Squared Financial is a group of 3 subjects that make the brokerage brand, SquaredFinTech which handles the platform and the back office, SquaredResearch dealing with the market analysis and educational programs, and SquaredDirect DMA/STP brokerage brand founded in 2018. The brand is new and founded by the same people managing now-defunct ProbusFX. While still new and now very popular on the scene, the broker managed to get a legit CySEC license and stay competitive on the trading conditions. Therefore, good transparency and quality of service are expected.

SquaredDirect website is professionally made with good structure, navigation, content, and transparency. Visitors will have the right marketing blend of promotion and information. Company location, team, and history are presented openly, giving out a good image of a trusty broker. Traders will also respect the MiFID II directive, Tier I banks funds segregation and the ICF €20,000 backup in case of the broker insolvency.

SquaredDirect also has another domain regulated by FSA of Seychelles where trading conditions are lax and do not have the leverage limits ESMA directs to brokers dealing with the EU clients. The broker is offering a very good value proposition with elements such as low trading costs, no conflict of interest, good educational, analysis and informative content, and 24h support. Still, the broker has not received enough attention to have a verdict by users and benchmark sites. Many aspects of this broker point to a well-organized business but we will review SquaredDrirect by sections so traders can make the right decisions.

Account Types

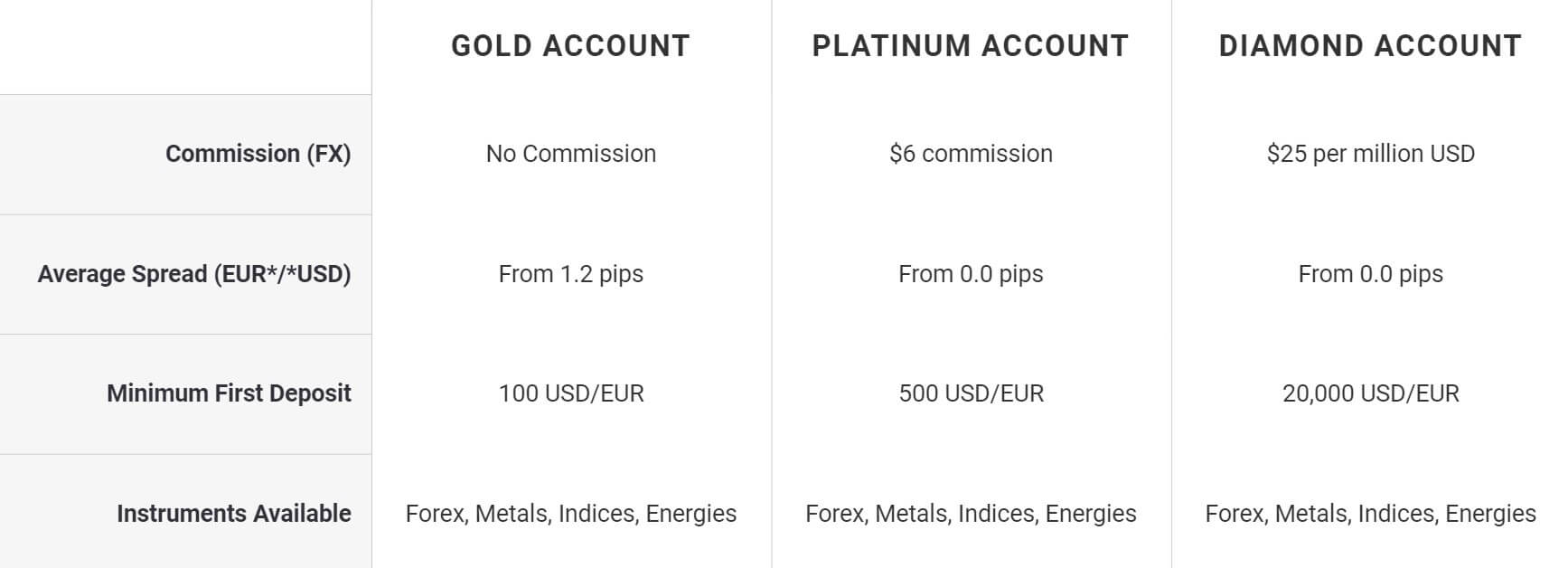

SquaredDirect has a very well overview of the trading conditions about every of the 3 account types they offer. Overall, the accounts are differentiated by the spreads, commissions, minimum deposit and, interestingly, negative balance protection. All of them are available in EUR and USD currency only. The most affordable account is the Gold where the spreads are promoted as starting from 1.2 pips. This account does not have commissions and has negative balance protection, it is described as for people who like simplicity in trading. According to the table, there are no other differences to other accounts except for the limitation to Forex and Precious metals range only.

