On the news front, the focus will be on the FOMC and Fed policy decision which is expected to be 0.25%. Since no change in rate is expected, there’s is likely to be a neutral sentiment in the market. Besides, the investors will also focus on the Pending Home Sales from the U.S. which is expected to have dropped sharply. The dollar can stay weaker on this news.

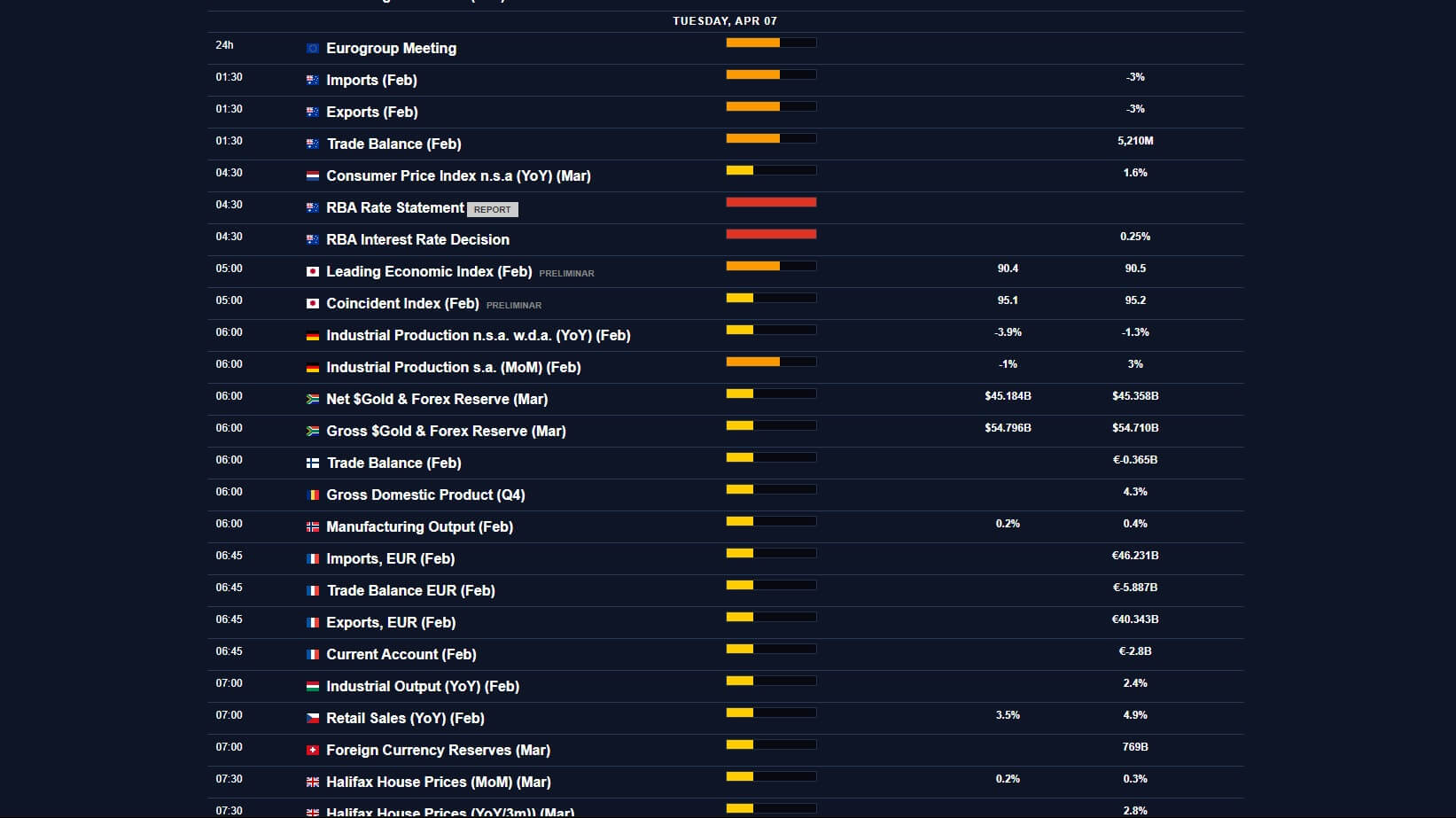

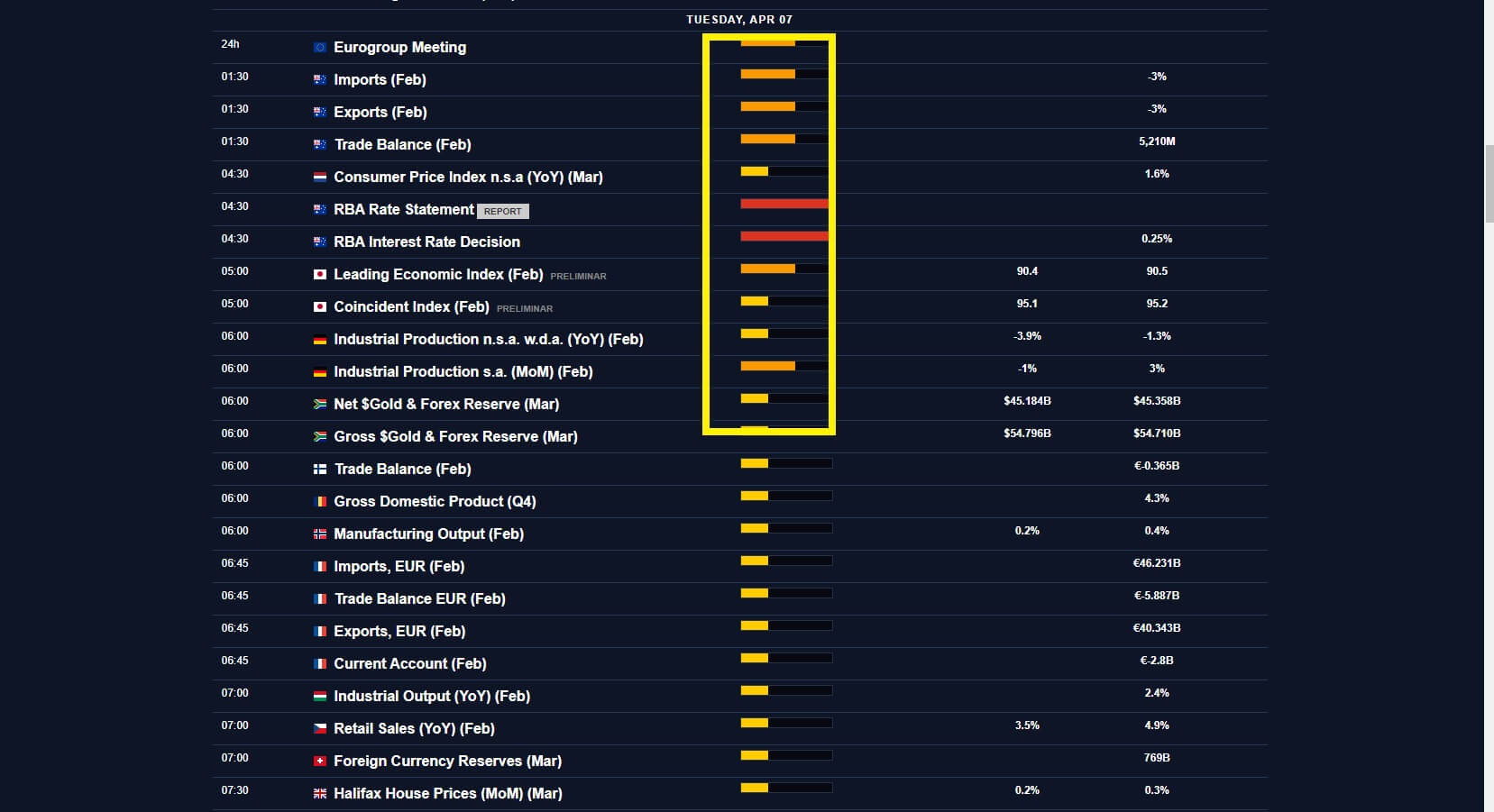

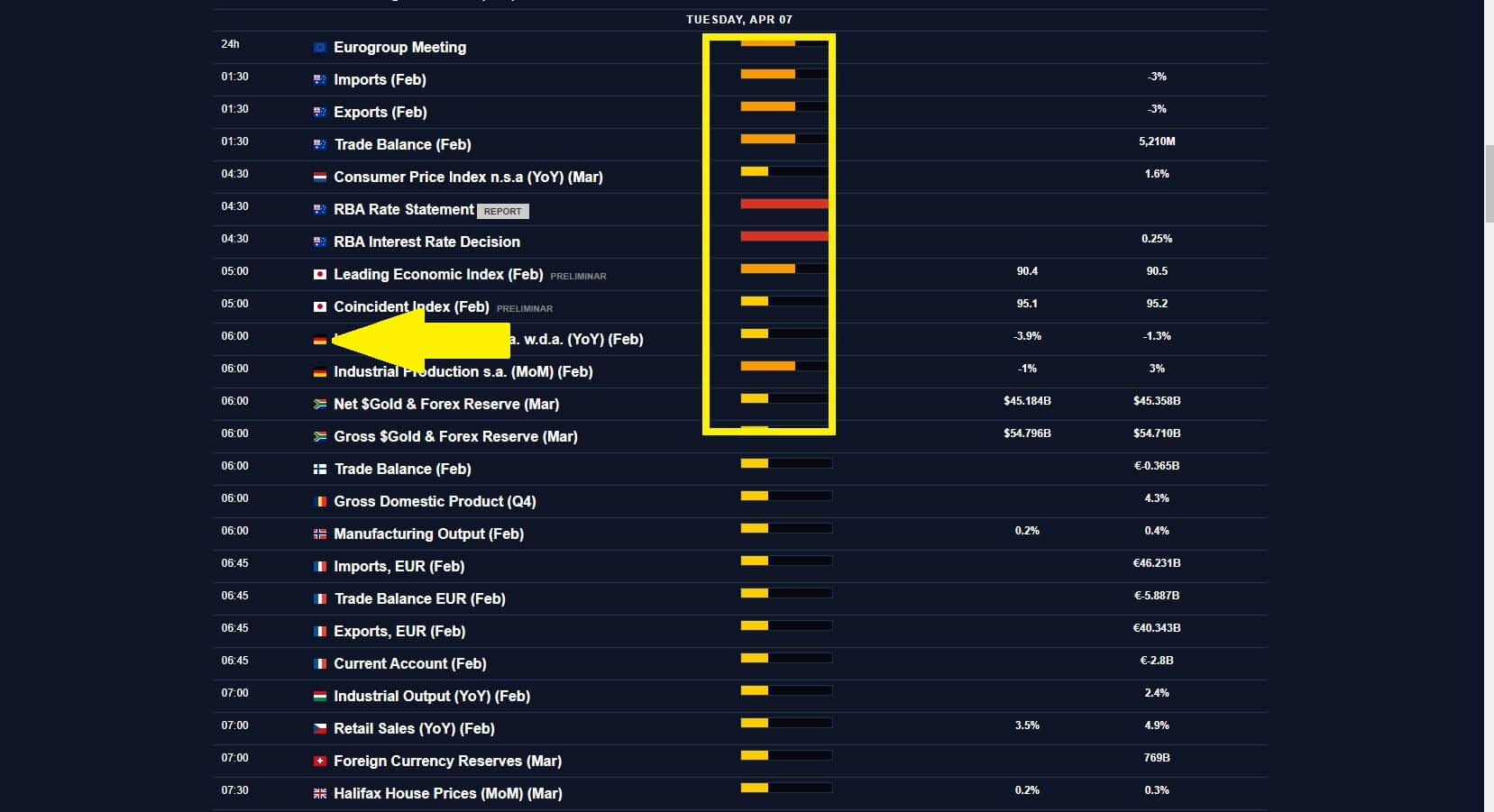

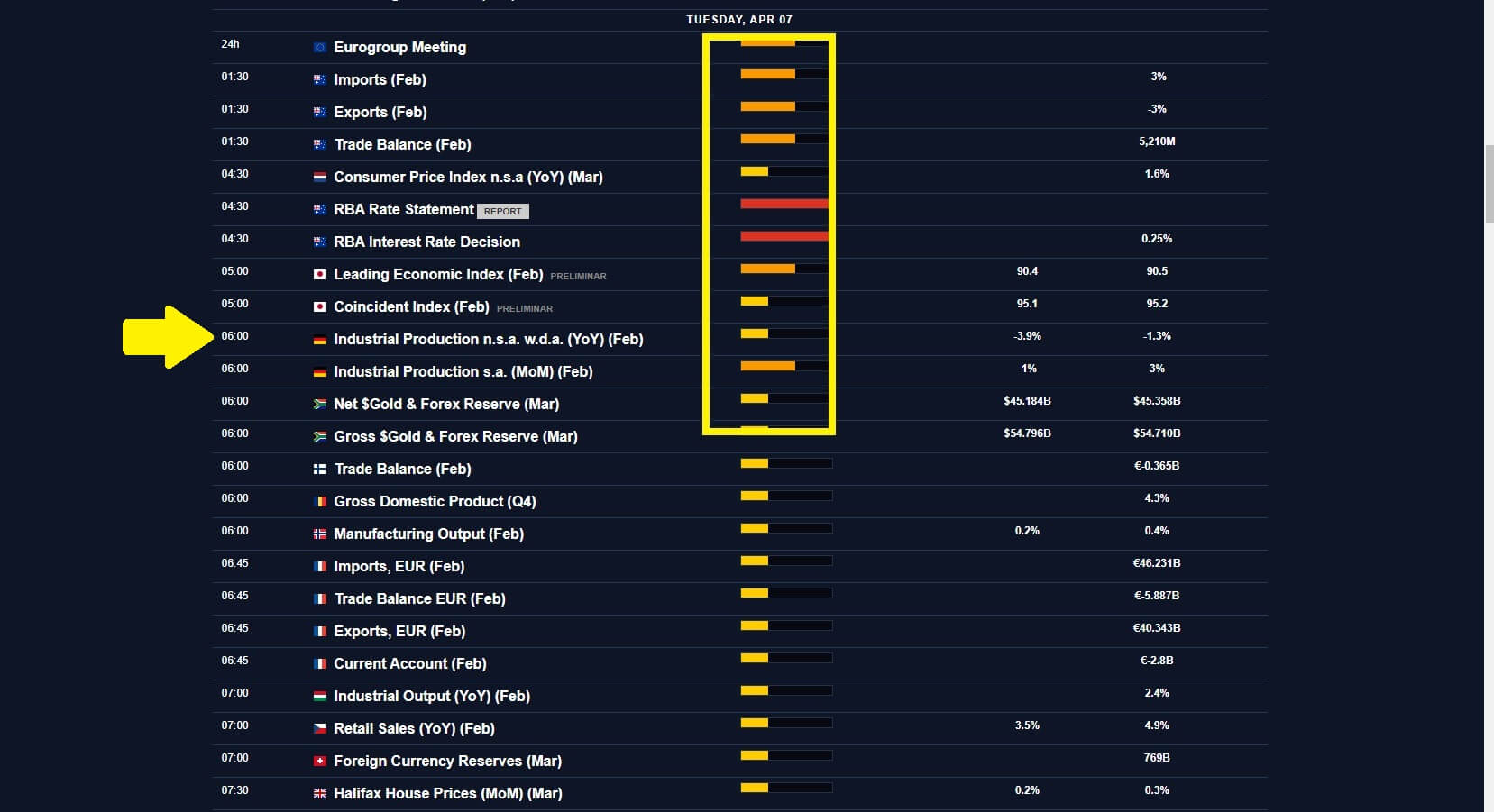

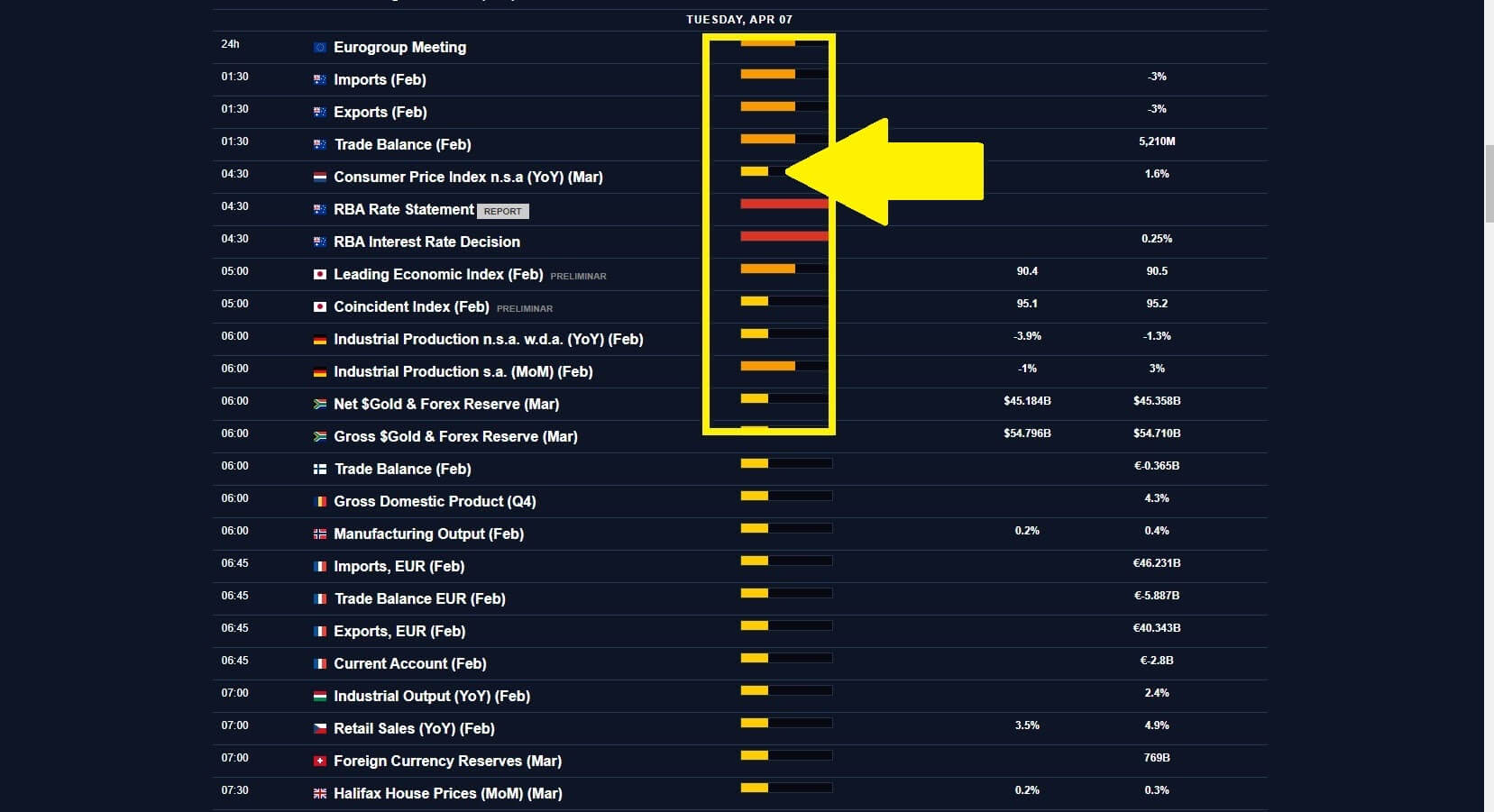

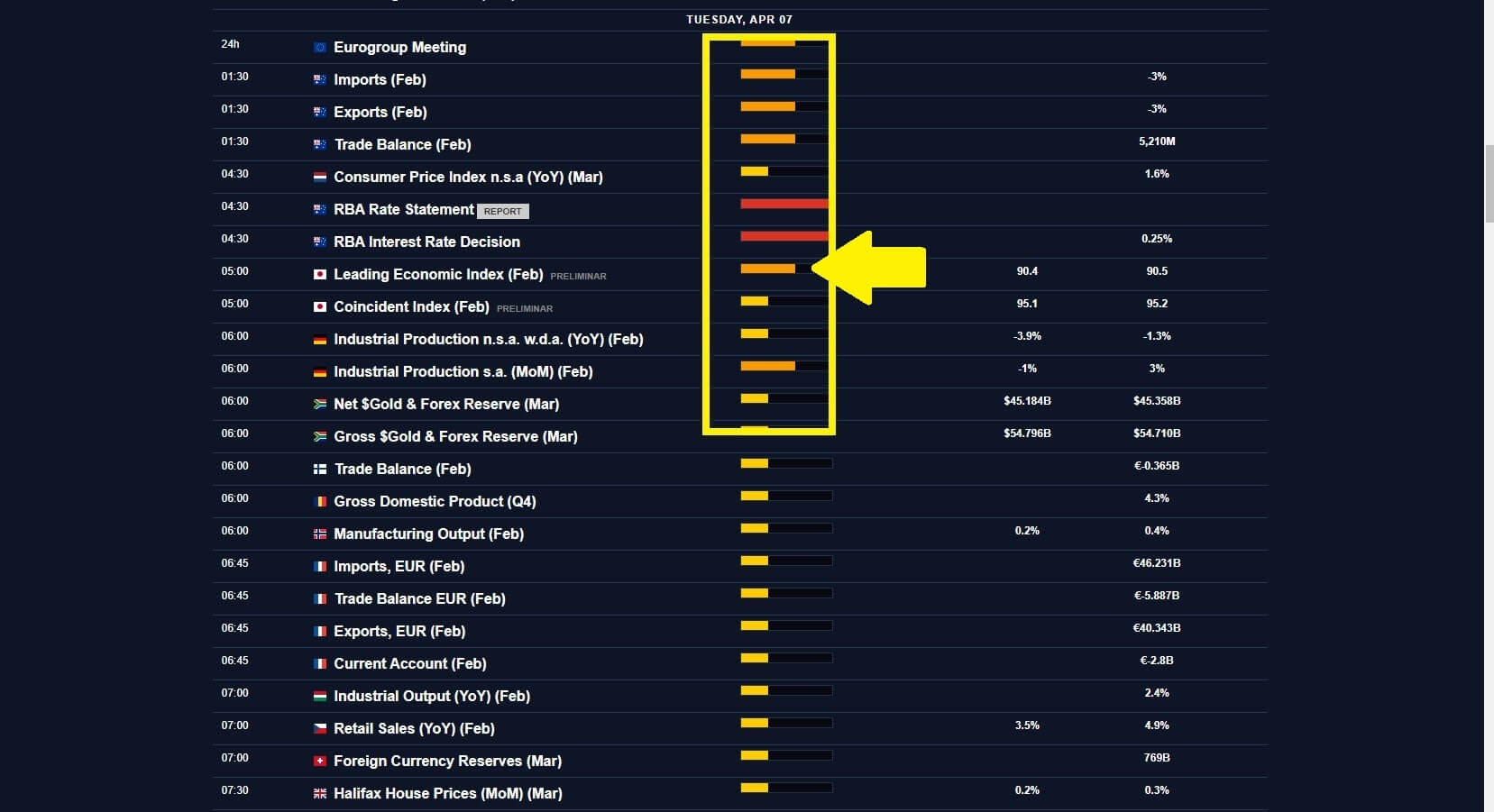

Economic Events to Watch Today

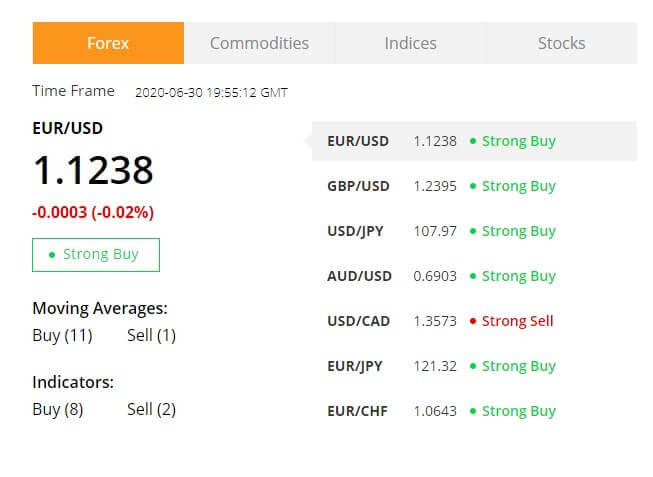

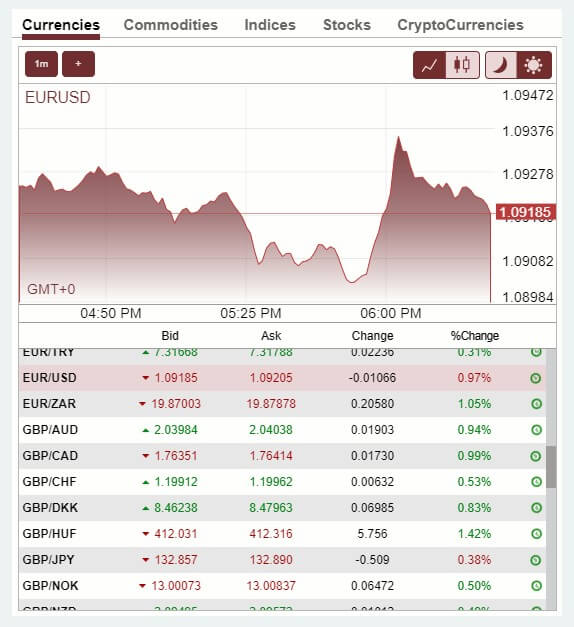

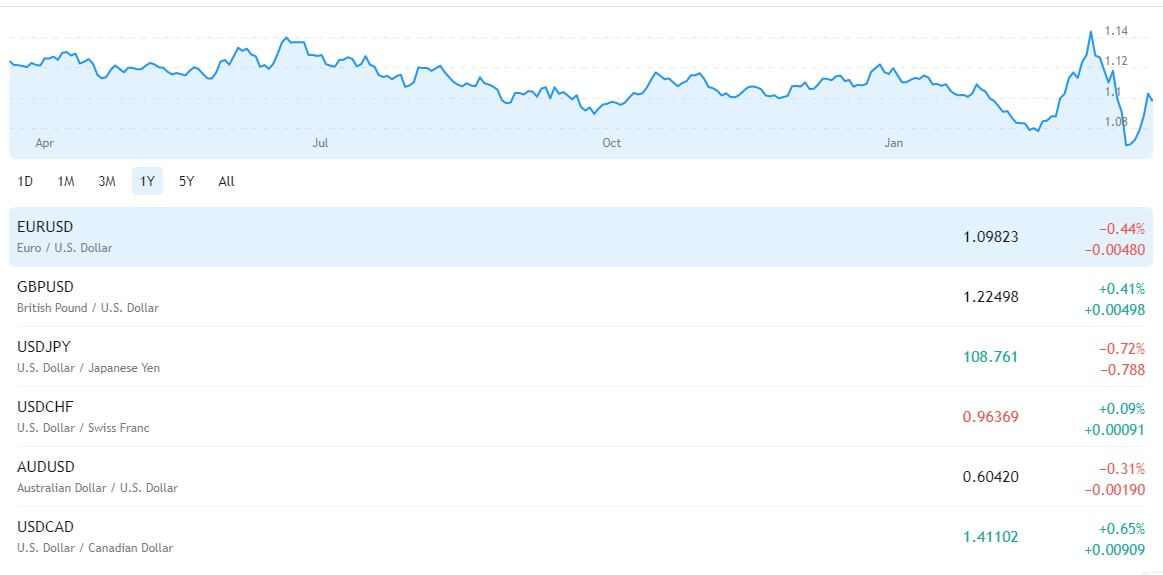

EUR/USD – Daily Analysis

The EUR/USD pair was closed at 1.17166 after placing a high of 1.17734 and a low of 1.16984. Overall the movement of the EUR/USD pair remained bearish throughout the day.

After rising for eight consecutive days, the EUR/USD pair dropped on Tuesday and posted losses for the day as the U.S. dollar rose marginally across the board but remained under pressure ahead of the Fed meeting.

The U.S. Dollar Index was also up on Tuesday and posted a high of 94.0. The recovery in the greenback could be because of correction after losing ground significantly over a few days. Or the recovery could also be because of the rising hopes of the U.S. stimulus package and the economic recovery hopes associated with it.

The Republicans made a proposal on Monday for a stimulus package worth about $1 trillion. The Senate Republicans plan to issue another round of stimulus checks of $1200 while it also cut the emergency unemployment benefit from $600 to $200 per week.

More than 100 billion dollars were allocated to reopen schools in the presented proposal of coronavirus relief fund by Republicans. The proposal is yet to be approved by the Democrats. On the data front, the Spanish Unemployment Rate was decreased to 15.3% from the expected 16.6% and supported Euro. From the American side, at 18:00 GMT, the S&P/CS Composite-20 Housing Price Index for the year was also dropped to 3.7% from the expectations of 4.1%. At 19:00 GMT, the C.B. Consumer Confidence from America dropped to 92.6 in July from 94.0and weighed on the U.S. dollar.

However, the EUR traders ignored the macroeconomic data on Tuesday, and the pair EUR/USD continued to follow the improved U.S. dollar movements.

A two-day Federal Reserve meeting started on Tuesday, during which investors expected reaffirmation on the outlook. Though no monetary policy changes were expected, traders were speculating about a change in emphasis in the Fed’s forward guidance at the meeting.

On the other hand, the bearish correction in EUR/USD pair on Tuesday was due to the rise in its prices for eight consecutive days. The trend in the EUR/USD pair was still positive, and even a sharper slide could have been normal.

On the previous day, the pair EUR/USD posted the highest daily close since June 2018 near 1.1780 level, confirmed that both single currencies had a solid momentum. And despite falling and posting losses on Tuesday, the pair EUR/USD continued to hold just below 1.18 level, which shows that it has a key multi-year trend resistance.

Daily Technical Levels

| Support | Pivot | Resistance |

| 1.1686 | 1.1730 | 1.1762 |

| 1.1654 | 1.1806 | |

| 1.1610 | 1.1837 |

EUR/USD– Trading Tip

The EUR/USD is trading at 1.1728 level, holding above resistance to become a support level of 1.1715. On the hourly timeframe, the EUR/USD was previously forming highers high and highers low pattern, but now the recent cycle seems to change the trend. A bearish breakout of 1.1715 can drive more sales until the 1.1683 level. On the higher side, the resistance can stay at 1.1780.

GBP/USD – Daily Analysis

The GBP/USD pair was closed at 1.29316 after placing a high of1.29526 and a low of 1.28379. Overall the movement of GBP/USD pair remained bullish throughout the day. The GBP/USD pair extended its previous day’s gains and maintained its bullish streak for the 8th consecutive day on Tuesday amid improved market mood on vaccine hopes. The U.S. Dollar struggled on Tuesday after hopes of a COVID-19 vaccine boosted the risk sentiment. As in result, the greenback suffered as markets inclined towards riskier assets. The positive news about vaccine development supported the risk sentiment.

The pharma firms worldwide are working on treatment and vaccine development that provides multiple routes to success. Companies like Moderna, Pfizer, and AstraZeneca were all pushing to get their vaccines across the line.

Meanwhile, the U.S. Dollar was also supported ahead of the 2-days Federal Reserve meeting that started on Tuesday. Though no change in interest rate is expected, the traders were cautious to know about the statement of meeting to find more clues about the U.S. economy.

However, the release of S&P/Case-Shiller Home Price Indices for May fell below the forecast of 3.9% to 3.7%. It is because investors have become concerned about America’s economic recovery from the coronavirus pandemic.

