Let’s make something perfectly clear before we say anything else, you cannot trade without risk, there is no way to make any money without there being any form of risk. Risk is what enables us to have rewards and so when you trade there will be risks. Now that we have made that clear, there are of course a number of different things that you can do to help reduce the risks that you will be taking when you trade. Managing your risk is one of the key elements for being a successful trader and so it is certainly something that you should be putting a lot of emphasis on when you create your trading plans and of course when you actually begin trading.

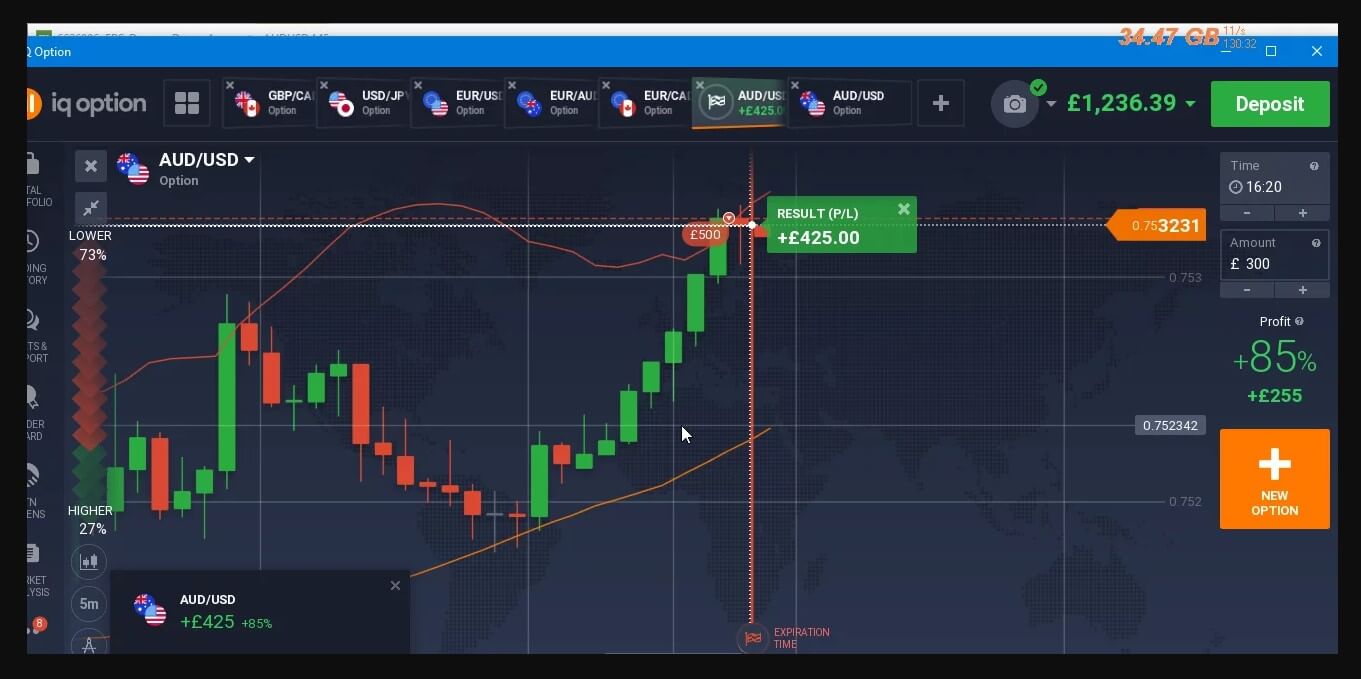

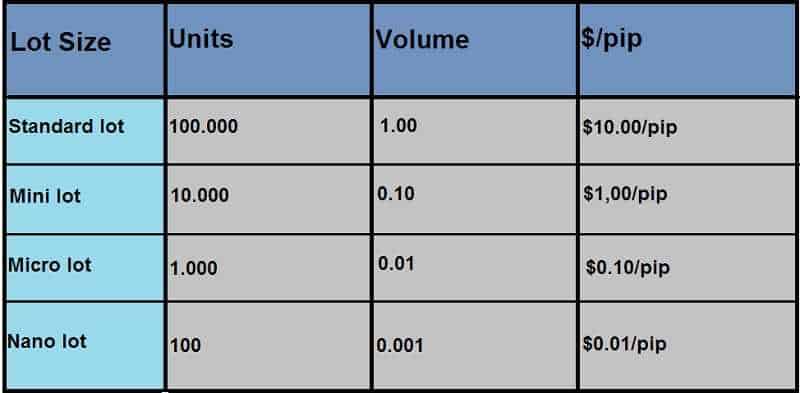

The first thing that you can do is to work out how large the trades that you are going to be putting on are. Of course, this needs to be decided in line with your overall account capital. If you have a balance of $1,000 and a leverage of 100:1, there is no point in trying to put on huge trade sizes like 1 lot or even 0.5 lots, this will only result in disaster. You need to limit your trade sizes, the lower they are, the less risk you are putting your account under. If you are looking for the lowest amount of risk, then you will want to go for the lowest trade size which for many brokers is 0.01 lots. Of course, this will then limit your profit potential, so really you are going to want to look for a happy medium, somewhere with low risk but somewhere that also offers returns. In relation to just risk though the lower the trade size the better.

You then need to work out where your stop losses are going to be, yes you will be using stop losses. They are the primary way and method that we as traders can use to help limit our potential losses. If we do not use them, then even the smallest trade has the potential to blow an account, it will take a lot but it is possible, so why take the risk? Putting in your stop losses is a sure-fire way to protect your account, when your trade goes the wrong way and reaches the level of the stop loss, the trade will automatically close. Yes, it will be at a loss, but it is a controlled loss and one that was taken into consideration before the trade was even placed. What is important is that we removed any potential risk for further losses and have limited things to be within our strategy criteria.

We spoke about leverage near the start of this article, it is important to get a good understanding of how it works and if you want to keep the risks on your account as low as possible, then you will also want to keep your leverage as low as possible. Leverage allows you to trade with more spending power than the capital in your account, this, in turn, increases the profit potential of the account, which is the main selling point of leverage. What they don’t tell you is how this leverage also increases the loss potential of your trades too, the more leverage that you use the higher the losses can be with each trade and a loss can take away a much larger sum of money than it would have with less leverage. So if you have the balance for it, go for a lower leverage in order to keep risks low.

