Last time we learned what makes Bitcoin inherently different from everything you’ve ever seen before and, today, we are starting with the opposite, looking at some prominent similarities.

6. Bitcoin as a free market

We ended Part 2 of the series explaining how money is a vehicle, a tool people use to obtain the things they need most. Thus, as with any other tool, money serves the purpose of saving us time. We will naturally type more words on our computer than we will write words in the same period.

Money is just a tool that helps us negotiate and execute trades more quickly. Still, the money we know now, the fiat currencies, are essentially created to fit a pyramid structure where top tiers derive value from the lower ones. And, the people at the very bottom are the everyday citizens using a particular fiat currency. That means the system we follow, wherever we are on this planet, is leverage-based. It cannot function without the accumulation of debt.

When governments took over the money market, they created a centrally planned design thus making it unfree. The main difference between the planned and the free market is that the latter is based on natural organizing principles. This further means that, in free markets, people strive to discover better ways of doing things by making bets among themselves.

All regulations and limitations on free-market dynamics, which essentially entail monopoly, only reduce their efficacy. And, Economics teaches us that any monopoly increases prices decrease innovation, and reduces trade. Free markets, on the contrary, operate to economic benefit through increasing productivity.

If we look at Bitcoin, we see an open environment that is, in its essence, impervious to politics and free from artificial impediments and hierarchy. Technology has helped us take an important step in differentiation between how measurement should be carried out. What is more organic and necessary in this world – payment as per the number of hits an athlete makes in a game or payment based on a politician’s charisma?

Some large companies, such as Facebook, have long adopted this mentality where results come before ego. We do not need to debate things or fight who is right when we can see the results of people’s actions and, therefore, know what is to be done next.

What we are seeing nowadays is this great divide between those who recognize the call for further embracing what Bitcoin is offering and the ones who are doing everything in their power to protect against the impending changes that are already taking place in the world.

This division essentially entails the rift between dominance and competence. People are no longer looking at who has more horses but who can guide and handle them more virtuously and skillfully. Domination is simply unsustainable, as the dominated will always find a way to get back at their subjugators. On the other hand, competence hierarchies entail ingenuity and innovation that rest on an entirely different idea, which is what Bitcoin exudes as well.

The top-down approach is a thing of the past in so many ways. As Steve Jobs said, “Do you know how many committees we have at Apple? Zero. We are organized like a startup. We all meet for three hours once a week and we talk about everything we’re doing […] You have to be run by ideas, not by hierarchy.” And, the same applies to larger systems – politics, and money.

When we look at markets, we understand their important role in disseminating knowledge. Still, knowledge has a localized quality to it, meaning that people living in one area would naturally be more informed about economic circumstances specific to their space-time reality. Free markets, however, are exceptionally good at both assimilating and spreading the localized pools of data. As a nexus, free markets merge many minds into one through the mechanism of price.

The omnipotence of digital technology rests in its power to allow fluid exchange that dissolves these dominance hierarchies and rewards competence, which precisely what Bitcoin is about.

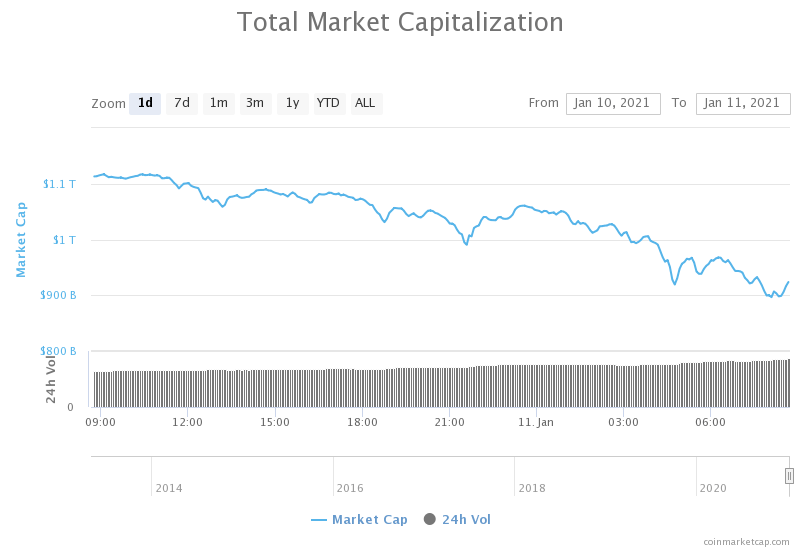

7. Bitcoin’s price as the ultimate truth

In the words of Ray Dalio, truth or more precisely an accurate understanding of reality is the essential foundation for any good outcome. This means that we need what he termed radical truth to create a world free of centralized dominance. In other words, free markets equal truthful price signals, which we will further explain down below.

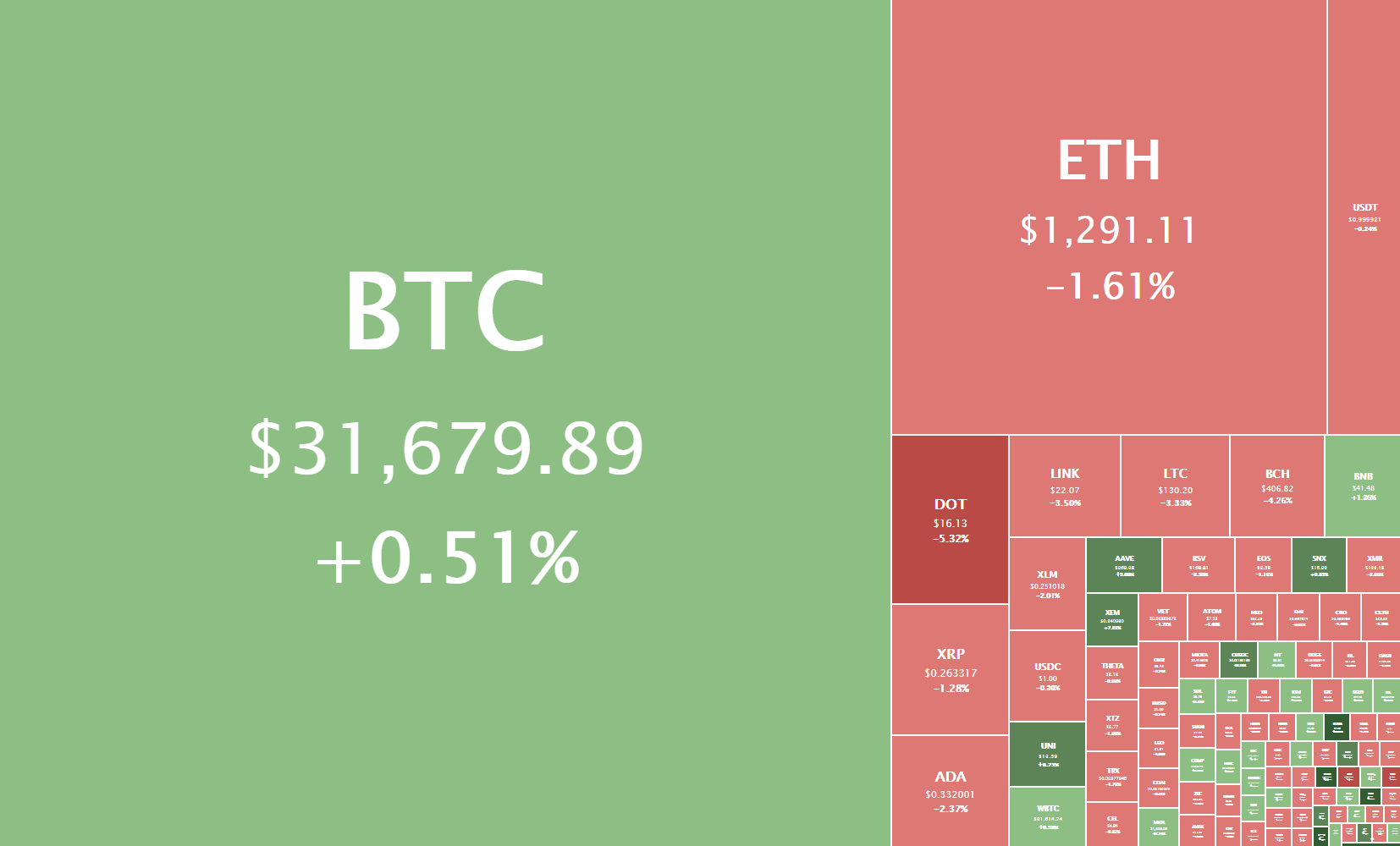

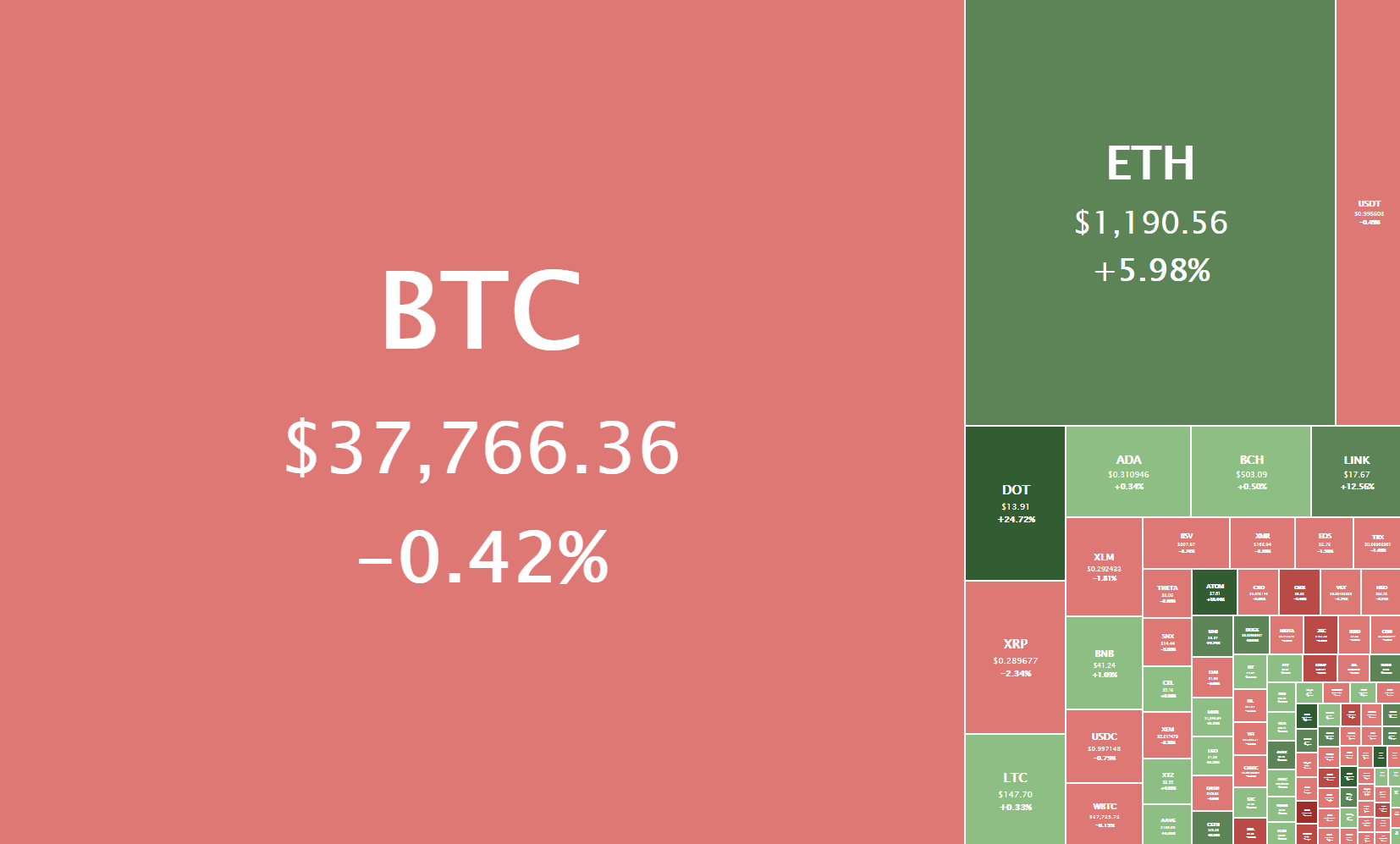

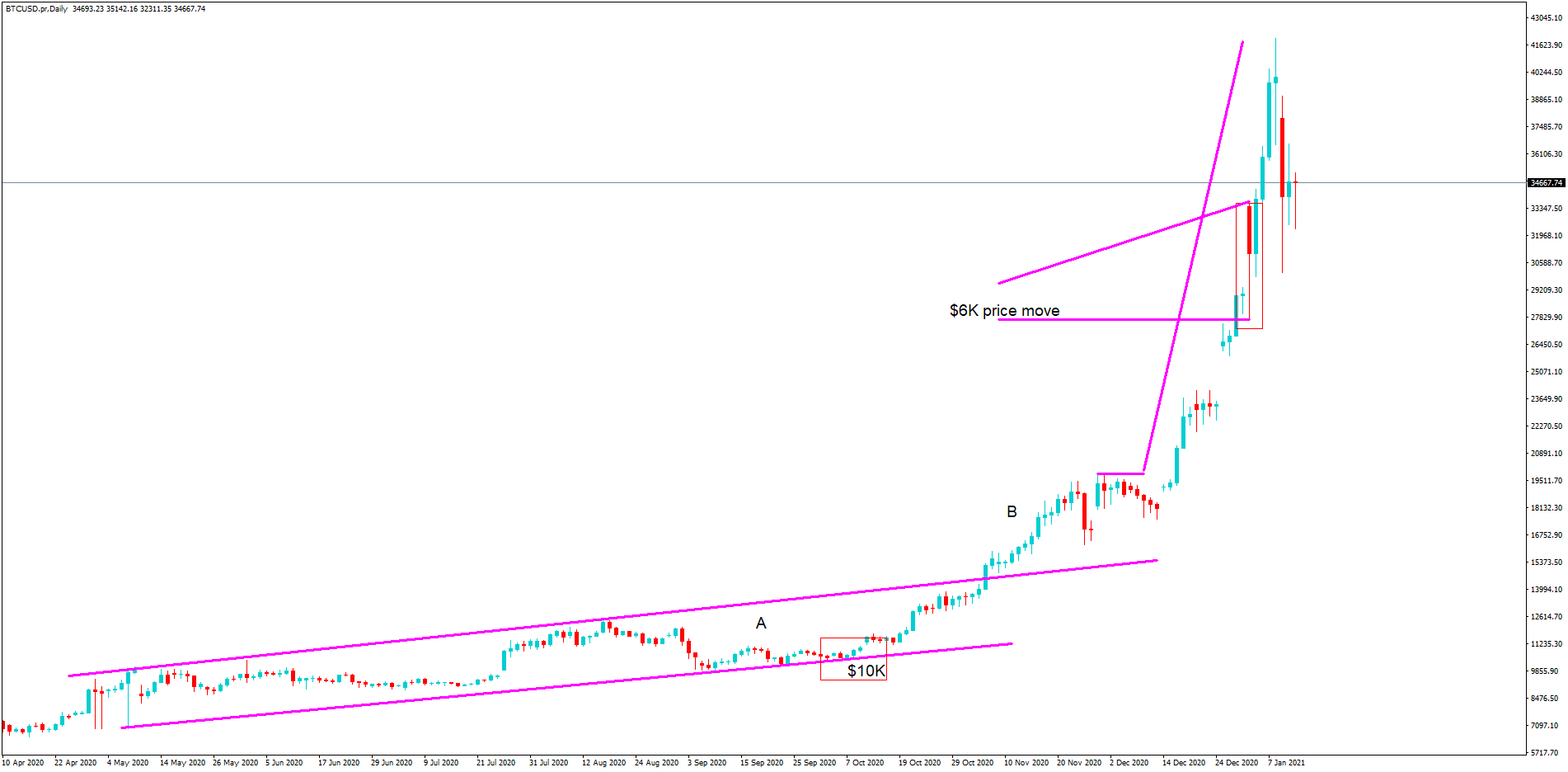

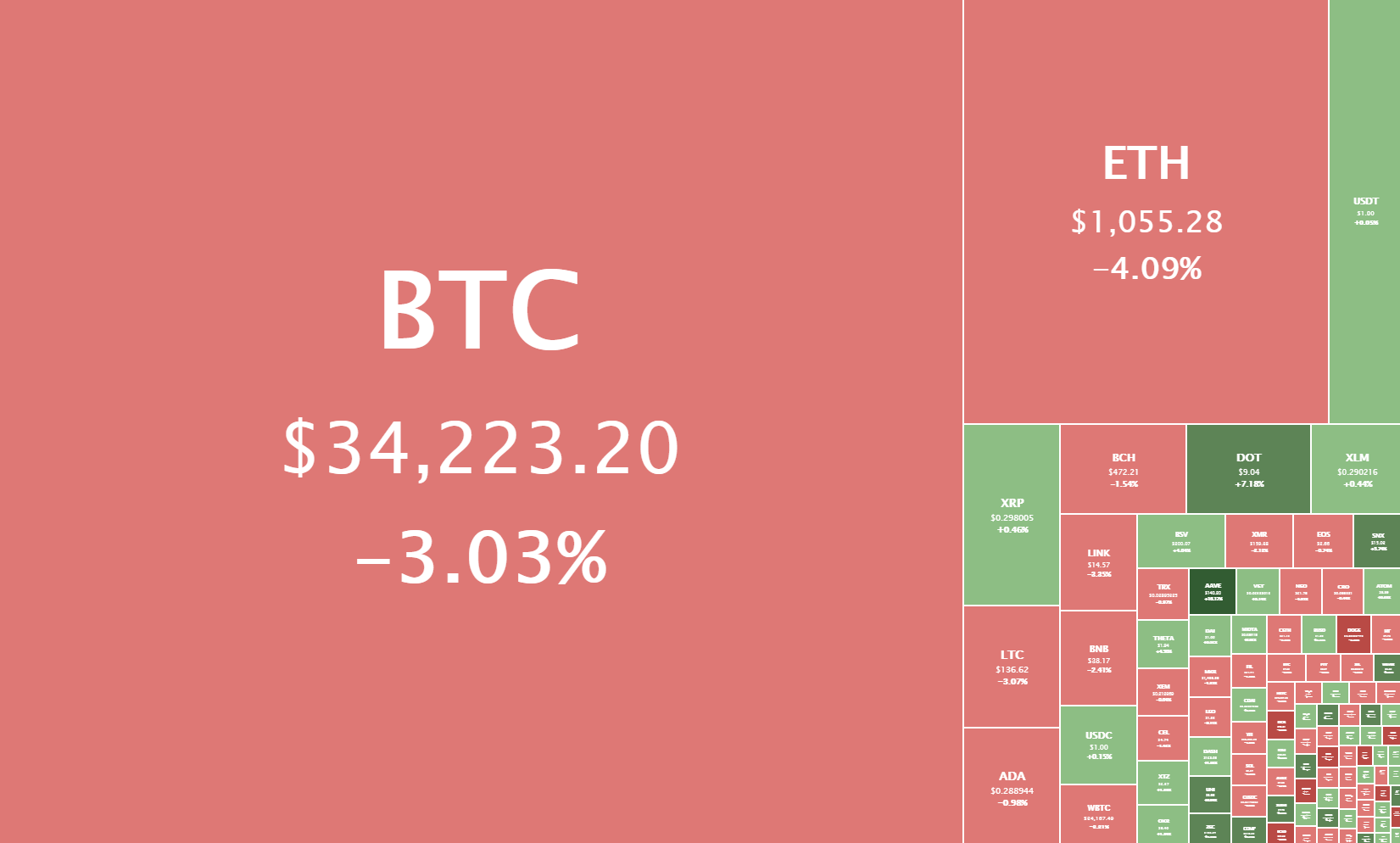

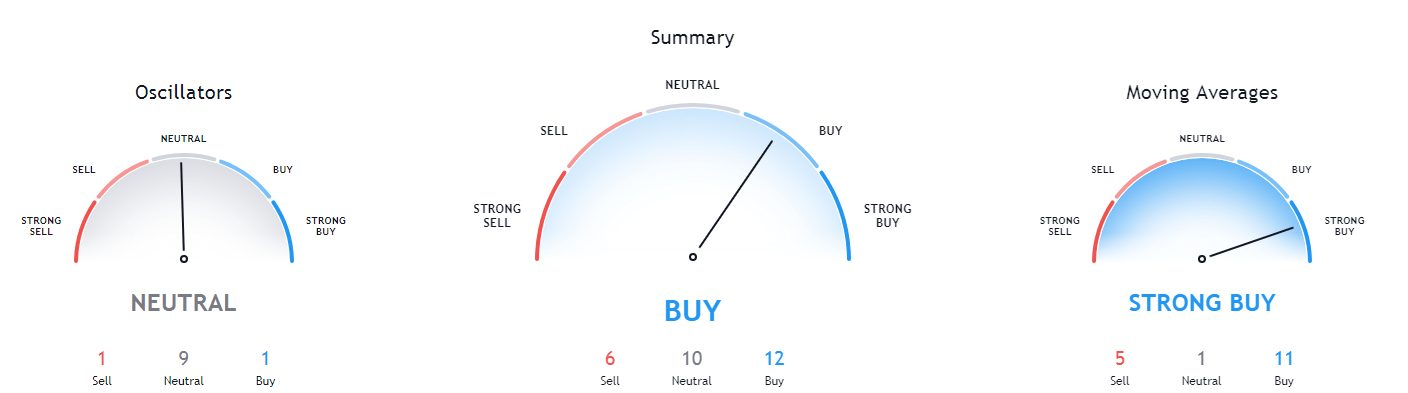

When we think of markets, we think of the price as truth that connects supply and demand. That way, prices are like data packets that convey information about scarcity and value. Therefore, each decision to buy or sell is based on prevailing prices that affect other market participants and thus continues the market exchange.

