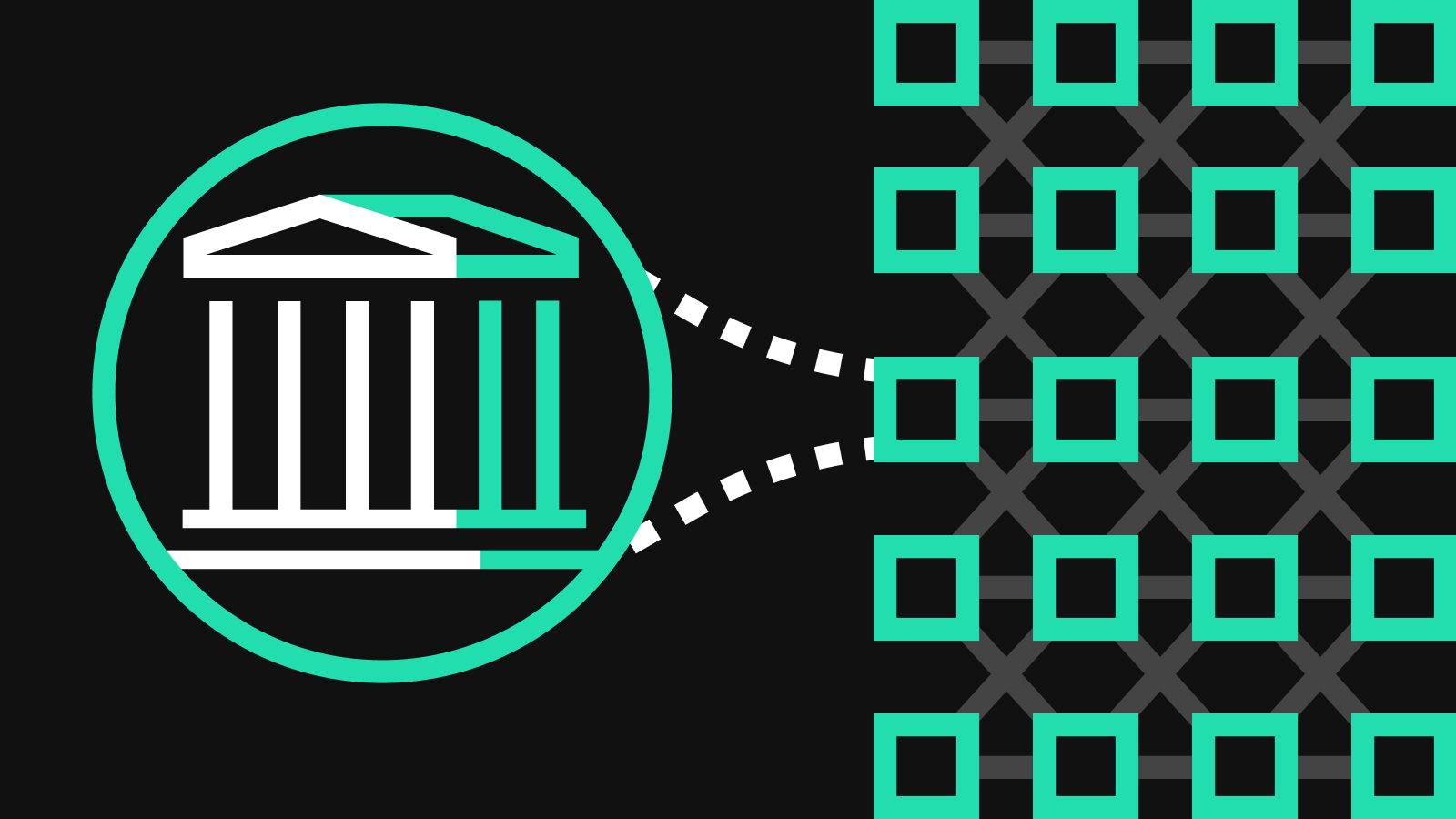

Blockchain technology was introduced to revolutionize the traditional fiat system, and it did. However, with time, developers have found an even better way to change the system by getting rid of financial intermediaries such as banks through decentralized finance. The industry has been booming over the last few months, and more is expected in the coming year.

