMV uses a risk scale between 1 and 7 depending on volatility to classify IFs. Thus, a “1” fund has virtually no risk, and a “7” fund is very risky.

“Even the CNMV uses a risk scale between 1 and 7 depending on volatility to classify investment funds… This doesn’t make any sense.”

This doesn’t make any sense. If we imagine a fund that loses exactly -2.00% every month, its volatility according to the standard deviation formula would be zero (it has no volatility) and could be considered “risk 1” on the scale. Perhaps avoiding these contradictions, on the CNMV website they heal in health and hide saying that even if a fund is classified as “1”, it does not mean that it does not have risk. But they don’t explain why.

The Volatility of the Crocodile

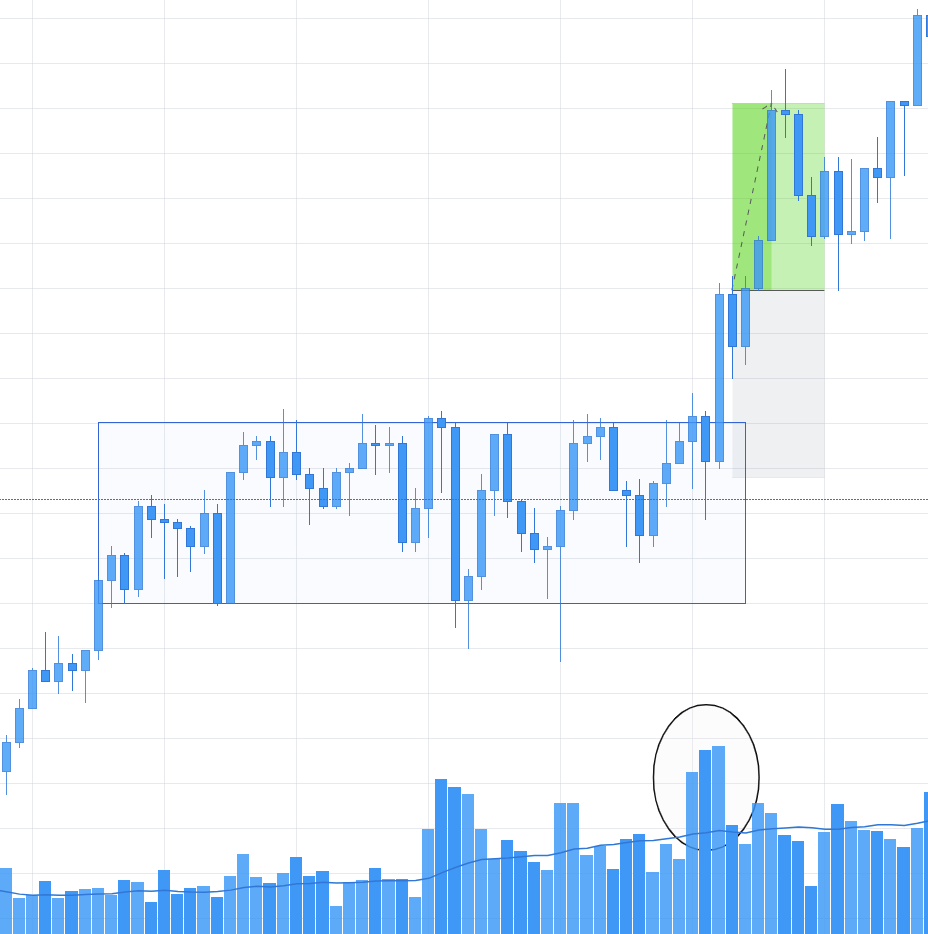

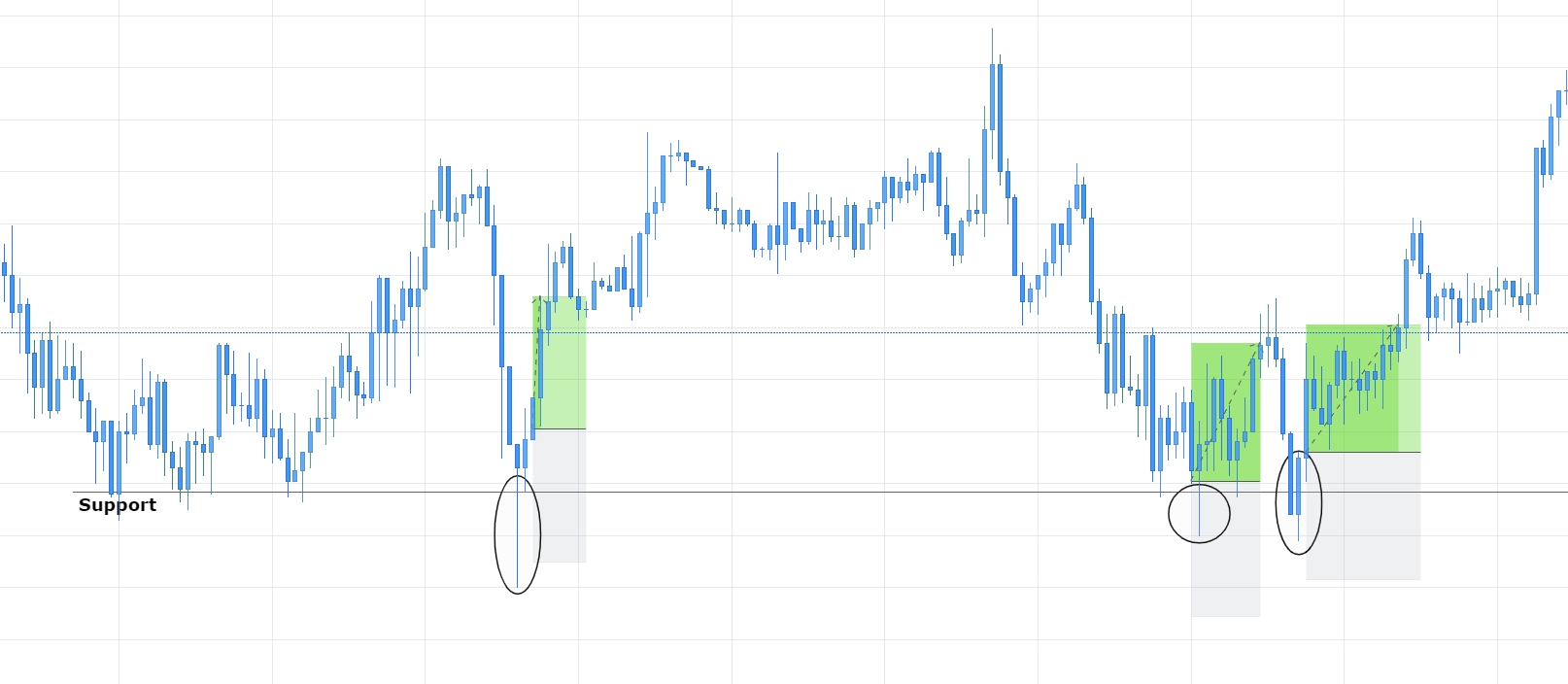

Investors seized on the back of a financial product of low volatility. To better understand why it is a mistake to make equivalent risk and volatility, let’s look at the example of the pelican and crocodile. If we observe for a long time the quiet movement of a crocodile by the river, it transmits to us the information that there is no danger, that its movements are slow (little volatile) and we can predict and adapt to them easily.

So, our sympathetic pelican can ask the crocodile to take him to the other end of the shore and trust that he will continue to behave as he has done so far. In this example, the pelican is equating the very low observable volatility of the crocodile with very low risk.

Why does the pelican think there’s no danger? Because if we do not know its underlying nature and only know its volatility (which is observable), the risk of not getting safely to the other shore should be minimal. But all who know the nature of the crocodile know that there is a great and silent (unobservable) danger.

“Why does the pelican believe there is no danger? Because if we do not know its underlying nature and only know its volatility (which is observable), the risk of not getting safely to the other shore should be minimal.”

Crocodiles move most of the time very slowly (they are very few volatile), but occasionally and unpredictably, their behavior changes radically: they move extraordinarily fast (much faster than its past volatility could even make us imagine) to trap in its jaws its trusting victim. Therefore, the mere empirical observation of the behavior of an asset, product, or strategy (its track record) is not sufficient to know the risks we face when investing.

