Risks are the first thing to consider by anyone who wants to undertake a role as a trader/ investor. The risks of losing money due to force majeure, due to manipulations of Forex by market makers, this is due to a mistake of technical analysis or if lose something in the fundamental analysis. It is not possible to avoid 100% risk, but it can be optimized or minimized. Read the article and learn how to minimize/optimize trading risks and how to create a balanced investment portfolio.

On Thursday, 15 January 2015, the Swiss Central Bank shocked the market when it announced that the fixed exchange rate of the Swiss franc could no longer be maintained against the euro, as it had for more than 3 years. After the announcement of the Central Bank, the rate of the franc rose by more than 30% against the US dollar and the euro, the Swiss stock market, on the contrary, plummeted by 10%, which affected the exporters. The consequences for traders were catastrophic. Those who made short on the franc (keeping the pair in short positions), simply in a second lost their deposits due to the stop out. The brokers also had a hard time, because a good number of them announced liquidity problems.

On Saturday, September 14, 2019, Saudi Arabia’s oil facilities were attacked by drones, which reduced approximately 50% of the country’s total oil production, which is more than 5% of the world’s oil supply. At the start of Monday’s day, the futures of Brent oil skyrocketed by 19-20%. The intraday jump was the largest since the Gulf War of 1991. Those who failed to close short transactions before the weekend lost a lot.

Both examples are trading risks. It is impossible to fully foresee them, because, as always, there is the probability of force majeure. But it is possible to minimize the risks. Also, as the risk increases, the probability of profit is higher. Let’s take the same example of oil: if short traders made losses, those who bet on growth earned about 20% in a single day.

From this summary, you will learn:

- What are trading risks and what types of risks exist.

- Methods to minimize trading risks,

- Types of diversification of the investment portfolio.

In the summary, I will try to present two main aspects of risk minimization: errors in employing technical analysis and general risks in foreign exchange trading and the creation of an investment portfolio. My opinion is partly subjective, so I suggest addressing it and discussing it in the comments.

Types of Trading Risks

Trading risk: The risk of losses arising from market factors affecting price direction or errors in the analysis (forecasting) of the market situation.

Technical risks: Risk of loss due to technical problems: platform failures, order failures, broker fraud, etc.

Psychological (behavioural) risks: Risk of error due to a person’s emotional state: stress, emotion, fatigue, euphoria, fear, greed, etc.

Trading risk is uncertainty about future price movements as a result of market and non-market factors. So, if we have an open position, we are facing a unique risk, that risk is that we have erred in identifying the price trend. If the price is directed in the opposite way to the open trade, the trader will lose.

If the transaction has not yet been opened, the risk is in the incorrect prognosis of the trend direction or its reversal. We have to admit there’s no clear definition of the concept of “trend”, so traders understand it in their own way. Traders themselves determine the value of the critical amplitude (price reversal), which is called the risk limit and this risk will always depend on the amount of capital in the deposit. In other words, a trader is willing to endure, for example, a 100 point reduction, another no more than 20 points. They all determine the level (limit) of risk themselves but must understand the nature of the trading risks.

Where Risks Come From

Error in analysis and prognosis. Any publication of statistical information, the publication of the results of the Fed meeting, and meetings of other central banks have their effects. The best question we have to solve first is whether the investor knew how to correctly examine the importance of this or that news item. And the forecasts, made by the majority, were justified? Traders should consider these and other factors in the forecast. And there can often be mistakes. Traders often ignore or lose something important, which can result in an incorrect forecast.

Force majeure: It can be presented in different ways: a humanitarian disaster, an unexpected political decision, or a terrorist attack, discovery of new mineral deposits, release to the market of a new product that has not been previously announced, sudden bankruptcy. Force majeure often leads to immediate and generally long-term consequences. Examples of long-term force majeure include the collapse of “dotcom” and the mortgage crisis in the United States, which has become a global crisis. It must be said that there are people who were able to make a profit from the crisis. (I recommend watching the American film “The Big Short”, which describes this situation quite well).

The human factor: Incorrect interpretation of patterns, signs due to fatigue, lack of attention, stress, etc.

Another classification is the simplified division of the causes of trading risks into forecasting errors in technical, fundamental, and human analysis. We have already said what are the reasons for the most important risks in the section we call “Force Majeure”, and I will dwell on more details on the risks resulting from errors in technical analysis.

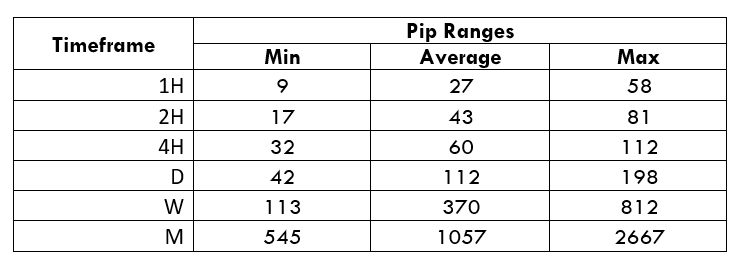

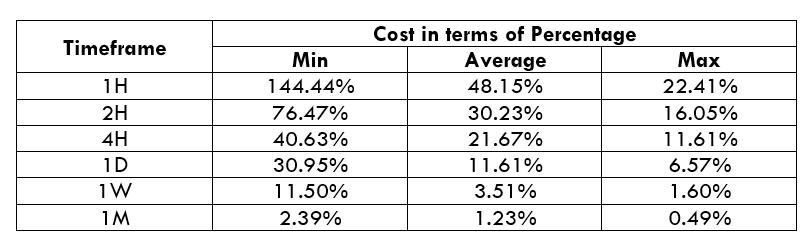

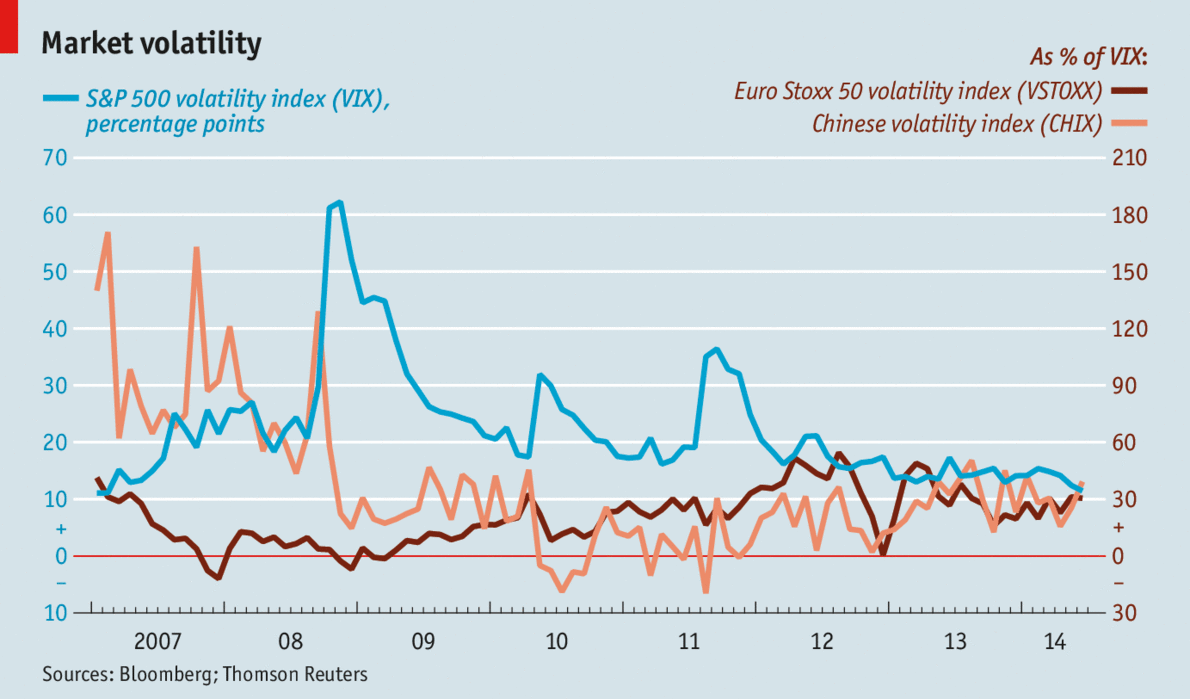

High volatility at the time of opening the transaction. The greater the volatility, the greater the breadth of price changes and, therefore, the more and faster you can gain from it. It seems reasonable, but the risk lies in assessing this volatility because if the price goes against you, you must be psyched that you can lose more than you usually win. The data of the indicators are relative, as well as the data of the volatility calculators.

