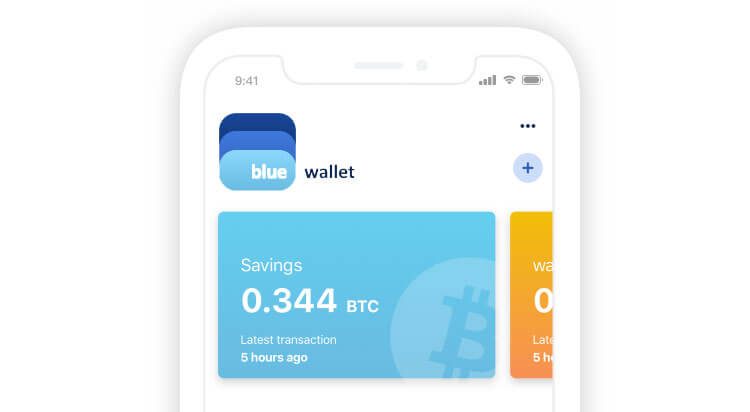

Blue Wallet is one of the best free and open-sourced wallets originally designed as an iOS-specific crypto wallet. It is relatively easy to use and features a wide range of both operational and security features that also make it one of the most versatile crypto wallet apps. For instance, it is extremely light, ensuring that it doesn’t eat up your phone memory, and this also facilitates faster transactions. Its top security features, on the other hand, include QR Code technology and 2-factor authentication.

In this review, we’ll get a deeper insight into its primary operational features, customer support, security features, and pros and cons.

Blue wallet key features

Batch Transactions: One of the most innovative and unique aspects of Blue wallet is its support for batch transactions. This implies that you can bundle up two or more crypto transactions and execute them as a single transaction. This ensures that your interactions with Blue wallet aren’t just less time consuming but that cheaper given that bundling multiple transactions into one makes your transfers out less expensive.

Lightning wallets: They are as its name suggests. Wallets with support for the Lightning Network Protocol are extremely fast and unbelievably cheap. You can send, receive, and top up your wallet at lightning speed.

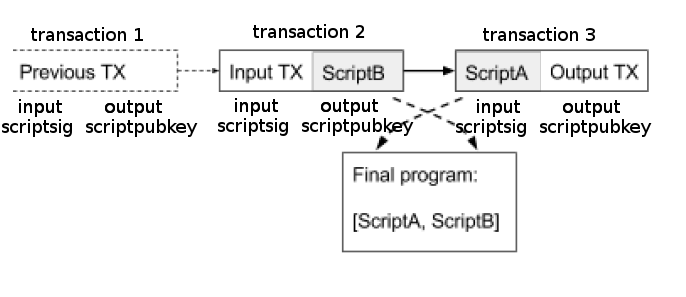

SegWit: If you are a crypto enthusiast, you’ve probably heard of SegWit. It’s a significant upgrade to the Bitcoin blockchain technology executed in 2017. Today, you’ll find the majority of wallets integrating this feature by default. SegWit is supported in both bech32 Native Mode and P2SH-compatibility.

Hardware wallet integration: Blue crypto wallet is considerably safe and supports a wide range of cryptocurrencies and tokens. You can, however, boost this security and make it possible for the app to support an even wider range of digitals assets and tokens. The crypto wallet app will integrate with any PSBT-enabled (Partially Signed Bitcoin Transactions) hardware wallet.

Offline transactions: Unlike most other crypto wallet apps that have to be online to initiate and execute transactions, the PSBT feature on Blue crypto makes it possible for you to send and receive cryptocurrencies while offline.

In-built marketplace: The fact that Blue Wallet operates within the Lightning Network implies it also has access to the network’s browser and associated marketplace.

BTCPay point-of-sale integrated: According to the Blue Wallet roadmap, the crypto app will soon integrate the BTCPay server point-of-sale system. This is an open-sourced and bitcoin-based payment solution that allows you to pay for your in-store purchases using Bitcoins.

