Biden shows his cards, markets are rattled! – where next for the US Dollar?

Thank you for joining this forex academy educational video.

On Thursday the 14th of January, president-elect Joe Biden addressed the US nation and said that ‘’the $600 already appropriated is simply not enough’’.

He carried on by saying that the new democrat government would issue another round of $1,400, on top of.the $600 payments, thus showing his hand with regard to the 15 million adult dependants relying on these stimulus checks. This segment of the Covid relief package runs to 1.9 trillion dollars.

With yet many more millions of Americans, including migrants, who have slipped the net with regard to relief packages, the wranglers about entitlement will go on as long as the pandemic continues to run rife throughout the United States. With some young adults purchasing new cars with the extra cash, and others boasting of savings of $13,000 from the relief payments, it is hardly surprising that there will be continued frictions between the two parties, let alone the public and pressure groups, which will only go to show that this is not a one-size-fits-all policy.

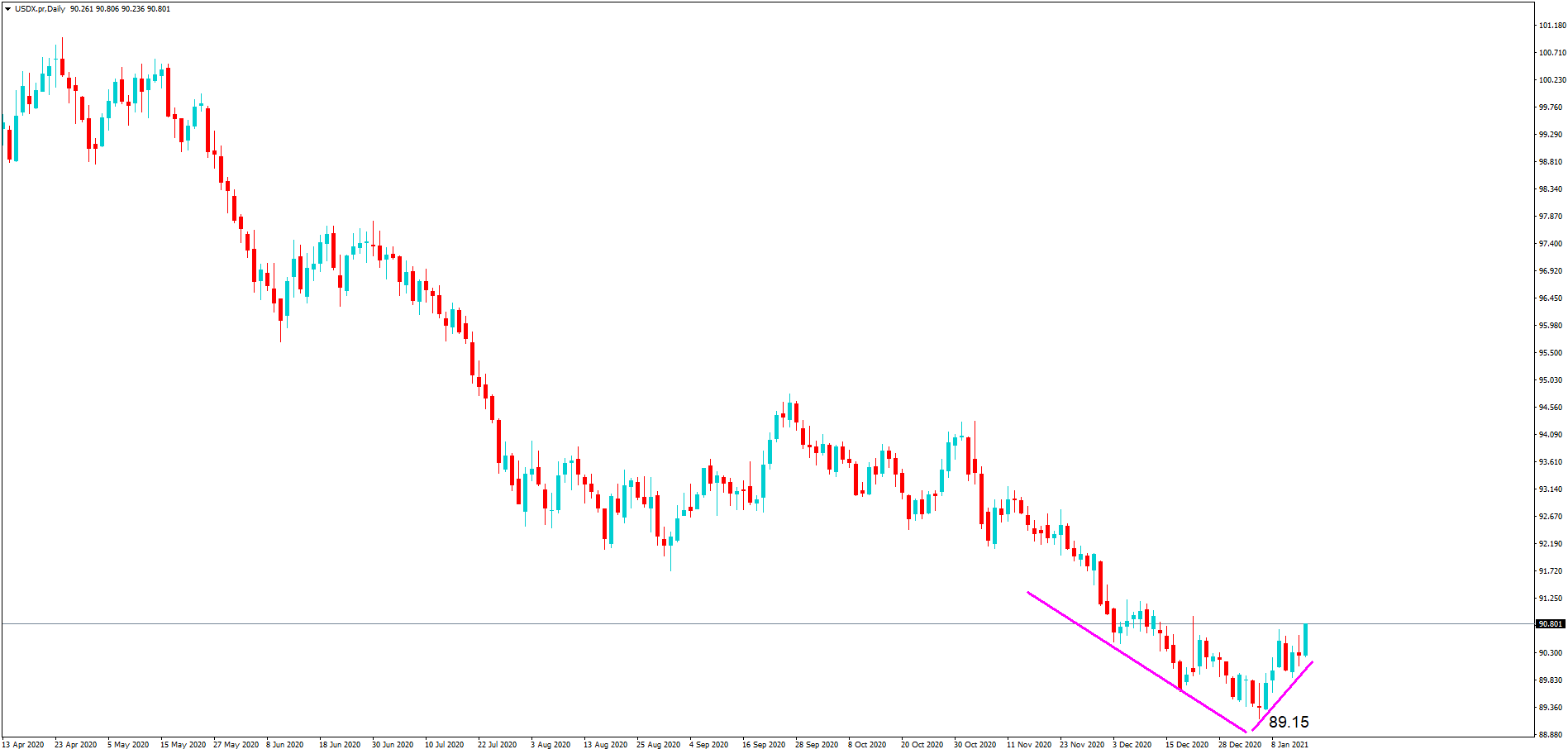

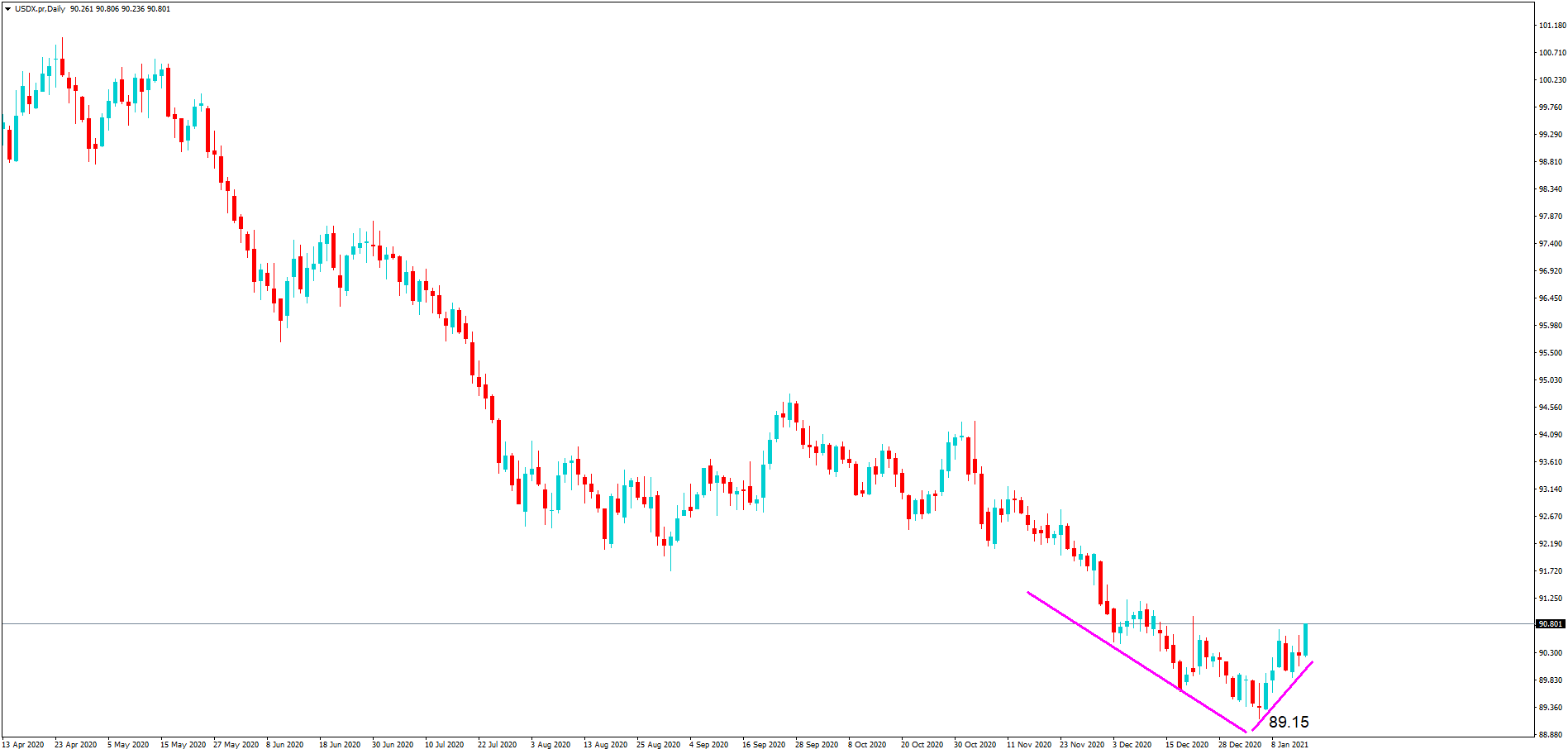

Markets saw volatility following the comments with the dollar index shown here on the daily time frame, recovering from its low of 89.15, in the dollar-weighted average against the pound, the Euro, the yen, Swiss franc Canadian dollar, and Australian and New Zealand dollars.

