If you are a trader then you have probably had an experience with a number of different brokers, some would have been good to you, others would have been not so good. No matter which broker you are with, there will be little things that you notice that may make you think about changing brokers and looking for a new one. So we are going to be looking at 10 tell-tale signs that you need to get a new broker. It is important to note that not any one solo broker is perfect, there will always be things that another broker does best, you need to weigh up the pros and cons of the one that you are using to work out whether a new one is actually needed. These are simply some of the things to look out for that could potentially go into the cons section of that list.

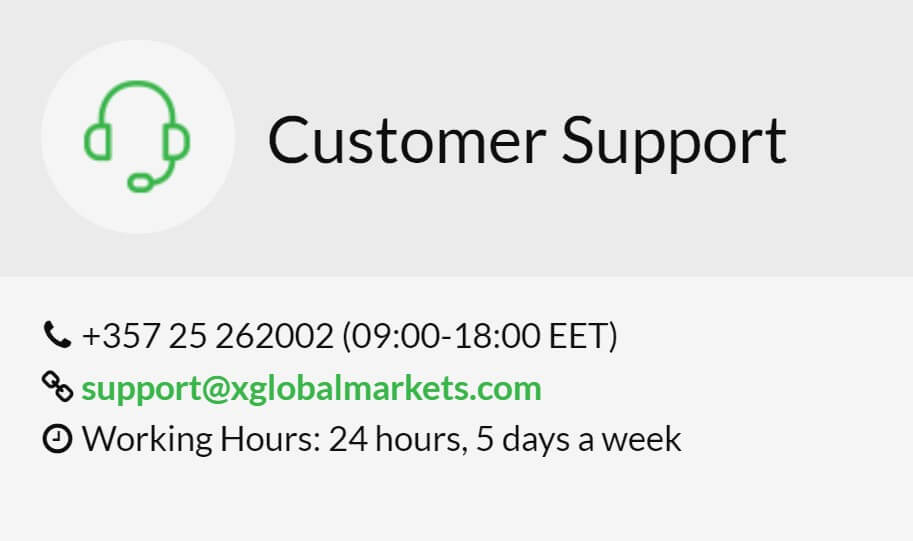

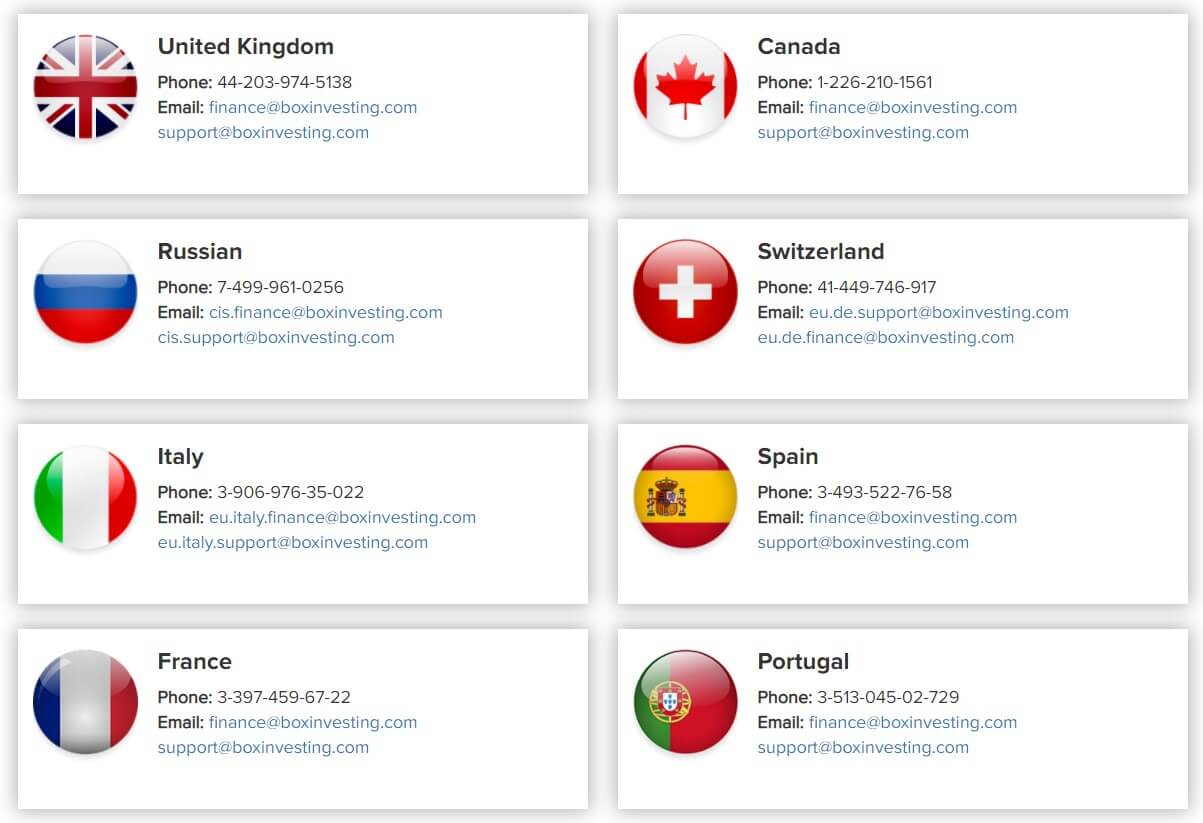

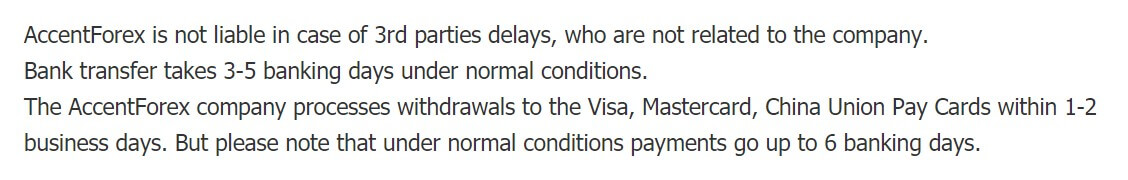

Can’t Contact Support: At times we all need help, maybe we are unsure of something and we want to ask a question, sometimes something might go wrong, with a trade or with a deposit. When these things happen we will want to get in contact with the support tea, unfortunately, it is not always that easy. In fact, we have been with some brokers where we have tried and tried to get in contact with the support team only to find that we simply cannot get in contact with them at all. If this happens to you, then it is a good idea to change broker, the support team is meant to be there to help, if you cannot contact them, then you are pretty much on your own.

Unhelpful support team: Similarly to above, the support team is there to help, so there is nothing worse than getting in touch and they simply aren’t bothered or do not know how to help. We are contacting them because they should know what to do or how to solve things with their own broker. If they do not, then it doesn’t give a good impression about the broker. What else might they not know about? Most likely time to get out of that broker if they are not helping you with what you need.

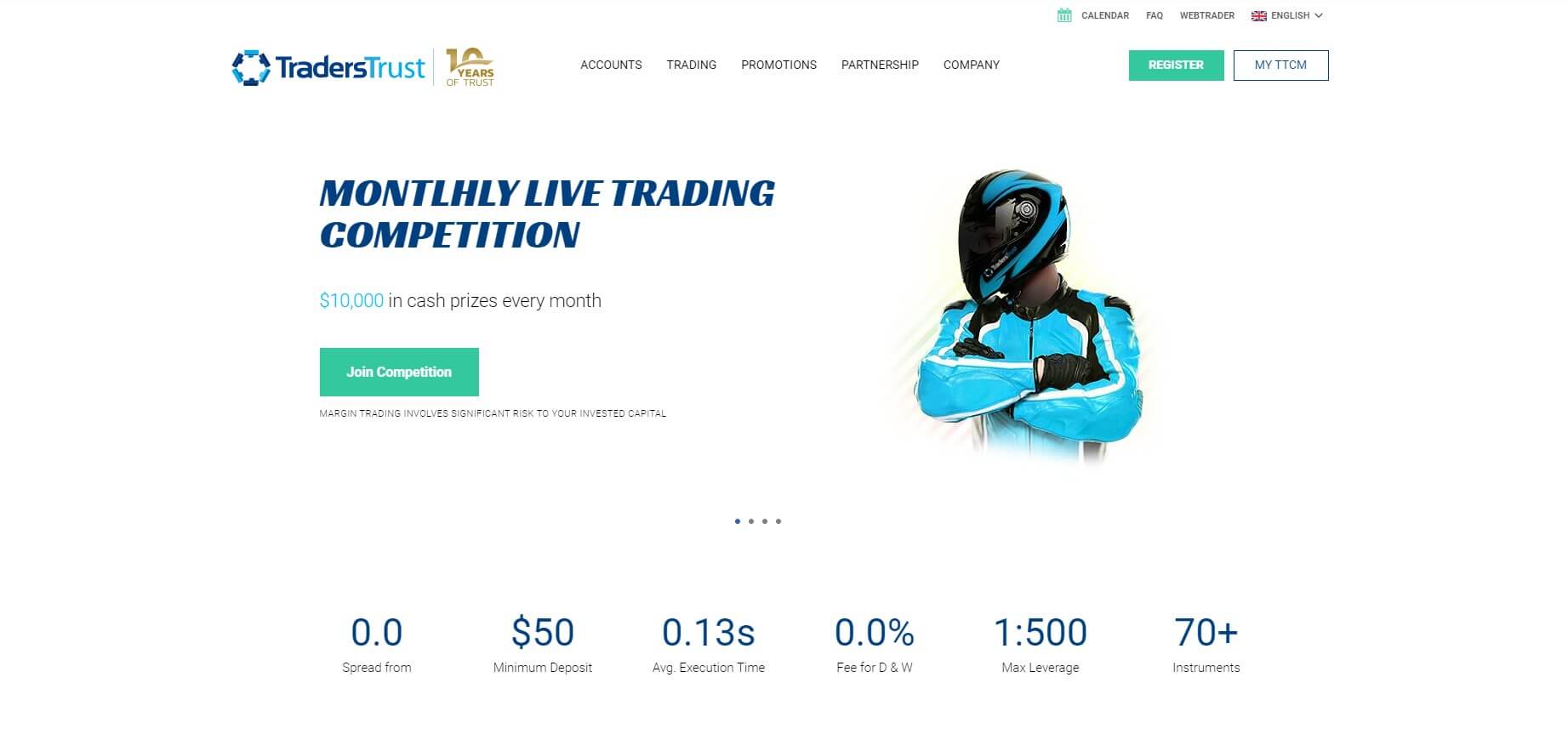

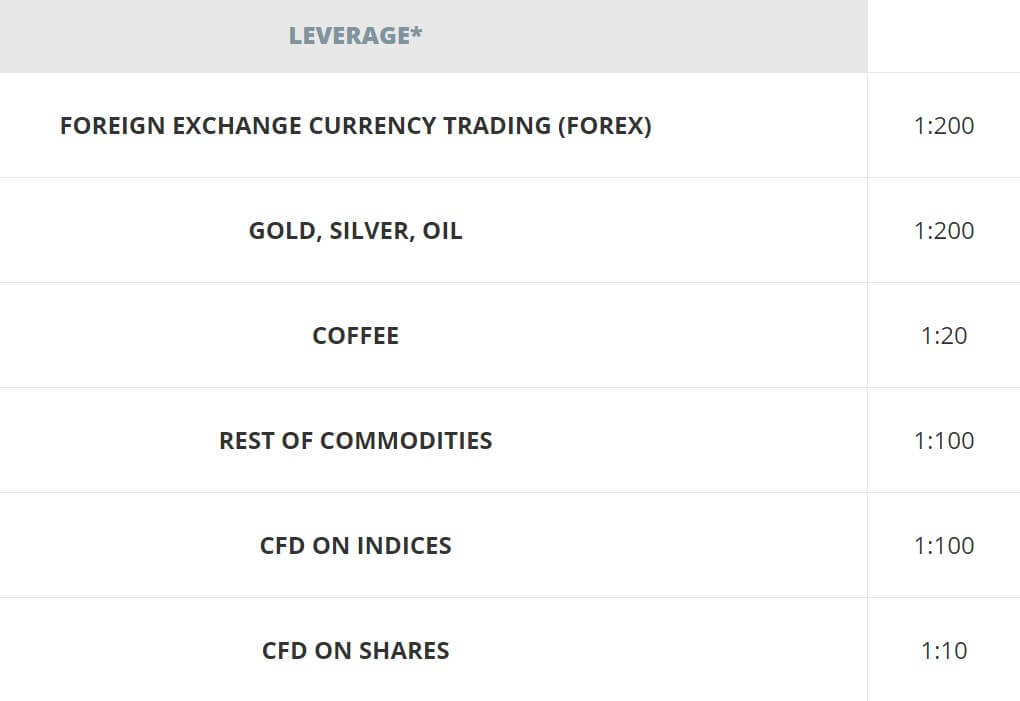

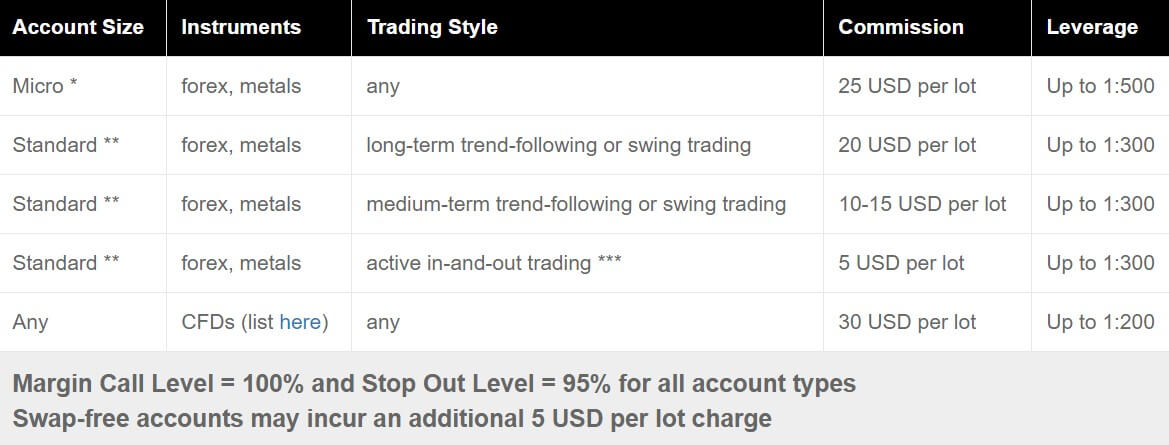

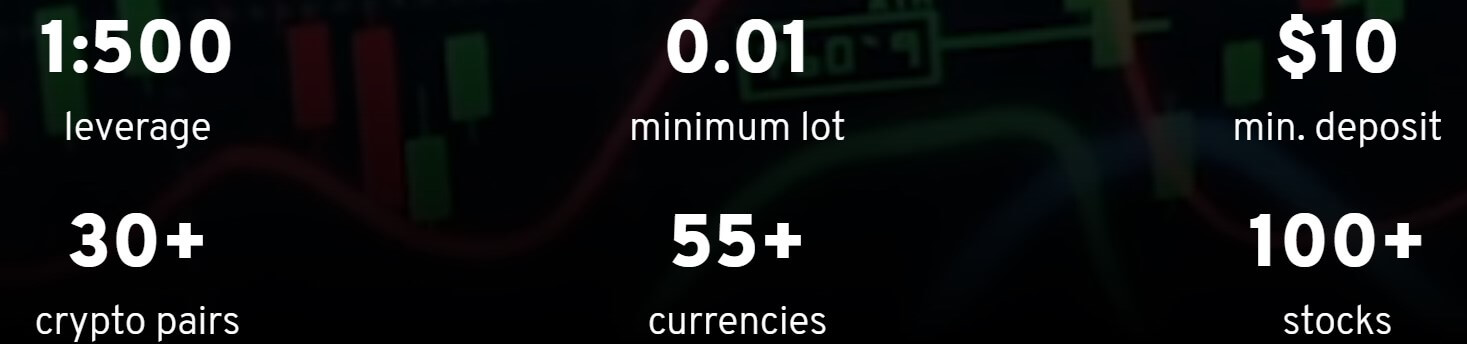

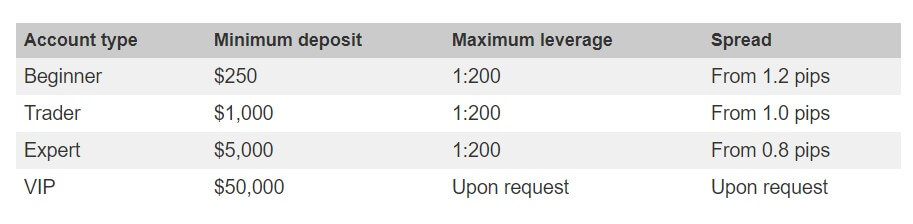

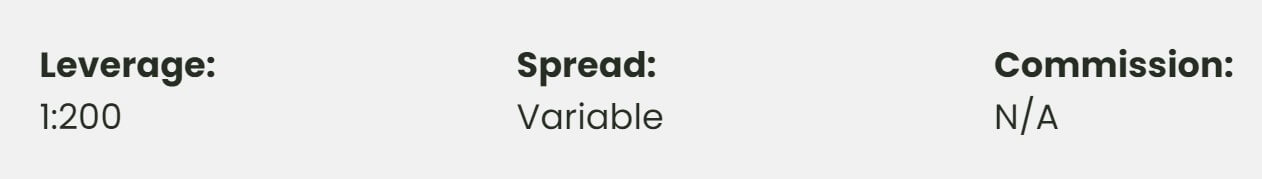

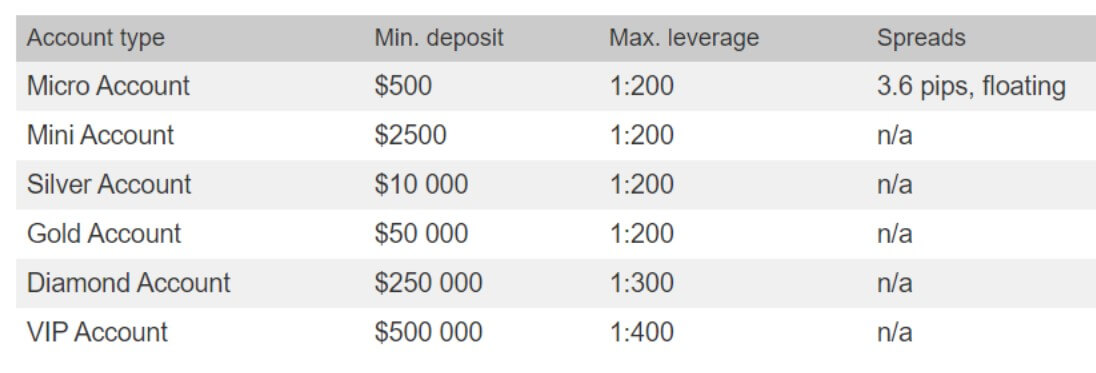

Not enough leverage: As traders, we love to trade with leverage, it increases our profit potential tenfold, but also our loss potential, so you should use it with caution. There has been a shakeup recently where a lot of brokers have reduced their leverage, so if you are used to trading with something like 500:1, your broker may have now forced you down to 30:1. If this is the case, and you wish to continue with huge leverage, then you may need to look for a new broker that will still offer you the higher leverage.