Everyone’s ideal dream is to earn money with little or no effort, and crypto investors are no exception. Like any other financial system, investing in DeFi presents the opportunity to earn both passive and active income. Andreas Antonopoulos, an avid Bitcoin enthusiast, pointed out that DeFi was one way to earn passive crypto income by putting your capital to work.

You’d certainly want your money to work for you, wouldn’t you? Here are some of the ways you can make some passive income from your initial DeFi investment.

Income Generating DeFi Products

Besides getting rid of third parties, another prominent feature of DeFi platforms is incentivization, which, in turn, increases liquidity in the industry. Through the increased liquidity, DeFi platforms present different income-generating products, which are:

- Liquidity Mining

- Staking

- Yield Farming

If you’d rather generate some active income, you’ll need to trade on DEx platforms actively. Obviously, you’ll need to be hands-on for this approach, and your investment could go either way because of the industry’s volatile nature. If you’d rather a less risky strategy, HODLing could work for you, but then you’d have to wait quite a while before you can get some significant yields.

Well, if you’d rather invest your money somewhere and wait for it to earn you something, let’s have an in-depth look at the options that you have.

Liquidity Mining

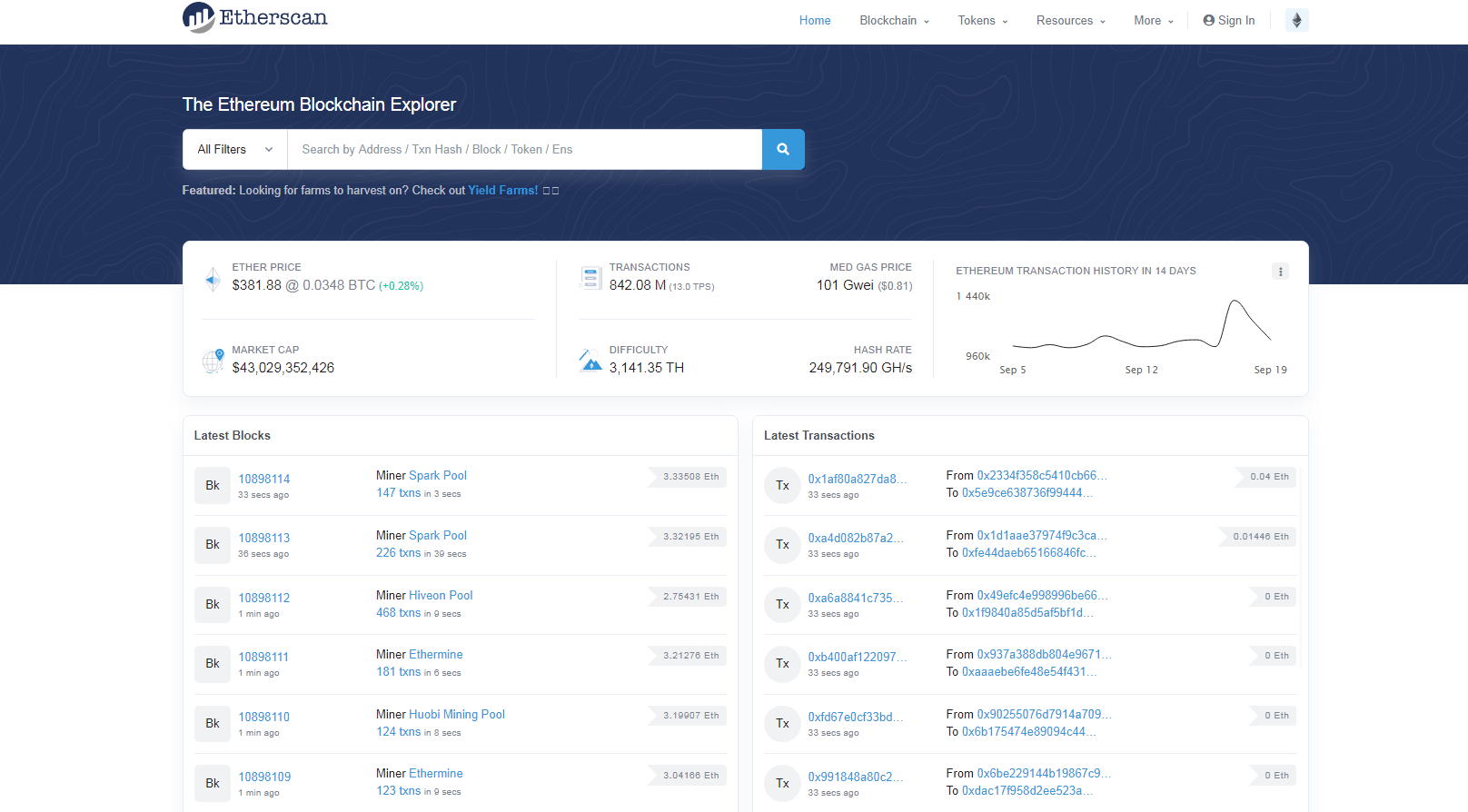

Decentralized exchanges or token issuers often offer rewards to the liquidity providers on the network. The users have to deposit some ETH or ERC-20 tokens into a liquidity pool through an automated market maker (AMM). The deposit acts as collateral in the liquidity pool.

If you’re looking to earn through liquidity mining, you’ll first need to find a pool that accepts your tokens. You can then stake them in the pool and get incentives in return. Often, the incentives are tokens that you can later exchange in a DEx.

The risks of investing in liquidity pools is high, which is why this method will earn you more than even money markets.

Staking

Mining new cryptocurrencies is every enthusiast’s dream. However, between the expensive technology needed and the difficulty of computational problems, not many people get to achieve this dream.

If you’re one such person, perhaps you should look into staking your tokens. The method is an excellent alternative consensus mechanism. Most networks will require that you store your tokens in a specific wallet and incentivize various network functions. By completing certain tasks, which may include minting or burning, the network rewards you with several tokens.

Obviously, you’ll need to be involved to some degree for you to complete the tasks required. How much involvement you’ll be needing will depend entirely on the DeFi project.

Before you go rushing for this method, you must know that staking involves high risk- but of course, that also translates to high returns.

Yield Farming

If you’ve come across a DeFi investor, there are high chances that they make most of their earnings through yield farming. The concept is quite popular among DeFi projects, and involves moving around your crypto assets to wherever they’ll earn the highest returns.

