VIBHS is an online foreign exchange broker that was established in 2013 and is based out of London in the United Kingdom. VIBHS are fully regulated by the Financial Conduct Authority and have over 50 years of combined experience on their senior management team. They offer a growing range of services that are provided through their global office network and regulated framework. VIBHS is proud to provide its clients with a range of user-friendly platforms, which cater to many languages and are extremely user-friendly. Through these platforms, customers have access to a variety of global markets.

So let’s jump into the review and see exactly what VIBHS is offering their clients.

Account Types

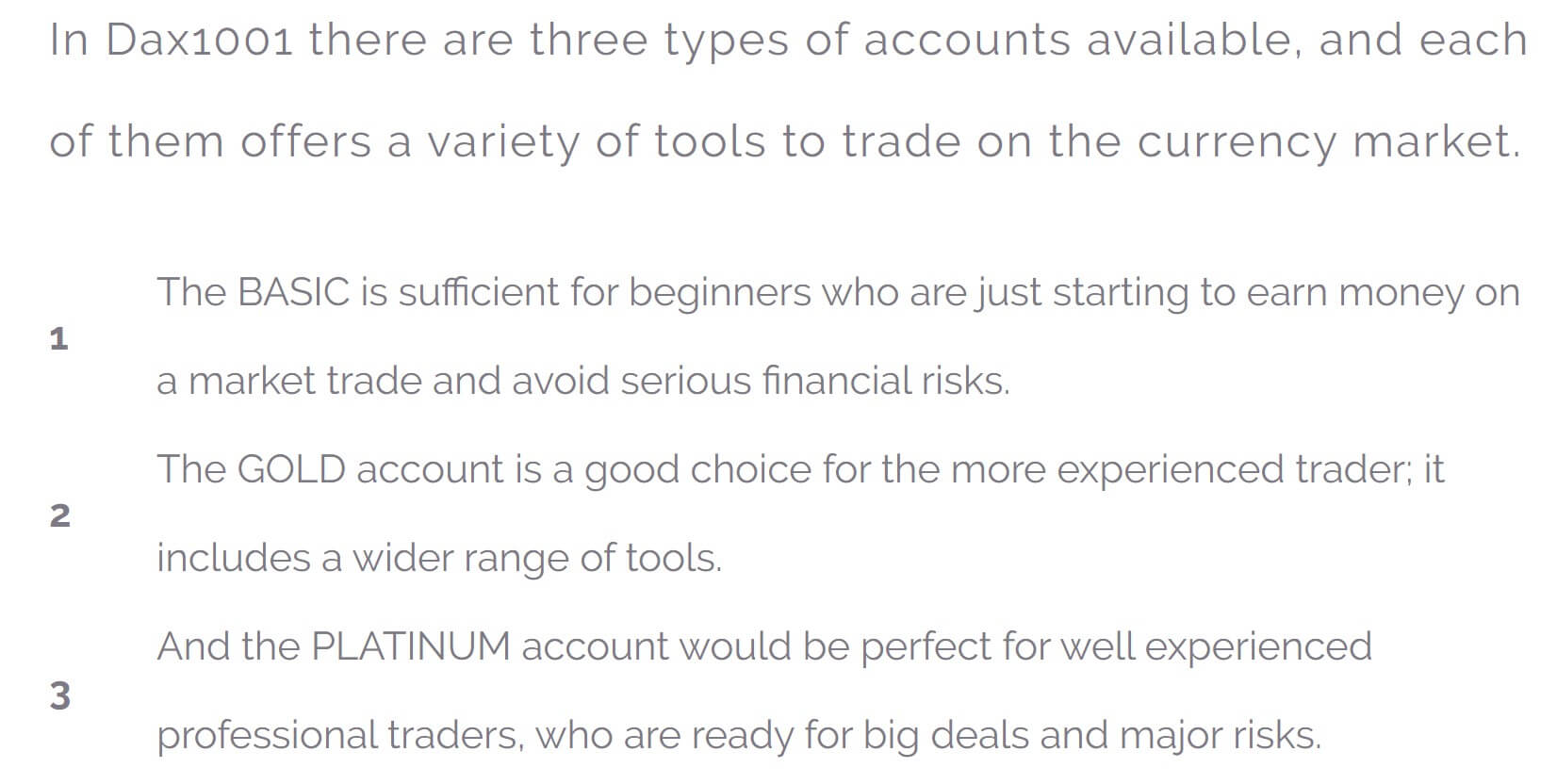

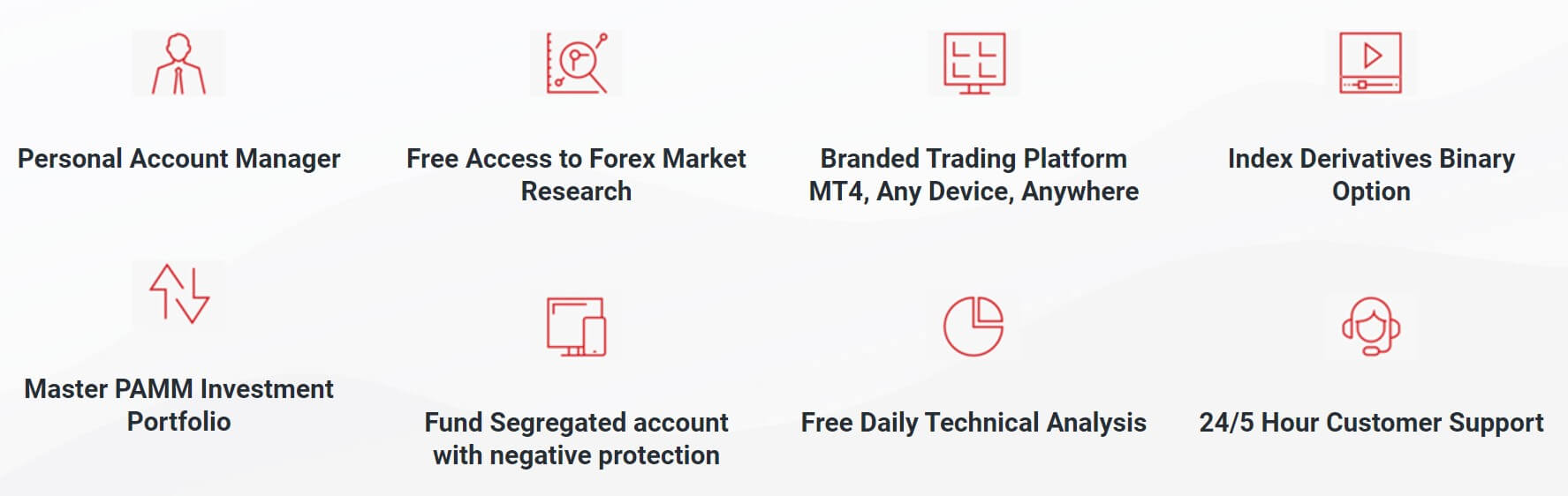

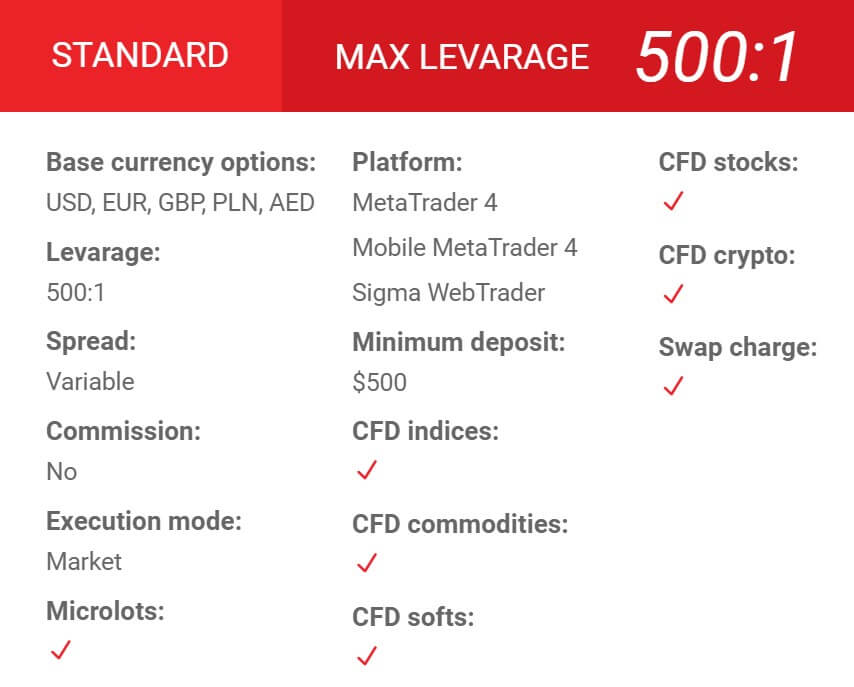

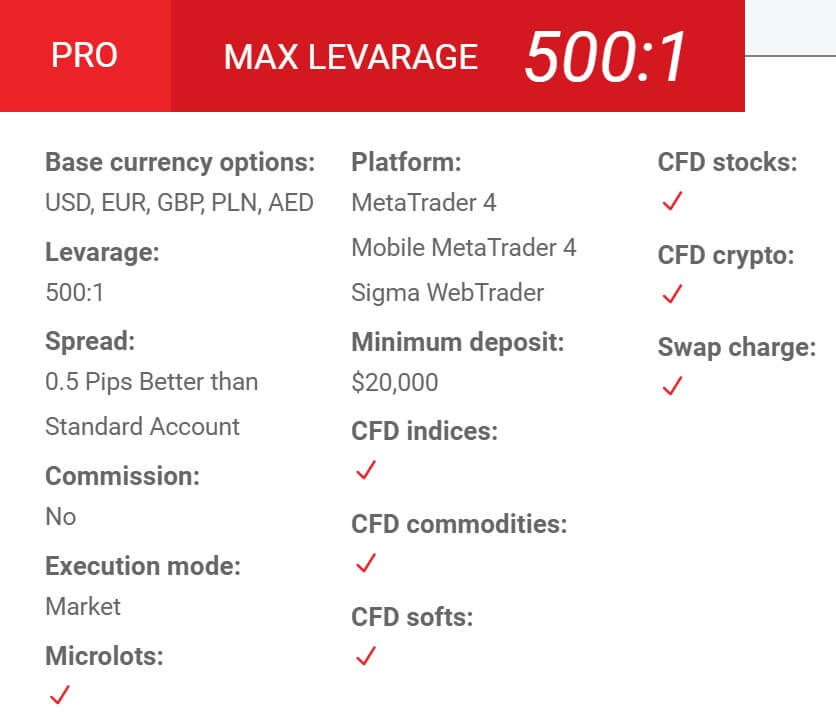

It seems that VIGHS is keeping things simple in the accounting department as there seems to just be a single account available. So as we go through this review, everything that we mention will be relevant to this single account type. We have outline da few of its major features below but will go into them in more detail as we go through the review.

Account Details:

The account requires a minimum deposit of $200 in order to open up, it comes with a maximum leverage up to 1:200 and has an average starting spread of 1 pip. The account can use the MetaTrader 4 trading platform and has multiple methods to deposit into it.

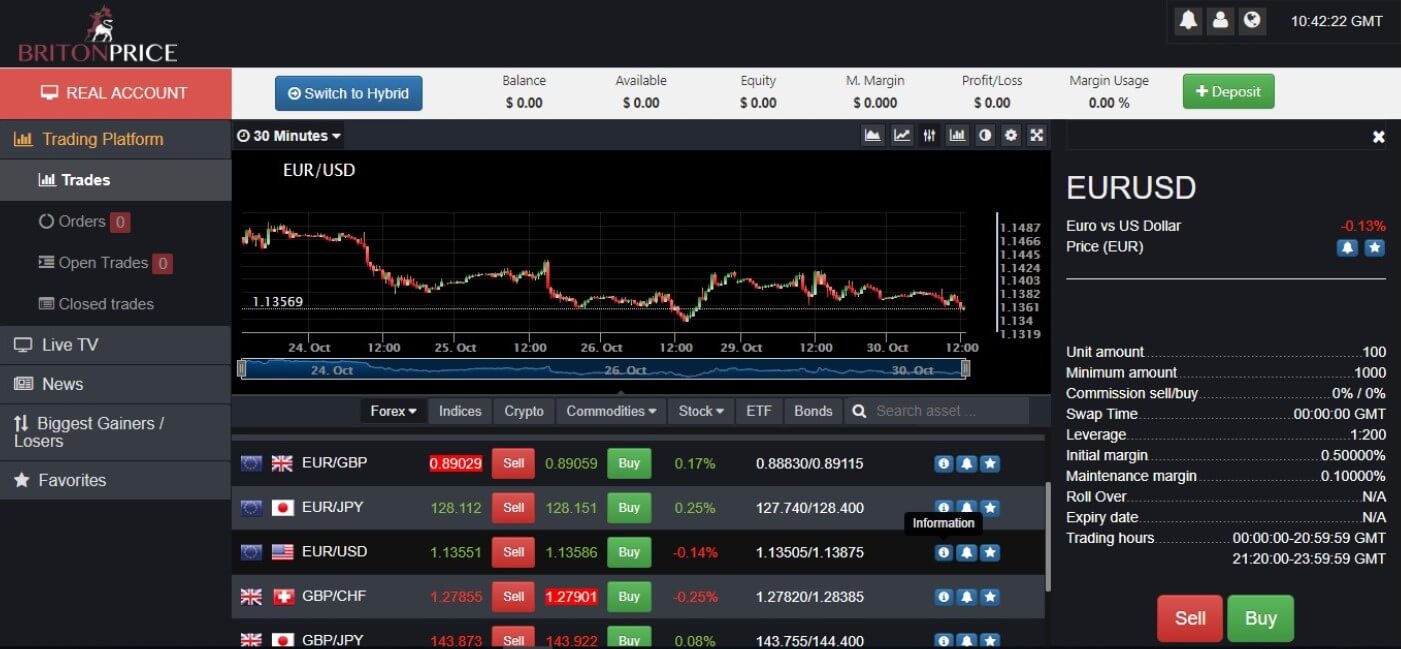

Platforms

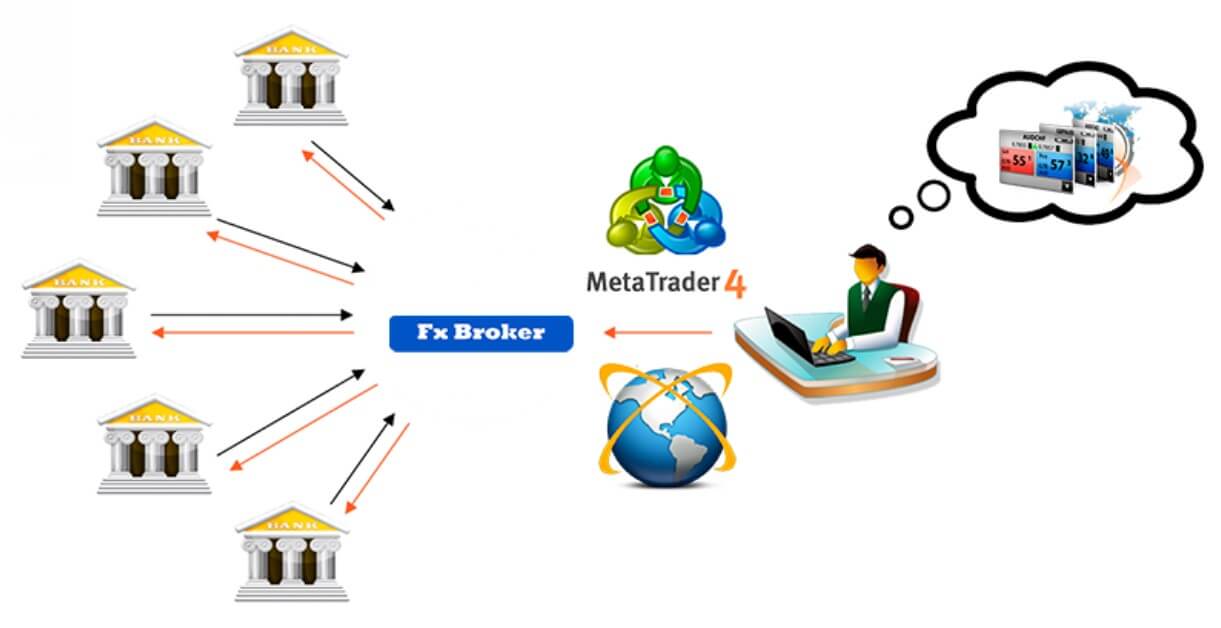

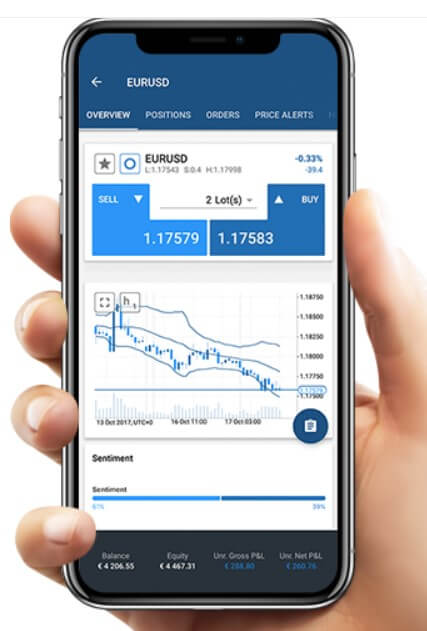

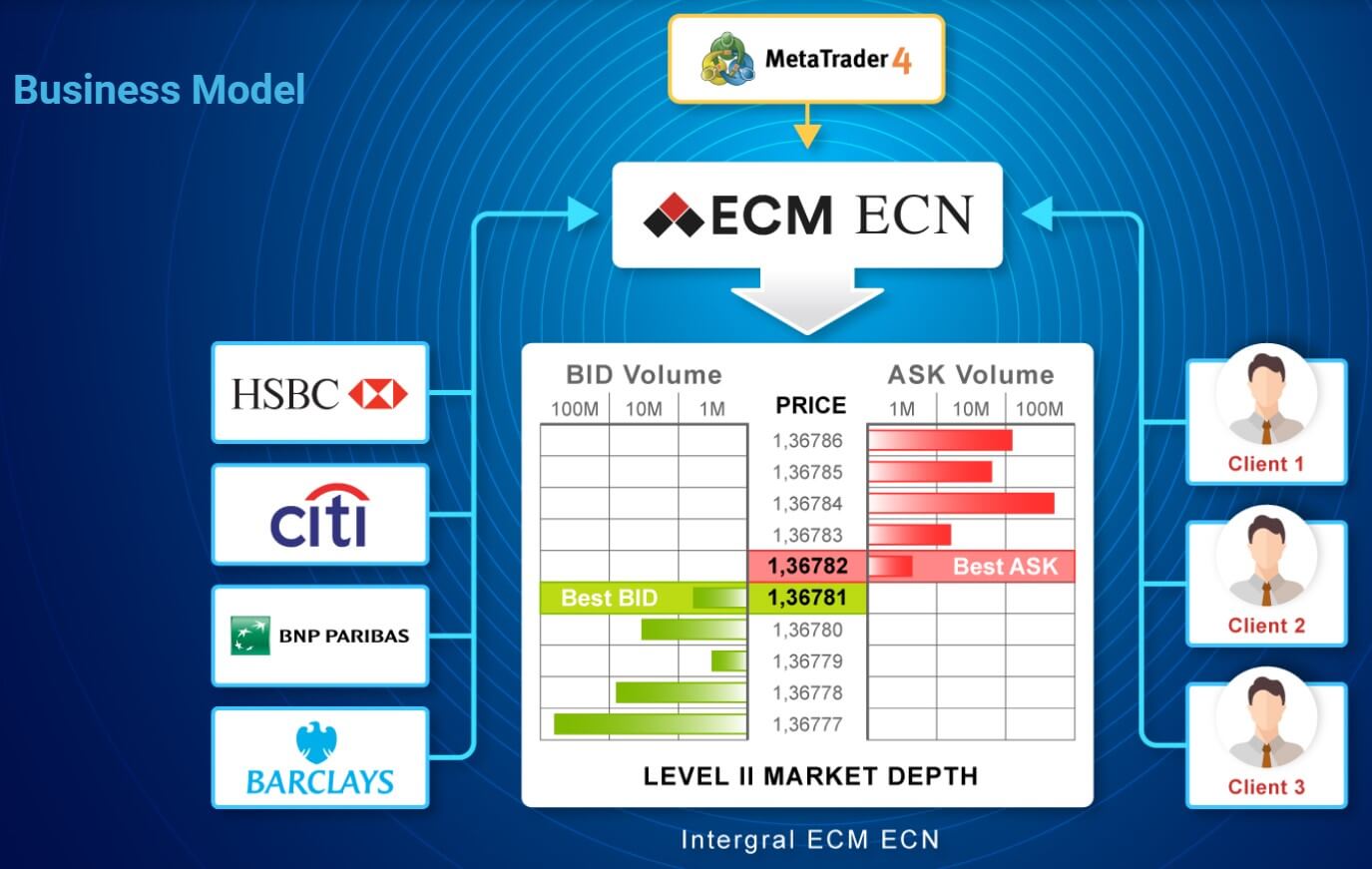

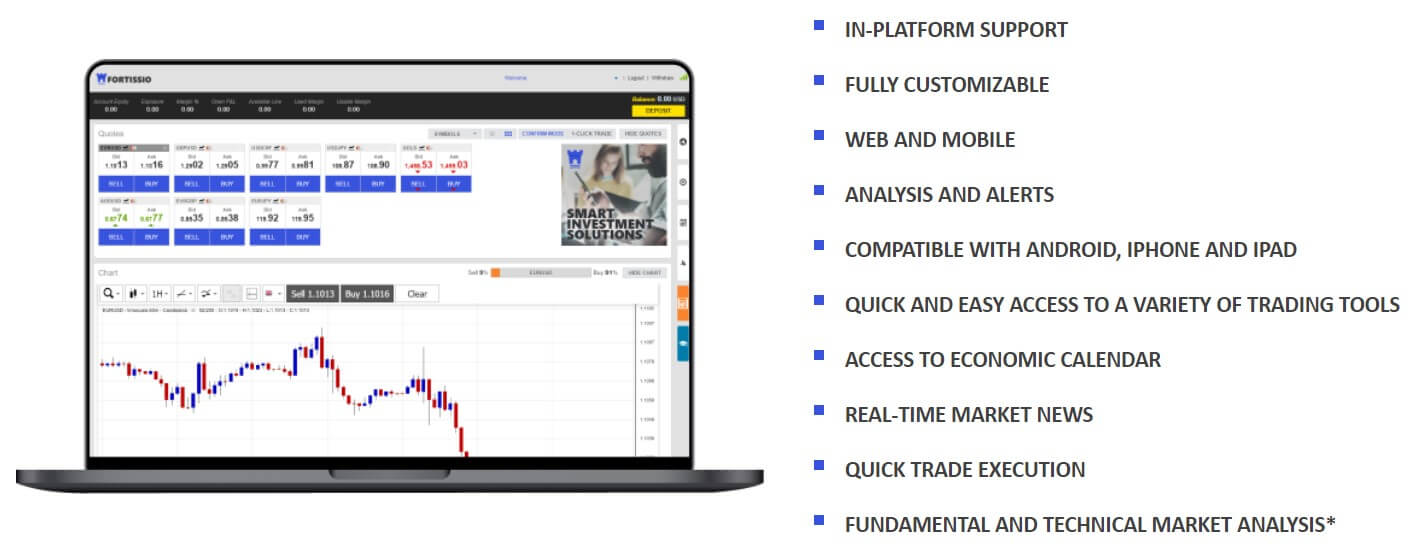

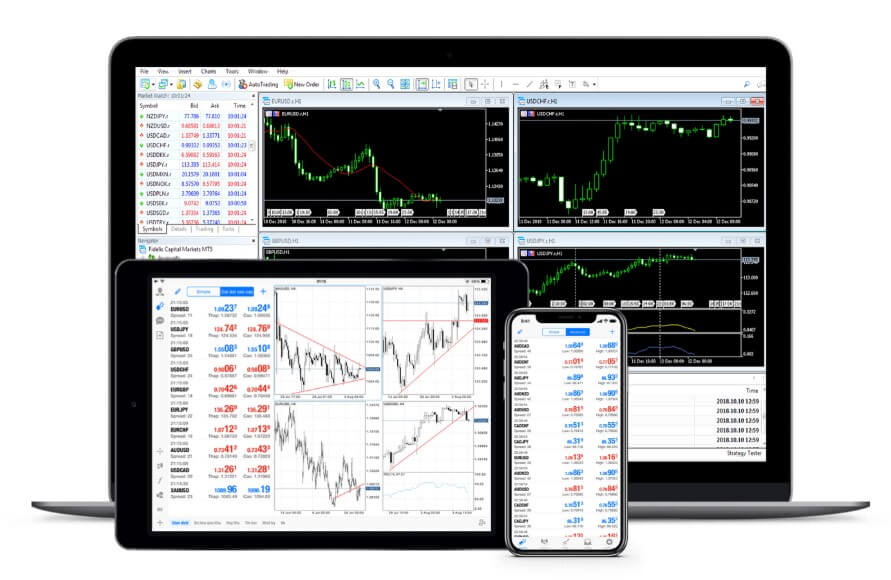

There are three different platforms available when trading with VIBHS, you can have the more traditional style of trading through the use of MetaTrader 4, but then there are some less conventional ways of trading through two different platforms, let’s look at what is on offer.

MetaTrader 4 (MT4):

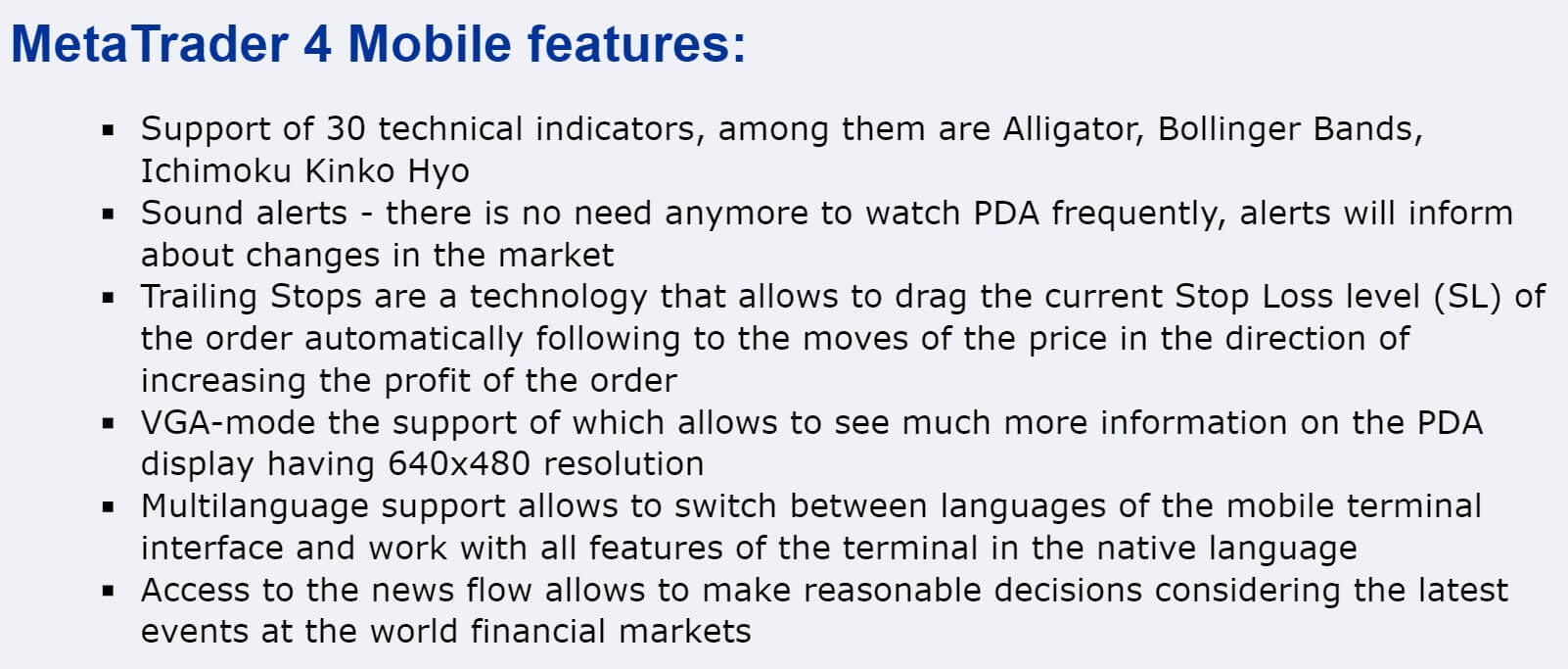

MetaTrader 4 was released by MetaQuotes back in 2005 and has become one of the world’s most renowned and most used trading platforms. It can be used as a desktop download, mobile application or as a web trader on your internet browser. It offers features like one-click trading, multiple charts, and timeframes and it is compatible with thousands of indicators and expert advisors which can be sued to help with your in-platform analysis and also allows for automated trading.

Dabbl:

Dabbl is an interesting platform, it allows you to search for a brand, theme or company in order to find investment ideas, it uses a technology that helps to translate complex data into insights which can help you decide how to trade. You can then follow and track the company, then choose how much in investment. Your investments are covered by the Government’s Financial Services Compensation Scheme up to a value of £85,000.

Torch:

Torch is an algorithmic auto trading software. Start off by defining your strategy basics. Simply choose your ‘instrument’, and then select the time frame over which you want your strategy to run. Set your parameters for trading – such as your stop loss and take profit – to stay in complete control of your investment. See how your newly-created strategy measures up in a safe setting. With Torch Markets you can back-test against historical price action, dating up to 10 years. Choose how far back to go; and get results in a matter of seconds. Adjust and refine the parameters until you are ready to test using current market data, with our paper testing feature. Deploy your newly created algorithm on the live markets.

