There are many reasons one could start looking for these, even though you are also learning or are already an experienced forex trader. You might want other income options, diversify your trades with some other trading type, have signals when you are not in your trading time, and so on. This option is more appealing to people looking for a quick fix. They have tried, they have burnt in forex trading. Now they can just skip the learning process and jump in the boat somebody else is driving. Sounds great, nothing to object with a reasonable plan for bonus income.

Unfortunately, this is a very good base for dishonest people, or scammers, to take advantage of that enthusiasm. Again, it seems that there is no easy path to get rich quick. This article will deal with possible scams you can get into if you are not informed and also give you a hint of what to expect when you find a legit service. There are many ways of how a signal service might be an actual scam, we have categorized red flags and scam patterns so you can filter those scammers out in your search.

The task of finding a legit forex signal service is difficult, especially now when the internet is flooded with dishonest ones. Approach this task with a healthy dose of skepticism, it will help you to find inconsistencies. The notion of an income generated just by copying someone else makes a very low barrier to entry, attracting all the people looking for a quick fix, people who are easer to scam. If you question everything the service is promoting, you will have an inherent edge.

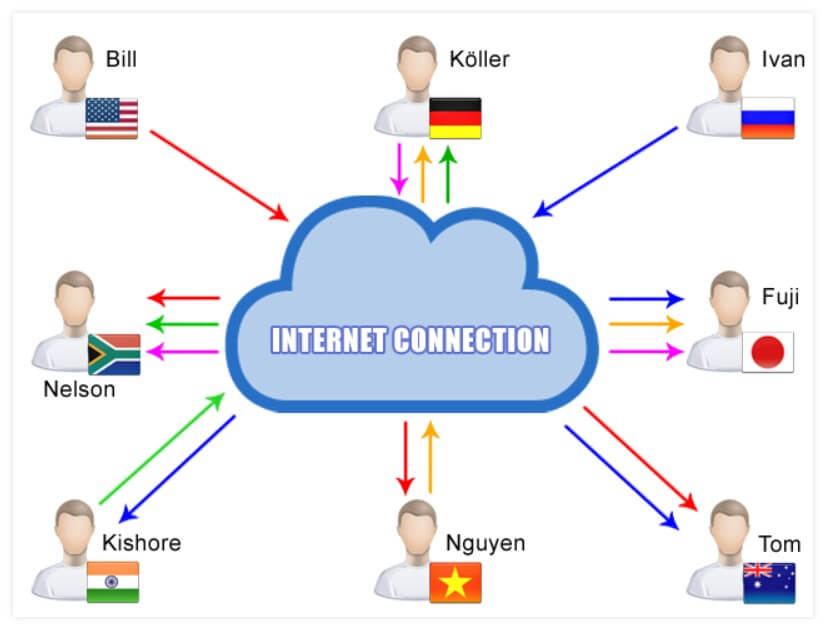

Let’s start with the first warning sign. The “service” is available on channels only. Social media channels like WhatsApp, Viber, Telegram, or Instagram. If you find out they require you to pay some fees to enter the channel without any other page or reference, you can with almost complete certainty say they are a scam. This is also a warning for anyone who honestly wants to start this business, find a better way to establish a platform got your signals, smart people will not find or trust you this way. Scammers like these channels. Why not use better and probably the best places to make yourself known like YouTube, Facebook, Tweeter, and many other platforms?

Just have a small group of people following you and by the word of mouth you should snowball followers exponentially. Well, scammers will not last long here, it will be a matter of days before they are exposed and could even become an easy target for criminal prosecution. So even a dishonest business has a risk to it that needs management. Honest signal service providers will still have a reputation to preserve, even if their signals are of high quality there will be bad reviews from people that fail to follow simple instructions (there are so many you would be surprised). Well, we guess this is just the nature of this business with no barriers to entry for consumers, everyone is interested.

Scammers will not be completely anonymous of Telegram or IG, but they have enough obscurity so they can scam a substantial group of people without prying eyes of justice. Whatsmore, these groups are easy to make and the whole cycle can start over. This should not inspire you, it is also a way to make money, you will just belong to the dark side to ruin what good is left about forex trading. Search out for the website or testimonial if they exist about the group, with good results you can check.

We have noticed a lot of these “scam chat groups” are younger, rarely passed the fourth decade. Interestingly, both the victims or customers and the scammers have a similar mentality. They both seek the easy way to gather substantial income in a short time. Although scammers have a plan on how to do it and they have better success than their customers. Another interesting pattern here can be noticed, when we use common sense, would you invest or trust the quality of a signal service run by mature traders in their 40s, or 50s, or rather a young group that rarely passes 35? Common sense says to go with the more experienced ones. We are sure there are talented and devoted trading killers in their 20s, this is just an observation we made. Forex trading, at least on the professional level, requires a long hard work on testing and forging the mindset for this market.

Only repetition, learning by mistakes, and swallowing most of the “unexpected” out of forex can make you experienced enough to become a signal provider. The signal whose many accounts depend on. Responsibility only experienced mind can take with confidence. All this, of course, needs time, unlikely to be a part of someone’s life when they are just out of high school. Whatsmore, even young great forex traders are simply better when they get older, their systems are improved, they have more irreplaceable experience and of course more consistent performance. A good and different perspective for young traders comes from the positive traits of a young mind. They are really great with new technologies, they can soak new concepts which in turn make interesting automated trading software solutions. EAs will take control of their early trading psychological challenges and now we have another type of signal provider and “traders”. We can go even further and say experience plays part in the making of EAs too, let’s say a combination of an experienced trader and a youngster who is great at making EAs from expert concepts produces rare masterpieces.

With experience, you will notice marketing tricks which are common flags of a service or product without substance. Have you noticed the marketing elements for signals and other parts of the forex business? Unfortunately, these marketing elements are common. They usually involve promoting an expensive, extravagant lifestyle, featuring supercars, champagne, private jets, girls, and suits. These target men, as they are more interested in forex (more on this topic in Women in Forex). Additionally, they target men who are still affected by this marketing. Be smart to them and they will filter you out, you are more likely to be a problem than a “customer”. Aside from the internet, TVs and mass media channels are full of it. You will see a sharp increase in specialized marketeer numbers for every segment of internet published product or service platforms nowadays. The question is, do you belong to this group of people affected by this type of marketing? If you are now you know better, if not your chances of finding a legit signal provider are very good. So let’s go deeper into other warning signs.

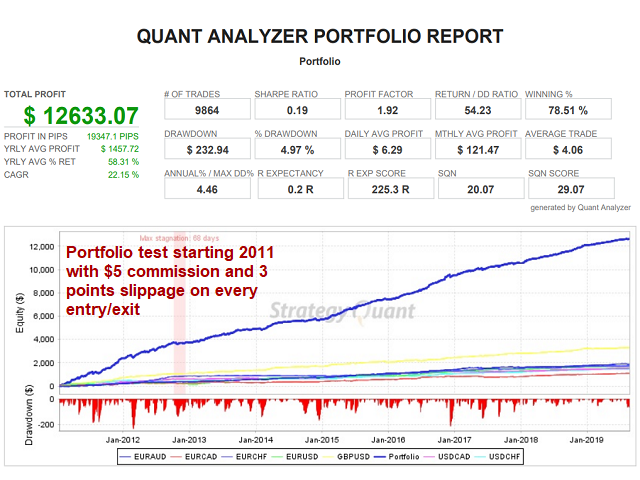

A legit signal provider will promote their results. Common sense says you want to invest into a money-making business, or at least the business with high and probable reward compared to the risk involved. Now you will want to measure the rewards to risks ratio by looking at their past performance. Do you still have that suspicious eyebrow? Good, you will need to check this performance sheet (more on this later). If they do not have one, but they have good reviews, check that too. Is the rating sample large enough to confirm the positive outlook of reviewers? Are the reviews informative and not too short?

If yes, then maybe you have something worth your while, still, your work is not over, most of the websites without the performance track record are a well-obscured scam. These scams are even reputable, a massive amount of marketing campaigns are funded to keep the bad covered and the “good” pushed to your face. The accessibility of the internet makes this easy, making your work to find the truth harder. Summing the elements, the websites would contain a very well and flashy presentation. Optimistic, inexperienced visitors will feel like these “pros” know what they are doing, just look at these charts, animations, pretty customer support girls, and percentages! “With this percentage gains, I could buy…soon!”. This should not be your thinking.

