iBrokers is a foreign exchange broker offering to trade for both Forex and CFDs. Their aims are to offer transparency, high execution speed, powerful trading platforms, ECN-spreads, and security. In this review, we will be looking into the services to see if they have offered what they aim for and so you can decide if they are the right broker for you.

Account Types

There are 6 different account types on offer if you sign up with iBrokers, each with varying requirements and trading conditions, we have detailed them below for you.

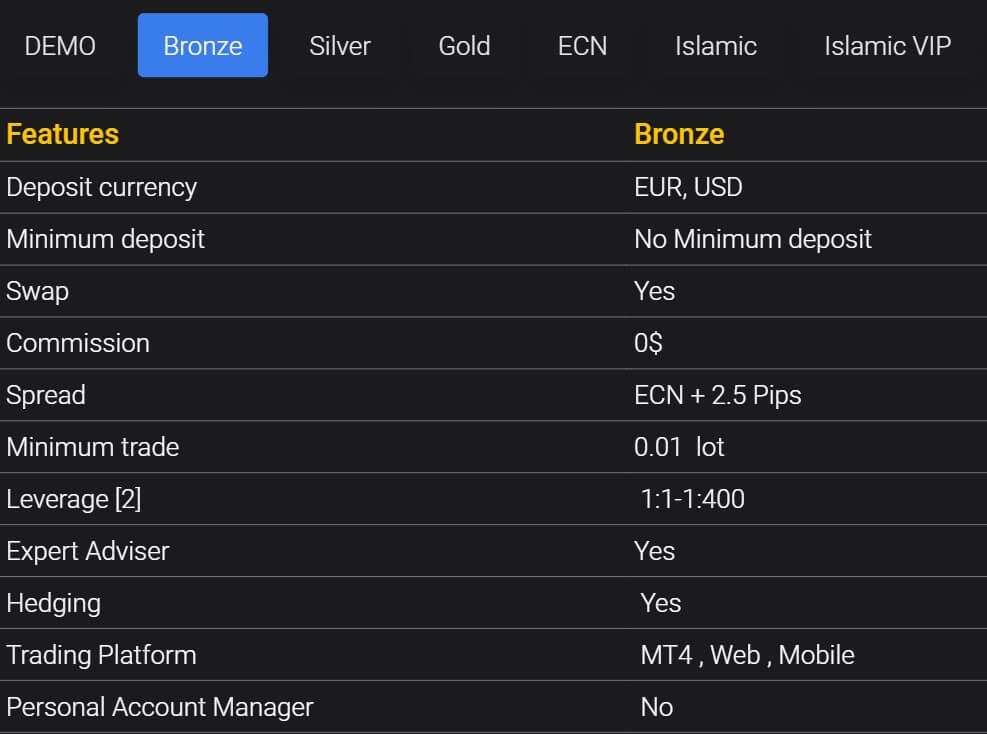

Bronze Account: There is no minimum deposit for this account so anyone can join, the account must be in EUR or USD, it has swap charges and comes with no commission. The account uses a raw spread but adds 2.4 pips on top of this, the minimum trade size is 0.01 lots and the leverage can be between 1:1 and 1:400. Expert advisors are allowed as it hedging it is uses MetaTrader 4 as its trading platform, this account does not come with an account manager.

