AIMS is a Singapore based forex broker who claims to be one of the world’s leading financial brokers. Their mission is to create the best trading environment for retail traders by offering superior spreads, execution, and service. AIMS is dedicated to maintaining open and transparent communication with our clients based on mutual respect, fairness, and integrity. We will be using this review to look into the services on offer to see if they achieve this or if they manage to fall short.

AIMS is a Singapore based forex broker who claims to be one of the world’s leading financial brokers. Their mission is to create the best trading environment for retail traders by offering superior spreads, execution, and service. AIMS is dedicated to maintaining open and transparent communication with our clients based on mutual respect, fairness, and integrity. We will be using this review to look into the services on offer to see if they achieve this or if they manage to fall short.

Account Types

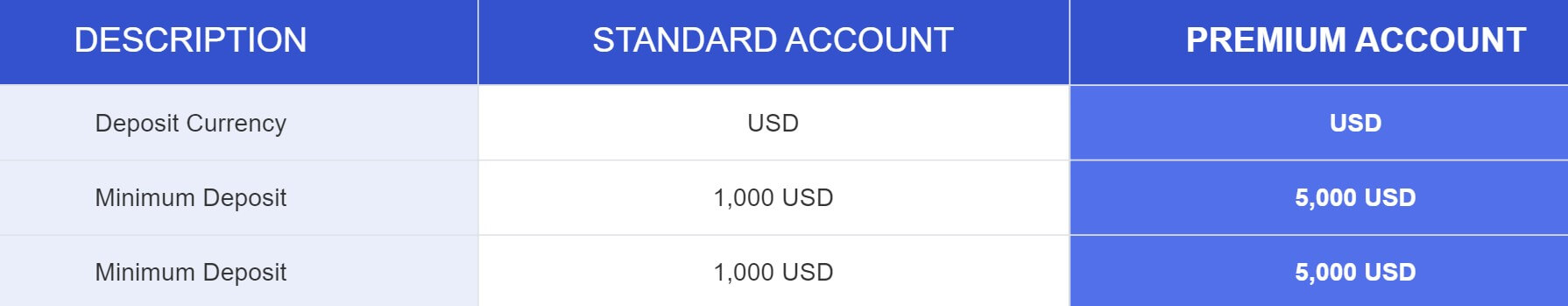

Should you decide to join AIMS, you will have a choice of two different accounts. They both have their own requirements and trading conditions to suit your style So let’s see what they offer.

Standard Account: This account requires a minimum deposit of at least $1,000 and must in USD as a base currency. The spreads on the account start from 1.8 – 2.0 pips for forex and 3.5 – 4.0 pips for gold. It can be leveraged up to 1:200 and there is a minimum trade size of 0.01 lots. There are 72 different trading products to trade and there are no added commissions on the account. One-click trading is available as well as index CFD trading.

Premium Account: This account requires a minimum deposit of at least $5,000 and must in in USD as a base currency. The spreads on the account start from 1.5 – 1.6 pips for forex and 2.8 – 3.0 pips for gold. It can be leveraged up to 1:200 and there is a minimum trade size of 0.01 lots. There are 72 different trading products available to trade and there are no added commissions on the account. One-click trading is available as well as index CFD trading.

Platforms

Just MetaTrader 4 is available from AIMS as a trading platform. MT4 comes with huge amounts of customization and accessibility, it is available on desktop, mobile and as a web trader. Some of its features include order, position, equity and exposure online management, live monitor for prices of financial instruments, advanced charting, online streaming news, complete control over a trading account, trade directly from the chart, real-time quotes of financial instrument activity reports and complete trading history.

Leverage

The maximum leverage available on both accounts is 1:200 and can be selected when opening up a new account. You can contact the customer service team should you wish to change the leverage on an account that is already open.

Trade Sizes

Trade sizes start from 0.01 lots (known as micro-lots) on both accounts and they go up in increments of 0.01 lots. We do not know what the maximum trade size is or what the maximum number of open trades you can have at any one time.

Trading Costs

There are no added commissions on any of the accounts as they both use a spread based system that we will look at later in the review. There are however swap charges these are fees that are charged when holding a trade overnight, and they can be viewed from within the MetaTrader 4 trading platform.

Assets

The assets have been broken down into a number of different categories, we have been through them and listed them for you below.