We spoke about leverage near the start of this article, it is important to get a good understanding of how it works and if you want to keep the risks on your account as low as possible, then you will also want to keep your leverage as low as possible. Leverage allows you to trade with more spending power than the capital in your account, this, in turn, increases the profit potential of the account, which is the main selling point of leverage. What they don’t tell you is how this leverage also increases the loss potential of your trades too, the more leverage that you use the higher the losses can be with each trade and a loss can take away a much larger sum of money than it would have with less leverage. So if you have the balance for it, go for a lower leverage in order to keep risks low.

Pick the right currency pair to trade, it’s probably not a surprise to you that different currency pairs offer different levels of risk, there are three main categories, the majors, minors (crosses), and exotics. The major pairs have the least volatility and the most liquidity, the minors are in the middle and the exotics offer the most volatility and least liquidity. Due to this, it is far more profitable and also risks to trade the exotic pairs, but it takes a lot more skill to do it successfully. Due to this, it is recommended that those looking for lower levels of risk should look to trade the major pairs, things like EURUSD are extremely liquid which means that their movements are less rapid and sudden. They are easier to predict and if something does happen, you often have more time to react than with the exotics. So if you are looking to trade with lower risk, go for the major currency pairs.

One of the riskiest things that you can do as a trader is to trade during times of economic news, there are certain news events that new traders are warned away from, things like the US non-farm payroll, you should not be trading during the times of these announcements. They have the ability to cause large movements in the markets and even economic experts get their predictions wrong on a regular basis, if they get it wrong, then there is a good chance you will too. In order to avoid this risk completely, simply do not trade during the news events Obviously there is unannounced news that comes up every now and then which is unavoidable, but as long as you avoid what you can, you will be reducing the risk that you account is being put under.

The last point that we quill look at is the fact that you need to ensure that your expectations and your goals are realistic. If you have come into trading thinking that you will make thousands each month with a small starting balance then you are mistaken. Many people make it seem like you can and many people probably have, but they are risking a lot with every single trade in order to do this and have most likely lost countless accounts in the process of getting their one successful one. Bring your expectations down and you will remain motivated and feel less like you need to risk more to achieve those goals.

Those are some of the things that you can do to help reduce the risks that your account is being put under, remember that it is impossible to trade with no risks at all, there will always be some otherwise there would be no way to make any money. If you hate risks, then you will need to do what you can to help reduce them, but remember that by reducing your risks you are also reducing your profit potential, so the key is to find the middle ground where you are happy with both the risks and the potential profits that you can make.