WesternFX is a forex broker serving both individual and corporate client around the world, offering their customers a comprehensive range of options and features such as fast deposit and withdrawals, up to $2000 new account bonus, experienced forex traders available to answer your market questions, industry-leading MetaTrader 5 platform and, convenient funding by credit card, bank wire, online payment gateway and off course by local support via well-trained representatives. In this review, we will be looking into the services being offered to see if they are of the standard stated and so you can decide if they are the right broker for you.

Account Types

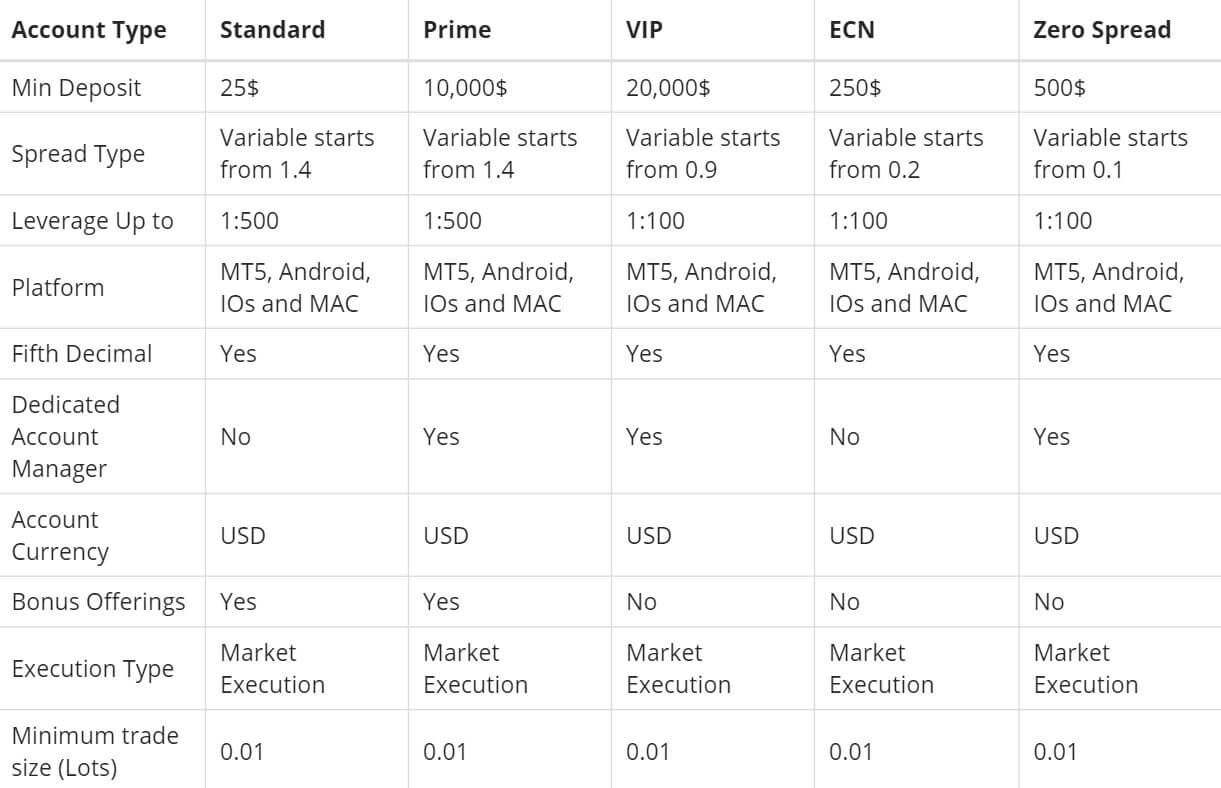

There are 5 different accounts available, each one offering their own entry requirements as well as features and trading conditions. Let’s see what they are.

Standard: An entry requirement of $25 makes this account very accessible. It comes with variable spreads starting at 1.4 pips and has leverage up to 1:500 available. It uses the MetaTrader 5 trading platform and the account currency must be in USD. It has bonuses available and uses market execution as its execution method. Minimum trade sizes start at 0.01 lots and the stop out level is set at 10%. There are no commissions and no swap charges on this account.