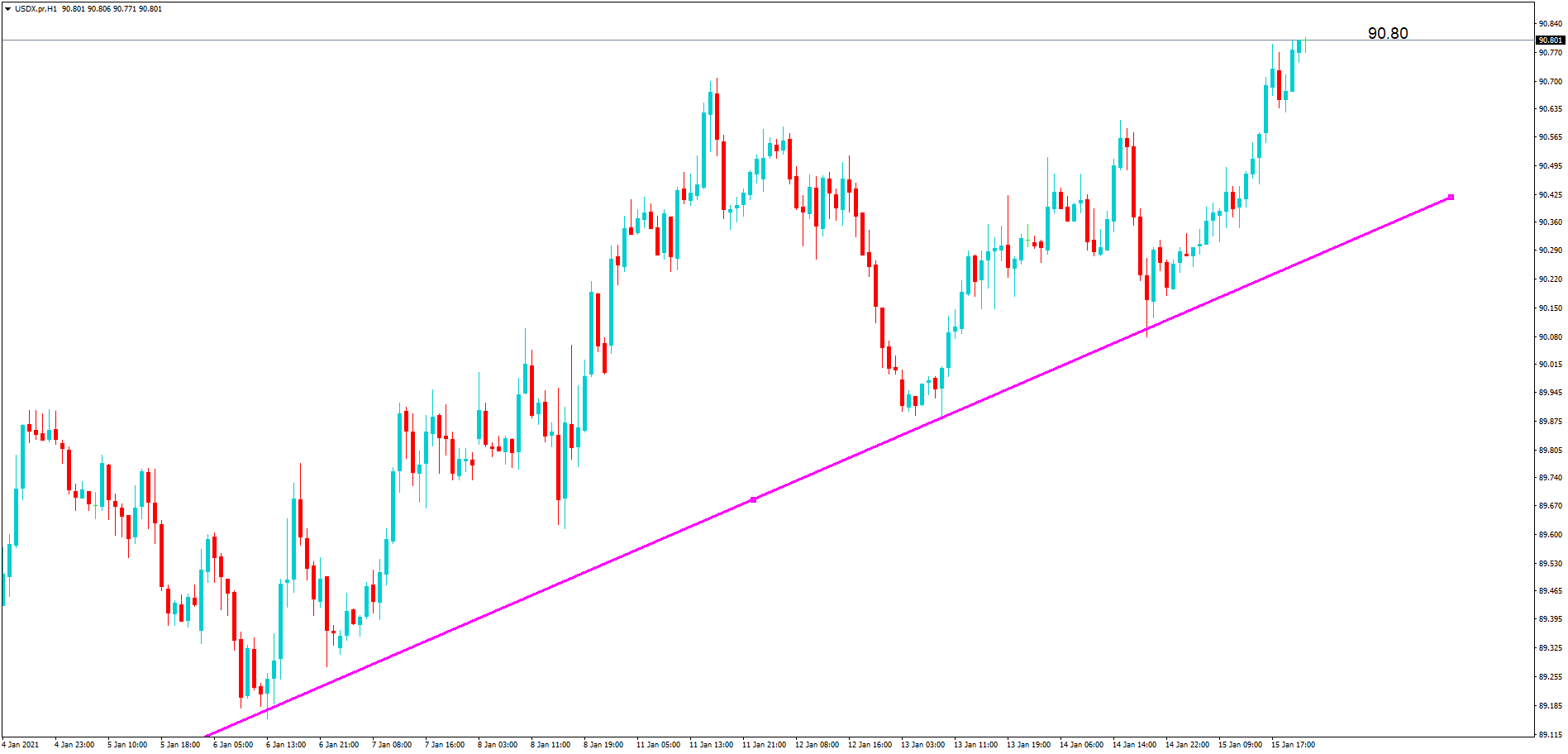

Although the rot stopped on the 6th of January, dollar strength has been conforming to this support line, on the 1-hour chart, which was bolstered by Joe Biden’s comments on the 14th , to the point where we have a high of 90.80 at the time of writing.

While the bull run on the US dollar may be partially down to Joe Biden’s covid relief policy, there are other factors to consider, including the buy the rumour sell the fact trading phenomenon, where market participants were largely expecting the incoming President to instigate a larger relief package and especially now that the democrats are in control in Congress, thus making it more easily to be able to get through new policies.