The volatility of a fund or product is not a good measure of risk because it only tells us how much it moves over time, not about the nature and risks of that movement or where the underlying strategy can take us. Risk is too complex and profound a concept to be reduced to a simple and comfortable (for clients and quantitative analysts) number.

The volatility of a fund or product is not a good measure of risk because it only tells us how much it moves over time. It is in the nature of the underlying strategy that the risk of investment funds and products lies, not in their volatility. There are very risky and non-volatile strategies (investment crocodiles). An extreme example is the sale of options out of money.

This strategy produces positive monthly returns over long periods with hardly any volatility, which makes them very easy to pack and market (its track record of continuous increases without volatility, for example of approximately +1% per month, sells very well). Eventually, a crash happens in the markets, causing the investor to lose, if not all, virtually everything previously invested and earned in the fund.

High volatility stock market investment, but harmless in the long run. On the other hand, there are very volatile strategies with little risk, which we might call the Chihuahua investment in our zoo: They move a lot and make a lot of noise, but they are totally harmless.

The trivial example is the investment in diversified stock exchange globally through ETFs or low-cost fund, considered as very risky because of its high volatility (we can temporarily lose half of the investment), but that in the long run will give us a return around double the world’s GDP growth. Paradoxically, it is the risk-averse investors who give up profitable and low-risk long-term investments, preferring low-volatility products that sometimes hide crocodiles.

The reason is more psychological than rational: they can’t bear to see that they are losing money for a while (a key point I already talked about in Volatility and Emotional Accounting). The industry knows this and gives the customer what he asks for, even if it’s not what’s best for him. That is, mostly crocodiles of low volatility instead of (noisy) chihuahuas of high profitability.