Blue wallet security features

Password: Like most other crypto mobile apps, the Blue wallet is secured by a password that you set when installing the app. The highly dynamic wallet has also added several biometric security features. You can now secure the app using the face ID or Fingerprint.

Military-grade encryption: The Blue wallet is also highly encrypted. Any piece of data collected and stored within the wallet app, including your passwords, sensitive personal information, and your private keys, are all encrypted.

Recovery seed: When setting the wallet app, you will also be presented with a set of random phrases referred to as the recovery seed. Write these down and keep them safe. You will need them to either reset your wallet app password or when recovering private keys.

Plausible deniability: It is a customized feature with the user’s personal security in mind. The app allows you to set up and encrypt several other fake wallets. These come in handy in the event you are forced or coerced to give access to your wallet.

Hierarchically deterministic: In addition to the plausible deniability feature, the crypto wallet app also uses its Hierarchical deterministic feature to throw trackers off. The features allow the wallet to auto-generate private wallet addresses for each transaction that mask your primary wallet address, making it impossible to track the activities of crypto activity and transaction history.

Open source: Blue wallet is designed using an open-sourced technology that speaks volumes about its transparency and commitment to security. This implies that the wallet has been probed and vetted by industry experts with possible defects identified and corrected in earnest.

Blue Wallet’s supported currencies

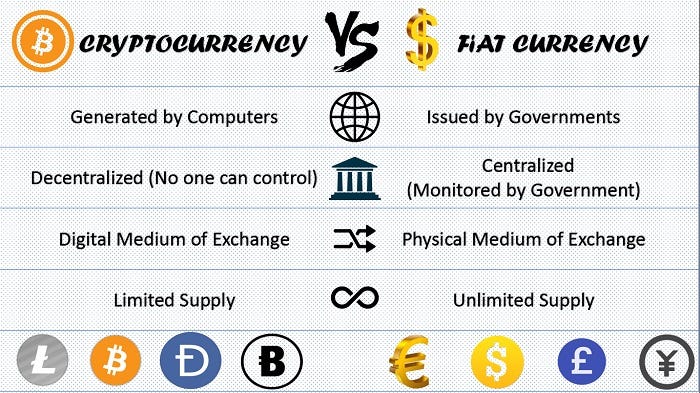

Blue wallet is a multi-currency crypto app that supports both fiat and cryptocurrencies. Currently, the wallet app supports up to 20 fiat currencies, including BRL, CNY, GDP, MXN, USD, CAD, RUB, AUD, CHF, and CZK as well as 100+ cryptocurrencies that include Ethereum, Bitcoin, NEO, Bitcoin Cash, and Dash.

How to set up and activate the Blue Wallet crypto app

Step 1: Download and install the blue wallet app

Start by downloading and installing the Blue wallet app from the Apple app store, Google Play, or the official Blue wallet website. Note that while the wallet was initially designed for the iOS infrastructure, the equally effective Android version has since been introduced to the market.

Step 2: Create a Wallet

Once you have downloaded the app, the next step would be to click on the “Create a wallet” button. It is recommended to start with a BTC on-chain wallet as it might come in handy when funding your lightning wallet.

In the advanced option, you can proceed to set up different wallets PSBT-enabled wallets that include HD SegWit (BIP 49 P2SH) – multiple addresses, SegWit (P3SH) – Single address, and HD SegWit (BIP84 BECH32 Native) – various addresses. The best option for a beginner is HD SegWit (BIP 84 Bech32 Native) – multiple addresses.

Step 3: Create a password for the wallet

After installing the app, you will now be required to create a password for the wallet.

Step 4: Back Up Your Recovery Phrase

The app will then display a set of seemingly random phrases that make up your app’s recovery seed. Write them down and keep the record safe.

Step 5: Complete the Set-Up

The app set-up process is now set, and you will be directed to the wallets dashboard. You can now start adding cryptos and fiat currencies into your app, using the in-built browser to monitor the cryptocurrency prices on the different exchanges and even interact with crypto traders on the LAPP marketplace.

How to add/receive cryptos into your Blue wallet

Step 1: Launch the Blue Wallet crypto app and clicking on the ‘Receive’ icon.

