2020 was revolutionary for DeFi markets, and investors flooded the young industry with over $7billion from a mere $1.2 billion. As the market cap and number of transactions surged, regulators came up with responsive ways to tax cryptocurrency income.

Initially, taxes were a foreign concept in crypto realms, but the IRS made definitive tax rules for blockchain transactions. Most digital currency taxation policies are based on cryptocurrencies, but regulation is spilling over to the DeFi markets.

Most crypto users are ignorant of digital currency tax laws, but the IRS will not let you plead ignorance. The federal tax agency is decisively cracking down on crypto tax compliance, and this article will help you gain some valuable insights.

Reading on will help you keep compliant with DeFi taxation requirements. Even more importantly, it will help you navigate DeFi, so you trigger as much tax deductibility as allowed in novel legal confines.

Crypto Taxes 101

The IRS categorizes digital tokens as properties and not currencies. Bitcoins, for example, are capital assets that can attract profits and losses from transactions.

Reporting your crypto taxes gets harder with the increasing number of blockchain transactions per financial year. The IRS adopted and has never changed its use of first-in, first-out accounting, which means you should determine your net gains/losses on crypto assets.

Profits are categorized as long-term or short-term capital gains. Losses on cryptocurrencies are considered deductible capital losses.

To prevent crypto holders from absconding cumbersome tax computing and filing, the IRS imposes the form 1099-K for all crypto exchange users posting over 200 transactions per year. This file is similar to form 1099-B that stockbrokers use for filing capital losses/gains, but it has some unique provisions.

Introduction to DeFi Taxes

DeFi exists within cryptocurrency realms, enabling digital token users to trade, lend, and borrow via low-cost automation that rules out third-party financial services. In DeFi markets, crypto owners earn interest on lending platforms, and the interest is paid in the same digital currencies.

Therefore, crypto interests increase the number of digital currencies. When you earn interests through your crypto tokens, a different taxable event occurs from profits/losses. Taxable events in DeFi markets transpire when:

- You trade one cryptocurrency for another via cross-chain money markets, realizing either profits or losses.

- You trade crypto tokens for fiat currencies, either realizing either profits or losses.

- You spend digital tokens on goods and services, realizing either profits or losses.

- You earn in cryptocurrencies, and DeFi services create numerous earning opportunities where you trade your time and skills by executing network protocols. Moreover, some CEOs and athletes prefer getting their salaries in digital tokens.

These taxable events in cryptocurrency transactions are either:

- Capital gains.

- Ordinary income.

Ordinary Income vs. Capital Gains Income

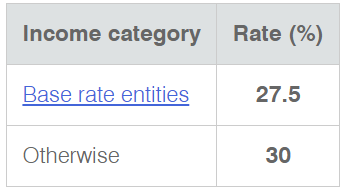

Ordinary income taxes apply for normal jobs, and the IRS doesn’t classify cryptocurrency miners any differently. You must pay according to your marginal tax bracket.

Bitcoin miners and validators on Proof of Stake protocols earn digital tokens for authenticating transactions. These earnings are categorized as ordinary income, and they offer minimal tax savings.

Capital gains income manifests when you swap your digital assets for a higher monetary value than you acquired them. These income streams present significant tax benefits and holidays. For starters, long-term capital gains tax rates are diminished compared to short-term capital gains.

Moreover, you can completely offset capital gains with capital losses. However, capital gains can only offset ordinary income up to $3,000.

DeFi Taxes in Lending and Borrowing

The DeFi ecosystem offers lending opportunities like no other. Your digital currencies can earn interest on Compound, Blanancer, and Uniswap by contributing to liquidity pools or lending directly.

Some DeFi protocols take crypto loans and issue out Liquidity Pool Tokens in return. The currencies you loan out determine the number of tokens from the liquidity pool and ultimately how much interest you make.

Interests that you make on crypto lending platforms qualify as ordinary income for tax purposes. The DeFi ecosystem allows you to boost your revenues, with some platforms paying out interests every second.

