HQBroker is a Marshall Island based forex broker which is committed to providing a secure, beneficial, trading environment for its traders and investors. They aim to provide reliable trading solutions as well as superb trading conditions, so join us as we go through the services on offer to see how they compare to the competitions and to see what they really do offer.

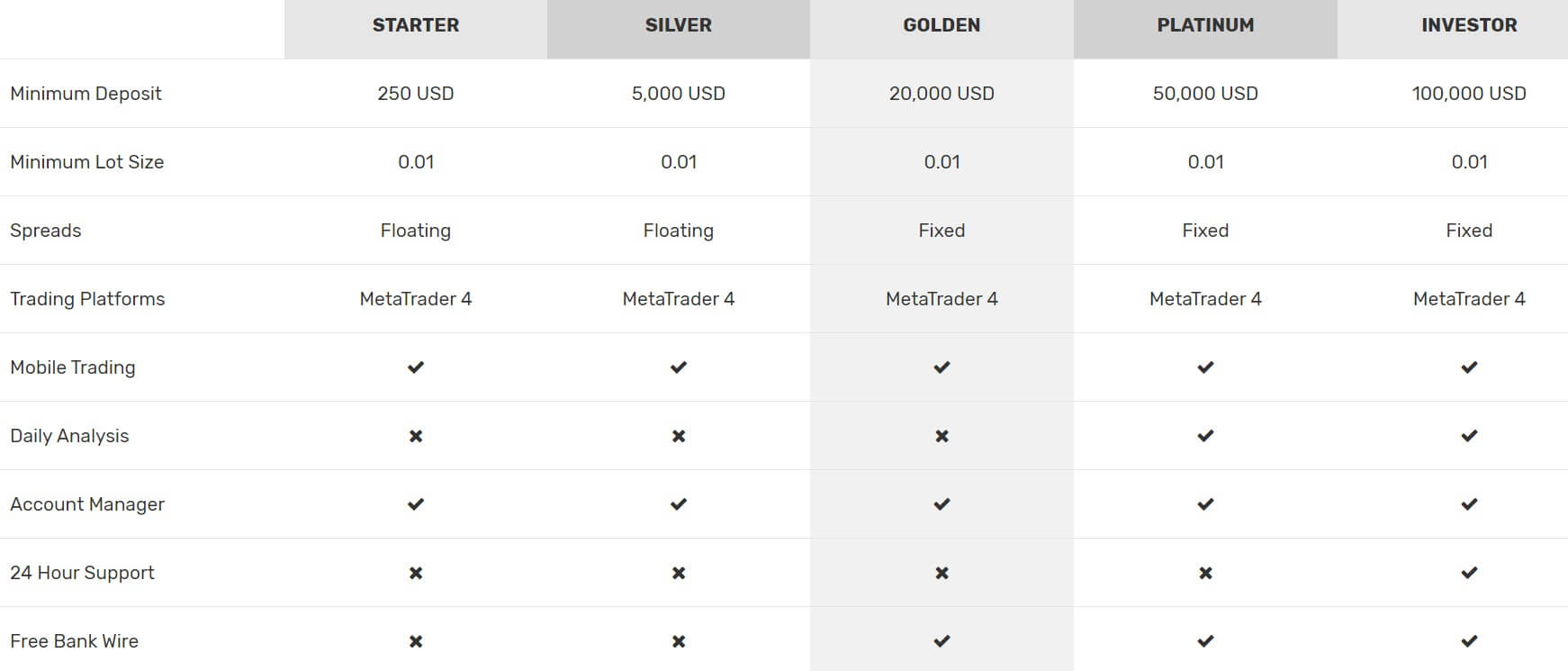

Account Types

There are 5 different accounts on offer, each one having its own trading conditions along with requirements to pen, so lets briefly look at some of the features.

Starter Account: This account requires a minimum deposit of $250 to open, it comes with a minimum trade size of 0.01 lots and has a floating spread. It uses the MetaTrader 4 trading platform and also has access to mobile trading. The account also comes with an account manager.

Silver Account: This account requires a minimum deposit of $5,000 to open, it comes with a minimum trade size of 0.01 lots and has a floating spread. It uses the MetaTrader 4 trading platform and also has access to mobile trading. The account also comes with an account manager.

Golden Account: This account requires a minimum deposit of $20,000 to open, it comes with a minimum trade size of 0.01 lots and has a floating spread. It uses the MetaTrader 4 trading platform and also has access to mobile trading. The account also comes with an account manager and free bank wire transfers.

