BNFX does not give a lot of information about themselves away, but it appears that they are a foreign exchange broker that is looking to provide the most transparent, stable and neutral trading environment to their clients. They pride themselves in their safety of funds and advanced technology. Throughout this review, we will be looking into the services being offered so you can decide if they are the right broker for you.

Account Types

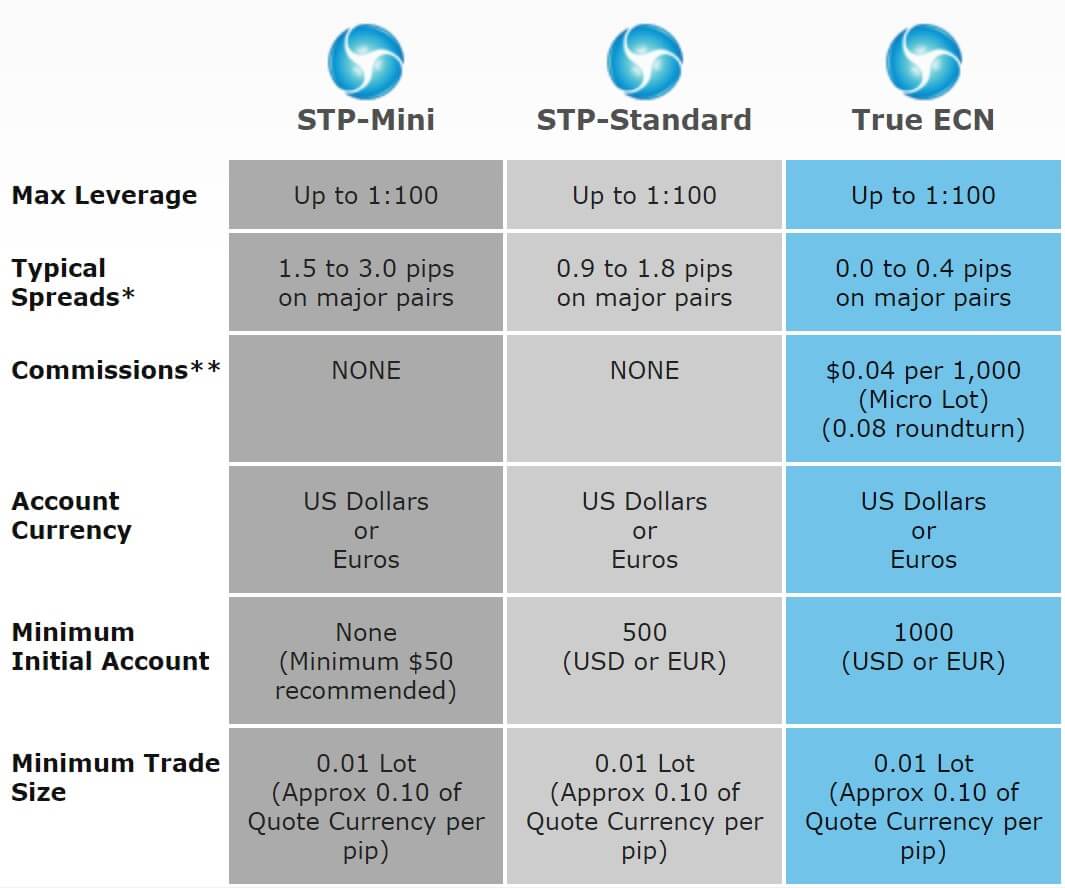

There are three different accounts on offer, each one having different trading conditions and requirements, so let’s briefly look at what is on offer.

STP – Mini Account: This account requires a minimum deposit of $50 and can be in either EUR or USD. It comes with leverage up to 1:100 and the typical spreads are between 1.5 pips to 3.0 pips on major pairs. Trade sizes start from 0.01 lots and it uses MetaTrader xStation as its trading platform. Mobile trading is also available as is market data, there is also no software fees or inactivity fees. There is no added commission on this account.

STP – Standard Account: This account requires a minimum deposit of $500 and can be in either EUR or USD. It comes with leverage up to 1:100 and the typical spreads are between 0.9 pips to 1.8 pips on major pairs. Trade sizes start from 0.01 lots and it uses MetaTrader xStation as its trading platform. Mobile trading is also available as is market data, there is also no software fees or inactivity fees. There is no added commission on this account.

True ECN Account: This account requires a minimum deposit of $1,000 and can be in either EUR or USD. It comes with leverage up to 1:100 and the typical spreads are between 0 pips to 0.4 pips on major pairs. Trade sizes start from 0.01 lots and it uses MetaTrader xStation as its trading platform. Mobile trading is also available as is market data, there is also no software fees or inactivity fees. There is an added commission of $0.04 per 1000 traded (0.01 lot) so $4 per lot traded.

Platforms

There are two different platforms available to trade with, one is the highly popular MetaTrader 4, the other is something called the BNFX xStation, so let’s see what they offer.

MetaTrader 4: MT4 has quickly become the world’s most used trading platform hosting millions of traders. Accessible as a mobile application, desktop download or web trader, it is accessible from anywhere in the world. It’s compatible with hundreds and thousands of expert advisors and indicators to help with your trading needs.

MetaTrader 4: MT4 has quickly become the world’s most used trading platform hosting millions of traders. Accessible as a mobile application, desktop download or web trader, it is accessible from anywhere in the world. It’s compatible with hundreds and thousands of expert advisors and indicators to help with your trading needs.