Mid-tier, and probably the most optimal account is the Platinum. The major difference is the minimal spreads and the commission charged per lot traded. Platinum Account is described as for the skilled traders who want raw spreads and access to all trading instruments. The increase in the minimum deposit requirement is small but the concern to some traders may be the absence of negative balance protection. A full range of trading instruments is available.

Diamond Account is the ultimate condition account with a very big minimum deposit requirement. The benefits are significantly reduced commission and spreads. We believe some additional arrangements can be made with the broker since this account is meant for high-volume institutional and individual traders.

We have contacted the SquaredDirect staff about the unusual negative balance protection absence for two of their accounts, we are informed the all accounts have negative balance protection. Therefore, the presentation table is not reflecting on real conditions.

Platforms

SquaredDirect offers only the Metatrader 4 platform even though the broker promoted the MT5 on the account comparison table. The license for the MT4 is saved despite the rebranding, MetaQotes discontinued issuing new MT4 licenses to favor the MT5. SquaredFinancial company promoted the MT5 and its proprietary platform although these are not yet operational with SquaredDirect.

MetaTrader 4 is available to download for Windows, Mac, and Linux operating systems. Also offered for mobile devices running on iOS and Android. The web-accessible MT4 platform is not offered so visitors will have to download the installation packages and install the platforms to see the trading conditions.

MetaTrader 4 is available to download for Windows, Mac, and Linux operating systems. Also offered for mobile devices running on iOS and Android. The web-accessible MT4 platform is not offered so visitors will have to download the installation packages and install the platforms to see the trading conditions.

Once installed the MT4 platform presented us 4 Squareddirect servers, two demos and two live. All of them have a great ping rate below 40 ms. Everything is by default settings without any added templates or indicators. The default 4 forex currency pairs on 4H timeframe have the One-click trading buttons enabled. Equinox LD4 is SquredDirect’s data hosting partner and it shows by extremely fast-changing price quotes in the platform. The symbols list is organized into many groups with the same asset category.

In our opinion, they are unnecessary as, for example, there are 4 groups for Indices without any logic. As for the execution times they are 145ms on average with slight deviations to 154ms. This is a very good execution time for scalpers and fast trading EAs, which are allowed by the broker. Specification window is showing enough trading conditions data except for the commission which is displayed in the trading Terminal module instead. We have not found any liquidity problems for any asset offered.

Leverage

As per ESMA directives, SquaredDirect leverage is capped to 1:30 for Retail category traders. To classify as a Professional trader where higher leverage is allowed, traders will have to meet certain criteria, which are disclosed in the respective legal document. What we did not like is that the broker is promoting 1:500 leverage which is reserved only for the Professional trader category, while most are ordinary, Retail traders. The leverage information is not disclosed for each instrument on the website.

According to the Leverage Policy legal document the leverage is set 1:30 for major currency pairs (comprising any two of the following currencies: USD, EUR, JPY, GBP, CAD, and CHF), 1:20 for non-major currency pairs, Gold and major indices, and 1:10 for commodities and non-major indices. Leverage of 1:5 is for individual equities and other reference values and 1:2 for cryptocurrencies. We have confirmed these values in the platform except there are no cryptocurrencies in the range.