Prime: The Prime account increases the minimum deposit up to $10,000. The account has variable spreads starting at 1.4 pips and has no added commission. Leverage is available up to 1:500 and it uses the MetaTrader 5 trading platform. You get a dedicated account manager as well as bonus offerings. The minimum trade size is 0.01 lots, uses market executions and the stop out level is set at 10%, the account must be in USD and does not receive any swap charges.

VIP: The VIP account increases the deposit requirement further up to $20,000. The account comes with spreads starting from 0.9 pips and has an added commission. Leverage can be up to 1:100 and it uses the MetaTrader 5 trading platform. It has a dedicated account manager, the base currency must be in USD and it does not have access to any bonuses. It uses market execution with the minimum trade size being 0.01 lots with the stop out level being set at 20%, there are swap charges charged on this account for holding trades overnight.

ECN: The ECN account has a minimum deposit requirement of $250, it has spread starting from 0.2 pips and has an added commission to compensate for this. Leverage can be up to 1:100 and it uses MetaTrader 5 as its trading platform. There is a dedicated account manager available and the currency must be in USD, it is not eligible for bonuses and uses market execution as its execution method. Minimum trade sizes start from 0.01 lots, there are swap charges applied and the stop out level is set at 20%.

Zero Spread: The Zero Spread account starts from $500, it has a variable spread starting from 0.1 pips, it’s leverage is 1:100 and it uses the MetaTrader 5 platform. It has added commissions and swap charges for holding trades overnight. It comes with a dedicated account manager and must be in USD as a base currency. It uses market execution and has a minimum trade size of 0.01 lots with a stop out level set at 20%.

Platforms

WesternFX is offering MetaTrader 5 as their sole trading platform, so let’s see what the platform actually offers.

WesternFX is offering MetaTrader 5 as their sole trading platform, so let’s see what the platform actually offers.

MetaTrader 5 (MT5): MetaTrader 5 was developed by MetaQuotes Software and released in 2010, MT5 is used by millions and for good reason. Offering plenty of trading and analysis features to ain in your trading. Additional services expand the functionality of the platform making its capabilities almost limitless. MetaTrader 5 is also highly accessible with it being available as a desktop download, application for iOS and Android devices and even as a WebTrader where you can trade from within your internet browser.

Leverage

The maximum leverage available depends on the account type that you are using, they are as follows:

1:500 – Standard, Prime

1:100 – VIP, ECN, Zero Spreads

The leverage can be selected when opening up an account, should you wish to change it on an already open account then you can do so by getting in touch with the customer service team with your request.

Trade Sizes

Trade sizes on all accounts start from 0.01 lots which are known as a micro lot, they then go up in increments of 0.01 lots so the next trade would be 0.02 lots and then 0.03 lots. The maximum trade size is unknown to us, however, we would recommend not trading in sizes larger than 50 lots, as the bigger a trade becomes the harder it is for the markets or liquidity provider to execute the trade quickly and without any slippage. It is also unknown how many open trades you are able to have at any one time.

Trading Costs

The Standard and Prime accounts do not have any added commissions as they use a spread based system that we will look into later in this review. The VIP, ECN and Zero Spread accounts have an added commission for each trade. Unfortunately, what the commission amount is is not known to us, we looked through the site and the terms of service but could not see any concrete information on how much they are, just that they exist.

Swap charges are present on the VIP, ECN and Zero Spread accounts, these are interest charges that are incurred for holding trades overnight, they can be both negative or positive and can usually be viewed from within the trading platform of choice.

Assets

WesternFX has broken down their assets into a number of different categories, we have outlined them for you below.

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURUAD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, SGDJPY, USDCAD, USDCHF, USDHKD, USDJPY, USDPLN, USDSGD, USDZAR.

Metals and Energies: Gold Spot, Silver Spot, Natural Gas.

CFDs: Crude Oil (WTI), Crude Oil (Brent).

Indices: Australia 200, France 40, Germany 30, Nikkei, Nasdaq 100, UK 100.

Shares: Apple, Amazon, Intel, Microsoft, Facebook, Twitter, Tesco, MasterCard, McDonald’s, Bank of America.