Step 2: Click on the cryptocurrency you wish to add or receive to your wallet to reveal the wallet address and QR code.

Step 3: Copy the wallet address and send it to the party sending you the crypto or have them scan the QR code.

Step 4: Wait for the crypto to reflect on your wallet.

How to send cryptos using your blue wallet

Step 1: Start by launching the app and clicking on the ‘Send’ icon.

Step 2: Click on the cryptocurrency you wish to send

Step 3: Paste or key in the recipient’s wallet address and enter the amount of coins you wish to send. Alternatively, you can also scan their QR code.

Step 4: Confirm that the wallet address and the amount are correct and hit send.

Blues Wallet ease of use

Installing and activating the Blue wallet crypto app is quite easy and straightforward. Blue wallet is also highly customizable, and this makes it easy to use for both beginners and highly experienced crypto traders. Besides, the website supports several languages such as Chinese, French, and Portuguese, which makes it a diverse platform for crypto users across the globe.

Blue wallet cost and fees

Acquiring a Blue Crypto wallet app is free and you also won’t be charged for storing your cryptocurrencies. You, however, will incur varied transaction fees every time you transfer cryptocurrencies out to exchanges or other wallets. How much you pay for each transaction is dependent on such factors as the transaction volumes and the type of cryptocurrency involved.

If you are looking to lower these transaction costs when executing multiple transactions, you may consider taking advantage of Blue Wallet’s unique Batch processing tool. This lets you bundle together all your transfers out and execute them as a single transaction, effectively lowering your transaction costs.

In yet another innovative gesture, the Blue wallet crypto app has introduced the Replace-By-Fee (RBF) feature that lets you take control of the transaction charges and speeds. By implementing RFB in your transactions, this feature lets you increase or decrease the speed by which a transaction is executed whereby low transaction fees equal lower transaction speeds while higher fees translate to faster crypto transaction processing. Note that these fees go to blockchain miners and network administrators – not Blue wallet.

Within the LAPP marketplace, cryptocurrency trades and conversions are subjected to spreads. This implies that the different cryptos and fiat currencies sold on the LAPP marketplace are availed at marked-up prices. These spreads are highly variable and largely depend on the type of crypto involved.

Blue wallet customer support

Apart from the flexible fees and seamless transactions, its customer support is exceptional. Blue wallet is a dedicated community of crypto enthusiasts aiming to educate and improve how we make transactions. As a result, they integrate a couple of customer support features, including a live chat section, 24-hour email support, and an online documentation section for Frequently Asked Questions (FAQs).

Apart from that, there is also a community channel and a telegram group where Blue Wallet sends relevant notifications, changes, or updates. Users can also interact, share ideas, or ask questions, which makes it quite an excellent platform for anyone looking for a reliable website.

What are the pros and cons of Blue wallet

Pros:

- It operates with the Lightning network and thus benefits from speedy transaction processing and reduced transaction fees.

- The app is multi-lingual and very user-friendly.

- The crypto wallet integrates several innovative security protocols like plausible deniability that make it highly secure.

- Blue wallet is non-custodial and therefore gives you near-absolute control over your digital assets.

- The mobile wallet app is highly innovative and features a host of unique features like batch processing and Partially Signed Bitcoin Transactions (PSBT)

- The mobile wallet app is built on an open-sourced technology and is hierarchically deterministic.

Cons:

- The online nature of the wallet app exposes it to virus threats and malicious attacks.

- The wallet doesn’t have the multi-signature function and doesn’t support two-factor authentication.

- One may consider the number of cryptocurrencies supported by the Blue Wallet relatively limited.

Comparing Blue wallet with other crypto wallet apps

The Blue wallet is by far one of the most innovative crypto wallet apps we have come across. It is highly dynamic and features some unmatched operational and security features. When compared to the eToro crypto wallet app, for instance, Blue wallet comes off as the most user effective and user friendly. Blue wallet users have access to a myriad of features and tools not available on eToro’s wallet, such as the batch processor, watch-only wallets, and even fake wallets for plausible deniability. eToro only has the upper hand when it comes to regulation and due to the fact that it has the backing of a more reputable brand – the globally renowned eToro Trading platform.