The group has extensive experience within financial institutions and financial investing ventures. Well, does this mean they are great trading forex? The short answer is no. The long answer will tell you why it is probably a “legit scam”. This experienced group has left corporate life so they can maintain their signals service, it is a better business option to them isn’t it? Okay, what about the fact financial institutions can generate mediocre results at best for you. They are not something a professional trader would aim for. To uncover it all in a funny way take a look at the book by Fred Schwed “Where Are the Customers’ Yachts?: or A Good Hard Look at Wall Street”. Put simply, they have experience making money from you more than for you.

Financial flashy words are making them educated, geeky, impressive, dedicated performers. Most websites may choose to go with this language or a simple approach in line with your age. Complex technical expressions will make you believe they know what they are doing for sure, a good place to invest. Well, it is another method of how to make you trust them. If you go a bit deeper, you will find no arguments their AI or algorithms are as good as they are promoted. Pay attention if the phrases tell you anything you can check, refer to, or measure. If not, this is a red flag sign to move on.

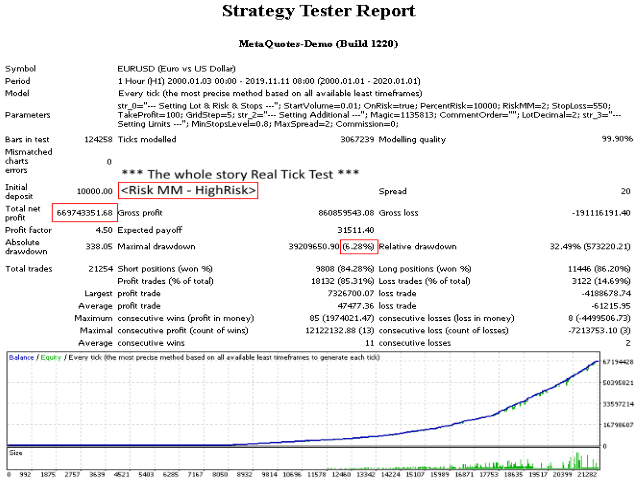

Back to the results sheet you need to check. Now, you may see some gain numbers on the page. How easy is to put some number in there? Takes you a second, is it backed up? Go on and inquire about how they attained this number by showing you their trades journal. Is this table legit and matches the data in your MT4 or other platforms? More often than not the table will be completely made up if you are even given one. After reading this it is not likely to be fooled, but know that even true results may not be completely what you want. Here is an example, the signal group could tell you they made an exaggerated figure gain, like 3000 pips per month. This could be true, or better said half true. The 3000 pip gain part is true but the other part about the 3500 pips lost is not mentioned. This is a nice example of wordplay and statistics multi presentation or interpretation.

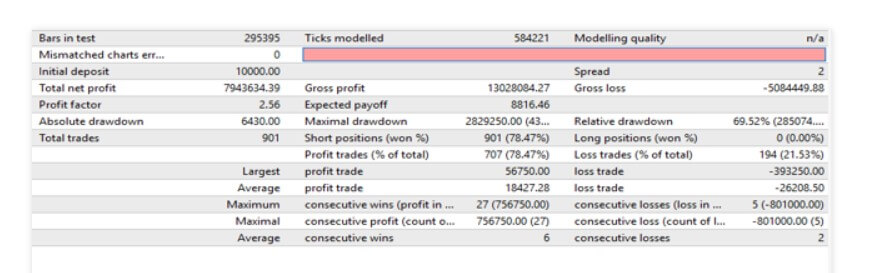

Nobody told you a lie, you just did not ask, you have assumed the losing in the equation. On top, you do not have arguments to accuse them of lying. Stating the more than 80% win rate is also a sign of this, some of the losing trades are omitted even when every trade matches. Similar is when we look at some EAs for sale, you will see extreme win ratios above 90% but you realize they are made on a very high number of short trades, and those 10% losing trades negated all the gains or worse. Inquire about the net results.

Speaking of net results, there is another interesting way to show great, truthful but deceiving performance. You may see a very high pip gain, for example, 3000 pips per month, including the losses. This is impressive, right? If you have assumed all is made on spot forex, you are deceived. Making 2000 pips on index trading is not great and an average trader can do it consistently. Some assets like Indexes, crypto, or precious metals move at extreme ranges when compared to spot forex. Therefore, pip gains from these assets carry different weights. If the result is all made from forex, know there is even more reason to be skeptical. An additional step to check is the period covered for this performance. Is it just a result of one month while all others do not even come close? Are the trades positions extremely big or only on exotic currencies?

One of the hardest to crack schemes is the dual lines approach and averaging packages. The Dual Lines method applies to many scam services, but let’s focus on results presentation. Scammers open two demo accounts or more. On one they pick a very volatile pair, probably an exotic and go long. The other account has a short position. Now all they have to do is wait, after some time they will have one loser and one winner. If they have more accounts, half will probably be very nice performers. Losing accounts are closed, winning ones are promoted to you or anyone willing to go with their signal service.

The Dual Line can even go trade by trade with their customers. They will tell you to go short and tell some other guy to go long. At the end of a few cycles, they will have one who is absolutely trusting their “service”. If they are using the channels mentioned above, they are still under the radar. Whatsmore, they can close the channel and start a new with a winning account they made in the previous venture. Nothing shady with the results right? Sports betting applies the science of averaging, bringing you various packages that perform but in reality, they are a “truthful half”. Everything is legit here, no lies. Is it ethical? Another debate.

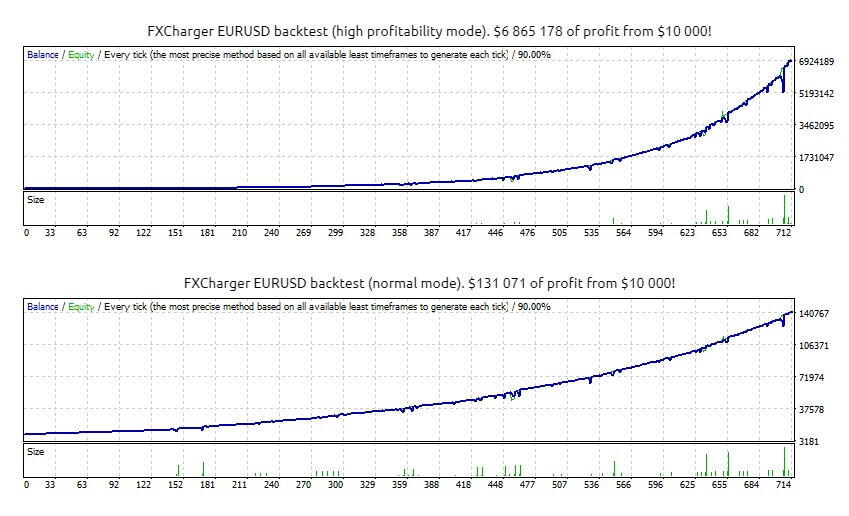

The results are outdated. Many will miss this red flag, even it is obvious. You may see EAs performance spooling gains until 2019, for example. No strong trends in the forex market and the account is shut down after a few losing streaks, but the overall performance is legit and good looking. Well, the website promoting this EA or signal service is still online, surprisingly. Guess what, they will still sell you the signal, like usual. Many do not pay attention to this and it is spreading the scam industry to the point forex becomes regarded as a scam at first thought.

After all of these flags, you may still think a signal service is worth the trouble. Here is what you need to consider, besides looking for the mentioned signs. Every signal service you have paid needs to be tried on a demo account. Assumed that the price of signing up for a service is more than coverable by the gains you will potentially have, you need to be sure the results from this forward testing matches. Since you are going to follow them for a long time, 2 months of demo testing will save you the trouble of risking real money. Note that you will need to have an optimal account size for this service to be profitable in the long run. Besides, you should consider investing only money you can afford to spend and not care about it, like the account is already gone.

Legit signal providers are rare, but it is even more rare to find the service in line with your lifestyle. The signals you are about to get could be at times you are sleeping, at work, or simply not convenient for you. Another reason to demo trade, but know that you are not a master of your account (time) and bound to signals pace.