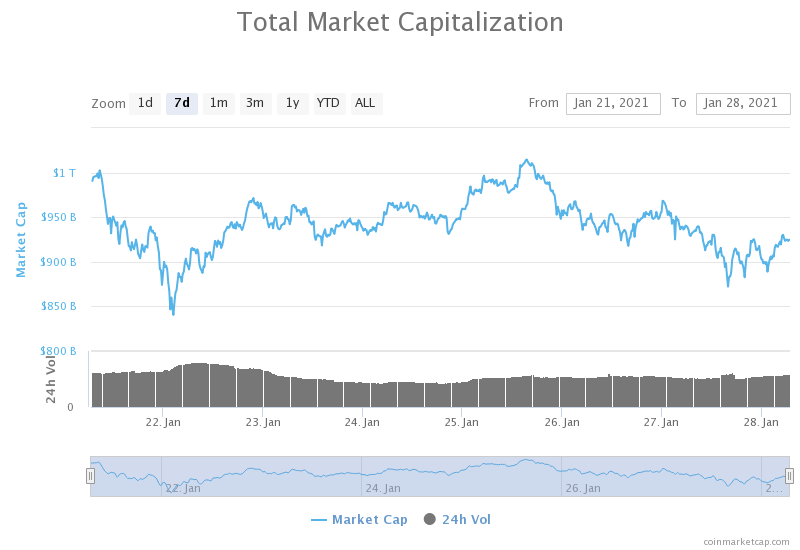

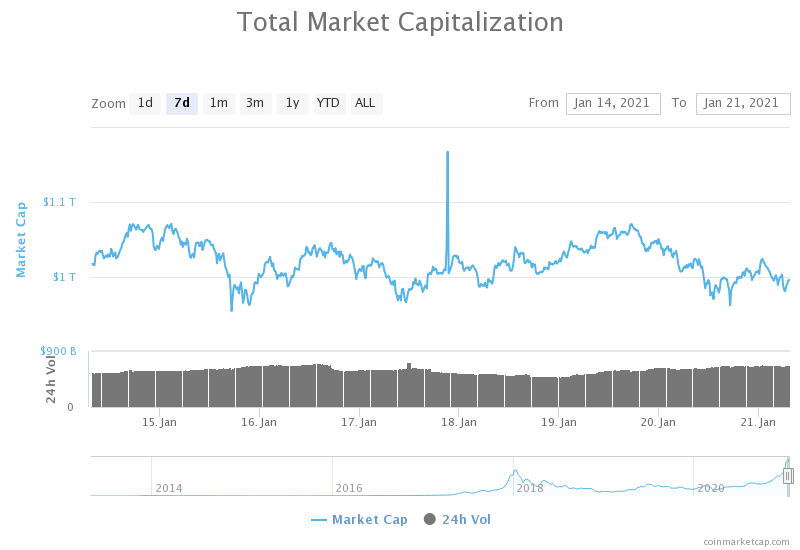

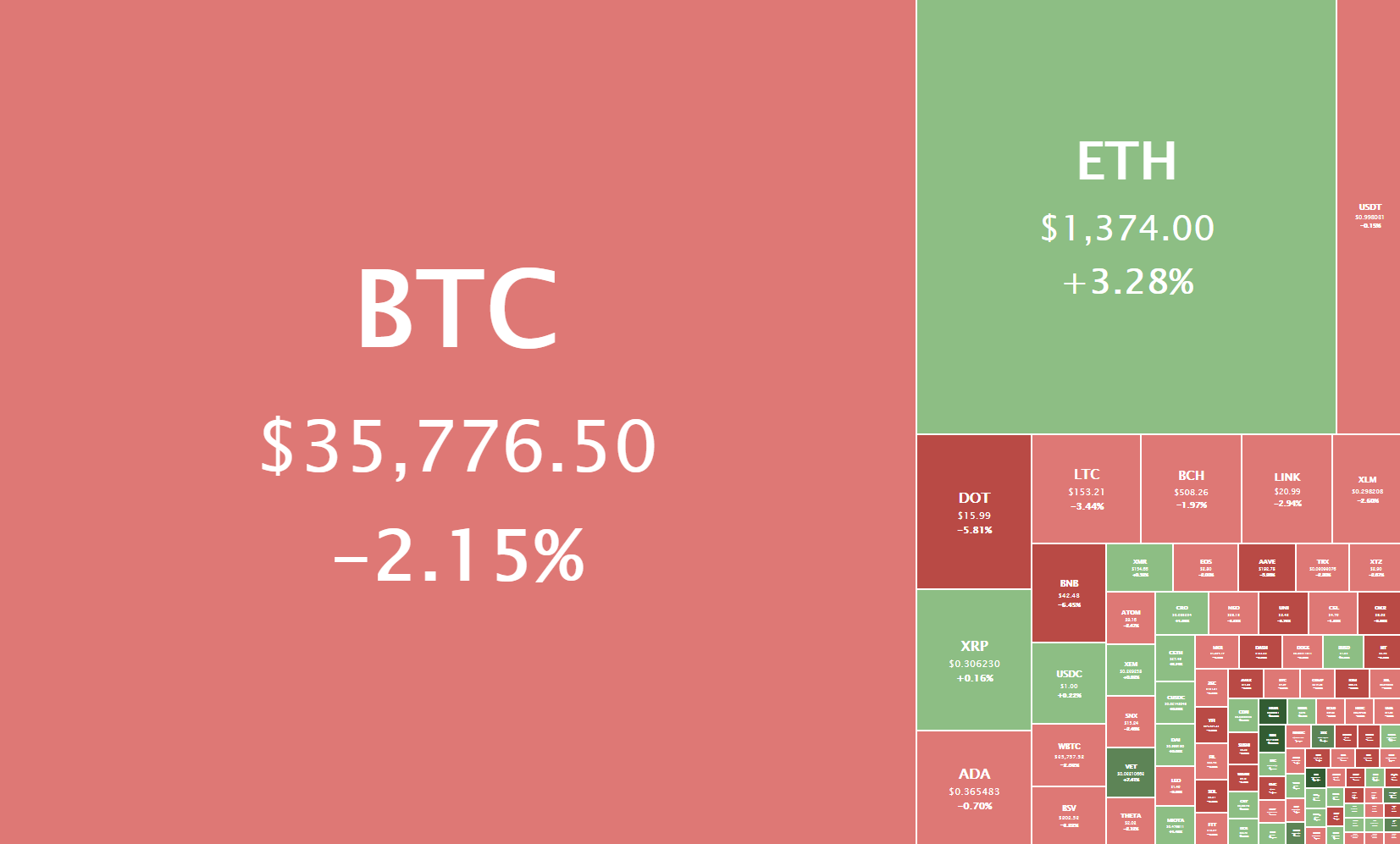

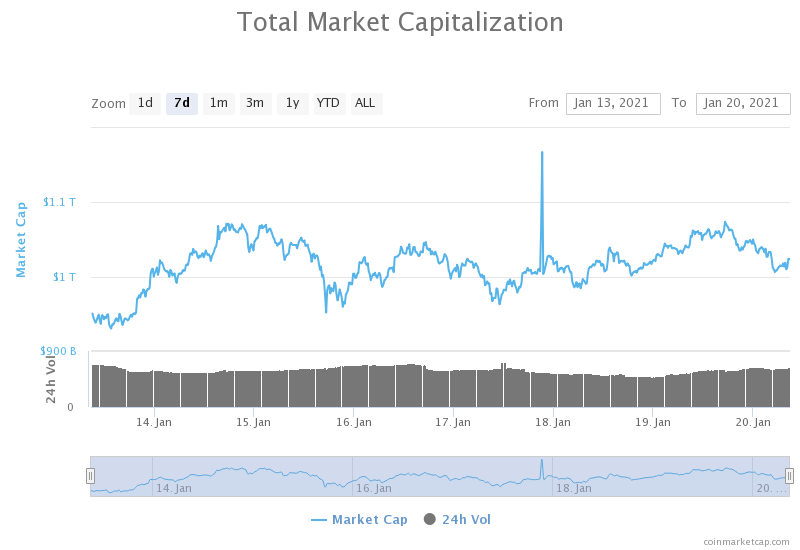

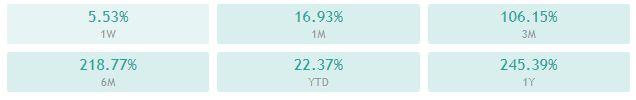

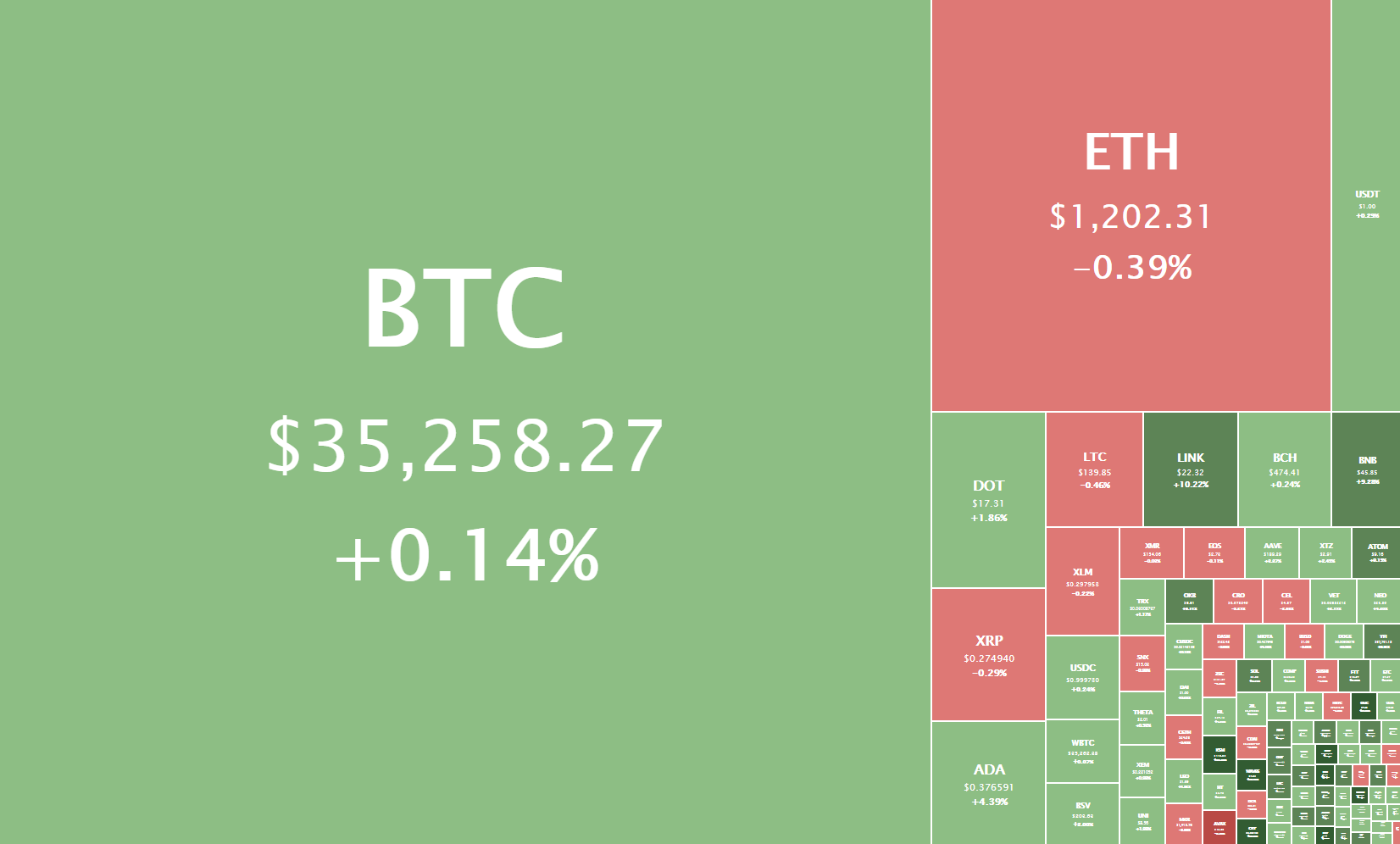

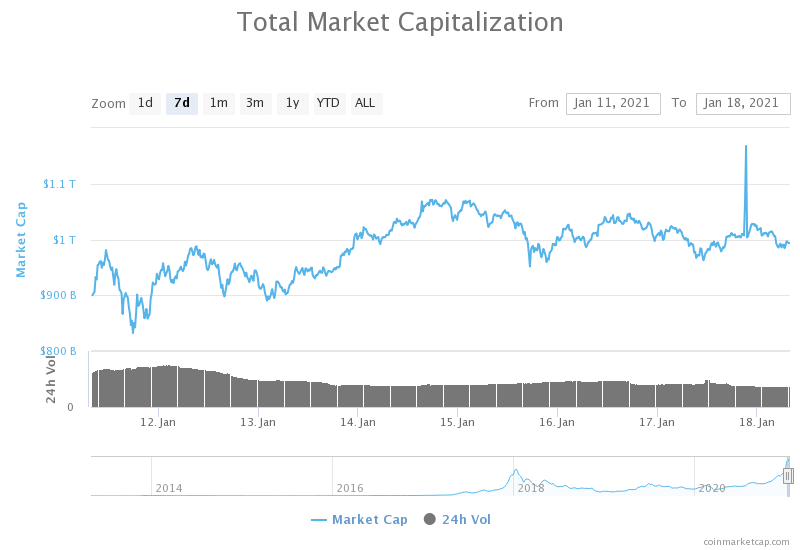

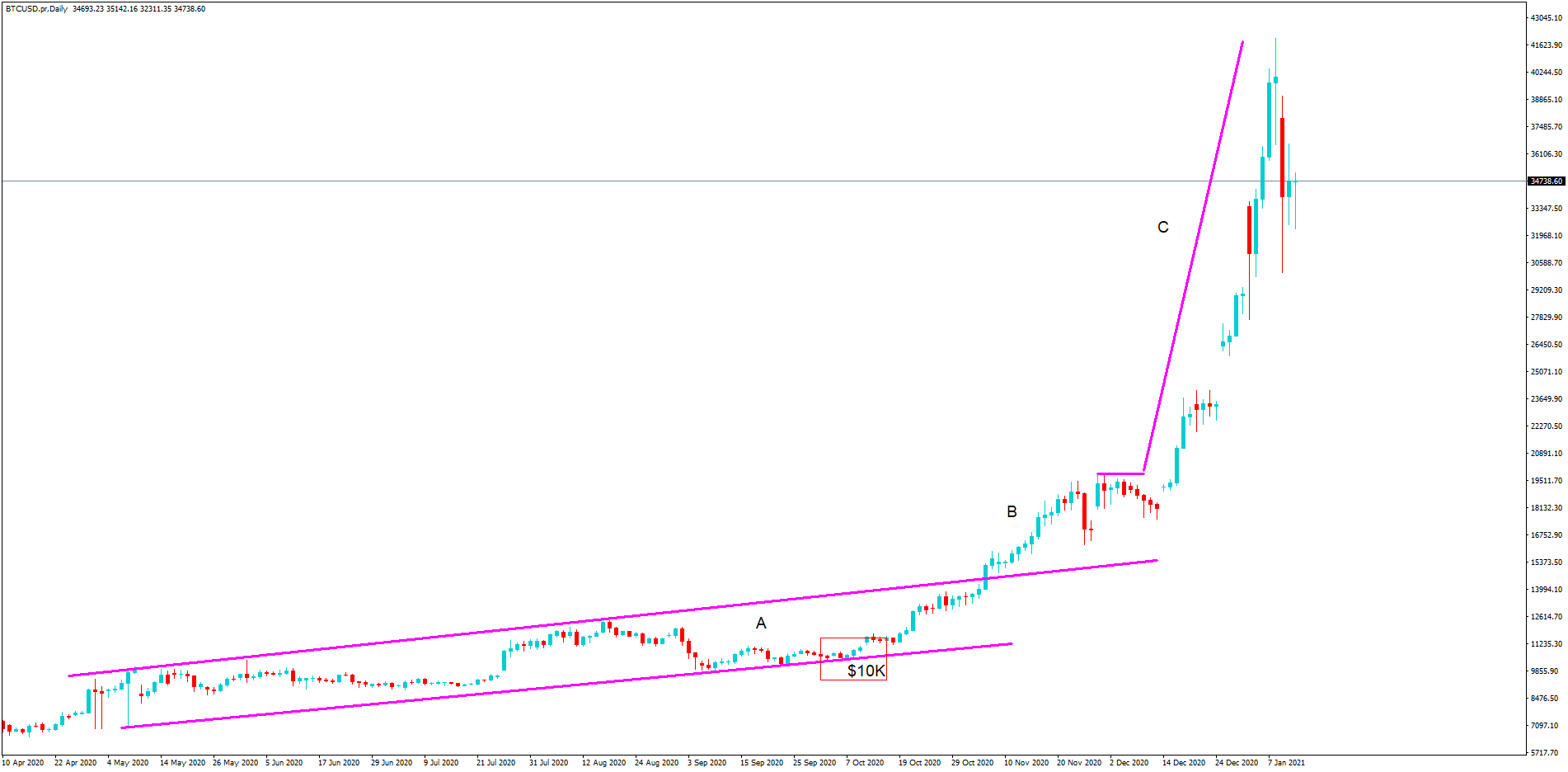

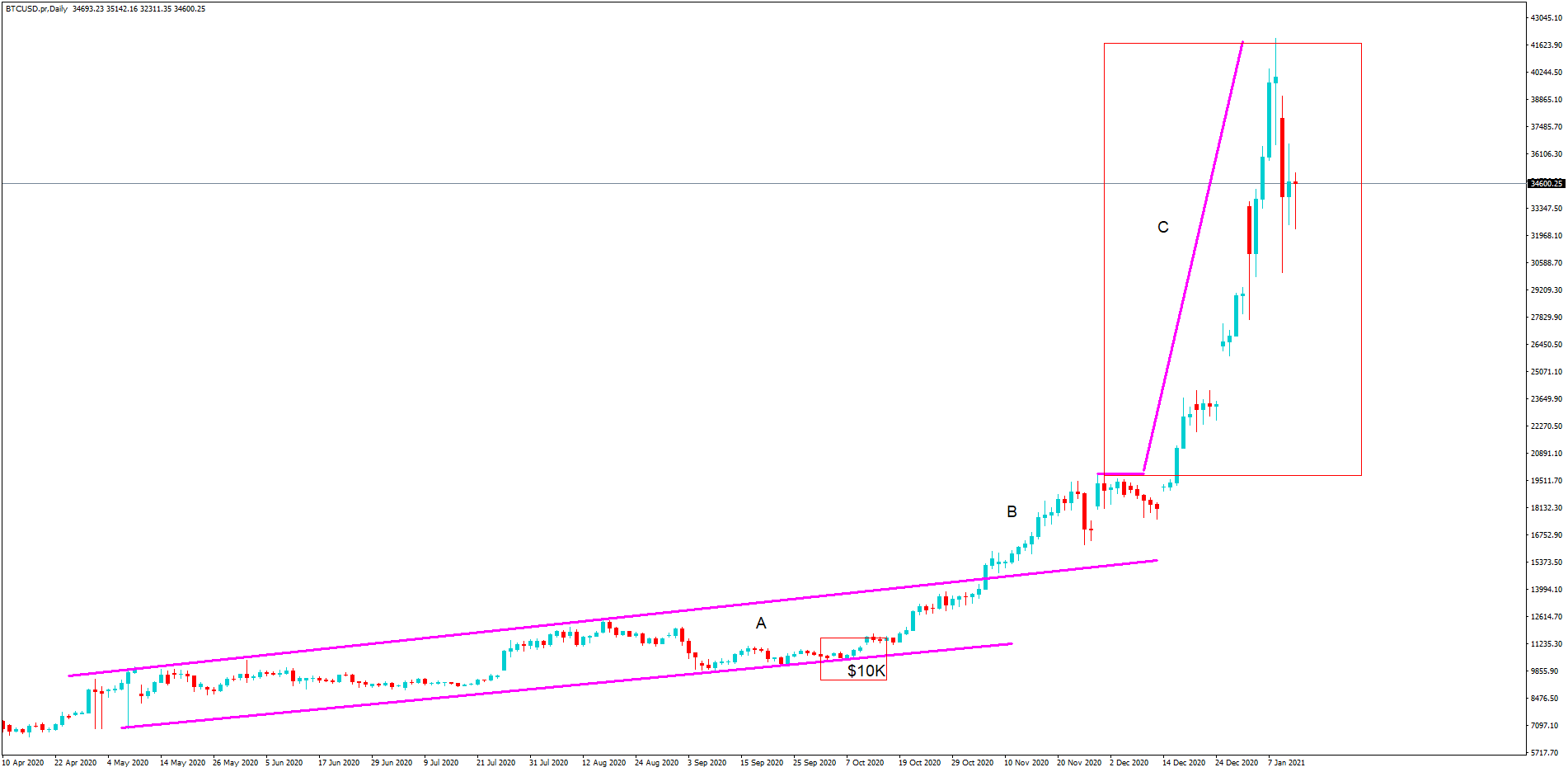

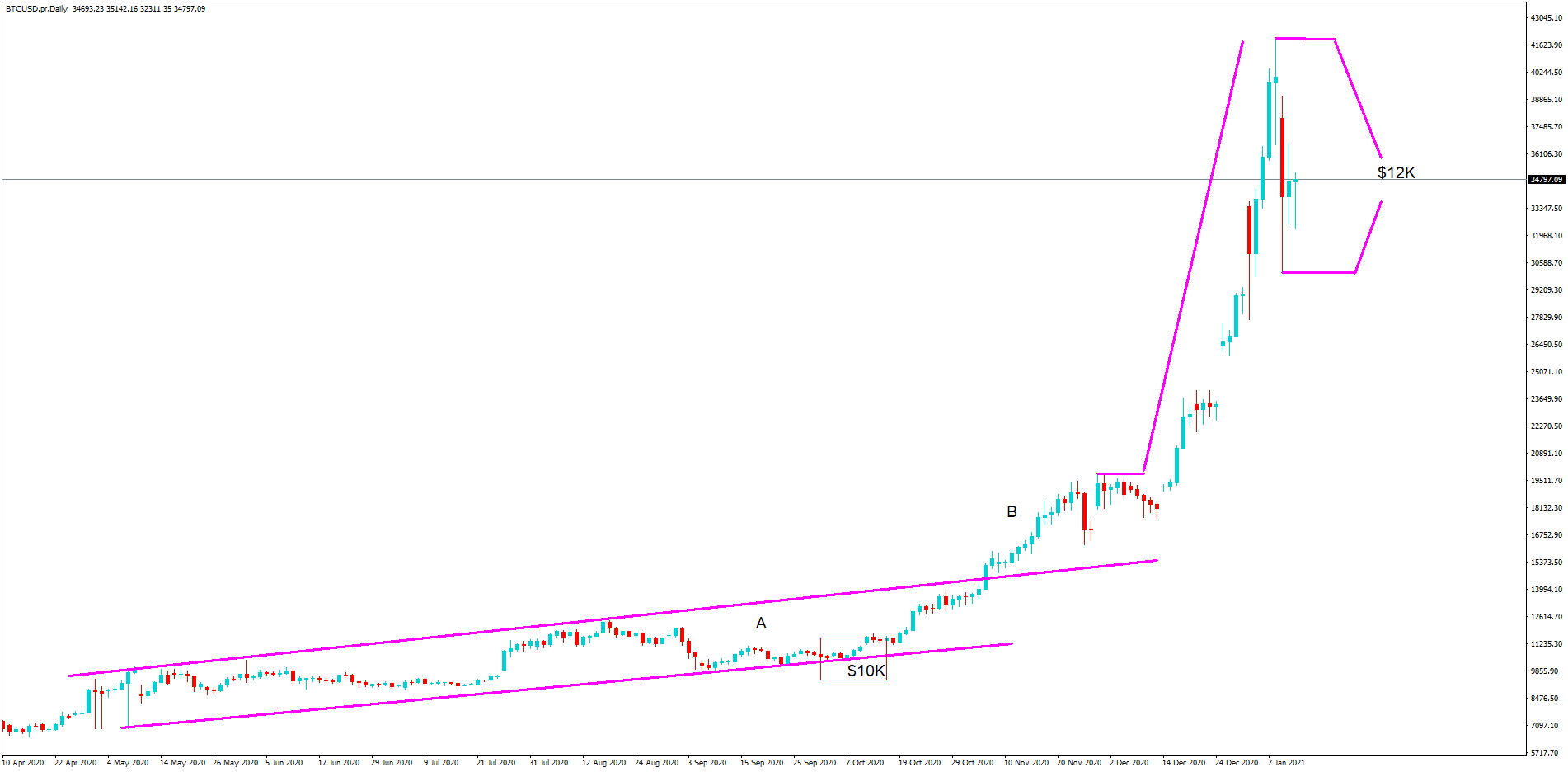

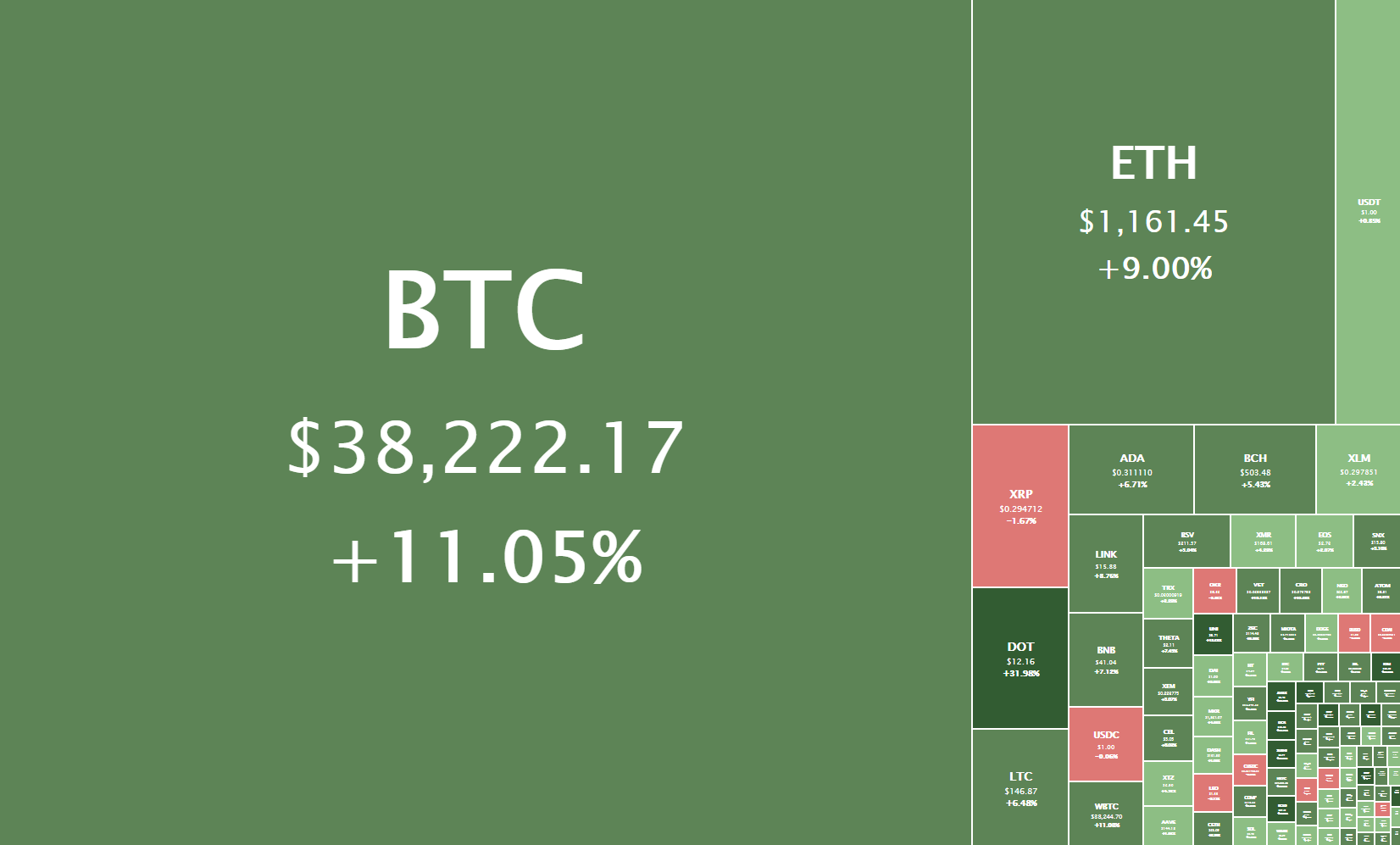

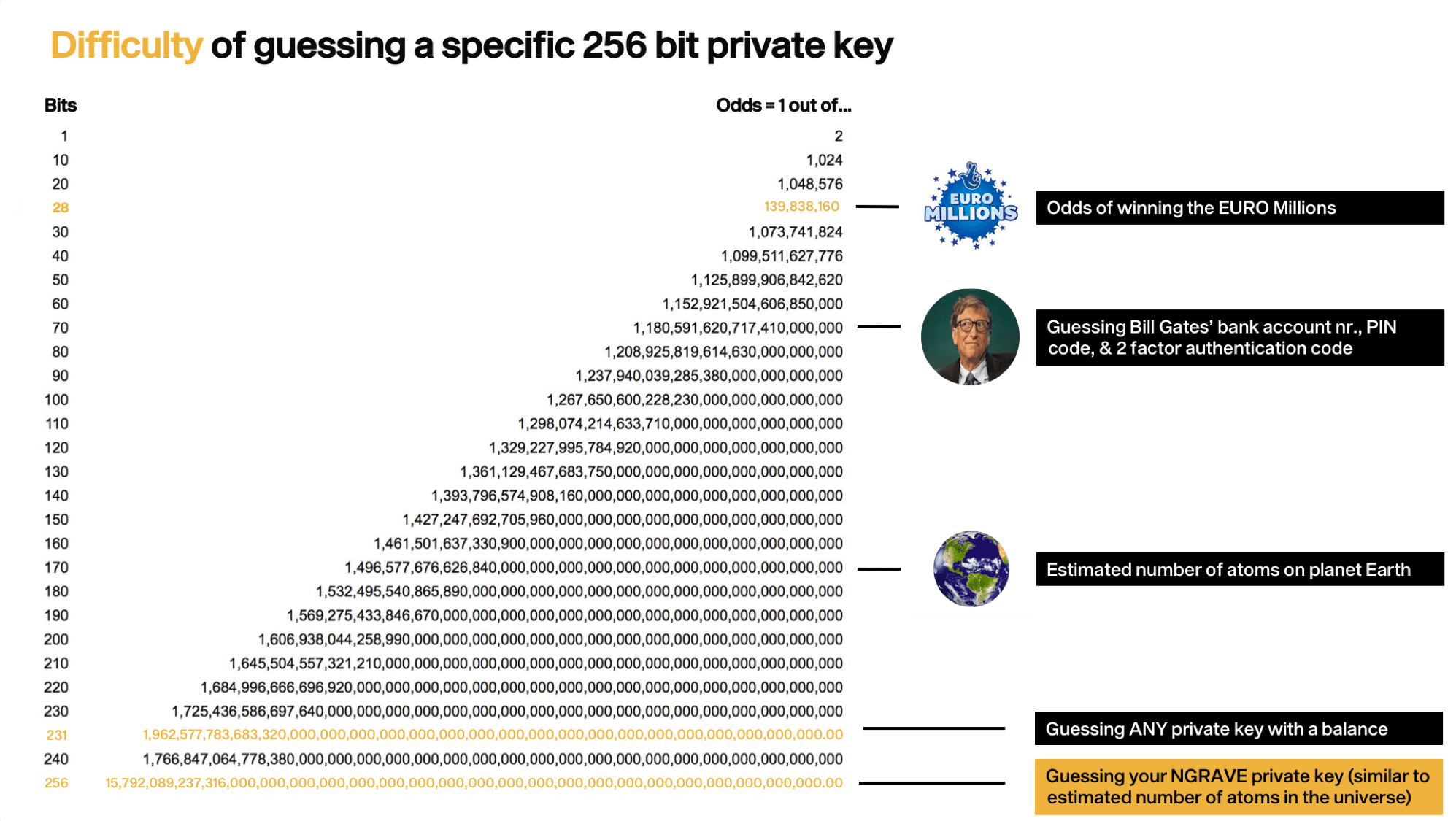

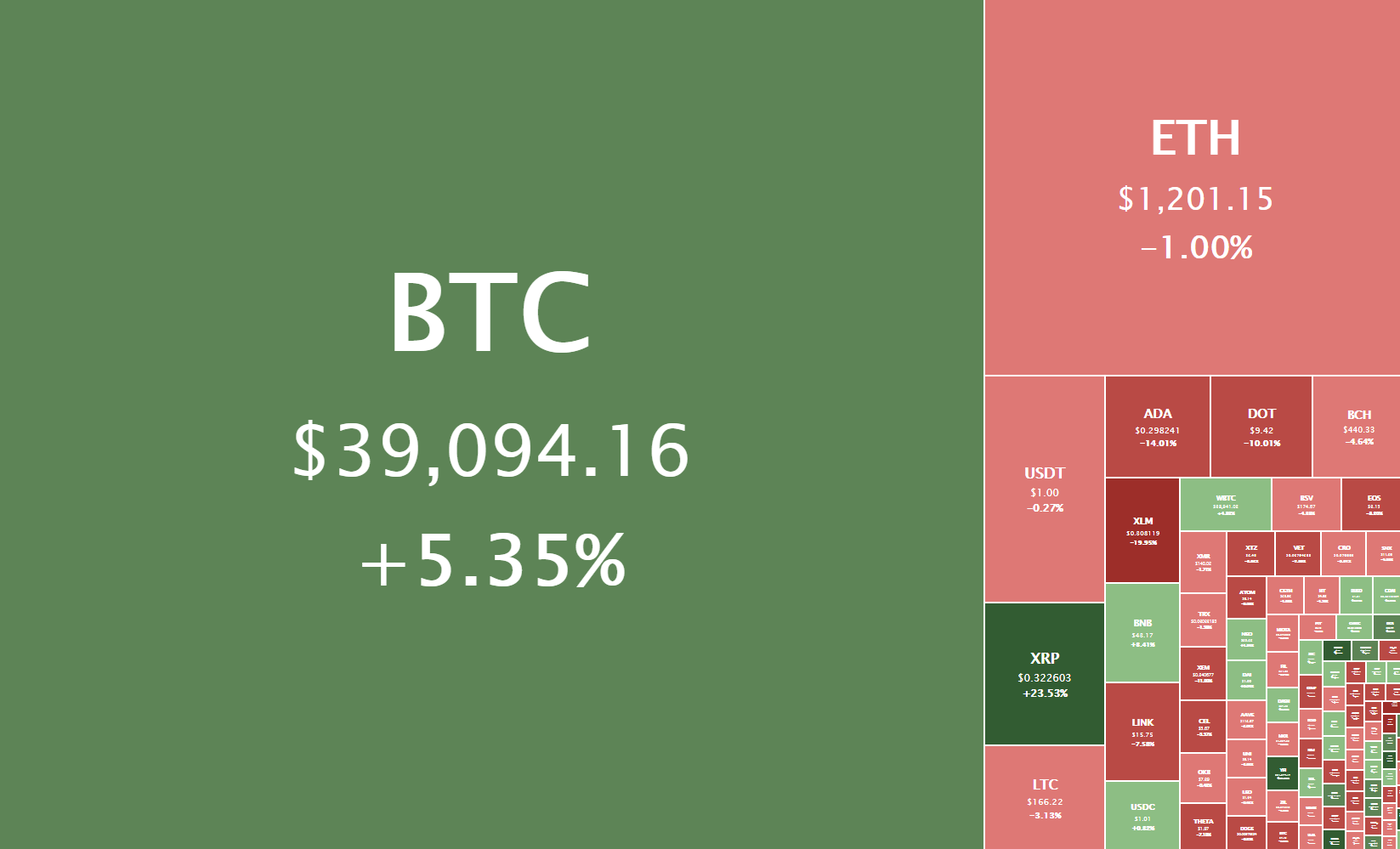

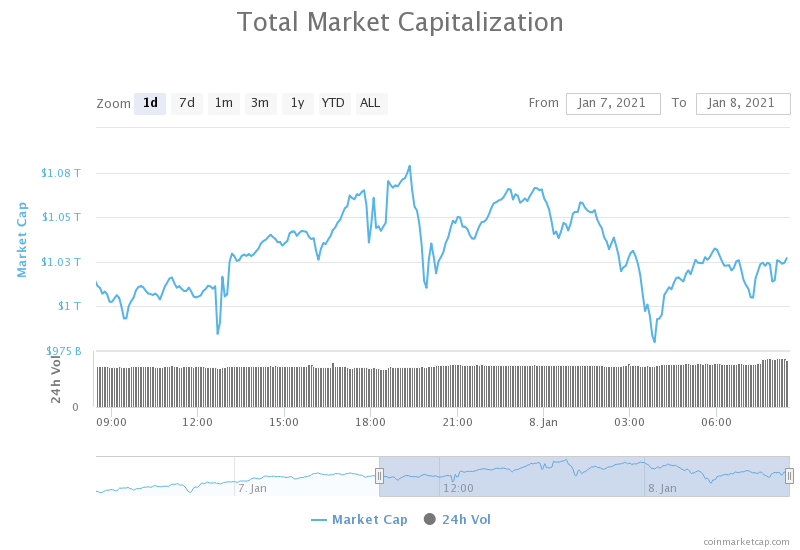

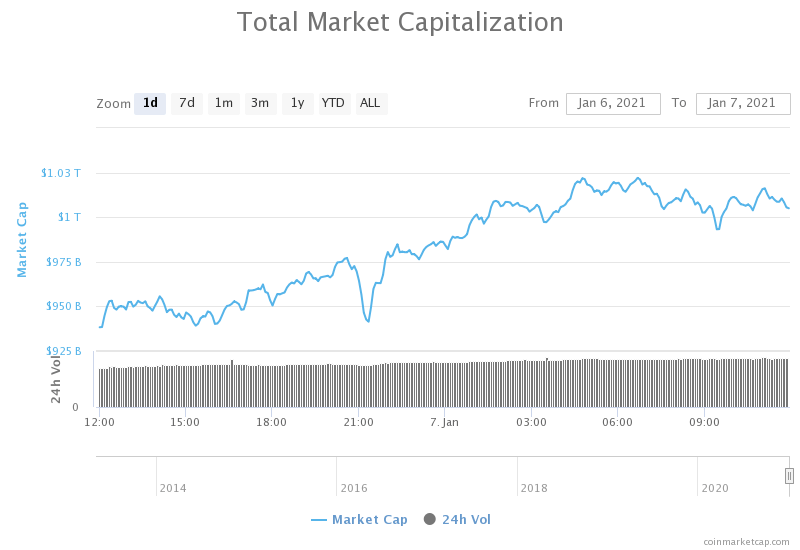

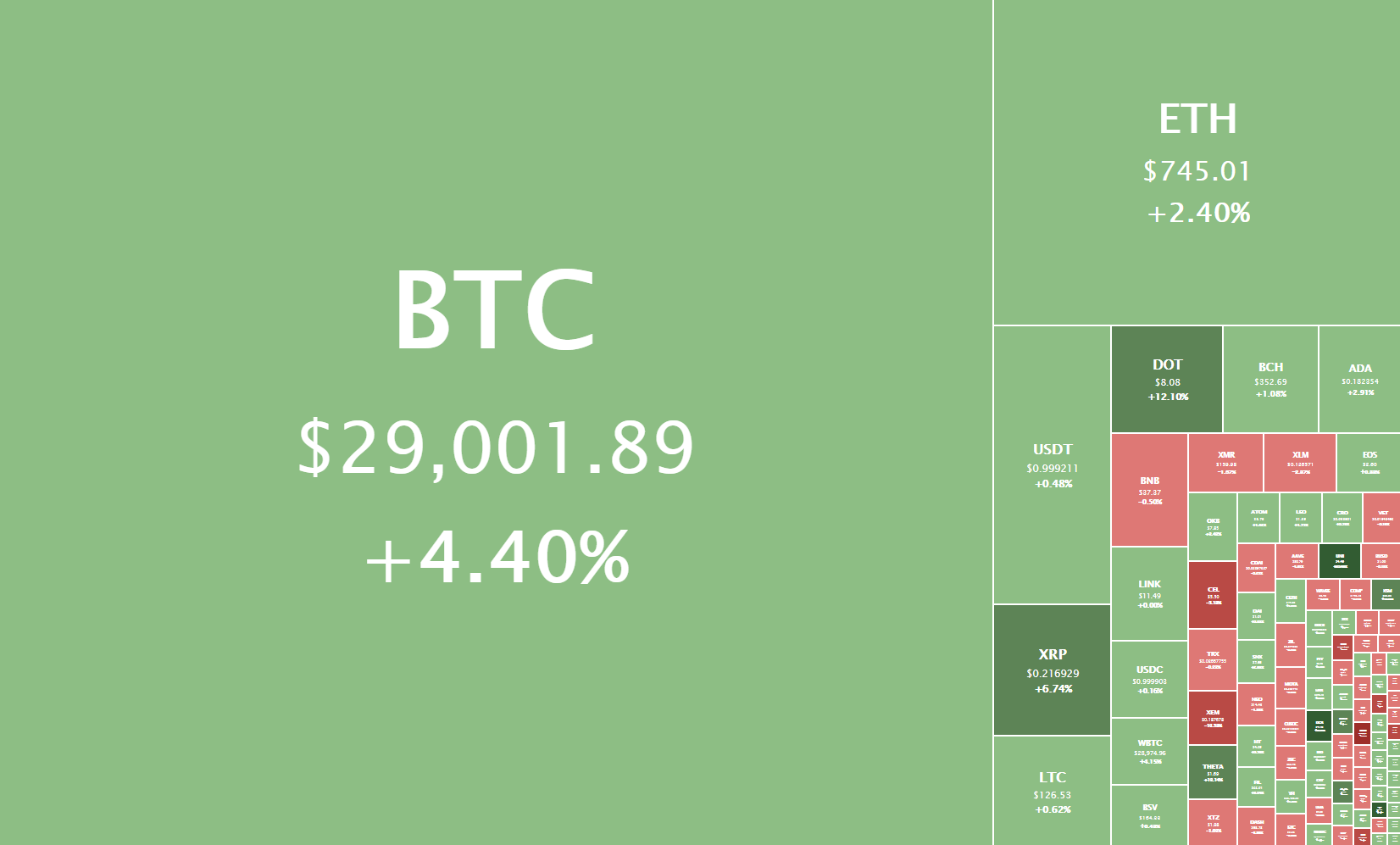

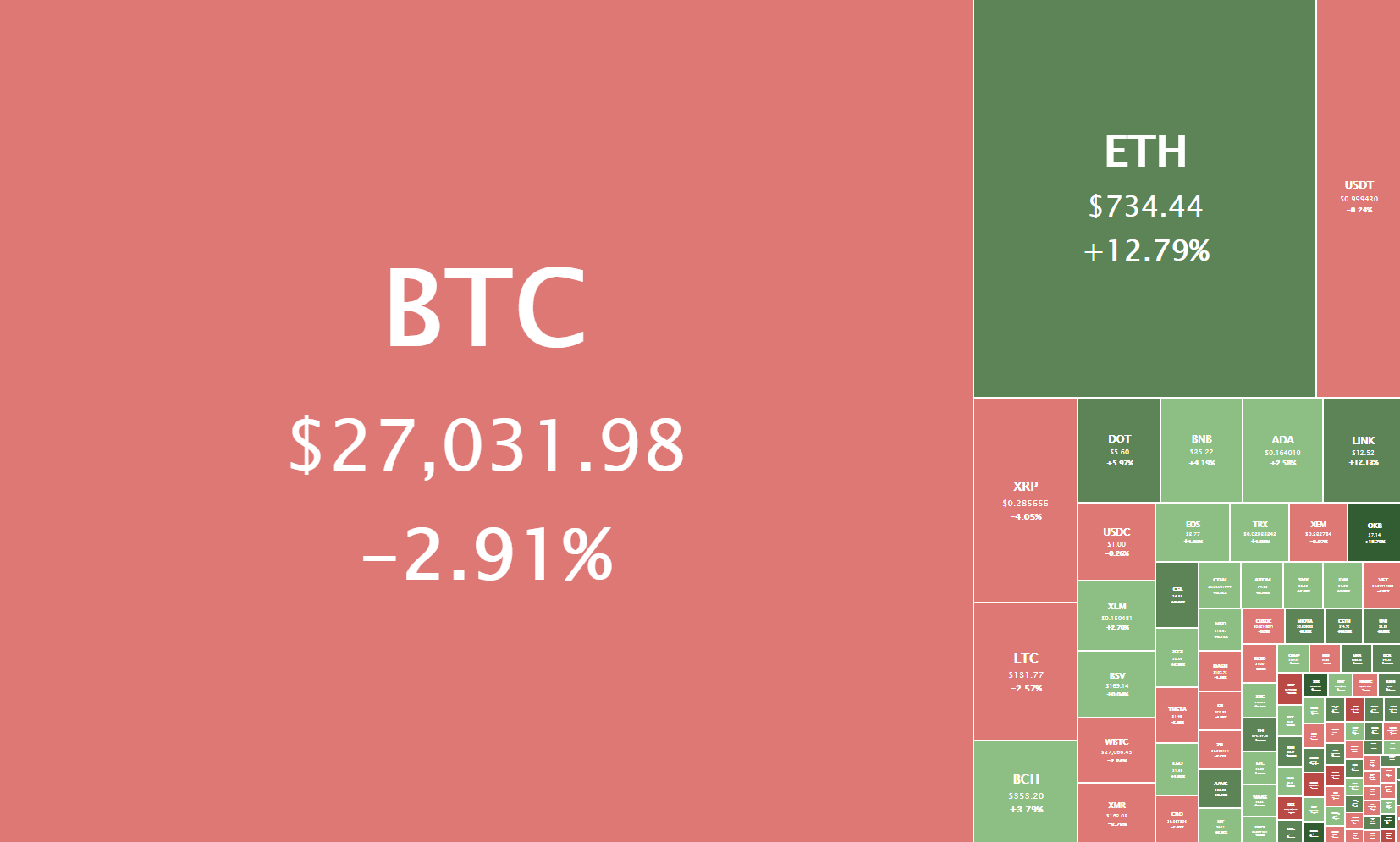

The supply and demand comprise the foundation of Bitcoin and the price rests on the juncture between subjectivity and objectivity. For example, we know that 1800 out of the total 21 million coins