Leverage

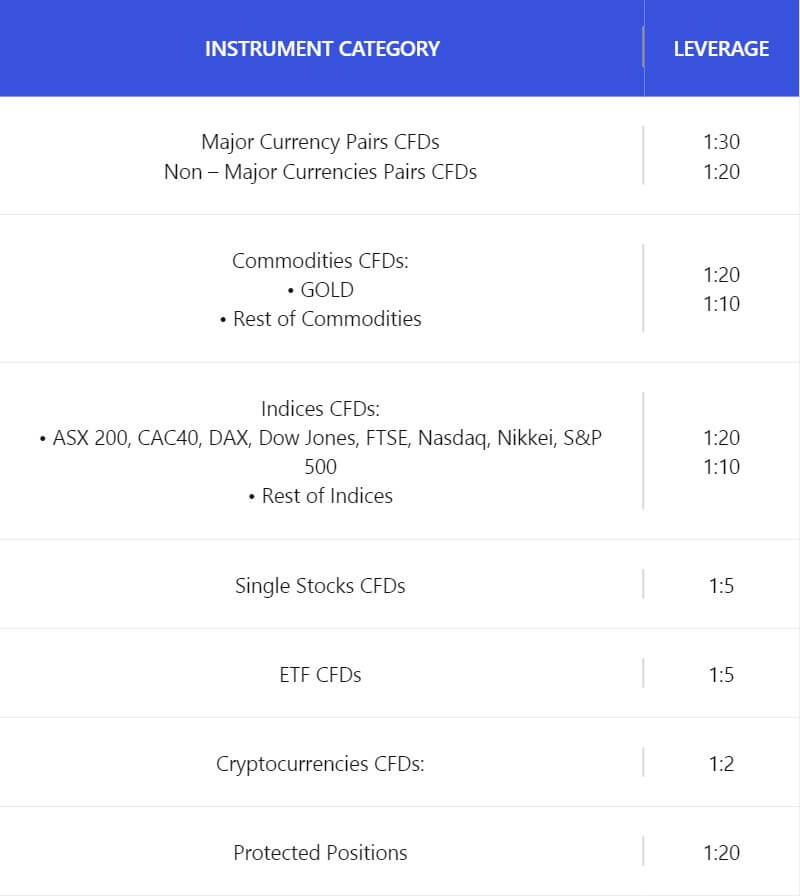

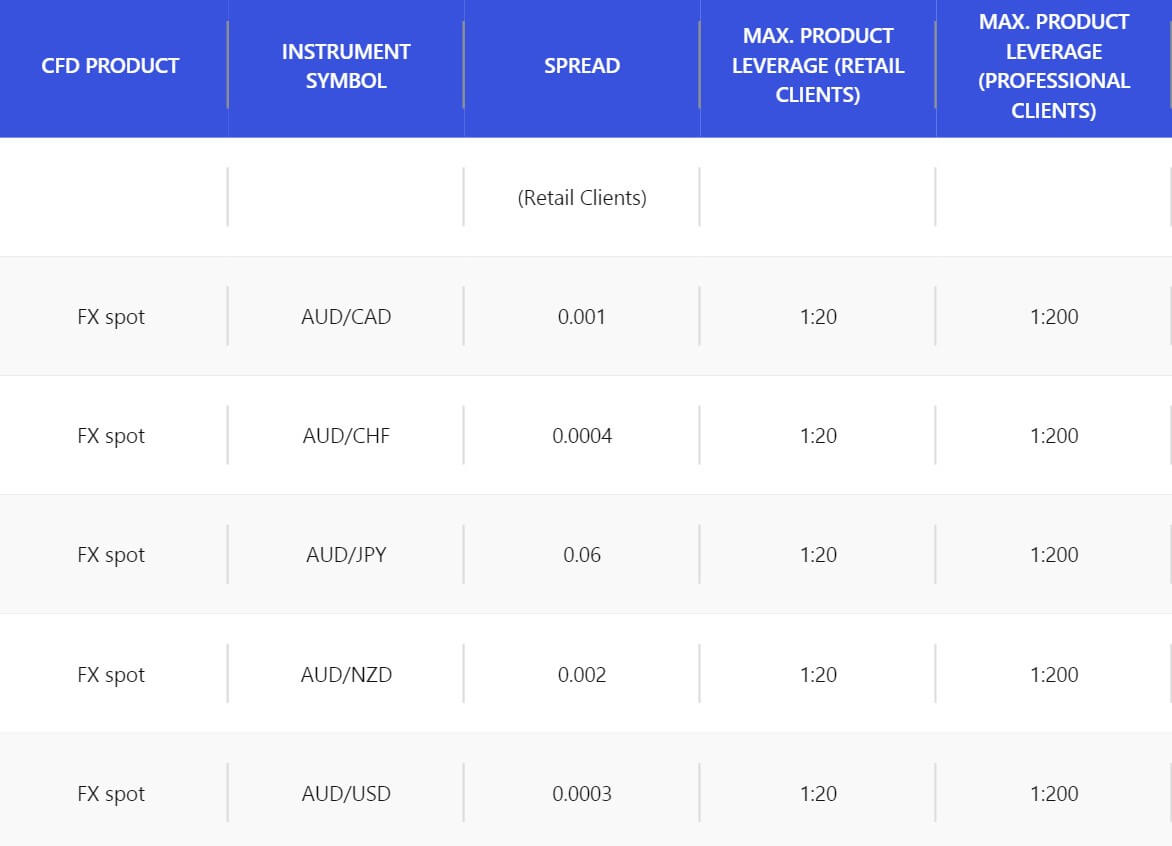

VIBHS is required to follow the recommendations from the ESAM, this means that the following limits are placed on the leverages available:

Leverage limits on the opening of a position by a retail client from 30:1 to 2:1, which vary according to the volatility of the underlying:

- 30:1 for major currency pairs

- 20:1 for non-major currency pairs, gold, and major indices

- 10:1 for commodities other than gold and non-major equity indices

- 5:1 for individual equities and other reference values

- 2:1 for cryptocurrencies

It is not clear if VIBHS will allow professional traders to have higher leverage if they do then the leverage for professional traders will be 1:200 as a new maximum level.

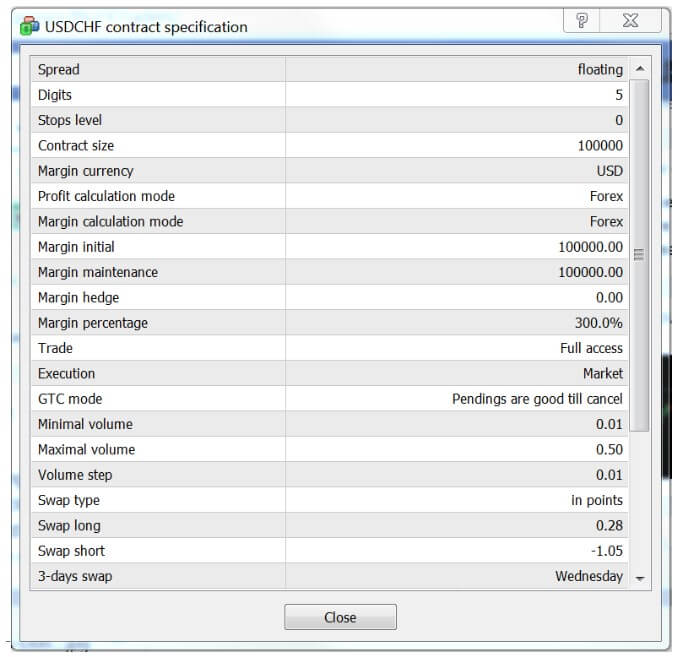

Trade Sizes

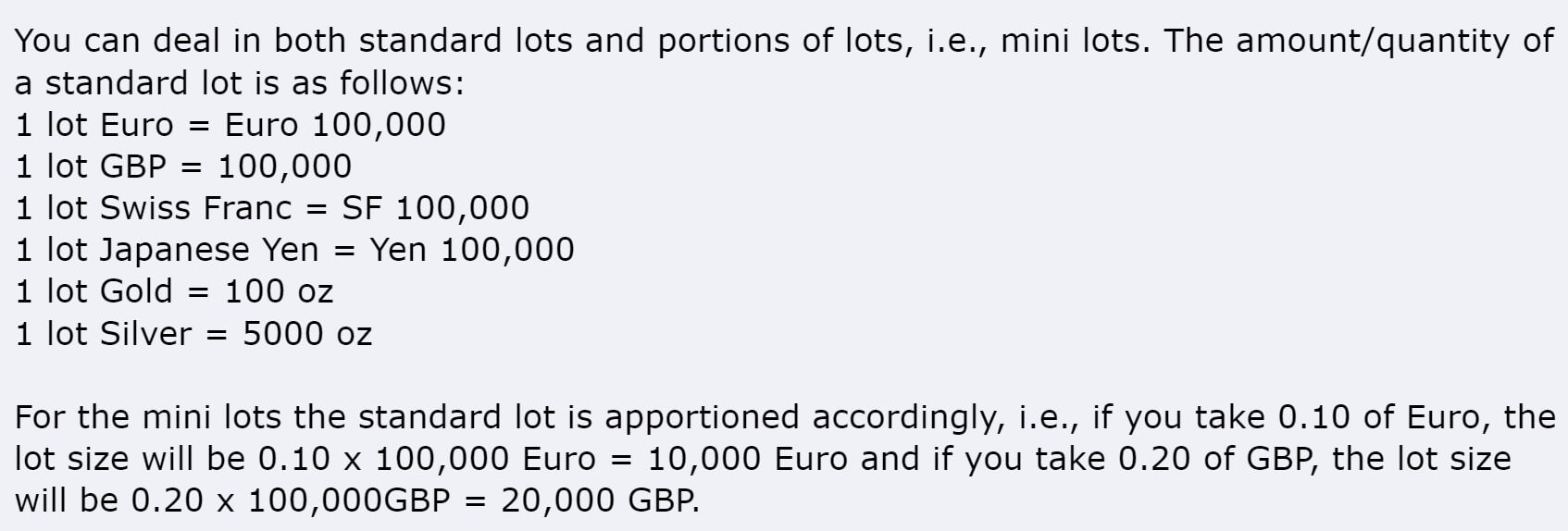

The smallest trade size starts from 0.01 lots which are equal to 1,000 base currency units as a full lot is equal to 100,00 base units. The trades then go up in increments of 0.01 lots so the next trade would be 0.02 lots and then 0.03 lots. We do not know what the maximum trade size is but would recommend not trading over 50 lots in a single trade. We do not know how many open trades or orders you are able to have at any one time.

Trading Costs

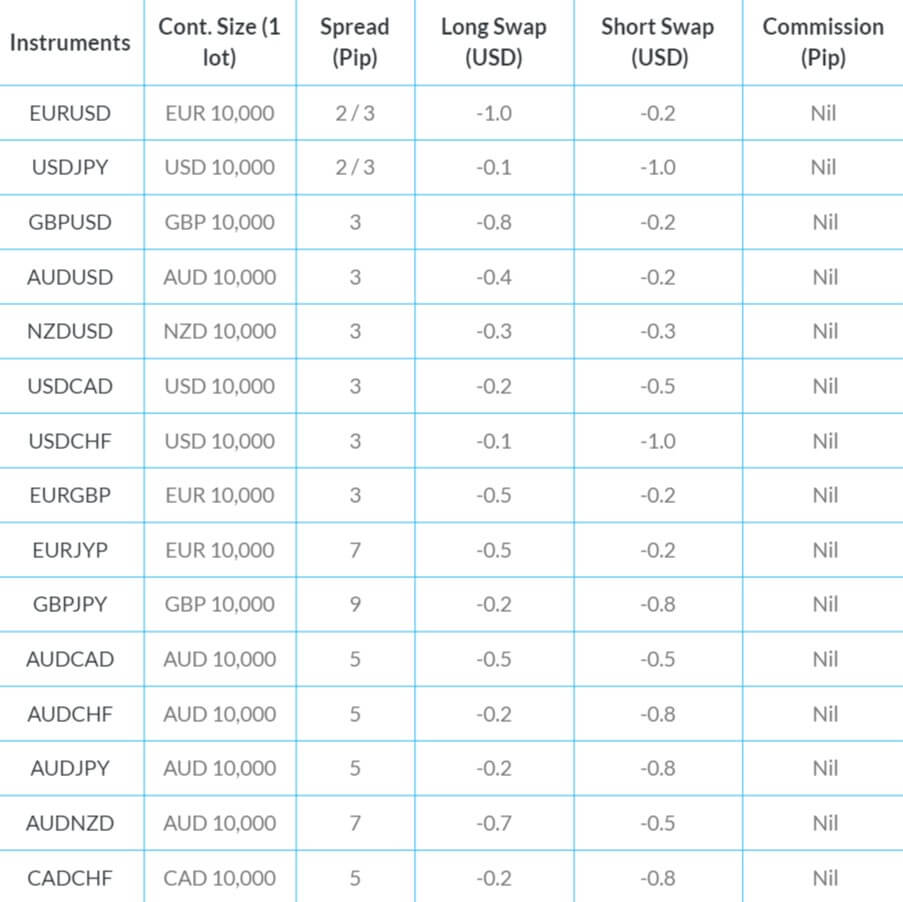

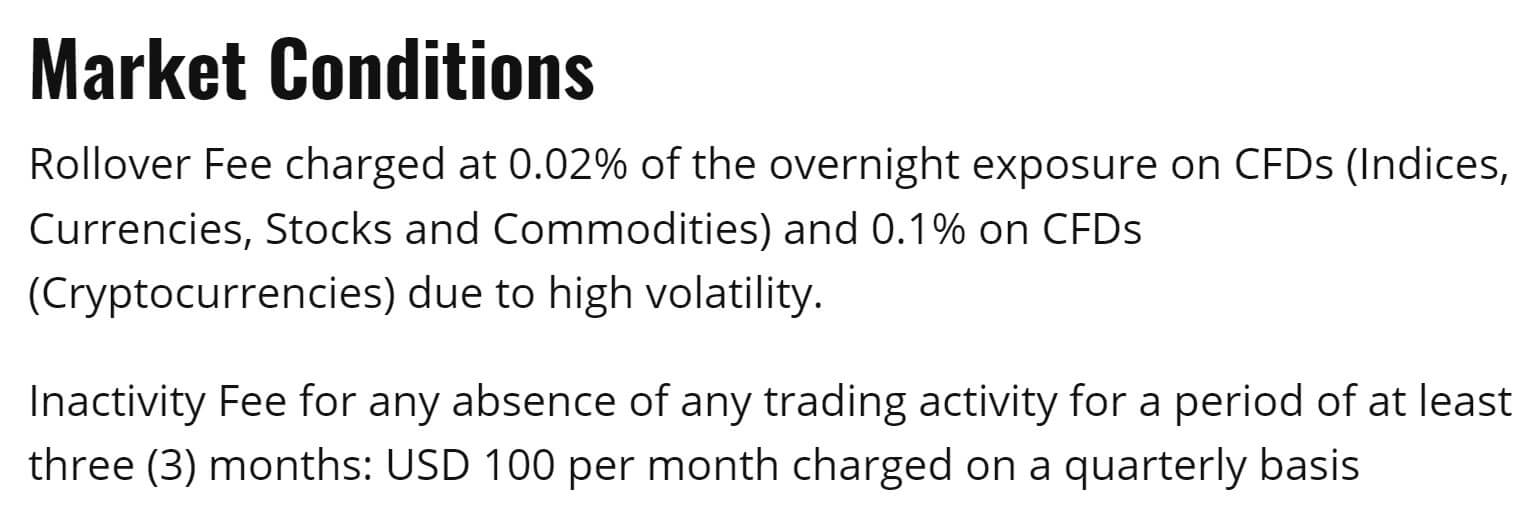

While going through the site we did not come across any information that was talking about commissions, so we are not entirely sure if there are any, but by the looks of it, there are not and instead their accounts use a spread based system (we will look at that later in this review).

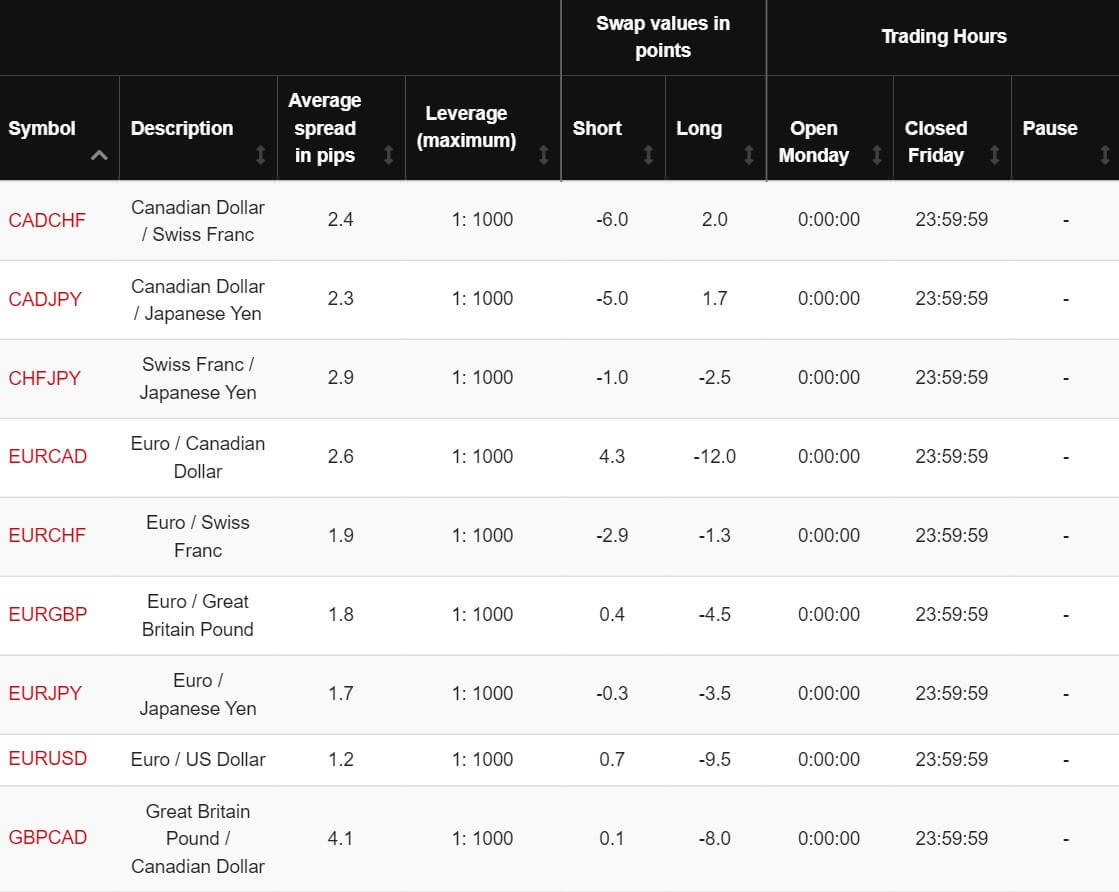

There will be swap charges involved, these are fees that are charged for holding trades overnight, they can be both positive or negative as they depend on the difference in interest rerates. These can be viewed within the trading platform that you are using.

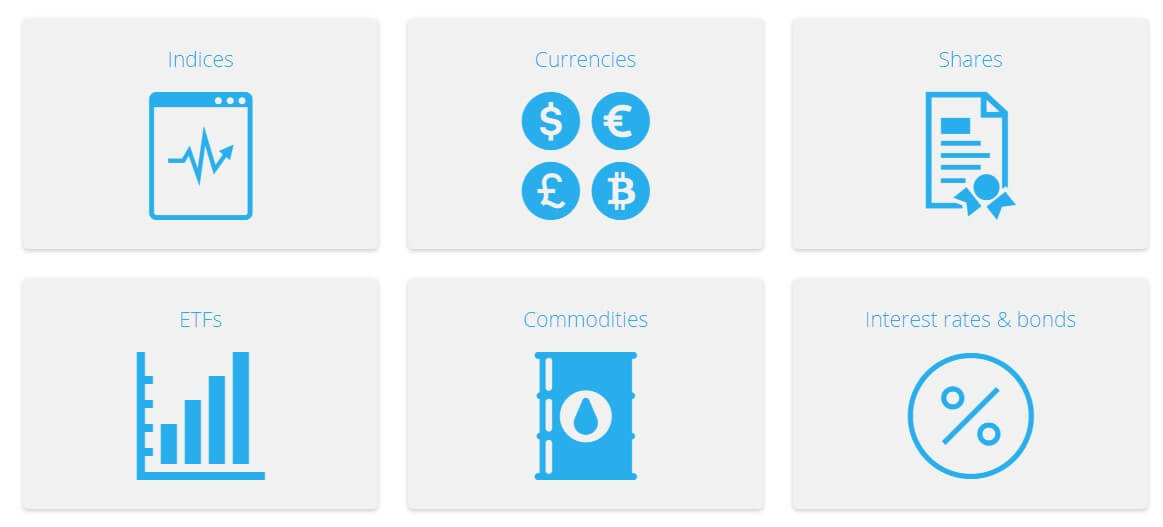

Assets

VIBHS have broken down their assets into a number of different categories, we have outlined them below so you can get an idea of what sort of instruments are available to trade.

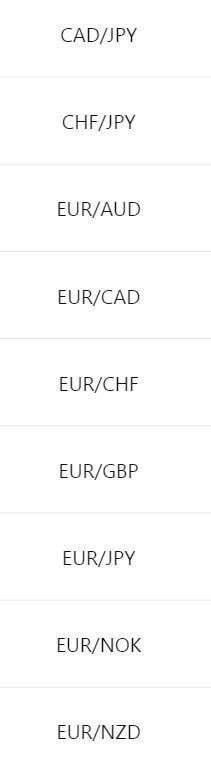

Forex:

AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, AUDUSD, CADJPY, CADSGD, CHFJPY, CHFSGD, CADCHF, EURAUD, EURCAD, EURCHF, EURDKK, EURNZD, EURPLN, EURSEK, EURSGD, EURTRY, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNOK, GBPNZD, GBPSEK, GBPSGD, GBPUSD, NZDCHF, NXDJPY, NZDSGD, NZDUSD, SEKJPY, SGDJPY, USDCAD, USDSCHF, USDCNH, USDDKK, USDHKD, USDJPY, USDMXN, USDPLN.

Indices:

AUS200, HK50, US500, FR40, EU50, ES35, JP225, UK100, DE30, US30, UT100, CH20.

Commodities:

Gold, Silver, Natural Gas, US Oil, UK Oil, WTI Crude Oil, Brent Crude Oil.

Crypto:

BTCUSD, BTCAUD, BTCEUR, BTCGBP, BTCJPY, BTCPLN, ETHUSD, ETHAUD, ETUEUR, ETHGBP, ETHJPY, LTCUSD, XRPUSD.

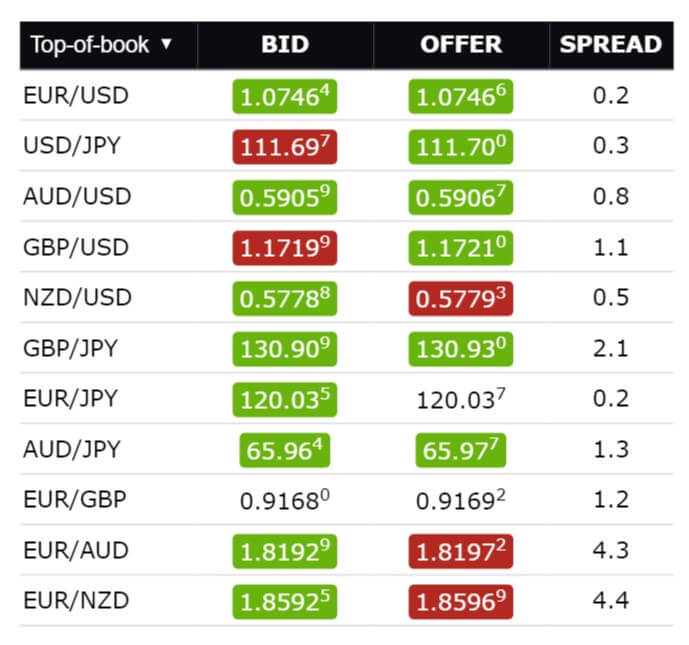

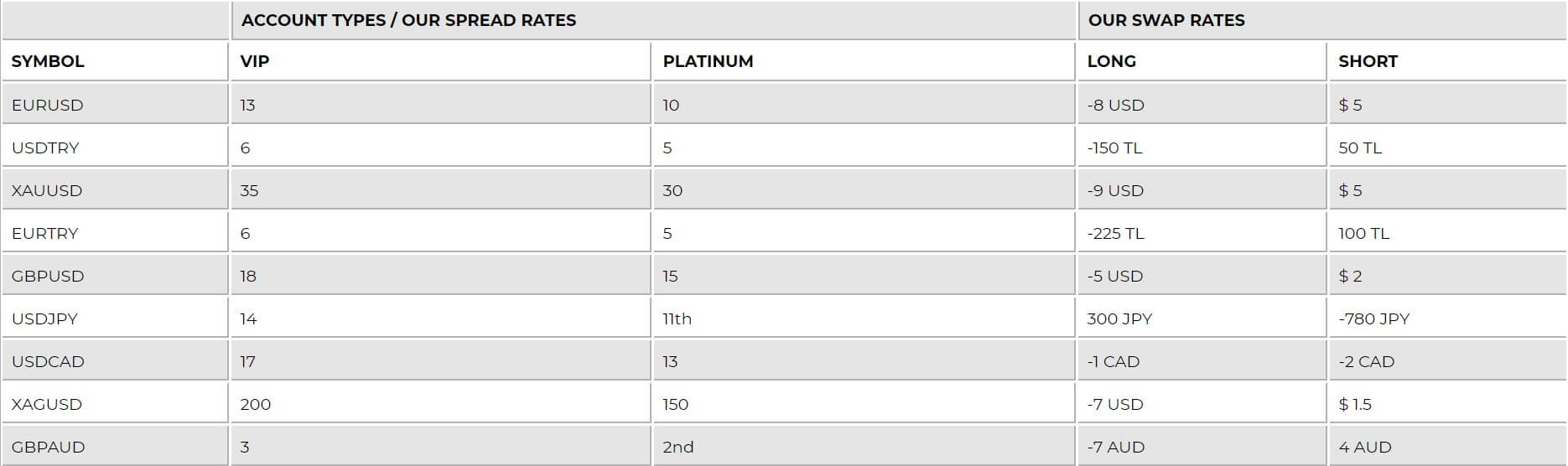

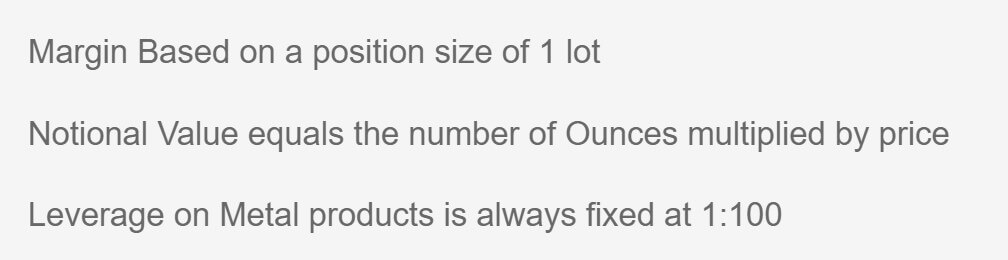

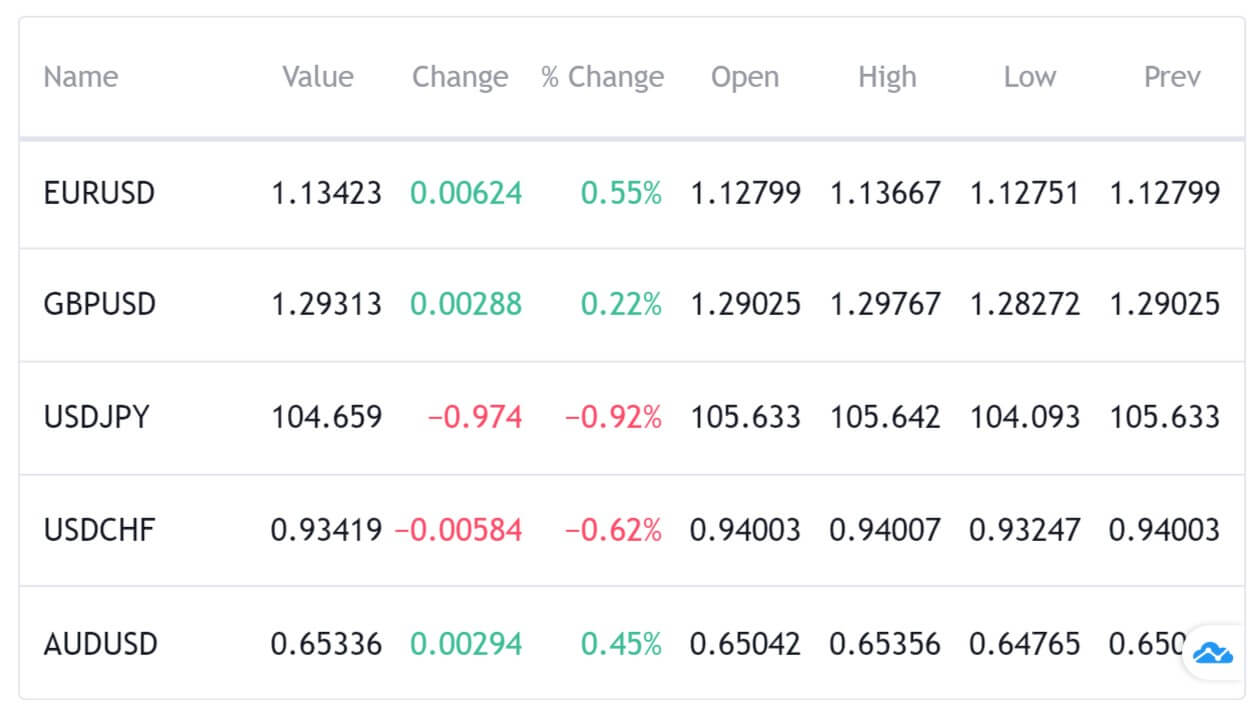

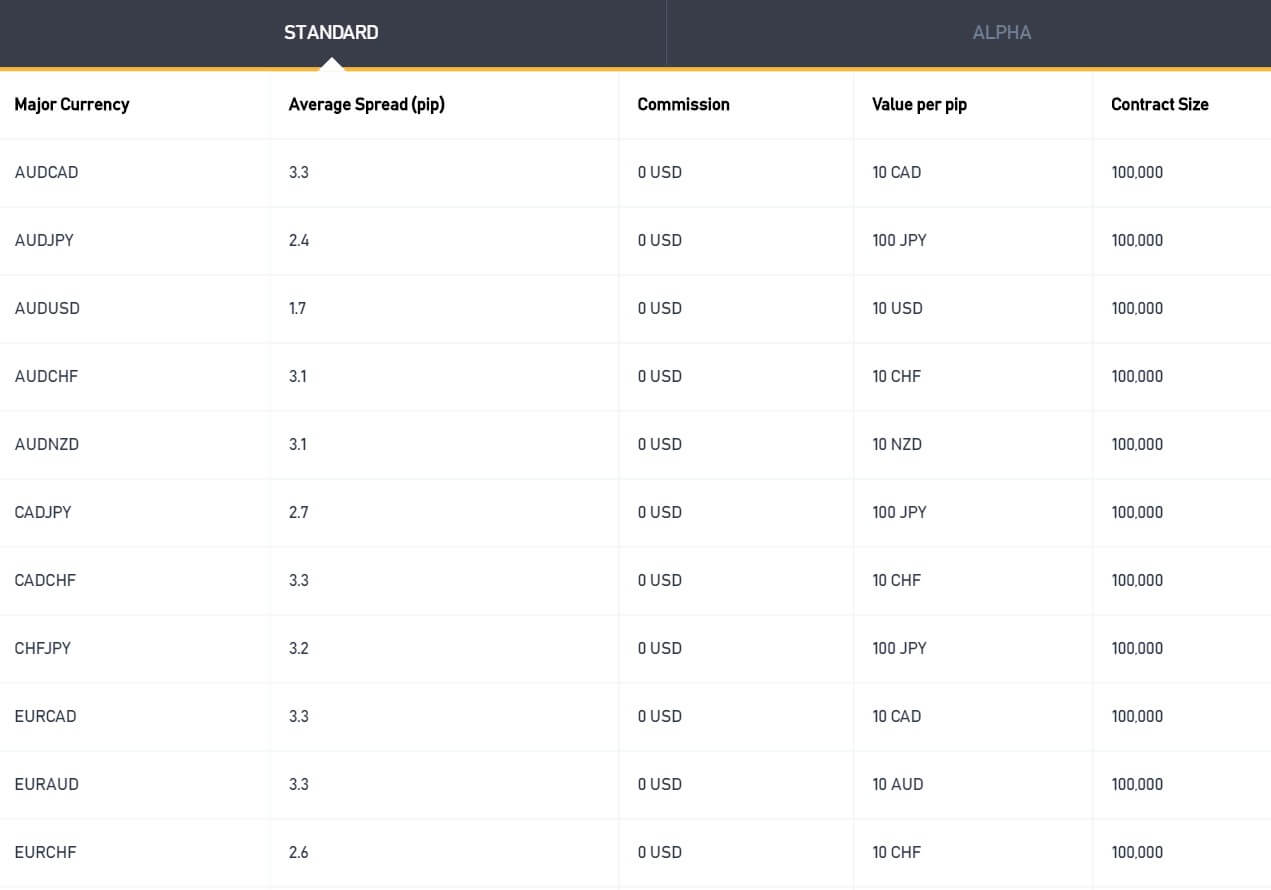

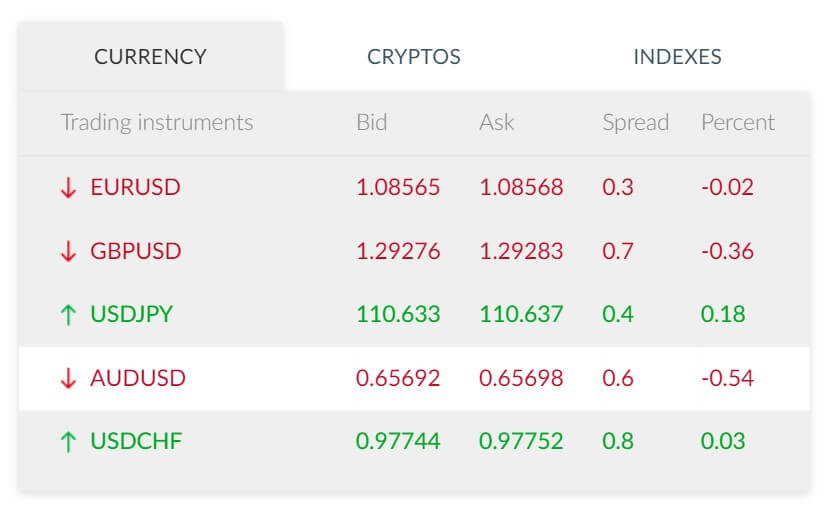

Spreads

Spreads seem to start with an average spread around 1 pip, from our understanding the spreads are variable which means they will move with the markets, the more volatility that there is, or lack of liquidity will cause the spreads to grow larger. There are also different spreads for different pairs, so while some may average around 1 pip, other currencies or assets may average around 2 pips instead.

