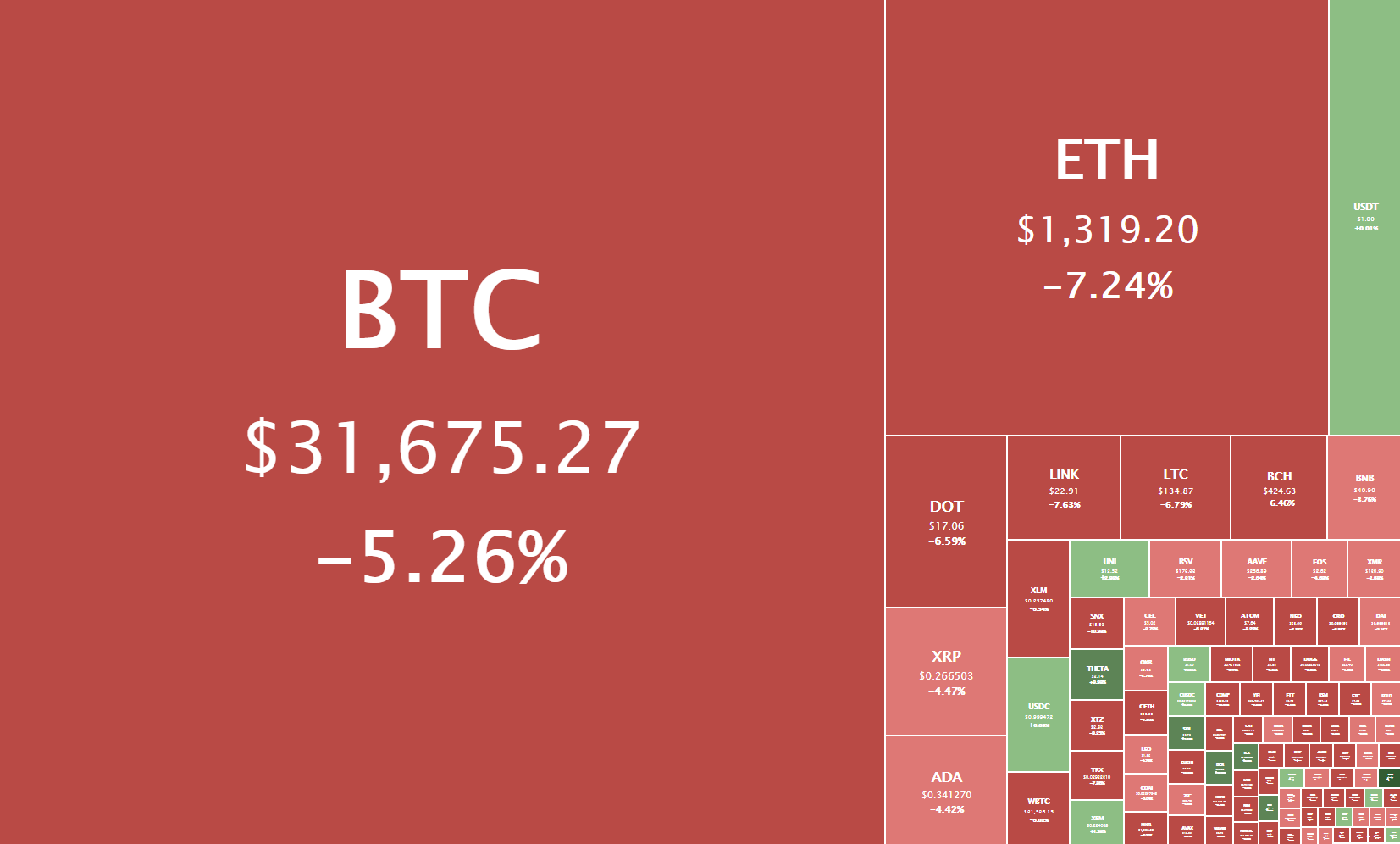

The crypto sector ended up almost completely in the red as most cryptocurrencies pulled back to lower levels. Bitcoin is currently trading for $31,575, representing a decrease of 5.26% compared to yesterday’s value. Meanwhile, Ethereum’s price has decreased by 7.24% on the day, while LTC lost 6.79% of its value.

