Blue Bull Capital is a Forex and CFD broker located in the United Kingdom. They were founded with one objective, to provide traders with safe, easy and low-cost access to the foreign exchange markets. They aim to become one of the leading providers of this service, in this review we will be looking into the services being offered to see if they achieve their mission and so you can decide if they are the right broker for you.

Account Types

It seems that there are two accounts on offer from Bue Bull Capital, both having different requirements and trading conditions.

Standard Account: The standard account requires a minimum deposit of $500, this account can be in a base currency of USD, EUR, GBP, PLN or AED. It comes with leverage up to 1:500 and the spreads are variable. There is no added commission and it used a market execution model. Micro lots (0.01 lots) are allowed and it uses the MetaTrader 4 trading platform. It has the availability to trade forex, indices, commodities, softs, stocks, and cryptos, the account also has swap charges for holding trades overnight.

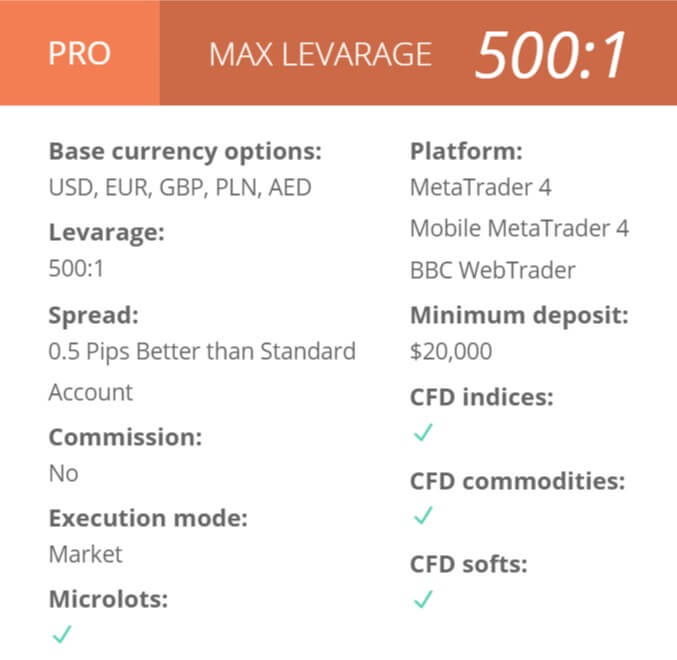

Pro Account: The pro account requires an increased minimum deposit of $20,000. The account can be in USD, EUR, GBP, PLN or AED. It comes with leverage up to 1:500 and the spreads are always 0.5 pips better than the starter account spreads. There is no added commission and it used a market execution model. Micro lots (0.01 lots) are allowed and it uses the MetaTrader 4 trading platform. It has the availability to trade forex, indices, commodities, softs, stocks, and cryptos, the account also has swap charges for holding trades overnight.

Platforms

Blue Bull Capital has chosen MetaTrader 4 as their only trading platform, so let’s see what it offers. MetaTrader 4 is compatible with hundreds and thousands of different indicators, expert advisors, signal providers and more. MT4 is second to none, available as a desktop download, an app for Android and iOS devices and as a WebTrader where you can trade from within your internet browser. MetaTrader 4 is a great trading solution to have.

Blue Bull Capital has chosen MetaTrader 4 as their only trading platform, so let’s see what it offers. MetaTrader 4 is compatible with hundreds and thousands of different indicators, expert advisors, signal providers and more. MT4 is second to none, available as a desktop download, an app for Android and iOS devices and as a WebTrader where you can trade from within your internet browser. MetaTrader 4 is a great trading solution to have.

Leverage

The maximum leverage for both account types is 1:500 which is what a lot of brokers are now aiming for. The leverage can be selected when opening up an account and should you wish to change it on an already open account, you should get in contact with the customer service team with this request.

The maximum leverage for both account types is 1:500 which is what a lot of brokers are now aiming for. The leverage can be selected when opening up an account and should you wish to change it on an already open account, you should get in contact with the customer service team with this request.

