MegaTrade FX is a leading provider of foreign exchange, CFD and other forms of financial trading. With high standard services and experienced team of finance professionals, MegaTrade Fx offers the best online trading experience in the market in terms of education, tools, user-friendly Platform, features and security. That is what this Saint Vincent and the Grenadines based broker says about itself. Throughout this review, we will be looking into the services being offered to see if they manage to live up to that statement, or if they fall short.

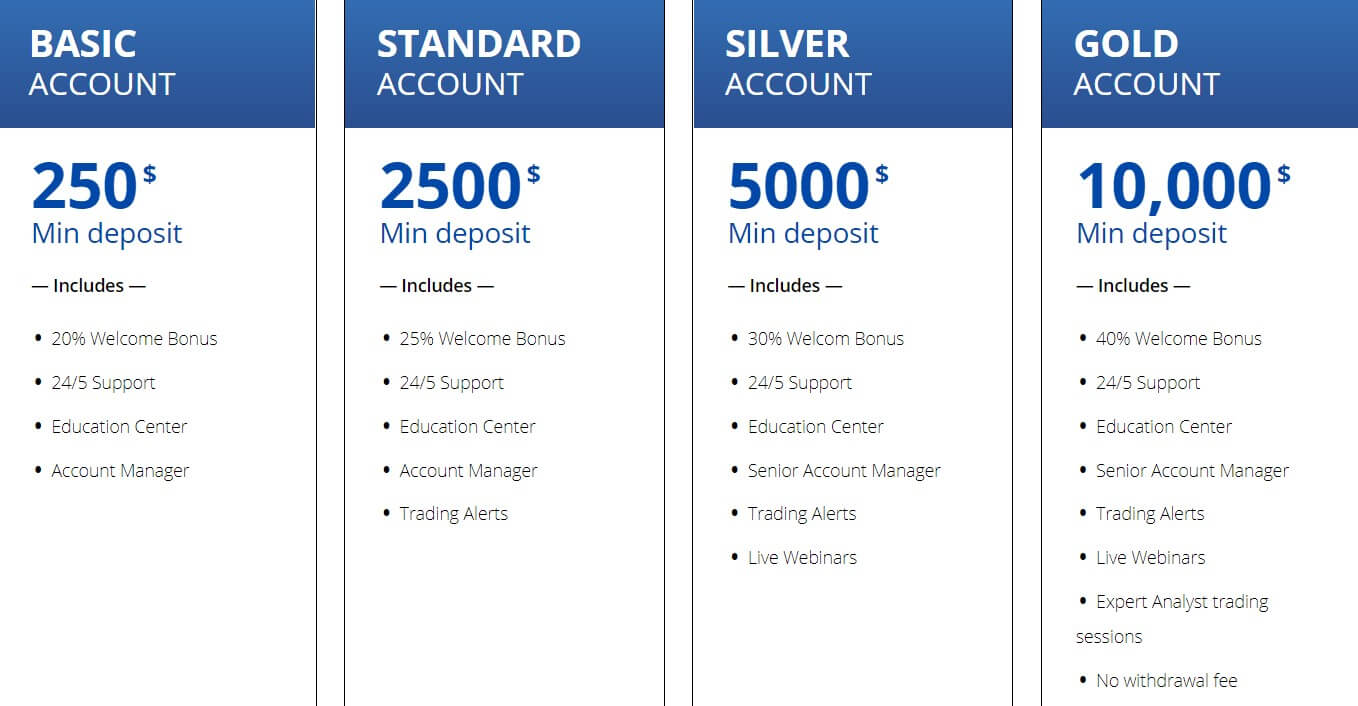

Account Types

There are six different accounts available to chose from each having its own requirements and trading conditions, so lets briefly look at what each one offers.

Basic Account: This account has a deposit requirement of $250, it comes with a 20% welcome bonus as well as access to the customer support team 24/5. It has access to the education centre and an account manager.

Standard Account: This account has a deposit requirement of $2,500, it comes with a 25% welcome bonus as well as access to the customer support team 24/5. It has access to the education centre, an account manager and access to trading alerts.