Tip: Identify volatility visually. The price range can be referred to as the distance between opposite fractal ends or candle accumulation. For starters, you can train on the history. At first, it will be difficult for beginner traders (know from experience). Second tip: greater volatility, different from the daily average, is observed at the time of the appearance of fundamental factors. Just don’t open any transactions at this time.

The trading strategy of trading by levels individually: someone opens positions expecting a level rebound, someone tries at breakup. For someone that’s a loss limiter. There is the so-called zone of turbulence around fractal levels in short-term time frames, where the price moves in different directions with a narrow amplitude. Predicting price movements in this area is inefficient.

Tip: Use the levels only as a guide. Open transactions out of levels and try to avoid staging at levels of resistance and stop support, as it can be used by large traders (market makers, which will be discussed below). If the transaction is already open in the direction of levels, then it is better to leave before reaching the level. Otherwise, there could be a rebound with the possible slip, which will worsen performance.

Basically, the analysis is reduced to determine whether the break/rebound of a level is true (the trend) or false (the correction). Does it really make sense to put him at risk?

Opening of transactions in overbought and oversold areas. This is the risk of opening a position at the end of a final trend. A classic mistake is trying to enter when the trend is already underway. At the peak of growth, large traders abandon trading, reaping some less intelligent traders.

It seems reasonable to employ RSI or stochastic, but they are not efficient at minimizing risks. They are often lagging behind, they invest in extreme price zones, and so on. So even if you use the indicators to determine the zones, you can still make a mistake.

Tip: You can identify signs of trend depletion as follows. The amplitudes in the three fractal sections are compared side by side in the time frame M1 (the exhaustion of the trend is clear there before). If the amplitude is shrinking (the amplitude of each subsequent fractal is shrinking), this suggests that the trend is exhausting.

And the simplest and wisest advice is that when starting an operation at the beginning of the trend, don’t do what most. Be careful when interpreting the signals of the indicators, there are no perfect and impeccable indicators.

Opening of transactions where there is no clear trend. There are situations where a trader makes a correction or a local price change for a new trend, which often occurs on flat. It is difficult, especially inexperienced. To identify the flat end, as it often does not have a clear beginning or end.

Tip: I suggest again using the comparison of price amplitude within the flat trend. If in the short term, there is a price movement whose amplitude deviates sharply from the average value, you should be alert. Do not enter an operation immediately, the first price change could be a correction. Analyze multiple time periods at a time: the signal period is М1-М5, confirming longer periods.

Incorrect indicator parameters: This will lead to an incorrect interpretation of the signals.

Council: Before starting to use an indicator with adjusted parameters in trading on a real account, try the system (tester МТ4, FxBlue). More detailed information about testing and optimization strategies in this summary.

Application of pending orders: Outstanding orders are used in trading strategies based on the opening of transactions when the price exceeds the consolidation area. Orders are placed in opposite directions, betting that one of them will work. The risk arises from the fact that outstanding orders are set on the basis of intuition, rather than actual price movements. The distance is calculated, for example, in percentages of the average value of the price movement in the consolidation area. We will always have to take the risk that the price will leave the area, touch the order and then move in the opposite direction.

Tip: To reduce risk, avoid using pending orders.

Abrupt reduction of contributions when a long position is opened. There are several examples when the price changed by 800-1000 points in just a few minutes. Of course, hardly anyone could react, make a decision and make a compromise.

Tip: Always use a stop loss.

Market makers. A particular trader is only a tiny part of a much bigger game. The creators of the market are therefore great players, who can influence price through their huge capitals. They can create a necessary repository of information by manipulating media, forums, and other resources through forecasting, analysis, and information.

But this is not his only means. They could see levels where purchase and sale orders are concentrated, that is, stop losses and pending orders established in advance. As practice shows, most traders set stop loss in the area of the local ends, being tied to strong or rounded levels of support/resistance. Pending commands can be configured the same way. The market makers oppose the majority, push the price to the area where the orders are accumulated, then, even taking into account all the forecasts, most traders are activated to stop.

For example. Market makers want to sell a certain currency at the best possible price. You see multiple stop loss higher than the current rates (green horizontal line at the bottom of the screen), which are basically the orders requested. On the other hand, market makers see many orders pending in the same price area, which does not allow the price to rise (volume equilibrium).

The price is pushed with small orders to the necessary level, after which it satisfies your sales volumes through purchase requests (stop loss). Given the number of short requests, it is unlikely that the price will go further.

Tip: There is no point in fighting with market makers. Therefore, you should learn to identify potential areas of command concentration and try to avoid them. It should also bear in mind that indicators cannot anticipate the possible actions of market makers. Therefore, it makes sense to rely less on indicators and pay more attention to levels, patterns, and exchange of information (trading volumes, order table).

You can suggest any other risk of technical analysis, write in the comments. Let’s look for more ways to minimize and optimize trading risks together. With regard to reducing the risks of erroneous forecasts based on fundamental analysis, there are few recommendations:

- Do not blindly trust everything that is reported in the media and be especially careful with “expert” forecasts. Check the official data reported by news agencies and official resources.

- Use complementary analytical tools: economic calendar, action analyzers.

- Evaluate dynamics statistics, comparing them with analysts’ expectations and previous reports.

- And prepare to react instantly to a force majeure.

Hedging and Blocking

Coverage and blocking mean the same thing, go into two opposite operations (I won’t dig too deep into the big difference between them). Let’s imagine that a trader opens a buying position, but unfortunately, the price drops. Then, the trader has opened a selling position with the same volume. The loss from the first position is offset by the gain from the second operation.

Advantages of blocking a position:

If you set the locks correctly and unlock the positions on time (cancel the unprofitable or secure position), you can even make profits this way. There is even a trading strategy based on the creation of an order grid.

The lock allows you to manage the floating loss that does not affect the balance or spoil the trading statistics. But, there is always a defect in the locking positions. In the event of incorrect opening and closing of insurance and major positions, the trader is more likely to receive the loss resulting from both the transactions and the spread. Therefore, blocking is a high-risk strategy for a novice trader, such as trading in a similar way to Martingale, but an advanced trader can protect against unprofitable trading employing blocking and hedging.

The lock allows you to manage the floating loss that does not affect the balance or spoil the trading statistics. But, there is always a defect in the locking positions. In the event of incorrect opening and closing of insurance and major positions, the trader is more likely to receive the loss resulting from both the transactions and the spread. Therefore, blocking is a high-risk strategy for a novice trader, such as trading in a similar way to Martingale, but an advanced trader can protect against unprofitable trading employing blocking and hedging.

The strategy and blocking rules should be highlighted in a separate article. If you want to do so, write in the comments.

How to Minimize Trading Risks

Diversification: So far, this is the best recommendation you can take into account when protecting your investment from certain business risks. But it is a kind of art to properly diversify its portfolio of investments and rebalance it regularly.

Types of diversification:

Asset division: It is the most widespread among the community to make a diversification. In addition, you can allocate your funds not only between different currency pairs or shares but also between deposit accounts, precious metals, cryptocurrencies, antiques, real estate, etc.

Diversification by risk level: There are assets that, in case of force majeure, increase in price (for example, gold). There are assets that, even in the midst of strong market fluctuations, hardly change prices. We have assets at our disposal with volatility, for example, of 5% per day. The way we distribute investments among assets with different volatility rates, risk (and, consequently, profitability) is the diversification of risks. I suggest you read the article on protective assets.

