Schatz Markets is a foreign exchange broker that was founded in 2016, they have a number of different goals which includes the desire to amaze their clients with an intense service, be devout and resolute, to manage colleagues and clients with respect, to consider customer opinion, to construct an optimistic crew, to always be responsible and efficient, to operate and adapt innovation and to accept responsibility to their behavior. This is all stuff that sounds great on paper, but we will be using this review to see if they also do these things in reality.

Account Types

Should you decide to sign up there are four different accounts available, each having their own entry requirements and trading conditions, we have outlined them for you below.

Schatz Lite: The minimum deposit requirement for this account is $1,000, it comes with spreads starting from 0.8 pips and has an added commission of $10 per lot traded, The account can be leveraged up to 1:100 and it has currencies, bullions, and indices available to trade. The stop out level for the account is set between 15 – 25%.

Schatz Pro: The minimum deposit requirement for this account is $1,000, it comes with spreads starting from 0.4 pips and has an added commission of $80 per lot traded, The account can be leveraged up to 1:500 and it has currencies, bullions, and indices available to trade. The stop out level for the account is set between 15 – 25%.

Schatz Premium: The minimum deposit requirement for this account is $2,000, it comes with spreads starting from 0.2 pips and has an added commission of $6 per lot traded, The account can be leveraged up to 1:100 and it has currencies, bullions, and indices available to trade. The stop out level for the account is set between 15 – 25%.

Schatz Islamic: The minimum deposit requirement for this account is $1,000, it comes with spreads starting from 0.8 pips and has an added commission of $8 per lot traded, The account can be leveraged up to 1:100 and it has currencies, bullions, and indices available to trade. The stop out level for the account is set between 15 – 25%. This account does not have any swap fees for holding trades overnight.

Platforms

Schatz Markets offers you the desktop, mobile, and web trader versions of MetaTrader 4, the platform comes with a whole host of features that makes it one of the most popular available They include things like live news feeds, ease of use through its user-friendly interface, available advisors make your trading easy, multilingual platform, daily account statement, trailing stop loss facility, configurable charts, and real-time quotes, view all trading activity, the ability to trade directly from the charts and many more features to help with both your trading and analysis.

Leverage

The maximum leverage that you get depends on the account you are using, the Lite, Premium and Islamic accounts all have maximum leverage for 1:100 while the Pro account can be leveraged up to 1:500. The leverage is selected when first opening up an account and should you need to change it, you will need to contact the customer service team with the request.

Trade Sizes

Trade sizes on all accounts start from 0.01 lots and go up in increments of 0.01 lots. We do not know what the maximum trade size available is or how many trades you can have open at any one time.

Trading Costs

There is an added commission on each account, we have detailed them below for you.

- Lite Account: $10 per lot traded

- Pro Account: $8 per lot traded

- Premium account: $6 per lot traded

- Islamic Account: $8 per lot traded

Apart from the Premium account, all the commissions charged are above the industry average of $6 per lot traded with the Lite account being quite expensive.

There are also swap charges on all accounts apart from the Islamic account, these are charged for holding trades overnight and can be viewed within the MetaTrader 4 trading platform.

