When it comes to crypto trading, there are a number of mistakes that all of us are making. Some mistakes are okay, as they don’t really affect our accounts or our emotions, others though can be horrible, so bad that they have a massive effect on pretty much everything that we do. Let’s take a look at some of the horrible mistakes that we see happening quite a lot and what we can do to try and avoid them in the future.

Trading the Same As Forex

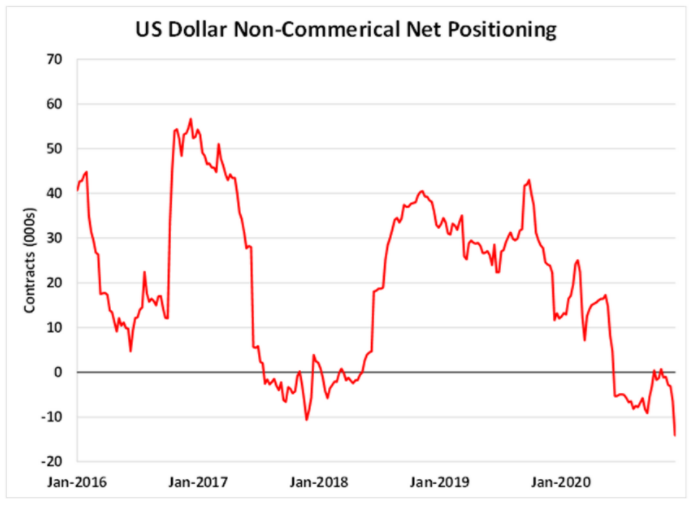

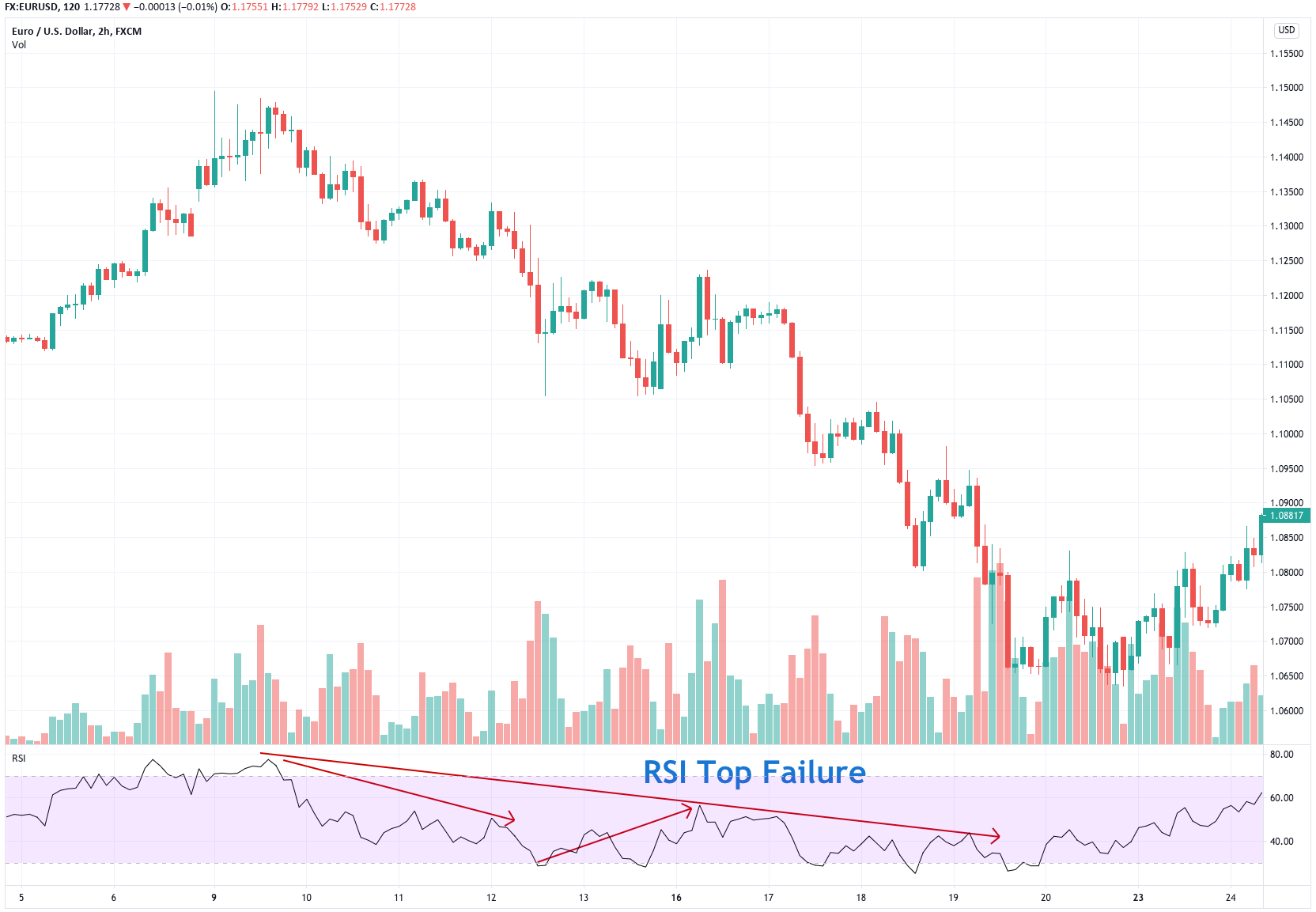

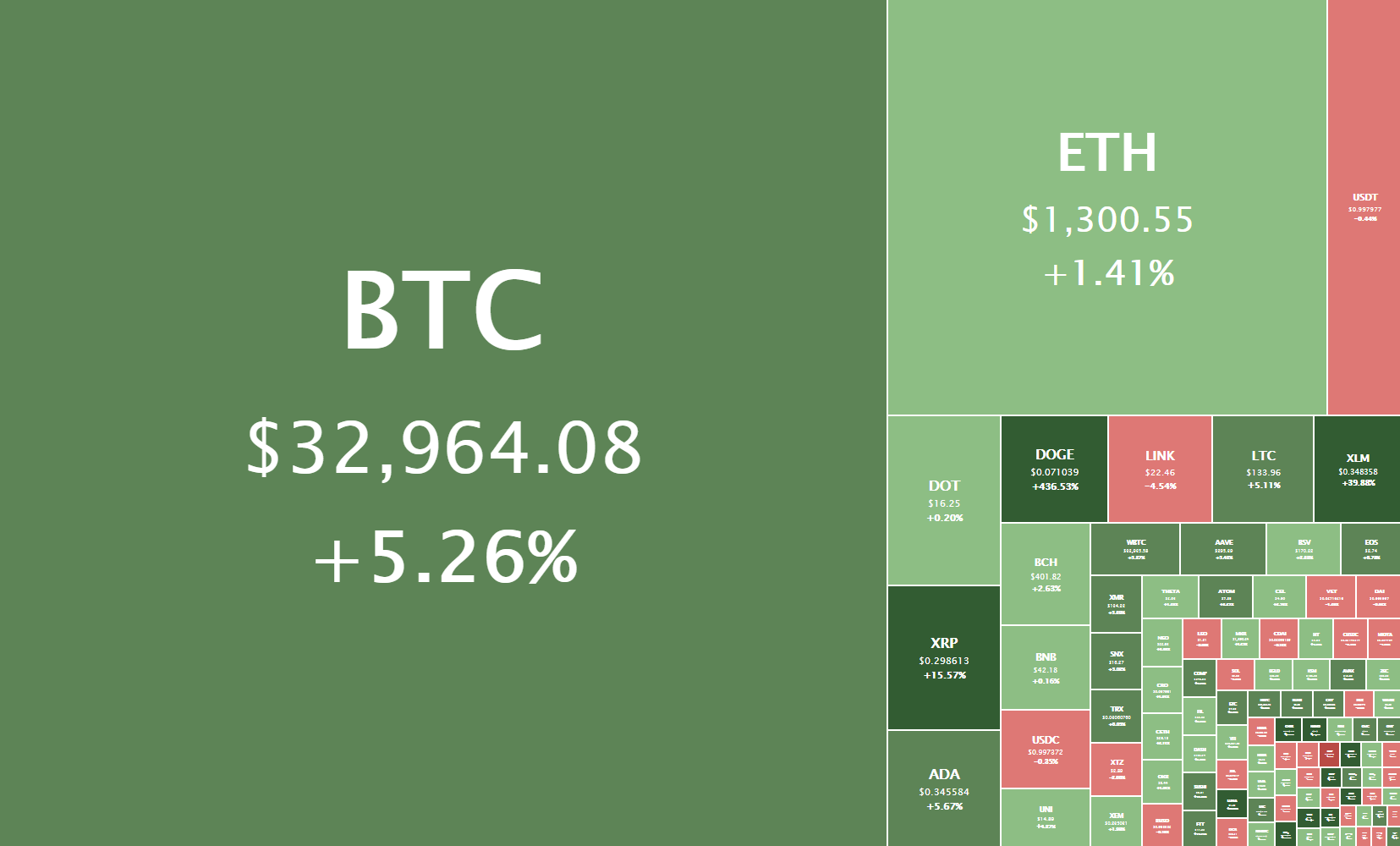

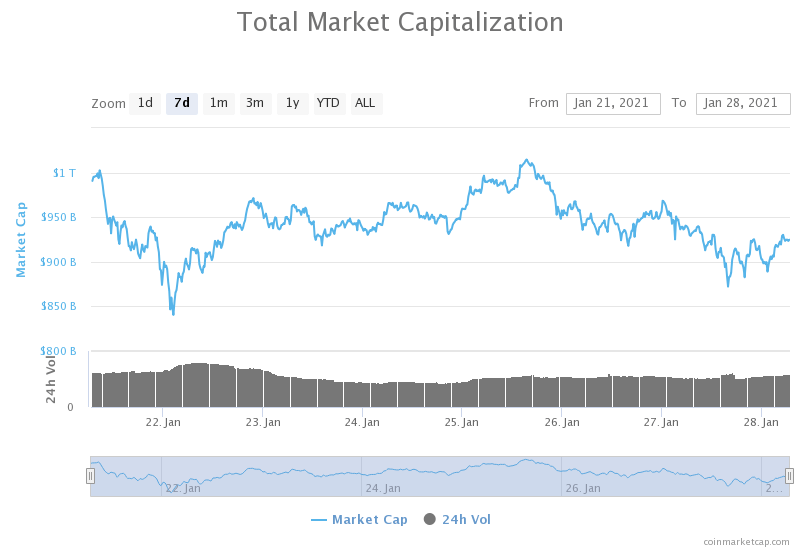

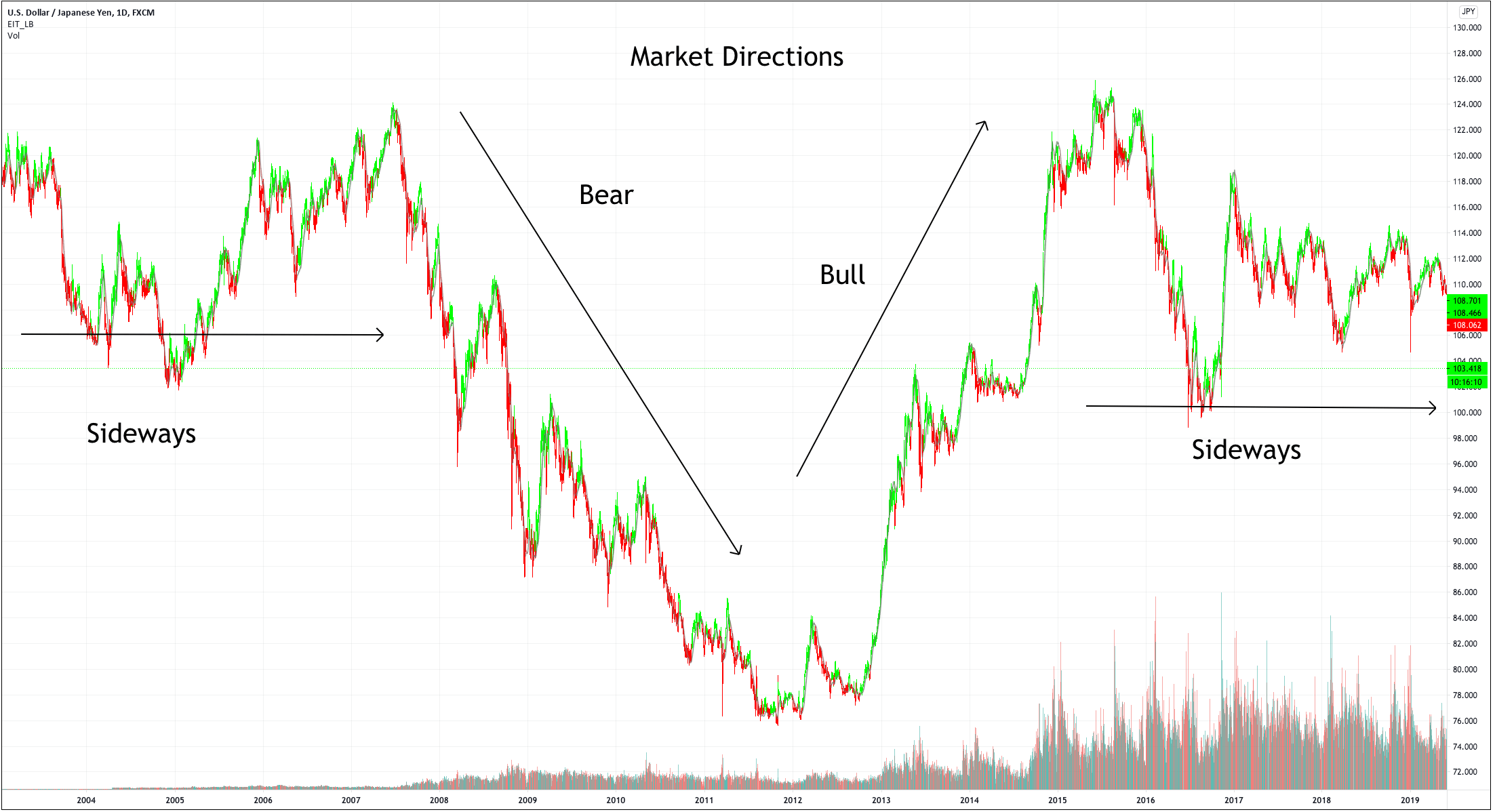

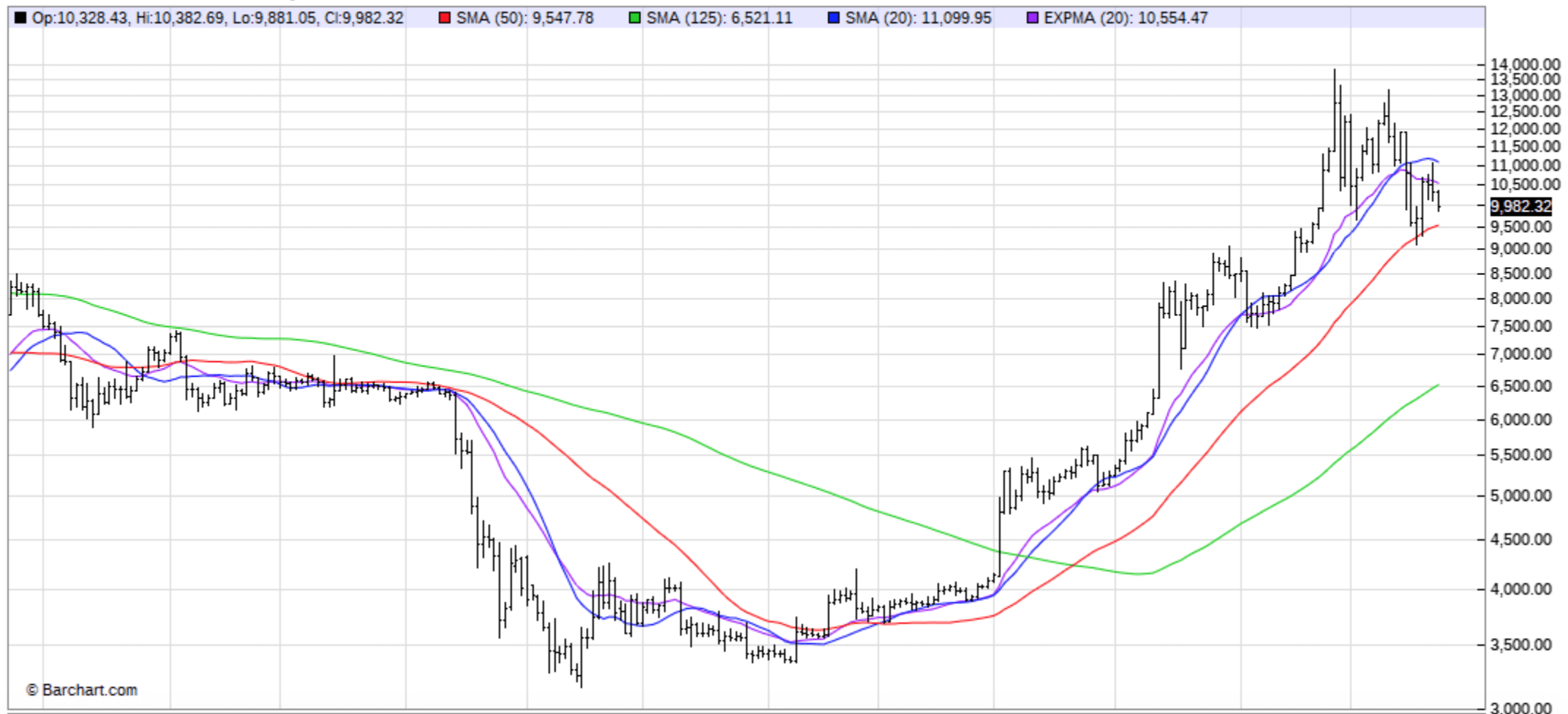

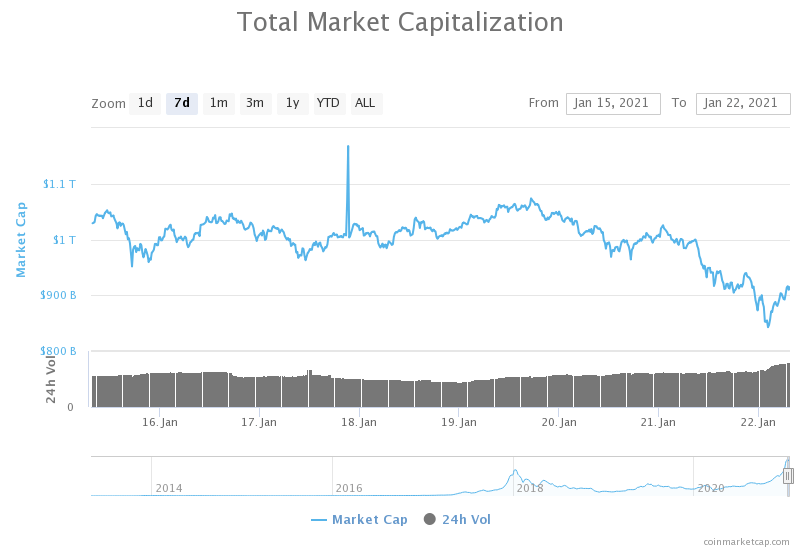

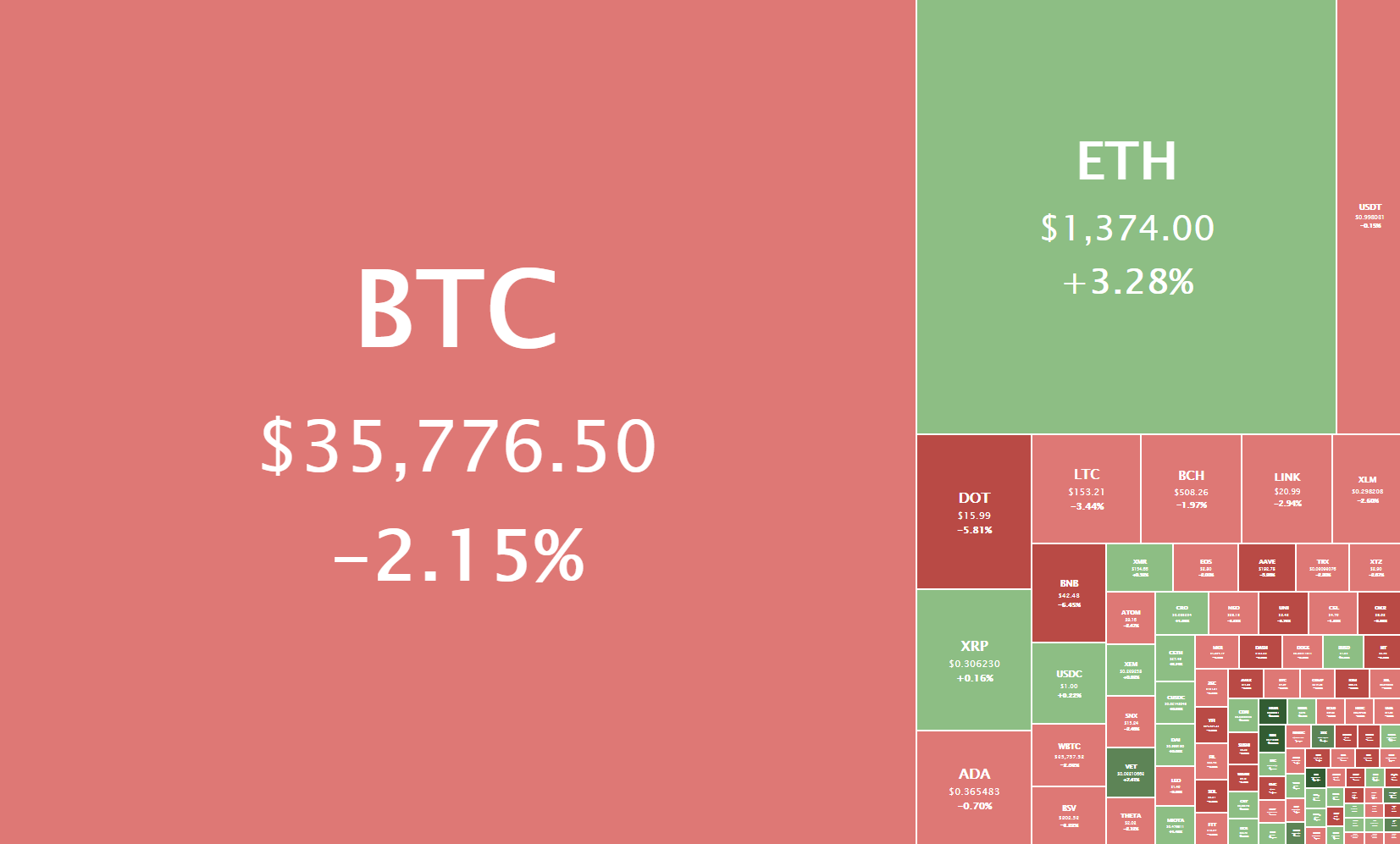

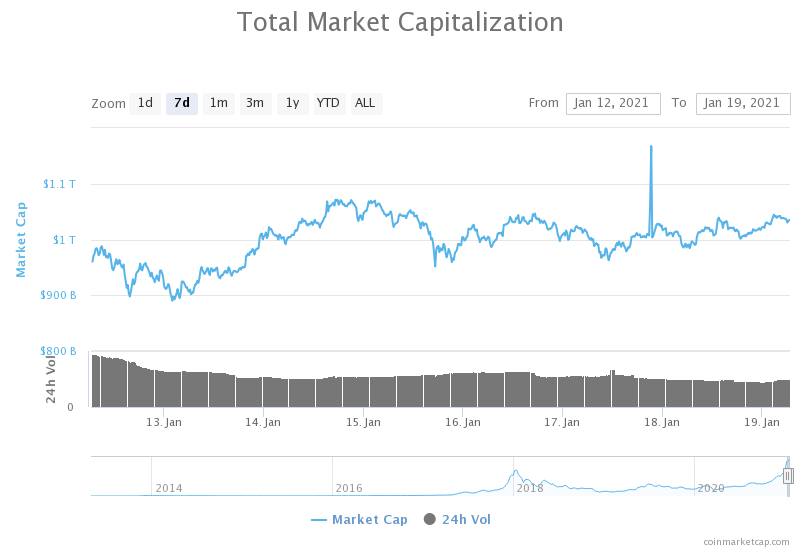

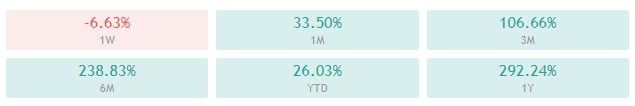

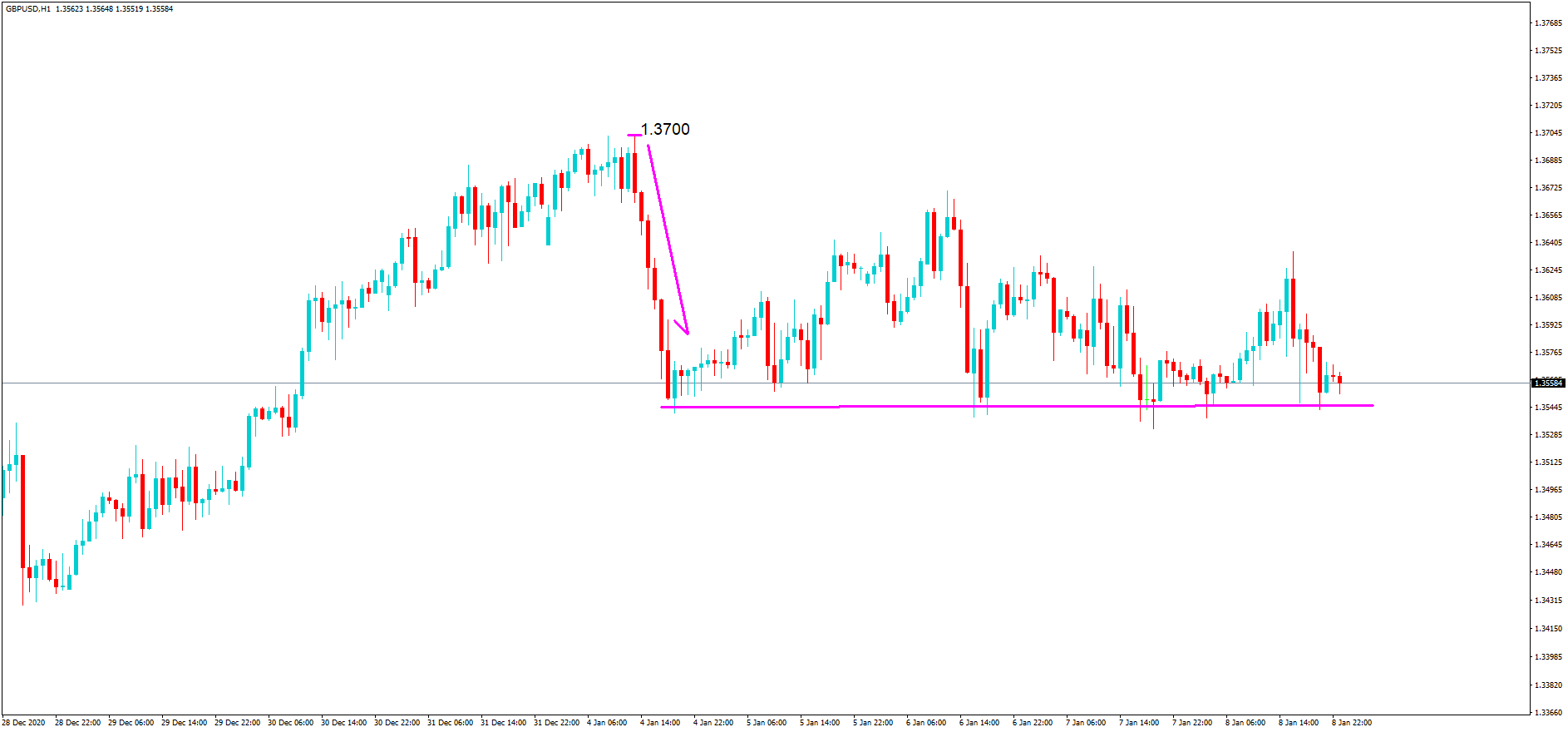

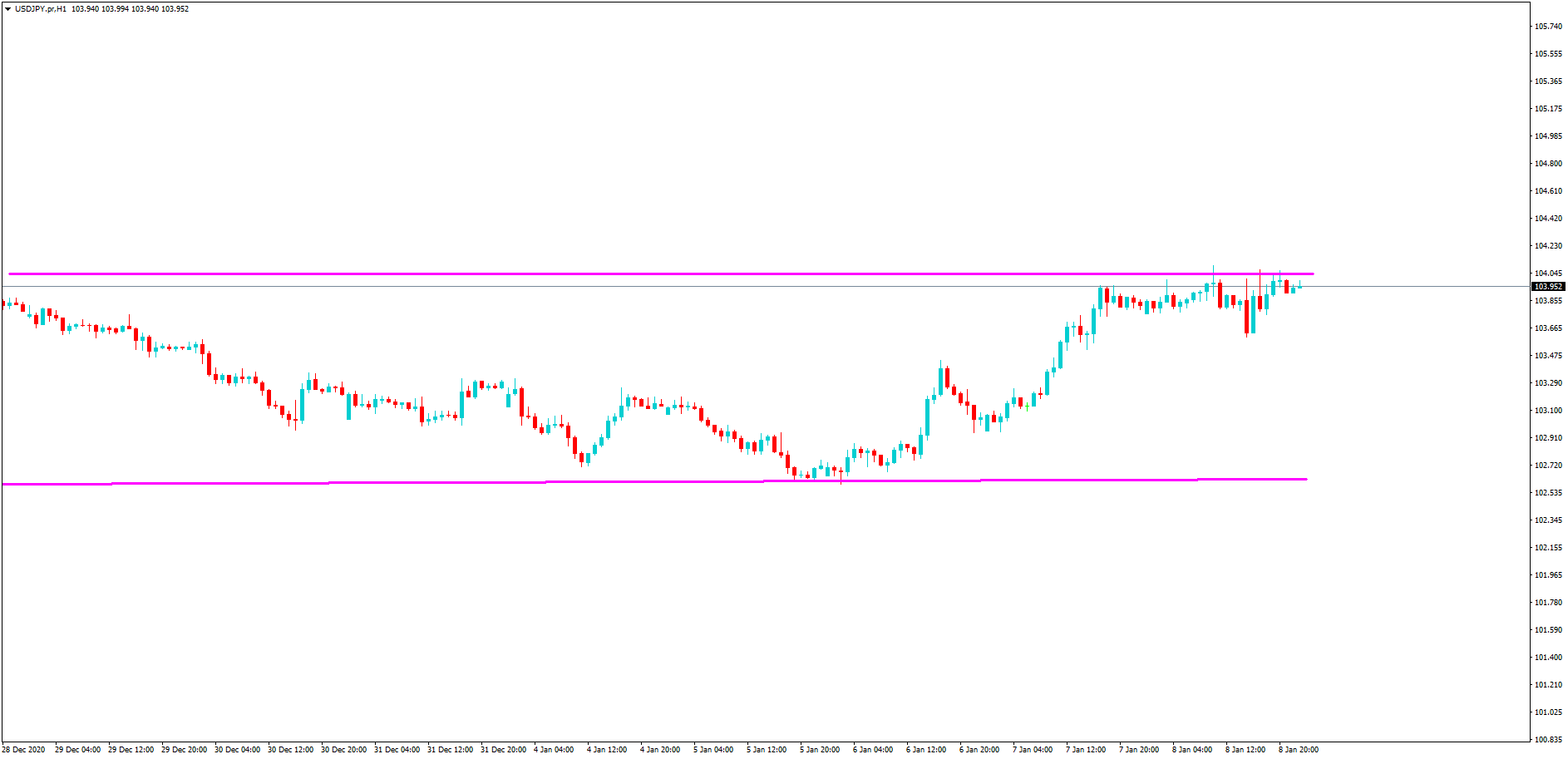

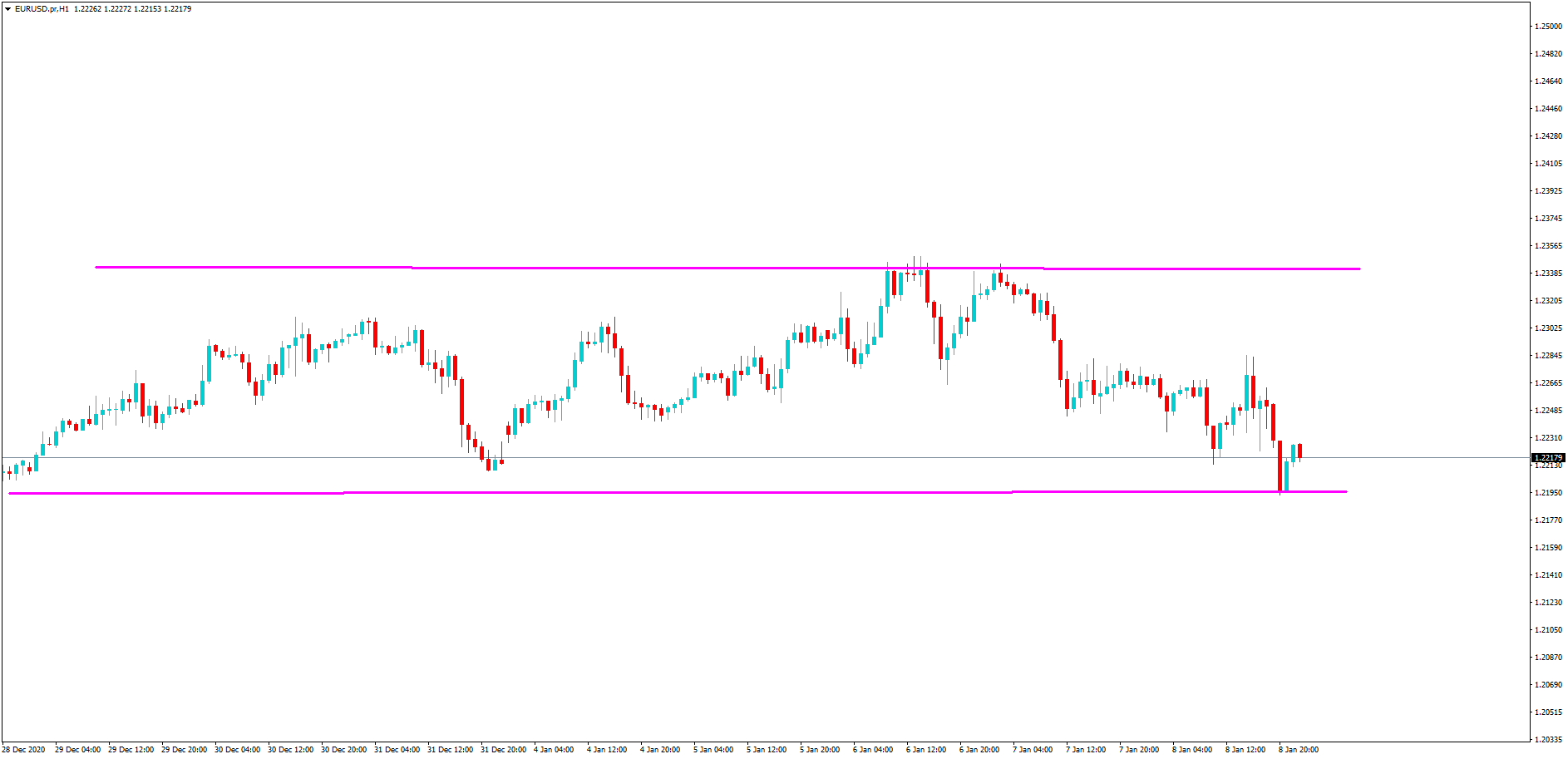

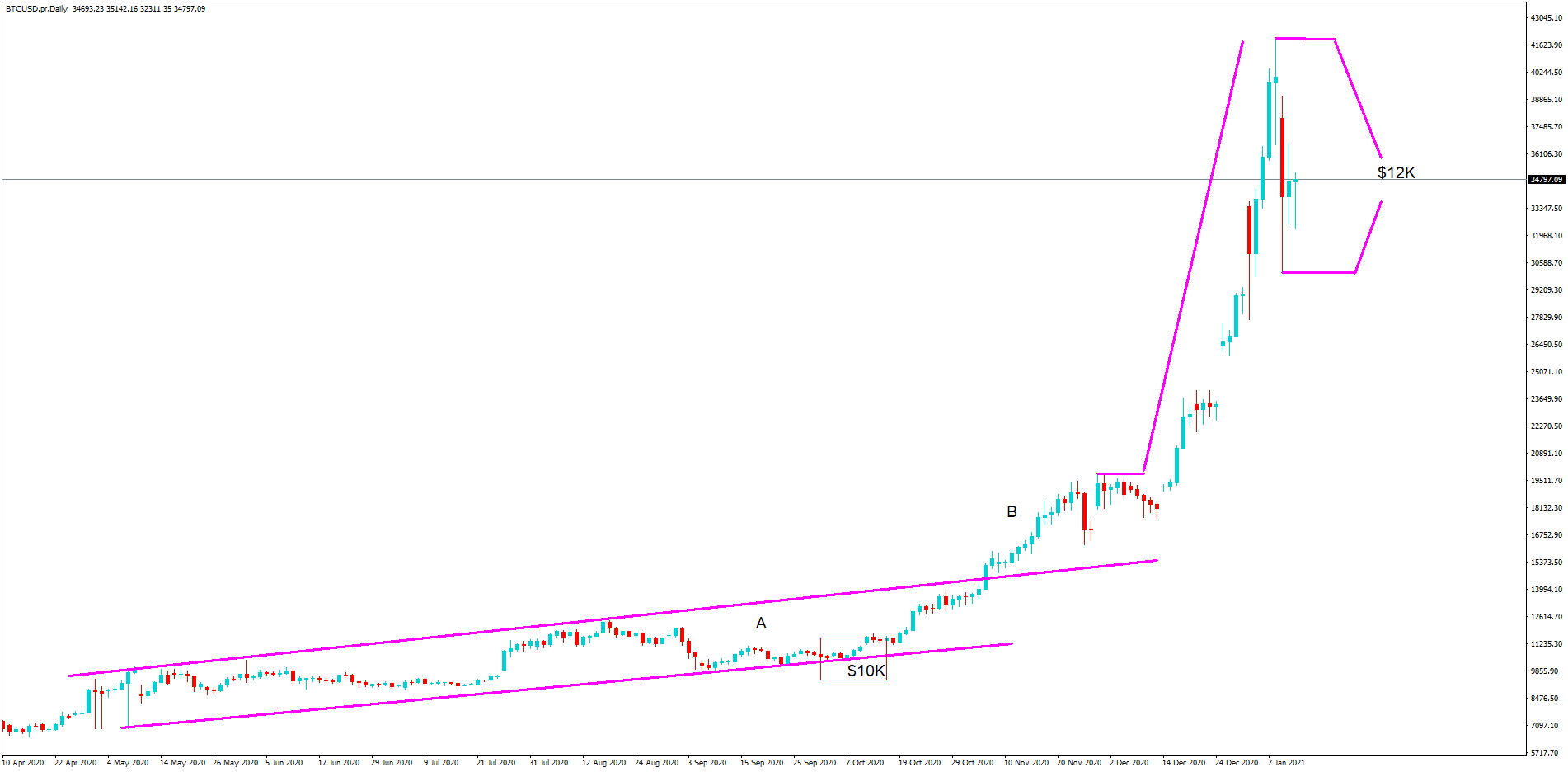

Crypto trading looks very similar to regular forex trading, in fact, it uses the same trading platforms and the same charts, from the outside it looks pretty much the same. In reality, the way that it works is very different, but a lot of people fall into the trap of trading crypto the same way that they do with forex. There are some fundamental differences to them, firstly the amount of money being traded is a lot lower, so the markets are a lot more volatile, the markets are also not quite as open as you would think when it comes to crypto.

