KB Capitals was founded in 2010 and is a forex trading provider and broker which currently hosts thousands of clients. Based in the Czech Republic, they aim for stability and make every effort to provide trouble-free services, safe and simple trading, financial viability, and strict legal compliance. We will be using this review to dive deep down into the services on offer to see how they compare to the competitions and to find out how transparent they are as a broker.

Account Types

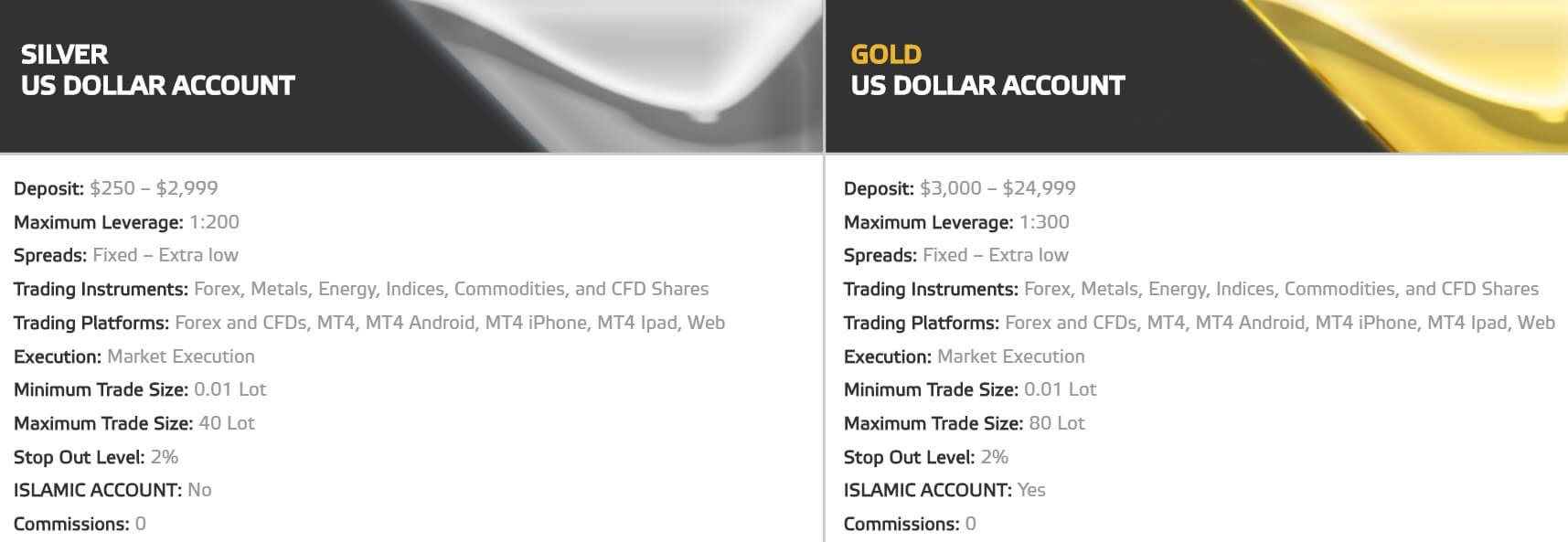

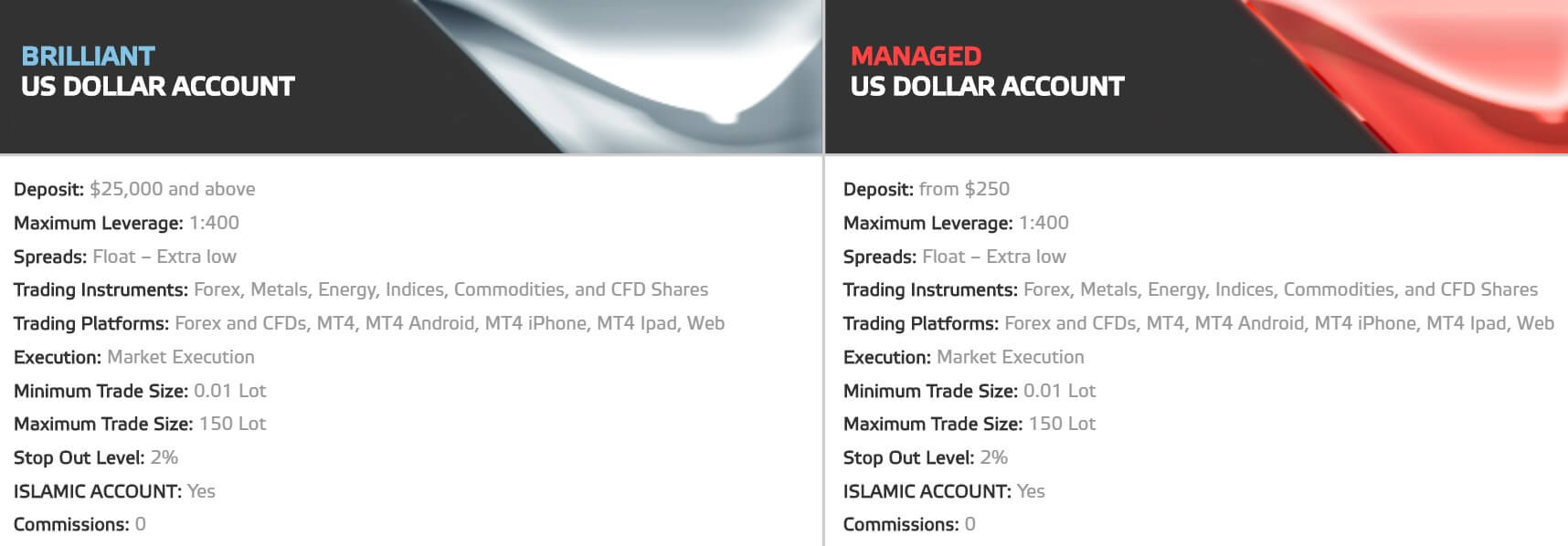

There are eight different account types listed but in reality, there are only four as each account type is listed with a EUR and USD version. We have outlined the main features of each account below.

Silver Account: The deposit requirement for this account is between $250 and $2,999. It comes with leverage up to 1:200 and has fixed, extra-low spreads. It has forex, metals, energies, indices, commodities and CFD shares available to trade and uses MetaTrader 4 as its trading platform. The account uses market execution and has a minimum trade size of 0.01 lots and a maximum trade size of 40 lots. The stop-out level is set at 2%, there is no added commission and the account cannot be used as an Islamic account.

Gold Account: The deposit requirement for this account is between $3,000 and $24,999. It comes with leverage up to 1:300 and has fixed, extra-low spreads. It has forex, metals, energies, indices, commodities and CFD shares available to trade and uses MetaTrader 4 as its trading platform. The account uses market execution and has a minimum trade size of 0.01 lots and a maximum trade size of 80 lots. The stop-out level is set at 2%, there is no added commission and the account can be used as a swap-free account.

Brilliant Account: The account has a minimum deposit requirement of $25,000. It comes with leverage up to 1:400 and has floating, extra-low spreads. It has forex, metals, energies, indices, commodities and CFD shares available to trade and uses MetaTrader 4 as its trading platform. The account uses market execution and has a minimum trade size of 0.01 lots and a maximum trade size of 150 lots. The stop-out level is set at 2%, there is no added commission and the account and the account can be used as a swap-free account.

Managed Account: The account has a minimum deposit requirement of $250. It comes with leverage up to 1:400 and has floating, extra-low spreads. It has forex, metals, energies, indices, commodities and CFD shares available to trade and uses MetaTrader 4 as its trading platform. The account uses market execution and has a minimum trade size of 0.01 lots and a maximum trade size of 150 lots. The stop-out level is set at 2%, there is no added commission and the account and the account can be used as a swap-free account.