Assets

Assets

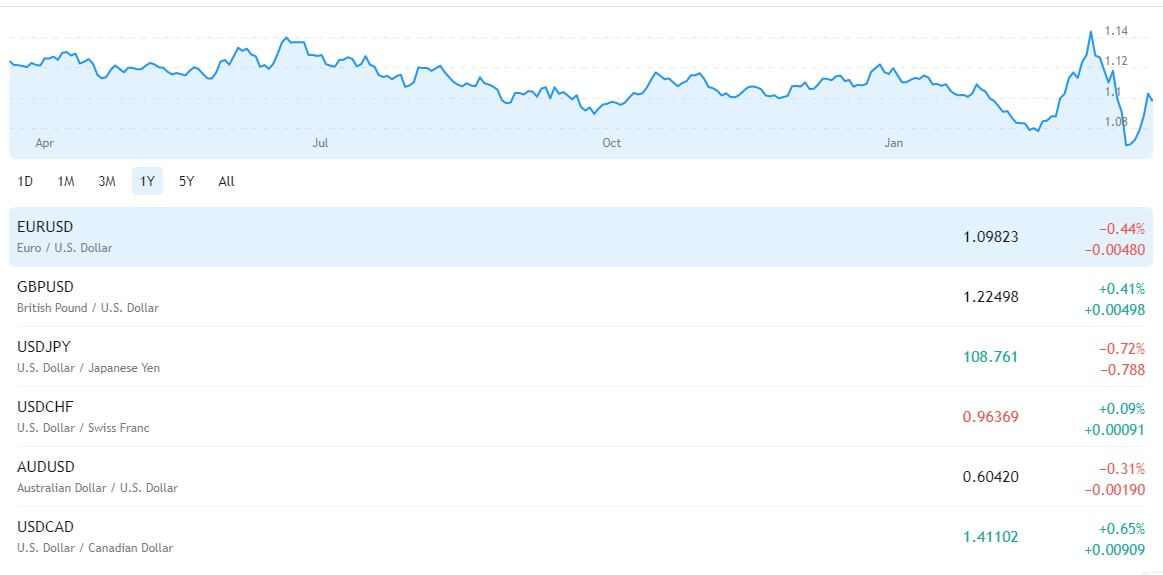

Sadly, there isn’t a full breakdown of tradable assets, there is a small selection shown but that it is. They have broken their instrument into a number of categories, the first being Forex where there are 60+ currency pairs available including EURUSD, GBPUSD, USDJPY, USDCHF, AUDUSD, and USDCAD. There are also metals and energies, for metals, there is just Gold and Silver but for energies, there are not any examples of what is on offer but we would expect oils and Natural Gas as a minimum. The final group is indices, but again, no examples are given so we cannot comment on what is available at this time.

Spreads

Each account type has a different initial starting spread, they are as follows.

- Lite Account: Starting from 0.8 pips

- Pro Account: Starting from 0.4 pips

- Premium account: Starting from 0.2 pips

- Islamic Account: Starting from 0.4 pips

The spreads are variable which means they will be constantly moving with the markets and different instruments will also have different starting spreads so some will naturally be higher than others.

Minimum Deposit

The minimum deposit required to open up an account is $1,000 which will allow you to open either the Lite, Pro or Islamic account. We do not know if this amount reduces for further deposits to top up the account but we suspect that it would.

Deposit Methods & Costs

There are over 9 different financing methods available, unfortunately, the page showing what they are and any details about them are giving a little error. At the bottom of the home page, there is an image of Visa/MasterCard, FasaPay, Neteller, and Skrill so we would assume that those methods are some of the ones available and then we would also expect Bank Wire Transfer to be there too. In terms of fees, we do not know as the page is not loading, but be sure to check with your own bank to see if they will add any transfer fees of their own.

Withdrawal Methods & Costs

As the funding page is not loading properly we do not know for sure what is available but suspect that Bank wire Transfer, Visa/MasterCard, FasaPay, Neteller, and Skrill will all be available to withdraw with. Just like with deposits we do not know of any fees, but you should check with your bank or card issuer to see if they add any processing fees of their own.

Withdrawal Processing & Wait Time

Schultz Markets will aim to process any requests within 24 hours of it being made (more time over weekends and bank holidays). The amount of time after this will depend on the method used but we would expect any requests to be fully processed within 1 to 5 days from it being processed by Schatz Markets.

Bonuses & Promotions

We did not notice any mentions of a bonus or promotions so it seems like there are none running at present, you could, however, contact the customer service team to see if any are coming up as sometimes they are happy to provide a small bonus to potential clients.

Educational & Trading Tools

There isn’t any fixed or dedicated education available, there are just a few small tools or information. There is a new section simply outlining what has happened around the markets and there is a live quotes section showing what the current prices of the markets are, that is about it. It would be good to see Schatz Markets add a few educational tools to help their clients improve on their trading in the future.

Customer Service

The customer service team is available to help and is available 24 hours a day 5 days a week. You can use the online submission form to fill in your query and then get a reply via email, there is also a postal address available as well as an email address so you can choose to contact in one of those ways too. It is a shame that there is no phone number but the methods provided will suffice.

Address: 20-22, Wenlock Road, London, N1 7GU

Email: [email protected]

Demo Account

You can open up a demo account by selecting demo instead of live when opening up an account, demo accounts allow you to test out the trading conditions and anew strategies without risking any of your own capital The trading conditions are not shown on the initial signup page so we do not know which of the accounts you can mimic the trading conditions of or if there is an expiration time on the accounts.

Countries Accepted

This information is not provided on the site so we would recommend contacting the customer service team prior to signing up for an account to ensure that you are eligible for one.

Conclusion

Schatz Markets offers a range of accounts each with their distinct trading conditions, they make things a little more straight forward with just the one platform choice. The spreads are starting low which is good, but they are coupled with a rather steep commission, considering the Lite account has a commission of $10 per lot we would expect the spreads to be a bit lower than 0.8 pips, these combined can make trading very expensive, the other accounts are slightly better but still a little too high compared to the competition.

There isn’t a full breakdown of assets available and the funding page seems to be broken so we do not have any concrete evidence of which methods are available or if there are any fees. With the broker being so expensive and some information missing we would suggest looking for a cheaper broker.