Trade Sizes

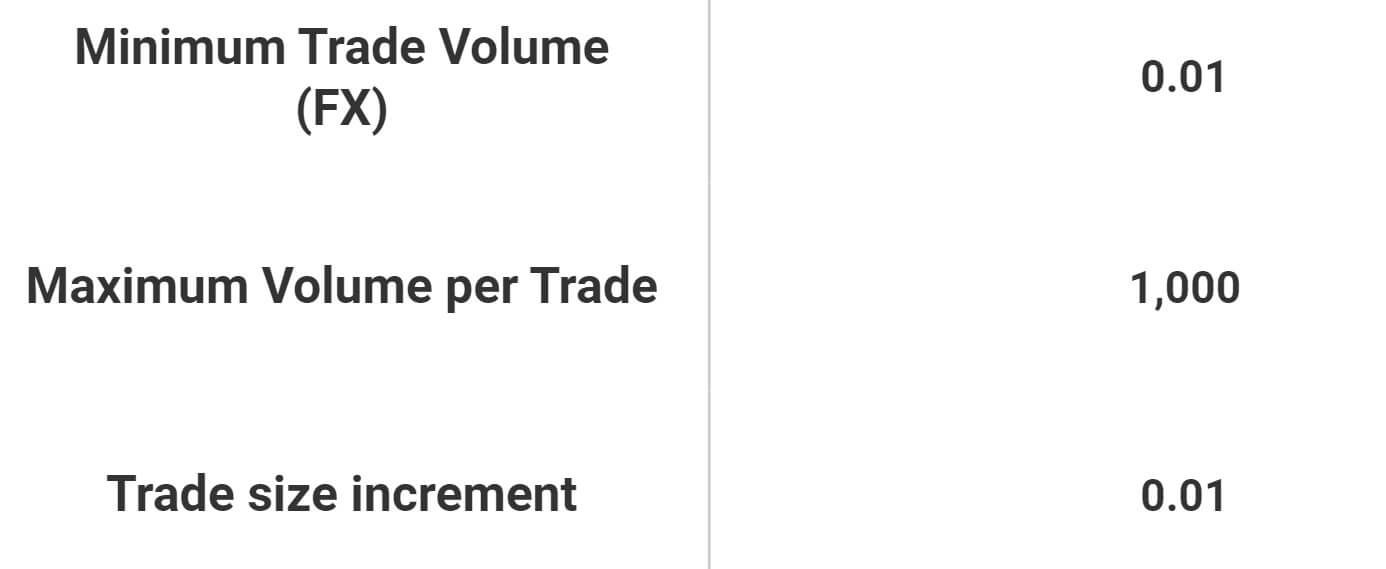

SquaredDirect sticks to the micro-lot trading volume size for all accounts. Additional steps volume is also 0.01 lots. The maximum trade volume size is set to 10000 lots which is more than enough for anyone. This trading size policy is applied to the whole instrument range. As for the Stops levels, it is set to none for Forex, precious metals, commodities and indices is set to 2 pips. For those not familiar with the Stops level values, it determines the range in points around the current asset price within Stop Loss and Take Profit orders cannot be placed in. Having no Stops level is convenient for scalpers and fast trading strategies where risk management is very narrow.

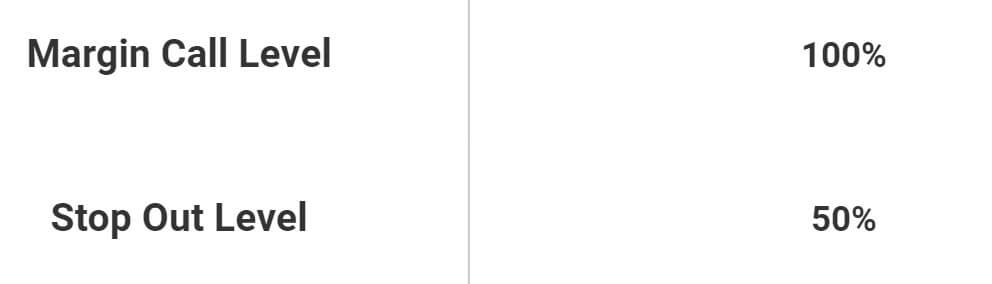

Margin Call is set to 100% level and Stop Out is at 50% for all account types. Note that the broker has negative balance protection for all accounts despite the table info on their website.

