TP Global FX is a foreign exchange broker based in Saint Vincent and the Grenadines. They claim that some of their main benefits include their excellent trading conditions, variety of markets, they are technology-driven and they offer the best in the class support team. Always looking to improve and innovate, we will be looking at the service they offer to see how they compare to the competition and so you can decide if they are the right broker for your trading needs.

Account Types

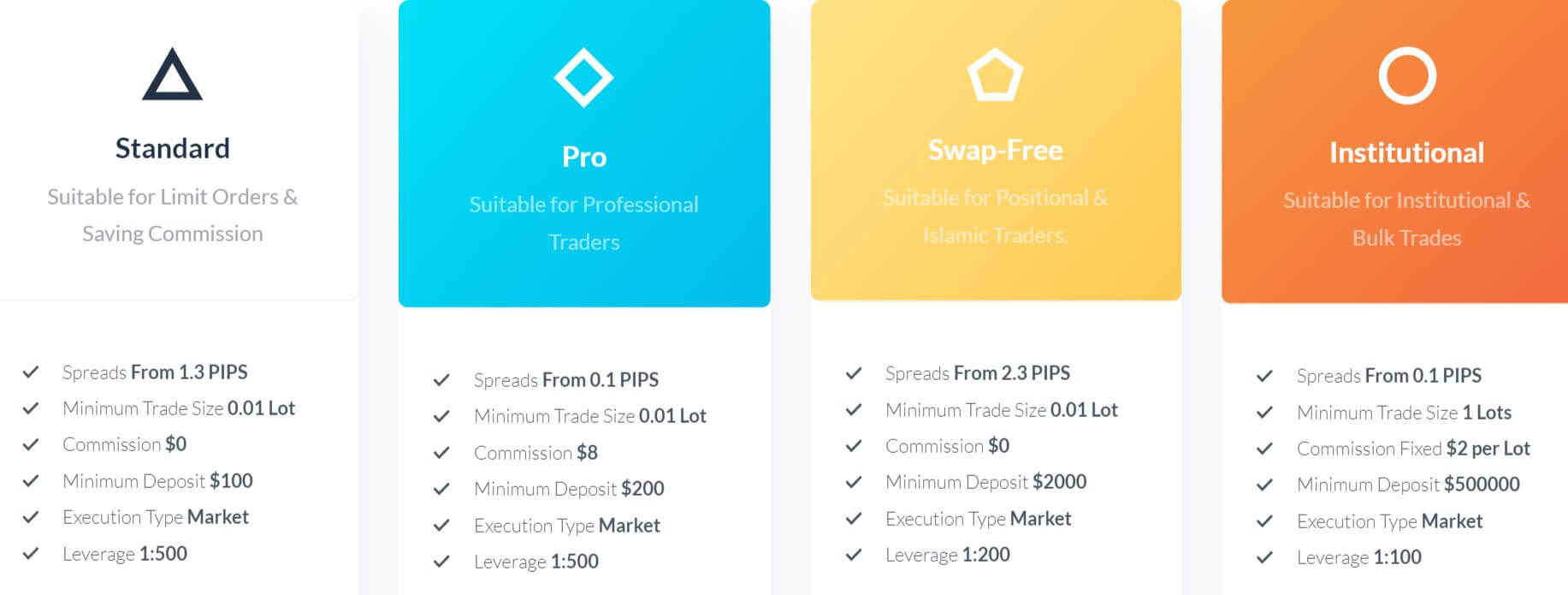

There are four different account types available, we will briefly overview some of their features below, as we go through the review we will look into each section in a little more detail.

Standard Account: This account requires a minimum deposit of $100, it comes with spreads starting from 1.3 pips and there are no added commissions when trading. Trade sizes start from 0.01 lots, the account can be leveraged up to 1:500 and it uses a market execution-style.

Pro Account: This account requires a minimum deposit of $200, it comes with spreads starting from 0.1 pips and there is an added commission of $8 per round lot when trading. Trade sizes start from 0.01 lots, the account can be leveraged up to 1:500 and it uses a market execution-style.

Swap-Free Account: This account requires a minimum deposit of $2,000, it comes with spreads starting from 2.3 pips and there are no added commissions on the account. Trade sizes start from 0.01 lots, the account can be leveraged up to 1:200 and it uses a market execution-style.

Institutional Account: This account requires a minimum deposit of $500,000, it comes with spreads starting from 0.1 pips and there is an added commission of $2 per round lot when trading. Trade sizes start from 1 lot, the account can be leveraged up to 1:100 and it uses a market execution-style.