When compared to most hardware wallets, Blue crypto wallet app comes off as more convenient and highly dynamic. One may even consider it more innovative and less expensive. It, however, pales in the face of some hardware crypto wallets like Trezor or Ledger Nano S when it comes to the number of supported cryptocurrencies and tokens as well as the security of your private keys. Neither the watch-only nor the fake wallet features of the crypto wallet app can compare to the cold storage attribute of a hardware wallet.

Verdict: Is blue crypto wallet safe?

Well, having introduced fake wallets, watch-only, and hierarchical deterministic security features, one may consider the Blue crypto wallet app relatively safe. The fact that it integrates with hardware wallet that not only boost the number of supported cryptocurrencies but provide an additional security layer make it even safer. We, however, would have been more confident about the wallet developers’ commitment to the security of your private keys if they integrated two-factor authentication.

The cryptocurrency, launched in 2014 under the name

The cryptocurrency, launched in 2014 under the name  Zcash uses zk-SNARKs — a novel and very advanced form of

Zcash uses zk-SNARKs — a novel and very advanced form of

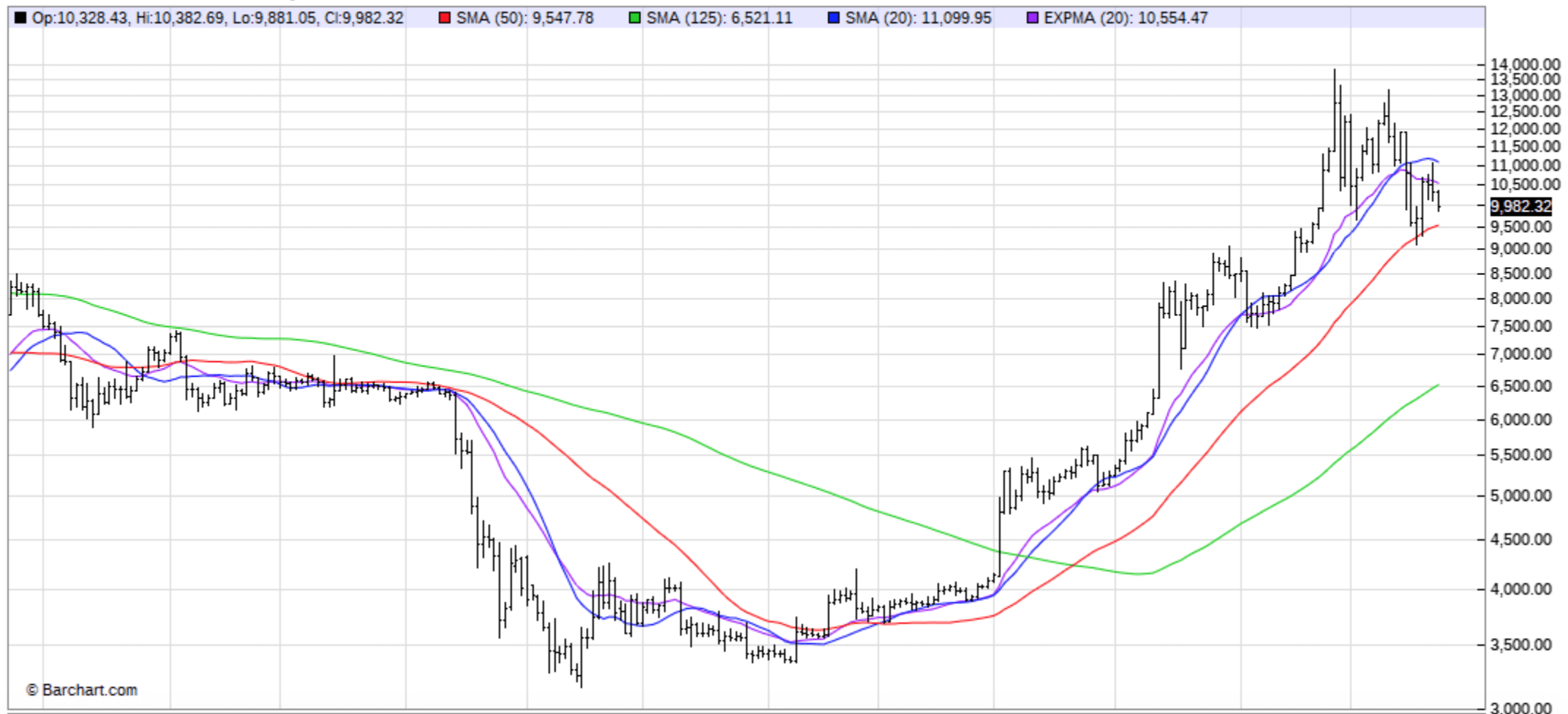

This little-known crypto is one of the fastest rising. It was launched in June 2019 (but appeared in exchanges in 2020) and has already made it to the top 203 cryptocurrencies by market capitalization. If you invested in CCXX in September 2020, your wealth would have grown over 4 times in less than 3 months! Even Bitcoin has never come this close. 