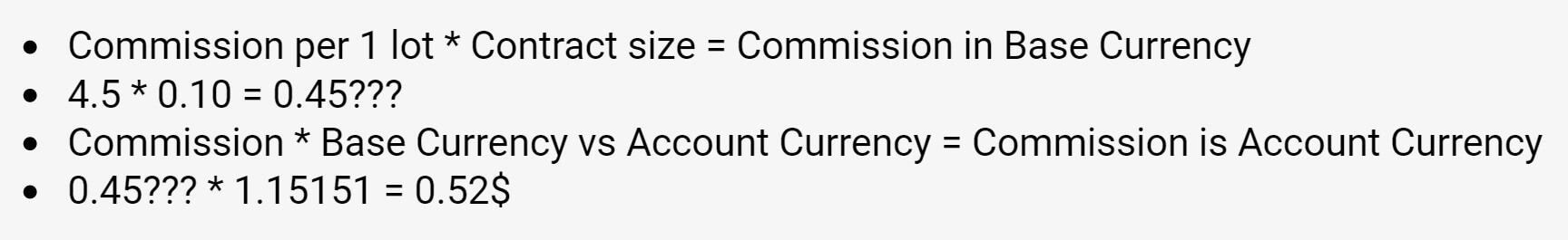

Trading Costs

SquaredDirect charges the commission per lot traded for Platinum and Diamond Accounts, while the Gold account has the commission included in the spread. Platinum account commission is $7 per lot but we have found that only for Forex currency pairs. For the stop Gold, the commission was $11.03 according to the MT4 platform. WTI Oil had a $3.67 per lot and Brent had $4 commission. These figures are completely inconsistent with the account presentation page where the commission is $6. For this reason, clients will have to check with SquaredDirect about the actual fees.

Swaps are calculated in points and tripled on Wednesdays. For major Forex pairs the swap is under normal levels but for Gold and other non-forex assets are a bit extreme. We will refer the cost for probably the most interesting platinum Account. Positive swaps are a frequent sight. First, the most liquid currency pair, the EUR/USD has low swaps, trade sides are in balance, -6 points for long and 6 for short position. USD/JPY has 3.2 for long and -7.78 for short, GBP/USD -5.64 long and 1.6 short, AUD/USD -3.12 long and 0.48 short, and NZD/USD with -2.4 points on long and 0.512 on short. For the exotics pairs, we found the swaps expectedly higher but in reasonable ranges. USD/CNH has -55.5 points on the long side and 0.24 on the short, USD/MXN has -441.375 on the long and 164.66 on the short and USD/ZAR -324.25 long and 139.1 points on the short.

Our major surprise is the spot Gold against the USD with -112.7 points for the long overnight position charge and 48.6 points credit for the short position. Spot Silver is not following the same pattern, -2.2 points for long and 0 for short. Again Oil assets both have extreme swaps comparing to what we usually see. As for Indexes, they also have high double-digit all negative swaps. We have approached the broker about this issue and we are informed that the conditions are not yet up to date.

Again, we urge any interested traders investing with this broker to check all of the conditions first. It came to our attention that the unusual swap range for these assets may come from the fact all of them have one digit more price calculation, so Gold and Oil have an additional digit than what most of the brokers have. There are no fees for inactivity or maintenance.

Assets

Squared Direct is not offering a great asset range, still, there are signs of development of introducing new, such as cryptocurrencies. At the moment of writing this review, the broker offers 4 asset categories, Forex, Energy assets, Precious metals, and Indexes. None of them are particularly developed except for the Forex. The forex range has a total of 41 pairs. The range is average without any exceptional number of exotics. Notable exotics are USD/CNH, USD/MXN, USD/HKD, USD/ZAR, USD/TRY, EUR/TRY, and Scandinavian currencies.

Precious metals are limited to only two most traded metals, Silver and Gold. Out of commodity assets, SquaredDirect only has two Oil types, Brent and WTI. Advanced traders that like to find opportunities on every market will not choose this broker for now, although trading conditions are one of the best for what it is offered. Indexes range is also limited to only 6 majors. These are US 100, Germany 30, EU 50, UK 100, France 40, US 30 and US 500. All of these instruments are stated as cash.

Spreads

SquaredDirect has a floating type spread on all of the accounts. The most affordable Gold Account has the spreads from 1.3 pips according to the table, although we know the commission is included here. Platinum and Diamond Account are stated to have the spreads from 0 pips. This is common said for promotional reasons but our MT4 platform showed this is really the case. During our testing of the Platinum Account in the MT4 we have noticed that the USD/JPY occasionally has 0 pips spread. EUR/USD is similar. In most cases, the spread is 1 point for both of these pairs meaning the spreads are raw.