Applied diversification: Distribution of investments between strategies with different levels of risk: Martingale and conservative negotiation, scalping and long-term strategies, manual and algorithmic negotiation.

Institutional diversification: Here it is about working with multiple counterparts: Forex, Exchange and different brokers, trust management, etc. If we’re in a force majeure situation (we already discussed the case of the Swiss franc) a counterparty fails, it can withdraw at least the rest of the money from the second.

Institutional diversification: Here it is about working with multiple counterparts: Forex, Exchange and different brokers, trust management, etc. If we’re in a force majeure situation (we already discussed the case of the Swiss franc) a counterparty fails, it can withdraw at least the rest of the money from the second.

Statistical diversification: This is a direct and inverse correlation. For example, corn and wheat futures often have the same price direction, USD and gold trends often go the opposite way. A portfolio composed of reverse-correlated assets. will be logically less profitable, but safer because at the time when a low-priced asset, an increase in the price of a different asset offset the loss.

The diversification of investments is limited only by the imagination of the trader and his ability to conduct a market analysis, as well as the appetite for risk. The greater the risk, the greater the potential benefit. That’s why trading risks are often intertwined with psychological risks.

Trade risk insurance:

Stop-loss placement: At this point, we could comment on an example of drivers who ignore the mandatory driving rules of fastening seatbelts. It’s not easy to guess because some people don’t want to use means of protection. On the one hand, market makers can determine the areas where many stops are concentrated and can deliberately push quotes to catch them. Also, a stop loss will be very helpful if a large price difference happens as a result of a force majeure event. We can find another argument, that a trader is not able to react in a volatile market, and a stop loss may save at least part of their deposit.

Close transactions before the weekend: Sometimes, the situation in the Forex market changes drastically for an hour. From Monday to Friday (suppose a trader works 24 hours a day), one could still react to a force majeure. But the weekend, when markets are closed, can bring unpleasant surprises. One example is drone strikes in Saudi Arabia. And it’s even worse if the market opens with a price gap after the weekend.

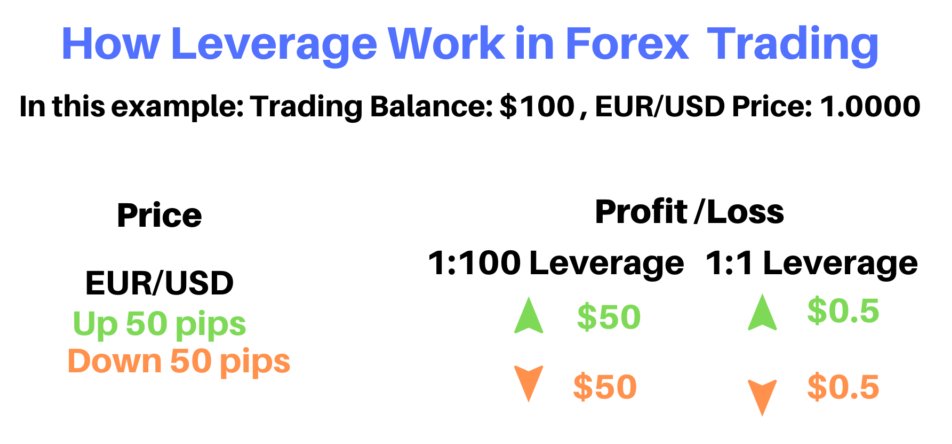

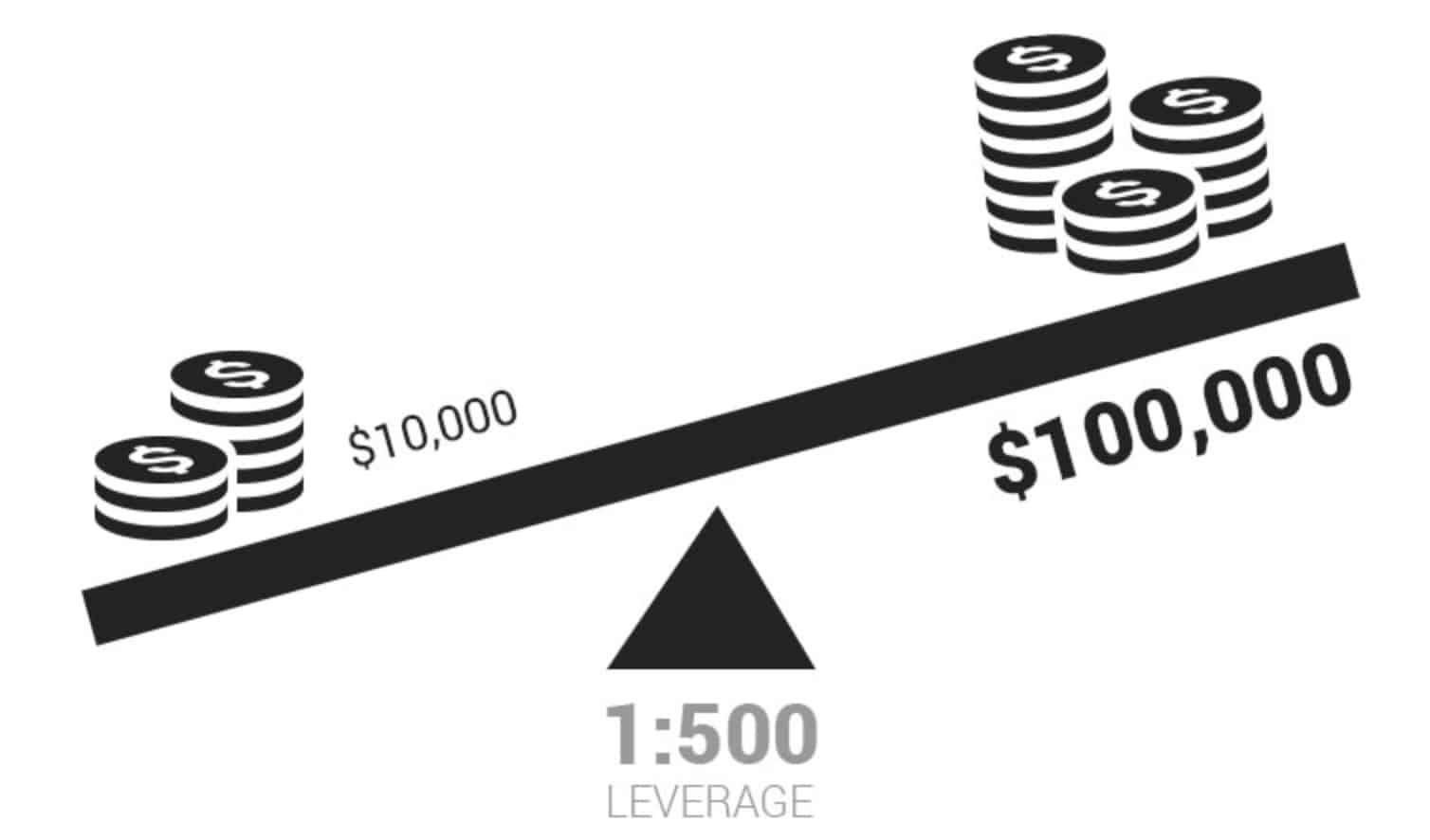

The moderate use of leverage: That’s logical. If you use high leverage, a negligible force majeure will close your positions due to the stop out.

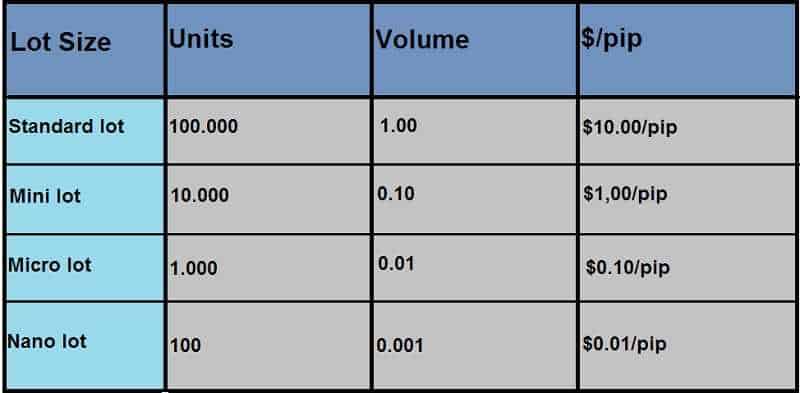

Calculation of the volume of the lot according to the volume of your deposit, level of risk of the transaction and deposit, and other factors More information in this article.