In the forex world, a single trader can’t make much of a difference, but when it comes to trading, a single trade can cause the markets to shift. The markets are controlled by the people rather than the markets controlling them, so the price is all based on what people want it to be. There are also much larger movements, both up and down, making it far riskier, so you need to ensure that you understand it before you trade. You cannot use the same tactics with crypto trading as you do with forex trading.

Trading Too Much

Trading Too Much

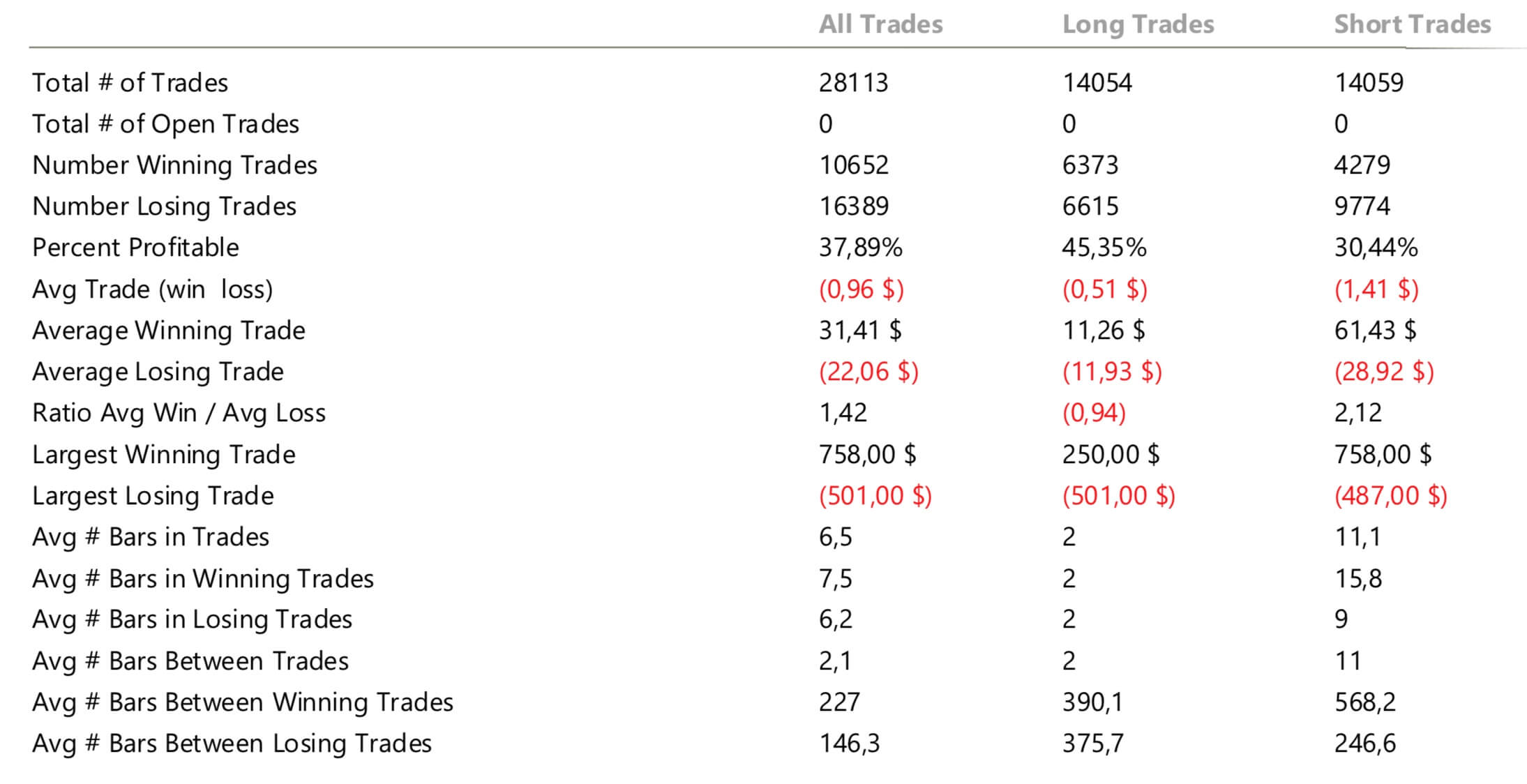

The trade sizes when it comes to crypto trading vary a lot, 1 lot does not always mean 1 coin. For some it does, things like bitcoin, a 1 lot trade may be trading 1 bitcoin, but if you trade XRP, 1 lot may mean 100 XRP, this can drastically affect your trading. You need to understand how much it is that you are going to be trading. Due to this, many crypto traders start out trading far too much. One major issue with placing trades that are too big is the volatility that comes with crypto trading. The markets are a lot more, so when you have a large trade, one that is too big for your account, as soon as the markets shift the wrong way and they can shift a lot, your account will be in trouble.