Trade Sizes

Trade sizes start at 0.01 lots (known as a micro lot), they then go up in increments of 0.01 lots, so the 0.02 would be the next available trade followed by 0.03 lots. There isn’t a mention of the maximum trade size, however, we would recommend not trading in sizes larger than 50 lots, as the bigger a trade becomes the harder it is for the markets or liquidity provider to execute the trade quickly and without any slippage.

Trading Costs

There are no additional commissions added to either of the accounts as they use a spread based structure that we will look at later in this review. Swap charges are present which is a charge, either positive or negative incurred from holding a trade overnight, these fees can be viewed from within the MetaTrader 4 trading platform.

Assets

The assets available from Blue Bull Capital have been broken down into 6 different categories, we will briefly look at each to see some examples of what is available to trade.

The assets available from Blue Bull Capital have been broken down into 6 different categories, we will briefly look at each to see some examples of what is available to trade.

Currency Pairs: There are 49 different currency pairs available which include forex majors and forex minors. Some examples of the pairs available are AUDCAD, CHFJPY, EURUSD, USDCNH, and USDZAR.

Metals: Three metals on offer including the regular Gold and Silver which are then joined by Platinum.

Indices: For Indices, there are 11 in total, these include GBP 100, AUD 200, JPY 225, GER 30, SPA 35, HKD 33 and NASDAQ 100.

Commodities: Just three commodities are available to trade with Blue Bull Capital which are Brent Crude Oil, WTI Crude Oil, and Natural Gas.

Futures: Two futures are also available which are Coffee Arabica and Coffee Robusta.

Shares: There are 193 different shares available which are lower than we would have expected, a range of these include the major shares such as Apple, Amazon, Facebook, Tesla, and many more.

Spreads

Spreads seem to be the same for both accounts and start at around 2.4 pips, we say to start as the yare variable (floating) which means they move with the markets, when the markets are being volatile then they will often be seen higher. Different instruments also have different starting spreads, so while EURUSD may start at 2.4 pips, other pairs such as GBP/CAD may start at 8.3 pips (numbers were taken from the instrument page of the website).

Minimum Deposit

The minimum amount required to open an account is $500 which gets you the Standard account, if you want the Pro account you will need to deposit $20,000. Once an account is open, further top-ups are as low as $5 depending on the method used.

The minimum amount required to open an account is $500 which gets you the Standard account, if you want the Pro account you will need to deposit $20,000. Once an account is open, further top-ups are as low as $5 depending on the method used.