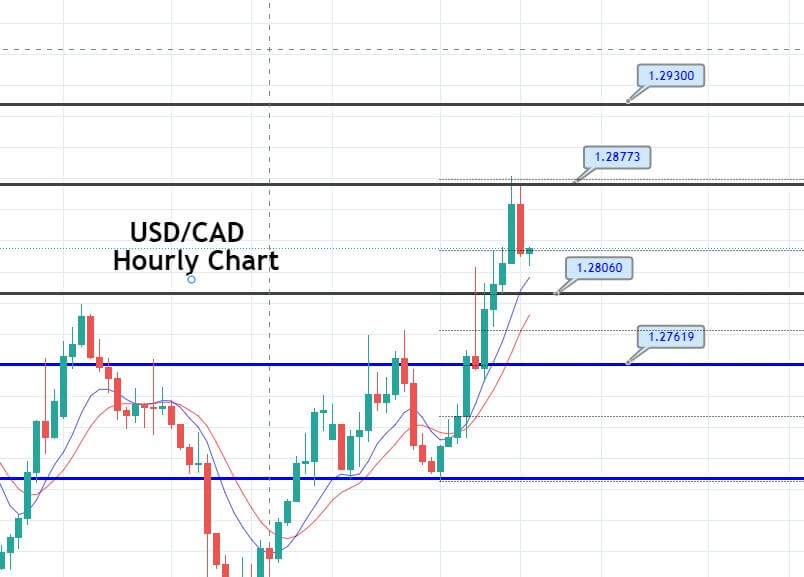

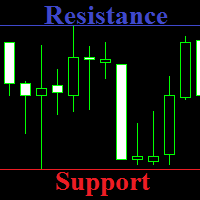

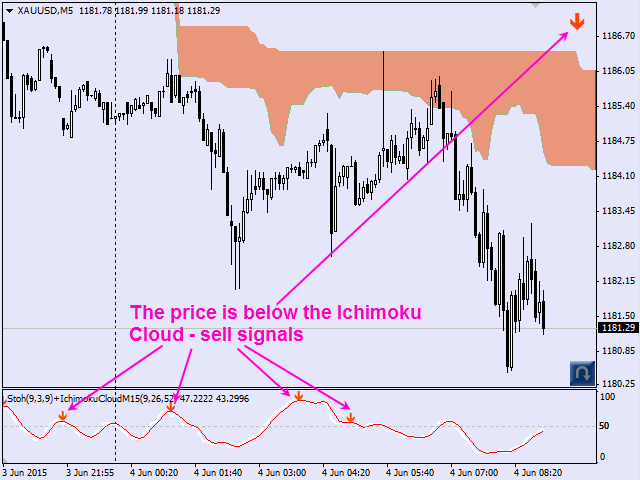

This indicator was designed to work either by itself or in combination with other indicators to provide better trading accuracy. The indicator works on the most popular trading platform MT4 and offers a special level of customization. Traders can choose support and resistance levels from Period 1 to Period infinity with any timeframe that is available. Traders can also manage the alert settings by turning the alarm on or off, or placing time limitations between alerts and setting a number of pips to be alerted at when the price is near the Support or Resistance line.

This indicator was designed to work either by itself or in combination with other indicators to provide better trading accuracy. The indicator works on the most popular trading platform MT4 and offers a special level of customization. Traders can choose support and resistance levels from Period 1 to Period infinity with any timeframe that is available. Traders can also manage the alert settings by turning the alarm on or off, or placing time limitations between alerts and setting a number of pips to be alerted at when the price is near the Support or Resistance line.

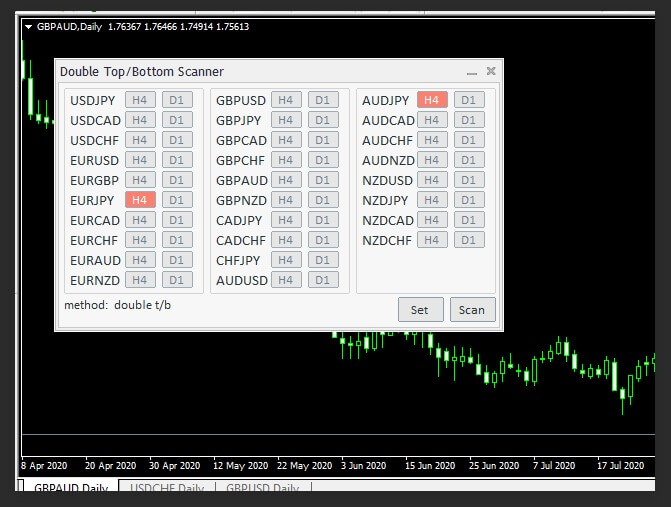

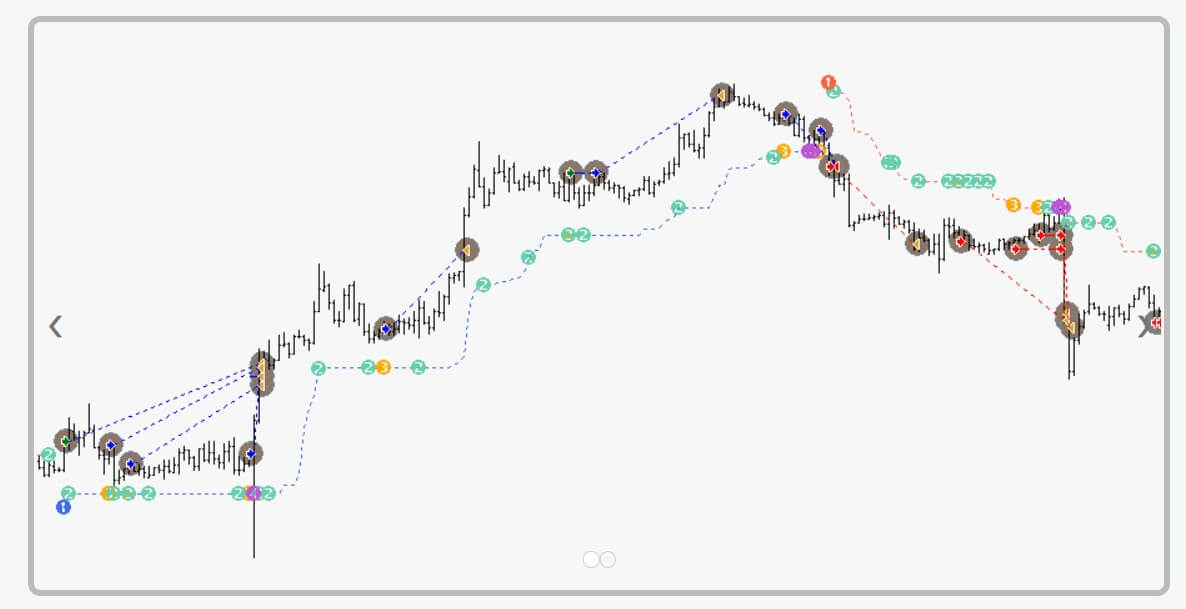

Mr Top Bottom is an indicator that was created in March 2019 by developer Mostafa Fouladi. Mr Top Bottom is a powerful no-paint indicator that draws arrows on Tops and Bottoms. It has too complicated calculations but is very simple to use. Each arrow has a specific impact value of 1 to 10. If the impact is greater it means that the signal is probably more reliable, because it is calculated on the basis of a larger oscillation.

Mr Top Bottom is an indicator that was created in March 2019 by developer Mostafa Fouladi. Mr Top Bottom is a powerful no-paint indicator that draws arrows on Tops and Bottoms. It has too complicated calculations but is very simple to use. Each arrow has a specific impact value of 1 to 10. If the impact is greater it means that the signal is probably more reliable, because it is calculated on the basis of a larger oscillation.