The Richmond Manufacturing Index was released at 18:59 GMT as 10 for July against the expectations of 5 and supported the U.S. dollar. However, the C.B. Consumer Confidence also dropped to 92.6 from the forecasted 94.0 and weighed on the U.S. dollar that eventually added in the currency pair gains.

From the GBP side, the Pound was benefited from a stronger than expected CBI Distributive Trades Survey that rose to 4% from the expected -37% and gave hopes to investors that the British economy could be on the road to recovery.

Meanwhile, the Sterling traders were cautious after Prime Minister Boris Johnson warned of the possible signs of the pandemic’s second wave in parts of Europe. This raised concerns that the U.K. could also suffer from a second wave of coronavirus in the month ahead. The London School of Economics has also reported that Brexit could prove a double-shock to the economy. As a result, GBP traders remained cautious as UK-EU post-Brexit trade talks continue despite a lack of progress.

The GBP/USD pair traders will look forward to the Fed’s interest rate decision and the statement of the meeting. If fed in notably downbeat in s monetary policy statement, the GBP/USD pair would edge higher as concerns about the global economy grow.

The Brexit developments will also drive the GBP/USD pair in the coming days of the week as there will be a lack of macroeconomic data until next week. If the talks between the E.U. & U.K. show any progress, then Sterling would rise.

Daily Technical Levels

| Support | Pivot | Resistance |

| 1.2863 | 1.2908 | 1.2978 |

| 1.2792 | 1.3024 | |

| 1.2747 | 1.3094 |

GBP/USD– Trading Tip

On the 4 hour chart, the GBP/USD has completed 23.6% retracement at 1.2927 level, and closing below this level has the potential to lead GBP/USD prices towards 1.2910, which marks 38.2% Fibonacci retracement level. On the lower side, the GBP/USD pair can find support at 1.2810 and 1.2765 level. Conversely, the resistance stays at 1.2975. Let’s consider taking buying trade over 1.2760 until 1.2860 level today.

USD/JPY – Daily Analysis

The USD/JPY pair was closed at 105.073 after placing a high of 105.684 and a low of 104.954. Overall the movement of the USD/JPY pair remained bearish throughout the day. The USD/JPY pair extended its bearish trend and losses on Tuesday amid U.S. dollar weakness and struggled with 105 level. The haven was on the bid, which supported the Japanese Yen and caused a decline in the USD/JPY pair.

The rising numbers off coronavirus cases in the U.S. and the Federal Reserve Interest Rate decision event were the market’s dominating sentiment. Meanwhile, the U.S. stimulus negotiations and mixed earnings reports sent the investors to the sidelines.

The greenback managed to correct some of its oversold conditions during the past sessions; however, the USD/JPY pair remained still on the bearish path on Tuesday. The reason behind it was that background picture containing the concerns about the spread of coronavirus, and the ongoing US-China tensions did not change.

The U.S. Senate Republicans revealed the new coronavirus aid proposal that will need Democrats’ support. The package would include another round of $1200 in direct payments to individuals and a reduction in federal unemployment benefits from $600 to $200 per week and also more than $100 billion for reopening schools.

In remarks, Nancy Pelosi, a white house speaker, criticized it and called it a “pathetic” offer that was not enough to support the country.

On the data front, Japan published the June Corporate Service Price Index, which improved to 0.8% from 0.5% in May. On the U.S. side, the Richmond Manufacturing Index raised to 10 from the expected five and supported the U.S. dollar. The S&P/CS Composite-20 HPI dropped to 3.7% from the expected 4% and weighed on the U.S. dollar. The C.B. Consumer Confidence also dropped to 92.6 from the expected 94.0 and weighed on the U.S. dollar.

The poor than expected Consumer Confidence and HPI data added further losses in the USD/JPY pair on Tuesday. Furthermore, despite the prospects of a prolonged U.S. recession, the U.S. dollar will favor any breakdown in the market confidence due to its dominance in the global payment system. On JPY front, the currency is sensitive to geopolitical news in the Asian region, and with the ongoing conflict between U.S. & China, JPY is set to remain firm for the time being. JPY was the third worst-performing currency this month after the USD and Canadian Dollar.

Daily Technical Levels

| Support | Pivot | Resistance |

| 104.80 | 105.25 | 105.55 |

| 104.50 | 106.00 | |

| 104.05 | 106.30 |

USD/JPY – Trading Tips

The USD/JPY trades with a selling bias around 105.526 level, trading within a downward channel that provides an immediate resistance at 106.120. On the lower side, the USD/JPY may find support at 105.375 level, and closing of candles below 105.375 can open further selling bias until 104.850. Overall the pair is forming lowers low and lowers high pattern, which signifies selling sentiment among traders. The RSI and MACD suggest selling signals; for instance, the RSI is holding below 50, and the MACD is staying below 0. Today, let’s look for buying trade above 105.200. Good luck!