24-hour trading volumes still remain low as the crypto is not yet available in any of the major exchanges such as Kraken, Coinbase, and Binance. However, you can get it from ExMarkets, LBank, and WhiteBit (exchanging with USDT or USDC), or SouthXchange (exchanging with BTC).

This little-known crypto is one of the fastest rising. It was launched in June 2019 (but appeared in exchanges in 2020) and has already made it to the top 203 cryptocurrencies by market capitalization. If you invested in CCXX in September 2020, your wealth would have grown over 4 times in less than 3 months! Even Bitcoin has never come this close. 24-hour trading volumes still remain low as the crypto is not yet available in any of the major exchanges such as Kraken, Coinbase, and Binance. However, you can get it from ExMarkets, LBank, and WhiteBit (exchanging with USDT or USDC), or SouthXchange (exchanging with BTC). /dash_cryptocurrency-5bfc31f5c9e77c005180f769.jpg) Much has been said about Dash, especially in 2020. The crypto, which has been hitting due to its uncompromisable privacy and anonymity controls, is fast gaining popularity. Although much of this popularity is being fueled by increased adoption among anonymity-focused businesses, such as dark web markets, there is no denying that the crypto is set to rise. As people become more privacy-centric, the demand for privacy cryptos will rise and merchants and retailers will have to start accepting them. With Dash leading the pack, its growth in the near future is almost guaranteed.