Conclusion

No risk-free Forex strategies. Is it necessary to minimize Forex trading risks? My opinion is no. Those who want to eliminate or minimize risks cannot participate in trading and invest their capital in a bank deposit. Risks must be optimised by properly assessing their opportunities and the capacity to withstand losses. The risk limitation and balancing policy is a risk management policy, which must be drawn up before trading in a real account begins. Only you can develop a risk management system yourself because in reality there are no recommendations that are good for everyone and that can be perfect for all investors regardless of their condition in all cases.

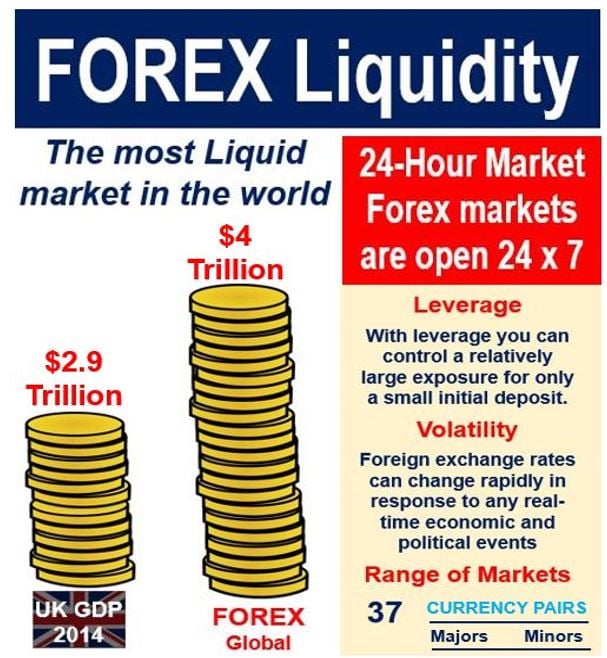

The forex markets are one of the most liquid markets in the world, this simply means that there is a lot of money available to be traded at any one time. Liquidity is basically defined as the ability for a currency or asset to be traded on demand. As the forex markets are so liquid, this basically means that you are able to trade at any given time whenever you want, and the more liquid that a currency pair is, the lower the

The forex markets are one of the most liquid markets in the world, this simply means that there is a lot of money available to be traded at any one time. Liquidity is basically defined as the ability for a currency or asset to be traded on demand. As the forex markets are so liquid, this basically means that you are able to trade at any given time whenever you want, and the more liquid that a currency pair is, the lower the

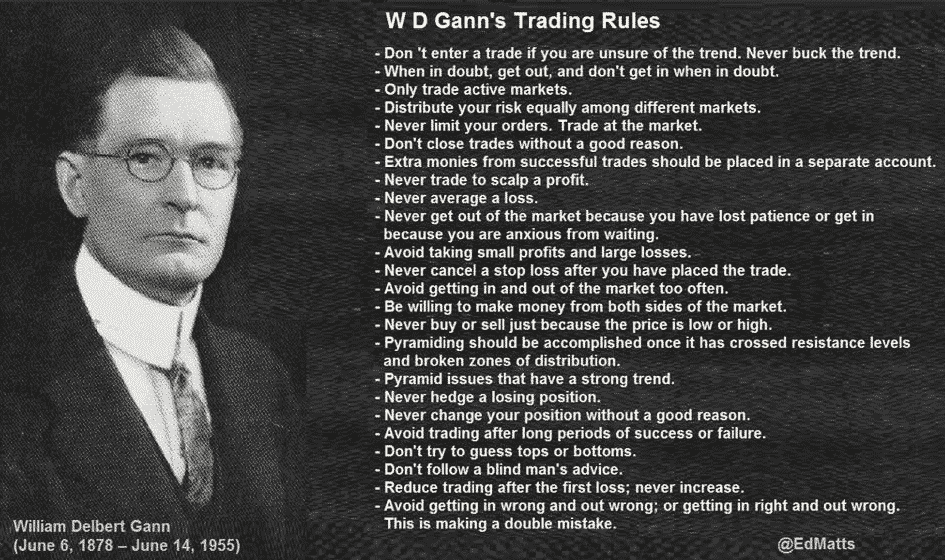

In this article, we will set out some of Gann’s most ambitious rules along with a brief commentary on each. Our purpose is that when you finish this article, you will have an idea that, although the market may change over time, there are many trading rules that remain unchanged.

In this article, we will set out some of Gann’s most ambitious rules along with a brief commentary on each. Our purpose is that when you finish this article, you will have an idea that, although the market may change over time, there are many trading rules that remain unchanged. 6 – Do not close operations without a reason.

6 – Do not close operations without a reason.

14 – Should be pyramided only once the support/resistance levels have been crossed.

14 – Should be pyramided only once the support/resistance levels have been crossed.

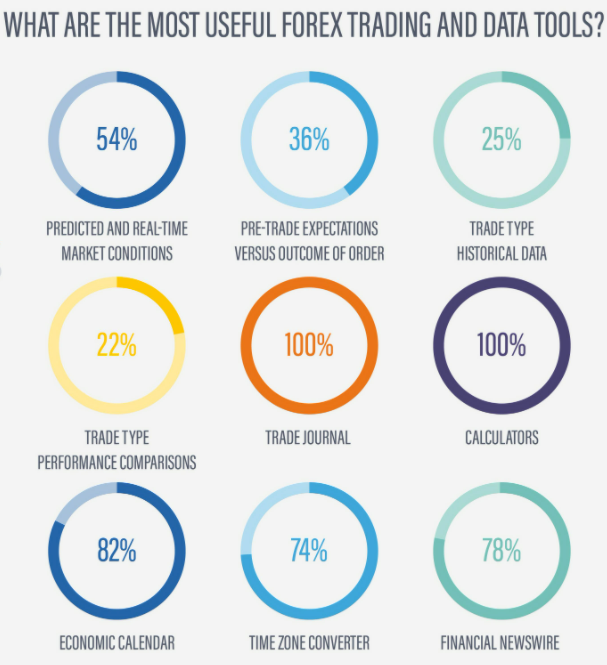

You have probably heard about trading journals, these are records where you jot down everything that you are doing, each trade that you open, the trades that you close, how long they were open, the profit and loss, the reason for the trade, any influencers and more. You are basically writing down everything that you are doing. A trading journal is beneficial for a number of reasons, it can be used for justification for your tradies, it can be used to find out where you may be going a bit wrong and it can be a way that you can check to see whether or not you are following your trading plan. Using it to find your weaknesses will mean that you will be able to make adjustments to your trading based on our findings, ultimately making you a much more

You have probably heard about trading journals, these are records where you jot down everything that you are doing, each trade that you open, the trades that you close, how long they were open, the profit and loss, the reason for the trade, any influencers and more. You are basically writing down everything that you are doing. A trading journal is beneficial for a number of reasons, it can be used for justification for your tradies, it can be used to find out where you may be going a bit wrong and it can be a way that you can check to see whether or not you are following your trading plan. Using it to find your weaknesses will mean that you will be able to make adjustments to your trading based on our findings, ultimately making you a much more  Taking breaks can really benefit your trading. Trading can be a stressful thing to do, it has its ups and downs which can cause stress and even anxiety. No matter your experience levels, when you do it for a long time, you will start to feel tired or stressed, so we need to do something about that. Take a 10-minute break, it can be as simple as that. Stepping away from the trading terminal in order to clear your mind or to think about something else will mean that you are able to help your mind and body to destress. A small break can bring you back with a much clearer mind which will make your trading a lot better, with less stress you will be able to better follow your trading plan and ensure that the trades that you are placing are in line with your trading plan.

