AXI Trader is an FX, index, and commodities broker. The company is regulated by the Australian Securities & Investments Committee (ASIC), while the UK based location is regulated by the Financial Conduct Authority (FCA). It didn’t take much digging to find out that the company has received several awards since its launch in 2007, including #1 Customer Service in 2013 and Best MT4 Broker and Most-Trusted Forex Broker in 2018, among many others. A regulated broker that has received as much attention is certainly worth reading about, but what is it about them that has really been attracting the masses? Stay with us to find the answers.

Account Types

All trading accounts share similar features, with a few key differences, aimed at different traders with different strategies. Those differences really just boil down to the choice between higher spreads with lack of commission fees, or lower spreads with some commissions charged.

All trading accounts share similar features, with a few key differences, aimed at different traders with different strategies. Those differences really just boil down to the choice between higher spreads with lack of commission fees, or lower spreads with some commissions charged.

There is no need to compare minimum deposit requirements, leverage options, trade sizes, or even product offers since both accounts share all of those. This makes the decision much easier, so long as the trader understands which account’s costs would be more of a benefit to their trading style. Traders can also begin with a Standard account and upgrade to a Pro account later if they wish to do so. Below, we have outlined some of the most important details for each account type.

Standard Account

Minimum Deposit: None

Leverage: Up to 400:1

Spreads: From 1 pip

Commissions: None

Pro Account

Minimum Deposit: None

Leverage: Up to 400:1

Spreads: From 0.0 pips

Commissions: $7 Round Trip (USD)

It only takes a few minutes to fill out an application but identity and address documents are required for verification. If the company can verify your identity electronically, an account will be approved instantly, while it can take 24 hours when an individual is required to submit additional documents. This broker also supports joint accounts and swap-free Islamic accounts, both of which can be requested upon sign-up.

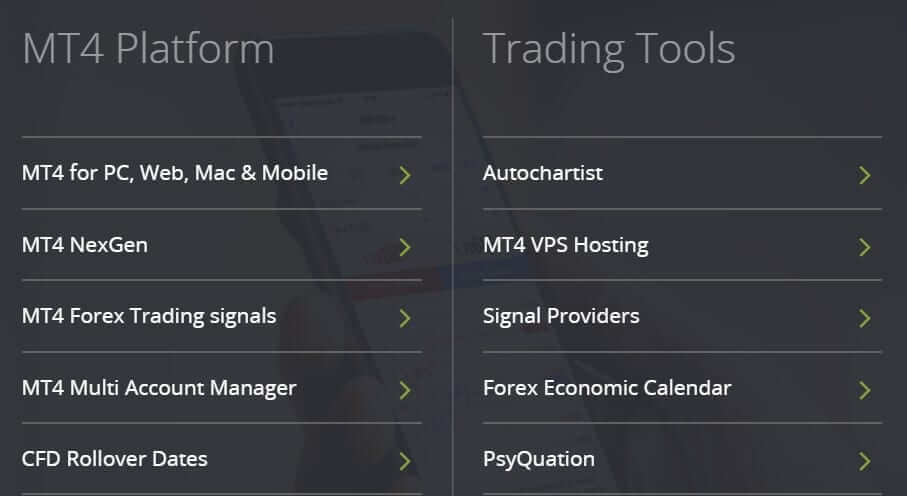

Platform

This broker features the award-winning MetaTrader 4 platform, along with several other useful tools that accompany the program. Allow us to mention a few of the program’s features, just in case you’re one of the few that haven’t heard of MT4. The program fully supports 1-click trading, a customizable dashboard that features drag and drop chart and analysis tools, full market coverage, automated trading and compatibility with Expert Advisors, and a range of third-party extensions.

The company is also offering MT4 NextGen, which features an economic calendar, more post-trade features, a mini manager, session map, and more. MT4 Multi Account Manager allows users to operate as many trading accounts as they wish. MT4 is widely accessible and available for download on PC and MAC, or through the App Store or Google Play for mobile, tablets, or other supported devices. The program can also be accessed on the WebTrader, which is simply a browser-based version of the platform.

