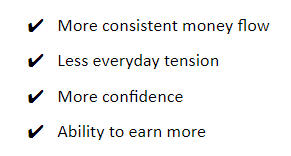

Well, understandably, there are quite a few practical benefits you get from polishing your skills in trading:

While these are just a few perquisites you get from improving your trading skills, you should ask yourself what it is that you feel comfortable with or that you really need in your life.

Some people are fine with doing things halfway. They are at peace with what they have and they are not looking for more.

If you are not one of them, then great – we are going to go deep today.

Ok, so the first step is always to see what type of trading you are interested in.

This is a crucial point because depending on your trading style, there are many additional questions we can ask. For example, if you are a naked chart reader, we would not be focusing on your ability to test different indicators but on your ability to understand what the chart is suggesting.

Most of the time people don’t make any changes because everything is going well on the surface. As Idowu Koyenikan said, you must have a level of discontent to feel the urge to want to grow. Still, do we need to get there? Do we need to take a major loss just to see that something in our system is not working? It’s like with beginner traders who manage to get some unbelievable returns month after month only because of reckless money management. This, of course, is never sustainable and, just because they lack experience and don’t listen to experts, they face the consequences of their actions and choices real soon.

You don’t want to get more than you bargained for and you don’t have to suffer. You need to be attentive to what your style of trading requires.

Therefore, the next step would be to see how you understand risk and how you manage it. This is vital for trading because, as a trader, you will soon learn that it’s not about winning but protecting your account from losses. The better you are at keeping your leverage balanced, the more in control you are of your emotions, but we will discuss this aspect of trading soon enough.

An excellent way to mitigate risk is to diversify your wealth structure (portfolio). As a trader, you have many different options – you can trade forex, stocks, bonds, ETFs, and so on. We cannot predict market behavior, but we can all agree on one thing – change is the only thing we can be sure of. The more you expand your portfolio, the further you are from putting all of your eggs into one basket.

Now, to get to this point and level of expertise, you do need to invest in your analytical skills. And, even if you say that you are more of a learner from my mistakes type of person, you truly need to acknowledge your ownership in your growth. It simply isn’t enough to say that you made a mistake. The trading world is not that forgiving and your account will prove it sooner or later.

So, how can we work on our analytical thinking? We journal our trades and we commit to backtesting and forward testing with diligence and a sense of purpose. You don’t have to like it but you do have to recognize its potential for it to work on a regular basis. Your notes are your strongest weapon because they help you track your progress, make conclusions, and think of additional tools, indicators, and strategies you can include in trading to improve your system and render better results.

Also, make sure not to be too quick to make changes. Developing one’s skills is a process, not a pill you can take for everything to turn to gold. If you see that your trading plan is making you feel concerned, you should give yourself some space and base your judgment on a bigger sample size. You need more trades and much more notetaking to make such vital changes in your trading.

This, of course, will teach you how to do research. In the same way you had to discover different resources on how to trade, now you need to be a detective and investigate how your actions and decisions generated specific results. This process does not have to be dull if you don’t build up unnecessary tension inside and attach negative meanings to it. This approach will help you tackle one of the key trading challenges – ensuring that you have fewer, not more, losses. What you come up with after such research may differ from other traders, but it is nonetheless relevant for you as we are all essentially different people.

Additionally, as traders, we really need to develop an insight into what the market needs. We may think something is relevant but if our everyday trading experience points at some other areas or skills, we cannot turn a blind eye and expect the problem to resolve itself. Similarly, we should strive to learn the conditions under which the market is the most permeable and agreeable with what we aim to achieve. For example, you should learn that unfavorable periods, such as elections, are there to be avoided because we do not need any excess volatility; we need flowing waters and a supportive breeze, not full-blown hurricanes, tsunamis, and volcano eruptions. Unless you adore these risky opportunities.

And, last but not least, you should really devote energy and attention to understanding yourself. Traders are often their own greatest sabotage. If you don’t know what you react to compulsively and why you are like a baby on its own – innocent and dangerous to yourself. Luckily, we are very predictable beings, so if you just take a little time and focus a little more on your emotional reactions, you can learn a great deal about what you do to hinder your personal development and financial growth. Psychology is a fundamental step in becoming a professional trader and ensuring a consistent money flow.

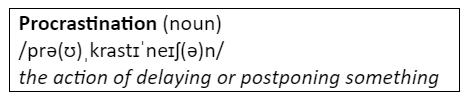

Still, remember that even if you can tick all of the points we listed at the beginning of this article and throughout the previous paragraphs, there is always room for improvement. Often we procrastinate to a large extent because we feel that what we need to do is big – sometimes in terms of the time and effort, we need to invest and, other times, in terms of the importance of what needs to be done.

In case you didn’t know…

We want things to be so perfect, but what we don’t understand is that this lack of confidence won’t go away unless we do something about it. And, the more we push things aside, trying to ignore whatever seems to be bugging us, the more they resurface. It’s like with the Hydra, the monster from Greek mythology – if you cut one head off, two more would grow back immediately. This is how you alone let yourself play out a part in this vicious circle.

Now, we have two major contemplative questions for you:

Who benefits from you staying in this loop of never progressing?

What is bigger – the fear of success or fear of failure?

The psychological benefits are no less impressive or significant than the increase in money in your account. Always keep in mind that what is essential is invisible to the eye (Little Prince).

Trust the process and trust yourself.

Still, if you ever feel overwhelmed with the improvements you need to make, just take one thing at a time. Take that notebook and write down one—three things that you can do each day to improve your trading skills.

Good luck!