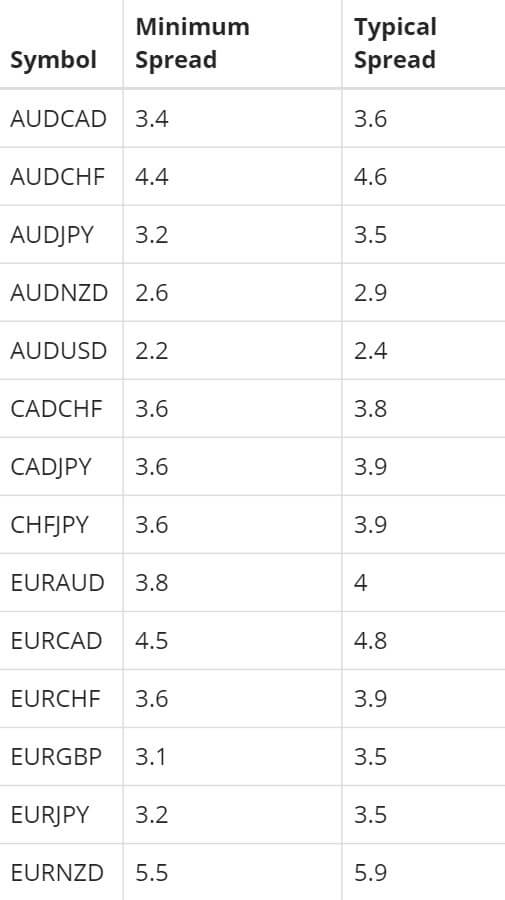

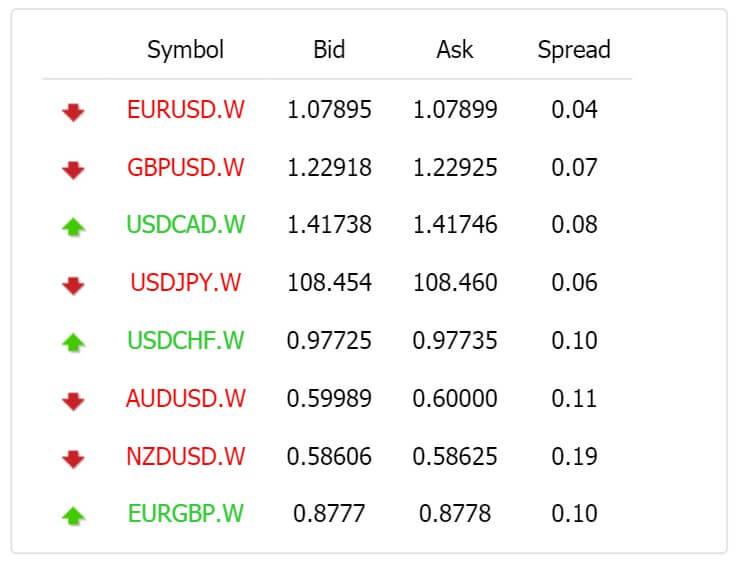

Spreads

The starting spread you get depends on the account you are using and are as follows.

- Standard: From 1.4 pips

- Prime: From 1.4 pips

- VIP: From 0.9 pips

- ECN: From 0.2 pips

- Zero Spread: From 0.1 pips

The spreads are variable (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads, so while EURUSD may start at 1.4 pips, other assets like GBPJPY may start slightly higher.

Minimum Deposit

The minimum amount required to open an account is $25 which gets you the Standard account, if you want a different account the next requirement is for the ECN account which is $250.

Deposit Methods & Costs

The following methods are available for a deposit.

Wire Transfer: Bank Wire Transfer, MegaTransfer

Credit Cards: Visa Credit / Debit, MasterCard Credit / Debit, UnionPay

Online Payment: Neteller, Perfect Money, fasapay, Payza.

There are no added fees for deposits from WesternFX, however, you should check with the bank or processor that you are using to see if they add any fees of their own.

Withdrawal Methods & Costs

The same methods are available for withdrawal, for clarification these are Bank Wire Transfer, MegaTransfer, Visa Credit / Debit, MasterCard Credit / Debit, UnionPay, Neteller, Perfect Money, fasapay and Payza.

