Is Binance crypto exchange an industry leader or just another hoax? Well, launched in China but expelled during the Chinese Crypto ban and forced to find a new home overseas, Binance has gone on to become one of the most popular crypto exchanges today. This popularity can largely be attributed to the impressive number of cryptos supported here, professionalism in customer support, low trading fees, and a friendly CEO – CZ.

But does Binance has a valid claim to the global crypto leaders post? Read on as we look at its contributions to the industry and everything else you need to know about this crypto exchange.

What is Binance?

Binance is a cryptocurrency exchange founded by Changpeng Zhao (CZ) in China in late 2017 before moving it to Europe’s Malta in 2018. Initially, Binance was a crypto-to-crypto exchange but has since started accepting fiat credit card and bank deposits. And during its less than two years of operation, Binance has become synonymous with highly competitive trading fees, most innovative exchange platform features, championing futuristic crypto policies, and spearheading charitable projects. Its strategic position in Malta outside the strict E.U and U.S. markets makes it a favorite for the rest of the world.

How does Binance work?

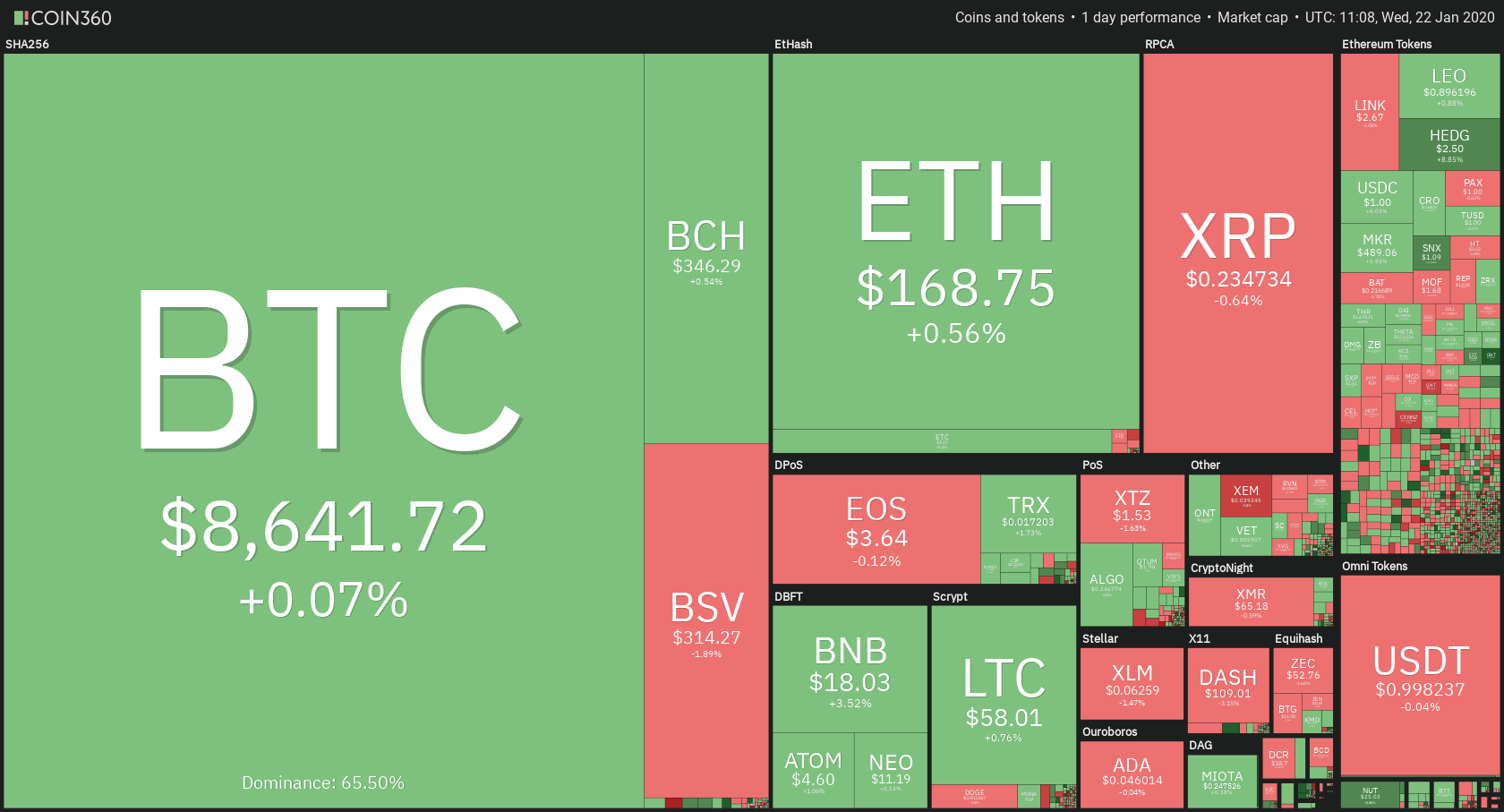

First off, Binance is a crypto exchange that allows you to buy, sell, and trade both the leading and other micro digital currencies. Their exchange is available in both the basic and advanced views ideal for both beginner and expert traders, respectively. On either trading chart view, you are exposed to 450+ crypto trading pairs with most of these priced against Bitcoin, Ethereum, and the crypto exchange’s native coin – Binance coin.

In addition to this, Binance trading exchange charts promise some of the most comprehensive as both basic and advanced views capture all the important details needed to push a trade on one page. From trading charts and price graphs to a coin’s trade history and latest prices in the order book to the buy/sell boxes.

How to set up a Binance account

Another of Binance’s endearing features is that it is easy to join and draws its membership from virtually every corner of the world. We found the account creation process on Binance quite straightforward whereupon admission you become tier 1 trader. Here, you can transact and withdraw up to 2BTC per day anonymously.

You will, however, need to pass the company’s KYC and AML policies if you wish to expand your transactional and withdrawal limit to 100 BTC per day as a tier 2 trader. This requires that you send the company a copy of your government-issued identification document and proof of address. Interestingly, there also exist higher levels that allow for even higher trade limits, but you will need to contact the company directly for that.

What cryptocurrencies does Binance support?

The Binance website claims that its exchange supports 150+ cryptocurrencies. But taking into account both the popular currencies and micro tokens launched daily on their Initial Exchange Offering (IEO) platform, we estimate that the exchange supports 300+ tradeable crypto coins, tokens, and stable coins.

How to trade on Binance