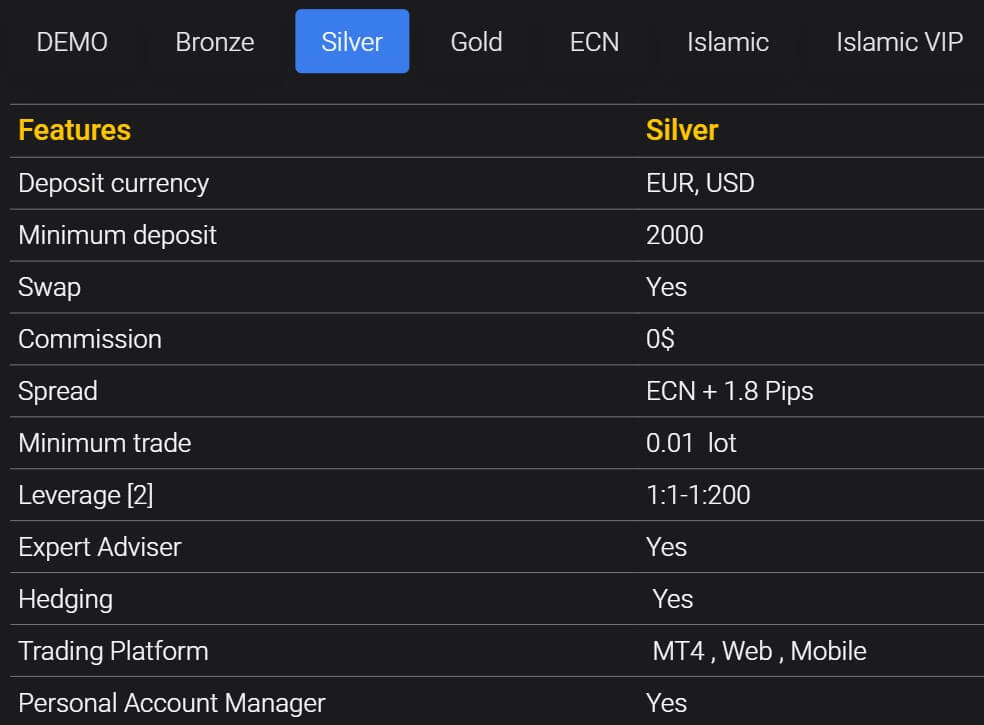

Silver Account: The silver account has a minimum deposit of $2,000, it has to be in EUR or USD as a base currency, the account also has swap charges. There is no added commission, the account has a raw spread with 1.8 pips added on top. Trade sizes start at 0.01 lots and the leverage can be between 1:1 and 1:200. Expert advisors are allowed as it hedging it is uses MetaTrader 4 as its trading platform, this account also comes with the services of an account manager.