It states that there are specific fees applied for withdrawals but it does not say what they are, so we know there are fees, just not how much, you should also check with the bank or processor that you are using to see if they add any fees of their own.

Withdrawal Processing & Wait Time

Withdrawal time will take between 2 to 7 working days for your withdrawals to be fully processed, this included both WesterFXs own processing and the processing of the method used such as your bank’s processing for Bank Wire Transfers.

Bonuses & Promotions

There are a number of different promotions taking place when we looked at the site, while some may not still be available, it will give an idea of the sort of promotions that take place.

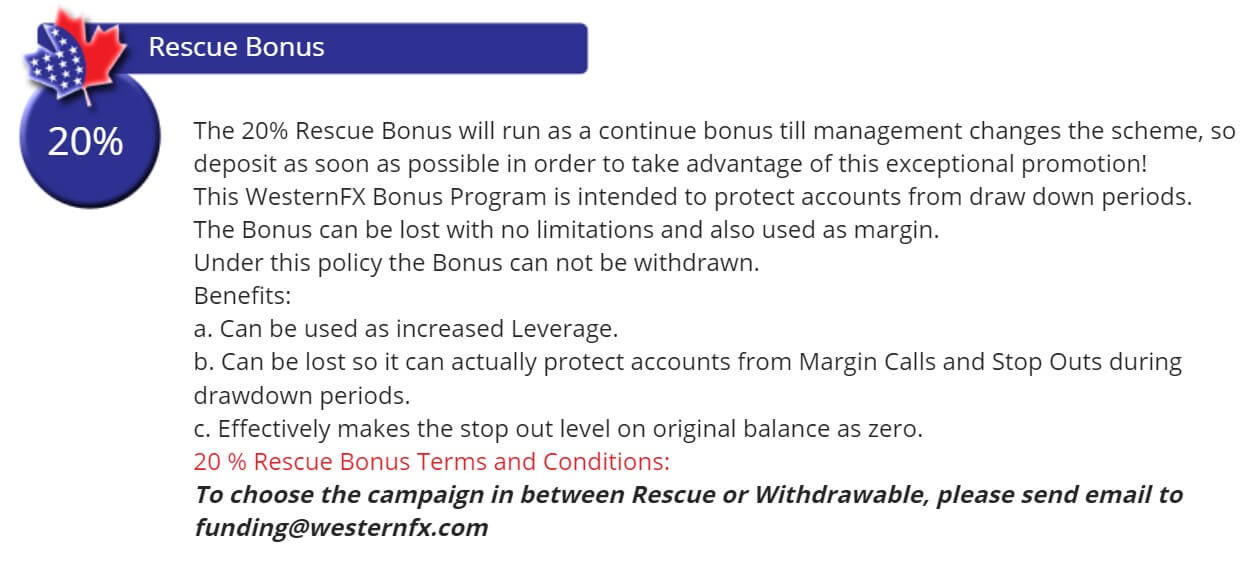

Rescue Bonus: This WesternFX Bonus Program is intended to protect accounts from drawdown periods. The Bonus can be lost with no limitations and also used as margin. Under this policy, the Bonus can not be withdrawn.

Benefits:

a. It can be used for increased Leverage.

b. It can be lost so it can actually protect accounts from Margin Calls and Stop Outs during drawdown periods.

c. Effectively makes the stop out level on original balance as zero.

4th Year Celebration Bonus: This WesternFX 4th-year anniversary Bonus Program is intended to protect accounts from drawdown periods. The Bonus can be lost with no limitations and also used as margin. The 30% Withdrawal Bonus will run for a limited time, so deposit as soon as possible in order to take advantage of this exceptional promotion! Under this policy, the Bonus can be withdrawn only after the targeted lots completed.

Benefits:

a. It can be used for increased Leverage.

b. It can be lost so it can actually protect accounts from Margin Calls and Stop Outs during drawdown periods.

c. Effectively makes the stop out level on original balance as zero.