Daily Crypto Sector Heat Map

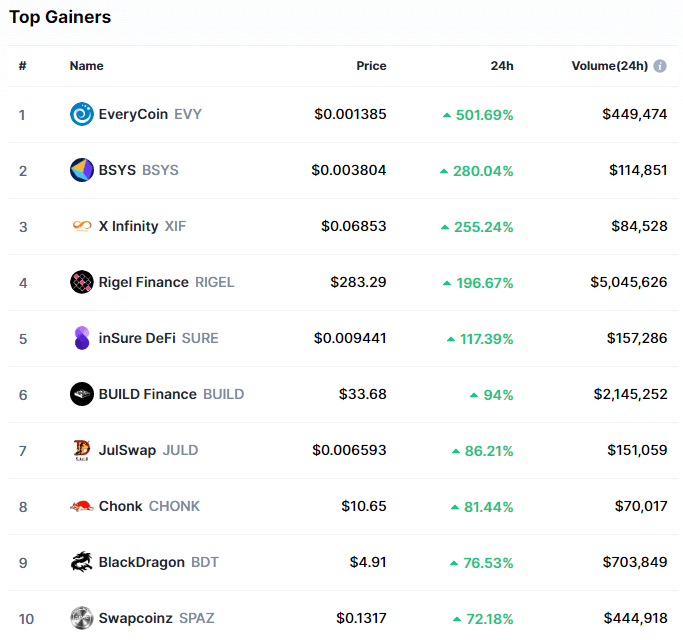

EveryCoin gained 501.69% in the past 24 hours, making it the most prominent daily crypto gainer by far. It is followed by BBYS’s 280.04% and X Infinity’s 255.24% gain. On the other hand, ARTH lost 61.58%, making it the most prominent daily loser. It is followed by Typhoon Cash’s loss of 44.07% and Aventus’s loss of 40.31%.

Top 10 24-hour Performers (Click to enlarge)

Bottom 10 24-hour Performers (Click to enlarge)

Bitcoin’s market dominance increased slightly from when we last reported, with its value currently being 62.9%. This represents a 0.2% increase from our previous report.

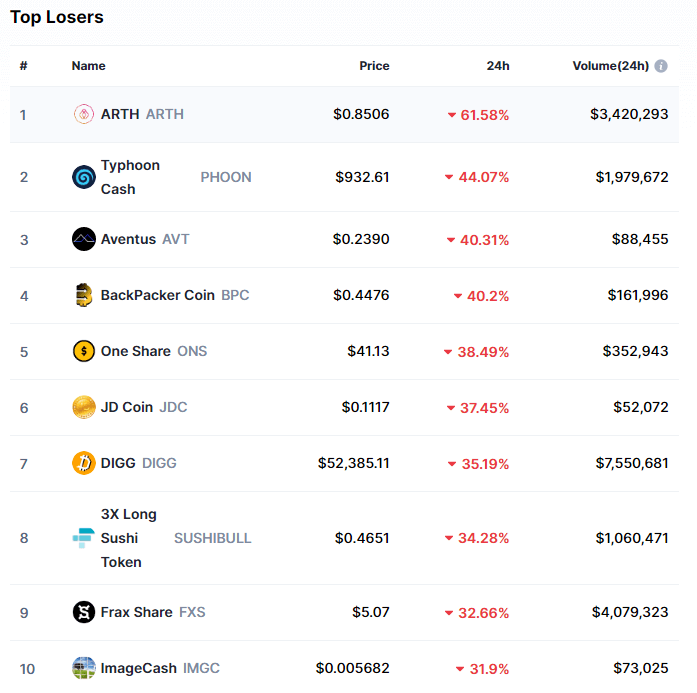

Weekly Crypto Market Cap Chart

The cryptocurrency sector’s market capitalization has decreased greatly since we last reported, with its current value being $936.54 billion. This represents a $54.92billion decrease when compared to our previous report.

_______________________________________________________________________

What happened in the past 24 hours?

_______________________________________________________________________

- January sees $237 billion in monthly stablecoin volume thus far, breaking prior record (The Block)

- Cryptocurrencies could serve role as electronic store of value: Bank of Singapore chief economist (The Block)

- Bank of England governor says a ‘lasting’ digital currency has yet to be invented (The Block)

- Janet Yellen confirmed as the Biden administration’s Treasury Secretary (The Block)

- Yearn Could Steal DeFi Spotlight From Aave, Uniswap (Cryptobriefing)

- Russians Donate $120,000 of BTC for Navalny’s Release (Cryptobriefing)

- The dominoes are falling: Another NASDAQ-listed firm just bought Bitcoin (Cryptoslate)

- Harvard, Yale, Brown Endowments Have Been Buying Bitcoin for at Least a Year: Sources (Coindesk)

- 3 reasons Bitcoin abruptly dropped by 7.4% overnight (Cointelegraph)

- Glassnode predicts BTC break-out as investors refuse to realize losses (Cointelegraph)

_______________________________________________________________________

Technical analysis

_______________________________________________________________________

Bitcoin

Bitcoin’s gains in the past two days were taken away when bears took over the market after BTC failed to break the $34,627 mark. The cryptocurrency declined to the $32,350 level but quickly lost hold of it as well. BTC is currently hovering right above the $31,000 mark.