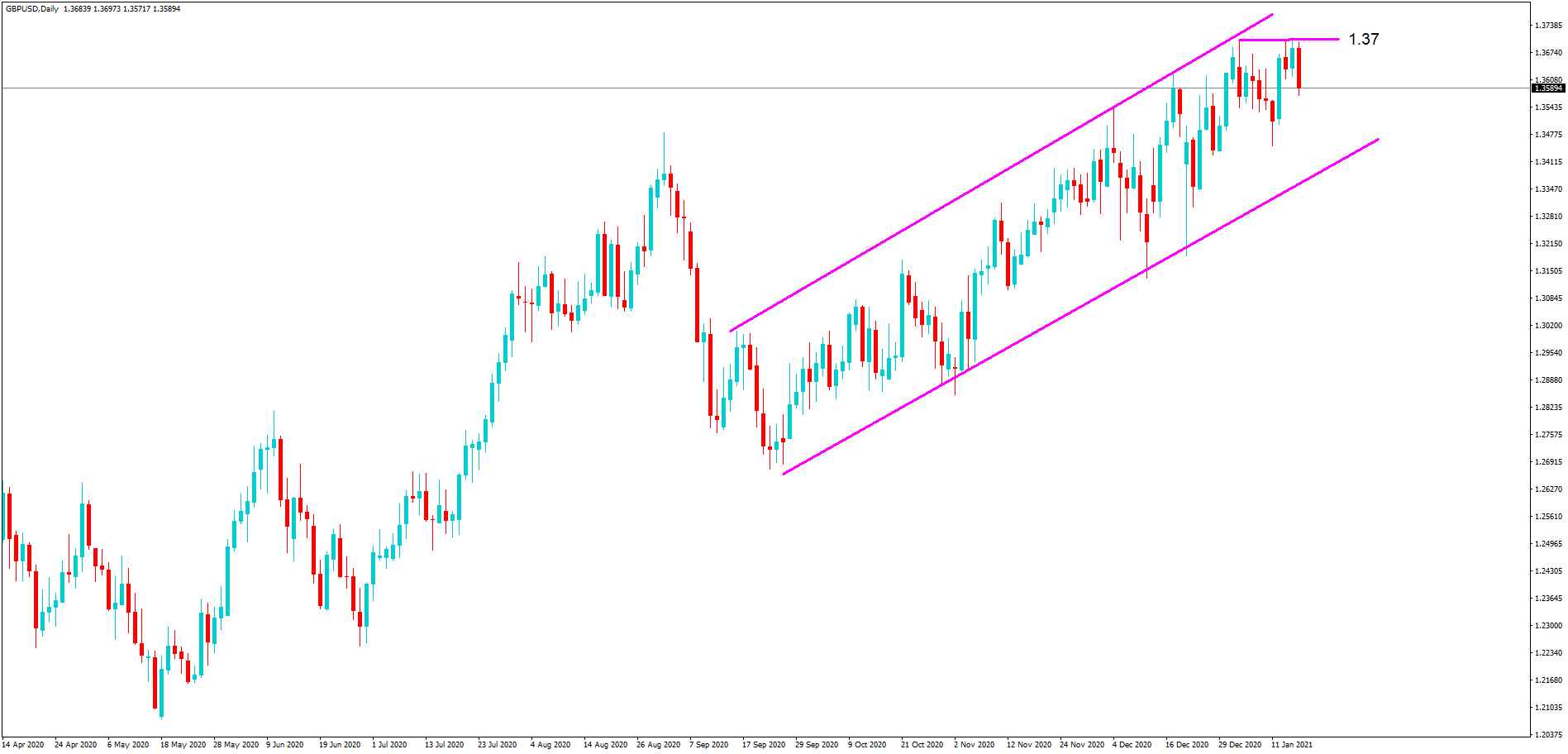

Other things to consider, as shown here on the daily cable chart, where the pound to US Dollar pair remains in a bull run, although it has topped out at the 1.37 exchange rate, having achieved the high due to the success of the UK and EU signing a post Brexit free trade deal, which has been giving the pair a lift, but where the United Kingdom is currently in a tier 4 lockdown due to the increasing covid transmission rate.