Leverage

Regardless of which account is chosen, traders will have access to leverages as high as 1:400 with this broker. This means that one would be able to trade with up to 400 times the amount of funds in their account. Of course, this high-stake, high-reward experience could really pay off, but it could also cause one to lose significant amounts quickly. We’re always happy to see brokers offering high options to their traders, although we feel obligated to point out how dangerous using such high leverages can be to those that may be inexperienced. On the bright side, beginners can start with a lower option and work their way up over time, while professionals should be more than happy with these options.

Trade Sizes

Both account types allow for the trading of micro-lots. Maximum trade sizes vary based on the exact product that is being traded. For example, some currency pairs, like the EURHUF, have a maximum trade size of 20 lots. Other products, like the AUDUSD, have a maximum trade size of 100 lots. You’ll find that some products have a maximum trade size of fewer than 10 lots, while oils go as high as 400 lots. All of these details can be viewed on the company’s Product Schedule page.

Trading Costs

For Standard accounts, transaction fees are incorporated into spreads and commissions are not charged. On Pro accounts, commissions are based on a number of standard contracts bought or sold in each transaction. The amount is typically equal to $7 round trip in USD. The swap fee is an adjustment reflecting the relative difference in interest rates or yield on the underlying instruments. Usually, the broker charges on long positions and pays swap benefits on short positions. However, in certain market conditions, the broker may require a client to pay a charge when they would have received a benefit. Swap-free accounts are liable for an administration fee if positions are kept open for seven days or more.

Assets

This broker offers 80 different currency pairs, including all major currencies like USD, EUR, GBP, JPY, in addition to minors. In addition, commodities, precious metals, equity indices, and one cryptocurrency, Bitcoin, are available. Precious metal options include Gold and Silver. In order to view more information on the company’s products, you can use the drop-down list under ‘Our Products’ at the top of the webpage.

Spreads

Spreads

Spreads are floating and start from 1 pip on Standard accounts, while spreads start from 0.0 pips on Pro accounts. At first glance, Pro accounts do seem to have the advantage here, but one must keep in mind that these accounts charge commissions, while the Standard accounts do not. Either way, both accounts are offering better than average starting spreads. Really, it comes down to one’s personal strategy when deciding which account would be more beneficial. Under ‘Our Advantage’, the company provides a link to view their live spreads on both account types, so this would be something to take a look at.

Minimum Deposit

This broker’s lack of deposit requirement offers a real advantage to those that may be wary of depositing, or who may not have a lot of funds to start with. Professionals may even like to test out the broker’s deposit methods and withdrawal times, to make sure that everything is up to standards before making a significant deposit. You’ll occasionally find others that allow accounts to be opened with no minimum, although many require at least $100 minimum. Fortunately, there is no need to save up to afford an account with this broker.

