The main reason for designing stablecoins was to provide some form of stability in the cryptocurrency world. Crypto assets are profitable but highly volatile.

No doubt, stablecoins have found their place in the cryptocurrency industry, not only as a risk hedger, but an investment vehicle, as well. As a serious investor, information such as the stablecoin with the best investment rate will come in handy.

Well, similar to any other investment such as stocks, the goal is to get the most profit, and if security comes along with it, even better.

USD Coin (USDC) and Tether (USDT) are some of the most popular in the stablecoin market, and it makes sense to shift your focus on them.

That said, which of the two market leaders has better ROI?

It is common practice to deposit fiat dollars in a bank to earn interest or loan them out for better earnings. The same is applicable with stablecoins, as well, and there is nothing wrong with it.

Investing in Stablecoins: What You Need to Know

USDT or Tether has been making headlines and attracting attention for both good and wrong reasons. Some people have even gone further to brand tether as a scam, but that is not entirely the case.

Tether may be a bit off with its ethics and may have a patchy past, but it has some good points. It is tethered to the US dollar and can give you some stability in a volatile investment market.

By market capitalization, USDT is the third largest, even though it has been on a minting spree, raising eyebrows in the process.

USDT and USDC are the most popular stablecoins with a USD 1:1 ratio that you can use to trade in exchanges. This has its benefits.

Typically, you can get into the crypto market very quickly and at the right time, which gives you leverage. There is no hassle of converting fiat into crypto and vice versa, and this allows you to short the markets whenever you feel that something is not heading in the right direction.

For example, if you think that BTC is heading for the downward spiral, you can quickly trade your bitcoins into USDT and wait for the market to turn up.

USDT and USDC are very useful for trading. In fact, many businesses are now using USDT for cheap and more straightforward USD trading.

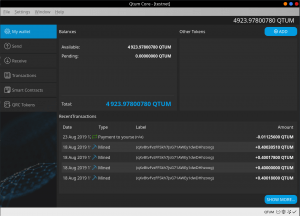

Stablecoin Staking

This is a very new trend in the investment space, and it is just picking up. Well, there are few stablecoin staking offerings on the market right now. But despite their low showing, their guaranteed interest and zero volatility indicate that they have a bright future.

- Staked.US: Staked.US is one of the most popular staking platforms with over 20 PoS coins. The USDC has a yield of around 1.1% on this platform.

- Tidex: With a USDT yield of 12%, Tidex may be your best bet yet for good stablecoin staking profits. Neutrino (USDN), backed by WAVES, is created using tether and guarantees daily leasing rewards for Tidex stakes.

- Coinbase: You are better off staking USDC on coinbase. Through USDC Rewards, you will earn a USDC yield of 1.25% by just holding USDC in your wallet.

Coinbase does not manage or lend your USD Coins. They stay safely in your account. You also get to see your investments grow in real-time.

Crypto Loan Company

If you are not so much into smart contracts as a way of giving crypto loans for profit, you still have the option of using a proper crypto loan company. Loaning using a loan company comes second after staking in terms of yields.

Nonetheless, this method is not very transparent. There is no way of determining if a loan is over-collateralized, and the company could run away with your money.

However, there is some comfort in knowing that the leading platforms are well established, and the real risk is very low.

- Nexo: Boasting more than 550,000 users, this platform claims to be the largest crypto lender. Nexo gives a daily interest of 8.00% for both USDT and USDC.

- Hodlnaut: the platform, founded by two Singaporean bitcoin maximalists, lends to institutions in need of hedging and market-marking assets. The company does not use over-collateralization. They can take legal action on defaulters. The yield for USDT and USDC is 8.3%, payable every end month.

- Celsius: the company shares most of its revenue with customers. You don’t need a minimum deposit, and you can choose to earn higher interests with CEL pay outs. CEL is the platform’s tokens. The yield of 8.05% for USDT and USDC is paid weekly.

Blockchain Lending

Even though carried out on smart contracts, Blockchain lending is more transparent than crypto company loan lending. Similar to any other dApp, you can always check how much is locked in the contract.

Unfortunately, DeFi decentralized lending is not beginner-friendly. And to add to this shortcoming, the method has low rates for investors.

The primary DeFi borrowers are traders looking for the cheapest credit to enlarge their operations. But despite the low margins, DeFi lending collateral is well over the 100% mark. In case of a default, it is sold to compensate for the losses.

- Compound. Finance: This is the best known DeFi app, and you can start lending instantly on the platform app section. Basically, the yield is 0.75% for USDT and 1.04% for USDC.

- DDEX: the decentralized margin exchange disburses all the loans to the margin traders. The application is easy to use, and connecting to MetaMask is direct. If you have some experience with crypto, lending at DDEX feels natural.

The USDT yield is much better at 3.92% than USDC at 1.20%.

- Aave: the recently Open Zeppelin-audited platform places a lot of weight on security, and its rates are attractive. On the downside, the website is not easy to navigate, especially for the novices, because of its focus on code and protocol.

Aave yield is 3.16% for the USDT and 3.56% for the USDC.

When it comes to blockchain lending, USDC has better yields than USDT, and that makes your choice much easier. Of course, several other platforms may give you a better yield on USDT, but they are few and far between. The USD Coin is the DeFi industry’s choice, and you can get favorable rates with the stablecoin.

Final Thoughts

Every investor’s main objective is to make several wins on their investments and laugh all the way to the bank. With the growing blockchain technology and market, investment in stablecoins has emerged as one of the most viable, no doubt about that, given the yields.

The uncertainty and recession in the world currently is another factor turning the focus of everyone to blockchain stablecoin investments such as lending and staking.

But the real question is, which is a better stablecoin investment? Is it USDC or USDT?

Inarguably, USDT staking has a mouth-watering rate of 12% by Tidex exchange, and therefore the clear winner. You can earn interest, and at the same time, hedge your currency risks, something that was not possible before. Given such attractive prospects, it is only a matter of time before the inevitable scramble to stake on the stablecoins for a share of the easy profits.

For Tidex and other exchanges, the future is bright, and it is possible that they are going to add other staking products with irresistible yields. Still pondering whether to enter the market?