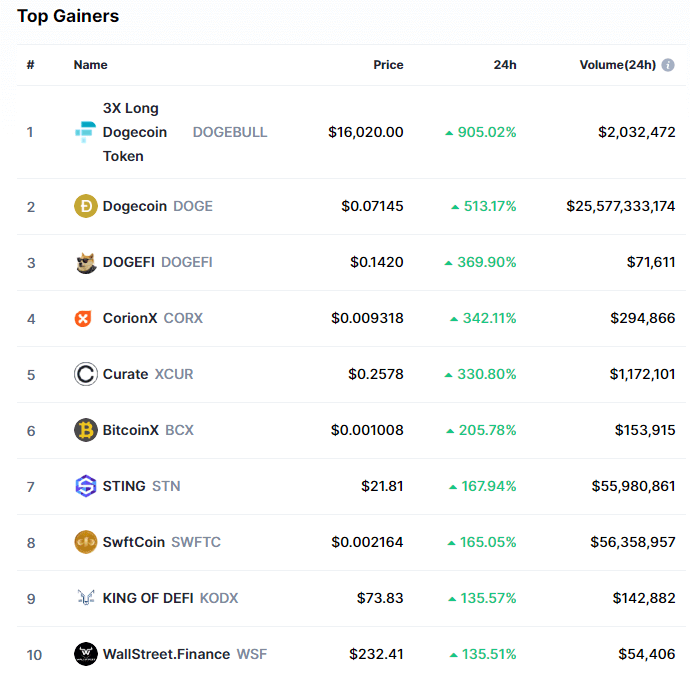

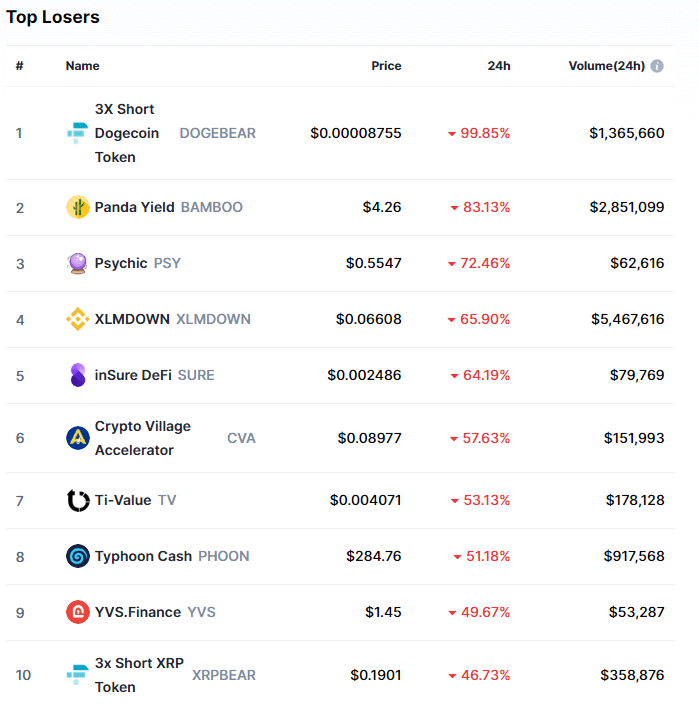

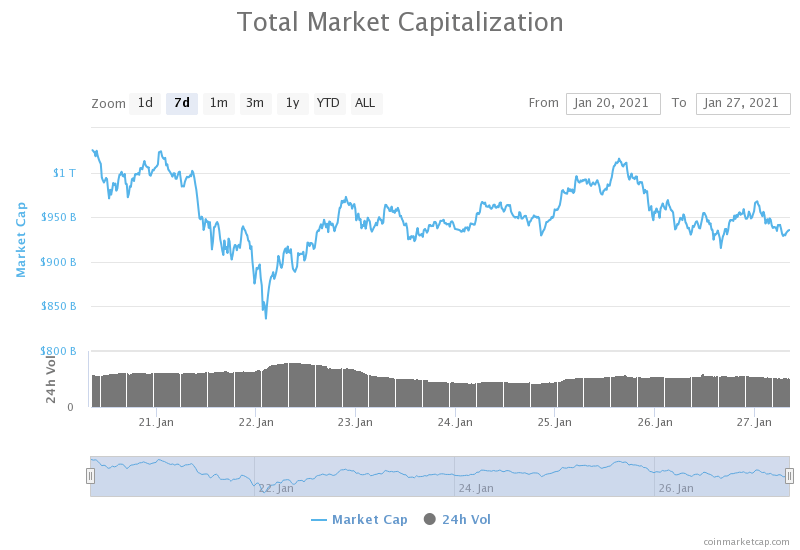

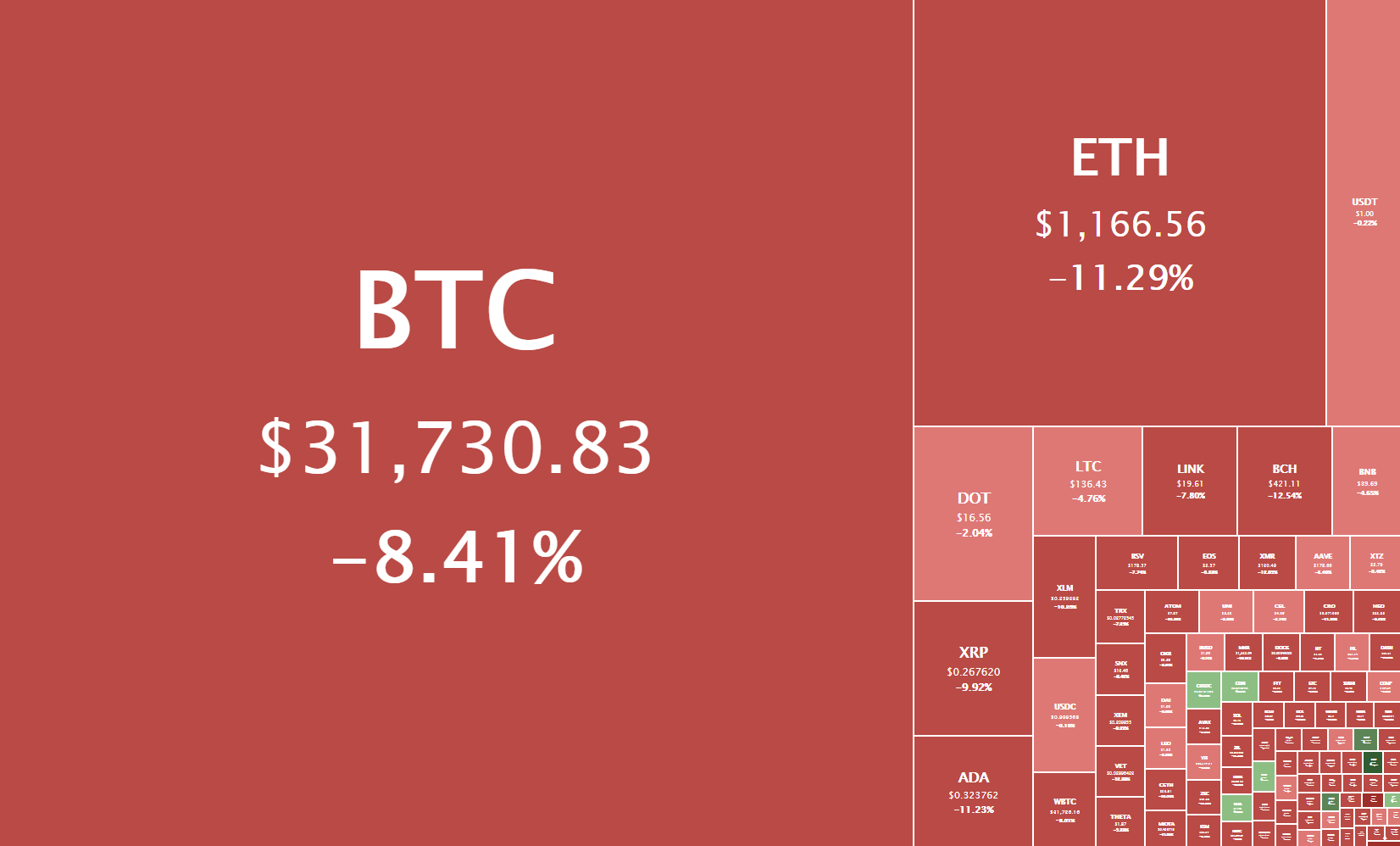

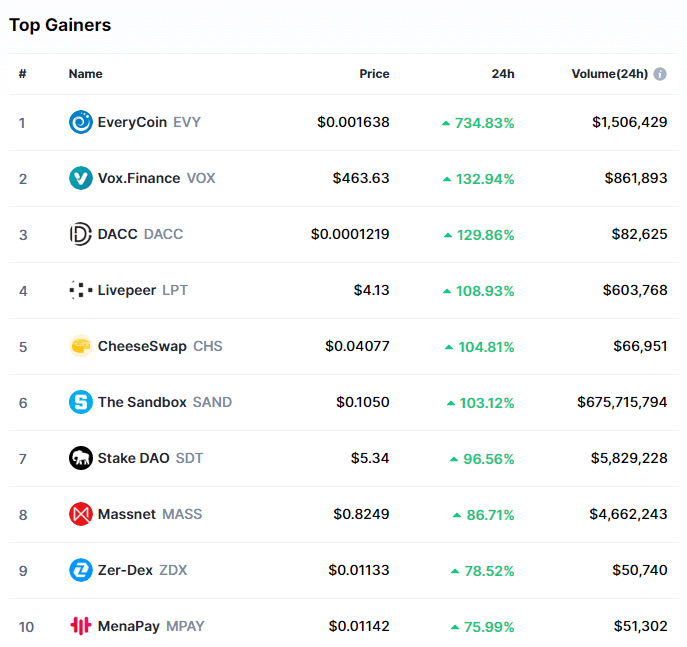

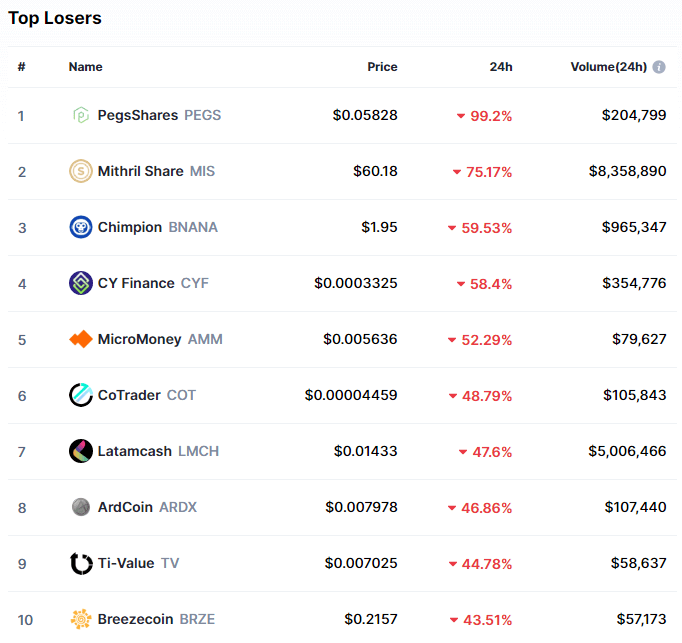

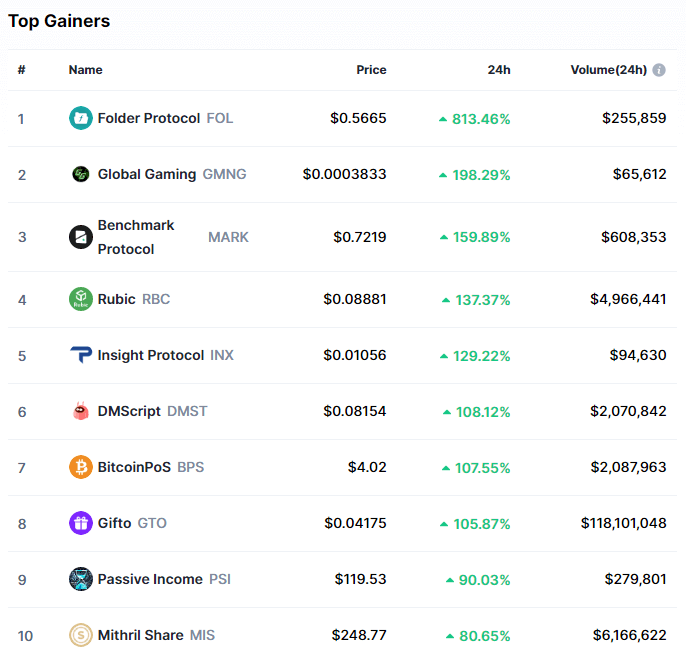

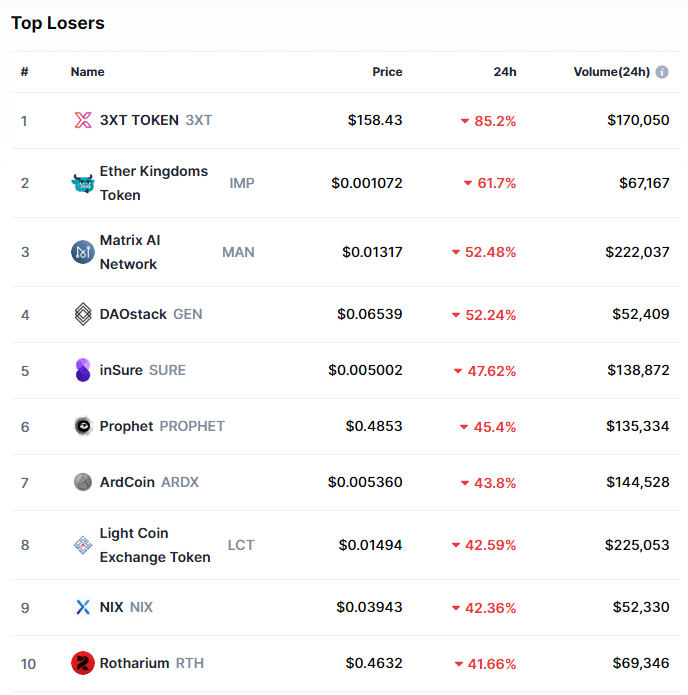

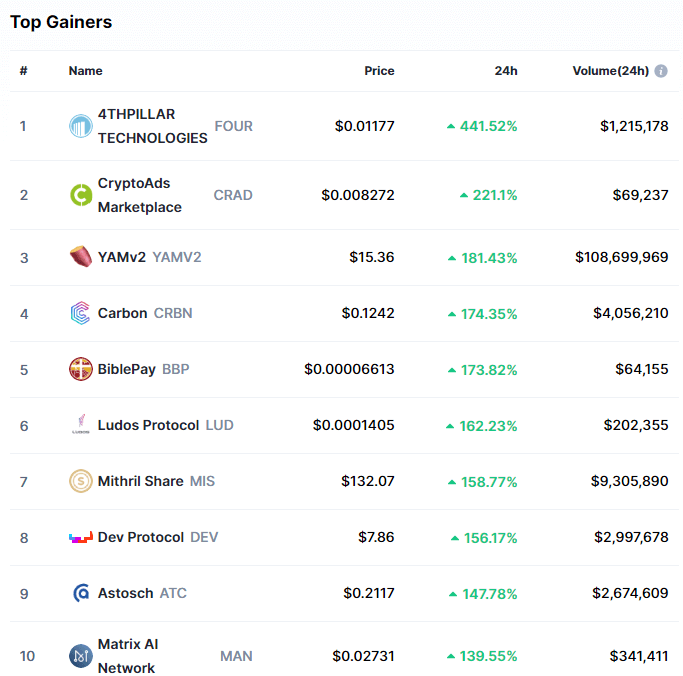

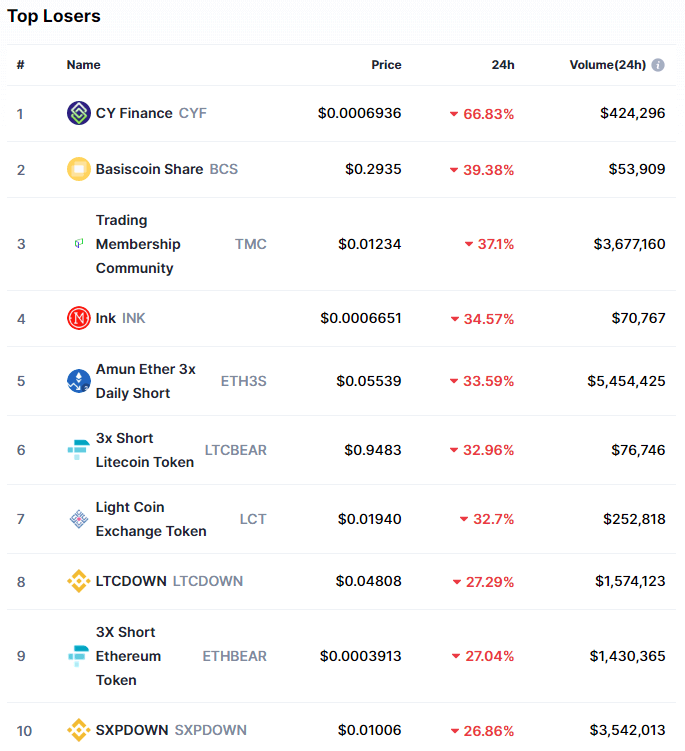

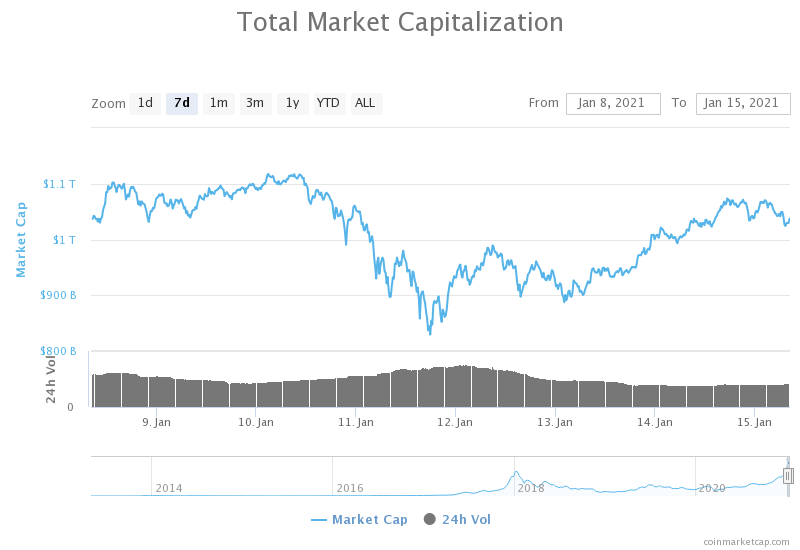

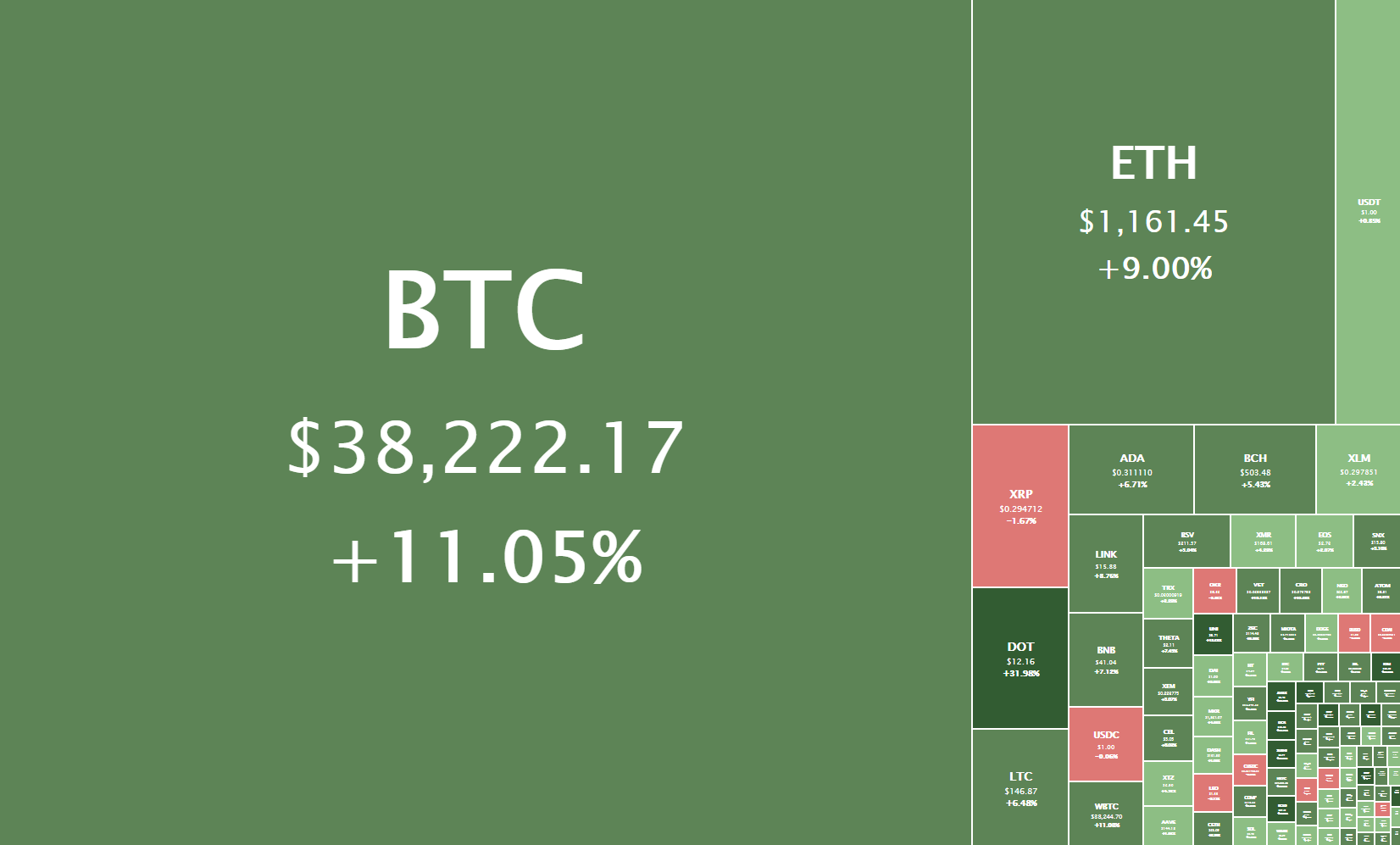

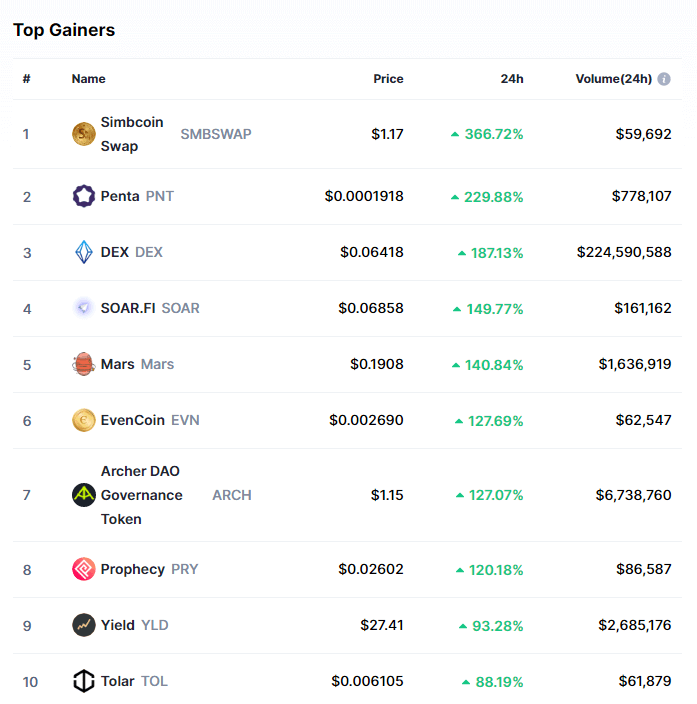

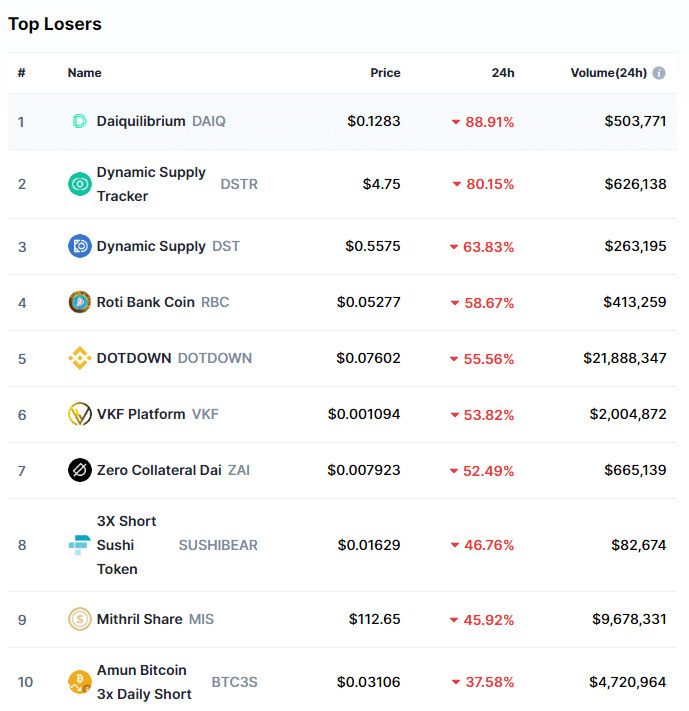

Not Watching the News

The crypto markets can be heavily influenced by news about the coin that you are trading or even a coin that you are not. Things like a big business taking up a currency into their service, or a country banning crypto can have a huge effect on the markets. You need to keep an eye on what is going on in the crypto world, if you do not, you may get caught out as you are treading a coin that has just been banned and the price will drop, but you won’t know that and you will only be greeted by the aftermath of a potentially blown account. There are a lot of sites out there that are quick to get the news up, use them regularly, even if it is just when you are on the toilet, as long as you are keeping up to date, you will be better protected from any sudden movements due to news events.

Not Using Risk Management

Risk Management is a key part of forex trading and it is also a key part of crypto trading, if you are trading without any form of risk management then you are asking for your account to blow. It is far riskier to trade crypto without a risk plan than it is forex too. The markets move so much that a single trade could very quickly blow and account if there aren’t things like stop losses in place, it is also vital that you understand how much you’re trading, as we mentioned above, different trade sizes mean different things depending on the coin that you are using. Risk management is key to keeping your account alive, yet so many people are convinced that a coin will go up that they trade without one, only to find the price drop and they lose quite a lot of money in the process. Always use risk management, no matter how sure you are of a trade, as nothing is guaranteed.

Trading With A Small Account Balance

One of the things that make trading so accessible is the fact that many brokers are now allowing you to trade with as little as $10. That is great but it does come with its own problems, if you want to trade successfully then you need a lot more money, in fact with some brokers a $10 account will allow you to place a single 0.01 lot trade on bitcoin, but as soon as the market moves down, even a few pips, the account will blow. You need a lot more to trade well on crypto than you do forex simply because the markets move a lot and the amount that you are trading is a lot higher, especially as you do not get as much leverage when it comes to crypto trading. So if you want to start, start with at least a few hundred, not the minimum that any broker will allow you to open an account with.