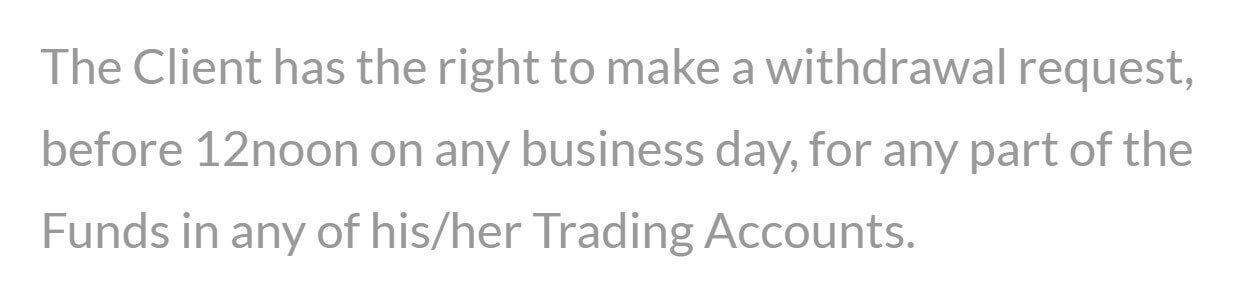

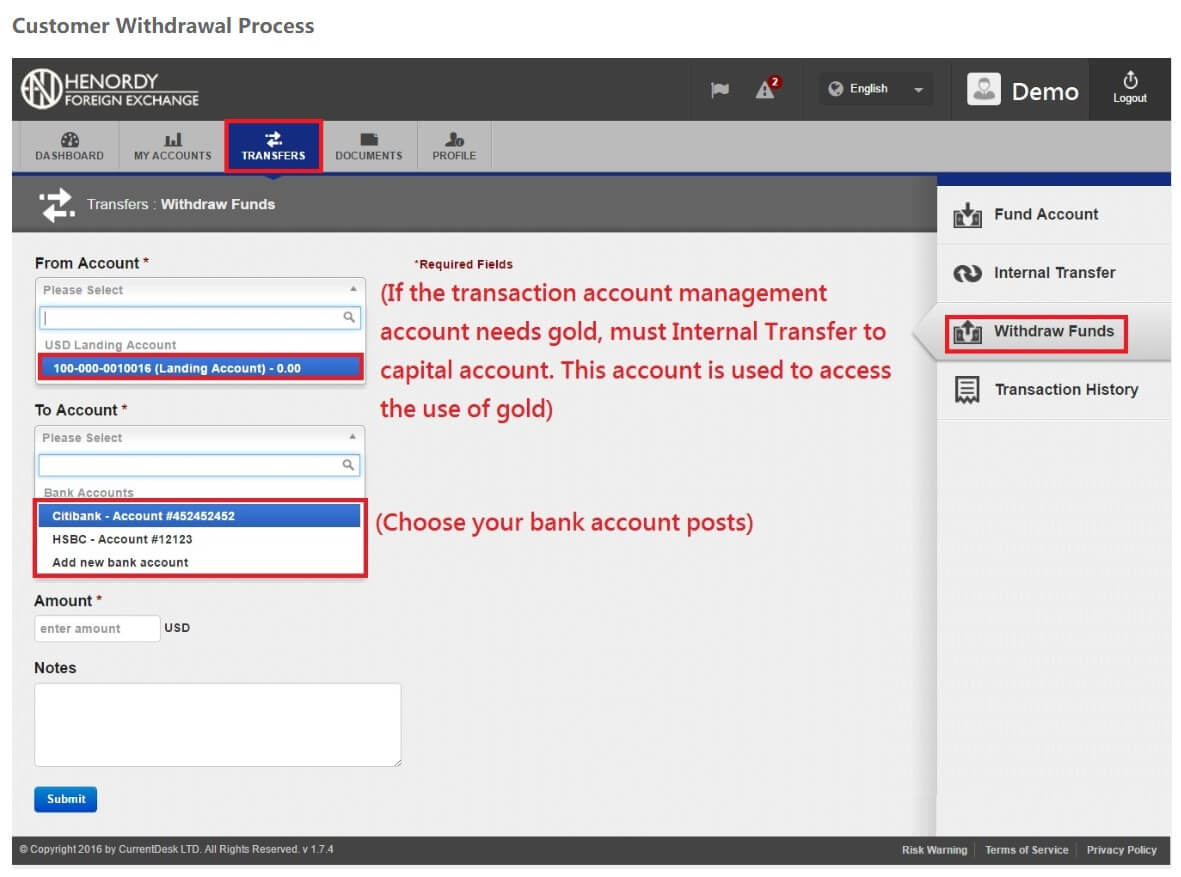

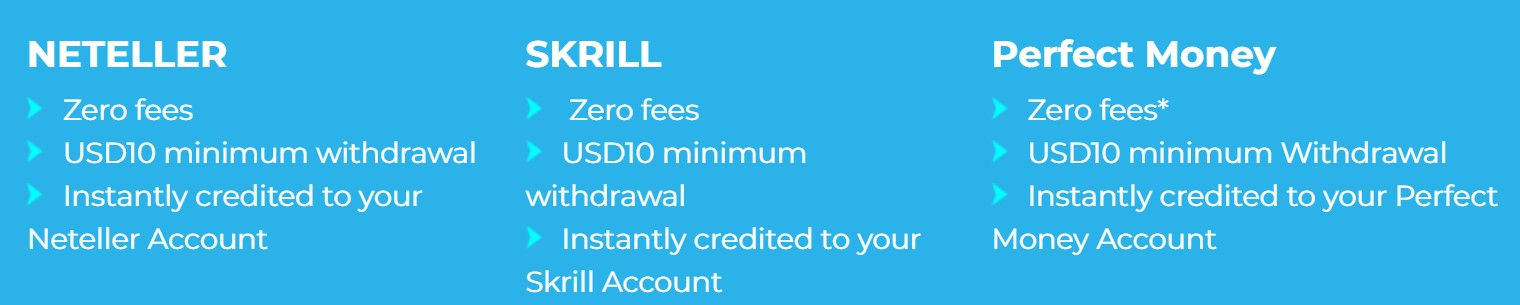

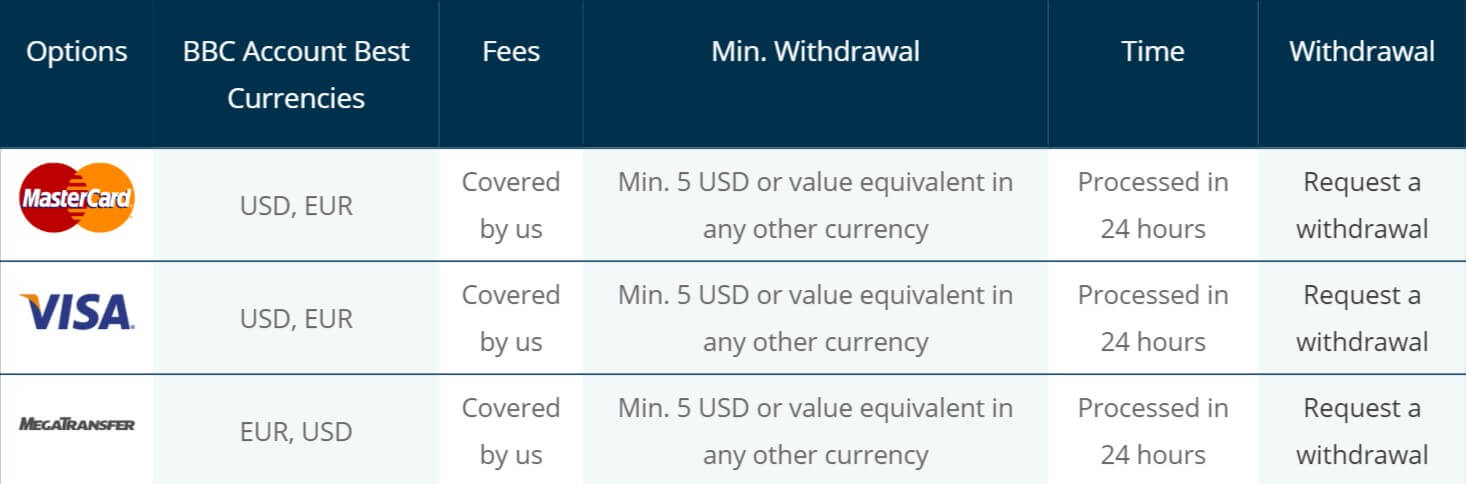

Withdrawal Processing & Wait Time

Withdrawal Processing & Wait Time

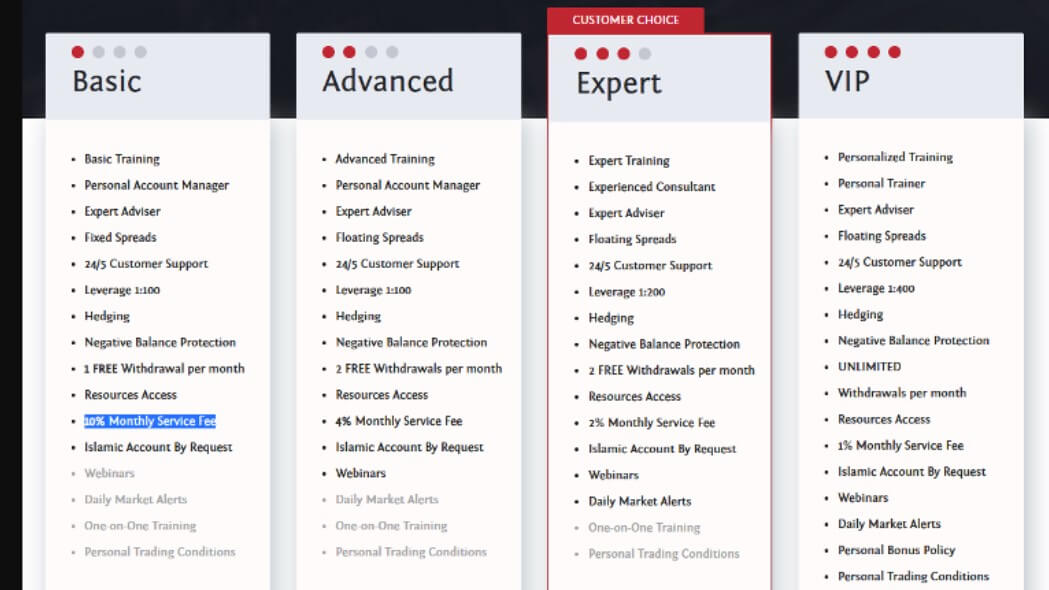

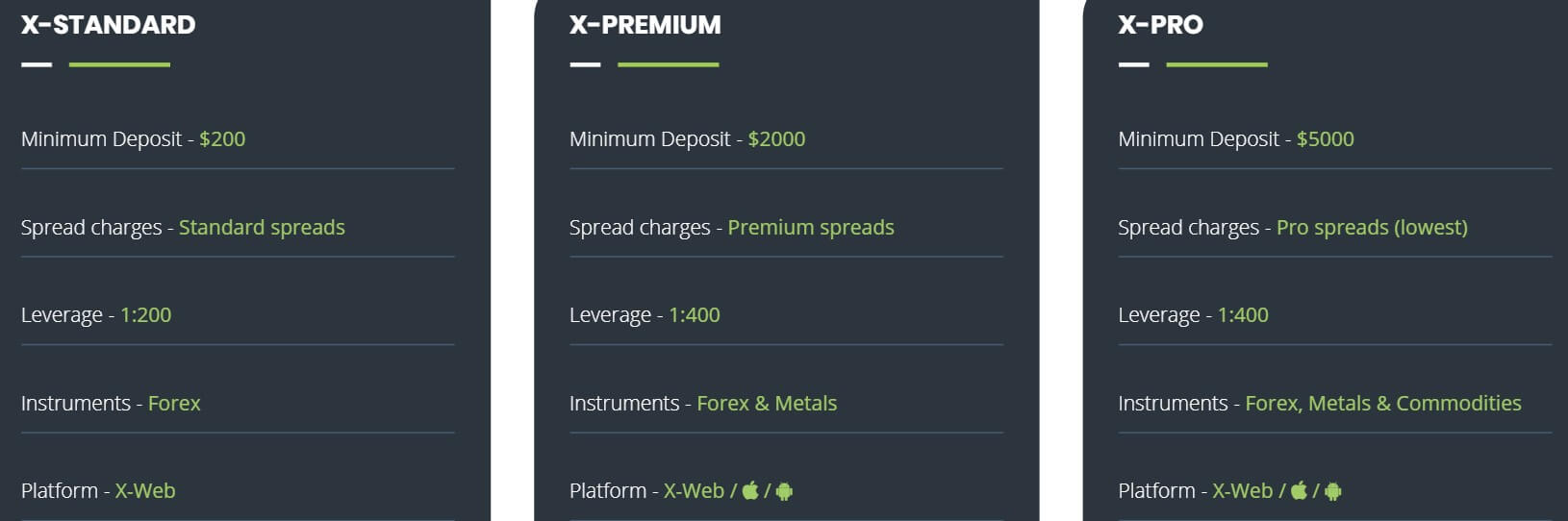

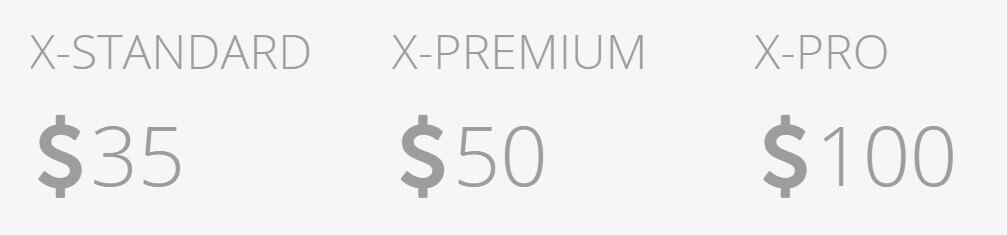

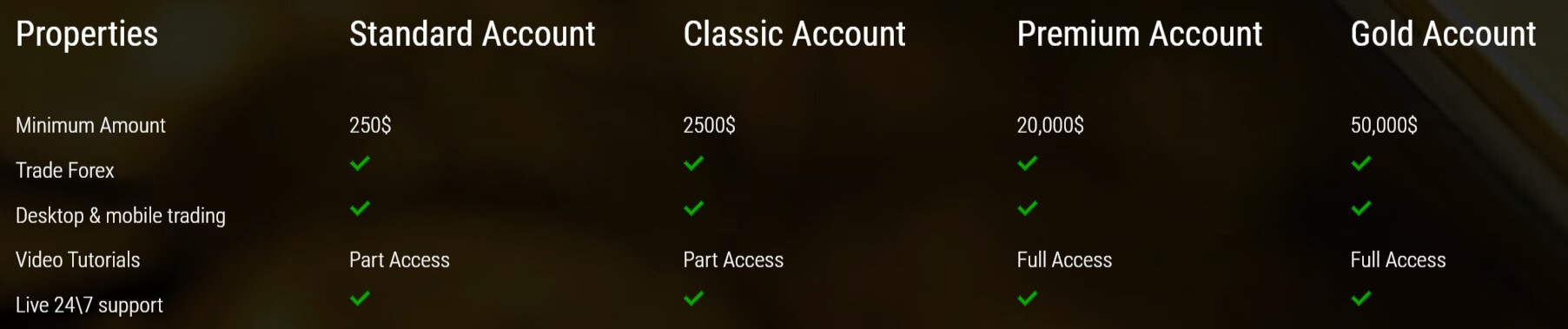

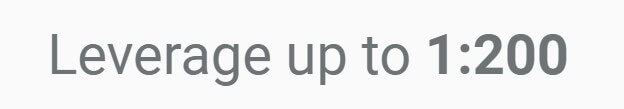

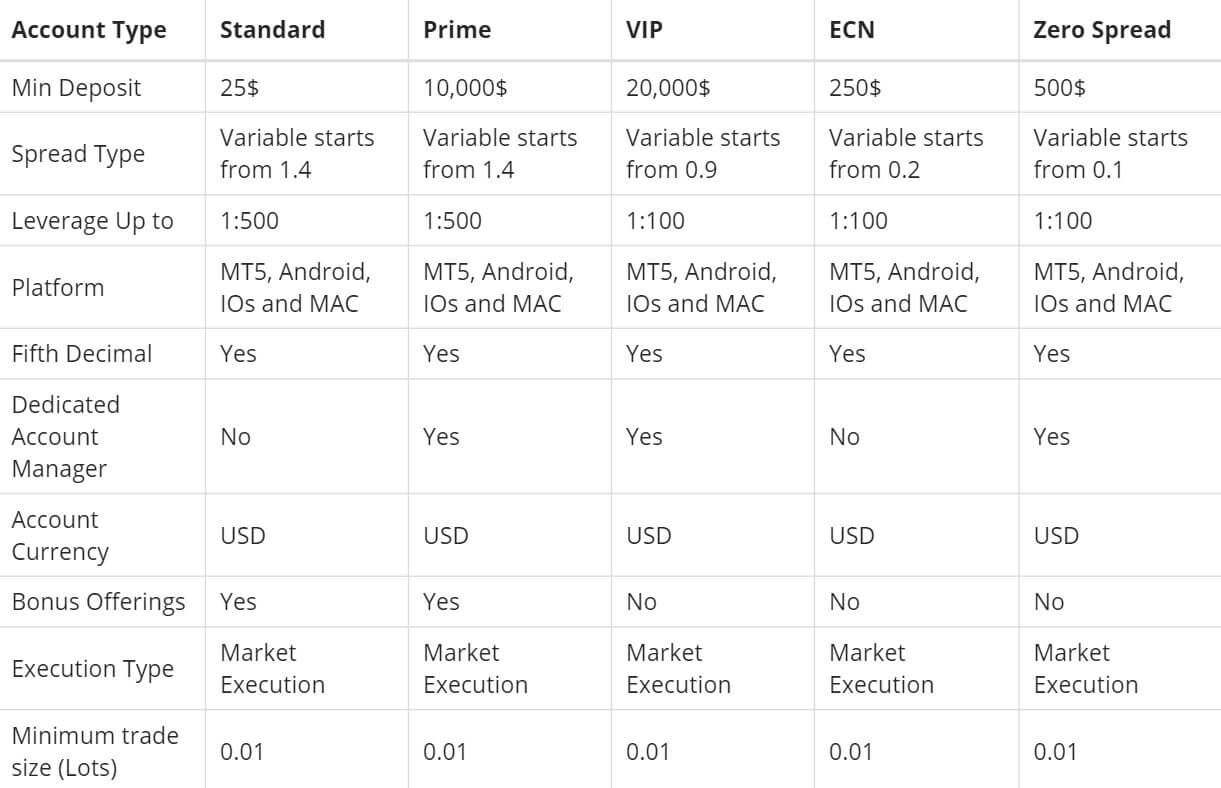

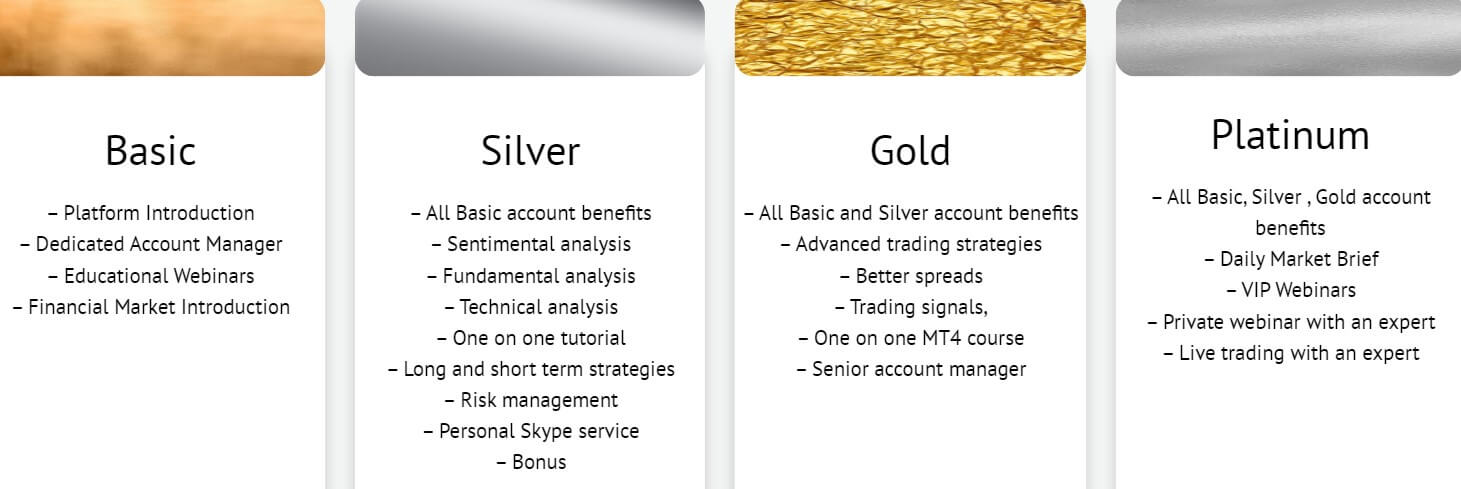

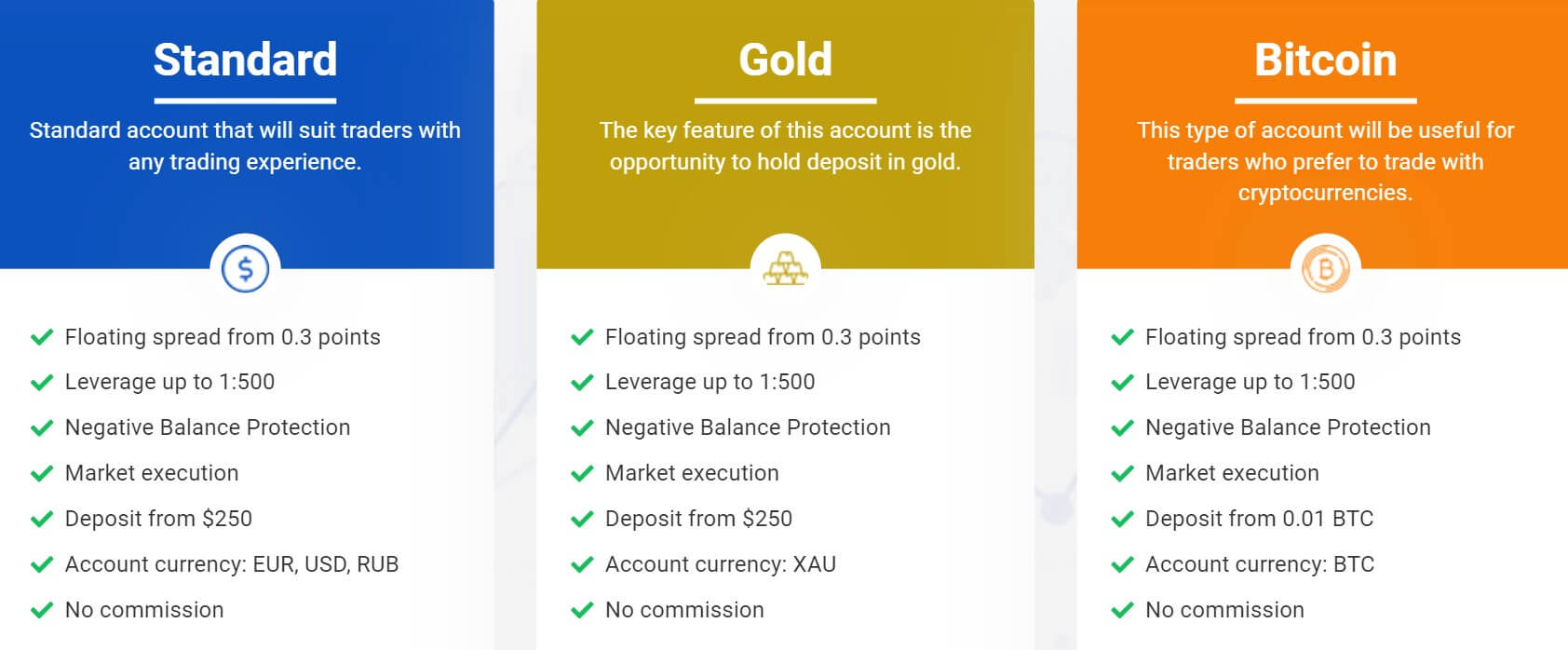

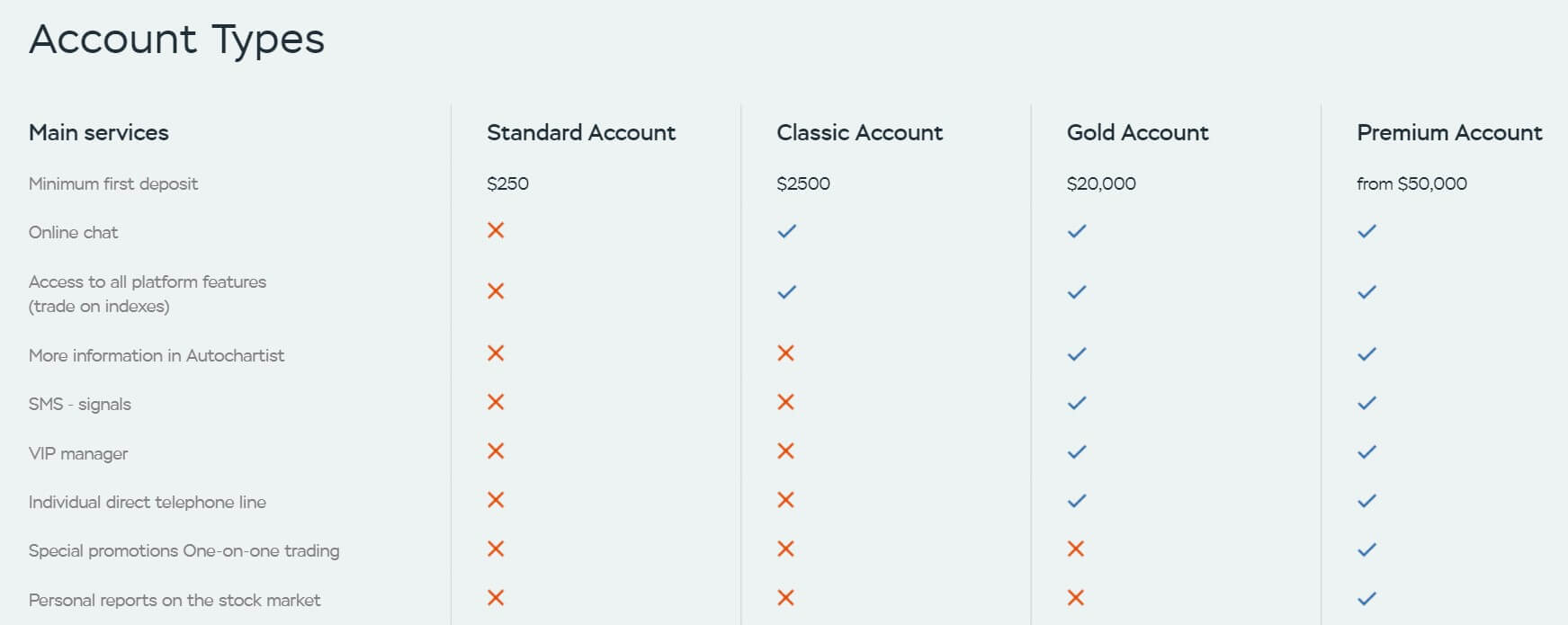

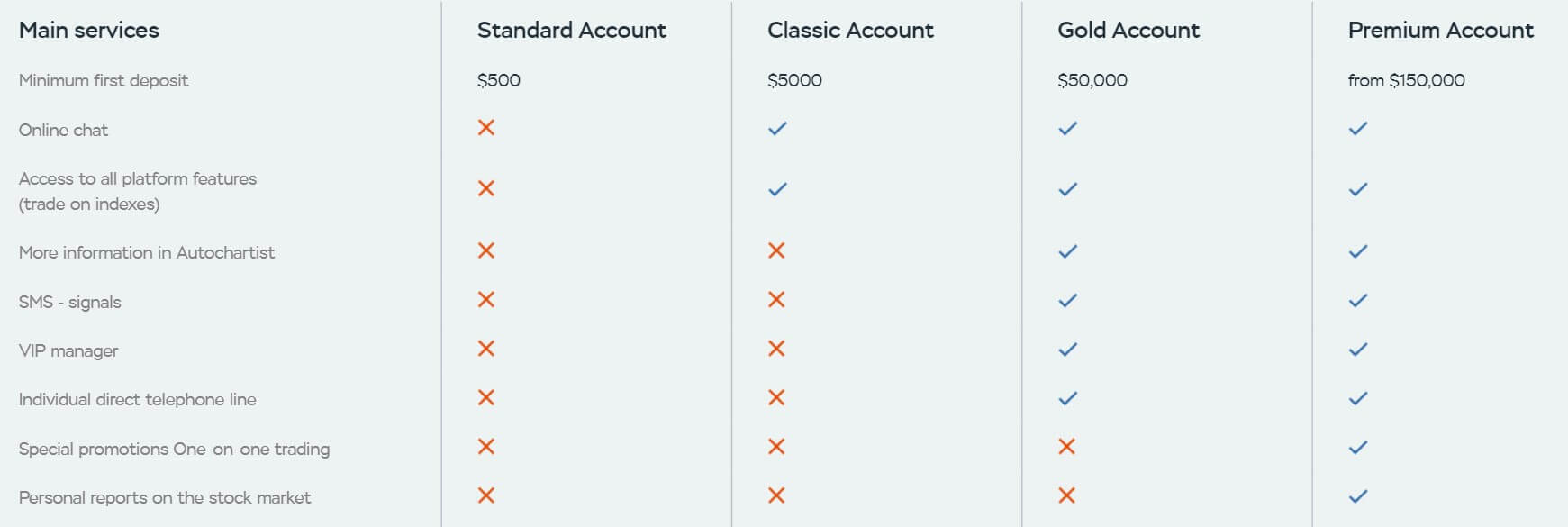

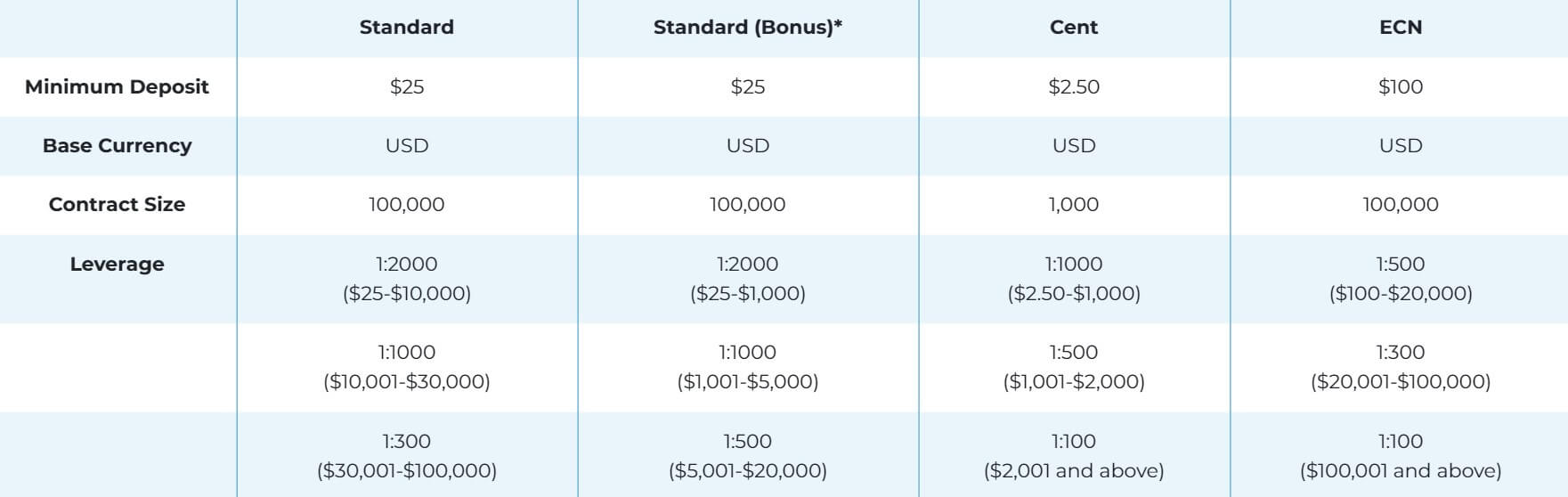

The Standard, Classic and Premium accounts all have a maximum leverage of 1:200, the Gold account doesn’t have a set limit, it instead can be selected when creating an account. All accounts can have their leverage (up to the maximum) selected when opening up an account and can have it changed by sending a request to the customer service team.