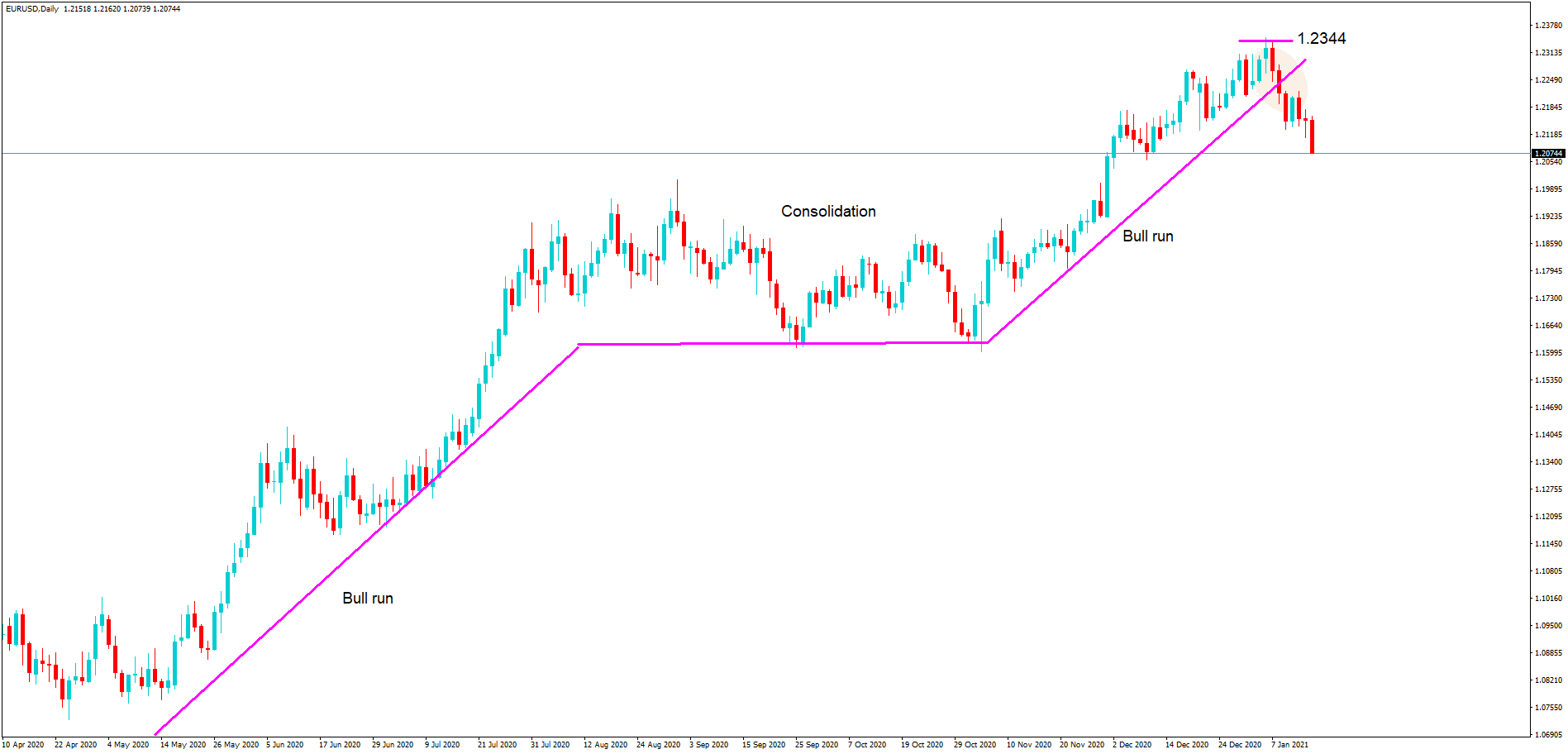

Here we can see a daily chart of the euro US dollar pair, which is by volume the largest traded component on a weighted basis of the dollar index, and where we can see CIA Here.

This is a daily chart of the euro US dollar pair, which by weighted volume is the largest component of the US dollar index. Therefore, it is more likely to be a larger contributing factor to the directional bias of the dollar index.

Here we have a classic bull run, followed by a period of consolidation, with a continuation bull run, to a high of 1.23, during the beginning of 2021, and where price action has breached the bull run’s resistance line as highlighted and is falling back to just below 1.21 at the time of writing. This is lending itself to the general strength of the US dollar when simultaneously combined with the actions of cable.

And so, although Joe Biden’s covid relief stimulus package would appear to be a pivotal point in the acceleration in the US dollar strength, there are other things to consider, such as multi-month highs, as shown with cable and the Eurodollar pair.

We also have to factor in the fact that the dollar index failed to breach the 89.00 key level, where the previous high going back to the beginning of the pandemic was 103.00, a hefty grabbing for the dollar, and where traders will always be eying the tops and bottoms of huge moves while looking for turning points.

Traders always expect volatility when there is a change of president, and even more so when there is a change in party, such as in this case where are the outgoing republicans will be replaced by the Democratic party’s polities. The next stage will be waiting to see if the outgoing party’s policies are replaced and, if so, what this might mean for the financial markets.