Minimum Deposit

The minimum amount required to open up a new account is $200, you can also deposit the same amount in GBP, USD, EUR, PLN or AUD. We are not sure if the minimum amount reduces once an account has already been opened but we suspect that it will, however, how low we do not know.

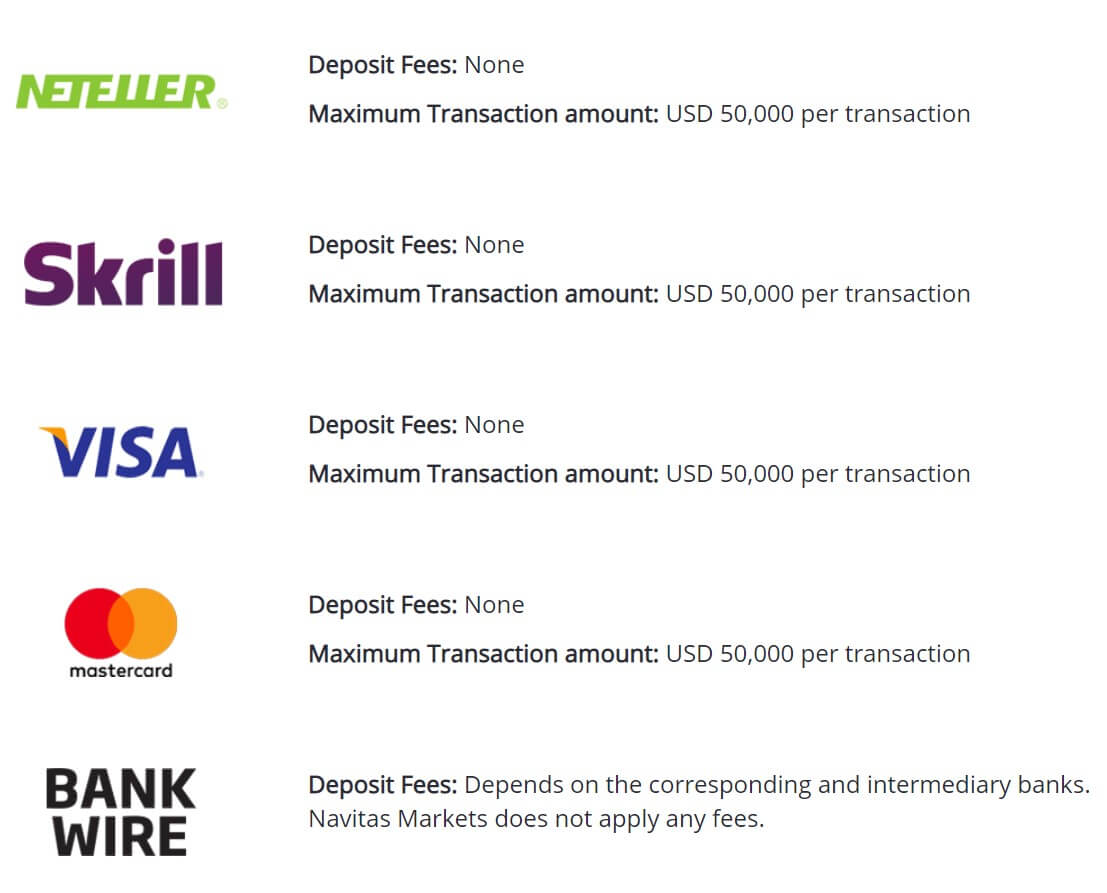

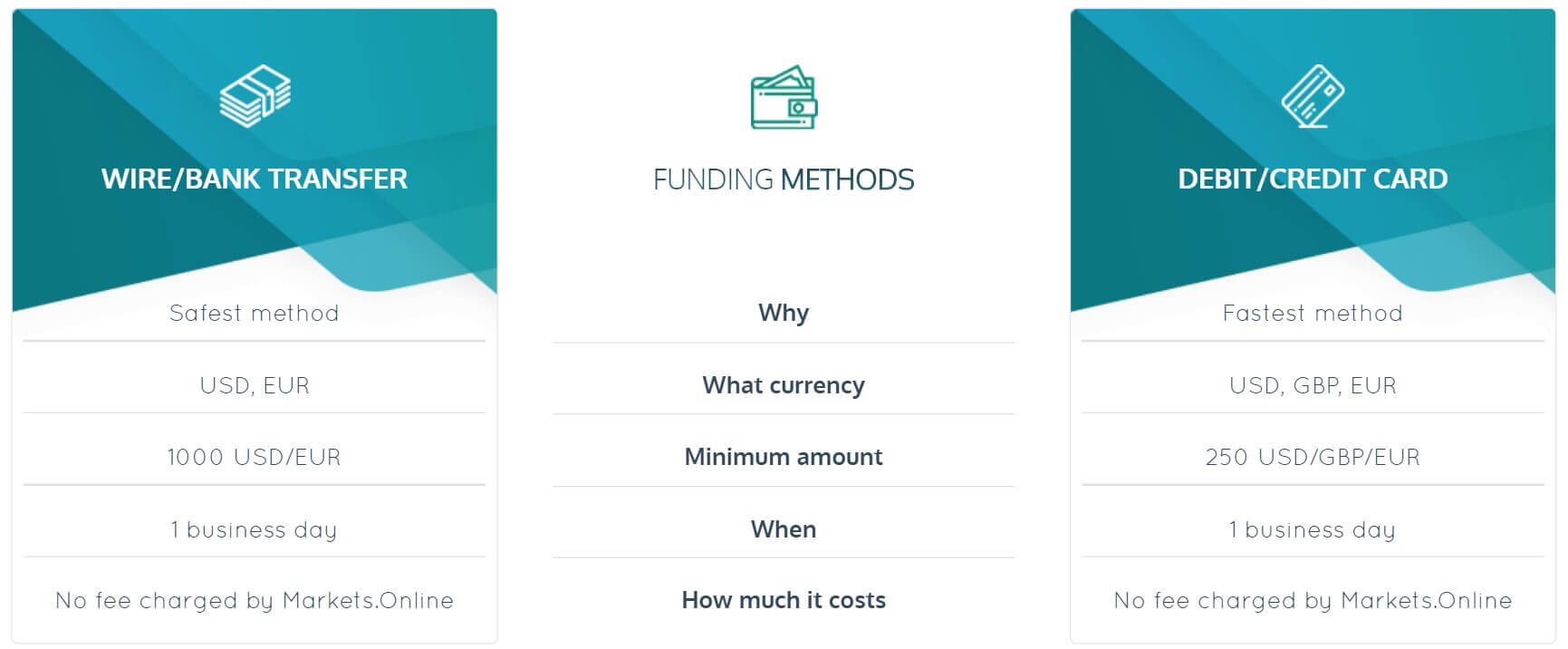

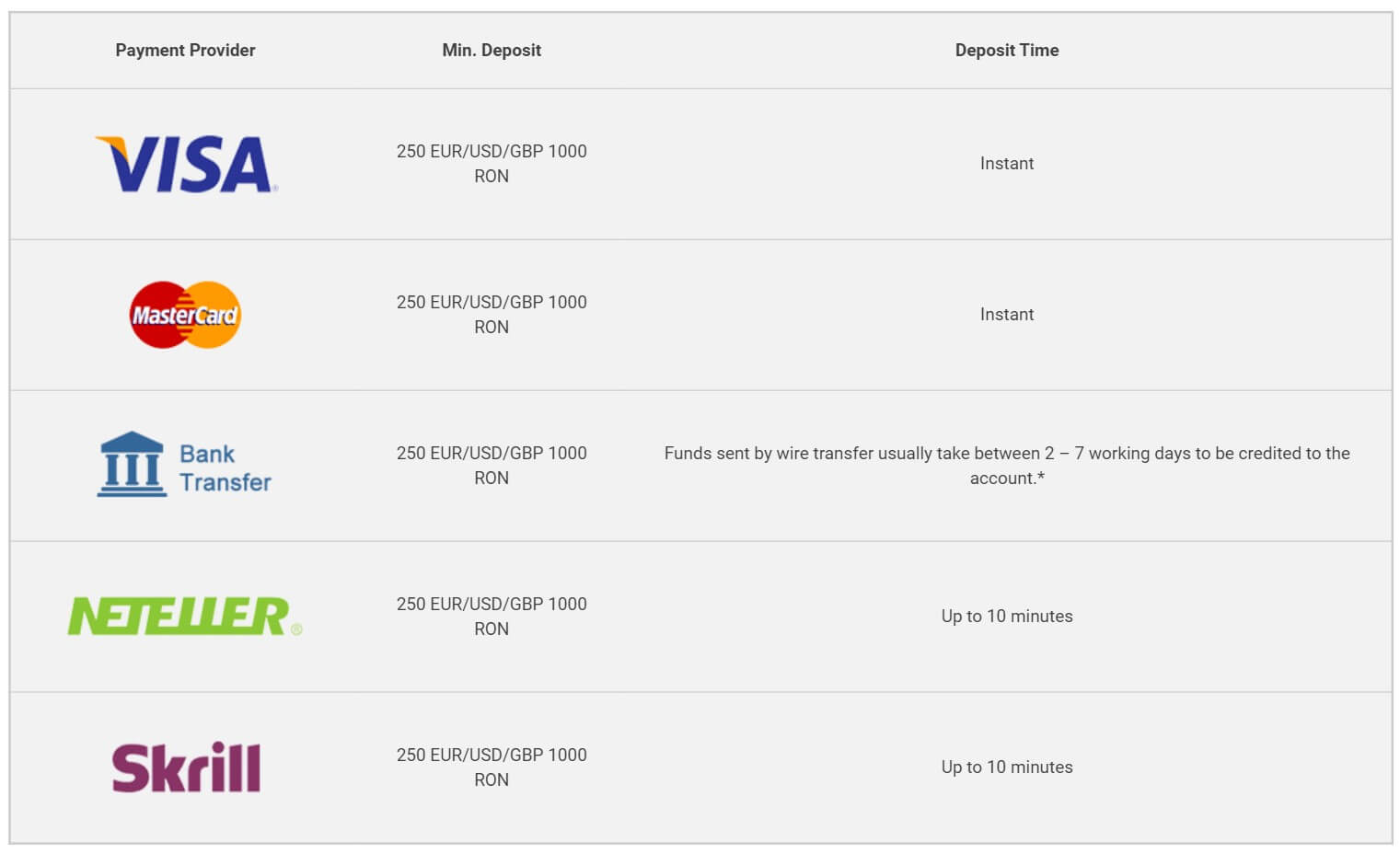

Deposit Methods & Costs

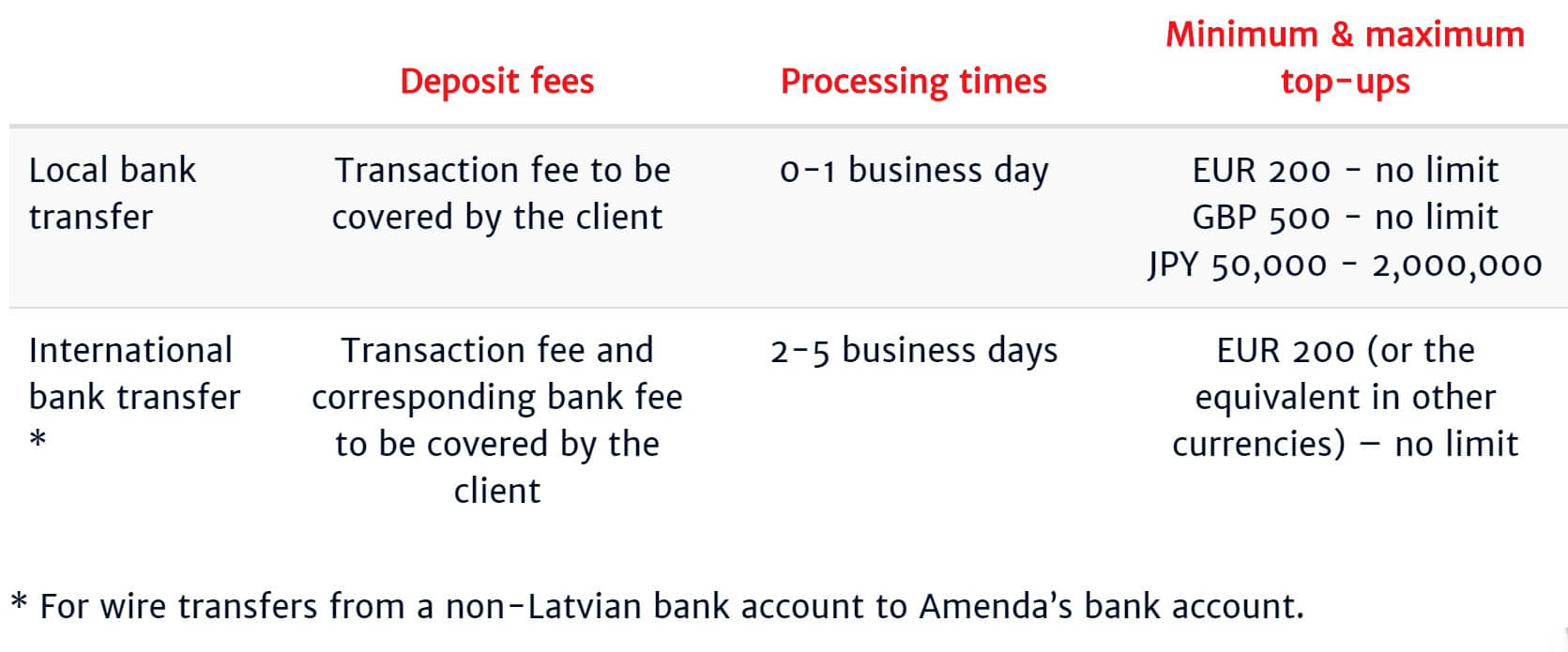

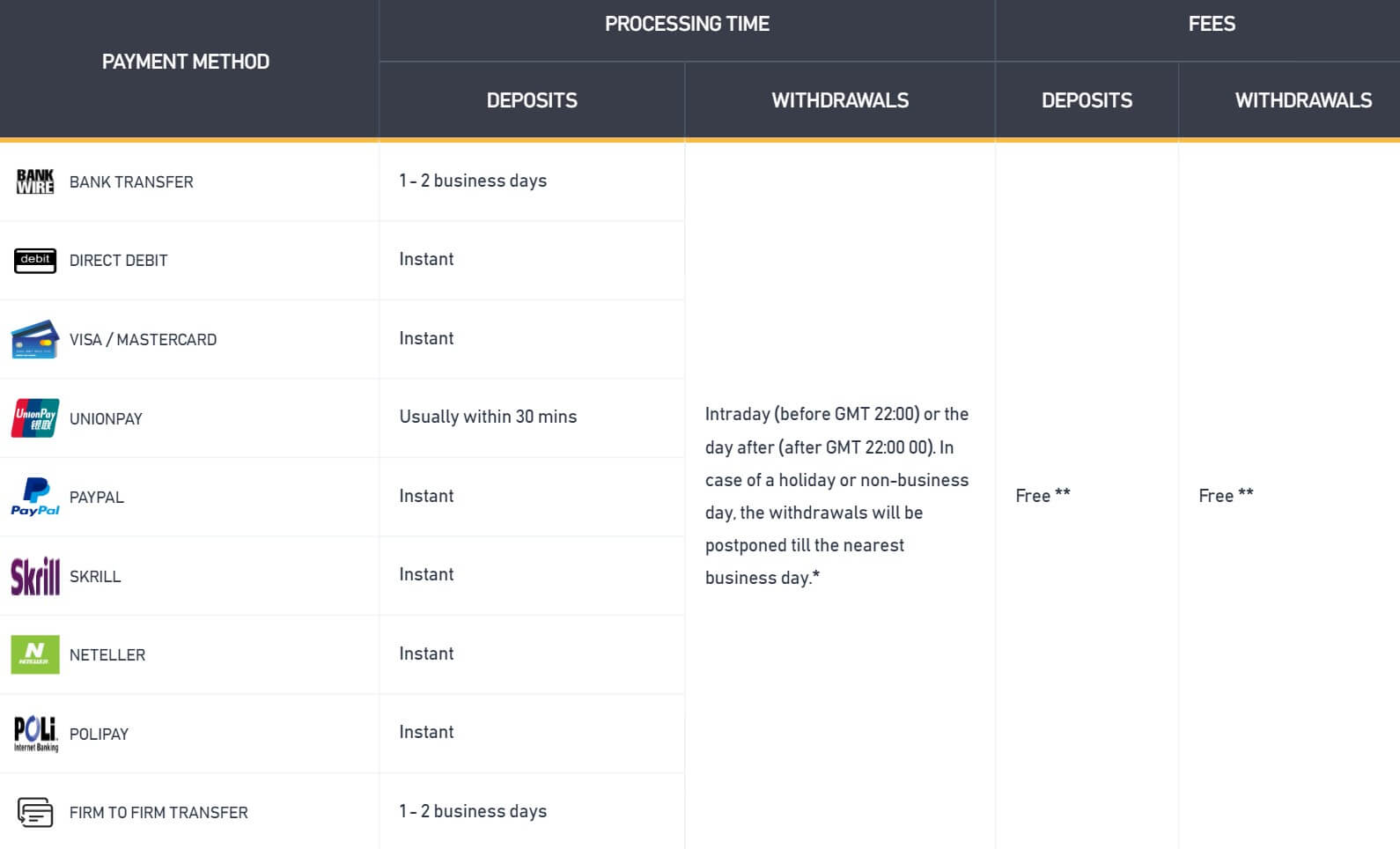

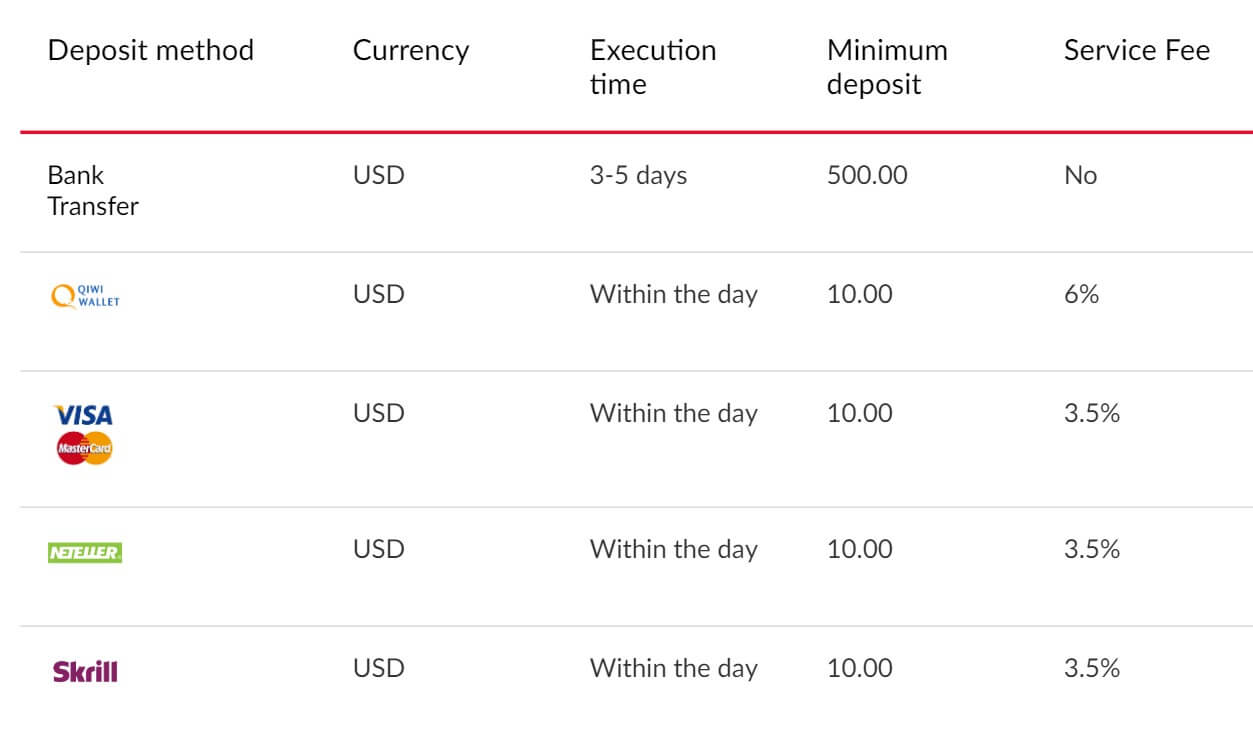

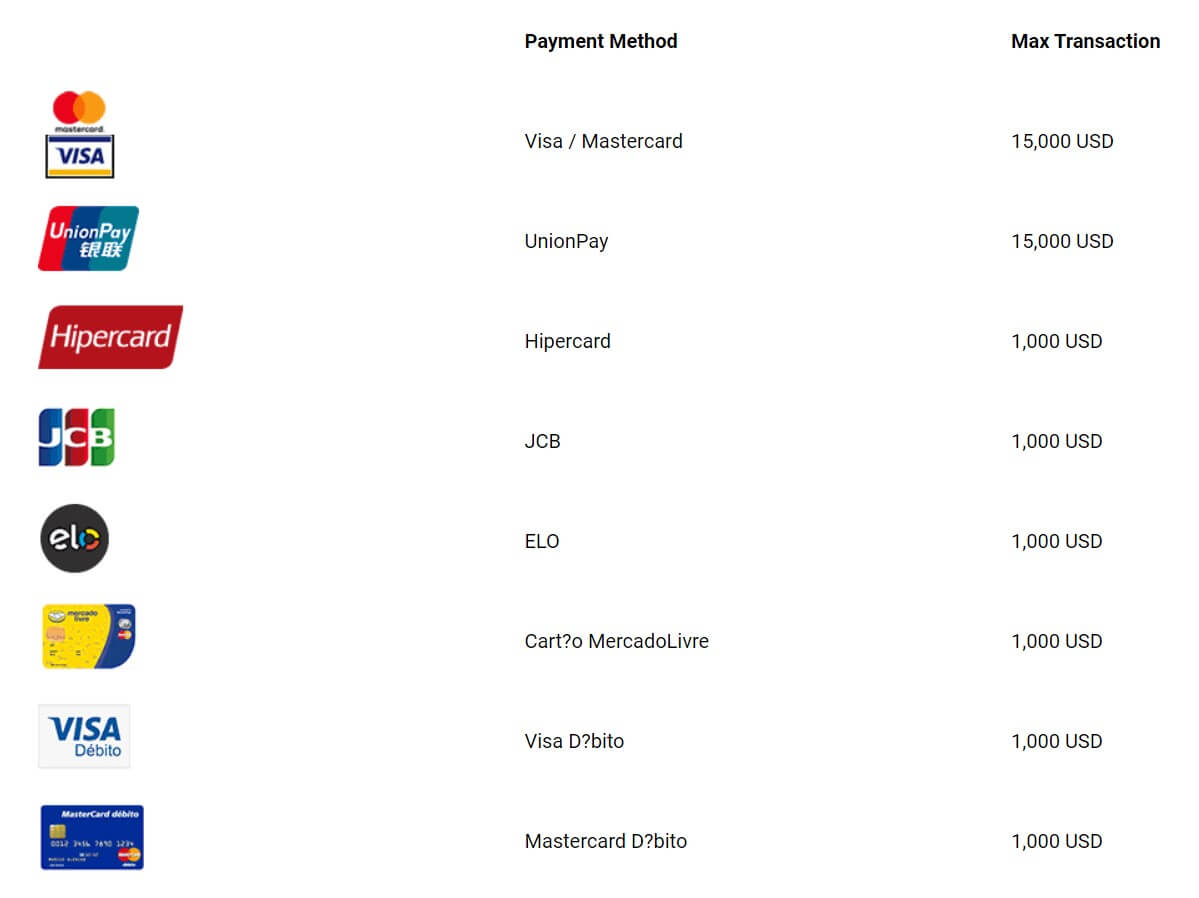

The website indicates that there are just two different methods available to deposit with, these are Bank Wire Transfers and Dinpay. Dinpay is a method for Chines clients to deposit using their bank or prepaid cards. Different sites over the internet also indicate further deposit methods but they are not mentioned on the site so we will not let them here.

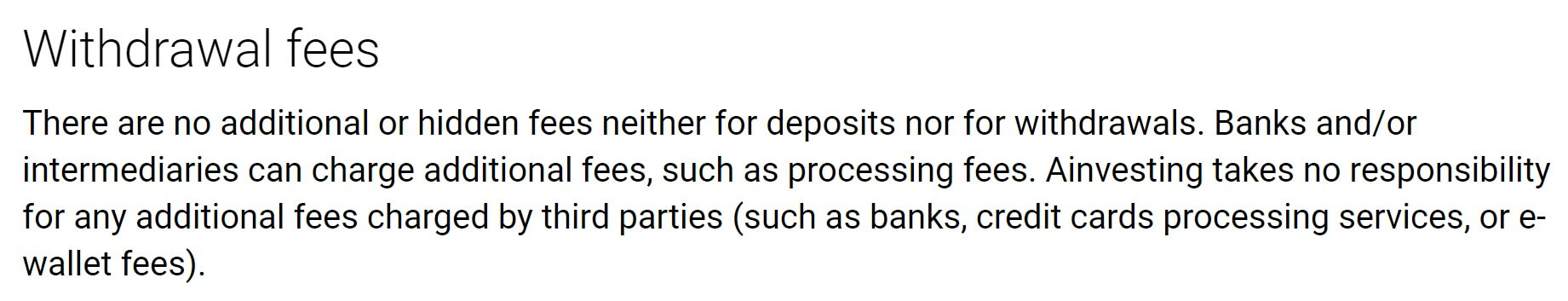

In regards to any fees, there isn’t anything mentioned on the deposit page so we would expect that there aren’t any, your bank, however, may charge some transfer fees of their own so be sure to check with them prior to making a deposit.