Forex: AUDUSD, EURUSD, GBPUSD, USDCHF, EURGBP, USDJPY, NZDUSD, AUDJPY, USDMXN, USDSEK, EURSEK, GBPSEK, EURNOK, USDNOK, USDHKD, USDZAR, USDCAD, AUDNZD, AUDCAS, AUDCHF, CHFJPY, EURJPY, EURCHF, EURNZD, EURCAD, GBPCHF, GBPAUD, EURAUD, GBPCAD, GBPJPY, NZDJPY, CADJPY, USDSGD, NZDCHF, EURSGD, AUDSGD, GBPNZD, CADCHF, NZDCAD, NOKJPY, USDCNH, EURDKK, USDDKK, USDRUB, USDPLN, EURPLN, USDDILS, USDRILS, USDTRY, EURTRY, GBPTRY, EURHUF, USDHUF

Metals: XAUUSD, XAGUSD, XAGEUR< XAUAUD, XAUEUR

Indices: ASX, SP500, EuroStoxx, IBEX, HangSeng, Nasdaq, CAC, STSE, DowJones, DAX, ChinaA50, Swiss20, AEX, CNHShares, Nikkei

Commodities: Natural Gas, US Oil, and UK Oil

Shares: Plenty of shares including Peugeot, Siemens, Barclays, ITV, Amazon, Apple, and Netflix.

Spreads

The spreads that you get depend on the account that you are using we have outlined them below.

Standard Account:

Forex: Starting from 1.8 pips to 2.0 pips

Gold: Starting from 3.5 pips to 4.0 pips

Premium Account:

Forex: Starting from 1.5 pips to 1.6 pips

Gold: Starting from 2.8 pips to 3.0 pips

Those are the starting numbers, but please note that the spreads are variable so they will move about with the markets and different instruments will have different starting spreads.

Minimum Deposit

The minimum amount required to open up an account is $1,000 which will get you the Standard Account. If you want the Premium account you will need to deposit at least $5,000. We do not know if the minimum amount reduces for further top-ups of an already active account.