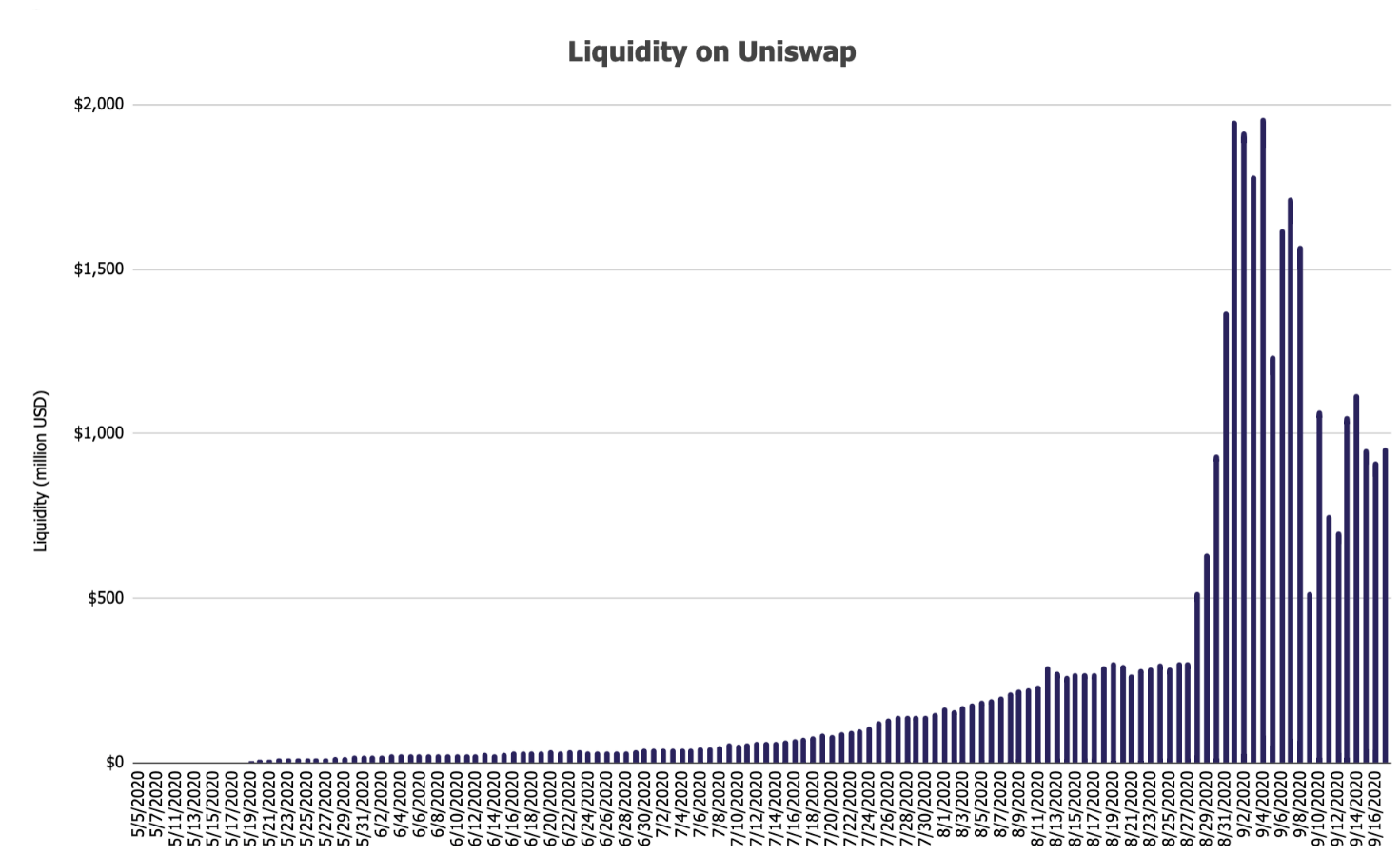

Yield farming allows you to generate income from the crypto assets you already have. You become a liquidity provider together with other users and add funds to liquidity pools. In return, you get rewarded with the fees generated from the underlying DeFi platform.

Typically, yield farming will be done using ERC-20 tokens, which are built on the Ethereum blockchain. Most DeFi platforms will reward liquidity providers with multiple tokens, which comes in handy for investors who want to diversify their portfolios.

Although it isn’t necessary, most times, the funds deposited in the liquidity pool will be stablecoins backed by the US Dollar. Depending on the platform you use, you may have the rewards as minted coins to represent your deposited coins. For example, if you deposit some ETH tokens in Compound, you’ll get cETH tokens as your rewards.