Bitcoin’s 1-hour RSI is getting dangerously close to the oversold territory, while its volume is descending, indicating a possible price stagnation or a direction reversal.

BTC/USD 1-hour chart

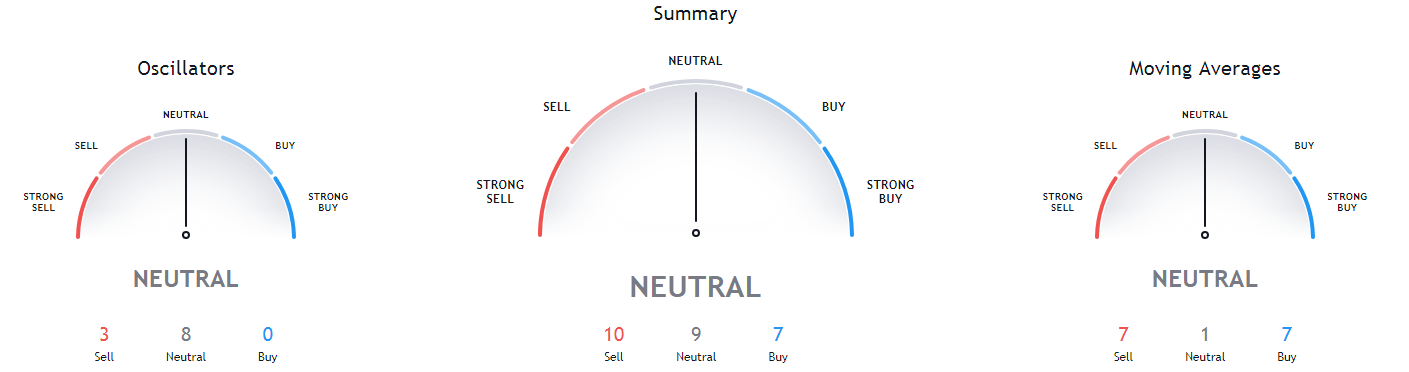

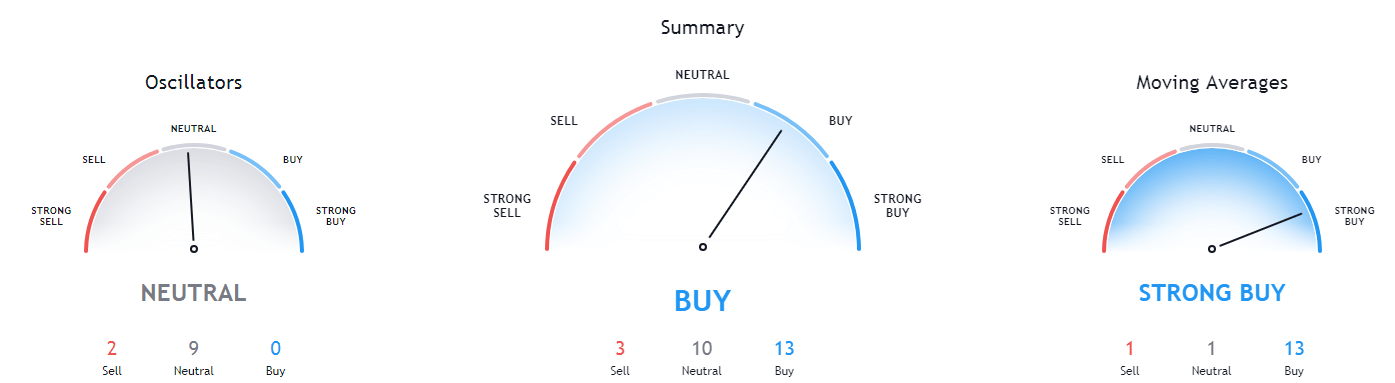

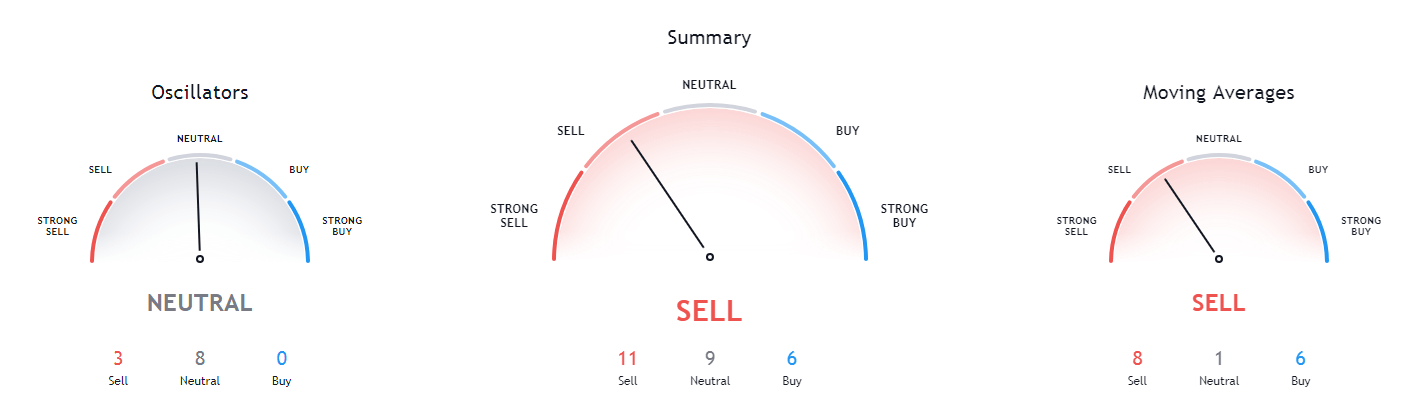

Bitcoin’s daily overview is completely neutral, while its weekly and monthly overviews are completely bullish. On the other hand, the 4-hour time-frame is completely bearish.

BTC/USD 1-day Technicals

Technical factors (1-hour Chart):

- Price is below its 50-period EMA and its 21-period EMA

- Price is close to its bottom Bollinger band

- RSI is near the oversold area (31.21)

- Volume is average

Key levels to the upside: Key levels to the downside:

1: $32,350 1: $30,072

2: $34,627 2: $30,000

3: $37,445 3: $27,960

Ethereum

The second-largest cryptocurrency by market cap spent the day retracing after posting a new all-time high at $1,477.30. ETH tested many levels but ultimately fell below the previous all-time high, and then the $1,420 and $1,350 levels as well. It is currently consolidating just above $1,300.

Ethereum seemingly created a zone of support just above the $1,300 level, which is holding up for 10 hours now. If this support holds long enough for BTC to change its price direction (or at least enter a sideways trading period), we may see ETH bulls reentering the market once again.

ETH/USD 1-hour Chart

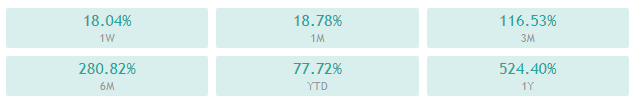