The highest spread among the majors is attributed to USD/CHF with 6 points spread and AUD/USD with 4 points. To confirm that the SquaredDirect is the king of spreads comes from the fact all of the minors have the single-digit spread in points except for occasional jump by the GBP/NZD, EUR/NZD, CHF/JPY and NZD/CAD to 10-15 points. For exotics, the spreads are not that attractive but still competitive. For example, USD/ZAR has 790 points, USD/CNH 193 points, USD/HKD 33 points, USD/MXN 169 points, and USD/TRY 403 points. Spot Gold and Silver have triple-digit price computing, the spread is 11 pips for Gold and 27 for Silver.

Minimum Deposit

The most affordable Gold Account requires at least a $100 initial deposit. Platinum Account with 0 pip spreads and commission requires at least $500 or EUR. For Dieamon you will need $20,000 initial deposit amount. Since SquaredDIrect is still in development the conditions about the accounts may change. The FAQ page shows completely different figures for minimum deposits and different account names so we will assume the FAQ is outdated.

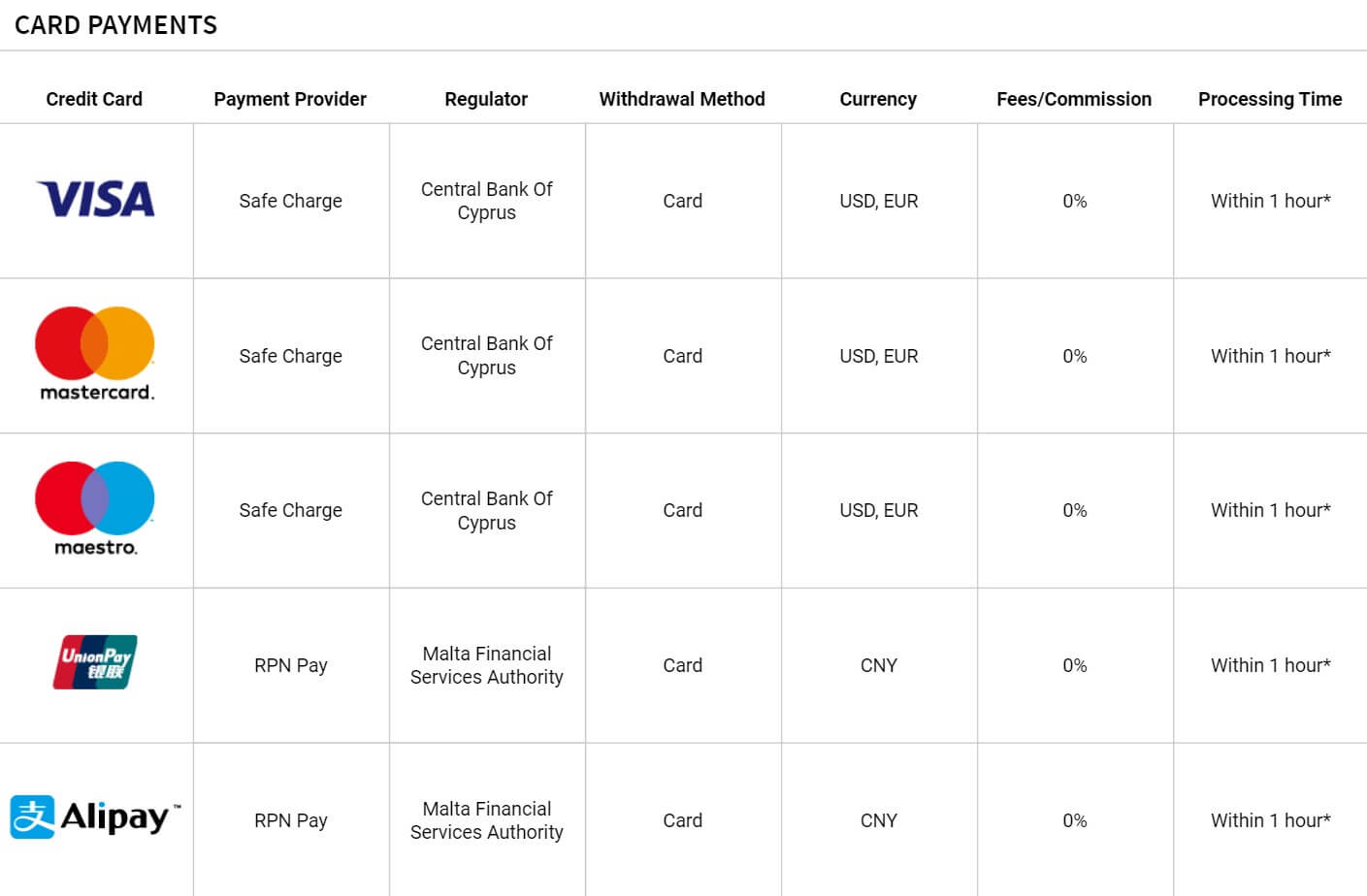

Deposit Methods & Costs

SquaredDirect Lounge, or client’s area, will notify you will need to verify your account before depositing. The deposit channels available are Bank Wire and Credit cards. Note that the legal documents also mention e-wallets such as Skrill and Neteller. The broker will not charge any fees for deposits. Any bank transfer fees will not be compensated.

Withdrawal Methods & Costs

Withdrawals channels are the same as with deposits. At the moment the broker only has bank transfers operational. There are no costs for any withdrawal methods.

Withdrawal Processing & Wait Time

Withdrawals are done within the SquaredDirect Lounge. Within 5 business days, the broker will pay the withdrawal. As per the Withdrawals Policy document, there are requirements. The account has to be the same where deposits come from and belonging to the client. The client has to be fully verified and the balance must exceed the amount specified.