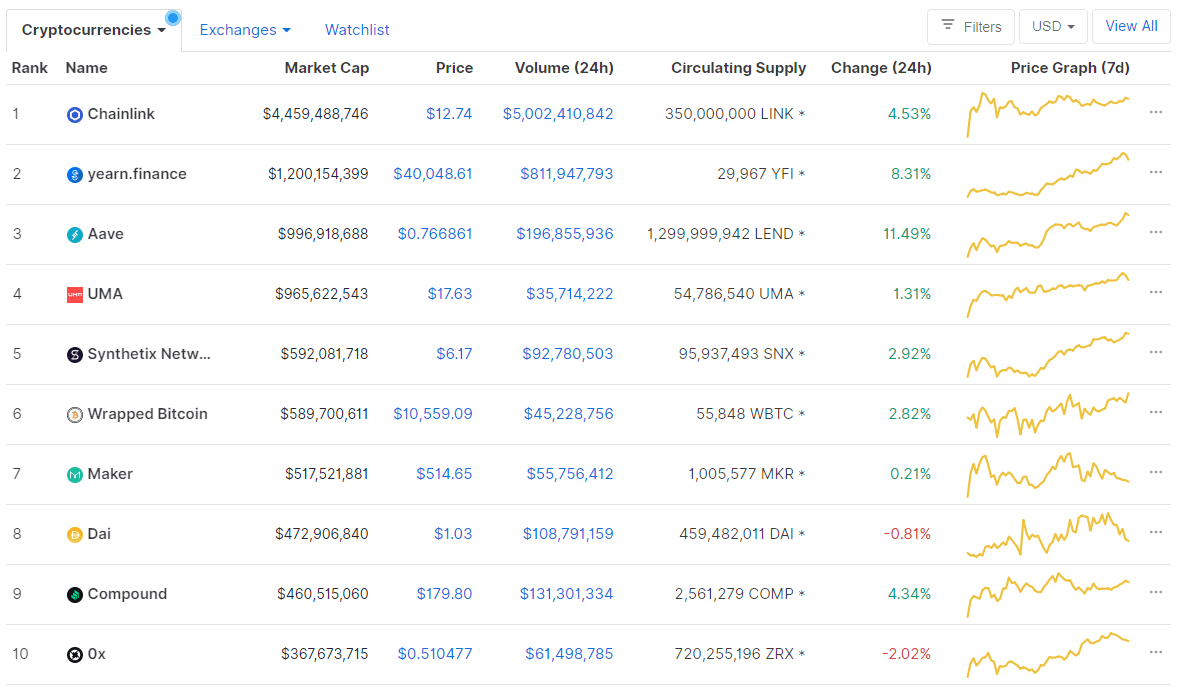

Best Platforms for Passive DeFi Income

Now that you know the different ways through which you can earn passive income from DeFi, you’re probably wondering where to apply all the useful information. Luckily, there are different DeFi platforms you can use to diversify your crypto portfolio. Have a look at three exchanges you should definitely check out.

Compound

If you’re interested in short term lending and borrowing, you should definitely check out Compound. This protocol is a money market for Ethereum based assets and tokens.

Using this platform, you can contribute to liquidity pools and accrue your compounded interest automatically.