that will ever be created are being created as you are reading this. However, how many people will actually want the 21 million falls in the field of subjectivity. This is the point between truth and perceived truth.

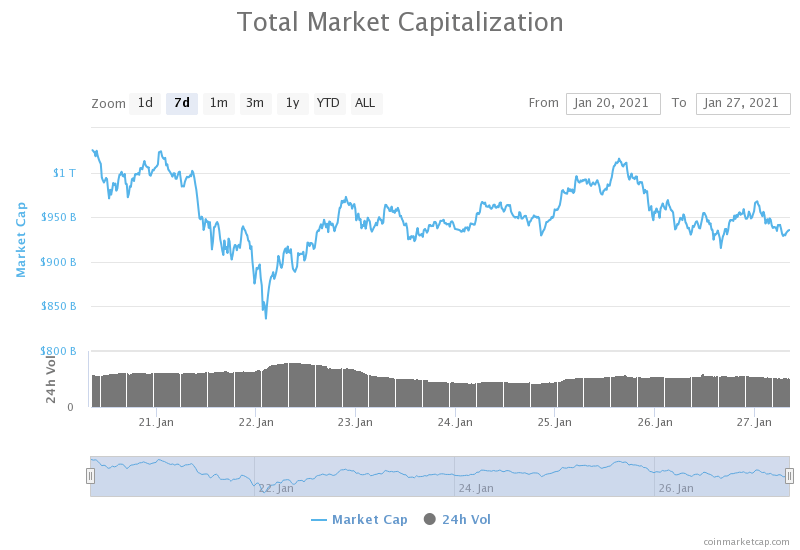

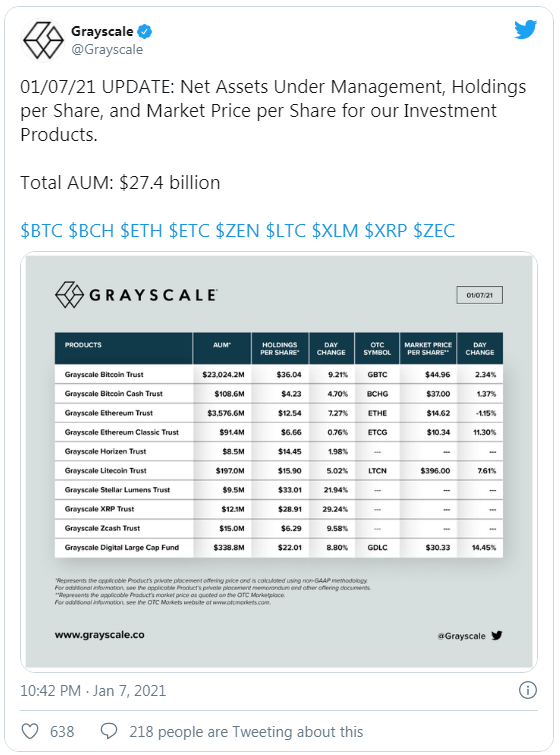

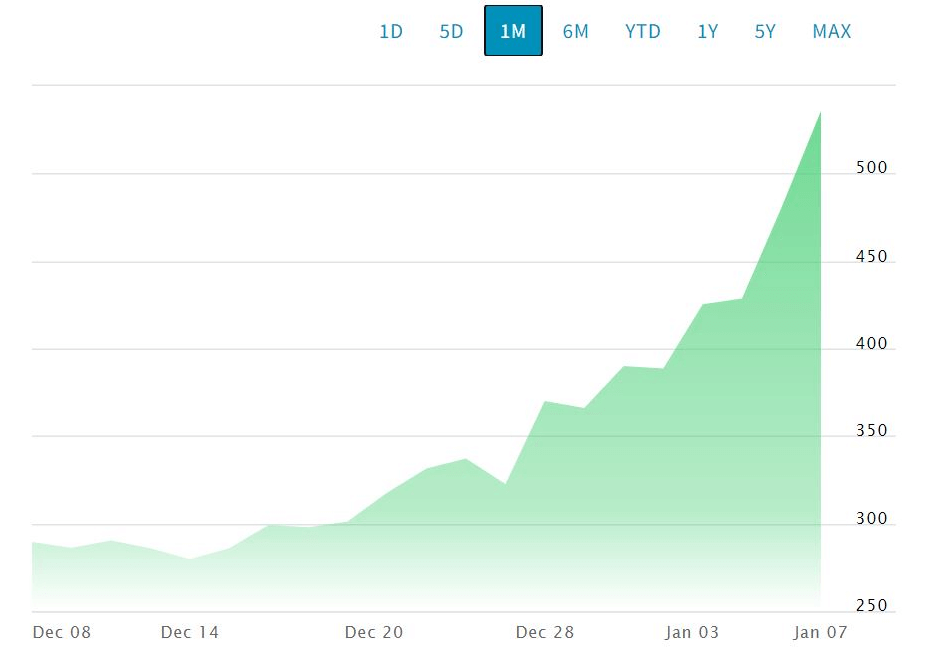

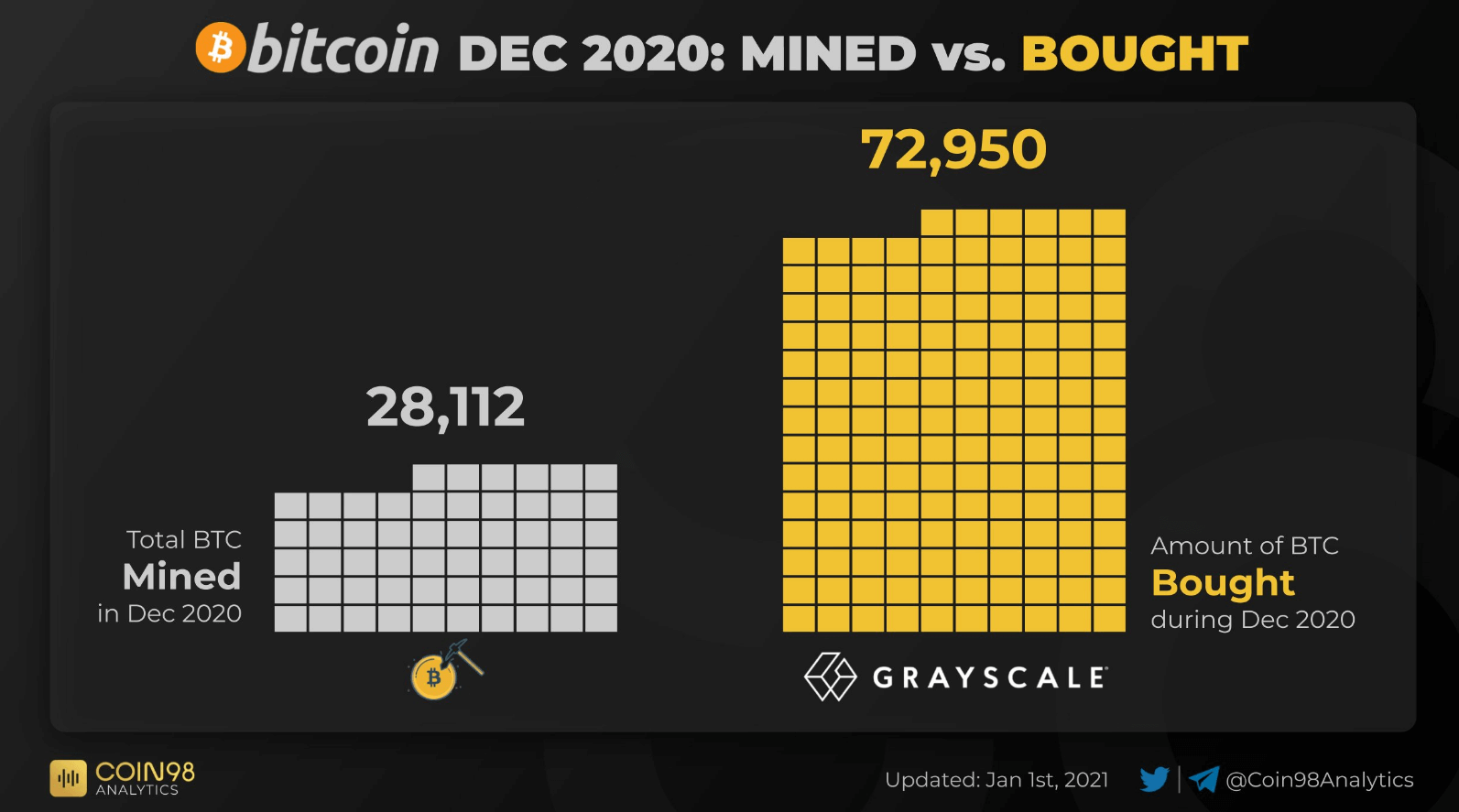

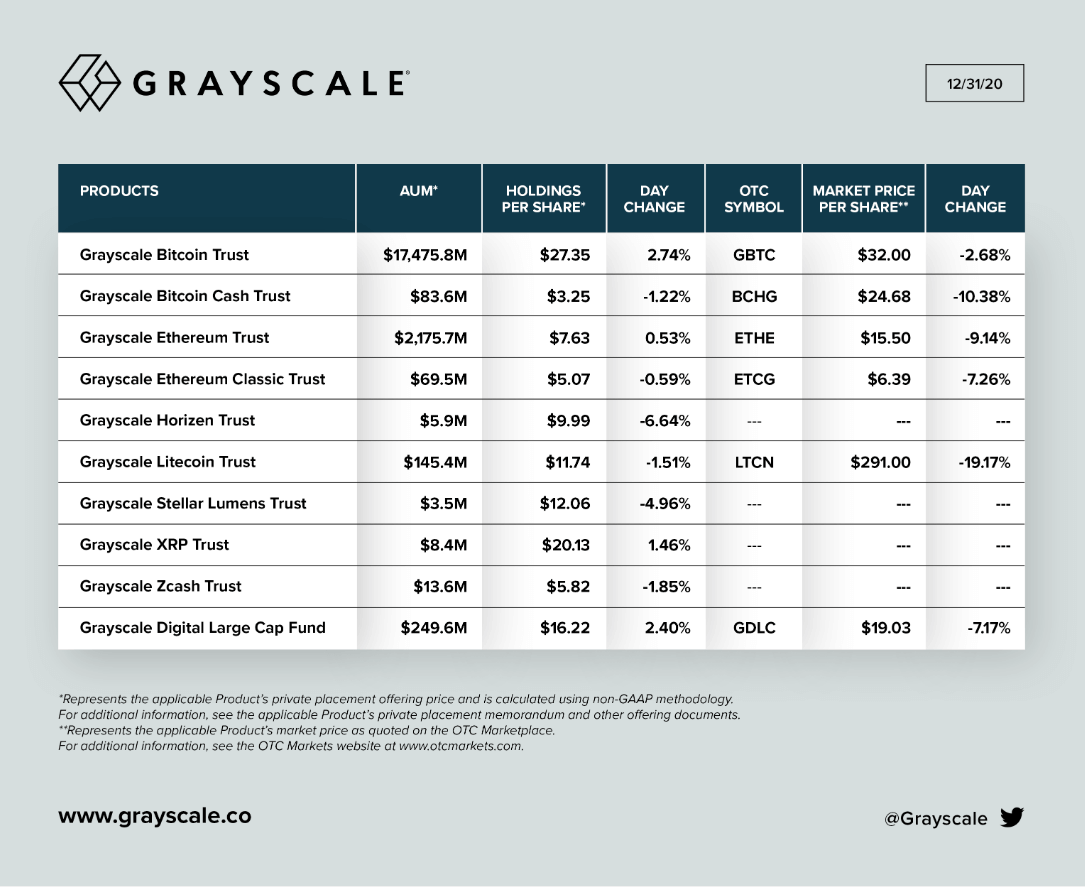

Large companies accepted Bitcoin as a treasury reserve and the resulting Bitcoin feedback loop essentially proves how scarcity drives the demand for money. Price signals are the basic truth in the marketplace.

When central banks centralized gold, they broke the truthfulness of money and corrupted the money issuance system. Today, we are witnessing excessive money printing which is slowly turning value into worthlessness. This is an example of a decision that pushed people towards free markets (and hence Bitcoin) and hard money.