The Standard, Classic and Premium accounts all have a maximum leverage of 1:200, the Gold account doesn’t have a set limit, it instead can be selected when creating an account. All accounts can have their leverage (up to the maximum) selected when opening up an account and can have it changed by sending a request to the customer service team.

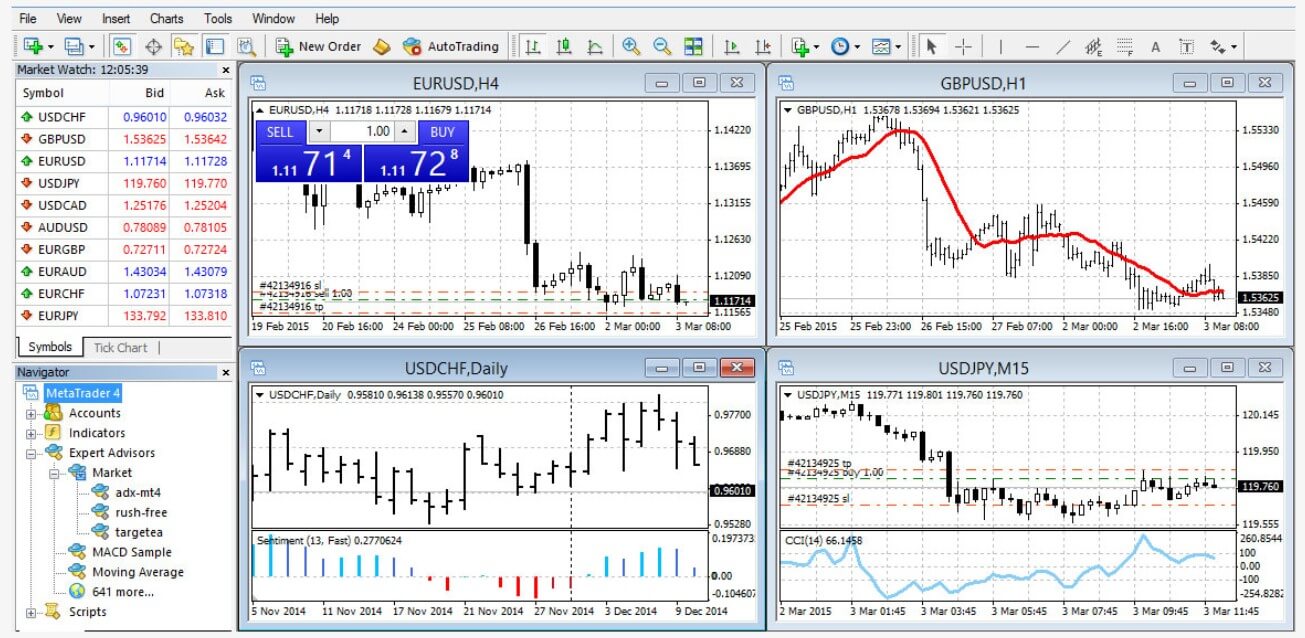

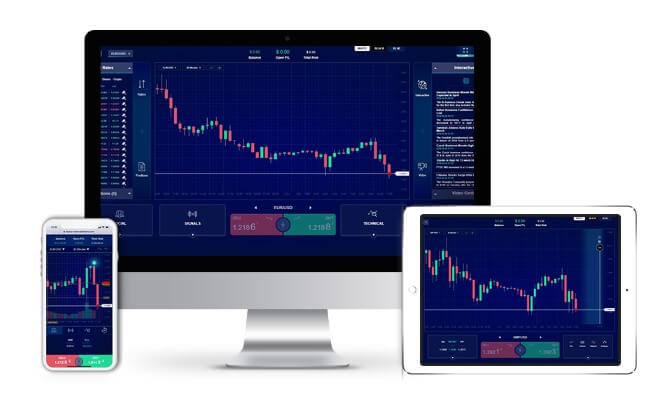

The only platform available to use with Traderia is MetaTrader 4, the good news is that it is an extremely popular and versatile platform. It is accessible anywhere as it can be used as a desktop download, mobile application or as a web trader. You can execute trades manually or with preloaded indicators and automated robot trading strategies (or Expert Advisors). Alternatively, MT4’s highly customizable, advanced software allows you to create your own trading strategies using its unique MQL4 programming language. Take advantage of MT4’s one-click functionality to make sure your trades are executed fast, every time.

The only platform available to use with Traderia is MetaTrader 4, the good news is that it is an extremely popular and versatile platform. It is accessible anywhere as it can be used as a desktop download, mobile application or as a web trader. You can execute trades manually or with preloaded indicators and automated robot trading strategies (or Expert Advisors). Alternatively, MT4’s highly customizable, advanced software allows you to create your own trading strategies using its unique MQL4 programming language. Take advantage of MT4’s one-click functionality to make sure your trades are executed fast, every time.

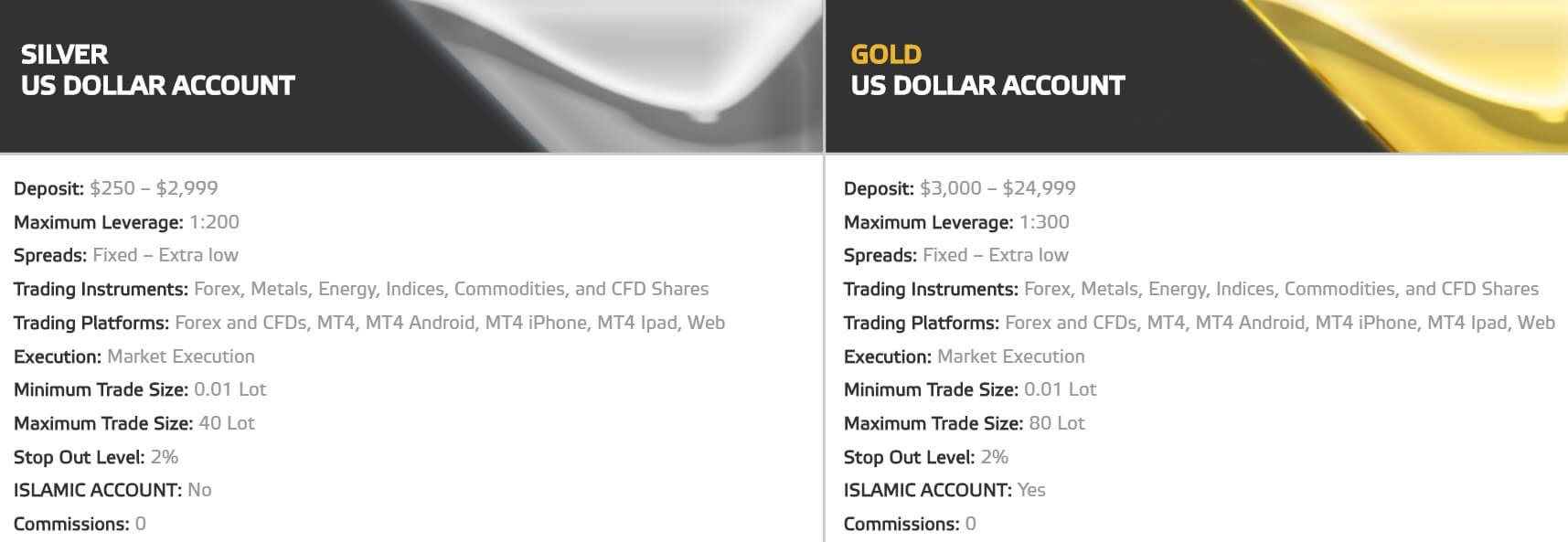

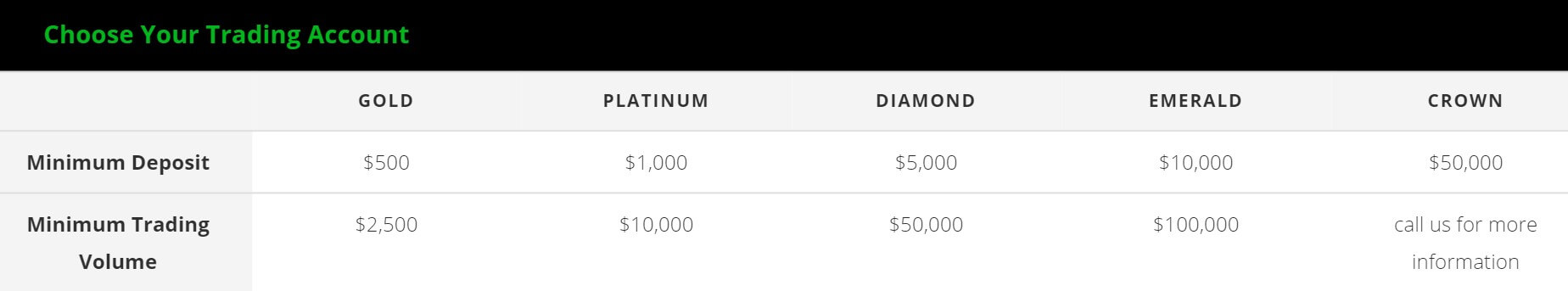

The minimum deposit depends on the funding account used but the bare minimum is 250 USD, EUR or GBP. It seems that this amount remains even after an account has been opened rather than reducing for top-up payments.

The minimum deposit depends on the funding account used but the bare minimum is 250 USD, EUR or GBP. It seems that this amount remains even after an account has been opened rather than reducing for top-up payments.

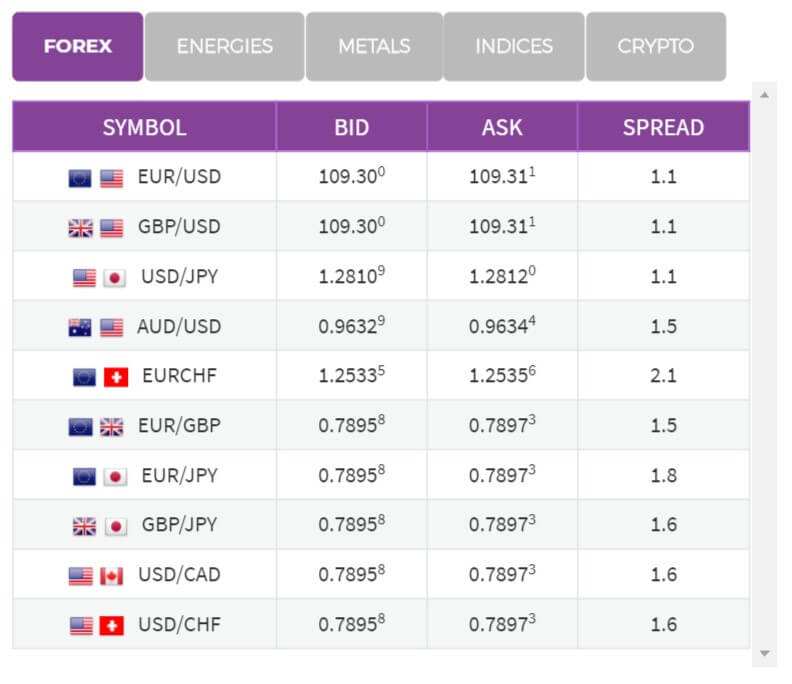

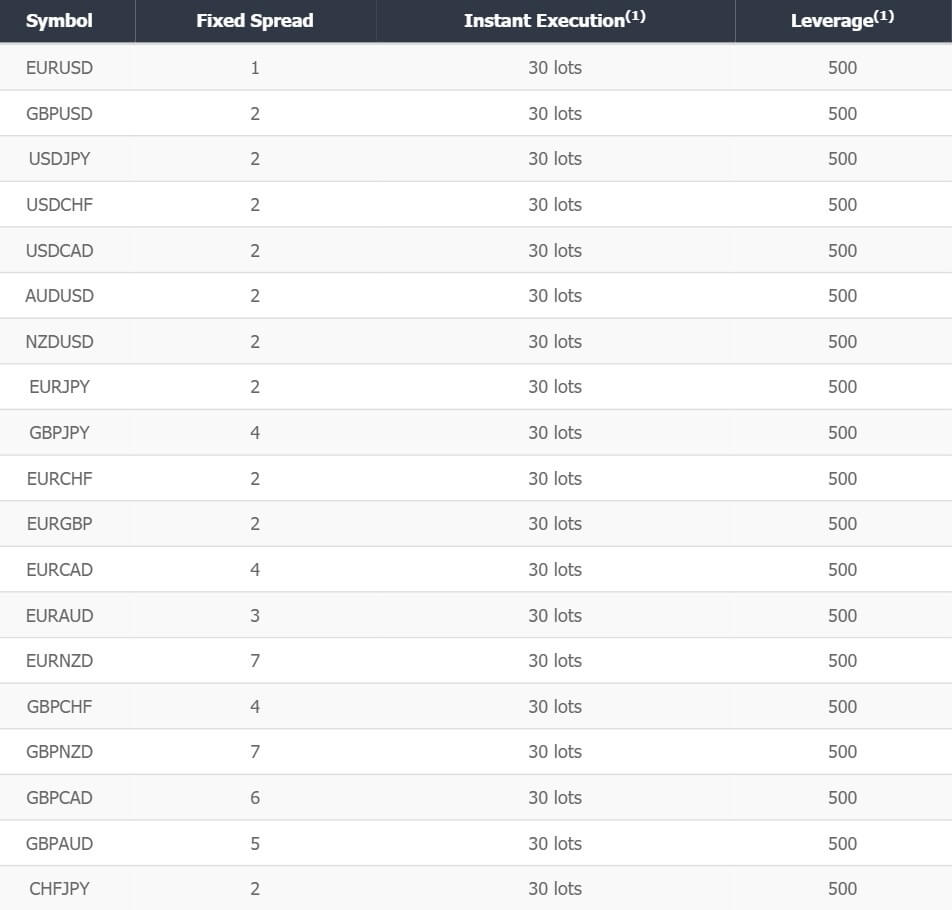

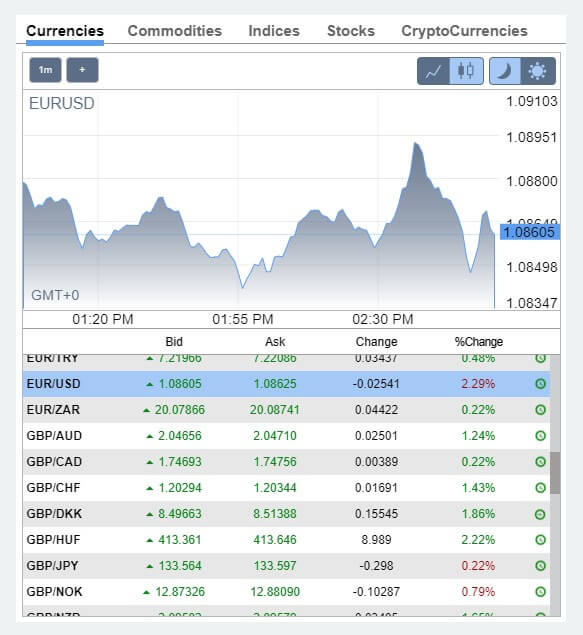

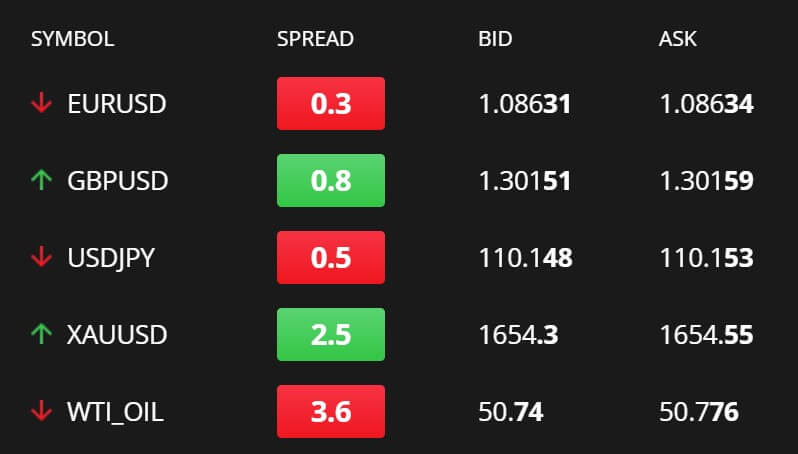

Looking through the platform it looks like the spreads for all currencies are set at 1 pip, the FAQ on the sites states that the spreads are fixed so this means that they will not change and the FAQ also said that they will remain fixed even during news events.

Looking through the platform it looks like the spreads for all currencies are set at 1 pip, the FAQ on the sites states that the spreads are fixed so this means that they will not change and the FAQ also said that they will remain fixed even during news events. There is not a minimum amount required to open up an account as you automatically get access to the lowest tier account, the overall minimum deposit requirement is $10 which is the lowest that the payment methods available allow.

There is not a minimum amount required to open up an account as you automatically get access to the lowest tier account, the overall minimum deposit requirement is $10 which is the lowest that the payment methods available allow.

Volumes Forex Group offers just MetaTrader 5 as its trading platform. It offers instant execution and request execution, complete technical analysis package: wide range of inbuilt indicators and charting tools, the ability to create various custom indicators, different time periods (from minutes to months), inbuilt program language

Volumes Forex Group offers just MetaTrader 5 as its trading platform. It offers instant execution and request execution, complete technical analysis package: wide range of inbuilt indicators and charting tools, the ability to create various custom indicators, different time periods (from minutes to months), inbuilt program language

We do not know if there are any added commission on the trading account as there is no mention of it anywhere, there are also no mentions of swap charges, looking a the Arabic version of the site the only account available is an Islamic account, however, we do not know what sort of account the English version uses, we would expect the same but cannot say for sure.

We do not know if there are any added commission on the trading account as there is no mention of it anywhere, there are also no mentions of swap charges, looking a the Arabic version of the site the only account available is an Islamic account, however, we do not know what sort of account the English version uses, we would expect the same but cannot say for sure.

