The Economic News Calendar, also known as the calendar of economic events, plays an important role in the life of every trader and investor in the world, whether this is a minor trader who speculates with a personal account or an operator trading as part of an institutional trading network (institutional operators). An economic calendar is a tool that shows the fundamental events that affect the trading environment of financial markets.

In financial markets like Forex, there are certain announcements that are made with some frequency that highlight very important events in the socio-political and economic world. These announcements come from government agencies, central banks, private organisations, lobbyists and others, and can sometimes serve as reference points on which economic policies are based and strategic movements are made in the business and political landscape.

For example, the onset of the global financial crisis led Governments around the world to respond in a political manner in accordance with how their countries and Governments were affected by the events from 2008 to 2010. In the eurozone, the sovereign debt crisis has boosted the change of governments, the implementation of economic policies and decisions. In the United States, we saw the birth of the Asset Rescue Program in Trouble (TARP), several major bailouts, and the easing policies of the Federal Reserve Bank. Several of these decisions were made around the world, changing the aspect of the calendar of economic news as we know it, forever.

The globalized nature of the world today means that these announcements directly affect the global economy, with far-reaching effects on how we live our lives and how future events will shape our future. Financial market operators have had to come to understand how these announcements affect the investment climate in a country, region, or global markets, and depending on the content and tone of these economic announcements, positive or negative sentiment in a currency, market or economy can develop. This in turn leads investors to operate in different markets in a certain way, as a result of the volatility that occurs. These ads are known as market news.

Market news is not published randomly but is published according to a well-planned month-to-month calendar, in a full-year cycle. This economic news publishing program is what is known as the economic calendar. For Forex traders, it is also known as the Forex calendar or Forex news calendar, because most of the news it shows has an immediate and direct (and sometimes lasting) impact on the currency market. Indeed, the economic calendar affects all markets, although the degree of affectation varies.

Components of the Economic Calendar

What is the Economic News Calendar made of? What is in this tool that traders need to consider? Here is a detailed description of the specific components of the Economic Calendar:

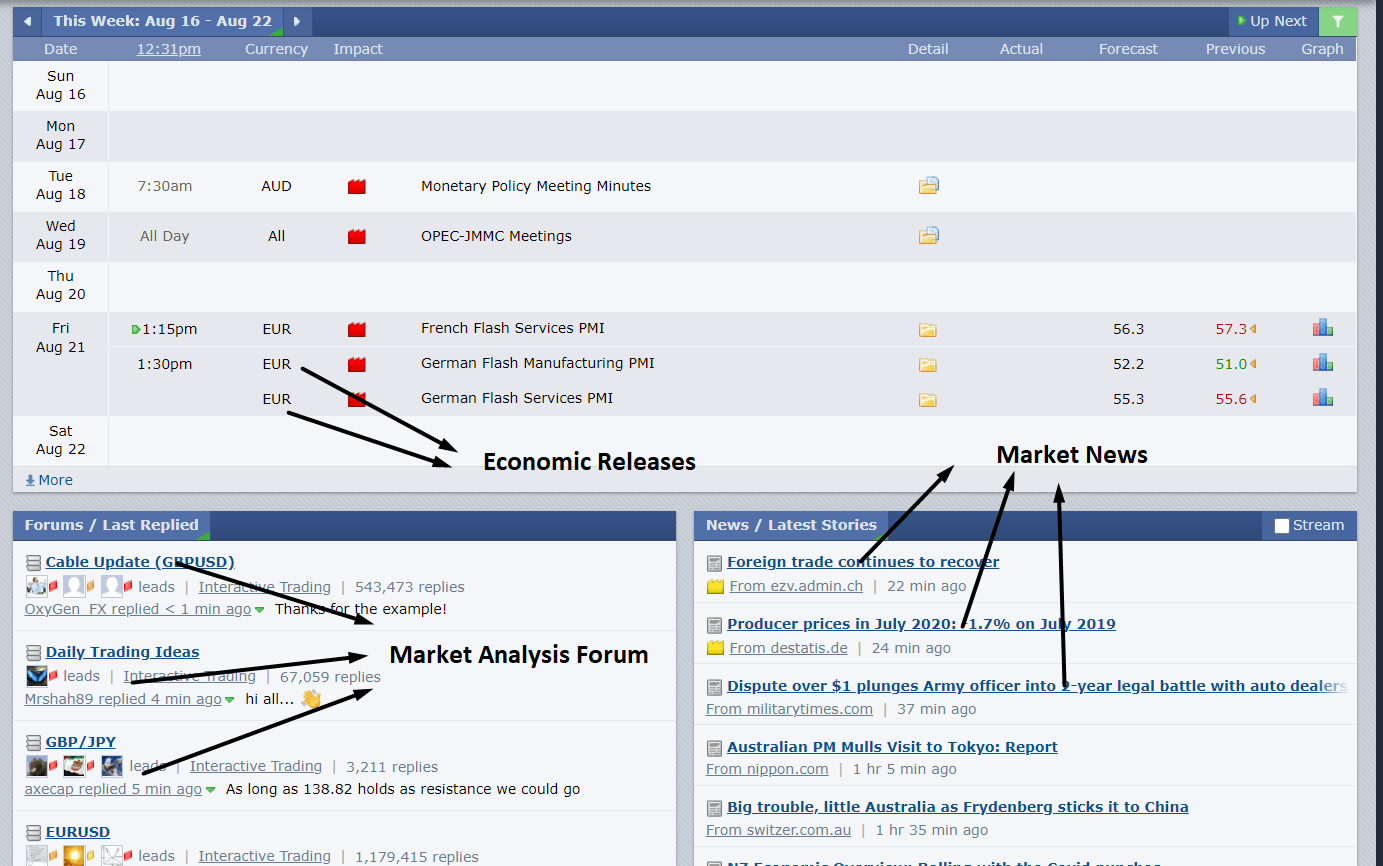

The date and time of publication of each economic news item included in the calendar. In this case, the operator can clearly see the exact time when the news will be released, which usually appears in Eastern United States time by default. Some economic calendars have tools that allow the operator to change time settings to match their local time. However, the global standard of reference is eastern time in the United States. Therefore, the operator needs to know how far from the Eastern Time Zone of the United States its own time zone is, in order to know the moments of the day when it must be attentive to the markets.

The economic news itself. Logically the trader should know what is economic news to be published and with which he is trying to act accordingly.

Below is a nice video created by Trading 212 regarding Economic Calendars…

In the case of Forex, the currency of the country of origin of each news item. This is the currency that is usually affected by the news, and therefore traders will be on the lookout for the currency pairs in question to see which pairs present the greatest trading opportunities. Usually, the ISO abbreviation of the currency will be displayed, or the flag of the country with the affected currency will be displayed.

The degree of impact on the market of the publication of the news. This is an indication of how strong the impact of the news can be on markets, measured by the degree of market volatility and the range of price movements. News on an economic calendar is classified into low-impact (green), medium-impact (amber), and high-impact (red) economic news. Some calendars will use the colour codes next to the news, while others may use stars (*) to indicate the degree of impact on the market so that the highest-impact news has a 5-star rating (*****) and low-impact news has two stars or even a single star.

Some economic calendar providers will display a «Detail» box. Operators can click here for more information on a particular news item, as well as the impact on the market in case there are higher than expected or lower than expected numbers.

Economic calendars usually show the previous value, expected value, present value, and revised value of each economic news item. This is where traders can get information about the benchmarks for each data and the actual numbers of the news as it arrives. Some providers provide a historical chart or template that shows the performance of a particular story in recent months or years for comparative analysis.

Sources of Economic News Calendars

The economic calendar can be obtained for free on the websites of almost every major Forex broker. There are also other external providers that can be useful. It is up to each trader to search the websites of Forex brokers, online market analysis sites, online forums related to markets, and analysis service providers to find a good economic calendar that offers complete and up-to-date information. Different economic calendar providers can add certain features that will make their calendar versions more attractive. This does not affect the dates and times of publication of each news item.

How to use the Economic Calendar?

Now that we know what the content of the economic calendar is, it is essential to understand how to use it correctly. While there are no strict rules on the use of economic calendars, here’s a guide on how this tool can be used to trade in markets like Forex.

Rule 1: Always study the news program on the economic calendar in a block of time of an allowance, and do this for the following month in advance. This is so that the trader can take note of the high-impact news and the dates and times on which this news is scheduled for publication. This allows you to plan your operations accordingly, so that you do not have open positions that may be negatively affected by the publication of the news, eliminating its gains or significantly increasing the unrealised losses of losing trades. It is impressive how many traders simply ignore this simple fact, at their own risk.

Rule 2: Use world time tools (showing the current time in any time zone) available in the search engines to know the time difference between the local time and the time shown in the economic calendar. This will allow you to adjust your time settings accordingly. This will help you not to miss the negotiation opportunities that will bring particular economic news.