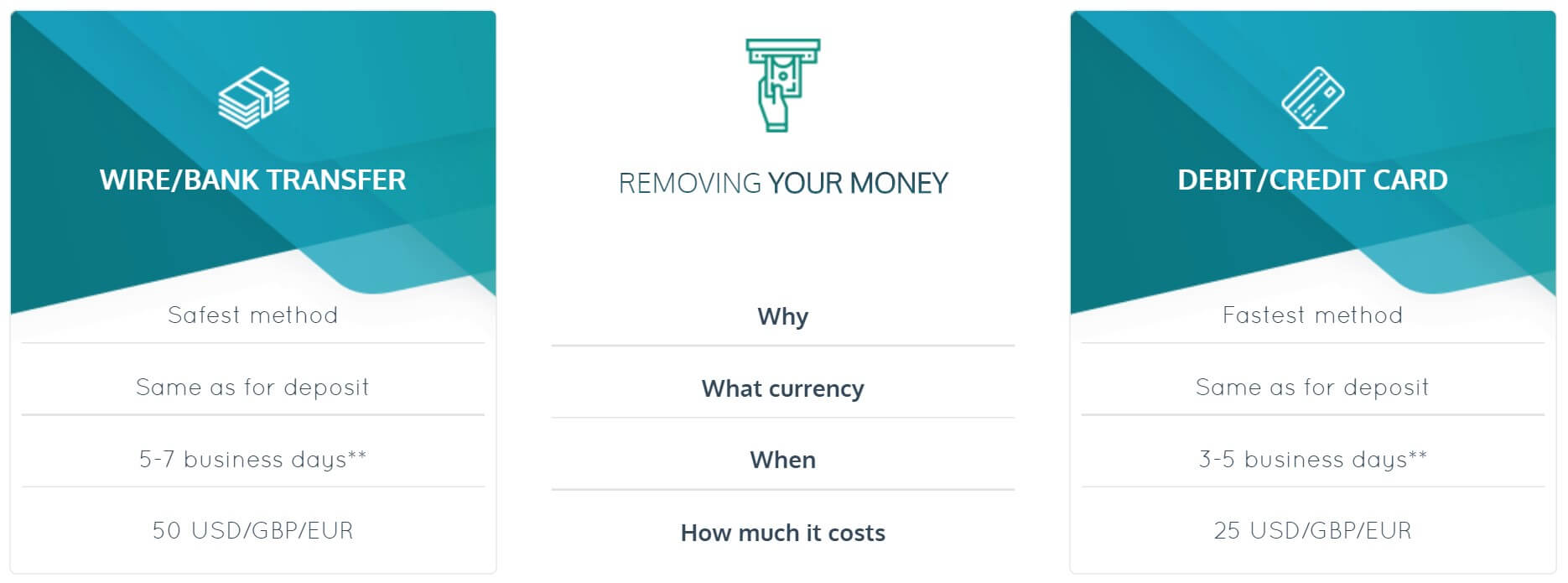

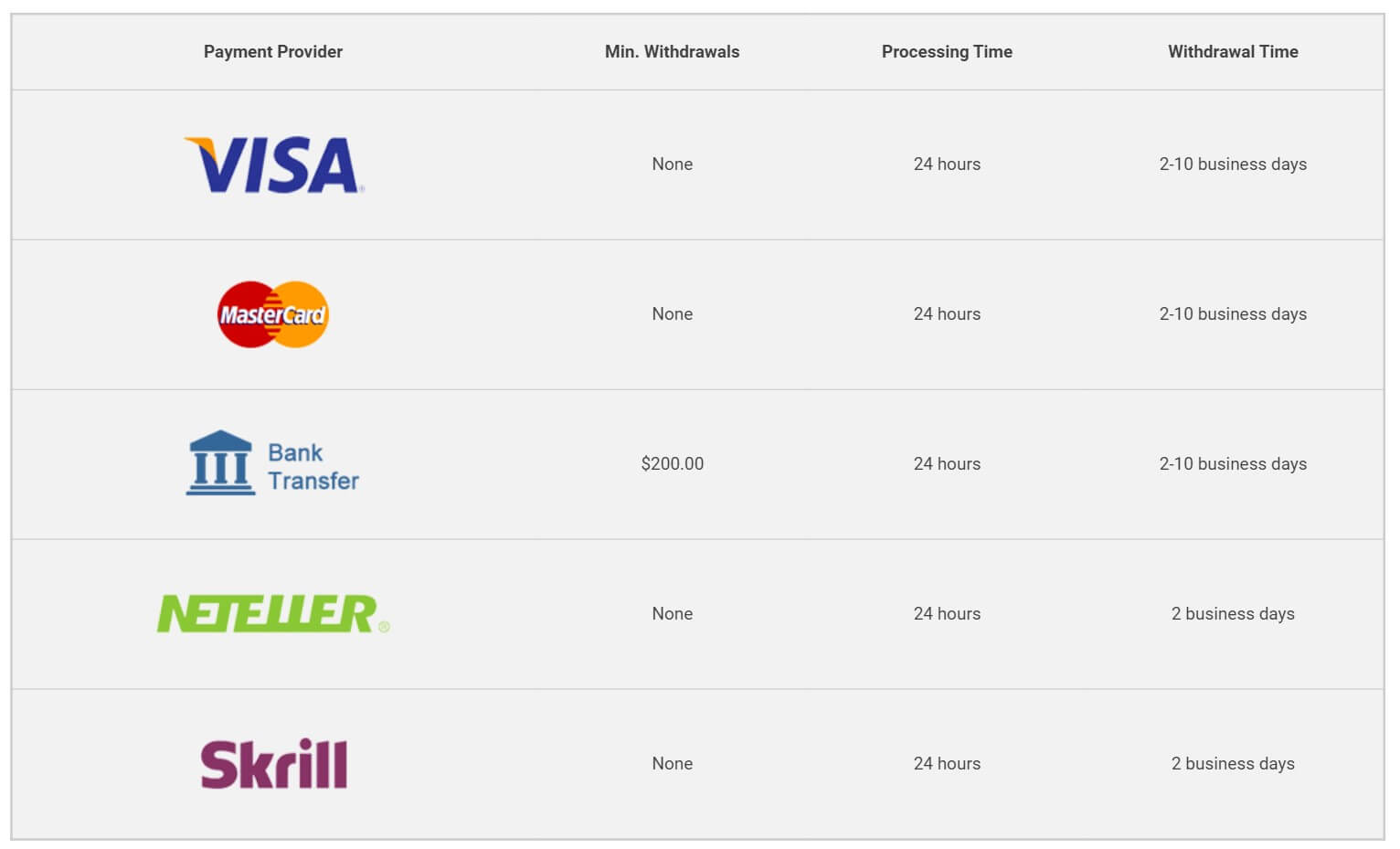

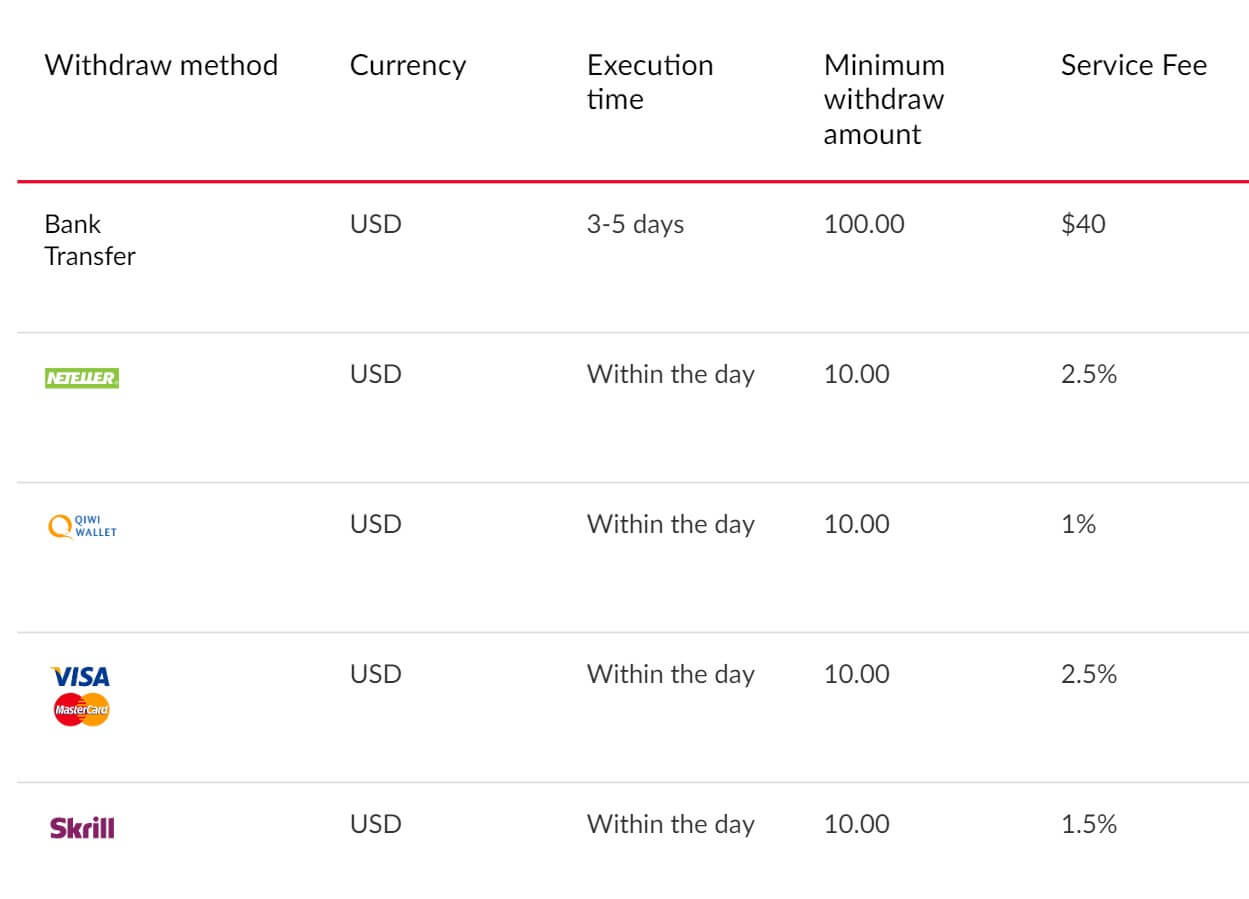

Withdrawal Methods & Costs

The same methods seem to be available to withdraw with, for clarification those are Bank Wire Transfer and Dinpay.

Once again there is no mention of any potential fees, this does not mean that there aren’t any, we just do not know what they are. You should always check with your own bank or payment provider to see if they add any incoming processing fees of their own.

Withdrawal Processing & Wait Time

The website states “VIBHS Financial process deposits within minutes to 24 hours (slower due to a large number of transactions) and process withdrawals within 24hours (typically) to 72 hours (slower due to a large number of requests).”

Withdrawals will be processed within 3 to 5 business days from the request of them being made. It will then take an additional 1 to 5 working days for your request to fully process, this time depends on the processing time of your own bank or payment processor.

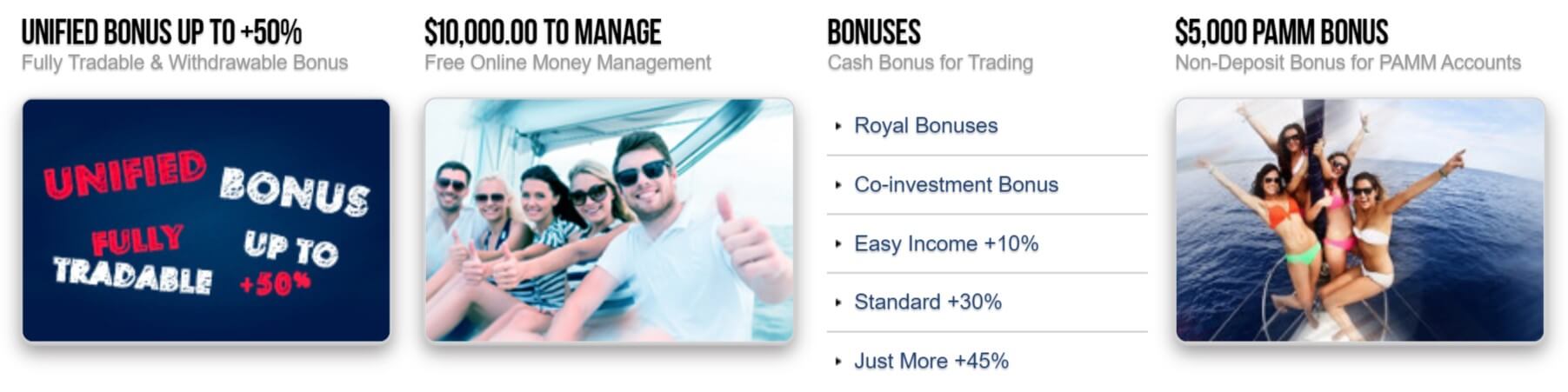

Bonuses & Promotions

There don’t seem to be any active bonuses at the time of writing this review, there is a promotion on a VPS service though, you are able to get a discount on a VPS server when trading with VIBHS, the do not give a lot of information away about the discount or the promotion as a whole, but we know that it is there and available. That seems to be all there is in regards to promotions from VIBHS.

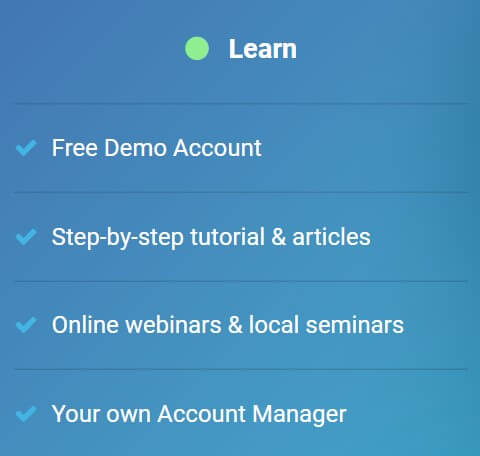

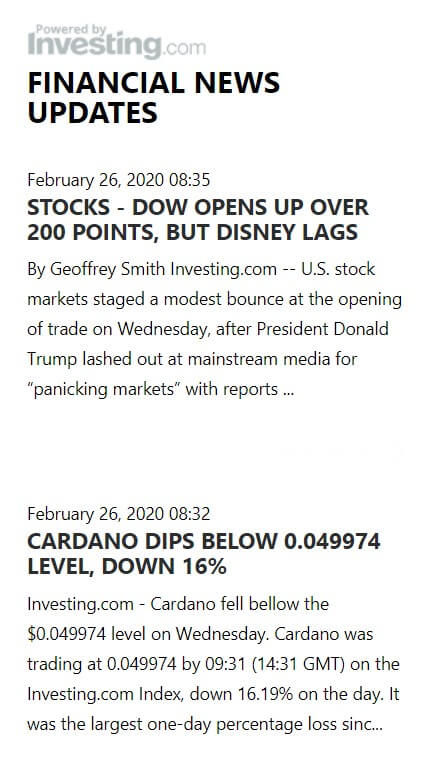

Educational & Trading Tools

The news and education side of the site is a little sparse, there is just the one page which is for news events, unfortunately, it does not look like the page has been updated since February 2019, so we do not a thin kit is still being actively used.

The news and education side of the site is a little sparse, there is just the one page which is for news events, unfortunately, it does not look like the page has been updated since February 2019, so we do not a thin kit is still being actively used.

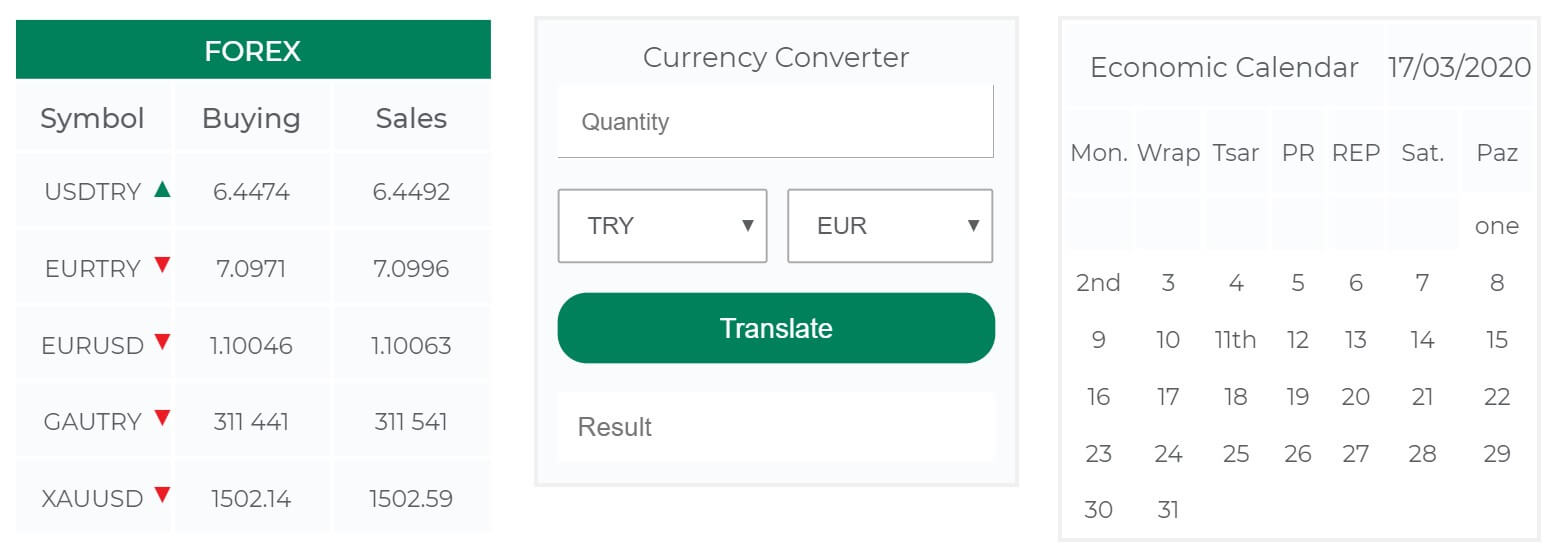

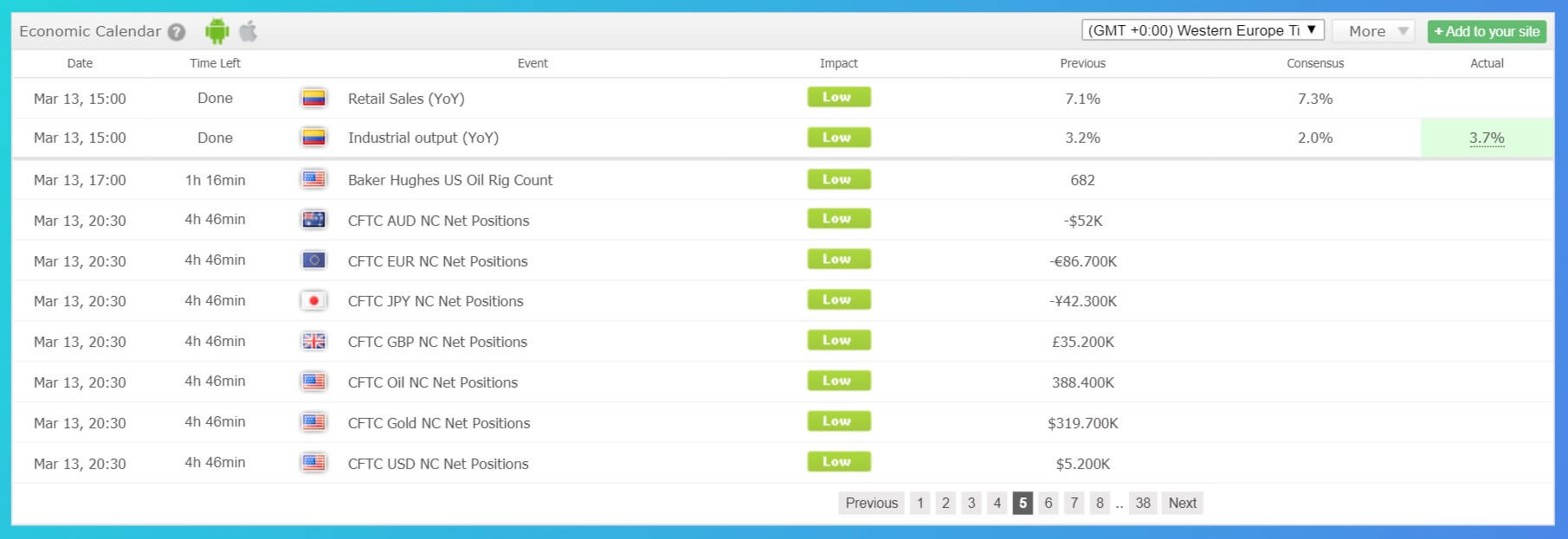

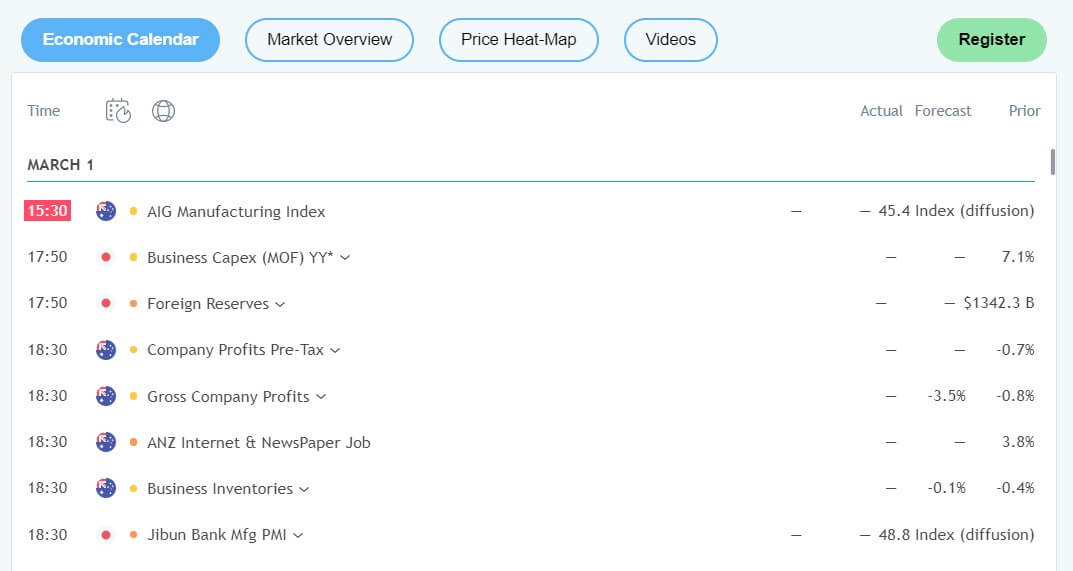

Hidden in the footer of the site there is another set of education and tools available, the first is some signals, they aren’t very detailed and simply stated to buy or sell, various currency pairs and commodities are included in the list, we do not know the accuracy or profitability of these signals. There is also an eBook available to read or download, it goes over the basics of trading. The video section also has a number of videos outlining various aspects of trading from the basics to analysis strategies. The final section is an Economic Calendar, this details different upcoming news events and also the potential impact that the news could have on the markets.

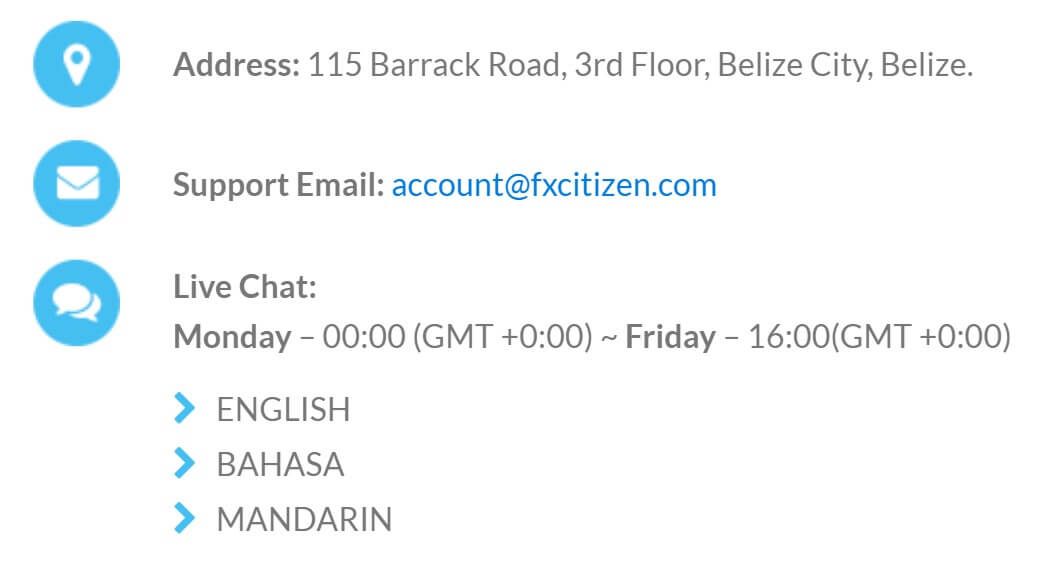

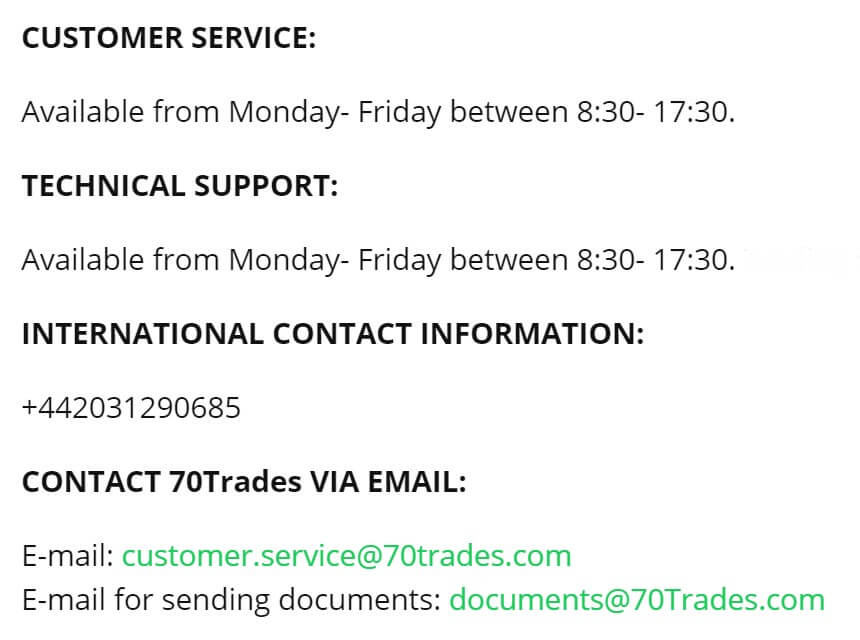

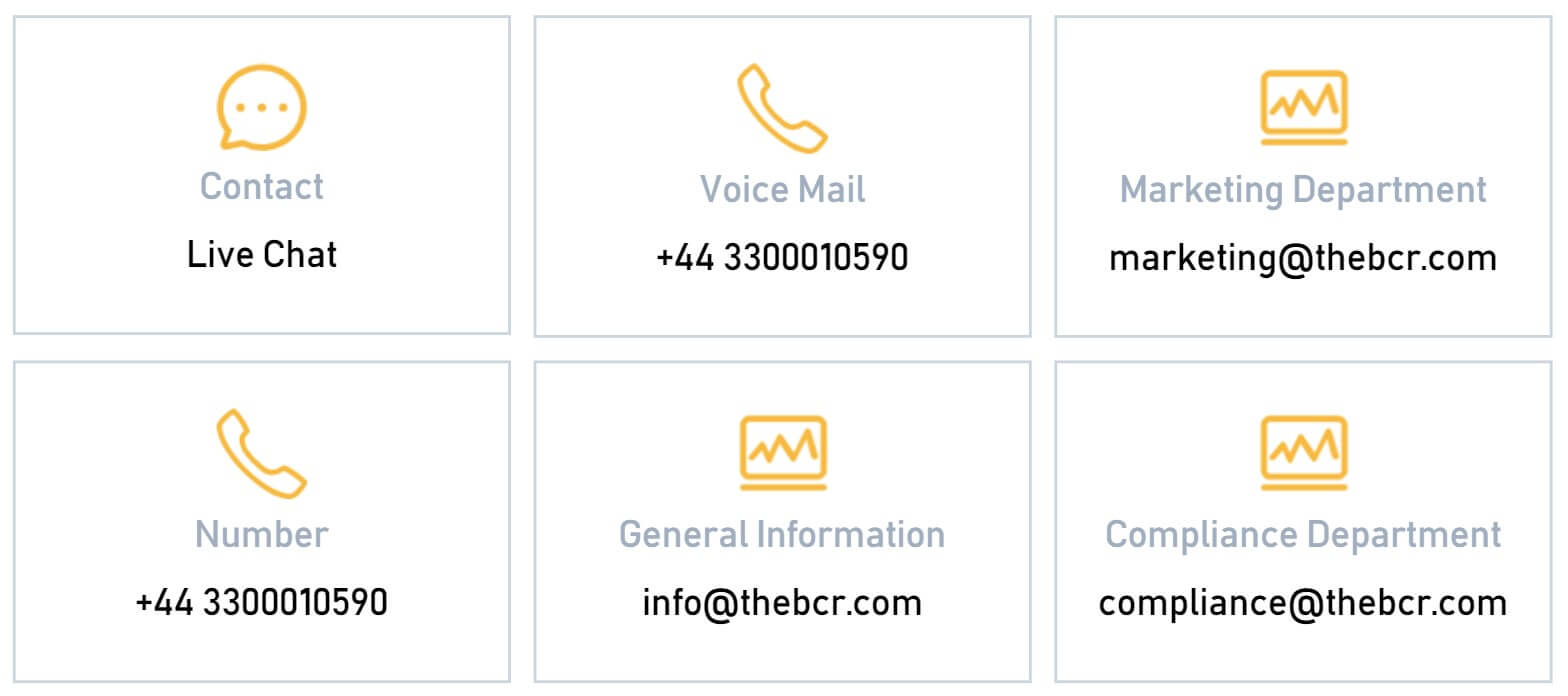

Customer Service

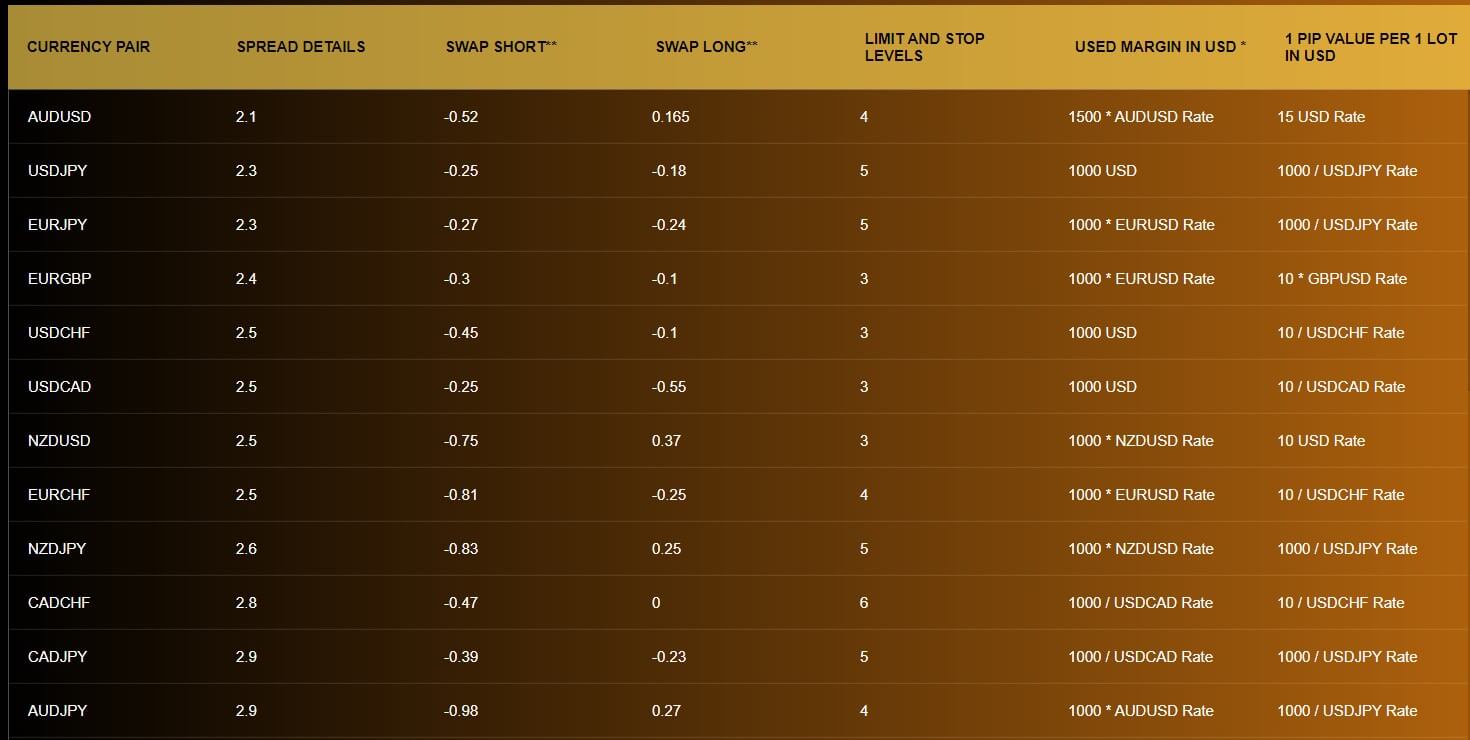

The customer service team can be contacted between 8 am to 5 pm from Monday to Friday, they are closed over the weekends and on bank holidays.