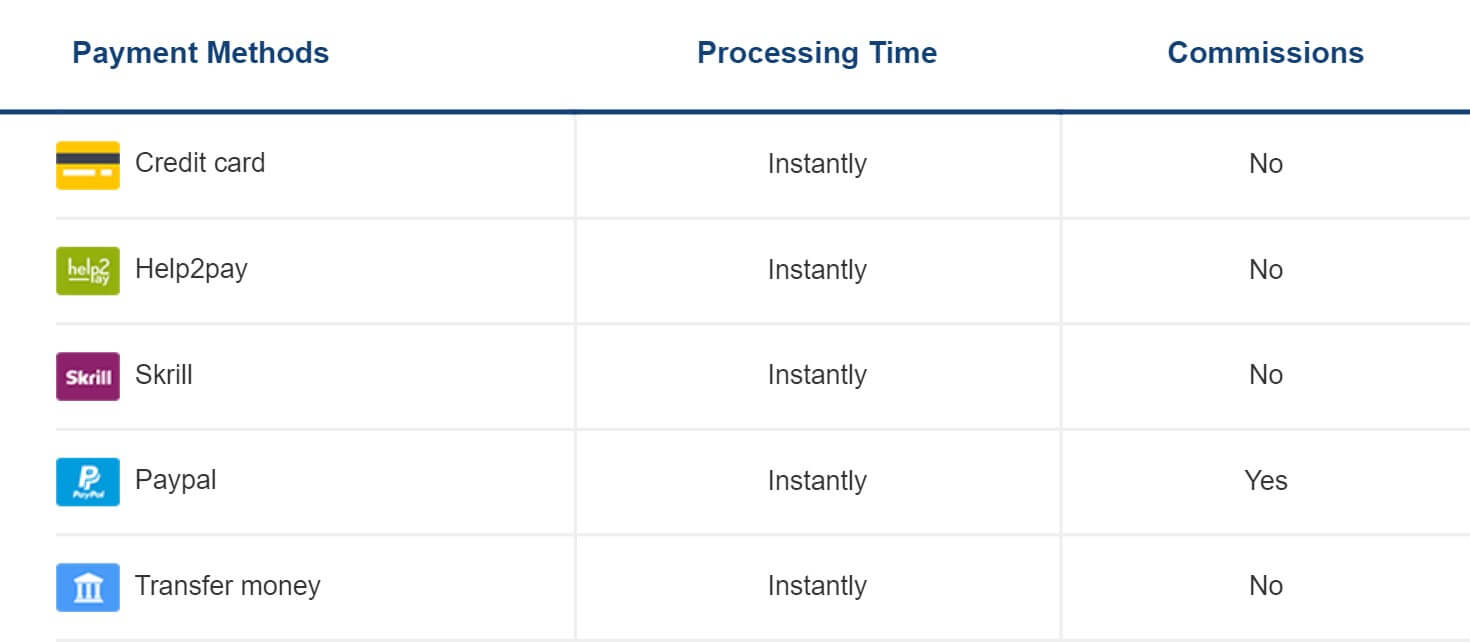

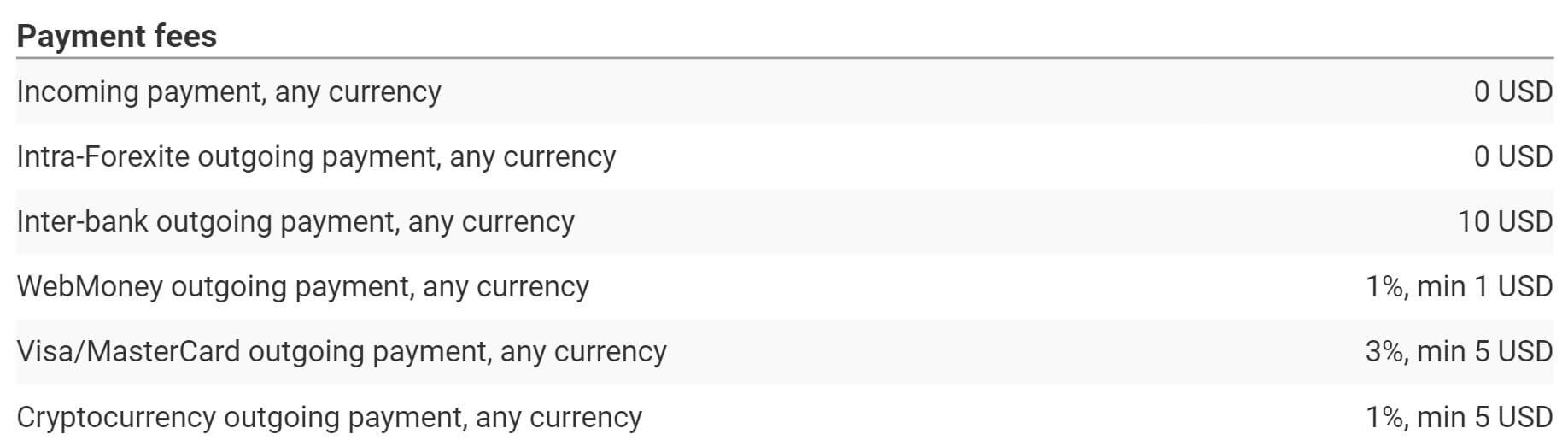

The two methods mentioned on the site are Bank Wire Transfer and PayPal, so it does, in fact, seem like PayPal is available. Volume Groups FX Does not charge any fees or commission for withdrawing funds. However, please note that PayPal and the banks that they deal with usually charge fees/commission for their services.

The two methods mentioned on the site are Bank Wire Transfer and PayPal, so it does, in fact, seem like PayPal is available. Volume Groups FX Does not charge any fees or commission for withdrawing funds. However, please note that PayPal and the banks that they deal with usually charge fees/commission for their services.

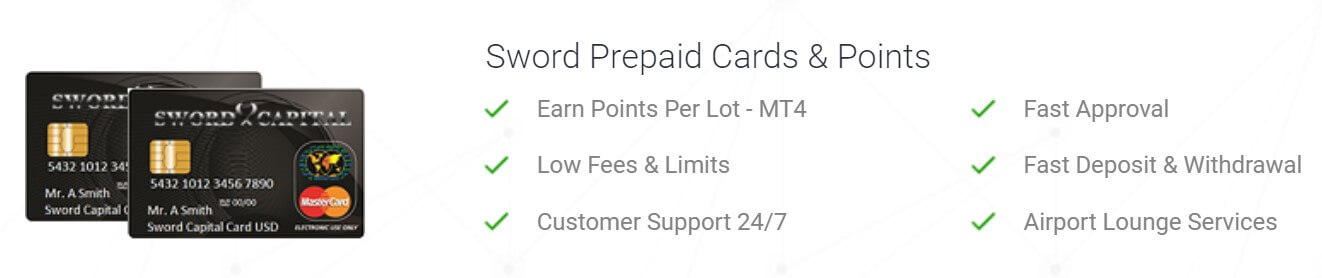

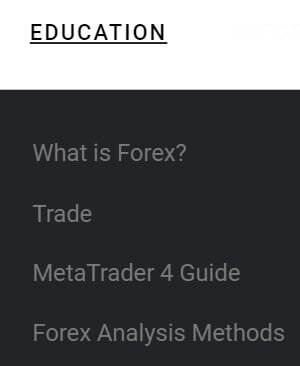

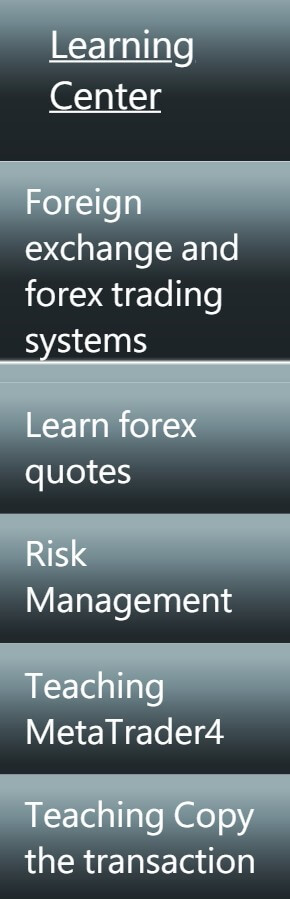

There are a few different aspects to the educational side of the site, there is a training section but this is just a signup form, no real information about the training. There is also some training based on the different platforms but again we did not get to experience any of this. Finally, there are some signals for both MT4 and via SMS, they seem to be showing some growth, but we do not know the full extent of their accuracy or profitability.

There are a few different aspects to the educational side of the site, there is a training section but this is just a signup form, no real information about the training. There is also some training based on the different platforms but again we did not get to experience any of this. Finally, there are some signals for both MT4 and via SMS, they seem to be showing some growth, but we do not know the full extent of their accuracy or profitability.

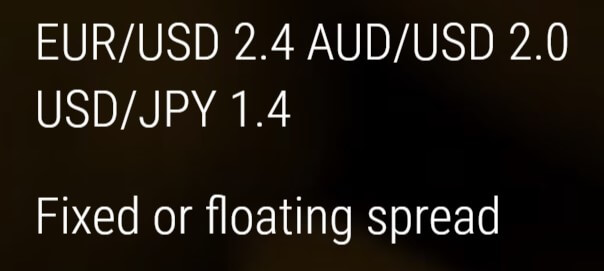

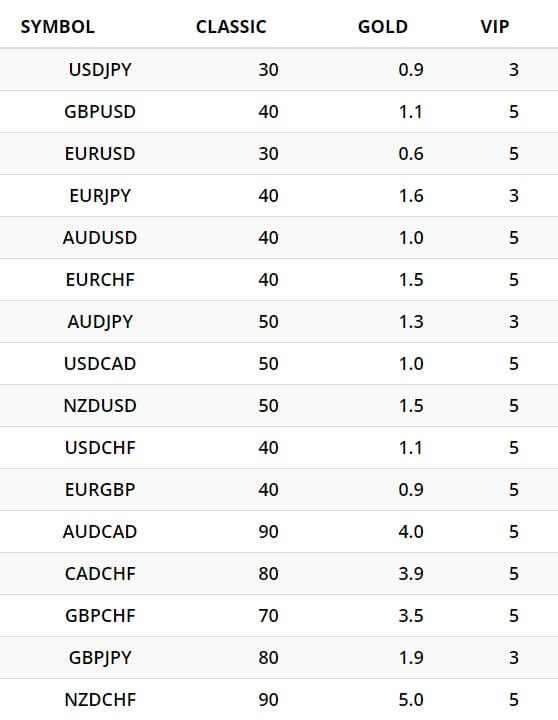

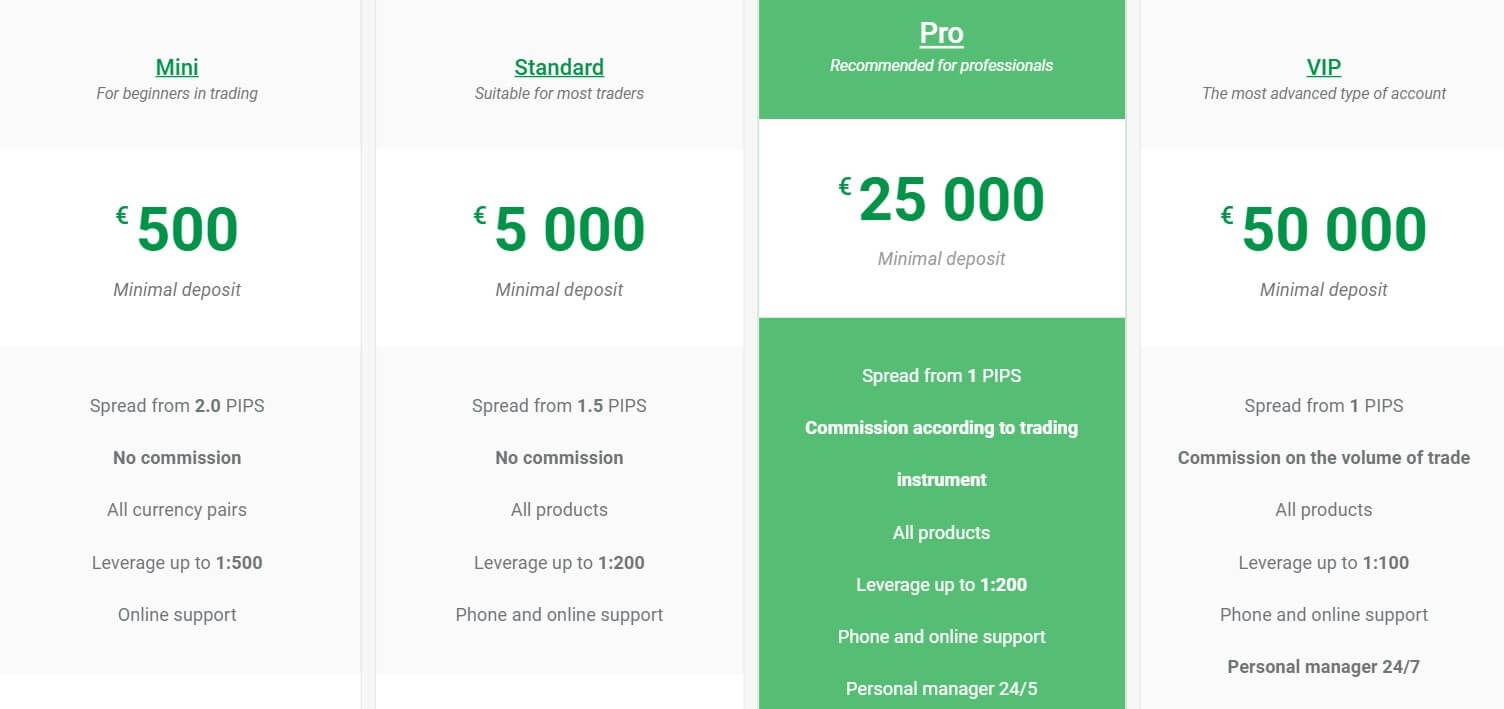

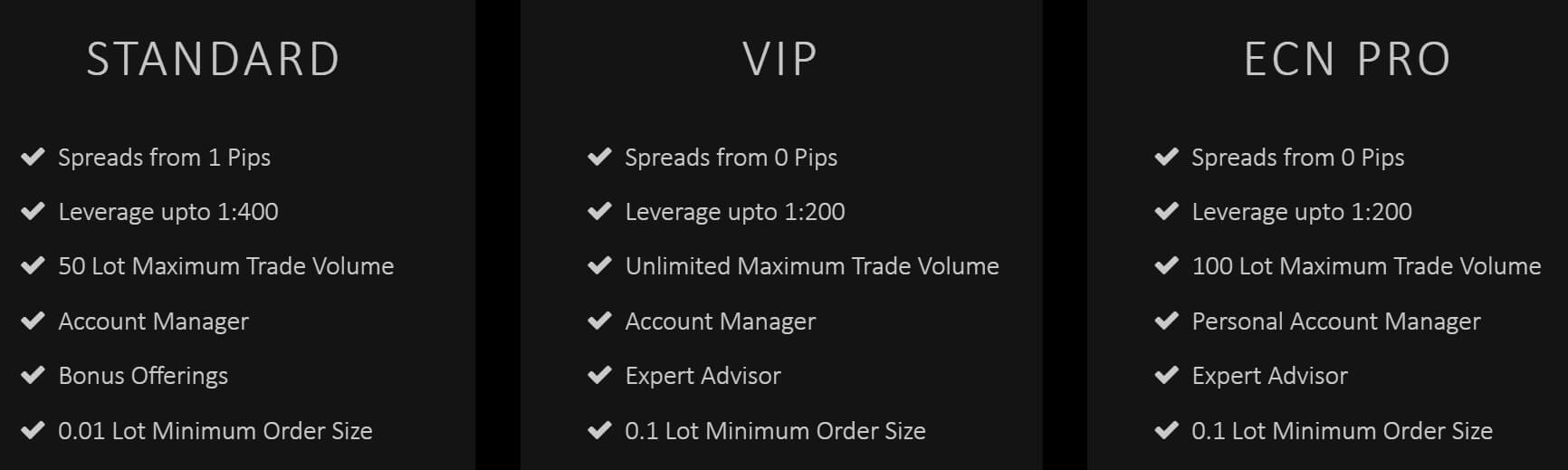

The spreads that you receive are dependent on the account that you are using, the mini account has spread starting from 2 pips, the standard account has spread starting from around 1.5 pips and the Pro and VIP account have spread as low as 0 pips. The product specification page unfortunately just has all instruments set as a minimum 0 pips so we can not see what they actually might be. What we do know though is that the spreads are variable (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads, so while EURUSD may start at 2 pips, other assets like GBPJPY may start slightly higher, 2.5 pips (numbers are estimated).

The spreads that you receive are dependent on the account that you are using, the mini account has spread starting from 2 pips, the standard account has spread starting from around 1.5 pips and the Pro and VIP account have spread as low as 0 pips. The product specification page unfortunately just has all instruments set as a minimum 0 pips so we can not see what they actually might be. What we do know though is that the spreads are variable (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads, so while EURUSD may start at 2 pips, other assets like GBPJPY may start slightly higher, 2.5 pips (numbers are estimated). Minimum Deposit

Minimum Deposit

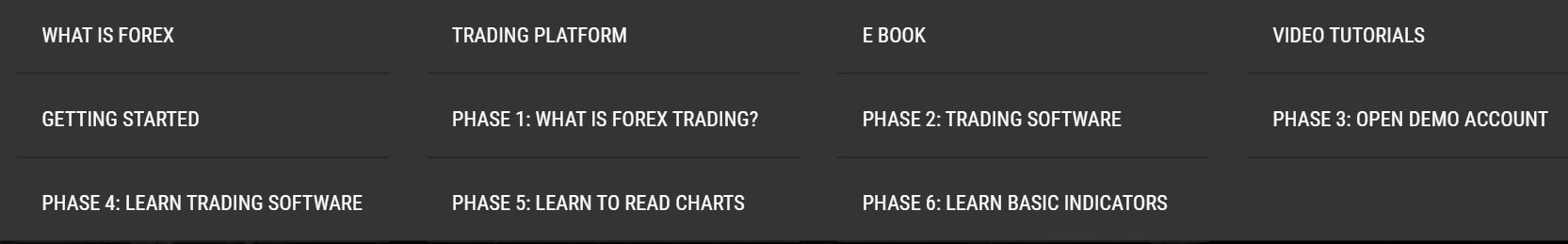

Educational & Trading Tools

Educational & Trading Tools

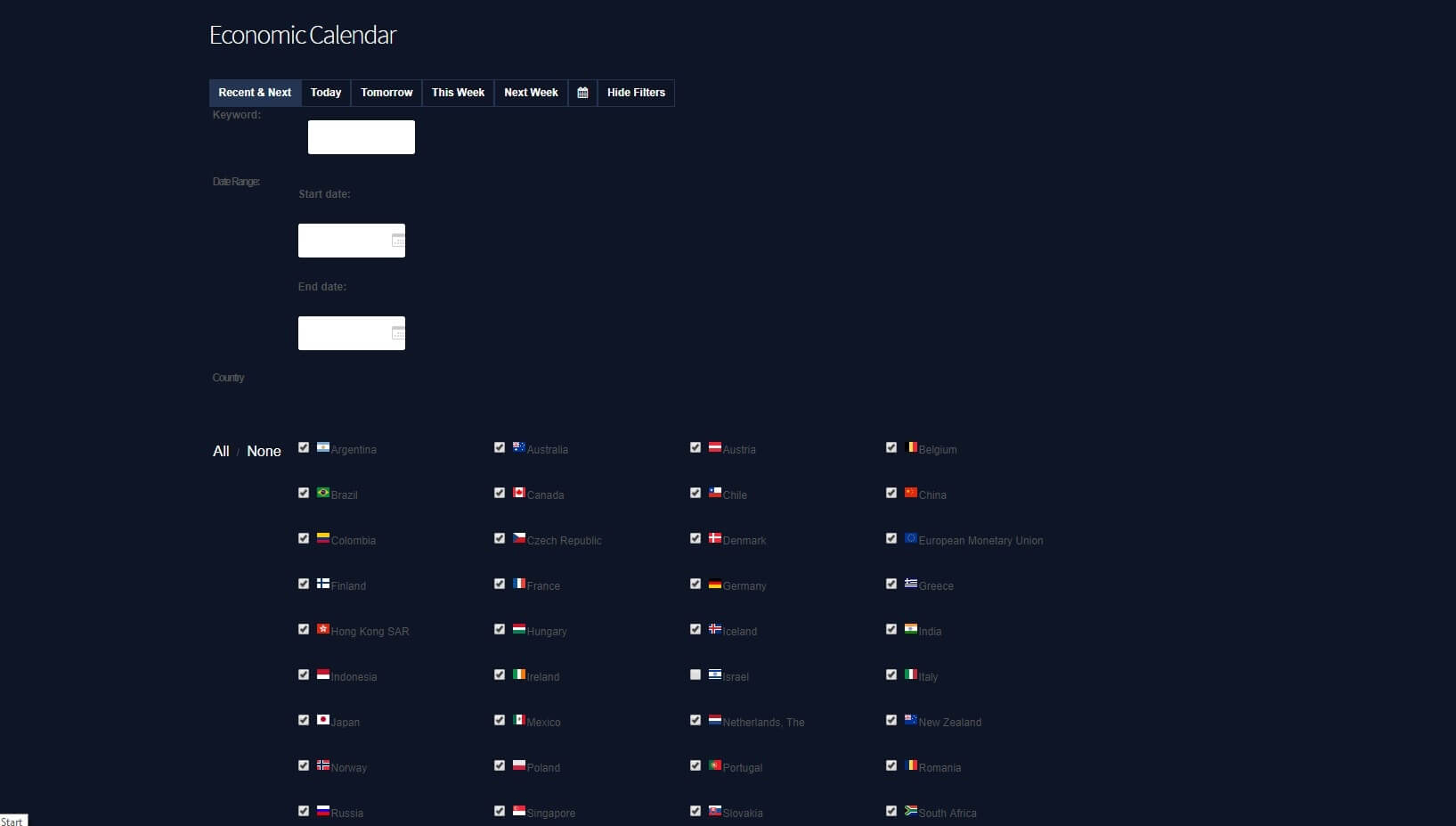

There are a few aspects to the educational side of the site, there are some 1-on-1 forex instructions for people with accounts larger than $1,000, there are also some webinars but we don’t really know how good they are. There is then an economic calendar, this shows you upcoming news events and also indicates which markets the news may affect. Next up is a glossary of trading-related terms, there is a page for video tutorials but the page currently states that it is coming soon. The final section is trading for beginners, but there isn’t much information on it so it isn’t the most helpful page you will come across when trying to educate yourself.

There are a few aspects to the educational side of the site, there are some 1-on-1 forex instructions for people with accounts larger than $1,000, there are also some webinars but we don’t really know how good they are. There is then an economic calendar, this shows you upcoming news events and also indicates which markets the news may affect. Next up is a glossary of trading-related terms, there is a page for video tutorials but the page currently states that it is coming soon. The final section is trading for beginners, but there isn’t much information on it so it isn’t the most helpful page you will come across when trying to educate yourself.