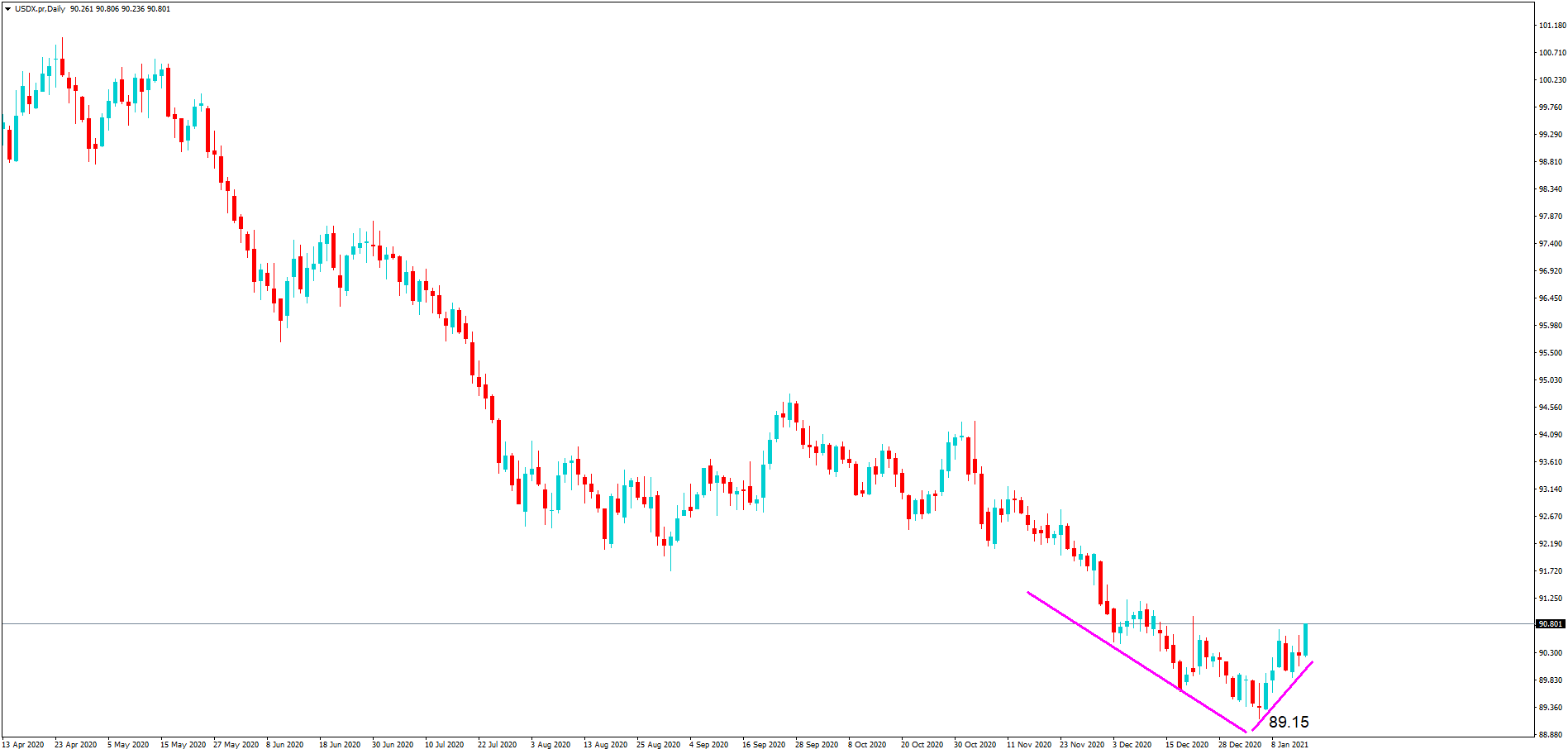

Rule 3: Use historical data to study how a particular story affects markets. If you want to know what is the way in which a currency pair or index will react to the publication of a certain economic news item (as an important economic indicator), then the most appropriate response might be to study your past behavior using historical data and graphs. This will prevent a trader from setting a profit goal of say 100 pips, for a story that will only move the market around 50 pips, for example. It will also help to know whether an individual economic news item is unstable.

Rule 4: Trading only with high-impact news is recommended, as these are the events that move markets and create the volatility needed to produce good trading opportunities. Low-impact economic news does not create enough volatility, and therefore is not suitable for high-profit markets because it generates small-scale movements.

Rule 5: Use calendars that have automatic update tools that add the current numbers to the calendar at the time the news is published. This will help you closely monitor your operations.

Conclusion

In summary, we can conclude that an economic calendar is an important tool for traders in all financial markets. It must be used in a complete and correct manner so that operators can derive the maximum benefits from the information it provides. Sometimes an operator may have to combine two or three calendars in order to get everything they want from an economic calendar, as some may have additional features and have shortcomings in other respects.

Trading is mainly based on planning. Knowing the economic calendar well in advance can help the trader to plan his operations in such a way that he does not end up trapped in some of the surprises that may occur during economic news publications.

Also, note that the market is constantly evolving. Some economic news that was low-impact a few years ago has become more important to markets and has a high impact due to the emergence of new sectors that are now engines of the global economy. An example of this is housing data in the United States. Before 2006, some of the housing sector indicators were not very important, but as the subprime mortgage crisis was identified as the main cause behind the global financial crisis, US housing data has become a highly monitored economic news item.

Finally, the trader should be aware of adding new economic news and removing some that are irrelevant and even archaic. Some of this news can be highly impacted, such as the JOLTS employment report from the United States, which was born out of the labor sector crisis in that nation.