You re able to use the provided online submissions to send in your query, you are also able to use the available email address, phone number or postal address, giving you a choice of contact methods.

Address: 11/12 Tokenhouse Yard London EC2R 7AS UK

Phone: 020 7709 2038

Email: [email protected]

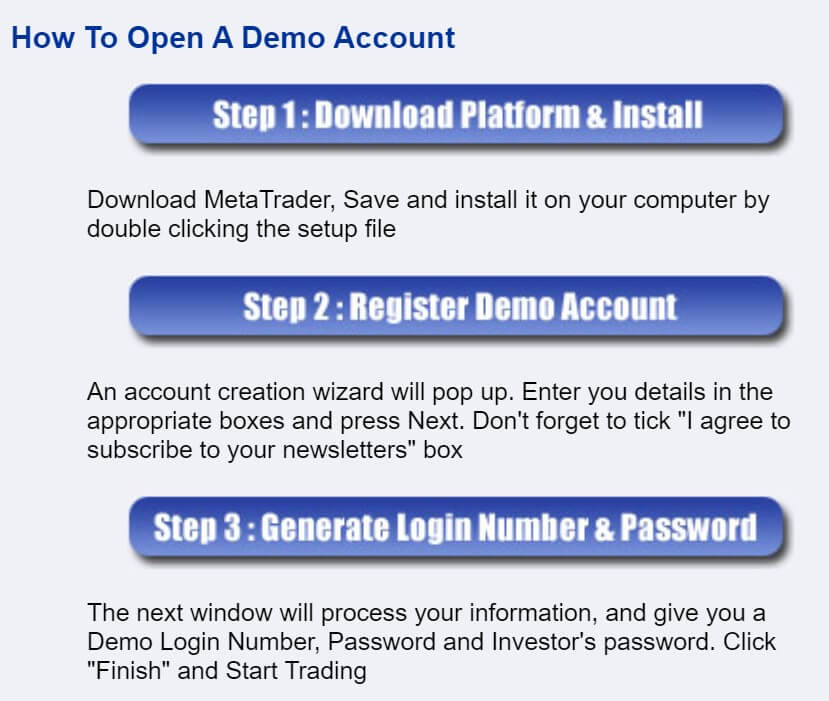

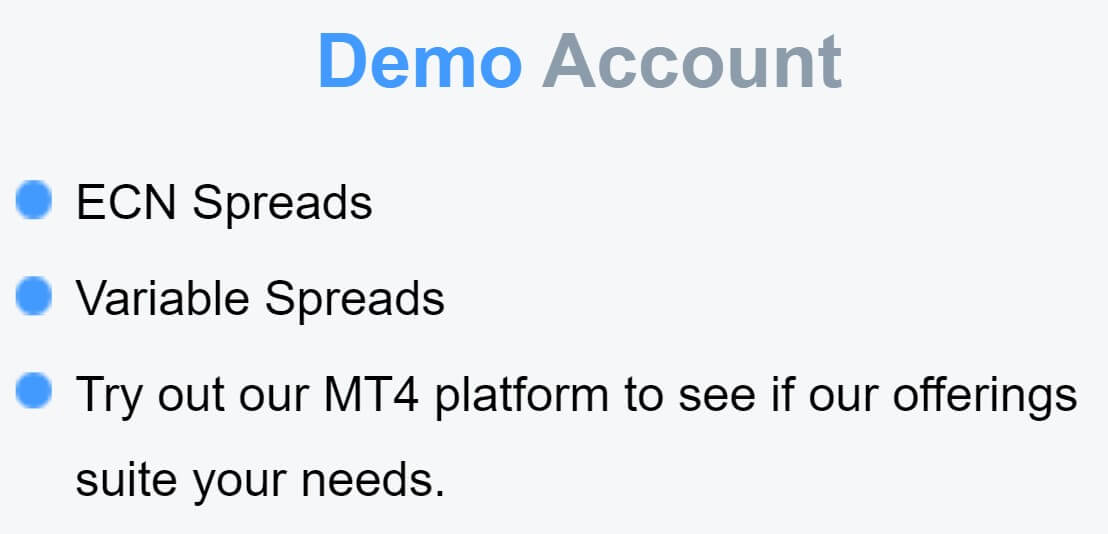

Demo Account

Demo accounts re a great way to test out the markets, trading platforms or new strategies without having to risk any of your own capital, so it is good to see them available from VIBHS. You are able to open up a demo account to use on MetaTrader 4, while the actual conditions of the account are not made clear, we suspect that they will mimic the conditions that we have specified throughout this review, the only information we do not know if whether or not there is an expiration on the accounts.

Countries Accepted

This information is not stated on the website, so if you are thinking of signing up with VIBHS, we would recommend getting in contact with the customer support team just to make sure that you are in fact eligible for an account, we would do this prior to opening one up.

Conclusion

VINGS tries to keep things simple with just the one account type, in terms of the available platform they have given a bit of variety, however, if you are looking for just the traditional trading experience there is only MetaTrader 4 available to use. In terms of the trading conditions, they are relatively competitive, it does not look like there are any added commissions and the spreads start pretty low at around 1 pip, the main downside is the lack of leverage, as the recommendations from the ESMA are being followed, the majority of clients will be stuck with a maximum leverage of 1:30 which can reduce the profit potential of the account quite a lot. There is also a limited number of ways to deposit and withdraw which could limit some potential clients, however, there are no fees which is positive.

Withdrawal Processing & Wait Time

Withdrawal Processing & Wait Time

There are some very basic educational tools, the main one being an introduction to the markets, this is very basic and won’t be making you into an expert. There is also an economic calculator which details upcoming news events along with the currencies that they may affect. There are video tutorials but these are based around how to use the MetaTrader 5 trading platform rather than how to trade. Finally, there are some articles and a glossary of terms should you come across something you do not understand the meaning of.

There are some very basic educational tools, the main one being an introduction to the markets, this is very basic and won’t be making you into an expert. There is also an economic calculator which details upcoming news events along with the currencies that they may affect. There are video tutorials but these are based around how to use the MetaTrader 5 trading platform rather than how to trade. Finally, there are some articles and a glossary of terms should you come across something you do not understand the meaning of. Address: Suite, 305 Griffith corporate center, PO Box 1510, Beachmont Kingstown, St.Vincent and the Grenadines

Address: Suite, 305 Griffith corporate center, PO Box 1510, Beachmont Kingstown, St.Vincent and the Grenadines

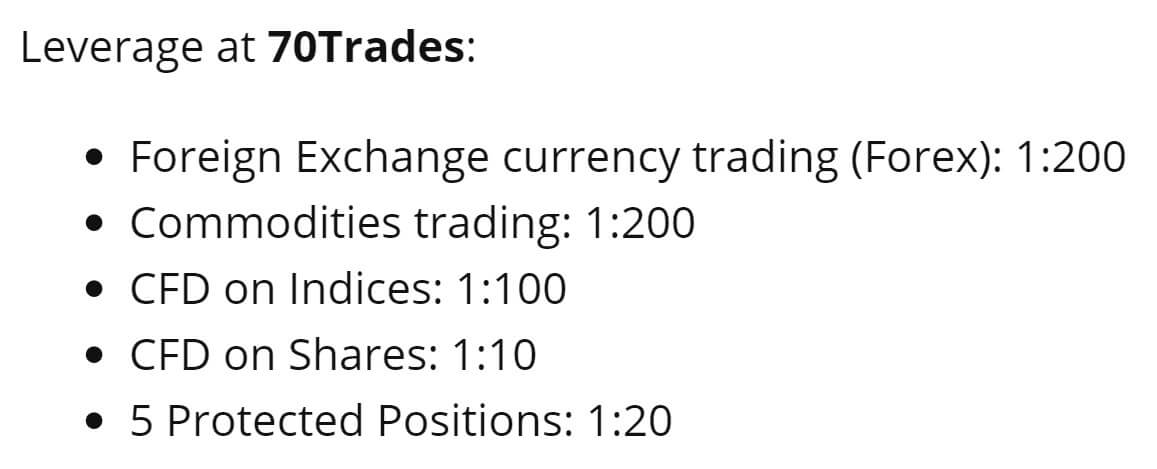

The maximum leverage available to you depends on the account you are using. The

The maximum leverage available to you depends on the account you are using. The

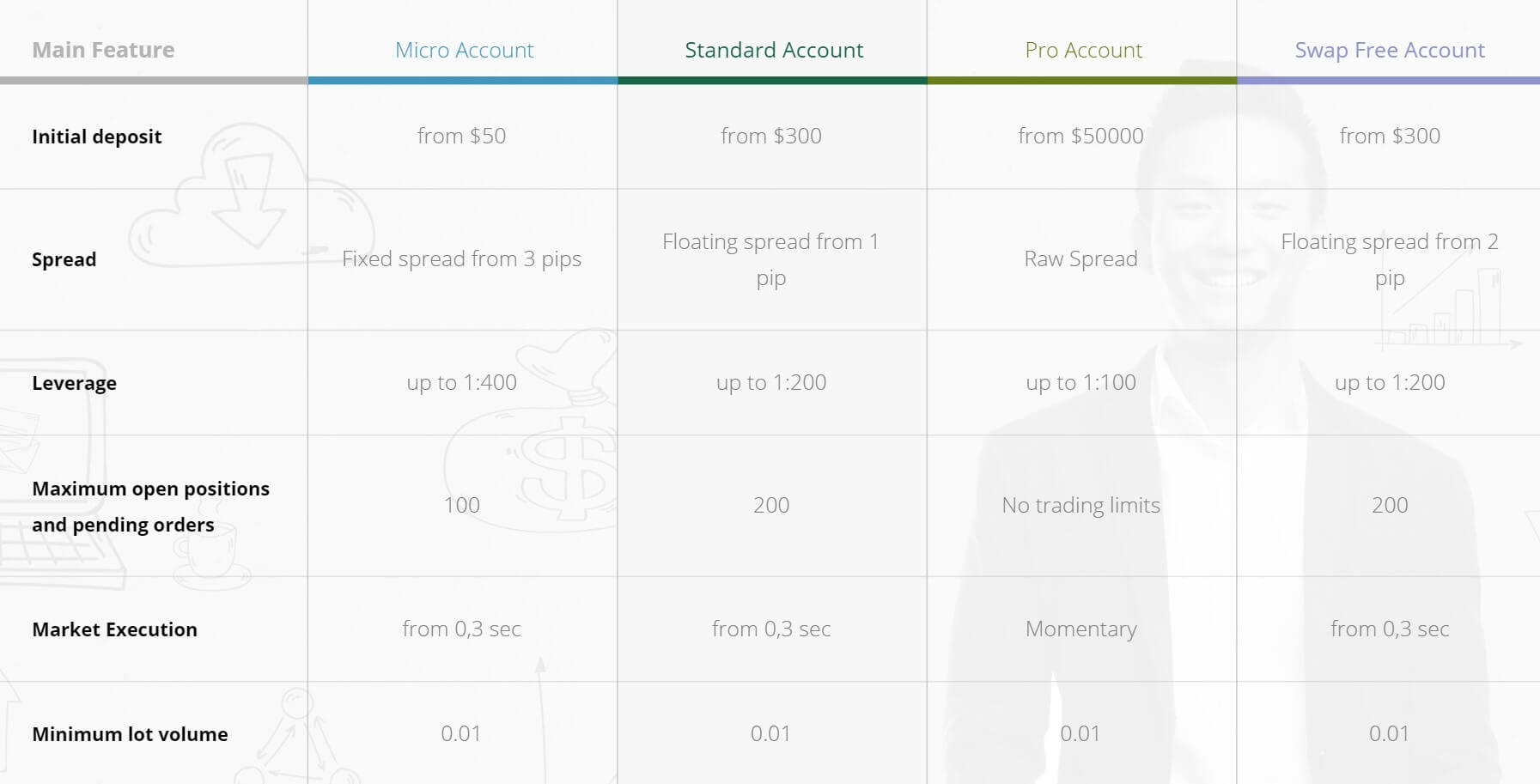

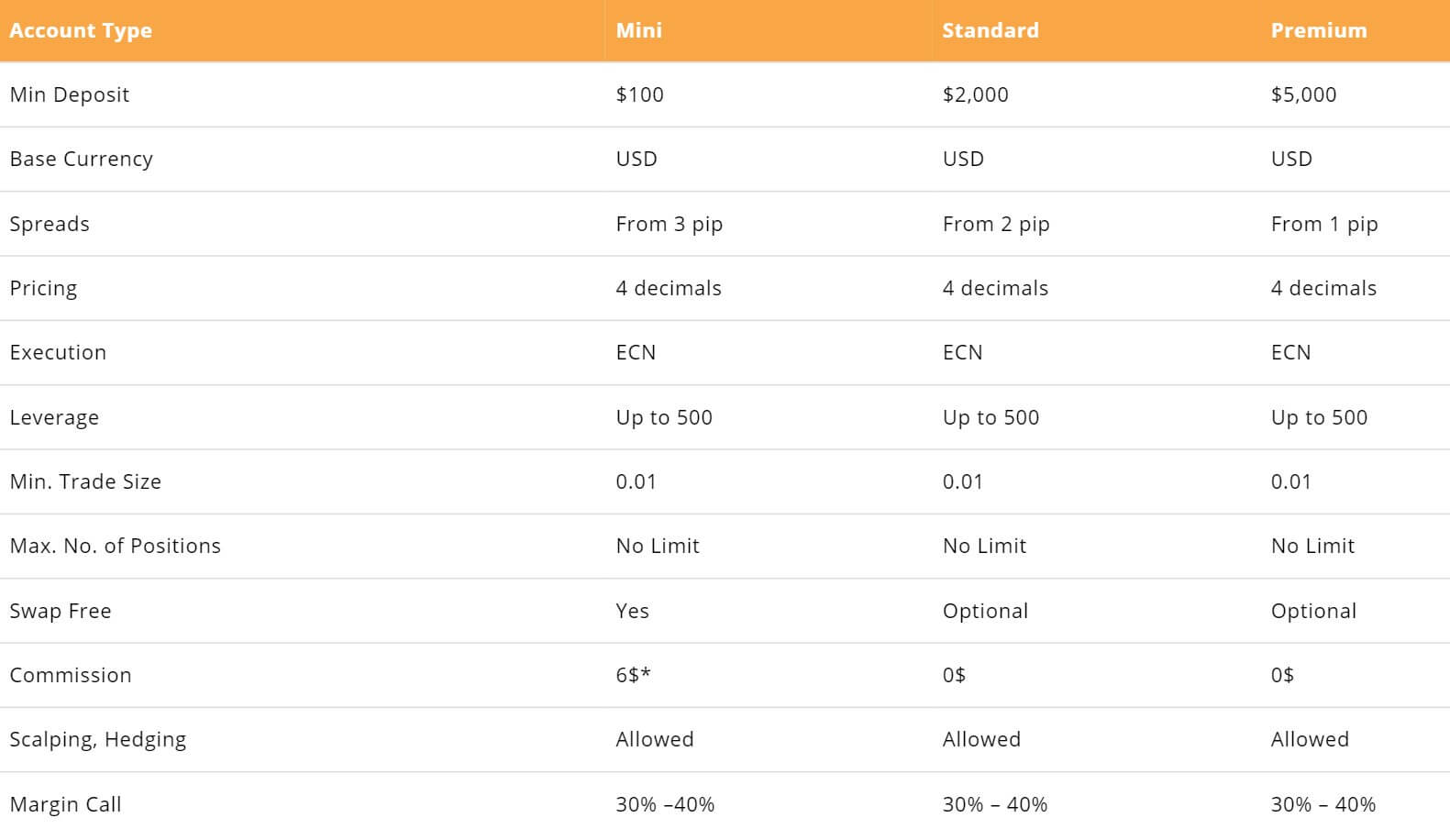

The Micro account has fixed spreads starting from 3 pips, the Standard account has floating spreads starting from 1 pip, the Pro account has raw spreads and the Swap-Free account has floating spreads starting from 2 pips.

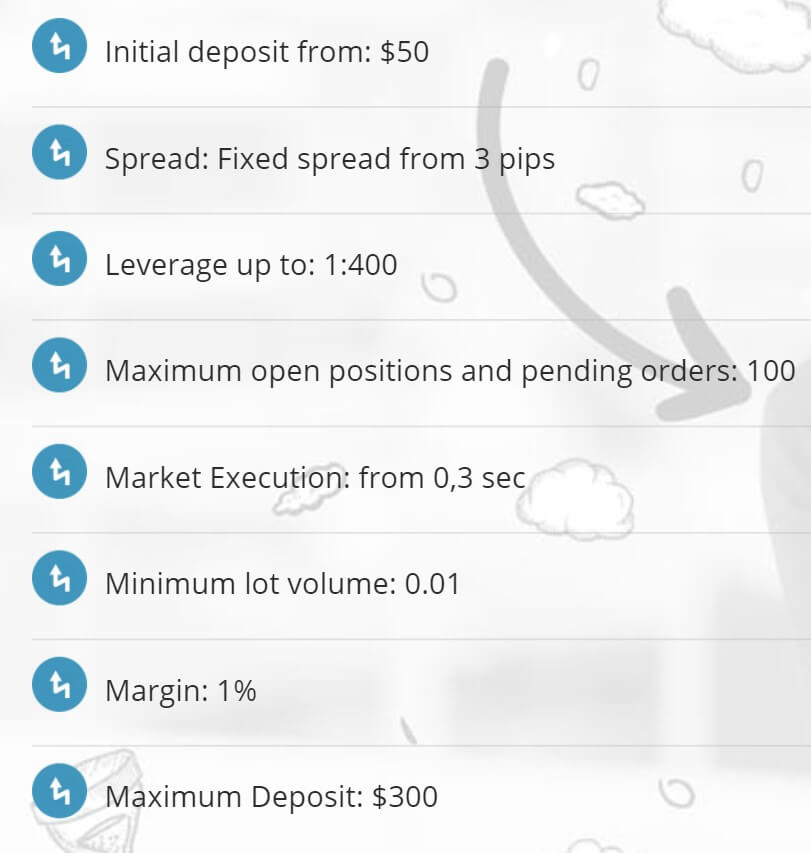

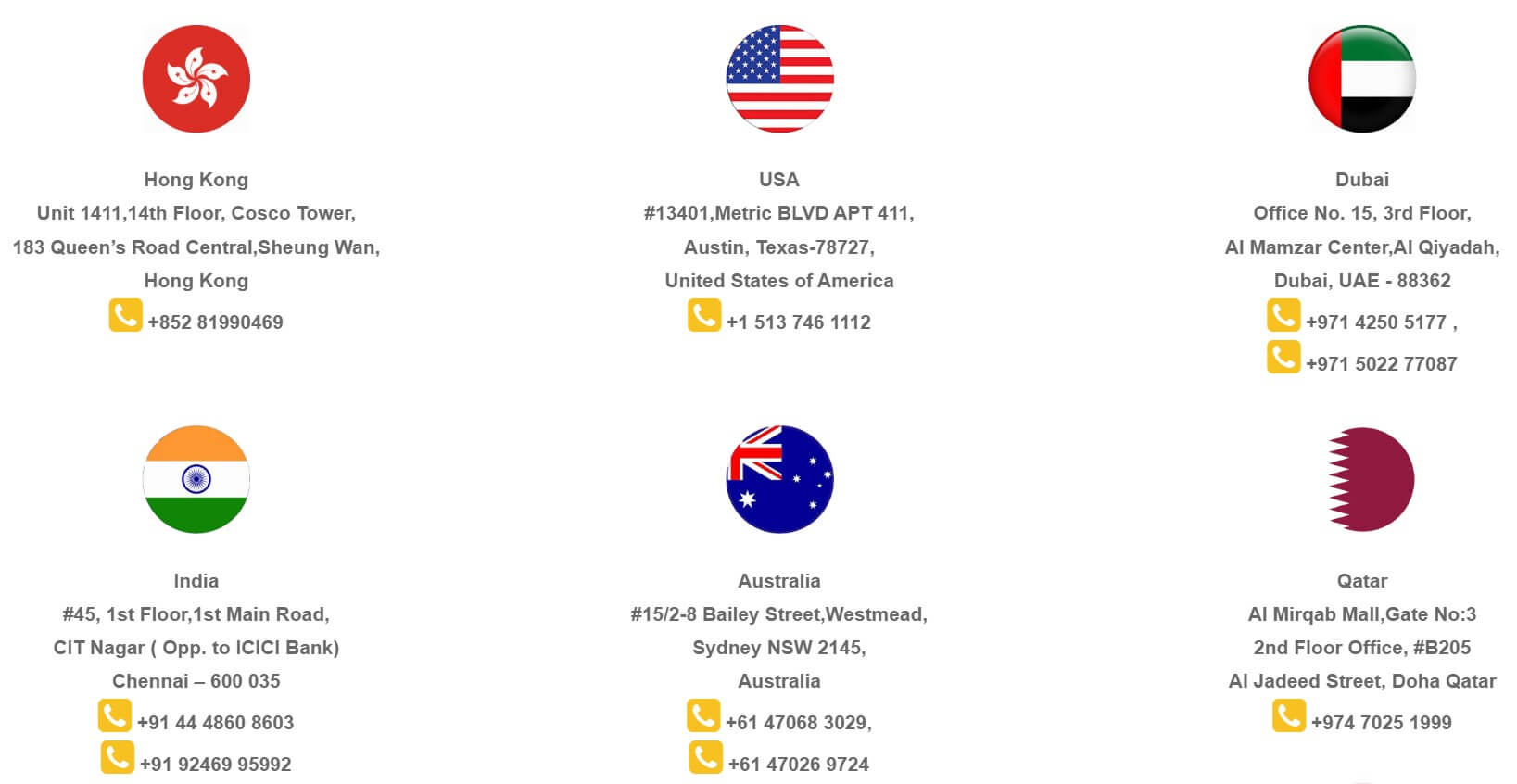

The Micro account has fixed spreads starting from 3 pips, the Standard account has floating spreads starting from 1 pip, the Pro account has raw spreads and the Swap-Free account has floating spreads starting from 2 pips. The minimum amount required to open up an account is $50, this will get you access to the Micro account, if you want a higher tier account then you will need to deposit at least $300 or $50,000 for the Pro account.

The minimum amount required to open up an account is $50, this will get you access to the Micro account, if you want a higher tier account then you will need to deposit at least $300 or $50,000 for the Pro account.

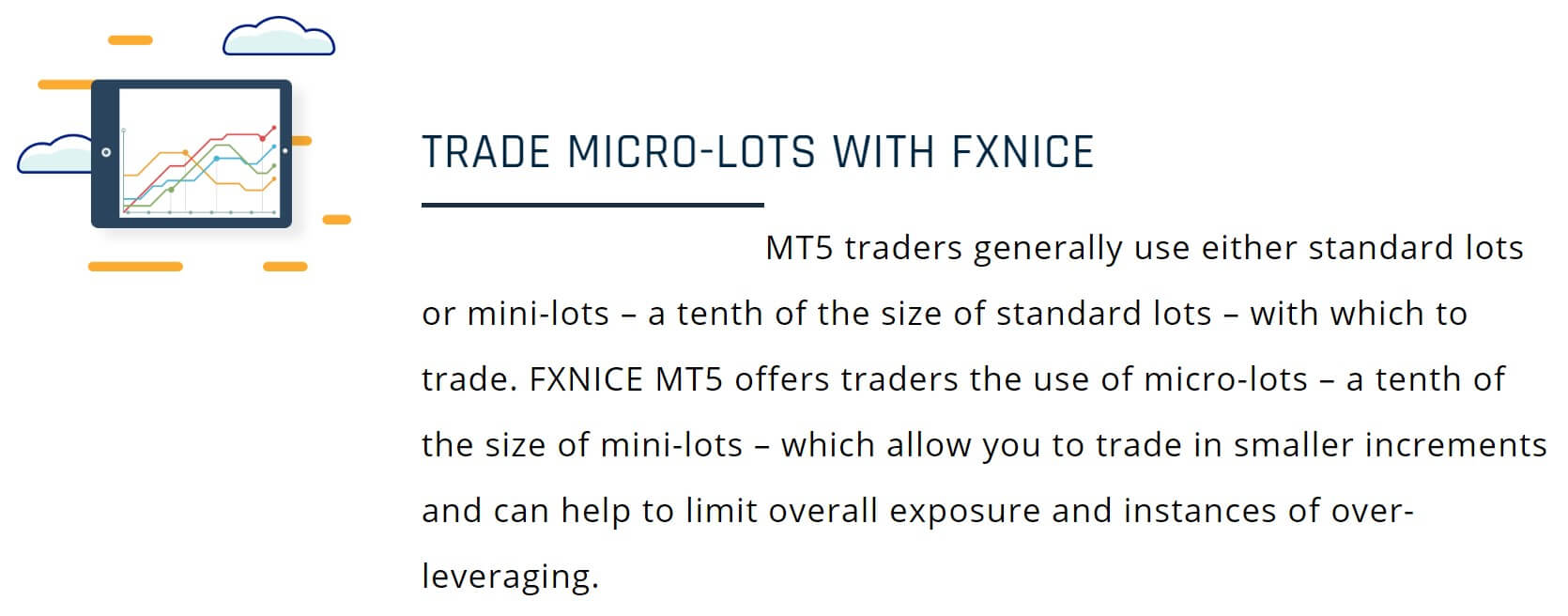

Just the single trading platform on offer from FxNice, this is MetaTrader 5 (MT5), a trading platform by MetaQuotes. MT5 is a well known and widely used trading platform providing a whole host of features. It has the ability to show multiple charts at the same time, to trade micro-lots, offers one-click trading, hedging, and is compatible with hundreds and thousands of indicators and expert advisors. MT5 is also highly accessible as it can be used as a desktop download, a mobile application or as a web trader in your internet browser, ensuring you can access it and trade wherever you are.

Just the single trading platform on offer from FxNice, this is MetaTrader 5 (MT5), a trading platform by MetaQuotes. MT5 is a well known and widely used trading platform providing a whole host of features. It has the ability to show multiple charts at the same time, to trade micro-lots, offers one-click trading, hedging, and is compatible with hundreds and thousands of indicators and expert advisors. MT5 is also highly accessible as it can be used as a desktop download, a mobile application or as a web trader in your internet browser, ensuring you can access it and trade wherever you are.