Taking breaks can really benefit your trading. Trading can be a stressful thing to do, it has its ups and downs which can cause stress and even anxiety. No matter your experience levels, when you do it for a long time, you will start to feel tired or stressed, so we need to do something about that. Take a 10-minute break, it can be as simple as that. Stepping away from the trading terminal in order to clear your mind or to think about something else will mean that you are able to help your mind and body to destress. A small break can bring you back with a much clearer mind which will make your trading a lot better, with less stress you will be able to better follow your trading plan and ensure that the trades that you are placing are in line with your trading plan. The news and economic events can have a huge effect on the forex markets. In fact, any news event has the potential to change the direction or to cause a small jump in the markets so it is important that you are aware of what is coming up. There are a number of different economic calendars out there which detail different economic news events that are coming up. Take just 1 minute a day to look at one before you start your trading, it will give you an idea of how volatile the markets could be at those stages of the day, so it may even tell you to avoid trading a certain currency pair when those events are coming up, which could save you from some potential losses. It does not take long to do this and it should be something that you are doing at the start of every trading or analysis session that you are doing.

The news and economic events can have a huge effect on the forex markets. In fact, any news event has the potential to change the direction or to cause a small jump in the markets so it is important that you are aware of what is coming up. There are a number of different economic calendars out there which detail different economic news events that are coming up. Take just 1 minute a day to look at one before you start your trading, it will give you an idea of how volatile the markets could be at those stages of the day, so it may even tell you to avoid trading a certain currency pair when those events are coming up, which could save you from some potential losses. It does not take long to do this and it should be something that you are doing at the start of every trading or analysis session that you are doing.

You may be able to automate your trading, at least in part, by using a Forex robot, say for trading entries. You can then decide on commercial departures every few hours or even on a daily basis. This way you can keep your income or primary salary and that, added to what you can do about exchange operations will look a lot like what you would do if you devoted yourself to this activity every minute of your day.

You may be able to automate your trading, at least in part, by using a Forex robot, say for trading entries. You can then decide on commercial departures every few hours or even on a daily basis. This way you can keep your income or primary salary and that, added to what you can do about exchange operations will look a lot like what you would do if you devoted yourself to this activity every minute of your day.

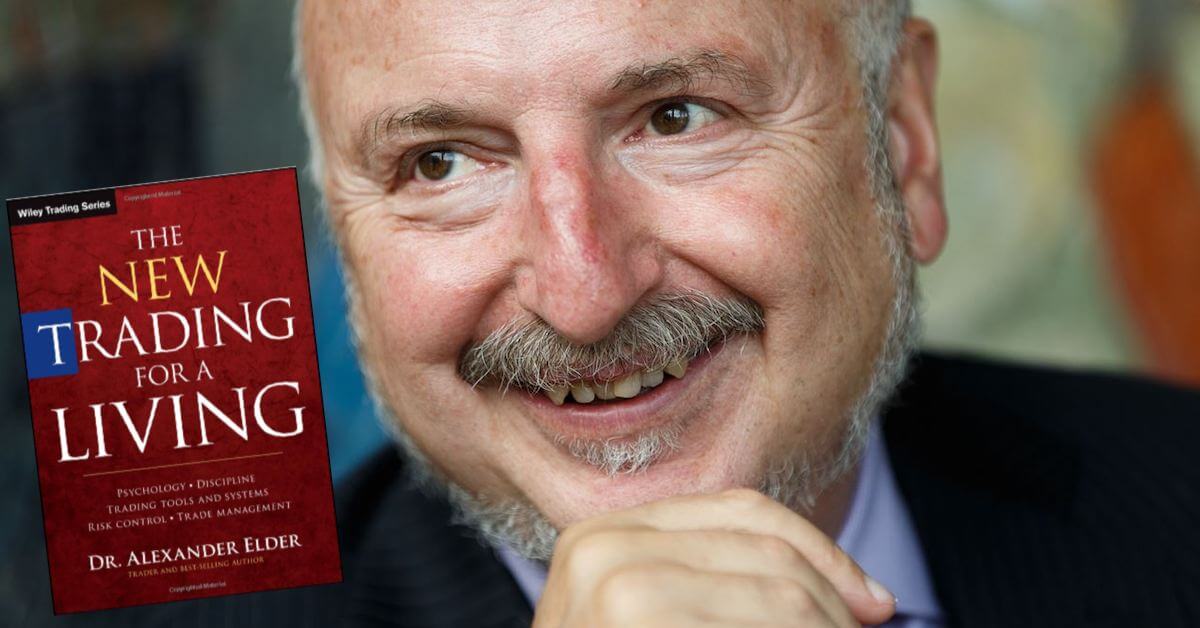

The New Life of Trading – Alexander Elder

The New Life of Trading – Alexander Elder Quantitative Trading Systems- Howard Bandy

Quantitative Trading Systems- Howard Bandy Technical Analysis Based on Statistics (Evidence-Based Technical Analysis) – David Aronson

Technical Analysis Based on Statistics (Evidence-Based Technical Analysis) – David Aronson Principles – Ray Dalio

Principles – Ray Dalio

Another thing that a lot of traders coming into the industry do not fully understand is the amount of time that it takes to learn and to actually begin trading. The initial periods can take a lot of your free time, you need to learn the basics, you need to create a trading strategy, you need a risk management plan for that strategy, and more. This can take a lot of time, more than most people expect as some come into it thinking they will set up an account and then trade, you can of course do that but it will ultimately result in loss.

Another thing that a lot of traders coming into the industry do not fully understand is the amount of time that it takes to learn and to actually begin trading. The initial periods can take a lot of your free time, you need to learn the basics, you need to create a trading strategy, you need a risk management plan for that strategy, and more. This can take a lot of time, more than most people expect as some come into it thinking they will set up an account and then trade, you can of course do that but it will ultimately result in loss.

When it comes to things like investing, you often hear the phrase “You need money to make money”, while to some extent that is true, if you want to make a lot, then you need a larger balance, but you certainly do not need a lot when you are first getting started. In fact, many brokers allow you to join from as little as $10, making it pretty accessible to most people in the world. Those that were once priced out of the markets can now very easily get involved. It will be hard to make much with such a small balance, for that you will need more, but it just shows that you do not need a lot in order to get started and to actually make anything.

When it comes to things like investing, you often hear the phrase “You need money to make money”, while to some extent that is true, if you want to make a lot, then you need a larger balance, but you certainly do not need a lot when you are first getting started. In fact, many brokers allow you to join from as little as $10, making it pretty accessible to most people in the world. Those that were once priced out of the markets can now very easily get involved. It will be hard to make much with such a small balance, for that you will need more, but it just shows that you do not need a lot in order to get started and to actually make anything.

Political changes (such as elections of major world countries) or economic ones (like breaking down of international trade agreements) will reflect on a currency. Sometimes the “how” is clear as day like with Britain leaving the EU. Ever since 2016, the very mention of Brexit made the Pound struggle. After the Brexit withdrawal agreement and ten months of transition, the new UK – EU partnership agreement was put into force on January 1

Political changes (such as elections of major world countries) or economic ones (like breaking down of international trade agreements) will reflect on a currency. Sometimes the “how” is clear as day like with Britain leaving the EU. Ever since 2016, the very mention of Brexit made the Pound struggle. After the Brexit withdrawal agreement and ten months of transition, the new UK – EU partnership agreement was put into force on January 1

Trading goes hand in hand with taking chances. As a trader, you acquire a high-risk tolerance, but it has nothing to with being hazardous. Pro traders take calculated risks, the ones that are more likely to turn into profit. They are simultaneously aware of the inevitability of losses. There’s no profit without a loss, they are just two sides of the same coin. Having that in mind, they never succumb to being exceedingly exultant about

Trading goes hand in hand with taking chances. As a trader, you acquire a high-risk tolerance, but it has nothing to with being hazardous. Pro traders take calculated risks, the ones that are more likely to turn into profit. They are simultaneously aware of the inevitability of losses. There’s no profit without a loss, they are just two sides of the same coin. Having that in mind, they never succumb to being exceedingly exultant about

The lock allows you to manage the floating loss that does not affect the balance or spoil the trading statistics.