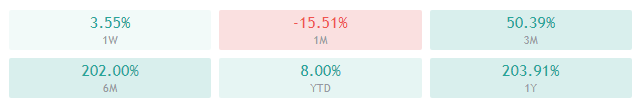

Ethereum’s technicals on all time-frames are slightly tilted towards the buy-side, with its oscillators taking a more neutral stance.

ETH/USD 1-day Technicals

Technical Factors (1-hour Chart):

- Price is below both its 50-period and its 21-period EMA

- Price near its bottom Bollinger band

- RSI is very close to being oversold (39.73)

- Volume is average

Key levels to the upside: Key levels to the downside:

1: $1,350 1: $1,211

2: $1,420 2: $1,183.85

3: $1,440 3: $1047.6

Litecoin

Litecoin has lost all of the gains it made yesterday, and then some. The eighth-largest cryptocurrency by market cap failed to pass the zone just under $150, which triggered a pullback and a dip below the $142.1 support (now resistance) level. On top of that, LTC also fell below the trading range it was in for the previous four days (excluding yesterday’s push).

LTC/USD 1-hour Chart

Litecoin’s short-term and long-term overviews have opposing stances: while its 4-hour and overviews show a slight tilt towards the sell-side, its weekly and monthly overviews are slightly bullish.

LTC/USD 1-day Technicals

Technical factors (1-hour Chart):

- Its price is below its 50-period EMA and its 21-period EMA

- Price slightly above its bottom Bollinger band

- RSI is close to being in the oversold territory (33.05)

- Volume is average

Key levels to the upside: Key levels to the downside:

1: $142.1 1: $128.42

2: $161.5 2: $120

3: $181.3 3: $114.75