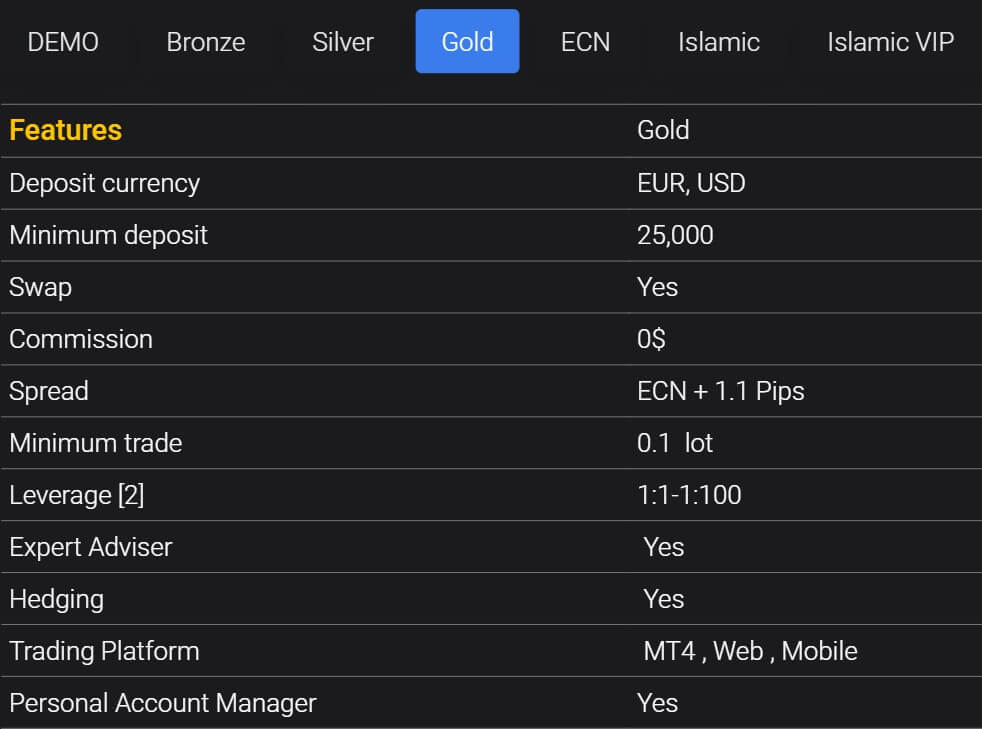

Gold Account: The gold account increases the minimum deposit of up to $25,000. It has a base currency of EUR or USD and, the account also has swap charges. There is no added commission, the account has a raw spread with 1.1 pips added on top. Trade sizes start at 0.1 lots and the leverage can be between 1:1 and 1:100. Expert advisors are allowed as it hedging it is uses MetaTrader 4 as its trading platform, this account also comes with the services of an account manager.

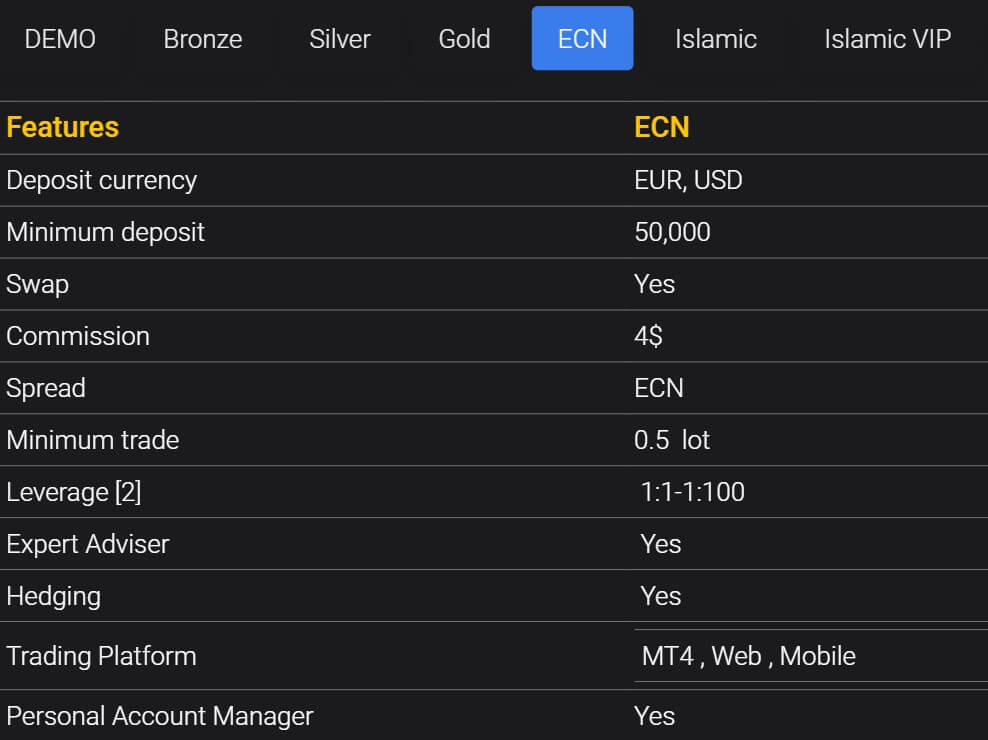

ECN Account: The ECN account requires a minimum deposit of $50,000 which is pricing out a lot of retail traders, the account needs to be in EUR or USD as a base currency and swap charges are present. The account has raw spreads with no markup and so there is an added commission of $5 per round lot traded. Minimum trade sizes are 0.5 lots and expert advisors are allowed as it hedging it is uses MetaTrader 4 as its trading platform, this account also comes with the services of an account manager. The account comes with leverage between 1:1 and 1:100.

