Exclusive Capital is an online FX and CFD broker that offers leveraged trading on several different asset classes, including FX, commodities, cash indices, ETFs, and stocks. The broker is located in Cyprus and fully regulated by the Securities and Exchange Commission (CySEC), making them more trustworthy than many of their unregulated competitors. The company has a commitment to provide the best customer service while providing maximum safety and security when handling their client’s funds. If you’re in the market for a broker, stay with us to find out whether that search can come to an end with this option.

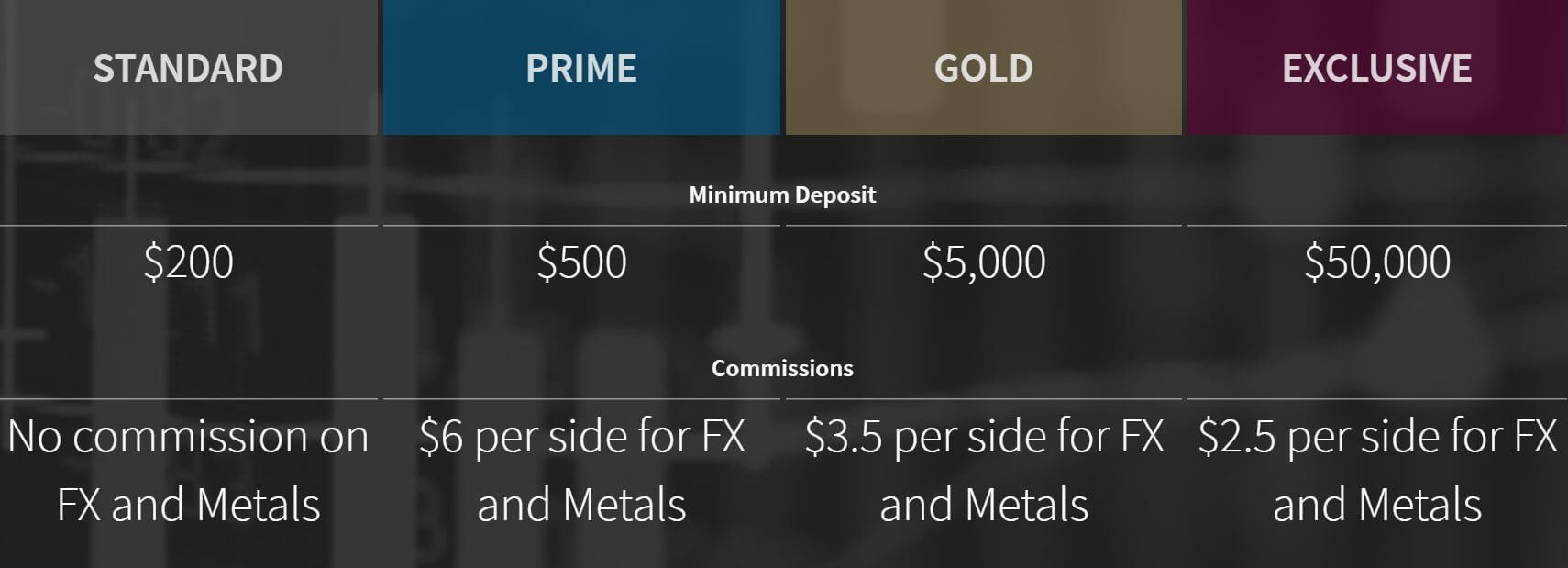

Account Types

Exclusive Capital offers four different account types: Standard, Prime, Gold, and Exclusive. Islamic accounts are offered in addition, to those that can provide supporting documentation of Muslim faith. The Standard and Prime accounts are the most affordable, while the Gold and Exclusive accounts are the most expensive. All accounts come with the same leverage cap of 1:100 for clients that are considered professional. Starting spreads range from as low as 0.2 pips, up to 1.5 pips. The broker doesn’t charge commissions on their Standard account, but these charges do apply in differing amounts on the other three account types. Accounts also share various other factors, including trade sizes, stop out levels, tradable instruments, etc. Take a look at the exact specifications for each account type below.

Standard Account

Minimum Deposit: $200

Leverage: Up to 1:100 (professionals)

Spread: As low as 1.5 pips

Commissions: None

Prime Account

Minimum Deposit: $500

Leverage: Up to 1:100 (professionals)

Spread: As low as 0.2 pips

Commissions: $6 per side on FX and metals

Gold Account

Minimum Deposit: $5,000

Leverage: Up to 1:100 (professionals)

Spread: As low as 0.2 pips

Commissions: $3.50 per side on FX and metals

Exclusive Account

Minimum Deposit: $50,000

Leverage: Up to 1:100 (professionals)

Spread: As low as 0.2 pips

Commissions: $2.50 per side on FX and metals

Platform

Exclusive Capital supports MetaTrader 5 as their sole trading platform. Some may feel disappointed that MetaTrader 4 isn’t available through this broker, although many do prefer the newer features and layout of the world-famous platform’s successor. MT5 is powerful and provides everything one could need for all analysis and trading activities. Some upgrades we see from the previous platform include more pending order types, 21 timeframes, a built-in economic calendar, and a more efficient programing language. MT5 is available for download on PC, iOS, and Android devices. If you own a Mac or prefer not to download the software, the browser-based version can also be accessed through WebTrader.