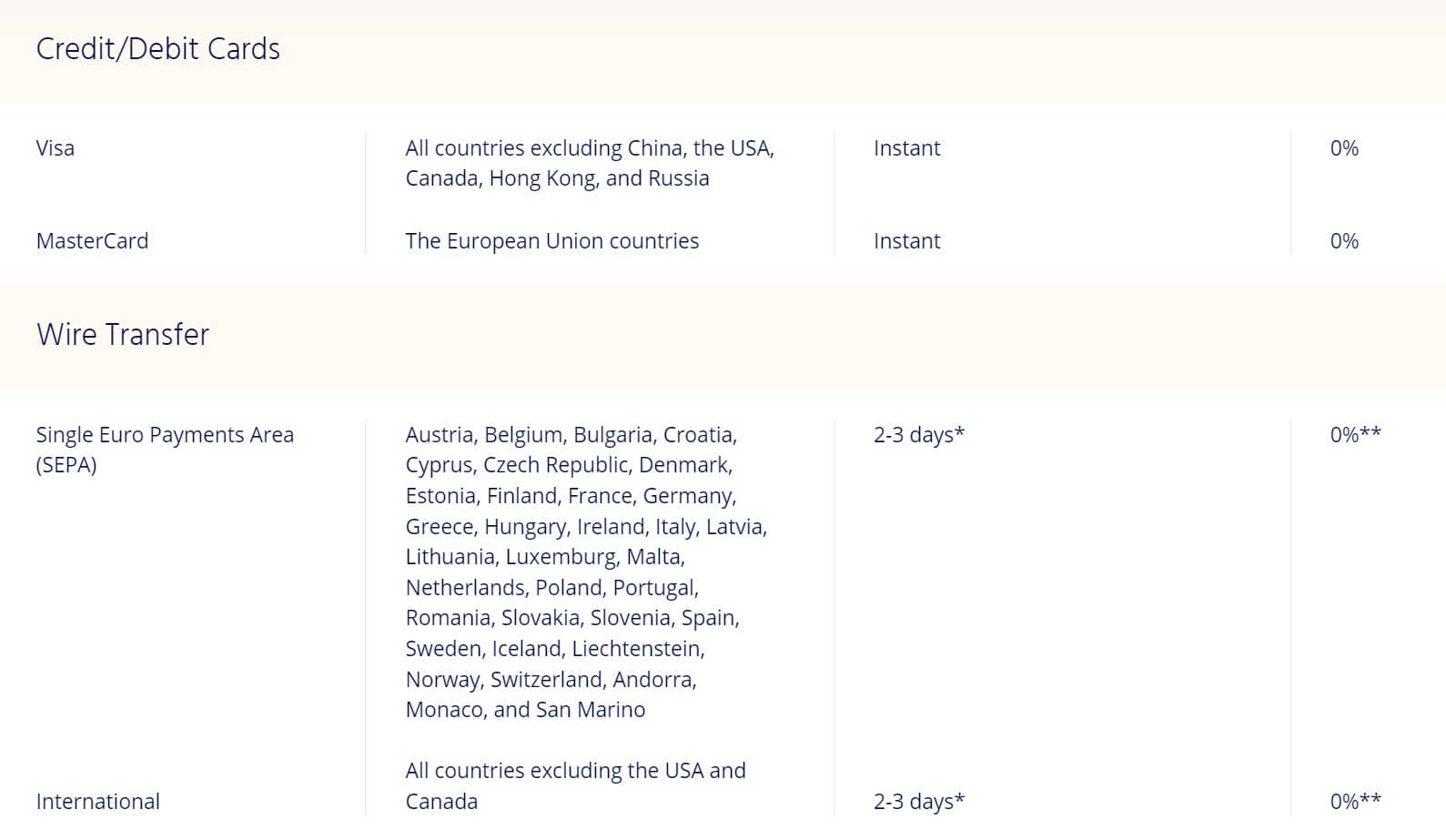

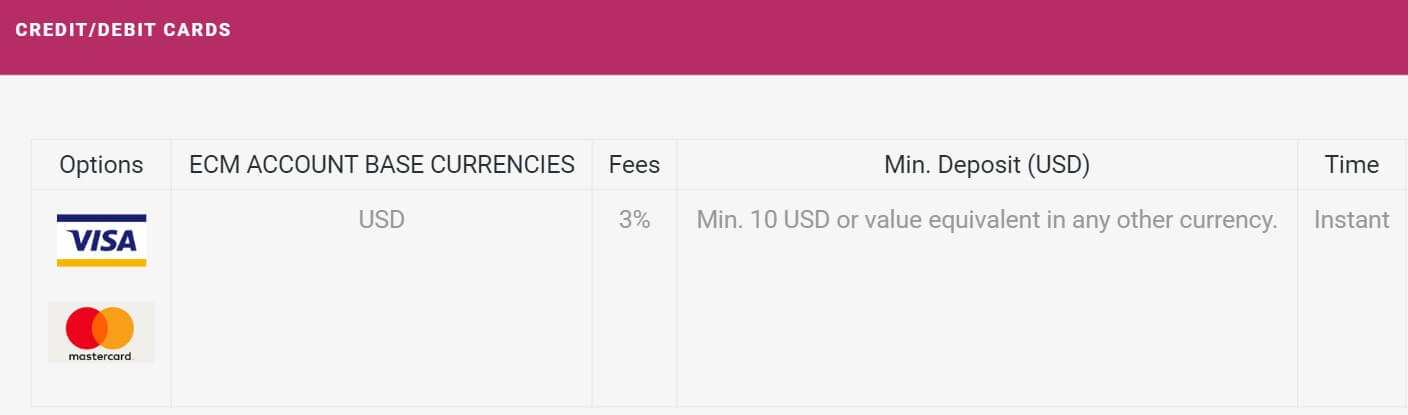

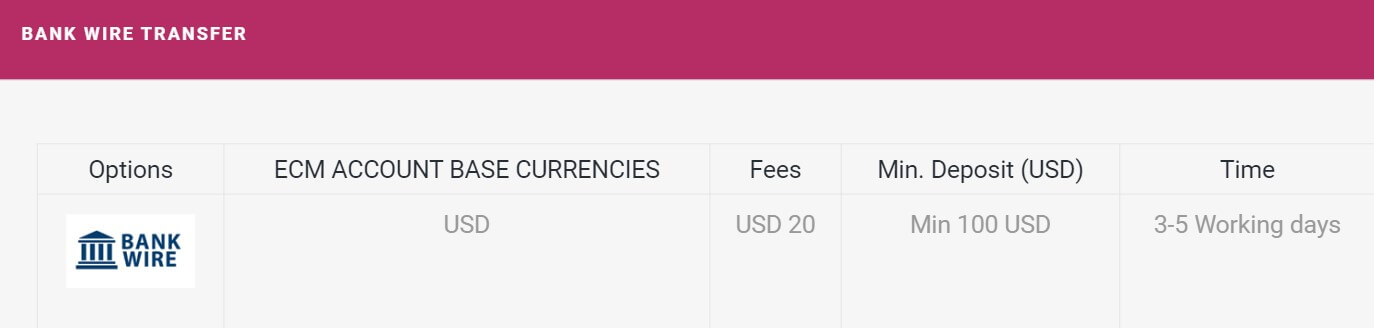

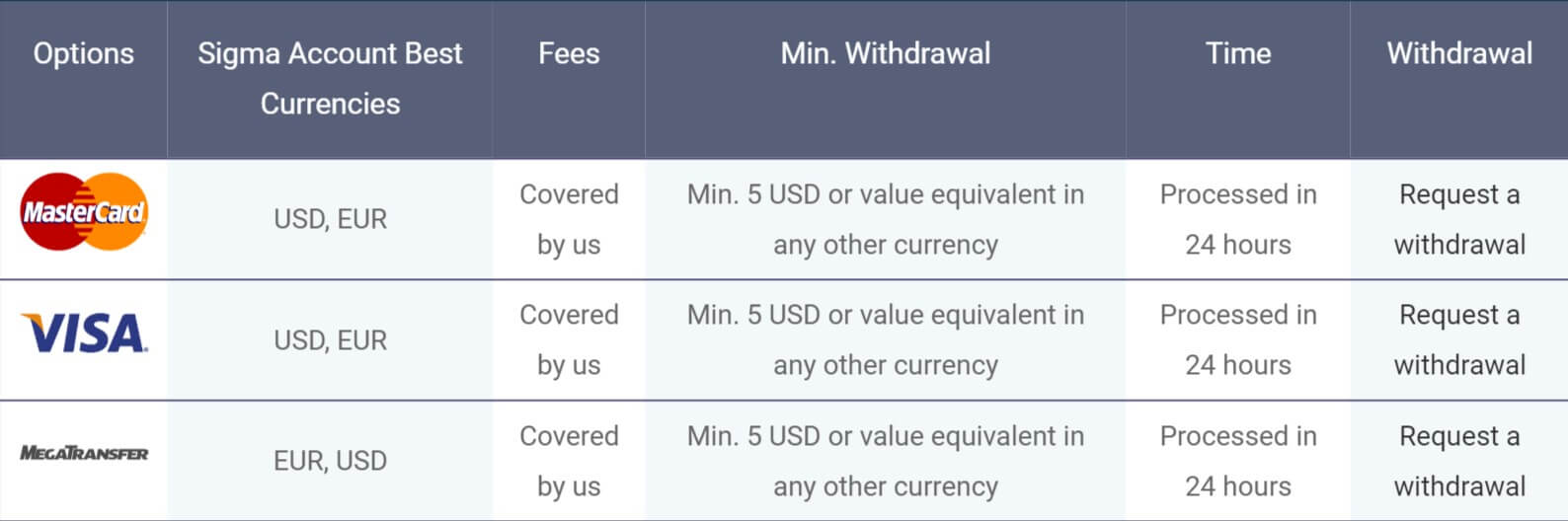

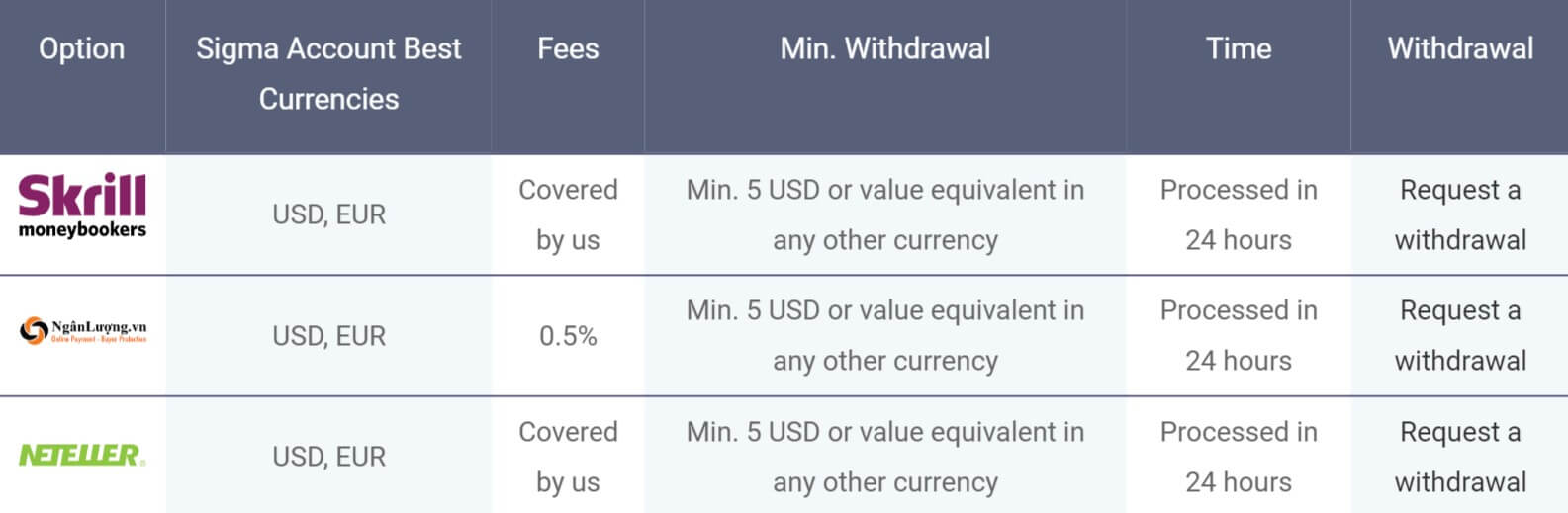

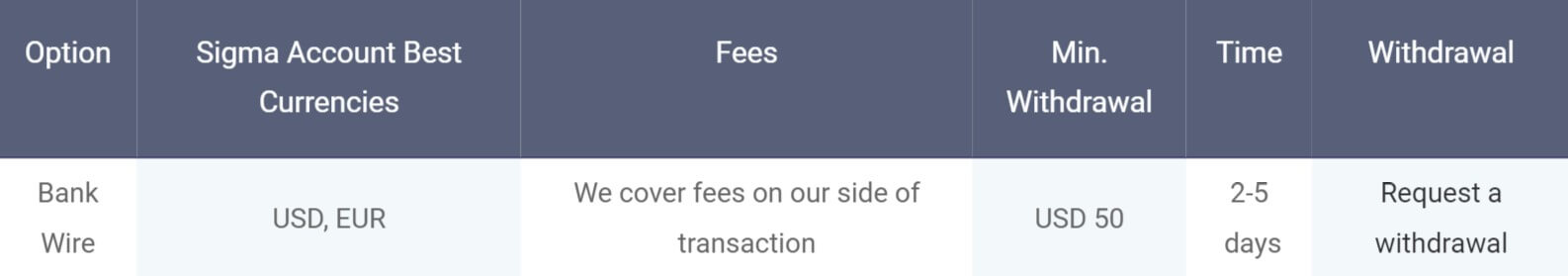

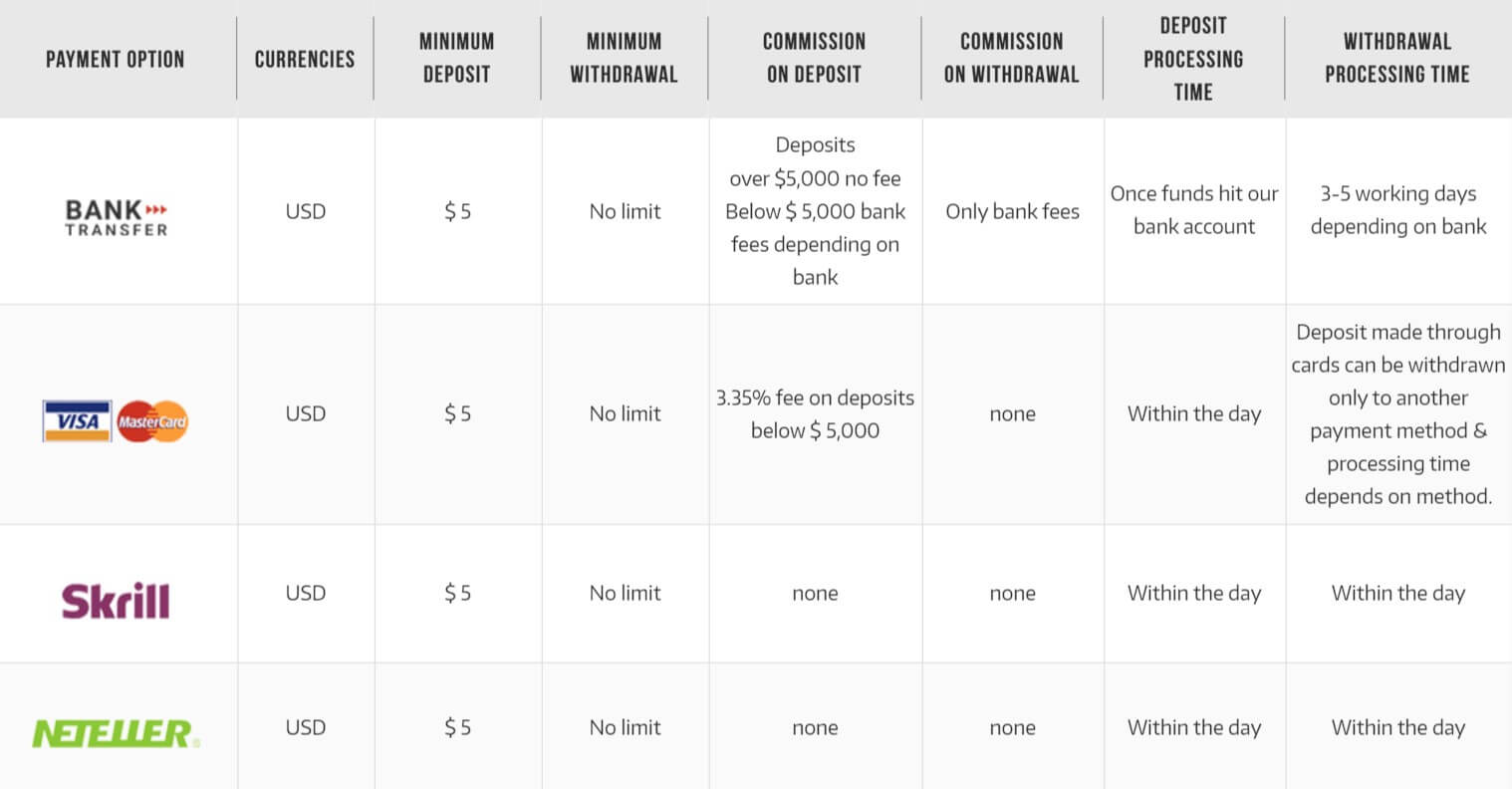

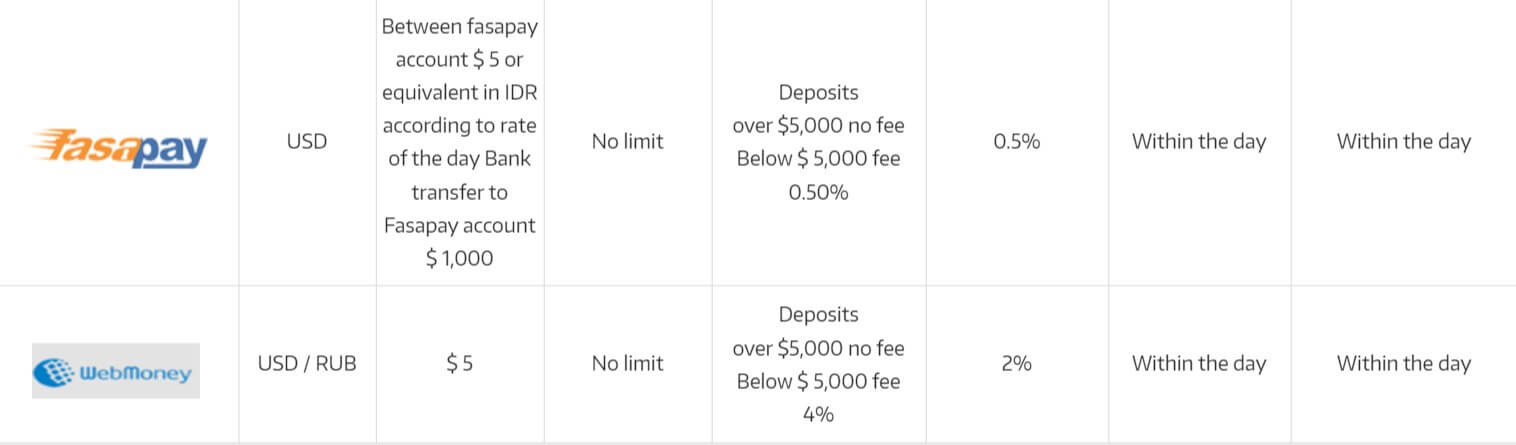

There are a few different ways to deposit, these are Bank Wire Transfer, Credit / Debit Card (Both Vias and MasterCard), Neteller, Bitcoin, and Skrill.

There are a few different ways to deposit, these are Bank Wire Transfer, Credit / Debit Card (Both Vias and MasterCard), Neteller, Bitcoin, and Skrill.

Commissions and swap charges are not known to us so we cannot state what they are or if there are any included in the accounts.

Commissions and swap charges are not known to us so we cannot state what they are or if there are any included in the accounts.

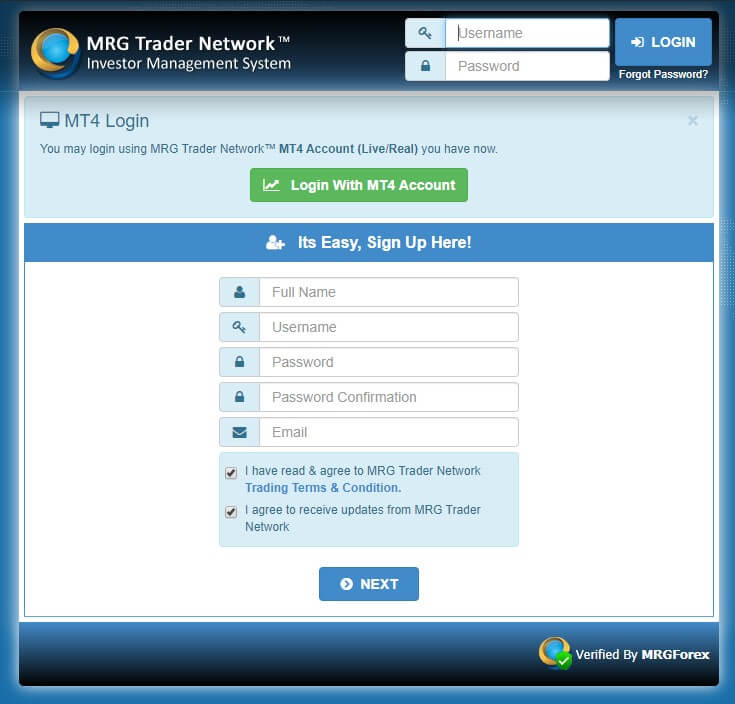

MetaTrader 4 (MT4):

MetaTrader 4 (MT4): There are only three categories of assets available. The first is Forex, and there isn’t a full breakdown of these instruments or even a statement to say how many there may be, we just know that there are some

There are only three categories of assets available. The first is Forex, and there isn’t a full breakdown of these instruments or even a statement to say how many there may be, we just know that there are some

You are able to get in contact with BrightWin in a number of ways. You can use the online submission form, fill it in and you should then get a reply via email. You can also use the provided postal address, email address or phone numbers. We don’t know what the opening times of the customer service are but we would assume that they would close over the weekends at the same time as the markets.

You are able to get in contact with BrightWin in a number of ways. You can use the online submission form, fill it in and you should then get a reply via email. You can also use the provided postal address, email address or phone numbers. We don’t know what the opening times of the customer service are but we would assume that they would close over the weekends at the same time as the markets. Demo accounts are available, but they don’t give any information about them. We know that you get a balance of $10,000 when using the account but nothing else. We would expect them to mimic the trading conditions of the available accounts but we are not sure exactly which one. We also do not know if there is an expiration on the accounts. The demo account will allow you to test out the trading conditions and also new strategies without having to risk any of your own capital.

Demo accounts are available, but they don’t give any information about them. We know that you get a balance of $10,000 when using the account but nothing else. We would expect them to mimic the trading conditions of the available accounts but we are not sure exactly which one. We also do not know if there is an expiration on the accounts. The demo account will allow you to test out the trading conditions and also new strategies without having to risk any of your own capital.

MetaTrader 4 (MT4) is the only platform on offer from FXCL. This is one of the most popular trading platforms in the world due to its reliability, adaptability, and it is easy to use. It is also highly accessible as you can use it as a desktop download, a web trader or as an application for your mobile devices. MetaTrader 4 is compatible with thousands of expert advisors and indicators to make your trading and analysis as easy as possible. Normally being stuck with a single platform is a negative, but there could be far worse platforms to be stuck with.

MetaTrader 4 (MT4) is the only platform on offer from FXCL. This is one of the most popular trading platforms in the world due to its reliability, adaptability, and it is easy to use. It is also highly accessible as you can use it as a desktop download, a web trader or as an application for your mobile devices. MetaTrader 4 is compatible with thousands of expert advisors and indicators to make your trading and analysis as easy as possible. Normally being stuck with a single platform is a negative, but there could be far worse platforms to be stuck with.

Deposit Methods & Costs

Deposit Methods & Costs 200% New Year Bonus:

200% New Year Bonus:

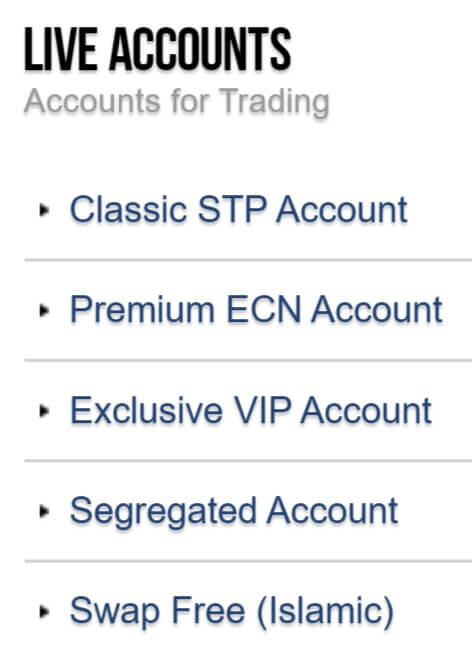

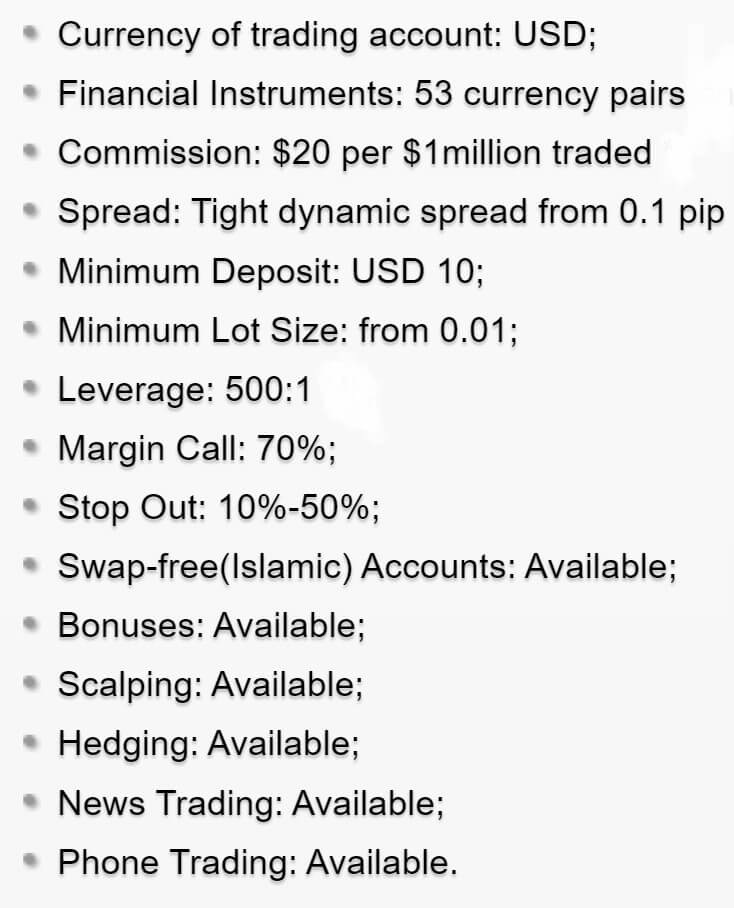

Premium ECN Account:

Premium ECN Account:

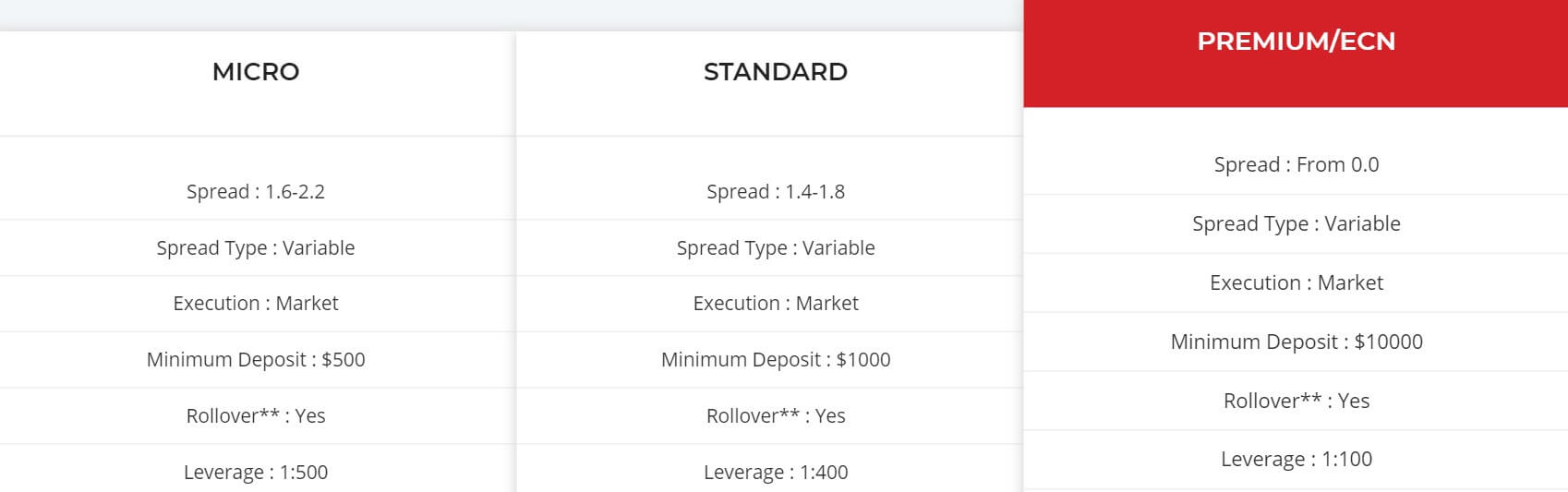

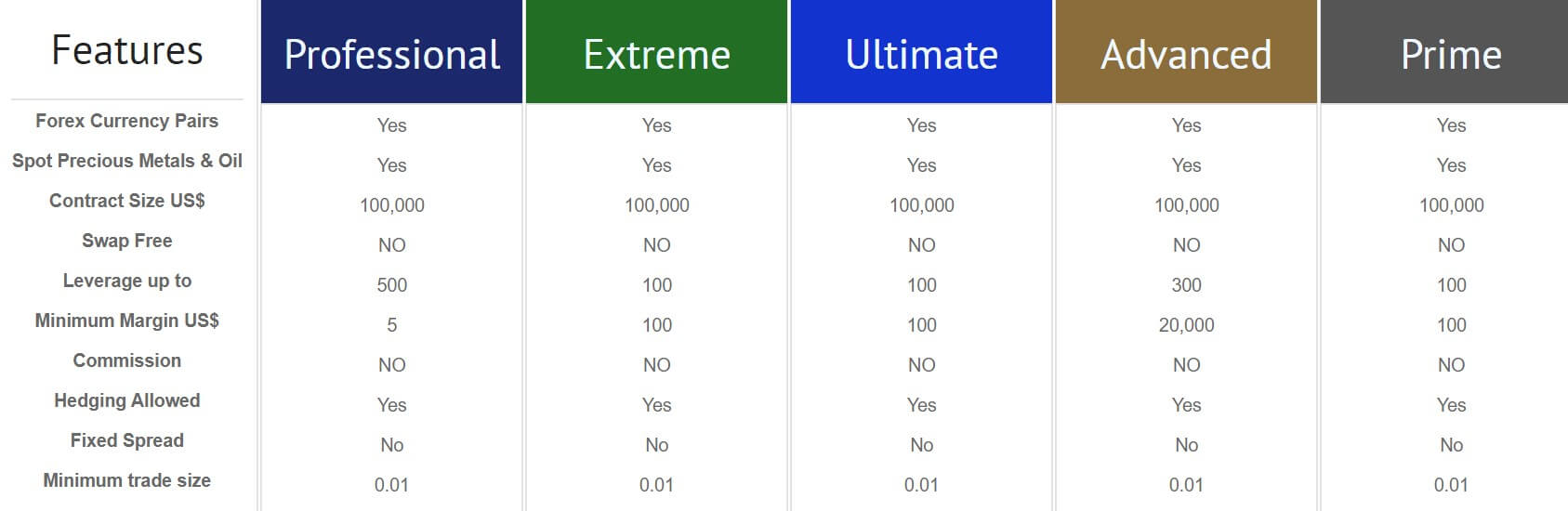

The leverage that you get depends on the account you are using. The Classic STP account holder can have a leverage up to 1:500, while the Premium ECN account can be leveraged up to 1:100, and the Exclusive VIP account holder can select what leverage they want the account to use. This can be selected when opening up an account and can be changed by contacting the customer service team with the request to change it.