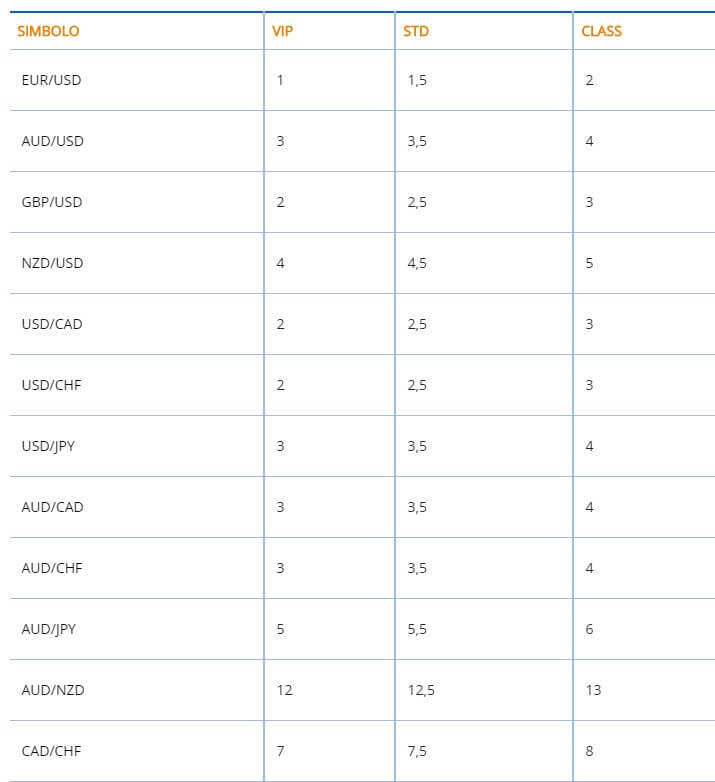

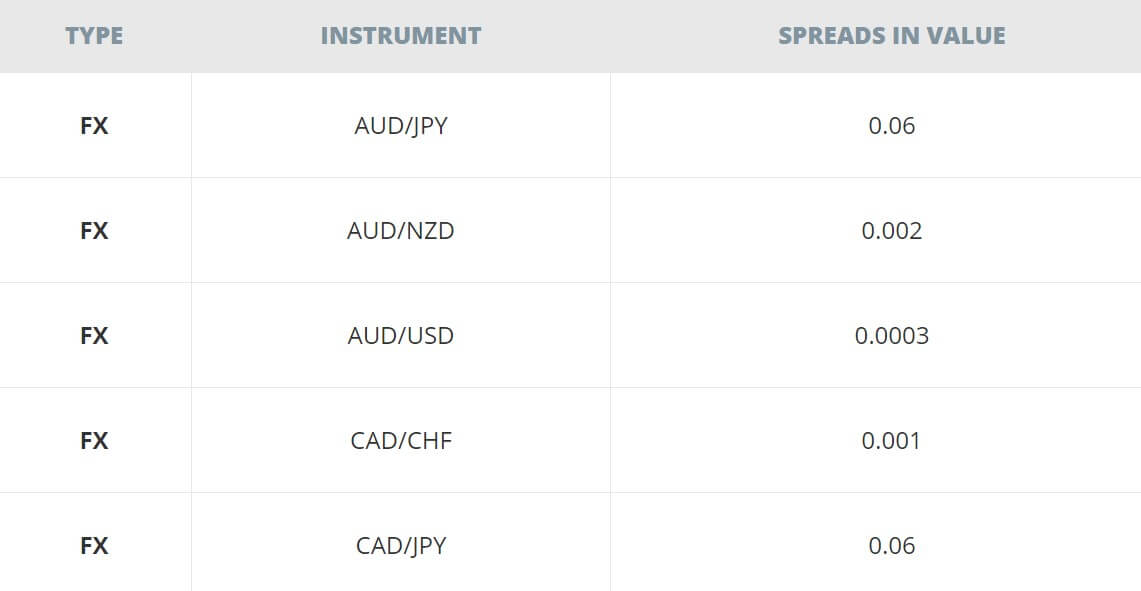

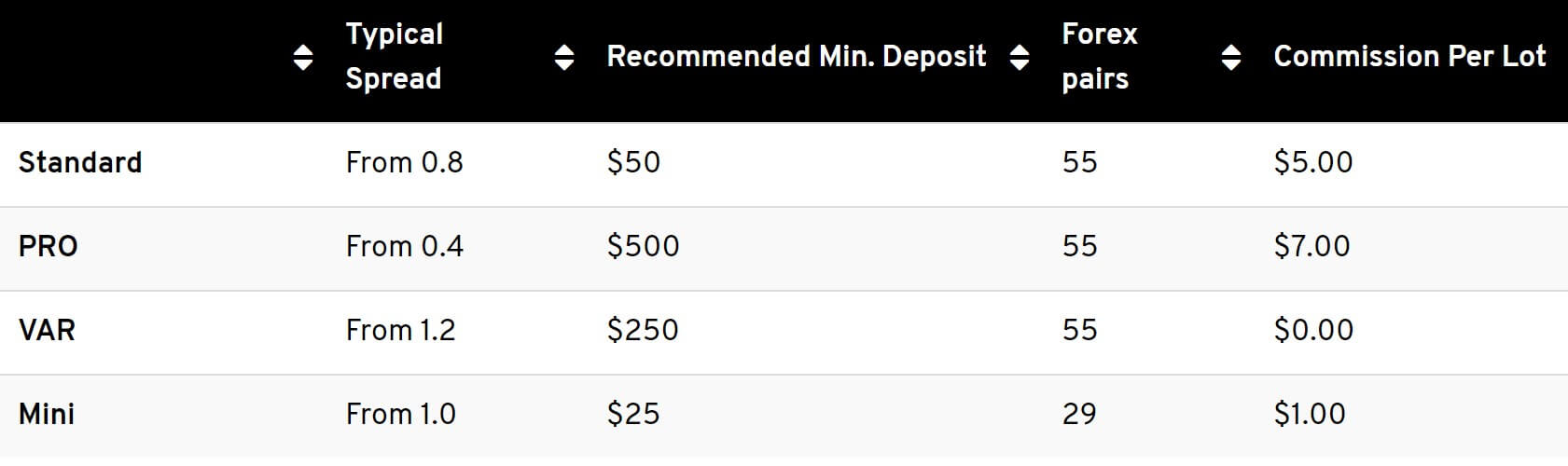

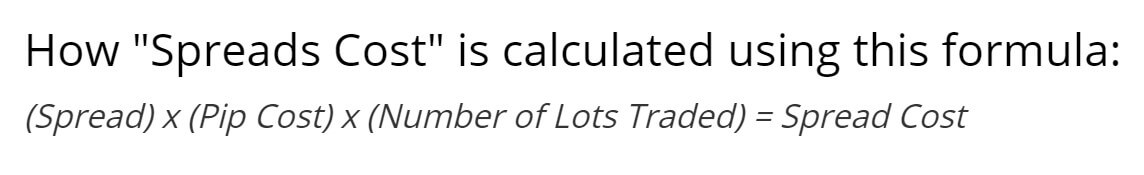

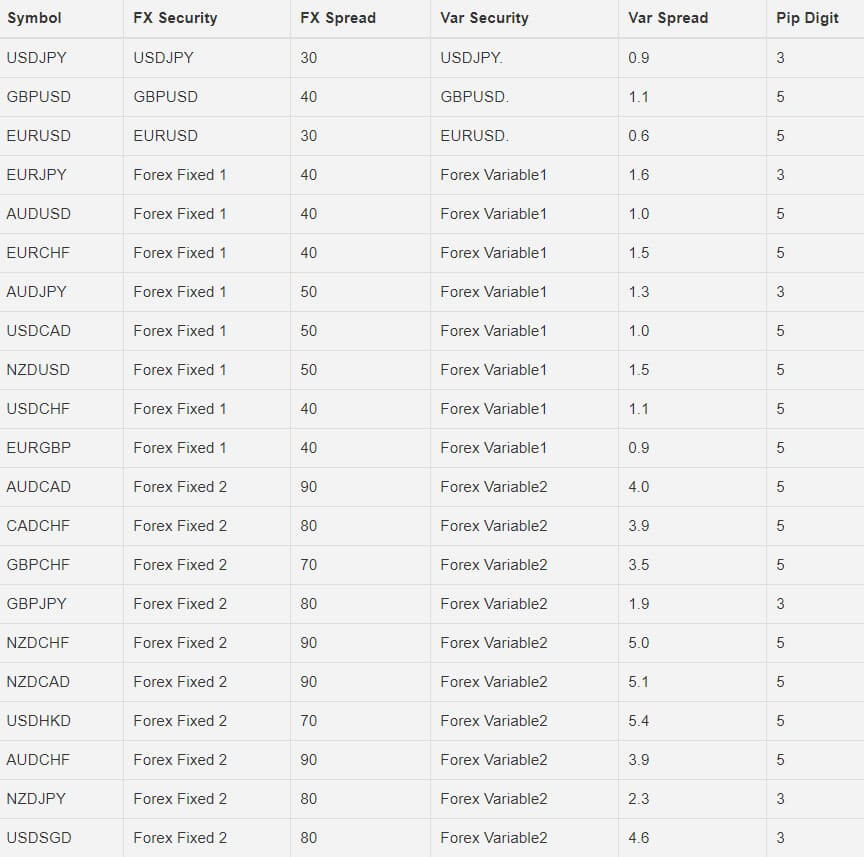

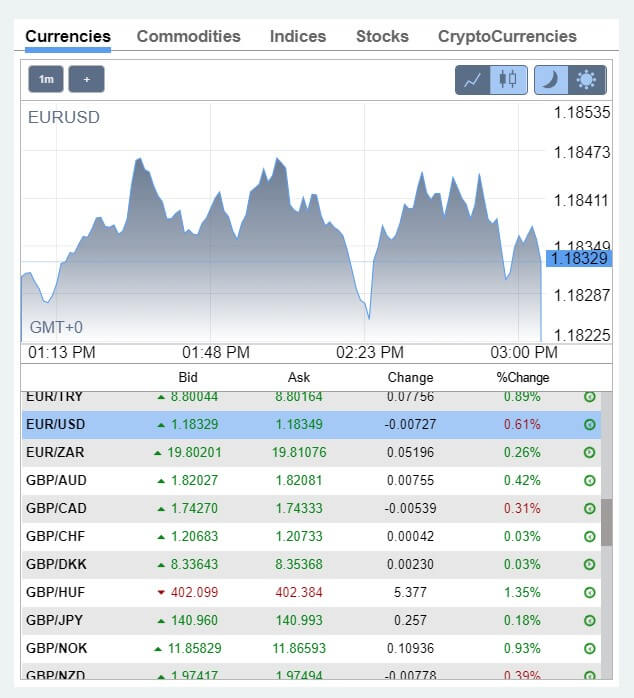

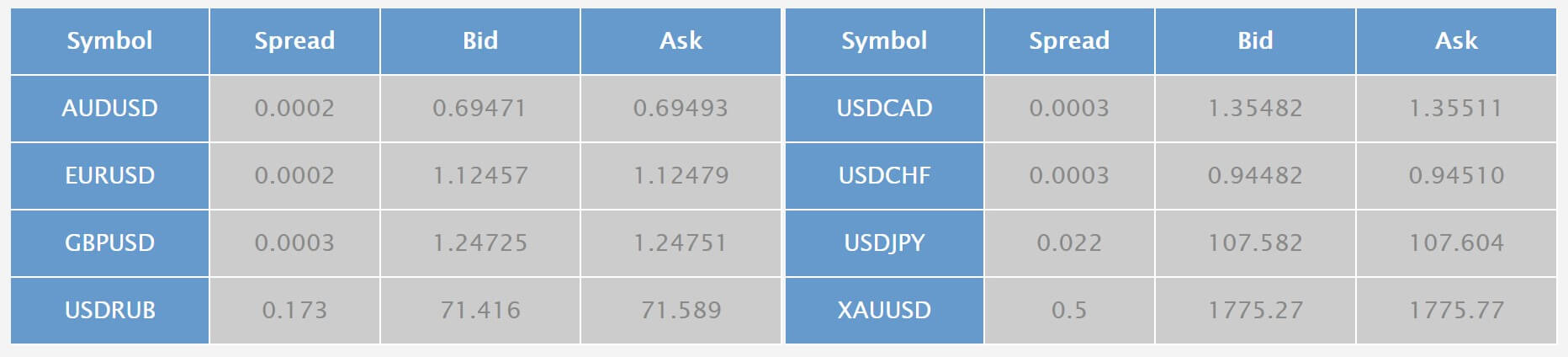

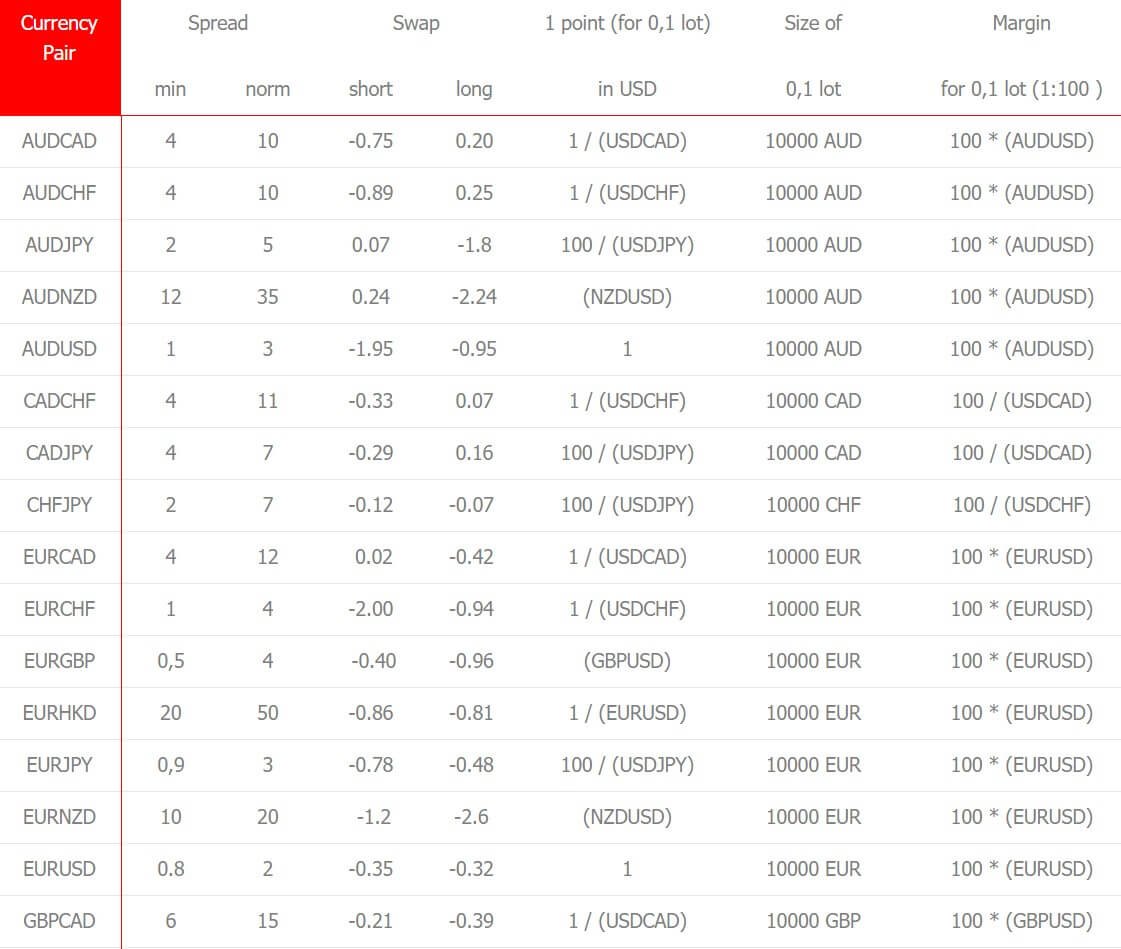

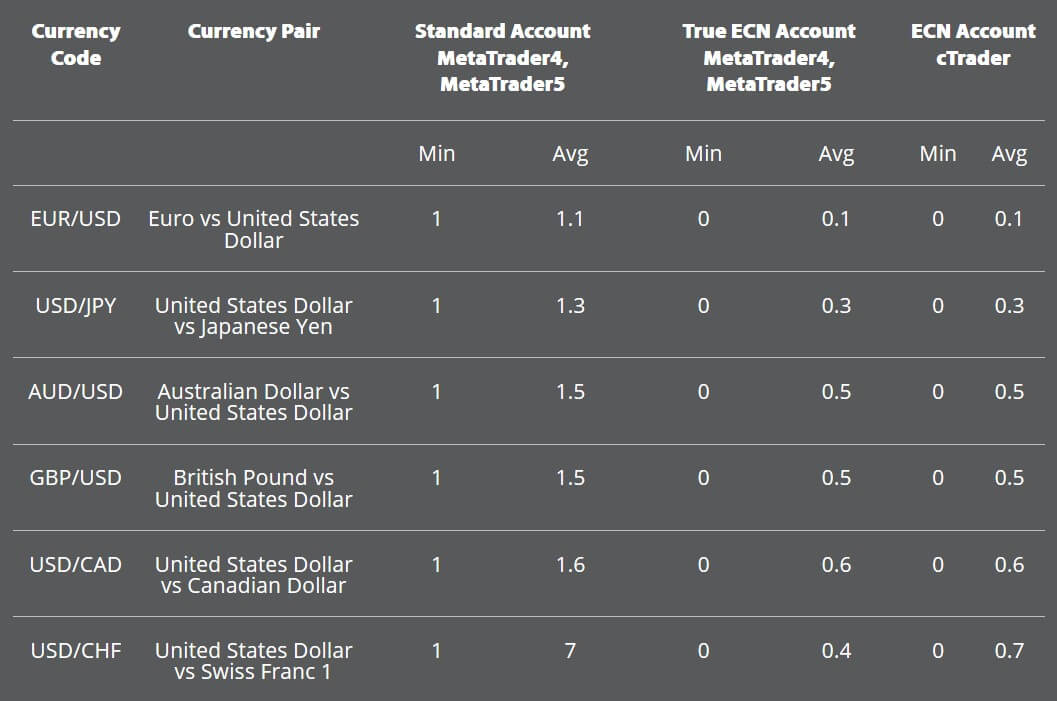

Spreads are too high: Spreads are one of the ways that a broker makes their money, some of them add a little bit onto the spreads in order to make money. That is normal and not something to be concerned about, but what should be checked is how much they have added on, if it is extremely high, such as the EURUSD pair being at 3 pips, then it would be better to find a cheaper one. You should also look out for brokers that have a commission and then add to the spreads, which is double costs for you, something to avoid.

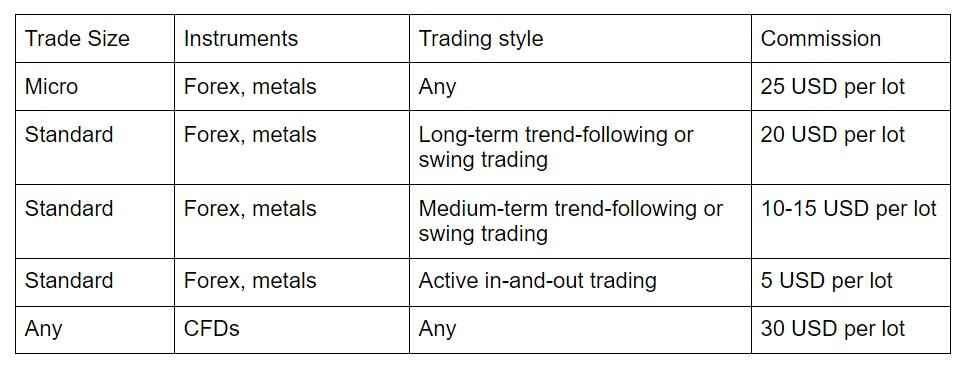

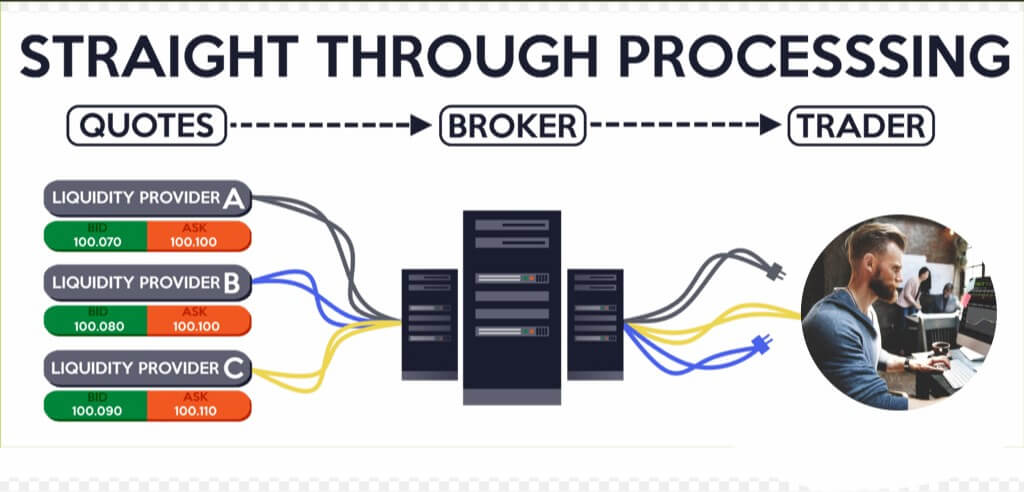

Commissions are too high: Commissions are the other way that a lot of brokers make their money, this is more prevalent on ECN and STP brokers where the spreads are kept low. Some brokers offer really good commissions at or below $6 per lot traded, but there are some that go as high as $20 per lot traded, if that is your broker, you are losing out on a lot of your profits, paying the majority of it back to the broker. If your broker has a commission higher than $6, then you should probably look for a new one that can save you quite a lot of money.

Slow servers: There is nothing worse than finding the perfect trade, placing the trade, and then nothing, it takes a few seconds or in the worst-case scenario, even minutes for the trait to be placed, meaning that you missed your optimum entry point and could potentially lose out on some of the profits. This Can also happen with stop losses, the price is drooping it gets to your stop loss, but the server then takes a few seconds to close the trade, buy that time, the price has moved further down past your stop loss. If this happens on a regular basis, we would suggest looking for a new broker.

