A commission is a cost for the trader. Brokers usually charge commissions for their work and this has an impact on our final result. These costs directly or indirectly undermine the profitability of trading. However, they are necessary operating costs, so it is important to know them in order to reduce them.

A commission is an economic consideration for a service performed. To do trading we must have the services of an intermediary (broker) that is responsible for executing the purchase-sale operations we request as well as other aspects such as money lent by leverage and, in some cases, currency changes, the cash movements we make on our account,…

Commissions and Their Importance in Our Outcomes

All financial services companies have the obligation to show their commissions before contracting the services; so that the customer is in a position to value and compare them. Almost all brokers apply the same commission rates and due to the increasing competition in recent years, these commissions are increasingly adjusted for the benefit of traders.

How Do Commissions Impact Our Trading?

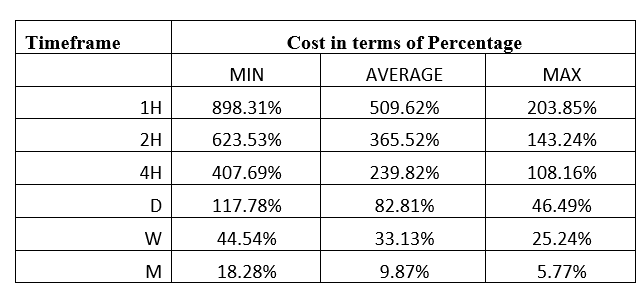

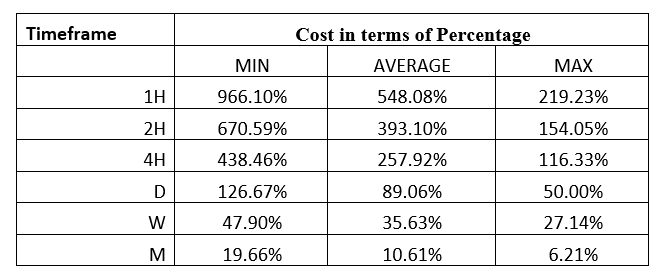

We’ll start by recognizing what kind of trading we’re going to do. The most important commissions, to have a greater impact, are those that come from the sale of assets. The size of the trade (amount of money to invest) and the number of trades we make (the more trades the more fees applied) have a direct impact on this type of commission.

Therefore, the trader must determine what type of trading you do. With what investment style do you feel most comfortable? (Scalping, Swing trading,…). After thinking about our trading style we will be in a better disposition to determine if we are interested in working with a broker that offers better conditions in one type of commission or in another.

Another important aspect is the level of average capital in the account. This determines the size of our operations and therefore we may be interested in working with one or other brokers based on their commissions.

“A study of how we operate in the financial markets can be very useful to save us commissions.”

More Frequent Commissions When Trading

Spread: It is the difference between the purchase price and the selling price of a financial asset. The market price is only one. However, the broker offers the trader two prices: one to buy and one to sell. Most Forex and CFDs brokers get their fees this way. This differential is applied to us when opening a trade. That is, we must recover the spread first to enter into profits if the operation advances in our favor.

Bid and Ask:

- Bid is the price offered to sell the currency pair or instrument it was.

- Ask is the price offered to buy the currency pair or instrument it was.

Ask will always be a few pips more expensive than the Bid. The difference between the two is the Spread.

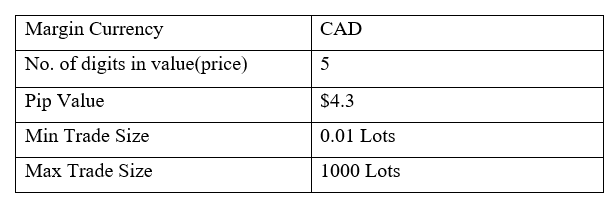

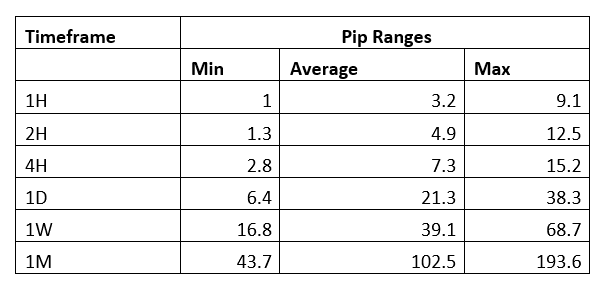

Position Size: Applying commissions per operation in the form of Spread assumes that this cost has a direct impact depending on the size of the position (the amount of money to invest). Therefore, the first thing we must do is to calculate the value of the pip; both to keep in mind the amount of the spread in monetary terms and to know how much our potential profit or our maximum loss can amount to.