The leverage that you get depends on the account you are using. The Classic STP account holder can have a leverage up to 1:500, while the Premium ECN account can be leveraged up to 1:100, and the Exclusive VIP account holder can select what leverage they want the account to use. This can be selected when opening up an account and can be changed by contacting the customer service team with the request to change it.

There is a large selection of tradable assets available, we have outlined them below so you can get an understanding of what is available to trade.

There is a large selection of tradable assets available, we have outlined them below so you can get an understanding of what is available to trade.

You can use the online submission form, simply fill it in and wait for a reply via email. They have also provided a postal address, email address, and phone number so you have a choice of methods available to use.

You can use the online submission form, simply fill it in and wait for a reply via email. They have also provided a postal address, email address, and phone number so you have a choice of methods available to use.

Liirat offers MetaTrader 4 as its go-to trading platform. It is an extremely popular trading platform that hosts more than 1,000,000 users trading activities. It can be used from anywhere in the world as it comes as a desktop download, mobile application and web trader. The main features stated by Liirat is that the platform comes with 3 execution modes, 2 market orders, 4 pending orders, 2 stop orders, and trailing stops. You can also perform analysis within the platform or use automated trading with the thousands of compatible indicators and expert advisors.

Liirat offers MetaTrader 4 as its go-to trading platform. It is an extremely popular trading platform that hosts more than 1,000,000 users trading activities. It can be used from anywhere in the world as it comes as a desktop download, mobile application and web trader. The main features stated by Liirat is that the platform comes with 3 execution modes, 2 market orders, 4 pending orders, 2 stop orders, and trailing stops. You can also perform analysis within the platform or use automated trading with the thousands of compatible indicators and expert advisors.

x24:

x24:

Assets

Assets

Educational & Trading Tools

Educational & Trading Tools

Platforms

Platforms There are plenty of assets and instruments available, and we have outlined them below.

There are plenty of assets and instruments available, and we have outlined them below.

Phone: +44 208 089 2065

Phone: +44 208 089 2065

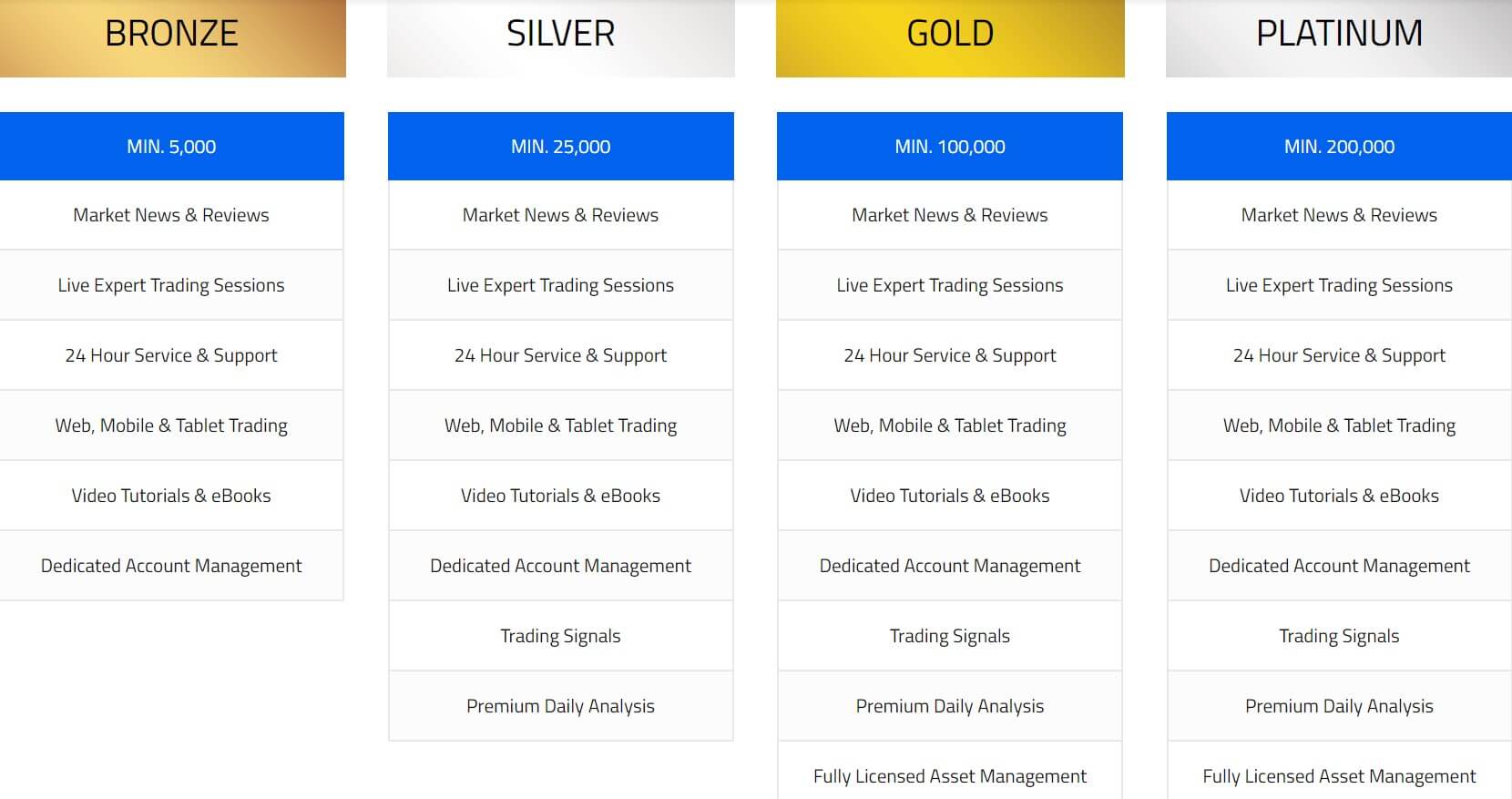

Account Types

Account Types

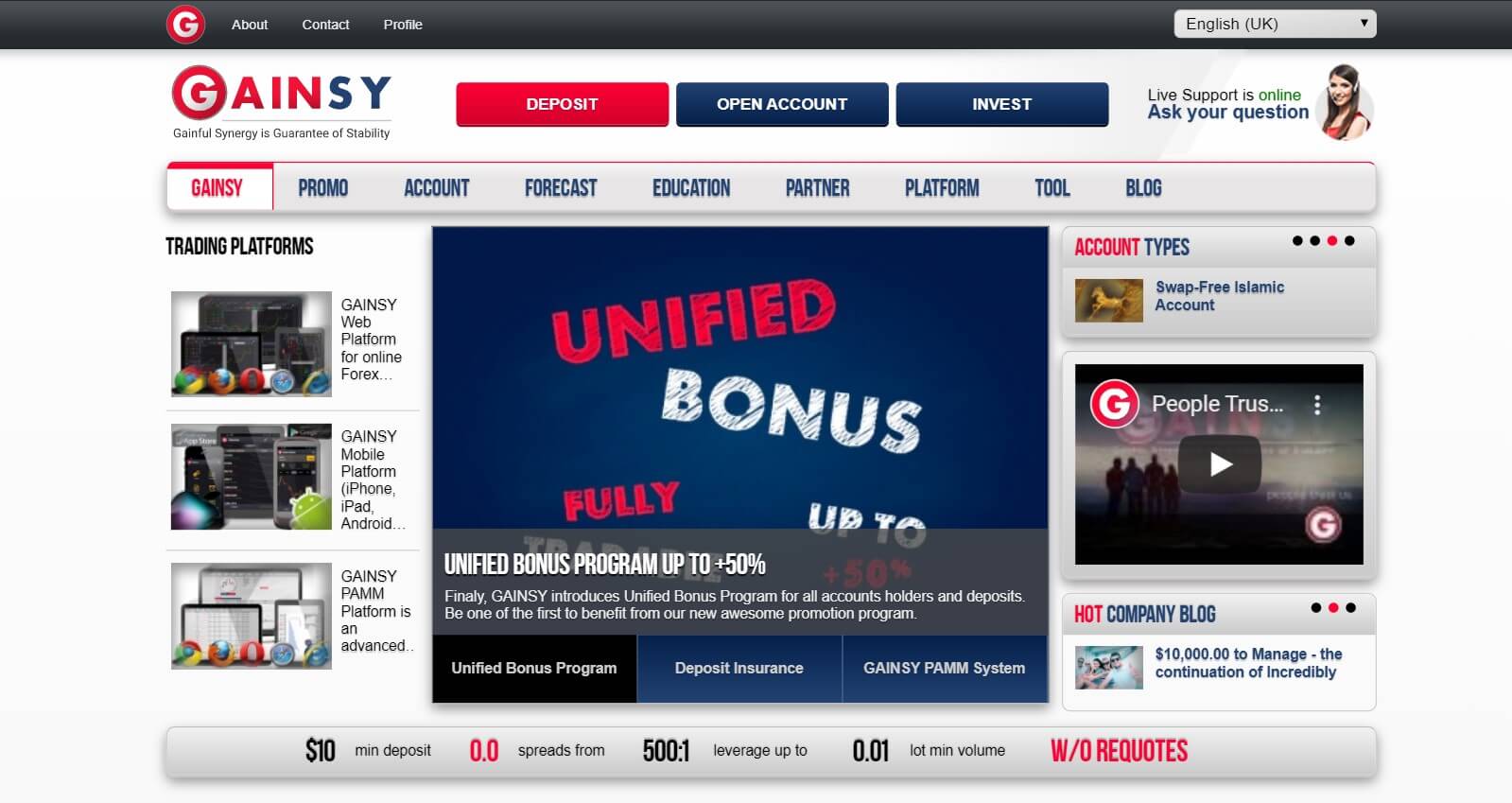

The leverage stated on the main page of the site is 1:200. This is all we have to go on as the accounts page doesn’t actually detail any differences in trading conditions and there are none mentioned anywhere else so it seems that all accounts have the same leverage. This can be selected when opening an account and we are not sure if it can be changed once an account has already been opened. Typically,

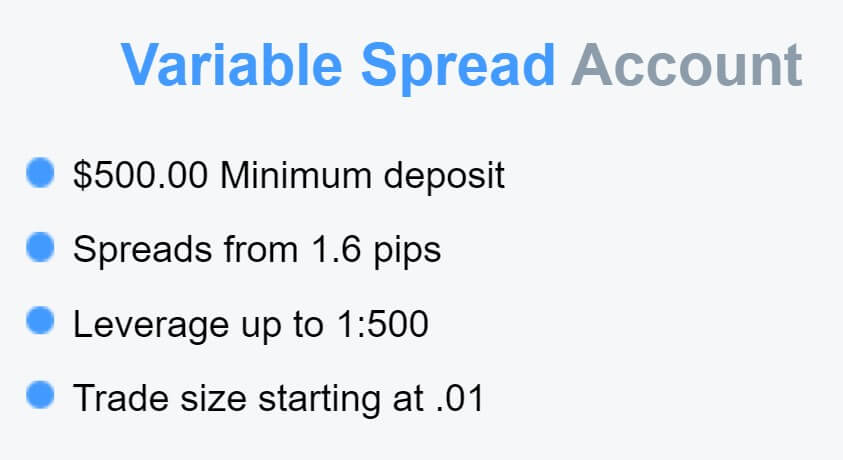

The leverage stated on the main page of the site is 1:200. This is all we have to go on as the accounts page doesn’t actually detail any differences in trading conditions and there are none mentioned anywhere else so it seems that all accounts have the same leverage. This can be selected when opening an account and we are not sure if it can be changed once an account has already been opened. Typically,  The only spreads that we have to go on are what is mentioned on the home page of the site. It states that the spread for EUR/USD is 1.6 pips. This is the starting spread as they are variable which means they will move with the markets. Different instruments will also have different starting spreads, 1.6 pips is the smallest they will be. It would be helpful for the broker to provide a full list of average spreads for most of the major assets.

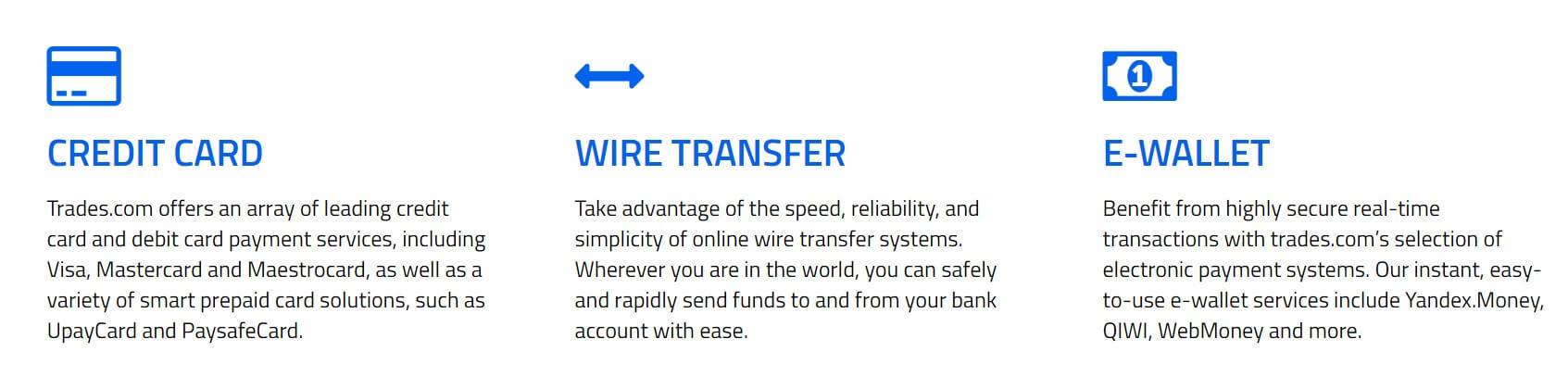

The only spreads that we have to go on are what is mentioned on the home page of the site. It states that the spread for EUR/USD is 1.6 pips. This is the starting spread as they are variable which means they will move with the markets. Different instruments will also have different starting spreads, 1.6 pips is the smallest they will be. It would be helpful for the broker to provide a full list of average spreads for most of the major assets. Sadly there isn’t a dedicated page for funding, the only information we have is some images at the bottom of the website. They indicate that Visa, Maestro, MasterCard, Neteller, and AstroPay are available to use, but we have no confirmation of this. We also do not know if there are any added fees when depositing.

Sadly there isn’t a dedicated page for funding, the only information we have is some images at the bottom of the website. They indicate that Visa, Maestro, MasterCard, Neteller, and AstroPay are available to use, but we have no confirmation of this. We also do not know if there are any added fees when depositing. When signing up for an account there is a bonus mentioned. There is a 100% welcome bonus however the terms of the bonus are rather confusing. It states that if you make a deposit of at least $5,000 you will receive a bonus of $1,500, which indicates that it is a 30% bonus and not a 100% bonus. As there are not dedicate terms and conditions for this bonus we do not know which one actually is or how to convert the bonus funds into real funds.

When signing up for an account there is a bonus mentioned. There is a 100% welcome bonus however the terms of the bonus are rather confusing. It states that if you make a deposit of at least $5,000 you will receive a bonus of $1,500, which indicates that it is a 30% bonus and not a 100% bonus. As there are not dedicate terms and conditions for this bonus we do not know which one actually is or how to convert the bonus funds into real funds. There is a news section of the site which details news from around the world which could be affecting the markets. There is also an economic calendar available that details different upcoming news events and the currencies or markets that they may affect.

There is a news section of the site which details news from around the world which could be affecting the markets. There is also an economic calendar available that details different upcoming news events and the currencies or markets that they may affect.

Entry Account:

Entry Account: Pro Account:

Pro Account:

Trading Costs

Trading Costs Forex:

Forex: Minimum Deposit

Minimum Deposit

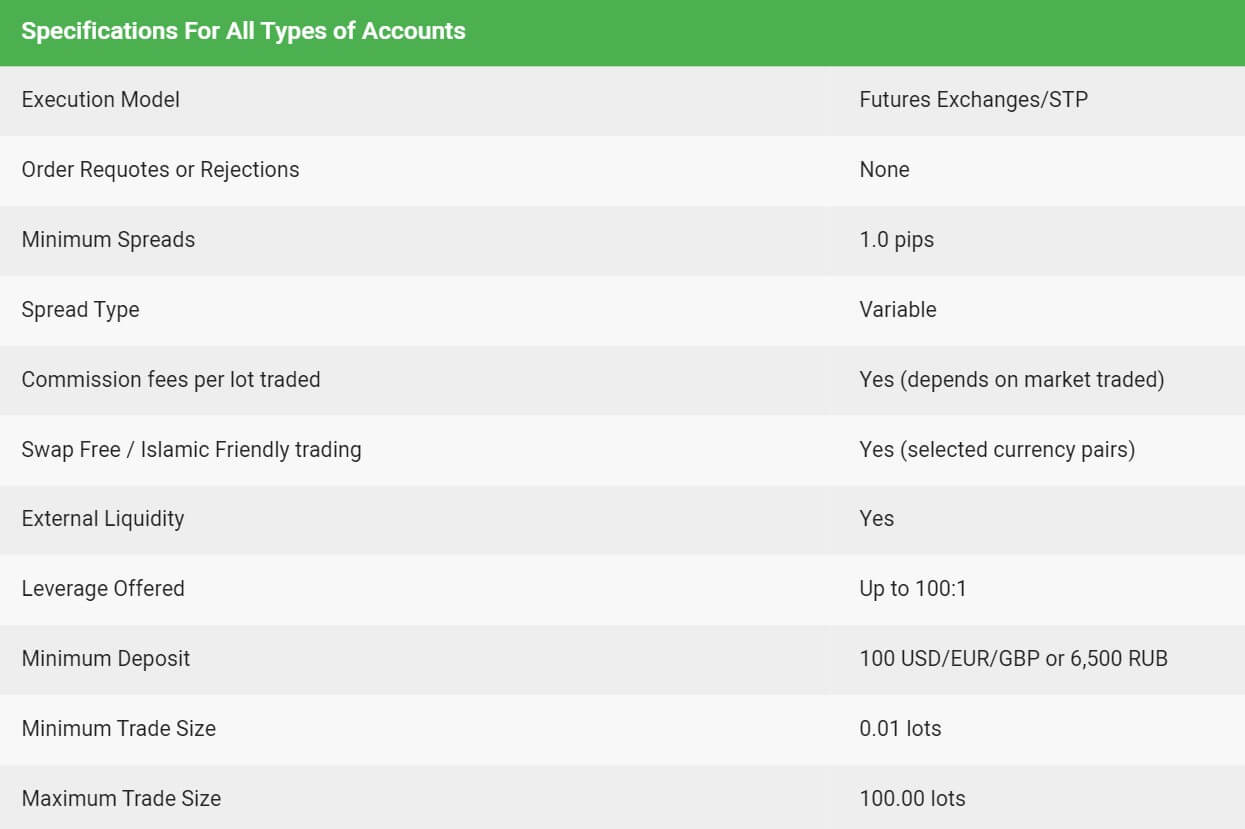

Demo accounts are available and allow you to test out the servers, conditions, platforms, and new strategies without any risk to your own capital. The demo account offers conditions such as spreads starting from 1 pip, this is a variable spread, it is commission-free, swap-free, can be leveraged up to 1:100, can have a minimum balance of 100 USD/EUR/GBP. The trade sizes start from 0.01 lots and go up to 100 lots with a lot being worth 100,000 base currency units.

Demo accounts are available and allow you to test out the servers, conditions, platforms, and new strategies without any risk to your own capital. The demo account offers conditions such as spreads starting from 1 pip, this is a variable spread, it is commission-free, swap-free, can be leveraged up to 1:100, can have a minimum balance of 100 USD/EUR/GBP. The trade sizes start from 0.01 lots and go up to 100 lots with a lot being worth 100,000 base currency units.

We would advise not trading over 50 lots in a single trade, but instead break up larger requests into smaller trades to help with execution and slippage issues.

We would advise not trading over 50 lots in a single trade, but instead break up larger requests into smaller trades to help with execution and slippage issues.

Leverage

Leverage

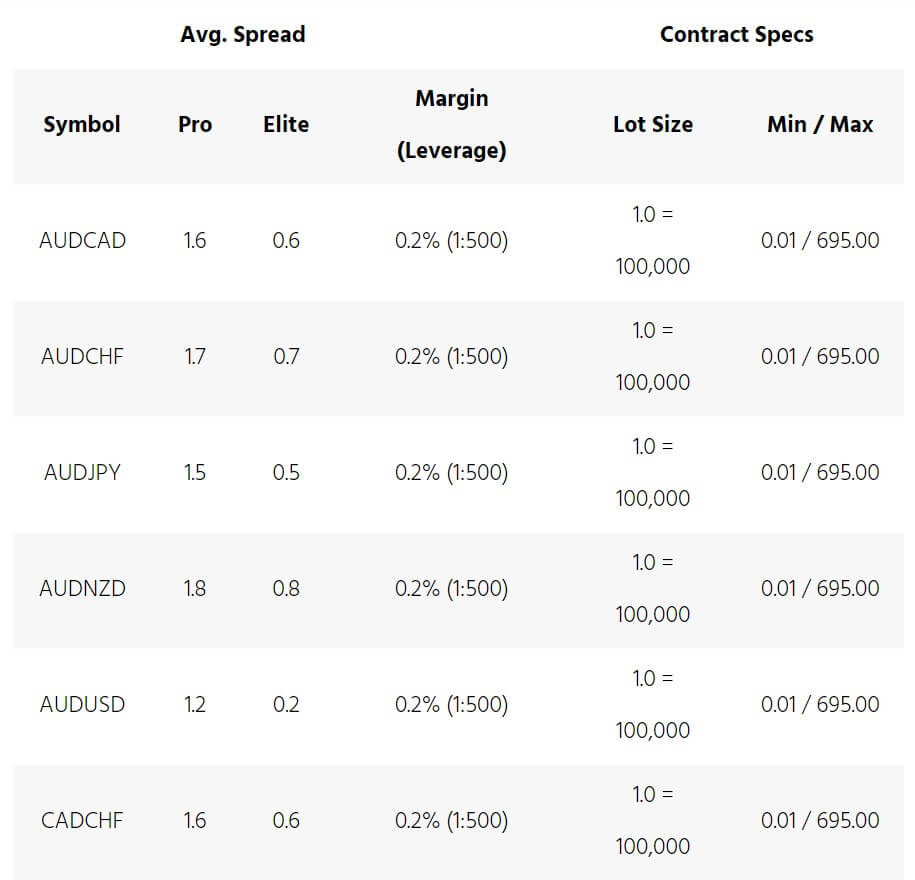

The spreads you receive depend on a few different factors, the first being the account you are using. The Pro account has spreads starting from 1 pip while the Elite account has spreads starting from 0.1 pips. The spreads are variable (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads. So while EURUSD may start at 1.

The spreads you receive depend on a few different factors, the first being the account you are using. The Pro account has spreads starting from 1 pip while the Elite account has spreads starting from 0.1 pips. The spreads are variable (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads. So while EURUSD may start at 1.

The assets on Dax1001 have been broken down into various categories. Unfortunately, there is not a full breakdown of the available assets. We have outlined the information we do know in each category below.

The assets on Dax1001 have been broken down into various categories. Unfortunately, there is not a full breakdown of the available assets. We have outlined the information we do know in each category below.

There are some very basic information pages provided which make up the majority of this section, they cover topics such as: What is Forex?, Forex History, Margin & Leverage, What is CFD?, Technical Analysis and Fundamental Analysis. There is also a

There are some very basic information pages provided which make up the majority of this section, they cover topics such as: What is Forex?, Forex History, Margin & Leverage, What is CFD?, Technical Analysis and Fundamental Analysis. There is also a

The only platform on offer is MetaTrader 4 which is a great option to have. MetaTrader 4 is a highly popular trading platform due to its many features. These include its accessibility, it is available as a desktop download, web trader and as an application for your mobile devices. Its distributed architecture, robust security system and convenient mobile trading are some of the core competencies that give MetaTrader 4 its compelling competitive advantages, offering the perfect solution to the even most demanding trading needs.

The only platform on offer is MetaTrader 4 which is a great option to have. MetaTrader 4 is a highly popular trading platform due to its many features. These include its accessibility, it is available as a desktop download, web trader and as an application for your mobile devices. Its distributed architecture, robust security system and convenient mobile trading are some of the core competencies that give MetaTrader 4 its compelling competitive advantages, offering the perfect solution to the even most demanding trading needs.

We have outlined below the different minimum trade sizes as well as the maximum trade size of each account.

We have outlined below the different minimum trade sizes as well as the maximum trade size of each account.

eDeal FX uses MetaTrader 4 from the MetaQuotes company as their only trading platform. It is one of the world’s most popular trading platform and comes with a whole host of features to make your trading life easier. These features include a complete friendly interface for ease of use, news feeds every second to keep traders updated, ready state analytical tools for your requirement, various best in class charts and calculations, developing advises from experts to use them on the go, multilingual platform, anytime account statement, real-time fund details, a summary of portfolios, unrealized/realized profits and loss and allocations and, effective and efficient indicators to determine trade dependencies and trailing stop loss facility. MetaTrader 4 is available on multiple paltforms including desktop, mobile devices and as a trader on your web browser.

eDeal FX uses MetaTrader 4 from the MetaQuotes company as their only trading platform. It is one of the world’s most popular trading platform and comes with a whole host of features to make your trading life easier. These features include a complete friendly interface for ease of use, news feeds every second to keep traders updated, ready state analytical tools for your requirement, various best in class charts and calculations, developing advises from experts to use them on the go, multilingual platform, anytime account statement, real-time fund details, a summary of portfolios, unrealized/realized profits and loss and allocations and, effective and efficient indicators to determine trade dependencies and trailing stop loss facility. MetaTrader 4 is available on multiple paltforms including desktop, mobile devices and as a trader on your web browser.

The contact us page is what you would expect of a Forex broker. There is an online submission form as well as a postal address, email address and phone number to choose your method of contact from.

The contact us page is what you would expect of a Forex broker. There is an online submission form as well as a postal address, email address and phone number to choose your method of contact from. There are plenty of options when it comes to accounts, but it is not fully clear what the differences between them are. Different bonus amounts, spreads, and commissions, all with no information on what any of them actually are. We have no idea what the trading costs are and even more worryingly, we have no idea how to deposit or withdraw and if it will cost us to do so. Not to mention the complete lack of information on available assets. With so much information missing, we cannot recommend Double Million as a broker to use at this point in time.

There are plenty of options when it comes to accounts, but it is not fully clear what the differences between them are. Different bonus amounts, spreads, and commissions, all with no information on what any of them actually are. We have no idea what the trading costs are and even more worryingly, we have no idea how to deposit or withdraw and if it will cost us to do so. Not to mention the complete lack of information on available assets. With so much information missing, we cannot recommend Double Million as a broker to use at this point in time.