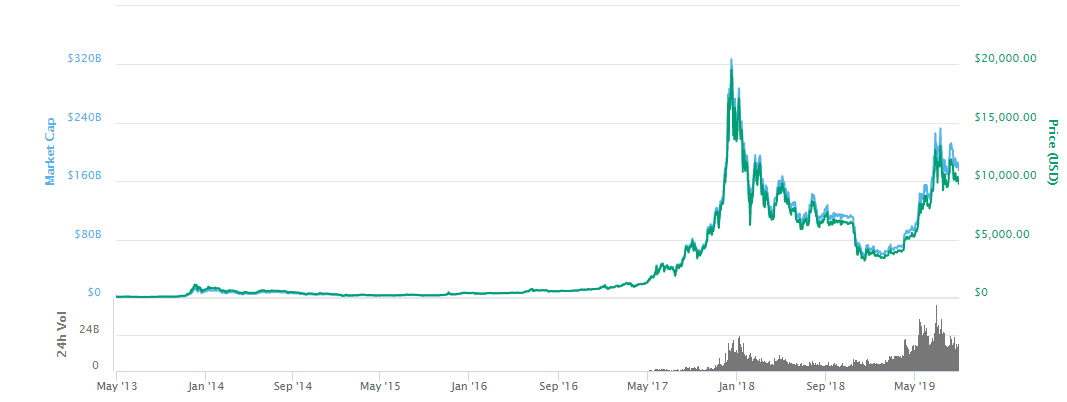

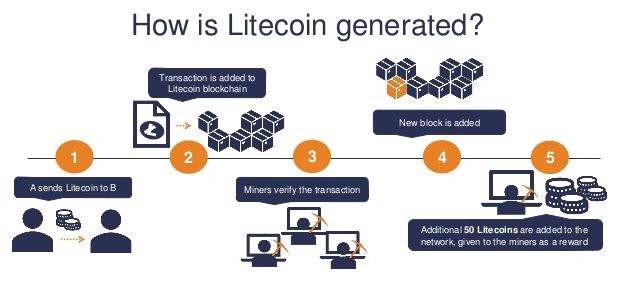

Much has been said about Dash, especially in 2020. The crypto, which has been hitting due to its uncompromisable privacy and anonymity controls, is fast gaining popularity. Although much of this popularity is being fueled by increased adoption among anonymity-focused businesses, such as dark web markets, there is no denying that the crypto is set to rise. As people become more privacy-centric, the demand for privacy cryptos will rise and merchants and retailers will have to start accepting them. With Dash leading the pack, its growth in the near future is almost guaranteed. Litecoin is among the oldest and most stable cryptos. However, it only started shining in 2017 and for the first time reached the $10 mark. Despite being similar to Bitcoin, LTC has had significantly more innovations around it. This has promoted its fast adoption among merchants and retailers. Coinbase, one of the world’s largest crypto exchanges, only supports BTC, ETH, and LTC on its wallet, which proves that the coin has been accepted in the major league.

Litecoin is among the oldest and most stable cryptos. However, it only started shining in 2017 and for the first time reached the $10 mark. Despite being similar to Bitcoin, LTC has had significantly more innovations around it. This has promoted its fast adoption among merchants and retailers. Coinbase, one of the world’s largest crypto exchanges, only supports BTC, ETH, and LTC on its wallet, which proves that the coin has been accepted in the major league.

It can be tempting to simply follow what other people are doing when it comes to trading bitcoin. There are a lot of people out there making a lot of money of fit, so there is no harm in just following them right? Well no, first they will certainly be trading with a strategy, secondly, you do not know what that strategy is and so blindly following trades is never a good idea in that situation. Also, you will not be getting the trades at the exact same time, so by the time you take the trade the optimum time may have already passed. So this is why you need a strategy, a strategy that outlines what you will be trading, when you will be trading and how you will be protecting your account. You should always trade with one and you should only put on trades that are properly in line with the strategy that you are using.

It can be tempting to simply follow what other people are doing when it comes to trading bitcoin. There are a lot of people out there making a lot of money of fit, so there is no harm in just following them right? Well no, first they will certainly be trading with a strategy, secondly, you do not know what that strategy is and so blindly following trades is never a good idea in that situation. Also, you will not be getting the trades at the exact same time, so by the time you take the trade the optimum time may have already passed. So this is why you need a strategy, a strategy that outlines what you will be trading, when you will be trading and how you will be protecting your account. You should always trade with one and you should only put on trades that are properly in line with the strategy that you are using. As mentioned above, you should not be blindly following other people’s trades, as tempting as it may seem. You need to remember that they have been doing this a long time, they have a strategy that they are following, they may even have information from sources that you do not know about, so blindly following their trade will basically mean that you are allowing them to

As mentioned above, you should not be blindly following other people’s trades, as tempting as it may seem. You need to remember that they have been doing this a long time, they have a strategy that they are following, they may even have information from sources that you do not know about, so blindly following their trade will basically mean that you are allowing them to  Risk Management is key when it comes to any form of trading and it is certainly the case for bitcoin too. You need to use it, things like a proper

Risk Management is key when it comes to any form of trading and it is certainly the case for bitcoin too. You need to use it, things like a proper  It can be very tempting to trade more when things are going well, especially when it is bitcoin due to the massive profit potential that it offers, but you need to be wary of this, you do not know what to overtrade. Overtrading is basically when you place more trades than you should. Overtrading can decrease your account’s margin, and when the margin gets too low, it will only take a small movement the wrong way for your account to blow and for your broker to close all of your trades in the negative. Only trade what you need to, do not get greedy, if you are being profitable, accept that, do not try to push too hard for more.

