Introduction

Industrial production contributes to over 62% of the jobs in the goods production industry. Therefore, any changes in this sector’s production activity bring forth ripple effects into the overall economy. Owing to the significant role that industrial production plays in the economy, the investment goods bought for use in the industrial sector offer invaluable insights into the changes in the sector. Thus, durable goods orders as an economic indicator can be used to signal economic growth and businesses’ and consumers’ sentiment.

Understanding Durable Goods Orders

Durable goods are expensive and long-lasting items that have a lifespan of at least three years. These goods do not depreciate quickly. They include; heavy-duty machinery used for industrial purposes, computers and telecommunication equipment, raw steel, and transport equipment.

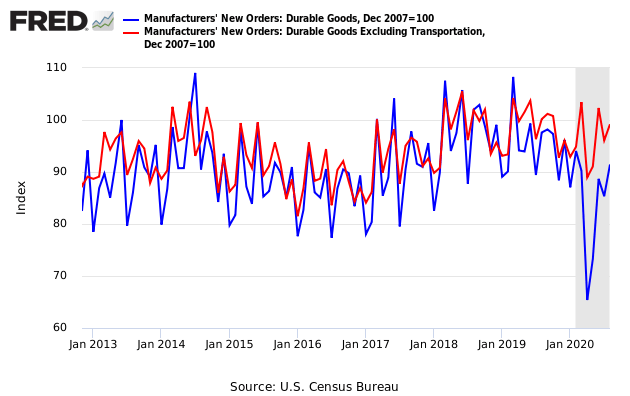

Core durable goods are the totality of durable goods, excluding data from transportation and military orders. The transportation equipment is excluded to ensure smoothening out the effects it would have on the durable goods data as a result of one-time large orders of new vehicles.

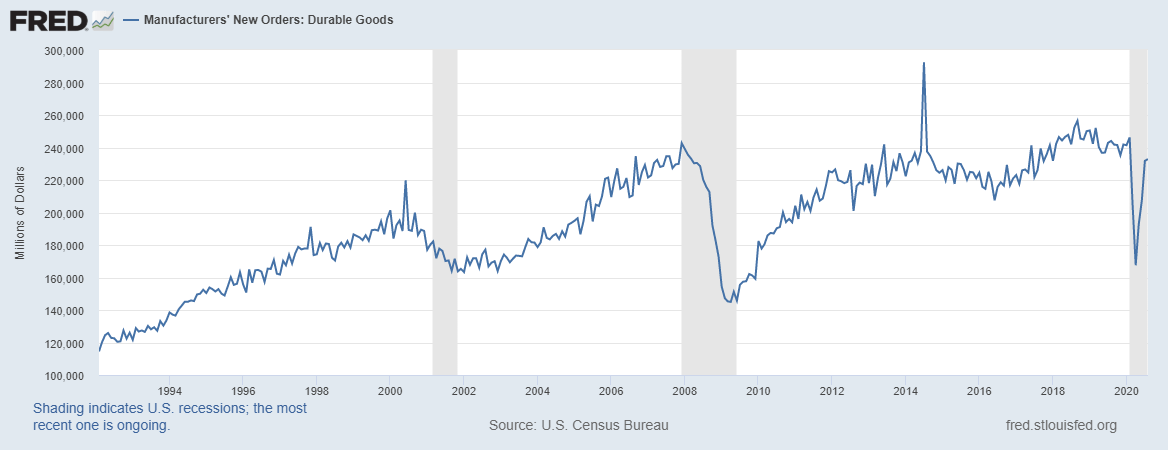

Durable goods orders data is, therefore, a monthly survey that tracks the purchase of durable goods. This data is used to assess the prevailing trend in industrial activity.

How to use Durable Goods Orders in Analysis

Since durable goods are expensive and long-lasting, their purchase is made on an occasional basis. For analysis reasons, the durable goods orders are treated as capital expenditure. The durable goods orders are used to signal near-term and future economic prospects. Let’s see what this data tells us about the economy.

Firstly, durable goods are heavy-duty machinery whose assembly and manufacture takes a long time. Therefore, the duration from when the assembly line of these goods begins to the time they are delivered to the buyers shows a period of sustained economic activity.

Capital expenditure in the industrial sector has a multiplier effect. The data on durable goods orders implicitly shows the level of activity in the industries along the supply chain of making and delivering these goods. Higher durable goods orders imply higher commercial activities in the relevant industries, while lower durable goods orders show reduced activities. So, what does this data tell us about the economy? Let’s take the example of increasing durable goods orders.

Higher durable goods orders imply that more jobs are created in the assembly lines, manufacturing, and mining. The resultant increase in employment levels leads to improved living standards and an increase in aggregate demand for consumer products in the economy. The increased aggregate demand for discretionary consumer products will force producers in these sectors to scale up their production, leading to more job creation and economic growth. Thus, the increase in durable goods orders can have both a direct and indirect impact on economic growth and the growth of other consumer industries.

Durable goods are used to further the process of production or service delivery. Therefore, the data on durable goods orders can gauge the sentiment of businesses and consumers. It is fair to say that businesses and consumers purchase durable goods when they are convinced that the economy is on an uptrend. Durable goods orders can thus be used as a testament to improving economic conditions and living standards. It follows the logic that businesses would not be scaling their productions or engaging in capital expenditure if they did not firmly believe that the economy is growing and a future increase in their products’ demand.

Due to their expensive nature, the purchase of durable goods heavily relies on credit financing. Thus, an increase in durable goods orders can be used to show that lending conditions are favorable. This willingness of lenders can be taken as a sign of improved liquidity in the banking sector, which in itself shows that the economy is performing well.

When capital expenditures are made, it is to replace the existing technology with a better one. Therefore, an increase in durable goods orders can be seen as businesses upgrading their current production means. Consequently, improved technology leads to efficiency in the production process and service delivery. This efficiency not only applies to improved quality and quantity of output but also in the allocation of factors of production.

Impact on Currency

In the forex market, the central banks’ perceived monetary policy is the primary mover of exchange rates. Forex traders pay close attention to economic indicators to gauge the health of the economy and speculate on the central banks’ policy decisions. Here’s how the durable goods orders can be used to this end.

Higher durable goods orders are associated with higher employment levels, increased wage growth, and steady growth in the aggregate demand and supply in the economy. When this trend is sustained for an extended period, governments and central banks may have to step in with contractionary monetary and fiscal policies to avoid an overly high inflation rate and an overheating economy. Therefore, sustained growth in the durable goods orders can be seen as a precursor to higher interest rates, which leads to the appreciation of the currency.

Conversely, a continuous decline in durable goods orders is an indication that businesses and consumers have a negative sentiment about the future. This sentiment could result from higher levels of unemployment, dropping levels of aggregate demand, or a stagnating economy. To spur economic growth, expansionary fiscal or monetary policies will be adopted. One such policy is lowering interest rates to encourage borrowing by making the cost of money cheap. Thus, a continuous drop in the durable goods orders can be seen to forestall a drop in the interest rates, which depreciates the currency relative to others.

Source of Information related to Durable Goods Orders

The US Census Bureau collates and publishes the data on the US durable goods orders. An in-depth and historical review of the US’s durable goods orders is found at St. Louis FRED. Trading Economics publishes global data on durable goods orders.

We hope you got an understanding of what this Fundamental Indicator is all about. Please let us know if you have any questions in the comments below. Cheers!