When you are trading in Forex, you will come across the term “recotization” sooner or later. While it’s not that common, it can happen and you should be aware of what it means and how to avoid it. What is an recotization? Read on to find out.

A recall in the Forex world means that the broker you are dealing with is unable or unwilling to give you trading based on the price you have entered. This usually occurs in a fast-moving market, usually around the time of a major news event affecting the market or some kind of a shock to the system. Basically, you decide to buy or sell a currency pair at a certain price and press the button to do so. By the time your broker receives the order, the market has already moved too fast to run at the advertised price. The recall notice then leaves the platform telling you that the price has been moved, and gives you the option of being able to think whether or not you are willing to access that price. It’s almost always a price that’s worse than what you originally ordered.

What Causes Recotization in Forex?

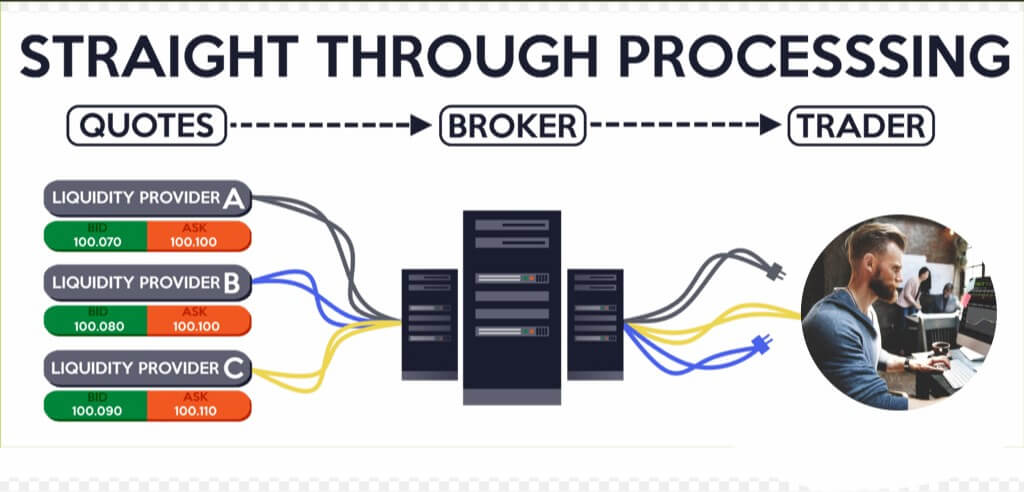

As mentioned above, markets are normally moving very fast, but they can move faster all of a sudden when a scoop is announced. This makes it can be tricky for the broker to make the order at the price you request. The broker you deal with has its own brokers dealing with it. The liquidity pool, or broker, may push orders, raise prices, or simply refuse to acknowledge anything if it so desires. Your broker considers the price available, not the one you ordered – and warns you that you will have a worse deal than you expected.

How to Protect Yourself from a Recotization

With a trusted Forex broker, it’s easier to protect yourself from recovery. We can put a limit order, and with this, we are telling the broker that he is only willing to make an order at a specific price or better. In this way, you are being told in advance that you are not prepared to pay more than this trade-determined price and that you are prepared to abandon the transaction if it cannot be done on these terms. Re-branding is very common in certain markets and is part of any Forex career. However, if you find in your Forex broker recounts often (especially in calmer markets) your broker may have a lack of liquidity. If that is the case, you will most likely want to find a new Forex broker. However, if we find recotizations mainly during the non-farm payroll report, give your broker a break – all brokers are flooded in times like these.

More Information about Recotizations

It is important to make it absolutely clear that, while stop and limit commands can work to avoid recotizations, both could be subject to sliding. The slide is where the stop or limit command is fired, but it is not executed at the specified price. Sliding is a fact of life, and it is tolerable as long as it is reasonable. Sliding should not occur in a slow market. Once your broker accepts a stop or limit order, you may slide, possibly giving you a worse price (or in some cases possibly a better price), but your order will be executed. This is why such orders can be a defense against unscrupulous brokers who use recotizations to keep it off the market when they want it off the market. However, it must be said that if you are in this position with your broker, you have a problem and should be looking for another broker instead of trying to find a way to work around your practices.

ECN brokers should never offer recotizations- if you enter an order to purchase at the prevailing market price, well, as soon as the price arrives there your order is executed. Of course, you may suffer from slippage, but if you have a good broker it should not be too damaging, as long as you are not negotiating in a crazy way during periods of extremely thin liquidity.

Large Trades and Recotizations

Another common problem that can trigger a broker that gives a customer a recotization is when the size of the trade is very large (in or near the maximum size of the trade that the broker stipulates from time to time in its terms and conditions) or bigger than the trades the customer normally does. Many brokers have a security feature embedded in their trading platforms, where if a customer enters a trade much larger than usual, then the platform asks them to confirm that they want to do a trade of this size, offering protection against a typical “big toe.”

Although this last scenario is not, strictly speaking, a recotization, it has the same effect: a delay in the execution of the trade that results in a potentially different price being available when the order is finally executed.

Flexible Brokers of Forex

There are some brokers, although they are hard to find, that allow their customers to take control and ownership of the recotization issue to some extent. These brokers have some mechanism through which customers can enter how much slip they are willing to tolerate, beyond which they demand a recotization. Thus, for example, if a customer says that he will tolerate up to 10 pips of negative slip in the EUR/USD currency pair, the broker will allow a sliding trade to pass without a recotization unless in this case, the negative slip is greater than 10 pips.

Forex Brokers Without Recotizations

But also, there are some forex brokers that follow the “market manufacturing” model (i.e., they are not ECN or STP brokers) that simply guarantee that they will never give recounts. Using this type of broker is another way to eliminate the problem, although you must then wait and see how much negative slip happens when you run trades. After all, any broker can eliminate recotizations as long as it is made 100% at the customer’s expense!