The lock allows you to manage the floating loss that does not affect the balance or spoil the trading statistics.  Institutional diversification: Here it is about working with multiple counterparts: Forex, Exchange and different brokers, trust management, etc. If we’re in a force majeure situation (we already discussed the case of the Swiss franc) a counterparty fails, it can withdraw at least the rest of the money from the second.

Institutional diversification: Here it is about working with multiple counterparts: Forex, Exchange and different brokers, trust management, etc. If we’re in a force majeure situation (we already discussed the case of the Swiss franc) a counterparty fails, it can withdraw at least the rest of the money from the second.

It is very common to listen to traders who say they will stop trading after losing or winning a certain number of trades per day. Whether this makes sense or not depends to a large extent on what kind of trading they are conducting. If we are talking about reselling or short-term trading, then this is a psychological defense mechanism that will probably only limit the profitability of an effective trader. However, for the longer-term swing trader or traders, such a rule is probably useful, since if the first three or four patterns fail quickly, forming a winning pattern becomes increasingly unlikely. Moreover, if the loss-making operations take place in the same price area, it is likely not a fruitful area in the near future.

It is very common to listen to traders who say they will stop trading after losing or winning a certain number of trades per day. Whether this makes sense or not depends to a large extent on what kind of trading they are conducting. If we are talking about reselling or short-term trading, then this is a psychological defense mechanism that will probably only limit the profitability of an effective trader. However, for the longer-term swing trader or traders, such a rule is probably useful, since if the first three or four patterns fail quickly, forming a winning pattern becomes increasingly unlikely. Moreover, if the loss-making operations take place in the same price area, it is likely not a fruitful area in the near future. The objectives of having a certain benefit can be sensible as a good trading method must provide a certain number of winning trades over time. The most important thing is that the profit targets are neither too small nor too large. Something in the range of twice or triple the risk per operation (from the entry point to the stop loss) is usually a good option. However, it may also make more sense to keep up with the pace of the market and let the operations that are doing very well keep running, at least until they show signs of turning. A productive commitment could be to make a profit when targets are reached very quickly, as such moves in Forex are often spikes that fall apart easily, but otherwise, we can apply a trailing stop, if only once the price is close to the goal. It is also very reasonable for-profit objectives to be based on volatility, for example, if a stop loss is more or less a true middle range of any time period being used so that the profit-taking is two or three times the same amount respects the current pattern of market volatility and the instrument it trades.

The objectives of having a certain benefit can be sensible as a good trading method must provide a certain number of winning trades over time. The most important thing is that the profit targets are neither too small nor too large. Something in the range of twice or triple the risk per operation (from the entry point to the stop loss) is usually a good option. However, it may also make more sense to keep up with the pace of the market and let the operations that are doing very well keep running, at least until they show signs of turning. A productive commitment could be to make a profit when targets are reached very quickly, as such moves in Forex are often spikes that fall apart easily, but otherwise, we can apply a trailing stop, if only once the price is close to the goal. It is also very reasonable for-profit objectives to be based on volatility, for example, if a stop loss is more or less a true middle range of any time period being used so that the profit-taking is two or three times the same amount respects the current pattern of market volatility and the instrument it trades.

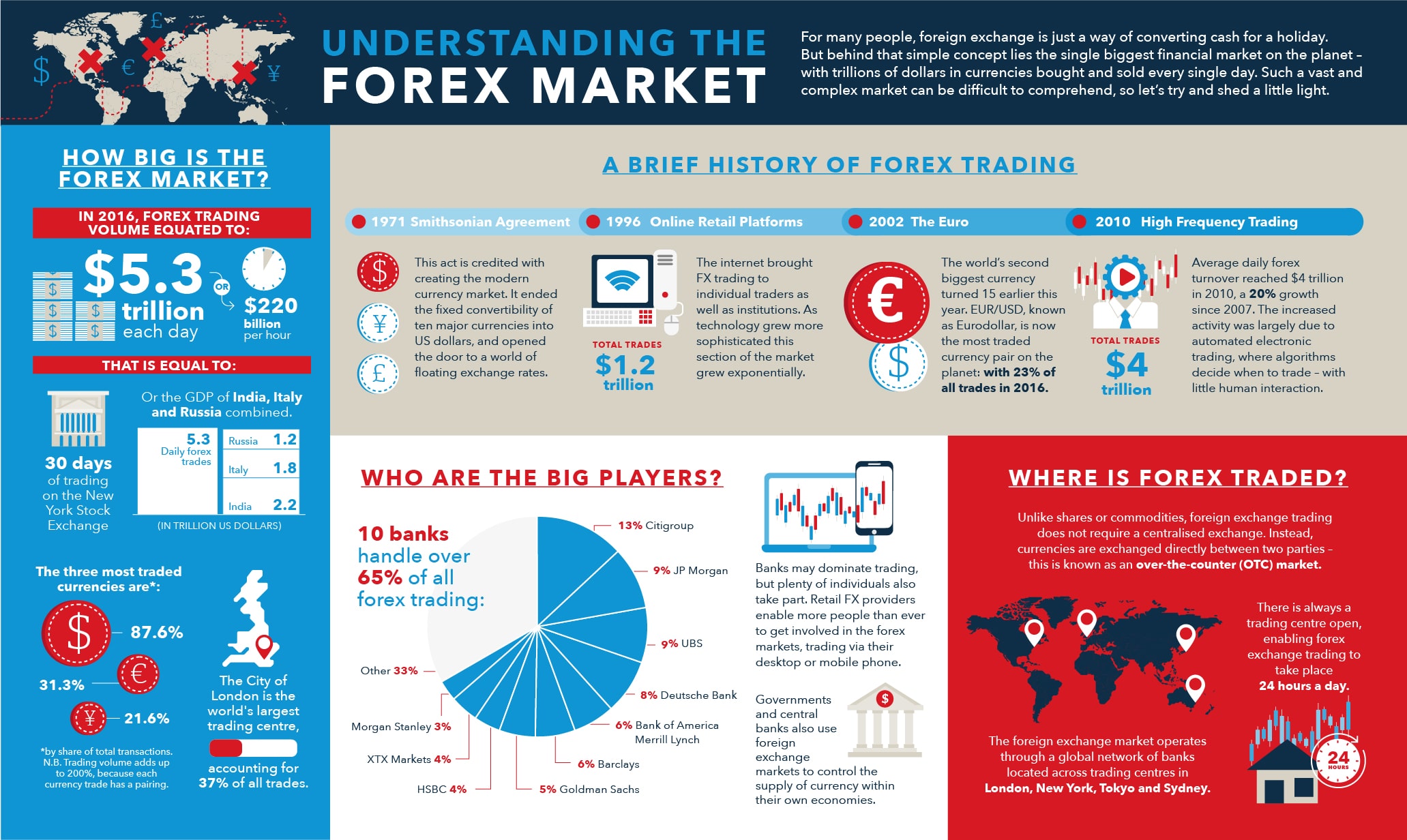

Many people, especially those that have seen some of the Hollywood or bigger films about trading and forex will often think that the USA is the center, it is where the most trading happens. When in reality, only around 19% of trades and trade volume takes place in the US, instead, the center of the trading world is actually London, it is predicted that 43% of all forex trading transactions take place in the United Kingdom, and London, making it the main hub for Forex trading.

Many people, especially those that have seen some of the Hollywood or bigger films about trading and forex will often think that the USA is the center, it is where the most trading happens. When in reality, only around 19% of trades and trade volume takes place in the US, instead, the center of the trading world is actually London, it is predicted that 43% of all forex trading transactions take place in the United Kingdom, and London, making it the main hub for Forex trading.