Platforms

Platforms The maximum leverage seems to be 1:200, however, there are mentions of 1:1000 on the site for example which is a little strange and could cause some confusion. For clarification, the

The maximum leverage seems to be 1:200, however, there are mentions of 1:1000 on the site for example which is a little strange and could cause some confusion. For clarification, the

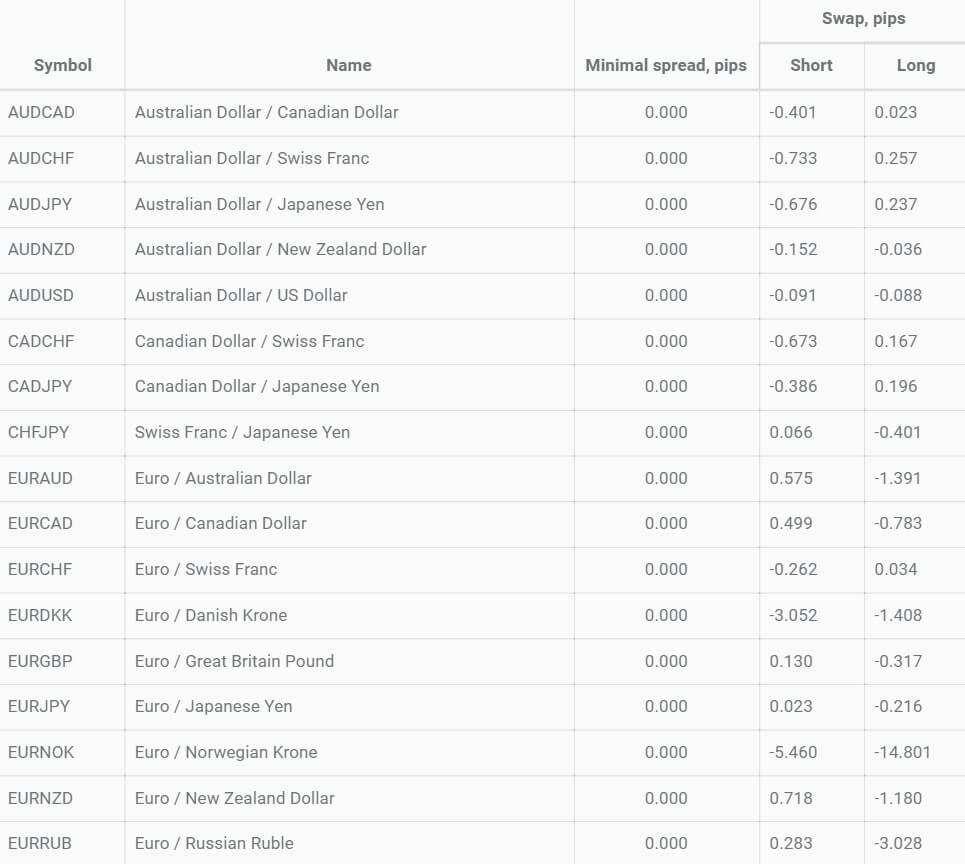

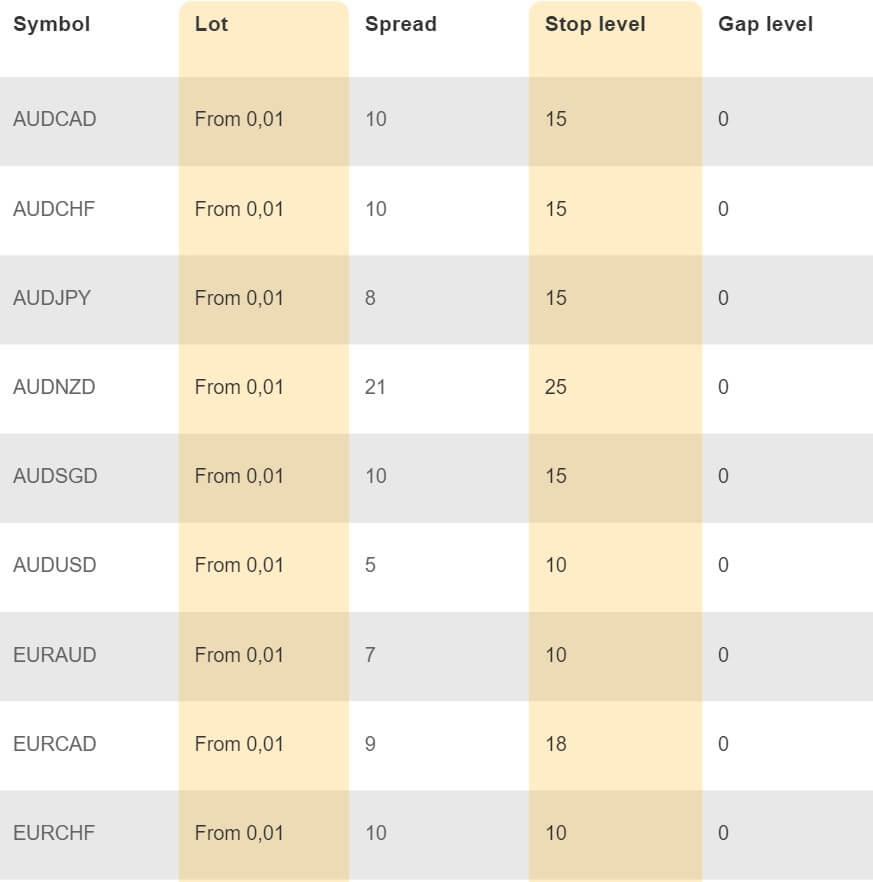

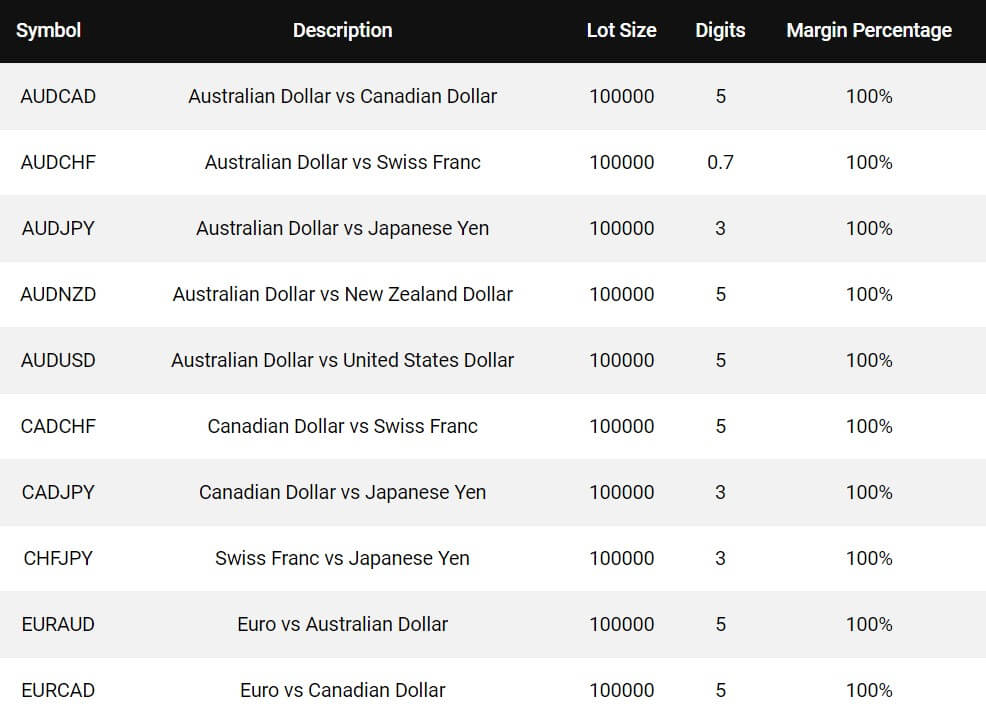

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, AUDUSD, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURSGD, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPSGD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDSGD, NZDUSD, USDCAD, USDCHF, USDDKK, USDJPY, USDMXN, USDNOK, USDSEK, USDSGD.

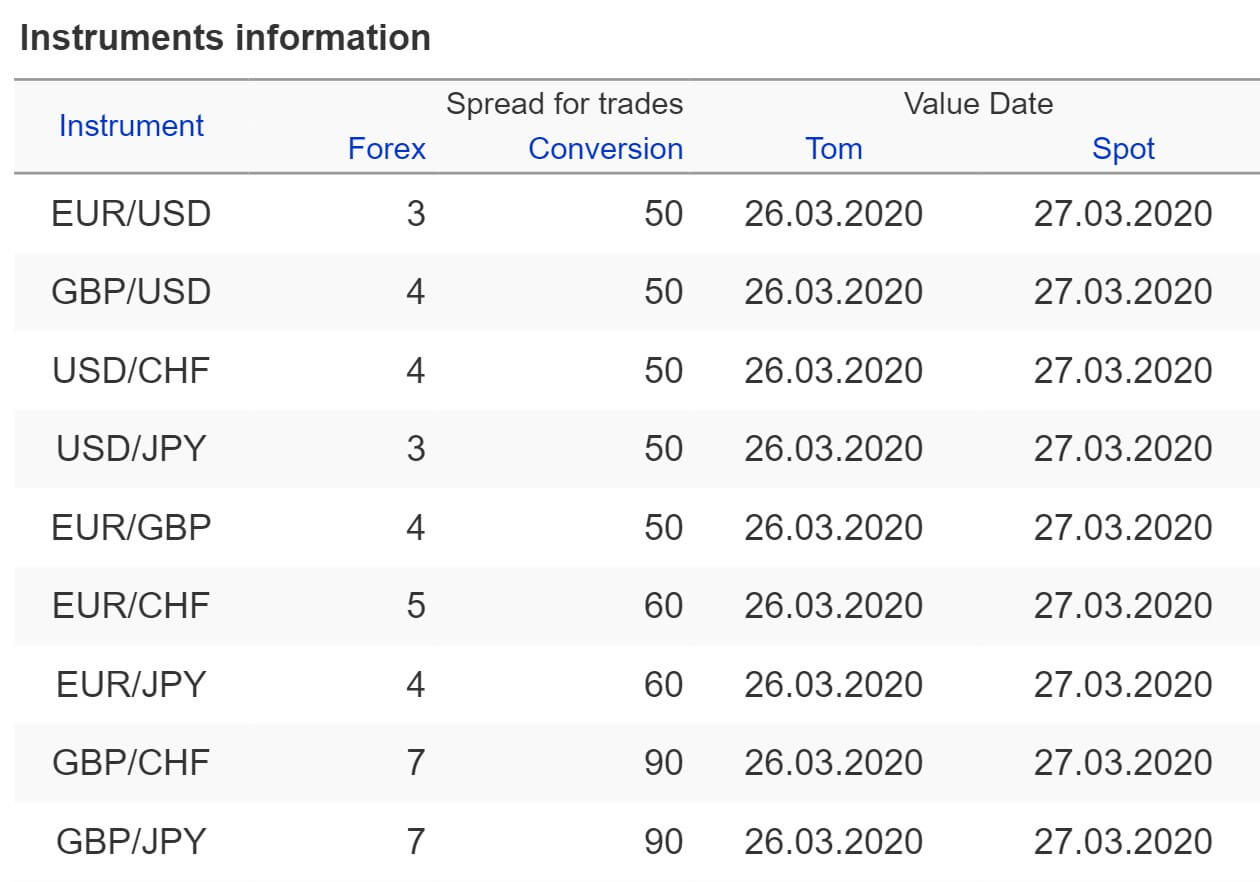

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, AUDUSD, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURSGD, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPSGD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDSGD, NZDUSD, USDCAD, USDCHF, USDDKK, USDJPY, USDMXN, USDNOK, USDSEK, USDSGD. The spreads on the account page state that they start from 2 pips fixed, however looking at the actual spreads the lowest available is 3 pips which are on the EURUSD pair. The spreads are fixed so they do not change and will always remain the same no matter what is happening on the markets. Different instruments will also have different spreads, so while EURUSD has a fixed spread of 3 pips, different pairs such as

The spreads on the account page state that they start from 2 pips fixed, however looking at the actual spreads the lowest available is 3 pips which are on the EURUSD pair. The spreads are fixed so they do not change and will always remain the same no matter what is happening on the markets. Different instruments will also have different spreads, so while EURUSD has a fixed spread of 3 pips, different pairs such as

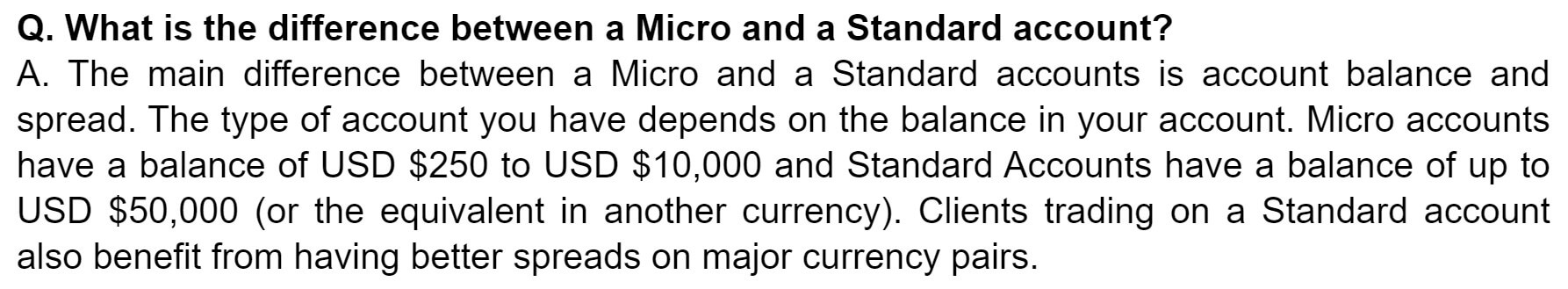

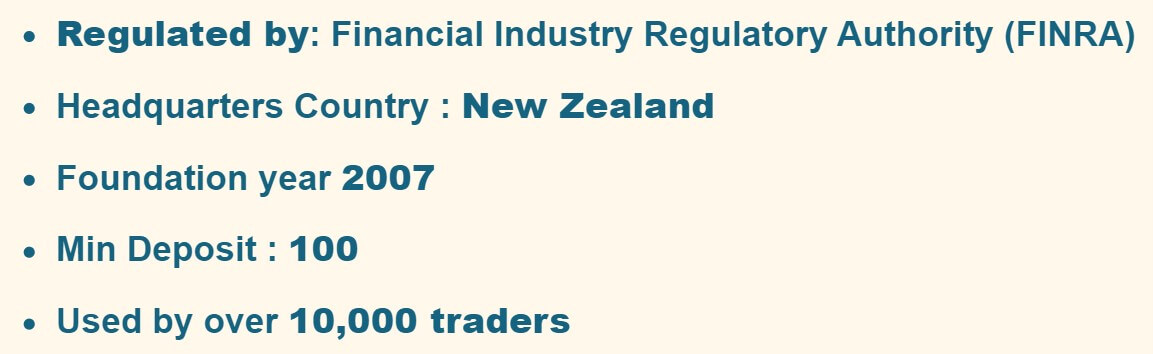

The minimum deposit required to open up an account is $100 which allows you to open up a Micro account, we do not know if the minimum amount reduces once an account has been opened.

The minimum deposit required to open up an account is $100 which allows you to open up a Micro account, we do not know if the minimum amount reduces once an account has been opened.

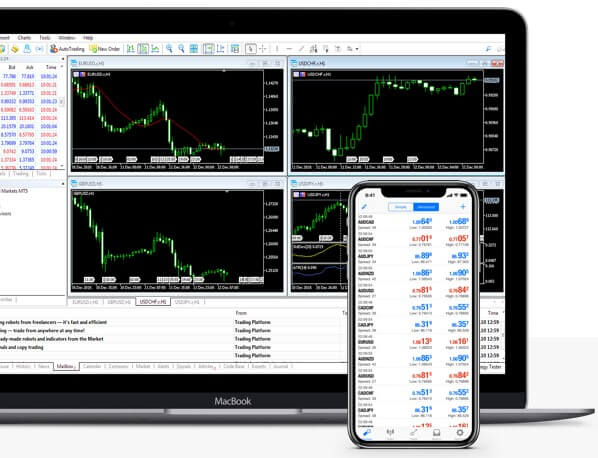

TP Global FX uses MetaTrader 4 as their trading platform which is available as a desktop download, mobile application or web trader. It is one of the world’s most used trading platforms hosting the trades of over 1,000,000 traders worldwide. Some of its many features include that it is available in 30+ languages, allows the use of EA’s & Robots for trade automation, has options to choose from instruments such as Commodities, Indices, and Forex, has requirement based customization with multiple charting as well as analysis, it also offers daily statement for an account, has the availability of analytical tools those are pre-programmed and had real-time account summary for clients which includes floating profit/loss and account equity, etc.

TP Global FX uses MetaTrader 4 as their trading platform which is available as a desktop download, mobile application or web trader. It is one of the world’s most used trading platforms hosting the trades of over 1,000,000 traders worldwide. Some of its many features include that it is available in 30+ languages, allows the use of EA’s & Robots for trade automation, has options to choose from instruments such as Commodities, Indices, and Forex, has requirement based customization with multiple charting as well as analysis, it also offers daily statement for an account, has the availability of analytical tools those are pre-programmed and had real-time account summary for clients which includes floating profit/loss and account equity, etc.

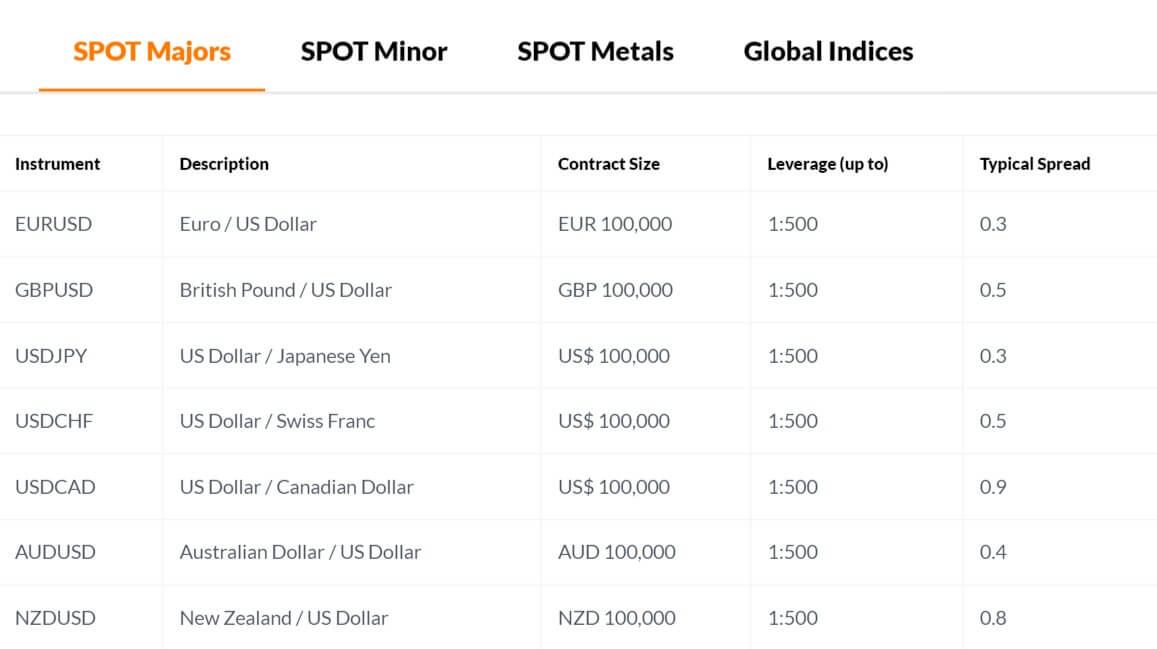

Forex Majors: EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD, NXDUSD

Forex Majors: EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD, NXDUSD

Educational & Trading Tools

Educational & Trading Tools

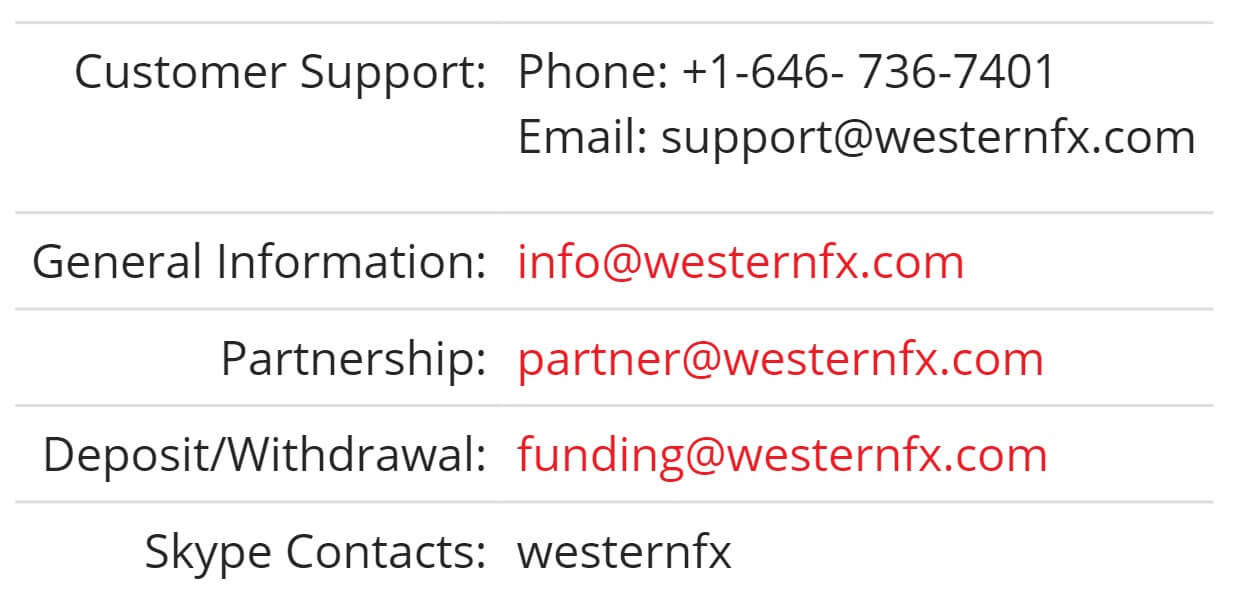

WesternFX is offering MetaTrader 5 as their sole trading platform, so let’s see what the platform actually offers.

WesternFX is offering MetaTrader 5 as their sole trading platform, so let’s see what the platform actually offers.

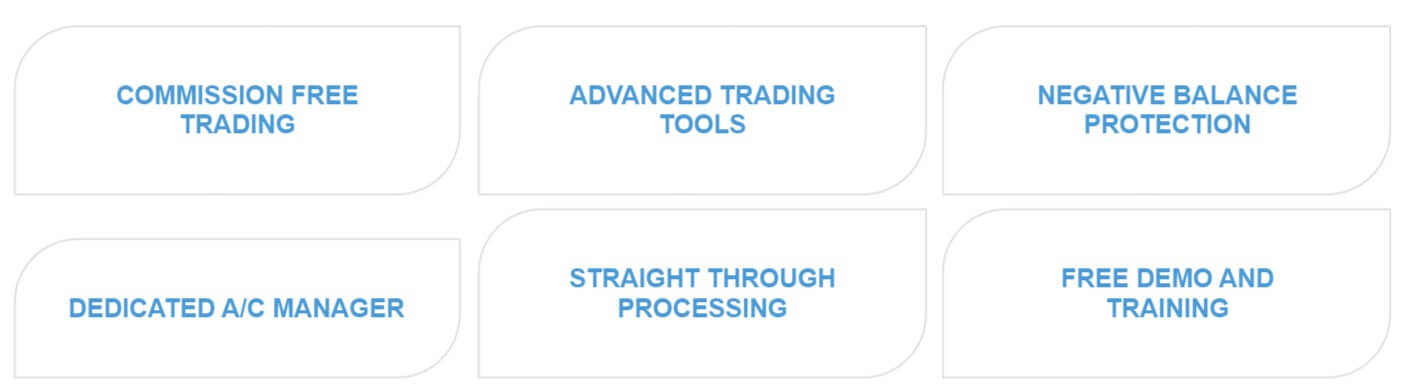

Just the one platform available which is X-Web, the platform is easy to use and does not require any installation or download it can be accessed by clients through a PC or Laptop from anywhere in the world. A few of its many features are its customization, chart analysis, and trading, news and analysis, one-click trading, built-in the economic calendar, and automated trading. It also comes as a mobile application that offers the ability to trade on the move, it’s easy to use and is optimized for mobile devices.