Platforms

TP Global FX uses MetaTrader 4 as their trading platform which is available as a desktop download, mobile application or web trader. It is one of the world’s most used trading platforms hosting the trades of over 1,000,000 traders worldwide. Some of its many features include that it is available in 30+ languages, allows the use of EA’s & Robots for trade automation, has options to choose from instruments such as Commodities, Indices, and Forex, has requirement based customization with multiple charting as well as analysis, it also offers daily statement for an account, has the availability of analytical tools those are pre-programmed and had real-time account summary for clients which includes floating profit/loss and account equity, etc.

TP Global FX uses MetaTrader 4 as their trading platform which is available as a desktop download, mobile application or web trader. It is one of the world’s most used trading platforms hosting the trades of over 1,000,000 traders worldwide. Some of its many features include that it is available in 30+ languages, allows the use of EA’s & Robots for trade automation, has options to choose from instruments such as Commodities, Indices, and Forex, has requirement based customization with multiple charting as well as analysis, it also offers daily statement for an account, has the availability of analytical tools those are pre-programmed and had real-time account summary for clients which includes floating profit/loss and account equity, etc.

Leverage

The leverage that you get depends on the account that you are using, if you are using the Standard or Pro account then the account can be leveraged up to 1:500, if you are using the Swap-Free account then you can get leverage up to 1:200 and the Institutional account can be leveraged up to 1:100.

Leverage can be selected when first opening up an account and should you need to change it, you can do so by sending a change request to the customer service department.

Trade Sizes

Trade sizes on the Standard, Pro and Swap-Free accounts start from 0.01 lots and go up in increments of 0.01 lots so the next trade would be 0.02 lots and then 0.03 lots. The maximum trade size for these accounts is set at 50 lots which is at a reasonable level. The Institutional account has trade sizes starting from 1 lot, we do not know the trade increments or maximum trade size for this account type. We also do not know how many open trades or orders you can have at any one time for any of the available account types.

Trading Costs

The Pro account has an added commission of $8 per lot traded while the Institutional accounts has an added commission of $2 per lot traded. The industry average seems to be around $6 per lot traded, so the Pro account is just slightly higher than the average. The Standard and Swap-Free account uses a spread based system that we will look at later in the review.

There are also swap charges for the Standard, Pro, and Institutional accounts, these are fees that are either charged or received for holding trades overnight, they can be viewed within the trading platform you are using. The Swap-Free account does not have these charges and instead has a slightly higher spread added to the account.

Assets

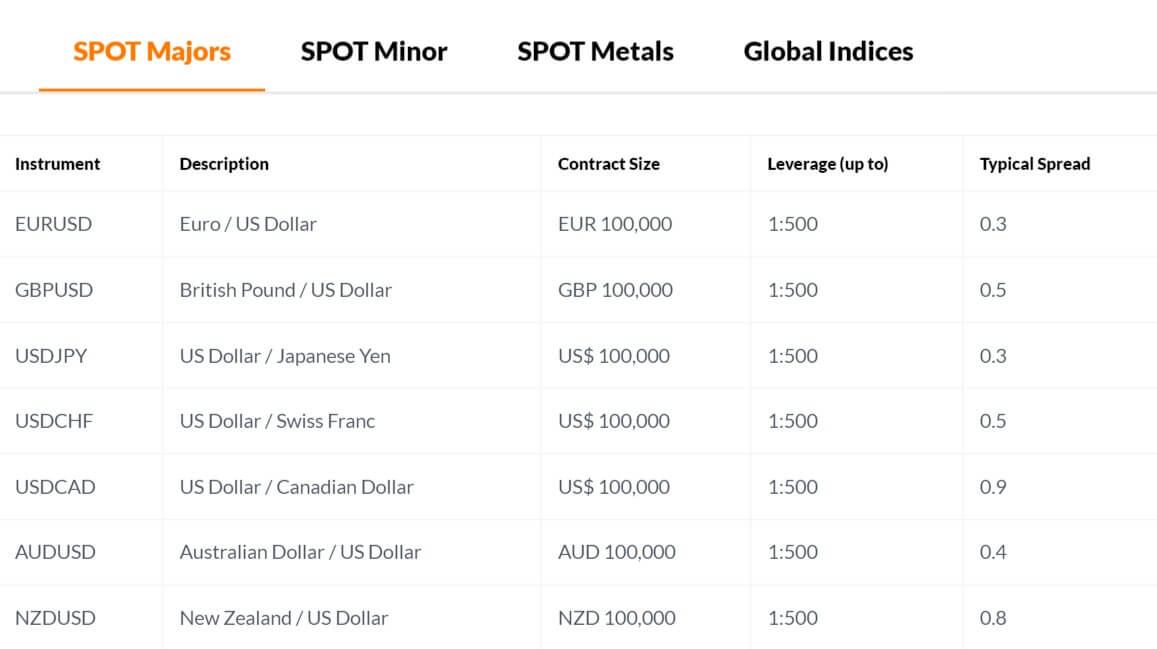

The assets at TP Global FX have been broken down into various categories, we have outlined them below along with the available instruments within them.