Platinum Account: This account requires a minimum deposit of $50,000 to open, it comes with a minimum trade size of 0.01 lots and has a floating spread. It uses the MetaTrader 4 trading platform and also has access to mobile trading. The account also comes with an account manager, free bank wire transfers and daily analysis.

Investor Account: This is the top tier account and requires a minimum deposit of $100,000 to open, it comes with a minimum trade size of 0.01 lots and has a floating spread. It uses the MetaTrader 4 trading platform and also has access to mobile trading. The account also comes with an account manager, free bank wire transfers, daily analysis and access to 24-hour support.

Platforms

HQBroker offers MetaTrader 4 as its trading platform, MT4 is full of features to help with your trading and when using it with HQBroekrs you get features including multiple chart setups, a market watch window, pre-installed indicators, a large collection of analysis tools, it has negative balance protection, customize EA for automated trades, you can develop technician indicators, you can Import/export historic data in real-time, 250+ available instruments to trade, flexible leverage up to 1:400, trade Forex, Commodities and Derivatives, an extensive list of shares from all world markets, optimum execution without rejections, Expert Advisors(EA) capabilities, 1+CLICK trading enabled and, multi-language support. MetaTrader 4 is also accessible as a desktop download, mobile application and as a web trader.

Leverage

There is a leverage choice up to 1:400 with HQBroker, you can select leverage when opening up an account and can be changed on an already open account by contacting the customer service team.

Trade Sizes

The minimum trade size for all accounts starts at 0.01 lots which is known as a micro lot, they then go up in increments of 0.01 lots. It is not known what the maximum trade size is or what the maximum number of open trades you can have at any one time is.

Trading Costs

We do not know if there are any added commissions but judging by the spreads (see later part of this review) it does not seem like there will be any added commissions. There are however swap charges, these are interest fees charged for holding trades overnight and can be both positive or negative, they can be viewed from within the MetaTrtader4 trading platform.

Assets

There is a breakdown of some of the assets, we are not clear if it is all of them but it is everything we could find.

There is a breakdown of some of the assets, we are not clear if it is all of them but it is everything we could find.

Forex: EURUSD, USDJPY, GBPUSD, EURJPY, AUDUSD, USDCHF, EURCHF, EURGBP, USDCAD, NZDUSD, AUDJPY, CHFJPY, GBPCHF, USDHKD, CADJPY, GBPJPY, NZDJPY, CADCHF, EURAUD, USDSGD, AUDCAD

Metals: Gold and Silver are the only metals available to trade.

Equities: Far too many for us to go through, there is a 14-page list of them, but anything you can think of that has shared will be there to trade.