BNFX xStation: BNFX X Station was designed for advanced currency traders who prefer more control, flexibility, customizations, and speed than traditional retail trading software packages. It provides true one-click trading on Level 2 market depth/order book views, built-in trading calculator, in-platform economic calendar, customizable layouts saved in the cloud, and a direct connection to the BNFX liquidity infrastructure. It was designed from the ground up as an ECN/STP platform

BNFX xStation: BNFX X Station was designed for advanced currency traders who prefer more control, flexibility, customizations, and speed than traditional retail trading software packages. It provides true one-click trading on Level 2 market depth/order book views, built-in trading calculator, in-platform economic calendar, customizable layouts saved in the cloud, and a direct connection to the BNFX liquidity infrastructure. It was designed from the ground up as an ECN/STP platform

Leverage

All three accounts come with a maximum leverage of 1:L100, the leverage can be selected when you open up a new account and should you need to change it on an already open account you will need to send your request to the customer service team.

Trade Sizes

Trade sizes start from 0.01 lots (also known as micro-lots) on all three accounts, they then go up in increments of 0.01 lots so the next trade would be 0.02 lots and then 0.03 lots. It is not known what the maximum trade size is but we would not recommend trading under 50 lots due to execution and slippage issues. We are also not clear on what the maximum number of open trades that you can have at any one time is.

Trading Costs

There is only one account that has any added commission and that is the True ECN account, it has a $0.04 commission per 1000 traded (0.01 lot), so $4 per round lot traded which is below the industry average of $6 per lot traded. The STP Mini and STP Standard accounts have noa added commissions as they use a spread based system that we will look at later in this review.

There are also swap fees which are charged for holding trades overnight, they can be both positive or negative and can be viewed within the trading platform of choice.

Assets

Unfortunately, there isn’t a full breakdown or product specification available, this means that we are not able to see exactly what assets and instruments are available to trade. This information is always good to have especially as many potential clients will look to see if their favorite assets are available before signing up. Not having this available makes it appear like there may not be a huge selection of instruments available to trade.

Spreads

The three different accounts have different starting spreads, we have outlined the ranges of them below.

- STP – Mini: Variable, starting between 1.5 pips to 3 pips for major pairs.

- STP – Standard: Variable, starting between 0.9 pips to 1.8 pips for major pairs.

- True ECN: Variable, starting between 0 pips to 0.4 pips for major pairs.

The spreads are variable which means they move with the markets, when there is added volatility they will often be seen higher and, as shown above, different instruments will have different starting spreads.

Minimum Deposit

The minimum amount required to open up an account is $50 which allows you to open up an STP Mini account, should you want to use the ECN account then you will need to deposit at least $1,000. It is unknown if the minimum deposit requirement reduces for further deposits to top up an account.

Deposit Methods & Costs

Sadly there isn’t any information on the site regarding deposit methods or anything to do with them except for two little images of Visa and MasterCard, so we will be confident to say that they will be available, but we cannot say about any other methods. We also cannot comment on whether there are any added fees for depositing by BNFX.

Sadly there isn’t any information on the site regarding deposit methods or anything to do with them except for two little images of Visa and MasterCard, so we will be confident to say that they will be available, but we cannot say about any other methods. We also cannot comment on whether there are any added fees for depositing by BNFX.

Withdrawal Methods & Costs

As there is no information about deposits you would be right to assume that there is none about the withdrawals either, we could not find anything apart from the two images of Visa and MasterCard mentioned before. Just like the deposits, there is also no mention of any potential fees for withdrawing.

Withdrawal Processing & Wait Time

Sadly we also do not have any information on this topic, we would hope that any withdrawal requests would be fully processed between 1 to 7 working days after the request is made depending on what methods are available to withdraw with.

Bonuses & Promotions

From what we can see there are no active promotions or bonuses at the time of writing this review, however, if you are interested in bonuses, you could contact the customer service team to see if there are any upcoming promotions you could take part in.

Educational & Trading Tools

There doesn’t seem to be any educational content on the site which is a shame as a lot of modern brokers are looking to help their clients improve through education or tools, so it would be nice to see BNFX do something too.

Customer Service

If you want to get in contact with BNFX it is unfortunate that there is only one way to do it, and that is via an online submission form. When filling out the form you can select the department between General Questions, Compliance Department, Media Relations and Technical Support. There is no access to a phone number or direct email address which is a little concerning.

Demo Account

There is an open demo account button, unfortunately clicking it brings up a page that doesn’t want to load properly, so it is currently impossible for us to open up a demo account. In regards to the demo account, there is no information about the trading conditions that they use or if there is an expiration time, however, this may have been present on the page that is not loading for us.

Countries Accepted

The only statement about accepted countries is the following “THIS WEBSITE IS NOT INTENDED TO SOLICIT RESIDENTS OF THE UNITED STATES OF AMERICA.” So if you are not sure of your eligibility we would recommend getting in contact with the customer service team to find out.

Conclusion

It is nice to have a choice between different types of accounts, in this case, STP and ECN, the trading costs of the ECN and STP Standard accounts seem reasonable and having a choice of trading platforms are good to have. Unfortunately, we do not know what assets are available as there is not a breakdown or specification and even more worryingly is the lack of information on funding. Not knowing how to deposit or withdraw and even how much it will cost you is a real concern. This coupled with the fact that there is only one way to contact the customer service team which can be quite limiting is enough for us to recommend looking elsewhere for your trading needs.