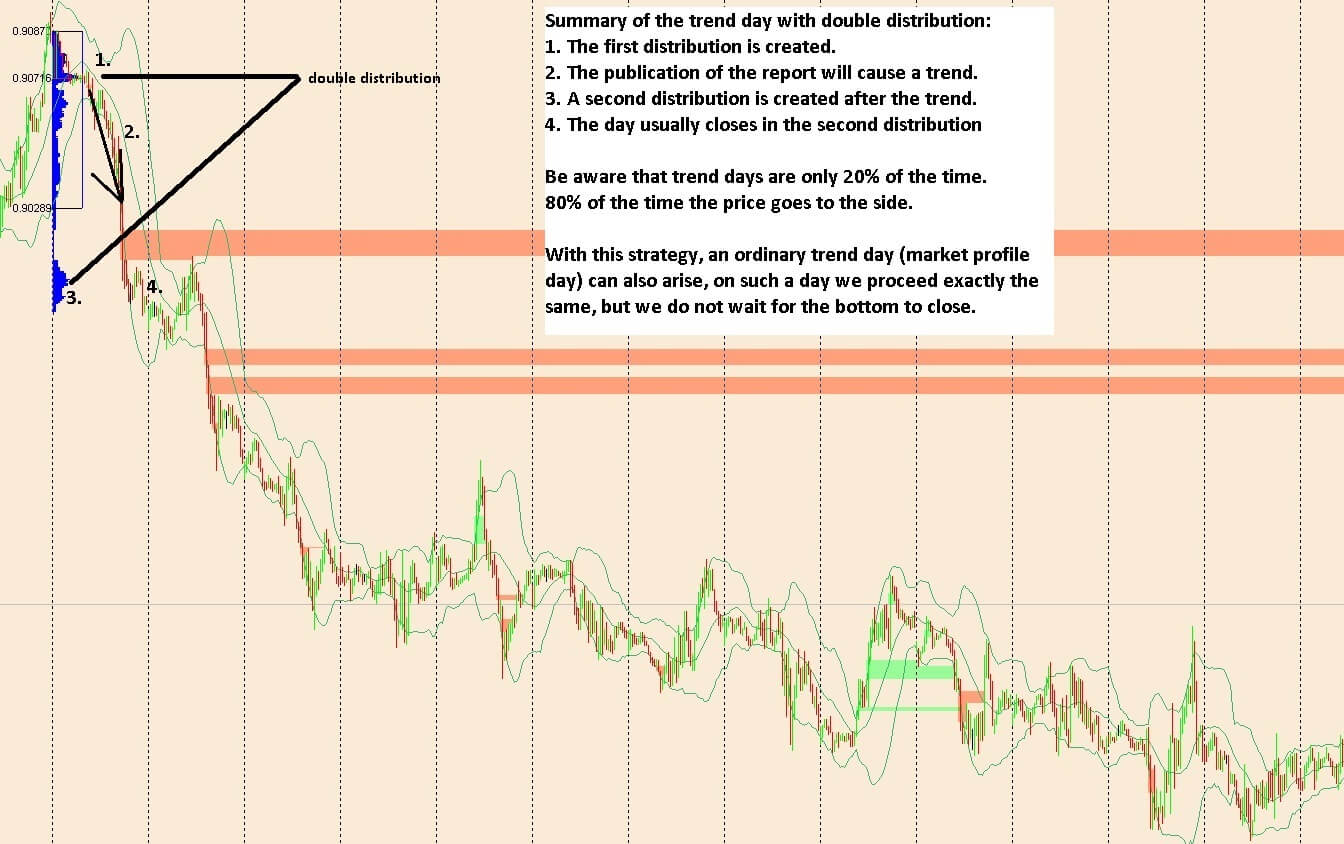

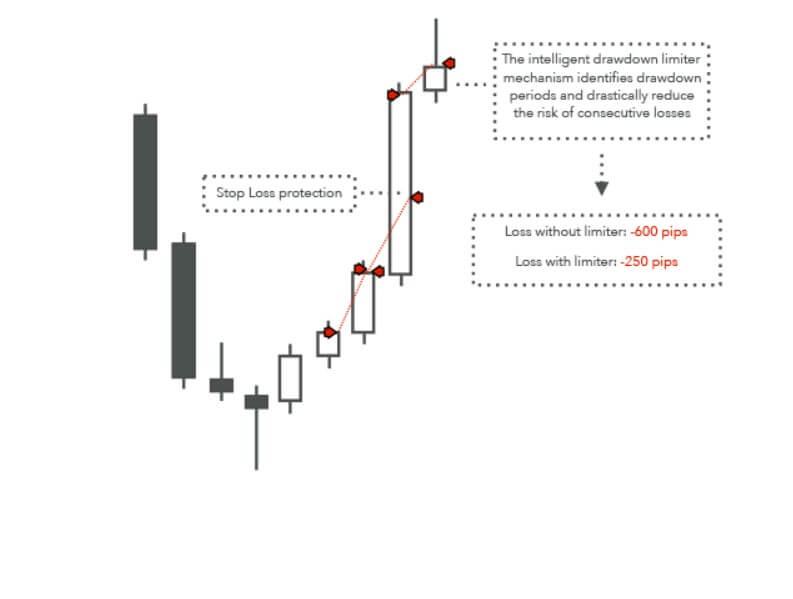

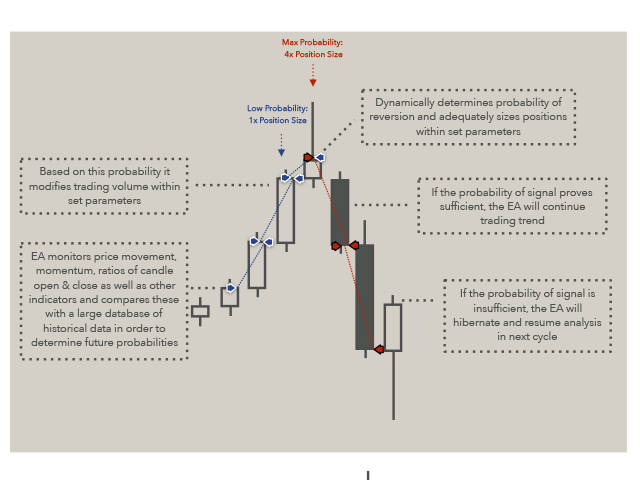

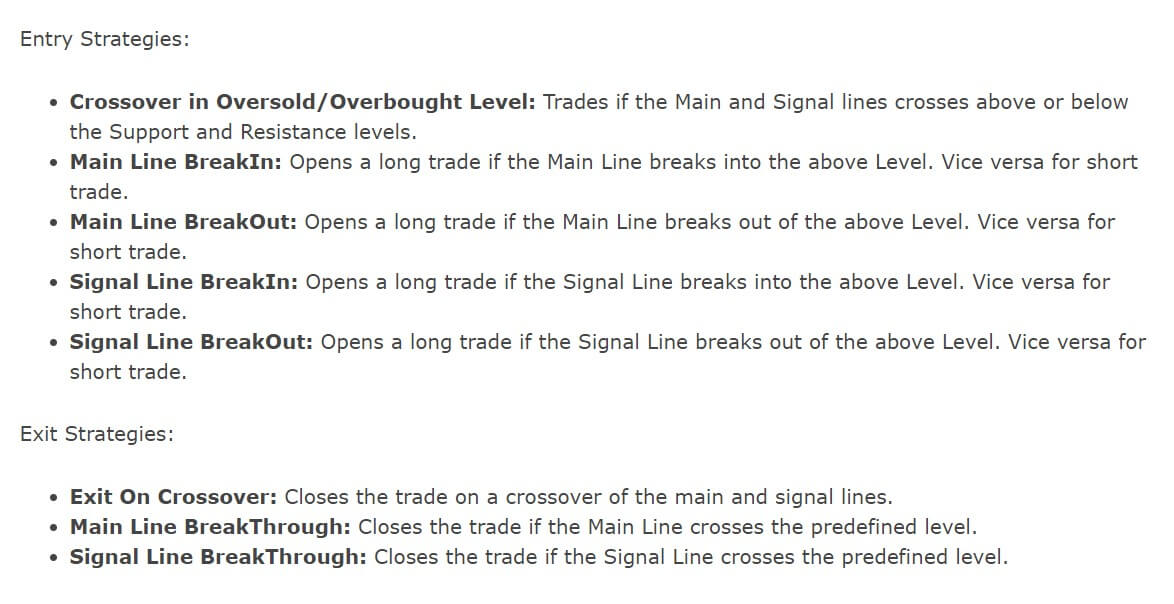

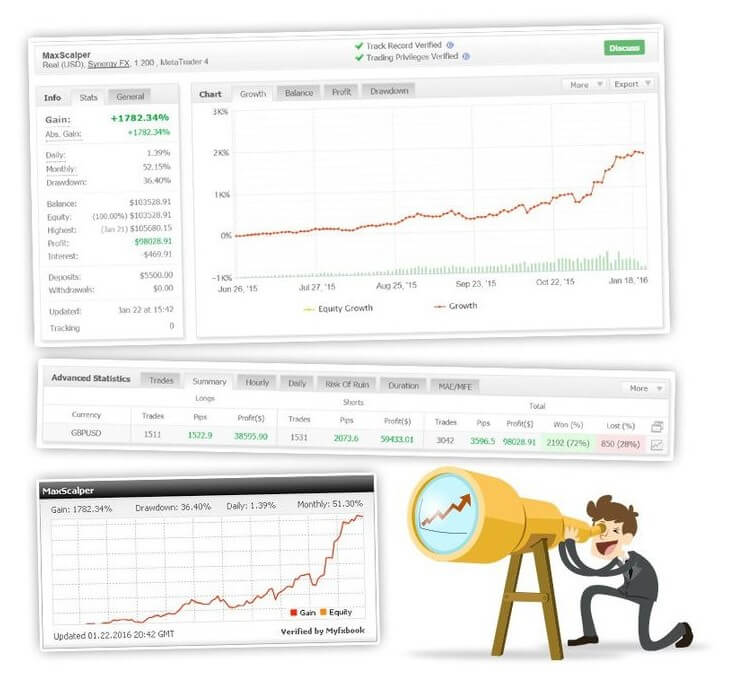

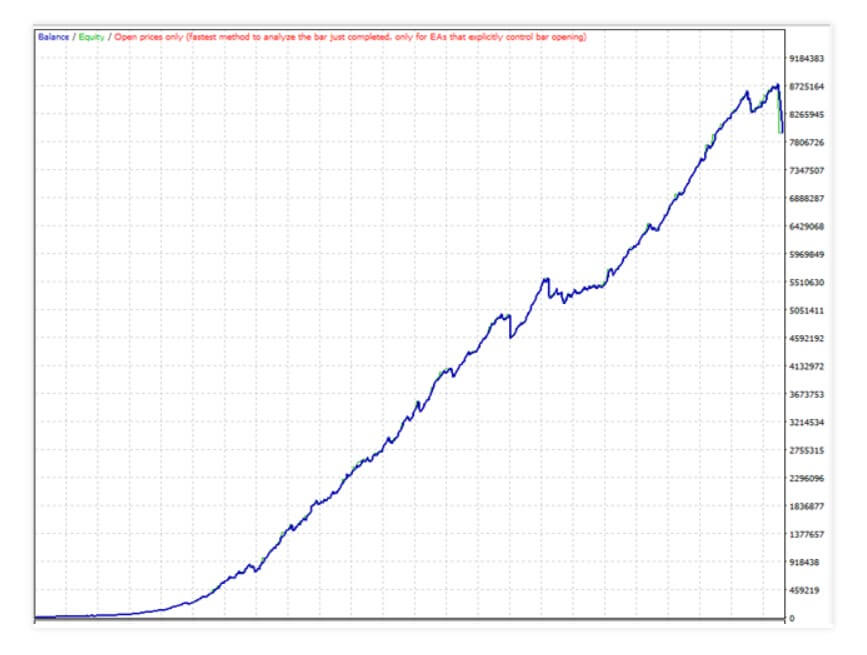

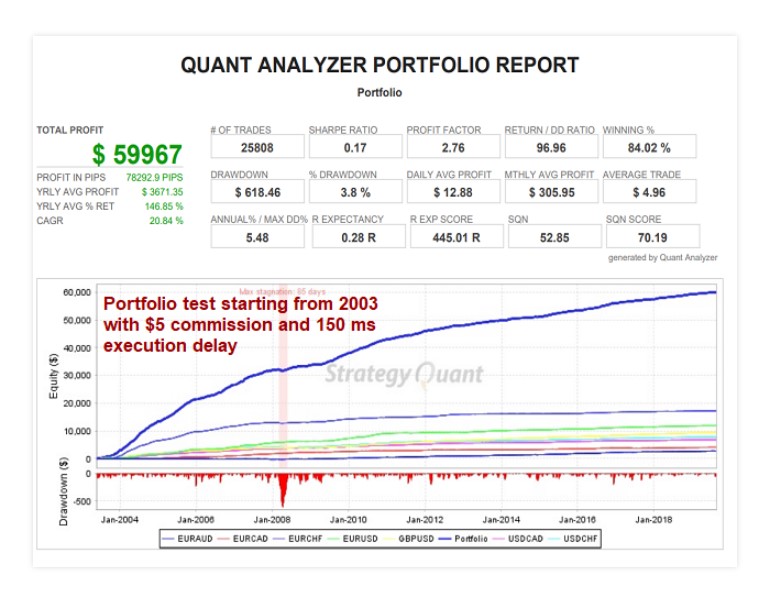

New Stable Profit is a robot that works in real accounts since August 2017. 100% of the trades in this system are based on algorithmic trading. The negotiation is based on trend correction movements, positions are opened depending on the strength of the trend and the volumes of negotiation according to a formula that the developer has not revealed.

New Stable Profit is a robot that works in real accounts since August 2017. 100% of the trades in this system are based on algorithmic trading. The negotiation is based on trend correction movements, positions are opened depending on the strength of the trend and the volumes of negotiation according to a formula that the developer has not revealed.

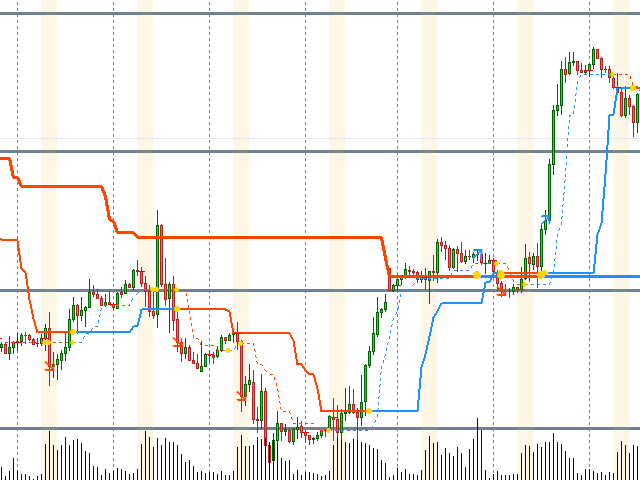

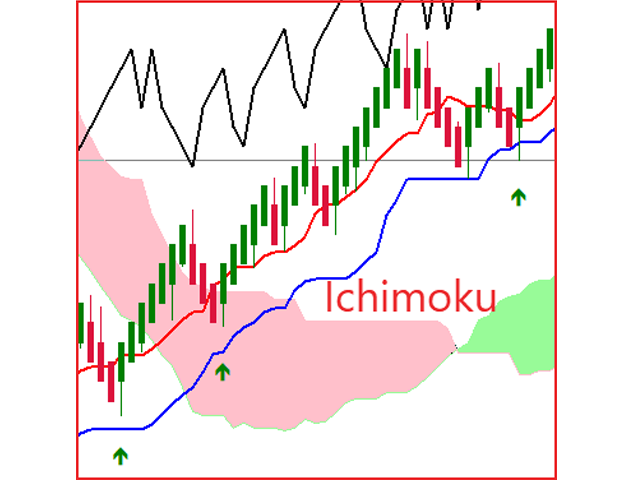

Multytrend PA is an indicator that was created in April 2019 by developer Mikhail Nazarenko. This indicator combines the principles of Price Action and a unique filtering algorithm with feedback for three moving averages. This allows you to know what are the pivot points and current trends in any time frame with a high probability of success in the trades you are pointing out. Multytrend PA is an update of the classic Trend PA indicator and can be used with the principle of the three Elder screens, but everything that is needed is shown in the same chart, which is easier for the user.