Deposit Methods & Costs

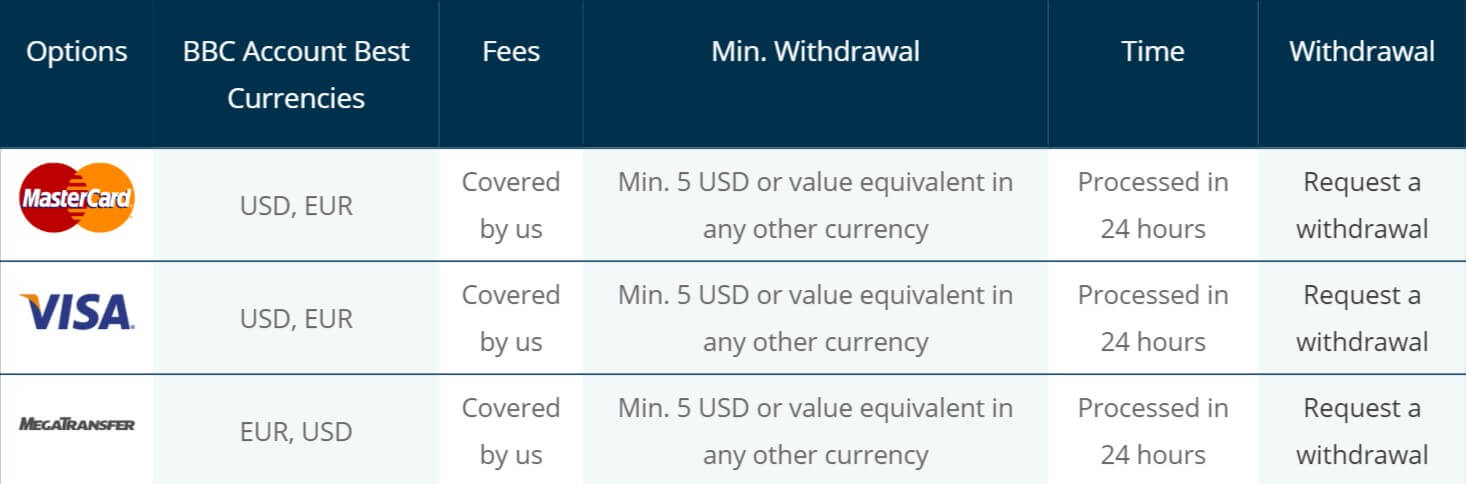

There are a number of different methods available, each one has the ability to deposit in USD or EUR and the good news is that there are no fees added by Blue Bull Capital and they even cover all costs from certain electronic methods.

Methods available:

Bank Wire Transfer, MasterCard Credit/Debit Card, Visa Credit/Debit Card, MegaTransfer, NganLuyng, Skrill and Neteller.

When using Bank Wire Transfer, be sure to check with your bank to make sure they do not add any fees of their own.

Withdrawal Methods & Costs

The same methods are available to withdraw with, for clarification, these are Bank Wire Transfer, MasterCard Credit/Debit Card, Visa Credit/Debit Card, MegaTransfer, NganLuyng, Skrill and Neteller.

All fees are covered by Blue Bull Capital except for NganLuyng which has a 0.5% fee, also be sure to check with your bank when using Bank Wire Transfer to see if they add any of their own fees.

Withdrawal Processing & Wait Time

PRocessing is done the same working day as the request is made, if made after closing hours then it will be processed on the next working day. The following times are advised by Blue Bull Capital.

24 Hours:

MasterCard Credit / Debit Card, Visa Credit / Debit Card, MegaTransfer, NganLuyng, Skrill and, Neteller.

2 – 5 Days:

Bank Wire Transfer

Bonuses & Promotions

There is apparently a bonus available, however, the promotions page simply states: “Special & Flexible bonus for your trading to benefit your investment!”. There isn’t any more context or information around it. However, we managed to find a PDF on the bonus which contains its features and terms. The bonus is a 100% deposit bonus and can be used once. There does not appear to be a limit to the amount. It states that the bonus period is 6 months but there is no indication how to change the bonus funds into real funds if that is possible at all, so it may be a bonus just to add extra margin rather than to eventually withdraw.

Educational & Trading Tools

There is an Academy section of the website but it is not actually an academy, in fact, there is very little to it at all. There are some very basic guides on how to do the bare minimum when it comes to trading such as opening a trade, a trading glossary and how to use the MetaTrader 4 trading platform. The glossary is the only thing that is potentially helpful as it tells you what different terms mean.

Customer Service

The contact us page consists of an online submission to fill in and that’s it, you can fill this in and you should then get a reply via email. It was really disappointing to see that there was no other way to get in touch, but luckily in the website footer, there is an email address available as well as a phone number to call.

Demo Account

You can sign up for a demo account using the demo account button. There doesn’t seem to be much more information regarding this. The trading conditions will mimic the real accounts however there is no indication as to how long the accounts remain open for, as some brokers impose a time limit such as 30 days and others do not, so this would be good to know.

Countries Accepted

Blue Bull Capital simply states that its services may be prohibited in certain countries but do not state which ones and that it is your responsibility to know. This is a little unfair as clients will not automatically know, so if you are interested in an account you may need to get in contact with the customer service team to find out if you are eligible or not.

Conclusion

Blue Bull Capital makes a positive start with plenty of information available, the main lack of information comes on the accounts pages as it does not display much information about trading conditions and instead we needed to go through the site to find any of it. Plenty of assets available to trade along with good information on spreads, which are a little on the high side but nothing out of the ordinary. Blue Bull Capital is let down a little with the lack of information on their customer service pages, but more ways to get in contact can be found around the site.