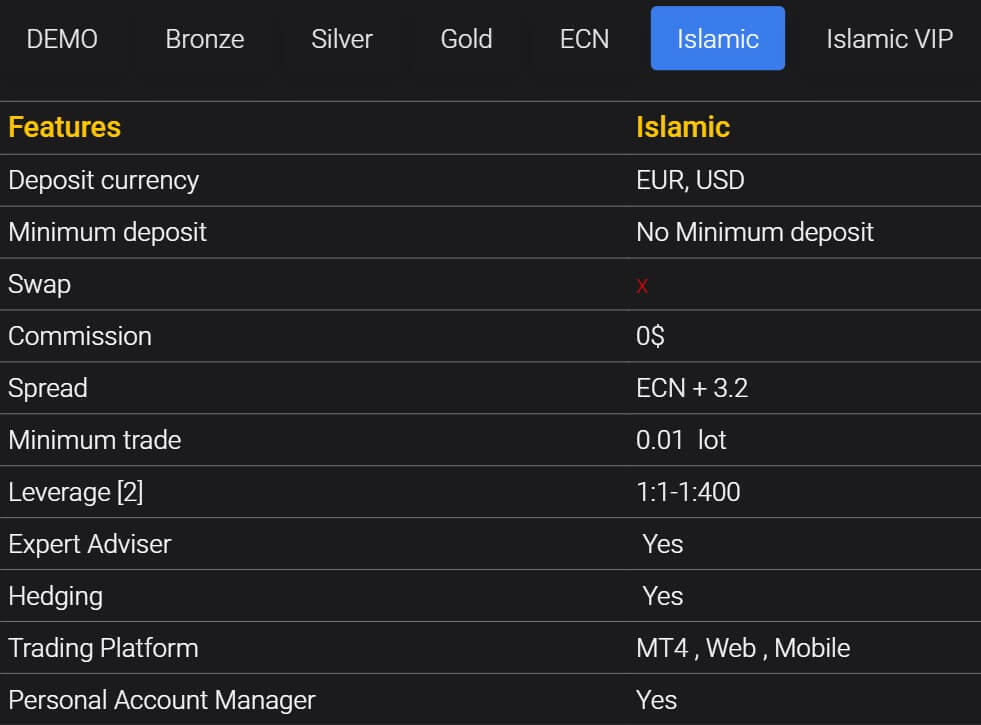

Islamic Account: This account is intended for people who can not use swap charges. There is no minimum deposit for this account so anyone can join, the account must be in EUR or USD, as mentioned it does not have any swap charges and comes with no commission. The account uses a raw spread but adds 2.4 pips on top of this, the minimum trade size is 0.01 lots and the leverage can be between 1:1 and 1:400. Expert advisors are allowed as it hedging it is uses MetaTrader 4 as its trading platform, this account does not come with an account manager.