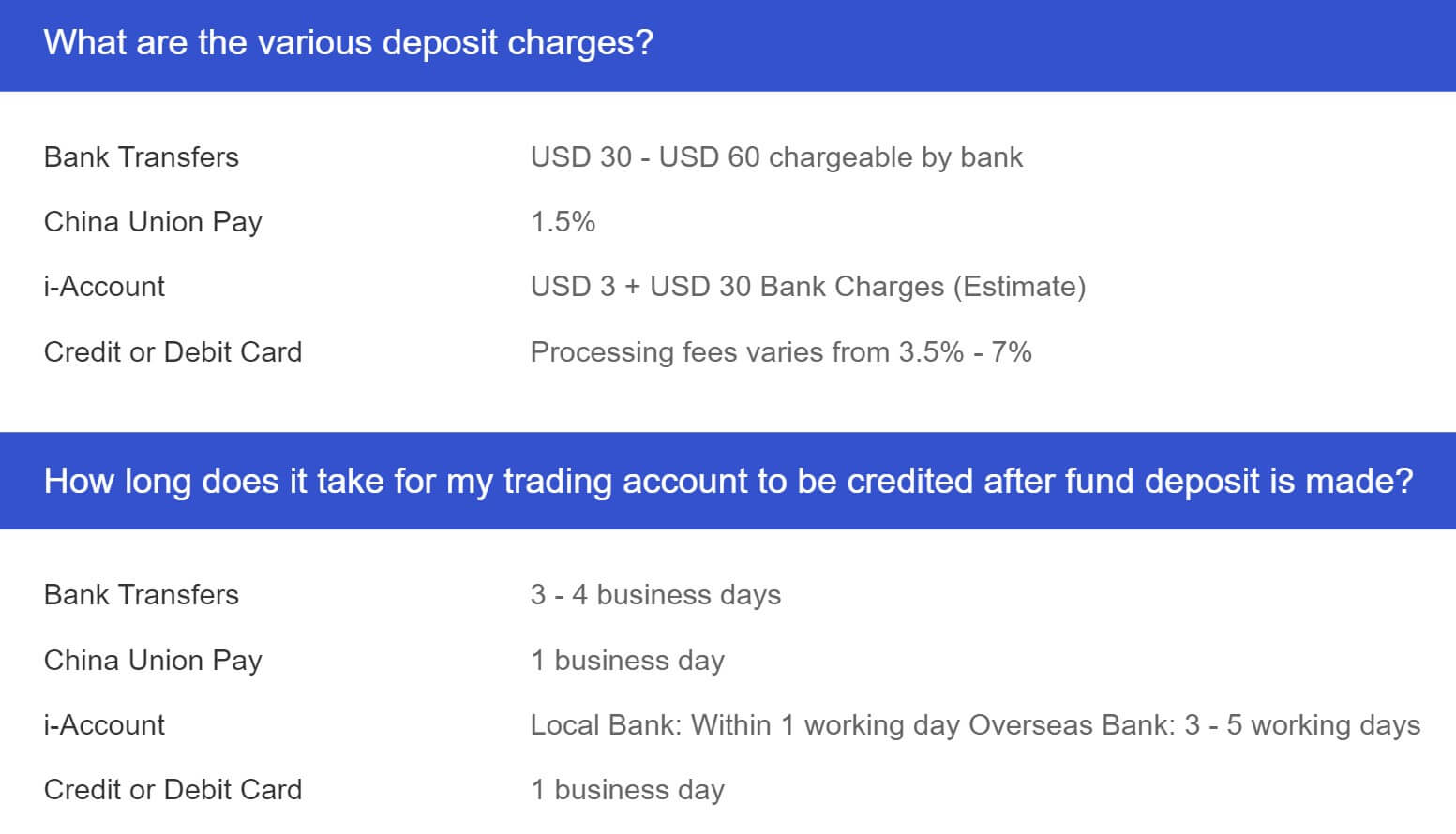

Deposit Methods & Costs

When we look at the deposit methods available it looks like only Bank Wire Transfer is available, at least that is the only method shown on the deposit guide page. In terms of any fees, there is a section there for it but it is currently blank, whether this means there are none or not we do not know. What we do know if that you should check with your own bank to see if they will charge any transfer fees of their own.

Looking further through the site we have found the following related to deposits:

- Bank Transfers – USD 30 – USD 60 chargeable by bank

- China Union Pay – 1.5%

- i-Account – USD 3 + USD 30 Bank Charges (Estimate)

- Credit or Debit Card – Processing fees vary from 3.5% – 7%

So there are in fact other ways to deposit, they are just not included on the deposit guide page for some reason.