Platforms

The accounts page indicates that MetaTrader 4 is an available trading platform, however the trading platform page only outlines a web trader, so we are assuming (maybe wrong) that the web trader is in fact MetaTrader 4. At any rate, MT4 is one of the world’s most used trading platforms hosting over 1,000,000 traders worldwide. The platform is compatible with hundreds and thousands of indicators and expert advisors and is fully customizable to your trading needs.

Leverage

The maximum leverage available depends on the account you are using, the Silver account has a maximum leverage of 1:200, the Gold account can be leveraged up to 1:300 and the Brilliant and Managed accounts can be leveraged up to 1:400. The leverage can be selected when opening up an account and can be changed by contacting the customer service ream wit your change request.

Trade Sizes

Trades sizes on all accounts start from 0.01 lots which are known as a micro-lot. They then go up in increments of 0.01 lots until the maximum trade size is reached. Each account has a different maximum trade size. The Bronze account has a maximum trade size of 40 lots, the Gold account is 80 lots, the Brilliant and Managed accounts have a maximum trade size of 150 lots. We would recommend not trading over 50 lots in a single trade though due to execution and slippage issues.

Trading Costs

There are no added commissions on any of the accounts as they all use a spread based structure. There are however swap fees on all accounts, these are fees charged for holding trades overnight and can be both positive and negative and can be viewed within the MetaTrader 4 trading platform. The Gold, Brilliant and Managed account can have a swap-free Islamic version should you not be able to pay or receive interest.

Assets

The assets at KB Kapitals have been broken down into a few different categories, we will now look into each category and outline the available instruments within them.

Forex: EURUSD, GBPUSD, USDJPY, AUDUSD, EURCHF, EURGBP, NZDUSD, EURJPY, USDCAD, USDCHF, AUDCAD, AUDCHF, AUDJPY, AUDNZD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURNZD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, NZDCAD, NZDCHF, NZDJPY, USDHKD, USDSGD, UEURDKK, EURHUF, EURNOK, EURPLN, EURSEK, USDDKK, USDHUF, USDMXN, USDNOK, USDPLN, USDRUB, USDSEK, USDTRY, USDZAR, EURILS, GBPILS, USDILS.