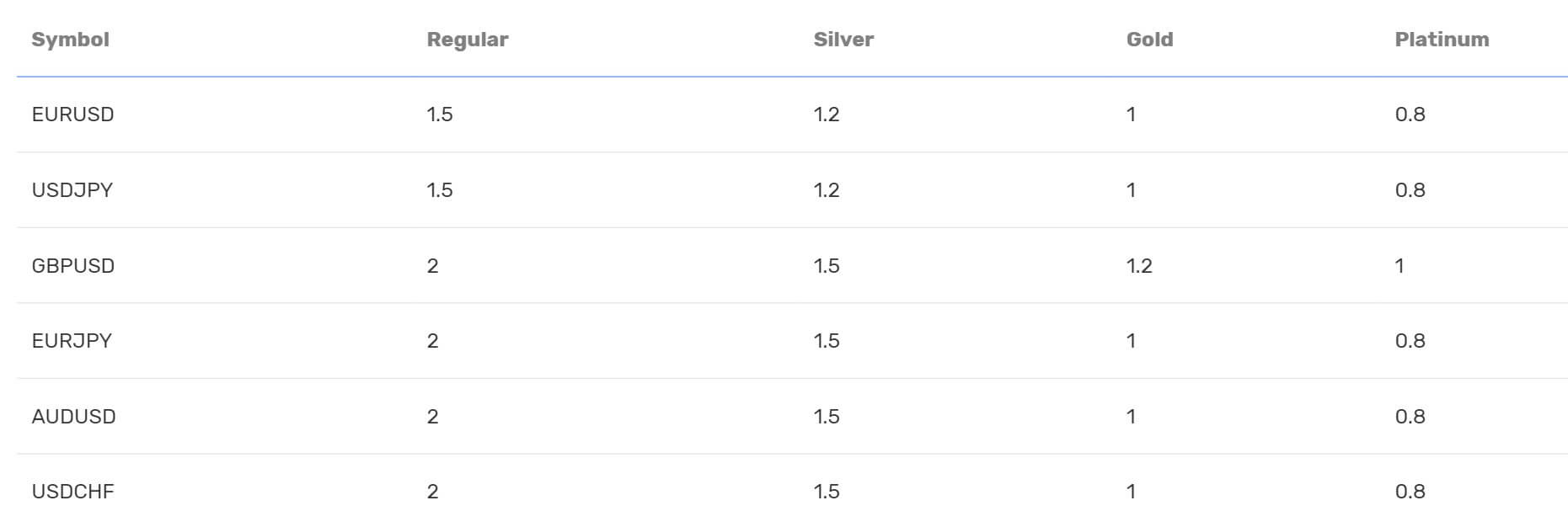

Spreads

The different accounts come with different spreads, if we take EURUSD as an example, the Regular account comes with spreads of 1.5 pips, the Silver account has spread of 1.2 pips, Gold 1 pip, and Platinum just 0.8 pips.

It should also be noted that different instruments have different spreads so on the Silver account, EURUSD may start at 1.2 pips, AUDUSD starts t 1.5 pips. The spreads are also variable which means they move when there is added volatility in the markets they will often be seen higher than the number stated above.

Minimum Deposit

The minimum amount required to open up an account is $250 which will allow you to open up a Starter account. It is not known if smaller amounts are able to be deposited once an account is already open.

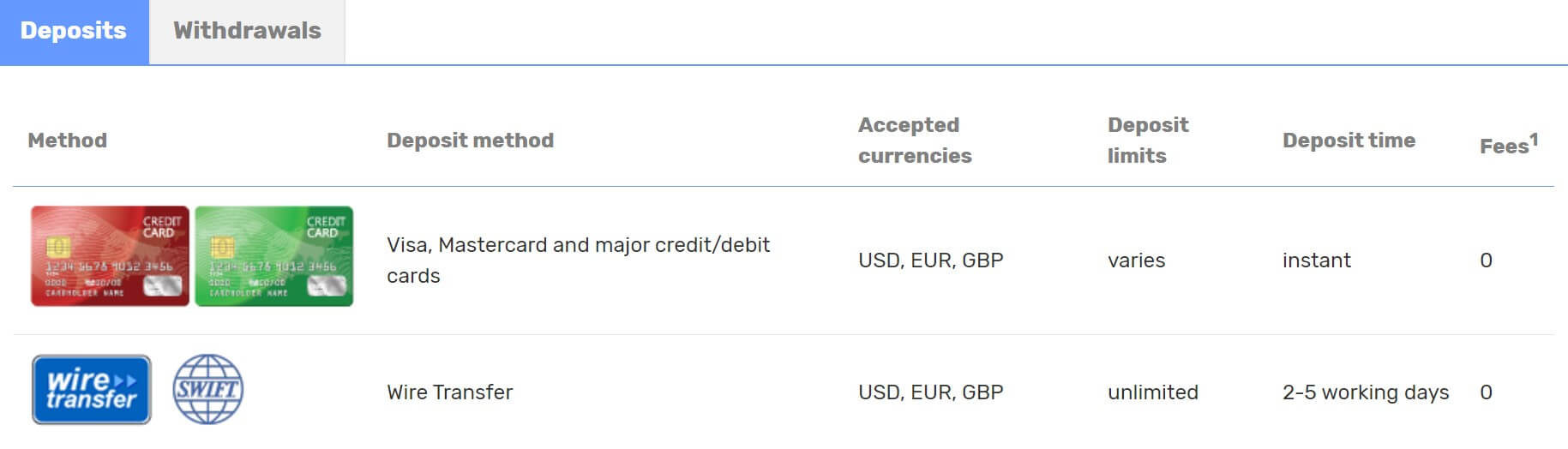

Deposit Methods & Costs

There are only two different methods available to deposit with, Bank Wire Transfer and Credit/Debit card. HQBroker does not add any fees of their own. However, you should check with your payment provider and bank to see if they add any fees of their own.