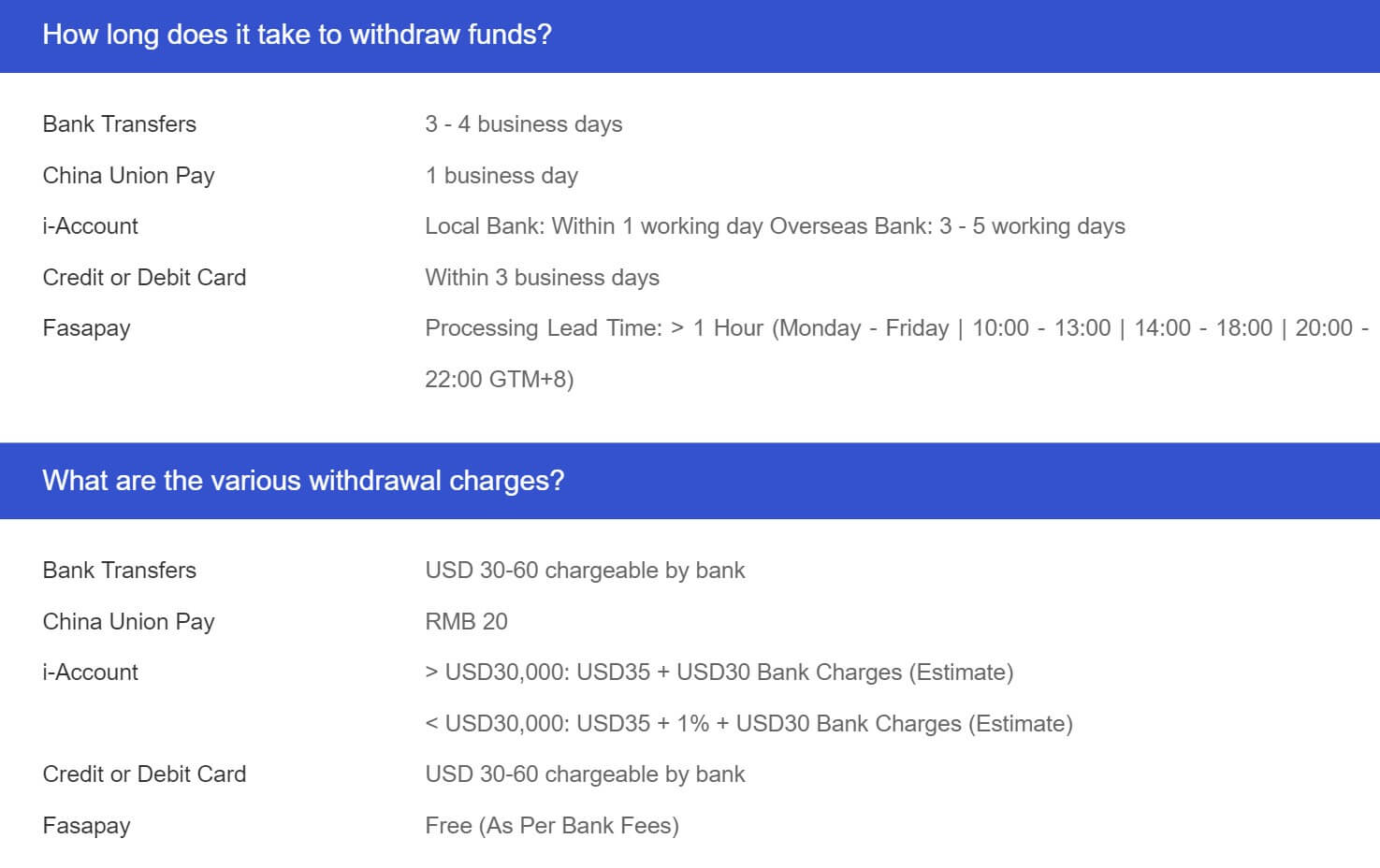

Withdrawal Methods & Costs

The withdrawal methods remain the same as the deposits and the fees for each method are as follows:

- Bank Transfers – USD 30 – 60 chargeable by bank

- China Union Pay – RMB 20

- i-Account – More than USD 30,000: USD35 + USD30 Bank Charges (Estimate), Less than USD30,000: USD35 + 1% + USD30 Bank Charges (Estimate)

- Credit or Debit Card – USD 30-60 chargeable by bank

- Fasapay – Free (As Per Bank Fees)

The minimum withdrawal amount ranges from USD 30 to USD 60.

Withdrawal Processing & Wait Time

The AIMS website states that a withdrawal request has a processing lead time of 3 to 4 business days, so you can expect your withdrawal request to be processed within that timeframe.

The processing times for individual methods are:

- Bank Transfers – 3 – 4 business days

- China Union Pay – 1 business day

- i-Account – Local Bank: Within 1 working day Overseas Bank: 3 – 5 working days

Credit or Debit Card – Within 3 business days - Fasapay – Processing Lead Time: > 1 Hour (Monday – Friday | 10:00 – 13:00 | 14:00 – 18:00 | 20:00 – 22:00 GTM+8)

Bonuses & Promotions

It appears that there is just one promotion active at the time of writing this review, which is a Cashback promotion.

“Get the most competitive cashback of 12 credit bonus per round turn lot from self-trading. Your effective trading cost could be as low as 0.3 pips only during this campaign!”

That is a fancy way of saying that you will get some of the spreads back as cashback. The terms and conditions of the promotion were unfortunately not loading for us, so we do not know what the full terms are or how you convert the cashback into real funds (if it isn’t already).

Educational & Trading Tools

It doesn’t look like there is any educational material available which is a shame as many brokers want to provide this to help their clients improve on their trading.

Customer Service

You can contact AIMS by using the online submission form, fill it in and you should get a reply via email, you can also use the provided email address. The support team is available 24 hours a day 5 days a week and you should get a reply to your email or callback request within 24 hours (unless it is the weekend or a bank holiday).

Demo Account

Demo accounts are available which is good as they allow you to test out the markets and new strategies without any risk to your actual capital. You can sign up via an online form but it is not clear which account the demo account mimics or if there is an expiration on the accounts.

Countries Accepted

This statement was found in the FAQ of the site if you still aren’t sure then you should contact the customer service team to find out about your eligibility. “AIMS does not accept U.S. clients. The U.S. CTFC regulation prevents U.S. clients from trading with brokers outside the United States. AIMS complies with International regulations.”

Conclusion

The accounts on offer from AIMS do not really offer much difference, although there is a slight decrease in spreads, that seems to be about it. There are enough assets to keep you busy but things take a small turn when we look at the deposit and withdrawals. There are plenty of methods available but there are fees for both depositing and withdrawing which can make it very expensive to get your money in or out of the broker. For that reason alone, you may want to consider looking elsewhere for somewhere that offers free or cheaper transactions.