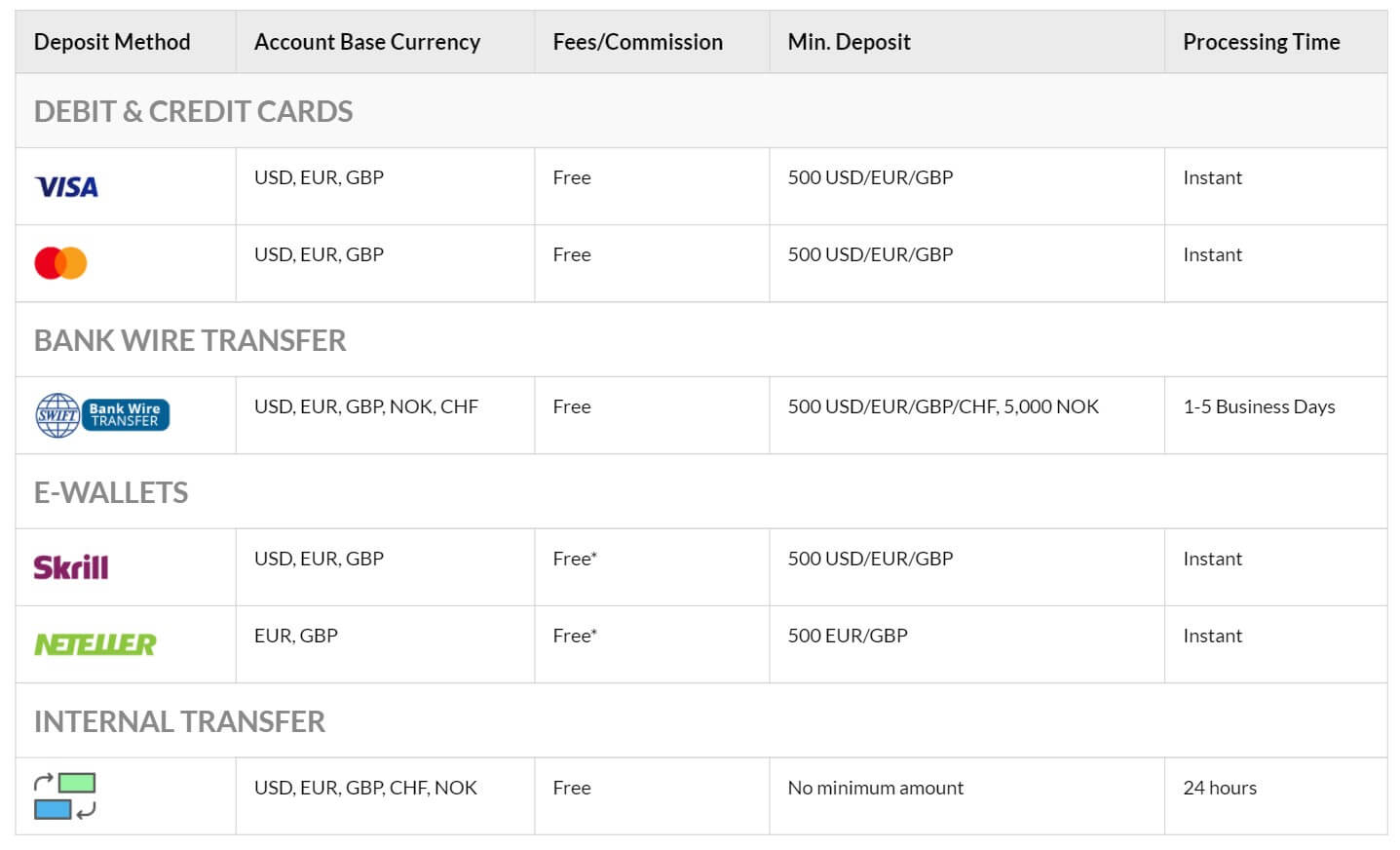

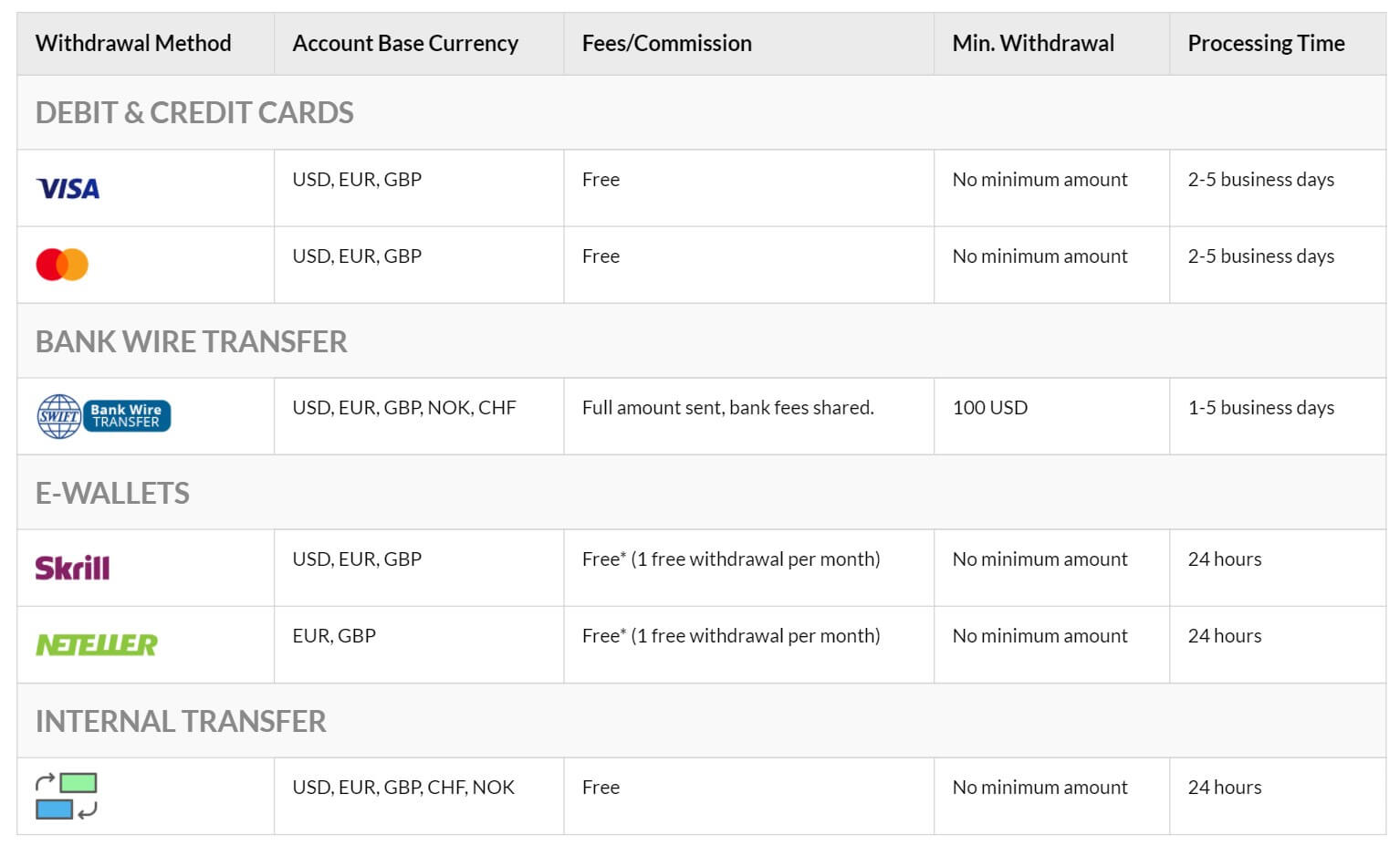

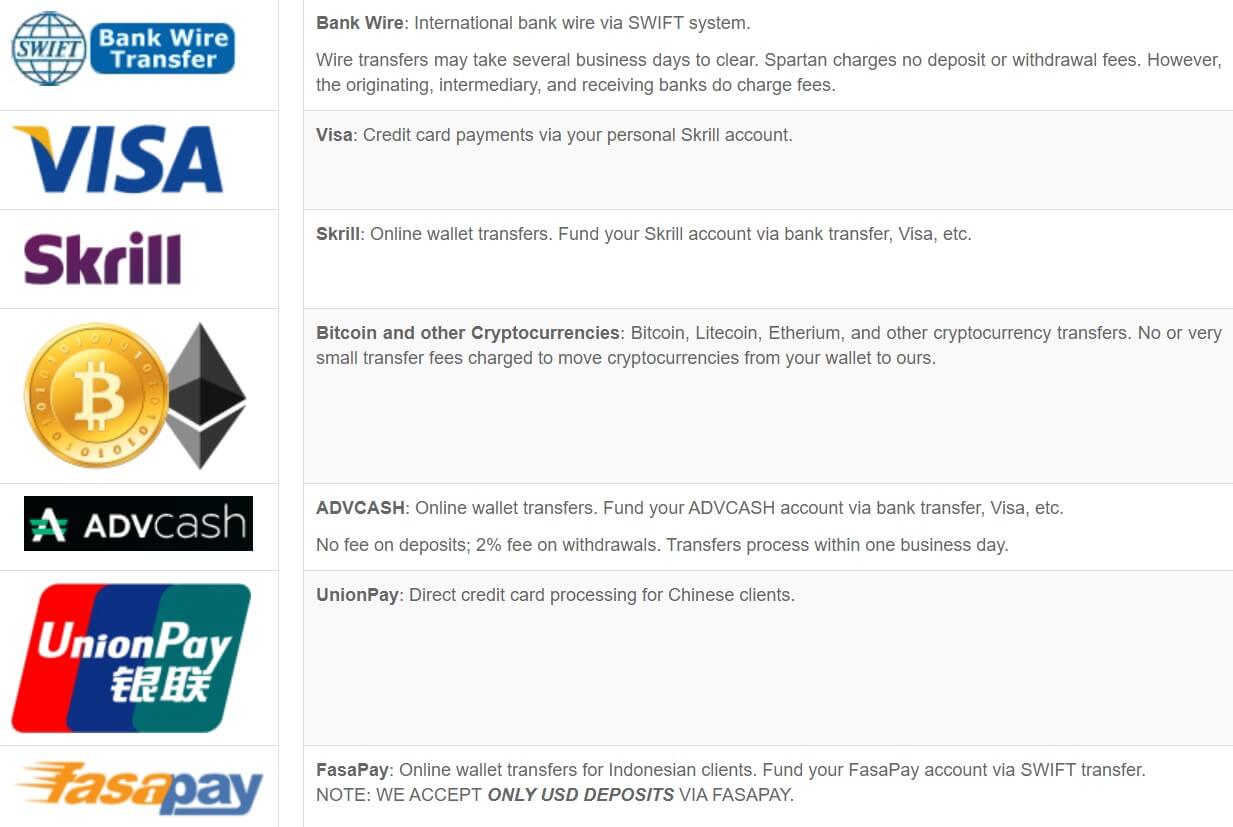

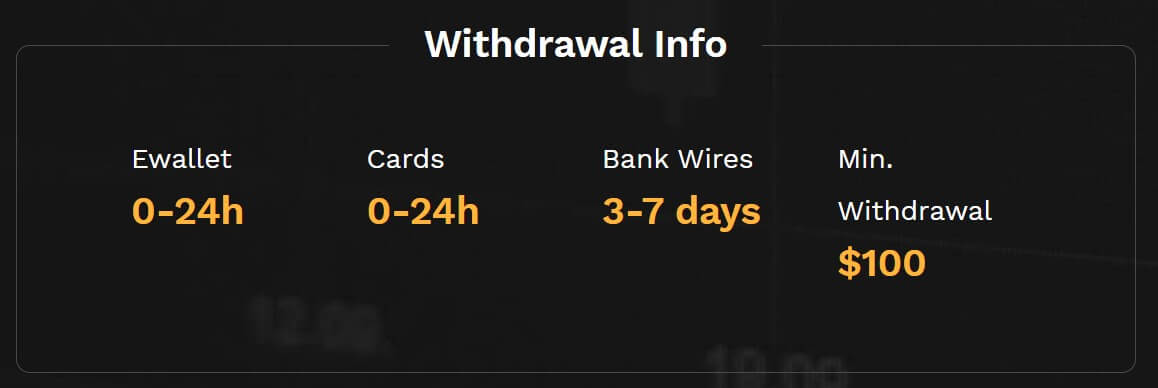

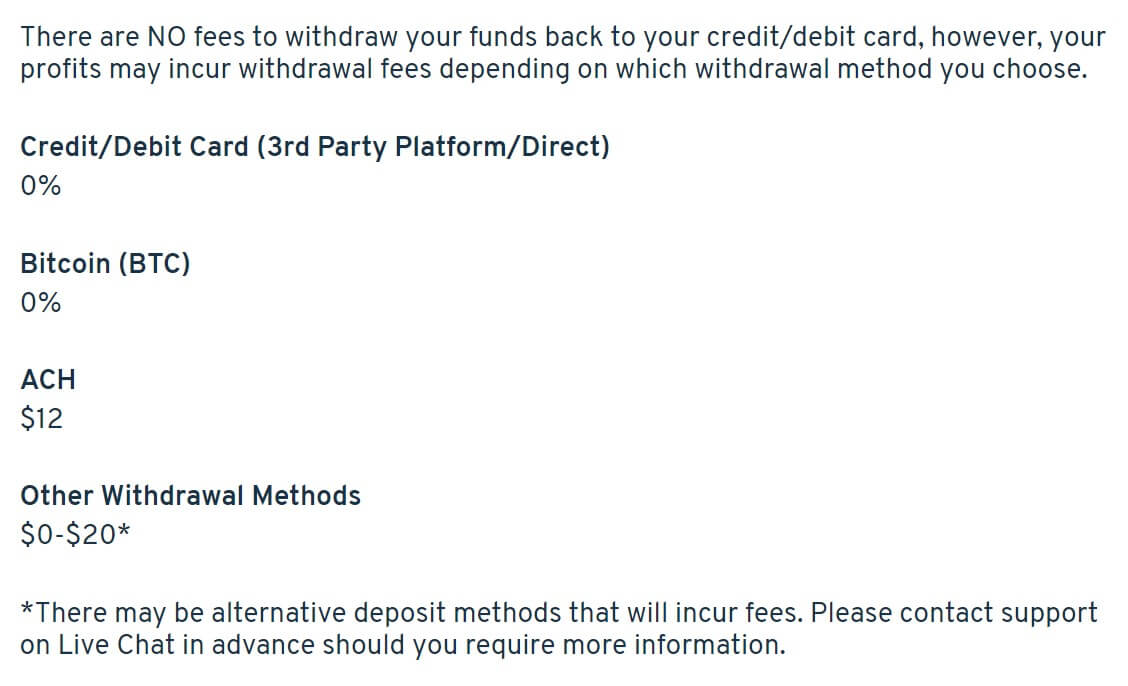

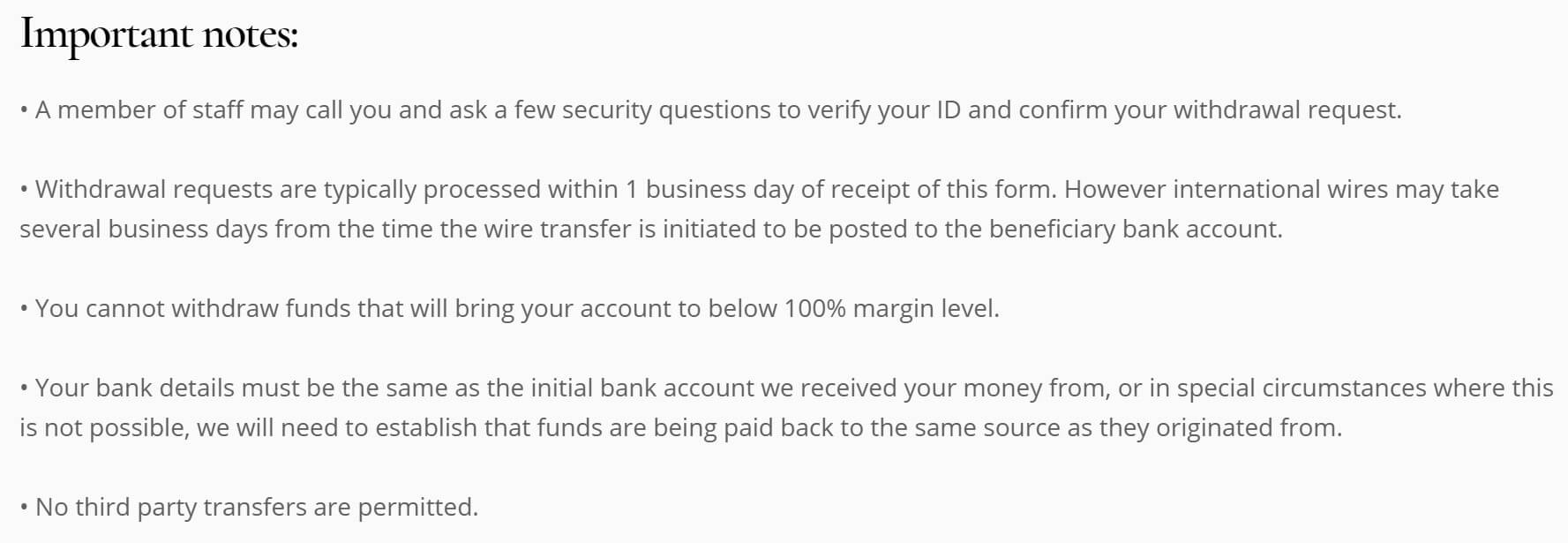

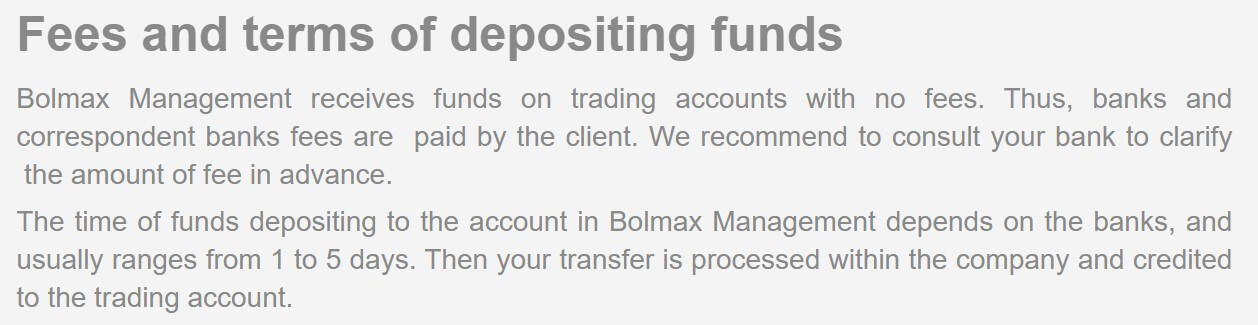

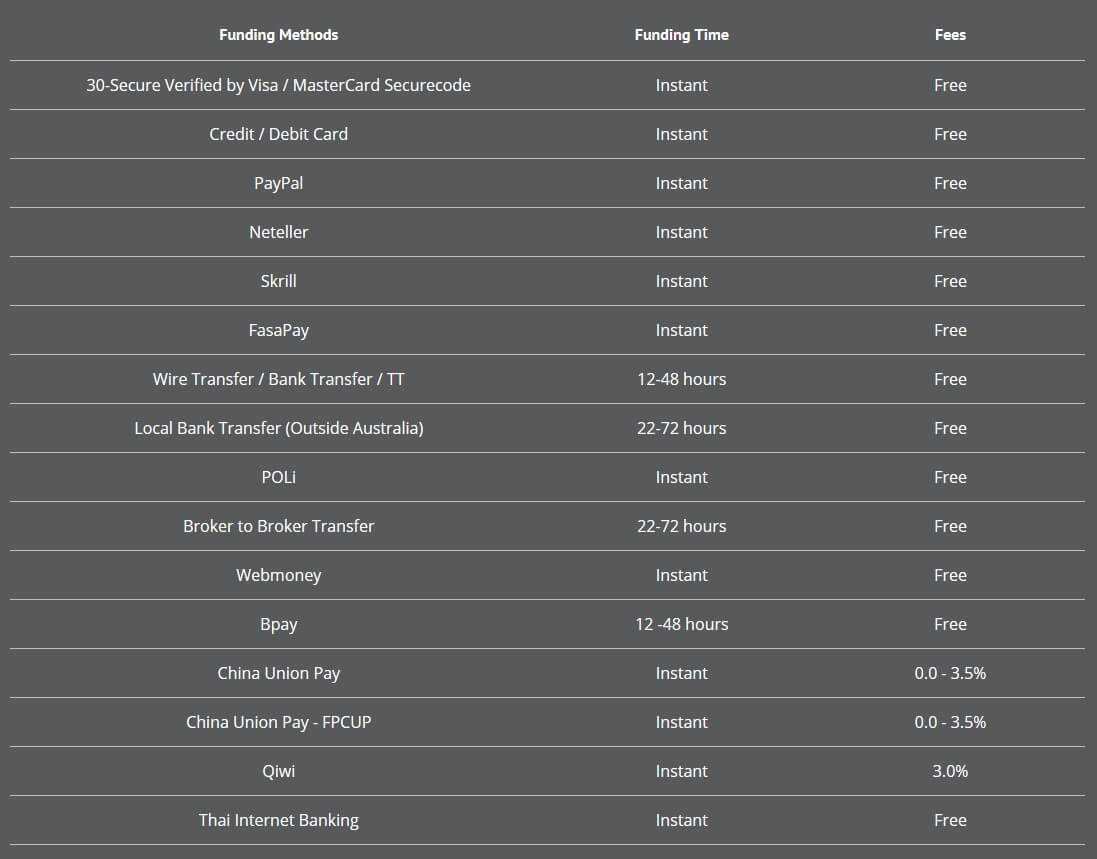

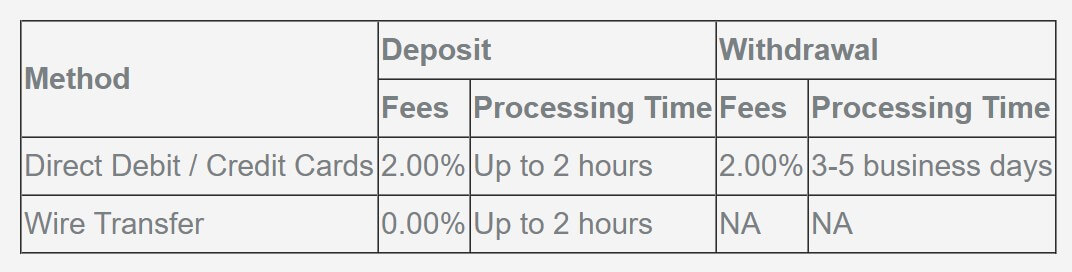

Deposit and withdrawal fees: Some brokers are still charging for deposits and withdrawals, this is something that happened a lot many years ago but most brokers have moved away from the practice. The worst are deposit feels, we are still not sure why you would be charged to give your money to the broker. If your broker is charging you deposits or withdrawals then you are basically throwing away some of your profits, they make their money on commissions and spreads, you do not need to be giving them any extra money.

Forced bonuses: Some brokers have a practice of forcing a bonus on you, a bonus sounds like a good thing, but the terms that come with them are often a little crazy. Things like needing to trade 10 lots to convert $1 of bonus money into real funds. If that was just the bonus then it could be fine, but many brokers do not allow you to withdraw your deposit until you have converted the bonus into real funds, which would take thousands of lots, meaning that you have very little chance of actually getting you money back out. If a broker tries to force a bonus on you, quickly walk the other way.

Odd chart behaviour: Sometimes things don’t quite add up on the charts, maybe the price is jumping when it isn’t on any other broker, or your stop losses are conveniently being triggered before the price reverses. These are things that some of the more dubious brokers do, the market makers who are actually trading against you. If there are strange behaviours on the markets then the broker could be influencing them and this is a sure sign that you should be getting away from that broker.

Requesting more deposits: Some brokers have a habit of calling you up asking for you to deposit more funds, or if you have not yet deposited, to make a deposit. If your broker does this, run away as fast as you can, those are clear signs that your broker is just looking for your money and it is what a lot of scam brokers do. So if you get a call or email asking for money, do not deposit and close that broker’s account straight away.

So those are 10 of the tell-tale signs that you need to look for a new broker. Remember, as we mentioned before, not any one single broker will be perfect, you will always find things that could be done differently with the broker that you are using. That doesn’t mean that you need to jump ship though, work with your broker to see if they can change things, some are willing to do that, but if your broker has quite a few of the things above, then you should probably start looking for a new one.