Metals and Energies: Silver, Gold, Brent Crude Oil, Light Sweet Crude Oil, Natural Gas, and RBOB Gasoline are available to trade.

Commodities: Cocoa, Coffee, Copper, Corn, Cotton #2, Orange Juice, Palladium, Platinum, Soybeans, Sugar #11, and Wheat.

Indices: CAC 40, DAX 30, Mini Size Dow Jones, FTSE 100, Nikkei 225, Nasdaq 100, E-Mini S&P 500, ASX XPI 200, DJ Euro Stoxx, China H-Shares, Hang Seng, IBEX 35, STSE/JSE Top 40, STSE / MB, CNX NIFTY, Volatility SP500, US Dollar Future, Tel Aviv 25.

Shares: There are plenty of shares available to trade, some of them include Amazon, Disney, Ferrari, IBM, General Motors and Verizon.

Spreads

The accounts use two different spread styles, the Silver and Gold account used fixed spreads that do not change, while the Brilliant and Managed accounts use a floating spread which moves with the markets when there is added volatility they will often be seen higher.

We do not know the differences in spreads as there is only one set of spreads shown on the asset breakdown page. The breakdown indicates that spreads average 1.8 pips for EURUSD, while other pairs have different average spreads with some like EURCHF having an average spread of 2.9 pips.

Minimum Deposit

The minimum deposit amount is $250, this will allow you to open up either a Silver account or a Managed account. Once an account has been opened, there is no minimum deposit enforced on subsequent deposits.

Deposit Methods & Costs

There are a few ways to get your money into KB Capitals, these are Credit / Debit Card (Visa or MasterCard), Bank Wire Transfer and WebMoney. So the selection isn’t the biggest and we do not know if there are any added fees. You should always check with your own bank or processor to see if they add any fees of their own. There are some additional images at the bottom of the screen but the terms and deposit pages do not indicate that they are actually usable as deposit methods.

Withdrawal Methods & Costs

The same methods are available to withdraw with, for clarification, these are Credit/Debit Card (Visa or MasterCard), Bank Wire Transfer and WebMoney. You must withdraw money back to the original deposit source. There is no indication of any potential fees but you should check with your own processor and bank for any incoming processing fees they may have.

Withdrawal Processing & Wait Time

Withdrawal requests can be made at any time. Requests are only processed once we receive all requested or required documentation and verified your account and payment methods. The process usually takes up to four days.

Bonuses & Promotions

There are a few different bonuses available, we will briefly outline a couple of them so you can get an idea of the sort of promotions that KB Capitals offers.

100% First Deposit Bonus: You can receive a 100% deposit bonus up to $1,000 on your first deposit, the site has the following information about the bonus, a trader must make a minimum of 10 trades. It also indicates to look into the bonus policy for more information but there is no information within it in regards to converting the bonus funds into real funds, so we don’t actually know how good the bonus really is.

Protected Trading Account: You can trade risk-free for the first month, this means that any lost trades will be refunded. Again, we do not know the full terms as they aren’t really specified anywhere.

Educational & Trading Tools

There are a few aspects to the educational side of the site, there are some 1-on-1 forex instructions for people with accounts larger than $1,000, there are also some webinars but we don’t really know how good they are. There is then an economic calendar, this shows you upcoming news events and also indicates which markets the news may affect. Next up is a glossary of trading-related terms, there is a page for video tutorials but the page currently states that it is coming soon. The final section is trading for beginners, but there isn’t much information on it so it isn’t the most helpful page you will come across when trying to educate yourself.

There are a few aspects to the educational side of the site, there are some 1-on-1 forex instructions for people with accounts larger than $1,000, there are also some webinars but we don’t really know how good they are. There is then an economic calendar, this shows you upcoming news events and also indicates which markets the news may affect. Next up is a glossary of trading-related terms, there is a page for video tutorials but the page currently states that it is coming soon. The final section is trading for beginners, but there isn’t much information on it so it isn’t the most helpful page you will come across when trying to educate yourself.

Customer Service

You can contact the customer support team by using the online form, fill it in and get a reply via email. They have also provided their clients with a postal address, phone number, and email address. The phone lines are available between 09:00 and 18:00 GMT+1 each day (except on weekends and bank holidays).

Address: Rybna 716/24, Stare Mesto, 110 00 Praha 1

Phone: +43720817958

Email: [email protected]

Demo Account

Demo accounts allow you to test out new strategies and trading conditions without risking any capital, they are an important part of a broker and so it is strange that there is no mention of them anywhere on the site. There may be a way to open a demo account once you have fully signed up, but there is no indication of them on the site.

Countries Accepted

This information is not available on the site and so we would recommend getting in contact with the customer service team to see if you are eligible prior to opening an account.

Conclusion

The available accounts offer a range of trading conditions, while we do not know all of the available spreads, the ones that we do see are around the average in the industry at around 1.8 pips, there is no added commission which is nice but it would be good to see examples of the fixed spreads too. There are plenty of assets available to trade which is a plus. In terms of funding, there is a slightly limited selection of available and this not fully clear if there are any fees added to the deposit or withdrawals.