Just the one platform available which is X-Web, the platform is easy to use and does not require any installation or download it can be accessed by clients through a PC or Laptop from anywhere in the world. A few of its many features are its customization, chart analysis, and trading, news and analysis, one-click trading, built-in the economic calendar, and automated trading. It also comes as a mobile application that offers the ability to trade on the move, it’s easy to use and is optimized for mobile devices.

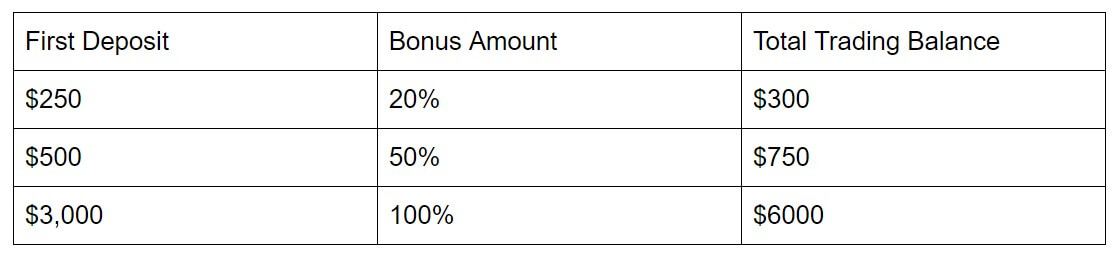

There are a few different promotions, however, the majority are based around referring people so we are not really interested in those types of promotions. There is one other type of bonus that is related to getting a 50% bonus on your first deposit up to $500. We, unfortunately, do not have knowledge of the terms of promotions such as how to convert the bonus funds into real funds.

There are a few different promotions, however, the majority are based around referring people so we are not really interested in those types of promotions. There is one other type of bonus that is related to getting a 50% bonus on your first deposit up to $500. We, unfortunately, do not have knowledge of the terms of promotions such as how to convert the bonus funds into real funds.

There are a few different aspects of the educational side of the CapitalXP site. There is a video course, which has a number of different videos going over various subjects such as forex trading, market analysis, trading strategies and more. There is also a webinar page, however, the calendar shows that there aren’t any coming up so we do not know if this part of the site is still active. You are able to download a number of ebooks which include subjects like “succeeding with Forex trading”, and “ Trading cryptocurrencies: the basics”. There is also a glossary of trading terms which you can refer back to if you come across something that you do not know the meaning of.

There are a few different aspects of the educational side of the CapitalXP site. There is a video course, which has a number of different videos going over various subjects such as forex trading, market analysis, trading strategies and more. There is also a webinar page, however, the calendar shows that there aren’t any coming up so we do not know if this part of the site is still active. You are able to download a number of ebooks which include subjects like “succeeding with Forex trading”, and “ Trading cryptocurrencies: the basics”. There is also a glossary of trading terms which you can refer back to if you come across something that you do not know the meaning of.

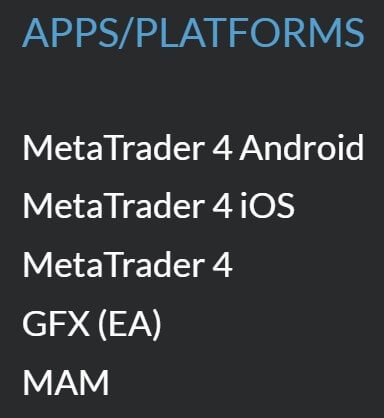

The use of MetaTrader 4 is available with Gold FX and for good reason, it is one of the most accessible platforms with a desktop download available as well as mobile applications and a web trader. Some of its other features include it being user-friendly, it has multiple languages, its equipped with advanced communication tools, provides personal information such as account balances, trade history, it works with all kind of currency, has advanced real-time charts, provides indicator, technical analysis, order management tools and customizable high tech chart, its a highly secure platform, and has the use of thousands of expert advisors and indicators to help with your trading and analytical needs.

The use of MetaTrader 4 is available with Gold FX and for good reason, it is one of the most accessible platforms with a desktop download available as well as mobile applications and a web trader. Some of its other features include it being user-friendly, it has multiple languages, its equipped with advanced communication tools, provides personal information such as account balances, trade history, it works with all kind of currency, has advanced real-time charts, provides indicator, technical analysis, order management tools and customizable high tech chart, its a highly secure platform, and has the use of thousands of expert advisors and indicators to help with your trading and analytical needs.

There are a few different aspects to the education and trading tools side of the site. The first section is some videos based on different strategies and how to trade them. There is also a section detailing a few different trading strategies. There is some research and analysis information, but this is pretty irrelevant as it has not been updated for 2 years now. Finally, there is an economic calendar, this details upcoming news events and also shows which markets they may affect.

There are a few different aspects to the education and trading tools side of the site. The first section is some videos based on different strategies and how to trade them. There is also a section detailing a few different trading strategies. There is some research and analysis information, but this is pretty irrelevant as it has not been updated for 2 years now. Finally, there is an economic calendar, this details upcoming news events and also shows which markets they may affect.

The maximum leverage available is 1:200, we believe that all accounts use the same leverage so they all have access to this amount. It can be selected when opening up an account, we are not sure if it can be changed once an account has been opened.

The maximum leverage available is 1:200, we believe that all accounts use the same leverage so they all have access to this amount. It can be selected when opening up an account, we are not sure if it can be changed once an account has been opened.

There is not a dedicated page for funding, the only information we have is some images at the bottom of the website, they indicate that Visa, Maestro, MasterCard, Neteller, and AstroPay are available to use, but we have no confirmation of this, we also do not know if there are any added fees when depositing but you should check with whatever method you are using to see if any are added by them.

There is not a dedicated page for funding, the only information we have is some images at the bottom of the website, they indicate that Visa, Maestro, MasterCard, Neteller, and AstroPay are available to use, but we have no confirmation of this, we also do not know if there are any added fees when depositing but you should check with whatever method you are using to see if any are added by them.

There is a 30% bonus available, the only details about the promotion are on the account sign up page which states that you can get a 30% bonus on your first deposit. There is no more information surrounding it such as how to convert the bonus into real funds or what the maximum bonus available is.

There is a 30% bonus available, the only details about the promotion are on the account sign up page which states that you can get a 30% bonus on your first deposit. There is no more information surrounding it such as how to convert the bonus into real funds or what the maximum bonus available is.

30:1 for major currency pairs

30:1 for major currency pairs

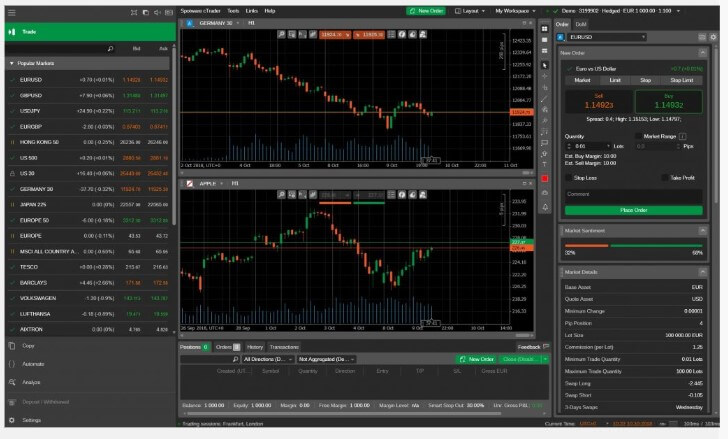

Just the one main platform available from Circle Markets, MT4 is an all-in-one trading platform with a user-friendly interface and easy to use functionalities allowing traders to analyze the markets, place orders and manage their own risk all with a single click; traders can also manage several trading accounts simultaneously, not to mention its cutting edge technology which includes a web-based solution enabling traders to trade at any time from any device and from anywhere in the world. Thousands of free and paid signals with various profitability and risk levels working on a demo and real accounts are at your fingertips. MetaTrader 4 provides the full-fledged environment for the development, testing and optimizing algorithmic/automated trading programs.

Just the one main platform available from Circle Markets, MT4 is an all-in-one trading platform with a user-friendly interface and easy to use functionalities allowing traders to analyze the markets, place orders and manage their own risk all with a single click; traders can also manage several trading accounts simultaneously, not to mention its cutting edge technology which includes a web-based solution enabling traders to trade at any time from any device and from anywhere in the world. Thousands of free and paid signals with various profitability and risk levels working on a demo and real accounts are at your fingertips. MetaTrader 4 provides the full-fledged environment for the development, testing and optimizing algorithmic/automated trading programs.

There are a few small aspects available on the site, the first is a forex compounding calculator allowing you to see how the compounding of your account will work, there is also a currency converter available. The next section is an economic calendar, this details different upcoming news events and also indicates any potential effect the news could have on the markets. There is also a guide to CFDs and even a few small guides based on how to use the trading platforms.

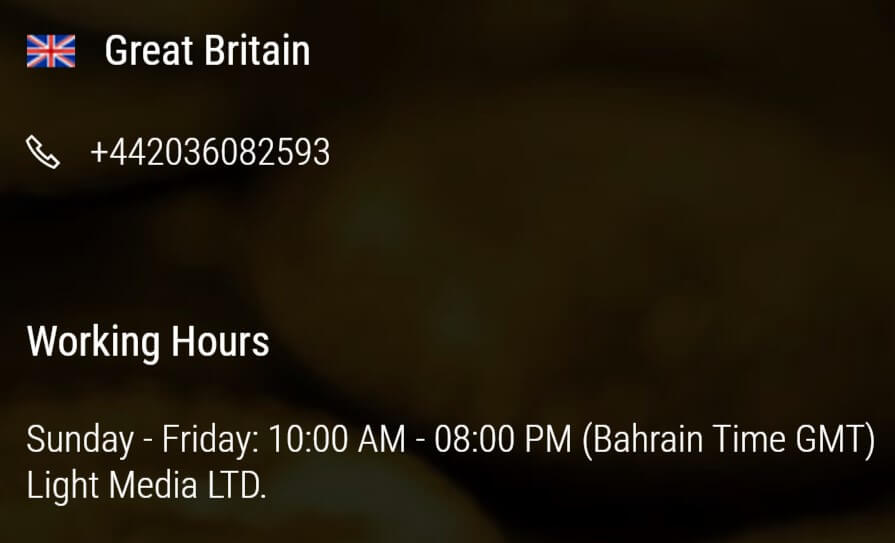

There are a few small aspects available on the site, the first is a forex compounding calculator allowing you to see how the compounding of your account will work, there is also a currency converter available. The next section is an economic calendar, this details different upcoming news events and also indicates any potential effect the news could have on the markets. There is also a guide to CFDs and even a few small guides based on how to use the trading platforms. The Circle Markets support team is available 24 hours a day 7 days a week so they are always reachable. You can contact Circle Markets using the available submission form, simply fill it in and you should then get a reply via email. They also provide you with a postal address, email address and a phone number for a choice of contact methods.

The Circle Markets support team is available 24 hours a day 7 days a week so they are always reachable. You can contact Circle Markets using the available submission form, simply fill it in and you should then get a reply via email. They also provide you with a postal address, email address and a phone number for a choice of contact methods.

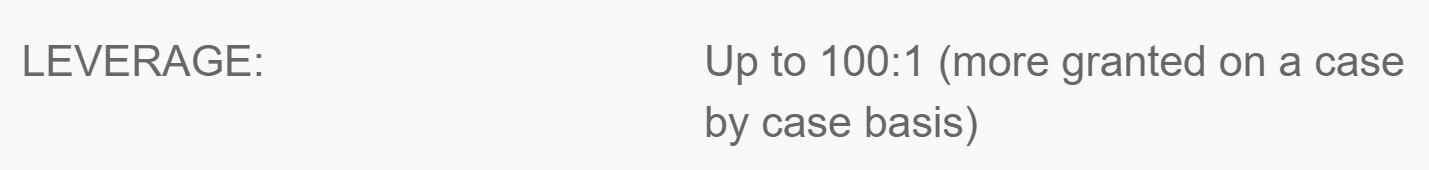

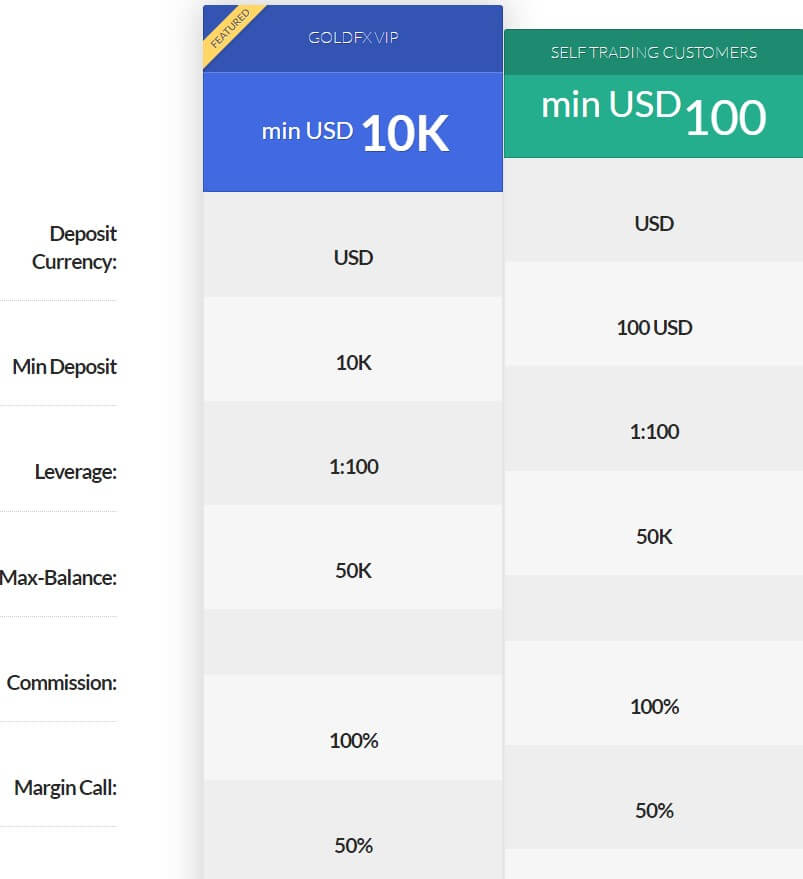

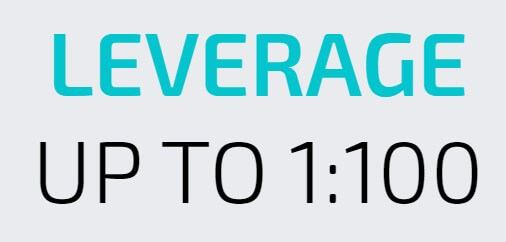

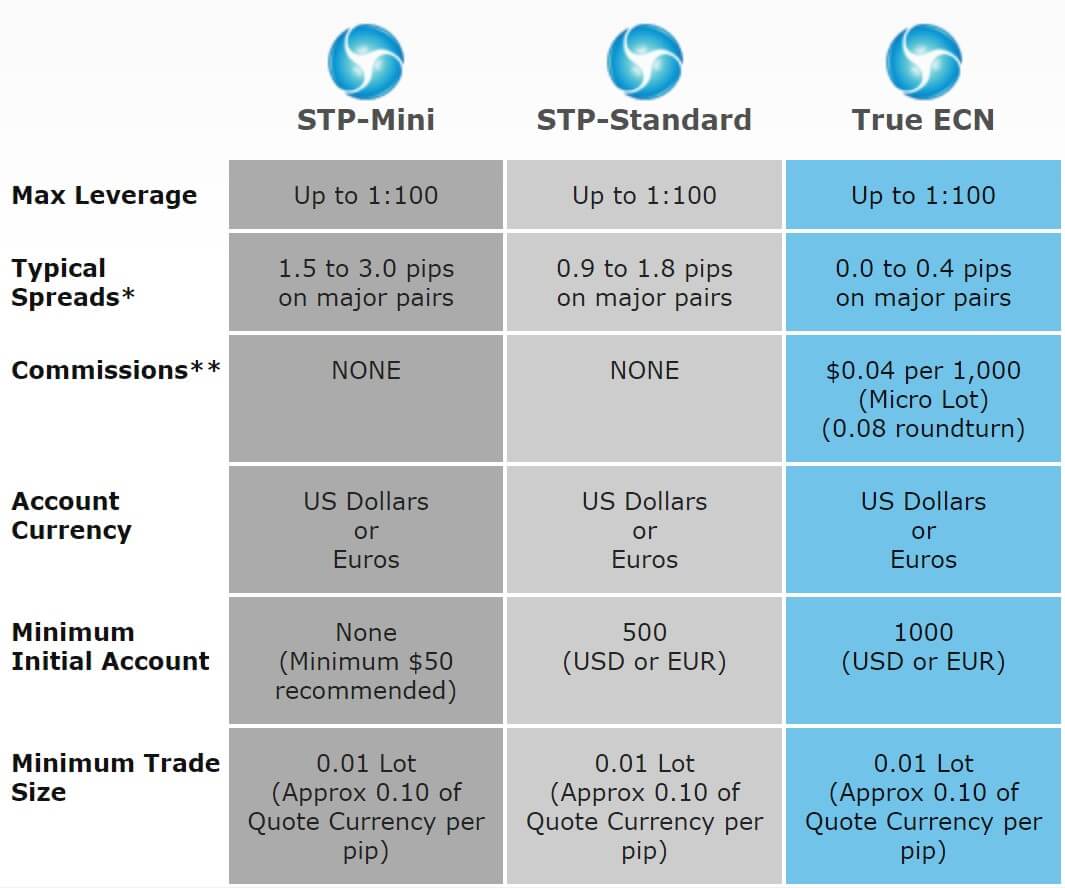

Leverage on all accounts can go up to 1:100, leverage can be selected when opening up an account, we are not sure if it can be changed once an account has been opened though.

Leverage on all accounts can go up to 1:100, leverage can be selected when opening up an account, we are not sure if it can be changed once an account has been opened though.

Educational & Trading Tools

Educational & Trading Tools

BMFN use MetaTrader 4 as their trading platform of choice, MT4 is compatible with hundreds and thousands of expert advisors and indicators to help make your trading more straight forward. It also offers high levels of customization and flexibility, impressive analytical tools and is accessible via a desktop download, mobile application, and web trader. There is a reason why it is one of the most used platforms and trusted by millions of traders all around the world.

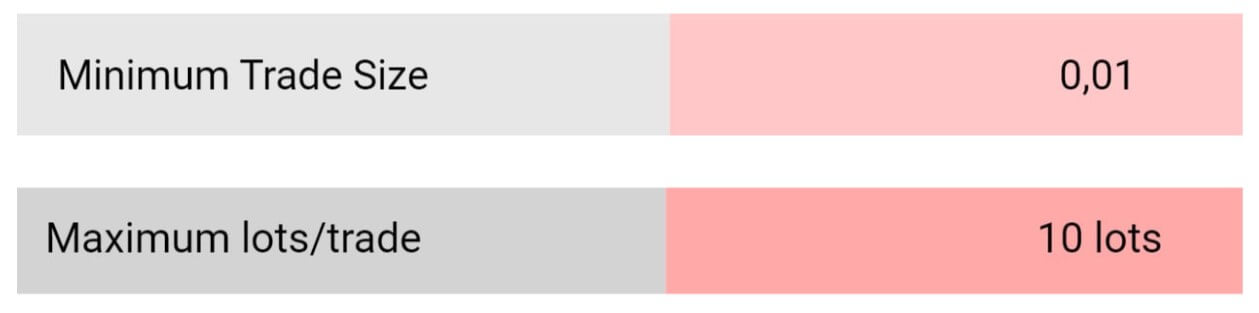

BMFN use MetaTrader 4 as their trading platform of choice, MT4 is compatible with hundreds and thousands of expert advisors and indicators to help make your trading more straight forward. It also offers high levels of customization and flexibility, impressive analytical tools and is accessible via a desktop download, mobile application, and web trader. There is a reason why it is one of the most used platforms and trusted by millions of traders all around the world. A lot on BMFX equals 10,000 units instead of the usual 100,000. The minimum

A lot on BMFX equals 10,000 units instead of the usual 100,000. The minimum  Forex:

Forex:

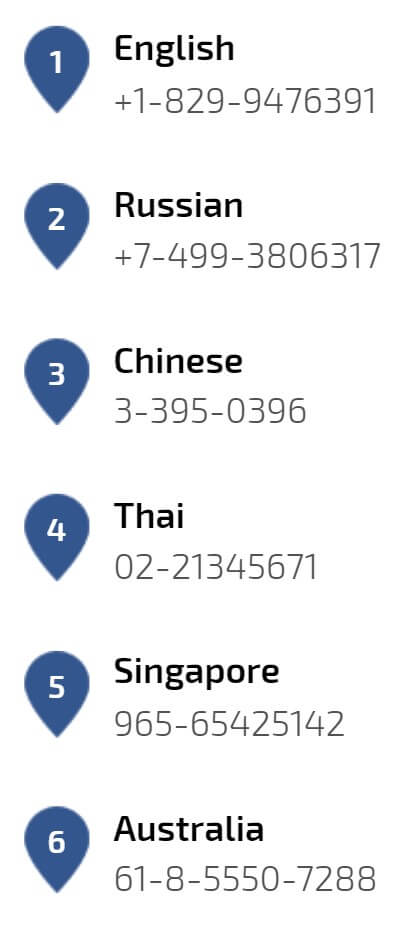

The customer support team is available 24 hours a day 5 days a week, they close over the weekends just like the markets do. Their contact form is very limiting, it only offers an online form to fill in with your name, email, phone and comment. The front page says that they have locations in 14 countries including Australia, the UK, UAE, Egypt and more, and it also states that the customer service team can speak any language as there are 2,5000 assistants worldwide. However, they don’t really offer a way to contact them.

The customer support team is available 24 hours a day 5 days a week, they close over the weekends just like the markets do. Their contact form is very limiting, it only offers an online form to fill in with your name, email, phone and comment. The front page says that they have locations in 14 countries including Australia, the UK, UAE, Egypt and more, and it also states that the customer service team can speak any language as there are 2,5000 assistants worldwide. However, they don’t really offer a way to contact them.