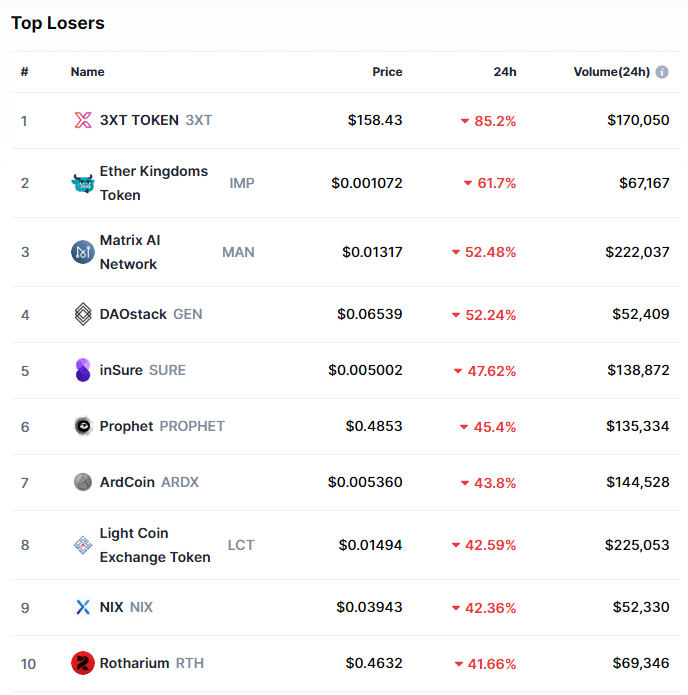

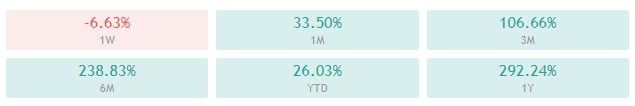

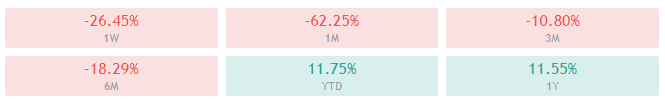

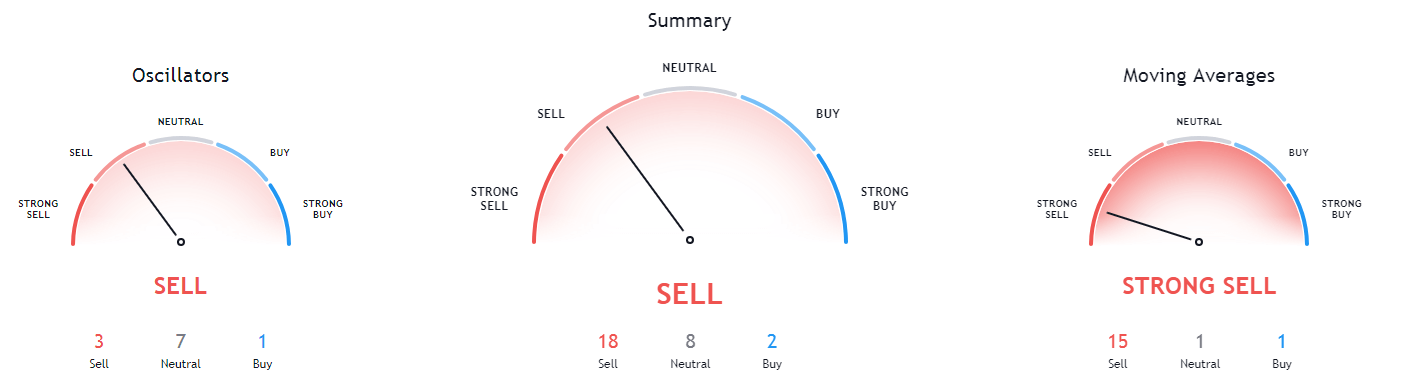

From the perspective of history, every currency ever created failed due to their debasement or devaluing. The very first currency and the more recent ones were wiped off the map due to hyperinflation, which central banks hope to fight against through more printing. Still, every fiat currency losses value with time. Look at the GBP, one of the eight major world currencies, which lost 99% of its original value.

As Charles Holt Carroll said, Inflation is the surest way to fertilize the rich man’s field with the sweat of the poor man’s brow. Inflation also twists fiat currencies’ price signals, causing entrepreneurs to overborrow, poorly manage their capital, and overleverage.