Forex trading is not hard, complicated yes, but not hard. We say this even with the knowledge that the majority of people that trade will lose money. People seem to put the term hard on everything these days, forex is not hard, it just takes time, and that’s for some people what makes things hard. Yet in reality, it is not hard at all, all you are technically doing is placing a trade, choosing whether it goes up or down and that is it, it is incredibly easy and quick to do. Yet people refer to it as being hard because of the amount of time and effort that you need to put in in order to be good at it and in order to know which way you should be placing your trade. Yet it is still not hard, it just takes time, time does not make things hard, hard shoulders mean that it takes a lot of effort in order to do the thing that you are trying to do, and that is playing the trade, which we have already discussed, is actually very simple.

Forex trading is not hard, complicated yes, but not hard. We say this even with the knowledge that the majority of people that trade will lose money. People seem to put the term hard on everything these days, forex is not hard, it just takes time, and that’s for some people what makes things hard. Yet in reality, it is not hard at all, all you are technically doing is placing a trade, choosing whether it goes up or down and that is it, it is incredibly easy and quick to do. Yet people refer to it as being hard because of the amount of time and effort that you need to put in in order to be good at it and in order to know which way you should be placing your trade. Yet it is still not hard, it just takes time, time does not make things hard, hard shoulders mean that it takes a lot of effort in order to do the thing that you are trying to do, and that is playing the trade, which we have already discussed, is actually very simple. Forex trading is not a scam, if it was there wouldn’t be over a trillion dollars being traded every single day. Forex is basically just a way of exchanging foreign currencies for each other. It has been happening for hundreds of years in one form or another and will happen for hundreds more. Businesses are run off of it and if it was a scam, the majority of businesses that we have today would have disappeared a long time ago.

Forex trading is not a scam, if it was there wouldn’t be over a trillion dollars being traded every single day. Forex is basically just a way of exchanging foreign currencies for each other. It has been happening for hundreds of years in one form or another and will happen for hundreds more. Businesses are run off of it and if it was a scam, the majority of businesses that we have today would have disappeared a long time ago. Many years ago this would be completely true, you used to need millions of dollars before you could even consider trading on the global forex markets, this made it so that only the biggest businesses and institutions could take part in the markets. These days though, this is certainly not the situation that we are in. These days anyone can trade, all that it takes is a computer or mobile phone, an internet connection, and a balance of as little as $10. That is all that you need to trade which is ridiculous and incredibly accessible. There are no more excuses available for it not being easy to get into. You can go from no account to your first trade being placed in the matter of about 10 minutes with some brokers. There are millions of people trading from their bedroom at home and things will only continue to get easier.

Many years ago this would be completely true, you used to need millions of dollars before you could even consider trading on the global forex markets, this made it so that only the biggest businesses and institutions could take part in the markets. These days though, this is certainly not the situation that we are in. These days anyone can trade, all that it takes is a computer or mobile phone, an internet connection, and a balance of as little as $10. That is all that you need to trade which is ridiculous and incredibly accessible. There are no more excuses available for it not being easy to get into. You can go from no account to your first trade being placed in the matter of about 10 minutes with some brokers. There are millions of people trading from their bedroom at home and things will only continue to get easier.

The first thing comes down to your education, there is such a thing as too little information, but also too much information. There are three types of traders, those that learn the very basics and then jump in, those that try to learn everything before they touch their trading account, and those that learn as they go along. We would say that there is no right way to do it, but there are certainly wrong ways. Firstly, those that simply jump in with very little information, are setting themselves up to fail, you cannot trade with very little info, you won’t know how to manage your risks, or what certain events or patterns mean.

The first thing comes down to your education, there is such a thing as too little information, but also too much information. There are three types of traders, those that learn the very basics and then jump in, those that try to learn everything before they touch their trading account, and those that learn as they go along. We would say that there is no right way to do it, but there are certainly wrong ways. Firstly, those that simply jump in with very little information, are setting themselves up to fail, you cannot trade with very little info, you won’t know how to manage your risks, or what certain events or patterns mean. You need to learn about risk management, this is how you will protect your account from losses and from the markets moving against you because they certainly will move against you at one point and on a regular basis. Your risk management plan should contain things like your

You need to learn about risk management, this is how you will protect your account from losses and from the markets moving against you because they certainly will move against you at one point and on a regular basis. Your risk management plan should contain things like your  Set your goals and expectations, many people come into trading with the idea that they will make ridiculous amounts of money very quickly, of course, is not the case and is not realistic. You need to set your goals at an appropriate level, think about things like your current capital and account balance, the strategy you are using, and other risk management things that you have in place. You should combine all of these to make more realistic goals. If you see them too high, then you will be risking too much with each trade, not something that anyone would recommend, so set your expectations at the right level and it will keep you grounded and will help to keep you consistent with your trading and risks.

Set your goals and expectations, many people come into trading with the idea that they will make ridiculous amounts of money very quickly, of course, is not the case and is not realistic. You need to set your goals at an appropriate level, think about things like your current capital and account balance, the strategy you are using, and other risk management things that you have in place. You should combine all of these to make more realistic goals. If you see them too high, then you will be risking too much with each trade, not something that anyone would recommend, so set your expectations at the right level and it will keep you grounded and will help to keep you consistent with your trading and risks.

:max_bytes(150000):strip_icc()/GettyImages-940035118-5b31152da474be0036210e94.jpg) You are naturally looking at the news:

You are naturally looking at the news:  You no longer blindly follow others:

You no longer blindly follow others:  You still understand that there is still a lot to learn:

You still understand that there is still a lot to learn:

We spoke about leverage near the start of this article, it is important to get a good understanding of how it works and if you want to keep the risks on your account as low as possible, then you will also want to keep your leverage as low as possible. Leverage allows you to trade with more spending power than the capital in your account, this, in turn, increases the profit potential of the account, which is the main selling point of leverage. What they don’t tell you is how this leverage also increases the loss potential of your trades too, the more leverage that you use the higher the losses can be with each trade and a loss can take away a much larger sum of money than it would have with less leverage. So if you have the balance for it, go for a lower leverage in order to keep risks low.

We spoke about leverage near the start of this article, it is important to get a good understanding of how it works and if you want to keep the risks on your account as low as possible, then you will also want to keep your leverage as low as possible. Leverage allows you to trade with more spending power than the capital in your account, this, in turn, increases the profit potential of the account, which is the main selling point of leverage. What they don’t tell you is how this leverage also increases the loss potential of your trades too, the more leverage that you use the higher the losses can be with each trade and a loss can take away a much larger sum of money than it would have with less leverage. So if you have the balance for it, go for a lower leverage in order to keep risks low.

It can be very easy to fall into the trap of taking shortcuts, when we say shortcuts we are referring to the rules and the methods that you use to place trades, your trading plan will have some rules on it, these rules will dictate how and when you place your trades. These can be pretty small shortcuts, like not waiting for additional confirmation, or they can be pretty significant ones like trying to speed up the process by not placing a stop loss with a trade. While they may not seem big, those little things like not placing a stop loss could potentially end up causing some quite considerable losses which will, in turn, put your overall trading results back quite a bit. It is important that you try to avoid these shortcuts, some may work, but when they don’t they can have big effects. Ensure that you stick to your rules and that you do them fully, not doing just half and hoping things are ok, that extra minute that you save is not worth the additional risks involved.