Putting All Your Eggs In One Basket

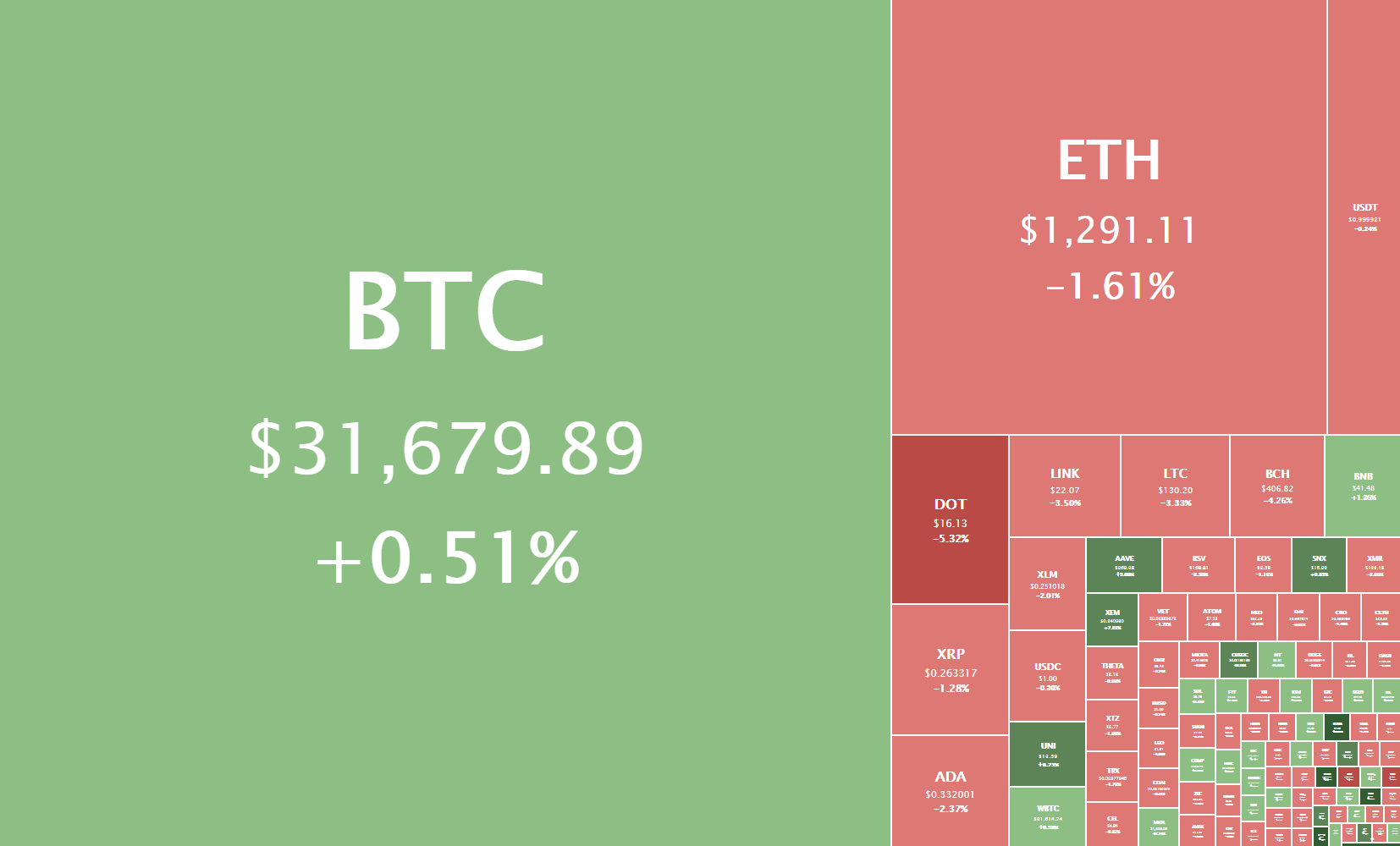

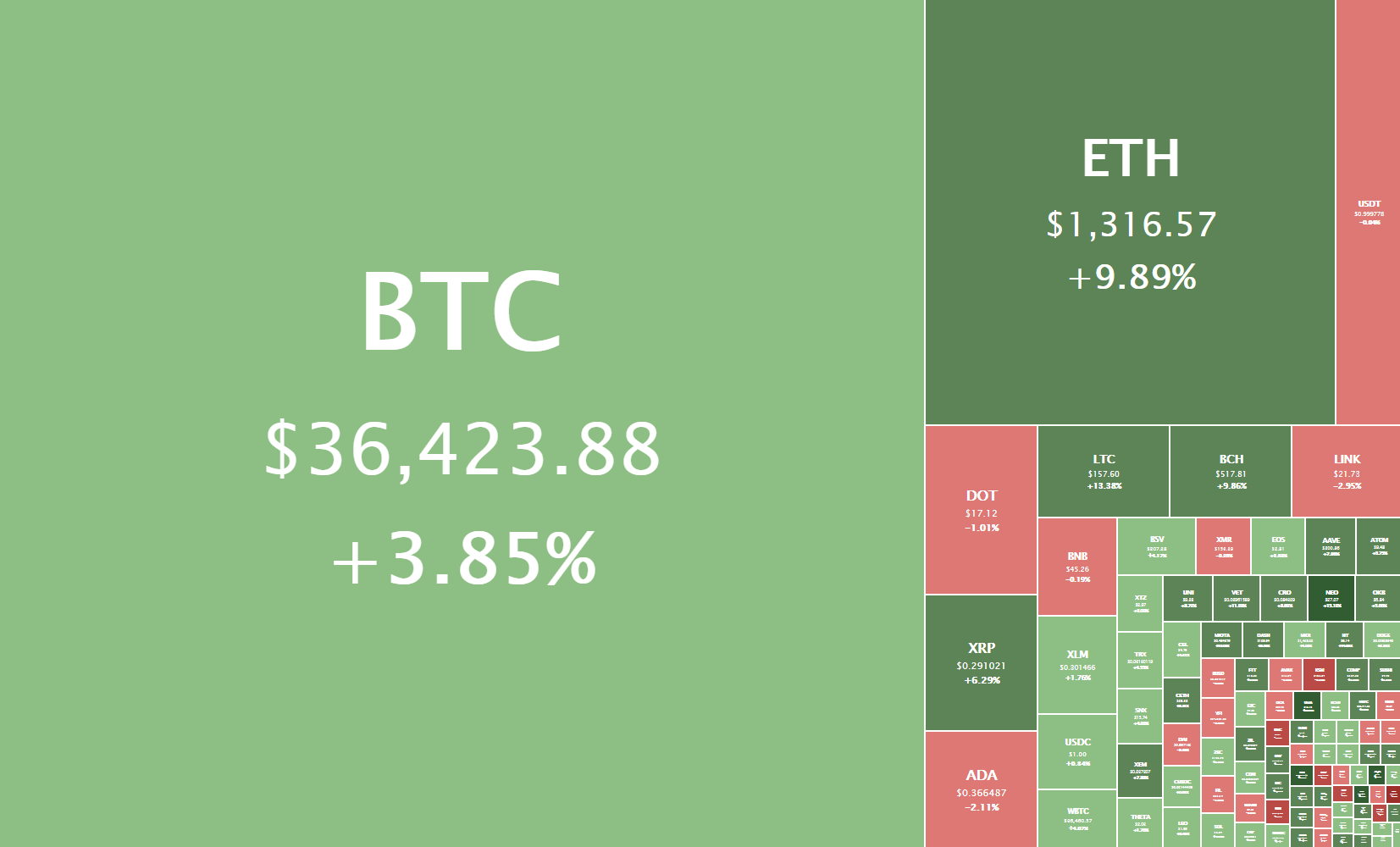

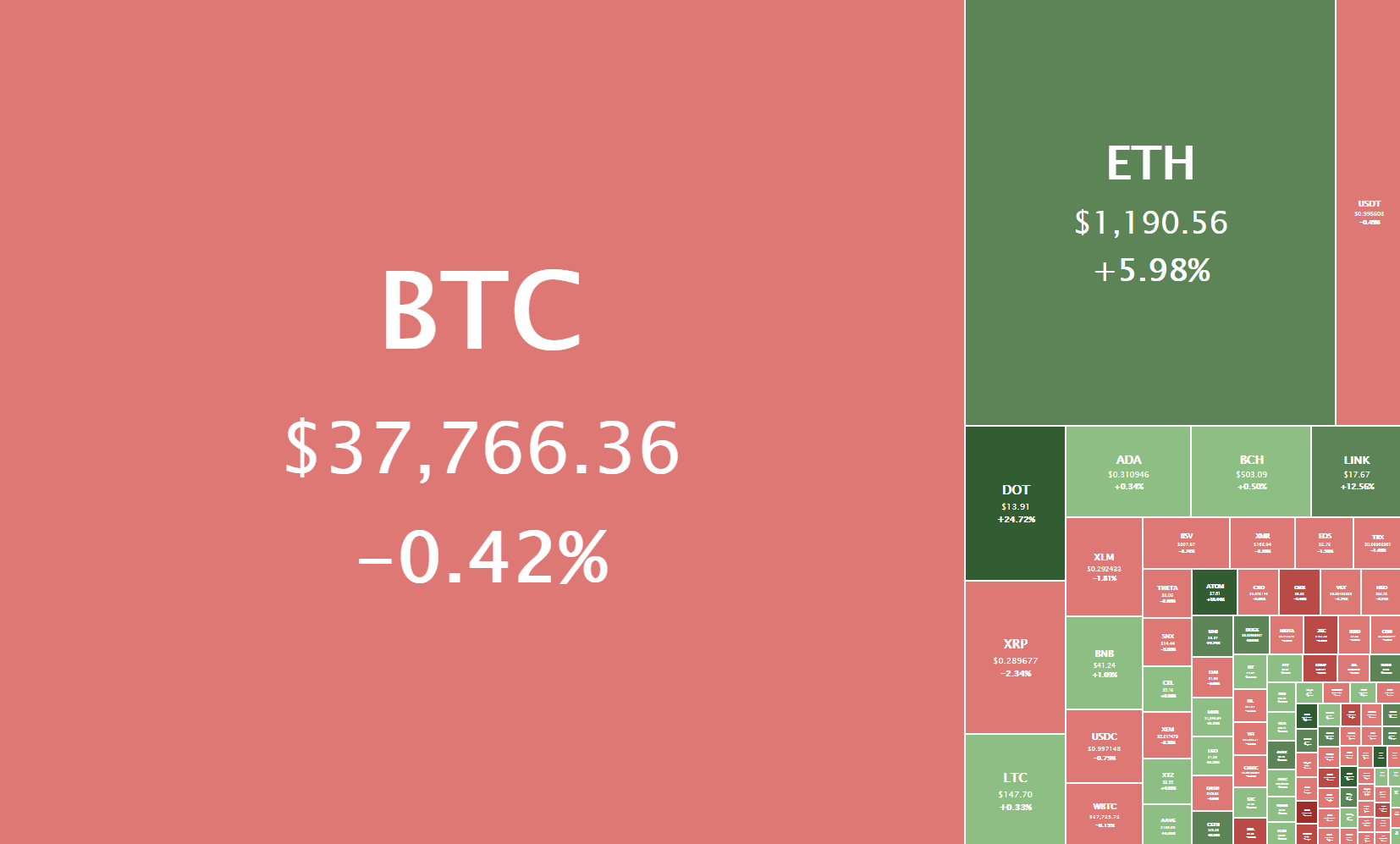

This is a phrase that you probably heard before, that you should not put all of your eggs into one basket. This basically means two things here, firstly that you should not put your entire balance into a single trade, and that you should not only trade single crypto coins. If we look at the latter, there are a lot of coins available, many of the crypto-focused brokers are now offering 30+ different crypto coins to trade, so there is a lot of variety. It is recommended that you do not trade only one, you need to diversify. Trading only one means that you are tied to its performance, if it is not doing well, neither will you, but if you diversify, even if one does not do well, others might, which will mean that you will negate any losses from the first coin. Try and trade more than one, but not too many for it to overwhelm you.

This is a phrase that you probably heard before, that you should not put all of your eggs into one basket. This basically means two things here, firstly that you should not put your entire balance into a single trade, and that you should not only trade single crypto coins. If we look at the latter, there are a lot of coins available, many of the crypto-focused brokers are now offering 30+ different crypto coins to trade, so there is a lot of variety. It is recommended that you do not trade only one, you need to diversify. Trading only one means that you are tied to its performance, if it is not doing well, neither will you, but if you diversify, even if one does not do well, others might, which will mean that you will negate any losses from the first coin. Try and trade more than one, but not too many for it to overwhelm you.

Those Are some of the horrible mistakes that we see a lot of crypto traders doing, the good thing is that most of them are very easily rectified by making a change to your trading plan or by simply changing your view of things. We all make mistakes when it comes to trading and we will continue to do so, what is important for us and the development of our trading is that we are able to recognise those mistakes and to learn from them, to adapt so that in the future we can do better and be a much more profitable trader overall.

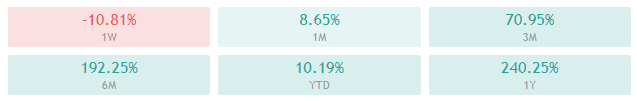

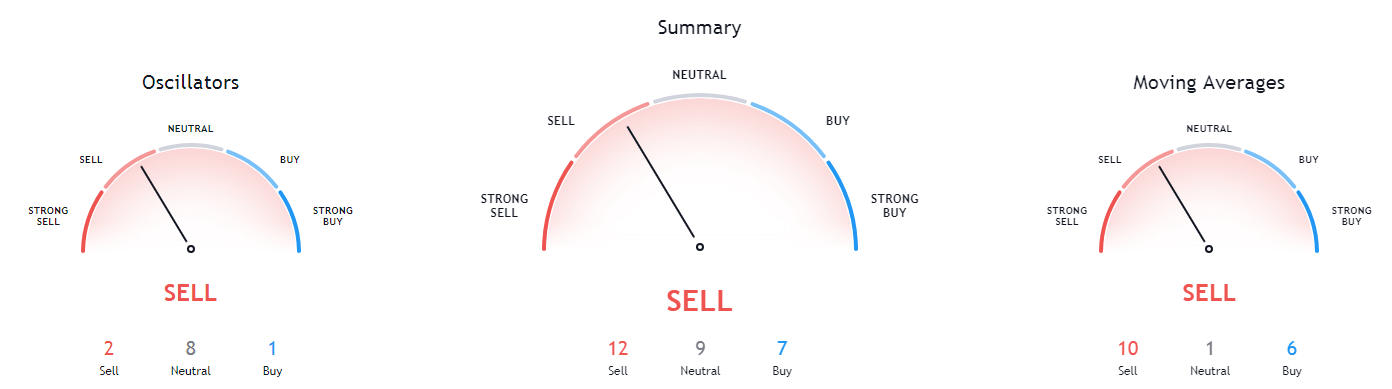

It can be tempting to simply follow what other people are doing when it comes to trading bitcoin. There are a lot of people out there making a lot of money of fit, so there is no harm in just following them right? Well no, first they will certainly be trading with a strategy, secondly, you do not know what that strategy is and so blindly following trades is never a good idea in that situation. Also, you will not be getting the trades at the exact same time, so by the time you take the trade the optimum time may have already passed. So this is why you need a strategy, a strategy that outlines what you will be trading, when you will be trading and how you will be protecting your account. You should always trade with one and you should only put on trades that are properly in line with the strategy that you are using.

It can be tempting to simply follow what other people are doing when it comes to trading bitcoin. There are a lot of people out there making a lot of money of fit, so there is no harm in just following them right? Well no, first they will certainly be trading with a strategy, secondly, you do not know what that strategy is and so blindly following trades is never a good idea in that situation. Also, you will not be getting the trades at the exact same time, so by the time you take the trade the optimum time may have already passed. So this is why you need a strategy, a strategy that outlines what you will be trading, when you will be trading and how you will be protecting your account. You should always trade with one and you should only put on trades that are properly in line with the strategy that you are using. As mentioned above, you should not be blindly following other people’s trades, as tempting as it may seem. You need to remember that they have been doing this a long time, they have a strategy that they are following, they may even have information from sources that you do not know about, so blindly following their trade will basically mean that you are allowing them to

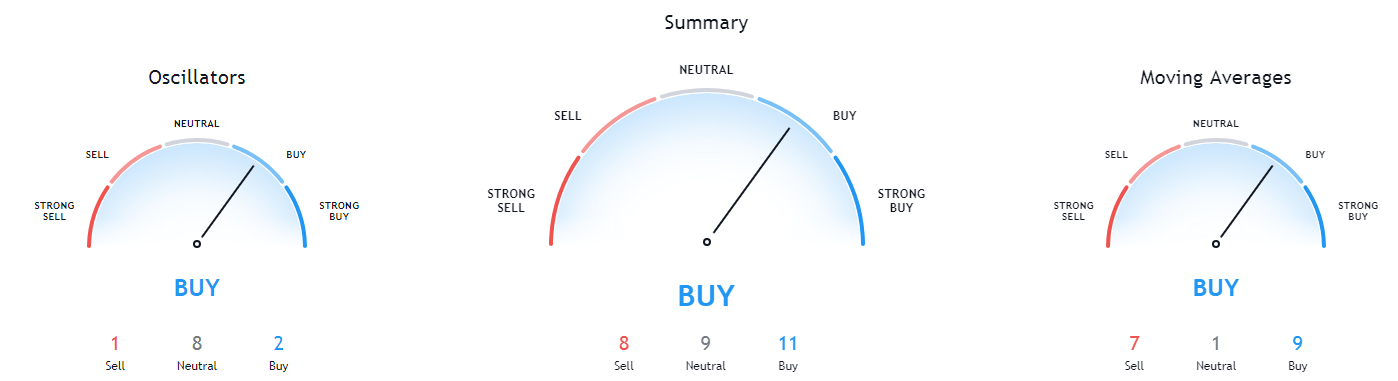

As mentioned above, you should not be blindly following other people’s trades, as tempting as it may seem. You need to remember that they have been doing this a long time, they have a strategy that they are following, they may even have information from sources that you do not know about, so blindly following their trade will basically mean that you are allowing them to  Risk Management is key when it comes to any form of trading and it is certainly the case for bitcoin too. You need to use it, things like a proper

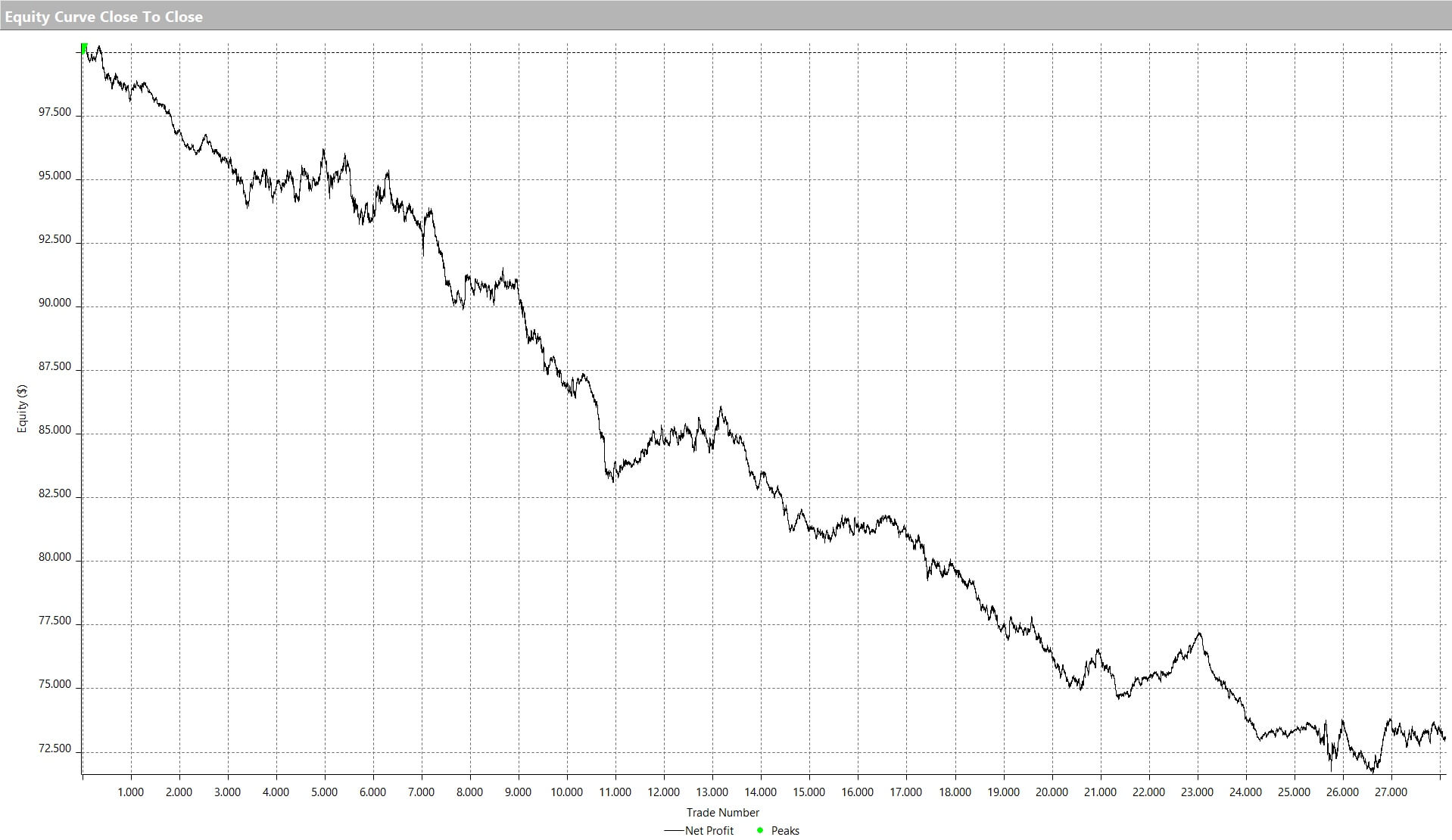

Risk Management is key when it comes to any form of trading and it is certainly the case for bitcoin too. You need to use it, things like a proper  It can be very tempting to trade more when things are going well, especially when it is bitcoin due to the massive profit potential that it offers, but you need to be wary of this, you do not know what to overtrade. Overtrading is basically when you place more trades than you should. Overtrading can decrease your account’s margin, and when the margin gets too low, it will only take a small movement the wrong way for your account to blow and for your broker to close all of your trades in the negative. Only trade what you need to, do not get greedy, if you are being profitable, accept that, do not try to push too hard for more.

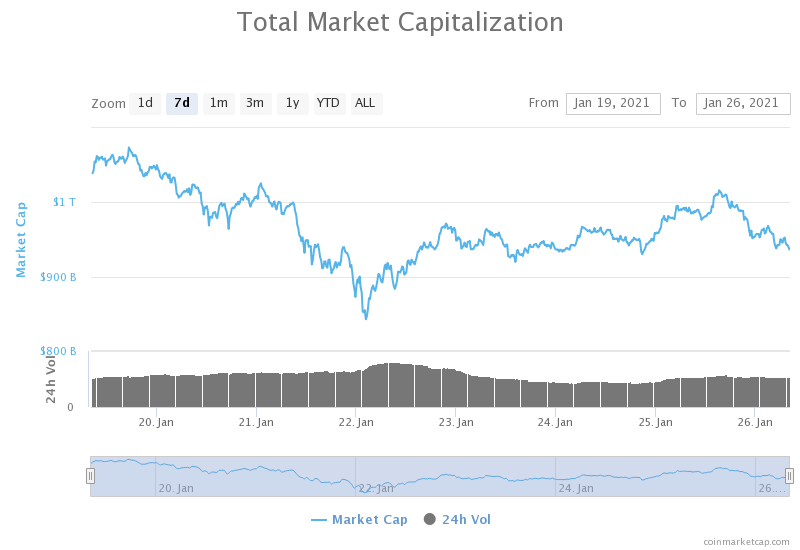

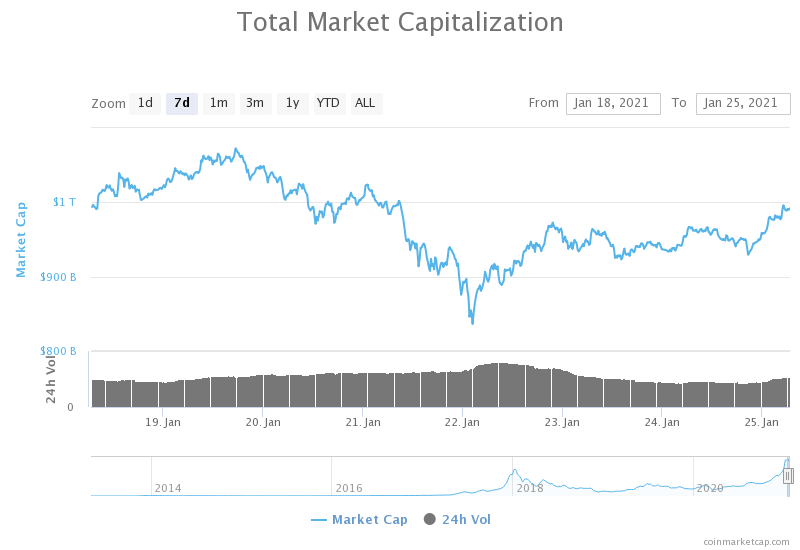

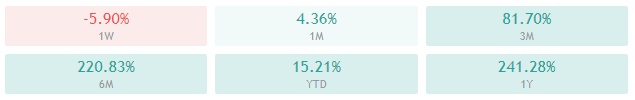

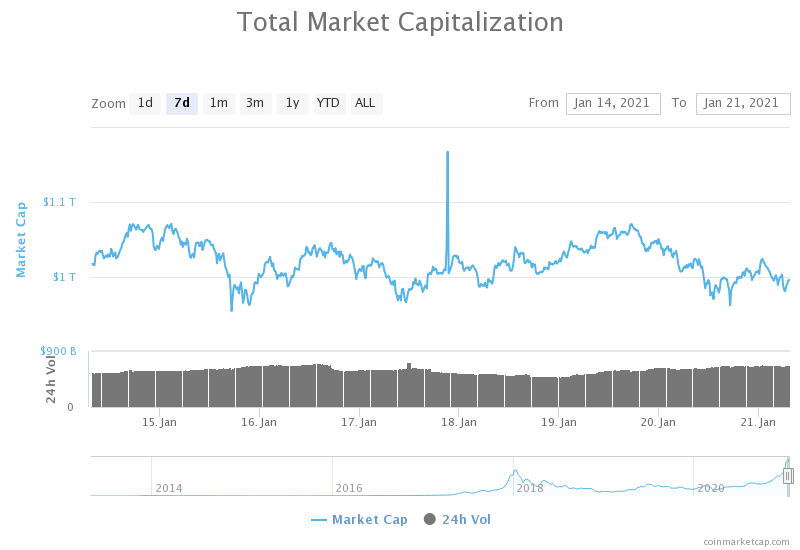

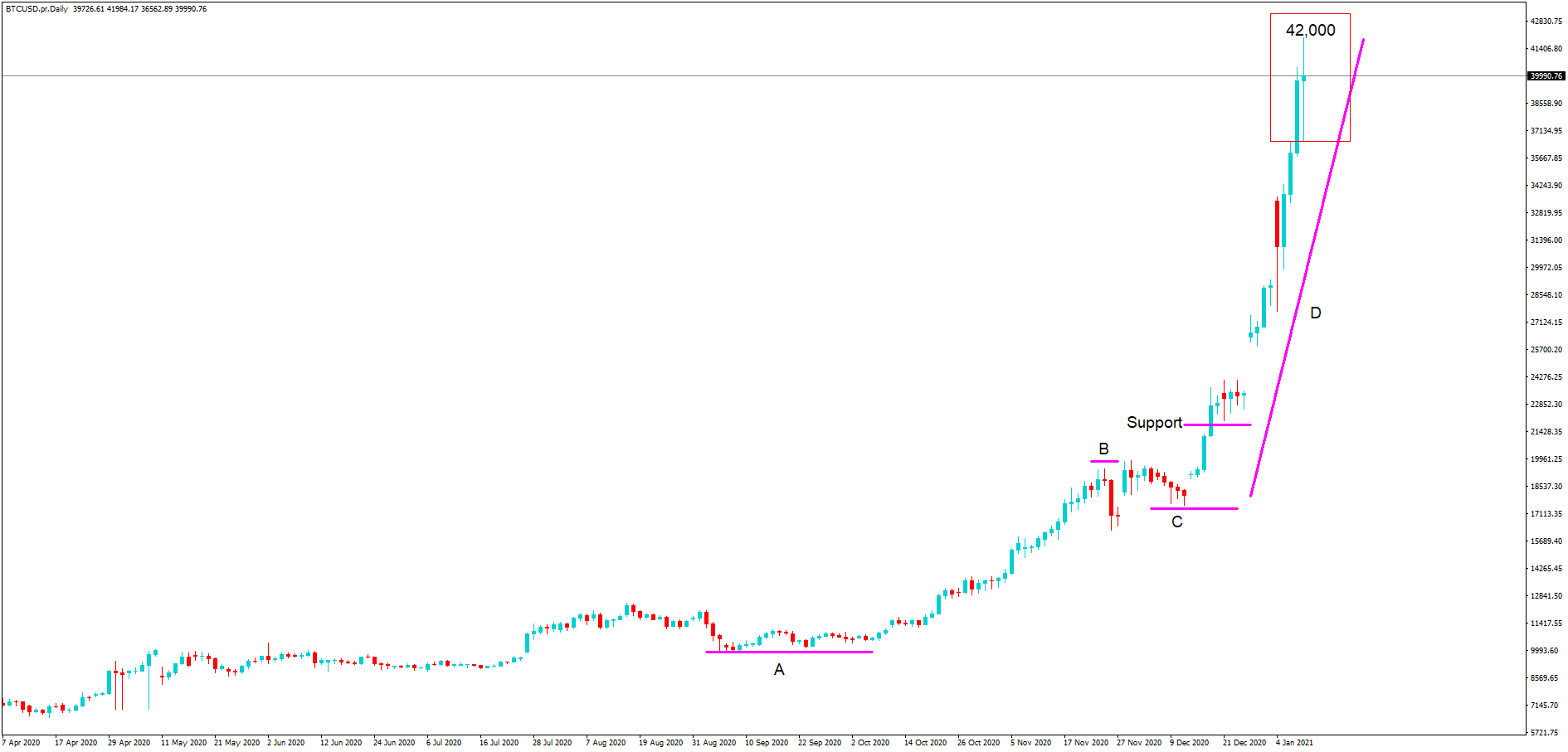

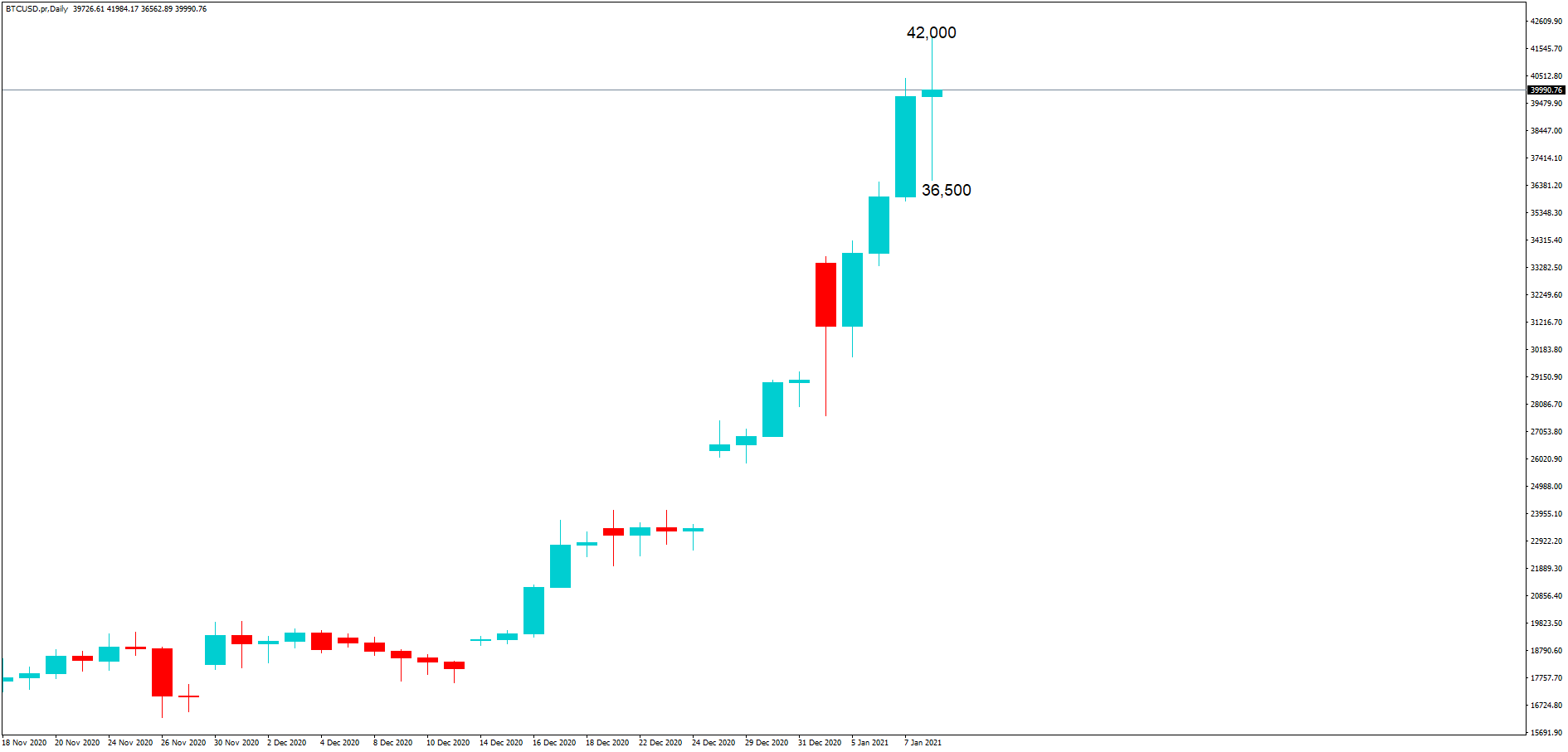

It can be very tempting to trade more when things are going well, especially when it is bitcoin due to the massive profit potential that it offers, but you need to be wary of this, you do not know what to overtrade. Overtrading is basically when you place more trades than you should. Overtrading can decrease your account’s margin, and when the margin gets too low, it will only take a small movement the wrong way for your account to blow and for your broker to close all of your trades in the negative. Only trade what you need to, do not get greedy, if you are being profitable, accept that, do not try to push too hard for more. When you are trading bitcoin, it is very important that you keep an eye on the news that is going on around you. Bitcoin can be heavily influenced by the news, if a country decides to ban its use it can have a very strong and very quick drop, if a major company decides to start accepting it, it can have a huge spike upwards. You do not want to miss out on the opportunities that the news can present, but maybe more importantly, you do not want to get caught out by a huge drop, which even with stop losses in place, can cause an account to blow if the price jumps passed the stop loss. If you are going to trade bitcoin or any other form of cryptocurrency, then it is very important that you keep an eye on the news and know what is going on in the crypto world.