It can be very tempting to trade more when things are going well, especially when it is bitcoin due to the massive profit potential that it offers, but you need to be wary of this, you do not know what to overtrade. Overtrading is basically when you place more trades than you should. Overtrading can decrease your account’s margin, and when the margin gets too low, it will only take a small movement the wrong way for your account to blow and for your broker to close all of your trades in the negative. Only trade what you need to, do not get greedy, if you are being profitable, accept that, do not try to push too hard for more. When you are trading bitcoin, it is very important that you keep an eye on the news that is going on around you. Bitcoin can be heavily influenced by the news, if a country decides to ban its use it can have a very strong and very quick drop, if a major company decides to start accepting it, it can have a huge spike upwards. You do not want to miss out on the opportunities that the news can present, but maybe more importantly, you do not want to get caught out by a huge drop, which even with stop losses in place, can cause an account to blow if the price jumps passed the stop loss. If you are going to trade bitcoin or any other form of cryptocurrency, then it is very important that you keep an eye on the news and know what is going on in the crypto world.

When you are trading bitcoin, it is very important that you keep an eye on the news that is going on around you. Bitcoin can be heavily influenced by the news, if a country decides to ban its use it can have a very strong and very quick drop, if a major company decides to start accepting it, it can have a huge spike upwards. You do not want to miss out on the opportunities that the news can present, but maybe more importantly, you do not want to get caught out by a huge drop, which even with stop losses in place, can cause an account to blow if the price jumps passed the stop loss. If you are going to trade bitcoin or any other form of cryptocurrency, then it is very important that you keep an eye on the news and know what is going on in the crypto world. It is very easy to let emotion take over, especially when there is money involved. This is no different for crypto and bitcoin trading. There is a lot of money to be made, the markets can move up and down a lot which can play havoc with your emotions, in fact, it can cause a lot of stress and anxiety. Things like anxiety can make you not want to trade at all, maybe this has come from a loss or consecutive losses. Then there are things like greed and overconfidence, these can make you start to place more trades, or larger trades, each of which will be putting your account under more and more pressure. If you feel that any form of emotion is starting to build up and that it has the potential to affect the trades that you are making, then you need to take a step back. Take a break, go out for a bit, clear your mind and then come back with a fresh view of the markets. Whatever you do, do not

It is very easy to let emotion take over, especially when there is money involved. This is no different for crypto and bitcoin trading. There is a lot of money to be made, the markets can move up and down a lot which can play havoc with your emotions, in fact, it can cause a lot of stress and anxiety. Things like anxiety can make you not want to trade at all, maybe this has come from a loss or consecutive losses. Then there are things like greed and overconfidence, these can make you start to place more trades, or larger trades, each of which will be putting your account under more and more pressure. If you feel that any form of emotion is starting to build up and that it has the potential to affect the trades that you are making, then you need to take a step back. Take a break, go out for a bit, clear your mind and then come back with a fresh view of the markets. Whatever you do, do not

The Bitcoin markets are exciting, they are a constant battle between the bulls and bears, and even without trading it, simply watching it can be exciting. In fact, we do that quite a lot, just sit by the charts and various other indicators watching things change and watching the battle between the buys and sells. Of course, it is a little more exciting when your money is on the line. Trading often brings adrenaline and it is no different from crypto trading. When our trade is going the right way, it feels fantastic, when it is going the wrong way it is a panic, but both of those emotions bring our adrenaline levels up. There is nothing better than a big trade dropping to near the stop loss only for it to reverse and end up in profit. You do not get that feeling in many other places in life, so that is one of the major reasons that we love to trade it.