Inflation corrupts the data packets on value and scarcity that we call price signals. When millions starved to death in Soviet Russia, they were merely casualties of economic decisions and price-fixing. These are the consequences of centrally planned money.

The FED forecasts have been publicly shamed for inaccuracy while we already know how much Bitcoin is produced today and every day forever. When we look at price signals, fiat currencies are vague, as we don’t know if a price is true or affected by inflation. Bitcoin, however, is a pure signal and has zero unexpected inflation forever.

With a fixed supply, Bitcoin will restore the trust in price signals that crucial for capital, risk, and business management across space and time. Like gold was, Bitcoin is free-market money and an uncorrupted, universal system of measurement.

So now, everyone in the lower tiers of the pyramid structure is opening towards really understating how the rich get richer while the poor get poorer. We are finally seeing the light at the end of the tunnel, a way to complete this cycle and finish this rat race once and for all.

Will centralized planning disappear? Probably never entirely. Nonetheless, at least we have the option that we haven’t had in a very long time. The only thing it takes is education, which may last between 1 and 3 hundred hours. No centralized power will ever invest in teaching their subjects about the way out.

So, it is on you to free yourself from the matrix. The resources are available.

8. Bitcoin is transparent

During Donald Trump’s presidency, we could see his tweets directed at the Federal Reserve. While nobody wants the president to openly criticize the central bank, this event did reflect even more the divide that exists in the US. The reasons for publicly displaying his thoughts may be diverse, but some things stated in this written exchange are still true.

Who makes decisions regarding money? How many dollars are there in circulation? How many more will be printed in the future? What criteria support these actions? And, who profits from the production of money? Much information is still hidden under the veil.

Last time, we discussed how fiat currencies are vague, but where does this opacity stem from? We know that central banks’ responsibilities include managing economies, and managing money is one side of it, not a sole function per se. Additionally, it seems that everything is politicized nowadays (hence the Twitter correspondence) although even the Federal Reserve, that is central banking in general, isn’t meant to be politically involved.

There is much that is simply out of alignment at the moment and this rift is the wound Bitcoin is designed to heal.

Earlier in this series, we explained why Bitcoin is a free market. We are leveling up now.

Free markets are essentially based on three pillars:

- Rule of law

- Private property rights

- Hard money

The rule of law allows us to resolve disputes in a non-violent manner; private property rights establish clear boundaries between people and assets; and, the last pillar represents free-market money and true price signals.

This three-layered system leaves room for enterers to take part in the market, obtain capital, and invest with their knowledge and experience back into the society through trading.

When we mentioned central banks’ role above, we intended to highlight the need for giving clear instructions for processes. No sportsperson would keep competing in a game where rules are hidden or constantly changed to the liking of the club board or organizers.

We are facing similar challenges at present because centrally planned money is safe only on the surface. The problem with today’s currencies, including the world reserve USD, is that the rules governing them are so opaque, which is why the questions we asked earlier remain unanswered.

While the US movies keep glorifying the American dream, the Americans are still unaware that the USD is just an SQL database kept confidential at the FED without them showing intention to disclose any of the records to audit.

At the same time, more and more market commentators and financial analysts scrutinize central bankers each time a statement is issued, assessing everything from the way they dressed to what they said. The current state of affairs only shows that we are all missing the point.

Central banks should not be in charge of setting the prices in the first place, just like any semi-governmental institution doesn’t dictate a universal price of cars. The market is the only one that should be entrusted with determining prices. How? Prices are generated at the point where supply and demand meet.

Why has the central bank then assumed this responsibility? Well, in the case of the United States, when the FED sets the prices, it essentially sets the interest rate, and the interest rate is their most lucrative export market.

All this is “naturally” carried out in complete secrecy, behind closed doors and away from the public eye, making it the exact opposite of what free market is. In the previous article of this series, we talked about the consequences of any interference with prices that Soviet Russia already experienced. Whenever central banks play with price-fixing, they meddle with free-market dynamics, thus creating surpluses/shortages and further damaging the economy.

The only solution for having a healthy, sustainable, and functioning economy is to establish a system in which everyone will be able to see and understand any pertaining criteria and processes. This approach people will trust, which has long been lost in societies across the world.

So, how is Bitcoin different?

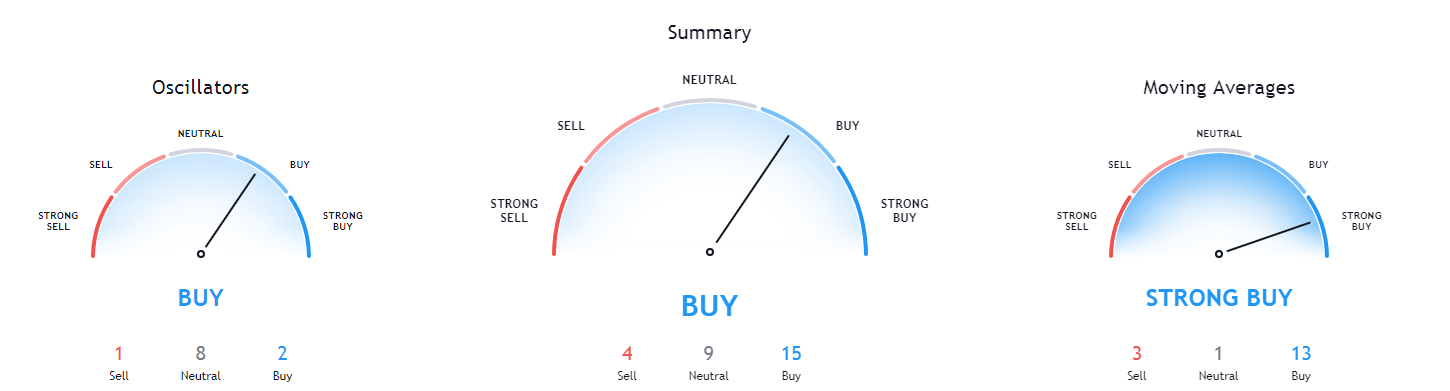

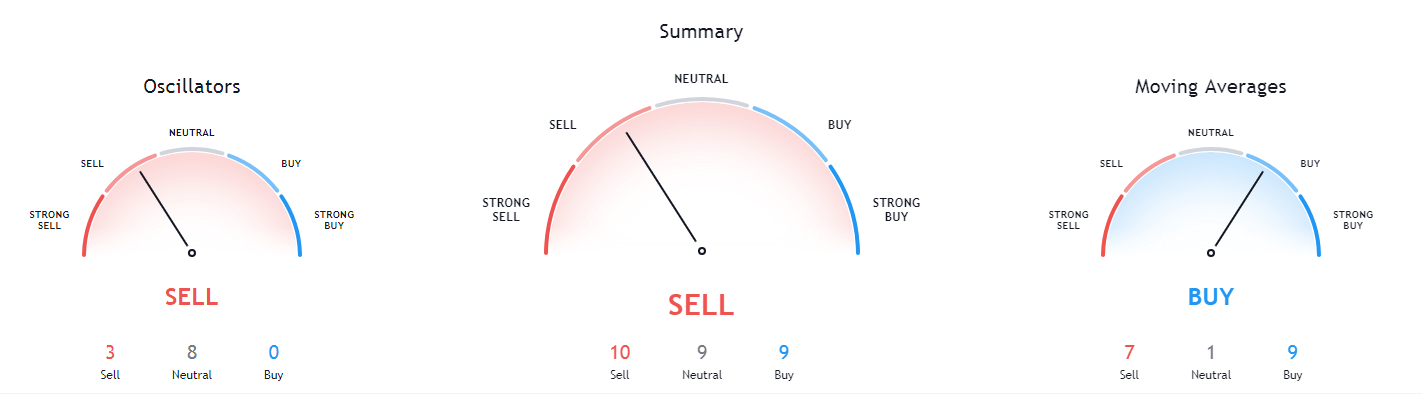

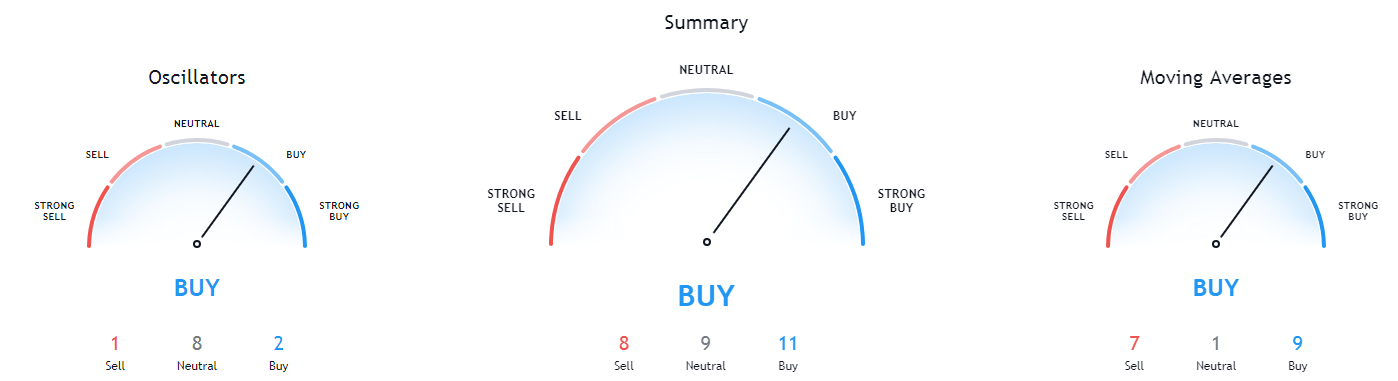

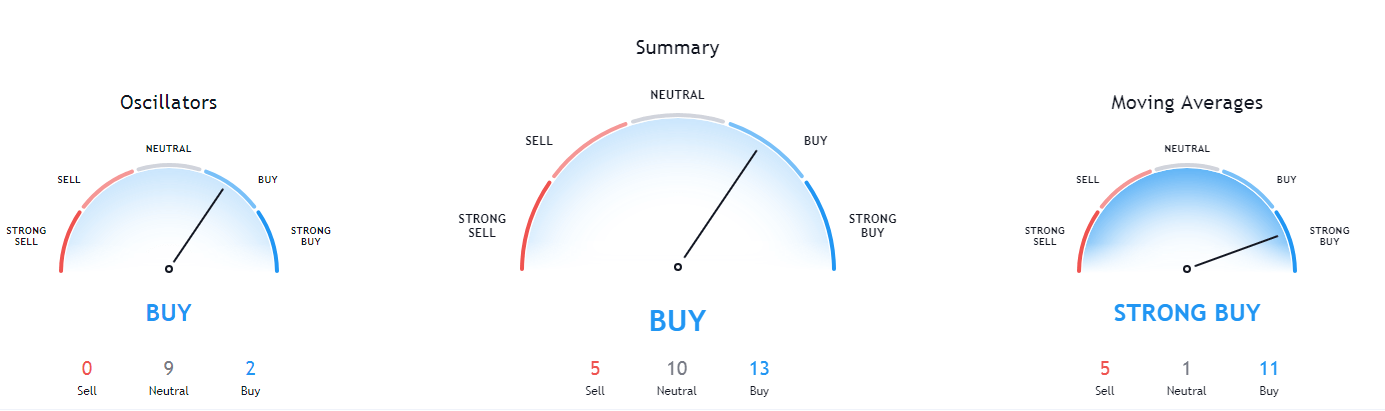

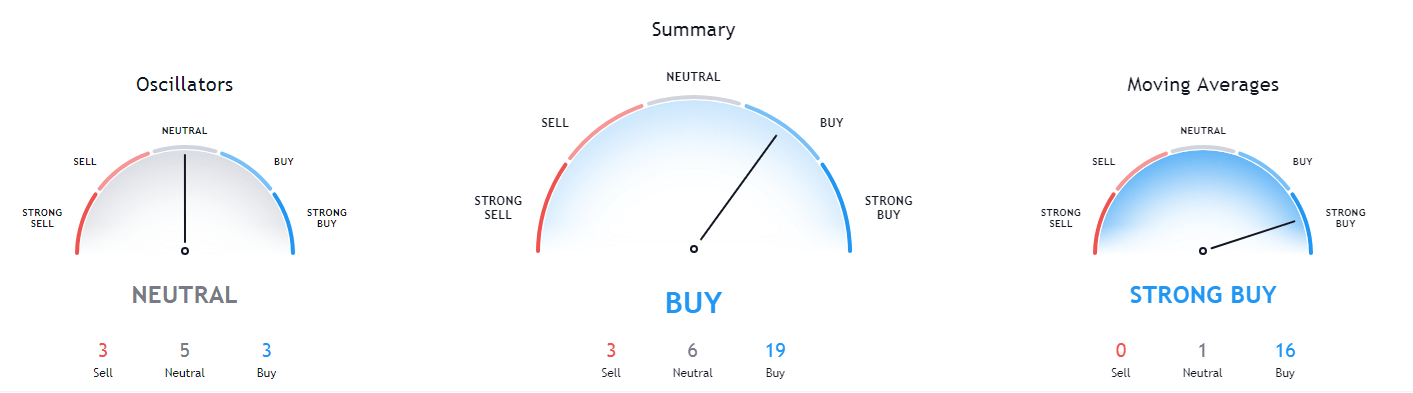

Bitcoin’s algorithm is entirely transparent. While it does set the money supply, people can collectively agree that the system is fair and unbiased.

When Ray Dalio talked about radical transparency as the essence of a healthy free market, he may not have thought about Bitcoin, but this is still one of Bitcoin’s key features.

Not only does Bitcoin exude transparency but it also achieves so perpetually. This is the reason why baking institutions aren’t in favor of Bitcoin.

What Bitcoin manages to do flawlessly is automatize what central banks are supposed to do, such as managing monetary policy for example. Central banks’ primary tasks are to maintain money supply, prevent inflation, and facilitate international value flows.

This is where Bitcoin outperforms central banks and the reason why it is the means to restore people’s trust, along with property rights and capital.

We’ve read and heard about inflation so many times that we’ve become accustomed to the word. However, did you know that monetary inflation is a direct violation of property rights? What makes this worse is that it is legally enforced, which takes us to another related topic.

When governments print more money, they are making changes in terms of ownership or who owns what. Money can be used to get anything in the market, which makes this system downright exploitation of property rights.

Now, Bitcoin, on the other hand, is the answer we have all been looking for. Some of us may not still know much about it, but it is the path to freedom from fiat currencies as an uninflated, confiscation-resistant free market-based money.

As a vividly transparent alternative to the current system, Bitcoin is a means to overcome the opacity of central banking and to return the power into the hands of everyday people like you.

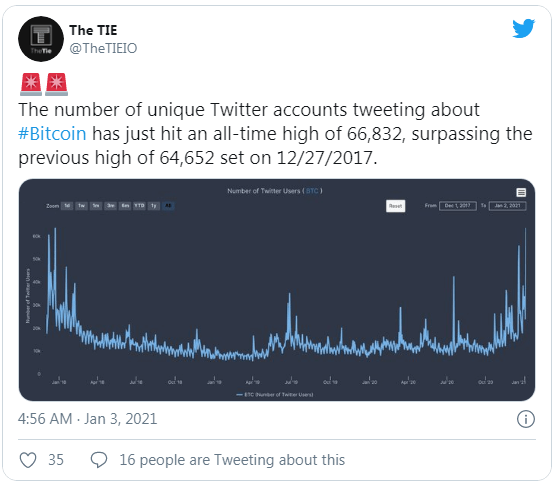

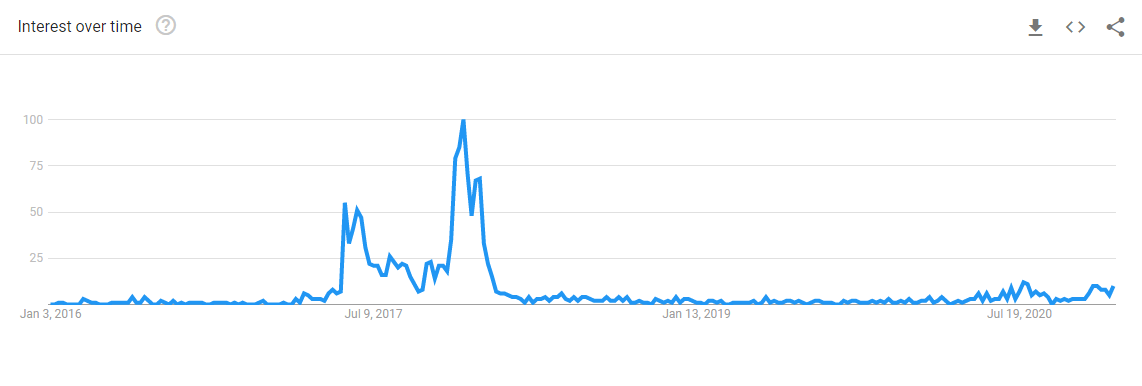

The more people allow themselves to learn about Bitcoin, the more Bitcoin is going to be believable. The reason why this is so is that there is nothing obscure or misguiding about it, but it does require time and effort to be properly understood.

Last time, we disclosed the average number of hours it takes for a person to learn about Bitcoin, which may be a reason why a percentage of the world population is going to be unwilling to adopt the new system. People generally dislike change because they fear it, but as Bitcoin is an immutable set of rules, it is currently the only true way to escape political agendas and banking institutions’ manipulation.

Bitcoin can endure and fight off the challenges inherent in the current system that dictates how and where things are going to play out. In this sense, Bitcoin is not just a beacon of hope but an effective tool to combat the pressures of the entitled.

Once you acknowledge how powerful this transparency is and how far it can reach, it cannot be unseen. As Ray Dalio said, having nothing to hide relieves stress and builds trust. And, we think the time for trust is long overdue and that we are all looking forward to a different system.

Luckily, it is no longer some distant future that we need to pray or hope for the children of our children to experience. Transparency and reliability are at the core of Bitcoin.

The question is…

Are you willing to accept the transformation towards the most credible, trustworthy monetary policy in the entire human existence?