Multytrend PA is an indicator that was created in April 2019 by developer Mikhail Nazarenko. This indicator combines the principles of Price Action and a unique filtering algorithm with feedback for three moving averages. This allows you to know what are the pivot points and current trends in any time frame with a high probability of success in the trades you are pointing out. Multytrend PA is an update of the classic Trend PA indicator and can be used with the principle of the three Elder screens, but everything that is needed is shown in the same chart, which is easier for the user.

PZ Wedges is an indicator created in September 2017 by Arturo López Pérez. Arturo López Pérez is a private investor and speculator, software engineer, and founder of Point Zero Trading Solutions.

PZ Wedges is an indicator created in September 2017 by Arturo López Pérez. Arturo López Pérez is a private investor and speculator, software engineer, and founder of Point Zero Trading Solutions.

Stable Ex EA is a Forex trading robot that was created in March 2020 by German developer Vitalii Zakharuk. Vitalii Zakharuk is a prolific creator of automated trading tools and has many of them available on the MQL market.

Stable Ex EA is a Forex trading robot that was created in March 2020 by German developer Vitalii Zakharuk. Vitalii Zakharuk is a prolific creator of automated trading tools and has many of them available on the MQL market.

Although it doesn’t hurt to have good trading results, today’s firms will not even ask for it, since many people can produce fake good resumes, you just have to be a good trader. But, if you do have the experience, all that learning and testing won’t go to waste, as firms today tend to release you into the wild, they will test you through their platform and trading. If you produce good results under pressure they will hire you for a long time. Everyone’s experience is different. These lines are just recommendations, showing you options, providing you with more chances for success.