To withdraw the Forex Bonus from your account you need to make a transaction (number of lots) in the amount of X 10% = EXAMPLE: You deposit $1000 and receive a $300 bonus, so the total account balance becomes $1300. To withdraw the received bonus ($300), you need to make a transaction of $1300X10% = 130 lots (only closed deals are taken into account) 12. In the

Educational & Trading Tools

There are a few analysis and information sections of the site, however, these have not been updated since 2014 so it appears that they are no longer active in their analysis, there are also a couple of calculators to help you work out trade sizes.

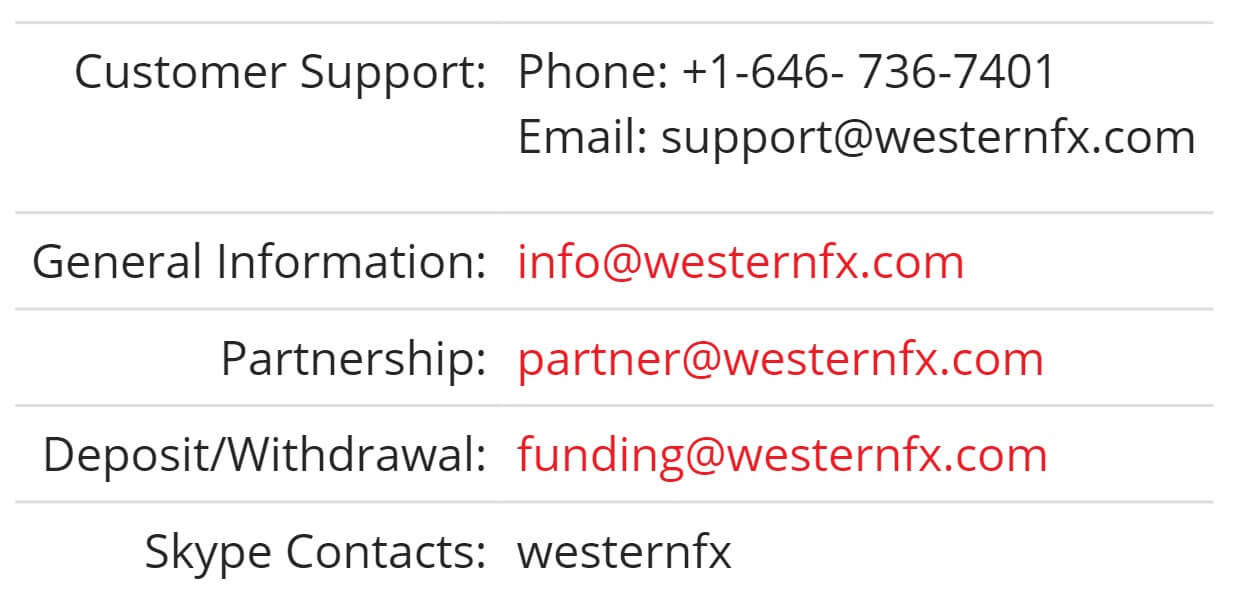

Customer Service

If you want to get in contact with WesternFX you can do so by using the online submission form, simply fill in your query and you should get a reply via email. There is also a phone number available as well as individual email addresses for General Informal, Customer Support, Deposit/Withdrawal and also a contact name for Skype. The support team is open 24/5 and is closed at the same time as the markets over the weekend and on bank holidays.

Demo Account

Demo accounts can be accessed by filling in a form, you can select the deposit amount on this initial form. The trading conditions of the demo account are not stated so it is not clear which account they mimic, there may be a choice of this later in the signup process. There is also no mention of any expiration times so hopefully, they last indefinitely.

Countries Accepted

The information about which countries are accepted and which are not is not present on the website, so if you are interested in joining, be sure to get in contact with the customer service team to check if you are eligible for an account or not.

Conclusion

There are a lot of choices when it comes to WesternFX, lots of different accounts with varying trading conditions, spreads are reasonable however we do not know what the commission charged actually is. In terms of tradable assets, there is a good selection, looking at the deposit and withdrawal methods, lots of options but there are additional fees for some methods which are unfortunately not stated, it is important for clients to know the charges but that information is not readily available. Plenty of ways to get in contact with the customer service team, WesternFX could be a decent broker to use as long as the commissions and withdrawal fees are in line with the industry standards.