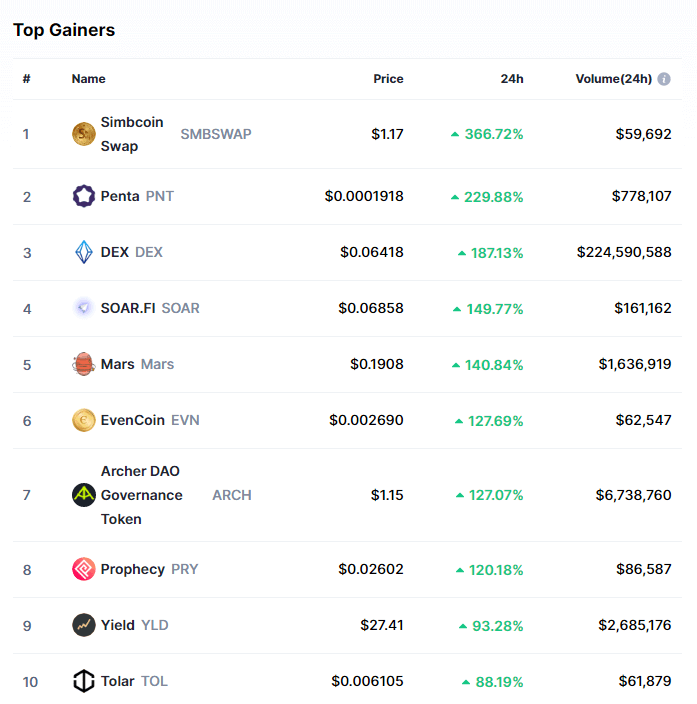

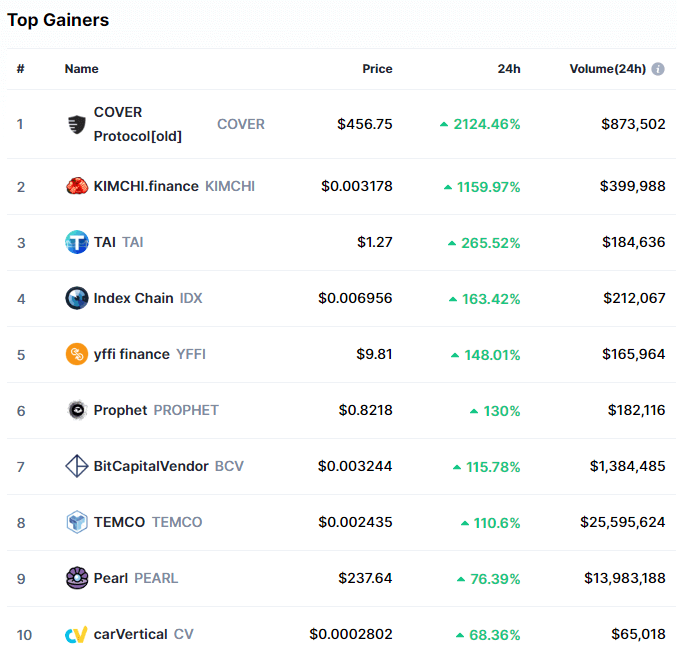

9: Bitcoin is a winning option

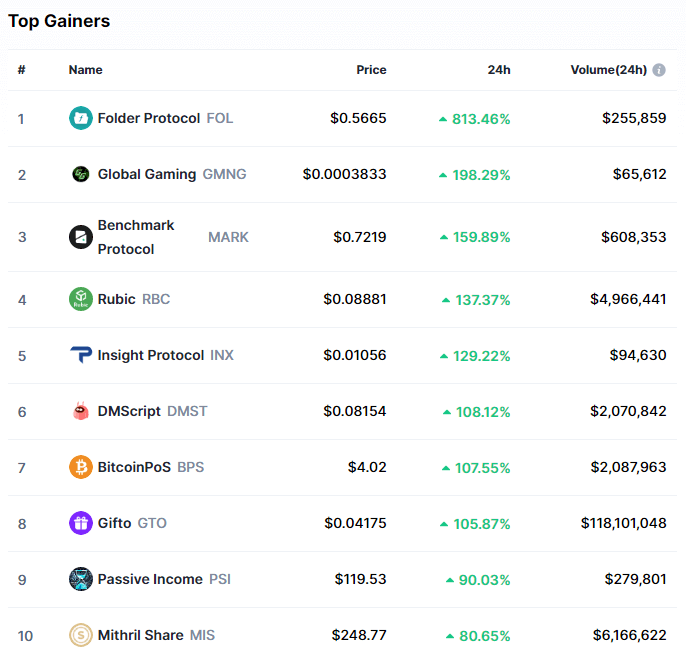

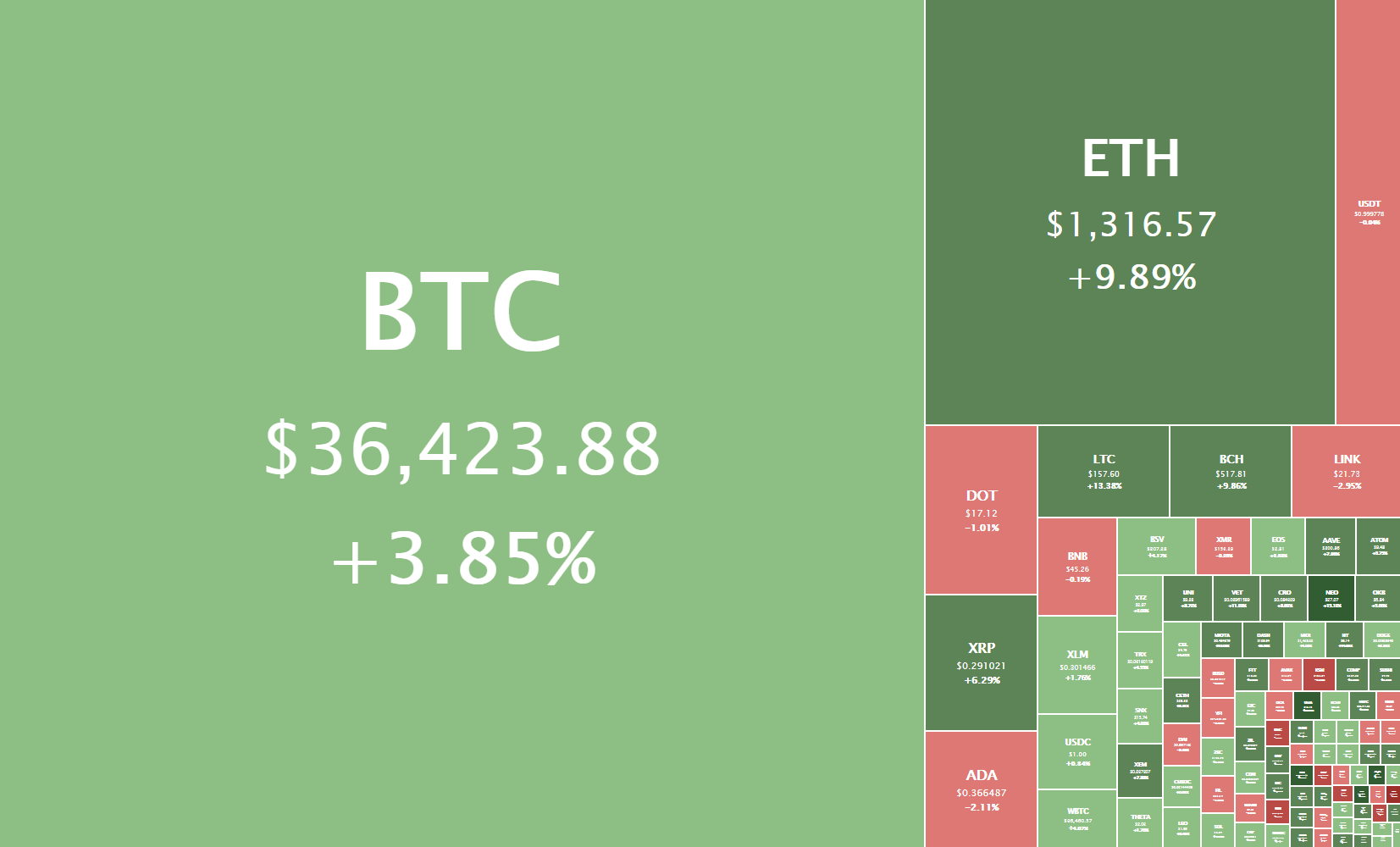

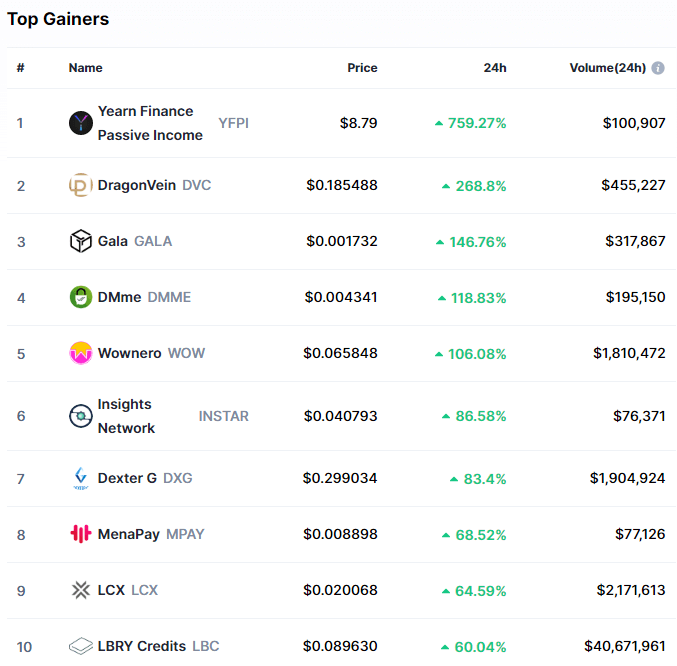

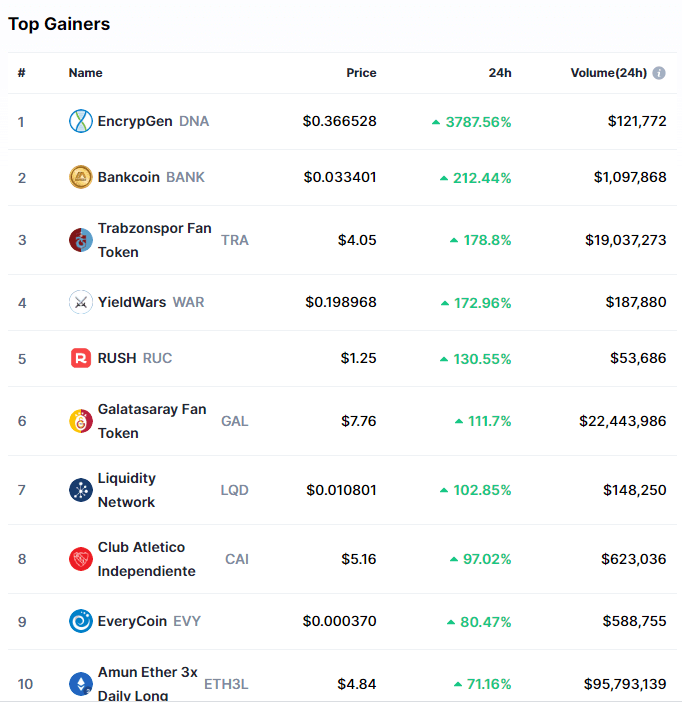

In the previous articles, we explained why Bitcoin is never happening again. We showed how its path of creation entirely closed off options for making Bitcoin 2.0 and the possible scenarios that await anyone who ever attempts to do this. Looking at the technological perspective, we know that everything is getting digitized. There are no reinvented wheels here. Digital currencies are slowly, but surely, becoming part of our everyday lives as we are seeing more and more news on this topic.

Still, as people need confirmation or a reason to place their trust in something, especially something new, we need to compare Bitcoin and other currencies, both digital and fiat, without any unnecessary descriptors. For example, before we never minded about the internet and now everything is happening there, in the virtual world. Even if we take a look at fiat currencies, only 6% of the entire USD has been printed on bills. Everything else is digital numbers, such as the money in individual bank accounts. That’s why the word digital should not be used here to weigh things in any currency’s favor.