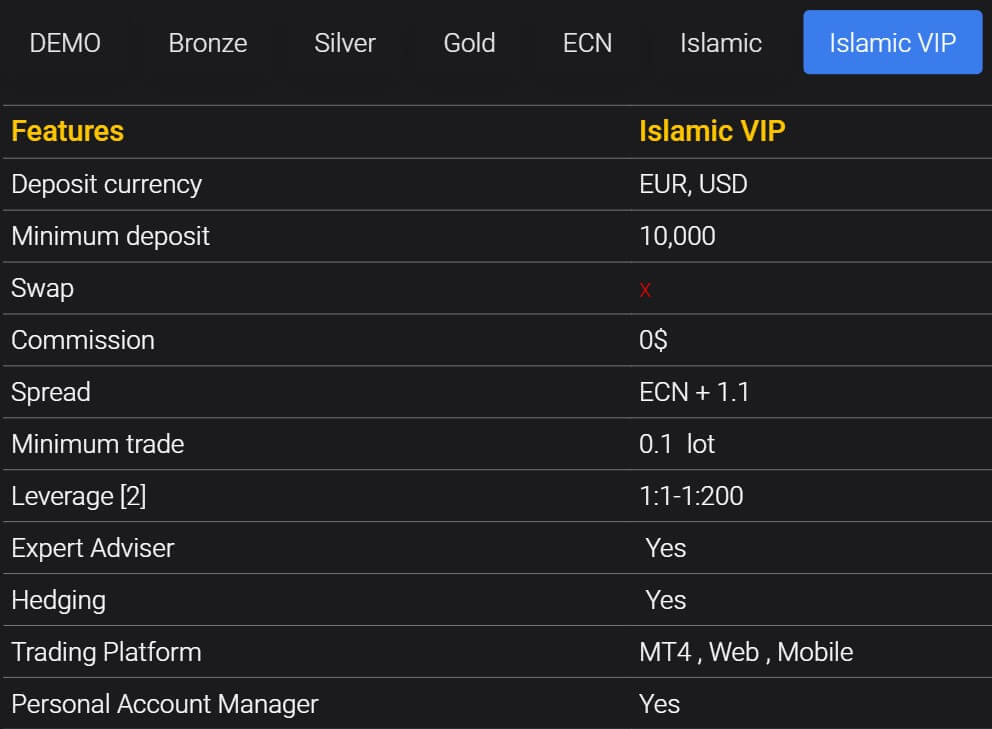

Islamic VIP Account: A VIP account for those that can not have swap charges, there is a minimum deposit of $10,000. It has a base currency of EUR or USD and, as mentioned the account does not have any swap fees. There is no added commission, the account has a raw spread with 1.1 pips added on top. Trade sizes start at 0.1 lots and the leverage can be between 1:1 and 1:200. Expert advisors are allowed as it hedging it is uses MetaTrader 4 as its trading platform, this account also comes with the services of an account manager.

Platforms

iBrokers use MetaTrader 4 as their sole trading platform, the good news is that MetaTrader 4 is pretty good, so let’s see what it offers. Trading on any particular FX system is going to differ from trading on another. Although there is no single trading platform that is going to meet all needs, the Ibroker MetaTrader 4 platform does provide a number of benefits to users. These include, but are not limited to the following…

- User-friendly interface

- Newsfeeds built directly into the trading platform

- Preprogrammed analytical tools

- The ability to overlay analytical studies

- Multiple charting and analysis tools

- Encourages the development of EAs and allows the use of them

- Multilingual platform

- Daily account statement

- Real-time client account summary (account equity, floating profit & loss, etc.)

- Trailing stop loss facility

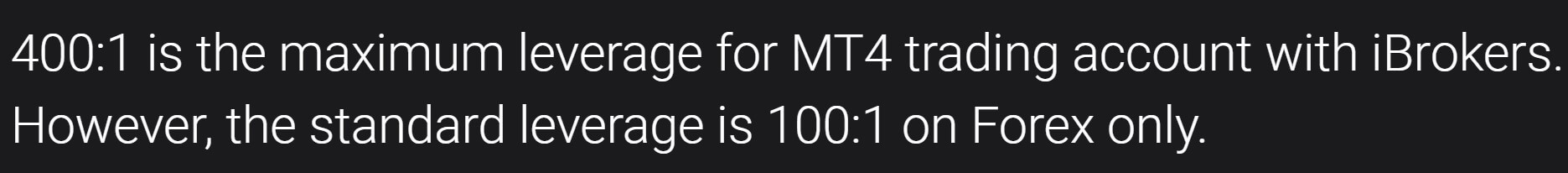

Leverage

The leverage that you receive is based on the account that you are using, we have listed them below.

- Bronze = 1:1 – 1:400

- Silver = 1:1 – 1:200

- Gold = 1:1 – 1:100

- ECN = 1:1 – 1:100

- Islamic = 1:1 – 1:400

- Islamic VIP = 1:1 – 1:200

Trade Sizes

The Bronze, Silver and Islamic accounts have trade sizes starting at 0.01 lots (known as a micro lot) and increments of 0.01 lots. The Gold and Islamic Pro account shave trade sizes starting from 0.1 lots (known as a mini lot) and go up in increments of 0.1 lots. The ECN account has a minimum trade size of 0.5 lots and the increments are currently unknown to us but it is most likely 0.5 lots.

We do not know the maximum trade size, however, we would recommend not trading in sizes larger than 50 lots, as the bigger a trade becomes the harder it is for the markets or liquidity provider to execute the trade quickly and without any slippage.

Trading Costs

The ECN account has an added commission of $4 for each lot traded, this is lower than the industry standard of $4 lots and is very competitive. The Bronze, Silver, Gold, Islamic and Islamic VIP accounts use a spread based system that we will look at later in this review and so there are no added commissions.

Swap charges are present on the Bronze, Silver, Gold, and ECN accounts, these are interest charges that are incurred for holding trades overnight, they can be both negative or positive and can usually be viewed from within the trading platform of choice.