Based on our experience on both the basic and advanced versions of Binance crypto exchange, we can comfortably say that you don’t need special skills to trade on the platform. Not when it has one of the most straightforward buy/sell processes. On their website, you will find the exchange tab that provides you with the option to trade on the Basic or Advanced platforms.

Choose basic (it is simpler), and on its left-hand side of the screen, you will have the order book with your preferred coin’s list price and the buy/sell order prices. You can then select or search for the coin you wish to trade on the right-hand side of the screen and use the buy/sell boxes on the bottom center to complete the transaction.

Binance trading fees

Binance will not impose any additional charges or fees on your deposits. You, however, will be charged an average of 0.1% of the transaction volume to trade on their platform. But this trading fee is slashed by 25% if you chose to pay via the native Binance coins. And this essentially makes it the most affordable crypto exchange we have come across so far and probably the secret behind their $2 billion transaction volumes.

Binance further maintains highly competitive withdrawal charges for different cryptos. Bitcoin and Ethereum withdrawals are, for instance, charged 0.0005 and 0.005, respectively.

Deposit and withdrawal

You will also be interested to note that there are no transfer limits into your Binance account for both anonymous and verified traders. There, however, is a limit as to how much you can withdrawal without verifying your trader account – currently set at 2BTC per day. The company is nonetheless open to both individual and corporate traders and therefore maintains a discretionally daily withdrawal limit that you can always agree on with the Binance management.

Supported payment processing methods

For the longest time, Binance was pure crypto to crypto exchange, implying that you could only deposit and withdraw into your crypto wallet. It, however, is gradually welcoming fiat to crypto transactions and also started processing fiat deposits. At the time of writing this Binance review, however, the exchange will only accept cards (both Visa and MasterCard’s) and bank transfers only. Binance card transactions support swift transfers where cash takes 10-30 minutes to reflect in your binance trader account plus has the lowest processing fees of $10 or 3.5% per transaction – whichever is higher.

Note, however, that the fiat deposits transactions are also limited to traders from specific regions, especially the UK and the larger European Union. Additionally, the platform will only accept USD and EUR currencies meaning that you will incur currency conversion fees for individuals holding other global currencies.

Security and digital asset protection

Binance maintains an online crypto wallet (Trust Wallet) that’s given freely alongside your trader account. You are free to choose between storing your digital assets here or transfer them to any other crypto wallet address. According to Binance, the larger percentage of the digital coins with Binance are held in cold storage, with only a few maintained in online lenders to facilitate the exchanges day-to-day operations.