Uniswap

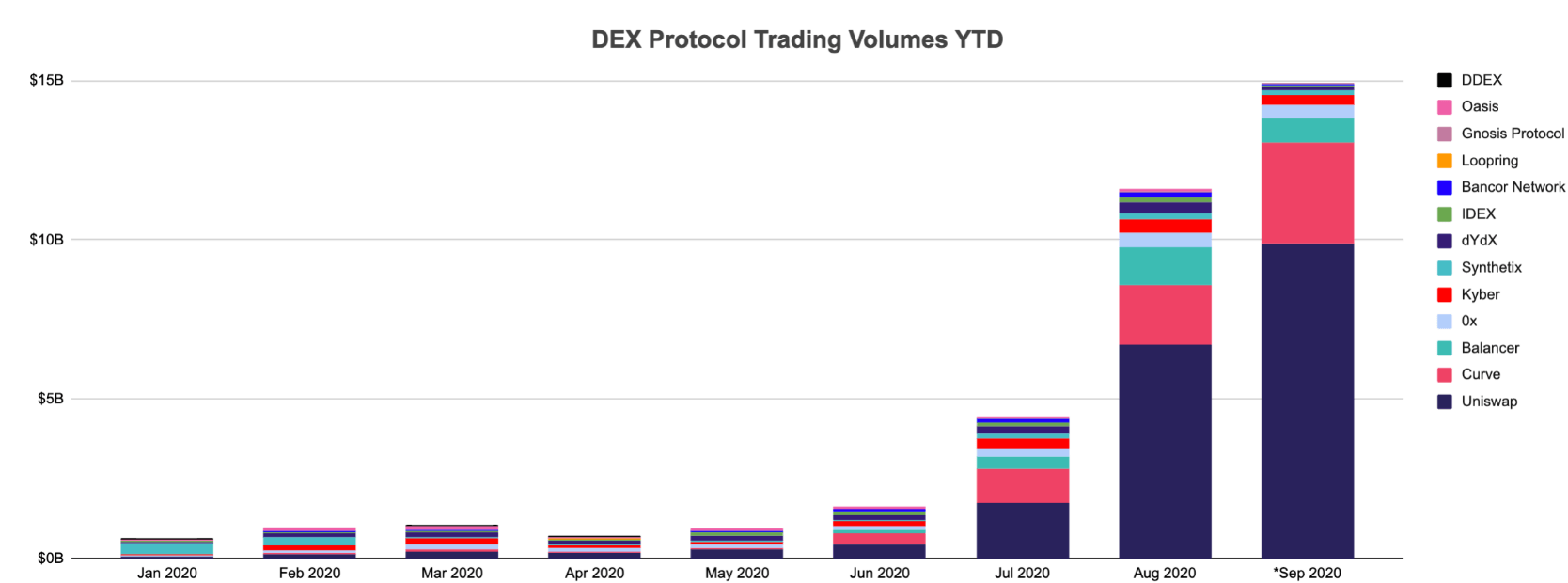

This platform is one of the popular ones in the DeFi space and is ideal for anyone who’s looking to tap into the goldmine. Uniswap offers an automated market maker that allows users to swap ETH for ERC-20 tokens and earn transaction fees by providing liquidity.

Aave

Aave is quite similar to Compound, but is a bit more flexible, which makes it an excellent alternative. Unlike compound, Aave users can switch between stable and variable interest rate models. Additionally, the platform features flash loans that developers can use to create dApps.

Parting Shot

Undoubtedly, DeFi remains a largely uncharted territory for investors, including those who’ve been following the recent crypto trends. However, if 2020 is anything to go by, the DeFi craze isn’t a passing wind but is here to stay. Therefore, if you have a knack for investing in crypto, you might want to get aboard the DeFi train soon enough.

Sure, actively investing in a relatively new venture that you don’t know much about can be risky. So, why not try to get some passive income as you learn more about it? There are different ways to achieve this, as we’ve discussed above. Like any other investment, be sure to do some research before putting your hard-earned money in any venture.

So, what passive income strategy will you be adopting in 2021? Let us know in the comments below.