Silver Account: This account has a deposit requirement of $5,000, it comes with a 30% welcome bonus as well as access to the customer support team 24/5. It has access to the education centre, a senior account manager, access to trading alerts as well as live Webinars.

Gold Account: This account has a deposit requirement of $10,000, it comes with a 40% welcome bonus as well as access to the customer support team 24/5. It has access to the education centre, a senior account manager, access to trading alerts as well as live Webinars, expert analysis trading sessions and there are no withdrawal fees.

Platinum Account: This account has a deposit requirement of $25,000, it comes with a 50% welcome bonus as well as access to the customer support team 24/5. It has access to the education centre, a senior account manager, access to trading alerts as well as live Webinars, expert analysis trading sessions and there are no withdrawal fees. This account also has access to VIP services.

VIP Account: This account has a deposit requirement of $50,000, it comes with a 50% welcome bonus as well as access to the customer support team 24/5. It has access to the education centre, a senior account manager, access to trading alerts as well as live Webinars, expert analysis trading sessions and there are no withdrawal fees. This account also has access to VIP services, a free savings account and daily personalised trading sessions.

Platforms

MegaTrade FX doesn’t use any of the standard trading platforms like the MetaTrader series, instead, they use an online web-based platform, they do not offer much information around this platform, so, unfortunately, we do not have much to say in regards to their trading platform. This is a shame as it would be good to know what sort of features there would be should we sign up with MegaTrade FX.

Leverage

The maximum leverage available seems to be 1:200 but it is hard for us to get confirmation on this as there is so little information available regarding the trading conditions.

Trade Sizes

Trade sizes start from 0.01 lots (known as micro-lots) and go up in increments of 0.01 lots so the next trade will be 0.02 lots and then 0.03 lots. There is no information about the maximum trade size however, we would recommend not trading in sizes larger than 50 lots, as the bigger a trade becomes the harder it is for the markets or liquidity provider to execute the trade quickly and without any slippage.

Trading Costs

There is no information about any additional commissions being charged on the accounts, this doesn’t mean that there aren’t any, it just means that there is currently no information on the website regarding them.

Swap charges are present though, these are interest charges that are incurred for holding trades overnight, they can be both negative or positive and can usually be viewed from within the trading platform of choice.

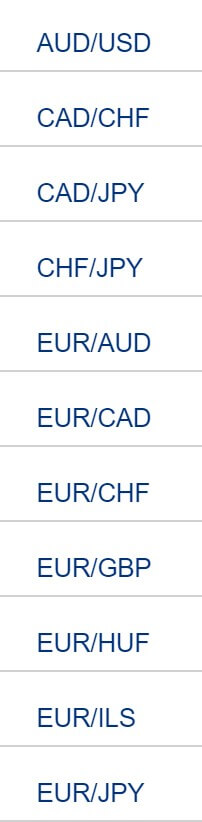

Assets

The assets have been broken down into a number of different categories, we have outlined them below along with the instruments within them.

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURHUF, EURILS, EURJPY, EURNOK, EURNZD, EURPLN, EURSEK, EURUSD, GBPAUD, GBPCAD, GBPCHF, GNPJPY, GBPNZD, GBPUSD, NAZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDDKK, USDHUF, USDILS, USDJPY, USDMXN, USDNOK, USDPLN, USDRUB, USDSEK USDSGD, USDZAR.

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURHUF, EURILS, EURJPY, EURNOK, EURNZD, EURPLN, EURSEK, EURUSD, GBPAUD, GBPCAD, GBPCHF, GNPJPY, GBPNZD, GBPUSD, NAZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDDKK, USDHUF, USDILS, USDJPY, USDMXN, USDNOK, USDPLN, USDRUB, USDSEK USDSGD, USDZAR.

Bonds: USA 10Y Bons, USA 30Y Bond, Canada 10Y Bond, French OAT, Germany Bund, Italy BTP, UK Gilt.

Indices: ASK, CAC, DAX, Hang Seng, Nikkei, SMI, FTSE, FTSE0MIB, DOW, Nasdaq, S&P, US Dollar, VIX.