Bonuses & Promotions

It is not allowed to offer the usual type of bonuses or promotions. This does not apply to the broker’s other domain regulated by FSC. SquaredDirect calls users to follow their Facebook, Instagram, LinkedIn, and Twitter profiles to keep clients up to date with corporate news, announcements and latest market events.

Educational & Trading Tools

This element of the broker service is very well developed. There are two sections of the SquaredDirect website with several information sources, educational content, and analysis.

The first part of the Market Analysis section is the Economic Calendar. It is designed by myfxbook.com with all the features it has on myfxbook website. There are settings for timezone, country filtering, impact, and the ability to save settings for the next session. Aside from the usual impact forecast, actual and past figures, the event description also has a chart with historical event levels.

Live Market News contains a very good introduction for beginners on how to interpret the news. The feed is updated hourly and arranged as a grid. Most of the news comes from Reuters or Investing.com, it is not the work of the broker staff. Therefore, clients will have to digest the information on their own.

Live Market News contains a very good introduction for beginners on how to interpret the news. The feed is updated hourly and arranged as a grid. Most of the news comes from Reuters or Investing.com, it is not the work of the broker staff. Therefore, clients will have to digest the information on their own.

The Financial Events section has more educational function than it is related to practical trading applications. The content covers main institutional and government actions that have a severe impact on the market, such as OPEC Meeting, Federal Reserve Meeting, European Central Bank Meeting, Bank of England Meeting, Brexit, and NonFarm Payrolls. These titles have a quality made content with links to outside credible sources that further enrich the value beginning traders will appreciate.