It can be very easy to fall into the trap of taking shortcuts, when we say shortcuts we are referring to the rules and the methods that you use to place trades, your trading plan will have some rules on it, these rules will dictate how and when you place your trades. These can be pretty small shortcuts, like not waiting for additional confirmation, or they can be pretty significant ones like trying to speed up the process by not placing a stop loss with a trade. While they may not seem big, those little things like not placing a stop loss could potentially end up causing some quite considerable losses which will, in turn, put your overall trading results back quite a bit. It is important that you try to avoid these shortcuts, some may work, but when they don’t they can have big effects. Ensure that you stick to your rules and that you do them fully, not doing just half and hoping things are ok, that extra minute that you save is not worth the additional risks involved. A lot of people don’t seem to stick to their risk management plans, at least not entirely. Your plan will have your

A lot of people don’t seem to stick to their risk management plans, at least not entirely. Your plan will have your  Something that we are all probably guilty of, we love to trade, but sometimes it is better not to and when you are tired, that can be one of those reasons. When we are tired we do not have the same concentration levels, we are far more easily distracted and we are far more likely to make mistakes. Yet we love trading so much or feel that we need to trade that sometimes it doesn’t matter how tired we are, we will still trade. This is where a lot of mistakes will be made, things missed out and potential losses gained. If you’re feeling tired, or that you cannot concentrate fully, then you should try and avoid trading as a whole, including analysing the markets and especially placing any trade.

Something that we are all probably guilty of, we love to trade, but sometimes it is better not to and when you are tired, that can be one of those reasons. When we are tired we do not have the same concentration levels, we are far more easily distracted and we are far more likely to make mistakes. Yet we love trading so much or feel that we need to trade that sometimes it doesn’t matter how tired we are, we will still trade. This is where a lot of mistakes will be made, things missed out and potential losses gained. If you’re feeling tired, or that you cannot concentrate fully, then you should try and avoid trading as a whole, including analysing the markets and especially placing any trade. Distractions are horrible things when it comes to trading, pretty much anything can be a distraction. When you set up your trading officer room, you should have ensured that a lot of the things that could cause you distractions were removed. Things like a TV, games consoles, things like hats, things that can take your attention away from your trading. Ensure that others know that you are trading and that you do not wish to be disturbed. Distractions can very easily cause you to miss things or to place trades incorrectly, so it is vital that you eliminate as many as you can.

Distractions are horrible things when it comes to trading, pretty much anything can be a distraction. When you set up your trading officer room, you should have ensured that a lot of the things that could cause you distractions were removed. Things like a TV, games consoles, things like hats, things that can take your attention away from your trading. Ensure that others know that you are trading and that you do not wish to be disturbed. Distractions can very easily cause you to miss things or to place trades incorrectly, so it is vital that you eliminate as many as you can. Emotions are wonderful things, they can make us feel amazing but at the same time, they can make us feel pretty rotten. One thing that we want to avoid is trading while our emotions are pretty high. They can cause us to want to do things that go against our trading strategy, things like greed and overconfidence can make us trade large or more often, while things like anxiety and fear can make us not want to trade at all. When we have our emotions high or you can feel something building up then it is important that you take a break, step away, clear your mind and come back when those emotions have died down.

Emotions are wonderful things, they can make us feel amazing but at the same time, they can make us feel pretty rotten. One thing that we want to avoid is trading while our emotions are pretty high. They can cause us to want to do things that go against our trading strategy, things like greed and overconfidence can make us trade large or more often, while things like anxiety and fear can make us not want to trade at all. When we have our emotions high or you can feel something building up then it is important that you take a break, step away, clear your mind and come back when those emotions have died down.

The first thing that any trader should do after placing their first trade is to write everything about it down on awesome paper in a trading journal if you have one. This will include things like the opening price and time, the closing price and time, how long the trade was open for, the profit or loss of the trade, what analysis you did beforehand, which of your trading rules you followed, and any other relevant information that you can think of. It sounds like a lot, but it will be worth it, this sort of information will then allow you to analyse the trade that you made (our next point) which in turn allows you to ensure that you are making even better trades in the future. This is only possible though if you remember to write things down. It does take a little extra time, time that is definitely worth it, so don’t skip this step just to save yourself a few extra minutes.

The first thing that any trader should do after placing their first trade is to write everything about it down on awesome paper in a trading journal if you have one. This will include things like the opening price and time, the closing price and time, how long the trade was open for, the profit or loss of the trade, what analysis you did beforehand, which of your trading rules you followed, and any other relevant information that you can think of. It sounds like a lot, but it will be worth it, this sort of information will then allow you to analyse the trade that you made (our next point) which in turn allows you to ensure that you are making even better trades in the future. This is only possible though if you remember to write things down. It does take a little extra time, time that is definitely worth it, so don’t skip this step just to save yourself a few extra minutes. When we place our first trade, we will have a number of different emotions flowing through us which is completely natural in this situation. We will feel nervous beforehand, during the trade we may feel a lot of adrenaline, afterward, depending on the result we may feel a high or a low. It is important to remember these feelings, however, the reason why we are remembering them is not so that we can try and recreate them, it is to show us that we need to try and get them out of our trading. The nerves that you get at the start should go with time, but if you allow them to remain it can become increasingly hard to actually place trades, the same with the highs and lows, they can become addicting or even bring on other emotions that can affect our trading like greed or overconfidence. So remember those feelings, if you then, later on, feel them becoming quite strong, that is a good time to take a break and clear your mind.

When we place our first trade, we will have a number of different emotions flowing through us which is completely natural in this situation. We will feel nervous beforehand, during the trade we may feel a lot of adrenaline, afterward, depending on the result we may feel a high or a low. It is important to remember these feelings, however, the reason why we are remembering them is not so that we can try and recreate them, it is to show us that we need to try and get them out of our trading. The nerves that you get at the start should go with time, but if you allow them to remain it can become increasingly hard to actually place trades, the same with the highs and lows, they can become addicting or even bring on other emotions that can affect our trading like greed or overconfidence. So remember those feelings, if you then, later on, feel them becoming quite strong, that is a good time to take a break and clear your mind. If we did our analysis properly, we will most likely have a few things to think about, did you follow your strategy? Did you place a good trade or a bad trade? These are things to think about. If things were not entirely perfect which they probably weren’t, then we can start to think about things that we need to change. When starting out there will most likely be a lot of different things that we need to change on our first, second, third, and more trades. They may be very few things, but each change that we make is an improvement that will ultimately improve our overall trading in the long run. Remember, these changes do not need to be big, any changes are also helpful, no matter how small they are.

If we did our analysis properly, we will most likely have a few things to think about, did you follow your strategy? Did you place a good trade or a bad trade? These are things to think about. If things were not entirely perfect which they probably weren’t, then we can start to think about things that we need to change. When starting out there will most likely be a lot of different things that we need to change on our first, second, third, and more trades. They may be very few things, but each change that we make is an improvement that will ultimately improve our overall trading in the long run. Remember, these changes do not need to be big, any changes are also helpful, no matter how small they are. So we placed our first trade, after looking at that trade, analysing it, working out what we need to change, we can then think about placing our second trade. We need to take into account anything that we previously looked at, so if we needed to make a change, this is where we can implement it, of course, if it is a huge change, then it will be good to test it on a demo account, but for very small changes it will be ok in our live account. It should be slightly easier and quicker to place this second trade as we have done one before and the majority will be exactly the same. Place the trade and then do exactly the same again, write down what you do, the same information as before, so you can then analyse the second trade to ensure you are still in line and that any changes that were made are working well. Then do the same for the third, fourth, and any other subsequent trades that you make.

So we placed our first trade, after looking at that trade, analysing it, working out what we need to change, we can then think about placing our second trade. We need to take into account anything that we previously looked at, so if we needed to make a change, this is where we can implement it, of course, if it is a huge change, then it will be good to test it on a demo account, but for very small changes it will be ok in our live account. It should be slightly easier and quicker to place this second trade as we have done one before and the majority will be exactly the same. Place the trade and then do exactly the same again, write down what you do, the same information as before, so you can then analyse the second trade to ensure you are still in line and that any changes that were made are working well. Then do the same for the third, fourth, and any other subsequent trades that you make.

Brokers are always very interested in being able to develop their business more and thus be able to attract new customers. They make profits by receiving commissions for the transactions made by their clients. They themselves do not always manage to attract a sufficient number of new customers. That’s why

Brokers are always very interested in being able to develop their business more and thus be able to attract new customers. They make profits by receiving commissions for the transactions made by their clients. They themselves do not always manage to attract a sufficient number of new customers. That’s why