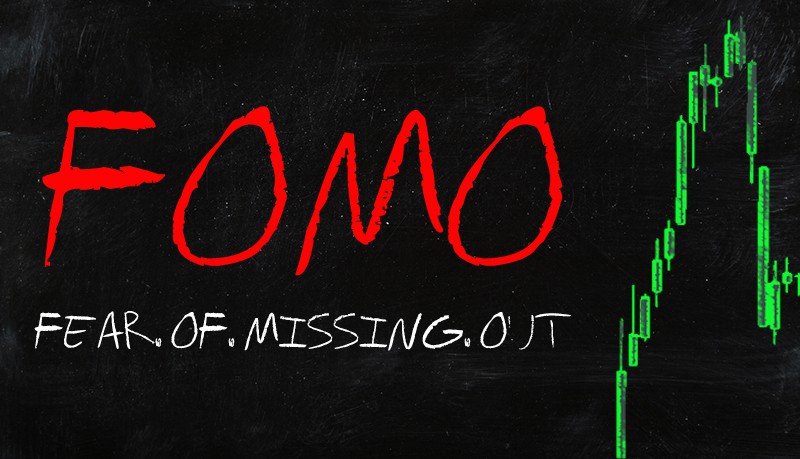

When you are trading bitcoin, it is very important that you keep an eye on the news that is going on around you. Bitcoin can be heavily influenced by the news, if a country decides to ban its use it can have a very strong and very quick drop, if a major company decides to start accepting it, it can have a huge spike upwards. You do not want to miss out on the opportunities that the news can present, but maybe more importantly, you do not want to get caught out by a huge drop, which even with stop losses in place, can cause an account to blow if the price jumps passed the stop loss. If you are going to trade bitcoin or any other form of cryptocurrency, then it is very important that you keep an eye on the news and know what is going on in the crypto world. It is very easy to let emotion take over, especially when there is money involved. This is no different for crypto and bitcoin trading. There is a lot of money to be made, the markets can move up and down a lot which can play havoc with your emotions, in fact, it can cause a lot of stress and anxiety. Things like anxiety can make you not want to trade at all, maybe this has come from a loss or consecutive losses. Then there are things like greed and overconfidence, these can make you start to place more trades, or larger trades, each of which will be putting your account under more and more pressure. If you feel that any form of emotion is starting to build up and that it has the potential to affect the trades that you are making, then you need to take a step back. Take a break, go out for a bit, clear your mind and then come back with a fresh view of the markets. Whatever you do, do not

It is very easy to let emotion take over, especially when there is money involved. This is no different for crypto and bitcoin trading. There is a lot of money to be made, the markets can move up and down a lot which can play havoc with your emotions, in fact, it can cause a lot of stress and anxiety. Things like anxiety can make you not want to trade at all, maybe this has come from a loss or consecutive losses. Then there are things like greed and overconfidence, these can make you start to place more trades, or larger trades, each of which will be putting your account under more and more pressure. If you feel that any form of emotion is starting to build up and that it has the potential to affect the trades that you are making, then you need to take a step back. Take a break, go out for a bit, clear your mind and then come back with a fresh view of the markets. Whatever you do, do not

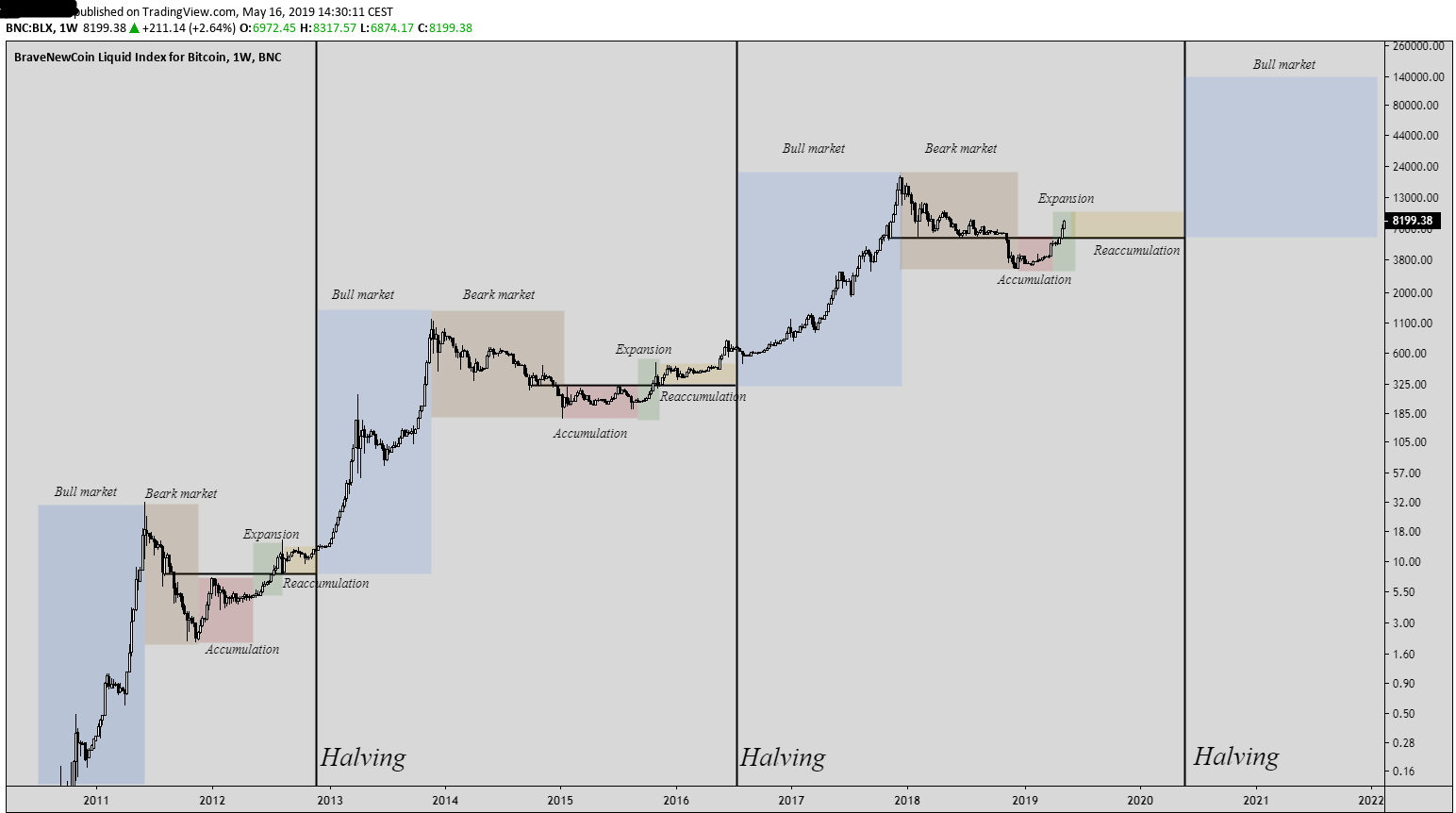

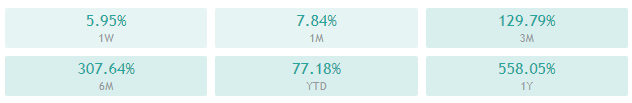

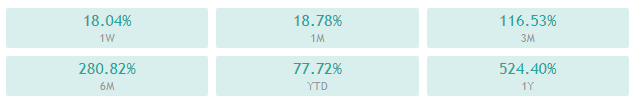

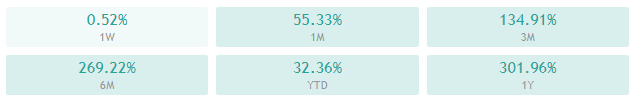

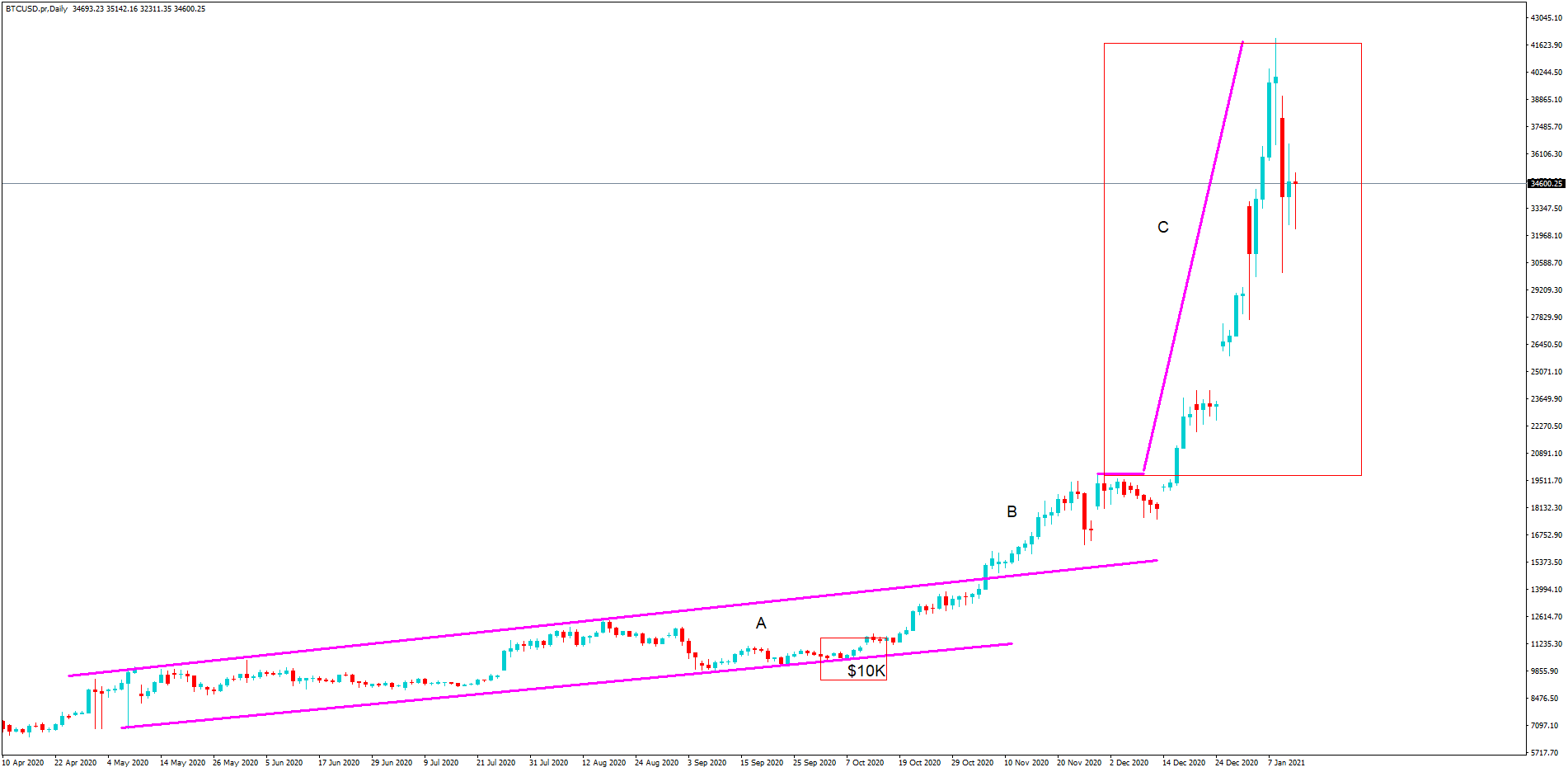

Buy, buy, buy, advice that is given out a lot, in the past, at any time throughout the life of coins like Bitcoin, if you had bought and helped you would now be in profit, it is as simple as that so the advice would have done pretty well. For other cryptocurrencies though, that advice may not be quite as good, a lot of them have had their all-time highs long ago and have not recovered back to that value. If you simply buy without any real plan or idea of where you will get out, including the historical process of the asset then you could be in for a disaster. Only buying can lead to a lack of funds, it can lead to losses should the markets turn and while it can make you money, it is a risky strategy to simply continue to buy at every opportunity that you can. There have been people doing very silly things, selling their house to put all of the money into Bitcoin, yes it paid off but the risk was far too high, do not put everything into it and do not put money in that you do not have.

Buy, buy, buy, advice that is given out a lot, in the past, at any time throughout the life of coins like Bitcoin, if you had bought and helped you would now be in profit, it is as simple as that so the advice would have done pretty well. For other cryptocurrencies though, that advice may not be quite as good, a lot of them have had their all-time highs long ago and have not recovered back to that value. If you simply buy without any real plan or idea of where you will get out, including the historical process of the asset then you could be in for a disaster. Only buying can lead to a lack of funds, it can lead to losses should the markets turn and while it can make you money, it is a risky strategy to simply continue to buy at every opportunity that you can. There have been people doing very silly things, selling their house to put all of the money into Bitcoin, yes it paid off but the risk was far too high, do not put everything into it and do not put money in that you do not have. Bitcoin is a cam, cryptocurrencies are a scam, you will hear that a lot, and there is absolutely no evidence behind those claims. The majority of people that state this do not have an understanding of what it is that they are calling scams. We have to admit, that yes, there are some scams within the cryptocurrency world, but then again there are within any industry you look at, this does not, however, mean that the entire cryptocurrency scene is a scam, much the same way that not all banks are scams. Those that are telling you it is a scam will also be advising you to avoid buying it and to avoid trading it. That is terrible advice. There is no harm in trading these coins and tokens, as there are a lot that are very safe to trade. Try and avoid the smaller ones but the majority of brokers that offer any sort of trading and purchasing will be monitoring the coins they have listed and will filter out the undesirable or less than legit ones.

Bitcoin is a cam, cryptocurrencies are a scam, you will hear that a lot, and there is absolutely no evidence behind those claims. The majority of people that state this do not have an understanding of what it is that they are calling scams. We have to admit, that yes, there are some scams within the cryptocurrency world, but then again there are within any industry you look at, this does not, however, mean that the entire cryptocurrency scene is a scam, much the same way that not all banks are scams. Those that are telling you it is a scam will also be advising you to avoid buying it and to avoid trading it. That is terrible advice. There is no harm in trading these coins and tokens, as there are a lot that are very safe to trade. Try and avoid the smaller ones but the majority of brokers that offer any sort of trading and purchasing will be monitoring the coins they have listed and will filter out the undesirable or less than legit ones. Something that came up at the start of the whole Bitcoin and cryptocurrency boom was the term HODL, this is basically the idea of holding onto your bitcoin no matter what, with no real aim or goal as to when you will sell or withdraw back into local currencies. While there is certainly some credit to the idea of holding Bitcoin and other cryptocurrencies long term, as there is certainly profit to be had in doing that, the idea of not having any sort of end goal is not. Yes by cashing out you may lose some potential profit, but you are cashing out at a level that is right for you and so you should be happy with that, just aimlessly holding things and hoping that they continue to go up is not a good thing to do as everything that goes up will eventually come back down.

Something that came up at the start of the whole Bitcoin and cryptocurrency boom was the term HODL, this is basically the idea of holding onto your bitcoin no matter what, with no real aim or goal as to when you will sell or withdraw back into local currencies. While there is certainly some credit to the idea of holding Bitcoin and other cryptocurrencies long term, as there is certainly profit to be had in doing that, the idea of not having any sort of end goal is not. Yes by cashing out you may lose some potential profit, but you are cashing out at a level that is right for you and so you should be happy with that, just aimlessly holding things and hoping that they continue to go up is not a good thing to do as everything that goes up will eventually come back down.