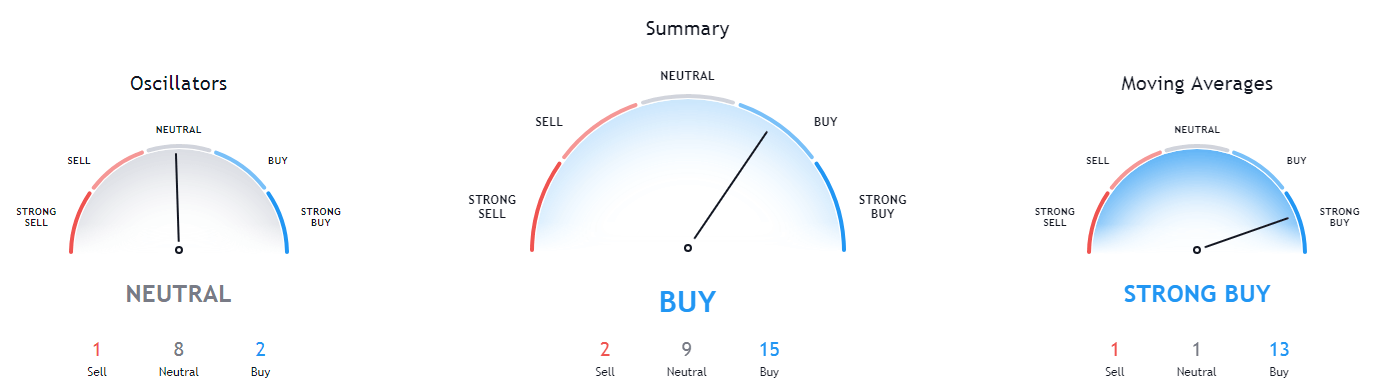

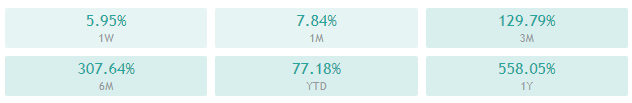

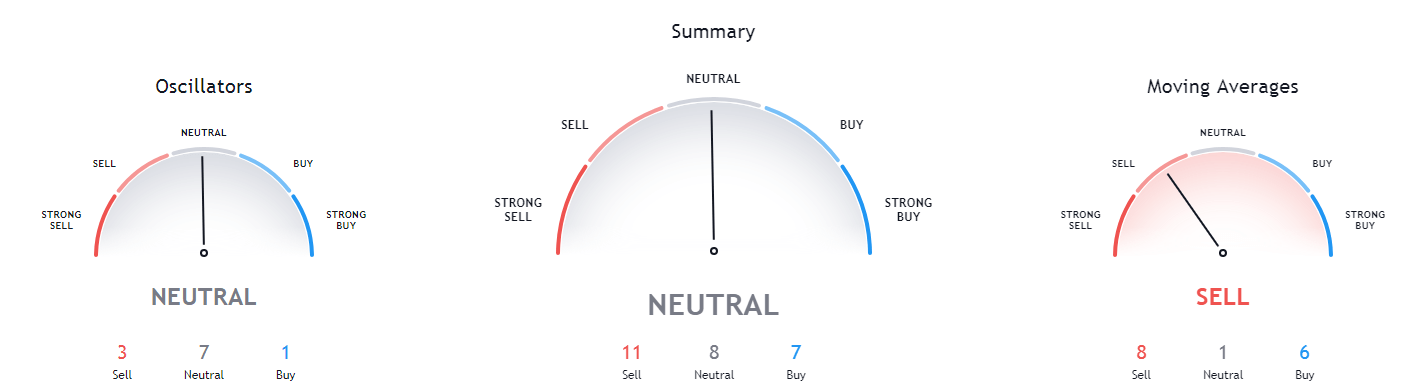

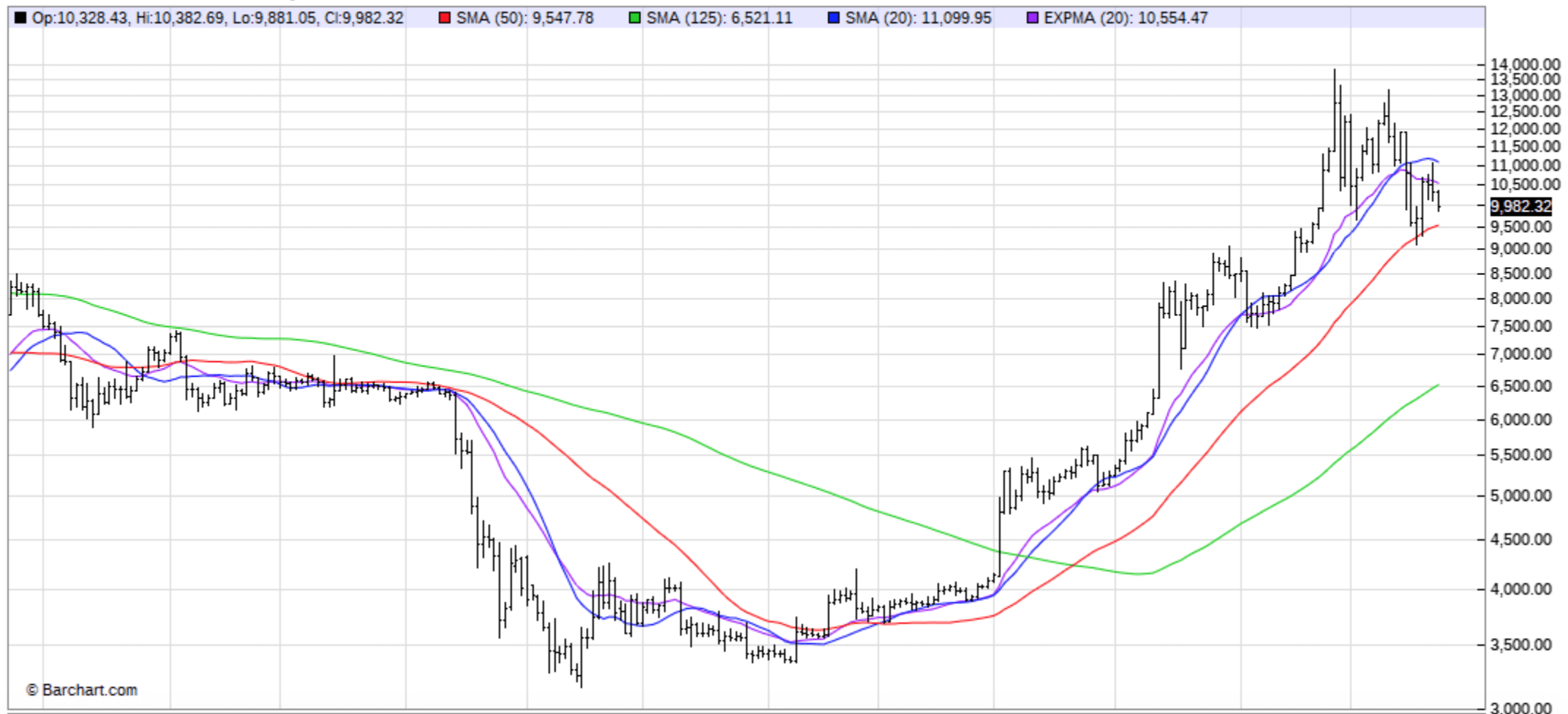

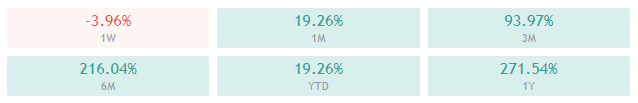

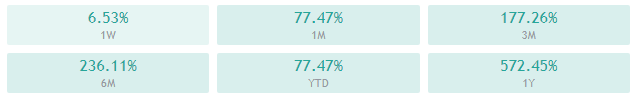

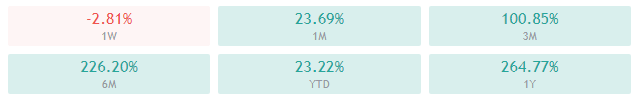

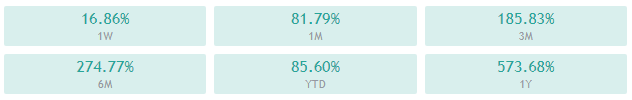

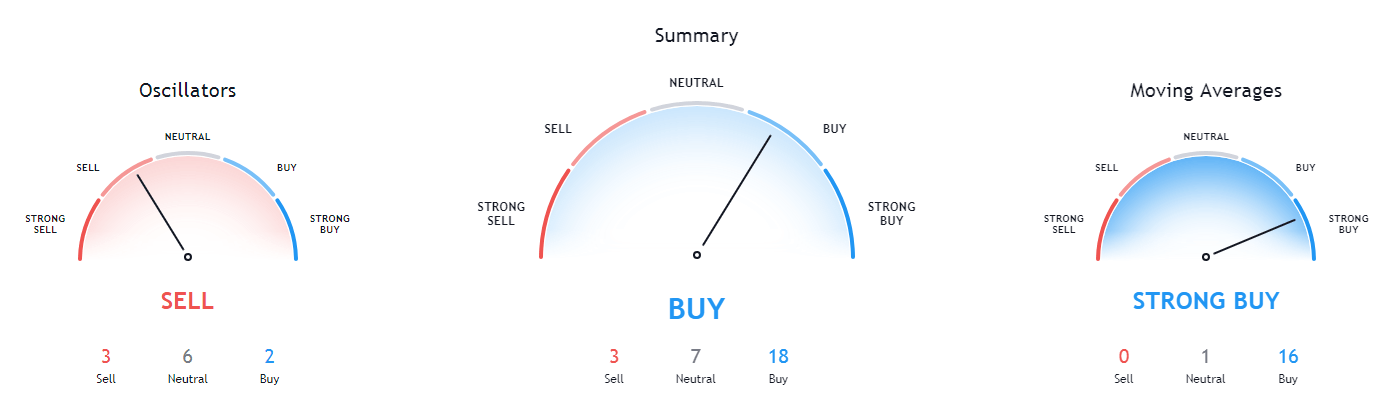

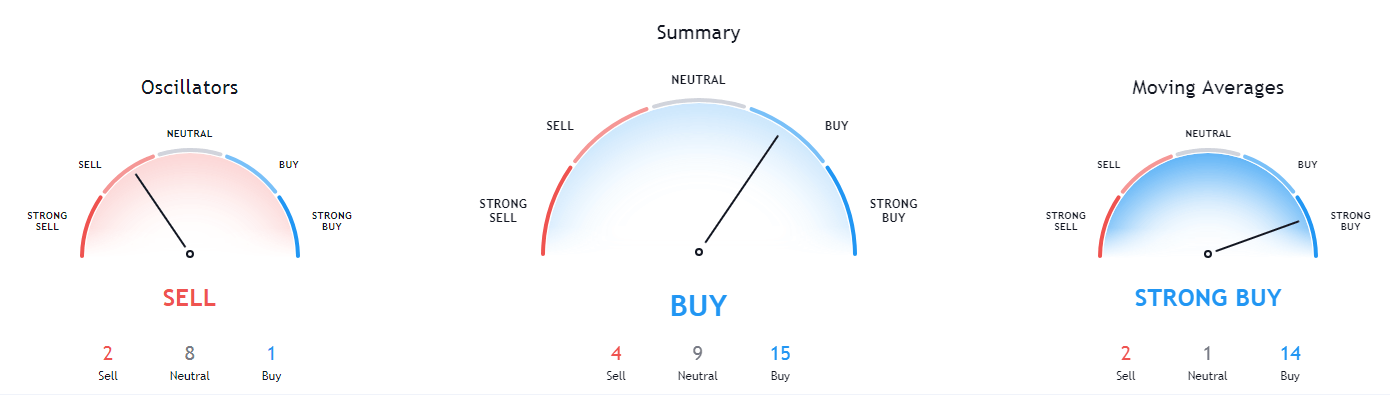

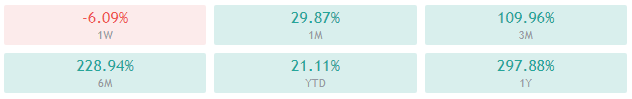

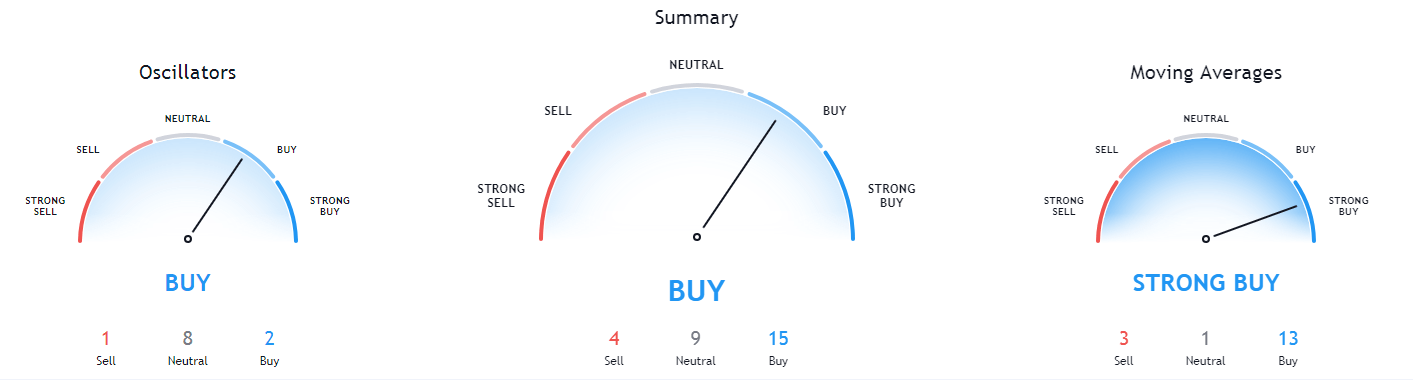

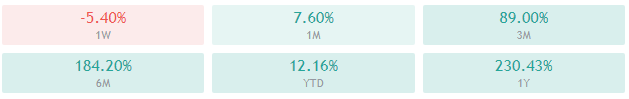

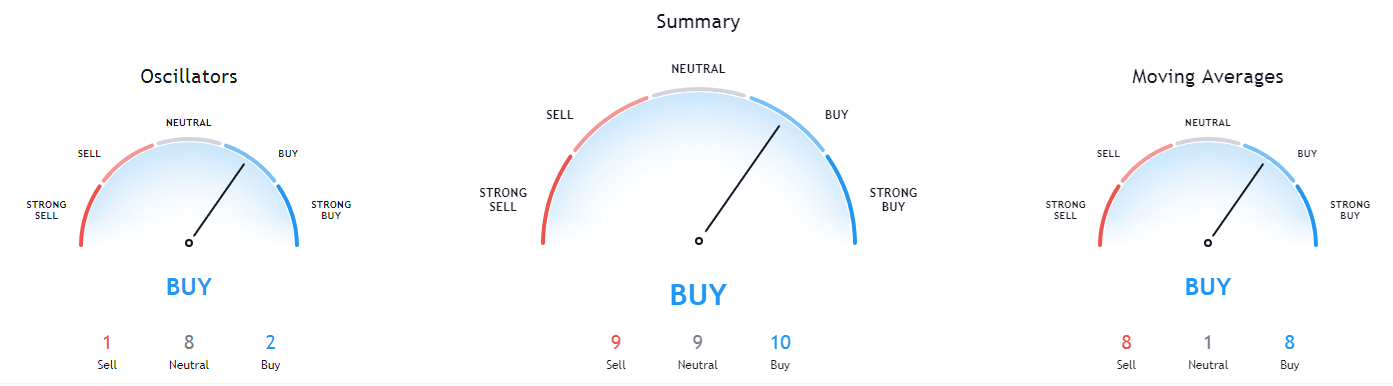

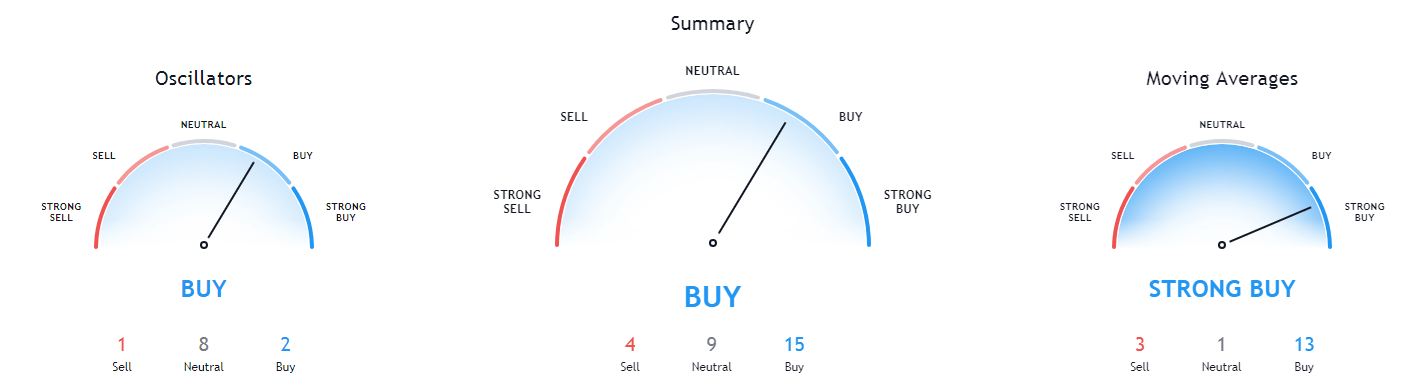

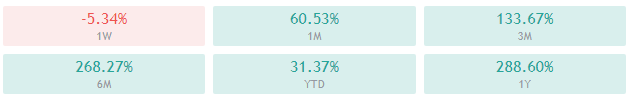

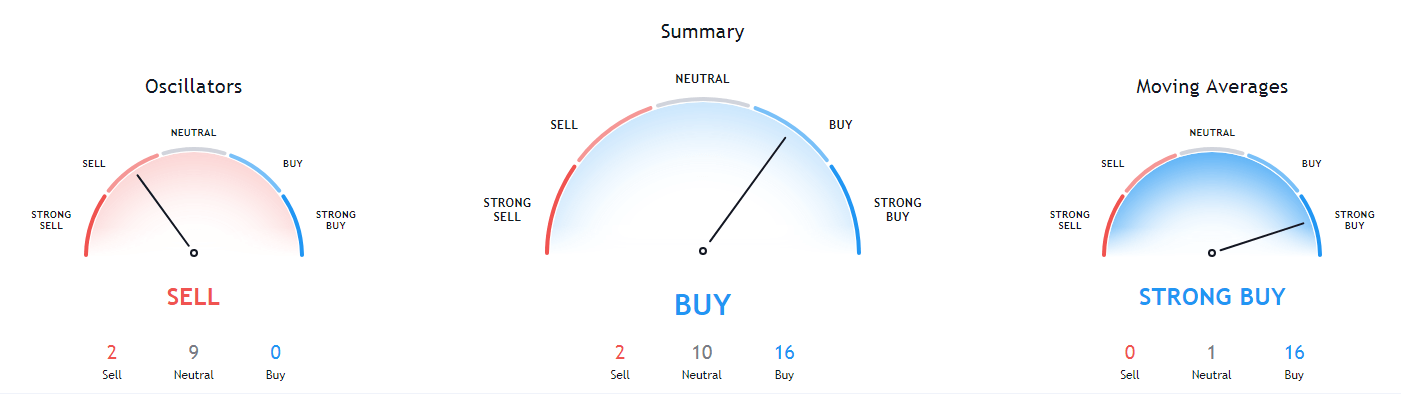

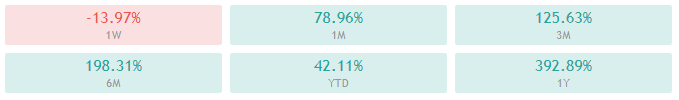

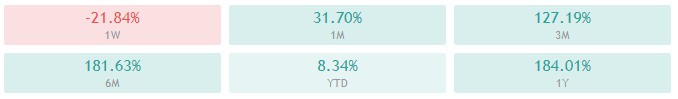

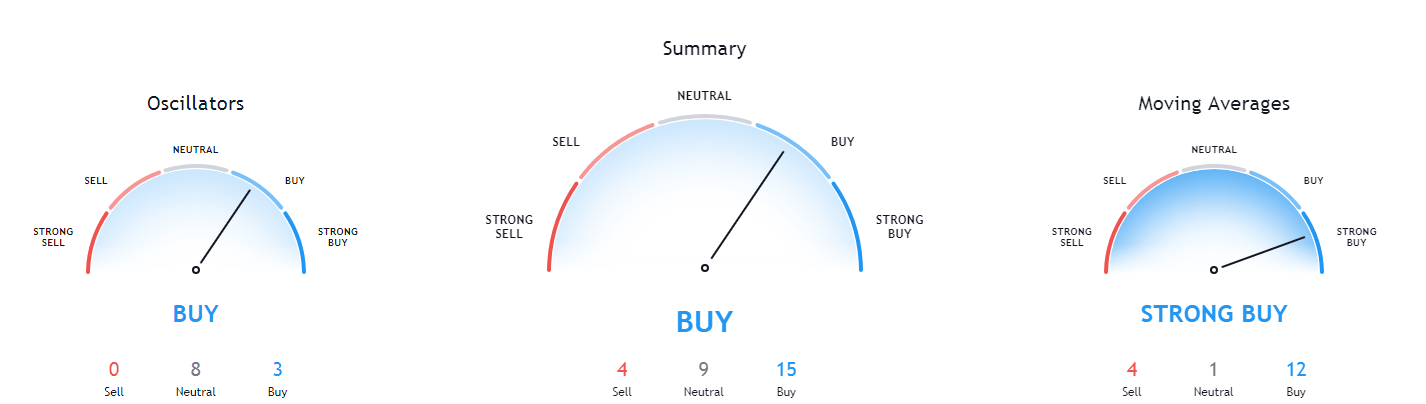

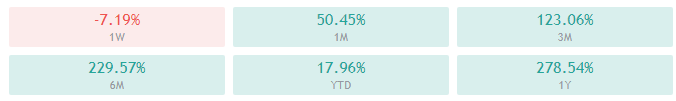

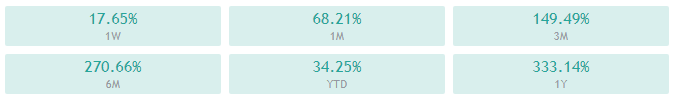

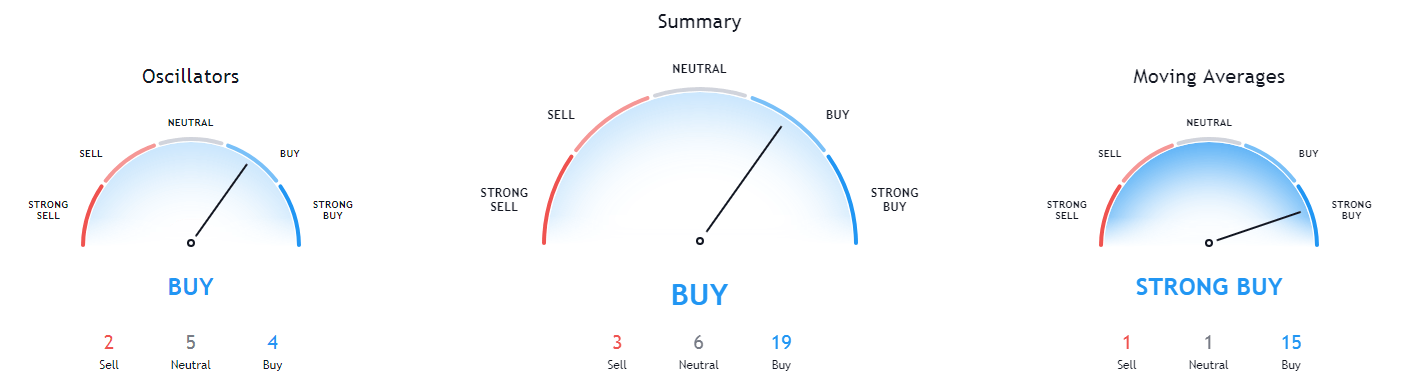

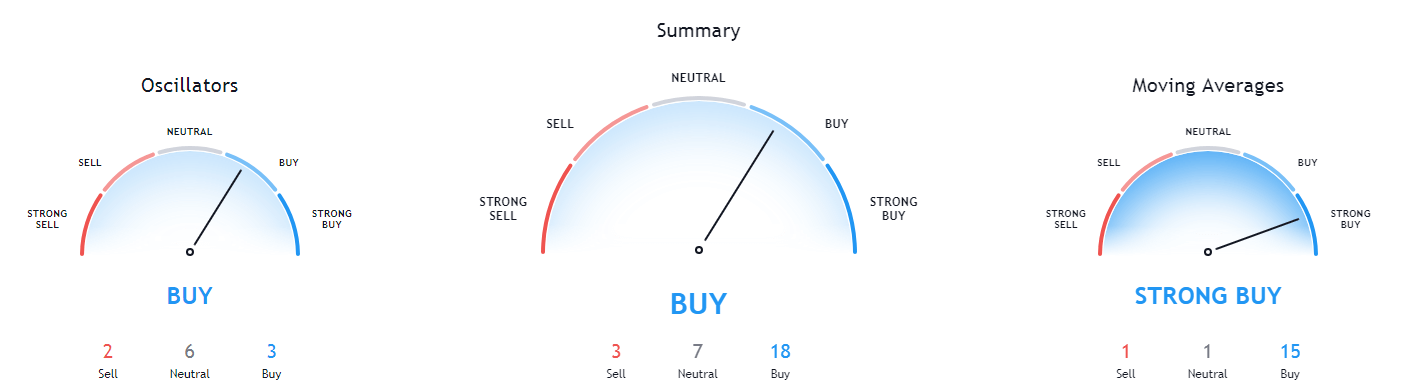

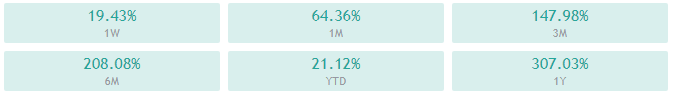

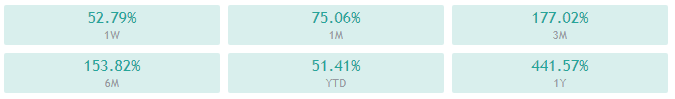

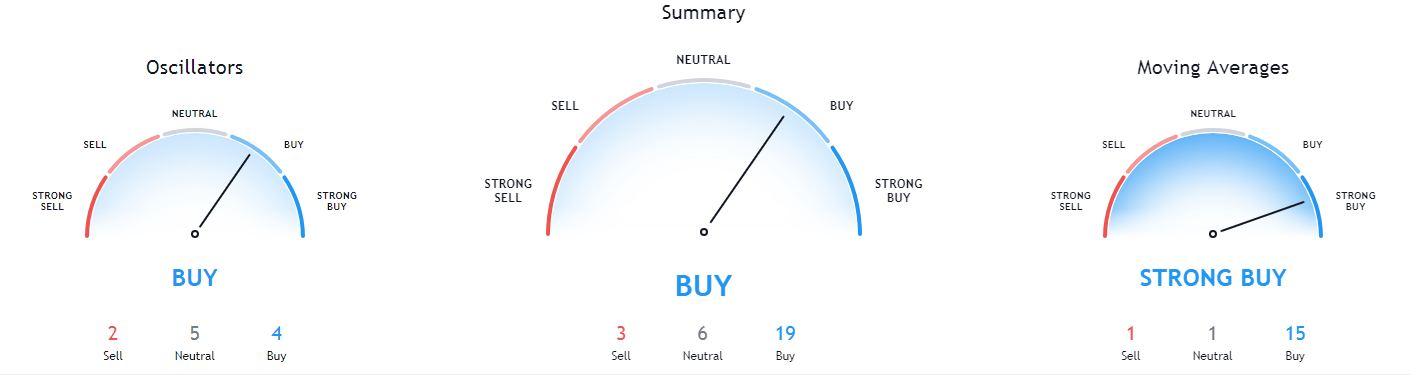

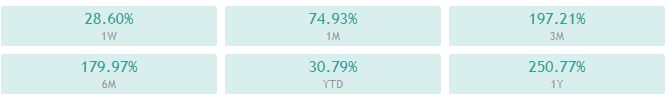

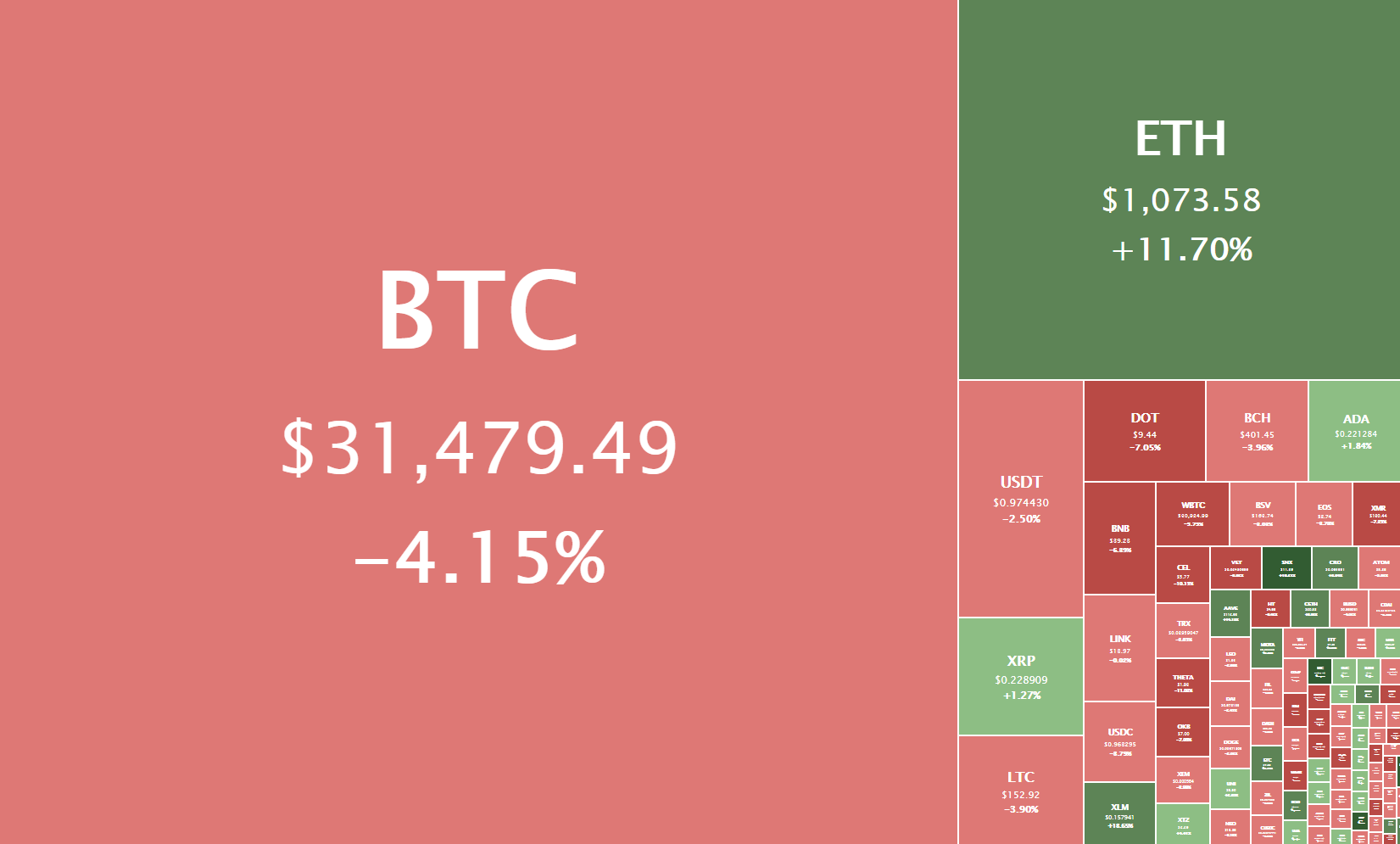

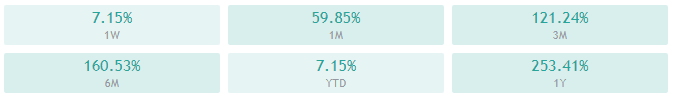

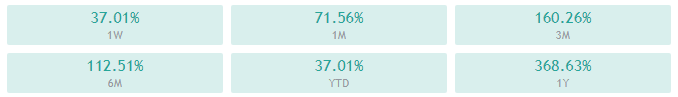

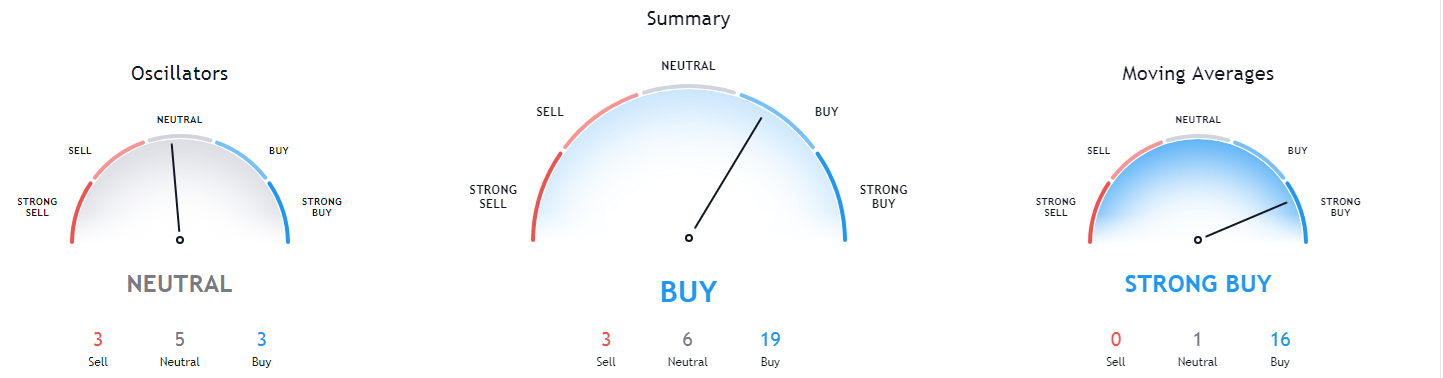

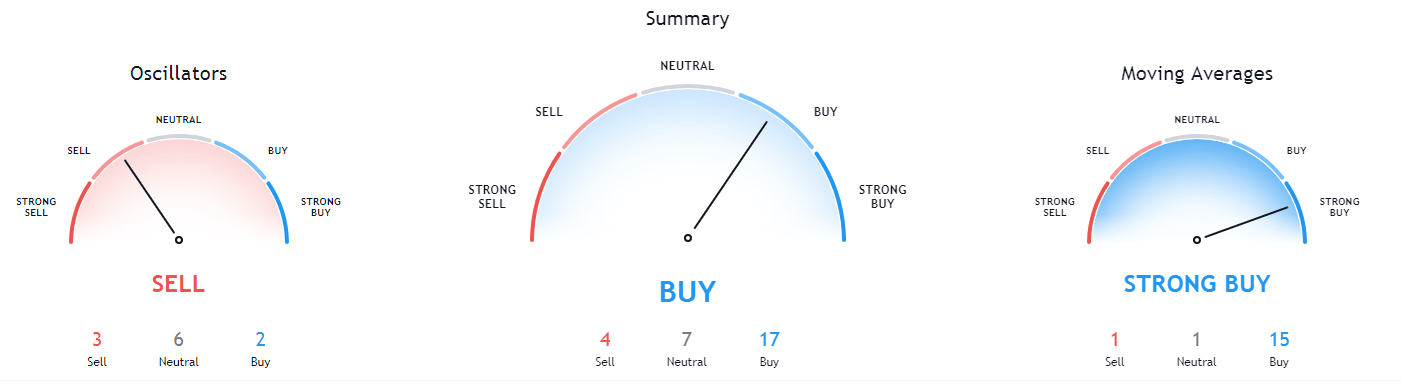

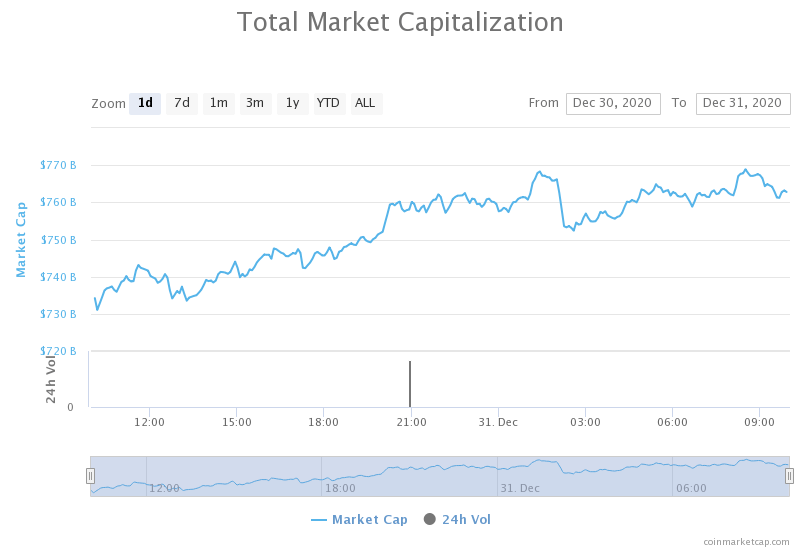

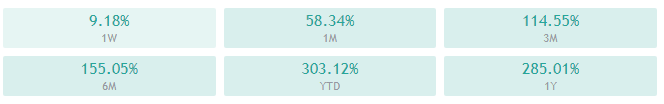

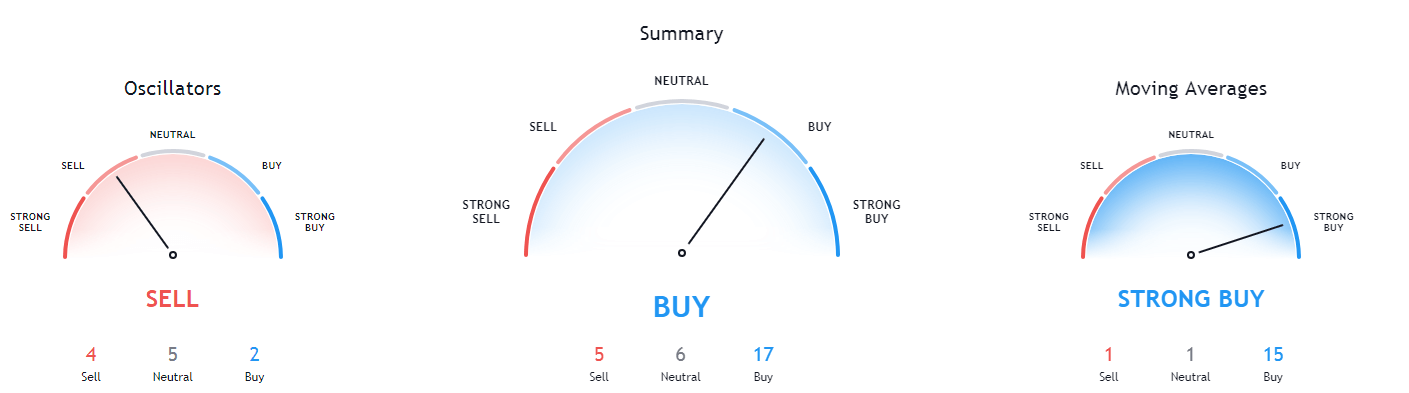

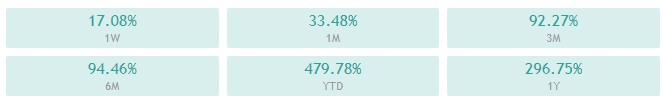

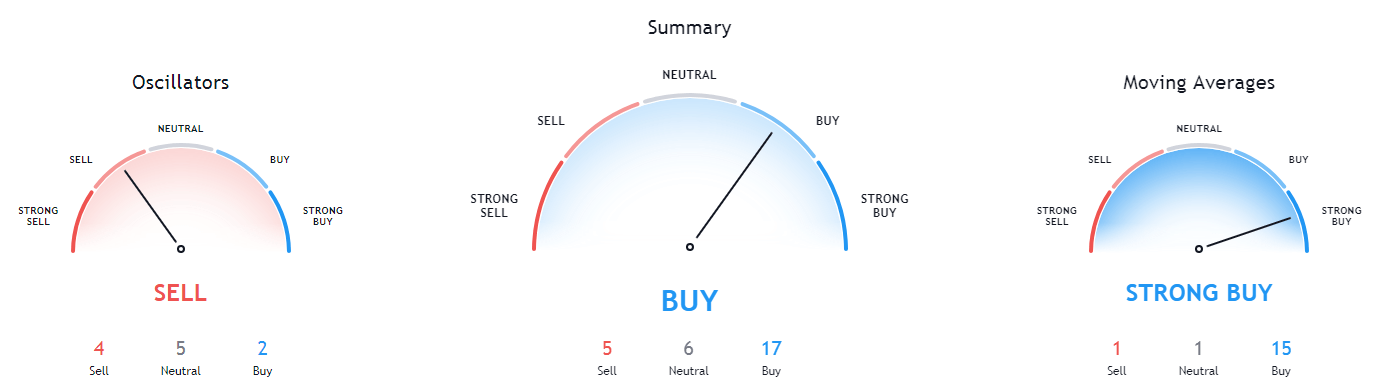

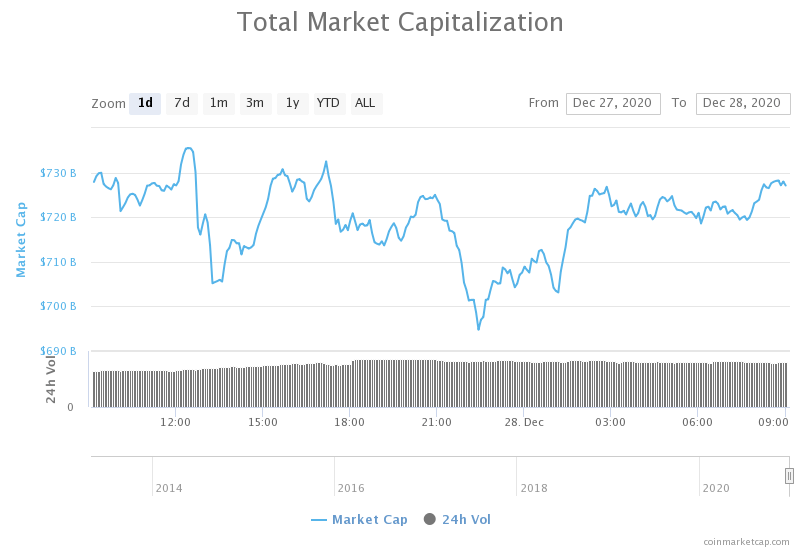

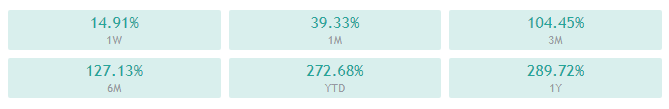

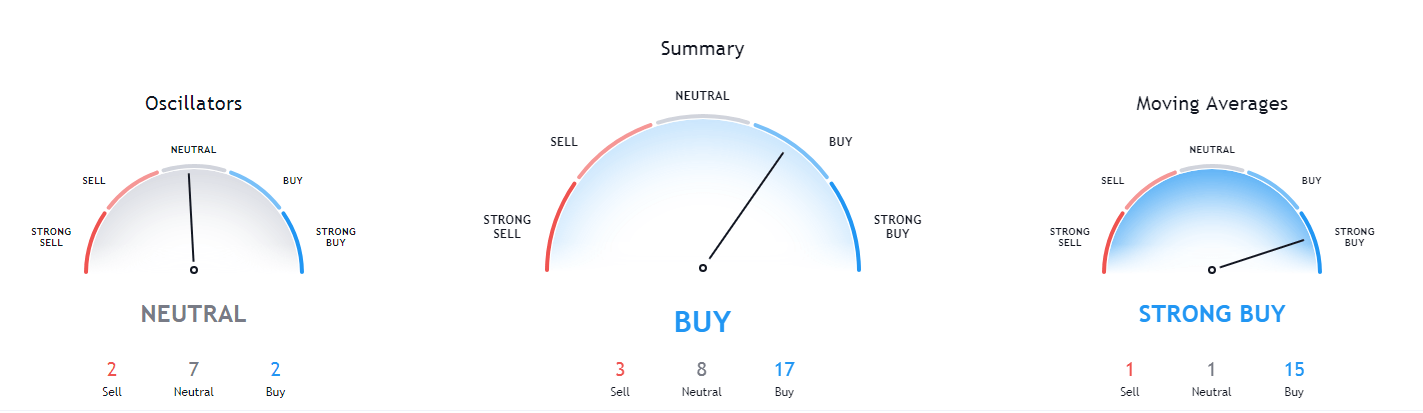

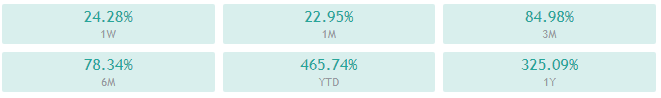

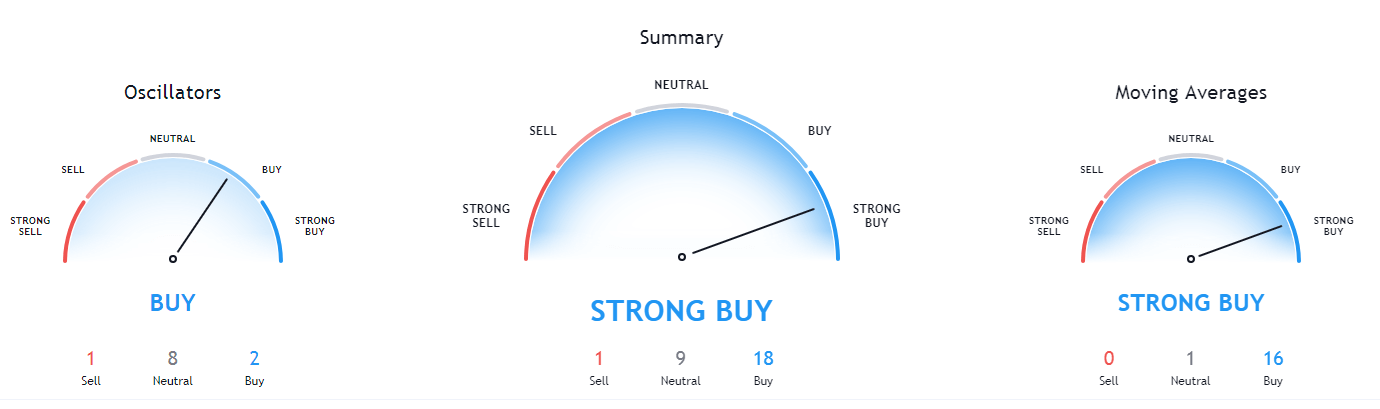

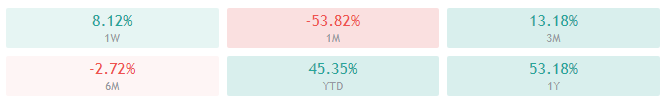

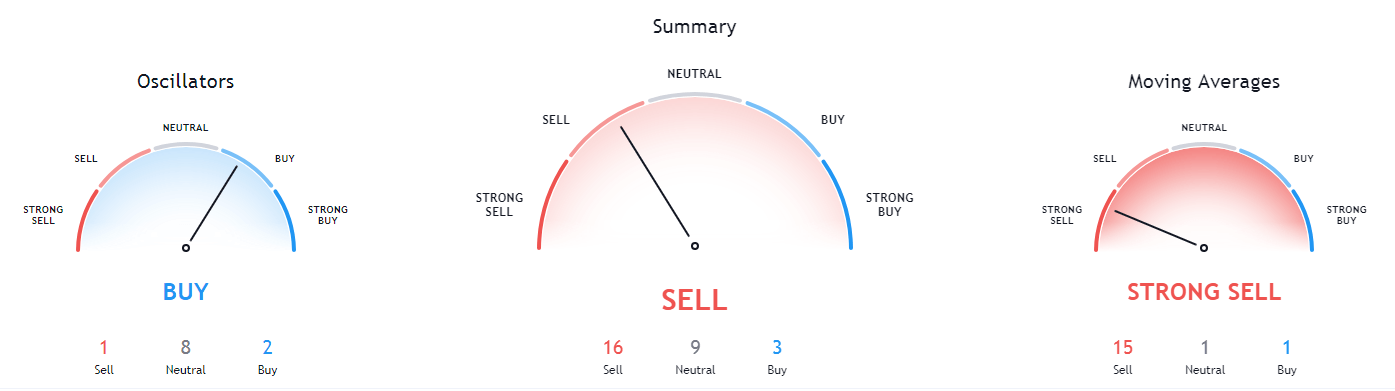

The only playfield where any relevant comparison should be made is monetary policy. Bitcoin is undeniably winning in terms of transparency, predictability, and believability as well. From the perspective of history, these three factors have always been important and people will always look for ways to hold on to their capital across time. That is why gold was the number one currency for such a long time. And, now, Bitcoin is taking over the precedence, as it’s gaining an impressive track record over the same dimensions.

Compared to central banks, Bitcoin’s indisputable reliability, auditability, cost-effectiveness, and predictability, along with its manipulation-proof nature, are helping bring down the wall of censorship and secretiveness created by central bankers. Bitcoin is winning because it is a symbol and harbinger of the new world order we have all been looking for.

10: Bitcoin is believable

The tarnished image of the banking systems across the world did not start with Bitcoin. With massive printing into worthlessness, we discussed in previous parts of this series and everything we’ve already talked about here is sufficient for anyone to feel frustrated with the status quo. Including financially literate or otherwise less interested in the topic.

There is no trust any longer – no trust in the system, no trust in the decision-making, and certainly no trust in the future promised by the central banks.

How is Bitcoin then more believable than what we already have?

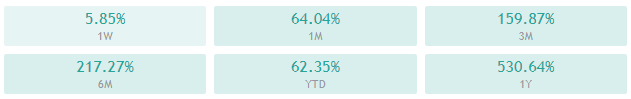

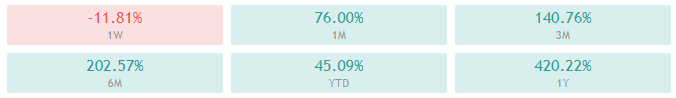

When we look at fiat currencies, we‘ve already mentioned that the GBP which, in a little over 300 years, lost 99.5% of its value. Gold, however, never depreciated with time in terms of purchasing power. We know what happened the moment the value of currencies got detached from the value of gold.