Forex Majors: EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD, NXDUSD

Forex Majors: EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD, NXDUSD

Forex Minors: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCADD, EURCHF, EURGBP, EURJPY, EURNZD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPSEK, GBPSGD, NZDCAD, NZDCHF, NXDJPY, EURPLN, EURSEK, EURSGD, EURTRY, USDDKK, USDNOK, USDPLN, USDSEK, USDSGD, USDTRY, USDZAR.

Metals: Gold (against EUR and USD) and Silver (against USD).

Indices: AUD 200, CHNIND, US 30, EUR 50, FRA 40, GER 30, HKIND, ITA 40, JAP 225, US 100, US 50, SGXSING, SWE 30, SUI 20, SGXTAI, TECH 30, UK 100, US 2000.

Spreads

The spreads that you get depends on the accounts that you are using, we have outlined the different spreads in a list below.

- Standard Account: Spreads starting from 1.3 pips

- Pro Account: Spreads starting from 0.1 pips

- Swap-Free Account: Spreads starting from 2.3 pips

- Institutional Account: Spreads starting from 0.1 pips

The spreads are variable (or floating), this means that they are influenced by the markets, at a time of higher volatility or lower liquidity the spreads will often widen and be seen higher than the starting figures. Different instruments will also have different spreads, so EURUSD will always have a different spread to GBPJPY as an example.

Minimum Deposit

The minimum amount required to pen up ana account is $100 which will allow you to use the Standard account, the other accounts all have different requirements that we have listed below.

- Standard Account: $100 minimum

- Pro Account: $200 minimum

- Swap-Free Account: $2,000 minimum

- Institutional Account: $500,000 minimum

Once an account has been opened the minimum amount required for future top-up deposits is reduced down to $5.

Deposit Methods & Costs

There are just two different methods available to deposit with, these are Bank Wire Transfer and Debit/Credit Card. The good news is that there are no added fees from TP Global FX, however, you should check with your own bank or card issuer to see if they are charging any outgoing transfer fees of their own.

Withdrawal Methods & Costs

The same two methods are available to withdraw with, so those are Credit/Debit Card and Bank Wire Transfer. You can only withdraw as much as you have deposited when using a Card, you will then need to withdraw any extra via Bank Wire. There are also no fees for withdrawals, but again, be sure to check with your own bank for any potential processing fees.

Withdrawal Processing & Wait Time

TP Global FX will process any withdrawal request the same day they are made, however, if not then it will be processed the next working day. It will then take between 1 to 5 days for the money to become available to you depending on the processing speed of your bank or card issuer.

Bonuses & Promotions

We didn’t see any signs of a promotion or bonus so it does not appear that there are any active at this time, this does not mean that there won’t be so if you are thinking of joining and like bonuses, you could always contact the customer service team to see if there are any coming up that you could take part in.

Educational & Trading Tools

Educational & Trading Tools

There are a few small tools available to use, the first is a set of calculators including pip, margin, Fibonacci, Pivot and Profit calculators. There is also an economic calendar that details upcoming news events and also the markets and currencies that the news could affect. The final section is a glossary detailing different trading-related terms and their meanings.

Customer Service

The customer service team is available to be contacted with a variety of methods, the first is the usual online submission form, fill it in and you should get a reply via email. You can then also use the available postal address, email address or phone number.

Address: 305 Griffith Corporate Park, Beachmont Kingston, Saint Vincent & the Grenadines

Email: [email protected]

Phone: +1 7754366970

Demo Account

Demo accounts are available and allow you to test out the trading conditions as well as trading strategies without any real risk. When opening up an account you can select leverage between 1:100 and 1:500 and a balance between 1,000 and 1,000,000. We do not know if there is an expiration on these accounts.

Countries Accepted

This information is not stated on the site so if you are thinking of signing up, we would recommend getting in contact with the customer service team to ensure that you are eligible to sign up.

Conclusion

The trading conditions offered by TP Global FX give you a variety of trading conditions to trade with. The spreads are ok, and the commissions are slightly higher than the industry average but it isn’t anything that would really stand out There are plenty of assets and instruments available to trade. When we look at the funding options they are a little limited with just the two methods being available, the good news is that there are no additional fees attached to them. If you use one of the two available funding methods then TP Global FX could be a decent broker to use.