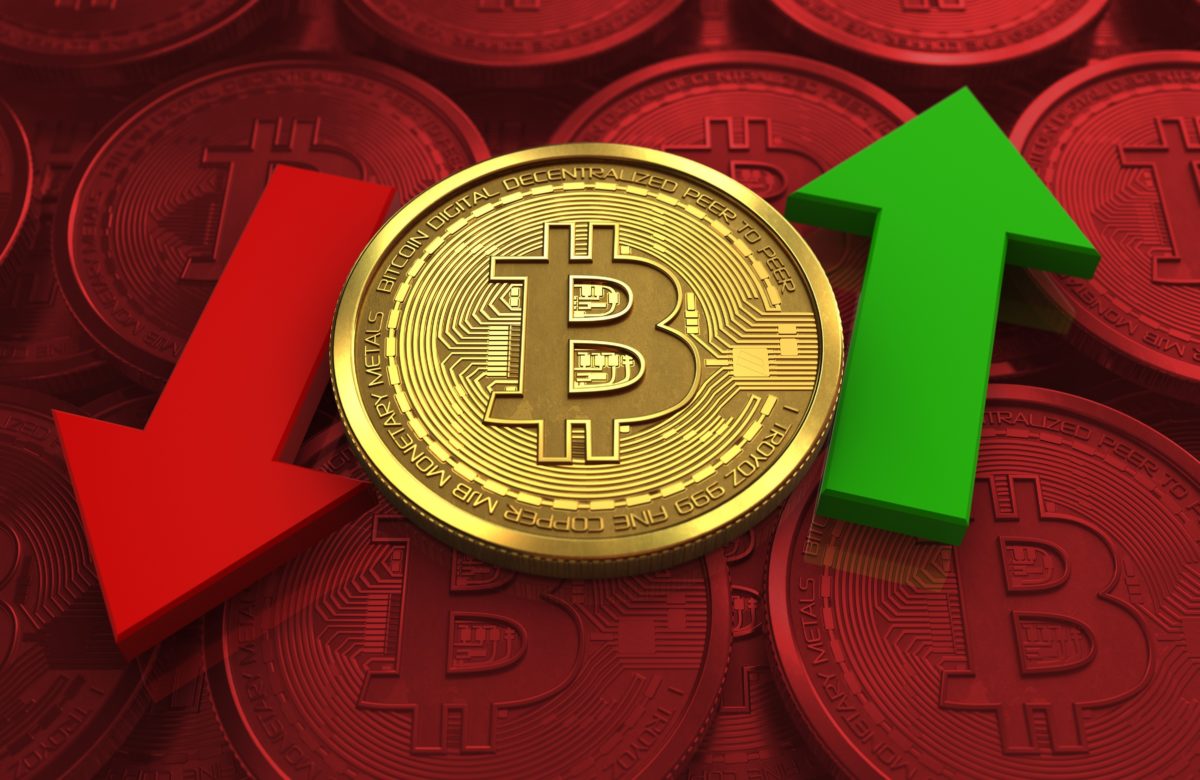

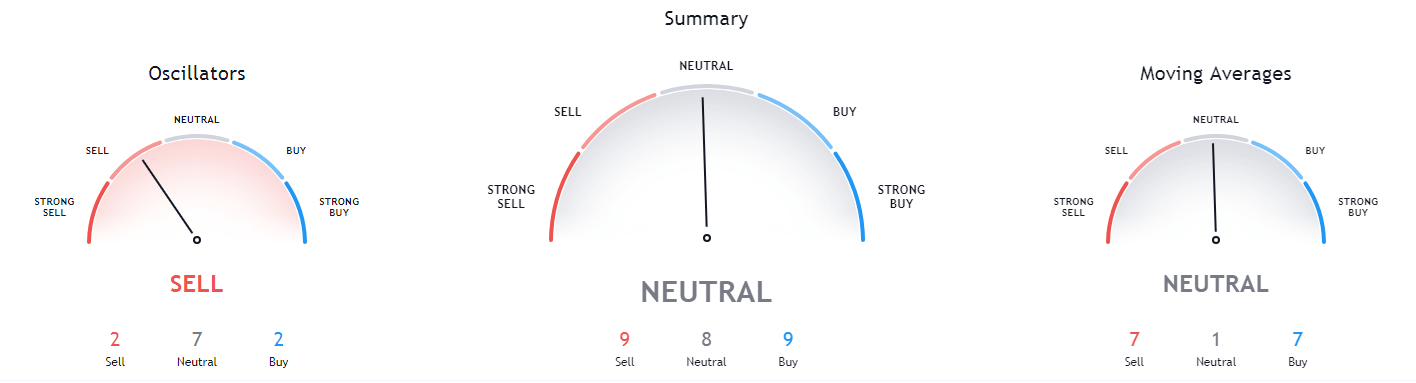

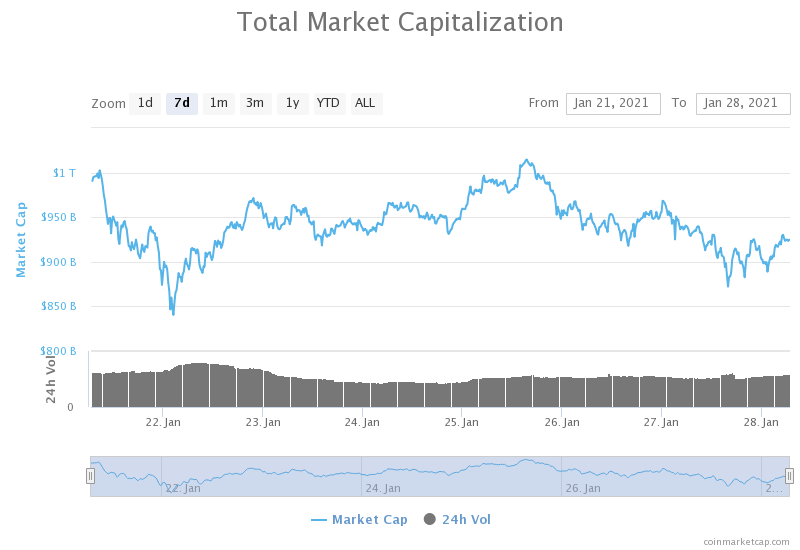

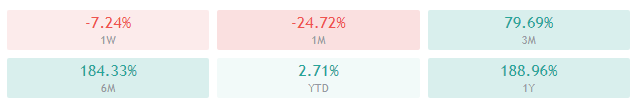

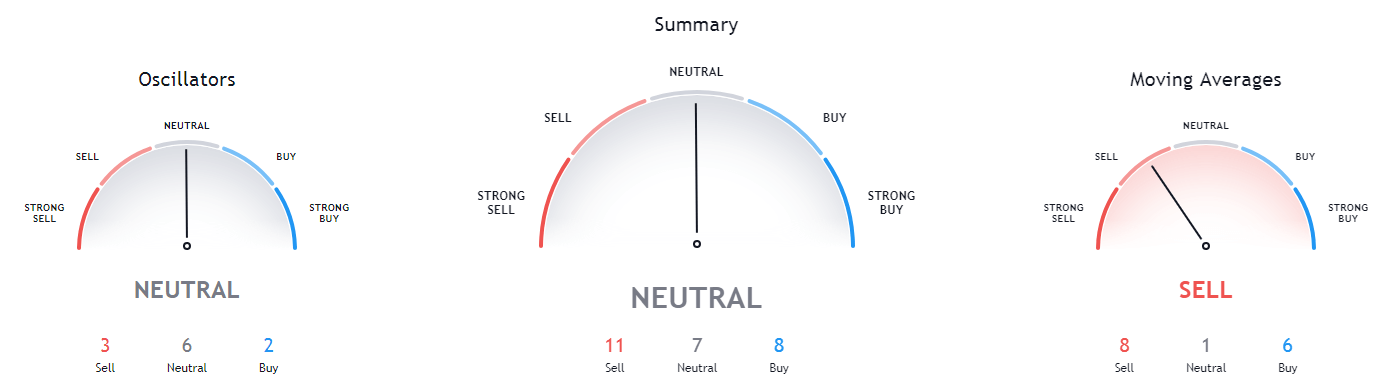

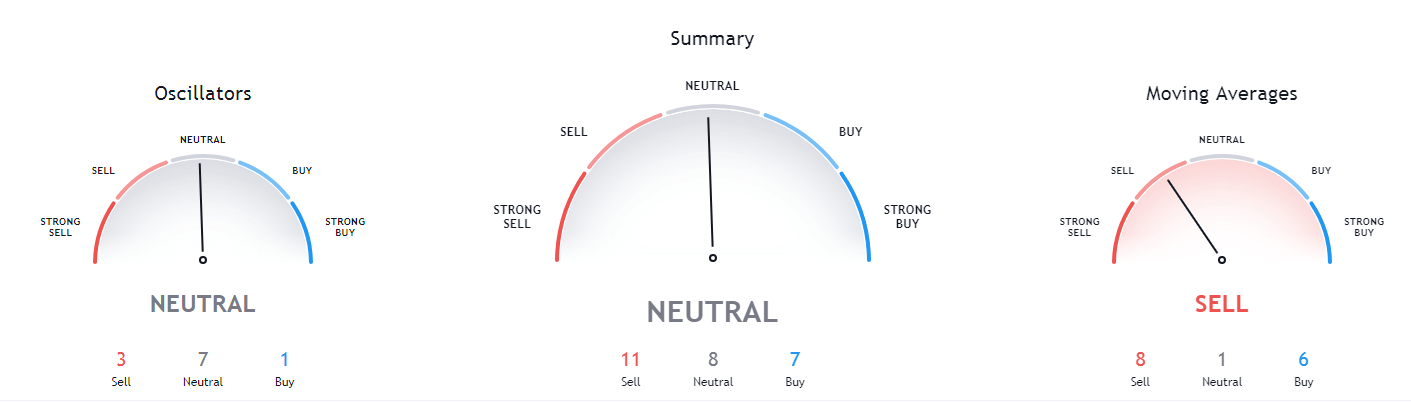

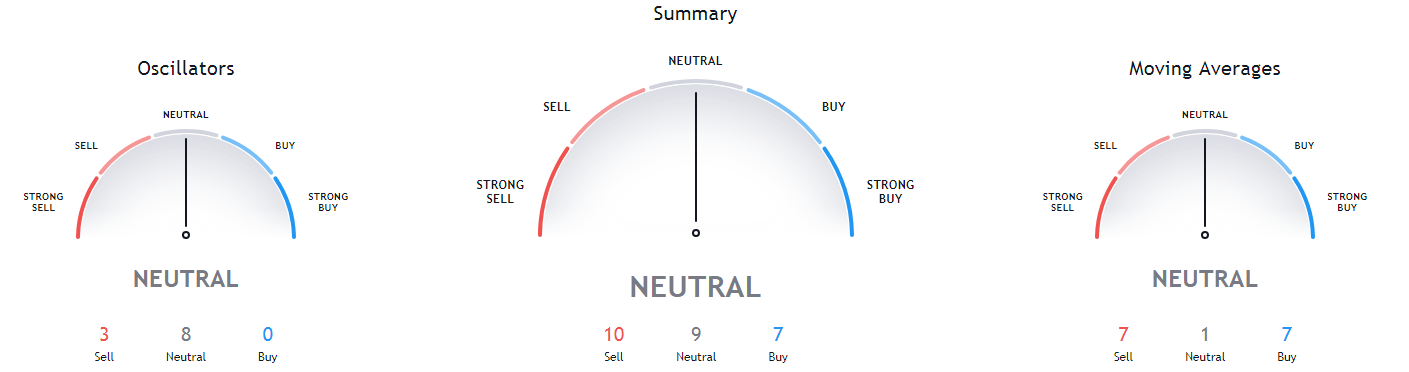

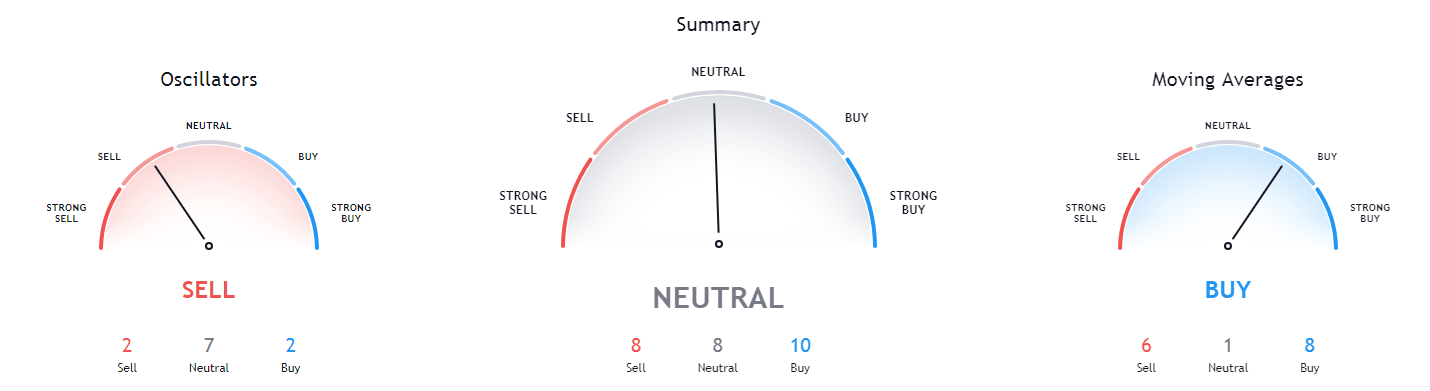

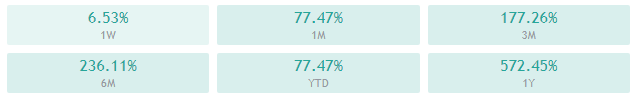

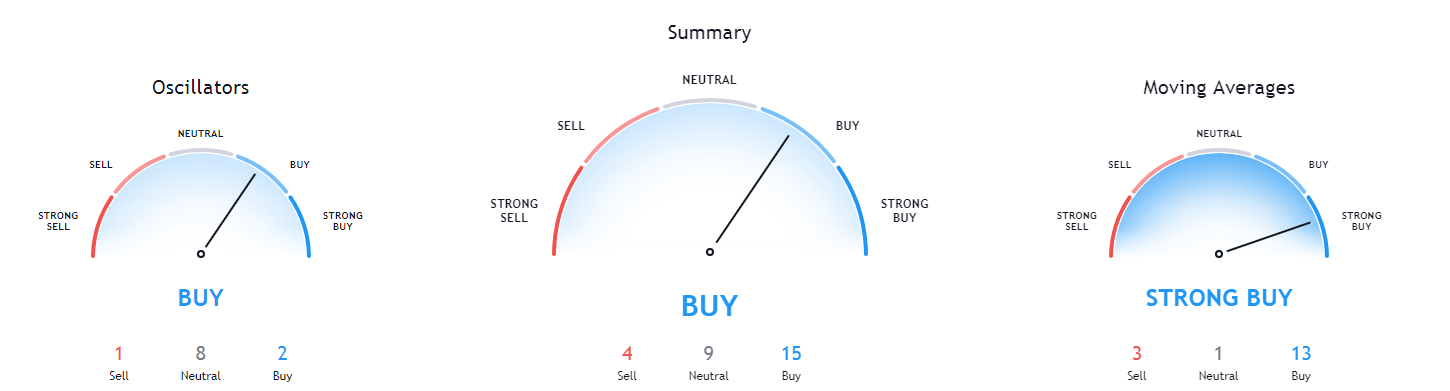

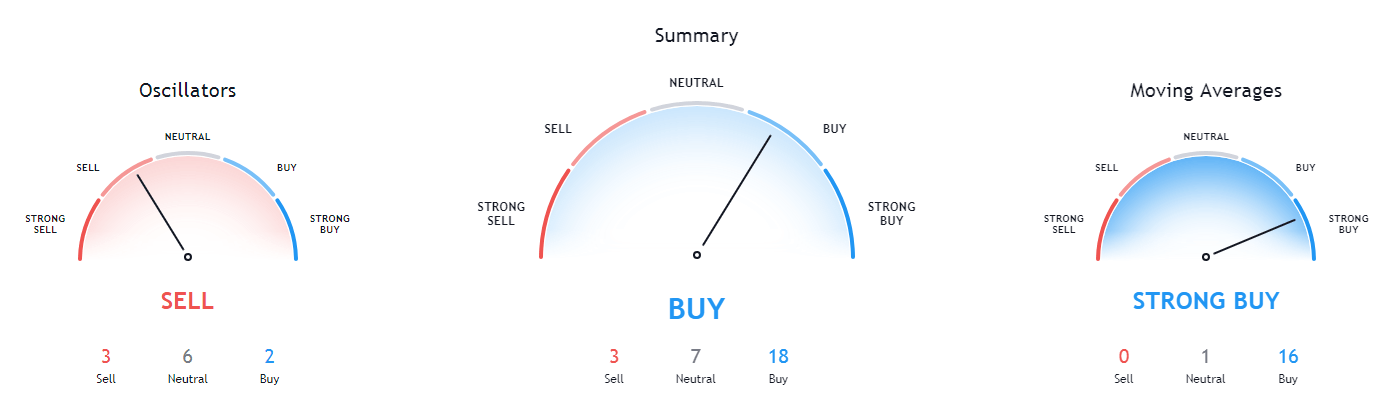

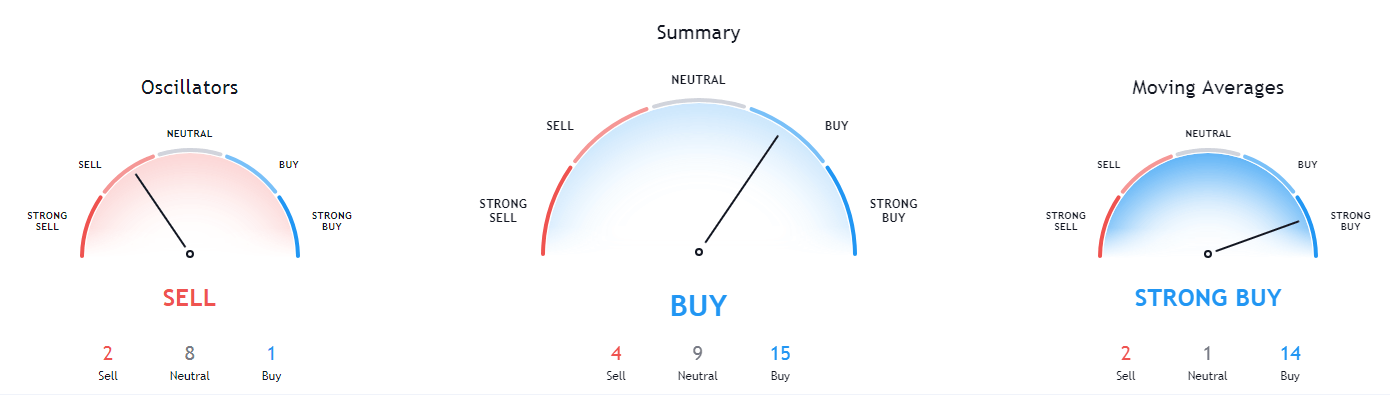

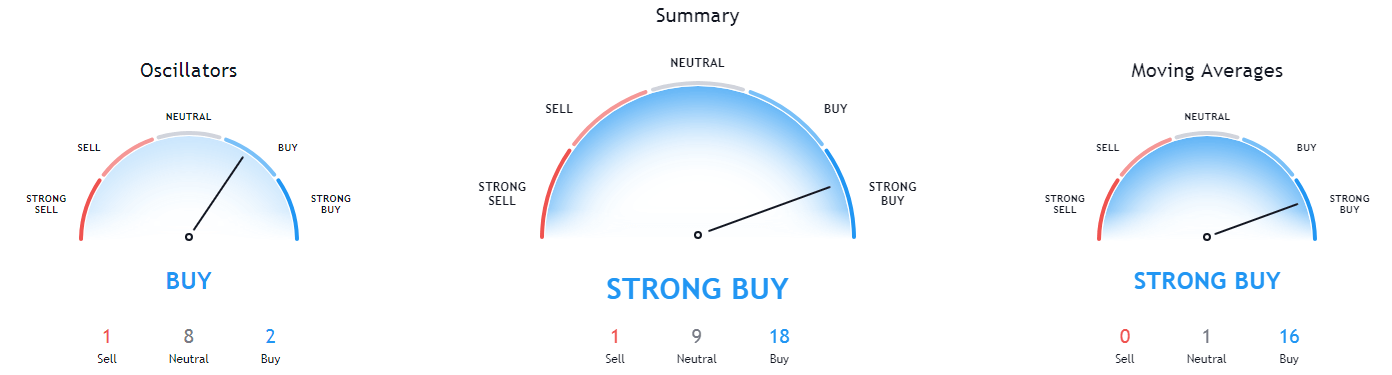

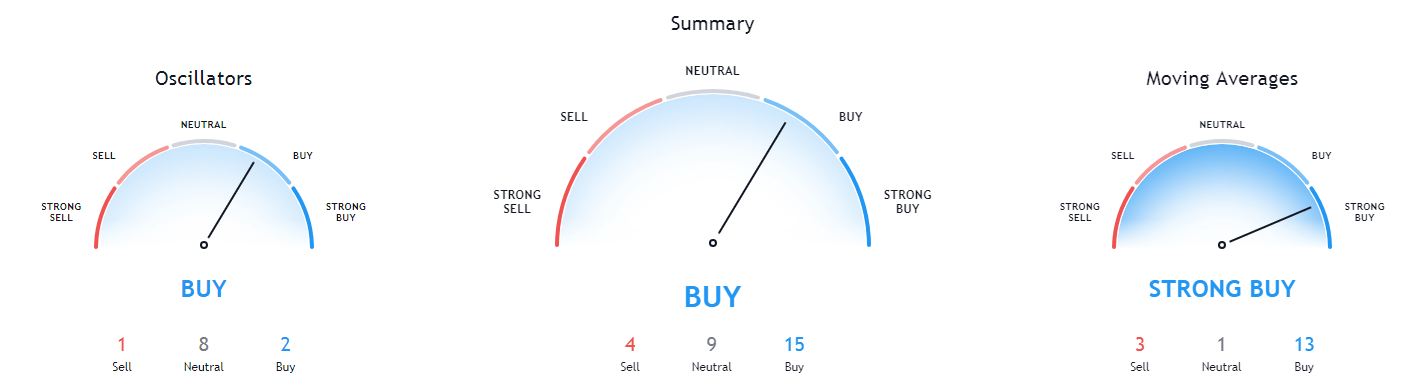

The Bitcoin markets are exciting, they are a constant battle between the bulls and bears, and even without trading it, simply watching it can be exciting. In fact, we do that quite a lot, just sit by the charts and various other indicators watching things change and watching the battle between the buys and sells. Of course, it is a little more exciting when your money is on the line. Trading often brings adrenaline and it is no different from crypto trading. When our trade is going the right way, it feels fantastic, when it is going the wrong way it is a panic, but both of those emotions bring our adrenaline levels up. There is nothing better than a big trade dropping to near the stop loss only for it to reverse and end up in profit. You do not get that feeling in many other places in life, so that is one of the major reasons that we love to trade it.

The Bitcoin markets are exciting, they are a constant battle between the bulls and bears, and even without trading it, simply watching it can be exciting. In fact, we do that quite a lot, just sit by the charts and various other indicators watching things change and watching the battle between the buys and sells. Of course, it is a little more exciting when your money is on the line. Trading often brings adrenaline and it is no different from crypto trading. When our trade is going the right way, it feels fantastic, when it is going the wrong way it is a panic, but both of those emotions bring our adrenaline levels up. There is nothing better than a big trade dropping to near the stop loss only for it to reverse and end up in profit. You do not get that feeling in many other places in life, so that is one of the major reasons that we love to trade it.

It used to be hard to get into any form of trading, but that is very accessible with the rise of the retail forex brokers, the same thing has happened with Bitcoin trading. Back when the coin first launched you could not trade it on a broker, you could buy it, or you could sell it at very limited places, that was it. Then brokers began to bring it in, but it was very exclusive, only a few brooks had it and those that did, had horrendous spreads, making it not trading at all. Now though, more and more brokers are picking it up, crypto-specific brokers are out there too. These brokers are now offering much better spreads, ones that make it profitable again, and many broilers are now offering leverage on their crypto markets including bitcoin. These developments have made it far easier to get into the world of bitcoin trading, and this added accessibility has helped to improve things like liquidity in the markets. We can only imagine that it will become even more accessible in the future, how we do not know, just that it most likely will.

It used to be hard to get into any form of trading, but that is very accessible with the rise of the retail forex brokers, the same thing has happened with Bitcoin trading. Back when the coin first launched you could not trade it on a broker, you could buy it, or you could sell it at very limited places, that was it. Then brokers began to bring it in, but it was very exclusive, only a few brooks had it and those that did, had horrendous spreads, making it not trading at all. Now though, more and more brokers are picking it up, crypto-specific brokers are out there too. These brokers are now offering much better spreads, ones that make it profitable again, and many broilers are now offering leverage on their crypto markets including bitcoin. These developments have made it far easier to get into the world of bitcoin trading, and this added accessibility has helped to improve things like liquidity in the markets. We can only imagine that it will become even more accessible in the future, how we do not know, just that it most likely will.

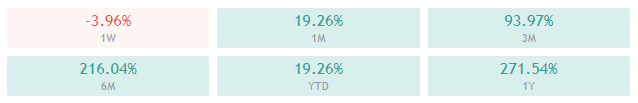

There are a lot of risks when it comes to trading crypto, a lot more than there are with things like forex and due to this you need to manage them properly, not doing so will only lead to losses and potential loss of your account. Risk management is paramount when it comes to trading crypto, more so than it is for any other asset that we have traded before. You need to ensure that you are using things like stop losses with every single trade, you need to ensure that your

There are a lot of risks when it comes to trading crypto, a lot more than there are with things like forex and due to this you need to manage them properly, not doing so will only lead to losses and potential loss of your account. Risk management is paramount when it comes to trading crypto, more so than it is for any other asset that we have traded before. You need to ensure that you are using things like stop losses with every single trade, you need to ensure that your  One thing that you certainly need to take note of when trading with cryptocurrencies is the vast difference in what a lot size is, when we trade more than one cryptocurrency, we need to be aware that they will act differently. A 0.

One thing that you certainly need to take note of when trading with cryptocurrencies is the vast difference in what a lot size is, when we trade more than one cryptocurrency, we need to be aware that they will act differently. A 0. Depending on what you are trading, you will often need a lot more capital in your account in order to trade crypto properly, things like Bitcoin can have huge movements, these huge movements can be both up and down, so if you get hit with a downward movement, you will either need to close out our trade or to have enough money to hold it, which can at times be very expensive and require a very large account. Other coins have similar things happening to them too, so if you are looking to successfully trade cryptocurrencies then you should certainly start with a higher balance.

Depending on what you are trading, you will often need a lot more capital in your account in order to trade crypto properly, things like Bitcoin can have huge movements, these huge movements can be both up and down, so if you get hit with a downward movement, you will either need to close out our trade or to have enough money to hold it, which can at times be very expensive and require a very large account. Other coins have similar things happening to them too, so if you are looking to successfully trade cryptocurrencies then you should certainly start with a higher balance.