Fixed spreads and variable spreads: When we talk about fixed spreads we are referring to the fact that, although the price fluctuates in the market, the Spread remains constant. The spread will be different depending on the currency pair. However, when a fixed spread is charged, it remains unchanged for that same financial asset.

On the other hand, there are brokers that offer variable or floating spreads. The spread between the “bid” and the “ask” varies depending on the market conditions. Depending on the liquidity that exists in the market at a specific time, a more or less low Spread will be applied. When the brokers offer us this condition of variable spread, in the rates we will put the minimum that they charge, and in moments of less liquidity the Spread will increase.

Fixed commission per trade: Outside of Spread, the broker may charge a fixed amount for opening and closing the position. Sometimes they can even apply the two commission rates at the same time (Spread plus fixed commission).

Most online brokers usually apply only the spread but there are others, especially ECN brokers, targeting traders with higher volumes, that choose to offer smaller spreads but compensate with a fixed commission each time a trade is made. Depending on the average size of our trades, we will assess whether it is convenient to use it or it is more profitable for us to trade only with Spreads.

“A very short-term trading style (scalping type) is more sensitive to this type of commissions. But if your trading style is to trade more in the medium term, these commissions are not so decisive for the final result.”

Leverage and Swap: When opening a Forex trading position it is not necessary to contribute all the money required by the transaction. The money is actually borrowed by the broker and what we leave is a guarantee to be able to open the transaction.

The margin guarantee is a percentage of the size of the trade. Depending on the asset we decide to trade, and the conditions of the online broker, this percentage will be higher or lower. It’s what’s known as leverage. This money is put on the market by the broker himself and must be liquidated before the end of the market day.

If this money is not settled before the end of the day, we will be granted an automatic extension, a refinancing (rollover) that earns interest. The Swap commission is based on these interests.

Therefore, the Swap fee is nothing more than the overnight interbank market interest rate for keeping the position open (with money borrowed from leverage). This fee varies according to central banks’ interest rate policy and interbank market conditions.

Swap: a percentage that is applied to the size of the transaction. It can also be expressed in pips, for each contract or lot traded in the operation (so it will be necessary to know the value of each pip). However, this fee can even be credited to our account instead of a fee. How is this possible? The explanation is given when trading on the Forex market, where each trade is composed of the purchase of one currency and simultaneously the sale of another.

When you sell a currency, you charge the interest rate. When you buy it, you pay us. Better explained: We will pay the Swap of the currency sold and we will pay the Swap of the currency purchased. In these situations, it may be positive to plan multi-day Forex operations if it is consistent with our trading strategy.

Commission on cash withdrawal: We are not referring to the one that charges the chosen means of payment. There will be means of payment that will not charge you anything and others that can apply some commission to send or receive money. We focus on the commissions your broker can charge you for withdrawing funds. Usually, when depositing there is no commission but when withdrawing the broker can apply a commission of its own.

Commission for foreign Exchange: This type of fee can have a greater impact if it is added with the withdrawal of funds from the account. Both can be added. A trading account is denominated in a particular currency. In most cases brokers allow us to deposit funds in the most common currencies. So, the funds in the account may or may not be in our local currency. Ideally, the trading account should be in the local currency, as not being so implies a currency conversion each time funds are deposited or withdrawn.

Commission for inactivity: There are brokers who can apply a commission of this type and others who do not. This commission is determined by the non-use of our trading account in a given period of time established by the broker. Inactivity means not trading or not logging into the trading platform.

Now, starting with demo accounts or small accounts is beneficial to smooth out the trading process, see where you are thin, and to show that you can do good trading in the long run with steady results. This is how we want to present ourselves to trading companies. When they engage you, trading companies will arrange their own tests. They will set a test period and see how you do under pressure, which is usually about 6 months. Don’t be upset by this time period, there is no other way for them to expose lesser traders that can’t maintain steady results. Constant results are hard to achieve, and that will separate a “trader” from a professional trader.

Now, starting with demo accounts or small accounts is beneficial to smooth out the trading process, see where you are thin, and to show that you can do good trading in the long run with steady results. This is how we want to present ourselves to trading companies. When they engage you, trading companies will arrange their own tests. They will set a test period and see how you do under pressure, which is usually about 6 months. Don’t be upset by this time period, there is no other way for them to expose lesser traders that can’t maintain steady results. Constant results are hard to achieve, and that will separate a “trader” from a professional trader.