Despite these cold room claims, however, Binance suffered their first and only successful hacking where someone withdrew over $40 million worth of cryptocurrencies from the exchange in May 2019. The hacker, according to Binance, succeeded with the heist by manipulating key user information like API keys used by bots and managers. The exchange, however, promised to cover the loss and reimburse users using their reserve funds.

Registration and regulation

Binance cryptocurrency exchange is regulated in Malta and operates under the country’s Virtual Financial Assets (VFA) policies. Unlike most other exchanges registered and regulated in two or more countries and under the scrutiny of several financial conduct authorities, Binance is not licensed by any other regulatory body.

Binance customer support

Binance has one of the most active and highly responsive customer support team we have come across in the crypto space. And it all starts with their multi-lingual website that supports up to 16 languages. Their customer support team is accessible 24/7 via email, live chat on the website, and all popular social media pages like Telegram, Twitter, Facebook, and Instagram.

Everything else you need to know about Binance:

Launched Blockchain academy:

In an industry first, the Malta-based crypto exchange company recently launched the Binance academy that it says brings “The World Of Blockchain” to your fingertips. It is ideally supposed to help introduce most individuals to the crypto world by teaching them about cryptocurrency and blockchain for free. This academy covers everything from basic blockchain and crypto terms to emerging trends and tutorials on different blockchain-related topics.

Binance Launchpad:

Binance refers to their Launchpad as “a token launch platform for transformative projects.” It ideally is a modern form of initial coin offering where different blockchain projects launch their tokens. Unlike traditional ICOs that were largely unregulated, projects on Launchpad have to apply for listing, after which they are vetted for such traits as transparency, security, reliability, sustainability, and the professionalism of its developers. This has gone a long way in curbing the runaway scams plaguing the crypto industry.

Margin trading:

Binance crypto exchange is also a margin trading champion and an industry leader in advocating for leveraged crypto trades. Crypto traders on Binance can, therefore, margin trade different crypto assets with leverages of up to 20X.

Binance DEX:

Binance has also been a front-runner in championing decentralized exchanges (DEX). This involves setting up several satellite exchanges around the world that complement the primary Binance exchange in a bid to improve efficiency. In actualizing the DEX, Binance has already come up with Binace Jersey and Binance Uganda – two independent crypto exchange outposts of Binance. It should also be noted that it is through these DEX that Binance has introduced fiat to crypto transactions.

Verdict: Is Binance legit?

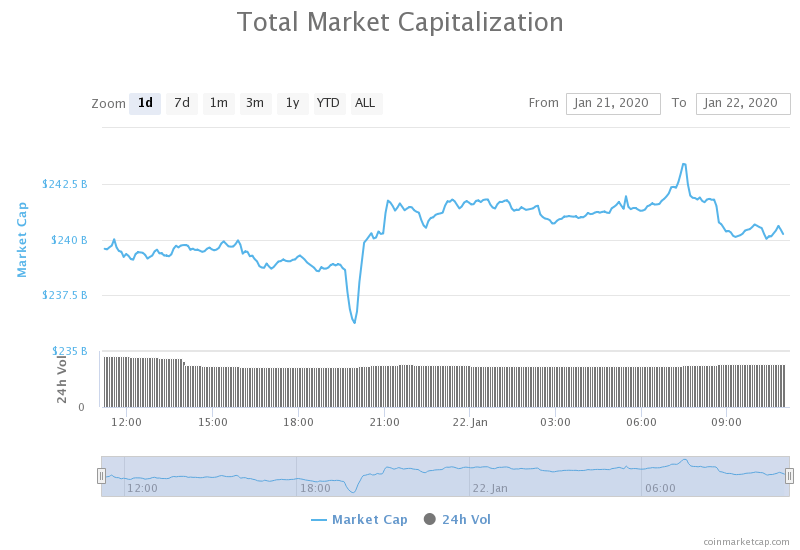

Despite joining the crypto exchange industry relatively late, Binance has gone to become one of the most popular exchanges. This is evidenced by its massive following and significantly high daily transaction volumes posted on the exchange – averaging $2 billion daily. And a few factors endear it to the crypto world. Key among this is its straightforward signup trading processes, its support for anonymous trading for low-volume crypto traders, and pursuance of the lowest trading fees in the industry.

These plus the innovativeness that has seen it welcome more crypto trading pairs on board and come up with transformational tools like decentralized exchanges (DEX) and Binance Launchpad, and these plus the fact that it is licensed and regulated in Malta don’t just prove its legitimacy but also go a long way in establishing affirming its market leaders position.