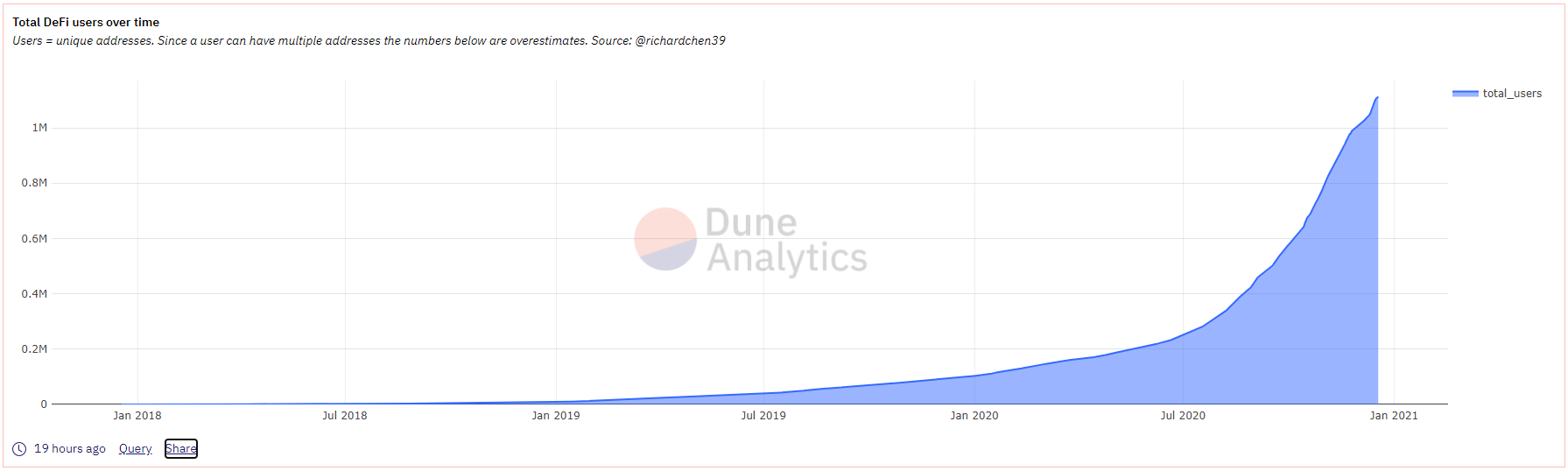

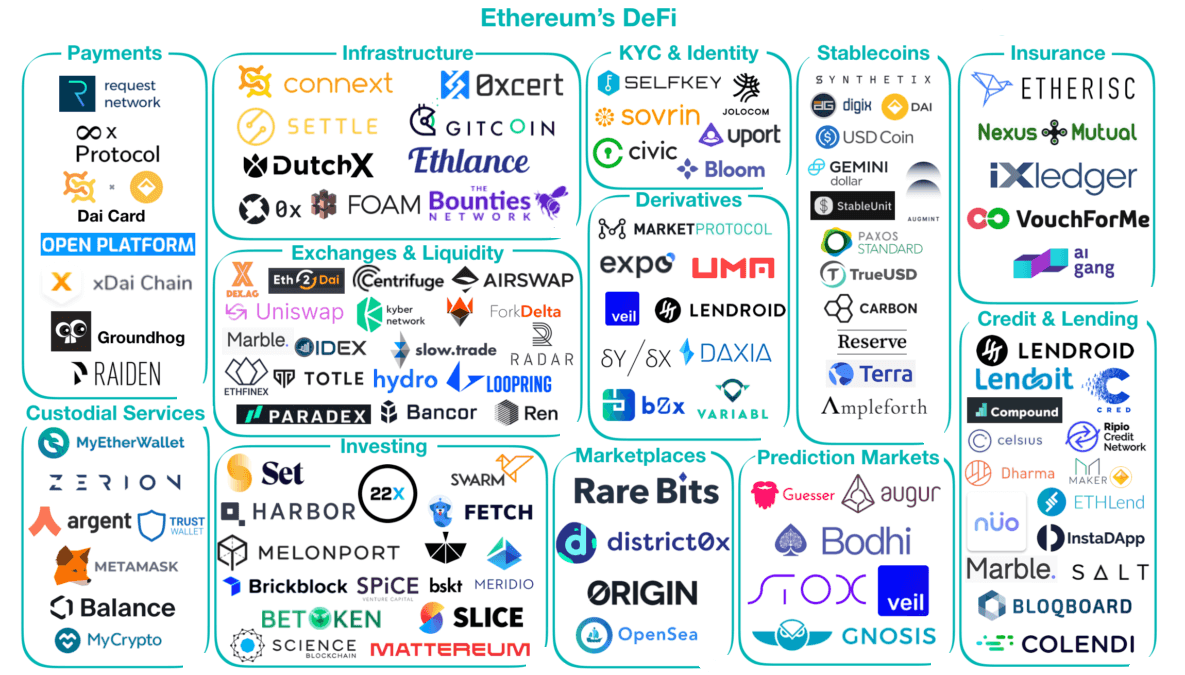

The crypto and DeFi sectors are growing exponentially, and there are currently more DeFi apps than ever. These projects are already saving businesses and customers both time and money. In fact, DeFi platforms started to emerge across nearly every branch of the financial sector. As the DeFi sector expands, it is important to understand what characteristics all DeFi applications have in common, and what they offer.

The crypto and DeFi sectors are growing exponentially, and there are currently more DeFi apps than ever. These projects are already saving businesses and customers both time and money. In fact, DeFi platforms started to emerge across nearly every branch of the financial sector. As the DeFi sector expands, it is important to understand what characteristics all DeFi applications have in common, and what they offer.