The same applies to crypto borrowing platforms. You can borrow bitcoins and other digital tokens to use for business or personal use. Commercial cryptocurrency loans qualify for tax-deductible expenses. Therefore, you can claim relief on costs you incur when borrowing cryptocurrencies for commercial use.

DeFi Taxes for Unexpected Income from Hard Forks and Token Distribution

Sometimes, blockchain networks award existing users or asset holders with free digital tokens. Such tokens are newly acquired assets with monetary value. Such a transaction is taxable, and the IRS categorizes it as regular income.

Therefore, you must report it within your appropriate tax brackets, and you won’t qualify for many deductions on these earnings. If you use such tokens profitably, file the revenue made on top separately.

Networks like Compound sometimes distribute their native tokens for free to users during initial offerings. For example, the DeFi platform distributed $100 worth of COMP. The users who enjoyed free $100-worth assets owed the IRS whatever your income rate is for that $100.

You won’t pay any more taxes if you hold the COMP, no matter how much they appreciate it. However, you will owe the day you redeem that appreciated monetary value, and you should report the net revenue as capital gains.

If the $100-worth of COMP appreciates to $300 within a year, you will owe short-term capital gains tax for $200 if you sell the COMP or redeem it for products and services. Your capital losses for the COMP are not deductible on the income tax you owe for unexpected digital income.

Cryptocurrency forks are other sources of unexpected digital income. Forks result when validators or miners in a network disagree on blockchain governance. A great example is that of Bitcoin and Bitcoin Cash. They disagreed, and the Fork was quite controversial because it created BTC tokens from scratch.

Investors of parent cryptocurrencies end up with an equal number of forked-off tokens. For example, if you had 4 BTC during the fork, you automatically got 4 BCH, and you became a member of two independent blockchains.

These unexpected incomes are also part of your taxable income, and you pay per your tax bracket. Any gains on them are taxable, and any losses on them are not tax-deductible.

DeFi Taxes in DEXs

Basic taxation rules for cryptocurrencies apply to DEXs. You do not incur taxation for transferring funds from one platform to another, so long as the accounts and funds are yours.

