BogoFinance is a foreign exchange broker based in Lebanon. It was founded in 2006 and since it was founded they have aimed to redefine the meaning of financial services. Bogofinance tries to see investing from your perspective and make recommendations based on your needs. One of their central goals is to simplify investing for you; along with this they also offer long term values to their customers. Bogo Finance values each and every customer whether they are intending on investing in small or larger amounts. That is what they say about themselves, now we will be looking into the services to see what is actually on offer.

Account Types

There are four different accounts to choose from when signing up with BogoFinance, each one having its own deposit requirement and trading conditions.

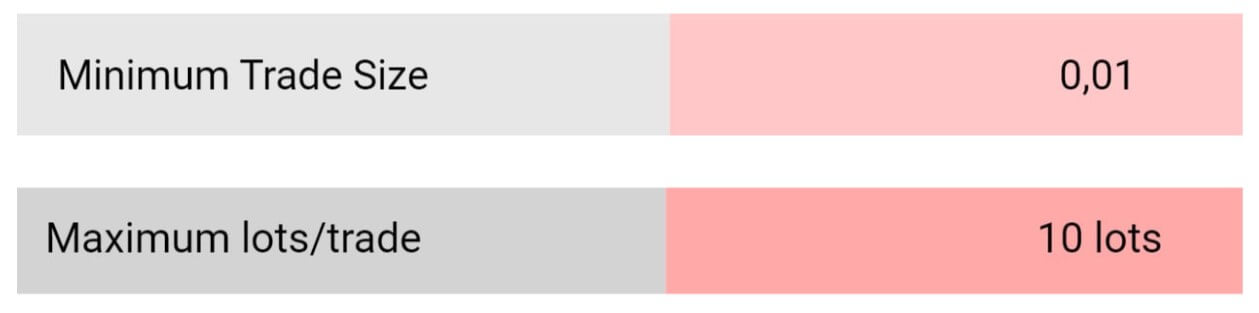

Micro Account: This account requires a minimum deposit of $100 and has an equity range between $0 and $2,000. The account can be in USD or EUR and has a minimum trade size of 0.01 lots. There is no added commission on the account and it comes with a spread of 1.4 pips. It has access to forex pairs, commodities, and indices. The margin call level is set at 100% with the stop out being set at 20%. The maximum trade size is 10 lots and hedging is allowed. Swap-free versions of the account are available and it uses MetaTrader 4 as its trading platform.

Classic Account: This account requires a minimum deposit of $2,000 and has an equity range between $2,000 and $10,000. The account can be in USD or EUR and has a minimum trade size of 0.01 lots. There is no added commission on the account and it comes with a spread of 1.2 pips. It has access to forex pairs, commodities, and indices. The margin call level is set at 100% with the stop out being set at 20%. The maximum trade size is 10 lots and hedging is allowed. Swap-free versions of the account are available and it uses MetaTrader 4 as its trading platform.

Executive Account: This account requires a minimum deposit of $10,000 and has an equity range between $10,000 and $50,000. The account can be in USD or EUR and has a minimum trade size of 0.01 lots. There is no added commission on the account and it comes with a spread of 1 pip. It has access to forex pairs, commodities, and indices. The margin call level is set at 100% with the stop out being set at 20%. The maximum trade size is 10 lots and hedging is allowed. Swap-free versions of the account are available and it uses MetaTrader 4 as its trading platform.

Premium Account: This account requires a minimum deposit of $50,000 and has an equity range of $50,000 or above. The account can be in USD or EUR and has a minimum trade size of 0.01 lots. There is no added commission on the account and it comes with a spread of 0.8 pips. It has access to forex pairs, commodities, and indices. The margin call level is set at 100% with the stop out being set at 20%. The maximum trade size is 10 lots and hedging is allowed. Swap-free versions of the account are available and it uses MetaTrader 4 as its trading platform.

Platforms

Developed by MetaQuotes Software and released in 2010, MetaTrader 5 is used by millions and for good reason. Offering plenty of trading and analysis features to aid in your trading. Additional services expand the functionality of the platform making its capabilities almost limitless. MetaTrader 5 offers the built-in Market of trading robots, the Freelance database of strategy developers, Copy Trading and the Virtual Hosting service (Forex VPS). Use all these services from one place, and access new trading opportunities. MetaTrader 5 is also highly accessible with it being available as a desktop download, application for iOS and Android devices and even as a WebTrader where you can trade from within your internet browser.