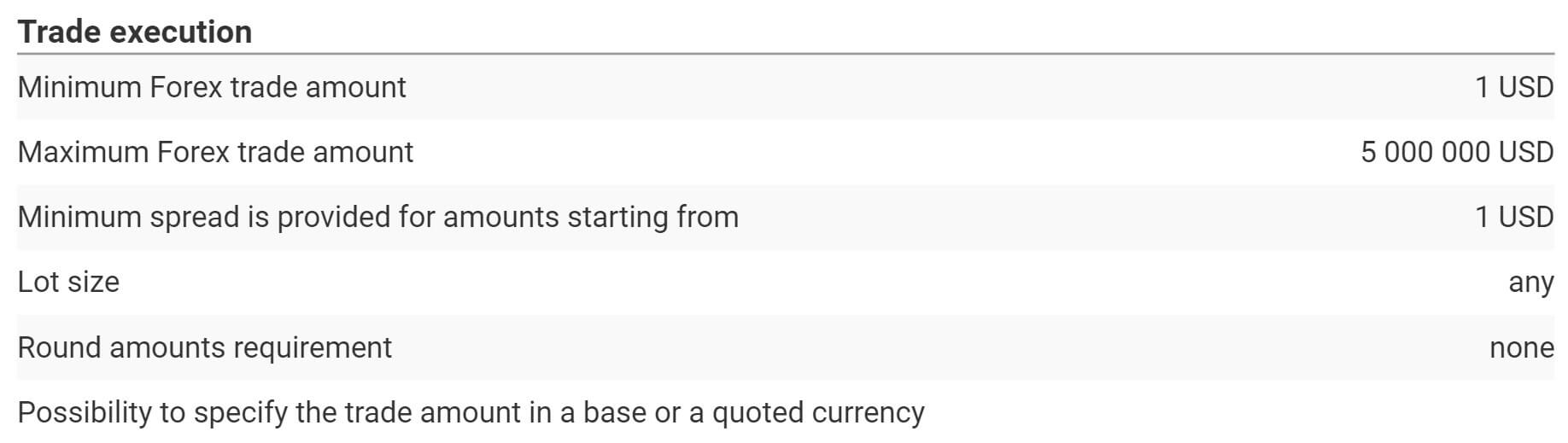

1) A possibility to trade with low risk – a safety Forex trading.

1) A possibility to trade with low risk – a safety Forex trading.

The maximum leverage available is 1:200, it is not clear which accounts this is relevant to but the homepage simply states that the max is 1:200. This can be selected when opening up a new account.

The maximum leverage available is 1:200, it is not clear which accounts this is relevant to but the homepage simply states that the max is 1:200. This can be selected when opening up a new account.

We do not have a full breakdown of the available assets so we also do not have a full breakdown of the available spreads. The only spread mentioned is on the home page which says that the spread on EUR/USD is around 1.6 pips, we would be assuming that this is the starting figure and would be relevant to the top tier account. Lower tier accounts will most likely have higher starting spreads. The spreads are variable though, which means they move with the markets when there is added volatility they will be seen higher and different instruments will have different starting spreads.

We do not have a full breakdown of the available assets so we also do not have a full breakdown of the available spreads. The only spread mentioned is on the home page which says that the spread on EUR/USD is around 1.6 pips, we would be assuming that this is the starting figure and would be relevant to the top tier account. Lower tier accounts will most likely have higher starting spreads. The spreads are variable though, which means they move with the markets when there is added volatility they will be seen higher and different instruments will have different starting spreads. There isn’t a dedicated funding page detailing deposit methods, instead, we can only go with the information provided which is an image of Visa, Maestro, MasterCard, Neteller and AstroPay at the bottom of the site. There are no added fees for depositing and we would always suggest contacting your bank or processor to see if they will add any fees of their own.

There isn’t a dedicated funding page detailing deposit methods, instead, we can only go with the information provided which is an image of Visa, Maestro, MasterCard, Neteller and AstroPay at the bottom of the site. There are no added fees for depositing and we would always suggest contacting your bank or processor to see if they will add any fees of their own. There is a 30% bonus available, the only details about the promotion are on the account sign up page which states that you can get a 30% bonus on your first deposit. There is no more information surrounding it such as how to convert the bonus into real funds or what the maximum bonus available is.

There is a 30% bonus available, the only details about the promotion are on the account sign up page which states that you can get a 30% bonus on your first deposit. There is no more information surrounding it such as how to convert the bonus into real funds or what the maximum bonus available is.

MetaTrader 4: MT4 has quickly become the world’s most used trading platform hosting millions of traders. Accessible as a mobile application, desktop download or web trader, it is accessible from anywhere in the world. It’s compatible with hundreds and thousands of expert advisors and indicators to help with your trading needs.

MetaTrader 4: MT4 has quickly become the world’s most used trading platform hosting millions of traders. Accessible as a mobile application, desktop download or web trader, it is accessible from anywhere in the world. It’s compatible with hundreds and thousands of expert advisors and indicators to help with your trading needs. BNFX xStation: BNFX X Station was designed for advanced currency traders who prefer more control, flexibility, customizations, and speed than traditional retail trading software packages. It provides true one-click trading on Level 2 market depth/order book views, built-in trading calculator, in-platform economic calendar, customizable layouts saved in the cloud, and a direct connection to the BNFX liquidity infrastructure. It was designed from the ground up as an ECN/STP platform

BNFX xStation: BNFX X Station was designed for advanced currency traders who prefer more control, flexibility, customizations, and speed than traditional retail trading software packages. It provides true one-click trading on Level 2 market depth/order book views, built-in trading calculator, in-platform economic calendar, customizable layouts saved in the cloud, and a direct connection to the BNFX liquidity infrastructure. It was designed from the ground up as an ECN/STP platform

Sadly there isn’t any information on the site regarding deposit methods or anything to do with them except for two little images of Visa and MasterCard, so we will be confident to say that they will be available, but we cannot say about any other methods. We also cannot comment on whether there are any added fees for depositing by BNFX.

Sadly there isn’t any information on the site regarding deposit methods or anything to do with them except for two little images of Visa and MasterCard, so we will be confident to say that they will be available, but we cannot say about any other methods. We also cannot comment on whether there are any added fees for depositing by BNFX.

Bonuses & Promotions

Bonuses & Promotions

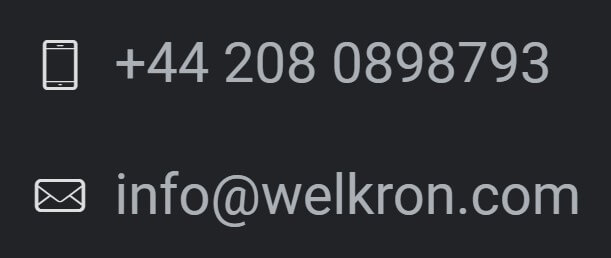

FXLatam is offering a number of different ways to get in contact with them, they do not state what their opening times are though. You are able to use the online submission form, fill it in and you should then get a reply via email, you can also use one of the many phone numbers which are available in countries such as Chile, Mexico, Panama, Peru, UK, and Colombia. There is also a postal address available and an email address, so plenty of ways to contact them.

FXLatam is offering a number of different ways to get in contact with them, they do not state what their opening times are though. You are able to use the online submission form, fill it in and you should then get a reply via email, you can also use one of the many phone numbers which are available in countries such as Chile, Mexico, Panama, Peru, UK, and Colombia. There is also a postal address available and an email address, so plenty of ways to contact them.

Platforms

Platforms

Blue Bull Capital has chosen MetaTrader 4 as their only trading platform, so let’s see what it offers. MetaTrader 4 is compatible with hundreds and thousands of different indicators, expert advisors,

Blue Bull Capital has chosen MetaTrader 4 as their only trading platform, so let’s see what it offers. MetaTrader 4 is compatible with hundreds and thousands of different indicators, expert advisors,  The maximum leverage for both account types is 1:500 which is what a lot of brokers are now aiming for. The leverage can be selected when opening up an account and should you wish to change it on an already open account, you should get in contact with the customer service team with this request.

The maximum leverage for both account types is 1:500 which is what a lot of brokers are now aiming for. The leverage can be selected when opening up an account and should you wish to change it on an already open account, you should get in contact with the customer service team with this request. The assets available from Blue Bull Capital have been broken down into 6 different categories, we will briefly look at each to see some examples of what is available to trade.

The assets available from Blue Bull Capital have been broken down into 6 different categories, we will briefly look at each to see some examples of what is available to trade.

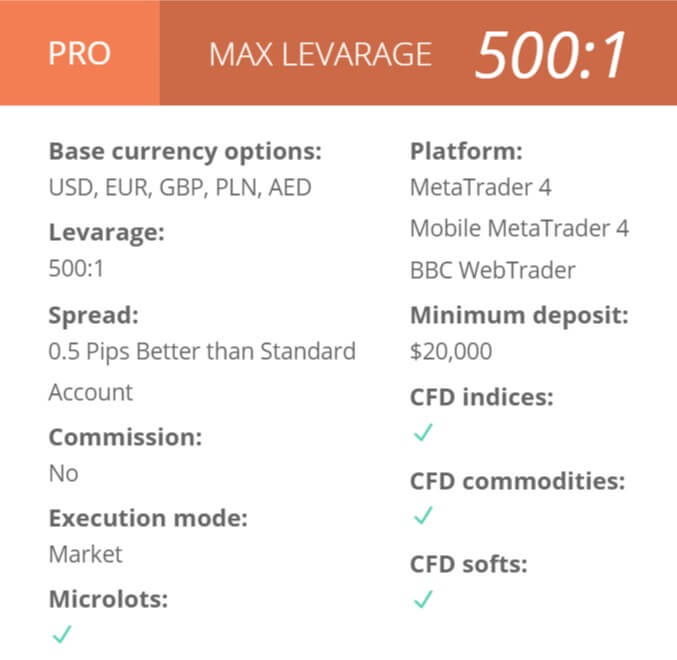

The minimum amount required to open an account is $500 which gets you the Standard account, if you want the Pro account you will need to deposit $20,000. Once an account is open, further top-ups are as low as $5 depending on the method used.

The minimum amount required to open an account is $500 which gets you the Standard account, if you want the Pro account you will need to deposit $20,000. Once an account is open, further top-ups are as low as $5 depending on the method used.

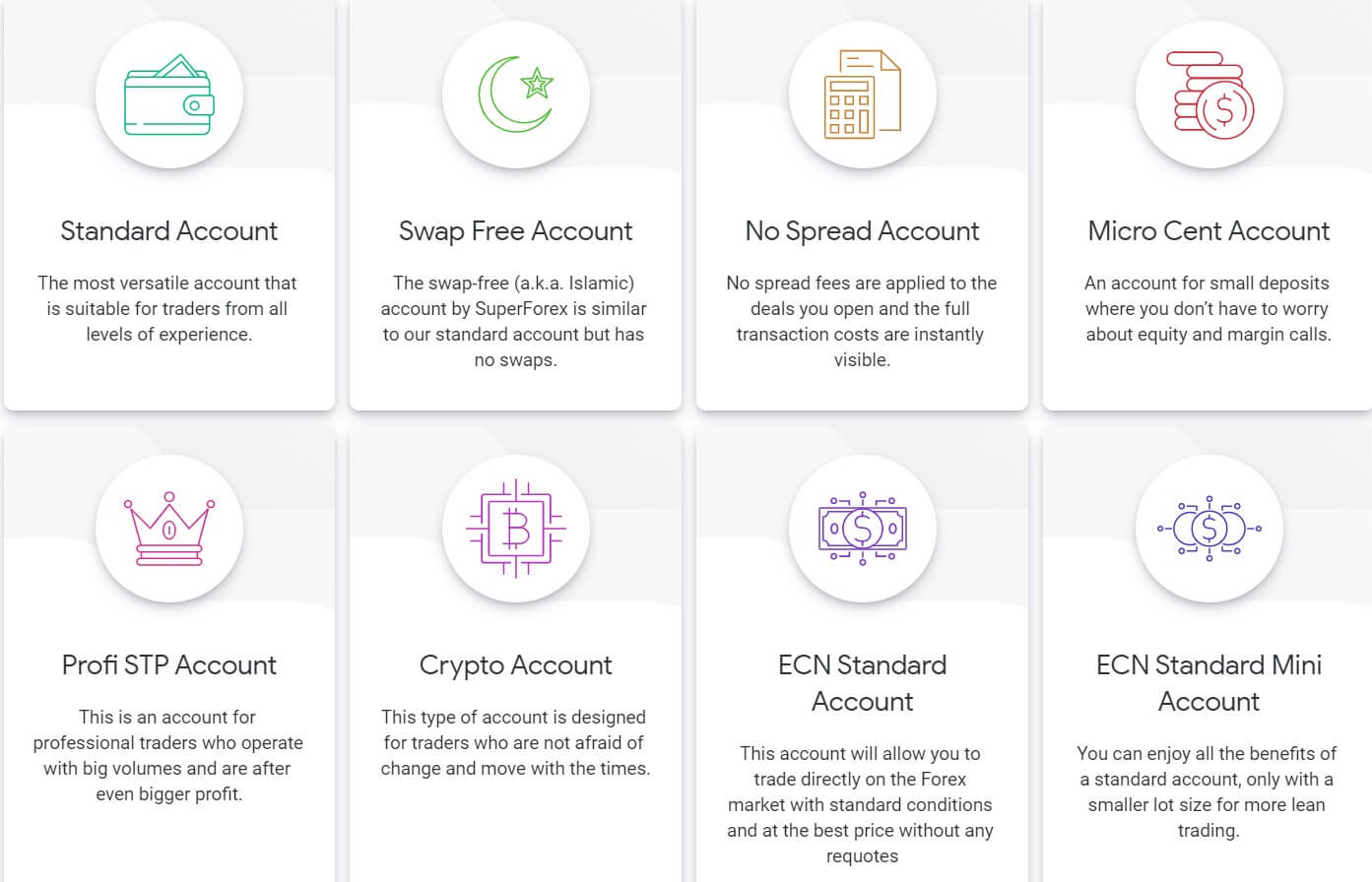

1:1000: STP Standard, STP Swap Free, STP No Spread, STP Micro Cent, ECN Standard, ECN Standard Mini, ECN Swap Free, ECN Swap-Free Mini

1:1000: STP Standard, STP Swap Free, STP No Spread, STP Micro Cent, ECN Standard, ECN Standard Mini, ECN Swap Free, ECN Swap-Free Mini The majority of accounts do not have any added trading commissions, the STP No Spread account has an added commission of 0.038 and 0.062 depending on the instrument. The rest of the accounts do not seem to have any according to the product specifications.

The majority of accounts do not have any added trading commissions, the STP No Spread account has an added commission of 0.038 and 0.062 depending on the instrument. The rest of the accounts do not seem to have any according to the product specifications. Forex:

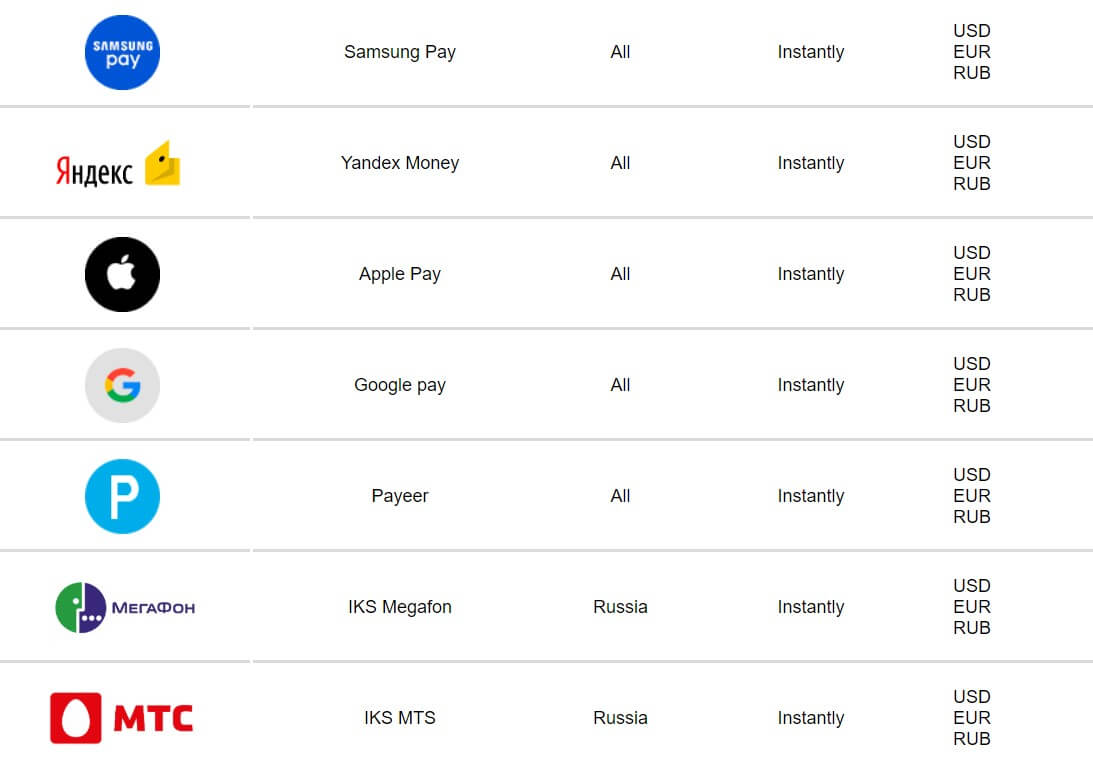

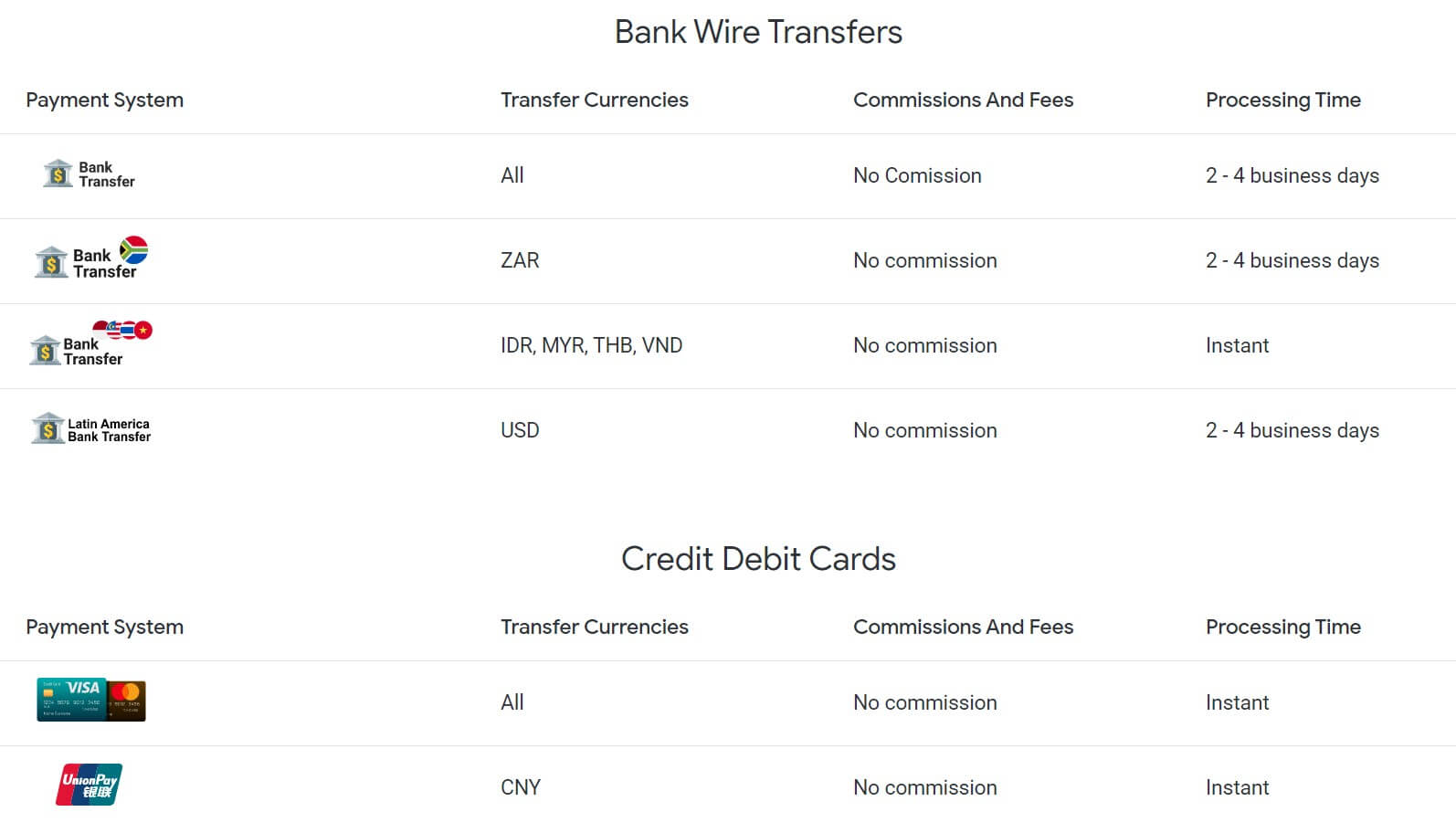

Forex: There are plenty of ways to deposit, the good news is that there are no added fees, however, you should contact your own bank or processor to see if they will add any fees of their own. Bank Wire Transfer, Visa/MasterCard, China UnionPay, Skrill, Sticpay, Neteller, PayCo, Triv, FasaPay, Perfect Money, Payeer, OnlineNaira, iPay, FlutterWave, Cryptocurrencies, and local payments are all available to use.

There are plenty of ways to deposit, the good news is that there are no added fees, however, you should contact your own bank or processor to see if they will add any fees of their own. Bank Wire Transfer, Visa/MasterCard, China UnionPay, Skrill, Sticpay, Neteller, PayCo, Triv, FasaPay, Perfect Money, Payeer, OnlineNaira, iPay, FlutterWave, Cryptocurrencies, and local payments are all available to use.

Educational & Trading Tools

Educational & Trading Tools

Assets

Assets

MetaTrader 4 is the available trading platform, released by MetaQuotes in 2005, MT4

MetaTrader 4 is the available trading platform, released by MetaQuotes in 2005, MT4