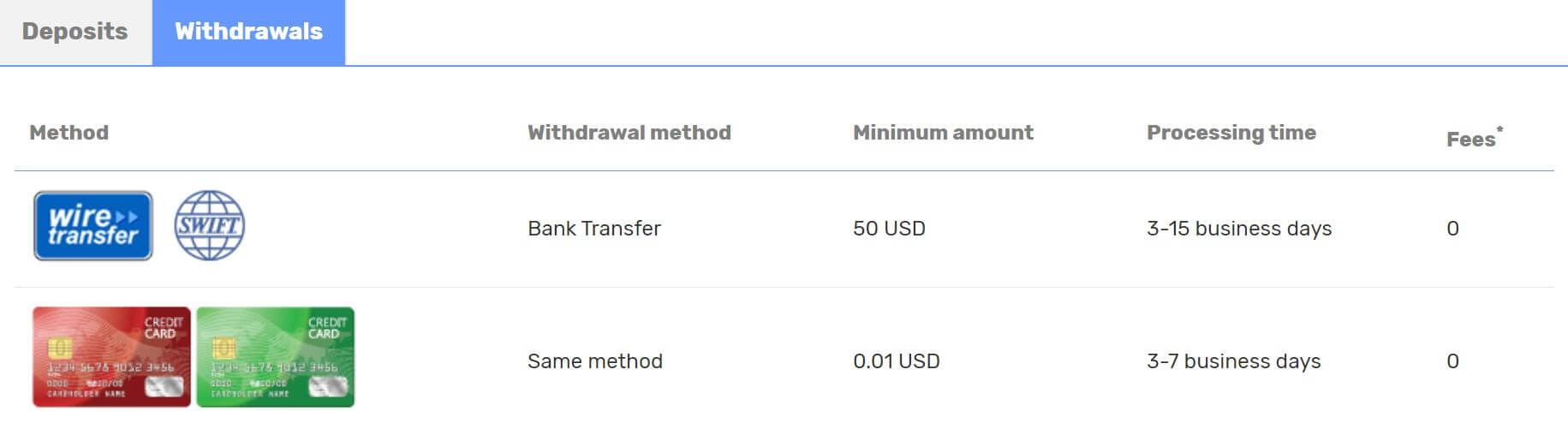

Withdrawal Methods & Costs

The same two methods are available to withdraw with, again these are Bank wire Transfer and Credit/Debit card. There are no added fees from HQBroker but again, be sure to check with your own bank or card issuer to see if they had any transfer fees of their own.

Withdrawal Processing & Wait Time

The withdrawal times stated on the site indicated that Bank Wire transfers should take between 3 to 15 business days and that Credit/Debit card withdrawals should take between 3 to 7 business days. These times vary depending on your bank or card issuer.

Bonuses & Promotions

It does not seem like there are any bonuses or promotions available but this does not mean that there won’t be in the future. So if you are looking for bonuses, you could always get in contact with the customer service team to see if there are any promotions coming up that you can participate in.

Educational & Trading Tools

When it comes to education there are a couple of videos available, they are pretty basic, ok if you are new but if you have traded before they won’t teach you anything new. There are some ebooks, but unfortunately, the page was not loading properly for us so we could not see what they were like. There is then a glossary of forex related terms, but again the page was not loading. Finally, there was some market news, and you can probably guess, the page wasn’t loading properly so we cannot comment on the quality of the source of the news.

Customer Service

Should you need to contact HQBroker they are available 24 hours a day 5 days a week and close over the weekend just like the markets do. You can contact them using the online submission form, or you can use the live chat service if you prefer there is also an email address and a phone number available to use.

Email: [email protected]

Phone: 852-5808-4980

Demo Account

We did not see the option to open up a demo account which is a shame as demo accounts allow existing clients to test out new strategies without risking capital and also allows new and potential clients to test out the trading conditions on offer.

Countries Accepted

The following statement is on the site: “Restricted jurisdiction: HQBroker does not offer its services to residents of certain jurisdictions such as USA, France and Hong Kong. HQBroker will not conduct any regulated activity in Hong Kong as they are not licensed by the Securities and Futures Commission. For more information, please see the Terms and Conditions.” If you are still not sure of your eligibility, we would recommend contacting the customer service team to find out prior to creating an account.

Conclusion

It was hard work to find some of the information such as the trading conditions, the meu system on the site can be a little confusing with multiple pages for the same topic each holding different details. From the information that we did get, the trading conditions seem okay, and the spreads are not too high for non-commission accounts. They were let down a bit in relation to the number of tradable assets and it would have been nice to see more currency pairs available. There also want many ways to deposit or withdraw, if you like using electronic wallets you will need to look elsewhere, it as good that there were no added transfer fees though.