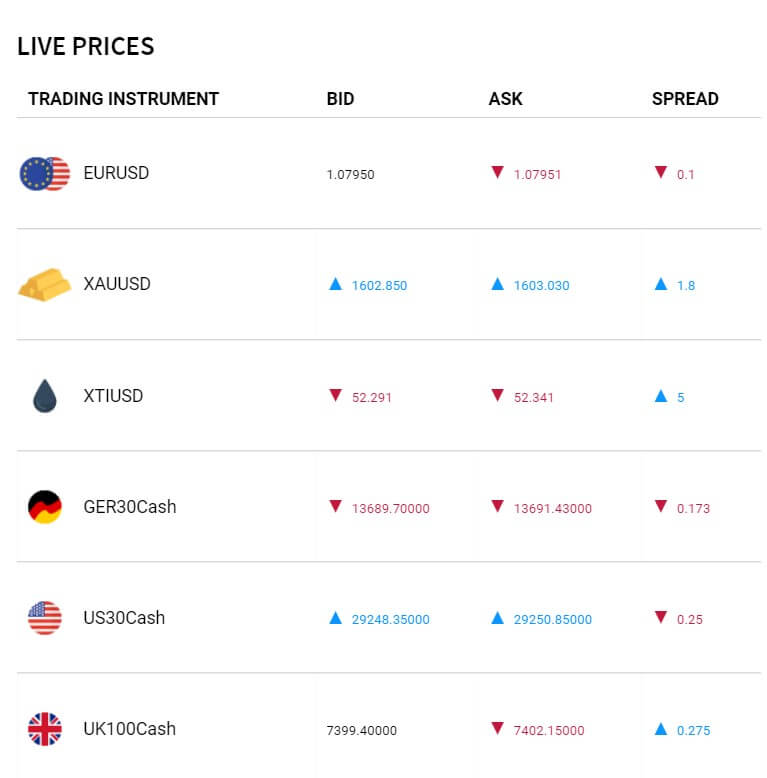

Pivot Points describes how the Resistance and Support lines are used with the additional ways of what pivot points indicate. There are examples from 2019, and we are not sure if this is intentional or just outdated. Live Prices contain the feed web element with live price movements and spreads for some forex pairs and spot Gold.

Learn part of the main menu holds video tutorials, trading guides, glossary and trading FAQ. Video Tutorials are numerous with over 60 lessons on topics such as Indicators, Trading Psychology, Trading Strategies, MT4, Market Analysis and so on. They are not long and have good explanations but as such do not have any depth.

Learn part of the main menu holds video tutorials, trading guides, glossary and trading FAQ. Video Tutorials are numerous with over 60 lessons on topics such as Indicators, Trading Psychology, Trading Strategies, MT4, Market Analysis and so on. They are not long and have good explanations but as such do not have any depth.

Trading Guides also have very good content with images and examples. There are 7 of them and cover topics such as Understanding Forex Charts, Understanding Currency Pairs, Identifying Chart Patterns in Forex Trading and so on. The Glossary and the Trading FAQ are a nice addition with not so deep explanations and coverage.

SquaredDirect best part is the blog in our opinion. Their blog has a very nice design, filtering, and quality content compared to some other brokers. The articles are written by the broker’s staff and are longer once you register. This section is active and updated frequently. Company News is also published here with the latest event important for traders.

Customer Service

SquaredDirect has solid customer support. There are multiple channels to contact them, via phone, call back service, chat, email and social networks. The chat service is 24/5 with responsive staff, we have not waited longer than one minute for any occasion. Most of the easy questions will be answered with the appropriate links and polite attitude. Although, once you start asking specific trading questions, representatives show inexperience or lack of authorized practice.

On the other hand, the broker is still new and emerging. Email responsitivity is also fast, within one hour. A complaint form is put in the Help center while the FAQ holds a good amount of information and a Search Box. Note that we have noticed several outdated information and inconsistencies.

Demo Account

The demo account is not time-limited and can be opened within the MT4 platform too. It will reflect the Platinum Account with all the commissions and swaps. Although the leverage you can select is not what you will get as a Retail Client. The options given in the demo opening process is 1:50 or 1:100. The execution and server ping rate are almost the same. Traders will have 50,000 EUR or USD virtual funds. Multiple demo accounts are allowed.

Countries Accepted

According to the legal documents and the CySEC license, SquaredDirect is allowed to provide services in the following countries: Austria, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom. Provision of Services to Countries Outside the EU to China, Hong Kong, Indonesia, Lebanon, Moldova, Nigeria, Switzerland, Ukraine, United Arab Emirates, Seychelles, Indonesia, Moldova, and Nigeria.

Note that the other domain of SquaredDirect has a wider list of accepted countries outside the EU and regulated by FSC. Traders should check with the broker for the latest list as it is still in relatively early development.

Conclusion

This section of the SquaredDirec review will reveal several important facts about the broker. Firstly we have noticed the low percentage of just 56.82% retail investor accounts lose money when trading CFDs with SquaredDirect while their FSC branch has this percentage about 77%. The percentage of 56.82 is way below the industry standard and we are not sure what is contributing to such high success of traders.

The broker is still not popular enough and does not have any ratings within the audience. Based on the facts of good transparency but somewhat messy information, it is possible that the broker is still not yet ready to open a bigger marketing campaign and keeps the small pool of skilled traders. Since the trading conditions are very good, SquaredDirect has a good future and an open slate for the reputation to fill.

At the current state, even with the modest trading instrument range, traders can enjoy the safety and no limits to trading techniques, EAs or any kind of fees except for the commission for the two raw spread accounts. Traders can expect this broker to introduce cryptocurrencies and other assets in the range. For those interested in working with the broker, there are several vacancies open.