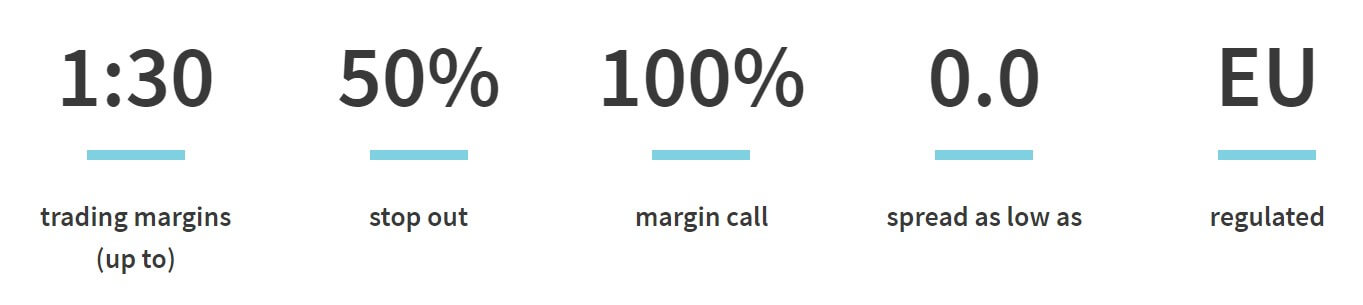

Leverage

This broker limits the maximum leverage cap to 1:30 for traders that are considered retail clients. For professionals, the cap is raised to a maximum of 1:100 and awarded based on prior trading knowledge and other prequalifications. While the professional cap is decent, it is definitely possible to find significantly higher leveraged options elsewhere. Other brokers rarely tend to limit their options based on how much prior experience one has. For many beginners and even some professionals, this company’s cap may be flexible enough to manage. Others may feel that the options are more restrictive.

Trade Sizes

All accounts have a minimum trade size of one micro lot and a maximum trade size of 30 lots. Hedging, scalping, and news trading are all allowed. Accounts also share the same margin call and stop out levels, which are listed below. Traders should consider closing out some traders or making a deposit if the margin call level is reached. If the account reaches the stop out level, the broker will immediately begin to close out positions, starting with the least profitable.

Margin Call: 100%

Stop Loss: 50%

Trading Costs

Like the majority of other forex brokers, Exclusive Capital profits through spreads, commissions, and swaps. If you’re interested in a commission-free experience, the broker does offer 0 commissions on the Standard account in exchange for higher spreads. Otherwise, commissions are $6 per side on FX and metals on the Prime account, $3.50 per side on the Gold account, and $2.50 on the Exclusive account. The lower commissions on the Exclusive account certainly seem more attractive, but many traders will not be able to meet the account’s 50k deposit minimum and will have to settle for one of the higher commission costs. The latest swap rates can be checked within the MT5 platform and traders should be advised that triple swaps are charged on Wednesdays in order to compensate for the coming weekend.

Assets

All accounts offer access to 64 currency pairs, 4 commodities, 12 cash indices, and stocks. The impressive number of currency pairs is made up of 6 majors, 22 minors, and 32 exotics. We also see several indexes, industrial, regional, country, fixed income, and commodity ETFs. Commodities include the US and UK Oil, Silver, and Gold. Stocks include 47 US options in popular companies like Amazon and Facebook, in addition to ten more European options.

Spreads

All of the costs have been built into the spread on the Standard account type, resulting in higher starting spreads of 1.5 pips. Taking a closer look, we noticed that the broker does manage to keep these spreads around the same area, with options ranging from 1.6 pips to 3.1 pips on majors. On minors, the spreads tend to range from 1.5 pips up to 3.7 pips, except for on EURNZD and GBPNZD, which have spreads of at least 4 pips. As for the Prime, Gold, and Exclusive accounts spreads start as low as 0.2 pips.

The spreads don’t climb higher than 0.9 pips on majors and spreads are no higher than 1.4 pips on minors, although we do see options as low as 0.2 pips and 0.5 pips on many options. On their website, the company lists the standard and premium spreads for all instruments, with standard spreads being offered on Standard accounts and premium spreads being offered on other accounts.