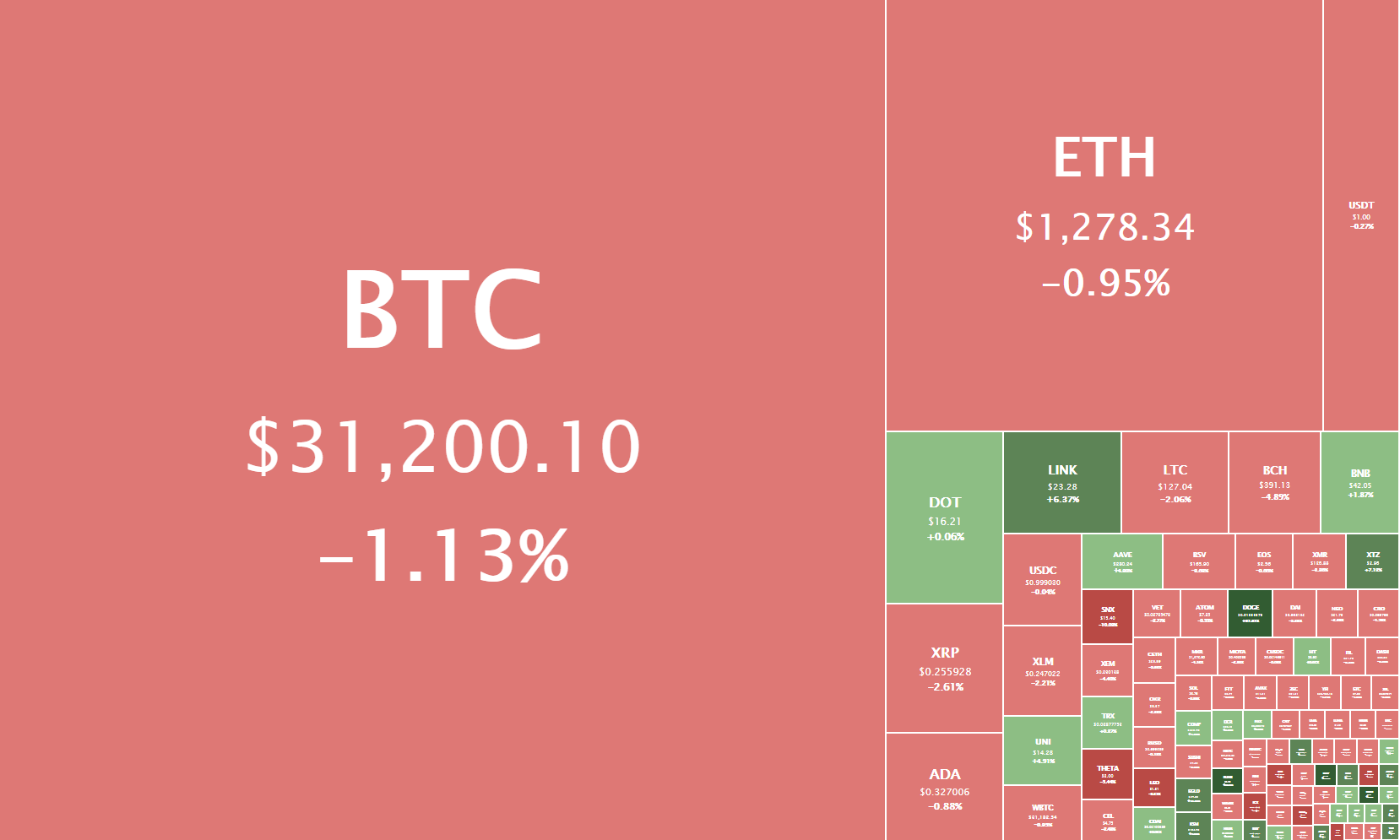

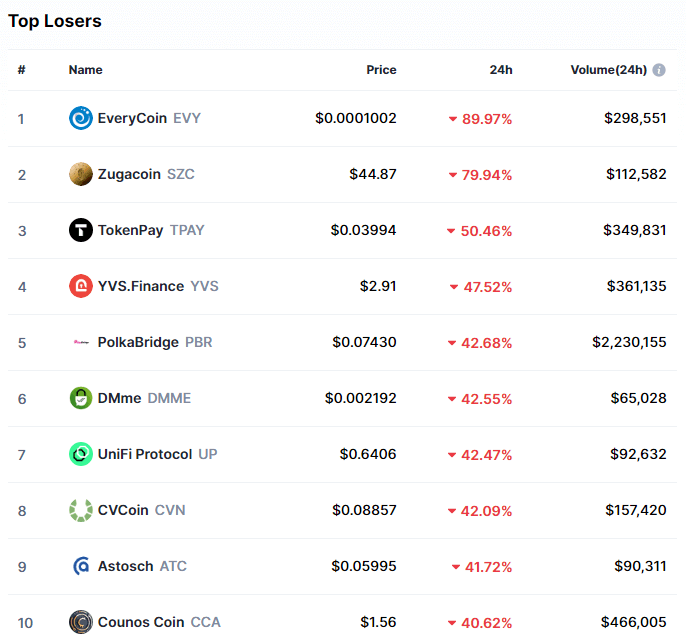

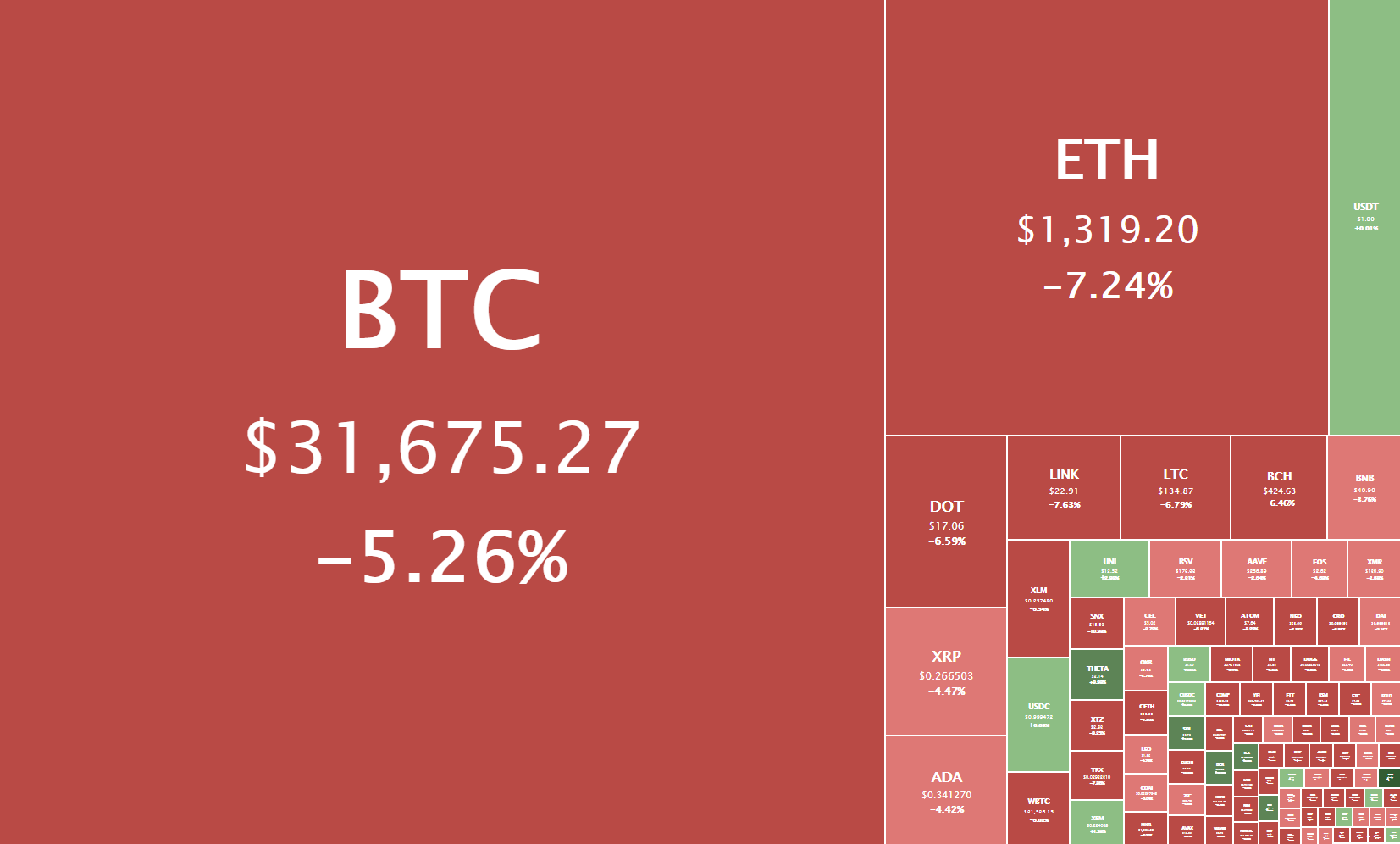

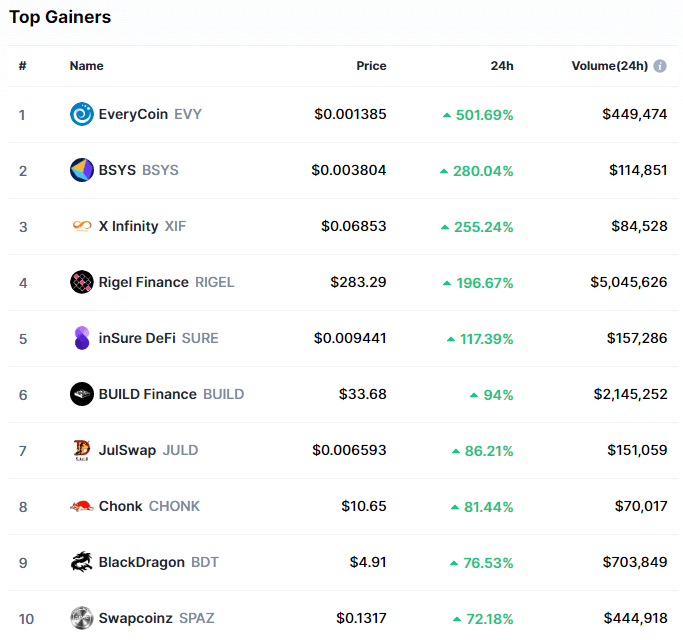

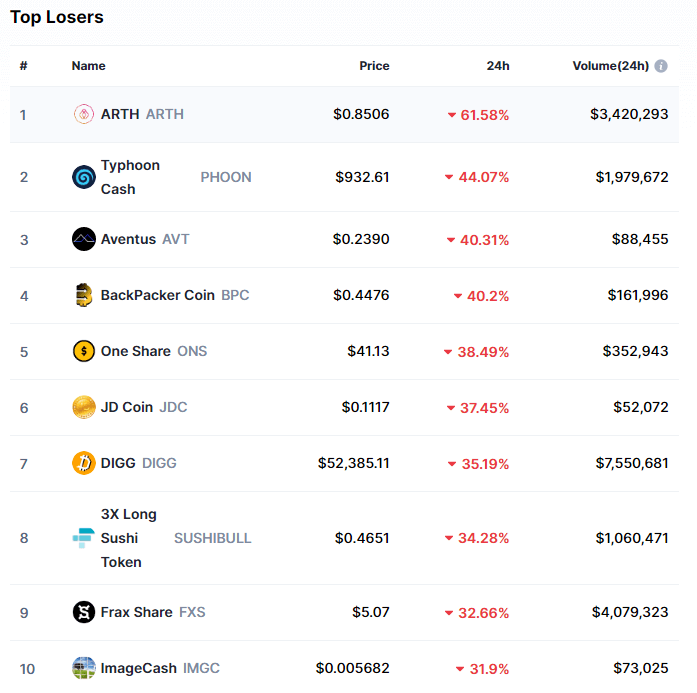

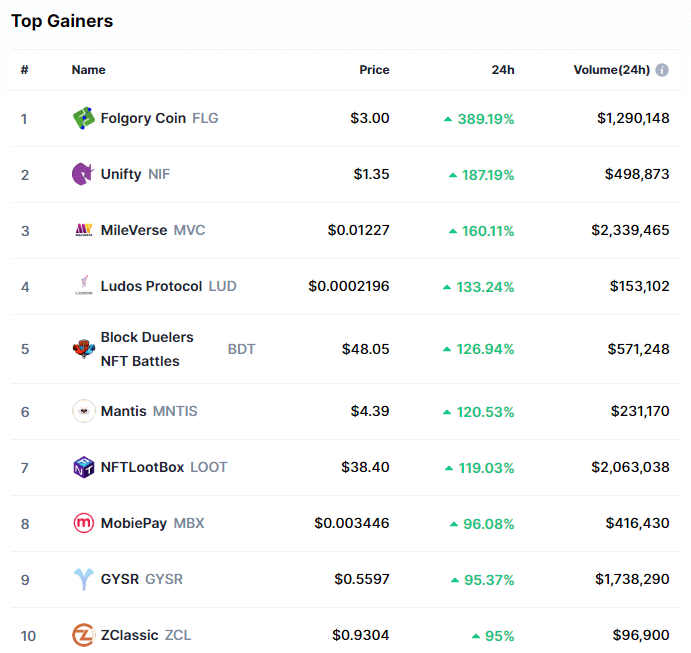

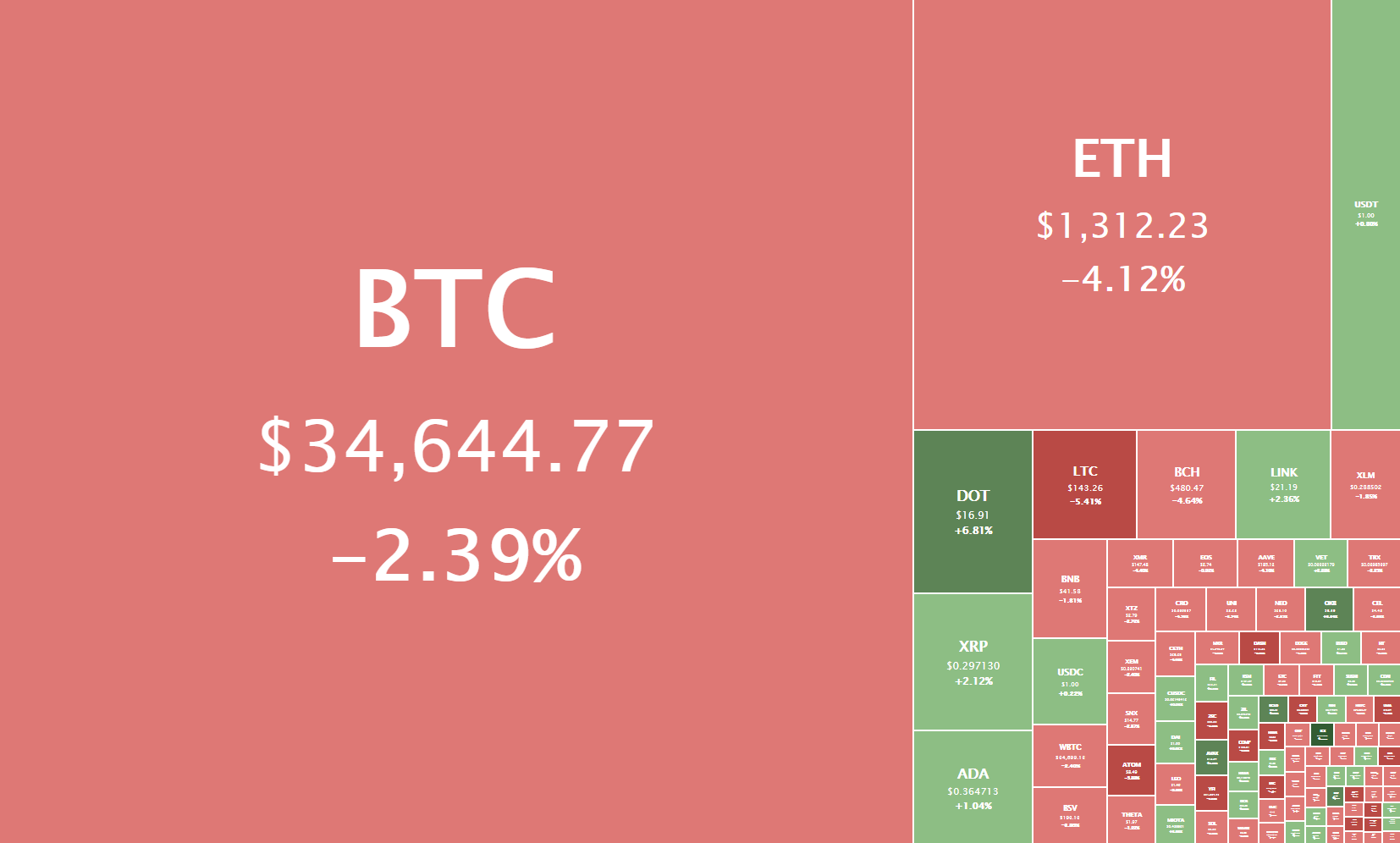

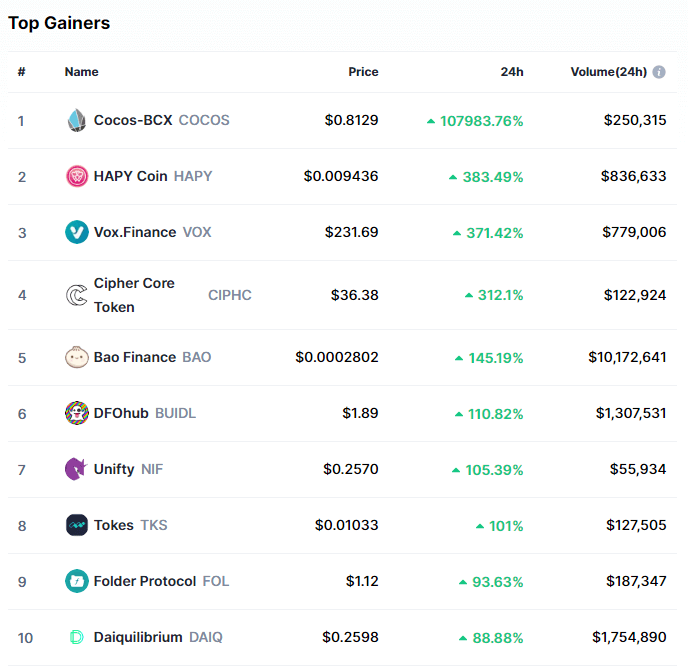

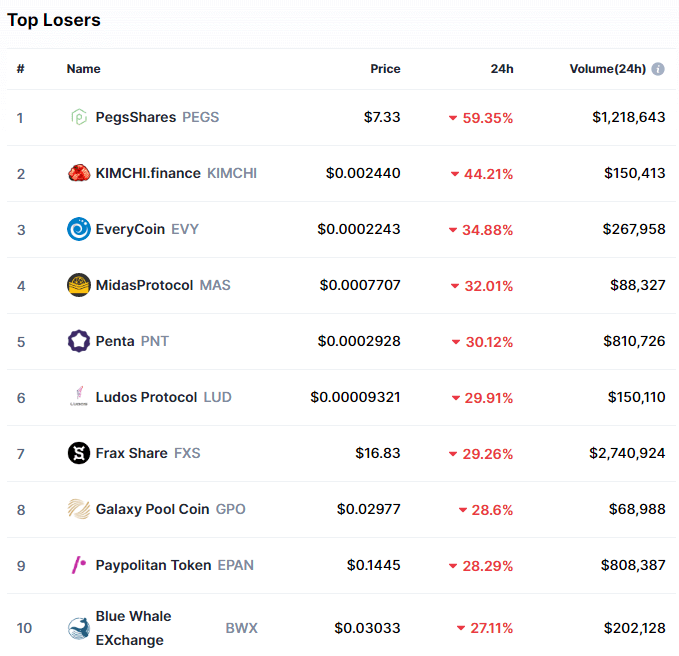

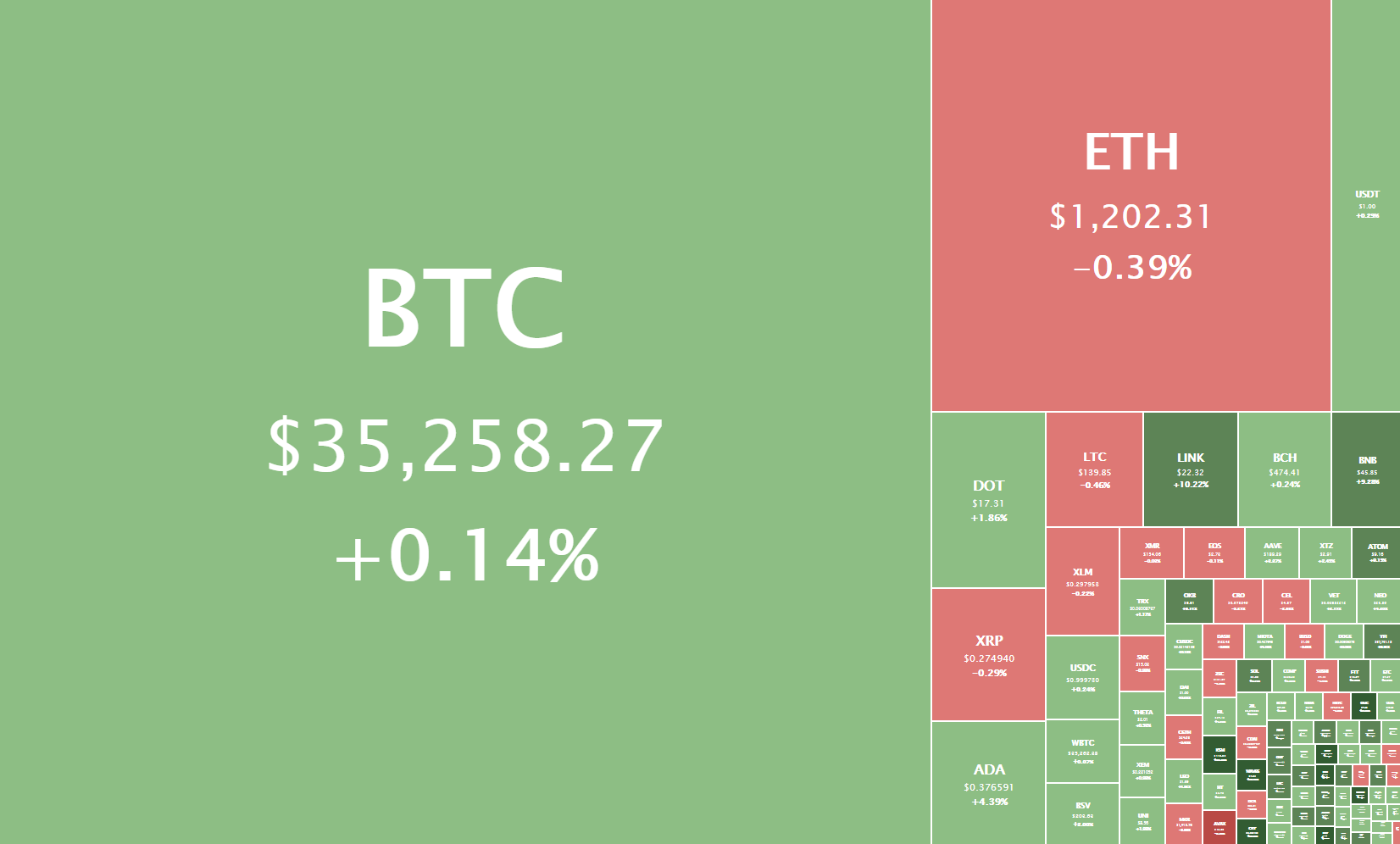

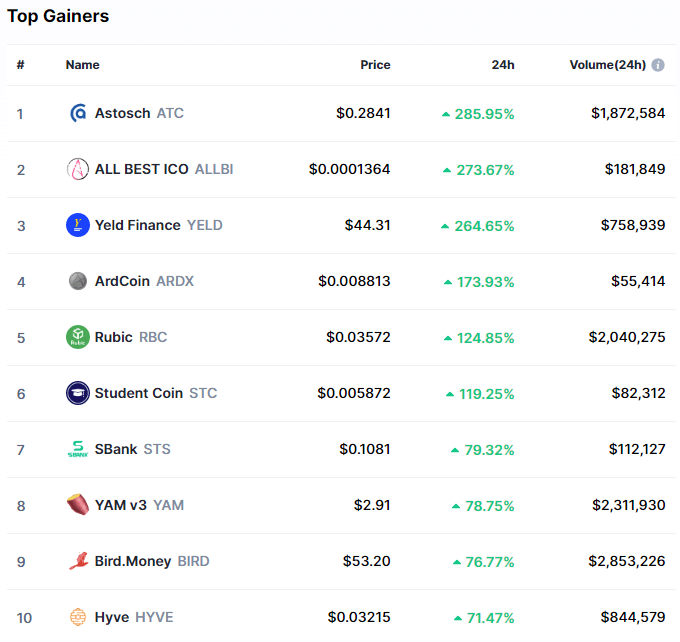

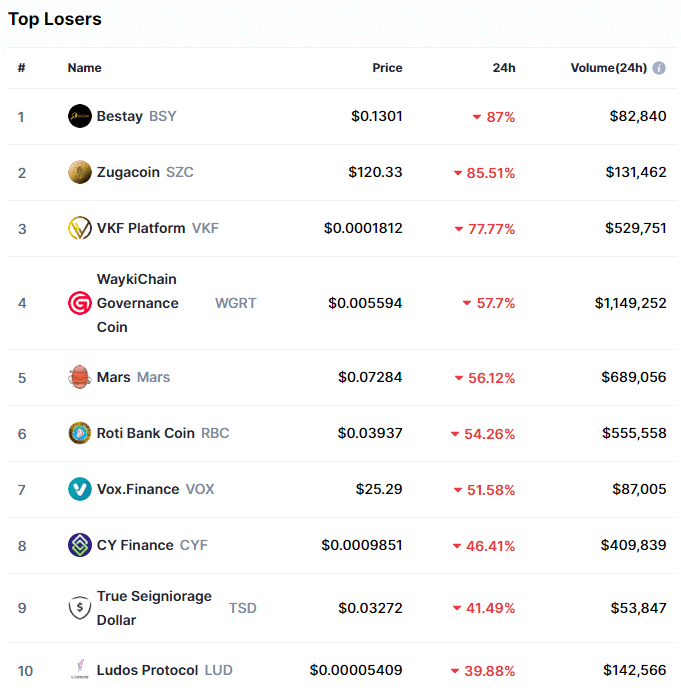

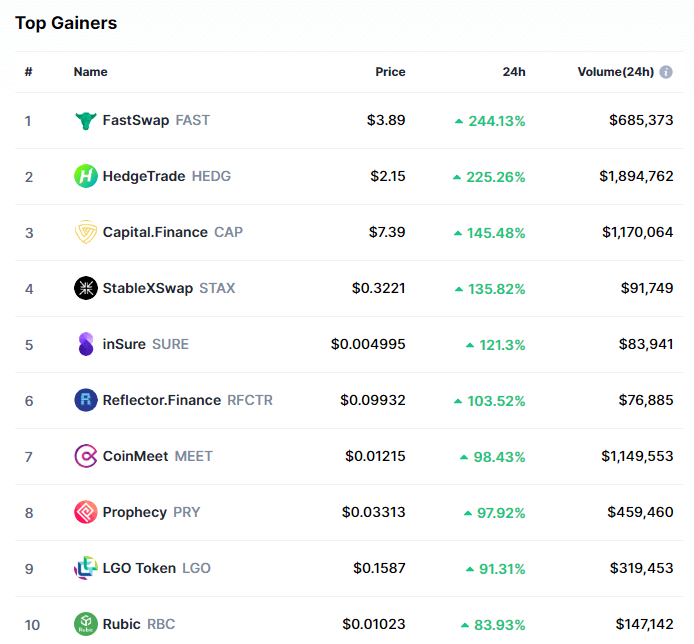

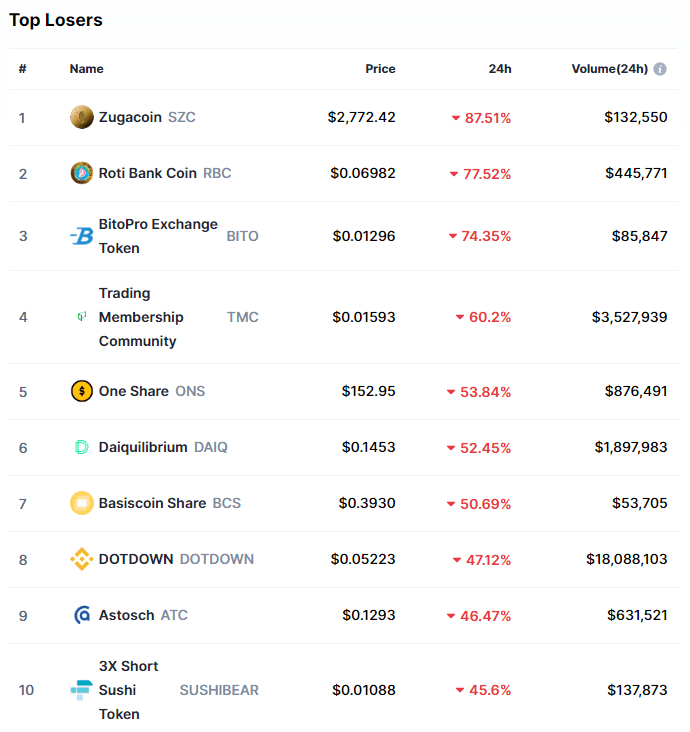

Bitcoin has always been the top coin that comes to mind when cryptocurrencies are mentioned, however, there are thousands of options out there. While it’s a good idea to diversify your investment portfolio with different types of assets and with a few other cryptocurrencies, be careful to avoid the least popular options. Some of the lesser-known cryptocurrencies are practically worthless, so always do your research before taking a chance with any questionable options.