Although it doesn’t hurt to have good trading results, today’s firms will not even ask for it, since many people can produce fake good resumes, you just have to be a good trader. But, if you do have the experience, all that learning and testing won’t go to waste, as firms today tend to release you into the wild, they will test you through their platform and trading. If you produce good results under pressure they will hire you for a long time. Everyone’s experience is different. These lines are just recommendations, showing you options, providing you with more chances for success.

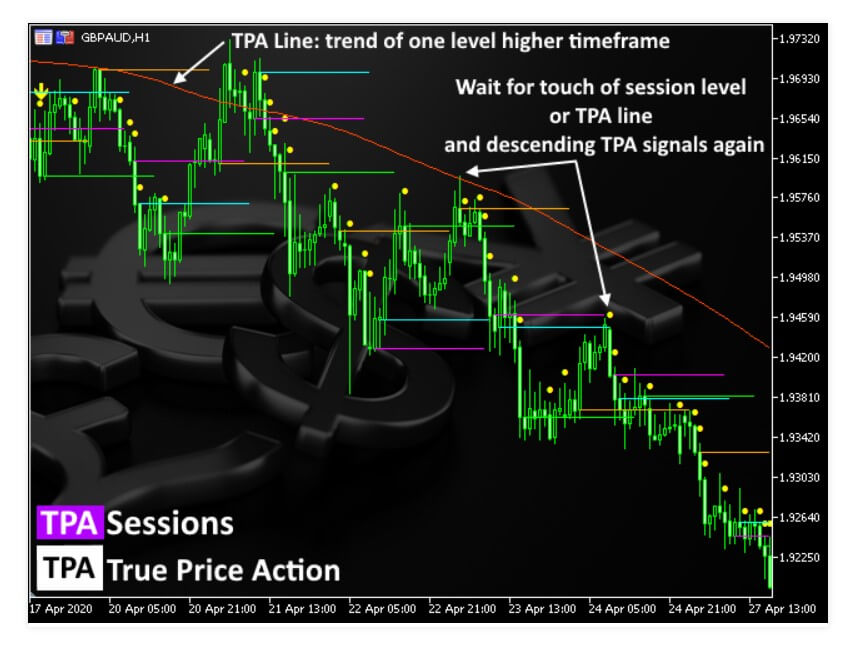

This indicator coded for the MetaTrader 4 and 5 platform belongs to the paid category and has a specific way of giving signals and trading use. The first version is published on the 3rd of July 2019, it is not a very old indicator but has received some attention. The developer is Janusz Trojca from Poland now under the team name of InvestSoft. This team has a total of 10 products with good ratings, some of them complement the TPA indicator for a complete trading system. As the name describes the indicator is based on the

This indicator coded for the MetaTrader 4 and 5 platform belongs to the paid category and has a specific way of giving signals and trading use. The first version is published on the 3rd of July 2019, it is not a very old indicator but has received some attention. The developer is Janusz Trojca from Poland now under the team name of InvestSoft. This team has a total of 10 products with good ratings, some of them complement the TPA indicator for a complete trading system. As the name describes the indicator is based on the

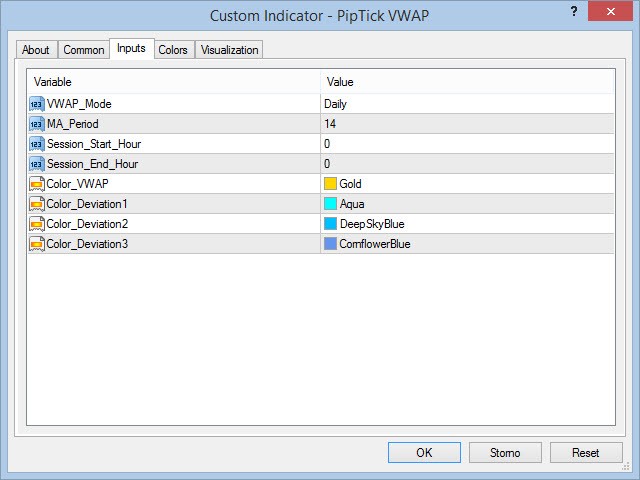

PipTick VWAP for the MT4 platform is a special form of the Volume-Weighted Average Price indicator. One of the most used Moving Averages apart from the EMA or Exponential Moving Average is VWAP for its adaptability to recent market changes. Michael Jurnik from the Czech Republic is the developer of this tool, partner at PipTick. They have published 59 products, many of them not having much popularity or ratings.

PipTick VWAP for the MT4 platform is a special form of the Volume-Weighted Average Price indicator. One of the most used Moving Averages apart from the EMA or Exponential Moving Average is VWAP for its adaptability to recent market changes. Michael Jurnik from the Czech Republic is the developer of this tool, partner at PipTick. They have published 59 products, many of them not having much popularity or ratings.

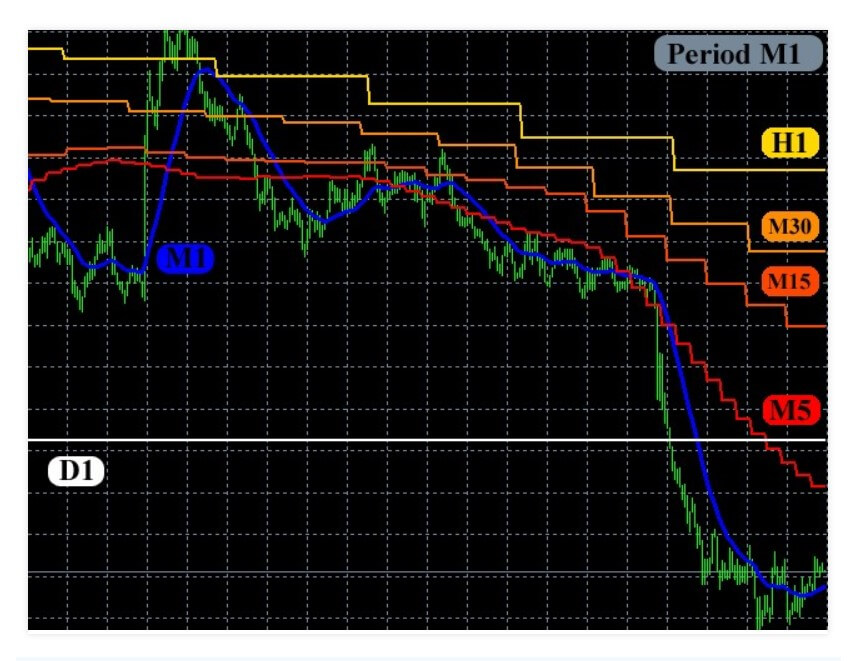

MA Multi stands for Moving Average Multi Timeframe indicator that is useful in many ways and for many strategies. The developer of this indicator is Dmitriy Susloparov from Russia having 16 products offered on the MQL5 marketplace. None of them have received much attention and only MA Multi and one more indicator have ratings. Most of the indicators published are similar, they are basic indicators made multi-timeframe on a single chart. MA Multi also exists for the MetaTrader 5 platform. The first appearance on the

MA Multi stands for Moving Average Multi Timeframe indicator that is useful in many ways and for many strategies. The developer of this indicator is Dmitriy Susloparov from Russia having 16 products offered on the MQL5 marketplace. None of them have received much attention and only MA Multi and one more indicator have ratings. Most of the indicators published are similar, they are basic indicators made multi-timeframe on a single chart. MA Multi also exists for the MetaTrader 5 platform. The first appearance on the