Minimum Deposit

The broker offers two account types with deposits on the lower side, with a $200 requirement on the Standard account and a $500 requirement on the Prime account. These amounts are realistic, although we do wish the broker would lower the requirement on their Standard account since many competitors do offer at least one account for $100 or less. On the high side of the spectrum, we see a jump up to a $5,000 requirement on the Gold account and the Exclusive account requires a much more significant $50,000 deposit.

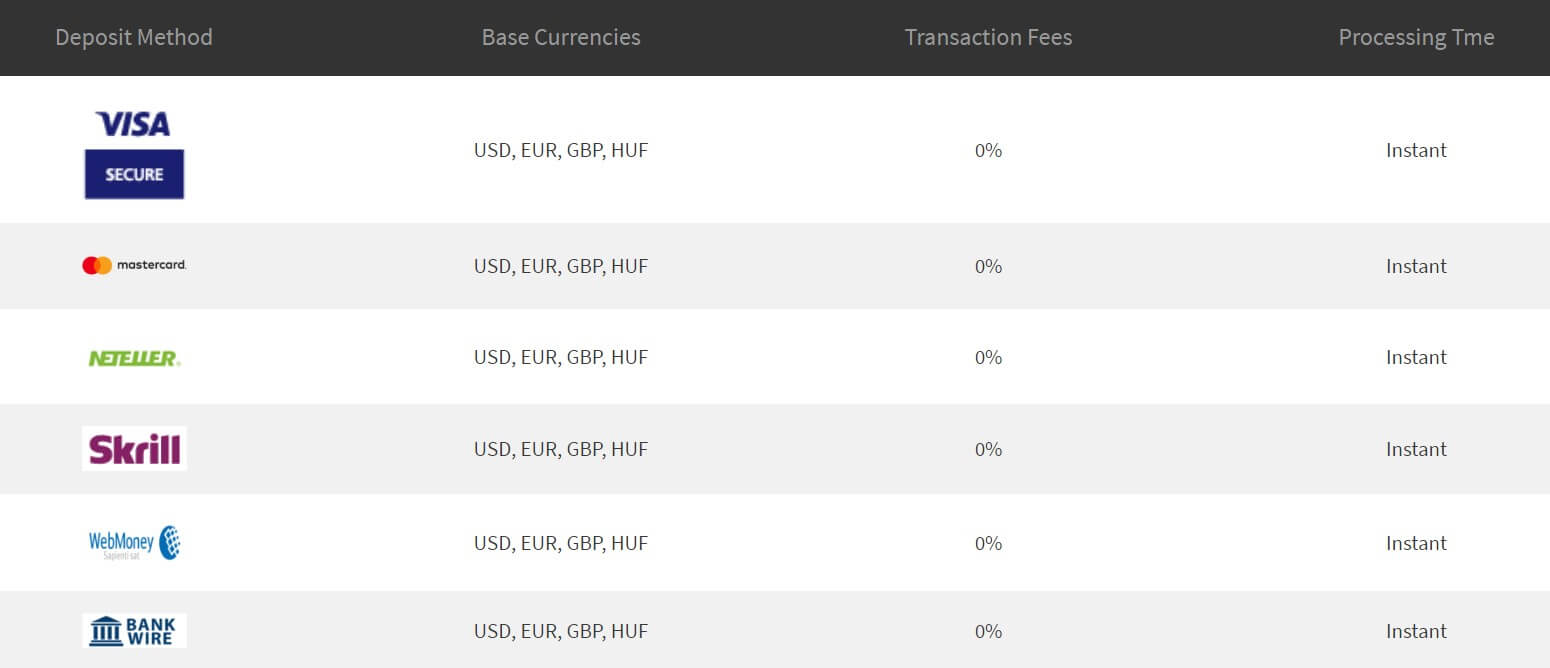

Deposit Methods & Costs

Exclusive Capital accepts deposits through a variety of methods, including Visa/MasterCard, Neteller, Skrill, WebMoney, bank wire, Eps, GiroPay, iDeal, Klarna, Poli, Przelewy24, Rapid, Trustly, and Nordea. In order to fund with a card, traders will need to provide a color copy of the front and back of the card, with the middle 8 digits on the front and the CVV code on the back covered. A screenshot of the client logged into an e-wallet account is also required to fund through one of those methods.

The first deposit must be verified manually by the funding department in order to verify the owner of the account, so it may take longer for the first deposit to be processed. Future deposits are credited instantly, except for in the case of bank wire, which can take 2-7 working days to be credited. There are no processing fees charged on incoming deposits.

Withdrawal Methods & Costs

All of the available deposit methods are also available for withdrawals, under the condition that withdrawals must be processed back to the original card, e-wallet, or bank account that was used to deposit. The majority of these methods have a flat withdrawal fee that is set at 1.8%. Exceptions would be Bank Wire, which has varying fees imposed on the bank’s behalf. Skrill would also be an exception, as it has a higher fee of 3% of the total withdrawal amount.