Fiat currencies are not only challenging to believe because of their depreciating value but also because of everything we’ve already said about central bankers. Even the predictions we follow are a cause of concern with regards to the percentage of what actually happened compared to what had officially been presented as a formal document to the people. In Part 3, we mentioned the FED’s reports which disappointingly carry less than 5% prediction power. And, naturally, this affected the degree to which people are open and capable of carrying forward as they used to before.

Political agendas, secrecy, manipulation, and varying criteria involving price and supply of fiat currencies have done it. When decision-making becomes compromised and humanity is presented with multiple waves of currency devaluation and unemployment, these are expected results. Reputation and trust are earned, and the results go both ways.

What central banks, along with their monetary policies, managed to do is raise more questions regarding deception because they strive so hard to conceal any misdeeds, wrongdoings, and mistakes. In one of the previous articles, we talked about the level of scrutiny people involve when assessing any financial reporting, so when the words mismatch results, the outcome is mistrust.

What is also interesting is that the world always seeks someone to blame, even if outcomes were predetermined by some other factors they had no control over. Predicting a country’s GDP is not an easy job, especially if we add to that politically determined ends. An even when someone losses their job due to not satisfying people’s criteria, we still “don’t see” the bad guy in the back. We need to acknowledge that it is the system that is faulty, not individual employees working for an organization.

Where Bitcoin surpasses central banks most prominently is that we have the data on Bitcoin and we can precisely measure how many coins are going to be produced in the time coming. With governmental institutions, no measurement can be done properly because of their impact on free-market dynamics, which we previously talked about in detail.

Soviet Russia failed because everything was micromanaged, as we mentioned before. A truly free economy cannot be planned like that. We are missing key components that comprise this naturally organized system. Centralized control dilutes facts. With gold, however, there are scientific, physical features (e.g. rarity) that can’t be left out of the picture, and the same is true for Bitcoin.

Don’t tell me what you think just show me what’s in your portfolio, said Nassim Nicholas Taleb. Results can speak volumes on the gap between the controlled systems the central banks impose and the free market Bitcoin offers.

It is not central banks that have to live with the consequences of trading but real people trading live every day. Living at the expense of the selected few freely exercising power to their own benefit is not the future anyone would want to succumb himself/herself to.

We don’t need to watch for people’s words. The pattern will suffice.

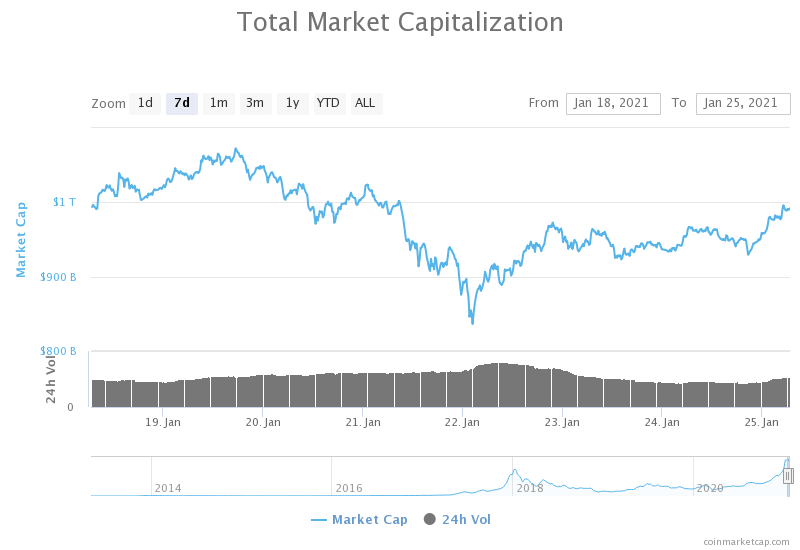

Next time, we are going to talk about some real numbers, some facts that we need to take into consideration when weighing the decision whether or not to invest in Bitcoin. Also, you will learn exactly why Bitcoin is never going to mess things up. Of course, Take all this information and process it in your way but try to stay with the facts. While these facts may look biased towards Bitcoin, as with everything, there are risks to contemplate about.

New interesting facts await in Part 3.