The Bitcoin markets are exciting, they are a constant battle between the bulls and bears, and even without trading it, simply watching it can be exciting. In fact, we do that quite a lot, just sit by the charts and various other indicators watching things change and watching the battle between the buys and sells. Of course, it is a little more exciting when your money is on the line. Trading often brings adrenaline and it is no different from crypto trading. When our trade is going the right way, it feels fantastic, when it is going the wrong way it is a panic, but both of those emotions bring our adrenaline levels up. There is nothing better than a big trade dropping to near the stop loss only for it to reverse and end up in profit. You do not get that feeling in many other places in life, so that is one of the major reasons that we love to trade it.

It used to be hard to get into any form of trading, but that is very accessible with the rise of the retail forex brokers, the same thing has happened with Bitcoin trading. Back when the coin first launched you could not trade it on a broker, you could buy it, or you could sell it at very limited places, that was it. Then brokers began to bring it in, but it was very exclusive, only a few brooks had it and those that did, had horrendous spreads, making it not trading at all. Now though, more and more brokers are picking it up, crypto-specific brokers are out there too. These brokers are now offering much better spreads, ones that make it profitable again, and many broilers are now offering leverage on their crypto markets including bitcoin. These developments have made it far easier to get into the world of bitcoin trading, and this added accessibility has helped to improve things like liquidity in the markets. We can only imagine that it will become even more accessible in the future, how we do not know, just that it most likely will.

It used to be hard to get into any form of trading, but that is very accessible with the rise of the retail forex brokers, the same thing has happened with Bitcoin trading. Back when the coin first launched you could not trade it on a broker, you could buy it, or you could sell it at very limited places, that was it. Then brokers began to bring it in, but it was very exclusive, only a few brooks had it and those that did, had horrendous spreads, making it not trading at all. Now though, more and more brokers are picking it up, crypto-specific brokers are out there too. These brokers are now offering much better spreads, ones that make it profitable again, and many broilers are now offering leverage on their crypto markets including bitcoin. These developments have made it far easier to get into the world of bitcoin trading, and this added accessibility has helped to improve things like liquidity in the markets. We can only imagine that it will become even more accessible in the future, how we do not know, just that it most likely will.

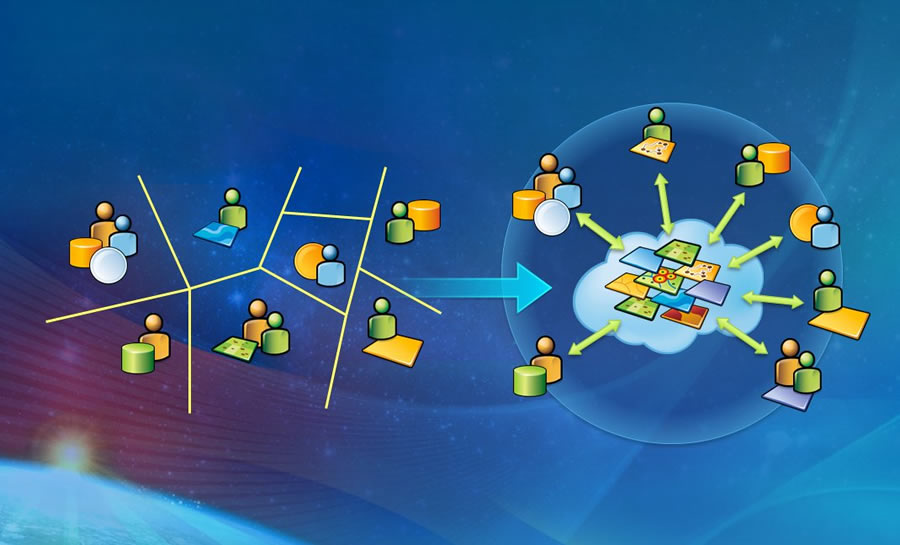

Ethereum is a cryptocurrency that works by PoW consensus protocol using the Ethash algorithm. This algorithm is designed to be highly demanding and targeted at GPU mining. For this reason, mining was in principle highly decentralized and diverse.

Ethereum is a cryptocurrency that works by PoW consensus protocol using the Ethash algorithm. This algorithm is designed to be highly demanding and targeted at GPU mining. For this reason, mining was in principle highly decentralized and diverse.