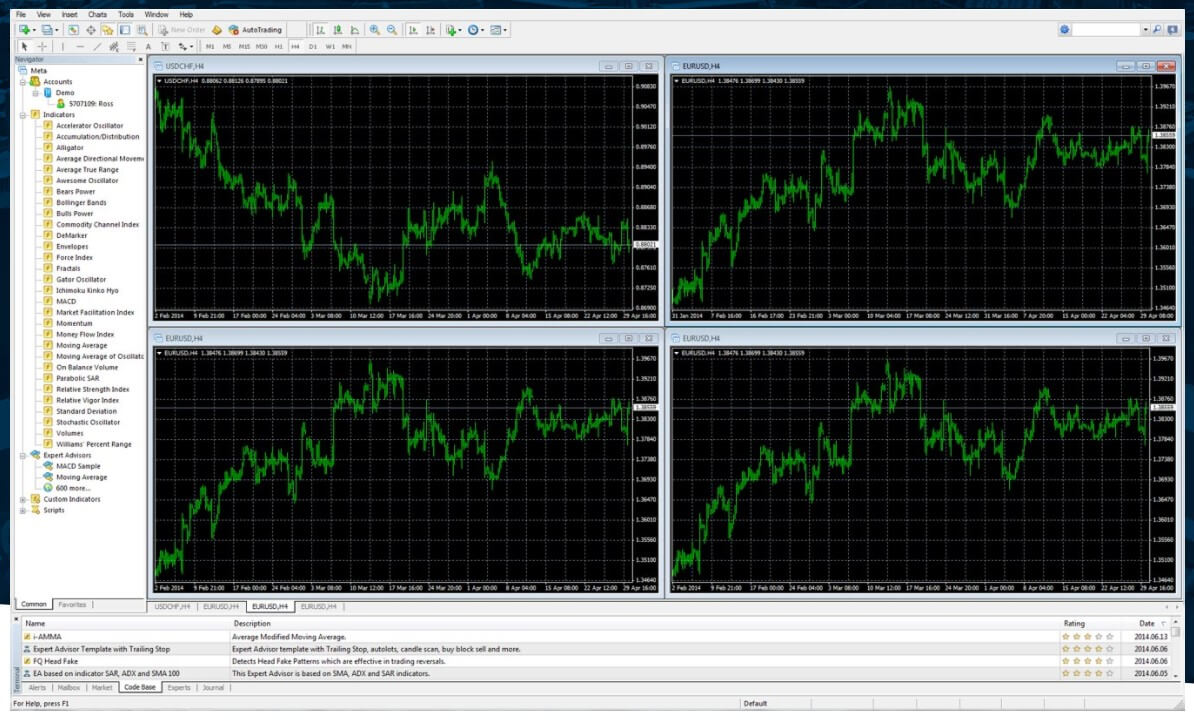

Grinta Invest provides us with the Metatrader 4 platform, a top-rated platform among traders. This platform is available both in the desktop version and in a mobile application for use on smartphones and tablets.

Grinta Invest provides us with the Metatrader 4 platform, a top-rated platform among traders. This platform is available both in the desktop version and in a mobile application for use on smartphones and tablets.

Just the one platform available, but thankfully it is a good one. Metatrader 4 (MT4) is the world’s preferred

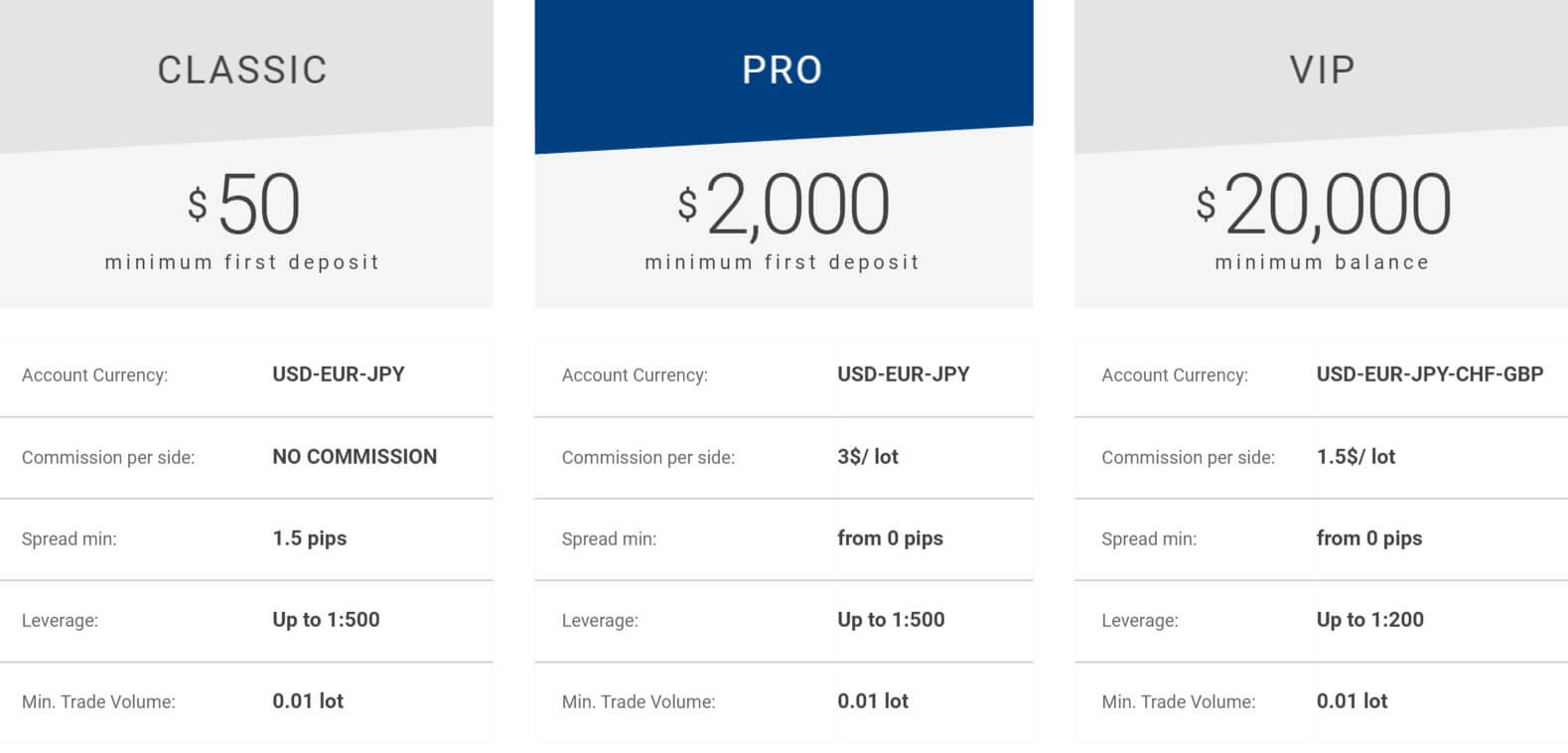

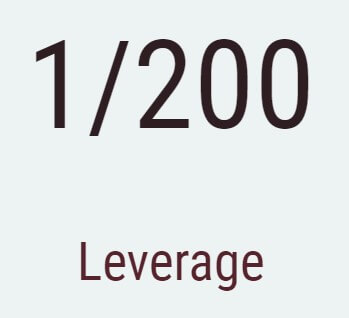

Just the one platform available, but thankfully it is a good one. Metatrader 4 (MT4) is the world’s preferred  The classic and Pro account c can be leveraged up to 1:500 while the VIP account can be leveraged up to 1:200. The leverage can be selected when first opening up an account and can be changed by sending a request to the customer service department.

The classic and Pro account c can be leveraged up to 1:500 while the VIP account can be leveraged up to 1:200. The leverage can be selected when first opening up an account and can be changed by sending a request to the customer service department.

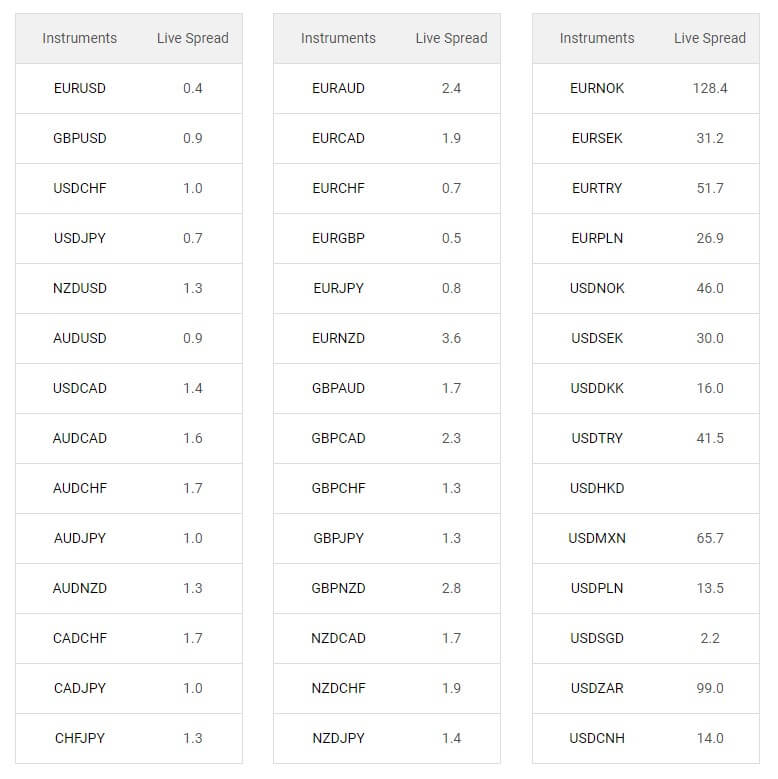

The spreads depend on the account you are using along with a few other factors. The Classic account has spreads starting from 1,.5 pips while the Pro and

The spreads depend on the account you are using along with a few other factors. The Classic account has spreads starting from 1,.5 pips while the Pro and

There isn’t too much when it comes to education, there are some pages explaining what each currency is and how it works and also some Webinars which seem to run each week, we do not know how good they are or if they are worth attending though.

There isn’t too much when it comes to education, there are some pages explaining what each currency is and how it works and also some Webinars which seem to run each week, we do not know how good they are or if they are worth attending though.

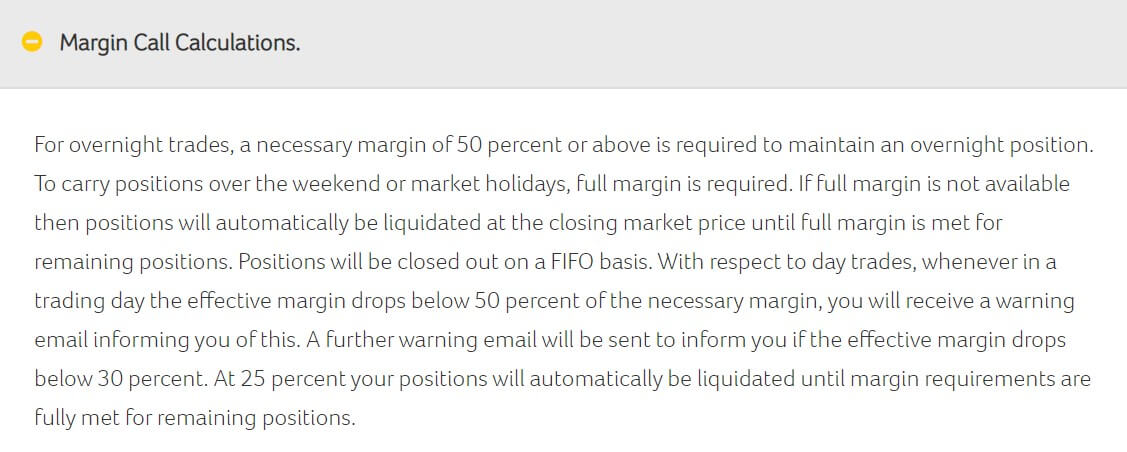

There isn’t any solid information when it comes to leverage, in fact, the only information available at all is in the terms and conditions, but it has nothing to do with what the maximum leverage is, there is a short sentence regarding the bonus funds, it mentions having a leverage of 1:400, so we would assume that this amount is available on the accounts, however, we can not say for sure. Why this information is not available is unknown to us, as it is quite important for potential clients to know.

There isn’t any solid information when it comes to leverage, in fact, the only information available at all is in the terms and conditions, but it has nothing to do with what the maximum leverage is, there is a short sentence regarding the bonus funds, it mentions having a leverage of 1:400, so we would assume that this amount is available on the accounts, however, we can not say for sure. Why this information is not available is unknown to us, as it is quite important for potential clients to know. Trading Costs