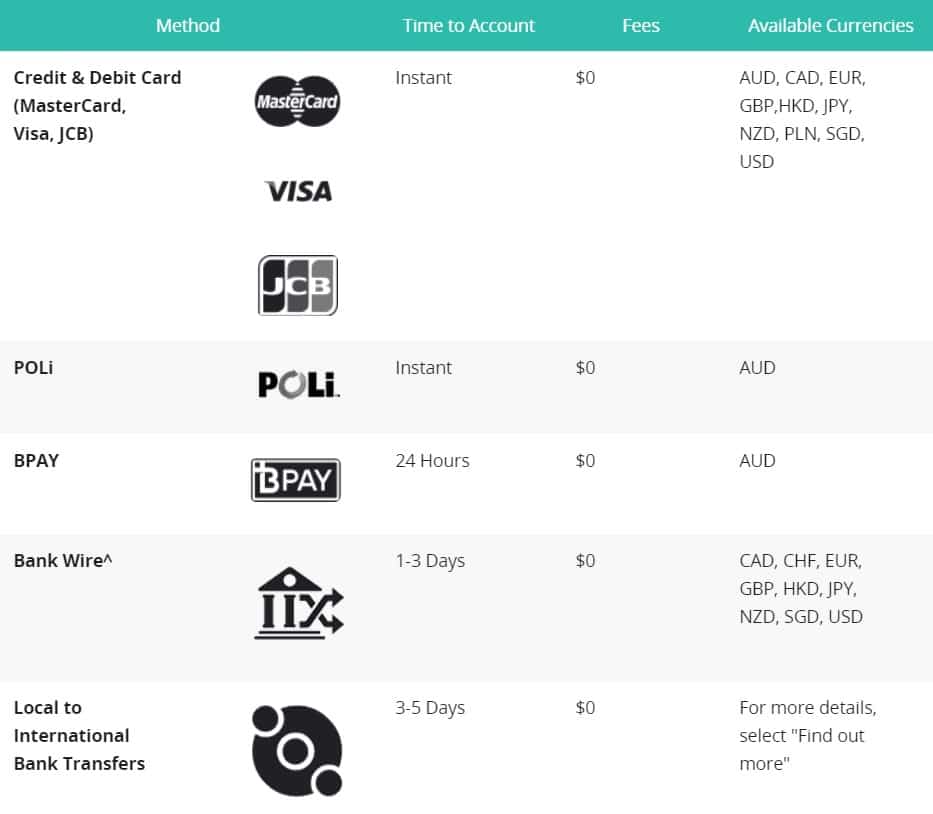

Deposit Methods & Costs

Accounts can be funded by Credit/Debit Cards (Visa, MasterCard, Maestro, JCB), Neteller, Skrill/Moneybookers, Global Correct (Australian clients), BPAY (Australian Clients), China UnionPay (Chinese Residents), Bank Transfer, and Broker to Broker Transfer. This broker does not charge fees on any deposits, but you should be advised that your card provider could view charges made as cash advances and may bill you accordingly. Most methods are deposited instantly or within 15 minutes. Exceptions would be Global Connect and Broker to Broker Transfer, both of which may take 3-5 business days or longer, BPAY, which is posted the same or next day, and China UnionPay, which is posted within 3-5 business days.

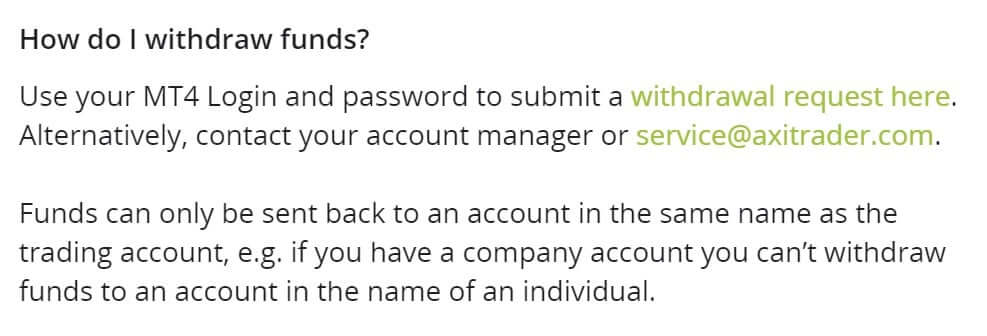

Withdrawal Methods & Costs

Withdrawals are processed back to the method used to fund the account, with e-wallet payments being returned directly to the client’s bank account. Funds can only be returned to an account bearing the client’s name, so be sure to avoid attempting any third-party withdrawals. The broker does not charge any fees on withdrawals, although your bank may charge a receiving fee on international payments that the broker will not reimburse.

Withdrawal Processing & Wait Time

Withdrawals take varying amounts of time to be returned, based on the method to which the refund is processed. Bank Transfer and Global Collect seem to take the longest amount of time, while Neteller and BPAY seem to be on the faster side. Note that the website didn’t specify about Skrill, but we’re assuming that it would also be credited the same or next day, based on the fact that withdrawals to Neteller and Skrill are often processed within the same amount of time. We’ve listed each method’s withdrawal timeframe below.

- Skrill – NA

- Neteller – Same or Next Day

- Global Collect – 3-5 Business Days or Longer

- BPAY – Same or Next Business Day

- China UnionPay – 1-3 Business Days

- Bank Transfer – Same or Next Day for Local Payments/3-5 Business Days or Longer for International Payments

Bonuses & Promotions

We couldn’t find any advertisements for extra bonuses on the website, so we double-checked with support to ensure that we weren’t missing anything. Sadly, support confirmed that there are no ongoing opportunities, although we do think that the broker may offer promotions from time to time. This assumption is based on the fact that the company has included the fact that promotions are excluded when advertising their lack of deposit requirement. This would mean that one would like need to make a certain deposit, likely of around $100 or so, in order to qualify for a deposit bonus. The support agent also informed us that nothing is available currently, so one would need to keep a lookout for any changes.