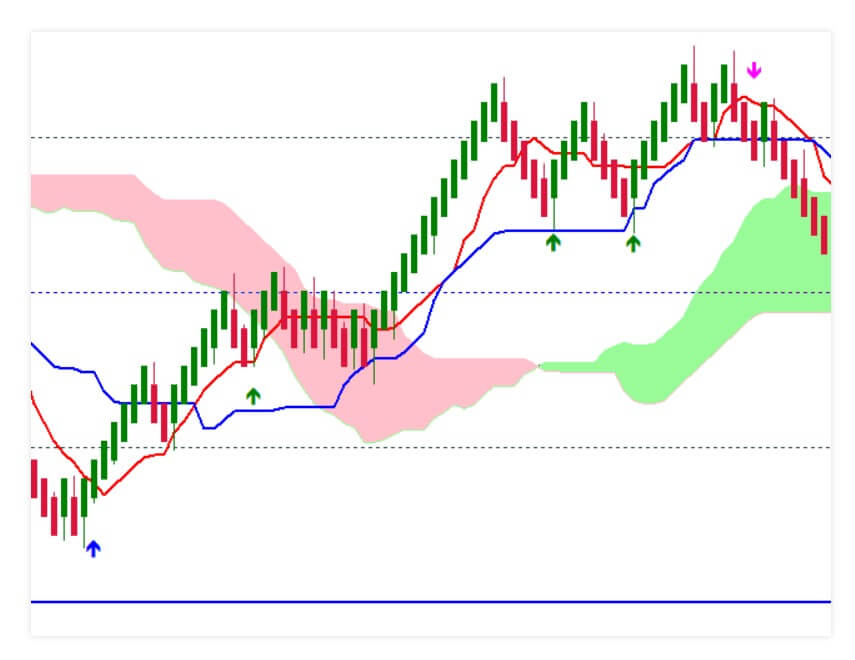

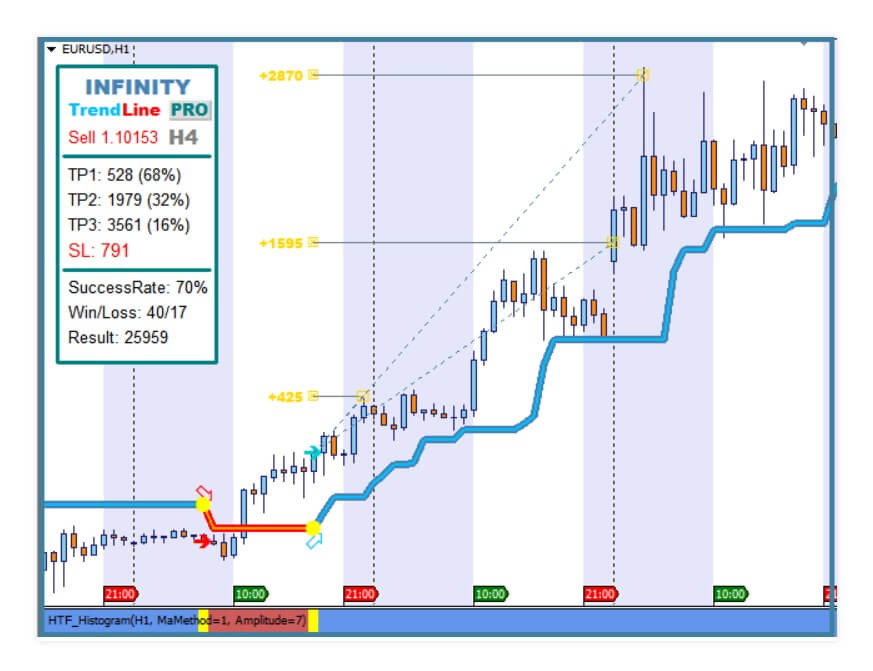

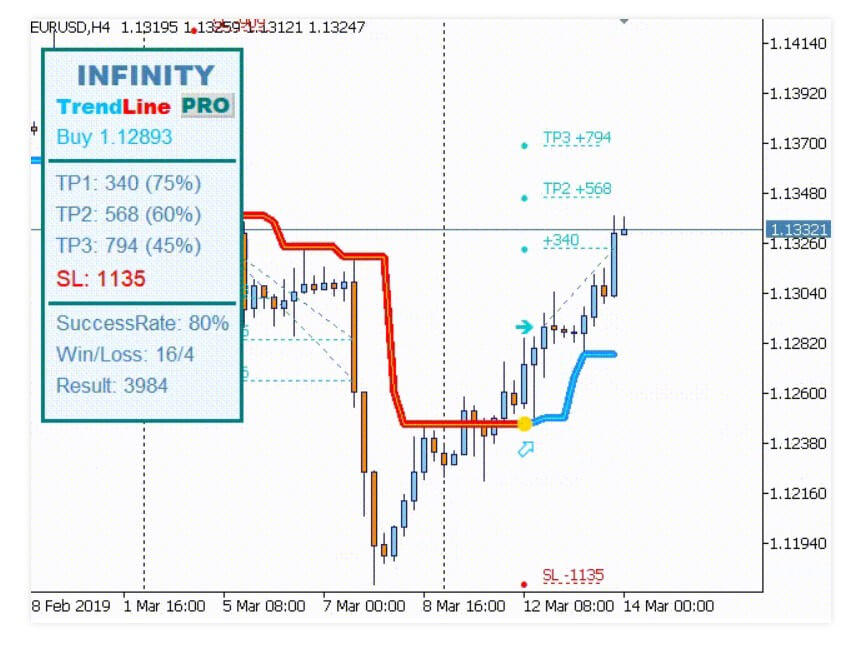

Infinity Trendline is a trend following indicator with integrated solutions for Taking Profit and Stop Loss management. It is developed for the MetaTrader 4 and 5. It was a top free indicator once it showed up in November 2018 on the MQL5 market and since it has received many updates. New things are mostly about adding features and updating the code, enriching the indicator with new goodies. The latest update sets the version to 52.0 and is updated recently, in March 2020. Evgenii Aksenov is the author of this popular indicator/ trading system consisting of few indicators. Main takeaways are the easy-to-use trading signal system, good support, and the fact this is a free indicator that is usable even though the PRO version has more features.

Infinity Trendline is a trend following indicator with integrated solutions for Taking Profit and Stop Loss management. It is developed for the MetaTrader 4 and 5. It was a top free indicator once it showed up in November 2018 on the MQL5 market and since it has received many updates. New things are mostly about adding features and updating the code, enriching the indicator with new goodies. The latest update sets the version to 52.0 and is updated recently, in March 2020. Evgenii Aksenov is the author of this popular indicator/ trading system consisting of few indicators. Main takeaways are the easy-to-use trading signal system, good support, and the fact this is a free indicator that is usable even though the PRO version has more features.

This is a MetaTrader 4 Expert Advisor that uses the popular “hamster” name commonly attributed to scapers working during night sessions or in very low volatility periods. The latest version is Version 9.0 updated on 9th June 2019, the first version was published in late 2017. Also, there is the MT5 version. Since then the EA received a few upgrades including the ATR filtering. The Author is a Russian named Ramil Minniakhmetov, he is the developer of 22 other products and 2 signals such as Rebate Robot, Brazil System, EA Black Star, or “TheFirst” signal service. Most of his work has above 4-star reviews on the

This is a MetaTrader 4 Expert Advisor that uses the popular “hamster” name commonly attributed to scapers working during night sessions or in very low volatility periods. The latest version is Version 9.0 updated on 9th June 2019, the first version was published in late 2017. Also, there is the MT5 version. Since then the EA received a few upgrades including the ATR filtering. The Author is a Russian named Ramil Minniakhmetov, he is the developer of 22 other products and 2 signals such as Rebate Robot, Brazil System, EA Black Star, or “TheFirst” signal service. Most of his work has above 4-star reviews on the