Assets

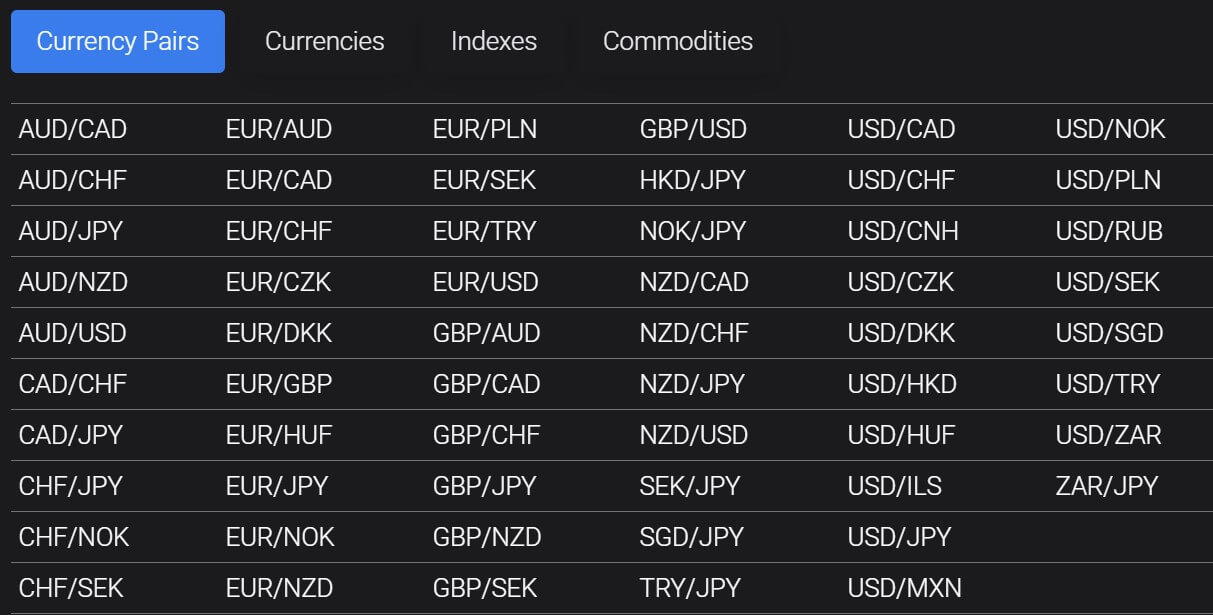

iBrokers allow you to trade a number of different assets, we have listed them for you below.

Currency Pairs: AUD/CAD, AUD/CHF, AUD/JPY, AUD/NZD, AUD/USD, CAD/CHF, CAD/JPY, CHF/JPY, CHF/NOK, CHF/SEK, EUR/AUD, EUR/CAD, EUR/CHF, EUR/CZK, EUR/DKK, EUR/GBP, EUR/HUF, EUR/JPY, EUR/NOK, EUR/NZD, EUR/PLN, EUR/SEK, EUR/TRY, EUR/USD, GBP/AUD, GBP/CAD, GBP/CHF, GBP/JPY, GBP/NZD, GBP/SEK, GBP/USD, HKD/JPY, NOK/JPY, NZD/CAD, NZD/CHF, NZD/JPY, NZD/USD, SEK/JPY, SGD/JPY, TRY/JPY, USD/CAD, USD/CHF, USD/CNH, USD/CZK, USD/DKK, USD/HKD, USD/HUF, USD/ILS, USD/JPY, USD/MXN, USD/NOK, USD/PLN, USD/RUB, USD/SEK, USD/SGD, USD/TRY, USD/ZAR, ZAR/JPY

Indexes: AUS 200, ESP 35, FRA 40, Ger 30, ITA 40, NAS 100, UK 100, US 30, HKG 33, JPY 225, EUSTX 50, SUI 20, SPX 500

Commodities: Natural Gas, Crude Oil (Brent), Crude Oil (WTI), Palladium, Silver, Gold, Platinum, Copper