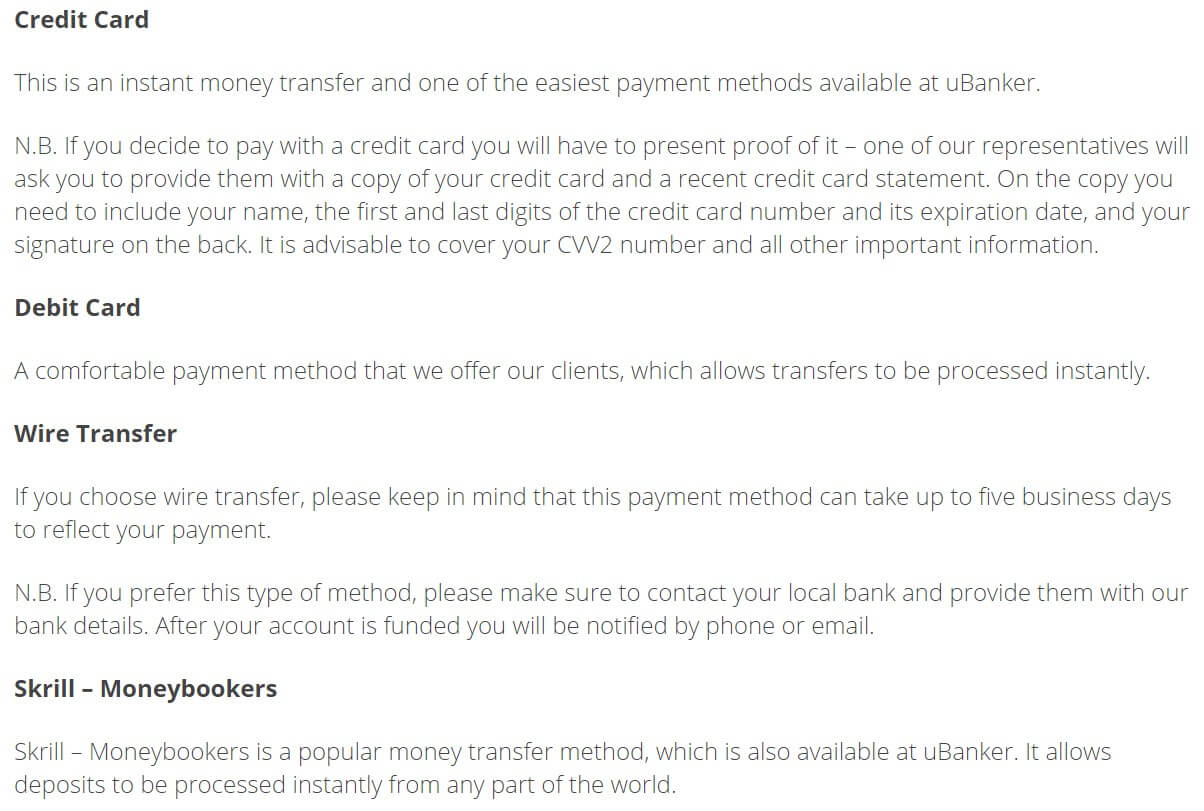

Trading Costs Deposit Methods & Costs

Deposit Methods & Costs

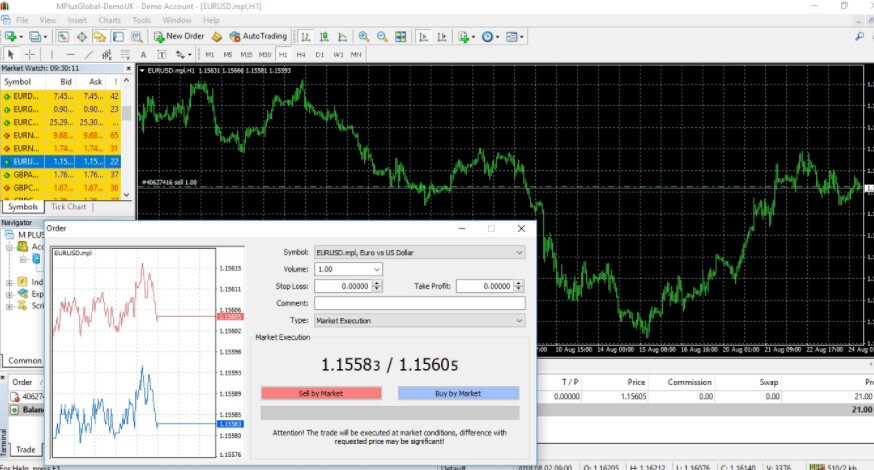

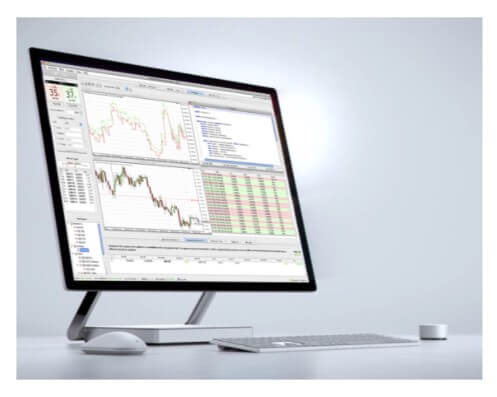

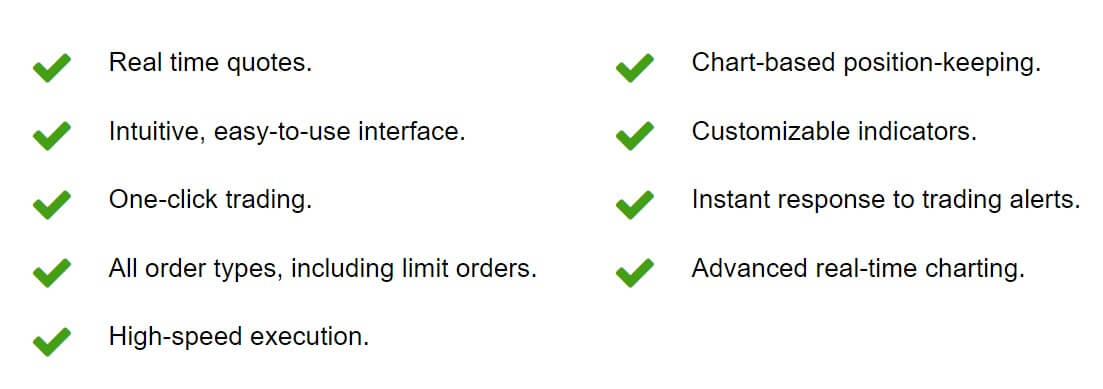

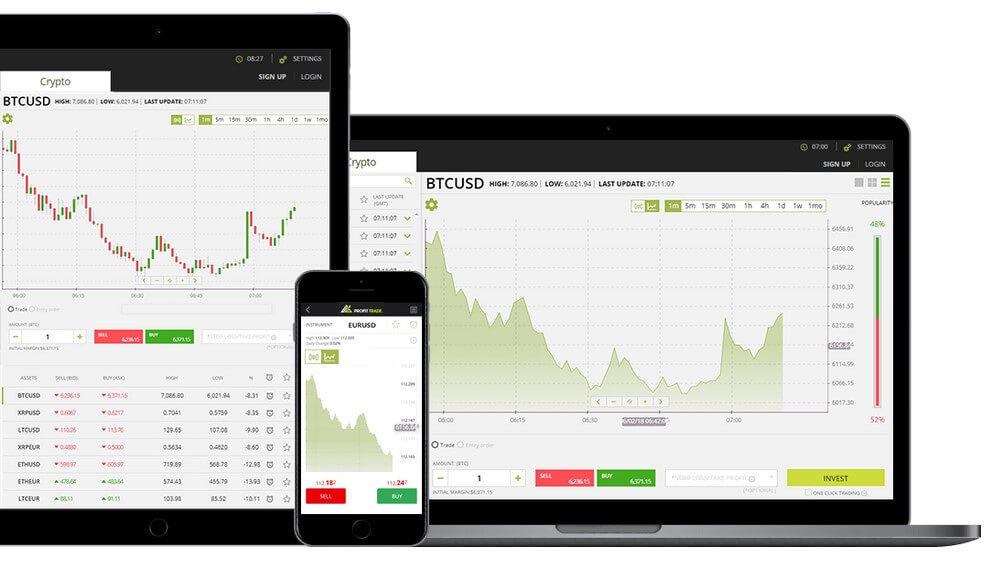

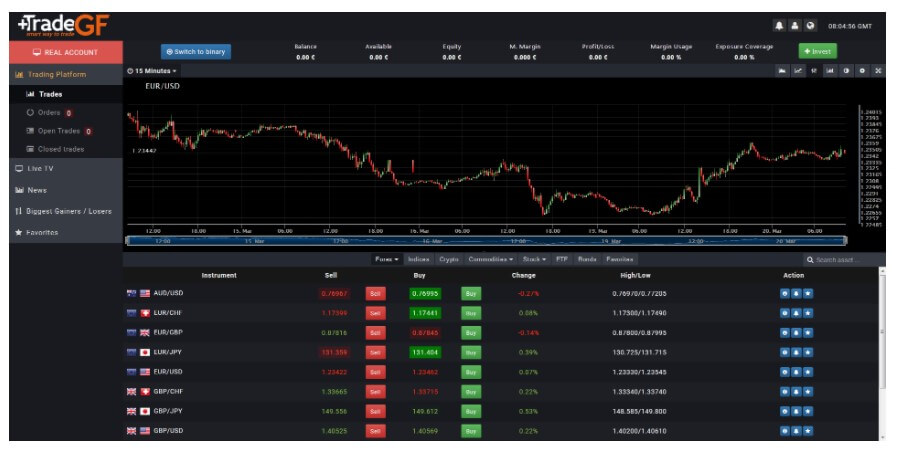

Your Trade Choice, like most brokers, offers its clients the MT4 trading platform. Remember that MT4 is one of the traders’ favorite tools for the following reasons, it is stable, it is reliable, has many functionalities and complements that have been perfected over the 10 years in the financial market.

Your Trade Choice, like most brokers, offers its clients the MT4 trading platform. Remember that MT4 is one of the traders’ favorite tools for the following reasons, it is stable, it is reliable, has many functionalities and complements that have been perfected over the 10 years in the financial market.

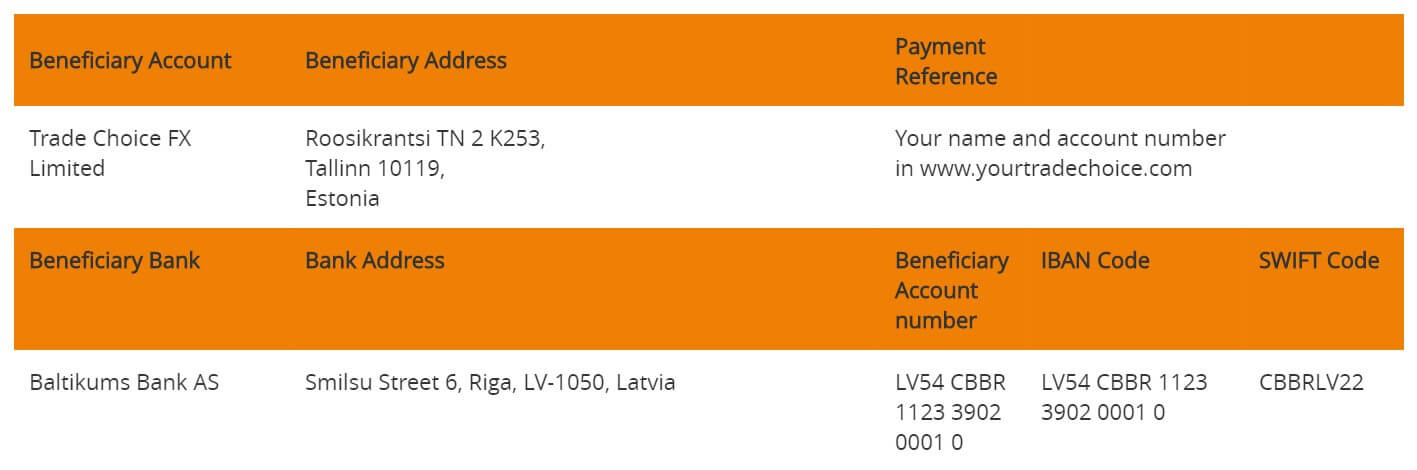

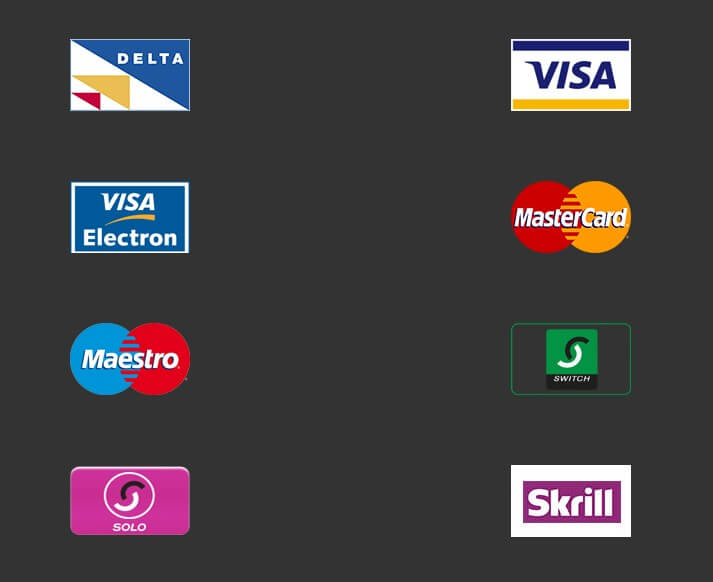

In the FAQ it states that Bank Wire Transfer, Credit / Debit Cards, Moneybookers (Skrill), and transfers from other existing broker accounts are available as deposit methods. However at the bottom of the site, there is also an image of UnionPay and AliPay, but we are not sure if they are actually usable or not.

In the FAQ it states that Bank Wire Transfer, Credit / Debit Cards, Moneybookers (Skrill), and transfers from other existing broker accounts are available as deposit methods. However at the bottom of the site, there is also an image of UnionPay and AliPay, but we are not sure if they are actually usable or not.

MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by

MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by

When opening up an account you are able to select leverage between 1:33 and 1:1000. We would suggest not trading over 1:500 as the risk grows exponentially the higher you go and 1:500 is a good balance of risk and reward. Should you wish to change the leverage on an account you have already opened, you should send a request to the customer service team to help you do this.

When opening up an account you are able to select leverage between 1:33 and 1:1000. We would suggest not trading over 1:500 as the risk grows exponentially the higher you go and 1:500 is a good balance of risk and reward. Should you wish to change the leverage on an account you have already opened, you should send a request to the customer service team to help you do this. According to the front page of the site, the average spread starts from 0.1 pips which, if true, is very low and quite impressive. We don’t actually have any examples of the available spreads but we do know that they are variable spreads, this means that they are affected by the markets and can move up and down according to liquidity and volatility.

According to the front page of the site, the average spread starts from 0.1 pips which, if true, is very low and quite impressive. We don’t actually have any examples of the available spreads but we do know that they are variable spreads, this means that they are affected by the markets and can move up and down according to liquidity and volatility.

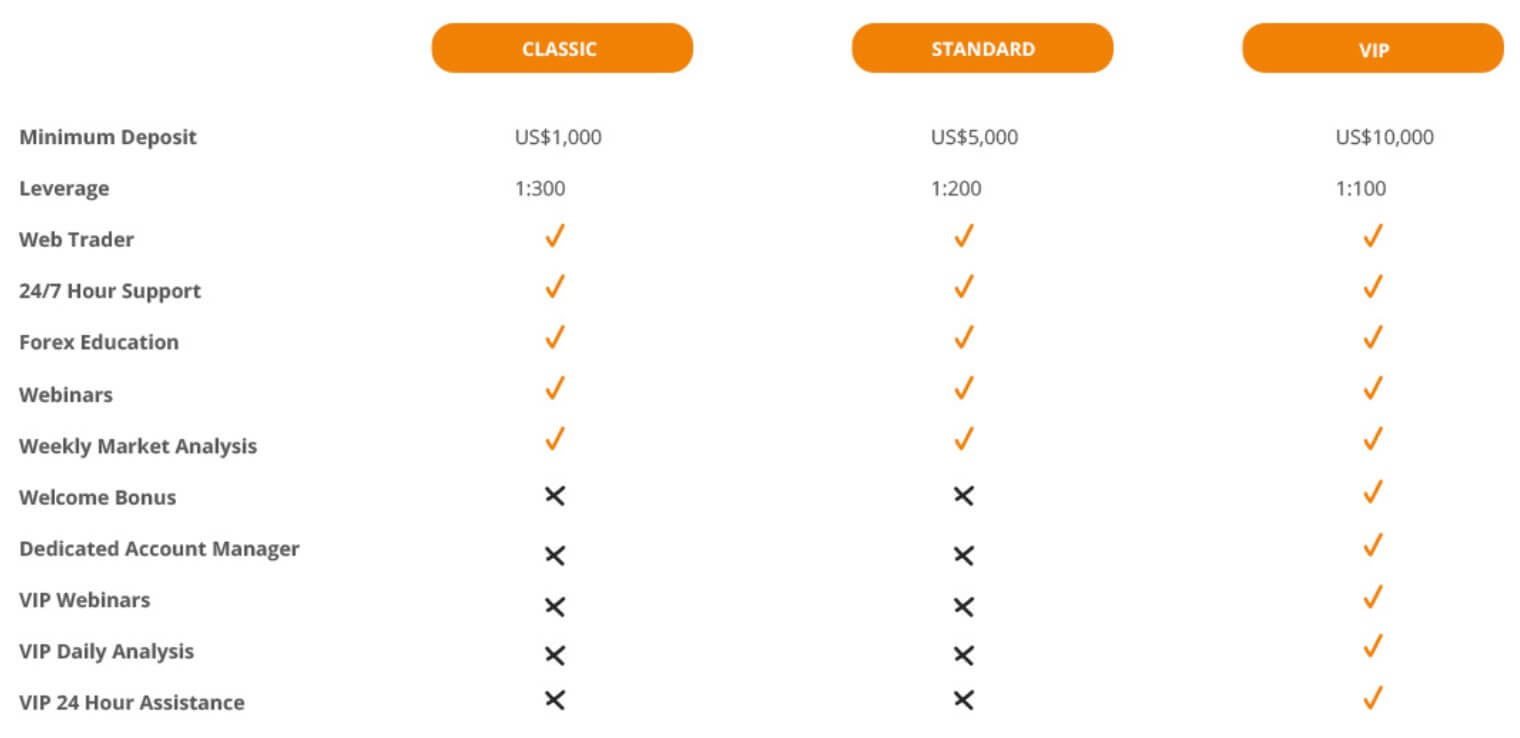

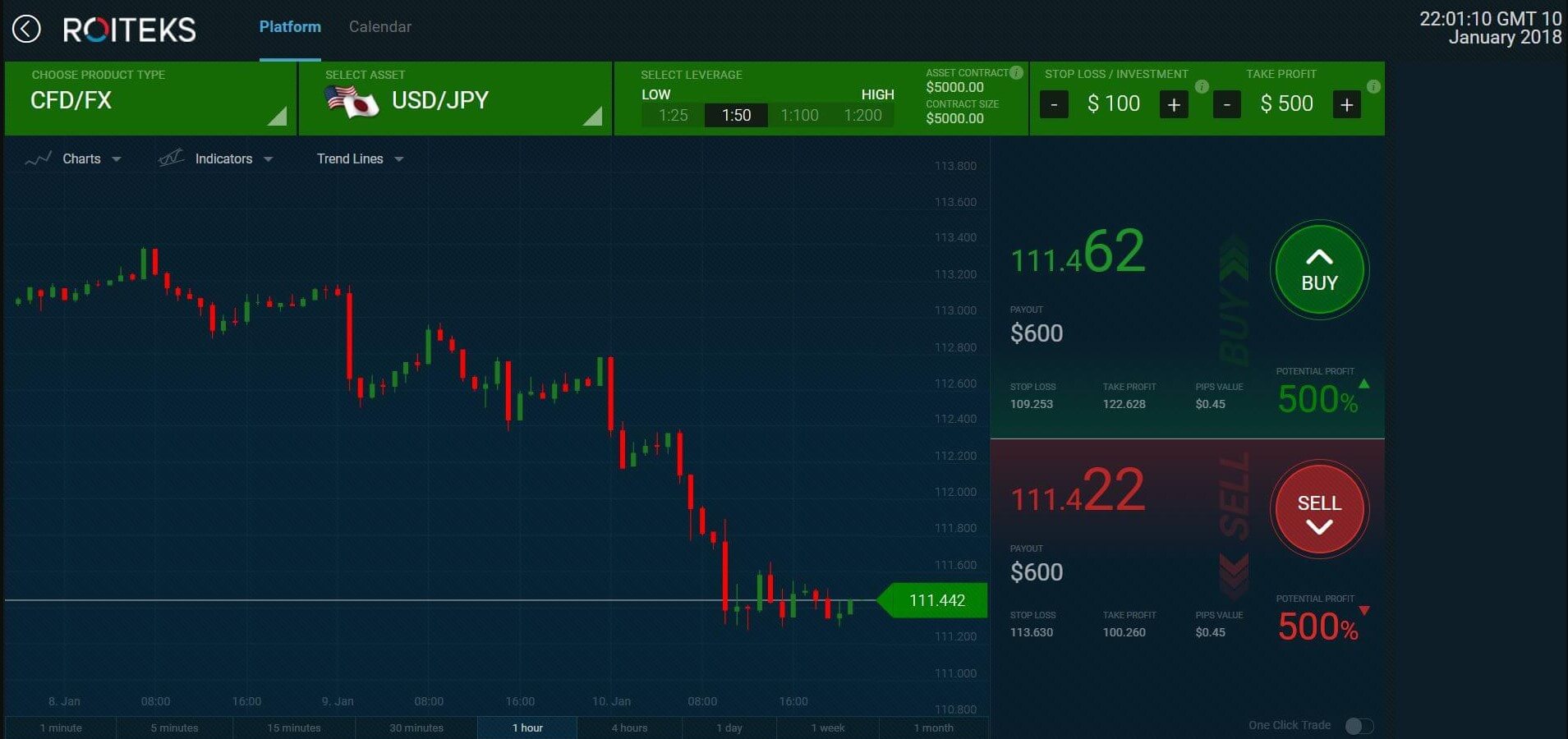

When placing a trade you are able to choose a leverage of 1:20, 1:50, 1:100, or 1:300. This is a slightly different way of doing things as it is not based on the account but the individual trade. 1:300 isn’t as high as we often like to see as many brokers are now looking towards offering 1:500, but 1:100 is still an acceptable level to use.