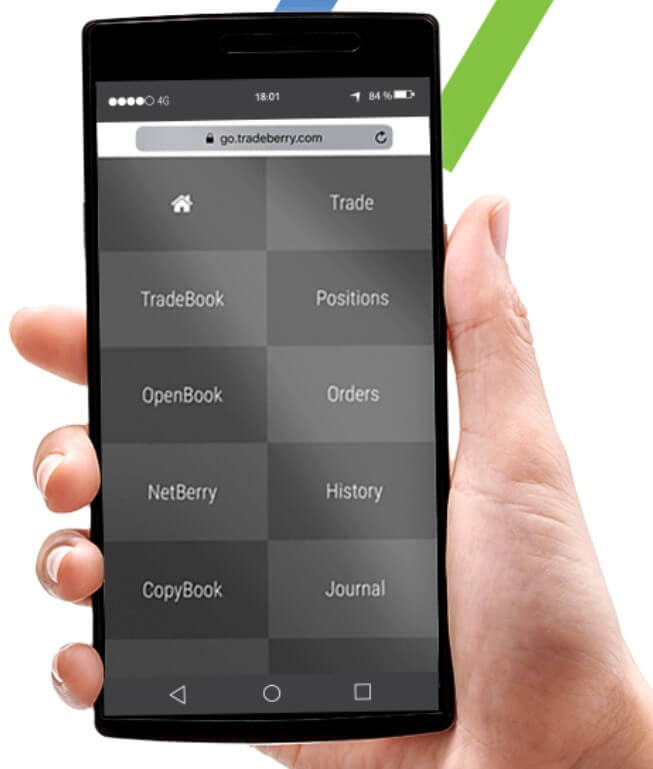

TradeBerry uses its own trading platform that they have developed themselves. Trade.Berry’s vision is to host the most transparent social trading community ever created. That is why they joined forces with TOOMIT to create an ultra-fast platform offering the transparency they want for their community of traders. Features include execution in milliseconds,

TradeBerry uses its own trading platform that they have developed themselves. Trade.Berry’s vision is to host the most transparent social trading community ever created. That is why they joined forces with TOOMIT to create an ultra-fast platform offering the transparency they want for their community of traders. Features include execution in milliseconds,

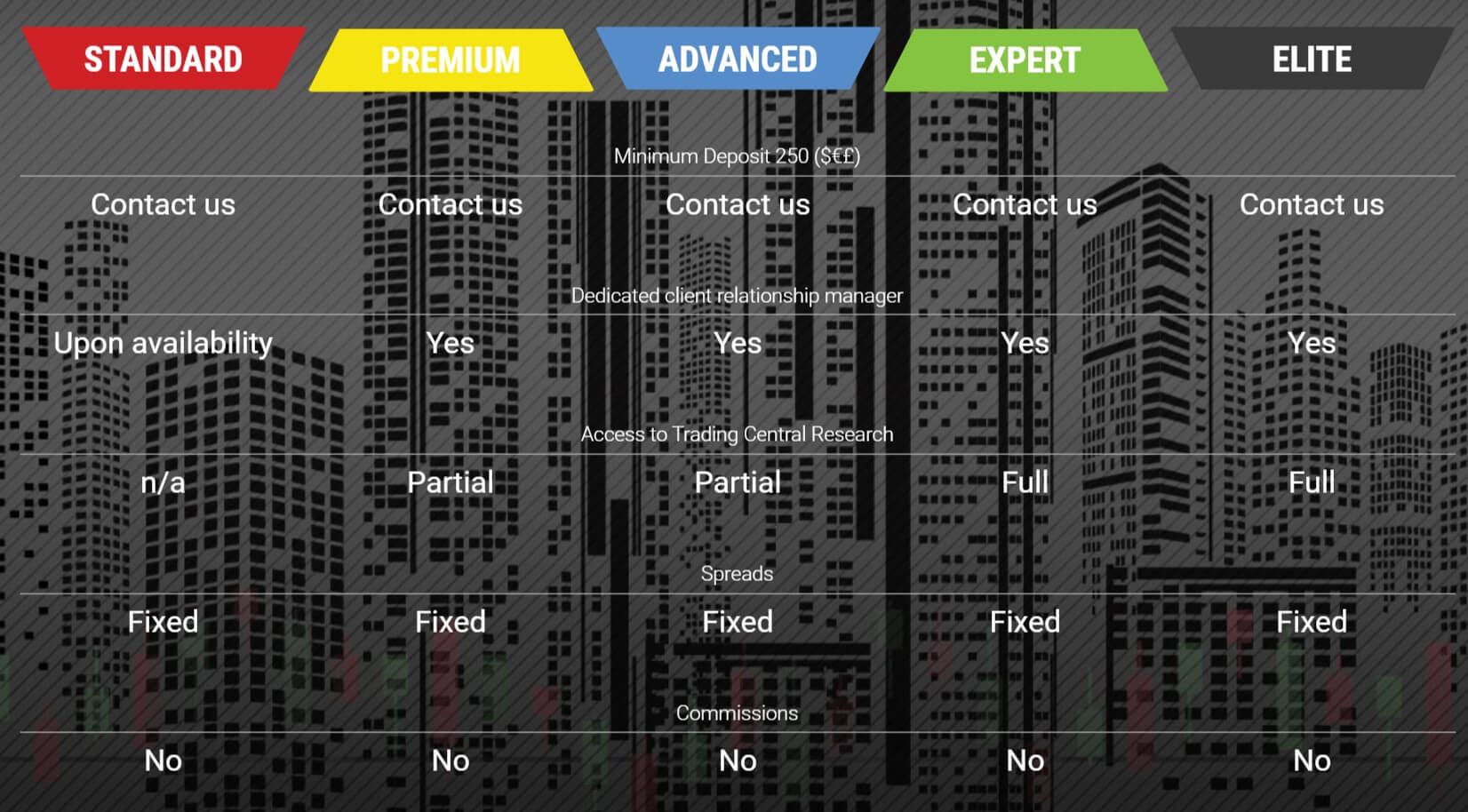

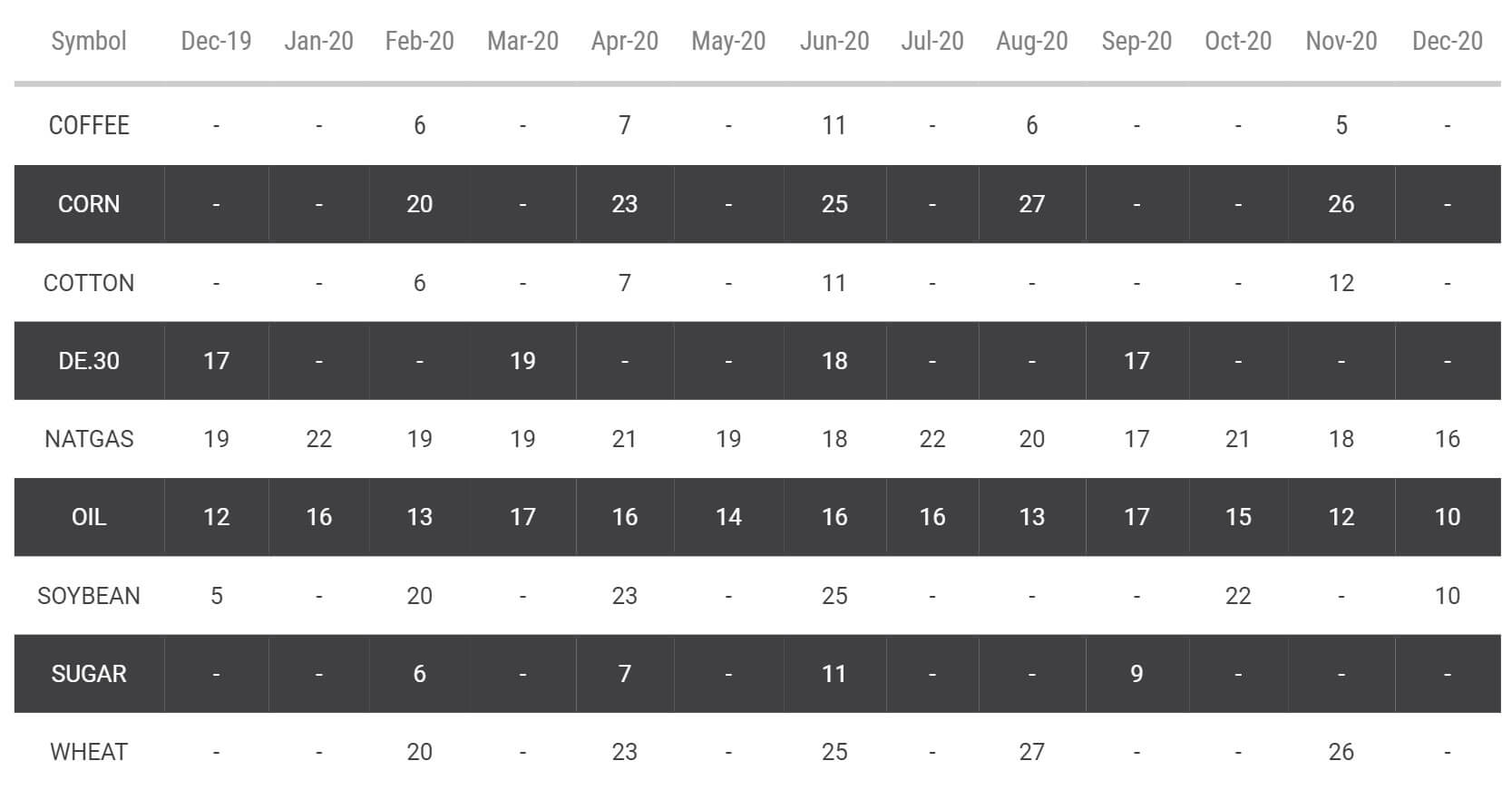

Trade.Berry has broken down its assets into 5 different categories, each with different instruments within them. They haven’t broken down their assets into each one so we will just give a little overview.

Trade.Berry has broken down its assets into 5 different categories, each with different instruments within them. They haven’t broken down their assets into each one so we will just give a little overview. There are a few examples of spreads available on the site. There is also a little confusion, on the accounts page it states that all the account shave fixed spreads. However, when looking at the product specification, they all say variable, so we are not sure which one it is. EUR/USD seems to have a spread of 1.2 pips, other instruments will naturally have a different spread and if we look at

There are a few examples of spreads available on the site. There is also a little confusion, on the accounts page it states that all the account shave fixed spreads. However, when looking at the product specification, they all say variable, so we are not sure which one it is. EUR/USD seems to have a spread of 1.2 pips, other instruments will naturally have a different spread and if we look at

Trade.Berry confused us a little with their accounts, as they all seem to have the same entry requirements and the same trading conditions The only differences are a few educational tools, but with the entry requirement being the same, everyone will just go for the Elite account. The spreads are average. For non-commission accounts, they are in line with the rest of the industry. There are a few different ways to deposit and withdraw and each having no additional fees is a big plus. The full break down of assets and instruments is a little overwhelming as it is all on a single page rather than broken down into categories. Overall, there seems to be plenty to trade at Trade Berry and the broker seems poised to meet the needs of a wide variety of Forex traders.

Trade.Berry confused us a little with their accounts, as they all seem to have the same entry requirements and the same trading conditions The only differences are a few educational tools, but with the entry requirement being the same, everyone will just go for the Elite account. The spreads are average. For non-commission accounts, they are in line with the rest of the industry. There are a few different ways to deposit and withdraw and each having no additional fees is a big plus. The full break down of assets and instruments is a little overwhelming as it is all on a single page rather than broken down into categories. Overall, there seems to be plenty to trade at Trade Berry and the broker seems poised to meet the needs of a wide variety of Forex traders.

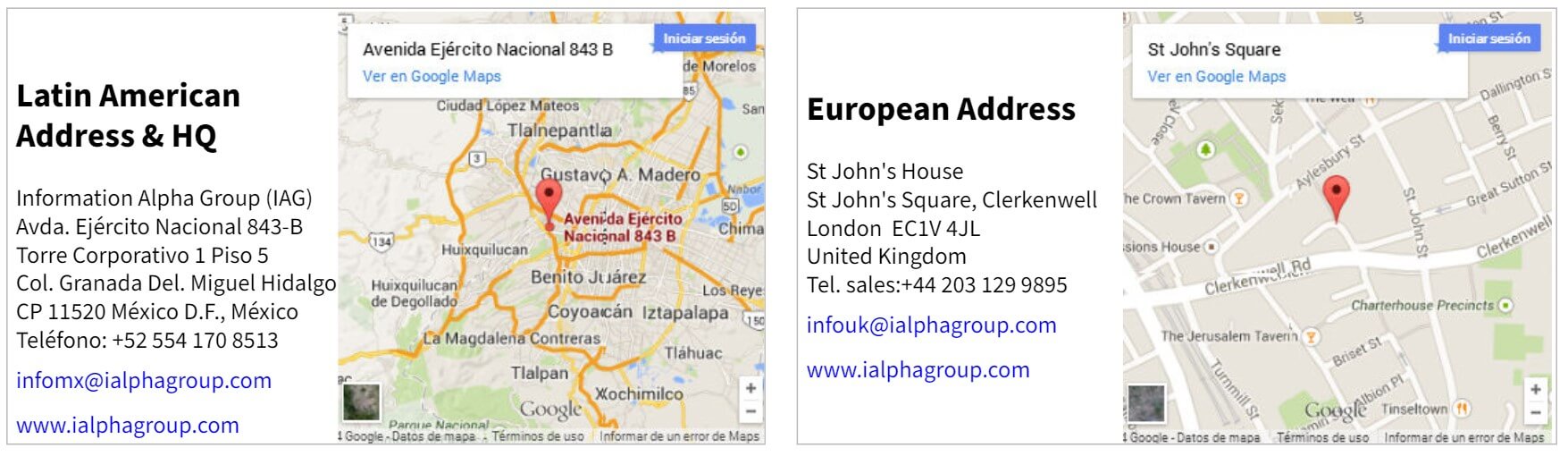

As mentioned above there isn’t any information available on the site that relates to funding, so this included the available deposit methods or any fees that come with them. This is a shame as Alpha Group will be dealing with our money so the least they could do is detail the methods are available and any fees relating to them.

As mentioned above there isn’t any information available on the site that relates to funding, so this included the available deposit methods or any fees that come with them. This is a shame as Alpha Group will be dealing with our money so the least they could do is detail the methods are available and any fees relating to them.

Educational & Trading Tools

Educational & Trading Tools

There are over 470 total assets and we have been broken down into a number of different categories, including FX pairs, commodities, stocks, metals, and more. We did not see any cryptocurrencies, and this could certainly be an issue for a number of traders.

There are over 470 total assets and we have been broken down into a number of different categories, including FX pairs, commodities, stocks, metals, and more. We did not see any cryptocurrencies, and this could certainly be an issue for a number of traders.

Minimum Deposit

Minimum Deposit

Customer Service

Customer Service

The assets have been broken down into a number of different categories, we have outlined them below along with the available instruments.

The assets have been broken down into a number of different categories, we have outlined them below along with the available instruments.

Educational & Trading Tools

Educational & Trading Tools

MT4: MT4 is one of the worlds most popular trading platforms, it offers a whole host of features that can help benefit you as a trader, some of these include ZERO commission account on spreads account, spreads from 0.0 pips on commission account, all accounts are STP accounts, direct market Access, micro Lots available for Spot Forex and Metals, no Dealing Desk, EA, scalping, and hedging allowed

MT4: MT4 is one of the worlds most popular trading platforms, it offers a whole host of features that can help benefit you as a trader, some of these include ZERO commission account on spreads account, spreads from 0.0 pips on commission account, all accounts are STP accounts, direct market Access, micro Lots available for Spot Forex and Metals, no Dealing Desk, EA, scalping, and hedging allowed

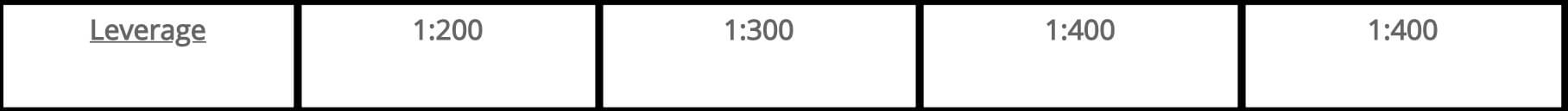

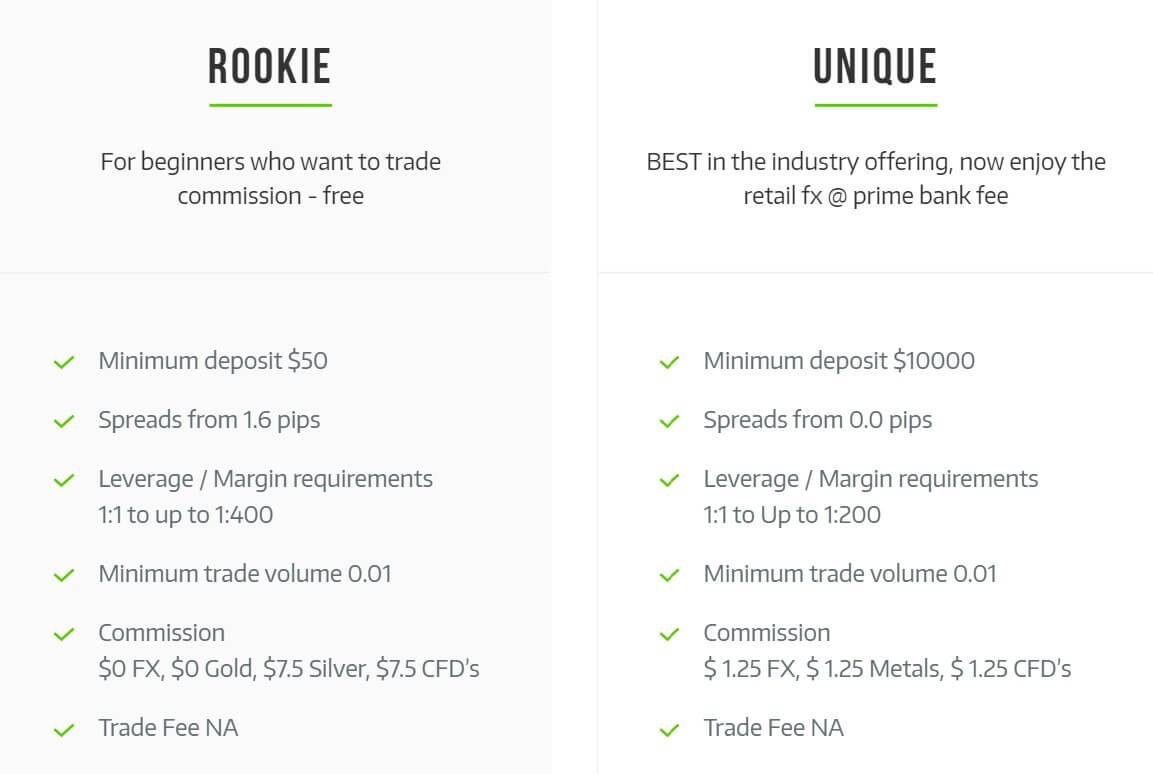

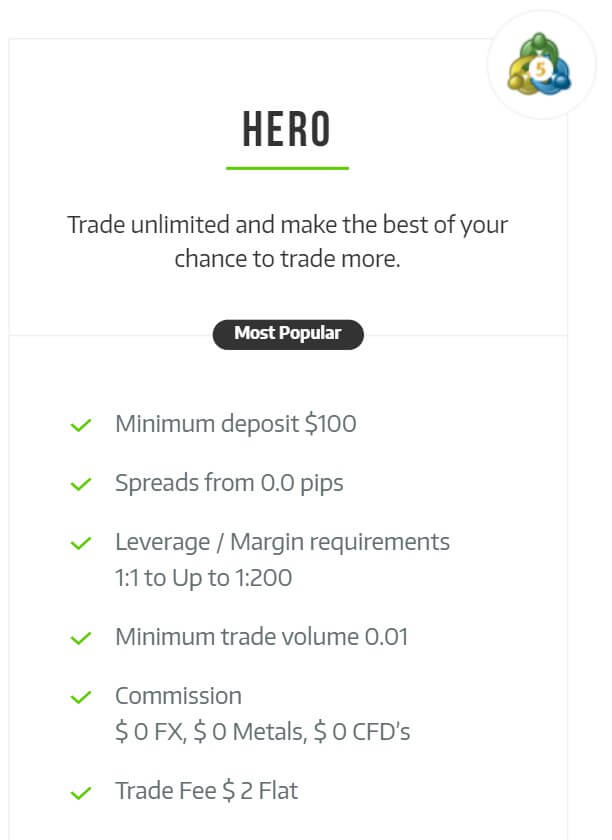

The Mini, Rookie, Prime and Elite accounts all have leverage that can go as high as 1:400, the Unique and Hero accounts have leverage as high as 1:200. Leverage can be selected when opening up a new account and you can change it on an account that is already open by contacting the customer service team.

The Mini, Rookie, Prime and Elite accounts all have leverage that can go as high as 1:400, the Unique and Hero accounts have leverage as high as 1:200. Leverage can be selected when opening up a new account and you can change it on an account that is already open by contacting the customer service team.

Forex: There are 62 different pairs available to trade, some of them include AUDCAD, CASCHF, EURAUD, EURGBP, EURUSD, GBPJPY, GBPNOK, NZDUSD, USDSEK, USDTRY and, USDZAR.

Forex: There are 62 different pairs available to trade, some of them include AUDCAD, CASCHF, EURAUD, EURGBP, EURUSD, GBPJPY, GBPNOK, NZDUSD, USDSEK, USDTRY and, USDZAR.

Withdrawal Methods & Costs

Withdrawal Methods & Costs

All three accounts shave maximum leverage of 1:400. This can be selected when first opening up an account and can be changed on ana already active account by sending a request to the customer service department. If your account balance goes above $100,000 then the maximum leverage available is reduced.

All three accounts shave maximum leverage of 1:400. This can be selected when first opening up an account and can be changed on ana already active account by sending a request to the customer service department. If your account balance goes above $100,000 then the maximum leverage available is reduced.

Minimum Deposit

Minimum Deposit

Platforms

Platforms

Aside from offering over 160 FX (and crosses) CFDs, HMS Markets offers a strong variety of assets to trade including Forex Spot, OTC Options and Forward Outrights. All symbols can be found directly on the website, and there is even a handy drop-down search feature to search for specific symbols. The addition of cryptocurrencies would be nice to see, but overall, the asset index is solid.

Aside from offering over 160 FX (and crosses) CFDs, HMS Markets offers a strong variety of assets to trade including Forex Spot, OTC Options and Forward Outrights. All symbols can be found directly on the website, and there is even a handy drop-down search feature to search for specific symbols. The addition of cryptocurrencies would be nice to see, but overall, the asset index is solid.

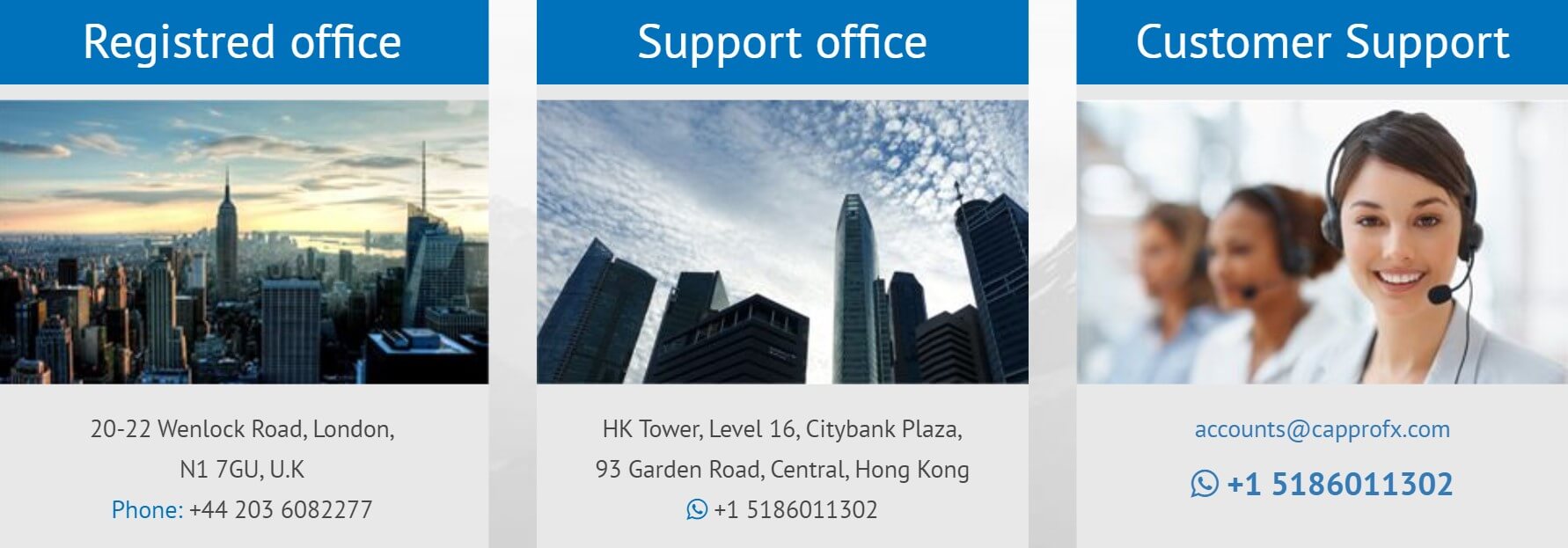

Cappro FX is a MetaTrader 4 platform broker only. It is offered as a downloadable installer for Windows, and for mobile devices running on iOS and Android. Web-accessible MT4 is not available and also the Mac operating system is not supported. Some users use emulators to run Windows designed programs in Mac. Upon installation of the platform, we have noticed some irregularities. The platform is not registered to Cappro FX but to Hermes Market, an alternative broker offering dubious services. The severs also bear the same name on the Live and Demo versions with a 31ms ping rate.

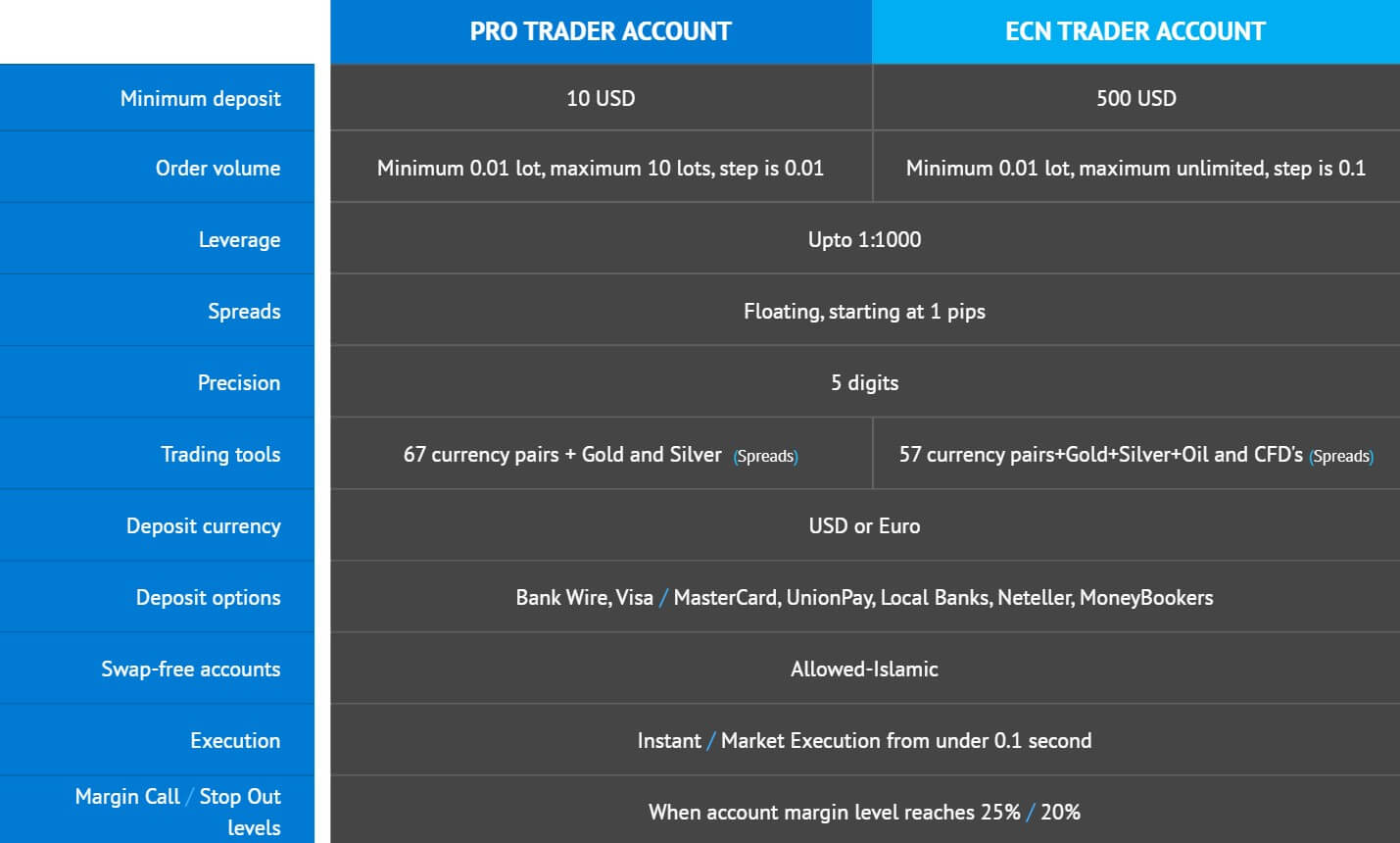

Cappro FX is a MetaTrader 4 platform broker only. It is offered as a downloadable installer for Windows, and for mobile devices running on iOS and Android. Web-accessible MT4 is not available and also the Mac operating system is not supported. Some users use emulators to run Windows designed programs in Mac. Upon installation of the platform, we have noticed some irregularities. The platform is not registered to Cappro FX but to Hermes Market, an alternative broker offering dubious services. The severs also bear the same name on the Live and Demo versions with a 31ms ping rate. According to the Cappro comparison table, all accounts feature 1:1000 leverage. We will check If this is true in the MT4 platform directly. The leverage we observed is not 1:1000 but 1:100 for

According to the Cappro comparison table, all accounts feature 1:1000 leverage. We will check If this is true in the MT4 platform directly. The leverage we observed is not 1:1000 but 1:100 for

Educational and tools are mixed in the Tools section of the Cappro FX website. An Economic Calendar is available and it is from fxstreet.com. This calendar is basic, without any filtering or sorting options, search field or graphs. It shows the impact level, forecasts and previous levels and the link to the fxstreet.com website about the event. The calculator is also under the tools but it is not working as intended on our browser. It is intended for calculating the pip value, margin, Profit/Loss, and

Educational and tools are mixed in the Tools section of the Cappro FX website. An Economic Calendar is available and it is from fxstreet.com. This calendar is basic, without any filtering or sorting options, search field or graphs. It shows the impact level, forecasts and previous levels and the link to the fxstreet.com website about the event. The calculator is also under the tools but it is not working as intended on our browser. It is intended for calculating the pip value, margin, Profit/Loss, and

Based on what we see in the MT4 platform, there are 5 tradeable instrument categories. From the Forex range, the most interesting are USD/TRY, USD/RUB,

Based on what we see in the MT4 platform, there are 5 tradeable instrument categories. From the Forex range, the most interesting are USD/TRY, USD/RUB,

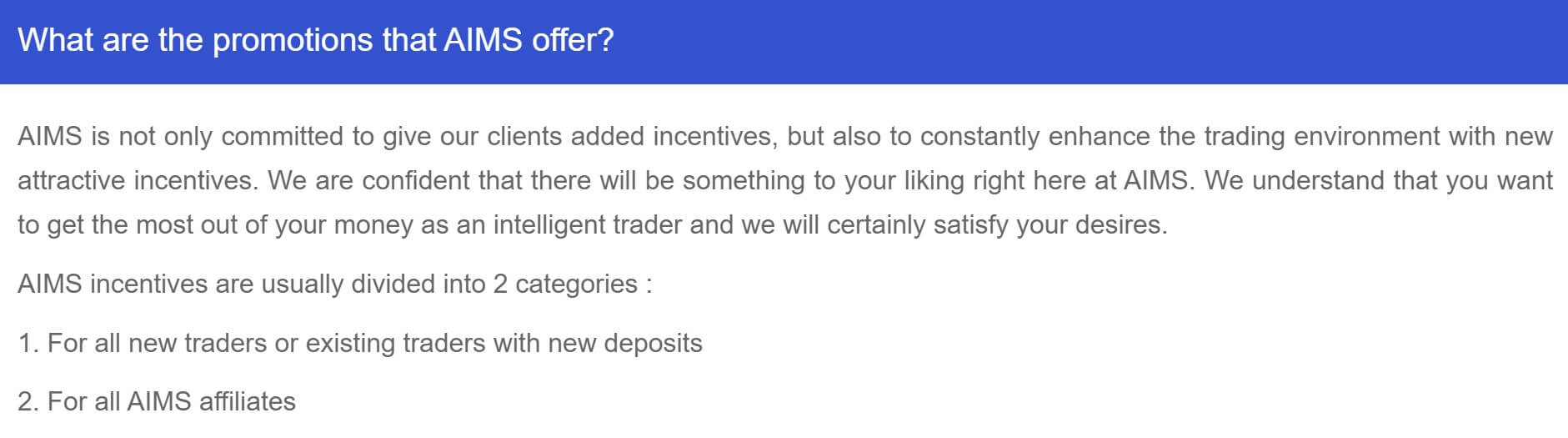

AIMS is a Singapore based forex broker who claims to be one of the world’s leading financial brokers. Their mission is to create the best trading environment for retail traders by offering superior spreads, execution, and service. AIMS is dedicated to maintaining open and transparent communication with our clients based on mutual respect, fairness, and integrity. We will be using this review to look into the services on offer to see if they achieve this or if they manage to fall short.

AIMS is a Singapore based forex broker who claims to be one of the world’s leading financial brokers. Their mission is to create the best trading environment for retail traders by offering superior spreads, execution, and service. AIMS is dedicated to maintaining open and transparent communication with our clients based on mutual respect, fairness, and integrity. We will be using this review to look into the services on offer to see if they achieve this or if they manage to fall short.