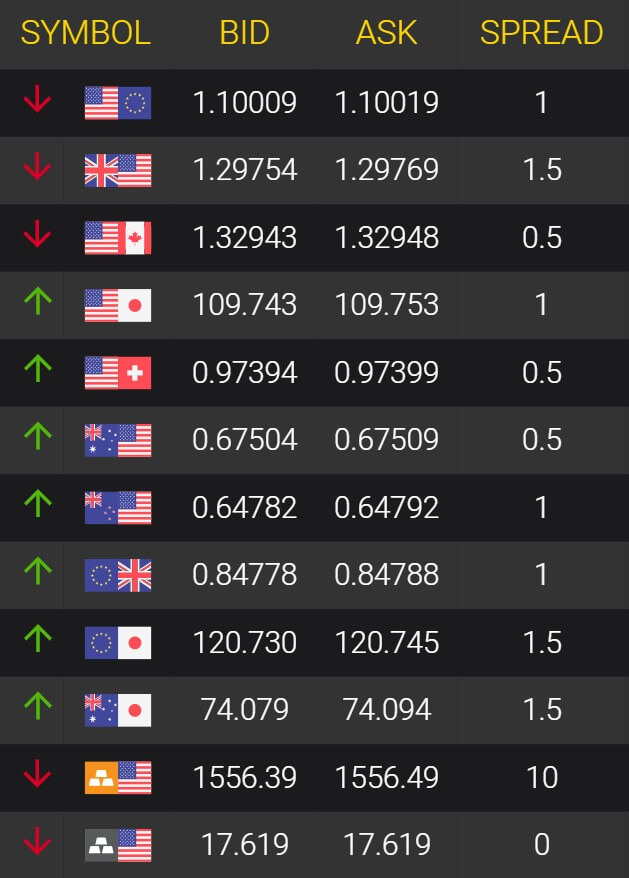

Spreads

All accounts come with an ECN spread which means they can as low as 0.1 pips, for the ECN account this is the final amount, other accounts have an additional spread added on top in order for the broker to make its money, we have outlined them below.

- Bronze: ECN + 2.5 pips

- Silver: ECN + 1.8 pips

- Gold: ECN + 1.1 pips

- Islamic: ECN + 3.2

- Islamic Pro: ECN + 1.1 pips

The spreads are variable (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads, so while EURUSD may start at 2.5 pips, other assets like GBPJPY may start slightly higher, such as 3 pips.

Minimum Deposit

The account page states that there is no minimum deposit, however, the FAQ on the website states that the minimum deposit is $200.

Deposit Methods & Costs

This is where things go a little wrong for iBrokers Trade, there doesn’t appear to be any information about what deposit methods are available on the website, nor is there any mention of potential fees. iBrokers have been very good at giving all the information needed so it is a surprise that such vital information is missing.

Withdrawal Methods & Costs

Just like the deposit methods, we are unclear on what methods are actually available ad if there are any fees, so we are not able to comment properly on this section apart to say that this information should be here and it is a real let down that it is not.

Withdrawal Processing & Wait Time

iBrokers will process your withdrawal request within 24 hours, once this has been done it can take between 2 – 5 business days for your money to be available to you depending on the withdrawal method, as we do not know what they are we can not be more specific.

Bonuses & Promotions

In terms and conditions, there is a mention of a bonus, however, the details are not clear and there is no mention of it on the main website so it may be leftover from a previous promotion. If you would like a bonus, we would recommend getting in touch with the customer service team to see if there are any new bonuses coming up.

Educational & Trading Tools

There is a trading tools section of the website which has 6 different sections to it, the first being Market News, this section details news that has happened, however, there is not a lot of it, just a single page with very brief information. The next section is an economic calendar detailing any upcoming news events and which markets they may affect. There is then an Education Centre which gives small lessons, these are short bite-sized chunks of information, unfortunately, it appeared that some of the links weren’t working but the majority were.

There is a trading tools section of the website which has 6 different sections to it, the first being Market News, this section details news that has happened, however, there is not a lot of it, just a single page with very brief information. The next section is an economic calendar detailing any upcoming news events and which markets they may affect. There is then an Education Centre which gives small lessons, these are short bite-sized chunks of information, unfortunately, it appeared that some of the links weren’t working but the majority were.