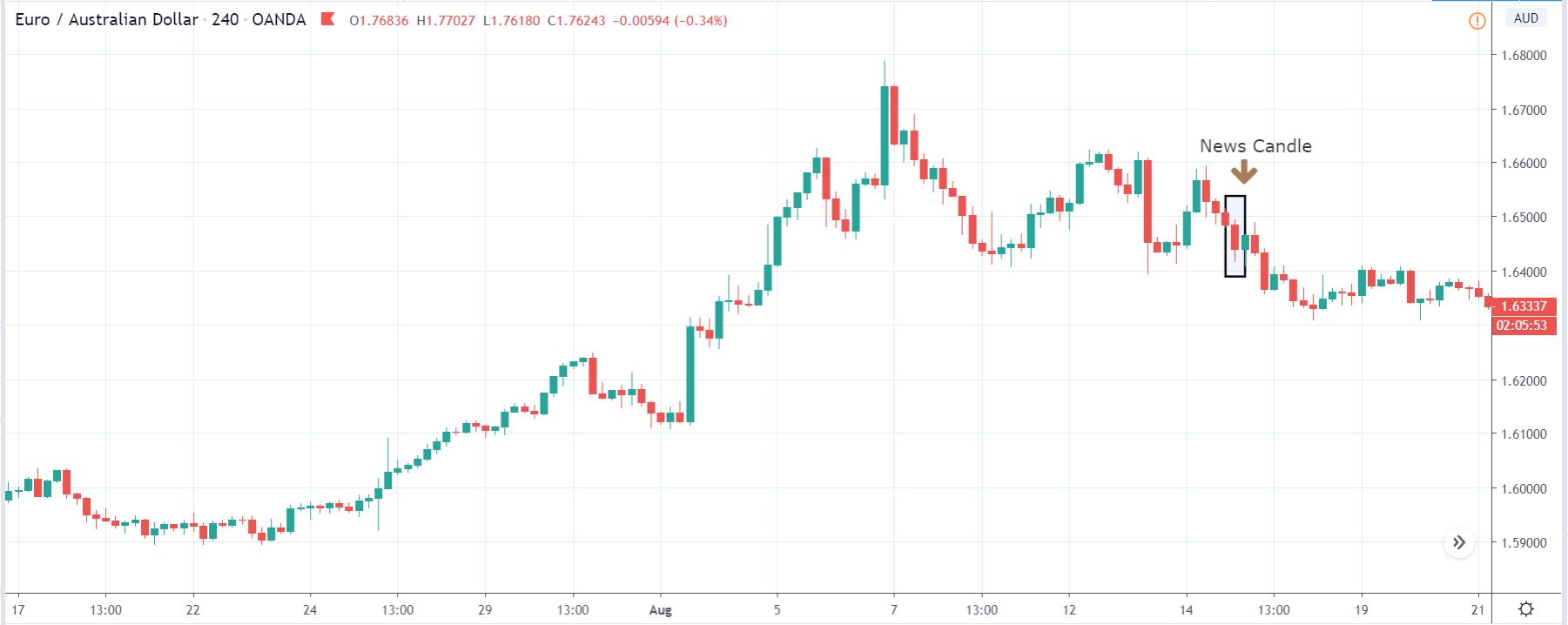

However, when DEXs allow cross-chain asset swaps, an element of profitability occurs. You either gain profits or losses on your initial capital assets.

Reporting DeFi Income on Your Taxes

It is your responsibility to report DEX revenue streams for tax purposes. The advantages of DeFi taxation are abundant. Report all DeFi buys and sells on the IRS Form 8949 for your capital gains filing.

Tax Advantages of DeFi

For starters, DeFi lending converts your currencies to Liquidity Pool Tokens. Your liquidity tokens remain the same, but their value increases over time. You make a capital gain when redeeming your LPTs for the original cryptocurrencies.

DeFi converts what should be your regular income into capital gains income. Consequently, you qualify for deductions if you make losses later selling the tokens.

DeFi allows you to borrow tokens with different cryptocurrencies acting as collateral in Ripple’s XRP for the long-run, but ETC is more profitable in the short-term.

Long-term capital gains offer more deductibles than short-term ones, and you shouldn’t keep selling your XRP to leverage ETH’s profitability. You can borrow ETH with XRP as the collateral if the prospective earnings are more than interest costs.

Tax Disadvantages of DeFi

Whenever you exchange a crypto asset for another, you are most likely triggering a taxable event. This makes it cumbersome to track all profits and losses made every time such DeFi transactions occur.

Tax Treatment Overview on Different Platforms

- Uniswap

Uniswap executes the Liquidity Pool protocol for its crypto lenders. It empowers you to swap income tax liability for capital gains liability, which is deductible. UNI tokens basically cushion you from future losses on the native coin you want to lend.

- Maker/Oasis

This DeFi service allows you to harness long-term tax deductions on capital gains. The platform allows you to trade between assets and even earn interest on other assets. They allow you to lock your ETH as collateral, and as it gathers capital gains, you can seize the short-term profitability of other blockchain networks.

- Compound

Compound is also a Liquidity Pool platform, which converts your ETH to cETH. When the liquidity pool earns interest, the value on your cETH will move from income tax liability to capital gains revenue, deductible for losses.

- Balancer

Balancer is another Liquidity Pool DeFi service. It’s sort of a tax-lien insurance package against future losses on crypto assets.

Parting Shot

Ignorance cannot be your defense when you are found to be non-compliant. The DeFi markets are enormous and have the potential to overtake centralized finance in years to come. The IRS knows this fact, as do most sovereign central banks.

Fortunately, DeFi taxes are friendly, and they offer numerous tax-saving opportunities. You stand to make tremendous capital gains and high, compounding interest rates investing in DeFi. The gains are way bigger than the tax costs.

Enforcement over DeFi taxes will only get more aggressive, intuitive, and efficient. That’s why you need to read this article and share it with your friends. Take charge of your tax compliance, and share some of your most effective tax filing tips for DeFi transactions.