When placing a trade you are able to choose a leverage of 1:20, 1:50, 1:100, or 1:300. This is a slightly different way of doing things as it is not based on the account but the individual trade. 1:300 isn’t as high as we often like to see as many brokers are now looking towards offering 1:500, but 1:100 is still an acceptable level to use. There are no additional commissions added to the trades, this is stated in the terms and conditions. There are however

There are no additional commissions added to the trades, this is stated in the terms and conditions. There are however

The minimum deposit requirement with Roiteks is 250 EUR, USD or GBP. We do not know if this amount reduces once an account has already been opened, and advise that you speak with customer service to be clear on what fees are associated with funding a trading account with Roiteks.

The minimum deposit requirement with Roiteks is 250 EUR, USD or GBP. We do not know if this amount reduces once an account has already been opened, and advise that you speak with customer service to be clear on what fees are associated with funding a trading account with Roiteks.

Forex: GBPUSD, USDJPY, EURUSD, USDTRY, USDCHF, AUDUSD, USDCAD, GBPJPY, EURGBP, USDRUB, EURJPY, GBPCHF, NZDUSD, EURCHF, USDZAR, EURTRY, AUDCAD, USDMXN, EURAUD, EURAUD, AUDJPY, GBPAUD, EURZAR, CHFJPY, GBPNZD, EURCAD, CADJPY, AUDNZD, GBPCAD, AUDCHF, CADCHF, NZDCHF, NZDCAD, EURNZD, EURRUB, USDNOK, GBPRUB, USDSEK, USDDKK, USDPLN, USDHKD, EURSEK, USDSHD, EURNOK, EURPLN, USDCZK, EURDKK.

Forex: GBPUSD, USDJPY, EURUSD, USDTRY, USDCHF, AUDUSD, USDCAD, GBPJPY, EURGBP, USDRUB, EURJPY, GBPCHF, NZDUSD, EURCHF, USDZAR, EURTRY, AUDCAD, USDMXN, EURAUD, EURAUD, AUDJPY, GBPAUD, EURZAR, CHFJPY, GBPNZD, EURCAD, CADJPY, AUDNZD, GBPCAD, AUDCHF, CADCHF, NZDCHF, NZDCAD, EURNZD, EURRUB, USDNOK, GBPRUB, USDSEK, USDDKK, USDPLN, USDHKD, EURSEK, USDSHD, EURNOK, EURPLN, USDCZK, EURDKK.

Address:

Address:

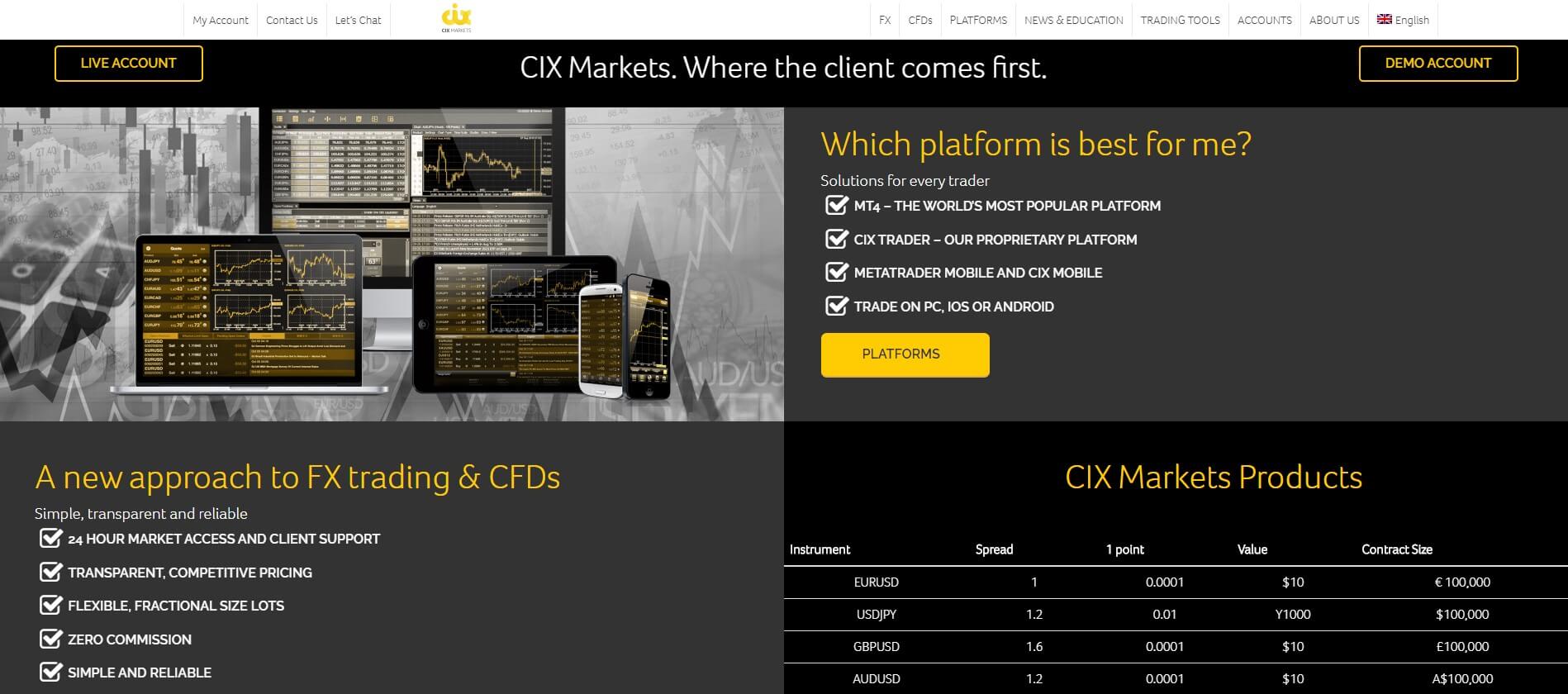

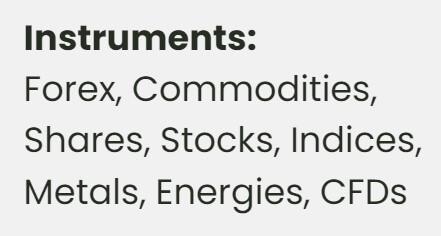

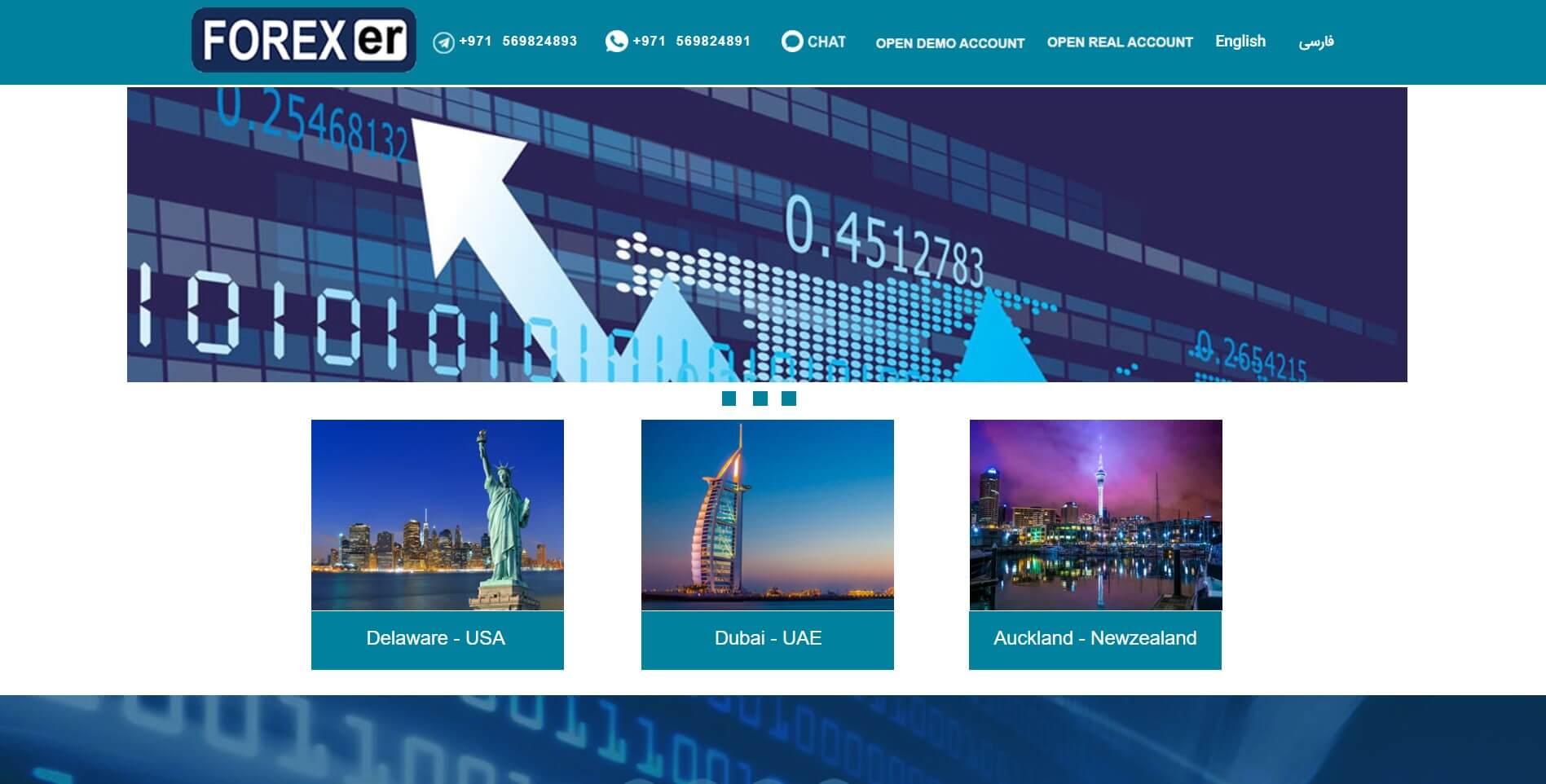

As they state on their website their objective is to create a safe and transparent environment where their clients can trade their available products. They specialize in CFDs and Forex trading whilst making use of sophisticated online trading systems such as the MT4.

As they state on their website their objective is to create a safe and transparent environment where their clients can trade their available products. They specialize in CFDs and Forex trading whilst making use of sophisticated online trading systems such as the MT4.

Customers who have an open account with this broker can trade a number of assets including – Forex pairs, Precious Metals, Energies, and Cash Indices. The broker does not have a full list of available assets on their website, so we assume customers are given this information once an open account is created.

Customers who have an open account with this broker can trade a number of assets including – Forex pairs, Precious Metals, Energies, and Cash Indices. The broker does not have a full list of available assets on their website, so we assume customers are given this information once an open account is created.

OGM has a firm set of obligations and standards set out for themselves which are; transparent executions, security and stability through their platform and strict regulators, connectivity infrastructure, a very strong liquidity offering, the ability for customers to educate themselves through their experience garnered over 29 years of experience within the industry and finally satisfaction through their service.

OGM has a firm set of obligations and standards set out for themselves which are; transparent executions, security and stability through their platform and strict regulators, connectivity infrastructure, a very strong liquidity offering, the ability for customers to educate themselves through their experience garnered over 29 years of experience within the industry and finally satisfaction through their service.

Indices:

Indices:

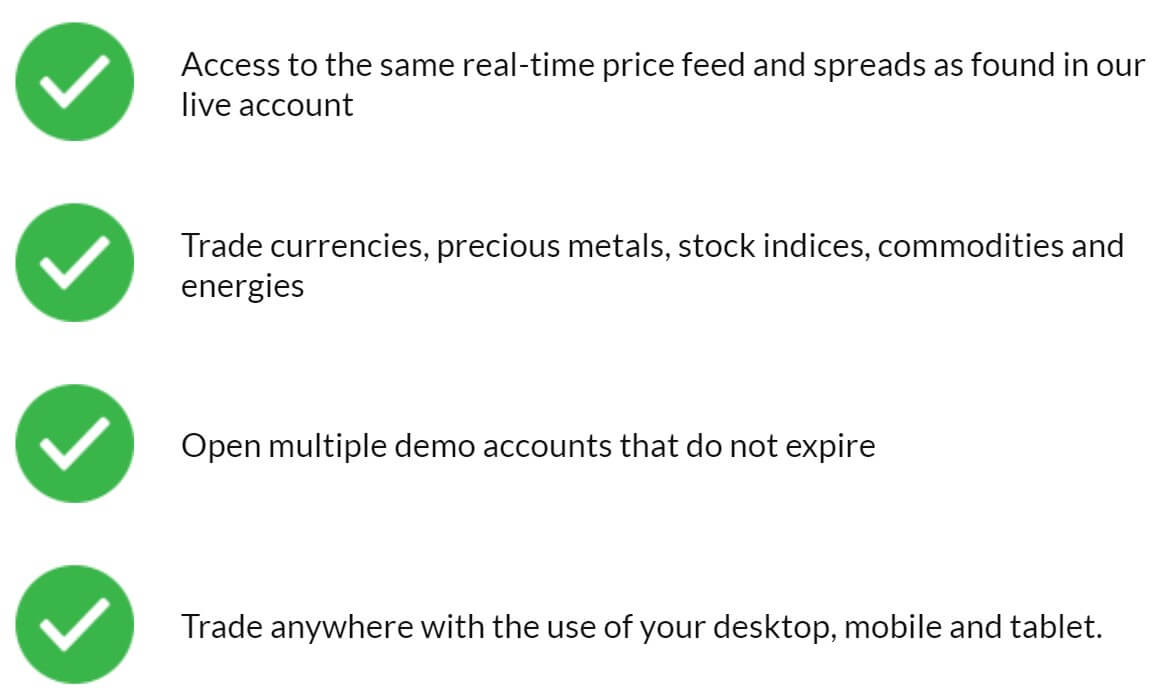

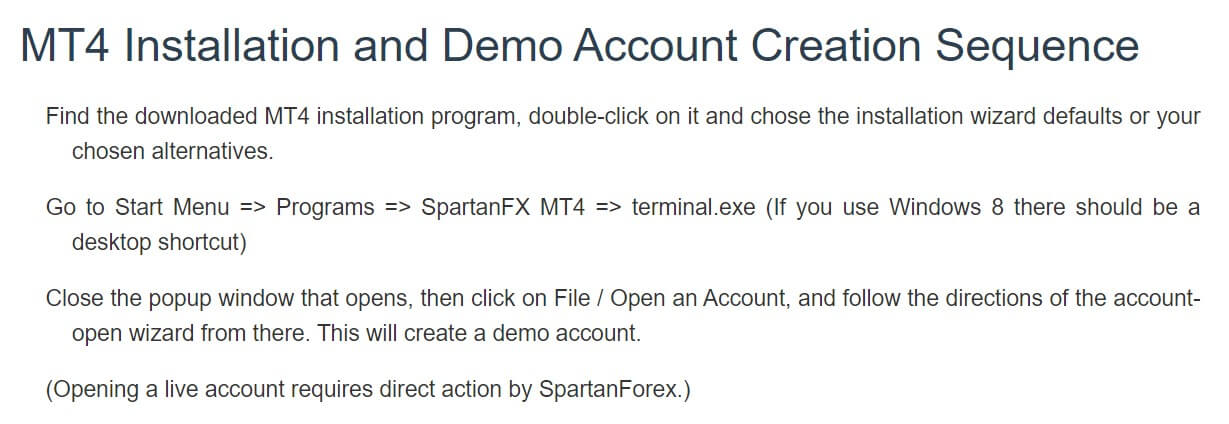

Demo accounts serve as simulation experiences for those that are considering opening an account with a forex broker, and these account types allow one to test out the broker’s conditions and practice trading on the offered platform, all while using virtual currency. Fortunately, BML provides access to these risk-free accounts, along with the majority of others. The broker’s demo account mimics all of the conditions offered on their live accounts and can be opened through the MT4 trading platform.

Demo accounts serve as simulation experiences for those that are considering opening an account with a forex broker, and these account types allow one to test out the broker’s conditions and practice trading on the offered platform, all while using virtual currency. Fortunately, BML provides access to these risk-free accounts, along with the majority of others. The broker’s demo account mimics all of the conditions offered on their live accounts and can be opened through the MT4 trading platform.