ETF: SPDR Financial, SPDR Gold, SPDR S&P 500, Powershares QQQ, SDPR Energy, iShares Russel 2000, iShares Brazil, iShares MSCI Emerging Markets, iShares Nasdaq Biotechnology.

Commodities: Brent Crude, Cocoa, Coffee, Copper, Golds, Natural Gas, Platinum, RBOB Gasoline, Silver, Sugar, WTI Crude, Corn, Cotton, Soybeans, Wheat.

Stocks: Plenty of stocks including Nintendo, AXA, Air France, Peugeot, BMW, Siemens, HSBC and Tesco.

Spreads

This another aspect of the trading conditions that don’t seem to be mentioned or advertised o the site. Looking through the internet there is a very mixed result when it comes to spreads so we do not want to mention them, what we will say is that this information should be made available for potential clients to better understand what the costs of trading are.

The only information that we do know is that the spreads are variable (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads, so while EURUSD may start at 2 pips (example), other assets like GBPJPY may start slightly higher.

Minimum Deposit

The minimum amount required to open an account is $250, this will get you the Basic account, it is unknown if this amount decreases for further top-ups of an already open account.

Deposit Methods & Costs

There isn’t a dedicated finance page detailing the methods available, however, they are briefly mentioned in the FAQ and also pictures added at the bottom of the site. They are MasterCard, Visa, Bank Wire Transfer, Skrill, Neteller, fasapay and UnionPay, there may be more but those are the ones we know about. Looking through the terms there is no mention of any fees so we are not sure if there are any, but be sure to check with your own bank or processor to see if they add any transfer fees of their own.

Withdrawal Methods & Costs

The same methods would seemingly be available to withdraw with, for clarification these are MasterCard, Visa, Bank Wire Transfer, Skrill, Neteller, fasapay and UnionPay. In the withdrawal policy, there is no mention of any added fees, just the fees that may be added by your won bank or processor, so again it is not clear if there are any added fees or not.

Withdrawal Processing & Wait Time

The terms and conditions state that withdrawal requests will be processed within 6 working days, this is a very long time when comparing it to the competition who rarely go over 48 hours. There will then be an additional wait after this period for the bank or card issuer to process the incoming withdrawal, normally between 1 to 5 business days. The FAQ on the site states between 2 to 7 days to receive your funds.

Bonuses & Promotions

The bonus terms surrounding the deposit bonus are a little confusing, they start by talking about binary, then change to forex, then keep alternating making it very confusing as to what they are actually talking about. We know the bonus exists from the accounts comparison page, but there is no additional information surrounding it.

Educational & Trading Tools

There is mention of an education centre, as well as Webinars, however looking through the site we could not locate any of it, so we are assuming it is within the account section of the site, either that or it is a simple marketing ploy to try and get more customers in.

Customer Service

The contact us page offers a few different ways to get in contact with them. You can use the online submission form to fill in your query and then you should get a reply via email. You can also request a callback or use one of the available telephone numbers to speak to someone directly. There is also a direct email to support to use as well as a physical address.

The customer service team is available 24/5 and is closed over the weekends and on bank holidays just like the markets are.

Demo Account

There doesn’t seem to be a demo account on offer, or at least we could not find any information about one. This is a shame as demo accounts allow potential new clients to test out the trading conditions and servers while it allows current clients to test out new strategies without risking any of their capital. This is an area that should be invested in and demo accounts should be made available.

Countries Accepted

The information about which countries are accepted and which are not is not present on the website, so if you are interested in joining, be sure to get in contact with the customer service team to check if you are eligible for an account or not.

Conclusion

There are a lot off highly negative reviews around the internet about this broker, on that alone we would recommend staying clear, however from our review, it doesn’t get much better. There is so much information missing, we are completely at a loss as to what the trading conditions actually are, what the spread, commission or leverage are. There is also a huge gap in information about the deposits and withdrawals, without any of this information it is impossible for us to recommend MegaTrade FX as a broker to sue at this point in time.