Leverage

Unfortunately, the leverage is the only bit of the trading conditions which are missing from the site, so, unfortunately, we do not know what the available leverage on any of the accounts is.

Trade Sizes

Trade sizes start from 0.01 lots which are known as a micro-lot, they then go up in increments of 0.01 lots so the next trade would be 0.02 lots and then 0.03 lots. We do not know what the maximum trade size is or how many trades you can have open at any one time.

Trading Costs

There are no added commissions on any of the accounts as they all use a spread based system, there are however swap charges which are fees for holding trades overnight. They can be viewed on the website and within the trading platform of choice.

Assets

The assets have been broken down into a few different categories which we will look at for you.

Forex:

EURUSD, GBPUSD, USDCAD, USDJPY, AUDUSD, NZDUSD, AUDCAD, AUDCHF, AUDJPY, AUDNZD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, NZDJPY, GBPNZD, EURDKK, EURNOK, EURSEK, GBPDKK, GBPNOK, GBPSEK, USDDKK, USDNOK, USDSEK.

Metals:

XAUUSD, CAGUSD, CAUEUR, XAGUSD (Gold and Silver).

Indices and Commodities:

DJ 30, SP 500, NAS 100, US Crude Oil, and Brent Crude Oil.

Spreads

The minimum spreads that you get depends on the account that you are using. The Micro account has spread starting from 1.4 pips, the Classic account starts from 1.2 pips, the Executive account 1 pip and the Premium account has a starting spread starting from 0.8 pips. The spreads are variable which means they move with the markets when there is more volatility the spreads will normally be higher. Different instruments will also have different spreads.

Minimum Deposit

The minimum deposit required to open up an account is $100 which allows you to open up a Micro account, we do not know if the minimum amount reduces once an account has been opened.

The minimum deposit required to open up an account is $100 which allows you to open up a Micro account, we do not know if the minimum amount reduces once an account has been opened.

Deposit Methods & Costs

Unfortunately, the isn’t any information surrounding funding methods so we do not know what methods you can use to deposit your funds into BogoFinance, we also do not know if there are any added fees.

Withdrawal Methods & Costs

Just like with the deposits, we also do not know what methods are available to withdraw with or if there are any fees. Both of these sections are vital, not having this information means no one will know how they can get their money in or out or how much it will cost to do so.

Withdrawal Processing & Wait Time

As we do not know the methods available, we also do not know how long it will take, we would hope that it would take between 1 to 7 days to fully process depending on the methods available but we cannot guarantee that this is the right information.

Bonuses & Promotions

There aren’t any advertised promotions or bonuses on the site so it does not appear that there are many active ones at the time of writing this review.

Educational & Trading Tools

Many brokers are now trying to give some education or trading tools to their client in order to help them improve their trading abilities, it is a shame to see no such thing here and so BogoFinance should try and do a little more for their clients in terms of learning materials.

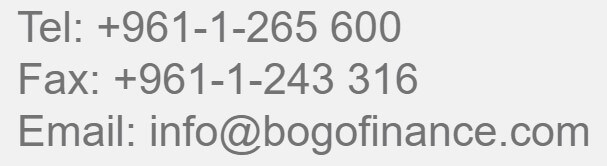

Customer Service

You can contact BogoFinance with a few different methods, the first being a submission form, fill it in and you should get a reply via email. There Is also a postal address available long with a phone number and email address.

Address: 6th floor – Aya center, Dora Highway, Metn, Lebanon

Phone: +961-1-265 600

Email: [email protected]

Demo Account

Demo accounts are available but they are provided by FXJet rather than Bogo Finance. The demo account allows you to test out trading conditions and strategies without any risk to your capital.

Countries Accepted

This information is not available on the site so we would suggest contacting the customer support team to find out if you are eligible for an account or not.

Conclusion

The BogoFinance website is a little awkward to use, the site randomly loses its scroll bar so you need to reload the page. In terms of accounts, there is a selection of them but there is very little difference between them, the only visible difference being the spreads, we actually don’t know what leverage is available on them either. There are plenty of assets but things quickly go downhill when we look at the deposit and withdrawal methods, or more that we don’t look at them as there is no information on them which is a massive negative. This information is vital and without it, we can not recommend them as a broker to use at this time.