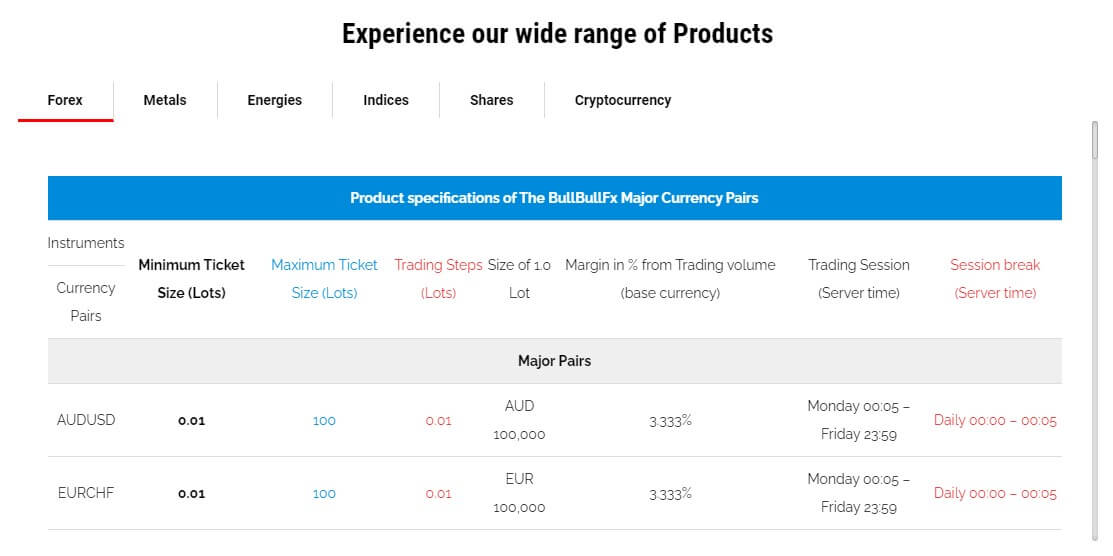

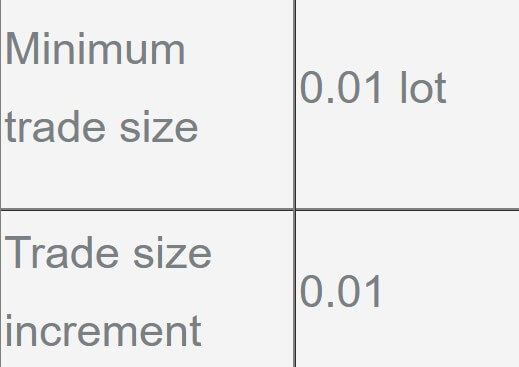

Trade sizes start from 0.01 lots and go up in increments of 0.01 lots. It is not known to us what the maximum

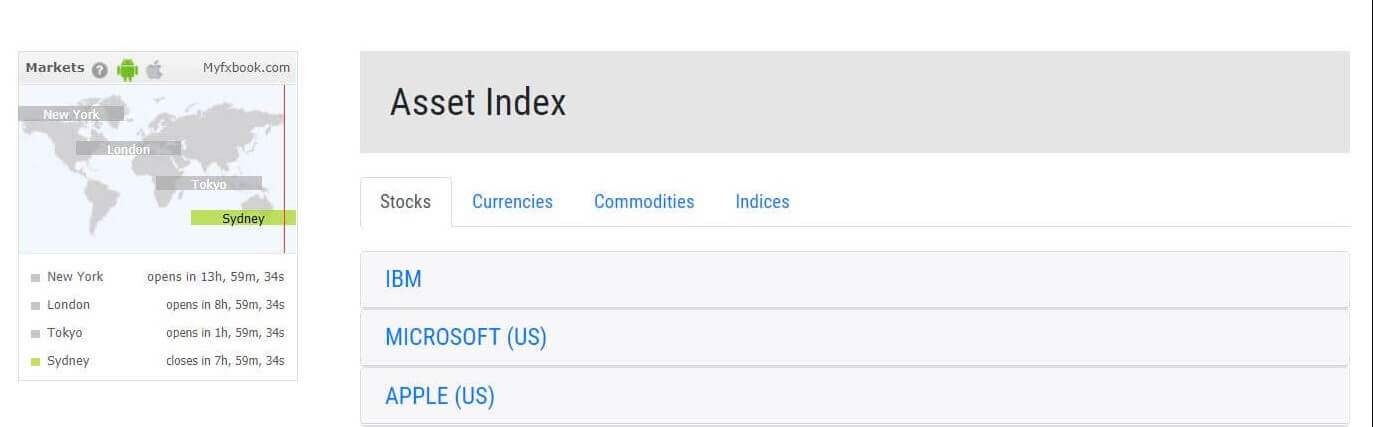

Trade sizes start from 0.01 lots and go up in increments of 0.01 lots. It is not known to us what the maximum  The available assets have been broken down into a number of different categories, we will be looking at what instruments are in them now.

The available assets have been broken down into a number of different categories, we will be looking at what instruments are in them now.

Different types of trading are supported, including high-low, touch-no-touch, AboveBelow, and many more. The broker features margin loans at a percentage rate that varies by account. The smallest loan starts at 10% on the Micro account, increases to 25% on the Mini account, and so forth, until topping out at a 100% loan on the VIP account. Not surprisingly, the website doesn’t actually mention which levels stop-out would occur, and it isn’t clear as to whether those levels are shared by each account, or differ based on one’s status.

Different types of trading are supported, including high-low, touch-no-touch, AboveBelow, and many more. The broker features margin loans at a percentage rate that varies by account. The smallest loan starts at 10% on the Micro account, increases to 25% on the Mini account, and so forth, until topping out at a 100% loan on the VIP account. Not surprisingly, the website doesn’t actually mention which levels stop-out would occur, and it isn’t clear as to whether those levels are shared by each account, or differ based on one’s status.

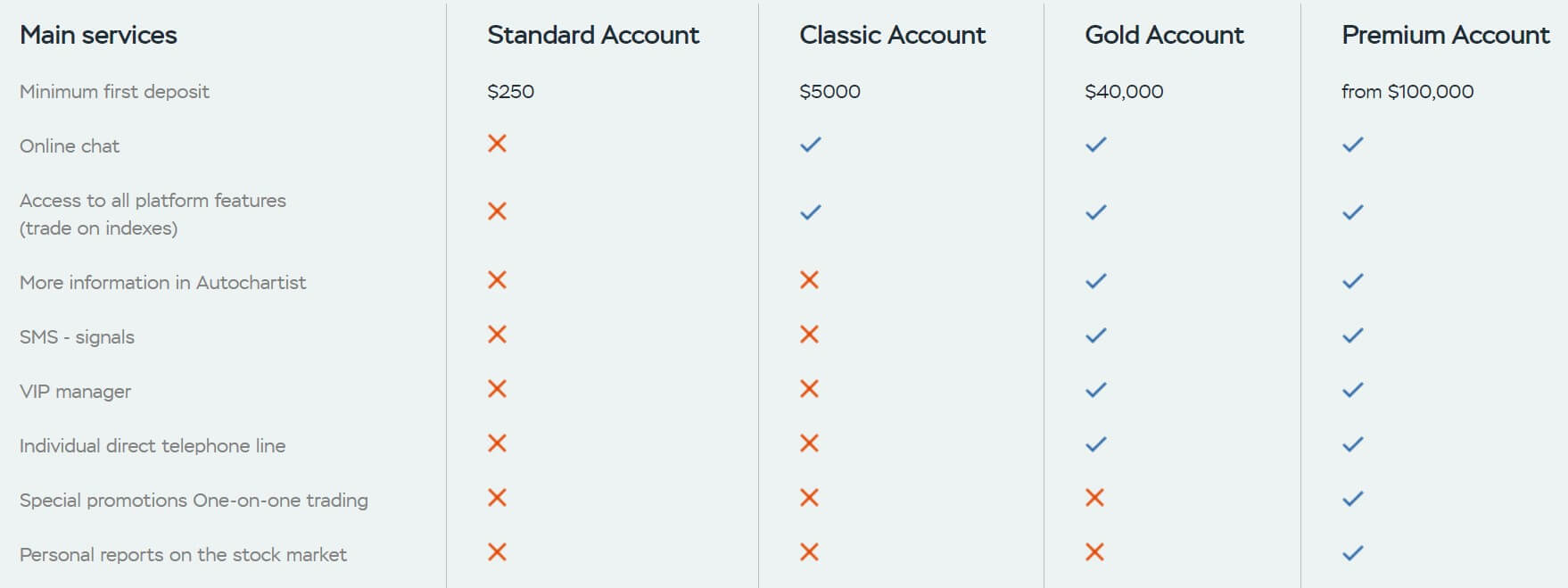

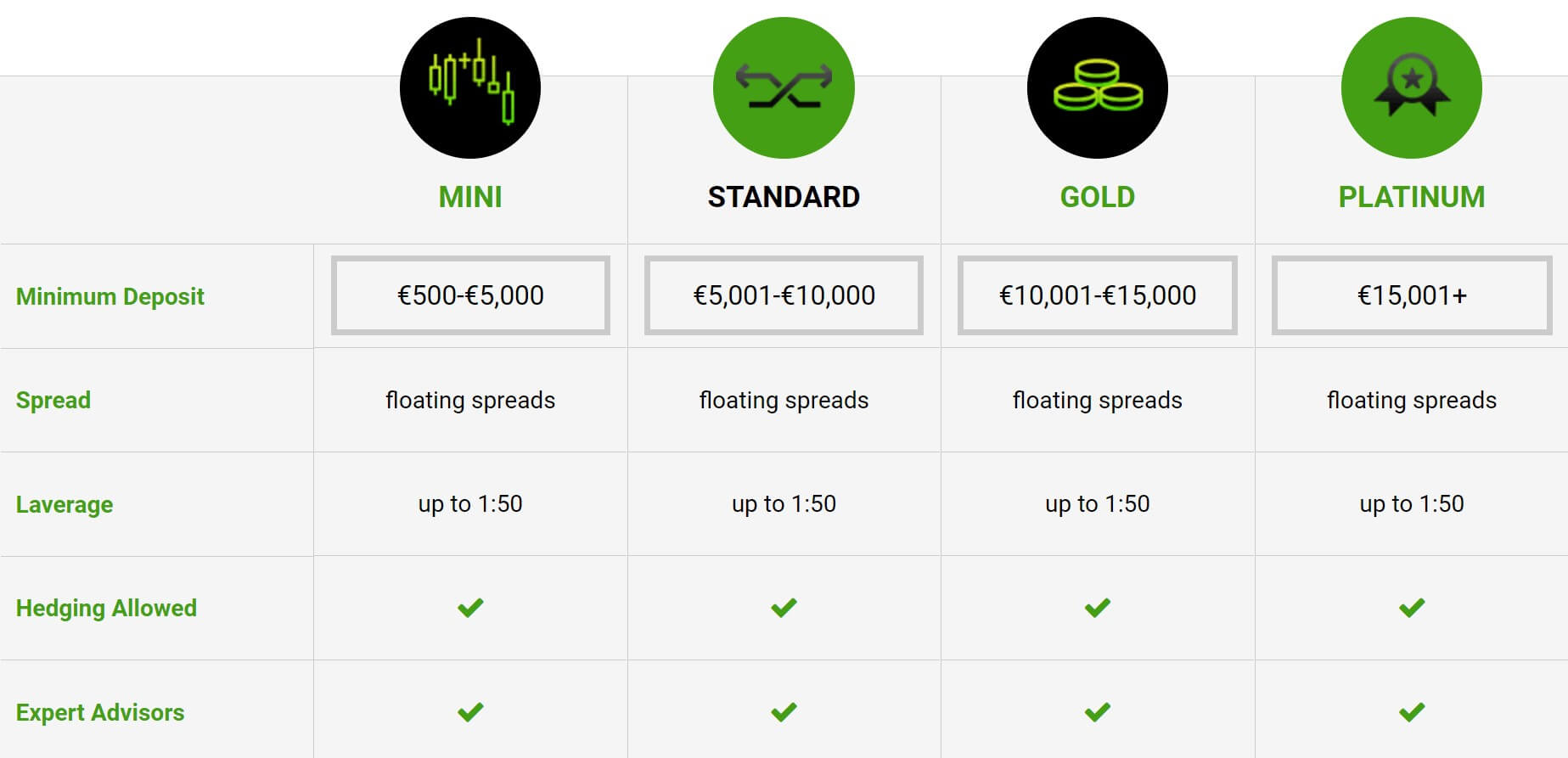

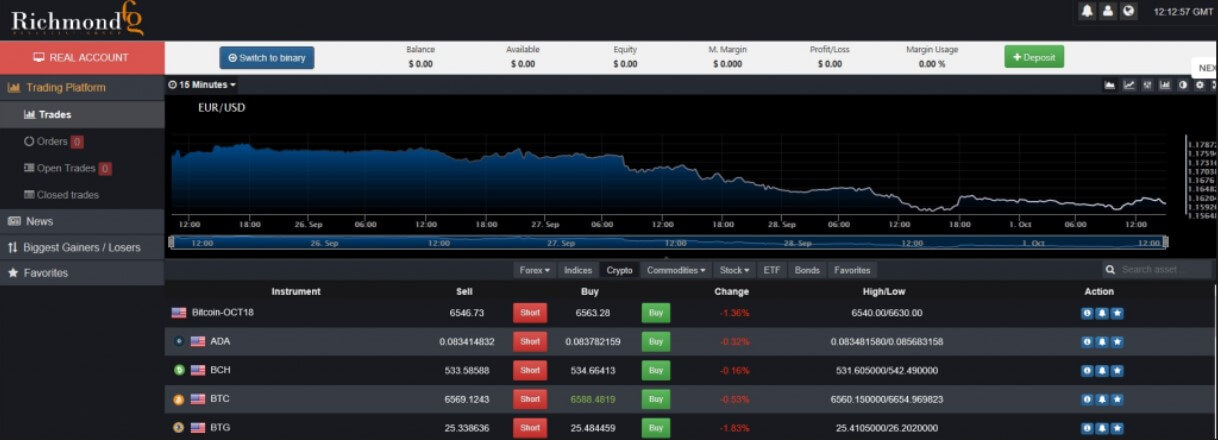

Richmond Financial Group features more than 60 animated videos on its website, along with some educational articles. Further resources are offered based on one’s account type. Traders that open an account of the Mini level or above can access a weekly live stream trading seminar. Gold level accounts and above can enjoy the benefit of a personal account manager. Gold account members are also given weekly one-on-one

Richmond Financial Group features more than 60 animated videos on its website, along with some educational articles. Further resources are offered based on one’s account type. Traders that open an account of the Mini level or above can access a weekly live stream trading seminar. Gold level accounts and above can enjoy the benefit of a personal account manager. Gold account members are also given weekly one-on-one

BS Trading is an online foreign exchange broker that offers investment options in FX pairs and CFDs, including a few cryptocurrencies. The company is based in Vanuatu under the regulatory oversight of the Vanuatu Financial Services Commission (VFSC). BS Trading manages to bring traders tight spreads and high leverage options, all for a low $1 deposit, but there are a few things missing from the overall experience. When it comes to describing themselves, the company only sticks to the basic facts. If you’re in the market for a broker, our detailed review should help to decide whether BS Trading is a worthy candidate.

BS Trading is an online foreign exchange broker that offers investment options in FX pairs and CFDs, including a few cryptocurrencies. The company is based in Vanuatu under the regulatory oversight of the Vanuatu Financial Services Commission (VFSC). BS Trading manages to bring traders tight spreads and high leverage options, all for a low $1 deposit, but there are a few things missing from the overall experience. When it comes to describing themselves, the company only sticks to the basic facts. If you’re in the market for a broker, our detailed review should help to decide whether BS Trading is a worthy candidate. Along with the majority of other forex brokers, BS Trading offers the award-winning MetaTrader 4 platform for download on PC and mobile devices, or through the web-browser. MT4 features one-click trading, EAs (Expert Advisors), multiple languages, and VPS functionality. The platform also comes with technical analysis tools, nearly 50 indicators, 3 chart types, charting tools, and the list goes on. Compared to other options, MetaTrader 4 will always remain one of the most preferred trading platforms on the market for the sheer fact that it offers all of these features and more from a navigable, powerful, and customizable interface. If you’re looking for a convenient all-in-one option, MT4 will be more than sufficient.

Along with the majority of other forex brokers, BS Trading offers the award-winning MetaTrader 4 platform for download on PC and mobile devices, or through the web-browser. MT4 features one-click trading, EAs (Expert Advisors), multiple languages, and VPS functionality. The platform also comes with technical analysis tools, nearly 50 indicators, 3 chart types, charting tools, and the list goes on. Compared to other options, MetaTrader 4 will always remain one of the most preferred trading platforms on the market for the sheer fact that it offers all of these features and more from a navigable, powerful, and customizable interface. If you’re looking for a convenient all-in-one option, MT4 will be more than sufficient.

BS Trading advertises 100+ instruments as being available. Among those options, traders will find 54

BS Trading advertises 100+ instruments as being available. Among those options, traders will find 54