Withdrawal Processing & Wait Time

The broker manages to process all withdrawal requests within 24 hours. The website isn’t clear about how long it can take for those funds to show up once they’ve been sent, so traders will want to be prepared for a longer wait time just in case. Typically, it takes much longer to receive funds via wire, while e-wallets are often credited much more quickly.

Bonuses & Promotions

Sadly, we don’t see any extra opportunities to earn bonuses or to take part in any ongoing promotions. It’s always nice to see brokers offering deposit bonuses or cashback through rebates, so this is a little disappointing. On the other hand, many brokers do set unrealistic terms when these are offered, so traders should always look into the terms and conditions, especially if considering a broker based on this alone. If you do notice the “Promotions” section at the top of the website, you’ll notice that the broker only offers VPS in this category.

Educational & Trading Tools

The broker has dedicated two sections of their website to providing helpful resources; “Research” and “Academy”. The first category is mostly dedicated to technical and fundamental analysis, in addition to providing economic and holiday calendars. Under the “Academy” section, the broker provides several different sections, including the following:

- Upcoming Webinars and Seminars

- Forex Perception

- Commodity Insights

- Equities & Indices

These sections focus on helping traders to interpret global economics that impact the forex market, understanding the factors that drive commodity prices, and research on key concepts and ideas on global equities and indices. In addition, the broker also offers free demo accounts. If you’re interested in one of the broker’s webinars or seminars, you can visit that section of the website to view and sign up for any upcoming events.

Demo Account

Like many other forex brokers, Exclusive Capital recognizes the importance of providing free demo accounts to their existing and possible future clients. Signing up for one is easy, as there is a button labeled “Demo Account” at the top of the website, right beside the button that allows one to register for a live account. The application simply asks if one is registering as an individual or a company, before asking for some basic information like name, email address, etc.

From there, traders would be able to verify their email address and then select some more detailed specifics for their demo account, such as leverage. Any trader that could use some practice, needs to become more acquainted with MT5, would like to practice different strategies, test out the broker’s conditions, and so on can benefit from creating one of these risk-free accounts.

Customer Service

Customer service can be reached through LiveChat, via email, or by filling out a contact form. As usual, we did test out the broker’s LiveChat option in order to make sure that our expectations of the service were upheld. Fortunately, an agent responded almost immediately, so there are no complaints about the instant contact option. If you’d prefer to correspond via email, you should know that the broker provides several different email addresses for different departments, all of which have been detailed below. There are no direct phone numbers listed on the website, so it seems that filling out the contact form and leaving a telephone number is the only way to speak to someone over the phone. This is a little slower than being able to call directly, but still effective enough.

Email Addresses:

Information: [email protected]

Backoffice: [email protected]

Funding: [email protected]

Customer Support: [email protected]

Compliance: [email protected]

Trading: [email protected]

Partnerships: [email protected]

Investment & Research: [email protected]

Marketing: [email protected]

Physical Address: 84-86 Pafou Street, 2nd floor, 3051, Limassol – Cyprus

Countries Accepted

The broker lists Canada, Cuba, Iran, Iraq, Japan, North Korea, Sudan, Syria, Turkey, Belgium, The United States, Latvia, and Russia as being restricted regions. To be sure, we did check out the registration page to see if any of these options were listed. Sadly, the US and any other related options, and all of the other listed countries are missing from the list, making it impossible to open an account from one of these locations.

Conclusion

Exclusive Capital is a regulated broker with an asset portfolio that includes currency pairs, ETFs, commodities, indices, and stocks. The broker allows hedging, scalping, and news trading from the MT5 platform. Leverage options are more limited with this broker, with an allowance of 1:30 for retail clients. The 1:100 cap isn’t set much higher for professional clients. It costs between $200 and $50k to open an account, depending on which of the four available account types have been chosen.

Taking a look at trading cost, we see spreads that start from 1.5 pips on the Standard account, while the other accounts offer spreads that start from 0.2 pips and stay below 1.4 pips on all currency pairs. The Standard account is a commission-free option, while the other accounts charge commissions up to $6 per side on FX and metals.

Accounts can be funded through a variety of methods, with zero fees on incoming deposits and instant processing times. Most of the withdrawal fees are set at 1.8%, aside from the 3% fee on Skrill or the bank fee charges on wires.

Support can be contacted directly through LiveChat or by email and we were able to get in contact with an agent instantly. The broker’s educational resources are a step ahead of many of their competitors, with live webinars and seminars, in addition to multiple other sections that focus on providing knowledge. One downside would be the lack of bonuses or promotional opportunities, which we do see offered by some competitors. The broker restricts clients in the US and several different countries from opening accounts.