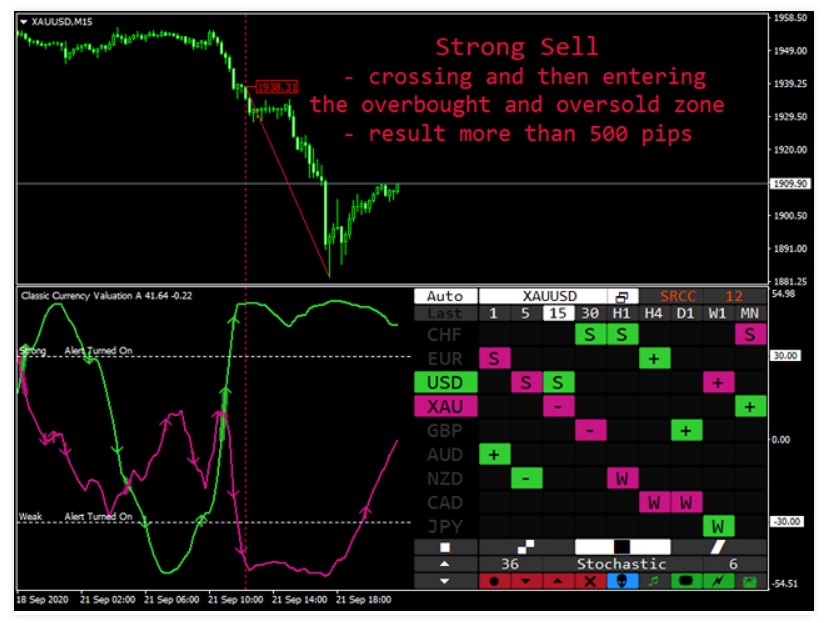

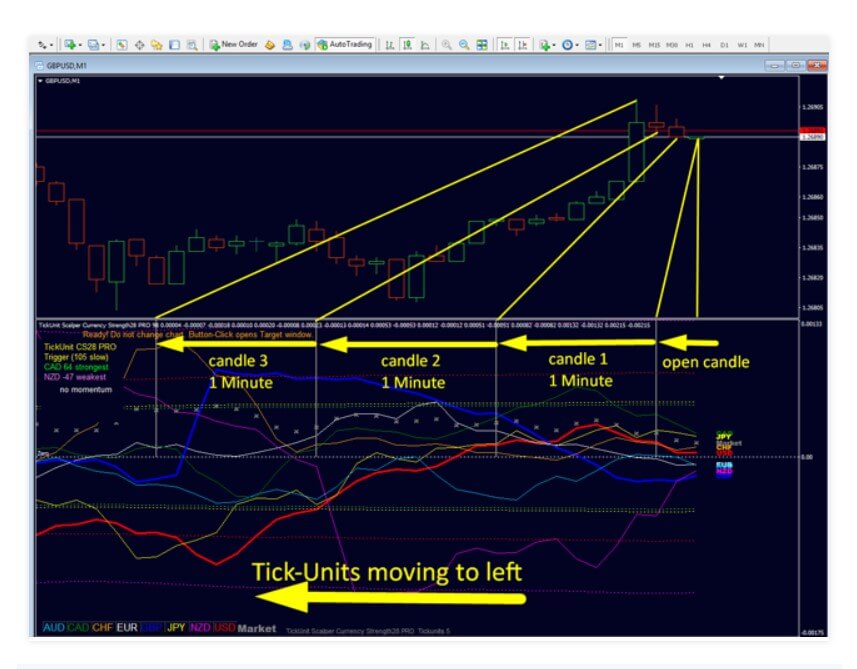

TickUnit Scalper Currency Strength28 PRO is a new indicator type on the scene popular with the scalper trading strategies. It is designed for the MetaTrader 4 and published on 5th July 2019. Since then it has received frequent updates with very good additions such as to save tick data for faster recovery. The developer of this combo indicator is Bernhard Schweigert from Morroco and he has 12 products offered on the MQL5 repository, most of them are popular and have very high ratings from the users. He made a currency correlation/strength indicator using Tick-Units data on 28 currency pairs, or all of the major currency combinations. It belongs to the paid category and could be regarded as a complete trading system.

TickUnit Scalper Currency Strength28 PRO is a new indicator type on the scene popular with the scalper trading strategies. It is designed for the MetaTrader 4 and published on 5th July 2019. Since then it has received frequent updates with very good additions such as to save tick data for faster recovery. The developer of this combo indicator is Bernhard Schweigert from Morroco and he has 12 products offered on the MQL5 repository, most of them are popular and have very high ratings from the users. He made a currency correlation/strength indicator using Tick-Units data on 28 currency pairs, or all of the major currency combinations. It belongs to the paid category and could be regarded as a complete trading system.

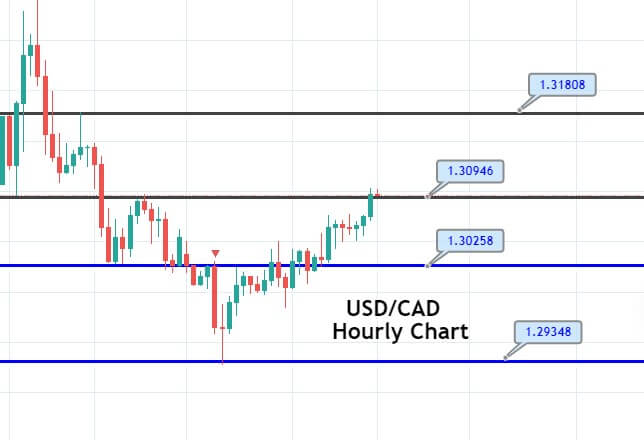

Scalp Tools Support and Resistance Levels is designed to do one thing, to identify the Support and Resistance levels. Usually, indicators that are specialized to do one thing are the ones that do this very well. Most successful trading systems are composed of a few specialized indicators for every aspect of the system. Even though the indicator name has the Scalp word, it is not limited just for scalper systems, most Price Action systems will rely on the Support and Resistance levels. This word is probably included in the name of the indicator for SEO purposes.

Scalp Tools Support and Resistance Levels is designed to do one thing, to identify the Support and Resistance levels. Usually, indicators that are specialized to do one thing are the ones that do this very well. Most successful trading systems are composed of a few specialized indicators for every aspect of the system. Even though the indicator name has the Scalp word, it is not limited just for scalper systems, most Price Action systems will rely on the Support and Resistance levels. This word is probably included in the name of the indicator for SEO purposes.

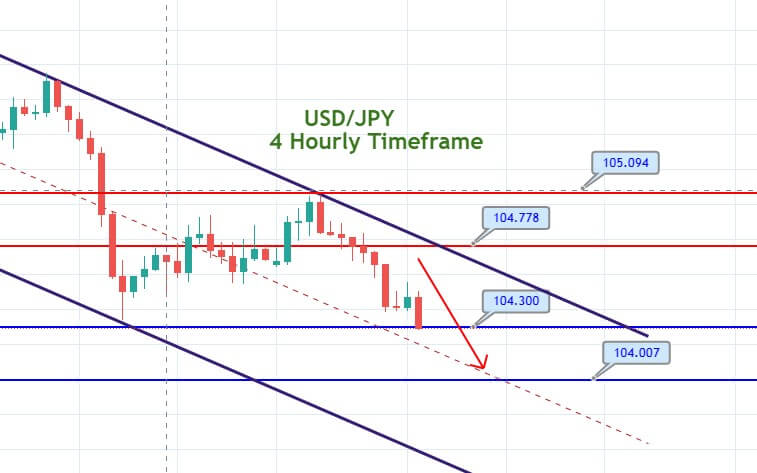

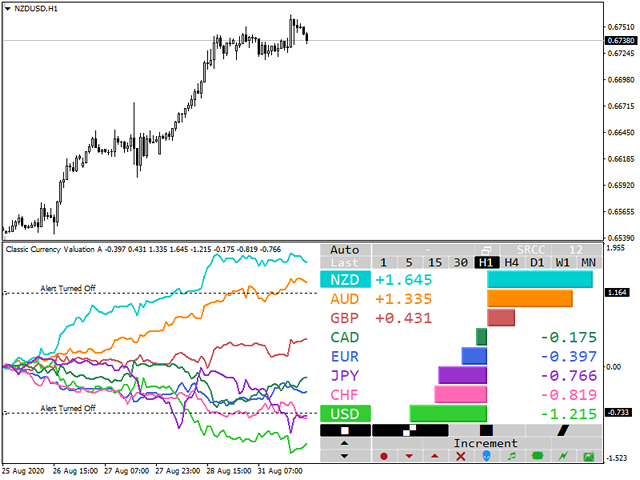

Currency Strength Matrix is a paid indicator published on the MQL5 marketplace designed for the MetaTrader 4 platform. It belongs to the trend confirmation category although it is used in conjunction with other indicators. It tries to differentiate by offering better information for Price Action, Reversal, and Momentum trading strategies, according to the developer’s words. The initial version was published on 5th July 2017 by Raymond Gilmour from the United Kingdom, author of just one more indicator called Cycle Finder Pro.

Currency Strength Matrix is a paid indicator published on the MQL5 marketplace designed for the MetaTrader 4 platform. It belongs to the trend confirmation category although it is used in conjunction with other indicators. It tries to differentiate by offering better information for Price Action, Reversal, and Momentum trading strategies, according to the developer’s words. The initial version was published on 5th July 2017 by Raymond Gilmour from the United Kingdom, author of just one more indicator called Cycle Finder Pro.

The latest version is 2.4 updated recently, on the 10th of March 2020 during the latest COVID-19 world market event. The base code and idea of this EA are not new from the author, the previous product called NY Close Scalper is using the same principles except Density Scalper is optimized for better slippage management. Therefore the release date does not mean the EA does not have enough forward testing done.

The latest version is 2.4 updated recently, on the 10th of March 2020 during the latest COVID-19 world market event. The base code and idea of this EA are not new from the author, the previous product called NY Close Scalper is using the same principles except Density Scalper is optimized for better slippage management. Therefore the release date does not mean the EA does not have enough forward testing done.