There are also some trading signals, however, we weren’t able to test them to see how accurate or profitable they were. You can also use an auto trader to do the trading for you and, finally, there is managed accounts should you wish for someone else to trade your money for you, we would advise against this as learning yourself is far greater.

Customer Service

A few different ways to get in contact you can use the online submission form to send your query and you should then get a reply via email. There is also direct email addressed for the customer support department as well as for affiliates. Finally, there is also a phone number and online chat should you wish to speak to someone in real-time.

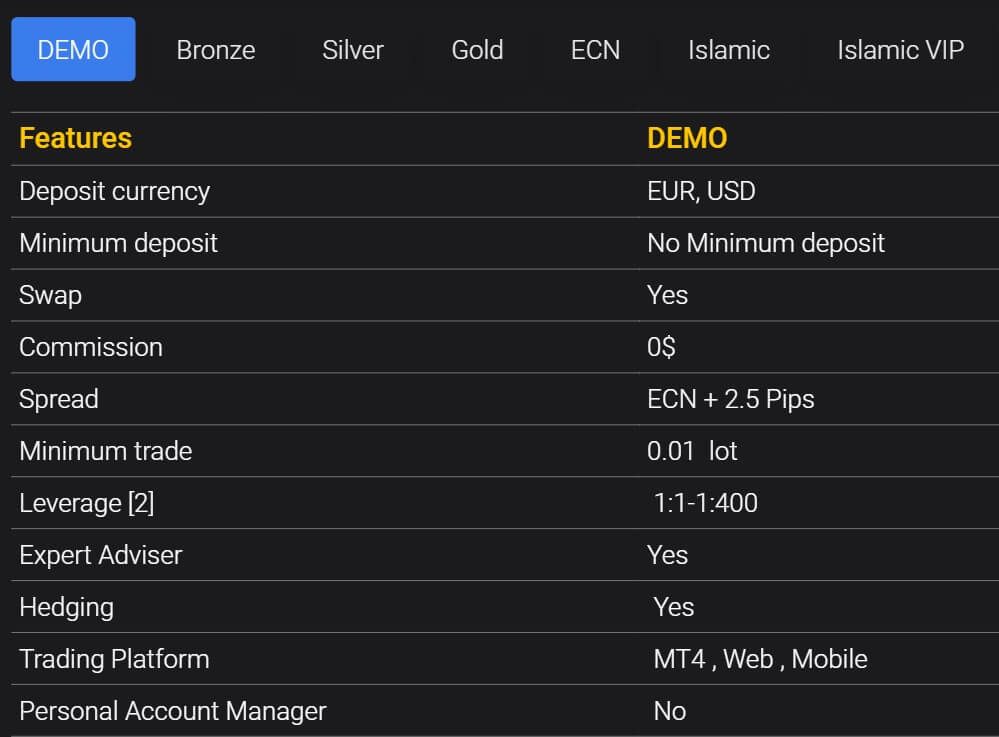

Demo Account

Demo accounts are available and come with certain trading conditions, you can choose the base currency as USD or EUR, swap charges are simulated and there is no commission. The spreads are ECN + 2.5 pips and the minimum trade size is 0.01 lots with leverage between 1:1 and 1:400. You can use expert advisors and hedging is fine, the account can be used with the MetaTrader 4 trading platform. There was no mention of how long the account lasts so we are assuming it works indefinitely until you close it or go inactive for too long.

Countries Accepted

We did not notice any information about eligible countries so if you are thinking of signing up, you could get in contact with the customer service team to see if you are eligible for an account or not.

Conclusion

iBrokers Trade made a strong start, their trading conditions are clear and competitive, the bronze account has slightly high spreads but the other accounts are more in line with the competition. Plenty of assets to trade but it would be nice to see a little more diversity. The customer service team has plenty of ways to get in touch with is always a good plus. The place where iBrokers Trade let themselves down was on their financial information, there is no info about depositing or withdrawing which is such a vital piece of information when they will be dealing with our money. If you can look past that or get the information out of the support team then they could be a potentially good broker.