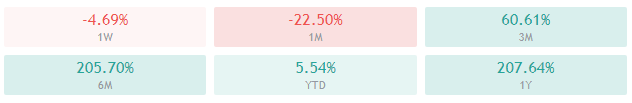

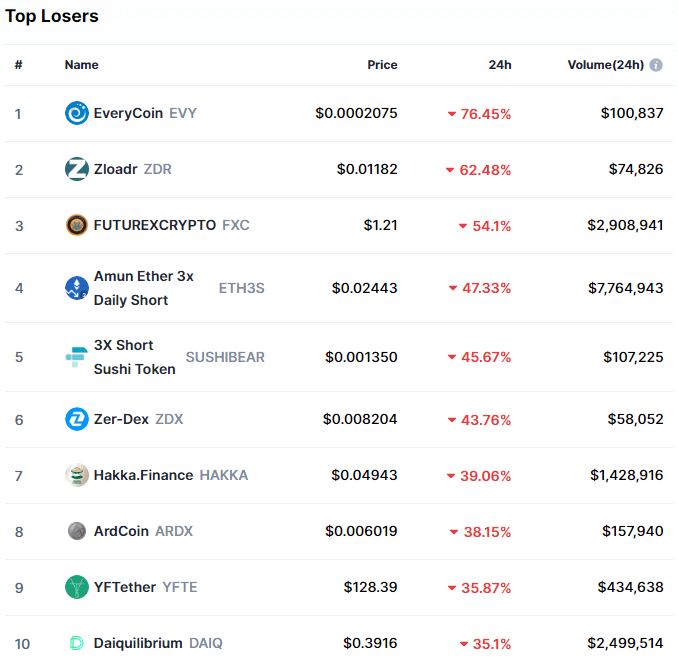

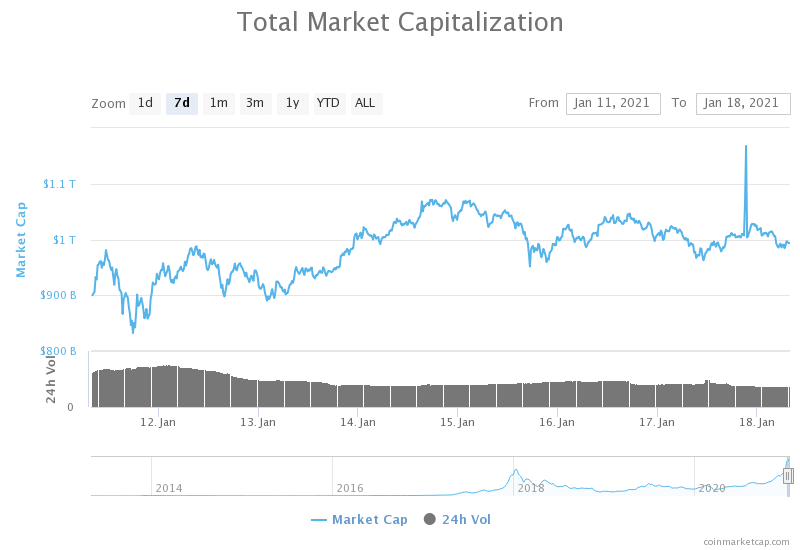

Bitcoin has always been the top coin that comes to mind when cryptocurrencies are mentioned, however, there are thousands of options out there. While it’s a good idea to diversify your investment portfolio with different types of assets and with a few other cryptocurrencies, be careful to avoid the least popular options. Some of the lesser-known cryptocurrencies are practically worthless, so always do your research before taking a chance with any questionable options.  The cryptocurrency market is no stranger to volatility, which isn’t exactly reassuring for beginner investors. Often times, the sharp swing in prices make beginners panic and sell at the wrong times. Even when prices dip low, they tend to rise again with cryptocurrencies, resulting in a loss from selling too soon. The best way to avoid this is to set a

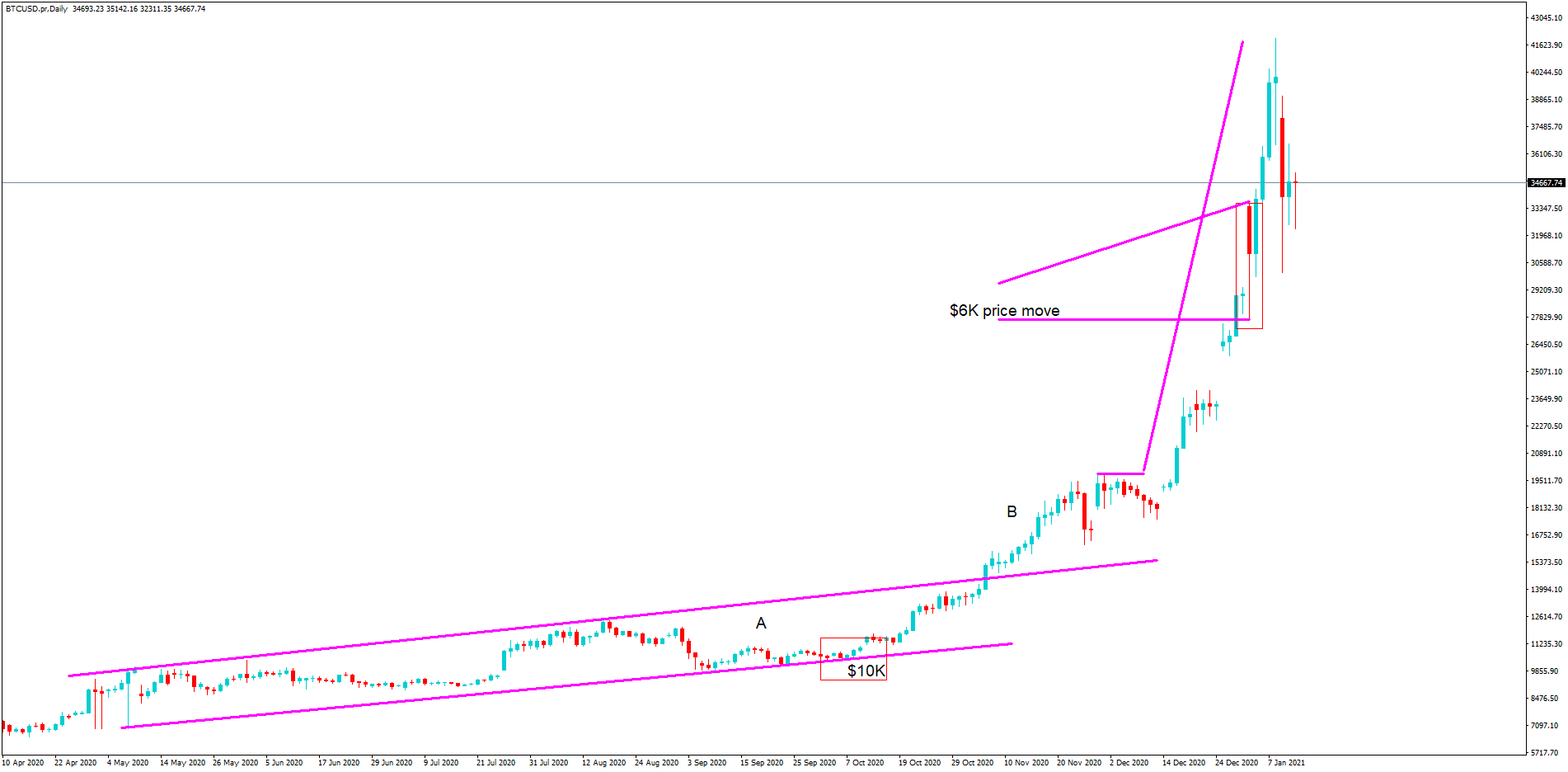

The cryptocurrency market is no stranger to volatility, which isn’t exactly reassuring for beginner investors. Often times, the sharp swing in prices make beginners panic and sell at the wrong times. Even when prices dip low, they tend to rise again with cryptocurrencies, resulting in a loss from selling too soon. The best way to avoid this is to set a

Traders, especially novice traders, get emotional and lose money because their emotions interfere and stop making rational decisions in the battle’s heat. Thus, the first thing to avoid is

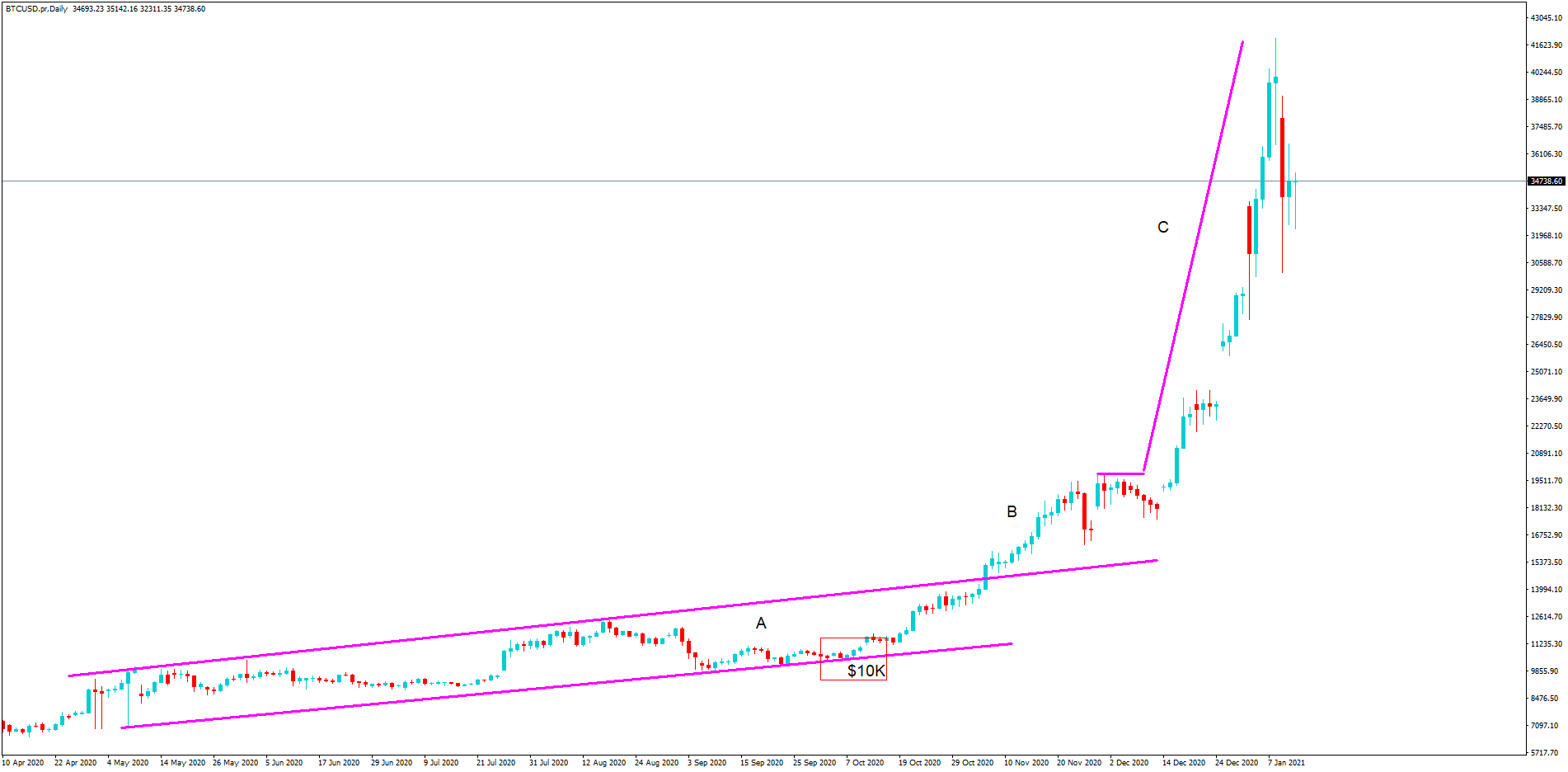

Traders, especially novice traders, get emotional and lose money because their emotions interfere and stop making rational decisions in the battle’s heat. Thus, the first thing to avoid is  The rubber band idea describes the price as if it was a rubber band or spring. When it moves far away from equilibrium, we expect the force to pull it to its center to increase and eventually drive it back to equilibrium.

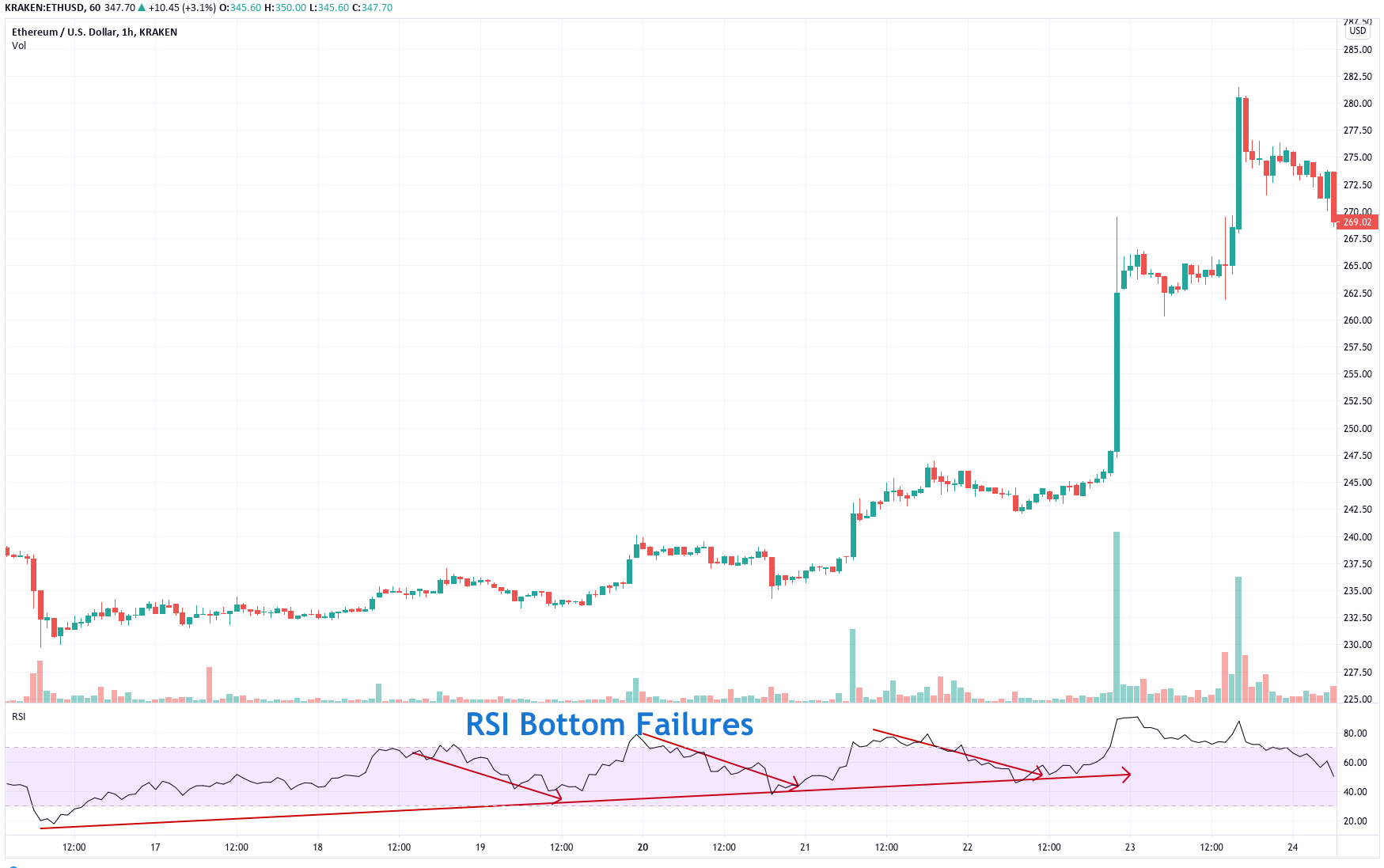

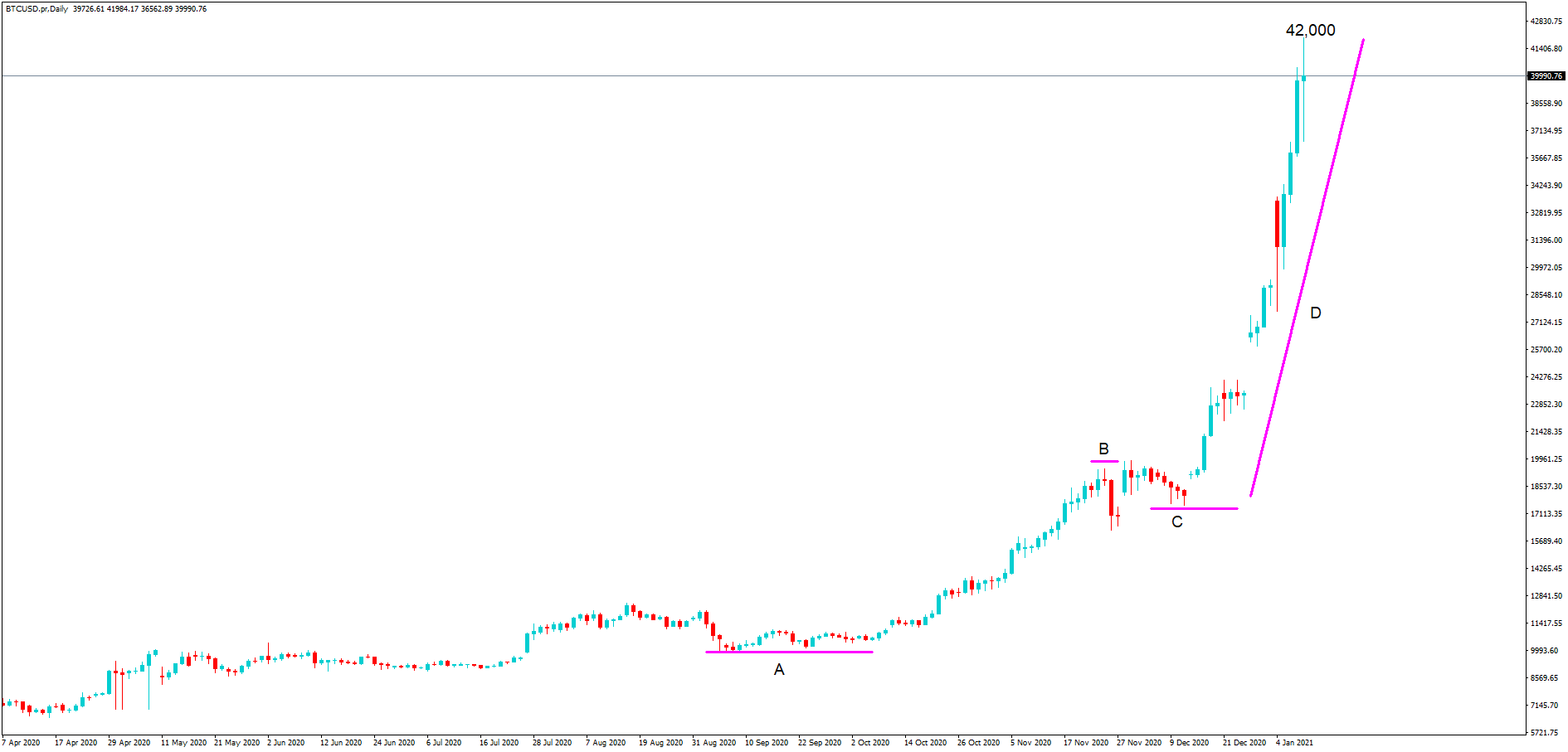

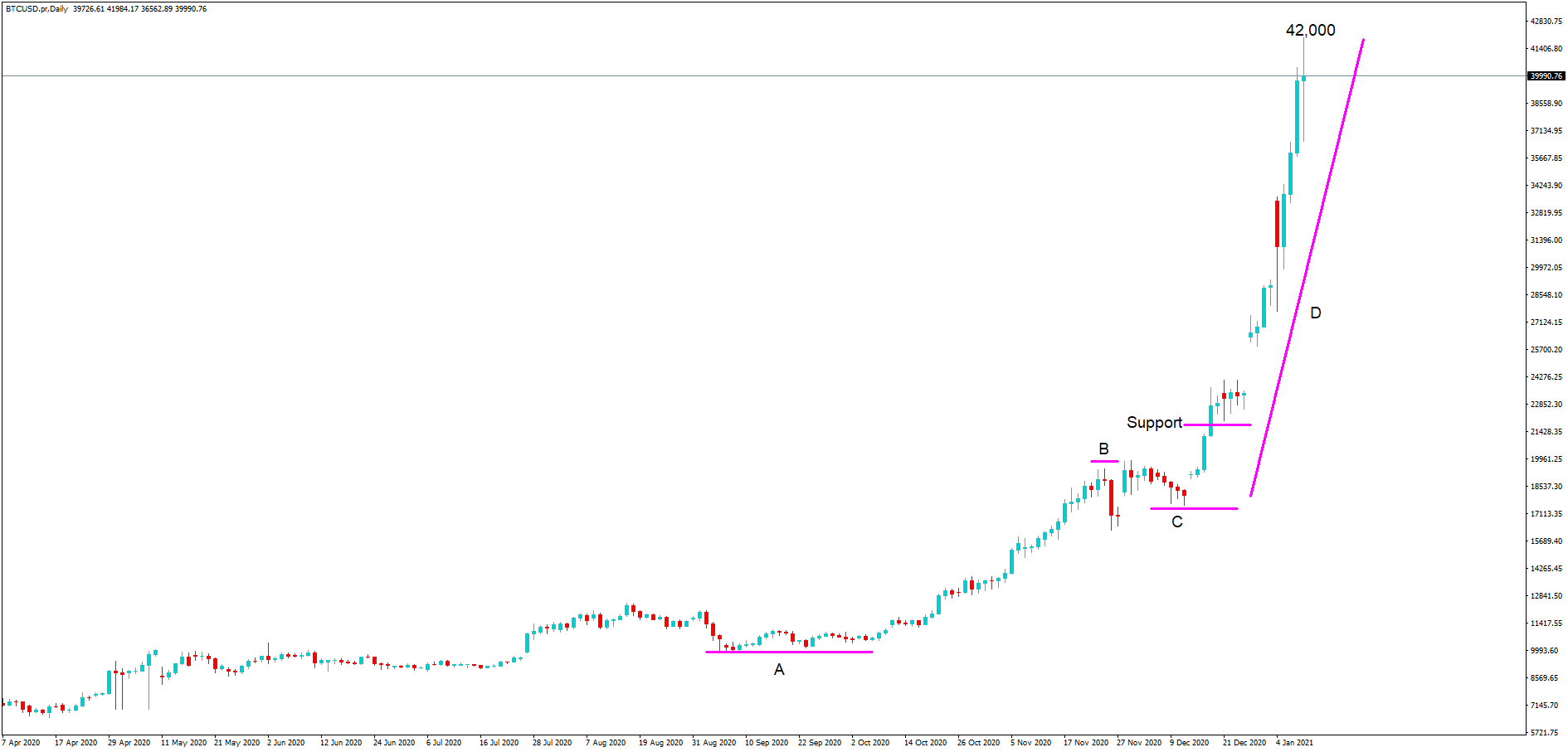

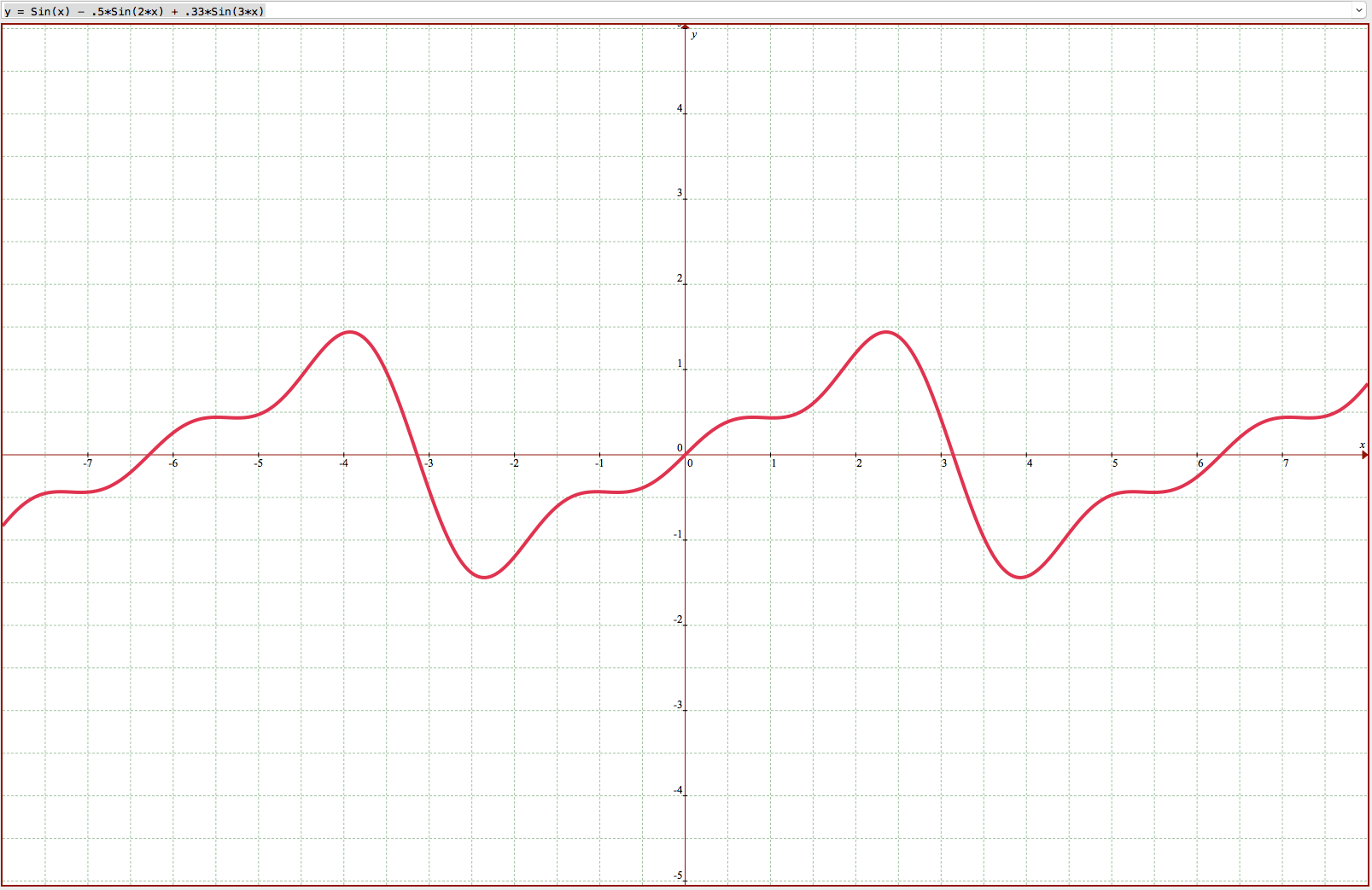

The rubber band idea describes the price as if it was a rubber band or spring. When it moves far away from equilibrium, we expect the force to pull it to its center to increase and eventually drive it back to equilibrium. fferent waves are in sync, and chaotic moves occur when waves desync.

fferent waves are in sync, and chaotic moves occur when waves desync.