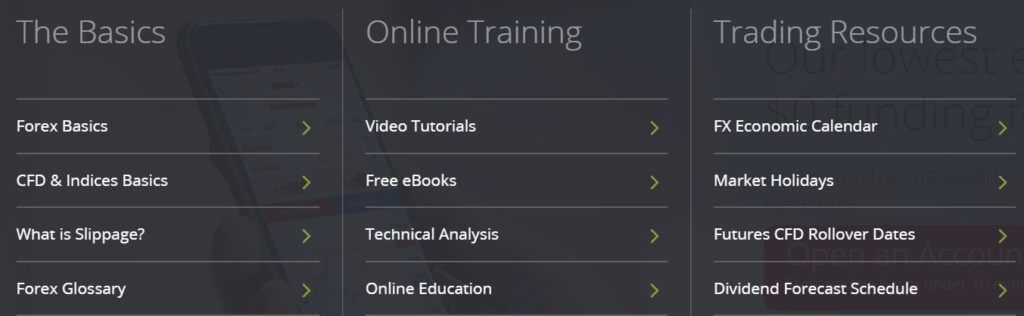

Educational & Trading Tools

Education: This company had done an excellent job providing multiple avenues of learning opportunities. We really thought the online Education Center was a nice touch. This feature offers more than 80 different lessons that are broken down into categories like ‘Forex Trading’, ‘Market Analysis’, ‘Trading Psychology’, and more. The website keeps track of one’s progress on a completion level from 0% to 100%, so there may be some sense of accomplishment in completing the course. We’ve listed all other educational resources below.

-Video Tutorials

-Free e-books

–Forex Glossary

–Forex Basics

-Online Education Center

Trading Tools: At the top of the webpage, one can select the ‘Market News & Blog’ tab. From there, you’ll find relevant articles that affect the market, AxiTrader News, Technical Analysis, Tools and Infographics, Videos, an Economic Calendar, and a Dividend Forecast Schedule.

Demo Account

AXI Trade offers the ability to select between two free demo accounts; Standard or Pro. Both accounts mimic the trading conditions on their live account versions and provide access to all of the tradable products. If you run out of funds, support is willing to top up demo accounts upon request. You can also request a leverage change, should you decide you’d like to try something different. Demo accounts expire after 30 days of registration; however, non-expiring demo accounts can be added to any funded live account by contacting support.

Customer Service

Support is available 24 hours a day, 5 days a week, beginning at 23:00 Sunday. Although we’d like to see some support hours on the weekends, customer service seems pretty easy to reach and is available via LiveChat, phone, or email. You can even follow this broker on Facebook, Twitter, subscribe to their YouTube channel, or contact them on LinkedIn. The company will allow clients to book appointments in-person at their offices. To do so, you’ll need to contact your account manager. Below, you’ll find all of the contact information.

Email: [email protected]

Australia: 1 300 888 936

Int.: +61 2 9965 5830

UK: +44 203 544 9646

Countries Accepted

On their FAQ, the company mentions that any countries missing from their sign-up page would have to do with their regulation. However, the broker doesn’t go as far as to mention the specific countries that are banned. We did a quick check and found that the United States is not available for selection – but the US Virgin Islands can be selected in its place. If you don’t see your country on the list, chances are you won’t be able to create an account, based on the company’s FAQ.

Conclusion

AXI Trader is a regulated FX, index, and commodities broker that has won several awards since its establishment in 2007. The company offers 24/5 support, maximum leverages of up to 1:400, and offers the advantage of no deposit requirement. Two account types are offered, with the key difference being the way traders will pay trading costs. Since neither account has deposit requirements and both offer the same product trading and leverages, traders can choose based on the costs alone, without making other considerations.

The company has also provided multiple educational resources and demo accounts on its website for any potential clients that may need help. Fee-free deposit and withdrawal options also add to this broker’s advantages and maximize the potential to come away with a profit.